| |

| SCHEDULE 14C INFORMATION |

| |

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| | Filed by the Registrant | ☒ |

| | Filed by a Party other than the Registrant | ☐ |

| | |

| Check the appropriate box: |

| | |

| ☐ | Preliminary Information Statement |

| | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| | |

| ☒ | Definitive Information Statement |

| |

| | JNL Series Trust | |

| | (Name of Registrant As Specified In Its Charter) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ | No fee required. |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| | |

| | (1) | Title of each class of securities to which transaction applies |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| |

| ☐ | Fee paid previously with preliminary materials. |

| |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

| | | | | | | |

Dear Variable Annuity and Variable Life Contract Owners:

Although you are not a shareholder of JNL Series Trust (the “Trust”), your purchase payments and the earnings on such purchase payments under your variable contracts (“Variable Contracts”) issued by Jackson National Life Insurance Company (“Jackson”) or Jackson National Life Insurance Company of New York (“Jackson NY”) are invested in sub-accounts of separate accounts established by Jackson or Jackson NY that, in turn, are invested in shares of one or more of the series of the Trust. References to shareholders in the enclosed information statement for the Trust (the “Information Statement”) may be read to include you as an owner of a Variable Contract.

On November 30 – December 2, 2021, the Board of Trustees (the “Board”) of the Trust voted to replace Invesco Advisers, Inc. (“Invesco”) with William Blair Investment Management, LLC (“William Blair”) as the sub-adviser for the JNL/Invesco International Growth Fund (the “Fund”), a series of the Trust, effective April 25, 2022. Enclosed please find the Trust’s Information Statement regarding this change in sub-adviser for the following Fund:

| Prior Fund Name | New Fund Name |

| JNL/Invesco International Growth Fund | JNL/William Blair International Leaders Fund |

The Information Statement is furnished to shareholders of the Fund on behalf of the Board of the Trust, a Massachusetts business trust, located at 1 Corporate Way, Lansing, Michigan 48951.

The Trust has filed an amendment to the registration statement on Form N-1A under the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, for the Trust to reflect the changes discussed in this Information Statement.

PLEASE NOTE THAT WE ARE NOT ASKING YOU FOR VOTING INSTRUCTIONS, AND YOU ARE REQUESTED NOT TO SEND US VOTING INSTRUCTIONS.

If you have any questions regarding any of the changes described in the Information Statement, please call one of the following numbers on any business day: 1-800-644-4565 (Jackson Service Center) or 1-800-599-5651 (Jackson NY Service Center), write to JNL Series Trust, P.O. Box 30314, Lansing, Michigan 48909-7814, or visit: www.jackson.com.

| | Sincerely, /s/ Mark D. Nerud

| |

| | Mark D. Nerud | |

| | President, Chief Executive Officer, and Trustee | |

| | JNL Series Trust | |

Information Statement To Shareholders Regarding:

JNL Series Trust

JNL/Invesco International Growth Fund

March 17, 2022

Table of Contents

Information Statement

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

JNL Series Trust (the “Trust”), a Massachusetts business trust, is an open-end investment company, commonly known as a mutual fund, registered under the Investment Company Act of 1940, as amended (“1940 Act”). The Trust currently offers shares in 128 series (the “Funds”).

As investment adviser to the Funds, Jackson National Asset Management, LLC (“JNAM” or “Adviser”) selects, contracts with and compensates investment sub-advisers (the “Sub-Advisers”) to manage the investment and reinvestment of the assets of most of the Funds. While the Sub-Advisers are primarily responsible for the day-to-day portfolio management of the Funds, JNAM monitors the compliance of the Sub-Advisers with the investment objectives and related policies of those Funds and reviews the performance of the Sub-Advisers and reports on such performance to the Board of Trustees of the Trust (the “Board”). Jackson National Life Distributors LLC (“JNLD”), an affiliate of the Trust and of the Adviser, is the principal underwriter for the Trust. JNAM is an indirect, wholly owned subsidiary of Jackson Financial Inc. (“Jackson”), a leading provider of retirement products for industry professionals and their clients. Jackson and its affiliates offer variable, fixed and fixed index annuities designed for tax-efficient growth and distribution of retirement income for retail customers, as well as products for institutional investors. Prudential plc and Athene Life Re Ltd. each hold a minority economic interest in Jackson. Prudential plc has no relation to Newark, New Jersey-based Prudential Financial Inc.

On November 30 – December 2, 2021, the Board, including a majority of the Trustees who are not “interested persons” as defined by the 1940 Act (the “Independent Trustees”), of the JNL/Invesco International Growth Fund (the “Fund”) voted to replace Invesco Advisers, Inc. (“Invesco”) with William Blair Investment Management, LLC (“William Blair”) as the Sub-Adviser for the Fund and to approve an investment sub-advisory agreement between JNAM and William Blair (the “William Blair Sub-Advisory Agreement”), appointing William Blair as the new Sub-Adviser to the Fund. William Blair does not currently serve as a Sub-Adviser to any Funds in the Trust.

The purpose of this information statement (the “Information Statement”) is to provide you with information about the William Blair Sub-Advisory Agreement and about William Blair’s appointment as the new Sub-Adviser to the Fund, effective April 25, 2022. In connection with William Blair’s appointment, the Fund’s name will change to the JNL/William Blair International Leaders Fund, effective April 25, 2022.

This Information Statement is provided in lieu of a proxy statement, pursuant to the terms of an exemptive order (the “Order”) that the Trust and its Adviser received from the U.S. Securities and Exchange Commission (the “SEC”). The Order permits JNAM to enter into sub-advisory agreements appointing Sub-Advisers that are not affiliates of the Adviser (other than by reason of serving as a Sub-Adviser to a Fund) without approval by the shareholders of the relevant Fund. The Adviser, therefore, is able to change unaffiliated Sub-Advisers from time to time, subject to Board approval, without the expense and delays associated with obtaining shareholder approval. However, a condition of this Order is that notice and certain information be sent to shareholders informing them of changes in Sub-Advisers.

William Blair, a Delaware a limited liability company, is located at 150 North Riverside Plaza, Chicago, Illinois 60606.

This Information Statement is being provided to contract owners of record for the Fund as of March 4, 2022. It will be mailed on or about March 25, 2022.

| II. | Changes to Fund Name, Investment Objective, and Principal Investment Strategies |

Upon the replacement of Invesco with William Blair as Sub-Adviser, effective April 25, 2022, the name of the Fund will change as follows:

| Prior Fund Name | New Fund Name |

| JNL/Invesco International Growth Fund | JNL/William Blair International Leaders Fund |

The Fund’s investment objective will change as a result of the appointment of William Blair as Sub-Adviser to the Fund. Effective April 25, 2022, the investment objective for the Fund will be as follows:

Investment Objective. The investment objective of the Fund is to seek long-term capital appreciation.

The Fund’s principal investment strategies will also change as a result of the appointment of the William Blair as Sub-Adviser to the Fund. Effective April 25, 2022, the principal investment strategies for the Fund will be as follows:

Principal Investment Strategies. Under normal market conditions, the Fund invests primarily in a diversified portfolio of equity securities, including common stocks and other forms of equity investments (e.g., securities convertible into common stocks) issued by companies of all sizes domiciled outside the United States that William Blair Investment Management, LLC, the Fund’s sub-adviser (the “Sub-Adviser”), believes have above-average growth, profitability, and quality characteristics. Under normal market conditions, the Fund typically holds a limited number of securities (i.e., 40-70 securities).

The Sub-Adviser seeks investment opportunities in companies at different stages of development ranging from large, well-established companies to smaller companies at earlier stages of development that are leaders in their country, industry, or globally in terms of products, services, or execution. The Fund’s investments are normally allocated among at least six different countries and no more than 50% of the Fund’s equity holdings may be invested in securities of issuers in one country at any given time. Normally, the Fund’s investments will be divided among Continental Europe, the United Kingdom, Canada, Japan, and the markets of the Pacific Basin. The Fund may invest at least 40% of its net assets in emerging markets, which include every country in the world except the United States, Canada, Japan, Australia, New Zealand, Hong Kong, Singapore, and most Western European countries.

