File No. 333-[ ]

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON DECEMBER 16, 2021

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. [ ]

Post-Effective Amendment No. [ ]

JNL Series Trust

(Exact Name of Registrant as Specified in Charter)

1 Corporate Way

Lansing, Michigan 48951

(Address of Principal Executive Offices)

(517) 381-5500

(Registrant’s Area Code and Telephone Number)

225 West Wacker Drive

Chicago, Illinois 60606

(Mailing Address)

With copies to:

EMILY J. BENNETT, ESQ. JNL Series Trust 1 Corporate Way Lansing, Michigan 48951 | PAULITA PIKE, ESQ. Ropes & Gray LLP 191 North Wacker Drive Chicago, Illinois 60606 |

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this Registration Statement will become effective on January 18, 2022, pursuant to Rule 488 under the Securities Act of 1933, as amended.

Title of securities being registered: Class A and Class I Shares of beneficial interest in the series of the registrant designated as the JNL Growth Allocation Fund.

No filing fee is required because the registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of shares (File Nos. 033-87244 and 811-08894).

JNL SERIES TRUST

CONTENTS OF REGISTRATION STATEMENT

This Registration Statement contains the following papers and documents:

Cover Sheet

Contents of Registration Statement

Letter to Contract Owners

Notice of Special Meeting

Contract Owner Voting Instructions

Part A - Proxy Statement/Prospectus

Part B - Statement of Additional Information

Part C - Other Information

Signature Page

Exhibits

JACKSON NATIONAL LIFE INSURANCE COMPANY

JACKSON NATIONAL LIFE INSURANCE COMPANY OF NEW YORK

1 Corporate Way

Lansing, Michigan 48951

February 11, 2022

Dear Contract Owner:

Enclosed is a notice of a Special Meeting of Shareholders of the JNL/Franklin Templeton Growth Allocation Fund (the “Franklin Fund” or the “Acquired Fund”), a series of the JNL Series Trust (the “Trust”). The Special Meeting of Shareholders of the Acquired Fund is scheduled to be held at the offices of Jackson National Life Insurance Company, 1 Corporate Way, Lansing, Michigan 48951, on March 25, 2022, at 9:30 a.m., Eastern Time (the “Meeting”). At the Meeting, the shareholders of the Acquired Fund will be asked to approve the proposal described below.

The Trust’s Board of Trustees (the “Board”) called the Meeting to request shareholder approval of the reorganization (the “Reorganization”) of the Acquired Fund into the JNL Growth Allocation Fund (the “Growth Allocation Fund” or the “Acquiring Fund”), also a series of the Trust. The Acquired Fund and the Acquiring Fund are each sometimes referred to herein as a “Fund” and collectively, the “Funds.”

Both the Acquired Fund and the Acquiring Fund are managed by Jackson National Asset Management, LLC (“JNAM”), but only the Acquired Fund is sub-advised by a sub-adviser and sub-sub advisers. If the Reorganization is approved and implemented, each person that invests indirectly in the Acquired Fund will automatically become an investor indirectly in the Acquiring Fund.

The Board considered that the Acquired Fund was converted from a fund-of-funds structure in 2019 to a sub-advised structure. The Board also considered the Acquired Fund’s performance since the 2019 conversion, noting that while performance improved relative to peers, the Acquired Fund still continued to underperform relative to its peers. The Board noted that the Acquired Fund incorporates several strategies, or “sleeves”, managed by sub-sub-advisers affiliated with the Acquired Fund’s sub-adviser and that JNAM has noted that the recent sleeve additions have presented operational challenges due to their complexity, as these sleeve additions require coordination of trading and oversight of three affiliates of the sub-adviser.

After considering JNAM’s recommendation, the Board concluded that: (i) the Reorganization will benefit the shareholders of the Acquired Fund; (ii) the Reorganization is in the best interests of the Acquired Fund; and (iii) the interests of the shareholders of the Acquired Fund will not be diluted as a result of the Reorganization. No one factor was determinative, and each Trustee may have attributed different weights to the various factors. The Board did not determine any considerations related to this Reorganization to be adverse. The Board, after careful consideration, approved the Reorganization.

Pending shareholder approval, effective as of the close of business on April 22, 2022, or on such later date as may be deemed necessary in the judgment of the Board in accordance with the Plan of Reorganization (the “Closing Date”), you will invest indirectly in shares of the Acquiring Fund in an amount equal to the dollar value of your interest in the Acquired Fund on the Closing Date. As of the date hereof, it is not expected that the Closing Date will be postponed. If the Closing Date is postponed to allow for additional time to solicit shareholder votes, shareholders will remain shareholders of their respective Fund(s). No sales charge, redemption fees, or other transaction fees will be imposed in the Reorganization. There will, however, be transaction costs associated with the Reorganization, which typically include, but are not limited to, trade commissions, related fees and taxes, and any foreign exchange spread costs. The Acquired Fund will bear the transaction costs due to the portfolio repositioning based on its relative net asset value at the time of the Reorganization. Such costs are estimated to be $339,961 (0.03% of net assets). There is no tax impact to contract owners as a result of portfolio repositioning. The Reorganization will not cause any fees or charges under your contract to be greater after the Reorganization than before the Reorganization, and the Reorganization will not alter your rights under your contract or the obligations of the insurance company that issued the contract. Following the Reorganization, the Acquiring Fund will be the accounting and performance survivor.

You may wish to take actions relating to your future allocation of premium payments under your insurance contract to the various investment divisions (the “Divisions”) of the separate account. You may execute certain changes prior to the Reorganization, in addition to participating in the Reorganization with regard to the Acquiring Fund, such as allocating your premium payments to other Divisions.

All actions with regard to the Acquired Fund need to be completed by the Closing Date. In the absence of new instructions prior to the Closing Date, future premium payments previously allocated to the Acquired Fund Division will be allocated to the Acquiring Fund Division. The Acquiring Fund Division will be the Division for future allocations under the Dollar Cost Averaging, Earnings Sweep, and Rebalancing Programs (together, the “Programs”). In addition to the Acquiring Fund Division, there are other Divisions investing in mutual funds that seek capital growth and current income. If you want to transfer all or a portion of your Contract value out of the Acquired Fund Division prior to the Reorganization, you may do so and that transfer will not be treated as a transfer for the purpose of determining how many subsequent transfers may be made in any period or how many may be made in any period without charge. In addition, if you want to transfer all or a portion of your Contract value out of the Acquiring Fund Division after the Reorganization, you may do so within 60 days following the Closing Date and that transfer will not be treated as a transfer for the purpose of determining how many subsequent transfers may be made in any period or how many may be made in any period without charge. You will be provided with an additional notification of this free-transfer policy on or about April 25, 2022.

If you want to change your allocation instructions as to your future premium payments or the Programs or if you require summary descriptions of the other underlying funds and Divisions available under your contract or additional copies of the prospectuses for other funds underlying the Divisions, please contact:

For Jackson variable annuity policies:

| Annuity Service Center |

| P.O. Box 24068 |

| Lansing, Michigan 48909-4068 |

| 1-800-644-4565 |

| www.jackson.com |

For Jackson New York variable annuity policies:

| Jackson of NY Service Center |

| P.O. Box 24068 |

| Lansing, Michigan 48909-4068 |

| 1-800-599-5651 |

| www.jackson.com |

An owner of a variable annuity contract or certificate that participates in the Acquired Fund through the Divisions of separate accounts established by Jackson National Life Insurance Company or Jackson National Life Insurance Company of New York (each, an “Insurance Company”) is entitled to instruct the applicable Insurance Company how to vote the Acquired Fund shares related to the ownership interest in those accounts as of the close of business on January 31, 2022. The attached Notice of Special Meeting of Shareholders and Proxy Statement and Prospectus concerning the Meeting describe the matters to be considered at the Meeting.

You are cordially invited to attend the Meeting. Because it is important that your vote be represented whether or not you are able to attend, you are urged to consider these matters and to exercise your right to vote your shares by completing, dating, signing, and returning the enclosed voting instruction card in the accompanying return envelope at your earliest convenience or by relaying your voting instructions via telephone or the Internet by following the enclosed instructions. Of course, we hope that you will be able to attend the Meeting, and if you wish, you may vote your shares in person, even if you may have already returned a voting instruction card or submitted your voting instructions via telephone or the Internet. At any time prior to the Meeting, you may revoke your voting instructions by providing the Insurance Company with a properly executed written revocation of such voting instructions, properly executing later-dated voting instructions by a voting instruction card, telephone, or the Internet, or appearing and voting in person at the Meeting. Please respond promptly in order to save additional costs of proxy solicitation and to make sure you are represented.

| | Very truly yours, |

| | |

| | /s/ Mark D. Nerud |

| | |

| | Mark D. Nerud |

| | Trustee, President, and Chief Executive Officer |

| | JNL Series Trust |

JNL SERIES TRUST

JNL/Franklin Templeton Growth Allocation Fund

1 Corporate Way

Lansing, Michigan 48951

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 25, 2022

To the Shareholders:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders of the JNL/Franklin Templeton Growth Allocation Fund (the “Franklin Fund” or the “Acquired Fund”), a series of JNL Series Trust (the “Trust”), will be held on March 25, 2022 at 9:30 a.m., Eastern Time, at the offices of Jackson National Life Insurance Company, 1 Corporate Way, Lansing, Michigan 48951 (the “Meeting”).

