Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

x Preliminary Proxy Statement | ¨ CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) Definitive Proxy Statement |

Definitive Additional Materials

¨ Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12

STORAGE COMPUTER CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Table of Contents

STORAGE COMPUTER CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 15, 2004

To our Stockholders:

The 2004 annual meeting of the stockholders of Storage Computer Corporation will be held at the offices of the Company at 11 Riverside Drive, Nashua, New Hampshire 03062 (Route 3, Exit 5) on Thursday July 15, 2004, beginning at 10:00 a.m. local time. At the meeting, the holders of common stock of the Company will act on the following matters:

| 1. | Election of five directors to hold office until the next annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| 2. | Amendment to the 1999 Stock Incentive Plan; |

| 3. | Amendment of the Company’s Certificate of Incorporation to increase the authorized number of shares of Common Stock of the Company from 50,000,000 shares to 100,000,000 shares; |

| 4. | Ratification of the appointment of Sullivan Bille PC as the Company’s independent auditors for 2004; and |

| 5. | Any other matters that properly come before the meeting. |

All holders of record of Storage common stock (AMEX:SOS) at the close of business on April 28, 2004 are entitled to receive notice of and to vote at the annual meeting of stockholders and any postponements or adjournments of the meeting.

By order of the Board of Directors,

MICHAEL J. O’DONNELL

Secretary

April 29, 2004

Nashua, New Hampshire

YOUR VOTE IS IMPORTANT

Whether or not you expect to attend the annual meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope so that your shares may be represented at the meeting.

Table of Contents

Table of Contents

STORAGE COMPUTER CORPORATION

11 Riverside Street

Nashua, New Hampshire 03062

PROXY STATEMENT

This proxy statement is being furnished in connection with the solicitation by the Board of Directors of the Company of proxies for the annual meeting of stockholders of Storage Computer Corporation to be held on Thursday July 15, 2004 at 10:00 AM EST at the offices of the Company, 11 Riverside Drive, Nashua, New Hampshire, and at any postponements or adjournments thereof.

The Company is mailing this proxy statement, the accompanying proxy card and the Company’s 2003 Annual Report on or about June 28, 2004 to the holders of record of the Company’s outstanding shares of common stock on April 28, 2004. The Board of Directors of the Company is soliciting the accompanying proxy for use at the annual meeting. The Company will bear the cost of solicitation of proxies. Directors, officers and employees may assist in the solicitation of proxies, in person or otherwise, without additional compensation.

What is the purpose of the annual meeting?

At our annual meeting, stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders on the cover page of this proxy statement. In addition, management will report on the performance of the Company during fiscal 2003 and respond to questions from stockholders.

Who is entitled to vote at the meeting?

Only stockholders of record at the close of business on April 28, 2004, the record date for the meeting, are entitled to receive notice of and to vote at the annual meeting. If you were a shareholder of record on that date, you will be entitled to vote all of the shares that you held on that date at the meeting, or any postponements or adjournments of the meeting. Each share of common stock is entitled to one vote on all matters presented at the annual meeting.

All stockholders as of the record date, or their duly appointed proxies, may attend the meeting, and each may be accompanied by one guest. Seating, however, is limited. Admission to the meeting will be on a first-come, first-served basis. Registration will begin at 8:30 a.m. If you attend, please note that you may be asked to present valid picture identification, such as a driver’s license or passport. Cameras, recording devices and other electronic devices will not be permitted at the meeting. Please also note that if you hold your shares in “street name” (that is, through a broker or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date and check in at the registration desk at the meeting.

The presence at the meeting, in person or by proxy, of the holders of a majority of the aggregate voting power of the Company’s common stock outstanding on the record date will constitute a quorum, permitting business to be conducted at the meeting. As of the record date, 38,910,125shares of the Company’s common stock, representing the same number of votes, were outstanding. Thus, the presence of the holders of common stock representing at least 19,455,064 votes will be required to establish a quorum. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of votes considered to be present at the meeting.

1

Table of Contents

If you complete and properly sign the accompanying proxy card and return it to the Company, it will be voted as you direct in the proxy card. If you are a registered stockholder and attend the meeting, you may either vote or deliver your completed proxy card in person at the meeting. “Street name” stockholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with the Secretary of the Company either a notice of revocation or a duly executed proxy bearing a later date. In addition, the powers of the proxy holders will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

What are the Board’s recommendations?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. The Board’s recommendations are set forth together with the description of each proposal to be voted upon in this proxy statement. In summary, the Board recommends you vote:For election of the nominated slate of directors (see page 6); ForAmendment to the 1999 Stock Incentive Plan (see page 17);ForAmendment of the Company’s Certificate of Incorporation to increase the authorized number of shares of Common Stock of the Company from 50,000,000 shares to 100,000,000 shares (see page 18); andFor ratification of the appointment of Sullivan Bille, P C as the Company’s independent auditors for fiscal year 2004 (see page 18).

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

What vote is required to approve each proposal?

Election of Directors. The affirmative vote of a plurality of the votes cast at the meeting is required for the election of directors. A properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. If no instructions are indicated on your proxy card, the shares represented by your proxy will be voted “FOR” the election of the nominees for director listed in this proxy statement.

Amendment to the 1999 Stock Incentive Plan. The affirmative vote of a plurality of the votes cast at the meeting is required for approval the amendment to the 1999 Stock Incentive Plan.+

Increase of Authorized Shares of Common Stock. To increase by 50,000,000 the number of authorized shares of the Company’s Common Stock requires the affirmative vote of a majority of all outstanding shares of Common Stock entitled to vote.

Other Items. For each other proposal, the affirmative vote of the holders of a majority of the shares represented in person or by proxy at the meeting and entitled to vote on the item will be required for approval. A properly executed proxy marked “ABSTAIN” with respect to any such matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum.

2

Table of Contents

Who beneficially owns more than five percent of the Company’s stock?

The following table lists certain information regarding the beneficial ownership of the Company’s common stock, par value $0.001 per share as of April 28, 2004, by those persons known to the Company to be beneficial owners of more than five percent of the outstanding shares of common stock.

| Shares of Common Stock Beneficially Owned | ||||||

Name and Address of Beneficial Owner | Number of Shares | Percent | ||||

Theodore J. Goodlander c/o Storage Computer Corporation 11 Riverside Street Nashua, New Hampshire 03062 | 12,763,906 | (1) | 32.00 | % | ||

Jeanne McCready, Trustee c/o Storage Computer Corporation 11 Riverside Street Nashua, New Hampshire 03062 | 2,728,380 | (2) | 7.01 | % | ||

| (1) | Includes 8,724,240 shares of common stock beneficially owned by Mr. Goodlander and 1,268,201 shares of common stock beneficially owned by Kristiania Corp., a corporation controlled by Mr. Goodlander, acquired upon conversion of all of the remaining outstanding shares of the Company’s Series A and Series C convertible preferred stock into shares of common stock in January 2003. Excludes 2,678,336 shares gifted by Mr. Goodlander in 2003. Also includes 787,856 shares of common stock issuable upon the exercise of a warrant held by Mr. Goodlander to purchase 787,856 shares of common stock at $21.03 per share and shares issuable pursuant to the exercise of a warrant held by Kristiania Corp. to purchase 186,989 shares of common stock at $10.58 per share. Does not include 2,728,380 shares of common stock held by the Goodlander children’s trusts established for the exclusive benefit of Mr. Goodlander’s children, and as to which Mr. Goodlander exercises no voting or dispositive control and disclaims beneficial ownership. |

| (2) | Jeanne McCready is the Trustee of three separate trusts established for each of the following of Mr. Goodlander’s minor children: Christine Marian Goodlander, Margaret Vivian Goodlander and John Samuel Goodlander. |

3

Table of Contents

How much stock do the Company’s directors and executive officers own?

