Stock Symbol: CDNR

Exchange: OTCBB

Basic Shares Outstanding: 59.4m

http://www.auroraogc.com

Investor Relations Contact:

Lori King: (231) 941-0073

Disclaimer

In this slide presentation, statements regarding our goals and objectives, our

expected methods of operation and development strategies, our expected and

potential production volumes, anticipated oil and gas prices, potential drilling

locations, the timing of drilling activities, when wells will begin producing, how many

wells will be drilled, potential new development theatres, the spacing of wells, drilling

and operating costs, and other statements that are not historical facts, contain

predictions, estimates and other Forward-Looking Statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. Although we believe that our expectations are based on reasonable

assumptions, we can give no assurance that our goals will be achieved. Important

factors that could cause our actual results to differ materially from those included in

the Forward-Looking Statements include the timing and extent of changes in

commodity prices for oil and gas, drilling and operating risks, the availability of

drilling rigs, uncertainties about the estimates of reserves, the availability of

transportation pipelines, changes in laws or government regulations, unforeseen

engineering and mechanical or technological difficulties in drilling the wells,

operating hazards, weather related delays, the loss of existing credit facilities,

availability of capital, and other risks more fully described in our filings with the

Securities and Exchange Commission, including an amended Form SB-2 Registration

Statement filed on November 10, 2005. We may also change our business focus as

new opportunities arise. All Forward-Looking Statements contained in this

presentation, including any forecasts and estimates, are based on management’s

outlook only as of the date of this presentation and we undertake no obligation to

update or revise these Forward-Looking Statements, whether as a result of

subsequent developments or otherwise.

Executive Summary

Low-risk development of unconventional gas

reserves in the Antrim and New Albany Shale

Over 290,000 net acres with ~2,000 potential drilling

locations and ~1.7 Tcf in potential reserves

Rapidly growing proved reserves and production

~150 gross wells drilled in 2005 with ~95% success

2006 Outlook:

200 well drilling program

Proved reserves expected to reach 100bcf by mid-year

Net production expected to reach 10mm cf/d in Q1’06 and

15mm cf/d by year end 2006

AMEX listing targeted in 1H’06

The Company

Aurora completed a merger with publicly traded

Cadence Resources Corporation in October 2005

~$250m pro forma market capitalization (1)

Aurora has been actively acquiring acreage in the

Antrim Shale (Michigan) and New Albany Shale

(Indiana / Kentucky) for ~10 years

Net acreage position has grown 120% since March

Rapidly accelerated drilling program with infusion of

$18.5m from equity private placement in early 2005 (2)

$30m TCW Mezzanine facility in place

(1)

Fully diluted using Treasury Stock Method.

(2)

Reflects proceeds raised by both Aurora Energy and Cadence Resources, which had not yet completed their merger.

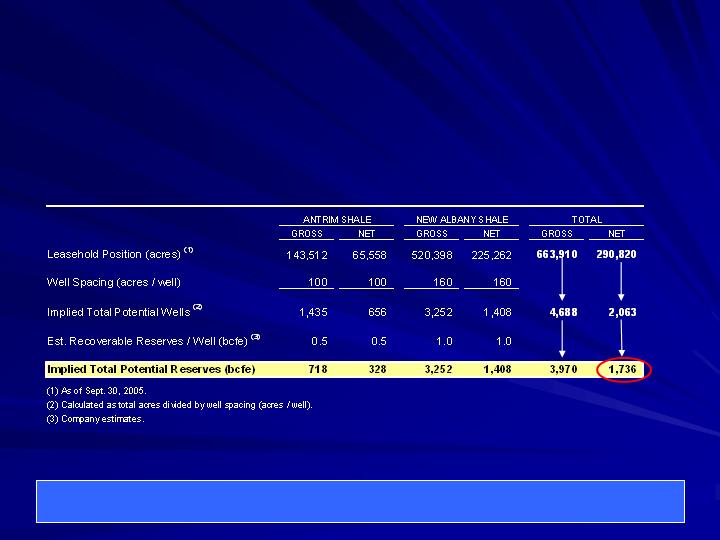

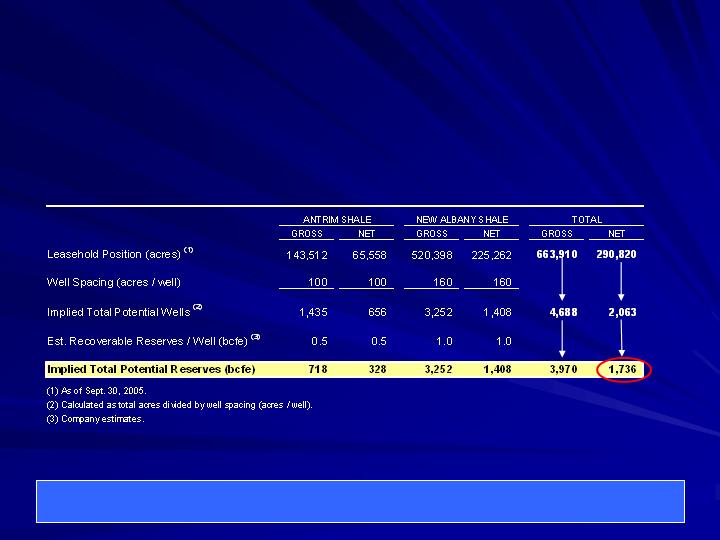

Summary Acreage Position

The Company has ~2,000 potential drilling locations

with ~1.7 Tcf in estimated total potential reserves.

Acreage potential does not currently translate into Proved Reserves.

Generating Proved Reserves will require successful drilling.

Antrim and New Albany Shale Plays

Relatively shallow

blanket shale formations

High-upside, lower-risk

development potential

Antrim and New Albany Shale Plays

Antrim Shale (~25 % of net acreage)

Well-developed, low-risk “resource play”

~8,000 wells drilled to date in the play w/ ~95%

historical drilling success rate

Focus of 2005 / 2006 drilling program to provide low-

risk source of production / cash flow

New Albany Shale (~75% of net acreage)

Emerging shale play with significant upside potential

Horizontal drilling key to unlocking potential of NAS

15-well pilot program yielding encouraging results

Schlumberger Holditch reservoir engineering indicates

1bcf+ horizontal wells on 160-acre spacing

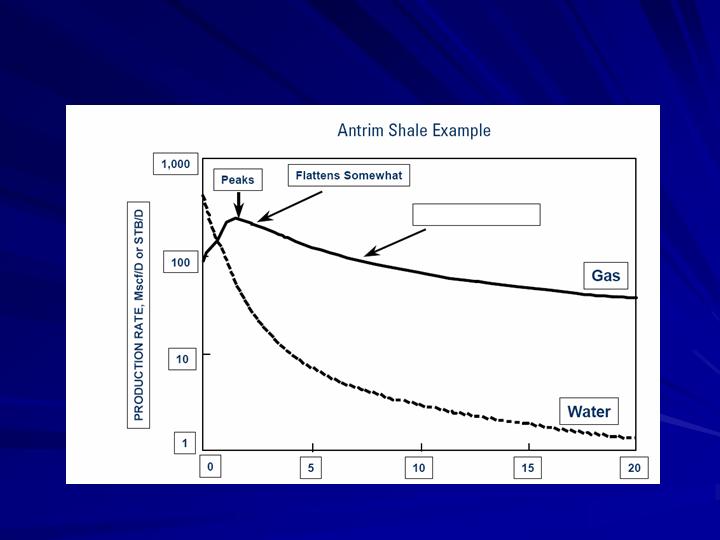

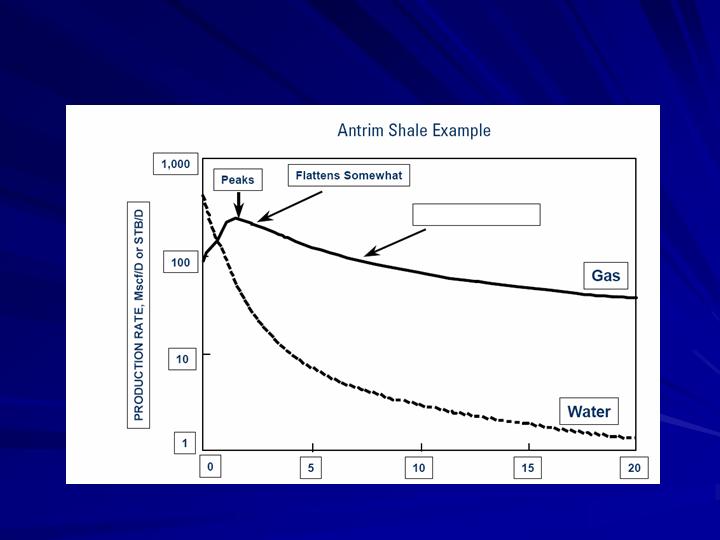

Antrim Shale Well Economics

Vertical Well Cost: ~ $300,000

Well Depth: 250 – 1,500 ft.

Reserves / Well: ~0.5 bcf (avg.)