The Meeting will be held to act on the following proposals:

| 1. | To approve the Plan of Reorganization, adopted by the Trust’s Board of Trustees (the “Board”), which provides for the reorganization of the Franklin Fund into the JNL Growth Allocation Fund, also a series of the Trust. |

| 2. | To transact other business that may properly come before the Meeting or any adjournments thereof. |

Due to the COVID-19 pandemic, shareholders who attend the Meeting will be required to practice social distancing and to abide by all state and local restrictions. Multiple conference rooms may be used, as applicable, depending on the number of attendees and a dial-in number will be provided. Each room is subject to frequent cleanings.

Please note that owners of variable annuity contracts or certificates (the “Contract Owners”) issued by Jackson National Life Insurance Company or Jackson National Life Insurance Company of New York (each, an “Insurance Company”) who have invested in shares of the Acquired Fund through the investment divisions of a separate account or accounts of an Insurance Company (“Separate Account”) will be given the opportunity, to the extent required by law, to provide the applicable Insurance Company with voting instructions on the above proposals.

You should read the Proxy Statement and Prospectus attached to this notice prior to completing your proxy or voting instruction card. The record date for determining the number of shares outstanding, the shareholders entitled to vote, and the Contract Owners entitled to provide voting instructions at the Meeting and any adjournments thereof has been fixed as the close of business on January 31, 2022. If you attend the Meeting, you may vote or give your voting instructions in person.

YOUR VOTE IS IMPORTANT.

PLEASE RETURN YOUR PROXY CARD OR VOTING INSTRUCTION CARD PROMPTLY.

Regardless of whether you plan to attend the Meeting, you should vote or give voting instructions by promptly completing, dating, signing, and returning the enclosed proxy or voting instruction card for the Acquired Fund in the enclosed postage-paid envelope. You also can vote or provide voting instructions through the Internet or by telephone using the 12-digit control number that appears on the enclosed proxy or voting instruction card and following the simple instructions. At any time prior to the Meeting, you may revoke your voting instructions by providing the Insurance Company with a properly executed written revocation of such voting instructions, properly executing later-dated voting instructions by a voting instruction card, telephone, or the Internet, or appearing and voting in person at the Meeting. If you are present at the Meeting, you may change your vote or voting instructions, if desired, at that time. The Board recommends that you vote or provide voting instructions to vote FOR the proposal.

| | By order of the Board, |

| | |

| | /s/ Mark D. Nerud |

| | |

| | Mark D. Nerud |

| | Trustee, President, and Chief Executive Officer |

February 11, 2022

Lansing, Michigan

JACKSON NATIONAL LIFE INSURANCE COMPANY

JACKSON NATIONAL LIFE INSURANCE COMPANY OF NEW YORK

CONTRACT OWNER VOTING INSTRUCTIONS

REGARDING A SPECIAL MEETING OF SHAREHOLDERS OF

JNL/FRANKLIN TEMPLETON GROWTH ALLOCATION FUND

A SERIES OF THE JNL SERIES TRUST

TO BE HELD ON MARCH 25, 2022

DATED: FEBRUARY 11, 2022

GENERAL

These Contract Owner voting instructions are being furnished by Jackson National Life Insurance Company (“Jackson National”), or Jackson National Life Insurance Company of New York (each, an “Insurance Company” and, together, the “Insurance Companies”), to owners of their variable annuity contracts or certificates (the “Contracts”) (the “Contract Owners”) who, as of January 31, 2022 (the “Record Date”), had net premiums or contributions allocated to the investment divisions of their separate accounts (the “Separate Accounts”) that are invested in shares of the JNL/Franklin Templeton Growth Allocation Fund (the “Franklin Fund” or “Acquired Fund”), a series of the JNL Series Trust (the “Trust”).

The Trust is a Massachusetts business trust registered with the Securities and Exchange Commission (the “SEC”) as an open-end management investment company.

Each Insurance Company is required to offer Contract Owners the opportunity to instruct it, as the record owner of all of the shares of beneficial interest in the Acquired Fund (the “Shares”) held by its Separate Accounts, as to how it should vote on the reorganization proposal (the “Proposal”) to be considered at the Special Meeting of Shareholders of the Acquired Fund referred to in the preceding Notice and at any adjournments (the “Meeting”). The enclosed Proxy Statement and Prospectus, which you should retain for future reference, concisely sets forth information about the proposed reorganization involving the Acquired Fund and another series of the Trust that a Contract Owner should know before completing the enclosed voting instruction card.

These Contract Owner Voting Instructions and the accompanying voting instruction card are being mailed to Contract Owners on or about February 17, 2022.

HOW TO INSTRUCT AN INSURANCE COMPANY

To instruct an Insurance Company as to how to vote the Shares held in the investment divisions of its Separate Accounts, Contract Owners are asked to promptly complete their voting instructions on the enclosed voting instruction card(s) and sign, date, and mail the voting instruction card(s) in the accompanying postage-paid envelope. Contract Owners also may provide voting instructions by phone at 1-866-256-0779 or by Internet at our website at www.proxypush.com/JNL.

If a voting instruction card is not marked to indicate voting instructions but is signed, dated, and returned, it will be treated as an instruction to vote the Shares in favor of the Proposal.

The number of Shares held in the investment division of a Separate Account corresponding to the Acquired Fund for which a Contract Owner may provide voting instructions was determined as of the Record Date by dividing (i) a Contract’s account value (minus any Contract indebtedness) allocable to that investment division by (ii) the net asset value of one Share of the Acquired Fund. At any time prior to an Insurance Company’s voting at the Meeting, a Contract Owner may revoke his or her voting instructions with respect to that investment division by providing the Insurance Company with a properly executed written revocation of such voting instructions, properly executing later-dated voting instructions by a voting instruction card, telephone or the Internet, or appearing and voting in person at the Meeting.

HOW AN INSURANCE COMPANY WILL VOTE

An Insurance Company will vote the Shares for which it receives timely voting instructions from Contract Owners in accordance with those instructions. Shares in each investment division of a Separate Account for which an Insurance Company receives a voting instruction card that is signed, dated, and timely returned but is not marked to indicate voting instructions will be treated as an instruction to vote the Shares in favor of the Proposal. Shares in each investment division of a Separate Account for which an Insurance Company receives no timely voting instructions from a Contract Owner, or that are attributable to amounts retained by an Insurance Company or its affiliate as surplus or seed money, will be voted by the applicable Insurance Company either for or against approval of the Proposal, or as an abstention, in the same proportion as the Shares for which Contract Owners (other than the Insurance Company) have provided voting instructions to the Insurance Company. Similarly, the Insurance Companies and their affiliates will vote their own shares and will vote shares that are held by the Fund of Funds whose shares are held by a Separate Account in the same proportion as voting instructions timely given by Contract Owners. As a result of proportionate voting, a small number of Contract Owners could determine the outcome of the Proposal. Please see “Additional Information about the Funds – Tax Status” below.

OTHER MATTERS

The Insurance Companies are not aware of any matters, other than the Proposal, to be acted on at the Meeting. If any other matters come before the Meeting, an Insurance Company will vote the Shares upon such matters in its discretion. Voting instruction cards may be solicited by employees of Jackson National or its affiliates as well as officers and agents of the Trust. The principal solicitation will be by mail, but voting instructions may also be solicited by telephone, personal interview, the Internet, or other permissible means.

The Meeting may be adjourned whether or not a quorum is present, by the chairperson of the Meeting from time to time to reconvene at the same or some other place as determined by the chairperson of the Meeting for any reason, including failure of a Proposal to receive sufficient votes for approval. No shareholder vote shall be required for any adjournment. No notice need be given that the Meeting has been adjourned other than by announcement at the Meeting. Any business that might have been transacted at the original Meeting may be transacted at any adjourned Meeting.

It is important that your Contract be represented. Please promptly mark your voting instructions on the enclosed voting instruction card; then sign, date, and mail the voting instruction card in the accompanying postage-paid envelope. You may also provide your voting instructions by telephone at 1-866-256-0779 or by Internet at our website at www.proxypush.com/JNL.

PROXY STATEMENT

for

JNL/Franklin Templeton Growth Allocation Fund, a series of JNL Series Trust

and

PROSPECTUS

for

JNL Growth Allocation Fund, a series of JNL Series Trust

Dated

February 11, 2022

1 Corporate Way

Lansing, Michigan 48951

(517) 381-5500

This Proxy Statement and Prospectus (the “Proxy Statement/Prospectus”) is being furnished to owners of variable annuity contracts or certificates (the “Contracts”) (the “Contract Owners”) issued by Jackson National Life Insurance Company (“Jackson National”) or Jackson National Life Insurance Company of New York (each, an “Insurance Company” and together, the “Insurance Companies”) who, as of January 31, 2022, had net premiums or contributions allocated to the investment divisions of an Insurance Company’s separate accounts (the “Separate Accounts”) that are invested in shares of beneficial interest in the JNL/Franklin Templeton Growth Allocation Fund (the “Franklin Fund” or the “Acquired Fund”), a series of the JNL Series Trust (the “Trust”), an open-end management investment company registered with the Securities and Exchange Commission (“SEC”). The purpose of this Proxy Statement/Prospectus is for shareholders of the Franklin Fund to vote on a Plan of Reorganization, adopted by the Trust’s Board of Trustees (the “Board”), which provides for the reorganization of the Franklin Fund into the JNL Growth Allocation Fund (the “Growth Allocation Fund” or the “Acquiring Fund”), also a series of the Trust.

