2006 Southwestern Showcase

Dallas, Texas

November 15, 2006

Exploiting Unconventional Gas Reservoirs in

the Antrim and New Albany Shales

Disclaimer

In this slide presentation, statements regarding our goals and objectives, our expected

methods of operation and development strategies, our expected and potential production

volumes, the amount of potential reserves and drilling locations, the timing of drilling

activities, when wells will begin producing, how many wells will be drilled, potential new

development theatres, the spacing of wells, drilling and operating costs, and other

statements that are not historical facts, contain predictions, estimates and other Forward-

Looking Statements within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Although we believe that our

expectations are based on reasonable assumptions, we can give no assurance that our

goals will be achieved. Important factors that could cause our actual results to differ

materially from those included in the Forward-Looking Statements include the timing and

extent of changes in commodity prices for oil and gas, changes in market demand, drilling

and operating risks, the availability of drilling rigs, uncertainties about the estimates of

reserves, the availability of transportation pipelines, changes in laws or government

regulations, unforeseen engineering and mechanical or technological difficulties in drilling

and operating the wells, operating hazards, weather related delays, the loss of existing

credit facilities, availability of capital, and other risks more fully described in our filings with

the Securities and Exchange Commission, including Form 10-KSB filed March 31, 2006. We

may also change our business focus as new opportunities arise. All Forward-Looking

Statements contained in this presentation, including any forecasts and estimates, are based

on management’s outlook only as of the date of this presentation and we undertake no

obligation to update or revise these Forward-Looking Statements, whether as a result of

subsequent developments or otherwise.

Key Investment Highlights

Focused on two unconventional “Resource Plays”

Extensive multi-year development drilling inventory in two project areas – Antrim and New

Albany Shale plays

Low-risk, repeatable drilling opportunities with large amounts of resources in place

Over 621,000 net acres assembled, ~ 93%(1) undeveloped as of 6/30/06

~2.3 Tcfe of reserve potential on 2,951 identified drilling locations

Accelerating transition from an acreage builder to a gas “harvester”

301 net wells budgeted to be drilled over 18-months (06/30/06 – 12/31/2007) with 181