In choosing investments, the Sub-Adviser performs fundamental company analysis and focuses on stock selection. The Sub-Adviser generally seeks equity securities, including common stocks of companies that historically have had superior growth, profitability and quality relative to local markets and relative to companies within the same industry worldwide and that are expected to continue such performance. The Sub-Adviser believes that such companies generally will exhibit superior business fundamentals, including leadership in their field, quality products or services, distinctive marketing and distribution, pricing flexibility and revenue from products or services consumed on a steady, recurring basis. These business characteristics should be accompanied by management that is shareholder return-oriented and that uses conservative accounting policies. Companies with above-average returns on equity, strong balance sheets, and consistent, above average earnings growth will be the primary focus. Stock selection will take into account both local and global comparisons.

The Sub-Adviser will vary the Fund’s sector and geographic diversification based upon the Sub-Adviser’s ongoing evaluation of economic, market, and political trends throughout the world. In making decisions regarding country allocation, the Sub-Adviser will consider such factors as the conditions and growth potential of various economies and securities markets, currency exchange rates, technological developments in the various countries, and other pertinent financial, social, national and political factors.

For a comparison of the changes made to the Fund’s prospectus due to the change in Sub-Adviser, please refer to Exhibit B.

| III. | Investment Sub-Advisory Agreement with William Blair Investment Management, LLC |

Invesco is the current Sub-Adviser to the Fund, pursuant to a Sub-Advisory Agreement between JNAM and Invesco. The Board most recently approved the Sub-Advisory Agreement at a meeting held on August 31 – September 2, 2021. However, a new Sub-Advisory Agreement became effective on September 13, 2021, which incorporated all terms of the previous agreement. The Sub-Advisory Agreement effective September 13, 2021 was approved by the Board at a meeting held on December 1-3, 2020 and approved by the Fund’s shareholders at a special meeting held on March 15, 2021. The special meeting of shareholders was called to, among other things, approve new advisory, sub-advisory, and distribution agreements pursuant to the announcement by Prudential plc of its intention to pursue a full separation of Jackson, an indirect subsidiary of Prudential plc and a parent company of JNAM (the “Separation”). The Separation was completed on September 13, 2021. The Separation automatically terminated the Trust’s investment advisory and management agreement with JNAM and the sub-advisory agreements with the Sub-Advisers, including the Sub-Advisory Agreement between JNAM and Invesco. The current Sub-Advisory Agreement between JNAM and Invesco became effective on the date of the Separation.

On November 30 – December 2, 2021, the Board, including a majority of the Independent Trustees, voted to replace Invesco with William Blair as Sub-Adviser for the Fund and approved the William Blair Sub-Advisory Agreement. Pursuant to the Order, shareholder approval is not required for the William Blair Sub-Advisory Agreement because William Blair is not affiliated with JNAM.

The following description of the William Blair Sub-Advisory Agreement is qualified by the William Blair Sub-Advisory Agreement, attached as Exhibit A.

The William Blair Sub-Advisory Agreement provides that it will remain in effect for its initial term through September 30, 2023, and thereafter only so long as the continuance is approved at least annually by September 30th by the Board or by vote of the holders of a majority of the outstanding voting securities of the Fund and by vote of the majority of the Independent Trustees cast in person at a meeting called for the purpose of voting on such approval. The William Blair Sub-Advisory Agreement may be terminated at any time, without the payment of any penalty, on sixty days’ written notice by the Trust or Adviser (with the consent of the Board, including a majority of the Independent Trustees), by a vote of a majority of the outstanding voting securities of the Fund, or by William Blair. The William Blair Sub-Advisory Agreement also terminates automatically in the event of its assignment or the assignment or termination of the Amended and Restated Investment Advisory and Management Agreement between JNAM and the Trust, effective September 13, 2021. Additionally, the William Blair Sub-Advisory Agreement will also terminate upon written notice of a material breach of the William Blair Sub-Advisory Agreement, if the breaching party fails to cure the material breach to the reasonable satisfaction of the party alleging the breach within thirty (30) days after written notice.

The William Blair Sub-Advisory Agreement generally provides that William Blair, its officers, members, or employees will not be subject to any liability to JNAM or the Trust for any error of judgment or mistake of law or for any loss suffered with respect to the Fund in connection with the performance of William Blair’s duties under the William Blair Sub-Advisory Agreement, except for a loss resulting from William Blair’s willful misconduct, bad faith, reckless disregard or gross negligence in the performance of its duties or obligations under the William Blair Sub-Advisory Agreement, or any untrue statement of a material fact, or omission, in materials pertaining to the Fund.

The management fees to be paid by the Fund will not increase as a result of the change in Sub-Adviser. The Fund currently pays JNAM an advisory fee equal to a percentage of its average daily net assets based on the following schedule:

| JNL/Invesco International Growth Fund |

| Advisory Fee Rates Before the Change in Sub-Adviser |

| Net Assets | Rate |

| $0 to $500 million | 0.550% |

| $500 million to $2 billion | 0.500% |

| $2 billion to $3 billion | 0.480% |

| $3 billion to $5 billion | 0.470% |

| Over $5 billion | 0.460% |

After the change, the Fund will pay JNAM an advisory fee equal to a percentage of its average daily net assets based on the following schedule:

| JNL/William Blair International Leaders Fund |

| Advisory Fee Rates After the Change in Sub-Adviser |

| Net Assets | Rate |

| $0 to $500 million | 0.525% |

| $500 million to $2 billion | 0.500% |

| $2 billion to $3 billion | 0.480% |

| $3 billion to $5 billion | 0.470% |

| Over $5 billion | 0.460% |

The following table sets forth the aggregate amount of management fees paid by the Fund to the Adviser for the year ended December 31, 2021. The pro forma aggregate amount of management fees paid to the Adviser would have been lower had the change of Sub-Advisers occurred during the applicable period.

| Fund Name | Actual Fees |

| JNL/Invesco International Growth Fund | $6,122,944 |

JNAM is responsible for paying all Sub-Advisers out of its own resources. Under the William Blair Sub-Advisory Agreement, the sub-advisory fee schedule is different than the sub-advisory fee schedule used to compensate Invesco. Invesco is currently paid a sub-advisory fee equal to a percentage of the Fund’s average daily net assets based on the below schedule:

| JNL/Invesco International Growth Fund |

| Sub-Advisory Rate Before the Change in Sub-Adviser |

| Net Assets | Annual Rate(1) |

| $0 to $250 million | 0.400% |

| $250 million to $750 million | 0.350% |

| $750 million to $1 billion | 0.300% |

| $1 billion to $2 billion | 0.275% |

| Over $2 billion | 0.250% |

| (1) | For the purpose of calculating the sub-advisory fee for Fund, Invesco applies a fee discount to total sub-advisory fees based on the average daily aggregate net assets of the funds that Invesco sub-advises for JNAM: 2.5% fee reduction for assets between $0 and $2.5 billion, 3.0% fee reduction for assets between $2.5 billion and $5 billion, 5% fee reduction for assets between $5 billion and $7.5 billion, 7.5% fee reduction for assets between $7.5 billion and $10 billion, a 10% fee reduction for assets over $10 billion. |

| | | |

Under the William Blair Sub-Advisory Agreement, William Blair will be paid a sub-advisory fee equal to a percentage of the Fund’s average daily net assets based on the below schedule:

JNL/William Blair International Leaders Fund |

| Sub-Advisory Rate After the Change in Sub-Adviser |

| Net Assets | Annual Rate |

| All Assets | 0.270% |

For the year ended December 31, 2021, JNAM paid Invesco $3,832,566 in sub-advisory fees for its services to the Fund. The pro forma sub-advisory fees would have been lower than the fees paid to Invesco assuming the William Blair Sub-Advisory Agreement was in place for the applicable period.

| | IV. | Description of William Blair Investment Management, LLC |

William Blair is a global investment firm registered as an investment adviser with the SEC. William Blair is affiliated with William Blair & Company, L.L.C. ("William Blair & Company"), a firm that was founded in 1935 and is registered with the SEC as both an investment adviser and a securities broker-dealer.