This Proxy Statement/Prospectus also is being furnished to the Insurance Companies as the record owners of shares and to other shareholders that were invested in the Acquired Fund as of January 31, 2022. Contract Owners are being provided the opportunity to instruct the applicable Insurance Company to approve or disapprove the proposal contained in this Proxy Statement/Prospectus in connection with the solicitation by the Board of proxies to be used at the Special Meeting of Shareholders of the Acquired Fund to be held at 1 Corporate Way, Lansing, Michigan 48951, on March 25, 2022, at 9:30 a.m., Eastern Time, or any adjournment or adjournments thereof (the “Meeting”).

Due to the COVID-19 pandemic, shareholders who attend the Meeting will be required to practice social distancing and to abide by all state and local restrictions. Multiple conference rooms may be used, as applicable, depending on the number of attendees and a dial in number will be provided. Each room is subject to frequent cleanings.

THE SEC HAS NOT APPROVED OR DISAPPROVED THE SECURITIES DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS OR DETERMINED IF THIS PROXY STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The proposal described in this Proxy Statement/Prospectus is as follows:

| Proposal | Shareholders Entitled to Vote on the Proposal |

| 1. | To approve the Plan of Reorganization, adopted by the Board, which provides for the reorganization of the Franklin Fund into the Growth Allocation Fund. | Shareholders of the Franklin Fund |

The reorganization referred to in the above proposal is referred to herein as the “Reorganization.”

This Proxy Statement/Prospectus, which you should retain for future reference, contains important information regarding the proposal that you should know before voting or providing voting instructions. Additional information about the Trust has been filed with the SEC and is available upon oral or written request without charge. This Proxy Statement/Prospectus is being provided to the Insurance Companies and mailed to Contract Owners on or about February 17, 2022. It is expected that one or more representatives of each Insurance Company will attend the Meeting in person or by proxy and will vote shares held by the Insurance Company in accordance with voting instructions received from its Contract Owners and in accordance with voting procedures established by the Trust.

The following documents have been filed with the SEC and are incorporated by reference into this Proxy Statement/Prospectus:

| 1. | The Prospectus and Statement of Additional Information of the Trust, each dated April 26, 2021, as supplemented, with respect to the Acquired Fund (File Nos. 033-87244 and 811-08894); |

| 2. | The Annual Report to Shareholders of the Trust with respect to the Acquired Fund for the fiscal year ended December 31, 2020 (File Nos. 033-87244 and 811-08894); |

| 3. | The Semi-Annual Report to Shareholders of the Trust with respect to the Acquired Fund for the period ended June 30, 2021 (File Nos. 033-87244 and 811-08894); |

| 4. | The Statement of Additional Information dated February 11, 2022, relating to the Reorganization (File No. 333-[ ]). |

For a free copy of any of the above documents, please call or write to the phone numbers or address below.

Contract Owners can learn more about the Acquired Fund and the Acquiring Fund in any of the documents incorporated into this Proxy Statement/Prospectus, including the Annual Report and Semi-Annual Report listed above, which have been furnished to Contract Owners. Contract Owners may request a copy thereof, without charge, by calling 1-800-644-4565 (Jackson Service Center) or 1-800-599-5651 (Jackson NY Service Center), by writing JNL Series Trust, P.O. Box 30314, Lansing, Michigan 48909-7814, or by visiting www.jackson.com.

The Trust is subject to the informational requirements of the Securities Act of 1933, as amended (the “1933 Act”), the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”). Accordingly, it must file certain reports and other information with the SEC. You can copy and review proxy materials, reports, and other information about the Trust at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549-1520. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090. Proxy materials, reports, and other information about the Trust are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may obtain copies of this information, at the prescribed rates, by electronic request at the following E-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, SEC Office of Consumer Affairs and Information Services, 100 F Street, N.E., Washington, DC 20549-1520.

TABLE OF CONTENTS

SUMMARY

You should read this entire Proxy Statement/Prospectus carefully. For additional information, you should consult the Plan of Reorganization, a copy of which is attached hereto as Appendix A.

The Proposed Reorganization

The proposed Reorganization is as follows:

| Proposal | Shareholders Entitled to Vote on the Proposal |

| 1. | To approve the Plan of Reorganization, adopted by the Board, which provides for the Reorganization of the Franklin Fund into the Growth Allocation Fund. | Shareholders of the Franklin Fund |

This Proxy Statement/Prospectus is soliciting shareholders with amounts invested in the Acquired Fund as of January 31, 2022, to approve the Plan of Reorganization, whereby the Acquired Fund will be reorganized into the Acquiring Fund. (The Acquired Fund and Acquiring Fund are each sometimes referred to herein as a “Fund” and collectively, the “Funds.”)

The Acquired Fund has two share classes, designated Class A and Class I shares (“Acquired Fund Shares”). The Acquiring Fund also has two share classes, designated Class A and Class I shares (“Acquiring Fund Shares”).

The Plan of Reorganization provides for:

| ● | the transfer of all of the assets of the Acquired Fund to the Acquiring Fund in exchange for Acquiring Fund Shares having an aggregate net asset value equal to the Acquired Fund’s net assets; |

| ● | the Acquiring Fund’s assumption of all the liabilities of the Acquired Fund; |

| ● | the distribution to the shareholders (for the benefit of the Separate Accounts, as applicable, and thus the Contract Owners) of those Acquiring Fund Shares; and |

| ● | the complete termination of the Acquired Fund. |

A comparison of the investment objective(s), principal investment policies and strategies, and principal risks of the Acquired Fund and the Acquiring Fund is included in the “Comparison of Investment Objectives and Principal Investment Strategies,” “Comparison of Principal Risk Factors,” and “Comparison of Fundamental Policies” sections below. The Funds have identical distribution procedures, purchase procedures, exchange rights, and redemption procedures, which are discussed in “Additional Information about the Funds” below. Each Fund offers its shares to Separate Accounts and certain other eligible investors. Shares of each Fund are offered and redeemed at their net asset value without any sales load. You will not incur any sales loads or similar transaction charges as a result of the Reorganization.

The Reorganization is expected to be effective as of the close of business on April 22, 2022, or on such later date as may be deemed necessary in the judgment of the Board in accordance with the Plan of Reorganization (the “Closing Date”). As a result of the Reorganization, a shareholder invested in shares of the Acquired Fund would become an owner of shares of the Acquiring Fund. Such shareholder would hold, immediately after the Closing Date, Acquiring Fund Shares having an aggregate net asset value equal to the aggregate net asset value of the Acquired Fund Shares that were held by the shareholder as of the Closing Date. Similarly, each Contract Owner whose Contract values are invested indirectly in shares of the Acquired Fund through the Investment Divisions of a Separate Account would become indirectly invested in shares of the Acquiring Fund through the Investment Divisions of a Separate Account. The Contract value of each such Contract Owner would be invested indirectly through the Investment Divisions of a Separate Account, immediately after the Closing Date, in shares of the Acquiring Fund having an aggregate net asset value equal to the aggregate net asset value of the Acquired Fund Shares in which the Contract Owner invested indirectly through the Investment Divisions of a Separate Account as of the Closing Date. Following the Reorganization, the Acquiring Fund will be the accounting and legal survivor. It is expected that the Reorganization will not be a taxable event for federal income tax purposes for Contract Owners. Please see “Additional Information about the Reorganization – Federal Income Tax Consequences of the Reorganization” below for further information.

The Board approved the Plan of Reorganization with respect to the Franklin Fund. Accordingly, the Board is submitting the Plan of Reorganization for approval by the Acquired Fund’s shareholders. In considering whether to approve the proposal (“Proposal”), you should review the Proposal for the Acquired Fund in which you were invested on the Record Date (as defined under “Voting Information”). In addition, you should review the information in this Proxy Statement/Prospectus that relates to the Proposal and the Plan of Reorganization generally.

The Board recommends that you vote “FOR” the Proposal to approve the Plan of Reorganization.

| PROPOSAL: | APPROVAL OF THE PLAN OF REORGANIZATION WITH RESPECT TO THE REORGANIZATION OF THE FRANKLIN FUND INTO THE GROWTH ALLOCATION FUND. |

This Proposal requests the approval of Franklin Fund shareholders of the Plan of Reorganization pursuant to which the Franklin Fund will be reorganized into the Growth Allocation Fund.