The following table sets forth certain information regarding the beneficial ownership of the Company’s common stock by its directors and executive officers and the directors and executive officers as a group. Except as otherwise indicated, all information is as of April 28, 2004.

| Shares of Common Stock Beneficially Owned | ||||||

Directors and Officers | Number of Shares | Percent | ||||

Theodore J. Goodlander | 12,763,906 | (1) | 32.00 | % | ||

President, Chief Executive Officer and Chairman of the Board of Directors | ||||||

Steven Chen | 17,200 | (2) | * | |||

Director | ||||||

Edward A. Gardner | 207,200 | (3) | * | |||

Director | ||||||

Peter N. Hood | 69,314 | (4) | * | |||

Chief Financial Officer | ||||||

Roger E. Gauld, Director | 38,000 | (5) | * | |||

(Chairman Audit Committee) | ||||||

Thomas A. Wooters | 19,028 | (6) | * | |||

Director | ||||||

All directors and executive officers as a group (7 persons) | 13,179,648 | (7) | 32.78 | % | ||

| * | less than 1%. |

| (1) | Includes 8,724,240 shares of common stock beneficially owned by Mr. Goodlander and 1,268,201 shares of common stock beneficially owned by Kristiania Corp., a corporation controlled by Mr. Goodlander, acquired upon conversion of all of the remaining outstanding shares of the Company’s Series A and Series C convertible preferred stock into shares of common stock in January 2003. Excludes 2,678,336 shares gifted by Mr. Goodlander in 2003. Also includes 787,856 shares of common stock issuable upon the exercise of a warrant held by Mr. Goodlander to purchase 787,856 shares of common stock at $21.03 per share and shares issuable pursuant to the exercise of a warrant held by Kristiania Corp. to purchase 186,989 shares of common stock at $10.58 per share. Does not include 2,728,380 shares of common stock held by the Goodlander children’s trusts established for the exclusive benefit of Mr. Goodlander’s children, and as to which Mr. Goodlander exercises no voting or dispositive control and disclaims beneficial ownership. |

| (2) | Includes 17,200 shares of common stock issuable upon the exercise of options granted pursuant the Company’s 1994 Amended and Restated Stock Incentive Plan that are exercisable or will become exercisable within sixty days. |

| (3) | Includes 200,000 shares of common stock issuable upon the exercise of options pursuant to the Company’s 1994 and 1999 Amended and Restated Stock Incentive Plan that are exercisable or will become exercisable within 60 days. Excludes options to purchase 65,000 shares of common stock gifted by Mr. Gardner. |

| (4) | Mr. Hood resigned as Chief Financial Officer of the Company on February 2, 2004. |

| (5) | Includes 30,000 shares of common stock issuable upon the exercise of options pursuant to the Company’s 1994 and 1999 Amended and Restated Stock Incentive Plans that are exercisable or will become exercisable within sixty days. |

| (6) | Includes 15,000 shares of common stock issuable upon the exercise of options pursuant to the Company’s 1999 Stock Incentive Plan that are exercisable or will become exercisable within sixty days. |

| (7) | See footnotes (1) through (6) above. |

4

Table of Contents

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires directors, executive officers and persons who own more than 10% of the outstanding common stock of the Company to file with the Securities and Exchange Commission and the American Stock Exchange reports of ownership and changes in ownership of voting securities of the Company and to furnish copies of such reports to the Company. Based solely on review of the copies of such reports furnished to the Company or written representations from certain persons that no reports were required for those persons, the Company believes that all Section 16(a) filing requirements were satisfied.

5

Table of Contents

PROPOSAL NO. 1—ELECTION OF DIRECTORS

The Board of Directors of the Company has nominated the following persons for election as directors, each to serve until the next annual meeting of stockholders and until his or her successor has been duly elected and qualified or until such director’s earlier resignation, death or removal: Steve S. Chen, Edward A. Gardner, Roger E. Gauld, Theodore J. Goodlander, and Thomas A. Wooters. The proxies solicited by the Board of Directors will be voted in favor of the five nominees named below, unless you mark “WITHHOLD AUTHORITY” on the proxy card. All of the nominees are currently members of the Board. There are no family relationships between any directors or executive officers of the Company. The Board knows of no reason why any of the nominees will be unavailable or unable to serve as a director, but in such event, proxies solicited hereby will be voted for the election of another person or persons to be designated by the Board of Directors.

THE BOARD RECOMMENDS A VOTEFOR THE ELECTION OF EACH OF THE NOMINEES LISTED BELOW.

The directors standing for election are:

THEODORE J. GOODLANDER

Director since August 1991

Mr. Goodlander, 60, founded the Company and has been Chairman of the Board of Directors and Chief Executive Officer since the Company’s inception. Mr. Goodlander served as the Company’s President from its inception until May 8, 2000 and, in August 2002 he reassumed the office of President. Mr. Goodlander served as President of Cab-Tek, Inc., a computer accessories manufacturing company, from 1981 to 1991. From 1978 to 1981, he was a private investor, and from 1968 to 1978 Mr. Goodlander held various management positions at Wang Laboratories, Inc., including Vice President International and Far East Marketing Manager. Mr. Goodlander attended Syracuse University and is a graduate of the Program for Management Development at Harvard Business School.

STEVEN CHEN

Director since May 1996

Mr. Chen, 58, has been the Chairman and Chief Executive Officer of Tonbu, Inc. since 1999. During 1996 and 1997, Mr. Chen was the Executive Vice President and Chief Technology Officer of Sequent Computer Systems, Inc. Prior to 1996, Mr. Chen was the founder and Senior Vice President of Chen Systems, Inc., a high performance computer server manufacturer, which was acquired by Sequent Computer Systems, Inc. in 1996. Prior to that, Mr. Chen founded Supercomputing Systems, Inc., with partial funding from IBM. He had previously been Senior Vice President of Cray Research, with responsibility for development of the Cray XMP and YMP Supercomputers.

EDWARD A. GARDNER

Director since May 2000

Mr. Gardner, 57, served as the Company’s President from May 8, 2000 until his resignation in August 2002. Mr. Gardner also served as President of Winnipesaukee Flagship Corp. for the past five years, a company in the tourism industry. Mr. Gardner has held several other senior positions, including president, of a national industrial gas and welding supply company. Previously, he served as controller for Fidelity Management and Research Company and was a certified public accountant while at the accounting firm of Deloitte and Touche (formerly Haskins and Sells).

6

Table of Contents

ROGER E. GAULD

Director since May 2000

Mr. Gauld, 57, has been a director and Chief Financial Officer of Hampshire Holdings, Inc. since 1995. Mr. Gauld was previously co-founder and Chief Financial Officer of several manufacturing and distribution firms. From 1993 to 1995, he was Chief Financial Officer of Phoenix Custom Molders, Inc. Earlier, he was founder and President of The Phoenix Consulting Group, Inc., which specialized in financial planning and controls, risk management, data processing, mergers and acquisitions. In addition, he is a certified public accountant, served as an audit manager with Ernst & Young (formerly Arthur Young) and was an officer in the U.S. Army for four years.

