UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-08876

Senior Debt Portfolio

(Exact Name of Registrant as Specified in Charter)

One Post Office Square, Boston, Massachusetts 02109

(Address of Principal Executive Offices)

Deidre E. Walsh

One Post Office Square, Boston, Massachusetts 02109

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

October 31

Date of Fiscal Year End

October 31, 2024

Date of Reporting Period

Item 1. Reports to Stockholders

Annual Shareholder Report October 31, 2024

This annual shareholder report contains important information about the Senior Debt Portfolio (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php and selecting Eaton Vance Floating-Rate Advantage Fund. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Senior Debt Portfolio | $236 | 2.23% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Morningstar® LSTA® US Leveraged Loan Index℠ (the Index):

↑ The Fund’s use of leverage ― not employed by the Index ― amplified the price appreciation and interest income of loans held in the Fund’s underlying portfolio

↑ An out-of-Index allocation to collateralized loan obligation debt investments, which performed strongly during the period, contributed to Index-relative returns

↑ An out-of-Index allocation to secured high yield bonds, which generally outperformed floating-rate loans during the period, helped Index-relative performance

↑ Loan selections in the diversified telecommunication services industry contributed to Index-relative returns during the period

↓ Loan selections in the health care providers & services, household durables, and energy equipment & services industries detracted from Index-relative returns

↓ An underweight exposure to CCC-rated loans hampered Index relative performance as lower-rated loans generally outperformed higher-rated loans during the period

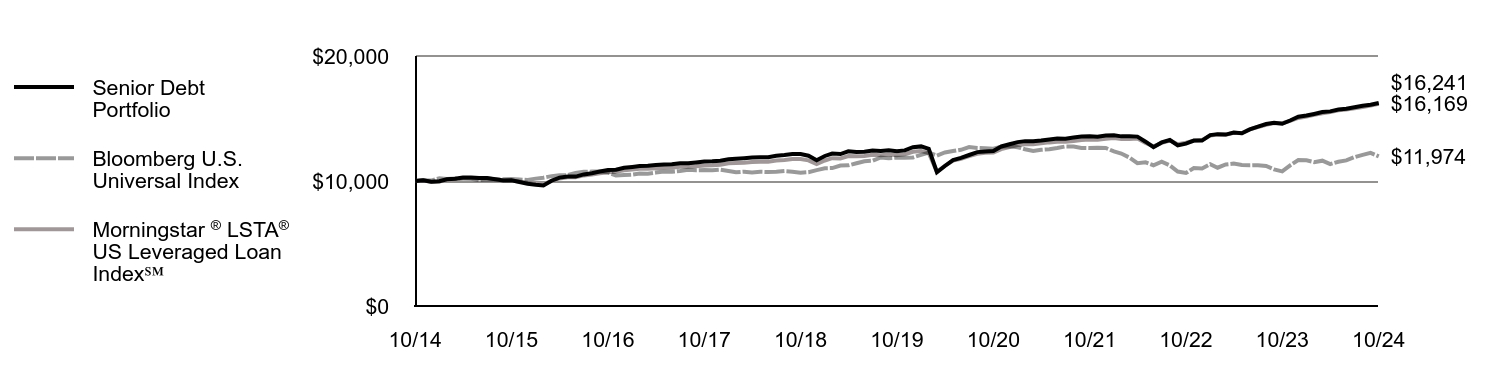

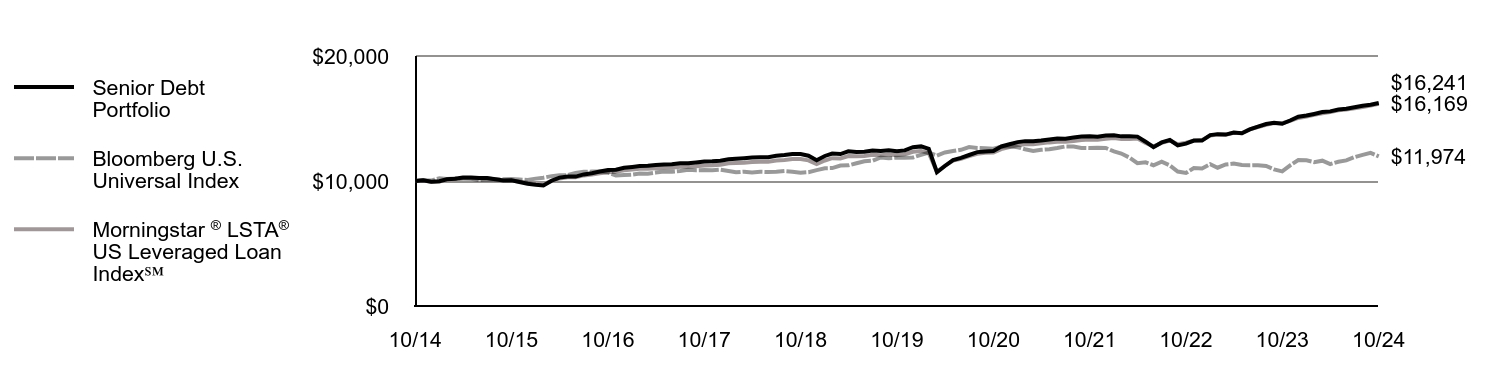

Comparison of the change in value of a $10,000 investment for the period indicated.

| Senior Debt Portfolio | Bloomberg U.S. Universal Index | Morningstar ® LSTA® US Leveraged Loan Index℠ |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 11/14 | $10,050 | $10,054 | $10,050 |

| 12/14 | $9,946 | $10,036 | $9,924 |

| 1/15 | $9,978 | $10,227 | $9,956 |

| 2/15 | $10,144 | $10,167 | $10,097 |

| 3/15 | $10,186 | $10,209 | $10,134 |

| 4/15 | $10,282 | $10,197 | $10,228 |

| 5/15 | $10,286 | $10,180 | $10,247 |

| 6/15 | $10,231 | $10,066 | $10,204 |

| 7/15 | $10,245 | $10,125 | $10,203 |

| 8/15 | $10,146 | $10,095 | $10,132 |

| 9/15 | $10,046 | $10,134 | $10,066 |

| 10/15 | $10,053 | $10,167 | $10,048 |

| 11/15 | $9,923 | $10,130 | $9,960 |

| 12/15 | $9,787 | $10,079 | $9,855 |

| 1/16 | $9,697 | $10,190 | $9,791 |

| 2/16 | $9,641 | $10,263 | $9,739 |

| 3/16 | $10,021 | $10,388 | $10,008 |

| 4/16 | $10,272 | $10,459 | $10,206 |

| 5/16 | $10,366 | $10,467 | $10,297 |

| 6/16 | $10,351 | $10,652 | $10,300 |

| 7/16 | $10,527 | $10,739 | $10,447 |

| 8/16 | $10,625 | $10,751 | $10,525 |

| 9/16 | $10,760 | $10,753 | $10,616 |

| 10/16 | $10,876 | $10,682 | $10,704 |

| 11/16 | $10,896 | $10,442 | $10,732 |

| 12/16 | $11,055 | $10,473 | $10,856 |

| 1/17 | $11,127 | $10,510 | $10,917 |

| 2/17 | $11,194 | $10,591 | $10,972 |

| 3/17 | $11,225 | $10,588 | $10,981 |

| 4/17 | $11,276 | $10,675 | $11,029 |

| 5/17 | $11,329 | $10,758 | $11,069 |

| 6/17 | $11,340 | $10,749 | $11,064 |

| 7/17 | $11,415 | $10,802 | $11,140 |

| 8/17 | $11,416 | $10,895 | $11,135 |

| 9/17 | $11,479 | $10,857 | $11,179 |

| 10/17 | $11,557 | $10,870 | $11,246 |

| 11/17 | $11,578 | $10,854 | $11,259 |

| 12/17 | $11,622 | $10,901 | $11,303 |

| 1/18 | $11,743 | $10,797 | $11,412 |

| 2/18 | $11,774 | $10,694 | $11,435 |

| 3/18 | $11,821 | $10,748 | $11,467 |

| 4/18 | $11,878 | $10,676 | $11,514 |

| 5/18 | $11,894 | $10,735 | $11,534 |

| 6/18 | $11,909 | $10,719 | $11,547 |

| 7/18 | $12,013 | $10,741 | $11,633 |

| 8/18 | $12,074 | $10,794 | $11,679 |

| 9/18 | $12,155 | $10,748 | $11,760 |

| 10/18 | $12,151 | $10,658 | $11,756 |

| 11/18 | $12,024 | $10,706 | $11,650 |

| 12/18 | $11,654 | $10,874 | $11,353 |

| 1/19 | $12,002 | $11,024 | $11,642 |

| 2/19 | $12,200 | $11,036 | $11,828 |

| 3/19 | $12,156 | $11,235 | $11,807 |

| 4/19 | $12,371 | $11,251 | $12,002 |

| 5/19 | $12,314 | $11,423 | $11,976 |

| 6/19 | $12,335 | $11,585 | $12,005 |

| 7/19 | $12,432 | $11,619 | $12,101 |

| 8/19 | $12,396 | $11,882 | $12,068 |

| 9/19 | $12,450 | $11,830 | $12,124 |

| 10/19 | $12,375 | $11,869 | $12,070 |

| 11/19 | $12,450 | $11,866 | $12,141 |

| 12/19 | $12,703 | $11,884 | $12,334 |

| 1/20 | $12,768 | $12,097 | $12,403 |

| 2/20 | $12,578 | $12,278 | $12,239 |

| 3/20 | $10,704 | $12,039 | $10,725 |

| 4/20 | $11,201 | $12,280 | $11,208 |

| 5/20 | $11,667 | $12,394 | $11,634 |

| 6/20 | $11,855 | $12,498 | $11,766 |

| 7/20 | $12,081 | $12,717 | $11,996 |

| 8/20 | $12,310 | $12,644 | $12,176 |

| 9/20 | $12,366 | $12,621 | $12,253 |

| 10/20 | $12,399 | $12,576 | $12,278 |

| 11/20 | $12,763 | $12,740 | $12,551 |

| 12/20 | $12,942 | $12,784 | $12,720 |

| 1/21 | $13,110 | $12,704 | $12,871 |

| 2/21 | $13,189 | $12,540 | $12,947 |

| 3/21 | $13,185 | $12,394 | $12,946 |

| 4/21 | $13,245 | $12,498 | $13,013 |

| 5/21 | $13,326 | $12,546 | $13,089 |

| 6/21 | $13,395 | $12,637 | $13,137 |

| 7/21 | $13,389 | $12,764 | $13,135 |

| 8/21 | $13,486 | $12,756 | $13,198 |

| 9/21 | $13,567 | $12,647 | $13,282 |

| 10/21 | $13,585 | $12,636 | $13,318 |

| 11/21 | $13,539 | $12,652 | $13,297 |

| 12/21 | $13,641 | $12,643 | $13,382 |

| 1/22 | $13,660 | $12,366 | $13,430 |

| 2/22 | $13,571 | $12,197 | $13,361 |

| 3/22 | $13,580 | $11,870 | $13,368 |

| 4/22 | $13,552 | $11,427 | $13,397 |

| 5/22 | $13,144 | $11,490 | $13,054 |

| 6/22 | $12,701 | $11,261 | $12,771 |

| 7/22 | $13,084 | $11,544 | $13,044 |

| 8/22 | $13,277 | $11,244 | $13,241 |

| 9/22 | $12,843 | $10,759 | $12,939 |

| 10/22 | $12,990 | $10,641 | $13,068 |

| 11/22 | $13,234 | $11,038 | $13,224 |

| 12/22 | $13,231 | $11,001 | $13,278 |

| 1/23 | $13,671 | $11,342 | $13,633 |

| 2/23 | $13,749 | $11,063 | $13,711 |

| 3/23 | $13,712 | $11,323 | $13,707 |

| 4/23 | $13,870 | $11,392 | $13,851 |

| 5/23 | $13,819 | $11,274 | $13,826 |

| 6/23 | $14,124 | $11,256 | $14,139 |

| 7/23 | $14,353 | $11,267 | $14,320 |

| 8/23 | $14,560 | $11,200 | $14,488 |

| 9/23 | $14,653 | $10,932 | $14,628 |

| 10/23 | $14,574 | $10,768 | $14,625 |

| 11/23 | $14,841 | $11,253 | $14,803 |

| 12/23 | $15,142 | $11,680 | $15,047 |

| 1/24 | $15,234 | $11,652 | $15,149 |

| 2/24 | $15,364 | $11,512 | $15,287 |

| 3/24 | $15,514 | $11,625 | $15,417 |

| 4/24 | $15,570 | $11,353 | $15,510 |

| 5/24 | $15,720 | $11,542 | $15,655 |

| 6/24 | $15,773 | $11,647 | $15,710 |

| 7/24 | $15,893 | $11,911 | $15,817 |

| 8/24 | $16,013 | $12,087 | $15,917 |

| 9/24 | $16,095 | $12,253 | $16,031 |

| 10/24 | $16,241 | $11,974 | $16,169 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Senior Debt Portfolio | 11.64% | 5.58% | 4.97% |