Executive/Principal Officers and General Partner of William Blair located at 150 North Riverside Plaza, Chicago, Illinois 60606:

| Names | Title |

| Brent Walker Gledhill | President, Chief Executive Officer, Executive Committee Member |

| John Roger Ettelson | Chairman, Executive Committee Member |

| Walter Ramsay Randall | Chief Compliance Officer |

| Jon Walter Zindel | Chief Financial Officer, Executive Committee Member |

| Cissie Citardi | General Counsel, Executive Committee Member |

| Lisa Dawn Anderson | Director of Operations |

| Stephanie Grieser Braming | Executive Committee Member |

| Matthew Montgomery Zimmer | Executive Committee Member |

| Ryan Jacob Devore | Executive Committee Member |

| Peter Plenk Dalrymple | Executive Committee Member |

| WBC Holdings, L.P. | Holding Company |

William Blair and William Blair & Company (each of which is a privately held company) are wholly owned subsidiaries of WBC Holdings, L.P., which is wholly owned by its limited partners and its general partner, WBC GP L.L.C.

WBC GP L.L.C., located at 150 North Riverside Plaza, Chicago, Illinois 60606, has a 0.2% ownership interest in WBC Holdings, L.P..

As the Sub-Adviser to the Fund, William Blair will provide the Fund with investment research, advice, and supervision, and will manage the Fund’s portfolio consistent with its investment objective and policies, including the purchase, retention, and disposition of securities, as set forth in the Fund’s current Prospectus. The principal risks of investing in the Fund will also be listed in the Fund’s Prospectus under the heading “Principal Risks of Investing in the Fund.”

As of March 4, 2022, no Trustees or officers of the Trust were officers, employees, directors, general partners, or shareholders of William Blair, and no Trustees or officers of the Trust owned securities or had any other material direct or indirect interest in William Blair or any other entity controlling, controlled by or under common control with William Blair. In addition, no Trustee has had any material interest, direct or indirect, in any material transactions since January 1, 2021, the beginning of the Trust’s most recently completed fiscal year, or in any material proposed transactions, to which William Blair, any parent or subsidiary of William Blair, or any subsidiary of the parent of such entities was or is to be a party.

JNL/William Blair International Leaders Fund

The portfolio managers responsible for management of the Fund are Alaina Anderson, CFA, Simon Fennell, and Kenneth J. McAtamney.

Alaina Anderson

Alaina Anderson, CFA, is a Partner of William Blair. Ms. Anderson has co-managed William Blair’s International Leaders strategy since 2021. Ms. Anderson has managed William Blair’s International Leaders ADR strategy since 2019. Before that, Ms. Anderson covered multiple sectors as a research analyst for William Blair, including the Consumer and Health Care sectors, along with her most recent responsibilities covering real assets companies. Before joining William Blair in 2006, Ms. Andersen was a senior analyst in the investments department of the MacArthur Foundation, where she provided research support for internally managed portfolios and was involved in investment manager due diligence, selection and monitoring for the foundation’s U.S., non-U.S., and hedge fund portfolios. Before joining the MacArthur Foundation, Ms. Andersen was an investor relations consultant with Ashton Partners and a financial advisor with UBS Painewebber. She is a member of the CFA Institute and the CFA Society Chicago. Education: B.S., Wharton School at the University of Pennsylvania and an M.B.A. from the University of Chicago’s Booth School of Business.

Simon Fennell

Simon Fennell is a Partner of William Blair. Mr. Fennell has co-managed William Blair’s International Growth strategy since 2013, its Institutional International Growth strategy since 2013, its International Leaders strategy since 2013 and its International Small Cap Growth strategy since 2017 along with associated separate accounts and commingled fund portfolios. He joined William Blair in 2011 as a research analyst, also focusing on idea generation and strategy more broadly. Prior to joining William Blair, Mr. Fennell was a Managing Director in the Equities division at Goldman Sachs in London and Boston, where he was responsible for institutional, equity research coverage for European and International stocks. Previously, he was in the Corporate Finance Group at Lehman Brothers in London and Hong Kong, working in the M&A and Debt Capital Markets Groups. Education: M.A., University of Edinburgh; M.B.A., Johnson Graduate School of Management, Cornell University.

Kenneth J. McAtamney

Kenneth J. McAtamney is a Partner of William Blair. Mr. McAtamney has co-managed William Blair’s Global Leaders strategy since 2008, its International Leaders strategy since its inception in 2012, its International Growth strategy since 2017 and its Institutional International Growth strategy since 2017 along with associated separate account and commingled fund portfolios. Mr. McAtamney joined William Blair in 2005 as an international stock analyst. From 1997 to 2005, he was with Goldman Sachs in various capacities, including as a Vice President representing both International and Domestic Equities. Education: B.A., Finance, Michigan State University; M.B.A., Indiana University.

| V. | Other Investment Companies Advised by William Blair Investment Management, LLC |

The following table sets forth the size and rate of compensation for other funds advised by William Blair having similar investment objectives and policies as those of the Fund.

| Similar Mandate | Assets Under Management as of December 31, 2021 | Rate of Compensation |

| WB Mutual Fund | $1.302 billion | 0.85% |

| Sub-Advised Account I* | $1.212 billion | $0 to $500 million: 0.30% $500 million to $1 billion: 0.25% Over $1 billion: 0.20% |

| Sub-Advised Account II | $1.164 billion | $0 to $150 million: 0.50% $150 million to $200 million:0.40% $200 million to $600 million: 0.30% Over $600 million: 0.25% |

| * | This Account is comprised of assets of multiple variable annuity product offerings of the same sponsor (or an affiliate of the sponsor). The combined assets are used in determining the rate of compensation. |

| VI. | Evaluation by the Board of Trustees |

The Board oversees the management of the Fund and, as required by law, determines annually whether to approve the Fund’s sub-advisory agreement. At a meeting on November 30 – December 2, 2021, the Board, including a majority of the Independent Trustees, considered information relating to the appointment of William Blair to replace Invesco as the Fund’s Sub-Adviser and the William Blair Sub-Advisory Agreement.

In advance of the meeting, independent legal counsel for the Independent Trustees requested that certain information be provided to the Board relating to the William Blair Sub-Advisory Agreement. The Board received, and had the opportunity to review, this and other materials, ask questions, and request further information in connection with its consideration of the William Blair Sub-Advisory Agreement. At the conclusion of the Board’s discussions, the Board approved the William Blair Sub-Advisory Agreement.

In reviewing the William Blair Sub-Advisory Agreement and considering the information, the Board was advised by independent legal counsel. The Board considered the factors it deemed relevant and the information provided by William Blair, including: (1) the nature, quality, and extent of the services to be provided, (2) the investment performance of the Fund, (3) cost of services of the Fund, (4) profitability data, (5) whether economies of scale may be realized and shared, in some measure, with investors as the Fund grows, and (6) other benefits that may accrue to William Blair through its relationship with the Trust. In its deliberations, the Board, in exercising its business judgment, did not identify any single factor that alone was responsible for the Board’s decision to approve the William Blair Sub-Advisory Agreement.

Before approving the William Blair Sub-Advisory Agreement, the Independent Trustees met in executive session with their independent legal counsel to consider the materials provided by JNAM and William Blair and to consider the terms of the William Blair Sub-Advisory Agreement. Based on its evaluation of those materials and the information the Board received throughout the year at its regular meetings, the Board, including the interested and Independent Trustees, concluded that the William Blair Sub-Advisory Agreement is in the best interests of the shareholders of the Fund. In reaching its conclusions, the Board considered numerous factors, including the following:

Nature, Quality, and Extent of Services

The Board examined the nature, quality and extent of the services to be provided by William Blair. The Board noted JNAM’s evaluation of William Blair, as well as JNAM’s recommendation, based on its review of William Blair, in connection with its approval of the William Blair Sub-Advisory Agreement.

The Board reviewed the qualifications, backgrounds and responsibilities of William Blair’s portfolio managers who would be responsible for the day-to-day management of the Fund. The Board reviewed information pertaining to William Blair’s organizational structure, senior management, financial condition, investment operations, and other relevant information pertaining to William Blair. The Board considered compliance reports about William Blair from the Trust’s Chief Compliance Officer.

Based on the foregoing, the Board concluded that the Fund is likely to benefit from the nature, extent and quality of the services to be provided by William Blair under the William Blair Sub-Advisory Agreement.