THOMAS A. WOOTERS

Director since July 2001

Mr. Wooters, 63.Since December 2003 Mr. Wooters has been Executive Vice President and General Counsel of LoJack Corporation, a NASDAQ listed company. LoJack is a world-leader in stolen vehicle recovery technology. From June 1999 to December 2003 he practiced law with the firm of Sullivan & Worcester LLP in Boston, MA. Prior to that, he was with the firm of Peabody & Arnold LLP in Boston, MA for more than five years. He has practiced law for more than 35 years, representing public and private companies and investors in such companies in a range of businesses including software, computer subsystems, biotechnology, communications, and leading edge metallurgy.

Who are the other executive officers of the Company?

Peter N. Hood, 63. Mr. Hood resigned as Chief Financial Officer of the Company on February 2, 2004.

Michael J. O’Donnell, 61, joined the Company as Chief Financial Officer on March 5, 2004. From January 2001 to April 2003 Mr. O’Donnell was Chief Financial Officer for Artisoft, Inc. a NASDAQ listed company. Artisoft develops and markets computer software telephony products and services. For the previous two years he was Chief financial Officer with Lilly Transportation Company, a provider of leasing and logistic services. From 1976 to 2000 he was Chief Financial Officer of Silver Platter International a content software and retrieval company focusing on medical industry verticals Mr. O’Donnell has held several other senior financial positions in manufacturing and industrial companies and started his career in public accounting with Peat Marwick Mitchell & Co in Boston Mass.

How are the directors compensated?

Prior to the second quarter of 2003, members of the Board of Directors did not receive any cash compensation for their service on the Board of Directors. In May 2003 in recognition of the increasing demands on the members of the Board of Directors, the Board of Directors approved the payment of director’s fees of $2,000 per quarter beginning in the second quarter of 2003 and an additional $2,000 per quarter to Mr. Gauld, Chairman of the Audit Committee, and to Mr. Gardner for his continuing efforts in the oversight of the Company’s enforcement of its intellectual property rights. Directors are also entitled to reimbursement of expenses related to attending Board of Directors meetings. Directors who are employees of the Company are not paid any additional compensation for serving as directors. In August 2003 the Board voted to suspend cash payments to Directors in order to conserve operating cash. In addition, each of the Directors receive stock option grants.

In August 2001, the Company’s Board of Directors approved the issuance of advances secured by demand notes receivable with interest at prime plus 1% to executive officers and directors of the Company in the aggregate amount of $500,000 for the purpose of purchasing the common stock of the Company in the public market. Demand notes receivable and accrued interest totaling $133,247 were outstanding at December 31, 2002.

7

Table of Contents

During 2003 $130,150 of demand notes receivable from three directors were forgiven in recognition of previous service on the Board of Directors.

Are there certain relationships and related transactions among the Company and its Executive Officers or the Board of Directors?

Kristiania Corp. The Company currently leases from Kristiania Corp. (an affiliated entity owned by Mr. Goodlander and Mr. Goodlander’s children), as a tenant under a non-cancelable, five year, triple-net lease that was entered into as of December 1, 2000, a 35,000 square foot facility that is occupied by its research and development and office operations in Nashua, New Hampshire. The lease provides for monthly rental payments of $25,000 commencing in January 2001, which lease payments are increased annually based upon changes in the consumer price index. The Company paid annual rentals of $311,904, $304,655 and $300,000 in 2003, 2002, and 2001, respectively.

Related Party Debt. Since the inception of the Company, Mr. Goodlander has made cash loans to the Company. The aggregate amount owing to Mr. Goodlander at the end of fiscal years 2003, 2002 and 2001 was $487,899 in 2003 and 2002 and, $810,000 in 2001. The debt is unsecured, and $387,899 bears interest at prime plus 1% and $100,000 bears interest at 6% and is convertible into common stock of the Company at $4.00 per share.

In August 2003 Mr. Goodlander, through an affiliate (Kristiania Corp.) of the Company controlled by him, began advancing funds to supplement the Company’s cash flow for operating expenses and occupancy costs until operating cash flows improve and permanent additional financing can be arranged. Originally such advances were unsecured, due upon demand and accrue interest at the affiliate’s cost of funds. Subsequently, the Board of Directors, with Mr. Goodlander abstaining, approved the Company formalizing the agreement with the affiliate in the form of a $500,000 line of credit, of which $358,285 was outstanding at December 31, 2003, secured by all the assets of the Company with interest at the affiliate’s cost of funds which is currently 21% and a one year term renewal by mutual agreement of the parties.

John Thonet resigned his position as a director of the Company on April 30, 2003. At the time of his resignation, the Company owed Mr. Thonet a balance of $177,101 plus accrued and unpaid interest on a note payable representing the balance of sums advanced by him to CyberStorage Systems that was acquired by the Company in 2000, and Mr. Thonet was due $156,333 in accrued and unpaid salary by CyberStorage Systems. The Company also had a demand note receivable due from Mr. Thonet of $44,729 plus accrued interest. On April 30, 2003, the Company and Mr. Thonet agreed to offset the note receivable and accrued interest against the note payable and accrued interest and Mr. Thonet agreed to accept a cash payment of $40,000 in exchange for cancellation by him of the balance of the note payable. In addition, Mr. Thonet gave up any and all claims to accrued and unpaid salary and any other amounts due to him as of that date in exchange for the extension of period for exercise of his vested stock options to purchase 62,500 shares of common stock until May 1, 2004.

Stock Purchase Loans. In August 2001, the Company’s Board of Directors approved the issuance of advances secured by demand notes receivable with interest at prime plus 1% to Messrs. Gauld, Gardner, Thonet and Hood, for the purpose of purchasing the Company’s common stock in the public market with no single director or executive officer having more than $50,000 outstanding. Mr. Thonet’s note was settled as described in the immediately preceding paragraph. In May 2003, Messrs. Gauld and Gardner’s notes were forgiven as described above under the caption “How are the directors compensated.” Mr. Hood’s note was repaid in May 2003.

How often did the Board of Directors meet during fiscal year 2003?

The Board metfourtimes during 2003. Each director attended at least an aggregate of 75% of the meetings of the Board of Directors and Committees on which he served. In addition the Board took action by written consent five times.

8

Table of Contents

What committees has the Board of Directors established?

The Board of Directors has standing Audit and Compensation Committees.

Audit Committee. The Audit Committee of the Board of Directors oversees the accounting and financial reporting processes of the Company and reviews the results and scope of the audit and other services provided by the Company’s independent auditors. The Audit Committee metfour during 2003. The current members of the Audit Committee are Roger E. Gauld (chairman of the Audit Committee), Steven Chen and Thomas A. Wooters.

Compensation Committee. The Compensation Committee makes recommendations concerning salaries and incentive compensation for employees of, and consultants to, the Company and administers the Company’s stock option plans and deferred compensation plan. The Compensation Committee metonce during 2003. The current members of the Compensation Committee are Edward A. Gardner and Thomas A. Wooters (Chairman of the Compensation Committee).

9

Table of Contents

The following report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange of 1934, except to the extent the Company specifically incorporates this Report by reference.

The Audit Committee of the Board of Directors consists of three directors, each of whom is independent as defined by Section 121(A) of the American Stock Exchange’s listing standards. The Audit Committee operates under a written charter that was approved by the full Board on June 9, 2000, and amended by the full Board on August 7, 2000 and May 15, 2003. The Audit Committee charter, as currently in effect, is attached to this proxy statement as Exhibit A. As set forth in more detail in the charter, the Audit Committee’s primary responsibilities fall into three broad categories:

| • | First, the Committee oversees that management has maintained the reliability and integrity of the accounting policies and financial reporting disclosure practices of the corporation; |

| • | Second, the Committee oversees that management has established and maintained processes to assure that an adequate system of internal control is functioning with the Corporation.; and |

| • | Third, the Committee oversees that management has established and maintained processes to assure compliance by the Corporation with all applicable laws, regulations and corporate policy. |

The Committee has implemented procedures to ensure that during the course of each fiscal year it devotes the attention that it deems necessary or appropriate to each of the matters assigned to it under the Committee’s charter. To carry out its responsibilities, the Committee metfour times during fiscal 2003.