Bloomberg U.S. Universal IndexFootnote Reference1 | 11.20% | 0.18% | 1.82% |

Morningstar®LSTA® US Leveraged Loan Index℠ | 10.56% | 6.02% | 4.92% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund’s primary benchmark to represent the overall applicable market, the Fund’s primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that an investor would pay on distributions or redemptions. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $5,855,695,948 |

| # of Portfolio Holdings | 687 |

| Portfolio Turnover Rate | 35% |

| Total Advisory Fees Paid | $30,948,747 |

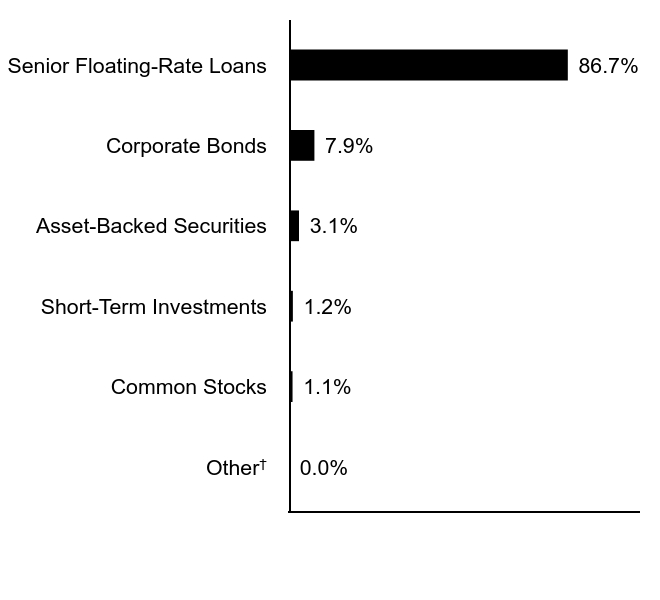

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference† | 0.0% |

| Common Stocks | 1.1% |

| Short-Term Investments | 1.2% |

| Asset-Backed Securities | 3.1% |

| Corporate Bonds | 7.9% |

| Senior Floating-Rate Loans | 86.7% |

| Footnote | Description |

Footnote† | Investment types less than 1% each |

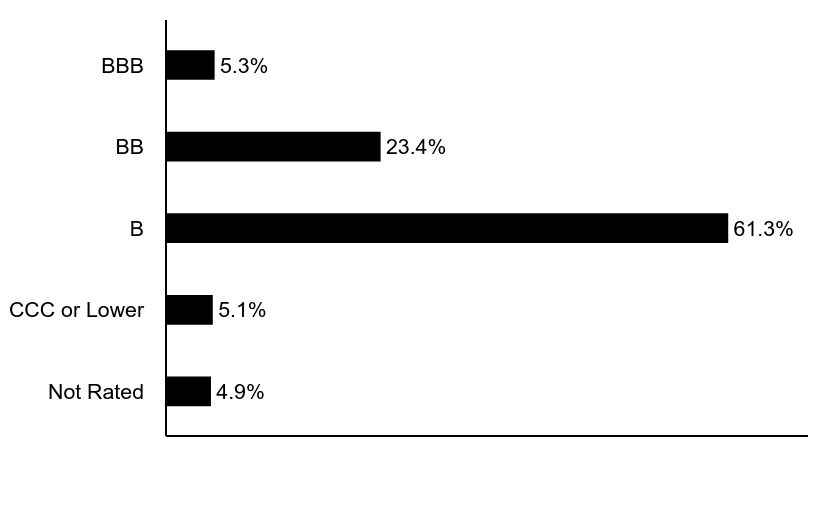

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 4.9% |

| CCC or Lower | 5.1% |

| B | 61.3% |

| BB | 23.4% |

| BBB | 5.3% |

| Footnote | Description |

Footnotea | Excludes Short-Term investments and Equities. Ratings are categorized using S&P Global Ratings (“S&P”), with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by S&P. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php and select Eaton Vance Floating-Rate Advantage Fund. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report October 31, 2024

Item 2. Code of Ethics

The registrant (sometimes referred to as the “Fund”) has adopted a code of ethics applicable to its Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer. The registrant undertakes to provide a copy of such code of ethics to any person upon request, without charge, by calling 1-800-262-1122. The registrant has not amended the code of ethics as described in Form N-CSR during the period covered by this report. The registrant has not granted any waiver, including an implicit waiver, from a provision of the code of ethics as described in Form N-CSR during the period covered by this report.

Item 3. Audit Committee Financial Expert

The registrant’s Board of Trustees (the “Board”) has designated George J. Gorman and Scott E. Wennerholm, each an independent trustee, as audit committee financial experts. Mr. Gorman is a certified public accountant who is the Principal at George J. Gorman LLC (a consulting firm). Previously, Mr. Gorman served in various capacities at Ernst & Young LLP (a registered public accounting firm), including as Senior Partner. Mr. Gorman also has experience serving as an independent trustee and audit committee financial expert of other mutual fund complexes. Mr. Wennerholm is a private investor. Previously, Mr. Wennerholm served as a Trustee at Wheelock College (postsecondary institution), as a Consultant at GF Parish Group (executive recruiting firm), Chief Operating Officer and Executive Vice President at BNY Mellon Asset Management (investment management firm), Chief Operating Officer and Chief Financial Officer at Natixis Global Asset Management (investment management firm), and Vice President at Fidelity Investments Institutional Services (investment management firm).

Item 4. Principal Accountant Fees and Services

(a)-(d)

The following table presents the aggregate fees billed to the registrant for the registrant’s fiscal years ended October 31, 2023 and October 31, 2024 by the registrant’s principal accountant, Deloitte & Touche LLP (“D&T”), for professional services rendered for the audit of the registrant’s annual financial statements and fees billed for other services rendered by D&T during such periods.

| | | | | | | | |

Fiscal Years Ended | | 10/31/23 | | | 10/31/24 | |

Audit Fees | | $ | 124,400 | | | $ | 129,400 | |

Audit-Related Fees(1) | | $ | 0 | | | $ | 0 | |

Tax Fees(2) | | $ | 0 | | | $ | 0 | |

All Other Fees(3) | | $ | 0 | | | $ | 0 | |

| | | | | | | | |

Total | | $ | 124,400 | | | $ | 129,400 | |

| | | | | | | | |

| (1) | Audit-related fees consist of the aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under the category of audit fees. |

| (2) | Tax fees consist of the aggregate fees billed for professional services rendered by the principal accountant relating to tax compliance, tax advice, and tax planning and specifically include fees for tax return preparation and other related tax compliance/planning matters. |

| (3) | All other fees consist of the aggregate fees billed for products and services provided by the principal accountant other than audit, audit-related, and tax services. |

(e)(1) The registrant’s audit committee has adopted policies and procedures relating to the pre-approval of services provided by the registrant’s principal accountant (the “Pre-Approval Policies”). The Pre-Approval Policies establish a framework intended to assist the audit committee in the proper discharge of its pre-approval responsibilities. As a general matter, the Pre-Approval Policies (i) specify certain types of audit, audit-related, tax, and other services determined to be pre-approved by the audit committee; and (ii) delineate specific procedures governing the mechanics of the pre-approval process, including the approval and monitoring of audit and non-audit service fees. Unless a service is specifically pre-approved under the Pre-Approval Policies, it must be separately pre-approved by the audit committee.

The Pre-Approval Policies and the types of audit and non-audit services pre-approved therein must be reviewed and ratified by the registrant’s audit committee at least annually. The registrant’s audit committee maintains full responsibility for the appointment, compensation, and oversight of the work of the registrant’s principal accountant.

(e)(2) No services described in paragraphs (b)-(d) above were approved by the registrant’s audit committee pursuant to the “de minimis exception” set forth in Rule 2-01(c)(7)(i)(C) of Regulation S-X.

(f) Not applicable.

(g) The following table presents (i) the aggregate non-audit fees (i.e., fees for audit-related, tax, and other services) billed to the registrant by D&T for the registrant’s fiscal years ended October 31, 2023 and October 31, 2024; and (ii) the aggregate non-audit fees (i.e., fees for audit-related, tax, and other services) billed to the Eaton Vance organization by D&T for the same time periods.

| | | | | | | | |

Fiscal Years Ended | | 10/31/23 | | | 10/31/24 | |

Registrant | | $ | 0 | | | $ | 0 | |

Eaton Vance(1) | | $ | 0 | | | $ | 18,490 | |

| (1) | The investment adviser to the registrant, as well as any of its affiliates that provide ongoing services to the registrant, are subsidiaries of Morgan Stanley. |

(h) The registrant’s audit committee has considered whether the provision by the registrant’s principal accountant of non-audit services to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant that were not pre-approved pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants

Not applicable.

Item 6. Schedule of Investments

| (a) | Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

Senior Debt Portfolio

October 31, 2024

| Asset-Backed Securities — 3.8% |

| Security | Principal

Amount

(000's omitted) | Value |

| Alinea CLO Ltd.: | | | |

| Series 2018-1A, Class D, 7.979%, (3 mo. SOFR + 3.362%), 7/20/31(1)(2) | $ | 2,500 | $ 2,523,717 |

| Series 2018-1A, Class E, 10.879%, (3 mo. SOFR + 6.262%), 7/20/31(1)(2) | | 3,000 | 3,014,940 |

| AMMC CLO XII Ltd., Series 2013-12A, Class ER, 11.544%, (3 mo. SOFR + 6.442%), 11/10/30(1)(2) | | 3,525 | 3,477,571 |

| AMMC CLO XV Ltd., Series 2014-15A, Class ERR, 11.828%, (3 mo. SOFR + 7.172%), 1/15/32(1)(2) | | 2,500 | 2,506,502 |

| ARES Loan Funding II Ltd., Series 2022-ALF2A, Class ER, 12.857%, (3 mo. SOFR + 8.24%), 10/20/36(1)(2) | | 1,675 | 1,746,720 |

| ARES LVIII CLO Ltd., Series 2020-58A, Class ER, 11.356%, (3 mo. SOFR + 6.70%), 1/15/35(1)(2) | | 3,000 | 3,019,863 |

| ARES XXXIIR CLO Ltd.: | | | |

| Series 2014-32RA, Class C, 8.28%, (3 mo. SOFR + 3.162%), 5/15/30(1)(2) | | 5,000 | 5,013,805 |

| Series 2014-32RA, Class D, 11.23%, (3 mo. SOFR + 6.112%), 5/15/30(1)(2) | | 1,000 | 1,003,960 |

| ARES XXXVR CLO Ltd., Series 2015-35RA, Class E, 10.618%, (3 mo. SOFR + 5.962%), 7/15/30(1)(2) | | 4,000 | 4,020,516 |

| Barings CLO Ltd.: | | | |

| Series 2015-1A, Class DR, 7.479%, (3 mo. SOFR + 2.862%), 1/20/31(1)(2) | | 2,500 | 2,518,375 |

| Series 2018-1A, Class C, 7.518%, (3 mo. SOFR + 2.862%), 4/15/31(1)(2) | | 3,500 | 3,502,236 |

| Battalion CLO XXII Ltd., Series 2021-22A, Class E, 11.829%, (3 mo. SOFR + 7.212%), 1/20/35(1)(2) | | 1,750 | 1,504,337 |

| Benefit Street Partners CLO VIII Ltd., Series 2015-8A, Class DR, 10.479%, (3 mo. SOFR + 5.862%), 1/20/31(1)(2) | | 5,401 | 5,284,797 |

| Benefit Street Partners CLO XVI Ltd., Series 2018-16A, Class E, 11.609%, (3 mo. SOFR + 6.962%), 1/17/32(1)(2) | | 2,250 | 2,267,681 |

| Benefit Street Partners CLO XXII Ltd., Series 2020-22A, Class ER, 11.547%, (3 mo. SOFR + 6.93%), 4/20/35(1)(2) | | 1,000 | 1,014,548 |

| Benefit Street Partners CLO XXV Ltd., Series 2021-25A, Class E, 11.768%, (3 mo. SOFR + 7.112%), 1/15/35(1)(2) | | 3,000 | 3,044,676 |

| Betony CLO 2 Ltd.: | | | |

| Series 2018-1A, Class C, 7.751%, (3 mo. SOFR + 3.162%), 4/30/31(1)(2) | | 2,500 | 2,516,250 |

| Series 2018-1A, Class D, 10.501%, (3 mo. SOFR + 5.912%), 4/30/31(1)(2) | | 2,525 | 2,504,300 |

| Security | Principal

Amount

(000's omitted) | Value |

| BlueMountain CLO Ltd.: | | | |

| Series 2015-3A, Class CR, 7.479%, (3 mo. SOFR + 2.862%), 4/20/31(1)(2) | $ | 5,000 | $ 5,006,550 |

| Series 2015-3A, Class DR, 10.279%, (3 mo. SOFR + 5.662%), 4/20/31(1)(2) | | 3,000 | 2,823,816 |

| Series 2016-3A, Class DR, 8.48%, (3 mo. SOFR + 3.362%), 11/15/30(1)(2) | | 1,500 | 1,503,465 |

| Series 2016-3A, Class ER, 11.33%, (3 mo. SOFR + 6.212%), 11/15/30(1)(2) | | 1,500 | 1,485,059 |

| Series 2018-1A, Class D, 7.901%, (3 mo. SOFR + 3.312%), 7/30/30(1)(2) | | 2,500 | 2,502,633 |

| Series 2018-1A, Class E, 10.801%, (3 mo. SOFR + 6.212%), 7/30/30(1)(2) | | 2,000 | 1,883,592 |

| BlueMountain CLO XXIV Ltd., Series 2019-24A, Class ER, 11.719%, (3 mo. SOFR + 7.102%), 4/20/34(1)(2) | | 1,250 | 1,221,439 |