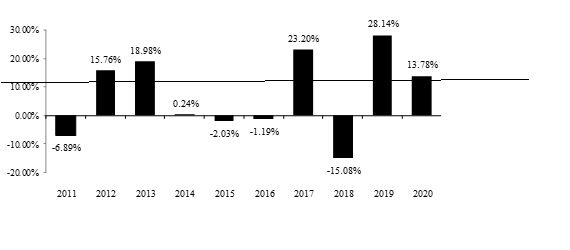

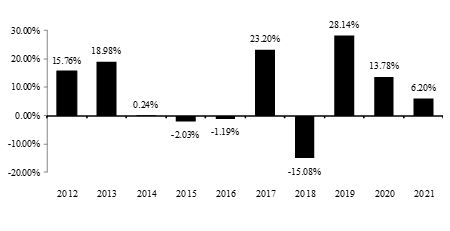

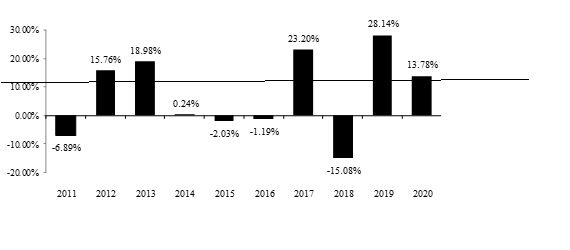

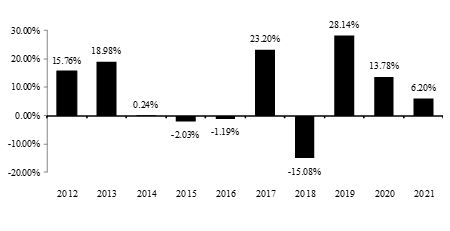

Investment Performance of the Fund

The Board reviewed the performance of William Blair’s proposed investment mandate with similar investment strategies as compared to the Fund, the Fund’s benchmark index, and the Fund’s peer group returns. The Board concluded that it would be in the best interests of the Fund and its shareholders to approve the William Blair Sub-Advisory Agreement.

Costs of Services

The Board reviewed the fees to be paid by JNAM to William Blair. The Board noted that the Fund’s sub-advisory fees would be paid by JNAM (not the Fund) and, therefore, would be neither a direct shareholder expense nor a direct influence on the Fund’s total expense ratio.

The Board considered that the proposed sub-advisory fee is lower than the current sub-advisory fee and the peer group average. The Board noted that in conjunction with the Sub-Adviser change, the Fund’s advisory fee is proposed to change. In this regard, the Board noted that the proposed advisory fee is lower than the current advisory fee and the peer group average. The Board also noted that the total expense ratio, after taking account of the proposed advisory and sub-advisory fee changes, will be lower than both the current total expense ratio and the peer group average. The Board concluded that the advisory and sub-advisory fees are in the best interests of the Fund and its shareholders in light of the services to be provided.

Profitability

The Board considered information concerning the costs to be incurred and profits expected to be realized by JNAM and William Blair. The Board determined that profits expected to be realized by JNAM and William Blair were not unreasonable.

Economies of Scale

The Board considered whether the Fund’s proposed fees reflect the potential for economies of scale for the benefit of Fund shareholders. Based on information provided by JNAM and William Blair, the Board noted that the advisory fee arrangement for the Fund contains breakpoints that decrease the fee rate as assets increase, while William Blair’s sub-advisory fee rate was not subject to breakpoints. The Board also considered that the sub-advisory fee is and will be paid by JNAM (not the Fund). The Board concluded that the Fund’s fee schedules in some measure share economies of scale with shareholders.

Other Benefits to William Blair

In evaluating the benefits that may accrue to William Blair through its relationship with the Fund, the Board noted that William Blair may from time to time pay for portions of meetings organized by the Fund’s distributor to educate wholesalers about the Fund. The Board considered JNAM’s assertion that those meetings do not yield a profit to the Fund’s distributor, that William Blair is not required to participate in the meetings, and that recommendations to hire or fire William Blair are not influenced by William Blair’s willingness to participate in the meetings.

In evaluating the benefits that may accrue to William Blair through its relationship with the Fund, the Board noted that William Blair may receive indirect benefits in the form of soft dollar arrangements for portfolio securities trades placed with the Fund’s assets and may also develop additional investment advisory business with JNAM, the Trust or other clients of William Blair as a result of its relationship with the Fund.

In light of all the facts noted above, the Board concluded that it would be in the best interests of the Fund and its shareholders to approve the William Blair Sub-Advisory Agreement.

| VII. | Additional Information |

Ownership of the Fund

As of March 4, 2022, there were issued and outstanding the following number of shares for the Fund:

| Fund | Shares Outstanding |

| JNL/Invesco International Growth Fund (Class A) | 55,629,251.017 |

| JNL/Invesco International Growth Fund (Class I) | 15,839,865.837

|

As of March 4, 2022, the officers and Trustees of the Trust, as a group, owned less than 1% of the then outstanding shares of the Fund.

Because the shares of the Fund are sold only to Jackson, Jackson National Life Insurance Company of New York (“Jackson NY”), certain affiliated funds organized as fund-of-funds, and certain qualified retirement plans, Jackson, through its separate accounts, which hold shares of the Fund as funding vehicles for Variable Contracts, is the owner of record of substantially all of the shares of the Fund.

As of March 4, 2022, the following persons beneficially owned more than 5% of the shares of the Fund :

| JNL/Invesco International Growth Fund – Class I Shares |

| Contract Owner’s Name | Address | Percentage of Shares Owned |

| JNL/Goldman Sachs Managed Growth Fund | 1 Corporate Way Lansing, Michigan 48951 | 43.10% |

| JNL/Goldman Sachs Managed Moderate Growth Fund | 1 Corporate Way Lansing, Michigan 48951 | 21.11% |

| JNL/Goldman Sachs Managed Aggressive Growth Fund | 1 Corporate Way Lansing, Michigan 48951 | 20.46% |

| JNL/Goldman Sachs Managed Moderate Fund | 1 Corporate Way Lansing, Michigan 48951 | 10.24% |

Persons who own Variable Contracts may be deemed to have an indirect beneficial interest in the Fund shares owned by the relevant separate accounts. As noted above, Variable Contract owners have the right to give instructions to the insurance company shareholders as to how to vote the Fund shares attributable to their Variable Contracts. To the knowledge of management of the Trust, as of March 4, 2022, no persons have been deemed to have an indirect beneficial interest totaling more than 25% of the voting securities of the Fund.

Brokerage Commissions and Fund Transactions

During the fiscal year ended December 31, 2021, the Fund paid no commissions to any affiliated broker.

During the fiscal year ended December 31, 2021, the Fund paid $1,761,890 in administration fees and $2,721,410 in 12b-1 fees to the Adviser and/or its affiliated persons. These services have continued to be provided since the William Blair Sub-Advisory Agreement was approved.

The Trust will furnish, without charge, a copy of the Trust’s annual report for the fiscal year ended December 31, 2021, or a copy of the Trust’s prospectus and statement of additional information to any shareholder upon request. To obtain a copy, please call 1-800-644-4565 (Jackson Service Center) or 1-800-599-5651 (Jackson NY Service Center), write to the JNL Series Trust, P.O. Box 30314, Lansing, Michigan 48909-7814, or visit www.jackson.com.

JNAM, located at 1 Corporate Way, Lansing, Michigan 48951, serves as the investment adviser to the Trust and provides the Fund with professional investment supervision and management. JNAM is registered with the SEC under the 1940 Act, as amended. JNAM is an indirect, wholly owned subsidiary of Jackson, a leading provider of retirement products for industry professionals and their clients. Jackson and its affiliates offer variable, fixed and fixed index annuities designed for tax-efficient growth and distribution of retirement income for retail customers, as well as products for institutional investors. Prudential plc and Athene Life Re Ltd. each hold a minority economic interest in Jackson. Prudential plc has no relation to Newark, New Jersey-based Prudential Financial Inc. Jackson is also the ultimate parent of PPM America, Inc. JNAM also serves as the Trust’s administrator. JNLD, an affiliate of the Trust and the Adviser, is principal underwriter for the Trust and an indirect, wholly owned subsidiary of Jackson. JNLD is located at 300 Innovation Drive, Franklin, Tennessee 37067.

The Trust is not required to hold annual meetings of shareholders, and, therefore, it cannot be determined when the next meeting of shareholders will be held. Shareholder proposals to be presented at any future meeting of shareholders of the Trust must be received by the Trust at a reasonable time before the Trust’s solicitation of proxies for that meeting in order for such proposals to be considered for inclusion in the proxy materials related to that meeting.