On March 19, 2004 after discussions between our management and BDO Seidman L.L.P. (BDO) it was mutually agreed that BDO would no longer serve as our independent auditor. The decision was approved by the Audit Committee of our Board of Directors.

BDO’s reports on the financial statements for our most recent two fiscal years ended December 2001 and 2002 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During our two most recent fiscal years ended December 31, 2001 and 2002, and through March 26, 2004, there were no disagreements with BDO on any matter of accounting principles or practices, financial statement disclosure or auditing scope and procedure, which disagreement, if not resolved to the satisfaction of BDO, would have caused BDO to make reference to the subject matter of the disagreement(s) in connection with its report. None of the reportable events as defined in paragraph (A) through (D) of Item 304(a)(1)(v) of regulation S-K occurred during our two most recent fiscal years ended December 31, 2001 and December 31, 2002, and through March 26, 2004.

We have provided BDO with a copy of the above disclosure as it appeared in our Form 8K filing. A copy of BDO’s letter dated March 25, 2004 stating its agreement with the above is filed in our Form 8K filing as exhibit 16.1.

We have engaged Sullivan Bille PC (“Sullivan Bille”) as our new independent auditor, effective March 19, 2004. The decision to engage Sullivan Bille was recommended by the Audit Committee of our Board of Directors and was approved by our Board of Directors.

During our two most recent fiscal years ended December 31, 2001 and December 31, 2002, and the subsequent interim period commencing December 31, 2002 we did not consult with Sullivan Bille regarding any matters or events set forth in Item 304 (a)(2)(i) and (ii) of regulation S-K.

In overseeing the preparation of the Company’s financial statements, members of the Committee met with both management and the Company’s outside auditors to review and discuss all financial statements prior to their

10

Table of Contents

issuance and to discuss significant accounting and disclosure issues. Management advised the Committee that all financial statements were prepared in accordance with generally accepted accounting principles, and the Committee discussed the statements with both management and the outside auditors. The Committee’s review included discussion with the outside auditors of matters required to be discussed pursuant to Statement on Auditing Standards No. 61 (Communication With Audit Committees).

With respect to the Company’s outside auditors, the Committee, among other things, discussed with Sulliuvan Bille PC matters relating to the auditors independence, and has received the written disclosures and letter from Sullivan Bille PC as required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees).

On the basis of these reviews and discussions, the Committee recommended to the Board of Directors that the Board approve the inclusion of the Company’s audited financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003, for filing with the Securities and Exchange Commission. In addition, the Committee recommended to the Board of Directors the appointment of Sullivan and Bille, PC as the Company’s independent auditors for fiscal year 2004.

Members of the Audit Committee

Roger E. Gauld, CPA, Chairman of the Audit Committee (Independent)

Steven Chen (Independent)

Thomas A. Wooters, Esq. (Independent)

11

Table of Contents

The following table sets forth certain information with respect to the compensation paid or accrued by the Company for services rendered to the Company by its Chief Executive Officer and Chief Financial Officer (the only other executive officer in fiscal year 2002 whose total salary and bonus exceeded $100,000) for the fiscal years 2001, 2002 and 2003:

| Annual Compensation | Long Term Compensation | |||||||||||||

Name and Principal Position | Fiscal (1) | Salary $ | Bonus $ | Awards Securities (#) | All Other Compensation ($)(2) | |||||||||

Theodore J. Goodlander, | 2003 | $ | 131,250 | — | — | — | ||||||||

Chief Executive Officer and President | 2002 | $ | 131,260 | — | — | — | ||||||||

(President as of August 28, 2002) | 2001 | $ | 200,000 | — | — | — | ||||||||

Peter N. Hood, | 2003 | $ | 97,626 | — | — | |||||||||

Chief Financial Officer (as of May 8, 2000) | 2002 | $ | 130,000 | (3) | $ | 8,270 | (3) | — | ||||||

Mr. Hood Resigned on February 2, 2004. | 2001 | $ | 130,000 | — | — | — | ||||||||

| (1) | The Company’s fiscal year ends on the last day of December. |

| (2) | In accordance with the rules of the Securities and Exchange Commission, other compensation in the form of prerequisites and other personal benefits has been omitted because such prerequisites and other personal benefits constituted less than the lesser of $50,000 or ten percent of the total annual salary and bonus reported for the executive officer during the fiscal year ended December 31, 2003. |

| (3) | The bonus amount in 2002 was in connection with Mr. Hood’s participation in the Company’s 2002 Short-Term Deferred Compensation Plan under which salary of $29,792 and bonus of $8,270 were accrued and deferred at December 31, 2002. In 2003 Mr. Hood was paid the amounts accrued at December 31, 2002 plus an additional $3,668.00 for 2003. The deferred compensation is reflected in salaries for the applicable years. The Short-Term Deferred Compensation Plan is no longer in effect. |

Aggregated Option Exercises In Last Fiscal Year And Fiscal Year-End Option Values

Number Of Securities Underlying Unexercised | Value Of Unexercised In- The-Money Options At Year-End(2) | |||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||

Theodore J. Goodlander | 0 | 0 | 0 | 0 | ||||

Peter N. Hood(3) | 75,000 | 25,000 | 0 | 0 | ||||

| (1) | No options were exercised during the year ended December 31, 2003 by the Named Executive Officers. |

| (2) | Based on the difference between closing price of the underlying shares of common stock on December 31, 2003 as reported by the American Stock Exchange ($0.36) and various option exercise prices. |

| (3) | Mr. Hood was granted 30,000 options to purchase shares of the Company’s common stock in May 2000, exercisable at $6.625 per share and was granted 70,000 options to purchase shares of the Company’s common stock in December 2000, exercisable at $4.00 per share. Mr. Hood’s options were repriced to $1.37 per share in July 2002. Mr. Hood’s options were cancelled upon his resignation on February 2, 2004. |

12

Table of Contents

10-Year Option / SAR Repricings

Name | Date | Number of Securities Underlying Options/SARs Repriced or Amended(#) | Market price of Stock at Time of Repricing or Amendment($) | Exercise Price at Time of Repricing or Amendment($) | New Exercise Price($) | Length of Original Option Term Remaining at Date of Repricing or Amendment (Months) | |||||||||

Peter N. Hood, | July 19, 2002 | 30,000 | $ | 1.37 | $ | 6.625 | $ | 1.37 | 94 | ||||||

Chief Financial Officer, | July 19, 2002 | 70,000 | $ | 1.37 | $ | 4.00 | $ | 1.37 | 101 | ||||||

Equity Compensation Plan Information

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights(1) | Weighted-average exercise price of outstanding options, warrants and rights(1) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column(a)(1) | ||||

Equity compensation plans approved by security holders: | |||||||

1994 Amended and Restated Stock Incentive Plan(2) | 286,407 | $ | 1.21 | 240,660 | |||

1999 Stock Incentive Plan | 1,516,700 | $ | 1.36 | 432,587 | |||

| (1) | Information is as of the most recently completed fiscal year ended December 31, 2003. |

| (2) | The 1994 Amended and Restated Stock Incentive Plan is intended to promote the long-term interests of the Company by providing directors, officers, other employees and consultants of the Company with an additional incentive arising from capital stock ownership to promote the financial success of, and to provide future services to, the Company. Options granted under this plan are for a ten-year term, granted at the fair market value on the date of grant and vest over a four-year period. |

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board of Directors consists of Messrs. Gardner and Wooters. Mr. Gardner was formerly an officer of the Company, serving as its President from May 8, 2000 until August 28, 2002. See “Are there certain relationships and related transactions among the Company and its Executive Officers or the Board of Directors?” on page 8 for a discussion of certain related transactions between Mr. Gardner and the Company.

13

Table of Contents

Report of the Compensation Committee

The following report of the Compensation Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange of 1934, except to the extent the Company specifically incorporates this Report by reference.

The Compensation Committee determines the compensation of the executive officers of the Company and sets policies for and reviews the compensation awarded to the other officers of the Company. This is designed to ensure consistency throughout the officer compensation programs. In reviewing the individual performances of the executive officers (other than the Chief Executive Officer and President) the Compensation Committee takes into account the views of the Chief Executive Officer. In fiscal year 2003, the Compensation Committee determined the base salary for executive officers, other than for the Chief Executive Officer and the President, based largely on recommendations by the Company’s Chief Executive Officer.

During the fiscal year ended December 31, 2003, the Compensation Committee of the Board of Directors was responsible for establishing and administering the compensation policies that govern annual salary, bonuses, and stock-based incentives (currently stock options) for directors, officers and employees.

The Company’s compensation program for executive officers consists of two key elements:

| • | A base salary; and |

| • | periodic grants of stock options. |

Base Salary. Base salary is generally set within the ranges of salaries of executive officers with comparable qualifications, experience and responsibilities at other companies of similar size, complexity and profitability, taking into account the position involved and the level of the executive’s experience. In addition, consideration is given to other factors, including an officer’s contribution to the Company as a whole.

Annual Bonus Compensation. Over the past five years, the Company has generally not awarded cash bonuses to its executive officers. In connection with Mr. Hood’s participation in the Company’s 2002 Short-Term Deferred Compensation Plan a bonus of $8,270 was accrued and deferred at December 31, 2002.

Long Term Incentives. Currently, stock options are the Company’s primary long-term incentive vehicle. Stock option awards have been made from time to time to persons who currently serve as middle and upper level managers, including the executive officers named in the Summary Compensation Table. The size of awards has historically been based on position, responsibilities, and individual performance.

The Compensation Committee is aware that the Company’s grants of stock options are less frequent and smaller in size than the grants of many comparable companies, although the Committee believes that the overall mix of compensation components has been adequate.

On July 19, 2002, the Committee at the direction of the Board of Directors authorized the repricing of options to purchase 2,610,110 shares of common stock from an exercise price ranging between $1.44 and $12.17 per share to an exercise price of $1.37 per share, which represented the fair market value of our common stock on the date of the repricing.

The Company has historically established levels of executive compensation that provide for a base salary intended to allow the Company to hire and retain qualified management. From time to time the Company has

14

Table of Contents

also granted stock options to executives and key employees to keep the management focused on the stockholders’ interests. The Compensation Committee believes that the Company’s past compensation practices provided an overall level of compensation that is competitive with companies of similar size and complexity. During 2003 salary levels were significantly reduced to conserve cash. The Company intends to restore competitive salary levels when cash flow permits. The Company has been able to retain a core of employees to continue the operations of the business.

Chief Executives Officers Compensation. After consideration and comparison of other industry executives, the Compensation Committee continued the annual salary level of the Company’s Chief Executive Officer, Mr. Goodlander, at $200,000 per year. However, Mr. Goodlander’s salary was temporarily reduced by 75% for the last five months of 2003 to conserve cash.

The Compensation Committee

Edward A. Gardner

Thomas A. Wooters (Chairman)

15

Table of Contents

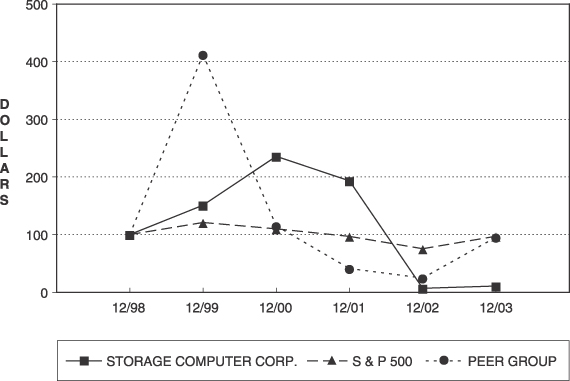

COMPARISON OF FIVE YEAR CUMULATIVE RETURN STOCK PERFORMANCE GRAPH

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG STORAGE COMPUTER CORPORATION, THE S&P 500 INDEX

AND A PEER GROUP

* $100 INVESTED ON 12/31/97 IN STOCK OR INDEX

INCLUDING REINVESTMENT OF DIVIDENDS.

FISCAL YEAR ENDING DECEMBER 31

This graph assumes that the value of investment in the Company’s common stock and each index to be $100 on December 31, 1997 and that any and all dividends were reinvested. This graph compares the Company’s cumulative total return with the S&P 500 Stock Index (a performance indicator of the overall stock market) and a peer group. The Company’s peer group consists of Ciprico, Dot Hill Systems and MTI Tech. These companies are viewed as similar in size to the Company and represent its competitors in certain geographic areas and markets.

16

Table of Contents

PROPOSAL NO. 2—AMENDMENT TO THE 1999 INCENTIVE STOCK PLAN

The Board of Directors proposes to amend Section 4(a) of the Company’s amended and restated 1999 Incentive Stock Plan (The 1999 Plan) to increase the maximum number of shares of Common Stock with respect to which options may be granted under The Plan from 2,000,000 to 6,000,000. (The 1999 Incentive Stock Plan, as amended and restated, is hereafter referred to as the “1999 plan”)

In all other respects, the 1999 plan is unchanged from the prior version. Accordingly, the Board of directors proposes that the first sentence of Section 4(a) of the 1999 Plan be amended to read as follows: “Subject to adjustment by the operation of Section 4(b) hereof, the maximum number of shares with respect to which Options may be granted under the 1999 plan is 6,000,000 shares’

The 1999 plan is intended to promote the long-term interests of the Company and its shareholders by providing directors, consultants, officers and other employees of the Company with additional incentive arising from capital stock ownership to promote the financial success of, and to provide future services to, the Company. The 1999 plan shall be administered by two or more members of the Board of Directors (the “Committee”), each of whom shall be a “disinterested person” as defined in Rule 16b-3 (or successor provision), promulgated by the SEC. The Committee has full authority and power to:

Construe and interpret provisions of the 1999 Plan and make rules and regulations for the 1999 plan not inconsistent with the 1999 Plan;

Decide all questions of eligibility for the 1999 plan participation and for the grant of awards;

Adopt forms of awards and other documents consistent with the 1999 plan;

Engage agents to perform legal, accounting, and other such professional services as it may deem proper for administering the 1999 plan; and

Take such other actions as may be reasonable, required or appropriate to administer the 1999 Plan or to carry out the Committee activities contemplated by other sections of the 1999 Plan.

The 1999 plan will be available to all employees, officers and directors of the Company. In accordance with the 1999 Plan, the exercise price of any option shall be determined by the committee. Grants will consist of Qualified (ISO) and Non-Qualified Options. With respect to an ISO option, the exercise price shall not be less then 100% (or with respect to any participant owning more than 10% of the combined voting of all classes of the Company’s or an affiliate’s stock, 110%) of the fair market value per share on the date of grant.