| BlueMountain CLO XXVI Ltd., Series 2019-26A, Class ER, 12.009%, (3 mo. SOFR + 7.392%), 10/20/34(1)(2) | | 3,000 | 2,996,007 |

| BlueMountain CLO XXX Ltd., Series 2020-30A, Class ER, 11.356%, (3 mo. SOFR + 6.70%), 4/15/35(1)(2) | | 2,000 | 1,969,420 |

| BlueMountain CLO XXXIII Ltd., Series 2021-33A, Class E, 12.22%, (3 mo. SOFR + 7.092%), 11/20/34(1)(2) | | 2,500 | 2,456,318 |

| Bryant Park Funding Ltd.: | | | |

| Series 2023-20A, Class D, 10.746%, (3 mo. SOFR + 6.09%), 7/15/36(1)(2) | | 5,250 | 5,360,161 |

| Series 2023-21A, Class D, 10.082%, (3 mo. SOFR + 5.45%), 10/18/36(1)(2) | | 4,475 | 4,576,927 |

| Canyon Capital CLO Ltd.: | | | |

| Series 2012-1RA, Class E, 10.618%, (3 mo. SOFR + 5.962%), 7/15/30(1)(2) | | 4,875 | 4,704,862 |

| Series 2016-1A, Class ER, 10.668%, (3 mo. SOFR + 6.012%), 7/15/31(1)(2) | | 4,000 | 3,880,936 |

| Series 2016-2A, Class ER, 10.918%, (3 mo. SOFR + 6.262%), 10/15/31(1)(2) | | 4,500 | 4,436,748 |

| Series 2018-1A, Class D, 7.818%, (3 mo. SOFR + 3.162%), 7/15/31(1)(2) | | 3,000 | 3,005,553 |

| Series 2018-1A, Class E, 10.668%, (3 mo. SOFR + 6.012%), 7/15/31(1)(2) | | 2,750 | 2,683,117 |

| Series 2019-2A, Class ER, 11.668%, (3 mo. SOFR + 7.012%), 10/15/34(1)(2) | | 1,500 | 1,478,550 |

| Carlyle C17 CLO Ltd.: | | | |

| Series C17A, Class CR, 7.651%, (3 mo. SOFR + 3.062%), 4/30/31(1)(2) | | 5,000 | 5,040,655 |

| Series C17A, Class DR, 10.851%, (3 mo. SOFR + 6.262%), 4/30/31(1)(2) | | 3,500 | 3,508,750 |

| Carlyle Global Market Strategies CLO Ltd.: | | | |

| Series 2012-3A, Class CR2, 8.418%, (3 mo. SOFR + 3.762%), 1/14/32(1)(2) | | 2,500 | 2,510,410 |

| Series 2012-3A, Class DR2, 11.418%, (3 mo. SOFR + 6.762%), 1/14/32(1)(2) | | 1,500 | 1,506,639 |

16

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

Carlyle Global Market Strategies CLO Ltd.:

(continued) | | | |

| Series 2014-3RA, Class C, 7.829%, (3 mo. SOFR + 3.212%), 7/27/31(1)(2) | $ | 1,000 | $ 1,002,448 |

| Series 2014-3RA, Class D, 10.279%, (3 mo. SOFR + 5.662%), 7/27/31(1)(2) | | 2,150 | 2,151,127 |

| Series 2014-4RA, Class C, 7.818%, (3 mo. SOFR + 3.162%), 7/15/30(1)(2) | | 2,750 | 2,759,927 |

| Series 2014-4RA, Class D, 10.568%, (3 mo. SOFR + 5.912%), 7/15/30(1)(2) | | 1,500 | 1,488,839 |

| Carlyle U.S. CLO Ltd.: | | | |

| Series 2019-4A, Class DR, 11.256%, (3 mo. SOFR + 6.60%), 4/15/35(1)(2) | | 3,000 | 3,020,814 |

| Series 2021-7A, Class D, 11.168%, (3 mo. SOFR + 6.512%), 10/15/35(1)(2) | | 250 | 251,580 |

| Series 2022-6A, Class DR, 9.376%, (3 mo. SOFR + 4.75%), 10/25/36(1)(2) | | 2,800 | 2,860,794 |

| CarVal CLO IV Ltd., Series 2021-1A, Class E, 11.479%, (3 mo. SOFR + 6.862%), 7/20/34(1)(2) | | 1,000 | 1,008,534 |

| CIFC Funding Ltd.: | | | |

| Series 2022-1A, Class E, 11.048%, (3 mo. SOFR + 6.40%), 4/17/35(1)(2) | | 750 | 755,495 |

| Series 2022-4A, Class D, 8.197%, (3 mo. SOFR + 3.55%), 7/16/35(1)(2) | | 1,750 | 1,758,692 |

| Crown City CLO I, Series 2020-1A, Class DR, 11.879%, (3 mo. SOFR + 7.262%), 7/20/34(1)(2) | | 250 | 248,707 |

| Dryden CLO Ltd.: | | | |

| Series 2018-55A, Class D, 7.768%, (3 mo. SOFR + 3.112%), 4/15/31(1)(2) | | 1,500 | 1,502,036 |

| Series 2018-55A, Class E, 10.318%, (3 mo. SOFR + 5.662%), 4/15/31(1)(2) | | 2,000 | 1,986,478 |

| Dryden Senior Loan Fund: | | | |

| Series 2015-41A, Class DR, 7.518%, (3 mo. SOFR + 2.862%), 4/15/31(1)(2) | | 7,000 | 6,987,750 |

| Series 2015-41A, Class ER, 10.218%, (3 mo. SOFR + 5.562%), 4/15/31(1)(2) | | 1,268 | 1,190,082 |

| Series 2016-42A, Class D1AR, 7.956%, (3 mo. SOFR + 3.30%), 7/15/37(1)(2) | | 2,500 | 2,518,077 |

| Series 2016-42A, Class ERR, 11.156%, (3 mo. SOFR + 6.50%), 7/15/37(1)(2) | | 3,500 | 3,455,550 |

| Empower CLO Ltd., Series 2023-2A, Class D, 10.056%, (3 mo. SOFR + 5.40%), 7/15/36(1)(2) | | 2,000 | 2,056,716 |

| Galaxy XIX CLO Ltd., Series 2015-19A, Class D1R, 11.426%, (3 mo. SOFR + 6.792%), 7/24/30(1)(2) | | 2,000 | 2,006,702 |

| Golub Capital Partners 48 LP, Series 2020-48A, Class D, 8.709%, (3 mo. SOFR + 4.062%), 4/17/33(1)(2) | | 2,000 | 2,008,074 |

| Golub Capital Partners CLO 53B Ltd., Series 2021-53A, Class E, 11.579%, (3 mo. SOFR + 6.962%), 7/20/34(1)(2) | | 1,250 | 1,256,294 |

| Security | Principal

Amount

(000's omitted) | Value |

| Golub Capital Partners CLO 58B Ltd., Series 2021-58A, Class E, 11.698%, (3 mo. SOFR + 7.072%), 1/25/35(1)(2) | $ | 2,500 | $ 2,515,125 |

| HalseyPoint CLO 5 Ltd., Series 2021-5A, Class E, 11.791%, (3 mo. SOFR + 7.202%), 1/30/35(1)(2) | | 2,000 | 1,964,728 |

| Harriman Park CLO Ltd., Series 2020-1A, Class ER, 11.279%, (3 mo. SOFR + 6.662%), 4/20/34(1)(2) | | 1,000 | 1,007,803 |

| ICG U.S. CLO Ltd.: | | | |

| Series 2018-2A, Class D, 7.993%, (3 mo. SOFR + 3.362%), 7/22/31(1)(2) | | 2,000 | 2,004,846 |

| Series 2018-2A, Class E, 10.643%, (3 mo. SOFR + 6.012%), 7/22/31(1)(2) | | 3,000 | 2,825,418 |

| Madison Park Funding LIX Ltd., Series 2021-59A, Class ER, 11.032%, (3 mo. SOFR + 6.40%), 4/18/37(1)(2) | | 1,550 | 1,557,598 |

| Madison Park Funding XXXVI Ltd., Series 2019-36A, Class ER, 11.706%, (3 mo. SOFR + 7.05%), 4/15/35(1)(2) | | 2,500 | 2,510,610 |

| Madison Park Funding XXXVII Ltd., Series 2019-37A, Class ER2, 11.256%, (3 mo. SOFR + 6.60%), 4/15/37(1)(2) | | 750 | 758,138 |

| Marble Point CLO XXIV Ltd., Series 2022-1A, Class D1, 8.857%, (3 mo. SOFR + 4.24%), 4/20/35(1)(2) | | 2,000 | 2,003,656 |

| Neuberger Berman CLO XVIII Ltd., Series 2014-18A, Class DR2, 10.799%, (3 mo. SOFR + 6.182%), 10/21/30(1)(2) | | 2,000 | 2,012,184 |

| Neuberger Berman Loan Advisers CLO Ltd., Series 2022-48A, Class E, 11.126%, (3 mo. SOFR + 6.50%), 4/25/36(1)(2) | | 2,600 | 2,617,969 |

| Palmer Square CLO Ltd.: | | | |

| Series 2013-2A, Class DRR, 10.759%, (3 mo. SOFR + 6.112%), 10/17/31(1)(2) | | 1,425 | 1,433,524 |

| Series 2015-1A, Class DR4, 11.888%, (3 mo. SOFR + 6.762%), 5/21/34(1)(2) | | 2,000 | 2,006,830 |

| Series 2021-2A, Class E, 11.268%, (3 mo. SOFR + 6.612%), 7/15/34(1)(2) | | 1,000 | 1,008,784 |

| RAD CLO 5 Ltd., Series 2019-5A, Class E, 11.596%, (3 mo. SOFR + 6.962%), 7/24/32(1)(2) | | 1,250 | 1,257,333 |

| RAD CLO 11 Ltd., Series 2021-11A, Class E, 11.168%, (3 mo. SOFR + 6.512%), 4/15/34(1)(2) | | 750 | 755,178 |

| RAD CLO 14 Ltd., Series 2021-14A, Class E, 11.418%, (3 mo. SOFR + 6.762%), 1/15/35(1)(2) | | 1,050 | 1,056,676 |

| Regatta XIII Funding Ltd., Series 2018-2A, Class D, 10.868%, (3 mo. SOFR + 6.212%), 7/15/31(1)(2) | | 5,000 | 4,904,900 |

| Regatta XV Funding Ltd., Series 2018-4A, Class D, 11.388%, (3 mo. SOFR + 6.762%), 10/25/31(1)(2) | | 2,875 | 2,886,322 |

17

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| Upland CLO Ltd.: | | | |

| Series 2016-1A, Class CR, 7.779%, (3 mo. SOFR + 3.162%), 4/20/31(1)(2) | $ | 4,500 | $ 4,511,250 |

| Series 2016-1A, Class DR, 10.779%, (3 mo. SOFR + 6.162%), 4/20/31(1)(2) | | 2,125 | 2,134,871 |

| Vibrant CLO IX, Ltd.: | | | |

| Series 2018-9A, Class C, 8.079%, (3 mo. SOFR + 3.462%), 7/20/31(1)(2) | | 2,500 | 2,511,342 |

| Series 2018-9A, Class D, 11.129%, (3 mo. SOFR + 6.512%), 7/20/31(1)(2) | | 3,500 | 3,366,923 |

| Voya CLO Ltd.: | | | |

| Series 2014-1A, Class DR2, 10.894%, (3 mo. SOFR + 6.262%), 4/18/31(1)(2) | | 3,250 | 3,201,578 |

| Series 2015-3A, Class CR, 8.029%, (3 mo. SOFR + 3.412%), 10/20/31(1)(2) | | 2,500 | 2,503,923 |

| Series 2015-3A, Class DR, 11.079%, (3 mo. SOFR + 6.462%), 10/20/31(1)(2) | | 5,500 | 5,245,927 |

| Series 2016-3A, Class CR, 8.144%, (3 mo. SOFR + 3.512%), 10/18/31(1)(2) | | 2,000 | 2,002,730 |

| Series 2016-3A, Class DR, 10.974%, (3 mo. SOFR + 6.342%), 10/18/31(1)(2) | | 2,375 | 2,245,330 |

| Wellfleet CLO Ltd., Series 2021-3A, Class E, 12.018%, (3 mo. SOFR + 7.362%), 1/15/35(1)(2) | | 1,050 | 988,857 |

