Stock Symbol: CDNR

Exchange: OTCBB

Basic Shares Outstanding: 81.3 million

http://www.auroraogc.com

1

Disclaimer

In this slide presentation, statements regarding our goals and objectives, our

expected methods of operation and development strategies, our expected and

potential production volumes, the volume of potential reserves, anticipated oil and

gas prices, anticipated market growth, potential drilling locations, the timing of

drilling activities, when wells will begin producing, how many wells will be drilled,

potential new development theatres, the spacing of wells, drilling and operating

costs, and other statements that are not historical facts, contain predictions,

estimates and other Forward-Looking Statements within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Although we believe that our expectations are based on reasonable assumptions, we

can give no assurance that our goals will be achieved. Important factors that could

cause our actual results to differ materially from those included in the Forward-

Looking Statements include the timing and extent of changes in commodity prices for

oil and gas, changes in market demand, drilling and operating risks, the availability of

drilling rigs, uncertainties about the estimates of reserves, the availability of

transportation pipelines, changes in laws or government regulations, unforeseen

engineering and mechanical or technological difficulties in drilling the wells,

operating hazards, weather related delays, the loss of existing credit facilities,

availability of capital, and other risks more fully described in our filings with the

Securities and Exchange Commission, including Form 10-KSB filed on March 31,

2006. We may also change our business focus as new opportunities arise. All

Forward-Looking Statements contained in this presentation, including any forecasts

and estimates, are based on management’s outlook only as of the date of this

presentation and we undertake no obligation to update or revise these Forward-

Looking Statements, whether as a result of subsequent developments or otherwise.

2

Executive Summary

Low-risk development of unconventional gas

reserves in the Antrim and New Albany Shale

Over 460,000 net acres with ~3,196 potential drilling

locations and ~2.7 Tcf in potential reserves

Rapidly growing proved reserves and production

~150 gross wells drilled in 2005 with ~95% success

2006 Outlook:

200 well drilling program

Proved reserves expected to reach 100 Bcf by mid-year

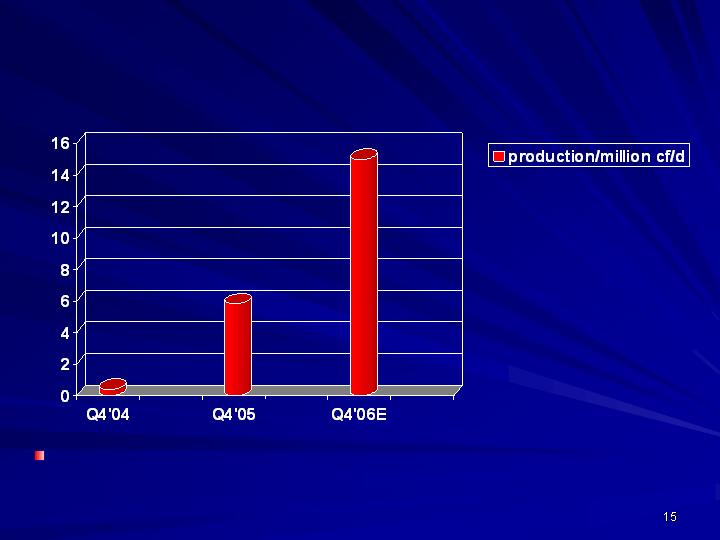

Net production expected to reach 15 million cf/d in Q4’06

AMEX listing targeted in 1H’06

3

The Company

Cadence/Aurora - reverse merger October 31, 2005

~$482 million pro forma market capitalization (1)

Aurora has been actively acquiring acreage in the

Antrim Shale (Michigan) and New Albany Shale

(Indiana / Kentucky) for ~10 years

$100 million BNP Paribas senior credit facility with $40

million borrowing base

$50 million TCW Mezzanine drilling facility in place

(1)

Fully diluted using Treasury Stock Method.