Notwithstanding the foregoing, in no event shall the Exercise Price of an Option be less than the par value per share.

Any option granted under the 1999 Plan will expire no later then ten years from the date of the grant. As of April 23, 2004 each share of Common Stock had a closing price of $0.37, so that the 6,000,000 shares of common stock underlying the 1999 plan had an aggregate market value of $2,220,000.

The approval of the Company’s shareholders to increase the number of shares of Common Stock with respect to which options may be granted under the 1999 plan is required pursuant to Section 422 of the Internal Revenue Code and Rule 16b-3 of the Exchange Act. (See Exhibit B)

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR PROPOSAL NUMBER 2 TO AMEND THE 1999 INCENTIVE STOCK PLAN.

17

Table of Contents

PROPOSAL NO. 3—AMENDMENT TO CERTIFICATE OF INCORPORATION

On April 13, 2004, the Board of Directors approved an amendment to the Company’s Certificate of Incorporation, subject to stockholder approval, to increase the authorized number of shares of Common Stock from 50,000,000 shares to 100,000,000 shares. The number of preferred shares will remain unchanged at 1,000,000 shares. On April 28, 2004,38,910,125 shares of Common Stock were issued and outstanding, 1,803,107 shares were reserved for issuance of outstanding options, 1,097,856 shares were reserved for issuance upon exercise of outstanding warrants and 673,247 were reserved for future grants under existing option plans.

The Board believes that authorizing additional shares of Common Stock is essential to provide the Company with financial and strategic flexibility. With the authorization of the additional 50,000,000 shares of Common Stock, the Company will better be able to take advantage of opportunities that may present themselves, such as future acquisitions of businesses or assets. Furthermore, such increase in authorized shares could provide a source of financial liquidity to the Company by direct sale of Common Stock or other securities convertible into Common Stock. Additional authorized shares could also be used to increase the number of shares available for issuance to employee benefit plans. At present, The Company has no specific plans for the use of the additional 50,000,000 shares of Common Stock proposed to be authorized.

If the stockholders approve the proposed amendment, the Company will file with the Secretary of State of the State of Delaware an amendment to its Certificate of Incorporation effecting the increase in the authorized shares.

Rights of dissenting stockholders

Under the Delaware General Corporate Law, you are not entitled to any rights of appraisal of dissenters’ rights in connection with the adoption of Proposal No. 3—Amendment to Certificate of Incorporation.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR PROPOSAL NO. 3

PROPOSAL NO. 4—RATIFICATION OF APPOINTMENT OF AUDITORS

The Board of Directors of the Company has appointed Sullivan Bille PC as independent auditors of the Company for the 2004 fiscal year, subject to ratification of such appointment by the stockholders. Sullivan Bille PC audited of the Company’s consolidated financial statements, for the year ended December 31, 2003. BDO Sideman, LLP, the Company’s former auditors performed a limited reviews of quarterly consolidated financial statements and provided services related to filings with the Securities and Exchange Commission and consultations on various tax matters during 2003.

Representatives of Sullivan Bille PC are expected to be present at the Annual Meeting, with the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

Fees Paid to Sullivan Bille PC

Sullivan Bille PC charged $43,500 for audit work on the Company’s consolidated financial statements for the year ended December 31, 2003.

Fees Paid to BDO Seidman, LLP

BDO Seidman, LLP charged $39,078 for its services in the 2003 fiscal year.

The Company paid $18,433 of fees for the limited review of quarterly consolidated financial statements.

18

Table of Contents

All Other Fees

The Company paid an aggregate of $21,800 for all services other than the services described above, consisting of fees, for the re-issue of BDO Seidman’s opinion for 2002 and 2001 and providing their consent for inclusion in the 2003 10K ($10,000) Review and consultation relating to the S-8, 10K/A, preferred stock conversion and audit committee charter ($11,800).

The Company did not retain the independent auditors for any other services than those disclosed above, including any consultative services such as financial systems design and did not pay any fees other than those disclosed above. As such, the audit committee has considered, and believes that the payments of the fees described above, were in the ordinary course of business and are compatible with maintaining Sullivan Bille PC and BDO Seidman LLP’s independence.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR PROPOSAL NO. 4 TO RATIFY THE CHOICE OF SULLIVAN BILLE, PC, AS THE COMPANY’S AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2004.

DEADLINE FOR SUBMISSION OF STOCKHOLDER PROPOSALS

Any stockholder proposal intended to be presented at the Company’s 2005 annual meeting of stockholders must be received at the executive offices of the Company not later than February 11, 2005 in order to be considered for inclusion in the Company’s proxy statement and form of proxy for that meeting. Proxies solicited by the Board of Directors will confer discretionary voting authority with respect to stockholder proposals, other than proposals to be considered for inclusion in the Company’s proxy statement described above, that the Company receives after February 11, 2005.

As of the date of this proxy statement, management of the Company knows of no matter not specifically referred to above as to which any action is expected to be taken at the annual meeting. The persons named in the enclosed form of proxy, or their substitutes, will vote the proxies in regard to such other matters and the transaction of such other business as may properly be brought before the annual meeting, in their best judgment.

19

Table of Contents

STORAGE COMPUTER CORPORATION

As Amended through May 15, 2003

| I. | PURPOSE |

The Audit committee has been established by the Board of Directors of the Corporation (the “Board”) for the purpose of overseeing the accounting and financial reporting processes of the Corporation and audits of the financial statements of the Corporation. The Audit Committee’s primary duties and responsibilities are to:

| • | Oversee that management has maintained the reliability and integrity of the accounting policies and financial reporting and disclosure practices of the Corporation. |

| • | Oversee that management has established and maintained processes to assure that an adequate system of internal control is functioning within the Corporation. |

| • | Oversee that management has established and maintained processes to assure compliance by the Corporation with all applicable laws, regulations and corporate policy. |

| II. | COMPOSITION |

The Audit Committee shall be comprised of at least three members of the Board who meet the independence, education and experience requirements of the Securities Exchange Act of 1934 and the American Stock Exchange (or such other exchange or automated quotation system on which the Corporation’s common stock is listed or otherwise quoted), as in effect from time to time.

The members of the Audit Committee shall be elected by the Board at the annual organizational meeting of the Board and serve until their successors shall be duly elected and qualified. Unless a Chairperson is elected by the full Board, the members of the Audit Committee may designate a Chairperson by majority vote of the full Audit Committee membership.

| III. | MEETINGS |

The Audit Committee shall meet at least four times annually, or more frequently as circumstances dictate. As part of its responsibility to foster open communication, the Audit Committee shall meet at least annually with management and the independent auditors separately to discuss any matters that the Audit Committee or each of these groups believe should be discussed privately. In addition, the Audit Committee or at least its Chairperson shall meet with the independent auditors and management quarterly to review the Corporation’s financial information consistent with the provisions of this Charter.