Total Asset-Backed Securities

(identified cost $225,833,251) | | | $ 225,101,470 |

| Security | Shares | Value |

| Aerospace and Defense — 0.0% |

| IAP Worldwide Services LLC(3)(4)(5) | | 168 | $ 0 |

| | | | $ 0 |

| Commercial Services & Supplies — 0.1% |

| Monitronics International, Inc.(4)(5) | | 199,603 | $ 4,191,663 |

| Phoenix Services International LLC(4)(5) | | 291,132 | 1,200,920 |

| Phoenix Services International LLC(4)(5) | | 26,562 | 109,568 |

| | | | $ 5,502,151 |

| Containers and Glass Products — 0.0%(6) |

| LG Parent Holding Co.(4)(5) | | 342,076 | $ 1,539,342 |

| | | | $ 1,539,342 |

| Electronic Equipment, Instruments & Components — 0.4% |

| Range Red Acquisitions LLC, Class A1(3)(4)(5) | | 10,660 | $ 23,631,941 |

| | | | $ 23,631,941 |

| Security | Shares | Value |

| Electronics/Electrical — 0.0%(6) |

| Skillsoft Corp.(4)(5) | | 50,519 | $ 771,425 |

| | | | $ 771,425 |

| Entertainment — 0.0%(6) |

| New Cineworld Ltd.(4)(5) | | 113,548 | $ 2,583,217 |

| | | | $ 2,583,217 |

| Health Care — 0.3% |

| Akorn Holding Co. LLC(3)(4)(5) | | 792,089 | $ 0 |

| Cano Health, Inc.(4)(5) | | 380,806 | 4,379,269 |

| Envision Parent, Inc.(4)(5) | | 953,838 | 10,134,529 |

| | | | $ 14,513,798 |

| Household Durables — 0.2% |

| Serta Simmons Bedding, Inc.(4)(5) | | 1,401,999 | $ 9,930,779 |

| Serta SSB Equipment Co.(3)(4)(5) | | 1,401,999 | 0 |

| | | | $ 9,930,779 |

| Investment Companies — 0.0%(6) |

| Aegletes BV(4)(5) | | 138,671 | $ 90,136 |

| | | | $ 90,136 |

| Nonferrous Metals/Minerals — 0.2% |

| ACNR Holdings, Inc., Class A(5) | | 116,152 | $ 8,914,666 |

| | | | $ 8,914,666 |

| Oil and Gas — 0.0% |

| AFG Holdings, Inc.(3)(4)(5) | | 281,241 | $ 0 |

| | | | $ 0 |

| Pharmaceuticals — 0.1% |

| Covis Midco 1 SARL, Class A(4)(5) | | 8,349 | $ 4,258 |

| Covis Midco 1 SARL, Class B(4)(5) | | 8,349 | 4,258 |

| Covis Midco 1 SARL, Class C(4)(5) | | 8,349 | 4,258 |

| Covis Midco 1 SARL, Class D(4)(5) | | 8,349 | 4,258 |

| Covis Midco 1 SARL, Class E(4)(5) | | 8,349 | 4,258 |

| Mallinckrodt International Finance SA(4)(5) | | 107,065 | 8,123,554 |

| | | | $ 8,144,844 |

| Retail — 0.0% |

| Jubilee Enterprise PCL, Class A1(3)(4)(5) | | 2,563 | $ 0 |

| Jubilee Enterprise PCL, Class A2(3)(4)(5) | | 2,048,265 | 0 |

| | | | $ 0 |

18

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Security | Shares | Value |

| Retailers (Except Food and Drug) — 0.0% |

| Phillips Feed Service, Inc.(3)(4)(5) | | 2,960 | $ 0 |

| | | | $ 0 |

| Telecommunications — 0.0% |

| GEE Acquisition Holdings Corp.(3)(4)(5) | | 390,679 | $ 0 |

| | | | $ 0 |

Total Common Stocks

(identified cost $111,484,313) | | | $ 75,622,299 |

| Security | Principal

Amount*

(000's omitted) | Value |

| Aerospace and Defense — 0.3% |

| TransDigm, Inc.: | | | |

| 6.75%, 8/15/28(1) | | 3,825 | $ 3,911,870 |

| 6.875%, 12/15/30(1) | | 15,000 | 15,389,460 |

| | | | $ 19,301,330 |

| Air Transport — 0.6% |

| American Airlines, Inc./AAdvantage Loyalty IP Ltd.: | | | |

| 5.50%, 4/20/26(1) | | 9,650 | $ 9,628,046 |

| 5.75%, 4/20/29(1) | | 14,475 | 14,345,556 |

| United Airlines, Inc.: | | | |

| 4.375%, 4/15/26(1) | | 5,050 | 4,965,944 |

| 4.625%, 4/15/29(1) | | 5,050 | 4,836,910 |

| | | | $ 33,776,456 |

| Automotive — 0.1% |

| Adient Global Holdings Ltd., 7.00%, 4/15/28(1) | | 650 | $ 661,365 |

| Clarios Global LP/Clarios U.S. Finance Co., 6.25%, 5/15/26(1) | | 4,478 | 4,489,781 |

| | | | $ 5,151,146 |

| Building and Development — 0.2% |

| Miter Brands Acquisition Holdco, Inc./MIWD Borrower LLC, 6.75%, 4/1/32(1) | | 5,425 | $ 5,521,967 |

| Smyrna Ready Mix Concrete LLC, 8.875%, 11/15/31(1) | | 2,500 | 2,628,364 |

| Winnebago Industries, Inc., 6.25%, 7/15/28(1) | | 1,100 | 1,094,543 |

| | | | $ 9,244,874 |

| Security | Principal

Amount*

(000's omitted) | Value |

| Business Equipment and Services — 0.7% |

| Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas Luxco 4 SARL: | | | |

| 4.625%, 6/1/28(1) | | 18,725 | $ 17,551,417 |

| 4.625%, 6/1/28(1) | | 20,575 | 19,316,397 |

| Prime Security Services Borrower LLC/Prime Finance, Inc., 5.75%, 4/15/26(1) | | 4,175 | 4,180,010 |

| | | | $ 41,047,824 |

| Capital Markets — 0.2% |

| Focus Financial Partners LLC, 6.75%, 9/15/31(1) | | 14,500 | $ 14,415,032 |

| | | | $ 14,415,032 |

| Chemicals — 0.6% |

| INEOS Finance PLC: | | | |

| 3.375%, 3/31/26(1) | EUR | 2,000 | $ 2,179,941 |

| 7.50%, 4/15/29(1) | | 9,075 | 9,374,012 |

| Olympus Water U.S. Holding Corp.: | | | |

| 4.25%, 10/1/28(1) | | 10,050 | 9,469,307 |

| 7.125%, 10/1/27(1) | | 1,075 | 1,092,558 |

| 9.75%, 11/15/28(1) | | 11,400 | 12,108,613 |

| | | | $ 34,224,431 |

| Commercial Services — 0.3% |

| Neptune Bidco U.S., Inc., 9.29%, 4/15/29(1) | | 13,600 | $ 12,719,179 |

| Wand NewCo 3, Inc., 7.625%, 1/30/32(1) | | 6,525 | 6,749,059 |

| | | | $ 19,468,238 |

| Containers & Packaging — 0.2% |

| Pactiv Evergreen Group Issuer, Inc./Pactiv Evergreen Group Issuer LLC: | | | |

| 4.00%, 10/15/27(1) | | 6,325 | $ 6,046,547 |

| 4.375%, 10/15/28(1) | | 6,350 | 5,978,308 |

| | | | $ 12,024,855 |

| Diversified Financial Services — 0.2% |

| AG TTMT Escrow Issuer LLC, 8.625%, 9/30/27(1) | | 3,350 | $ 3,464,064 |

| Aretec Group, Inc., 10.00%, 8/15/30(1) | | 5,375 | 5,863,346 |

| | | | $ 9,327,410 |

| Diversified Telecommunication Services — 0.9% |

| Altice France SA: | | | |

| 5.125%, 1/15/29(1) | | 1,600 | $ 1,200,033 |

| 5.125%, 7/15/29(1) | | 20,275 | 15,187,764 |

| 8.125%, 2/1/27(1) | | 22,500 | 18,652,383 |

19

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Security | Principal

Amount*

(000's omitted) | Value |

| Diversified Telecommunication Services (continued) |

| Level 3 Financing, Inc., 10.75%, 12/15/30(1) | | 11,175 | $ 12,542,453 |

| Virgin Media Secured Finance PLC, 4.50%, 8/15/30(1) | | 7,625 | 6,684,959 |

| | | | $ 54,267,592 |

| Drugs — 0.2% |

| Jazz Securities DAC, 4.375%, 1/15/29(1) | | 10,050 | $ 9,519,290 |

| | | | $ 9,519,290 |

| Electronics/Electrical — 0.3% |

| Imola Merger Corp., 4.75%, 5/15/29(1) | | 15,700 | $ 15,191,998 |

| | | | $ 15,191,998 |

| Engineering & Construction — 0.1% |

| Artera Services LLC, 8.50%, 2/15/31(1) | | 6,375 | $ 6,324,190 |

| | | | $ 6,324,190 |

| Entertainment — 0.1% |

| Caesars Entertainment, Inc., 6.50%, 2/15/32(1) | | 5,275 | $ 5,352,754 |

| Six Flags Theme Parks, Inc., 7.00%, 7/1/25(1) | | 662 | 661,947 |

| | | | $ 6,014,701 |

| Health Care — 0.7% |

| Medline Borrower LP, 3.875%, 4/1/29(1) | | 21,150 | $ 19,802,538 |

| Tenet Healthcare Corp., 4.25%, 6/1/29 | | 22,375 | 21,184,058 |

| | | | $ 40,986,596 |

| Hotels, Restaurants & Leisure — 0.5% |

| Carnival Corp., 4.00%, 8/1/28(1) | | 31,975 | $ 30,505,208 |

| | | | $ 30,505,208 |

| Household Products — 0.1% |

| Kronos Acquisition Holdings, Inc., 8.25%, 6/30/31(1) | | 5,000 | $ 4,957,283 |

| | | | $ 4,957,283 |

| Insurance — 0.6% |

| Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer: | | | |

| 4.25%, 10/15/27(1) | | 700 | $ 664,558 |

| 7.00%, 1/15/31(1) | | 5,250 | 5,289,706 |

| AmWINS Group, Inc., 6.375%, 2/15/29(1) | | 12,350 | 12,418,666 |

| Panther Escrow Issuer LLC, 7.125%, 6/1/31(1) | | 14,525 | 14,884,210 |

| | | | $ 33,257,140 |

| Security | Principal

Amount*

(000's omitted) | Value |

| Internet Software & Services — 0.3% |

| Central Parent, Inc./CDK Global, Inc., 7.25%, 6/15/29(1) | | 15,225 | $ 15,297,030 |

| | | | $ 15,297,030 |

| Leisure Goods/Activities/Movies — 0.4% |

| Lindblad Expeditions LLC, 6.75%, 2/15/27(1) | | 3,475 | $ 3,494,210 |

| NCL Corp. Ltd., 5.875%, 2/15/27(1) | | 20,375 | 20,367,626 |

| | | | $ 23,861,836 |

| Machinery — 0.3% |

| Madison IAQ LLC, 4.125%, 6/30/28(1) | | 12,300 | $ 11,727,447 |

| TK Elevator U.S. Newco, Inc., 5.25%, 7/15/27(1) | | 4,950 | 4,872,889 |

| | | | $ 16,600,336 |

| Media — 0.0%(6) |

| iHeartCommunications, Inc., 6.375%, 5/1/26 | | 1,159 | $ 982,276 |

| | | | $ 982,276 |

| Oil, Gas & Consumable Fuels — 0.2% |

| CITGO Petroleum Corp., 7.00%, 6/15/25(1) | | 12,175 | $ 12,198,267 |

| | | | $ 12,198,267 |

| Professional Services — 0.0%(6) |

| CoreLogic, Inc., 4.50%, 5/1/28(1) | | 3,500 | $ 3,289,978 |

| | | | $ 3,289,978 |

| Real Estate Investment Trusts (REITs) — 0.2% |

| Cushman & Wakefield U.S. Borrower LLC, 6.75%, 5/15/28(1) | | 7,493 | $ 7,539,770 |

| Park Intermediate Holdings LLC/PK Domestic Property LLC/PK Finance Co-Issuer, 5.875%, 10/1/28(1) | | 5,925 | 5,869,157 |

| | | | $ 13,408,927 |

| Retail — 0.1% |

| Fertitta Entertainment LLC/Fertitta Entertainment Finance Co., Inc., 4.625%, 1/15/29(1) | | 6,790 | $ 6,344,465 |

| | | | $ 6,344,465 |

| Software — 0.8% |

| Cloud Software Group, Inc.: | | | |

| 8.25%, 6/30/32(1) | | 19,590 | $ 20,149,151 |

| 9.00%, 9/30/29(1) | | 5,100 | 5,103,464 |

| GoTo Group, Inc., 5.50%, 5/1/28(1) | | 5,405 | 4,180,110 |

20

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Security | Principal

Amount*

(000's omitted) | Value |

| Software (continued) |

| UKG, Inc., 6.875%, 2/1/31(1) | | 10,525 | $ 10,791,559 |

| Veritas U.S., Inc./Veritas Bermuda Ltd., 7.50%, 9/1/25(1) | | 6,850 | 6,526,099 |

| | | | $ 46,750,383 |

| Technology — 0.3% |

| Clarivate Science Holdings Corp., 3.875%, 7/1/28(1) | | 10,575 | $ 9,990,435 |

| NCR Atleos Corp., 9.50%, 4/1/29(1) | | 8,700 | 9,582,665 |

| | | | $ 19,573,100 |

| Telecommunications — 0.1% |

| VMED O2 U.K. Financing I PLC, 4.25%, 1/31/31(1) | | 4,375 | $ 3,778,667 |

| | | | $ 3,778,667 |

| Wireless Telecommunication Services — 0.1% |

| Digicel Intermediate Holdings Ltd./Digicel International Finance Ltd./DIFL U.S., 12.00%, (9.00% cash and 3.00% PIK), 5/25/27 | | 7,284 | $ 7,325,366 |

| | | | $ 7,325,366 |

Total Corporate Bonds

(identified cost $580,292,514) | | | $ 568,416,225 |

| Senior Floating-Rate Loans — 107.0%(7) |

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Aerospace and Defense — 1.3% |

| Aernnova Aerospace SAU, Term Loan, 7.25%, (3 mo. EURIBOR + 4.00%), 2/27/30 | EUR | 7,550 | $ 8,217,644 |

| Dynasty Acquisition Co., Inc., Term Loan, 8/24/28(8) | | 793 | 794,329 |

| HDI Aerospace Intermediate Holding III Corp., Term Loan, 9/19/31(8) | | 8,325 | 8,309,391 |

| IAP Worldwide Services, Inc., Term Loan - Second Lien, 0.00%, 7/18/23(3)(9) | | 1,184 | 941,309 |

| Novaria Holdings LLC, Term Loan, 9.035%, (SOFR + 4.25%), 6/6/31 | | 2,600 | 2,606,500 |

| TransDigm, Inc.: | | | |

| Term Loan, 7.104%, (SOFR + 2.50%), 2/28/31 | | 26,825 | 26,878,633 |

| Term Loan, 7.354%, (SOFR + 2.75%), 3/22/30 | | 29,224 | 29,324,159 |

| | | | $ 77,071,965 |

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Air Freight & Logistics — 0.1% |

| AIT Worldwide Logistics, Inc., Term Loan, 4/5/30(8) | | 8,025 | $ 7,984,875 |

| | | | $ 7,984,875 |

| Airlines — 0.4% |

| American Airlines, Inc., Term Loan, 9.629%, (SOFR + 4.75%), 4/20/28 | | 22,400 | $ 23,073,277 |

| | | | $ 23,073,277 |

| Apparel & Luxury Goods — 0.8% |

| ABG Intermediate Holdings 2 LLC, Term Loan, 7.447%, (SOFR + 2.75%), 12/21/28 | | 9,282 | $ 9,313,252 |

| Gloves Buyer, Inc., Term Loan, 8.80%, (SOFR + 4.00%), 12/29/27 | | 29,962 | 29,886,744 |

| Hanesbrands, Inc., Term Loan, 8.435%, (SOFR + 3.75%), 3/8/30 | | 2,593 | 2,601,364 |

| Varsity Brands, Inc., Term Loan, 8/26/31(8) | | 6,000 | 5,986,608 |

| | | | $ 47,787,968 |

| Auto Components — 1.9% |

| Adient U.S. LLC, Term Loan, 7.435%, (SOFR + 2.75%), 1/31/31 | | 19,141 | $ 19,216,613 |

| Autokiniton U.S. Holdings, Inc., Term Loan, 8.80%, (SOFR + 4.00%), 4/6/28 | | 22,662 | 22,706,356 |

| Clarios Global LP: | | | |

| Term Loan, 6.102%, (EURIBOR + 3.00%), 7/16/31(10) | EUR | 8,186 | 8,902,375 |

| Term Loan, 7.185%, (SOFR + 2.50%), 5/6/30 | | 499 | 499,893 |

| DexKo Global, Inc.: | | | |

| Term Loan, 7.345%, (3 mo. EURIBOR + 4.00%), 10/4/28 | EUR | 4,719 | 4,952,165 |

| Term Loan, 7.345%, (3 mo. EURIBOR + 4.00%), 10/4/28 | EUR | 6,931 | 7,272,637 |

| Term Loan, 8.615%, (SOFR + 3.75%), 10/4/28 | | 10,123 | 9,715,890 |

| Garrett LX I SARL, Term Loan, 7.335%, (SOFR + 2.75%), 4/30/28 | | 6,208 | 6,231,280 |

| LSF12 Badger Bidco LLC, Term Loan, 10.685%, (SOFR + 6.00%), 8/30/30 | | 3,970 | 3,915,413 |

| LTI Holdings, Inc., Term Loan, 9.435%, (SOFR + 4.75%), 7/19/29 | | 10,500 | 10,464,563 |

| RealTruck Group, Inc.: | | | |

| Term Loan, 8.30%, (SOFR + 3.50%), 1/31/28 | | 11,256 | 11,133,165 |

| Term Loan, 9.80%, (SOFR + 5.00%), 1/31/28 | | 8,905 | 8,820,650 |

| | | | $ 113,831,000 |

| Automobiles — 1.0% |

| Bombardier Recreational Products, Inc., Term Loan, 7.435%, (SOFR + 2.75%), 1/22/31 | | 34,833 | $ 34,838,611 |

21

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Automobiles (continued) |

| MajorDrive Holdings IV LLC: | | | |

| Term Loan, 8.865%, (SOFR + 4.00%), 6/1/28 | | 22,276 | $ 22,373,532 |

| Term Loan, 10.254%, (SOFR + 5.50%), 6/1/29 | | 1,481 | 1,490,731 |

| | | | $ 58,702,874 |

| Beverages — 1.1% |

| Arterra Wines Canada, Inc., Term Loan, 8.365%, (SOFR + 3.50%), 11/24/27 | | 3,369 | $ 3,315,310 |

| City Brewing Co. LLC: | | | |

| Term Loan, 8.418%, (SOFR + 3.50%), 4/5/28 | | 12,846 | 10,019,787 |

| Term Loan, 10.906%, (SOFR + 6.25%), 4/5/28 | | 7,155 | 6,009,806 |

| Term Loan - Second Lien, 9.676%, (SOFR + 5.00%), 4/5/28 | | 14,502 | 6,888,599 |

| Triton Water Holdings, Inc., Term Loan, 8.115%, (SOFR + 3.25%), 3/31/28 | | 35,203 | 35,275,398 |

| | | | $ 61,508,900 |

| Biotechnology — 0.5% |

| Alkermes, Inc., Term Loan, 7.332%, (SOFR + 2.50%), 3/12/26 | | 12,572 | $ 12,587,633 |

| Alltech, Inc., Term Loan, 8.80%, (SOFR + 4.00%), 10/13/28 | | 13,222 | 13,205,854 |

| Grifols Worldwide Operations USA, Inc., Term Loan, 6.735%, (SOFR + 2.00%), 11/15/27 | | 6,310 | 6,143,335 |

| | | | $ 31,936,822 |

| Building Products — 1.5% |

| Cornerstone Building Brands, Inc., Term Loan, 8.154%, (SOFR + 3.25%), 4/12/28 | | 17,783 | $ 17,516,340 |

| CPG International, Inc., Term Loan, 9/19/31(8) | | 9,175 | 9,204,626 |

| LHS Borrower LLC, Term Loan, 9.535%, (SOFR + 4.75%), 2/16/29 | | 6,628 | 6,362,679 |

| LSF12 Crown U.S. Commercial Bidco LLC, Term Loan, 10/10/31(8) | | 25,575 | 25,511,062 |

| MI Windows and Doors LLC, Term Loan, 7.685%, (SOFR + 3.00%), 3/28/31 | | 11,621 | 11,676,562 |

| Oscar AcquisitionCo LLC, Term Loan, 8.495%, (SOFR + 4.25%), 4/29/29 | | 4,982 | 4,952,944 |

| Sport Group Holding GmbH, Term Loan, 7.50%, (3 mo. EURIBOR + 4.25%), 7/8/31 | EUR | 1,700 | 1,858,421 |

| Standard Industries, Inc., Term Loan, 6.759%, (SOFR + 2.00%), 9/22/28 | | 8,635 | 8,662,396 |

| | | | $ 85,745,030 |

| Capital Markets — 4.8% |

| Advisor Group, Inc., Term Loan, 8.685%, (SOFR + 4.00%), 8/17/28 | | 25,181 | $ 25,212,568 |

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Capital Markets (continued) |

| AllSpring Buyer LLC, Term Loan, 8.137%, (SOFR + 3.25%), 11/1/28 | | 8,146 | $ 8,152,330 |

| Aretec Group, Inc., Term Loan, 8.685%, (SOFR + 4.00%), 8/9/30 | | 28,031 | 27,880,082 |

| Brookfield Property REIT, Inc., Term Loan, 7.285%, (SOFR + 2.50%), 8/27/25 | | 4,449 | 4,447,491 |

| CeramTec AcquiCo GmbH, Term Loan, 7.005%, (3 mo. EURIBOR + 3.50%), 3/16/29 | EUR | 14,461 | 15,760,827 |

| Citco Funding LLC, Term Loan, 7.308%, (SOFR + 2.75%), 4/27/28 | | 10,321 | 10,368,745 |

| Clipper Acquisitions Corp., Term Loan, 6.715%, (SOFR + 1.75%), 3/3/28 | | 6,767 | 6,750,399 |

| Edelman Financial Center LLC, Term Loan, 7.935%, (SOFR + 3.25%), 4/7/28 | | 18,113 | 18,139,544 |

| EIG Management Co. LLC, Term Loan, 9.759%, (SOFR + 5.00%), 5/17/29 | | 5,555 | 5,582,461 |

| FinCo I LLC, Term Loan, 6.935%, (SOFR + 2.25%), 6/27/29 | | 16,121 | 16,181,391 |

| Focus Financial Partners LLC: | | | |

| Term Loan, 0.00%, 9/15/31(11) | | 1,455 | 1,458,527 |

| Term Loan, 7.935%, (SOFR + 3.25%), 9/15/31 | | 13,545 | 13,580,008 |

| Franklin Square Holdings LP, Term Loan, 6.935%, (SOFR + 2.25%), 4/25/31 | | 13,167 | 13,167,000 |

| Guggenheim Partners LLC, Term Loan, 7.854%, (SOFR + 3.25%), 12/12/29 | | 32,027 | 32,139,113 |

| HighTower Holdings LLC, Term Loan, 8.748%, (SOFR + 3.50%), 4/21/28 | | 12,659 | 12,696,533 |

| Kestra Advisor Services Holdings A, Inc., Term Loan, 9.057%, (SOFR + 4.00%), 3/22/31 | | 8,379 | 8,419,152 |

| LPL Holdings, Inc., Term Loan, 6.694%, (SOFR + 1.75%), 11/12/26 | | 17,526 | 17,523,108 |

| Mariner Wealth Advisors LLC, Term Loan, 7.604%, (SOFR + 3.00%), 8/18/28 | | 17,317 | 17,349,162 |

| Press Ganey Holdings, Inc., Term Loan, 8.185%, (SOFR + 3.50%), 4/30/31 | | 8,325 | 8,336,056 |

| Victory Capital Holdings, Inc.: | | | |

| Term Loan, 6.934%, (SOFR + 2.25%), 7/1/26 | | 12,800 | 12,806,086 |

| Term Loan, 6.934%, (SOFR + 2.25%), 12/29/28 | | 5,963 | 5,962,507 |

| | | | $ 281,913,090 |

| Chemicals — 5.4% |

| Axalta Coating Systems U.S. Holdings, Inc., Term Loan, 6.604%, (SOFR + 2.00%), 12/20/29 | | 19,614 | $ 19,696,013 |

| CPC Acquisition Corp., Term Loan, 8.615%, (SOFR + 3.75%), 12/29/27 | | 17,474 | 15,442,724 |

| Discovery Purchaser Corp., Term Loan, 10/4/29(8) | | 7,675 | 7,676,596 |

| ECO Services Operations Corp., Term Loan, 6.835%, (SOFR + 2.25%), 6/12/31 | | 30,413 | 30,346,050 |

22

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Chemicals (continued) |

| Flint Group Topco Ltd., Term Loan - Second Lien, 11.888%, (SOFR + 7.26%), 4.988% cash, 6.90% PIK, 12/30/27 | | 325 | $ 65,755 |

| Gemini HDPE LLC, Term Loan, 7.847%, (SOFR + 3.00%), 12/31/27 | | 5,400 | 5,413,680 |

| GEON Performance Solutions LLC, Term Loan, 9.115%, (SOFR + 4.25%), 8/18/28 | | 7,545 | 7,585,412 |

| Groupe Solmax, Inc., Term Loan, 9.585%, (SOFR + 4.75%), 5/29/28(10) | | 15,303 | 14,227,377 |

| INEOS Enterprises Holdings II Ltd., Term Loan, 7.505%, (3 mo. EURIBOR + 4.00%), 7/7/30 | EUR | 2,325 | 2,542,296 |

| INEOS Enterprises Holdings U.S. Finco LLC, Term Loan, 8.907%, (SOFR + 3.75%), 7/8/30 | | 13,895 | 13,981,843 |

| INEOS Finance PLC, Term Loan, 6.646%, (1 mo. EURIBOR + 3.50%), 6/23/31 | EUR | 7,846 | 8,517,862 |

| INEOS Quattro Holdings U.K. Ltd.: | | | |

| Term Loan, 7.146%, (1 mo. EURIBOR + 4.00%), 3/14/30 | EUR | 4,075 | 4,424,270 |

| Term Loan, 8.535%, (SOFR + 3.75%), 3/14/30 | | 6,048 | 6,018,195 |

| INEOS U.S. Finance LLC: | | | |

| Term Loan, 7.285%, (SOFR + 2.50%), 11/8/28 | | 6,699 | 6,704,429 |

| Term Loan, 7.935%, (SOFR + 3.25%), 2/18/30 | | 14,472 | 14,482,918 |

| Term Loan, 8.435%, (SOFR + 3.75%), 2/7/31 | | 7,082 | 7,106,599 |

| Lonza Group AG: | | | |

| Term Loan, 7.27%, (3 mo. EURIBOR + 3.93%), 7/3/28 | EUR | 7,575 | 8,028,563 |

| Term Loan, 8.629%, (SOFR + 3.93%), 7/3/28 | | 9,321 | 9,094,429 |

| Momentive Performance Materials, Inc., Term Loan, 8.75%, (SOFR + 4.00%), 3/29/28 | | 15,960 | 16,019,438 |

| Nobian Finance BV, Term Loan, 7/2/29(8) | EUR | 500 | 545,099 |

| Olympus Water U.S. Holding Corp., Term Loan, 8.104%, (SOFR + 3.50%), 6/20/31 | | 9,455 | 9,485,989 |

| Orion Engineered Carbons GmbH, Term Loan, 5.745%, (3 mo. EURIBOR + 2.40%), 9/24/28 | EUR | 1,250 | 1,349,490 |

| Paint Intermediate III LLC, Term Loan, 10.00%, (USD Prime + 2.00%), 9/11/31 | | 6,600 | 6,583,500 |

| Rohm Holding GmbH: | | | |

| Term Loan, 8.84%, (6 mo. EURIBOR + 5.25%), 8.59% cash, 0.25% PIK, 1/31/29 | EUR | 14,706 | 14,944,603 |

| Term Loan, 10.588%, (SOFR + 5.50%), 1/31/29 | | 17,173 | 16,214,460 |

| SCUR-Alpha 1503 GmbH, Term Loan, 10.085%, (SOFR + 5.50%), 3/29/30 | | 15,548 | 14,861,056 |

| Tronox Finance LLC: | | | |

| Term Loan, 7.14%, (SOFR + 2.50%), 9/18/31(10) | | 12,836 | 12,833,856 |

| Term Loan, 7.354%, (SOFR + 2.75%), 4/4/29 | | 21,663 | 21,667,733 |

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Chemicals (continued) |

| W.R. Grace & Co.-Conn., Term Loan, 7.854%, (SOFR + 3.25%), 9/22/28 | | 22,837 | $ 22,917,396 |

| | | | $ 318,777,631 |

| Commercial Services & Supplies — 2.2% |

| Albion Financing 3 SARL, Term Loan, 9.096%, (SOFR + 4.25%), 8/16/29 | | 24,003 | $ 24,152,672 |

| Belfor Holdings, Inc., Term Loan, 8.435%, (SOFR + 3.75%), 11/1/30 | | 7,871 | 7,930,269 |

| EnergySolutions LLC, Term Loan, 8.104%, (SOFR + 3.50%), 9/20/30 | | 16,267 | 16,304,124 |

| Flame Newco LLC, Term Loan, 10.785%, (SOFR + 6.10%), 6/30/28 | | 3,610 | 3,520,172 |

| Foundever Group, Term Loan, 6.90%, (1 mo. EURIBOR + 3.75%), 8/28/28 | EUR | 4,575 | 3,224,330 |

| Foundever Worldwide Corp., Term Loan, 8.55%, (SOFR + 3.75%), 8/28/28 | | 15,753 | 10,112,869 |

| GFL Environmental, Inc., Term Loan, 6.61%, (SOFR + 2.00%), 7/3/31 | | 12,125 | 12,125,000 |

| Harsco Corp., Term Loan, 7.05%, (SOFR + 2.25%), 3/10/28 | | 1,287 | 1,285,354 |

| Heritage-Crystal Clean, Inc., Term Loan, 9.259%, (SOFR + 4.50%), 10/17/30 | | 9,305 | 9,369,820 |

| Monitronics International, Inc., Term Loan, 12.447%, (SOFR + 7.50%), 6/30/28 | | 10,890 | 10,944,913 |

| Prime Security Services Borrower LLC, Term Loan, 7.107%, (SOFR + 2.25%), 10/13/30 | | 11,945 | 11,963,040 |

| Tempo Acquisition LLC, Term Loan, 6.935%, (SOFR + 2.25%), 8/31/28 | | 3,418 | 3,424,024 |

| TMF Group Holding BV, Term Loan, 8.092%, (SOFR + 3.50%), 5/3/28 | | 5,136 | 5,165,144 |

| TruGreen LP, Term Loan, 8.797%, (SOFR + 4.00%), 11/2/27 | | 9,237 | 8,994,922 |

| | | | $ 128,516,653 |

| Construction Materials — 0.9% |

| Construction Partners, Inc., Term Loan, 10/29/31(8) | | 6,525 | $ 6,508,688 |

| Quikrete Holdings, Inc.: | | | |

| Term Loan, 6.935%, (SOFR + 2.25%), 3/19/29 | | 13,318 | 13,333,037 |

| Term Loan, 7.185%, (SOFR + 2.50%), 4/14/31 | | 20,207 | 20,229,539 |

| Star Holding LLC, Term Loan, 9.185%, (SOFR + 4.50%), 7/31/31 | | 10,900 | 10,720,924 |

| | | | $ 50,792,188 |

| Consumer Staples Distribution & Retail — 0.8% |

| Cardenas Markets, Inc., Term Loan, 11.454%, (SOFR + 6.75%), 8/1/29 | | 5,319 | $ 5,209,562 |

23

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Consumer Staples Distribution & Retail (continued) |

| Peer Holding III BV: | | | |

| Term Loan, 7.095%, (3 mo. EURIBOR + 3.75%), 9/29/28 | EUR | 7,550 | $ 8,251,439 |

| Term Loan, 7.604%, (SOFR + 3.00%), 7/1/31 | | 18,075 | 18,123,947 |

| Term Loan, 7.854%, (SOFR + 3.25%), 10/28/30 | | 14,552 | 14,610,984 |

| | | | $ 46,195,932 |

| Containers & Packaging — 1.3% |

| Altium Packaging LLC, Term Loan, 7.185%, (SOFR + 2.50%), 6/11/31 | | 6,334 | $ 6,306,413 |

| Berlin Packaging LLC, Term Loan, 8.57%, (SOFR + 3.75%), 6/9/31(10) | | 18,534 | 18,598,075 |

| Clydesdale Acquisition Holdings, Inc., Term Loan, 7.86%, (SOFR + 3.18%), 4/13/29 | | 26,957 | 26,921,443 |

| Pregis TopCo Corp.: | | | |

| Term Loan, 8.685%, (SOFR + 4.00%), 7/31/26 | | 2,310 | 2,320,158 |

| Term Loan, 8.80%, (SOFR + 4.00%), 7/31/26 | | 1,601 | 1,608,503 |

| Pretium Packaging LLC, Term Loan - Second Lien, 9.848%, (SOFR + 4.60%), 10/2/28 | | 1,714 | 1,405,120 |

| Pretium PKG Holdings, Inc., Term Loan - Second Lien, 12.068%, (SOFR + 6.75%), 10/1/29 | | 7,100 | 2,669,600 |

| Proampac PG Borrower LLC, Term Loan, 8.839%, (SOFR + 4.00%), 9/15/28 | | 16,503 | 16,582,948 |

| | | | $ 76,412,260 |

| Distributors — 0.8% |

| CD&R Hydra Buyer, Inc., Term Loan, 8.785%, (SOFR + 4.00%), 3/25/31 | | 12,919 | $ 12,906,325 |

| Parts Europe SA, Term Loan, 6.701%, (3 mo. EURIBOR + 3.50%), 2/3/31 | EUR | 19,225 | 20,964,271 |

| Phillips Feed Service, Inc., Term Loan, 11.785%, (SOFR + 7.00%), 11/13/24(3) | | 532 | 324,130 |

| Rubix Group Midco 3 Ltd.: | | | |

| Term Loan, 7.302%, (3 mo. EURIBOR + 4.25%), 9/30/26 | EUR | 2,000 | 2,180,031 |

| Term Loan, 7.712%, (6 mo. EURIBOR + 4.25%), 9/30/26 | EUR | 6,000 | 6,540,094 |

| Winterfell Financing SARL, Term Loan, 8.557%, (3 mo. EURIBOR + 5.00%), 5/4/28 | EUR | 2,500 | 2,701,813 |

| | | | $ 45,616,664 |

| Diversified Consumer Services — 1.7% |

| Ascend Learning LLC: | | | |

| Term Loan, 8.285%, (SOFR + 3.50%), 12/11/28 | | 9,857 | $ 9,866,461 |

| Term Loan - Second Lien, 10.535%, (SOFR + 5.75%), 12/10/29 | | 7,743 | 7,638,786 |

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Diversified Consumer Services (continued) |

| Chrysaor Bidco SARL: | | | |

| Term Loan, 5/14/31(8) | | 1,791 | $ 1,799,690 |

| Term Loan, 7/17/31(8) | | 24,220 | 24,334,942 |

| FrontDoor, Inc., Term Loan, 7.05%, (SOFR + 2.25%), 6/17/28 | | 943 | 946,260 |

| KUEHG Corp., Term Loan, 7.839%, (SOFR + 3.25%), 6/12/30 | | 18,114 | 18,187,966 |

| Project Boost Purchaser LLC: | | | |

| Term Loan, 8.147%, (SOFR + 3.50%), 7/16/31 | | 10,875 | 10,900,915 |

| Term Loan - Second Lien, 9.897%, (SOFR + 5.25%), 7/16/32 | | 4,800 | 4,833,998 |

| Spring Education Group, Inc., Term Loan, 8.604%, (SOFR + 4.00%), 10/4/30 | | 4,690 | 4,724,148 |

| Wand NewCo 3, Inc., Term Loan, 7.905%, (SOFR + 3.25%), 1/30/31(10) | | 16,459 | 16,479,324 |

| | | | $ 99,712,490 |

| Diversified Financial Services — 0.1% |

| Concorde Midco Ltd., Term Loan, 7.092%, (6 mo. EURIBOR + 4.00%), 3/1/28 | EUR | 7,480 | $ 8,124,506 |

| | | | $ 8,124,506 |

| Diversified Telecommunication Services — 1.1% |

| Altice France SA, Term Loan, 8/14/26(8) | | 6,455 | $ 5,496,432 |

| Anuvu Holdings 2 LLC: | | | |

| Term Loan, 8.963%, (SOFR + 4.00%), 9/27/27(3) | | 9,869 | 7,895,074 |

| Term Loan, 13.213%, (SOFR + 8.25%), 3/23/26(3) | | 8,545 | 3,411,164 |

| Level 3 Financing, Inc.: | | | |

| Term Loan, 11.278%, (SOFR + 6.56%), 4/15/29 | | 5,750 | 5,879,375 |

| Term Loan, 11.278%, (SOFR + 6.56%), 4/15/30 | | 11,900 | 12,162,443 |

| Lumen Technologies, Inc.: | | | |

| Term Loan, 7.182%, (SOFR + 2.35%), 4/15/29 | | 11,999 | 10,919,007 |

| Term Loan, 7.182%, (SOFR + 2.35%), 4/15/30 | | 11,999 | 10,780,275 |

| Virgin Media Bristol LLC, Term Loan, 7.418%, (SOFR + 2.50%), 1/31/28 | | 4,843 | 4,708,861 |

| | | | $ 61,252,631 |

| Electrical Equipment — 0.6% |

| AZZ, Inc., Term Loan, 7.185%, (SOFR + 2.50%), 5/13/29 | | 1,844 | $ 1,852,046 |

| Dynamo Newco II GmbH, Term Loan, 10/1/31(8) | | 2,875 | 2,883,984 |

| WEC U.S. Holdings Ltd., Term Loan, 7.595%, (SOFR + 2.75%), 1/27/31 | | 29,340 | 29,407,385 |

| | | | $ 34,143,415 |

24

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Electronic Equipment, Instruments & Components — 1.3% |

| Chamberlain Group, Inc., Term Loan, 8.185%, (SOFR + 3.50%), 11/3/28 | | 9,588 | $ 9,608,677 |

| Creation Technologies, Inc., Term Loan, 10.351%, (SOFR + 5.50%), 10/5/28 | | 15,356 | 15,010,454 |

| II-VI, Inc., Term Loan, 7.185%, (SOFR + 2.50%), 7/2/29 | | 1,312 | 1,314,929 |

| Ingram Micro, Inc., Term Loan, 7.564%, (SOFR + 2.75%), 9/22/31 | | 2,838 | 2,844,959 |

| Mirion Technologies, Inc., Term Loan, 6.854%, (SOFR + 2.25%), 10/20/28 | | 2,350 | 2,351,621 |

| MX Holdings U.S., Inc., Term Loan, 7.561%, (SOFR + 2.75%), 7/31/28 | | 3,317 | 3,330,320 |

| Range Red Operating, Inc.: | | | |

| Term Loan, 12.693%, (SOFR + 8.00%), 10/1/29 | | 4,296 | 4,285,699 |

| Term Loan - Second Lien, 12.693%, (SOFR + 8.00%), 10/1/29 | | 16,279 | 16,239,679 |

| Sector Alarm Holding AS, Term Loan, 7.755%, (3 mo. EURIBOR + 4.25%), 6/14/29 | EUR | 500 | 546,561 |

| Verifone Systems, Inc., Term Loan, 9.333%, (SOFR + 4.00%), 8/20/25 | | 20,192 | 18,839,953 |

| | | | $ 74,372,852 |

| Energy Equipment & Services — 0.6% |

| Ameriforge Group, Inc.: | | | |

| Term Loan, 15.811%, (SOFR + 11.00%), 4.811% cash, 11.00% PIK, 12/31/25(3) | | 2,375 | $ 1,093,438 |

| Term Loan, 15.811%, (SOFR + 11.00%), 4.811% cash, 11.00% PIK, 12/31/25(3) | | 20,566 | 9,468,587 |

| GIP Pilot Acquisition Partners LP, Term Loan, 7.09%, (SOFR + 2.50%), 10/4/30 | | 6,209 | 6,216,367 |

| PG Investment Co. 59 SARL, Term Loan, 7.604%, (SOFR + 3.00%), 3/26/31 | | 18,015 | 18,063,036 |

| | | | $ 34,841,428 |

| Engineering & Construction — 1.3% |

| American Residential Services LLC, Term Loan, 8.365%, (SOFR + 3.50%), 10/15/27 | | 8,359 | $ 8,389,904 |

| APi Group DE, Inc., Term Loan, 6.685%, (SOFR + 2.00%), 1/3/29 | | 17,095 | 17,118,509 |

| Arcosa, Inc., Term Loan, 6.935%, (SOFR + 2.25%), 8/12/31 | | 4,750 | 4,776,719 |

| Artera Services LLC, Term Loan, 9.104%, (SOFR + 4.50%), 2/15/31 | | 5,597 | 5,539,507 |

| Azuria Water Solutions, Inc., Term Loan, 8.435%, (SOFR + 3.75%), 5/17/28 | | 17,509 | 17,654,451 |