The cost of the preparation, printing, and distribution of this Information Statement will be paid by JNAM.

Exhibit A

Investment Sub-Advisory Agreement Between

Jackson National Asset Management, LLC and William Blair Investment Management, LLC

JNL Series Trust

Investment Sub-Advisory Agreement

Agreement, dated as of April 25, 2022, by and between Jackson National Asset Management, LLC, a limited liability company organized in the State of Michigan (the “Adviser”), and William Blair Investment Management, LLC (the “Sub-Adviser”), a limited liability company organized in the State of Delaware.

Whereas, the Adviser is registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”);

Whereas, the Adviser has entered into an Amended and Restated Investment Advisory and Management Agreement effective September 13, 2021 with JNL Series Trust (the “Trust”), an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”);

Whereas, the Trust’s shareholders are primarily separate accounts maintained by insurance companies for variable life insurance policies and variable annuity contracts (the “Policies”) under which income, gains and losses, whether or not realized, from assets allocated to such accounts are, in accordance with the Policies, credited to or charged against such accounts without regard to other income, gains, or losses of such insurance companies, as well as other shareholders as permitted under Section 817(h) of the Internal Revenue Code of 1986, as amended (the “Code”), and the rules and regulations thereunder;

Whereas, the fund or funds listed on Schedule A hereto (each, a “Fund”) are series of the Trust;

Whereas, the Sub-Adviser is registered as an investment adviser under the Advisers Act;

Whereas, the Board of Trustees of the Trust (the “Board”) and the Adviser desire that the Adviser retain the Sub-Adviser to render investment advisory services to each Fund identified on Schedule A in the manner and on the terms hereinafter set forth;

Whereas, the Adviser has the authority under the Investment Advisory and Management Agreement with the Trust to select sub-advisers for each Fund; and

Whereas, the Sub-Adviser is willing to furnish such services to the Adviser and each Fund.

Now, Therefore, in consideration of the mutual covenants contained herein, the Adviser and the Sub-Adviser agree as follows:

| 1. | Appointment of Sub-Adviser |

The Adviser hereby appoints the Sub-Adviser to act as the investment sub-adviser for each Fund, subject to the supervision and control of the Adviser and the Board and in accordance with the terms and conditions of this Agreement.

The Sub-Adviser accepts such appointment and agrees to furnish the services herein set forth, for the compensation herein provided.

In the event the Adviser designates one or more funds other than the Fund or Funds identified on Schedule A with respect to which the Adviser wishes to retain the Sub-Adviser to furnish investment advisory services hereunder, it shall notify the Sub-Adviser in writing. If the Sub-Adviser is willing to furnish such services, it shall notify the Adviser in writing, whereupon, subject to the approval of the Board, such fund shall be added to Schedule A and become a Fund hereunder subject to this Agreement.

| 2. | Services to be Rendered by the Sub-Adviser to the Trust |

A. As investment sub-adviser to each Fund, the Sub-Adviser will coordinate and monitor the investment and reinvestment of the assets of each Fund and determine the composition of the assets of each Fund, subject always to the supervision and control of the Adviser and the Board.

B. As part of the services it will provide hereunder, the Sub-Adviser will:

(i) obtain and evaluate pertinent economic, statistical, financial, and other information affecting the individual companies or industries, the securities of which are included in each Fund or are under consideration for inclusion in each Fund;

(ii) formulate and implement a continuous investment program and make investment decisions for all assets in each Fund;

(iii) take whatever steps are necessary to implement the investment program for each Fund by placing all orders, on behalf of each Fund, for the purchase and sale of securities and other property and investments, including issuing directives to the administrator of the Trust as necessary for the appropriate implementation of the investment program of each Fund;

(iv) use the same skill and care in providing its services as it uses in providing services to its other similar client mandates for which it has investment responsibilities;

(v) keep the Board and the Adviser fully informed in writing on an ongoing basis of all material facts concerning the investment and reinvestment of the assets in each Fund, the Sub-Adviser and its key investment personnel and operations; make regular and periodic special written reports of such additional information concerning the same as may reasonably be requested from time to time by the Adviser or the Board; and attend meetings with the Adviser and/or the Board, as reasonably requested, to discuss the foregoing;

(vi) cooperate fully with the Trust’s Chief Compliance Officer in executing his/her responsibilities to monitor service providers of each Fund pursuant to Rule 38a-1 under the Investment Company Act, including but not limited to providing compliance and reporting information as reasonably requested by the Adviser and the Board;

(vii) in accordance with procedures and methods established by the Board, which may be amended from time to time, provide assistance in determining the fair value of securities and other investments/assets in each Fund, as necessary, and use reasonable efforts to arrange for the provision of valuation information or a price(s) from a party(ies) independent of the Sub-Adviser for each security or other investment/asset in each Fund for which market prices are not readily available. In addition, the Sub-Adviser shall provide the Trust’s custodian on each business day with information relating to all transactions concerning each Fund’s assets under the Sub-Adviser’s supervision, and shall promptly provide Adviser with such information upon the reasonable request of the Adviser;

(viii) provide any and all material composite performance information, records and supporting documentation about accounts the Sub-Adviser manages, if appropriate, which are relevant to each Fund and that have investment objectives, policies, and strategies substantially similar to those employed by the Sub-Adviser in managing each Fund that may be reasonably necessary, under applicable laws; and

(ix) cooperate with and provide reasonable assistance to the Adviser, the Board, the Trust’s administrator, the Trust’s custodian and foreign custodians, the Trust’s transfer agent and pricing agents and all other agents and representatives of the Trust and the Adviser, keep all such persons fully informed as to such matters as they may reasonably deem necessary to the performance of their obligations to the Trust and the Adviser, provide prompt responses to reasonable requests made by such persons and maintain any appropriate interfaces with each so as to promote the efficient exchange of information.

C. In furnishing services hereunder, the Sub-Adviser shall be subject to, and shall perform in compliance with the following: (i) the Trust’s Agreement and Declaration of Trust, as the same may be modified or amended from time to time (the “Declaration”); (ii) the By-Laws of the Trust, as the same may be modified or amended from time to time (the “By-Laws”); (iii) the stated investment objectives, policies and restrictions of each Fund and other matters contained in the currently effective Prospectus and Statement of Additional Information of the Trust filed with the Securities and Exchange Commission (the “SEC”), as the same may be modified, amended or supplemented from time to time (the “Prospectus and SAI”); (iv) the Investment Company Act, the Advisers Act, the Commodity Exchange Act, as amended (the “CEA”) and the rules under each, and all other federal and state laws or regulations applicable to the Trust and each Fund; (v) any applicable controlling foreign laws, regulations and regulatory requirements as set forth by applicable foreign regulatory agencies; (vi) the Trust’s compliance and other policies and procedures adopted from time to time by the Board; and (vii) the instructions of the Adviser and the Board (except as to the voting of proxies). Prior to the commencement of the Sub-Adviser’s services hereunder, the Adviser shall provide the Sub-Adviser with current copies of the Declaration, By-Laws, Prospectus and SAI, Fund compliance manual and other relevant policies and procedures that are adopted by the Board. The Adviser undertakes to provide the Sub-Adviser with copies or other written notice of any amendments, modifications or supplements to any such above-mentioned document.

D. Without Adviser’s prior consent to each transaction, Sub-Adviser shall have full discretionary authority as agent and attorney-in-fact, with full power of substitution and full authority in each Fund’s name, to (a) buy, sell, hold, exchange, convert or otherwise deal in any manner in any assets; (b) place orders for the execution of such assets and other transactions with or through such brokers, dealers, counter-parties, issuers, agents or arrangers as Sub-Adviser may select; (c) execute, on behalf of a Fund, such brokerage, derivatives, subscription and other agreements and documents (including, without limitation, ISDA, LSTA, and/or Master Securities Forward Transaction Agreement or MSFTA documentation) as Sub-Adviser deems necessary or appropriate in connection with each Fund’s investment activities; and (d) negotiate, enter into, make and perform any other contracts, agreements or other undertakings it may deem advisable in connection with the performance of the Sub-Adviser’s duties hereunder.