Bcfe of potential

Extensive operating experience in Antrim and New Albany Shale plays

Application of leading edge technologies increases recoveries and drives returns

Strong Management / Shareholder alignment

Officers and Directors own ~12%(2) of which ~73% is locked-up through 11/01/08

(2) As of August 15th 2006

(1) 93% refers to undeveloped shale acreage

Aurora Overview

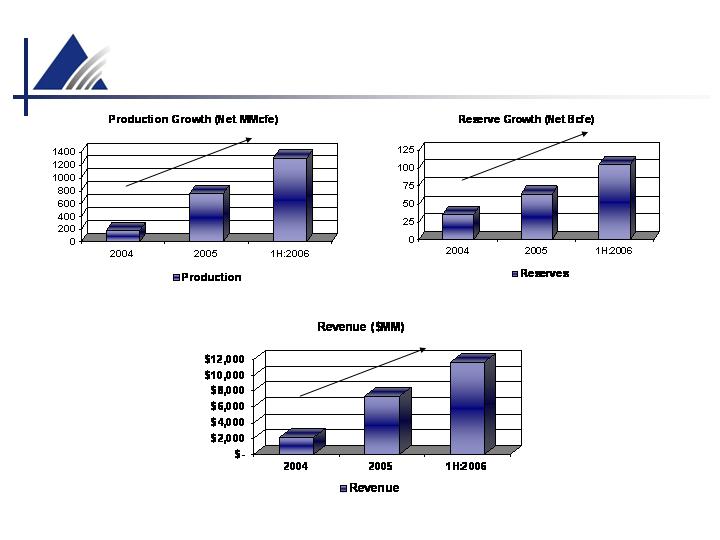

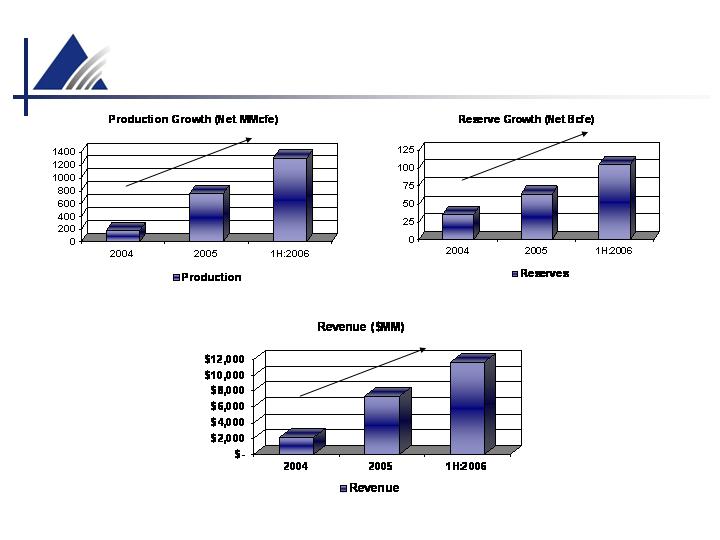

Total Proved Reserves (6/30/06): 105 Bcfe

% Proved Developed: 69%

Est. Net Average Daily Prod. (9/06): 8,074 mcfe/d

Net Shale Acreage (6/30/06): 575,453

% Undeveloped: ~93%

Budgeted Net Wells:

Second half of 2006E: 73

18 month plan: 301

Identified Locations: 2,951

Drilling inventory(1): 10+ years

Portfolio Highlights

168 net wells drilled over the past 30 months

96% success rate

170 net wells producing

38 net wells awaiting hook-up

Historical Drilling Success

(1) Based on 2007 budgeted wells to be drilled.

As of 6/30/06.