Except as the Board may otherwise determine or as otherwise set forth in this Charter, the Audit Committee shall make its own rules for the conduct of its business, but unless otherwise permitted by the Board, its business shall be conducted as nearly as may be in the same manner as the By-laws of the Corporation provide for the conduct of business by the Board.

| IV. | RESPONSIBILITIES AND DUTIES |

To fulfill its responsibilities and duties the Audit Committee shall:

| 1. | Review and reassess, at least annually, the adequacy of this Charter. Make recommendations to the Board, as conditions dictate, to update this Charter. |

A-1

Table of Contents

| 2. | Review with management and the independent auditors the Corporation’s annual financial statements, including a discussion with the independent auditors of the matters required to be discussed by Statement of Auditing Standards No. 61 (“SAS No. 61”), prior to filing with the Securities and Exchange Commission. |

| 3. | Review with management and the independent auditors the Corporation’s quarterly reports on Form 10-Q prior to filing or prior to the release of earnings, including a discussion with the independent auditors of the matters required to be discussed by SAS No. 61. The Chairperson of the Audit Committee may represent the entire Audit Committee for purposes of this review. |

| 4. | The Audit Committee shall be directly responsible for the appointment, compensation, retention and oversight of the work of any public accounting firm engaged by the Corporation (including resolution of disagreements between management and such firm regarding financial reporting) for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attest services for the Corporation, and each such independent firm shall report directly to the Audit Committee. These accountants shall be ultimately accountable to the Board and the Audit Committee as representatives of the stockholders. |

| 5. | Oversee independence of the independent auditors by: |

| • | Receiving from the auditors, on a periodic basis, a formal written statement delineating all relationships between the auditors and the Corporation consistent with Independence Standards Board Standard 1 (“ISB No. 1”); |

| • | Reviewing, and actively discussing with the Board, if necessary, and the auditors on a periodic basis (and at least annually), any disclosed relationships or services between the auditors and the Corporation or any other disclosed relationships or services that may impact the objectivity and independence of the auditors; and |

| • | Take any action necessary or appropriate to satisfy itself of the auditor’s independence. |

| 6. | The Audit Committee (or one or more designated members thereof) shall pre-approve all auditing and non-audit services (except de minimis non-audit services and auditing services within the scope of an approved engagement of the accountant) provided to the Corporation by the independent accountant. |

| 7. | The Audit Committee shall review the Corporation’s financial statements to be filed with the Securities and Exchange Commission and the results of any independent audit thereof, including the adequacy and integrity of internal controls and financial accounting policies. The Audit Committee shall review management’s assessment of the effectiveness of the internal control structure and procedures of the Corporation for financial reporting and the auditor’s attestation and report on the assessment made by management. The Audit Committee shall review and discuss the Corporation’s annual audited financial statements with management and shall recommend to the Board of Directors whether these financial statements should be included in the Corporation’s Annual Report on Form 10-K to be filed with the Securities and Exchange Commission. |

| 8. | Consider and approve, if appropriate, changes to the Corporation’s auditing and accounting principles and practices as suggested by the independent auditors or management. |

| 9. | Establish regular systems of reporting to the Audit Committee by both management and the independent auditors regarding any significant judgments made in management’s preparation of the financial statements and any significant difficulties encountered during the course of the review or audit, including any restrictions on the scope of work or access to required information. |

| 10. | Review any significant disagreement among management and the independent auditors in connection with the preparation of the financial statements. |

| 11. | Review and approve all related-party transactions to the extent required by state or federal law and/or the American Stock Exchange (or such other exchange or automated quotation system on which the Corporation’s common stock is listed or otherwise quoted). |

A-2

Table of Contents

| 12. | The Audit Committee shall establish procedures for: |

| • | the receipt, retention and treatment of complaints received by the Corporation regarding accounting, internal controls, or auditing matters, and |

| • | the confidential, anonymous submission by employees of the Corporation of concerns regarding questionable accounting or auditing matters. |

| 13. | The Audit Committee shall have the authority to engage, and to determine appropriate compensation for, independent counsel and other advisers, as it determines necessary to carry out its duties. The Corporation shall provide appropriate funding, as determined by the Audit Committee, for payment of compensation (i) to any public accounting firm engaged for the purpose of rendering or issuing an audit report or related work or performing other audit, review or attest services for the Corporation and (ii) to any advisors employed by the Audit Committee as provided in this Charter. The Audit Committee may request any officer or employee of the Corporation or the Corporation’s outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee. |

| 14. | Review, with the Corporation’s counsel, any legal matter that could have a significant impact on the Corporation’s financial statements. |

| 15. | Report through its Chairperson to the Board following meetings of the Audit Committee. |

| 16. | Maintain minutes or other records of meetings and activities of the Audit Committee. |

A-3

Table of Contents

STORAGE COMPUTER CORPORATION

RESTATED AND AMENDED 1999 STOCK INCENTIVE PLAN

1. PURPOSE OF PLAN

The 1999 Stock Incentive Plan (the “Plan”) is intended to promote the long-term interests of the Company and its shareholders by providing directors, consultants, officers and other employees of the Company with an additional incentive arising from capital stock ownership to promote the financial success of, and to provide future services to, the Company. Those provisions of the Plan which make reference to Section 422 of the Code (as defined below) shall apply only to ISOs (as defined below).

2. DEFINITIONS

Unless otherwise required by the context, the following terms when used in the Plan shall have the meaning set forth in this Section 2:

(a) “Affiliate”: Any “parent corporation” or “Subsidiary corporation” of the Company, as such terms are defined in Sections 424(e) and (f), respectively, of the Code.

(b) “Agreement”: An option agreement evidencing an Award in such form as adopted by the Committee pursuant to the Plan.

(c) “Award”: The grant of an Option under the Plan.

(d) “Board of Directors” or “Board”: The Board of Directors of the Company.

(e) “Change in Control”: A “Change in Control” occurs if the Company (i) ceases operations; (ii) merges or consolidates with another entity and is not the surviving entity; (iii) sells or otherwise transfers substantially all of its operating assets; or (iv) if more than fifty percent (50%) of the capital stock of the Company is transferred in a single transaction or in a series of related transactions other than a public offering of stock of the Company.

(f) “Code”: The Internal Revenue Code of 1986, as amended from time to time.

(g) “Committee”: The Compensation Committee of the Board of Directors or such other committee appointed by the Board of Directors which meets the requirements set forth in Section 10(a) hereof.

(h) “Company”: Storage Computer Corporation, a Delaware corporation.

(i) “Effective Date”: The date on which the Plan shall become effective as set forth in section 11 hereof.

(j) “Exchange Act”: The Securities Exchange Act of 1934, together with all regulations and rules issued there under.

(k) “Exercise Price”: In the case of an Option, the price per Share at which the Shares subject to such Option may be purchased upon exercise of such Option.

(l) “Fair Market Value”: As applied to a specific date, the closing price, if any, of the Company’s Common Stock on such date as reported by the American Stock Exchange or such other exchange on which the Company’s Common Stock may then be traded, or, if none, the fair market value shall be the closing price of the

B-1

Table of Contents

Company’s Common Stock on the nearest date before the grant. The Fair Market Value determined by the Committee or the Board in good faith in such manner shall be final, binding and conclusive on all parties.

(m) “ISO”: An Option is intended to qualify as an “incentive stock option”, as defined in Section 422 of the Code or any statutory provision that may replace such Section.

(n) ““NQSO”: An Option not intended to be an ISO and designated to Nonqualified Stock Option by the Committee.

(o) “Option”: Any ISO or NQSO granted under the Plan.

(p) “Participant”: A non-employee director, officer, consultant or other key employee of the Company who has been granted an Award under the Plan.

(q) “Plan”: This Storage Computer Corporation 1999 Stock Incentive Plan adopted by the Board of Directors on May 17, 1999, as the same may be amended from time to time.

(r) “Reporting Person”: Such persons as are required to file reports under Section 16(a) of the Exchange Act.

(s) “SEC”: Securities and Exchange Commission.

(t) “Shares”: Shares of the Company’s authorized but un-issued or reacquired $.001 par value Common Stock, or such other class or kind of shares or other securities as may be applicable pursuant to the provisions of Section 4(b) hereof.