E. In furnishing services hereunder, the Sub-Adviser will not consult with any other sub-adviser to the Trust or the sub-adviser to any other investment company managed by the Adviser concerning transactions of each Fund in securities or other assets. (This shall not be deemed to prohibit the Sub-Adviser from consulting with any of the other sub-advisers concerning compliance with paragraphs (a) and (b) of Rule 12d3-1 under the Investment Company Act. This shall also not be deemed to prohibit consultations between current and successor sub-advisers of a Fund in order to effect an orderly transition of sub-advisory duties so long as such consultations are not concerning transactions prohibited by Section 17(a) of the Investment Company Act.)

F. The Sub-Adviser and Adviser will each make its officers and employees available to the other from time to time at reasonable times to review investment policies of each Fund and to consult with each other regarding the investment affairs of each Fund. Sub-Adviser will report to the Board and to Adviser with respect to the implementation of such program as requested by the Board or the Adviser.

G. The Sub-Adviser at its expense, will furnish: (i) all necessary facilities and personnel, including salaries, expenses, and fees of any personnel required for the Sub-Adviser to faithfully perform its duties under this Agreement; and (ii) administrative facilities, including bookkeeping, and all equipment necessary for the efficient conduct of the Sub-Adviser’s duties under this Agreement. The Sub-Adviser shall, at its expense, bear any fees or costs associated with regulatory investigations or litigation arising from or pertaining to (i) the services provided by the Sub-Adviser under the Agreement (but excluding litigation for services provided and/or fees charged by the Adviser); and (ii) the Sub-Adviser’s general business operations that require the involvement or participation of the Adviser, the Fund, and/or any Trustee of the Fund.

H. The Sub-Adviser will select brokers and dealers to effect all portfolio transactions subject to the conditions set forth herein. The Sub-Adviser is granted authority to negotiate, open, continue and terminate brokerage accounts and other brokerage arrangements with respect to all portfolio transactions it enters into on behalf of each Fund. The Sub-Adviser will provide to the Adviser copies of all agreements regarding brokerage arrangements. The Sub-Adviser will place all necessary orders with brokers, dealers, or issuers, and will negotiate brokerage commissions, if applicable. The Sub-Adviser is directed at all times to seek to execute transactions for each Fund (i) in accordance with any written policies, practices or procedures that may be established by the Board or the Adviser from time to time and which have been provided to the Sub-Adviser or (ii) as described in the Trust’s Prospectus and SAI. In placing any orders for the purchase or sale of securities and instruments for each Fund, the Sub-Adviser is hereby authorized, to the extent permitted by applicable law, to aggregate the securities and instruments to be so purchased or sold and shall use its best efforts to obtain for each Fund best price and execution, considering all of the circumstances, and shall maintain records adequate to demonstrate compliance with this requirement. Consistent with this policy, the Sub-Adviser, in selecting broker-dealers and negotiating commission rates, will take all relevant factors into consideration, including but not limited to: the best price available; the reliability, integrity and financial condition of the broker-dealer; the size of and difficulty in executing the order; the broker’s execution capabilities; any research provided by the broker that aids the Sub-Adviser’s investment decision-making process and the value of the expected contribution of the broker-dealer to the investment performance of the applicable Fund on a continuing basis.

I. Subject to such policies and procedures as the Board may determine, the Sub-Adviser may, to the extent authorized by Section 28(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as interpreted by the SEC or its staff, cause each Fund to pay a broker or dealer that provides brokerage or research services to the Adviser, the Sub-Adviser and the Fund an amount of commission for effecting a portfolio investment transaction in excess of the amount of commission another broker-dealer would have charged for effecting that transaction, if the Sub-Adviser determines in good faith that such amount of commission is reasonable in relation to the value of the brokerage or research services provided by such broker-dealer, viewed in terms of either that particular investment transaction or the Sub-Adviser’s overall responsibilities with respect to each Fund and other accounts to which the Sub-Adviser exercises investment discretion (as such term is defined in Section 3(a)(35) of the Exchange Act). Allocation of orders placed by the Sub-Adviser on behalf of each Fund to such broker-dealers shall be in such amounts and proportions as the Sub-Adviser shall determine in good faith in conformity with its responsibilities under applicable laws, rules and regulations. The Sub-Adviser will submit reports on such allocations to the Adviser or the Board as reasonably requested by the Adviser or the Board, in such form as may be mutually agreed to by the parties hereto, indicating the broker-dealers to whom such allocations have been made and the basis therefor. To the extent authorized by Section 28(e) and the Board, the Sub-Adviser shall not be deemed to have acted unlawfully or to have breached any duty created by this Agreement or otherwise solely by reason of such action. Subject to seeking best price and execution, the Board or the Adviser may direct the Sub-Adviser to effect transactions in portfolio securities through broker-dealers in a manner that will help generate resources to pay the cost of certain expenses that the Trust is required to pay or for which the Trust is required to arrange payment.

J. The Sub-Adviser will maintain all accounts, books and records with respect to each Fund as are required of an investment sub-adviser of a registered investment company pursuant to the Investment Company Act, Advisers Act, and Commodity Exchange Act and the rules thereunder, will furnish the Adviser and the Board such periodic and special reports as they may reasonably request, and shall timely file with the SEC all forms pursuant to Section 13 of the Exchange Act, with respect to its duties as are set forth herein.

K. The Sub-Adviser shall ensure that each Fund complies with the provisions of Section 851 and Section 817(h) of the Code and the regulations thereunder, including, but not limited to, Treas. Reg. Section 1.817-5. Sub-Adviser shall be responsible for the correction of any failure under the provisions cited above attributable to its actions whether in good faith, negligent, or reckless disregard, including any penalties, taxes, and interest and for any other obligations to Contract-owners and insurance company investors in each Fund.

L. Consistent with its fiduciary duties to each Fund and on the Fund’s behalf, the Sub-Adviser is hereby appointed the Fund’s agent to exercise, in its discretion, all rights and perform all duties with respect to the Fund’s right to vote (or refrain from voting), each Fund’s securities and exercise rights in corporate actions or otherwise in accordance with the Sub-Adviser’s proxy voting guidelines, as amended from time to time, which shall be provided to the Trust and the Adviser. For the avoidance of doubt, the Sub-Adviser will have full discretion in this regard and the Adviser will not attempt to influence the Sub-Adviser’s voting decisions. The Sub-Adviser further agrees to report significant shareholdings for itself and on behalf of the Fund where required by local law.

M. The Sub-Adviser may execute on behalf of each Fund certain agreements, instruments and documents in connection with the services performed by it under this Agreement. These may include, without limitation, brokerage agreements, clearing agreements, account documentation, futures and options agreements, swap agreements, other investment-related agreements, and any other agreements, documents or instruments the Sub-Adviser believes are appropriate or desirable in performing its duties under this Agreement.

N. The Sub-Adviser will provide to the Adviser (i) a completed monthly compliance checklist developed for each Fund by Adviser and Sub-Adviser, (ii) quarterly reports developed for each Fund by Adviser and Sub-Adviser, and (iii) other compliance and reporting information as reasonably requested by the Adviser or the Board from time-to-time.

O. The Sub-Adviser will review each Fund’s investment-related risk disclosures in the Prospectus and SAI, and the Sub-Adviser will certify to the Adviser on a quarterly basis that, based on the Sub-Adviser’s knowledge after due inquiry including consideration of market conditions, such disclosures appropriately address current market conditions affecting investments in the Fund.

| 3. | Compensation of Sub-Adviser |

The Adviser will pay the Sub-Adviser a sub-advisory fee, accrued daily and payable monthly on the average daily net assets of each Fund, as specified in Schedule B to this Agreement to cover the Sub-Adviser’s services under and expenses assumed in carrying out this Agreement. The Sub-Adviser agrees that the fee rate paid to the Sub-Adviser shall not be in excess of the fee rates at equivalent asset size charged by the Sub-Adviser to any other future investment company client, registered under the Investment Company Act, for which the Sub-adviser acts in a sub-advisory capacity, being managed by the Sub-Adviser having a substantially similar investment objective, style and strategy as each Fund.

Sub-Adviser shall at no time physically possess the assets of the Funds or have the assets registered in its own name or the name of its nominee, nor shall Sub-Adviser in any manner acquire or become possessed of any income, whether in kind or cash, or proceeds, whether in kind or cash, distributable by reason of selling, holding or controlling such assets of the Funds. In accordance with the preceding sentence, Sub-Adviser shall have no responsibility with respect to the collection of income, physical acquisition or the safekeeping of the assets of the Funds. All such duties of collection, physical acquisition and safekeeping shall be the sole obligation of the custodian.

| 5. | Liability and Indemnification |

A. Except as may otherwise be provided by law, neither the Sub-Adviser nor any of its officers, members or employees (its “Affiliates”) shall be liable (i) for any losses, claims, damages, liabilities or litigation (including legal and other expenses) incurred or suffered by the Adviser or the Trust as a result of any error of judgment or mistake of law by the Sub-Adviser or its Affiliates with respect to any Fund or (ii) for any failure to recommend the purchase or sale of any security on behalf of any Fund on the basis of any information which might, in the Sub-Adviser’s reasonable opinion, constitute a violation of any federal or state laws, rules or regulations; except that nothing in this Agreement shall operate or purport to operate in any way to exculpate, waive or limit the liability of the Sub-Adviser or its Affiliates for, and the Sub-Adviser shall indemnify and hold harmless the Trust, the Adviser, all affiliated persons thereof (within the meaning of Section 2(a)(3) of the Investment Company Act) and all controlling persons (as described in Section 15 of the Securities Act of 1933, as amended (the “1933 Act”)) (collectively, “Adviser Indemnitees”) against, any and all losses, claims, damages, liabilities or litigation (including reasonable legal and other expenses) to which any of the Adviser Indemnitees may become subject under the 1933 Act, the Investment Company Act, the Advisers Act, or under any other statute, or common law or otherwise arising out of or based on (i) any willful misconduct, bad faith, reckless disregard or gross negligence of the Sub-Adviser in the performance of any of its duties or obligations hereunder or (ii) any untrue statement of a material fact contained in the Prospectus and SAI, proxy materials, reports, advertisements, sales literature, or other materials pertaining to any Fund by the Sub-Adviser or the omission to state therein a material fact known to the Sub-Adviser which was required to be stated therein or necessary to make the statements therein not misleading, if such statement or omission was made in reliance upon information furnished to the Adviser or the Trust by the Sub-Adviser Indemnitees (as defined below) for use therein.

B. Except as may otherwise be provided by law, the Adviser and the Trust shall not be liable for any losses, claims, damages, liabilities or litigation (including legal and other expenses) incurred or suffered by the Sub-Adviser as a result of any error of judgment or mistake of law by the Adviser with respect to any Fund, except that nothing in this Agreement shall operate or purport to operate in any way to exculpate, waive or limit the liability of the Adviser for, and the Adviser shall indemnify and hold harmless the Sub-Adviser, all affiliated persons thereof (within the meaning of Section 2(a)(3) of the Investment Company Act) and all controlling persons (as described in Section 15 of the 1933 Act) (collectively, the “Sub-Adviser Indemnitees”) against, any and all losses, claims, damages, liabilities or litigation (including reasonable legal and other expenses) to which any of the Sub-Adviser Indemnitees may become subject under the 1933 Act, the Investment Company Act, the Advisers Act, or under any other statute, at common law or otherwise arising out of or based on (i) any willful misconduct, bad faith, reckless disregard or gross negligence of the Adviser in the performance of any of its duties or obligations hereunder or (ii) any untrue statement of a material fact contained in the Prospectus and SAI, proxy materials, reports, advertisements, sales literature, or other materials pertaining to any Fund or the omission to state therein a material fact known to the Adviser that was required to be stated therein or necessary to make the statements therein not misleading, unless such statement or omission was made in reliance upon information furnished to the Adviser or the Trust by the Sub-Adviser.

| 6. | Representations of Adviser |

The Adviser represents, warrants and agrees that:

A. The Adviser has been duly authorized by the Board to delegate to the Sub-Adviser the provision of investment services to each Fund as contemplated hereby.

B. The Adviser is currently in compliance and shall at all times continue to comply with the requirements imposed upon the Adviser by applicable law and regulations.

C. The Adviser (i) is registered as an investment adviser under the Advisers Act and will continue to be so registered for so long as this Agreement remains in effect; (ii) is not prohibited by the Investment Company Act, the Advisers Act or other law, regulation or order from performing the services contemplated by this Agreement; (iii) to the best of its knowledge, has met and will seek to continue to meet for so long as this Agreement is in effect, any other applicable federal or state requirements, or the applicable requirements of any regulatory or industry self-regulatory agency necessary to be met in order to perform the services contemplated by this Agreement; (iv) has the authority to enter into and perform the services contemplated by this Agreement; and (v) will promptly notify Sub-Adviser of the occurrence of any event that would disqualify Adviser from serving as investment manager of an investment company pursuant to Section 9(a) of the Investment Company Act or otherwise. The Adviser will also promptly notify the Sub-Adviser if it is served or otherwise receives notice of any action, suit, proceeding, inquiry or investigation, at law or in equity, before or by any court, public board or body, involving the affairs of any Fund, provided, however, that routine regulatory examinations shall not be required to be reported by this provision.

D. The Adviser certifies that as of the date of this Agreement the Trust is a Qualified Institutional Buyer (“QIB”) as defined in Rule 144A under the 1933 Act, and the Adviser will promptly notify the Sub-Adviser if the Trust ceases to be a QIB.

E. The Adviser, through its designated administrator or sub-administrator, will regularly notify the Sub-Adviser if any “government entity” assets, within the meaning of Rule 206(4)-5 under the Advisers Act, are contributed to any Fund.

| 7. | Representations of Sub-Adviser |

The Sub-Adviser represents, warrants and agrees as follows:

A. The Sub-Adviser is currently in compliance and shall at all times continue to comply with the requirements imposed upon the Sub-Adviser by applicable law and regulations.

B. The Sub-Adviser (i) is registered as an investment adviser under the Advisers Act and will continue to be so registered for so long as this Agreement remains in effect; (ii) is not prohibited by the Investment Company Act, the Advisers Act or other law, regulation or order from performing the services contemplated by this Agreement; (iii) has met and will seek to continue to meet for so long as this Agreement remains in effect, any other applicable federal or state requirements, or the applicable requirements of any regulatory or industry self-regulatory agency necessary to be met in order to perform the services contemplated by this Agreement; (iv) has the authority to enter into and perform the services contemplated by this Agreement; and (v) will promptly notify Adviser of the occurrence of any event that would disqualify the Sub-Adviser from serving as an investment sub-adviser of an investment company pursuant to Section 9(a) of the Investment Company Act or otherwise. The Sub-Adviser will also promptly notify the Trust and the Adviser if it is served or otherwise receives notice of any action, suit, proceeding, inquiry or investigation requesting information about any Fund that directly relates to or otherwise materially and adversely affects a Fund, at law or in equity, before or by any court, public board or body, involving the affairs of a Fund. The Sub-Adviser represents that this Agreement does not violate any existing agreement between the Sub-Adviser and any other party.

C. The Sub-Adviser has reviewed the Prospectus and SAI of the Trust with respect to each Fund, as it may be amended from time to time, that contains disclosure about the Sub-Adviser, and represents and warrants that, with respect to the disclosure about the Sub-Adviser or information relating to the Sub-Adviser, such Registration Statement contains, as of the date hereof, no untrue statement of any material fact and does not omit any statement of a material fact necessary to make the statements contained therein not misleading.

D. The Sub-Adviser has adopted a written code of ethics complying with the requirements of Rule 17j-1 under the Investment Company Act and will provide the Adviser and the Board with a copy of such code of ethics, together with evidence of its adoption. The Sub-Adviser will promptly provide the Adviser any material amendments thereto. As requested, the president, Chief Operating Officer or a vice-president of the Sub-Adviser shall certify to the Adviser that the Sub-Adviser has complied with the requirements of Rule 17j-1 during the previous year and that there has been no material violation of the Sub-Adviser’s code of ethics or, if such a material violation has occurred, that appropriate action was taken in response to such violation. Upon the written request of the Adviser, the Sub-Adviser shall permit the Adviser, its employees or its agents to examine the reports required to be made to the Sub-Adviser by Rule 17j-1(d)(1) and all other records relevant to the Sub-Adviser’s code of ethics.

E. The Sub-Adviser has provided the Trust and the Adviser with a copy of its Form ADV, which as of the date of this Agreement is its Form ADV as most recently filed with the SEC, and promptly will furnish a copy of all amendments and annual updates to the Adviser. Such amendments shall reflect all changes in the Sub-Adviser’s organizational structure, professional staff or other significant developments affecting the Sub-Adviser, as required by the Advisers Act.