Net Acreage by Area

Other

8%

Antrim Shale

20%

New Albany Shale

72%

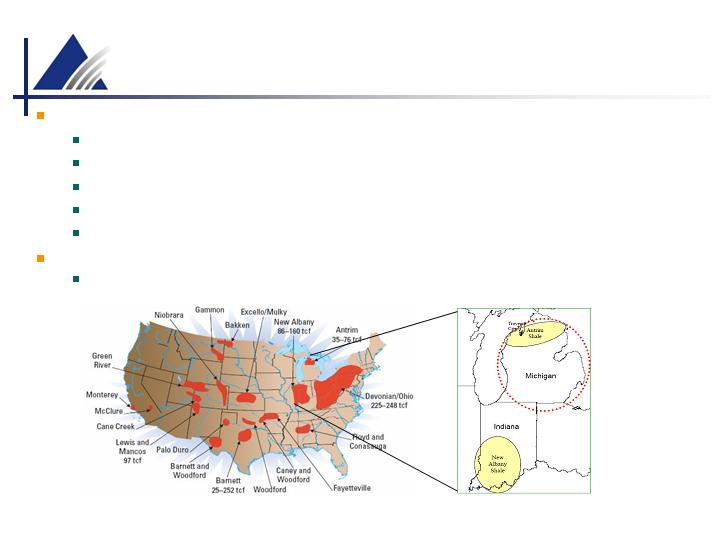

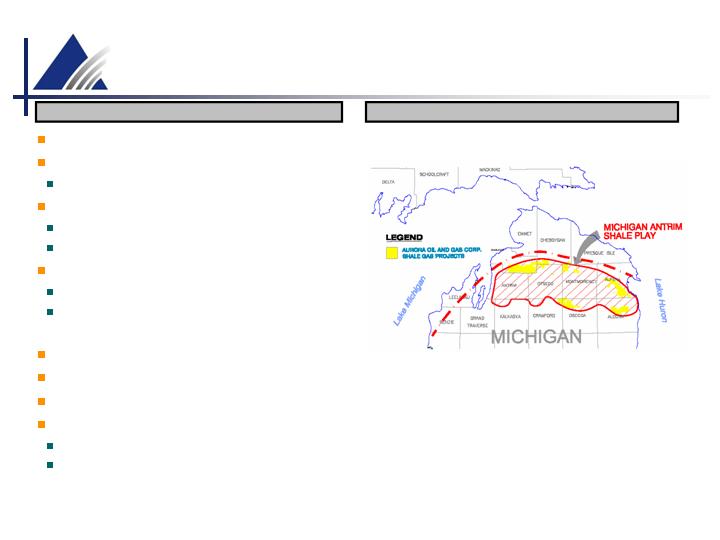

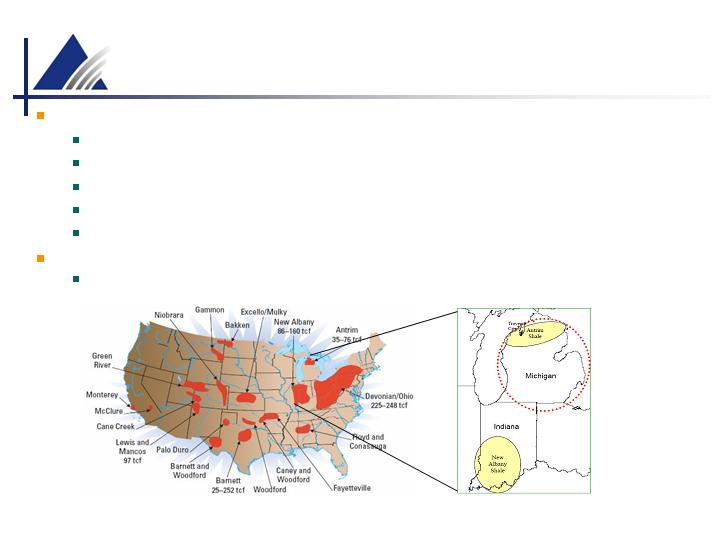

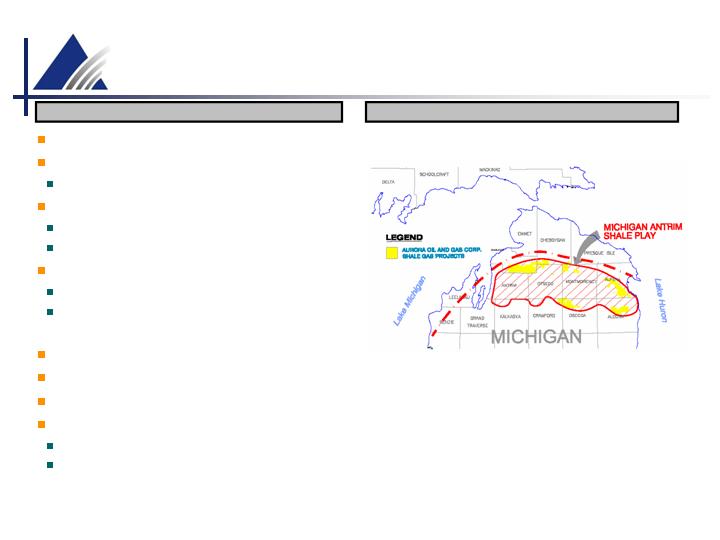

Map of Operations

The Antrim Shale is an established play that provides significant upside to Aurora’s reserve base

Similar characteristics to other shale plays

Extensively drilled (over 8,000 wells) with a historical success rate of over 95%

Shallow blanket shale formation

Characterized by low development risk and high returns

Current acreage has over 600 Bcfe of potential

The New Albany Shale, though less developed, appears to have similar characteristics to the Antrim

Current acreage has over 1.5 Tcfe of potential

Resource Potential

Over 2.3 Tcfe of reserve potential based on conservative spacing and per well reserve