In considering whether you should approve this Proposal, you should note that:

| ● | Investment Objectives. The Funds have different investment objectives. The Franklin Fund seeks long-term total return that is consistent with an acceptable level of risk, while the Growth Allocation Fund seeks capital growth and current income. For a detailed comparison of each Fund’s investment policies and strategies, see “Comparison of Investment Objectives and Principal Investment Strategies” below and Appendix B. |

| ● | Principal Investment Strategies. The Funds also have different principal investment strategies. The Franklin Fund is managed by a sub-adviser and has significant flexibility to invest in a broad range of equity, fixed income, and alternative asset classes in the U.S. and other markets throughout the world, both developed and emerging and less developed countries. The Franklin Fund may invest up to 10% of the Fund’s assets in mutual funds or exchange-traded funds (“ETFs”), including those advised by the sub-adviser or its affiliates. The Franklin Fund may also invest in derivative instruments and regularly uses currency derivatives, including forward foreign currency exchange contracts, currency futures contracts, currency swaps and currency options to hedge (protect) against currency risks. The Growth Allocation Fund is managed by the Adviser (rather than a sub-adviser) and is structured as a fund-of-funds. The Growth Allocation Fund seeks to achieve its objective by investing in Class I shares of a diversified group of other funds (the “Underlying Funds”) that invest primarily in equity securities and fixed-income securities. The Underlying Funds in which the Growth Allocation Fund may invest are a part of the Trust. Not all funds of the Trust are available as Underlying Funds. The Growth Allocation Fund, under normal circumstances, allocates approximately 60% to 100% of its assets to Underlying Funds that invest primarily in equity securities, 0% to 40% to Underlying Funds that invest primarily in fixed-income securities and 0% to 20% of its assets to Underlying Funds that invest primarily in money market securities. Some of the Underlying Funds may invest in securities issued by companies located in countries outside the United States, including a range of developing and emerging market countries. For a detailed comparison of each Fund’s investment policies and strategies, see “Comparison of Investment Objectives and Principal Investment Strategies” below and Appendix B. |

| ● | Fundamental Policies. The Funds have the same fundamental policies. For a detailed comparison of each Fund’s fundamental investment policies, see “Comparison of Fundamental Policies” below. |

| ● | Principal Risks. While there are some similarities in the risk profiles of the Funds, there are also some differences of which you should be aware. Each Fund’s principal risks include allocation risk, credit risk, emerging markets and less developed countries risk, equity securities risk, fixed-income risk, foreign securities risk, high-yield bonds, lower-rated bonds, and unrated securities risk, interest rate risk, investment in other investment companies risk, market risk, and mid-capitalization and small-capitalization investing risk. However, the Franklin Fund is also subject to derivatives risk, exchange-traded funds investing risk, investment style risk, and managed portfolio risk, which are not principal risks of investing in the Growth Allocation Fund. In addition, the principal risks of investing in the Growth Allocation Fund include underlying funds risk, which is not a principal risk of investing in the Franklin Fund. For a detailed comparison of each Fund’s risks, see both “Comparison of Principal Risk Factors” below and Appendix B. |

| ● | Investment Adviser and Other Service Providers. Jackson National Asset Management, LLC (“JNAM” or the “Adviser”) serves as the investment adviser and administrator for each Fund and will continue to manage and administer the Growth Allocation Fund after the Reorganization. JNAM has received an exemptive order from the SEC that generally permits JNAM, with approval from the Board, to appoint, dismiss, and replace each Fund’s unaffiliated sub-adviser(s) and to amend the advisory agreements between JNAM and the unaffiliated sub-advisers, without obtaining shareholder approval. However, any amendment to an advisory agreement between JNAM and the Trust that would result in an increase in the management fee rate specified in that agreement (i.e., the aggregate management fee) charged to a Fund will be submitted to shareholders for approval. JNAM has appointed Franklin Advisers, Inc. (“Franklin”) as the sub-adviser to manage the assets of the Franklin Fund. Franklin has appointed ClearBridge Investments, LLC (“ClearBridge”), Franklin Templeton Institutional, LLC (“FTI”), and Templeton Global Advisors Limited (“TGAL”) (together, along with Franklin, the “Franklin Entities”) as sub-sub-advisers to the Franklin Fund. JNAM is responsible for managing the assets of the Growth Allocation Fund directly and has not appointed a sub-adviser for the Growth Allocation Fund. It is anticipated that JNAM will continue to manage the assets of the Growth Allocation Fund after the Reorganization. For a detailed description of JNAM and the Franklin Entities, please see “Additional Information about the Funds - The Adviser” and “Additional Information about the Funds - The Sub-Adviser and Sub-Sub-Advisers” below. |

| ● | Asset Base. The Franklin Fund and Growth Allocation Fund had net assets of approximately $1.20 billion and $2.70 billion, respectively, as of June 30, 2021. Thus, if the Reorganization had been in effect on that date, the combined Fund (the “Combined Fund”) would have had net assets of approximately $3.90 billion (net of estimated transaction expenses). |

| ● | Description of the Securities to be Issued. Class A Shareholders of the Franklin Fund will receive Class A shares of the Growth Allocation Fund, and Class I Shareholders of the Franklin Fund will receive Class I shares of the Growth Allocation Fund pursuant to the Reorganization. Shareholders will not pay any sales charges in connection with the Reorganization. Please see “Comparative Fee and Expense Tables,” “Additional Information about the Reorganization,” and “Additional Information about the Funds” below for more information. |

| ● | Operating Expenses. Following the Reorganization, the total annual fund operating expense ratio for the Growth Allocation Fund is expected to be higher than that of the Franklin Fund currently; however, the management fee for the Growth Allocation Fund is expected to be lower than that of the Franklin Fund currently. For a more detailed comparison of the fees and expenses of the Funds, please see “Comparative Fee and Expense Tables” and “Additional Information about the Funds” below. |

The maximum management fee for the Franklin Fund is equal to an annual rate of 0.55% of its average daily net assets, while the maximum management fee for the Growth Allocation Fund is equal to an annual rate of 0.13% of its average daily net assets. The minimum management fee for the Franklin Fund is equal to an annual rate of 0.51% of its average daily net assets over $5 billion, while the minimum management fee for the Growth Allocation Fund is equal to an annual rate of 0.07% of its average daily net assets over $5 billion. As of December 31, 2020, the actual management fees of the Franklin Fund and the Growth Allocation Fund were 0.55% and 0.09%, respectively. In addition, the maximum administrative fee for the Franklin Fund is equal to an annual rate of 0.15% of its average daily net assets, while the maximum administrative fee for the Growth Allocation Fund is equal to an annual rate of 0.05% of its average daily net assets. As of December 31, 2020, the actual administrative fees of the Franklin Fund and the Growth Allocation Fund were 0.15% and 0.05%, respectively. For a more detailed description of the fees and expenses of the Funds, please see “Comparative Fee and Expense Tables” and “Additional Information about the Funds” below.

| ● | Costs of Reorganization. Following the Reorganization, the Combined Fund will be managed in accordance with the investment objective, policies and strategies of the Growth Allocation Fund. It is currently anticipated that approximately 100% of the Franklin Fund’s holdings will be liquidated in advance of the Reorganization and the resulting proceeds will be invested in accordance with the Growth Allocation Fund’s principal investment strategies. It is not expected that the Growth Allocation Fund will revise any of its investment policies following the Reorganization to reflect those of the Franklin Fund. |

The costs and expenses associated with the Reorganization relating to the solicitation of proxies, including preparing, filing, printing, and mailing of the Proxy Statement/Prospectus and related disclosure documents, and the related legal fees, including the legal fees incurred in connection with the analysis under the Internal Revenue Code of 1986, as amended (the “Code”), of the tax treatment of this transaction, and the costs associated with the preparation of the tax opinion, and obtaining a consent of independent registered public accounting firm will be borne by JNAM whether or not the Reorganization is consummated. No sales or other charges will be imposed on Contract Owners in connection with the Reorganization.

The Franklin Fund will bear transaction expenses, which typically include, but are not limited to, trade commissions, related fees and taxes, and any foreign exchange spread costs, where applicable (the “Transaction Costs”), associated with the Reorganization. Such Transaction Costs are estimated to be $339,961 (0.03% of net assets). Please see “Additional Information about the Reorganization” below for more information.

| ● | Federal Income Tax Consequences. The Reorganization is not expected to be a taxable event for federal income tax purposes for owners of variable contracts whose contract values are determined by investment in shares of the Franklin Fund. Provided that the Contracts qualify to be treated as life insurance contracts under Section 7702(a) of the Code or annuity contracts under Section 72 of the Code, the Reorganization will not be a taxable event for federal income tax purposes for Contract Owners regardless of the tax status of the Reorganization, and any dividend declared, allocations or distributions in connection with the Reorganization will not be taxable to Contract Owners. The Insurance Companies, as shareholders, and Contract Owners are urged to consult with their own tax advisers as to the specific consequences to them of the Reorganizations, including the applicability and effect of any possible state, local, non-U.S. and other tax consequences of the Reorganization. Please see “Additional Information about the Reorganization – Federal Income Tax Consequences of the Reorganization” below for more information. |

Comparative Fee and Expense Tables

The following tables show the current fees and expenses of each Fund and the estimated pro forma fees and expenses of Class A and Class I shares of the Acquiring Fund after giving effect to the proposed Reorganization. The fee and expense information is presented as of December 31, 2020. The tables below do not reflect any fees and expenses related to the Contracts, which would increase overall fees and expenses. See a Contract prospectus for a description of those fees and expenses.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | Acquired Fund: Franklin Fund | Acquiring Fund: Growth Allocation Fund | Pro Forma Growth Allocation Fund (assuming expected operating expenses if the Reorganization is approved) |

| | Class A | Class I | Class A | Class I | Class A | Class I |

| Management Fee | 0.55% | 0.55% | 0.09% | 0.09% | 0.09% | 0.09% |

| Distribution and/or Service (12b-1) Fees | 0.30% | 0.00% | 0.30% | 0.00% | 0.30% | 0.00% |

| Other Expenses1 | 0.15% | 0.15% | 0.06% | 0.06% | 0.06% | 0.06% |

| Acquired Fund Fees and Expenses2 | 0.03%2 | 0.03% | 0.74% | 0.74% | 0.74% | 0.74% |

| Total Annual Fund Operating Expenses3 | 1.03% | 0.73% | 1.19% | 0.89% | 1.19% | 0.89% |

| 1 | “Other Expenses” include an Administrative Fee of 0.15% for the Franklin Fund and an Administrative Fee of 0.05% for the Growth Allocation Fund, which is payable to JNAM. |

| 2 | Acquired Fund Fees and Expenses are the indirect expenses of investing in other investment companies. Accordingly, the expense ratio presented in the Financial Highlights section of the Proxy Statement/Prospectus will not correlate to the Total Annual Fund Operating Expenses disclosed above. |

| 3 | Expense information for the Franklin Fund has been restated to reflect current fees. |