F. The Sub-Adviser will promptly notify the Trust and the Adviser of any proposed assignment of this Agreement or change of control of the Sub-Adviser and any proposed changes in the key personnel who are either the portfolio manager(s) of a Fund or senior management of the Sub-Adviser. The Sub-Adviser agrees to bear all reasonable expenses of the Trust, if any, arising out of an assignment or change in control.

G. The Sub-Adviser has provided the Adviser with a summary of its insurance coverage and will promptly provide the Adviser any material amendments thereto. The Sub-Adviser will maintain its insurance coverage at least at the amounts set forth in the summary.

H. The Sub-Adviser agrees that neither it, nor any of its affiliates, will knowingly in any way refer directly or indirectly to its relationship with the Trust, each Fund, the Adviser or any of their respective affiliates in offering, marketing or other promotional materials without the express written consent of the Adviser, except as required by law, rule, regulation or upon the request of a governmental authority and only upon providing written notice to the Adviser and the Trust. However, the Sub-Adviser may incorporate the performance of each Fund in its composite performance.

I. The Sub-Adviser will not file class action claim forms or otherwise exercise any rights the Adviser or the Trust may have with respect to participating in, commencing or defending suits or legal proceedings involving securities or issuers of securities held in, or formerly held in, each Fund, unless the Sub-Adviser, the Adviser and the Trust mutually agree that the Sub-Adviser may take such actions.

J. The Sub-Adviser will promptly notify the Adviser and the Trust if the Sub-Adviser suffers a material adverse change in its business that would materially impair its ability to perform its relevant duties for a Fund. For the purposes of this paragraph, a “material adverse change” shall include, but is not limited to, a material loss of assets or accounts under management that impacts the ability of the Sub-Adviser to fulfill its obligations under this Agreement or the departure of senior investment professionals involved in the management of the Fund to the extent such professionals are not replaced promptly with professionals of comparable experience and quality.

K. The Sub-Adviser will promptly notify the Adviser and the Trust to the extent required by applicable law in the event that the Sub-Adviser or any of its affiliates: (1) becomes aware that it is subject to a statutory disqualification that prevents the Sub-Adviser from serving as an investment adviser pursuant to this Agreement; or (2) becomes aware that it is the subject of an administrative proceeding or enforcement action by the SEC or other regulatory authority. The Sub-Adviser further agrees to notify the Trust and the Adviser immediately of any material fact known to the Sub-Adviser respecting or relating to the Sub-Adviser that would make any written information previously provided to the Adviser or the Trust materially inaccurate or incomplete or if any such written information becomes untrue in any material respect.

| 8. | Commodity Exchange Act Matters |

A. The Adviser hereby represents and warrants to the Sub-Adviser that:

(i) with respect to each Fund where the Adviser is not excluded from the definition of a commodity pool operator (“CPO”) pursuant to Commodity Futures Trading Commission (“CFTC”) Regulation 4.5, the Adviser (A) is registered as a CPO under the CEA and is a member of the National Futures Association (the “NFA”) and (B) consents to being treated by the Sub-Adviser as a “qualified eligible person” as defined in the rules promulgated under the CEA for the purposes of the CEA and the regulations thereunder;

(ii) with respect to each Fund where the Adviser is excluded from the definition of a CPO pursuant to CFTC Regulation 4.5, the Adviser (A) filed the notice required by CFTC Regulation 4.5(c) and shall re-file such notice annually as required and (B) will promptly notify the Sub-Adviser if it can no longer rely on the exclusion pursuant to CFTC Regulation 4.5 with respect to a Fund; and

(iii) only with respect to any Funds that may trade swaps, the Fund is an “eligible contract participant” within the meaning of Section 1a(18) of the CEA.

B. The Sub-Adviser hereby represents and warrants to the Adviser that:

(i) the Sub-Adviser is registered with the CFTC in all capacities, if any, in which the Sub-Adviser is required under the CEA and the CFTC’s regulations to be so registered and is a member of the NFA if required to be a member thereof;

(ii) if the Sub-Adviser is exempt from registration as a commodity trading advisor (“CTA”) under CFTC Regulation 4.14(a)(8) with respect to a Fund, it has filed notice required under CFTC Regulation 4.14(a)(8) and shall re-file such notice annually as required; and

(iii) if the Adviser has filed the exclusion under CFTC Regulation 4.5 with respect to a Fund, the Sub-Adviser (A) will cause such Fund to comply with the trading limitations in CFTC Regulation 4.5 unless otherwise agreed with the Adviser, and (B) promptly will notify the Adviser if it is reasonably likely that one or more Funds will not comply with such trading limitations.

C. The Adviser and the Sub-Adviser each further agree that:

(i) to the extent that the CEA and the then-current CFTC regulations require (A) registration by such party as a CPO or CTA and/or membership with NFA with respect to any Fund, (B) specific disclosure, as applicable to the investors in any Fund, or (C) filing of reports and other documents with respect to any Fund, it shall promptly and fully comply, or take reasonable steps to cause such Fund to comply, with all such requirements;

(ii) the Adviser and the Sub-Adviser shall each comply with all requirements of the CEA, then-current CFTC regulations and NFA rules that apply to the Adviser and the Sub-Adviser, respectively, with respect to each Fund;

(iii) the Sub-Adviser shall provide reasonable cooperation to the Adviser and the Adviser shall provide reasonable cooperation to the Sub-Adviser in fulfilling, or causing to be fulfilled, any disclosure or reporting requirements applicable to such party with respect to each Fund under the CEA and/or then-current CFTC regulations and NFA rules; and

(iv) the Adviser and the Sub-Adviser each further agrees to notify the other party promptly in writing if any of the representations and warranties herein ceases to be accurate in any respect with respect to the Adviser, the Sub-Adviser or any Fund.

The services of the Sub-Adviser to the Adviser, each Fund and the Trust are not to be deemed to be exclusive, and the Sub-Adviser shall be free to render investment advisory or other services to others and to engage in other activities. Adviser has no objection to Sub-Adviser rendering such services to any other person, provided that whenever the Fund and one or more other investment advisory clients of Sub-Adviser have available funds for investment, investments suitable and appropriate for each will be allocated in a manner believed by Sub-Adviser to be equitable to each. Sub-Adviser may group orders for a Fund with orders for other funds and accounts to obtain the efficiencies that may be available on larger transactions when it determines that investment decisions are appropriate for each participating account. It is understood and agreed that the directors, officers, and employees of the Sub-Adviser are not prohibited from engaging in any other business activity or from rendering services to any other person, or from serving as partners, officers, directors, trustees, or employees of any other firm or corporation.

The Sub-Adviser shall submit to all regulatory and administrative bodies having jurisdiction over the services provided pursuant to this Agreement any information, reports, or other material which any such body by reason of this Agreement may request or require pursuant to applicable laws and regulations. The Sub-Adviser shall provide prompt notice to the Adviser and the Trust of any such submission.

The records relating to the services provided under this Agreement shall be the property of the Trust and shall be under its control; however, the Trust shall furnish to the Sub-Adviser such records and permit it to retain such records (either in original or in duplicate form) as it shall reasonably require in order to carry out its business. In the event of the termination of this Agreement, such records shall promptly be returned to the Trust by the Sub-Adviser free from any claim or retention of rights therein, provided that the Sub-Adviser may retain any such records that are required by law or regulation.

| 12. | Confidential Treatment |

All information and advice furnished by one party to the other party (including their respective agents, employees and representatives and the agents, employees, and representatives of any affiliates) hereunder shall be treated as confidential and shall not be disclosed to third parties, except as may be necessary to comply with applicable laws, rules and regulations, subpoenas, court orders, and as required in the administration and management of the Funds. It is understood that any information or recommendation supplied or produced by Sub-Adviser in connection with the performance of its obligations hereunder is to be regarded as confidential and for use only by the Adviser and the Trust. Without limiting the foregoing, the Adviser and the Trust will only disclose portfolio information in accordance with the Trust’s portfolio information policy as adopted by the Board.

The confidential treatment of the information noted in this Agreement shall also apply to information shared between the Adviser and the Sub-Adviser relating to potential future funds for which the Adviser may wish to retain the Sub-Adviser’s investment advisory services.