estimates

Provides over 10 years of drilling inventory at current drilling pace

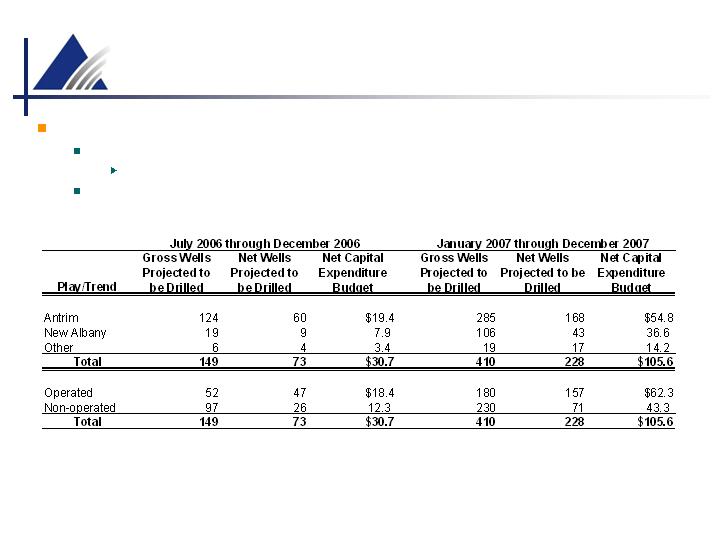

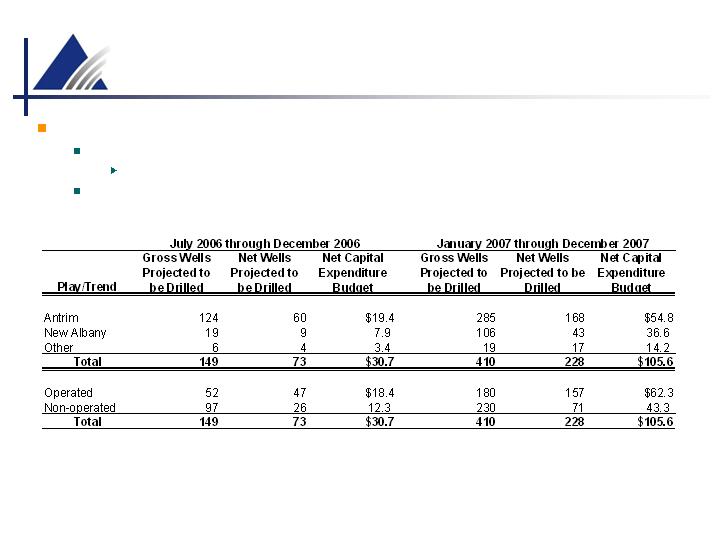

Aurora’s 18-Month Drilling Plan

18-month drilling plan includes over 301 net identified drilling locations

Estimated reserve potential of over 181 Bcfe on planned drilling capital of over $136 million

Excludes potential PUD locations that can be booked with success

Future activity will come with increased working interest and a higher percentage of operated wells

Experienced Leadership

Operational Team

William Deneau

C.E.O. & President

22 Years

Ronald Huff

C.F.O.

27 Years

John Miller

V.P. Science and

Strategic Planning

18 Years

Thomas Tucker

V.P. Operations

25 Years

2 senior geologists, 1 staff geologist, 1 senior petroleum engineer, 1 drilling superintendent, 1

production supervisor, 1 completion engineer

3 senior land professionals

Operational managers have an average of 24 years of experience in the oil and gas business

Shareholder / Management / Employee alignment

Officers and Directors own ~15% of common stock(1)

(1) As of August 15th 2006

Antrim Shale Project – Development Stage

Portfolio Highlights

Unconventional Shale Play

Net Acreage: 125,993

Net Undeveloped Acreage 90,483

As of 6/30/06:

Total Reserves 101 Bcfe

Estimated Sept. 2006 Production 7,438 Mcfe/d

Net Budgeted Drilling Locations:

Second half of 2006E 60

2007E 168

Historic w.i.: 48%

Anticipated w.i.: 56%

Pricing: NYMEX:+/-$.05

Hedges:

5,000 MMBtu/day @ $8.59 through March 2007

5,000 MMBtu/day @ $9.00 from April 2007 through

December 2008

Antrim Shale

Note: Acreage as of 6/30/06.