Peak Production: ~ 150 mcf / day avg.

Time to Peak: 6-12 mo. (de-watering period)

Decline Rate: ~ 7% / yr.

Productive Life: ~ 40 years

Avg. W.I.: 46%

IRR: ~30%+ @ $5.00 gas

Antrim Shale Production Profile

~ 7% / yr.

Source: Schlumberger Holditch.

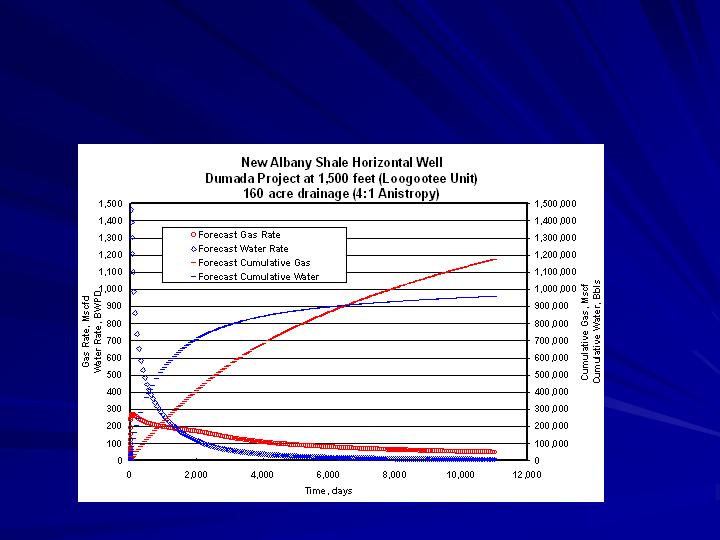

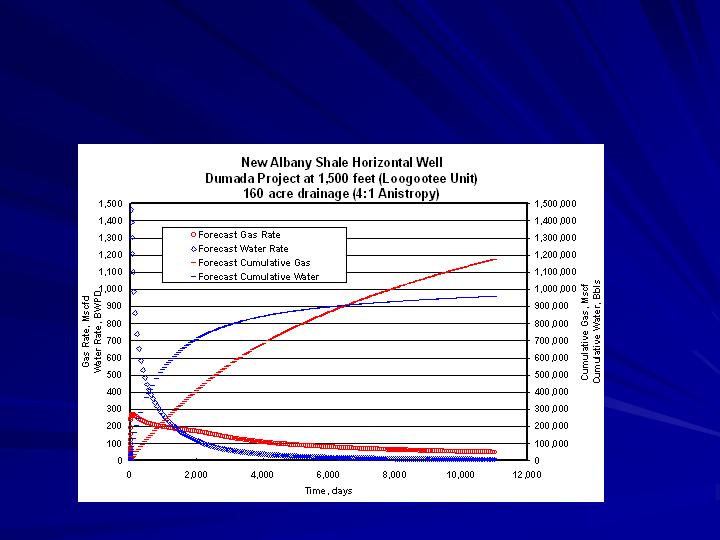

New Albany Shale Well Economics

Horizontal Well Cost: ~ $750,000

Well Depth: 500 – 2,500 ft.

Reserves / Well: ~0.7 – 1.2 bcf

Peak Production: ~ 200-300 mcf / day

Time to Peak: 6-12 mo. (de-watering period)

Decline Rate: ~ 5% / yr.

Productive Life: ~ 30 years

Average W.I.: 43%

IRR: ~45% @ $5.00 gas

New Albany Shale Production Profile

Source: Schlumberger Holditch.

1bcf+ wells, drilled and completed for $750,000.

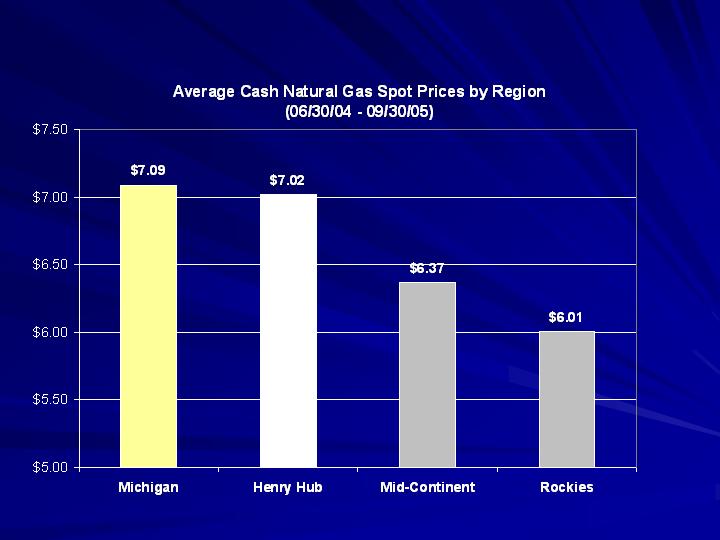

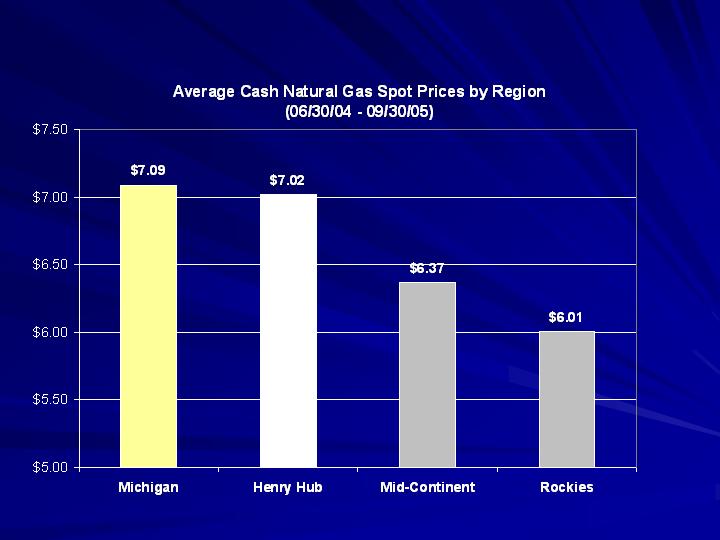

Natural Gas Price Differentials

Source: Bloomberg.

Proved Reserves

Current Schlumberger Holditch reserve reports

only ascribe proved reserves to the Antrim Shale

48bcf proved reserves as of 8/1/05

By 1H’06, a number of factors are expected to

increase proved reserves to ~100bcf:

Continued drilling activity in both the Antrim and

New Albany Shale (200 gross wells targeted for 2006)

Increased average working interests in new properties,

with 100% W.I. targeted where possible

Addition of developed / PUD New Albany Shale locations

to proved reserve category

Production Profile

Q4’05 estimated net production of 4mm cf/d

This represents 45% production growth vs. Q3’05

(2.8mm) and 260% growth vs. Q2’05 (1.1mm)

As new wells are drilled and existing wells de-water,

net production is expected to grow by ~150% by mid-

2006 to ~10mm cf/d

By the end of ’06, net production is expected to

approach15mm cf/d as New Albany Shale wells begin

to contribute meaningfully to production

A large inventory of drilling prospects and an

aggressive development program have the potential to

provide for years of strong production growth

Management Team

The 4 key members of Aurora’s management team each

have between 13 – 23 years of experience in oil & gas.

William Deneau (Chief Executive Officer)

21 yrs. experience in oil & gas industry

18 yrs. experience in Antrim shale

CEO of Aurora since 1997

John Miller (VP, Exploration & Production)

17 yrs. experience in oil & gas industry

Focused on Michigan / Indiana shale E&P since 1994

Current role at Aurora since 1997

Thomas Tucker (VP, Land & Development)

23 yrs. experience in oil & gas industry

Current role at Aurora since 1997

Lori King (Chief Financial Officer)

Joined Aurora in 2001 after serving as CFO of an independent E&P

company for 8 yrs

Trained as CPA to oil & gas clients

Partners

Forest Oil

Samson Resources

El Paso Production Company

Aurora has a number of drilling joint ventures with

industry leaders that allow it to more effectively leverage

its asset base and spread development risks and cost:

Key Operating Statistics

Total Net Acres: 290,820

Total Net Wells (9/30/05): 106

Proved Reserves (8/1/05): 48 bcf

Avg. Operating Cost (Q4’05E): $2.25 / mcf

Average F&D Cost

$0.60 / mcf (Antrim)

$0.75 / mcf (New Albany)

Daily Production (Q4’05E): 4,076 mcf/d

Key Financial Statistics

Current Stock Price (11/11/05): $3.48

Common Shares (11/1/05): 59,373,693 (1)

Warrants: 22,032,500 ($1.72 exercise price) (2)

Pro Forma Net Debt: ~$28m

(1)

Excludes approximately 6.8m shares pursuant to outstanding options.

(2)

Warrants issued in conjunction with equity private placements in early 2005.

Summary

Aurora is a Resource Play Developer

Gas Manufacturer

ROR expected to be exceptional

Growth Oriented Company