Expense Examples

This example is intended to help you compare the costs of investing in the Funds with the cost of investing in other mutual funds. This example does not reflect fees and expenses related to the Contracts, and the total expenses would be higher if they were included. The example assumes that:

| ● | You invest $10,000 in a Fund for the time periods indicated; |

| ● | Your investment has a 5% annual return; |

| ● | The Fund’s operating expenses remain the same as they were as of December 31, 2020; and |

| ● | You redeem your investment at the end of each time period. |

Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | 1 Year | 3 Years | 5 Years | 10 Years |

| Franklin Fund (Acquired Fund) | | | | |

| Class A | $105 | $328 | $569 | $1,259 |

| Class I | $75 | $233 | $406 | $906 |

| Growth Allocation Fund (Acquiring Fund) | | | | |

| Class A | $121 | $378 | $654 | $1,443 |

| Class I | $91 | $284 | $493 | $1,096 |

Pro Forma Growth Allocation Fund (assuming expected operating expenses if the Reorganization is approved) | | | | |

| Class A | $121 | $378 | $654 | $1,443 |

| Class I | $91 | $284 | $493 | $1,096 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in Annual Fund Operating Expenses or in the Expense Examples, affect a Fund’s performance. For the period ended June 30, 2021, the portfolio turnover rates for the Franklin Fund and the Growth Allocation Fund were 35% and 5%, respectively, of the average value of each portfolio. For the fiscal year ended December 31, 2020, the portfolio turnover rate for the Franklin Fund and the Growth Allocation Fund were 81% and 22%, respectively, of the average value of each portfolio.

Comparison of Investment Adviser, and Sub-Adviser, and Sub-Sub-Advisers

The following table compares the investment adviser, sub-adviser, and sub-sub-advisers of the Franklin Fund with the investment adviser of the Growth Allocation Fund.

| Acquired Fund | Acquiring Fund |

| Franklin Fund | Growth Allocation Fund |

Investment Adviser Jackson National Asset Management, LLC Investment Sub-Adviser Franklin Advisers, Inc. Investment Sub-Sub-Advisers ClearBridge Investments, LLC Franklin Templeton Institutional, LLC Templeton Global Advisors Limited | Investment Adviser Jackson National Asset Management, LLC Investment Sub-Adviser None Investment Sub-Sub-Adviser None |

Comparison of Investment Objectives and Principal Investment Strategies

The following table compares the investment objectives and principal investment strategies of the Franklin Fund with those of the Growth Allocation Fund. The Funds have different investment objectives. The Franklin Fund seeks long-term total return that is consistent with an acceptable level of risk, while the Growth Allocation Fund seeks capital growth and current income. The Funds also have different principal investment strategies. The Franklin Fund is managed by a sub-adviser and has significant flexibility to invest in a broad range of equity, fixed income, and alternative asset classes in the U.S. and other markets throughout the world, both developed and emerging and less developed countries. The Franklin Fund may invest up to 10% of the Fund’s assets in mutual funds or exchange-traded funds (“ETFs”), including those advised by the sub-adviser or its affiliates. The Franklin Fund may also invest in derivative instruments, and regularly uses currency derivatives, including forward foreign currency exchange contracts, currency futures contracts, currency swaps and currency options to hedge (protect) against currency risks. The Growth Allocation Fund is managed by the Adviser (rather than a sub-adviser) and is structured as a fund-of-funds. The Growth Allocation Fund seeks to achieve its objective by investing in Class I shares of a diversified group of other funds (the “Underlying Funds”) that invest primarily in equity securities and fixed income securities. The Underlying Funds in which the Growth Allocation Fund may invest are each a separate series of the Trust. Not all funds of the Trust are available as Underlying Funds. The Growth Allocation Fund, under normal circumstances, allocates approximately 60% to 100% of its assets to Underlying Funds that invest primarily in equity securities, 0% to 40% to Underlying Funds that invest primarily in fixed-income securities and 0% to 20% of its assets to Underlying Funds that invest primarily in money market securities. Some of the Underlying Funds may invest in securities issued by companies located in countries outside the United States, including a range of developing and emerging market countries. The Board may change the investment objective of a Fund without a vote of the Fund’s shareholders. For more detailed information about each Fund’s investment strategies and risks, see below and Appendix B.

| Acquired Fund | Acquiring Fund |

| Franklin Fund | Growth Allocation Fund |

Investment Objective The investment objective of the Fund is long-term total return that is consistent with an acceptable level of risk. | Investment Objective The investment objective of the Fund is to seek capital growth and current income. |

Principal Investment Strategies The Fund has significant flexibility to invest in a broad range of equity, fixed income, and alternative asset classes in the U.S. and other markets throughout the world, both developed and emerging and less developed countries. | Principal Investment Strategies The Fund seeks to achieve its objective by investing in Class I shares of a diversified group of other Funds (“Underlying Funds”). The Underlying Funds in which the Fund may invest are a part of the JNL Series Trust. Not all Funds of the JNL Series Trust are available as Underlying Funds. Please refer to the statutory prospectus for a list of available Underlying Funds. |

| Under normal market conditions, Franklin Advisers, Inc., the Fund’s sub-adviser (the “Sub-Adviser”), uses a flexible allocation approach when allocating the Fund’s assets among the broad asset classes of equity and fixed-income investments. | Under normal circumstances, the Fund allocates approximately 60% to 100% of its assets to Underlying Funds that invest primarily in equity securities, 0% to 40% to Underlying Funds that invest primarily in fixed-income securities and 0% to 20% of its assets to Underlying Funds that invest primarily in money market securities. The Fund allocates its assets among Underlying Funds categorized by the Adviser into the following investment categories: ● Allocation ● Alternative Assets ● Alternative Strategies ● Domestic/Global Equity ● Domestic/Global Fixed-Income ● International ● International Fixed-Income ● Sector The Fund considers the Underlying Funds in the Domestic/Global Fixed-Income and International Fixed-Income investment categories to be funds that invest primarily in fixed-income securities, and the Underlying Funds in the Domestic/Global Equity, International, Sector, and Specialty investment categories to be funds that invest primarily in equity securities. The Underlying Funds in the Risk Management and Allocation investment categories include funds that can invest in a variety of asset classes in various proportions, may take measures to manage risk and/or adapt to prevailing market conditions and may have significant exposure to both fixed-income and equity securities. To the extent the Fund invests in one of these Underlying Funds, the Fund’s exposure to fixed-income securities and equity securities will be allocated according to the Underlying Fund’s relative exposure to these asset classes. The Fund considers the Underlying Funds in the Alternative Assets and Alternative Strategies investment categories to be funds that invest primarily in alternative assets and employ alternative strategies. |

| Acquired Fund | Acquiring Fund |

| Franklin Fund | Growth Allocation Fund |

| When selecting equity investments, the Sub-Adviser considers foreign and domestic exposure, market capitalization ranges, and investment style (growth vs. value). | No corresponding strategy. |

| When selecting fixed-income investments, the Sub-Adviser focuses primarily on maximizing income appropriate to the Fund’s risk profile and considers the duration and maturity of its investments. The Fund may also invest in fixed income securities of any credit rating, including below investment grade or “junk” bonds. | Some of the Underlying Funds, particularly those classified as Fixed Income Strategies, may hold a significant amount of asset-backed securities, mortgage-backed securities, derivatives, and/or junk bonds in order to execute their investment strategy. In determining allocations to any particular Underlying Fund, the Fund’s Adviser considers, among other things, long-term market and economic conditions, historical performance of each Underlying Fund, and expected long-term performance of each Underlying Fund, as well as diversification to control overall portfolio risk exposure. The Adviser may change the Underlying Funds in which the Fund invests from time to time at its discretion without notice or shareholder approval. Therefore, the Fund may invest in Underlying Funds that are not listed in the statutory prospectus. |

| In determining an optimal mix of the equity and fixed income asset classes for the Fund, the Sub-Adviser assesses changing economic, market and industry conditions. The Sub-Adviser allocates among strategies using a top-down approach, taking into account market conditions, risk factors, diversification, liquidity, transparency and other investment options, among other things. | No corresponding strategy. |

| As part of these equity and fixed-income investments, the Sub-Adviser may invest up to 10% of the Fund’s assets in mutual funds or exchange-traded funds (“ETFs”), including those advised by the Sub-Adviser or its affiliates. Such mutual funds or ETFs may invest in a variety of U.S. and foreign equity and fixed income securities of any rating that may employ a growth or value investment style. | No corresponding strategy. |

| Acquired Fund | Acquiring Fund |

| Franklin Fund | Growth Allocation Fund |

| The Fund may also invest in derivative instruments. The Fund regularly uses currency derivatives, including forward foreign currency exchange contracts, currency futures contracts, currency swaps and currency options to hedge (protect) against currency risks. The Fund also may, from time to time, use a variety of equity-related derivatives, which may include purchasing or selling call and put options on equity securities and equity security indices, futures on equity securities and equity indexes and options on equity index futures, for various purposes including enhancing Fund returns, increasing liquidity, gaining exposure to particular instruments in more efficient or less expensive ways and/or hedging risks relating to changes in certain equity markets. In addition, the Fund may, from time to time, use credit default swaps and options on credit default swaps and interest rate derivatives, including interest rate swaps and interest rate/bond futures contracts, and options on interest rate/bond futures and on interest rate swaps (swaptions) for various purposes including enhancing Fund returns, increasing liquidity, gaining exposure to particular instruments in more efficient or less expensive ways and/or hedging risks relating to changes in interest rates. The use of such derivative transactions may allow the Fund to obtain net long or net short exposures to selected markets, interest rates, countries, currencies or durations. | No corresponding strategy. |

| Emerging markets countries are those countries that are in the initial stages of their industrial cycles. | Some of the Underlying Funds may invest in securities issued by companies located in countries outside the United States, including a range of developing and emerging market countries. An “emerging market country” is a country that, at the time of investment, is classified as an emerging or developing country by any supranational organization such as an institution in the World Bank Group or the United Nations, or similar entity, or is considered an emerging market country for purposes of constructing a major emerging market securities index. |