3. PARTICIPANT

The class of persons eligible to receive Awards under the Plan shall be those officers, directors, consultants and other employees of the Company as designated by the Committee from time to time.

4. SHARES SUBJECT TO PLAN

(a) Maximum Shares. Subject to adjustment by the operation of Section 4(b) hereof, the aggregate maximum number of Shares with respect to which Options may be granted under the Plan is 6,000,000 shares. The Shares with respect to which Options may be granted under the Plan may be either authorized and un-issued shares or issued shares heretofore or hereafter reacquired and held as treasury shares. An award shall not be considered to have been made under the Plan with respect to an Option to the extent that it terminates without being exercised, and new Awards may be granted under the Plan with respect to the number of Shares as to which such termination has occurred.

(b) Adjustment of Shares and Price. In the event that the Shares are changed into or exchanged for a different kind or number of Shares of stock or securities of the Company as the result of any stock dividend, stock split, combination of shares, exchange of shares, merger, consolidation, reorganization, recapitalization or other change in capital structure, than the number of Shares subject to this Plan and to Awards granted hereunder and the purchase or Exercise Price for such Shares shall be equitably adjusted by the Committee to prevent the dilution or enlargement of Awards, and any new stock or securities into which the Shares are changed or for which they are exchanged shall be substituted for the Shares subject to this Plan and to Awards granted hereunder; provided, however that fractional Shares may be deleted from any such adjustment or substitution.

5. GENERAL TERMS AND CONDITIONS OF OPTIONS

(a) General Terms. The Committee shall have full and complete authority and discretion and as otherwise expressly limited by the Plan, to grant Options and to provide the terms and conditions (which need not be

B-2

Table of Contents

identical) among Participants thereof. In particular, the Committee shall prescribe the following terms and conditions with respect to any Options:

(i) the Exercise Price of any Option determined in accordance with Section 5(b) hereof.

(ii) the number of Shares subject to and the expiration date of any Option, provided, however that no Option shall have a term in excess of ten years from the date of grant of the Option.

(iii) the manner, time and rate (cumulative or otherwise) of exercise of such Option.

(iv) the restrictions, if any to be placed upon such Option or upon Shares which may be issued upon exercise of such Option. The Committee may as a condition of granting any Option require that a Participant agree not to exercise thereafter one or more Options previously granted to such Participant.

(v) provisions, if any, for automatic vesting of any Option upon a “Change in Control” of the Company.

(b) Exercise Price. The exercise price of any Option shall be determined by the Committee. With respect to an ISO, the Exercise Price of an Option shall not be less than 100% (or with respect to any participant owning more than 10% of the combined voting power of all classes of the Company’s or an Affiliate’s Stock, (110%) of the Fair Market Value per Share on the date of the grant. If the Company engages in a merger or business combination with another entity, options may be issued under the Plan at a price lower than Fair Market Value per share to employees of such other entity who hold employee options to purchase securities of such entity and who become employees of the Company or of a subsidiary of the Company, provided that the Exercise Price and number of shares shall be determined by the Committee generally in accordance with the principles set forth in Section 4(b) above. To the extent permitted by the Code, the Committee may designate such options as ISO’S.

Notwithstanding the foregoing, in no event shall the Exercise Price of an Option be less than the par value per Share.

6. EXERCISE OF OPTIONS

(a) General Exercise Rights. An Option granted under the Plan shall be exercisable during the lifetime of the Participant to whom such Option was granted only by such Participant and, except as provided in Section 6(c), no such Option may be exercised unless at the time such Participant exercises such Option, such Participant is an employee, director or consultant of, and has continuously since the grant thereof been an employee, director or consultant of the Company. A leave of absence by an employee at the request or with the approval of the Company shall not be deemed an interruption or termination of employment, so long as the period of such leave does not exceed 180 days, or, if longer, so long as the Participant’s right to re-employment with the Company is guaranteed by contract, applicable law, a vote of the Board of Directors or the Company’s corporate policy in effect on the date such leave commences. An Option also shall contain such conditions upon exercise (including, without limitation, conditions limiting the time of exercise to specified periods) as may be required to satisfy applicable regulatory requirements, including, without limitation, Rule 16b-3 (or any successor rule) promulgated by the SEC.

(b) Notice of Exercise. An Option may not be exercised with respect to less than 100 Shares, unless the exercise relates to all Shares covered by the Options at the date of exercise. An Option shall be exercised by delivery of written notice to the Company. Such notice shall state the election to exercise the Option and the number of whole Shares in respect of which it is being exercised, and shall be signed by the person or persons so exercising the Option. In the case of an exercise of an Option such notice shall either: (a) be accompanied by payment of the full Exercise Price and all applicable withholding taxes, in which event the Company shall deliver any certificate(s) representing Shares which the Participant is entitled to receive as a result of the exercise as soon as practicable after the notice has been received; or (b) fix a date (not less than 5 nor more than 15 business days from the date such notice has been received by the Company) for the payment of the full Exercise Price and all applicable withholding taxes, against delivery by the Company of any certificate(s) representing Shares which

B-3

Table of Contents

the Participant is entitled to receive as a result of the exercise. Payment of such Exercise Price and withholding taxes shall be made as provided in Sections 6(d) and 9 hereof, respectively. In the event the Option be exercised pursuant to Section 6(c)(i) hereof, by any person or persons other than the Participant, such notice shall be accompanied by appropriate proof of the right of such person or persons to exercise the Option.

(c) Exercise After Termination of Employment. Subject to Section 6(a) and except as otherwise determined by the Committee at the date of the grant of the Option, upon termination of a Participant’s employment with the Company, such Participant (or in the case of death, the persons to whom the Option is transferred by will or the laws of descent and distribution) may exercise such Option during the following periods of time (but in no event after the normal expiration date of such Option) to the extent that such Participant was entitled to exercise such Options at the date of such termination:

(i) in the case of termination as a result of death, disability or retirement of the Participant, the Option shall remain exercisable for one year after the date of termination; for this purpose, “disability” shall mean such physical or mental condition affecting the Participant as determined by the Committee in its sole discretion, and “retirement” shall mean voluntary retirement under a retirement plan, policy or program of the Company;

(ii) in the case of termination for cause or the Participant’s voluntary resignation, the Option shall immediately terminate and shall no longer be exercisable; and

(iii) in the case of termination for any reason other than those set forth in subparagraphs (i) and (ii) above, the Option shall remain exercisable for three months after the date of termination.

TO THE EXTENT THE OPTION IS NOT EXERCISED WITHIN A TIMELY MANNER AS SET FORTH ABOVE, AND IN THE PROPER MANNER AS PRESCRIBED HEREIN, THE OPTION SHALL AUTOMATICALLY TERMINATE AT THE END OF THE APPLICABLE PERIOD OF TIME.

Notwithstanding the foregoing provisions, failure to exercise an ISO within the periods of time prescribed under Sections 421 and 422 of the Code shall cause an ISO to cease to be treated as an “incentive stock option” for purposes of Section 421 of the Code.

(d) Payment of Option Exercise Price. Upon the exercise of an Option, payment of the Exercise Price shall be made either (i) in cash (by certified check, bank draft or money order), (ii) with the consent of the Committee and subject to Section 6(c) hereof, by delivering the Participant’s duly executed promissory note and related documents, (iii) with the consent of the Committee, by delivering Shares already owned by the Participant valued at Fair Market Value; provided that no shares received upon exercise of the Option thereafter may be exchanged to pay the Option price for additional Shares within the following six months, or (iv) by a combination of the foregoing forms of payment.