4

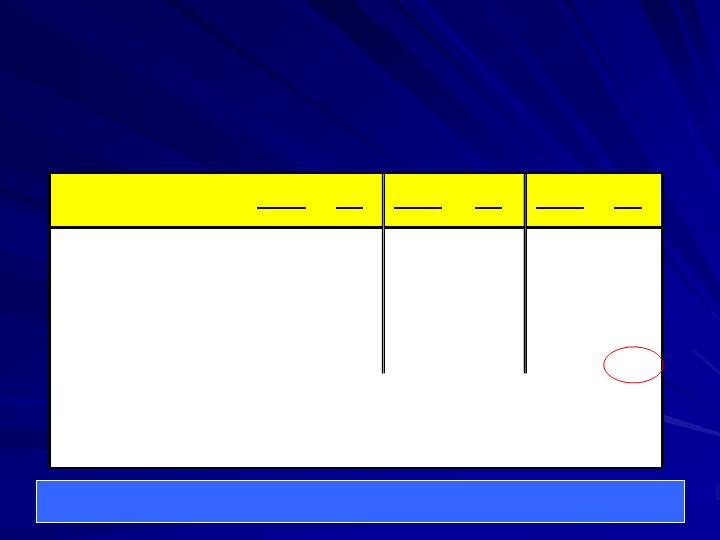

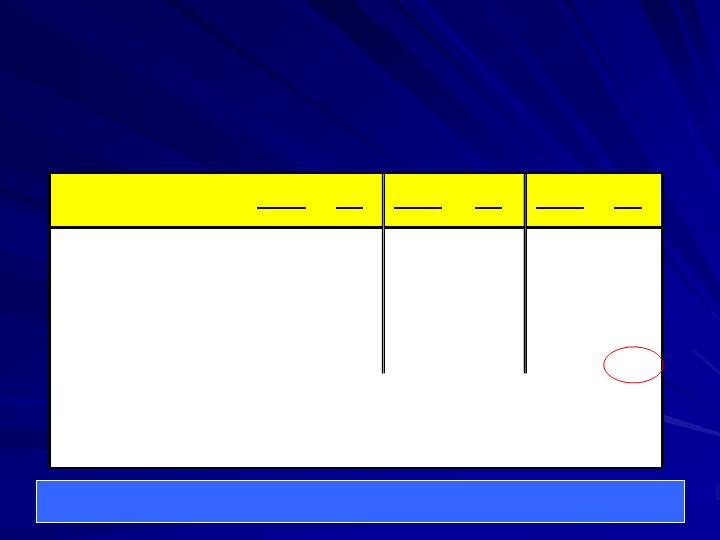

Summary Acreage Position

The Company has ~3,196 potential drilling locations

with ~2.7 Tcf in estimated total potential reserves.

Acreage potential does not currently translate into Proved Reserves.

Generating Proved Reserves will require successful drilling.

5

GROSS

NET

GROSS

NET

GROSS

NET

Leasedhold Position (acres)

(1)

214,319

85,288

681,230

374,810

895,549

460,098

Well Spacing (acres/well)

100

100

160

160

Implied Total Potential Wells

(2)

2,143

853

4,258

2,343

6,401

3,196

Est. Recoverable Reserves/Well

(bcfe)

(3)

0.5

0.5

1.0

1.0

IMPLIED TOTAL POTENTIAL

RESERVES (bcfe)

1,072

427

4,258

2,343

5,330

2,770

(1)

Potential Shale Acres as of 3/31/06.

(2)

Calculated as total acres divided by well spacing (acres/well).

(3)

Company estimates.

ANTRIM SHALE

NEW ALBANY SHALE

TOTAL

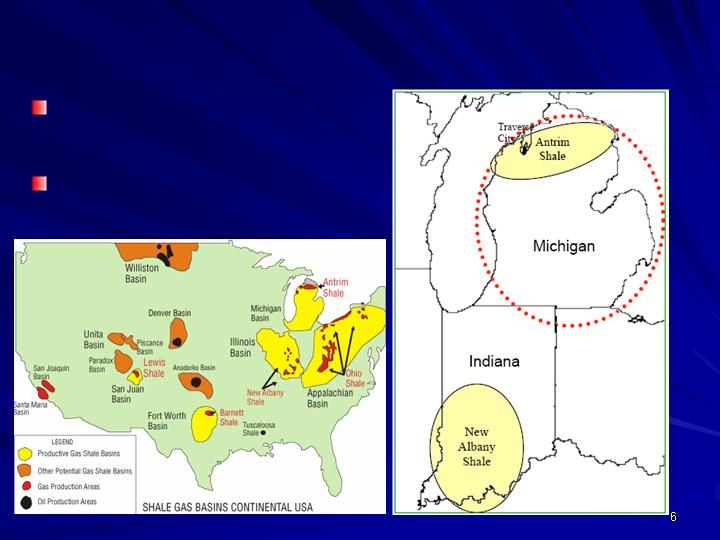

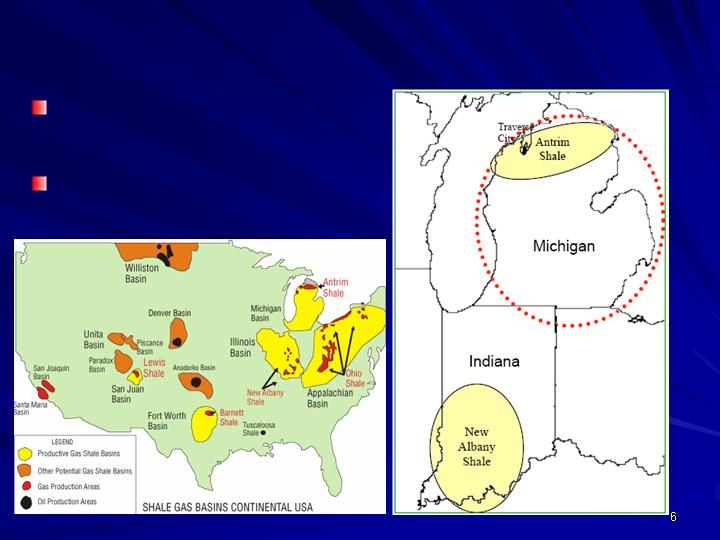

Antrim and New Albany Shale Plays

Relatively shallow

blanket shale formations

High-upside, lower-risk

development potential

6

Antrim and New Albany Shale Plays

Antrim Shale (~19% of net acreage)

Well-developed, low-risk “resource play”

~8,000 wells drilled to date in the play w/ ~95%

historical drilling success rate

Focus of 2005 / 2006 drilling program to provide low-

risk source of production / cash flow

New Albany Shale (~81% of net acreage)

Emerging shale play with significant upside potential

Horizontal drilling key to unlocking potential of NAS

5-well pilot program yielding encouraging results

Schlumberger Holditch reservoir engineering indicates

1bcf+ horizontal wells on 160-acre spacing

7

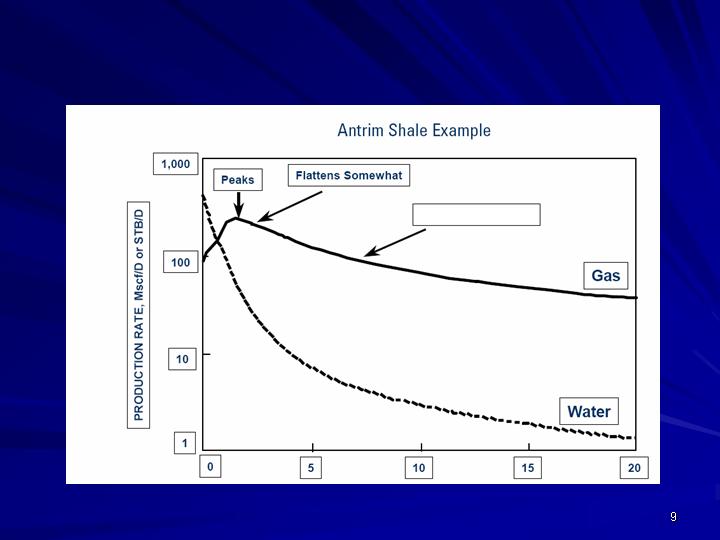

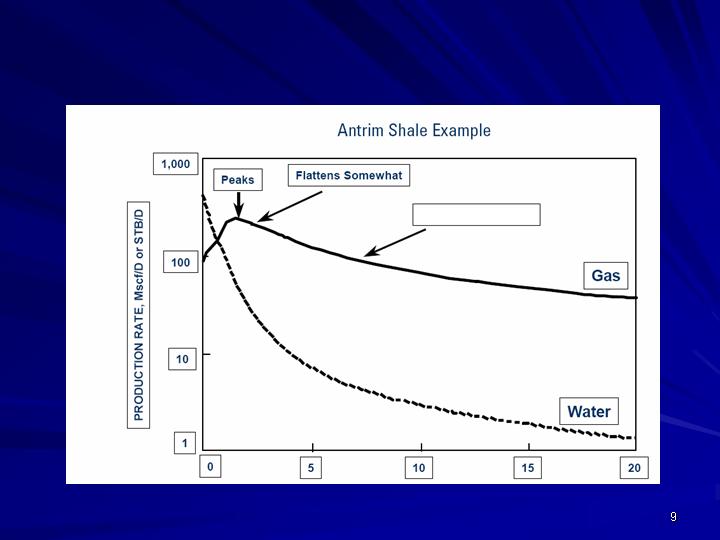

Antrim Shale Well Economics

Vertical Well Cost: ~ $300,000

Well Depth: 250 – 1,500 ft.

Reserves / Well: ~0.5 bcf (avg.)

Peak Production: ~ 150 mcf / day avg.

Time to Peak: 6-12 mo. (de-watering period)

Decline Rate: ~ 7% / yr.

Productive Life: ~ 40 years

Avg. W.I.: 46%

IRR: ~30%+ @ $5.00 gas

8

Antrim Shale Production Profile

~ 7% / yr.

Source: Schlumberger Holditch.

9

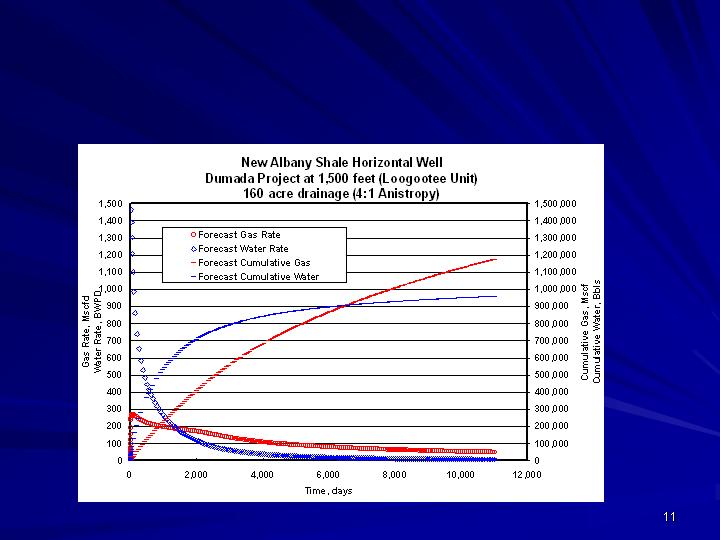

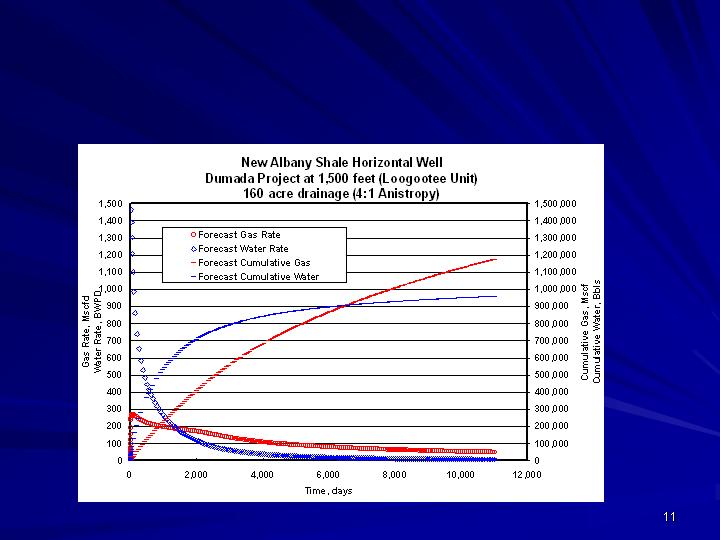

New Albany Shale Well Economics

Horizontal Well Cost: ~ $750,000

Well Depth: 500 – 2,500 ft.

Reserves / Well: ~0.7 – 1.2 bcf

Peak Production: ~ 200-300 mcf / day

Time to Peak: 6-12 mo. (de-watering period)

Decline Rate: ~ 5% / yr.

Productive Life: ~ 30 years

Average W.I.: 43%

IRR: ~45% @ $5.00 gas

10

New Albany Shale Production Profile

Source: Schlumberger Holditch.

1bcf+ wells, drilled and completed for $750,000.