Comparison of Principal Risk Factors

While there are some similarities in the risk profiles of the Funds, there are also some differences of which you should be aware. Each Fund’s principal risks include allocation risk, credit risk, emerging markets and less developed countries risk, equity securities risk, fixed-income risk, foreign securities risk, high-yield bonds, lower-rated bonds, and unrated securities risk, interest rate risk, investment in other investment companies risk, market risk, and mid-capitalization and small-capitalization investing risk. However, the Franklin Fund is also subject to derivatives risk, exchange-traded funds investing risk, investment style risk, and managed portfolio risk, which are not principal risks of investing in the Growth Allocation Fund. In addition, the principal risks of investing in the Growth Allocation Fund include underlying funds risk, which is not a principal risk of investing in the Franklin Fund. For a detailed comparison of each Fund’s risks, see both the table below and Appendix B.

An investment in a Fund is not guaranteed. As with any mutual fund, the value of a Fund’s shares will change, and an investor could lose money by investing in a Fund. The Acquiring Fund will incur the risks associated with each Underlying Fund in which it is invested. The following table compares the principal risks of an investment in each Fund. For additional information about each principal risk and other applicable risks, see Appendix B.

| | Acquired Fund | Acquiring Fund |

| Risks | Franklin Fund | Growth Allocation Fund |

| Allocation risk | X | X |

| Credit risk | X | X |

| Derivatives risk | X | |

| Emerging markets and less developed countries risk | X | X |

| Equity securities risk | X | X |

| Exchange-traded funds investing risk | X | |

| Fixed-income risk | X | X |

| Foreign securities risk | X | X |

| High-yield bonds, lower-rated bonds, and unrated securities risk | X | X |

| Interest rate risk | X | X |

| Investment in other investment companies risk | X | X |

| Investment style risk | X | |

| Managed portfolio risk | X | |

| Market risk | X | X |

| Mid-capitalization and small-capitalization investing risk | X | X |

| Underlying funds risk | | X |

Comparison of Fundamental Policies

Each Fund is subject to certain fundamental policies and restrictions that may not be changed without shareholder approval. The following table compares the fundamental policies of the Franklin Fund with those of the Growth Allocation Fund.

| Acquired Fund | Acquiring Fund |

| Franklin Fund | Growth Allocation Fund |

| (1) The Fund is a “diversified company,” as such term is defined under the 1940 Act. | Same. |

| (2) The Fund may not invest more than 25% of the value of its assets in any particular industry (other than U.S. Government securities and/or foreign sovereign debt securities). | Same. |

| Acquired Fund | Acquiring Fund |

| Franklin Fund | Growth Allocation Fund |

| (3) The Fund may not invest directly in real estate or interests in real estate; however, the Fund may own debt or equity securities issued by companies engaged in those businesses. | Same. |

(4) The Fund may not purchase or sell physical commodities other than foreign currencies unless acquired as a result of ownership of securities (but this limitation shall not prevent the Fund from purchasing or selling options, futures, swaps and forward contracts or from investing in securities or other instruments backed by physical commodities). | Same. |

| (5) The Fund may not lend any security or make any other loan if, as a result, more than 33 1/3% of the Fund’s total assets would be lent to other parties (but this limitation does not apply to purchases of commercial paper, debt securities or repurchase agreements). | Same. |

| (6) The Fund may not act as an underwriter of securities issued by others, except to the extent that the Fund may be deemed an underwriter in connection with the disposition of portfolio securities of the Fund. | Same. |

| (7) The Fund may not invest more than 15% of its net assets in illiquid securities. | Same. |

| (8) The Fund may not borrow money, except to the extent permitted by the 1940 Act, the rules and regulations thereunder, and any applicable exemptive relief. | Same. |

Comparative Performance Information

The performance information shown below provides some indication of the risks of investing in each Fund by showing changes in each Fund’s performance from year to year and by showing how each Fund’s average annual returns compared with those of broad-based securities market indices and composite indices which have investment characteristics similar to those of such Fund. Performance prior to June 24, 2019 reflects the Franklin Fund’s results when the Fund did not have a sub-adviser and operated as a fund-of-funds. Effective June 24, 2019, the Franklin Fund is sub-advised and no longer operates as a fund-of-funds. For the Growth Allocation Fund, performance prior to August 29, 2011 reflects the Growth Allocation Fund’s results when managed by the former sub-adviser, Standard & Poor’s Investment Advisory Services LLC. Each Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

The returns shown in the bar charts and tables below do not include charges imposed under the Contracts. If these amounts were reflected, returns would be less than those shown.

Following the Reorganization, the Acquiring Fund will be the accounting and performance survivor.

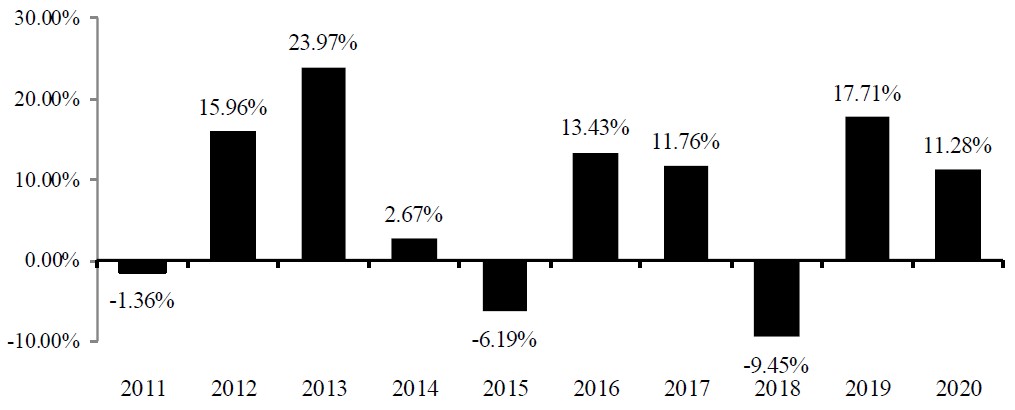

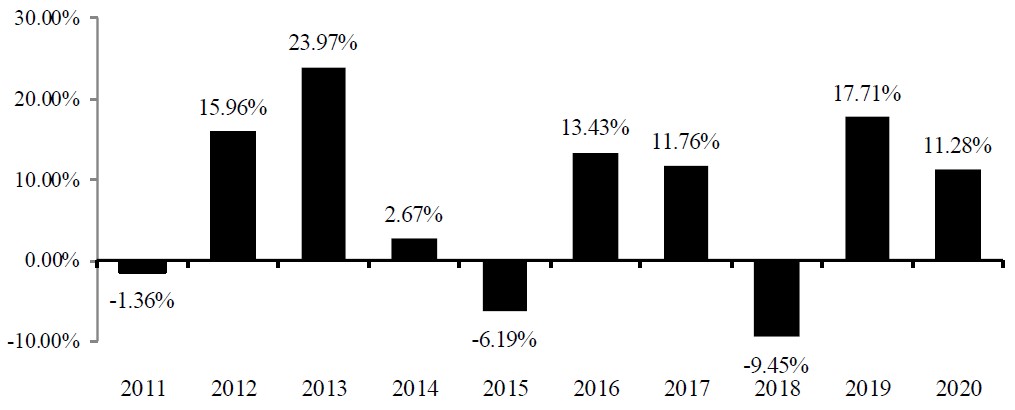

Franklin Fund – Calendar Year Total Returns

(Acquired Fund)