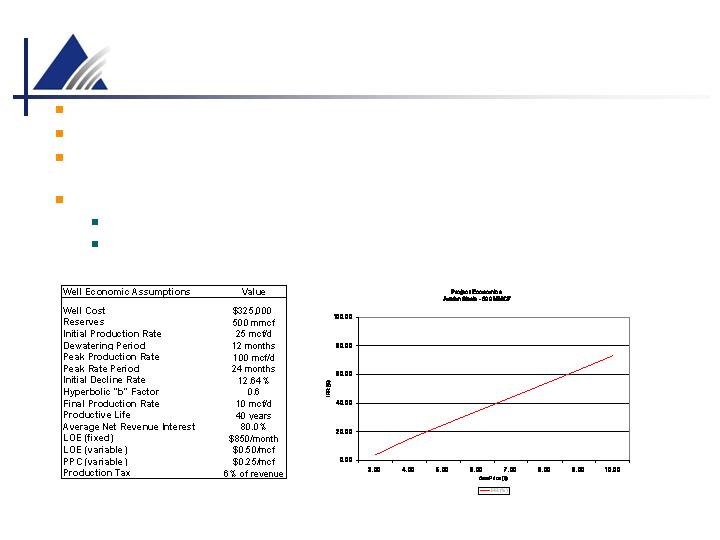

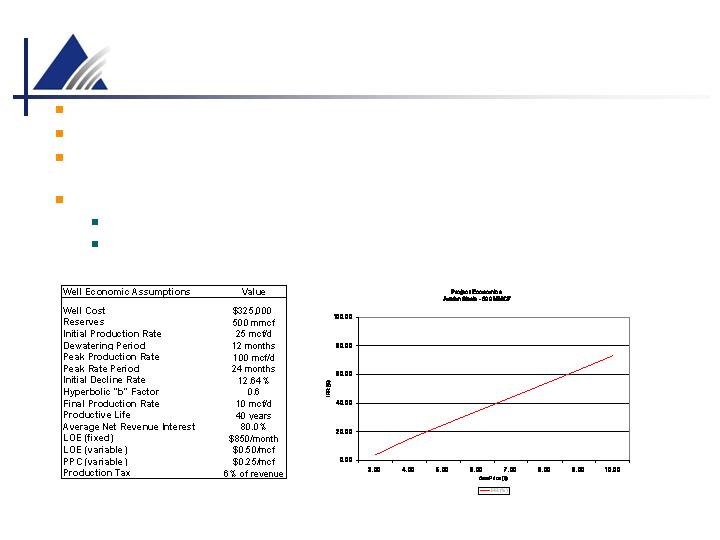

Antrim Shale Project Economics

Established, low-risk “Resource Play”

Over 8,000 wells drilled to date in the play w/ ~95% historical drilling success rate

Focus of 2005 / 2006 / 2007 drilling program to provide low-risk source of reserve, production

and cash flow growth

At $6.00 gas we generate an IRR of 35 – 40% (excludes hedging impact)

5,000 MMBtu/day @ $8.59 through March 2007

5,000 MMBtu/day @ $9.00 from April 2007 through December 2008

Antrim Shale Type Curve

Unique Low Pressure Production Technology

Aurora’s Skid-mounted compressor and

water separator

Reduces development costs

Increases production rates

Extends the commercial life of the wells

Facility capacity maximized over life of the wells

Electrical fired

Traditional Large Central Compressor Unit

High production costs

Lower production rates

Shortens commercial life of the well

Less efficient use of facility capacity

Gas fired

Patent Pending Electric Submersible Pumps

(ESP’s) / Tubing Connection

Patent pending on ESP/composite tubing

connection

Allows for “rig-less” installation and

maintenance of ESP’s using coiled tubing

spread

Leads to significant cost savings and

operational advantages especially for

ongoing maintenance

New Albany Shale Project: Early Stage

Development

Portfolio Highlights

Unconventional Shale Play

Net Acreage: 449,460

Net Undeveloped Acreage: 444,494

As of 6/30/06:

Total Reserves: 2 Bcfe

Estimated Sept. 2006 Production: 123 Mcfe / day

Net Budgeted Drilling Locations:

Second Half of 2006E: 9

2007E: 43

Historic w.i.: 17%

Anticipated w.i.: 42%

Pricing: NYMEX: - $0.30

Lease Terms: 5 yr. primary w/

5 year option

New Albany Shale

Note: Acreage as of 3/31/06.

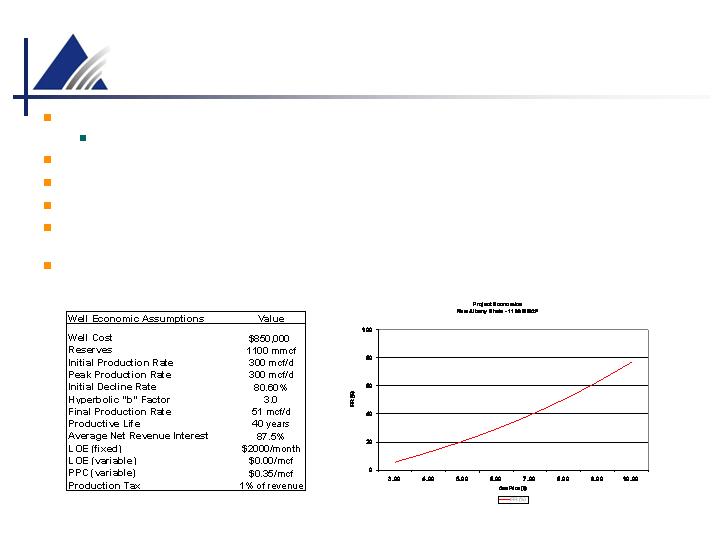

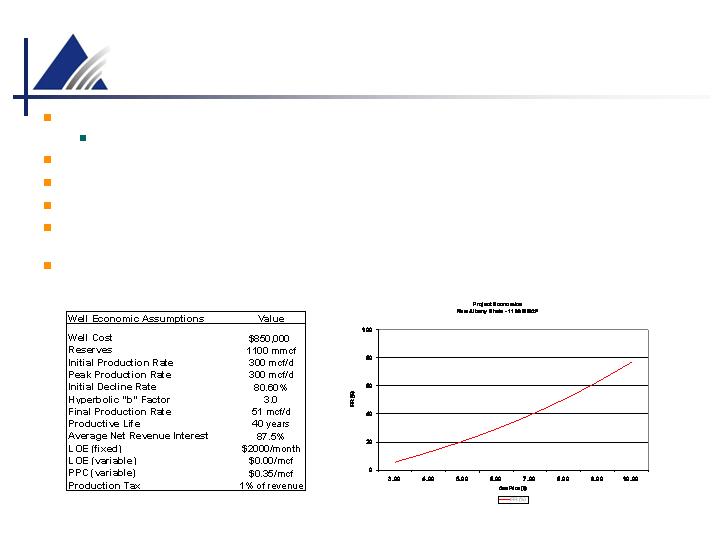

New Albany Shale Project Economics

AOG has participated in the drilling of 123 vertical and 28 horizontal wells since 1995

Provided data -- defining extent and location of shale

Horizontal drilling - key to unlocking potential of New Albany Shale

14 horizontal wells currently producing and validating economic assumptions

Independent review performed by Schlumberger Data and Consulting Services

Schlumberger reservoir engineering indicates 0.9 – 1.3 bcfe horizontal wells on 320-acre

spacing

At $6.00 gas we generate an IRR of 28 – 35%

New Albany Shale Type Curve

The “Fractured Fairway” of the NAS

1)

El Paso NAS Pilot (14 wells)

2)

Horizontal Test (3.5 bcfg-single well)

3)

1950’s Loogootee Field (3 verticals @750 mcfg/d)

4)

Baker Well Blowout (3,000 mcfg/d)

5)

Horizontal (3 big gas shows)

6)

Horizontal Well (strong gas flow)

7)

Diversified Pilot Wells (announced 100 well program)

8)

Highly Fractured NAS Cores

9)

Highly Fractured NAS Test

10)

1970’s Linton NAS Field

11)

Gas Well (vertical @ 700 mcfg/d)

12)

Aurora Pilot Well (Cardinal Unit)

13)

Aurora Pilot Well (Eagle Unit)

14)

1980’s Coalmont NAS Gas Field (vertical wells)

15)

Test Wells (strong gas flows)

16)

Yankeetown Test Well (1,200 mcfg/d)

17)

Dickeyville Test Well (4,400 mcfg/d)

18)

Fritz Well (strong gas shows)

19)

Russellville Field (vertical wells)

Kentucky

Indiana

Fractured Fairway

Early Stage Development Project Reserve

Add Potential

Early stage development projects benefit

from PUD offset booking potential

Leads to rapid reserve growth

13 wells have added 25 PUD locations at

6/30/2006

18-month drilling budget in New Albany

shale

52 net wells with 57.2 Bcfe of net potential

Provides opportunity to add a multiple of

reserve totals with PUD offset bookings

In time, the mix will shift to a more

balanced reserve-production growth profile

Note: Represents a 1,600 acre section

PDP Location

PUD Offset

Historical Operating Results

EBITDA and LOE

Aurora Summary

Two compelling shale plays at different stages of development:

(1) Antrim: Development Stage Project

1,260 locations with 630 Bcfe of net potential

228 net wells to be drilled over 18-months

~$74.2 million in drilling capital expenditures

114 Bcfe of net reserve potential

(2) New Albany: Early Stage Development Project

Encountering encouraging results from first 14 wells

Validating assumptions about the New Albany Shale

1,405 locations with 1.5 Tcfe of net potential

52 net wells to be drilled over 18-months

~$44.5 million in drilling capital expenditures

57 Bcfe of net reserve potential

(3) Other

21 net wells to be drilled over 18 months

+181 Bcfe

18-month Plan - Reserve Impact

Questions?

Contact:

Jeffrey W. Deneau - Investor Relations

Aurora Oil & Gas Corp.

4110 Copper Ridge Drive, Suite 100

Traverse City, MI 49684

www.auroraogc.com

T: 231-941-0073

E: jdeneau@auroraogc.com

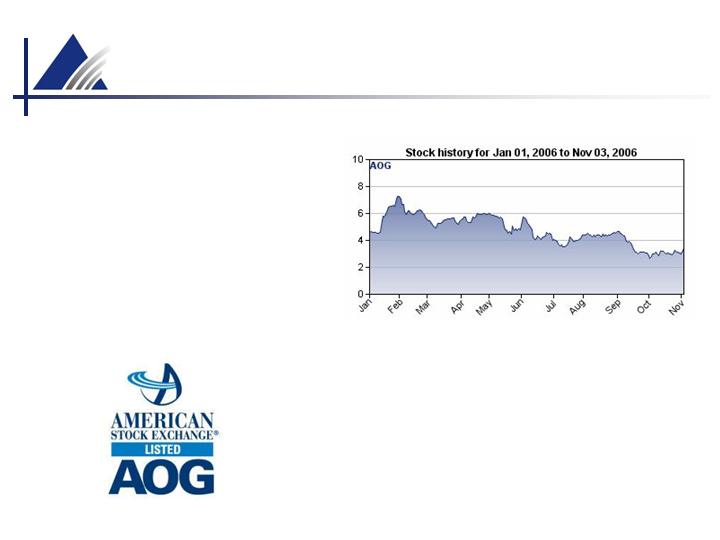

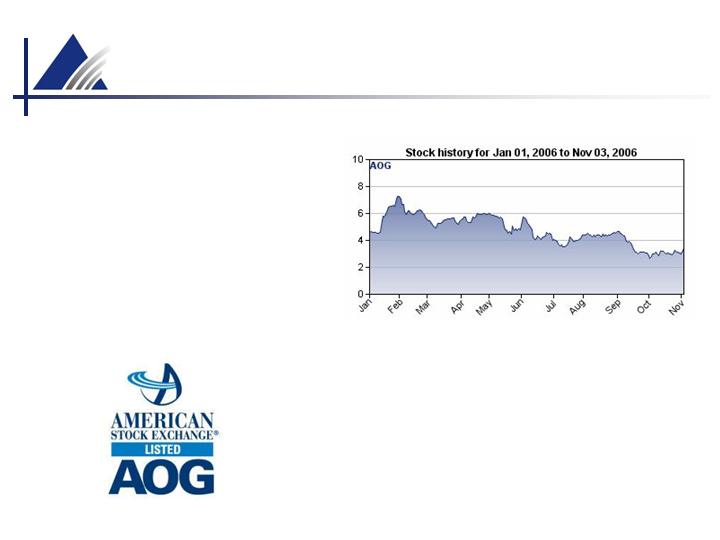

Share Price: $3.38

Shares Outstanding: 82.025M

Market Cap: $277M

*Figures based on close 11/03/06