11

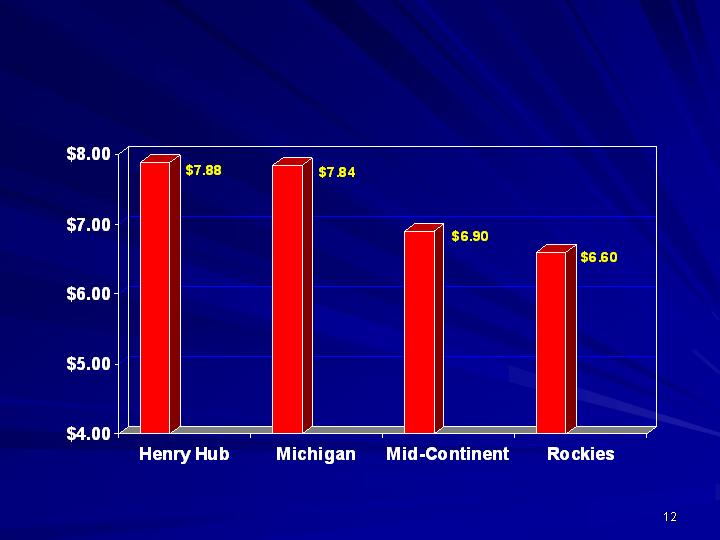

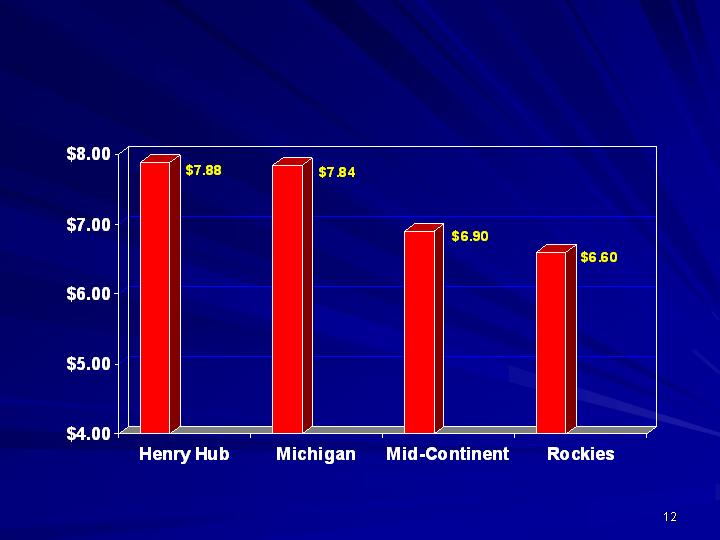

Natural Gas Price Differentials

Source: Bloomberg.

(06/30/04 – 2006 YTD)

12

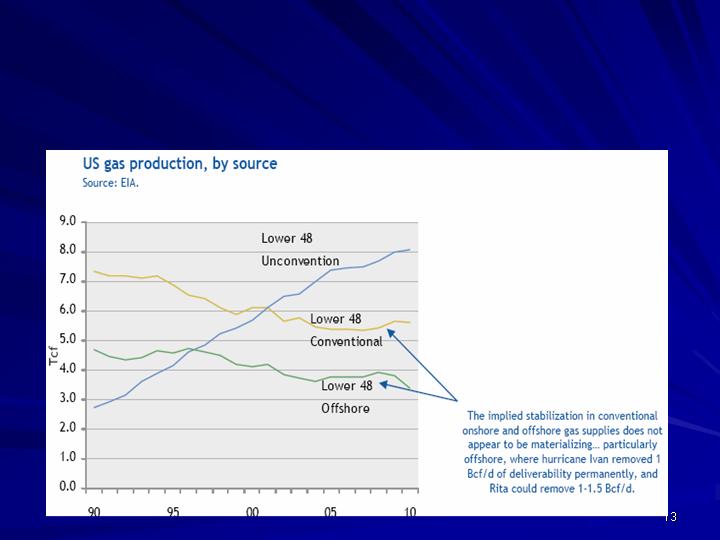

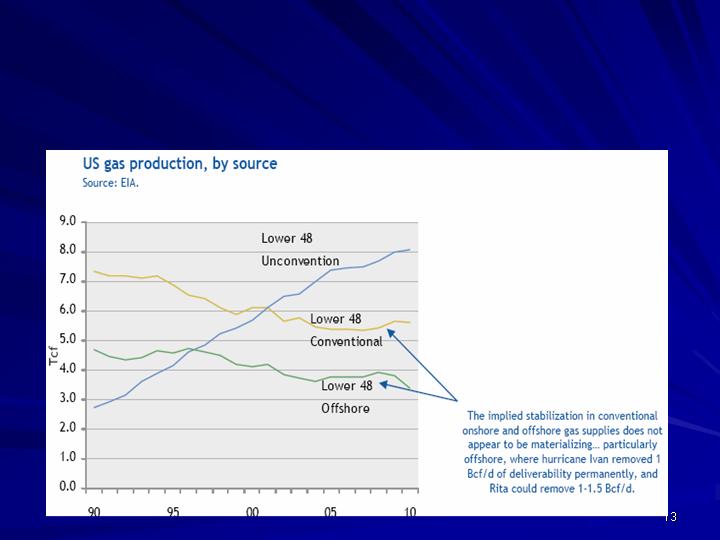

Unconventional Gas Growth

Unconventional gas sources are expected to be the key

source of domestic production growth.

Source: JP Morgan.

13

Proved Reserves

Proved reserves 12/31/05 64 Bcf

Proved reserves acquired 1/06 24 Bcf

Reserve reports prepared by:

Schlumberger: Data & Consulting Services

Netherland, Sewell & Associates, Inc.

Ralph E. Davis Associates, Inc.

Note: Reserve reports do not include New Albany Shale

By 1H’06, a number of factors are expected to increase

proved reserves to ~100 bcf:

Continued drilling activity (200 gross wells targeted for 2006)

New Albany Shale: Proved Reserves

14

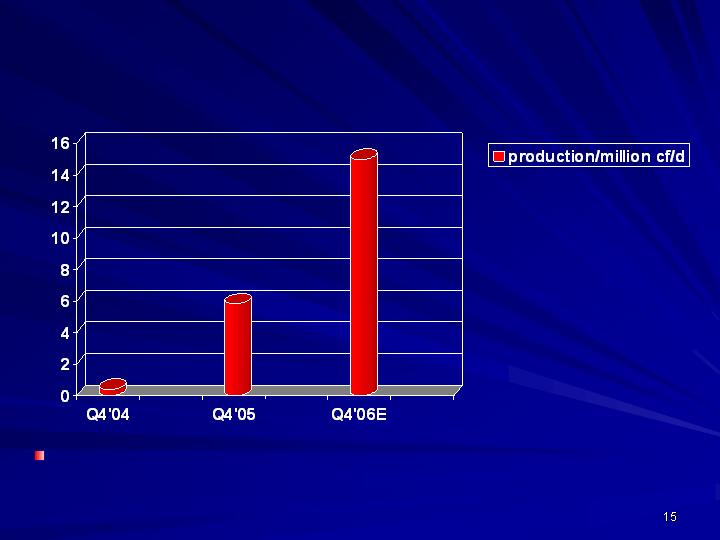

Production Profile

A large inventory of drilling prospects and an aggressive development

program have the potential to provide for years of strong production growth

15

Aurora’s Low Impact Natural

Gas Production System

Low Pressure and Safe

Small modular style compression facilities

100% Electrified and Quiet

Stainless steel pumps

Fiberglass tubing

Poly pipeline systems (no decay or leaking)

Improved production of shale natural gas

Properly designed flow systems (oversized pipelines to

guarantee maximum gas flow)

Closed system of disposing water (no tanks)

16

Cost-Efficient Production

Technology is Key

Advantages of Aurora’s low pressure

system of producing wells

reduces development costs

increases production rates

extends commercial life of wells

facility capacity maximized over life of wells

17

Traditional

Large

Central

Compressor

Unit

Aurora’s

Skid-

mounted

Compressor

and

Separator

18

10" Poly Pipe used as flow lines for gas and water

19

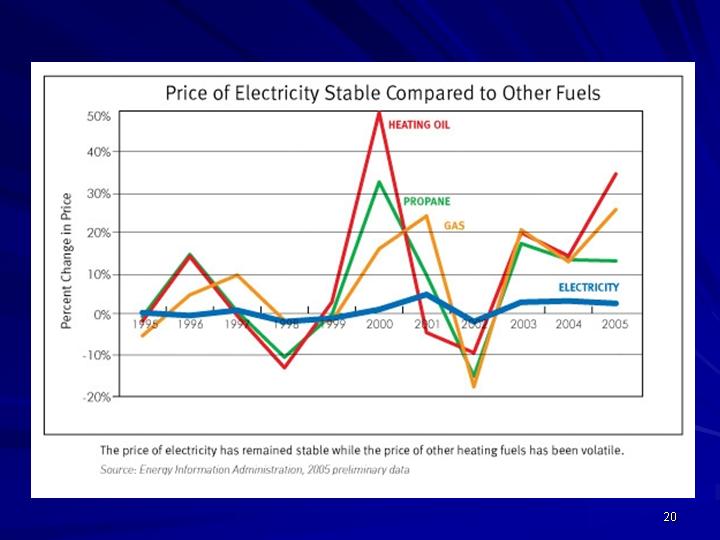

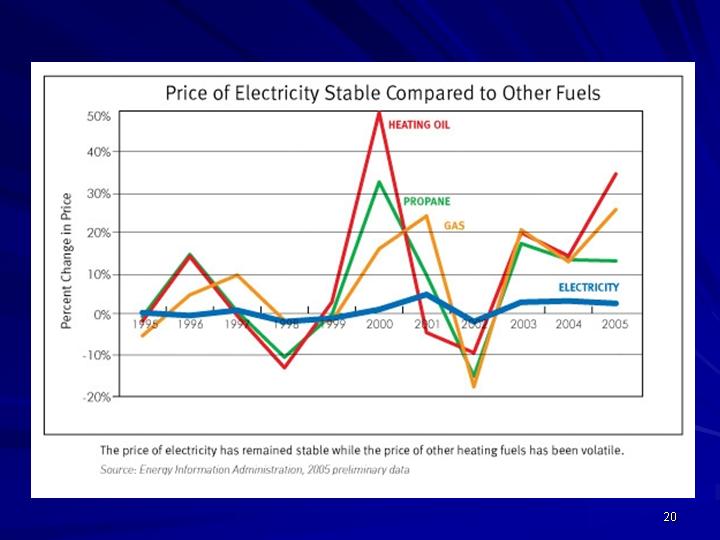

20

Management Team

The 4 key members of Aurora’s management team each

have between 16 – 24 years of experience in oil & gas.

William Deneau (Chief Executive Officer)

22 yrs. experience in oil & gas industry

19 yrs. experience in Antrim shale

CEO of Aurora since 1997

John Miller (VP, Exploration & Production)

18 yrs. experience in oil & gas industry

Focused on Michigan / Indiana shale E&P since 1994

Current role at Aurora since 1997

Thomas Tucker (VP, Land & Development)

24 yrs. experience in oil & gas industry

Focused on Land Acquisition and Drilling

Current role at Aurora since 1997

Lori King (Chief Financial Officer)

Trained as CPA to oil & gas clients

16 years experience in the oil and gas industry

Current role at Aurora since 2001

21

Partners

Samson Resources - Tulsa, OK

El Paso Production Company –

Houston, TX

Rex Energy – College Park, PA

Aurora has a number of drilling joint ventures with

industry leaders that allow it to more effectively leverage

its asset base, spread development risks and cost:

22

Key Operating Statistics

Total Net Acres: 460,098

Total Net Wells (12/31/05): 182

Proved Reserves: 88 Bcf (total thru 1/31/06)

Avg. Operating Cost (2005): $2.73 / Mcf

Average F&D Cost

$0.60 / Mcf (Antrim Shale)

$0.75 / Mcf (New Albany Shale)

23

Key Financial Statistics

Current Stock Price (03/28/06): $5.46

Common Shares (2/07/06): 81,298,683

Warrants: 2,249,500 ($1.71 exercise price)

Options: 3,165,776 ($0.75 exercise price)

Pro Forma Net Debt (3/31/06): ~$83 million

24

Summary

Company Focus:

Develop Significant Acreage in Shales

Multi-year Drilling Inventory:

2 TCF potential

Proved Reserves Expected to Grow:

To 100 BCF in 2006

Rapid Production Growth:

15 million cf/d target by year end

25

Stock Symbol: CDNR

Exchange: OTCBB

Basic Shares Outstanding: 81.3 million

http://www.auroraogc.com

Investor Relations Contact:

Jeff Deneau: (231) 941-0073

26