Class A

Best Quarter (ended 6/30/2020): 14.99%; Worst Quarter (ended 3/31/2020): -17.13%

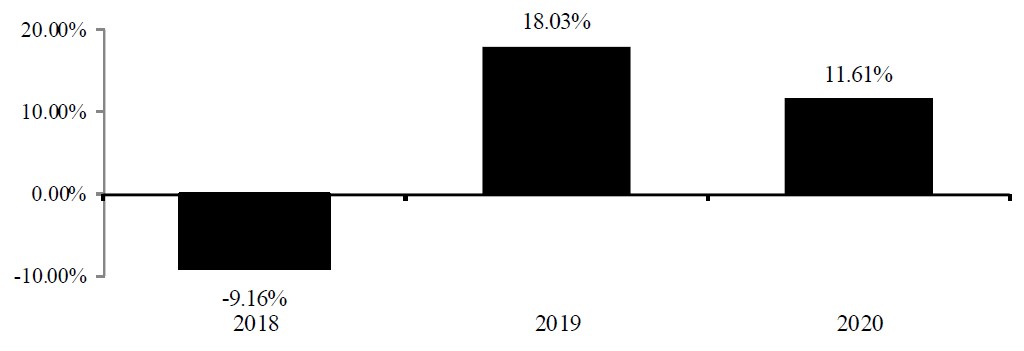

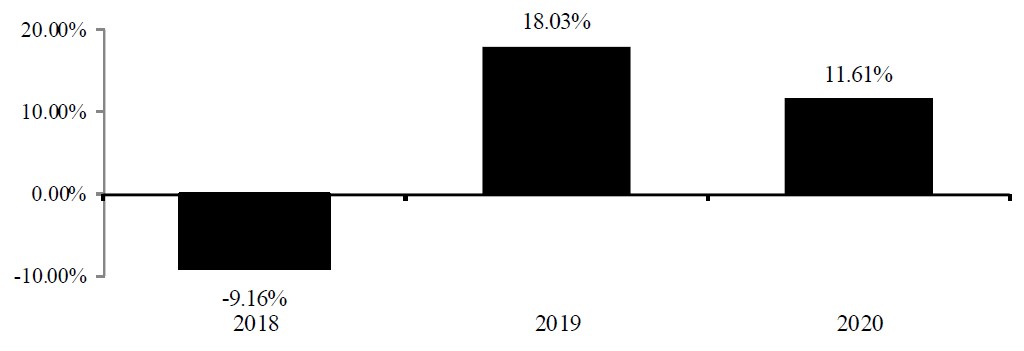

Class I

Best Quarter (ended 6/30/2020): 15.04%; Worst Quarter (ended 3/31/2020): -17.08%

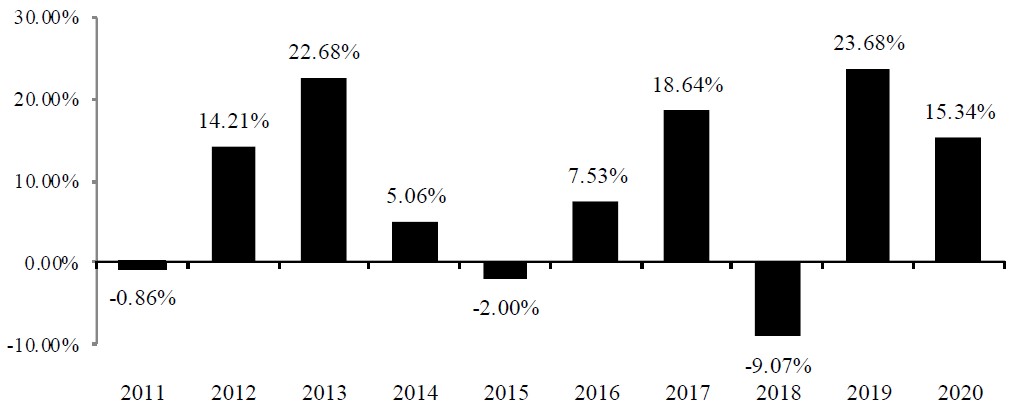

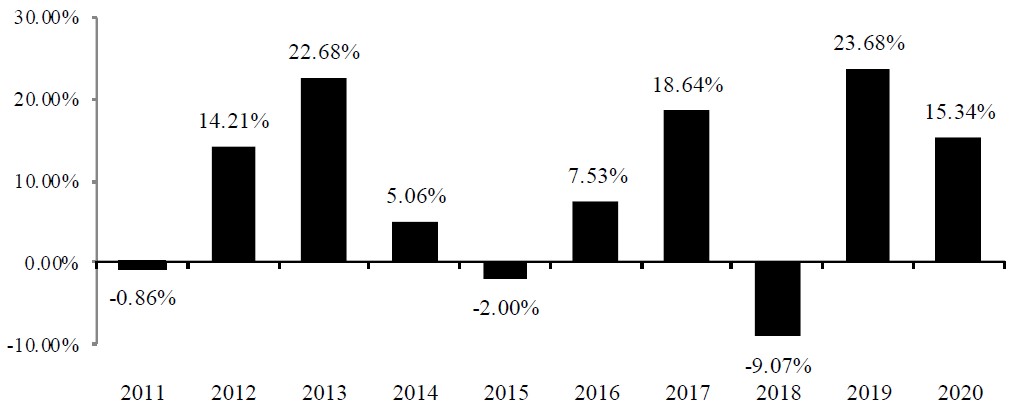

Growth Allocation Fund – Calendar Year Total Returns

(Acquiring Fund)

Class A

Best Quarter (ended 6/30/2020): 18.77%; Worst Quarter (ended 3/31/2020): -20.33%

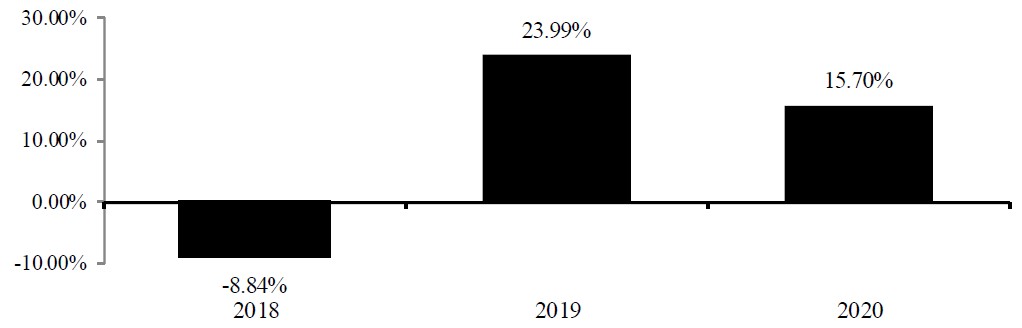

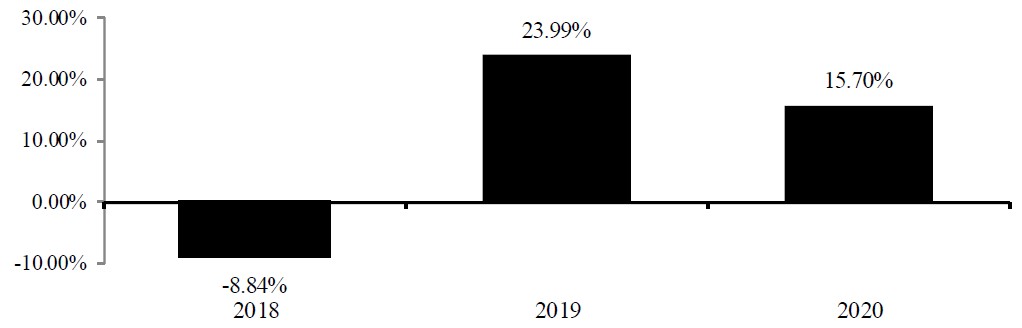

Class I

Best Quarter (ended 6/30/2020): 18.78%; Worst Quarter (ended 3/31/2020): -20.20%

| Average Annual Total Returns as of 12/31/2020 | | | | | | |

| | 1 year | | 5 year | | 10 year | |

| Franklin Fund (Class A) | 11.28 | % | 8.50 | % | 7.46 | % |

| Morningstar Moderately Aggressive Target Risk Index (reflects no deduction for fees, expenses, or taxes) | 13.51 | % | 11.27 | % | 8.94 | % |

| 50% S&P 500 Index, 25% MSCI All Country World Index ex USA Index (Net), 25% Bloomberg U.S. Aggregate Index (reflects no deduction for fees, expenses, or taxes) | 14.32 | % | 11.15 | % | 9.29 | % |

| S&P 500 Index (reflects no deduction for fees, expenses, or taxes) | 18.40 | % | 15.22 | % | 13.88 | % |

| MSCI All Country World ex USA Index (Net) (reflects no deduction for fees, expenses, or taxes) | 10.65 | % | 8.93 | % | 4.92 | % |

| Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 7.51 | % | 4.44 | % | 3.84 | % |

| Average Annual Total Returns as of 12/31/2020 | | | |

| | 1 year | | Life of Class (September 25, 2017) |

| Franklin Fund (Class I) | 11.61 | % | 6.49 | % |

| Morningstar Moderately Aggressive Target Risk Index (reflects no deduction for fees, expenses, or taxes) | 13.51 | % | 10.10 | % |

| 50% S&P 500 Index, 25% MSCI All Country World Index ex USA Index (Net), 25% Bloomberg U.S. Aggregate Index (reflects no deduction for fees, expenses, or taxes) | 14.32 | % | 10.70 | % |

| S&P 500 Index (reflects no deduction for fees, expenses, or taxes) | 18.40 | % | 15.44 | % |

| MSCI All Country World ex USA Index (Net) (reflects no deduction for fees, expenses, or taxes) | 10.65 | % | 5.89 | % |

| Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 7.51 | % | 4.98 | % |

| Average Annual Total Returns as of 12/31/2020 | | | | | | |

| | 1 year | | 5 year | | 10 year | |

| Growth Allocation Fund (Class A) | 15.34 | % | 10.60 | % | 9.00 | % |

| Morningstar Moderately Aggressive Target Risk Index (reflects no deduction for fees, expenses, or taxes) | 13.51 | % | 11.27 | % | 8.94 | % |

| 80% MSCI All Country World Index (Net), 20% Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 15.01 | % | 10.86 | % | 8.23 | % |

| MSCI All Country World Index (Net) (reflects no deduction for fees, expenses, or taxes) | 16.26 | % | 12.26 | % | 9.13 | % |

| Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 7.51 | % | 4.44 | % | 3.84 | % |

| Average Annual Total Returns as of 12/31/2020 | | | |

| | 1 year | | Life of Class (September 25, 2017) |

| Growth Allocation Fund (Class I) | 15.70 | % | 9.96 | % |

| Morningstar Moderately Aggressive Target Risk Index (reflects no deduction for fees, expenses, or taxes) | 13.51 | % | 10.10 | % |

| 80% MSCI All Country World Index (Net), 20% Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 15.01 | % | 10.14 | % |

| MSCI All Country World Index (Net) (reflects no deduction for fees, expenses, or taxes) | 16.26 | % | 11.11 | % |

| Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 7.51 | % | 4.98 | % |

Capitalization

The following table shows the capitalization of each Fund as of June 30, 2021, and of the Growth Allocation Fund on a pro forma combined basis as of June 30, 2021 after giving effect to the proposed Reorganization. The actual net assets of the Franklin Fund and the Growth Allocation Fund on the Closing Date will differ due to fluctuations in net asset values, subsequent purchases, and redemptions of shares. No assurance can be given as to how many shares of the Growth Allocation Fund will be received by shareholders of Franklin Fund on the Closing Date, and the following table should not be relied upon to reflect the number of shares of the Growth Allocation Fund that will actually be received.