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Engineering & Construction (continued) |

| Centuri Group, Inc., Term Loan, 7.311%, (SOFR + 2.50%), 8/27/28 | | 6,707 | $ 6,720,903 |

| Northstar Group Services, Inc., Term Loan, 10.014%, (SOFR + 4.75%), 5/8/30 | | 17,656 | 17,739,615 |

| | | | $ 77,939,608 |

| Entertainment — 1.0% |

| Crown Finance U.S., Inc., Term Loan, 13.30%, (SOFR + 8.50%), 6.30% cash, 7.00% PIK, 7/31/28 | | 2,689 | $ 2,712,528 |

| Playtika Holding Corp., Term Loan, 7.55%, (SOFR + 2.75%), 3/13/28 | | 23,022 | 23,022,034 |

| Renaissance Holding Corp., Term Loan, 8.935%, (SOFR + 4.25%), 4/5/30 | | 13,613 | 13,661,491 |

| UFC Holdings LLC, Term Loan, 7.638%, (SOFR + 2.75%), 4/29/26 | | 14,534 | 14,565,917 |

| Vue Entertainment International Ltd., Term Loan, 11.446%, (6 mo. EURIBOR + 8.40%), 3.046% cash, 8.40% PIK, 12/31/27 | EUR | 1,524 | 1,023,890 |

| Vue International Bidco PLC, Term Loan, 11.046%, (6 mo. EURIBOR + 8.00%), 6/30/27 | EUR | 385 | 418,525 |

| | | | $ 55,404,385 |

| Equity Real Estate Investment Trusts (REITs) — 0.1% |

| Iron Mountain, Inc., Term Loan, 6.685%, (SOFR + 2.00%), 1/31/31 | | 7,889 | $ 7,859,454 |

| | | | $ 7,859,454 |

| Financial Services — 2.0% |

| Boost Newco Borrower LLC, Term Loan, 7.104%, (SOFR + 2.50%), 1/31/31 | | 31,850 | $ 31,879,875 |

| CPI Holdco B LLC, Term Loan, 6.685%, (SOFR + 2.00%), 5/19/31 | | 15,625 | 15,475,266 |

| Ditech Holding Corp., Term Loan, 0.00%, 6/30/25(9) | | 14,624 | 2,888,319 |

| Grant Thornton Advisors LLC, Term Loan, 7.935%, (SOFR + 3.25%), 6/2/31 | | 27,925 | 27,965,156 |

| NCR Atleos LLC, Term Loan, 8.398%, (SOFR + 3.75%), 3/27/29 | | 12,110 | 12,129,168 |

| Nuvei Technologies Corp., Term Loan, 7.785%, (SOFR + 3.00%), 12/19/30 | | 10,809 | 10,816,123 |

| Walker & Dunlop, Inc., Term Loan, 7.035%, (SOFR + 2.25%), 12/16/28 | | 13,834 | 13,902,982 |

| WEX, Inc., Term Loan, 6.685%, (SOFR + 2.00%), 3/31/28 | | 4,295 | 4,306,980 |

| | | | $ 119,363,869 |

25

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Food Products — 1.1% |

| Artisan Newco BV, Term Loan, 7.827%, (3 mo. EURIBOR + 3.75%), 2/12/29 | EUR | 500 | $ 545,982 |

| Badger Buyer Corp., Term Loan, 10.30%, (SOFR + 3.50%), 12/27/24 | | 9,652 | 9,242,117 |

| CHG PPC Parent LLC, Term Loan, 7.55%, (SOFR + 2.75%), 12/8/28 | | 6,166 | 6,154,075 |

| Del Monte Foods, Inc.: | | | |

| Term Loan, 13.166%, (SOFR + 8.00%), 8/2/28 | | 4,565 | 4,371,373 |

| Term Loan - Second Lien, 9.427%, (SOFR + 4.25%), 8/2/28(10) | | 6,493 | 3,708,841 |

| Froneri International Ltd., Term Loan, 6.685%, (SOFR + 2.00%), 9/17/31 | | 8,616 | 8,587,186 |

| Monogram Food Solutions LLC, Term Loan, 8.80%, (SOFR + 4.00%), 8/28/28 | | 1,752 | 1,745,004 |

| Nomad Foods U.S. LLC, Term Loan, 6.968%, (SOFR + 2.50%), 11/12/29 | | 14,032 | 14,056,210 |

| Simply Good Foods USA, Inc., Term Loan, 7.318%, (SOFR + 2.50%), 3/17/27 | | 1,875 | 1,885,547 |

| United Petfood Group BV, Term Loan, 5.822%, (3 mo. EURIBOR + 2.75%), 4/24/28 | EUR | 7,600 | 8,260,013 |

| Valeo F1 Co. Ltd. (Ireland), Term Loan, 9.70%, (SONIA + 4.75%), 6/28/28 | GBP | 5,500 | 6,902,489 |

| | | | $ 65,458,837 |

| Gas Utilities — 0.4% |

| CQP Holdco LP, Term Loan, 6.854%, (SOFR + 2.25%), 12/31/30 | | 21,933 | $ 21,944,317 |

| | | | $ 21,944,317 |

| Health Care Equipment & Supplies — 1.1% |

| Bayou Intermediate II LLC, Term Loan, 9.347%, (SOFR + 4.50%), 8/2/28 | | 11,985 | $ 11,745,247 |

| Journey Personal Care Corp., Term Loan, 9.05%, (SOFR + 4.25%), 3/1/28 | | 25,880 | 25,868,774 |

| Medline Borrower LP, Term Loan, 7.435%, (SOFR + 2.75%), 10/23/28 | | 24,302 | 24,355,333 |

| | | | $ 61,969,354 |

| Health Care Providers & Services — 5.8% |

| AEA International Holdings (Lux) SARL, Term Loan, 7.354%, (SOFR + 2.75%), 9/7/28 | | 14,711 | $ 14,747,989 |

| BW NHHC Holdco, Inc., Term Loan - Second Lien, 12.604%, (SOFR + 8.00%), 10.354% cash, 2.25% PIK, 1/15/26 | | 23,083 | 19,967,037 |

| Cano Health LLC: | | | |

| Term Loan, 4.00%, 6/28/28(11) | | 3,440 | 3,448,987 |

| Term Loan, 12.604%, (SOFR + 8.00%), 6/28/29 | | 1,547 | 1,550,374 |

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Health Care Providers & Services (continued) |

| CCRR Parent, Inc., Term Loan, 9.05%, (SOFR + 4.25%), 3/6/28 | | 5,181 | $ 3,986,481 |

| Cerba Healthcare SAS: | | | |

| Term Loan, 6.846%, (1 mo. EURIBOR + 3.70%), 6/30/28 | EUR | 15,825 | 14,960,221 |

| Term Loan, 7.096%, (1 mo. EURIBOR + 3.95%), 2/16/29 | EUR | 8,600 | 8,126,851 |

| CHG Healthcare Services, Inc.: | | | |

| Term Loan, 8.30%, (SOFR + 3.50%), 9/29/28 | | 2,565 | 2,574,590 |

| Term Loan, 8.30%, (SOFR + 3.50%), 9/29/28 | | 5,235 | 5,260,798 |

| Concentra Health Services, Inc., Term Loan, 6.935%, (SOFR + 2.25%), 7/28/31 | | 4,775 | 4,786,938 |

| Covis Finco SARL: | | | |

| Term Loan, 0.00%, 2/18/27(9) | | 10,270 | 4,159,516 |

| Term Loan, 0.00%, 2/18/27(9) | | 4,368 | 4,193,458 |

| Ensemble RCM LLC, Term Loan, 7.585%, (SOFR + 3.00%), 8/1/29 | | 22,359 | 22,411,180 |

| Hanger, Inc.: | | | |

| Term Loan, 10/23/31(8) | | 14,330 | 14,352,326 |

| Term Loan, 10/23/31(8) | | 1,845 | 1,847,939 |

| IVC Acquisition Ltd.: | | | |

| Term Loan, 8.795%, (6 mo. EURIBOR + 5.00%), 12/12/28 | EUR | 20,825 | 22,716,656 |

| Term Loan, 9.393%, (SOFR + 4.75%), 12/12/28 | | 13,647 | 13,718,121 |

| Medical Solutions Holdings, Inc.: | | | |

| Term Loan, 8.185%, (SOFR + 3.50%), 11/1/28 | | 15,021 | 11,284,282 |

| Term Loan - Second Lien, 11.685%, (SOFR + 7.00%), 11/1/29 | | 9,500 | 6,365,000 |

| Mehilainen Yhtiot Oy: | | | |

| Term Loan, 4.00%, 8/5/31(11) | EUR | 1,218 | 1,330,850 |

| Term Loan, 7.345%, (3 mo. EURIBOR + 4.00%), 8/5/31 | EUR | 6,475 | 7,074,875 |

| Term Loan, 7.345%, (3 mo. EURIBOR + 4.00%), 8/5/31 | EUR | 6,807 | 7,437,624 |

| Midwest Physician Administrative Services LLC, Term Loan, 7.865%, (SOFR + 3.00%), 3/12/28 | | 9,927 | 9,039,886 |

| National Mentor Holdings, Inc.: | | | |

| Term Loan, 8.454%, (SOFR + 3.75%), 3/2/28 | | 572 | 563,003 |

| Term Loan, 8.52%, (SOFR + 3.75%), 3/2/28(10) | | 20,223 | 19,903,387 |

| Term Loan - Second Lien, 11.954%, (SOFR + 7.25%), 3/2/29 | | 6,475 | 6,199,813 |

| Pacific Dental Services LLC, Term Loan, 7.536%, (SOFR + 2.75%), 3/15/31 | | 11,094 | 11,113,898 |

| Phoenix Guarantor, Inc., Term Loan, 7.935%, (SOFR + 3.25%), 2/21/31 | | 21,974 | 22,009,766 |

| R1 RCM, Inc., Term Loan, 7.685%, (SOFR + 3.00%), 6/21/29 | | 3,002 | 2,992,332 |

26

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Health Care Providers & Services (continued) |

| Radnet Management, Inc., Term Loan, 7.132%, (SOFR + 2.50%), 4/18/31 | | 9,277 | $ 9,304,775 |

| Raven Acquisition Holdings LLC: | | | |

| Term Loan, 10/24/31(8) | | 18,480 | 18,406,080 |

| Term Loan, 10/24/31(8) | | 1,320 | 1,314,720 |

| Select Medical Corp., Term Loan, 7.685%, (SOFR + 3.00%), 3/6/27 | | 10,013 | 10,069,541 |

| Sound Inpatient Physicians, Term Loan - Second Lien, 11.365%, (SOFR + 5.00%), 9.865% cash, 1.50% PIK, 6/28/28 | | 2,227 | 2,009,592 |

| Synlab Bondco PLC, Term Loan, 6.178%, (6 mo. EURIBOR + 2.50%), 7/1/27 | EUR | 2,600 | 2,829,032 |

| TTF Holdings LLC, Term Loan, 8.435%, (SOFR + 3.75%), 7/18/31 | | 18,150 | 18,274,781 |

| U.S. Anesthesia Partners, Inc., Term Loan, 9.209%, (SOFR + 4.25%), 10/1/28 | | 8,394 | 8,292,306 |

| | | | $ 338,625,005 |

| Health Care Technology — 1.6% |

| Certara LP, Term Loan, 7.685%, (SOFR + 3.00%), 6/26/31 | | 9,212 | $ 9,223,839 |

| Cotiviti Corp., Term Loan, 8.094%, (SOFR + 3.25%), 5/1/31 | | 11,495 | 11,516,146 |

| eResearchTechnology, Inc., Term Loan, 8.685%, (SOFR + 4.00%), 2/4/27 | | 9,463 | 9,504,787 |

| Imprivata, Inc., Term Loan, 8.085%, (SOFR + 3.50%), 12/1/27 | | 22,178 | 22,302,321 |

| PointClickCare Technologies, Inc.: | | | |

| Term Loan, 7.604%, (SOFR + 3.00%), 12/29/27 | | 4,245 | 4,257,955 |

| Term Loan, 10/10/31(8) | | 7,950 | 7,974,844 |

| Project Ruby Ultimate Parent Corp., Term Loan, 8.30%, (SOFR + 3.50%), 3/10/28 | | 4,652 | 4,673,139 |

| Symplr Software, Inc., Term Loan, 9.185%, (SOFR + 4.50%), 12/22/27 | | 11,328 | 10,417,880 |

| Waystar Technologies, Inc., Term Loan, 7.435%, (SOFR + 2.75%), 10/22/29 | | 12,678 | 12,745,021 |

| | | | $ 92,615,932 |

| Hotels, Restaurants & Leisure — 5.7% |

| 1011778 BC Unlimited Liability Co., Term Loan, 6.435%, (SOFR + 1.75%), 9/20/30 | | 42,295 | $ 41,969,935 |

| Caesars Entertainment, Inc., Term Loan, 7.435%, (SOFR + 2.75%), 2/6/31 | | 30,074 | 30,144,368 |

| Carnival Corp., Term Loan, 7.435%, (SOFR + 2.75%), 10/18/28 | | 30,936 | 31,037,926 |

| ClubCorp Holdings, Inc., Term Loan, 9.865%, (SOFR + 5.00%), 9/18/26 | | 19,928 | 19,984,468 |

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Hotels, Restaurants & Leisure (continued) |

| Fertitta Entertainment LLC, Term Loan, 8.185%, (SOFR + 3.50%), 1/27/29 | | 37,286 | $ 37,336,841 |

| Flutter Financing BV, Term Loan, 6.604%, (SOFR + 2.00%), 11/29/30 | | 41,015 | 41,079,128 |

| GVC Holdings (Gibraltar) Ltd., Term Loan, 6.922%, (6 mo. EURIBOR + 3.25%), 6/30/28 | EUR | 17,325 | 18,916,030 |

| Hilton Domestic Operating Co., Inc., Term Loan, 6.488%, (SOFR + 1.75%), 11/8/30 | | 8,750 | 8,743,753 |

| Light & Wonder International, Inc., Term Loan, 7.034%, (SOFR + 2.25%), 4/14/29 | | 7,845 | 7,848,289 |

| Ontario Gaming GTA LP, Term Loan, 8.893%, (SOFR + 4.25%), 8/1/30 | | 23,686 | 23,724,177 |

| Oravel Stays Singapore Pte. Ltd., Term Loan, 13.325%, (SOFR + 8.25%), 6/23/26 | | 3,800 | 3,830,593 |

| Playa Resorts Holding BV, Term Loan, 7.435%, (SOFR + 2.75%), 1/5/29 | | 43,850 | 43,827,251 |

| SeaWorld Parks & Entertainment, Inc., Term Loan, 7.185%, (SOFR + 2.50%), 8/25/28 | | 19,281 | 19,297,097 |

| Station Casinos LLC, Term Loan, 6.935%, (SOFR + 2.25%), 3/14/31 | | 5,846 | 5,844,959 |

| | | | $ 333,584,815 |

| Household Durables — 1.8% |

| ACProducts, Inc., Term Loan, 9.115%, (SOFR + 4.25%), 5/17/28 | | 22,997 | $ 19,266,812 |

| Libbey Glass, Inc., Term Loan, 11.267%, (SOFR + 6.50%), 11/22/27 | | 19,249 | 19,104,841 |

| Madison Safety & Flow LLC, Term Loan, 7.968%, (SOFR + 3.25%), 9/26/31 | | 8,050 | 8,091,924 |

| Serta Simmons Bedding LLC: | | | |

| Term Loan, 12.218%, (SOFR + 7.50%), 6/29/28 | | 20,679 | 17,473,426 |

| Term Loan, 12.232%, (SOFR + 7.50%), 6/29/28 | | 2,245 | 2,233,718 |

| Solis IV BV, Term Loan, 8.571%, (SOFR + 3.50%), 2/26/29 | | 17,785 | 17,766,307 |

| Tempur Sealy International, Inc., Term Loan, 10/3/31(8) | | 20,900 | 20,913,063 |

| | | | $ 104,850,091 |

| Household Products — 0.6% |

| Energizer Holdings, Inc., Term Loan, 6.759%, (SOFR + 2.00%), 12/22/27 | | 6,883 | $ 6,902,612 |

| Kronos Acquisition Holdings, Inc., Term Loan, 9.314%, (SOFR + 4.00%), 7/8/31 | | 26,700 | 25,157,327 |

| | | | $ 32,059,939 |

27

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Independent Power and Renewable Electricity Producers — 0.9% |

| Alpha Generation LLC, Term Loan, 7.447%, (SOFR + 2.75%), 9/30/31 | | 4,625 | $ 4,629,953 |

| Calpine Construction Finance Co. LP, Term Loan, 6.685%, (SOFR + 2.00%), 7/31/30 | | 10,466 | 10,422,254 |

| Calpine Corp.: | | | |

| Term Loan, 6.685%, (SOFR + 2.00%), 1/31/31 | | 3,030 | 3,025,869 |

| Term Loan, 6.685%, (SOFR + 2.00%), 1/31/31 | | 18,123 | 18,095,506 |

| Thunder Generation Funding LLC, Term Loan, 7.61%, (SOFR + 3.00%), 10/3/31 | | 13,625 | 13,659,063 |

| | | | $ 49,832,645 |

| Industrial Conglomerates — 1.5% |

| AAG U.S. GSI Bidco, Inc., Term Loan, 10/8/31(8) | | 6,325 | $ 6,325,000 |

| Ammeraal Beltech Holding BV, Term Loan, 8.345%, (3 mo. EURIBOR + 5.00%), 12/30/28 | EUR | 9,528 | 10,397,699 |

| Crown Equipment Corp., Term Loan, 7.324%, (SOFR + 2.50%), 10/10/31 | | 13,200 | 13,222,004 |

| Kohler Energy Co. LLC, Term Loan, 9.354%, (SOFR + 4.75%), 5/1/31 | | 30,224 | 30,413,152 |

| nVent Electric PLC, Term Loan, 9/12/31(8) | | 14,300 | 14,344,687 |

| Rain Carbon GmbH, Term Loan, 8.56%, (3 mo. EURIBOR + 5.00%), 10/31/28 | EUR | 13,948 | 15,067,917 |

| | | | $ 89,770,459 |

| Insurance — 3.3% |

| Acrisure LLC, Term Loan, 8.009%, (SOFR + 3.25%), 11/6/30 | | 6,983 | $ 6,973,772 |

| Alliant Holdings Intermediate LLC, Term Loan, 7.759%, (SOFR + 3.00%), 9/19/31 | | 21,946 | 21,887,615 |

| AmWINS Group, Inc., Term Loan, 7.05%, (SOFR + 2.25%), 2/19/28 | | 23,396 | 23,407,639 |

| AssuredPartners, Inc., Term Loan, 8.185%, (SOFR + 3.50%), 2/14/31 | | 28,592 | 28,668,494 |

| Broadstreet Partners, Inc., Term Loan, 7.935%, (SOFR + 3.25%), 6/13/31 | | 31,870 | 31,895,462 |

| Financiere CEP SAS, Term Loan, 7.146%, (1 mo. EURIBOR + 4.00%), 6/18/27 | EUR | 6,242 | 6,807,626 |

| HUB International Ltd., Term Loan, 7.367%, (SOFR + 2.75%), 6/20/30 | | 17,625 | 17,683,946 |

| Ryan Specialty Group LLC, Term Loan, 6.935%, (SOFR + 2.25%), 9/15/31 | | 15,725 | 15,744,656 |

| Truist Insurance Holdings LLC: | | | |

| Term Loan, 7.854%, (SOFR + 3.25%), 5/6/31 | | 13,745 | 13,770,772 |

| Term Loan - Second Lien, 9.354%, (SOFR + 4.75%), 5/6/32 | | 4,500 | 4,573,125 |

| USI, Inc.: | | | |

| Term Loan, 7.354%, (SOFR + 2.75%), 11/22/29 | | 8,955 | 8,964,376 |

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Insurance (continued) |

| USI, Inc.: (continued) | | | |

| Term Loan, 7.354%, (SOFR + 2.75%), 9/27/30 | | 10,950 | $ 10,963,413 |

| | | | $ 191,340,896 |

| Interactive Media & Services — 0.3% |

| Buzz Finco LLC, Term Loan, 8.035%, (SOFR + 3.25%), 1/29/27 | | 549 | $ 548,155 |

| Foundational Education Group, Inc., Term Loan, 8.597%, (SOFR + 3.75%), 8/31/28 | | 3,522 | 3,451,408 |

| Getty Images, Inc., Term Loan, 8.845%, (SOFR + 4.50%), 2/19/26 | | 11,430 | 11,386,680 |

| Match Group, Inc., Term Loan, 6.714%, (SOFR + 1.75%), 2/13/27 | | 3,100 | 3,100,000 |

| | | | $ 18,486,243 |

| IT Services — 4.6% |

| Asurion LLC: | | | |

| Term Loan, 8.785%, (SOFR + 4.00%), 8/19/28 | | 21,326 | $ 21,155,685 |

| Term Loan, 9.035%, (SOFR + 4.25%), 8/19/28 | | 7,264 | 7,232,049 |

| Term Loan - Second Lien, 10.05%, (SOFR + 5.25%), 1/31/28 | | 18,610 | 17,991,217 |

| Term Loan - Second Lien, 10.05%, (SOFR + 5.25%), 1/20/29 | | 4,375 | 4,189,972 |

| Endure Digital, Inc., Term Loan, 8.471%, (SOFR + 3.50%), 2/10/28 | | 33,399 | 30,359,914 |

| Gainwell Acquisition Corp., Term Loan, 8.704%, (SOFR + 4.00%), 10/1/27 | | 25,222 | 24,323,917 |

| Go Daddy Operating Co. LLC, Term Loan, 6.685%, (SOFR + 2.00%), 11/9/29 | | 45,628 | 45,654,664 |

| Informatica LLC, Term Loan, 6.935%, (SOFR + 2.25%), 10/27/28 | | 33,979 | 34,042,460 |

| NAB Holdings LLC, Term Loan, 7.354%, (SOFR + 2.75%), 11/23/28 | | 13,757 | 13,757,177 |

| Plano HoldCo, Inc., Term Loan, 8.092%, (SOFR + 3.50%), 10/2/31 | | 7,550 | 7,606,625 |

| Rackspace Finance LLC: | | | |

| Term Loan, 11.183%, (SOFR + 6.25%), 5/15/28 | | 13,581 | 13,844,198 |

| Term Loan - Second Lien, 7.683%, (SOFR + 2.75%), 5/15/28 | | 27,543 | 16,548,904 |

| Sedgwick Claims Management Services, Inc., Term Loan, 7.585%, (SOFR + 3.00%), 7/31/31 | | 14,887 | 14,910,779 |

| Synechron, Inc., Term Loan, 8.36%, (SOFR + 3.75%), 10/3/31 | | 10,950 | 10,908,937 |

| team.blue Finco SARL, Term Loan, 7.045%, (3 mo. EURIBOR + 3.70%), 9/30/29 | EUR | 4,350 | 4,685,871 |

| Virtusa Corp., Term Loan, 7.935%, (SOFR + 3.25%), 2/15/29 | | 1,990 | 1,992,488 |

| | | | $ 269,204,857 |

28

See Notes to Financial Statements.

Senior Debt Portfolio

October 31, 2024

Portfolio of Investments — continued

| Borrower/Description | Principal

Amount*

(000's omitted) | Value |

| Leisure Products — 0.9% |

| Accell Group NV, Term Loan, 8.648%, (6 mo. EURIBOR + 4.90%), 6/14/29 | EUR | 3,500 | $ 575,828 |

| Fender Musical Instruments Corp., Term Loan, 8.785%, (SOFR + 4.00%), 12/1/28 | | 1,222 | 1,172,985 |

| GSM Holdings, Inc., Term Loan, 9/29/31(8) | | 9,250 | 8,868,437 |

| Hayward Industries, Inc., Term Loan, 7.30%, (SOFR + 2.50%), 5/30/28 | | 9,163 | 9,174,105 |

| Recess Holdings, Inc., Term Loan, 9.085%, (SOFR + 4.50%), 2/20/30 | | 22,643 | 22,787,657 |

| Tait LLC, Term Loan, 9.197%, (SOFR + 4.50%), 10/1/31 | | 12,675 | 12,754,219 |

| | | | $ 55,333,231 |

| Life Sciences Tools & Services — 1.0% |

| Cambrex Corp., Term Loan, 8.285%, (SOFR + 3.50%), 12/4/26 | | 5,910 | $ 5,896,844 |

| Catalent Pharma Solutions, Inc.: | | | |

| Term Loan, 6.859%, (SOFR + 2.00%), 2/22/28 | | 774 | 774,301 |

| Term Loan, 7.745%, (SOFR + 3.00%), 2/22/28 | | 3,532 | 3,538,873 |

| Curia Global, Inc., Term Loan, 8.336%, (SOFR + 3.75%), 8/30/26(10) | | 19,220 | 18,342,914 |

| LGC Group Holdings Ltd., Term Loan, 6.396%, (1 mo. EURIBOR + 3.25%), 4/21/27 | EUR | 4,025 | 4,353,018 |

| Loire Finco Luxembourg SARL, Term Loan, 8.285%, (SOFR + 3.50%), 4/21/27 | | 3,450 | 3,439,887 |

| Packaging Coordinators Midco, Inc., Term Loan, 7.835%, (SOFR + 3.25%), 11/30/27 | | 14,563 | 14,607,453 |