| | Net Assets | Net Asset Value Per Share | Shares Outstanding |

| Franklin Fund (Acquired Fund) – Class A | $1,200,589,084 | 18.15 | 66,135,008 |

| Growth Allocation Fund (Acquiring Fund) – Class A | $2,680,258,619 | 19.51 | 137,346,451 |

| Adjustments | $(339,450)(a) | 0 | (4,615,293)(b) |

| Pro forma Growth Allocation Fund – Class A (assuming the Reorganization is approved) | $3,880,508,253 | 19.51 | 198,866,166 |

| Franklin Fund (Acquired Fund) – Class I | $1,806,993 | 18.36 | 98,438 |

| Growth Allocation Fund (Acquiring Fund) – Class I | $15,734,297 | 19.74 | 797,151 |

| Adjustments | $(511)(a) | 0 | (6,924)(b) |

| Pro forma Growth Allocation Fund – Class I (assuming the Reorganization is approved) | $17,540,779 | 19.74 | 888,665 |

| (a) | The costs and expenses associated with the Reorganization relating to the solicitation of proxies, including preparing, filing, printing, and mailing of the Proxy Statement/Prospectus and related disclosure documents, and the related legal fees, including the legal fees incurred in connection with the analysis under the Code of the tax treatment of this Reorganization as well as the costs associated with the preparation of the tax opinion and obtaining a consent of independent registered public accounting firm, will be borne by JNAM whether or not the Reorganization is consummated. No sales or other charges will be imposed on Contract Owners in connection with the Reorganization. It is currently anticipated that approximately 100% of the Franklin Fund’s holdings will be liquidated in advance of the Reorganization and the resulting proceeds will be invested in accordance with the Growth Allocation Fund’s principal investment strategies. The Franklin Fund will bear the Transaction Costs associated with the Reorganization. Such Transaction Costs are estimated to be $339,961 (0.03% of net assets). |

| (b) | The adjustment to the pro forma shares outstanding number represents a decrease in shares outstanding of the Acquiring Fund to reflect the exchange of shares of the Acquired Fund. |

The Reorganization provides for the acquisition of all the assets and all the liabilities of the Franklin Fund by the Growth Allocation Fund. If the Reorganization had taken place on June 30, 2021, shareholders of the Franklin Fund would have received 61,519,715 and 91,514 Class A and Class I shares, respectively, of the Growth Allocation Fund.

After careful consideration, the Board approved the Plan of Reorganization with respect to the Franklin Fund. Accordingly, the Board has submitted the Plan of Reorganization for approval by the Franklin Fund’s shareholders. The Board recommends that you vote “FOR” this Proposal.

* * * * *

ADDITIONAL INFORMATION ABOUT THE REORGANIZATION

Terms of the Plan of Reorganization

The terms of the Plan of Reorganization are summarized below. For additional information, you should consult the Plan of Reorganization, a copy of which is attached as Appendix A.

If shareholders of the Acquired Fund approve the Plan of Reorganization, then the assets of the Acquired Fund will be acquired by, and in exchange for, Class A and Class I shares, respectively, of the Acquiring Fund and the liabilities of the Acquired Fund will be assumed by the Acquiring Fund. The Acquired Fund will then be terminated by the Trust, and the Class A and Class I shares of the Acquiring Fund distributed to the Class A and Class I shareholders, respectively, of the Acquired Fund in the redemption of the Class A and Class I Acquired Fund Shares. Immediately after completion of the Reorganization, the number of shares of the Acquiring Fund then held by former shareholders of the Acquired Fund may be different than the number of shares of the Acquired Fund that had been held immediately before completion of the Reorganization, but the total investment will remain the same (i.e., the total value of the Acquiring Fund shares held immediately after the completion of the Reorganization will be the same as the total value of the Acquired Fund shares formerly held immediately before completion of the Reorganization).

It is anticipated that the Reorganization will be consummated as of the close of business on April 22, 2022, or on such later date as may be deemed necessary in the judgment of the Board and in accordance with the Plan of Reorganization, subject to the satisfaction of all conditions precedent to the closing. It is not anticipated that the Acquired Fund will hold any investment that the Acquiring Fund would not be permitted to hold (“non-permitted investments”).

Description of the Securities to Be Issued

The Class A shareholders of the Acquired Fund will receive Class A shares of the Acquiring Fund, and the Class I shareholders of the Acquired Fund will receive Class I shares of the Acquiring Fund in accordance with the procedures provided for in the Plan of Reorganization. Each such share will be fully paid and non-assessable by the Trust when issued and will have no preemptive or conversion rights.

The Trust may issue an unlimited number of full and fractional shares of beneficial interest of the Acquiring Fund and divide or combine such shares into a greater or lesser number of shares without thereby changing the proportionate beneficial interests in the Trust. Each share of the Acquiring Fund represents an equal proportionate interest in that Fund with each other share. The Trust reserves the right to create and issue any number of Fund shares. In that case, the shares of the Acquiring Fund would participate equally in the earnings, dividends, and assets of the Fund. Upon liquidation of the Acquiring Fund, shareholders are entitled to share proportionally (according to the net asset value of their shares of the Acquiring Fund) in the net assets of the Fund available for distribution to shareholders. The Acquiring Fund is a series of the Trust.

The Trust currently offers two classes of shares, Class A and Class I shares, for the Acquired Fund and the Acquiring Fund. Each series of the Trust has adopted a distribution plan in accordance with the provisions of Rule 12b-1 under the 1940 Act. Pursuant to the distribution plan, Class A shares of the Acquired Fund and Acquiring Fund are charged a Rule 12b-1 fee at the annual rate of 0.30% of the average daily net assets attributable to the Class A shares of the respective Fund. Because these distribution/service fees are paid out of the Funds’ assets on an ongoing basis, over time these fees will increase your cost of investing and may cost more than paying other types of charges. Class I shares are not charged a Rule 12b-1 fee.

Board Considerations

At a meeting of the Board held on November 30 – December 2, 2021 (the “Board Meeting”), the Board, including all of the independent trustees, who are not interested persons of the Funds (as defined in the Investment Company Act of 1940, as amended) (the “Independent Trustees”), considered information relating to the proposed reorganization of the Acquired Fund, a series of the Trust, into the Acquiring Fund, also a series of the Trust (the “Reorganization”). Before approving the Reorganization, the Independent Trustees reviewed the foregoing information with their independent legal counsel and with management, reviewed with independent legal counsel applicable law and their duties in considering such matters, and met with independent legal counsel in a private session without management present.

The Board considered that the Acquired Fund was converted from a fund-of-funds structure in 2019 to a sub-advised structure. The Board also considered the Acquired Fund’s performance since the 2019 conversion, noting that while performance improved relative to peers, the Acquired Fund still continued to underperform relative to its peers. The Board noted that the Acquired Fund incorporates several strategies, or “sleeves”, managed by sub-sub-advisers affiliated with the Acquired Fund’s sub-adviser and that JNAM has noted that the recent sleeve additions have presented operational challenges due to their complexity, as these sleeve additions require coordination of trading and oversight of three affiliates of the sub-adviser. The Board considered that the Reorganization is part of an overall rationalization of the Trust’s offerings designed to eliminate inefficiencies arising from offering overlapping funds with similar investment objectives and investment strategies that serve as investment options for the Contracts issued by the Insurance Companies and certain non-qualified plans. The Board also considered that the Reorganization seeks to increase assets under management in the Acquiring Fund in an effort to achieve additional economies of scale for Contract Owners. The Board noted that the objective of the Reorganization is to seek to ensure that a consolidated family of investments offers a streamlined, complete, and competitive set of underlying investment options to serve the interests of shareholders and Contract Owners. Thus, the Board considered the recommendation of JNAM to merge the Acquired Fund into the Acquiring Fund given the similarities in asset allocation mix and risk profile, the greater flexibility of the Acquiring Fund to invest across asset allocation (equities and fixed income), styles, (growth and value) and market capitalization (large-, mid-, and small-cap), and the Acquiring Fund’s stronger performance.

The Board considered a number of principal factors presented at the time of the Board Meeting in reaching its determinations, including the following: