UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. __)

Filed by the Registrant X

Filed by a party other than the Registrant

Check the appropriate box:

X Preliminary Proxy Statement

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Definitive Proxy Statement

Definitive Additional Materials

Soliciting Material Pursuant to 240.14a-12

MIRAVANT MEDICAL TECHNOLOGIES

------------------------------------------------------------------------------------------

(Name of Registrant as Specified in Its Charter)

------------------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

X No fee required.

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transactions applies:

(2) Aggregate number of securities to which transactions applies:

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

Fee paid previously with preliminary materials.

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing party:

Miravant Medical Technologies 336 Bollay Drive Santa Barbara, California 93117 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Be Held on June 23, 2005 |

Notice is hereby given that the Annual Meeting of Stockholders of Miravant Medical Technologies, or the Company, will be held on Thursday, June 23, 2005, at 10:00 a.m., at The Mar Monte Hotel, 1111 East Cabrillo Boulevard, Santa Barbara, California, 93103, (805) 963-0744, for the following purposes:

1. To elect six directors to serve until the 2006 Annual Meeting or until their successors are elected and qualified;

2. To approve an amendment to the Company's existing Certificate of Incorporation to increase the authorized number of shares of Common Stock from 75,000,000 to 100,000,000;

3. To ratify the appointment of Ernst & Young LLP, as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2005; and

4. To transact such other business as may properly come before the meeting or any continuations, adjournments or postponements thereof.

These items are more fully described in the following pages. The Board of Directors has fixed the close of business onApril 27, 2005, as the Record Date for the determination of stockholders entitled to receive notice of and to vote at the meeting.Stockholders are reminded that shares cannot be voted unless the stockholder is present at the meeting or the signed proxy is returned or other arrangements are made to have the shares represented at the meeting. |

As set forth in the enclosed Proxy Statement, proxies are being solicited by and behalf of the Board of Directors of the Company. All proposals set forth above are proposals of the Board of Directors. It is expected that these materials will be first mailed to Stockholders on or about May 11, 2005.

Whether or not you expect to attend the meeting, please complete, date and sign the enclosed proxy and mail it promptly in the enclosed envelope.

By Order of the Board of Directors

__________

Joseph E. Nida

Secretary

Santa Barbara, California

May 9, 2005

PLEASE SIGN AND RETURN THE ENCLOSED PROXY |

Proxy Statement | 2 |

Voting and Solicitation of Proxies | 3 |

| Security Ownership of Certain Beneficial Owners and Management | 5 |

Corporate Governance and Other Matters | 7 |

Board Meetings, Remuneration of Directors and Committees | 9 |

Report of the Audit Committee | 11 |

Executive Officers | 12 |

Compensation Committee Report on Executive Compensation | 13 |

Summary Compensation | 16 |

Option Grants in 2004 | 18 |

Stock Option Expiration Date Extensions | 18 |

Employment Agreements | 18 |

Employee Stock Option Plans | 21 |

| Equity Compensation Plan Information | 22 |

Certain Relationships and Related Transactions | 22 |

Comparison of Total Stockholder Return | 24 |

Item No. 1 - Election of Directors | 25 |

| Item No. 2 - Proposal: Amendment to the Company's Existing | 28 |

Certificate of Incorporation | |

| Item No. 3 - Proposal to Ratify Appointment of the Company's | 30 |

Independent Registered Public Accounting Firm | |

Compliance with Section 16(a) of the Securities Exchange Act of 1934 | 31 |

Other Matters | 31 |

Stockholder Proposals for the 2006 Proxy Statement | 31 |

Miravant Medical Technologies 336 Bollay Drive Santa Barbara, California 93117 |

This Proxy Statement and the accompanying proxy card are first being mailed to stockholders on or about May 11, 2005 in connection with the solicitation of proxies on behalf of the Board of Directors, or the Board, of Miravant Medical Technologies (collectively with its subsidiaries, the "Company") for the 2005 Annual Meeting of Stockholders, or the Annual Meeting, to be held on Thursday, June 23, 2005, at 10:00 a.m. local time, at The Mar Monte Hotel, 1111 East Cabrillo Boulevard, Santa Barbara, California, or at any adjournment thereof. Proxies are solicited to give all stockholders of record at the close of business on April 27, 2005 an opportunity to vote on matters to be presented at the Annual Meeting. Shares can be voted at the meeting only if the stockholder is present or represented by proxy.

At the Annual Meeting, stockholders will be asked to consider and vote upon three items as follows:

ITEM NO. 1 To elect six directors to serve until the 2006 Annual Meeting or until their successors are elected and qualified;

ITEM NO. 2 To approve an amendment to the Company's existing Certificate of Incorporation to increase the authorized number of shares of Common Stock from 75,000,000 to 100,000,000;

ITEM NO. 3 To ratify the appointment of Ernst & Young LLP, as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2005; and

ITEM NO. 4 To transact such other business as may properly come before the meeting or any continuations, adjournments or postponements thereof.

Miravant stockholders will also be asked to consider and vote upon such other business as may properly come before the meeting or any adjournments or postponements thereof.

Any stockholder giving a proxy may revoke it at any time prior to its exercise at the Annual Meeting by giving notice of such revocation either personally or in writing to the Secretary of the Company at the Company's executive offices, by subsequently executing and delivering a later-dated proxy, or by voting in person at the Annual Meeting. Stockholders whose shares are held in “street name” should consult with their broker or nominee concerning the method for revoking their proxy.

A copy of the Annual Report to Stockholders is included herewith but shall not constitute proxy solicitation materials.

The Board of Directors of the Company believes that the election of each of its director nominees in Item No. 1 and approval of Item No. 2 and Item No. 3 are in the best interests of the Company and its stockholders and unanimously recommends that the stockholders vote to elect each of the director nominees in Item No. 1 and vote FOR Item No. 2 and FOR Item No. 3. |

VOTING AND SOLICITATION OF PROXIES

Only holders of record at the close of business on April 27, 2005, or the Record Date, of the Company's Common Stock, $0.01 par value, or the Common Stock, or Series A-1 Convertible Preferred Stock, $0.01 par value, or the Preferred Stock, will be entitled to vote at the Annual Meeting. On April 15, 2005, there were 37,049,842 shares of Common Stock outstanding and 1,112,966 shares of Preferred Stock outstanding. The holders of a majority of all of the Company’s outstanding shares present in person or by proxy and entitled to vote will constitute a quorum at the meeting. Votes withheld, abstentions and broker non-votes (see below) will be counted toward the establishment of a quorum. On all matters to come before the Annual Meeting, each holder of Common Stock will be entitled to one vote for each share owned. Each holder of Preferred Stock is entitled to one vote for each share of Common Stock into which such holder’s shares of Preferred Stock are convertible into. On April 15, 2005, the 1,112,966 shares of Preferred Stock outstanding were convertible into 1,112,966 shares of Common Stock.

Please specify your choices on the items by marking the appropriate boxes on the enclosed proxy card and signing it. Shares represented by duly executed and unrevoked proxies in the enclosed form received by the Board will be voted at the Annual Meeting in accordance with the specifications made therein by the stockholders, unless authority to do so is withheld. If no specification is made, shares represented by duly executed and unrevoked proxies will be voted FOR the election as directors of the nominees listed in Item No. 1 and FOR Item No. 2, and FOR Item No. 3 and in accordance with the recommendations of the Board of Directors as to any other matter that may properly come before the Annual Meeting, or any continuation, adjournment or postponement thereof.

This proxy solicitation is being made by the Board of Directors of the Company. The Company intends to solicit proxies by use of the mail. In addition, solicitation of proxies may be made by personal and telephonic meetings with stockholders by directors, officers and regular employees of the Company. The cost of preparing, assembling and mailing the proxy materials will be borne by the Company.

Vote Required

The election of the director nominees pursuant to Item No. 1 requires a plurality of the votes cast in person or by proxy at the Annual Meeting. A plurality means that the nominees with the largest number of votes are elected as directors up to the maximum number of directors to be chosen at the meeting. Under Delaware law, the Company's Certificate of Incorporation and the Company's Bylaws, shares as to which a stockholder abstains or withholds from voting on the election of Directors, and shares as to which a broker indicates that it does not have discretionary authority to vote ("broker non-votes") on such nominees, will not affect the outcome of the election of directors.

If any stockholder gives notice at the meeting of his or her intention to cumulate votes in the election of directors, each stockholder will be entitled to cumulate his or her votes and give one nominee a number of votes equal to the number of directors to be elected, multiplied by the number of shares then held, or distribute the votes on the same principle among as many nominees as the stockholder deems fit. Stockholders voting by means of the accompanying proxy will be granting the proxy holders discretionary authority to vote their shares cumulatively, but such stockholders may not mark the proxy to cumulate their own votes. The Board of Directors does not presently intend to give notice to cumulate votes, but it may elect to do so in the event of a contested election or other, presently unexpected, circumstances. In the event of cumulative voting, the accompanying proxy authorizes the individuals named as proxy holders, in their discretion, to vote cumulatively and to distribute, in any manner, the votes to which each share is entitled in the election of directors, among the nominees for whom the authority to vote has not been withheld in the accompanying proxy.

The approval of the amendment to the Company's Certificate of Incorporation pursuant to Item No. 2 requires the affirmative vote of holders of at least a majority of all of our outstanding shares of Common Stock as of the Record Date. Since a majority of all outstanding shares is required, any shares that are not voted, including shares represented by a proxy that is marked "abstain" and broker non-votes, will effectively count against this proposal. Since shares which abstain and shares represented by broker non-votes are nonetheless considered outstanding shares.

Approval of the ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm for the Company pursuant to Item No. 3 requires the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote. Under Delaware law, the Company's Certificate of Incorporation and the Company's Bylaws, abstentions on such proposals have the same legal effect as a vote against such proposals. Broker non-votes are not counted as being present for the purposes of voting on the proposal and, accordingly, will have the effect of reducing the number of affirmative votes required to approve the proposal.

A list of the stockholders of record as of the Record Date will be available for examination during ordinary business hours at least ten days prior to the Annual Meeting by any stockholder, for any purpose germane to the Annual Meeting at the Company's principal executive offices at 336 Bollay Drive, Santa Barbara, California 93117 (telephone (805) 685-9880), Attention: Shadean Runyen or John Philpott. The Company's website is www.miravant.com.

If you plan to attend the meeting, please mark the appropriate box on the proxy card. Stockholders whose shares are held of record by brokers or other institutions, will be admitted upon presentation of proper identification and proof of ownership (e.g., a brokers' statement) at the door. |

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Common Stock and Preferred Stock as of April 15, 2005 by (i) each person known by the Company to own beneficially five percent or more of the outstanding shares of its Common Stock or Preferred Stock, (ii) each of the executive officers named in the Summary Compensation Table included herein, (iii) each director and nominee for director of the Company and (iv) all directors and named executive officers of the Company as a group.

The percentage of shares of Common Stock beneficially owned is based on 37,049,842 shares of Common Stock and 1,112,966 shares of Preferred Stock on April 15, 2005.The number of shares of Common Stock outstanding used in calculating the percentage for each listed securityholder includes shares of Common Stock underlying options, warrants and/or other convertible securities that are exercisable or convertible within 60 calendar days of April 15, 2005, but excludes shares of Common Stock underlying options, warrants or convertible securities held by any other person.Except as indicated below, and subject to applicable community property laws, each person identified in the table has sole voting and investment power with respect to all shares of Common Stock owned by them.

Name | Number of Shares Beneficially Owned (1) | Percentage of Outstanding Stock |

St. Cloud Investments, LTD. (2) | 18,922,934 | 34.03% |

Gary S. Kledzik, Ph.D. | 2,313,872 | 5.93% |

| Advanced Cardiovascular Systems, Inc. (3) | 1,112,966 | 2.92% |

David E. Mai | 824,213 | 2.13% |

John M. Philpott | 347,730 | * |

Charles T. Foscue (4) | 200,677 | * |

Barry Johnson | 30,000 | * |

Michael Khoury | 13,290 | * |

Robert J. Sutcliffe | ¾ | * |

All directors and executive officers as a group (7 persons) | 3,729,782 | 9.62% |

* Less than one percent.

| (1) | Includes the following shares of Common Stock issuable upon exercise of options and/or warrants exercisable within 60 days of April 15, 2005: Dr. Kledzik—883,477 shares; Mr. Mai—497,338 shares; Mr. Philpott¾181,480 shares; Mr. Foscue¾147,500 shares; Mr. Johnson—20,000 shares; and directors and executive officers as a group—1,729,795 shares. |

| (2) | According to the Schedule 13D (Amendment No. 1) jointly filed by Mr. Paul Caland and st. Cloud Investments, Ltd., with the SEC on January 11, 2005 with respect to their security holdings on December 31, 2004, St. Cloud Investments, Ltd., or SCI, is a privately-held investment company organized under the laws of the British Virgin Islands and its principal business address is SCI, c/o Nomina Financial Services Ltd., Waldmannstrasse 8, P.O. Box 391, Zurich Switzerland CH-8024. According to the Schedule 13D (Amendment No.1), both Mr. Caland and SCI have sole voting and dispositive power over the 18,922,934shares and Mr. Caland is the majority shareholder of SCI. In addition, the 18,922,934 shares beneficially owned by St. Cloud Investments, Ltd. includesCommon Stock issuable upon exercise of 8,075,000 warrants and 9,361,162 convertible securities within 60 days of April 15, 2005. |

| (3) | Includes 1,112,966 shares issuable upon conversion of 1,112,966 shares of Preferred Stock (representing beneficial ownership of 100% of the outstanding shares of such class of stock). Advanced Cardiovascular Systems, Inc. is a wholly owned subsidiary of Guidant Corporation and its principal business address is 3200 Lakeside Drive, Santa Clara, CA 95054-2807. |

| (4) | The shares beneficially owned by Mr. Foscue exclude 12,069 shares of Common Stock to which Mr. Foscue disclaims beneficial ownership. 11,521 of these shares are held by HAI Financial, Inc., of which Mr. Foscue is the Chairman and Chief Executive Officer and the remaining 548 shares are held in a pension plan for the benefit of Mr. Foscue. |

CORPORATE GOVERNANCE AND OTHER MATTERS

Board Independence

We have determined that all of our directors, other than 2, are independent directors under the marketplace rules of the Nasdaq Stock Market. We have also determined that all directors serving as members of our Audit Committee, Compensation Committee, and Governance and Nominating Committee are independent under the marketplace rules of the Nasdaq Stock Market and the rules of the SEC. Although we are currently listed on the OTC Bulletin Board®, we are not subject to the marketplace rules of the Nasdaq Stock Market.

Consideration of Stockholder Recommendations and Nominations

In April 2004, we established a Governance and Nominating Committee of our Board. The Governance and Nominating Committee of our Board will consider both recommendations and nominations for candidates to our Board from stockholders. A stockholder who desires to recommend a candidate for election to our Board shall direct the recommendation in writing to the attention of the CFO, 336 Bollay Drive, Santa Barbara, CA 93117 and must include the candidate's name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and the Company within the last three years and evidence of the nominating person's ownership of Company stock and amount of stock holdings. For a stockholder recommendation to be considered by the Governance and Nominating Committee as a potential candidate at an Annual Meeting, nominations must be received on or before the deadline for receipt of stockholder proposals.

If, instead, a stockholder desires to nominate a person directly for election to our Board, the stockholder must follow the rules set forth by the SEC (see "Stockholder Proposals for the 2006 Proxy Statement" below) and meet the deadlines and other requirements as may be set forth in our Bylaws, as they may be amended from time to time.

Identifying and Evaluating Nominees for Director

The Governance and Nominating Committee will use the following procedures to identify and evaluate the individuals that it selects, or recommends that our Board select, as director nominees:

| · | The Committee will review the qualifications of any candidates who have been properly recommended or nominated by stockholders, as well as those candidates who have been identified by management, individual members of our Board or, if the Committee determines, a search firm. Such review may, in the Committee's discretion, include a review solely of information provided to the Committee or may also include discussions with persons familiar with the candidate, an interview with the candidate or other actions that the Committee deems proper. |

| · | The Committee will evaluate the performance and qualifications of individual members of our Board eligible for re-election at the Annual Meeting of stockholders. |

| · | The Committee will consider the suitability of each candidate, including the current members of our Board, in light of the current size and composition of our Board. In evaluating the qualifications of the candidates, the Committee considers many factors, including, among other things, issues of character, judgment, independence, age, expertise, diversity of experience, length of service, other commitments and the like. The Committee evaluates such factors, among others, and does not assign any particular weighting or priority to any of the factors. The Committee considers each individual candidate in the context of the current perceived needs of our Board as a whole. While the Committee has not established specific minimum qualifications for director candidates, the Committee believes that candidates and nominees must reflect a board that is comprised of directors who (i) are predominately independent, (ii) are of high integrity, (iii) have qualifications that will increase overall Board effectiveness and (iv) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to Audit Committee members. |

| · | In evaluating and identifying candidates, the Committee has the authority to retain and terminate any third party search firm that is used to identify director candidates, and has the authority to approve the fees and retention terms of any search firm. |

| · | After such review and consideration, the Committee selects, or recommends that our Board select, the slate of director nominees, either at a meeting of the Committee at which a quorum is present or by unanimous written consent of the Committee. |

The Committee will endeavor to notify, or cause to be notified, all director candidates of its decision as to whether to nominate such individual for election to our Board.

Stockholder Communication with our Board of Directors

Any stockholder may contact any of our directors by writing to them by mail or express mail c/o Miravant Medical Technologies, 336 Bollay Drive, Santa Barbara, CA 93117.

Any stockholder communications directed to our Board (other than concerns regarding questionable accounting or auditing matters directed to the Audit Committee or otherwise in accordance with our Financial Information Integrity Policy) will first go to the CFO, who will log the date of receipt of the communication as well as (for non-confidential communications) the identity of the correspondent in our stockholder communications log.

In addition, material that is undulyhostile, threatening, illegal or similarly unsuitable will be excluded, with the provision that any communication that is excluded must be made available to any outside director upon request.

The CFO will forward all such original stockholder communications to our Board for review.

Code of Business Conduct and Ethics for Principal Executive and Senior Financial Officials

We have adopted a Code of Business Conduct and Ethics applicable to all employees, including our directors, principal executive officer, principal financial officer and any persons performing similar functions, which is available on our website at www.miravant.com.

Attendance by Board Members at the Annual Meeting of Stockholders

It is the policy of our Board to encourage board members to attend the Annual Meeting of stockholders. All members of our Board serving at the time of the 2004 Annual Meeting of stockholders attended in person on June 24, 2004.

BOARD MEETINGS, REMUNERATION OF DIRECTORS AND COMMITTEES

During 2004, the Board of Directors met on 4 occasions and also acted by written consent. Each director then in office attended in person or by telephone all of the Board of Director meetings and all of their respective Committee meetings.

Directors that are also employees of the Company do not receive any additional compensation for serving as members of the Board of Directors or any of its Committees. Directors who are not employees of the Company do not receive fees for board or committee meetings attended, but do receive an annual stock option grant under the Miravant Medical Technologies 2000 Stock Compensation Plan, or the 2000 Plan. The Company provides the non-employee directors with an automatic grant of nonstatutory stock options to purchase 20,000 shares of Common Stock for each director who has served more than four years on the Company's Board and 10,000 shares of Common Stock for each director who has served less than four years,on or about the first day of the fourth quarter of each year that a non-employee director serves on the Board of Directors. Each option is fully vested upon the grant date and is granted at an option price equal to the fair market value of the Common Stock on the grant date. The options terminate on the earlier of 90 days from the date on which a director is no longer a member of the Board of Directors for any reason other than death, ten years from the date of grant or six months from the director's death. Non-employee directors are also eligible for discretionary awards. The Company also reimburses directors for out-of-pocket expenses incurred in connection with attending Board and Committee meetings.

During the year ended December 31, 2004, Charles T. Foscue was automatically granted a stock option to purchase 20,000 shares of Common Stock under the 2000 Plan and Barry Johnson was automatically granted a stock option to purchase 10,000 shares of Common Stock under the 2000 Plan. In addition, Mr. Johnson was also granted a stock option to purchase 40,000 shares of Common Stock that vest annually over 4 years as consideration for joining the Company's Board of Directors.

The Board has standing Audit, Compensation and Governance and Nominating Committees. The current members of each of the Board's Committees are listed below.

The Audit Committee

The Audit Committee currently is composed of four independent directors, as defined in the listing standards of the Nasdaq National Market: Charles T. Foscue, Barry Johnson, Michael Khoury and Robert J. Sutcliffe.During fiscal year 2004, the members of the Audit Committee were Charles T. Foscue, and Barry Johnson, and beginning on January 27, 2005, the Company added its two newly elected Board members, Michael Khoury and Robert J. Sutcliffe, to the Audit Committee. The Audit Committee meets with the Company's independent accountants and management to discuss, recommend and review accounting principles, financial and accounting controls, the scope of the annual audit and other matters; advises the Board on matters related to accounting and auditing; and reviews management's selection of the independent registered public accounting firm. TheAudit Committee chairman is Charles T. Foscue.

The Audit Committee reviews and monitors the corporate financial reporting, internal controls and the internal and external audits of the Company, including, among other things, the audit and control functions, the results and scope of the annual audit and other services provided by the Company's independent registered public accounting firm, and the Company's compliance with legal matters that have a significant impact on its financial reports. The Audit Committee meets independently with our independent registered public accounting firm and our senior management and reviews the general scope of our accounting, financial reporting, annual audit and the results of the annual audit, interim financial statements, auditor independence issues, and the adequacy of the Audit Committee charter. The Board has determined that Charles T. Foscue is an "audit committee financial expert" as that term is defined in Item 401(h) of Regulation S-K of the Securities Act of 1933, as amended.

The Audit Committee held four meetings during fiscal year 2004.In addition, the Chairman of the Audit Committee met quarterly with the Company's independent registered public accounting firm and management.For more information regarding the functions performed by the Audit Committee, please see "Report of the Audit Committee of the Board of Directors," included in this Proxy Statement. The Audit Committee Charter is available on our website at www.miravant.com.

The Compensation Committee

The Compensation Committee, composed solely of four independent directors, reviews and takes action regarding terms of compensation, employment contracts and pension matters that concern officers of the Company. During fiscal year 2004, the members of the Compensation Committee were Charles T. Foscue, and Barry Johnson, beginning on January 27, 2005, the Company added its two newly elected Board members, Michael Khoury and Robert J. Sutcliffe, to the Compensation Committee. The Compensation Committee chairman is Barry Johnson. During 2004, the Compensation Committee acted by written consent one time. The Compensation Committee Charter is available on our website at www.miravant.com.

Governance and Nominating Committee

In April 2004, the Board established a Governance and Nominating Committee. This committee is composed of our four independent directors, Charles T. Foscue, Barry Johnson, Michael Khoury and Robert J. Sutcliffe.During fiscal year 2004, the members of theGovernance and NominatingCommittee were Charles T. Foscue, and Barry Johnson, beginning on January 27, 2005, the Company added its two newly elected Board members, Michael Khoury and Robert J. Sutcliffe, to theGovernance and Nominating Committee.Our four Committee members are considered independent, as defined in the listing standards of the Nasdaq National Market. The purpose of this Committee is to assist the Board in meeting appropriate governance standards. To carry out this purpose, the Committee's role is to, among other things: (1) develop and recommend to the Board the governance principles applicable to the Company; (2) oversee the evaluation of the Board and management; (3) recommend to the Board director nominees for each committee; (4) assist the Board by identifying prospective director nominees and determine the director nominees for the next Annual Meeting of stockholders and (5) manage and oversee the recruitment of successor CEO candidates. The Governance and Nominating Committee Charter is available on our website at www.miravant.com.

REPORT OF THE AUDIT COMMITTEE

The Securities and Exchange Commission rules require the Company to include in its proxy statement a report from the Audit Committee of the Board. The following report concerns the Committee's activities regarding oversight of the Company's financial reporting and auditing process.

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the consolidated financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Committee reviewed the audited consolidated financial statements in the Annual Report on Form 10-K with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the consolidated financial statements.

The Committee reviewed with the independent registered public accounting firm, who are responsible for expressing an opinion on the conformity of those audited consolidated financial statements with accounting principles generally accepted in the United States, their judgments as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the Committee by Statement on Auditing Standards No. 61, as amended by Statement on Auditing Standards No. 90, (Communications with Audit Committees). In addition, the Committee has discussed with the independent registered public accounting firm the auditors' independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board and considered the compatibility of non-audit services with the auditors' independence.

The Committee discussed with the Company's independent registered public accounting firm the overall scope and plans for their respective audit. The Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company's internal controls and the overall quality of the Company's financial reporting. The Committee held four meetings during fiscal year 2004, which consisted of the Chairman of the Audit Committee, Charles T. Foscue, meeting quarterly with the Company's independent registered public accounting firm and management.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors (and the Board has approved) that the audited consolidated financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the Securities and Exchange Commission. The Committee has also recommended, subject to stockholder approval, the selection of the Company's independent registered public accounting firm for the fiscal year ending December 31, 2004.

Audit Committee

Charles T. Foscue, Audit Committee Chair

Barry Johnson

Michael Khoury

Robert J. Sutcliffe

March 23, 2005

EXECUTIVE OFFICERS

The names, ages and certain additional information (if not set out in Item No. 1 of this proxy statement) of the current executive officers of the Company are as follows:

Name Age Position

Gary S. Kledzik, Ph.D. 55 Chairman of the Board and Chief Executive Officer

David E. Mai 60 President and Director

John M. Philpott 44 Chief Financial Officer, Treasurer and Assistant Secretary

Biographical information about Dr. Kledzik and Mr. Mai is set forth in Item No. 1 of this proxy statement.

John M. Philpott has served as Chief Financial Officer since December 1995. From March 1995 to November 1995, Mr. Philpott had served as Controller. Prior to joining the Company, Mr. Philpott was a Senior Manager with Ernst & Young LLP, which he joined in 1986. Mr. Philpott is a Certified Public Accountant in the State of California. He holds a B.S. degree in Accounting and Management Information Systems from California State University, Northridge.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Compensation Committee Interlocks and Insider Participation

Our Compensation Committee's members, Charles T. Foscue, Barry Johnson, Michael Khoury and Robert J. Sutcliffe, are non-employee directors who are independent within the meaning of applicable standards. None of our executive officers served on the Board of Directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors or the Compensation Committee.

The Compensation Committee, composed entirely of outside directors, is responsible for the oversight and administration of executive compensation. The Committee also reviews the Company's overall compensation program as reported to the Committee by management. In establishing the Company's executive compensation program, the Committee takes into account the significance of the position to the Company, stockholder value, current market data and compensation trends for comparable companies and geographic locations, compares corporate performance to that of other companies in the same industry, gauges achievement of corporate and individual objectives and accomplishments and considers the overall effectiveness of the program in measuring and rewarding desired performance levels. These principles have been adhered to by developing incentive pay programs which provide competitive compensation and reflect the Company's performance. Both short-term and long-term incentive compensation are based on Company performance, achievement of specific milestones and the value received by stockholders. Since the Company is in the pre-commercialization stage, the use of traditional performance standards (such as revenue growth, operating income, profit levels and return on equity) is difficult and sometimes not appropriate in evaluating the performance of the executive officers on a year-to-year basis. In particular, the unique nature of the biotechnology industry, specifically the absence of commercial revenues and the fact that the Company's stock performance can be a consequence of large market forces than that of actual Company achievements, makes it difficult to tie financial performance objectives to standard financial consideration. The Committee believes the compensation of the Company's executive officers is in the low to middle range of compensation data compiled for comparable companies.

Compensation Philosophy

The Committee bases the executive compensation program on the following principles which reflect the value created for stockholders while supporting the Company's strategic business goals:

| · | Compensation should encourage increased stockholder value; |

| · | Compensation levels for executive officers are benchmarked to the outside market, utilizing information from general industry surveys; |

| · | Total compensation is targeted to the mid-range from comparable public companies with incremental amounts, which may be earned above that level depending upon corporate and individual performance. The Committee considers it essential to the vitality of the Company that the total compensation opportunity for executive officers remain competitive in order to attract and retain the talent needed to manage and build the Company's business; and |

| · | Incentive compensation is designed to reinforce the achievement of both short-term and long-term strategic business goals and objectives of the Company. |

Compensation Measurement

The Company's executive compensation is composed of three components, base salary, short-term incentives and long-term incentives, each of which is intended to serve the overall compensation philosophy.

Base Salary. The Company's salary levels are intended to be consistent with competitive pay practices and level of responsibility, with salary increases reflecting competitive trends, the overall financial position and performance of the Company, general economic conditions, as well as a number of factors relating to the particular individual, including the performance of the individual executive, and level of experience, ability and knowledge of the job.

Short-Term Incentives. The Compensation Committee has the ability to award cash or stock-based, short-term incentive compensation to executives under the 2000 Plan based on the executive's level of responsibility, potential contribution, the success of the Company and competitive conditions. Beginning in 2003, the Compensation Committee established a quarterly cash bonus program for the Chief Executive Officer, President and Chief Financial Officer. The quarterly cash bonus program for the executives was designed to award these individuals based on an increase in the Company's shareholder value. The bonus amount was calculated as 2.5% of the increase in the Company's market capitalization at the end of each quarter not to exceed a quarterly bonus total of $300,000 for the executive group. The market capitalization increase was determined each quarter and the increase was based on the change in the market capitalization value at the end of the current quarter compared to that of the previous quarter. The quarterly bonuses during 2004 were allocated 50% to the CEO, 30% to the President and 20% to the CFO. The program is considered an annual program and will be evaluated by the Compensation Committee for changes or renewal annually. Additionally, the Compensation Committee authorized two $250,000 milestone bonuses to be issued upon the submission of the Company's first New Drug Application, or NDA, in AMD and acceptance by the Food and Drug Administration, or FDA, of the NDA, respectively. The $250,000 milestone bonuses were allocated as follows; $100,000 to both the Chief Executive Officer and President and $50,000 to the Chief Financial Officer.

Long-Term Incentives. The Committee may award long-term incentive stock compensation based upon the achievement of the Company's research and development program goals, strategic alliance collaboration goals, capital fundings and the performance of the Common Stock on the applicable trading system. Under the Company's employment agreements and the 2000 Plan, stock options and other stock awards are granted from time to time to reward key employee's contributions and as an incentive for future contributions. Such grants of awards are based primarily on a key employee's past and potential contribution to the Company's accomplishments and growth. Under the 2000 Plan, the exercise price of stock options must equal or exceed the fair market value of the Common Stock on the date of grant and no stock options granted to executive officers in 2002 were granted with an exercise price below fair market value. Generally, the options under the 2000 Plan vest over a term of two to four years and generally employees must continue to be employed by the Company for such options to vest.

The stock option grants are designed to align the interests of the executive officers with those of the stockholders and provide each individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the Company.

2004 Compensation for the Chief Executive Officer. In setting the 2004 salary and incentive award levels for the Chief Executive Officer, the Committee reviewed the Company's achievements in 2003. The Committee also considered the Chief Executive Officer's leadership in continuing to strategically position the Company for the development and commercialization of drugs and devices for use in photodynamic therapy in ophthalmology, cardiovascular disease and dermatology indications. Some of the achievements during 2003 and 2004 include:

| · | The preparation of the Company's new drug application for the treatment of wet age-related macular degeneration; |

| · | Completed a Termination and Release Agreement with Pharmacia to retire the remaining $10.0 million in debt and release the Company's assets being held as collateral; |

| · | Completed a $6.0 million convertible debt financing in August 2003; |

| · | Completed a $2.0 million convertible debt financing in February 2004; |

| · | Liquidated the Company's investment in Xillix Technologies Corp, resulting in net proceeds to the Company of $1.6 million in November 2003; |

| · | Completed the sale of $10.3 million of Common Stock in April 2004; |

| · | Entered into a Collaboration and Equity Agreement with Guidant Corporation, which included a $3.0 million Preferred Stock investment in July 2004; |

| · | Advanced development programs of new photosensitivity drugs for use in cardiovascular disease; |

| · | Presented preclinical and clinical data at leading cardiology and ophthalmology meetings; and |

| · | Managed the Company's cash burn rate through cost resolutions and savings. |

While acknowledging the importance of the above mentioned achievements, and the continuing challenging of limited cash resources and a depressed stock price, the Committee felt it was in the best interest of the Company to continue to conserve the overall cash usage. Thus they determined to keep all the executive salaries in 2004 the same as in 2003, and to continue to implement the existing cost savings program, which included facility and operating cost savings. However, for retention purposes, a salary increase, for the first time since 2001, was approved for all non-executive employees. In addition, the Committee approved the utilization of long-term equity compensation for non-executive employees, such as stock options and stock awards to help make up for the lack of salary increases in past years. Based on the above, in 2004 the Committee did not increase the Chief Executive Officer’s salary, it remained the same as in 2003, which was $384,313. The Committee established a short-term incentive award program to the Chief Executive Officer for 2003 and 2004, as discussed earlier. With respect to long-term incentives, however, the Committee did approve a grant in 2004 to the Chief Executive Officer of stock options to purchase 200,000 shares of the Company's Common Stock under the 2000 Plan.

Section 162(m) Implications for Executive Compensation. It is the responsibility of the Committee to address the issues raised by Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), which makes certain "non-performance-based" compensation to certain executives of the Company in excess of $1,000,000 non-deductible to the Company. To qualify as "performance-based" under Section 162(m), compensation payments must be made pursuant to a plan, by a committee of at least two "outside" directors (as defined in the regulations promulgated under the Code) and must be based on achieving objective performance goals. In addition, the material terms of the plan must be disclosed to and approved by stockholders, and the outside directors or the Committee, as applicable, must certify that the performance goals were achieved before payments can be awarded.

The Committee, in planning for the future of the Company, has considered the impact of Section 162(m) and has taken several steps which are designed to minimize its effect to the extent practicable while maintaining competitive compensation practices. The Committee expects to continue to examine the effects of Section 162(m) and to monitor the level of compensation paid to the Company's executive officers in order to take any steps which may be appropriate in response to the provisions of Section 162(m) to the extent practicable while maintaining competitive compensation practices.

Compensation Committee

Barry Johnson, Compensation Committee Chair

Charles T. Foscue

Michael Khoury

Robert J. Sutcliffe

EXECUTIVE COMPENSATION

Summary Compensation

The following table summarizes all compensation paid to the Company's Chief Executive Officer and to the Company's other most highly compensated executive officers other than the Chief Executive Officer, whose total annual salary exceeded $100,000 for services rendered in all capacities to the Company during the fiscal years ended December 31, 2004, 2003 and 2002 (collectively, the "named executive officers").

| | | | | Long-Term Compensation Awards |

Name and Principal Position | Year | Salary (1) | Bonus (4) | Restricted Stock (# of Shares) (2) | Securities Underlying Options (# of Shares) (3) |

Gary S. Kledzik, Ph.D Chairman of the Board and Chief Executive Officer | 2004 | $ 384,313 | $ 391,009(5) | ¾ | 200,000 |

| | 2003 | 384,313 | 231,846(5) | ¾ | ¾ |

| | 2002 | 347,359 | ¾ | 564,375 | 518,477 |

David E. Mai Director and President | 2004 | $ 295,625 | $ 314,606(5) | ¾ | 100,000 |

| | 2003 | 295,625 | 71,337(5) | ¾ | ¾ |

| | 2002 | 267,199 | ¾ | 289,375 | 359,838 |

John M. Philpott Chief Financial Officer and Treasurer | 2004 | $ 206,938 | $ 176,404(5) | ¾ | 75,000 |

| | 2003 | 206,938 | 52,503(5) | ¾ | ¾ |

| | 2002 | 198,979 | ¾ | 158,750 | 162,730 |

(1) In February 2002, the Company implemented a cost restructuring program, which consisted of a temporary reduction of pay for all employees and executives of the Company for a period of approximately ten weeks. The reduced wages for this period were exchanged for stock options at a two-for-one ratio, with an exercise price of $1.35. The Chief Executive Officer and President each took a 50% salary reduction during this period, which amounted to reduced wages of approximately $37,000 and $28,000, respectively, and stock options granted of 18,477 shares and 14,213 shares, respectively. The Chief Financial Officer took a 20% salary reduction, consistent with all the other employees of the Company, which amounted to reduced wages of approximately $8,000 and stock options granted of 3,980 shares.

| (2) | In November 2002, the Compensation Committee of the Board of Directors approved a Stock Option Exchange Program. This program allowed eligible employees to exchange stock options that had an exercise price of greater than $5.00 for restricted Common Stock at a two-for-one ratio. The restricted Common Stock became fully vested as of December 31, 2003. Dr. Kledzik exchanged 1,128,750 stock options for 564,375 shares of restricted Common Stock, Mr. Mai exchanged 578,750 stock options for 289,375 shares of restricted Common Stock, Mr. Philpott exchanged 317,500 stock options for 158,750 shares of restricted Common Stock. |

(3) The options vest over a period of one to four years and expire upon the earlier of (i) three months after termination of employment (or upon termination if terminated for cause), or (ii) ten years from the date of grant.

| (4) | In 2003, the Compensation Committee of the Board of Directors approved a short-term quarterly cash bonus program to be awarded to the Chief Executive Officer, the President and the Chief Financial Officer. The quarterly bonus amount is determined based on 2.5% of the increase in the Company's market capitalization each quarter as compared to the prior quarters ending market capitalization, with the total lower amount limited to $300,000 per quarter. In 2003, the quarterly bonus amount was allocated 65% to the Chief Executive Officer, 20% to the President and 15% to the Chief Financial Officer. In 2004, the quarterly bonus amount was allocated 50% to the Chief Executive Officer, 30% to the President and 20% to the Chief Financial Officer Quarterly bonuses earned in 2003 and 2004 totaled of $356,686 and $882,019, respectively. Additionally, in 2004, two milestone bonuses of $250,000 each were awarded to the Chief Executive Office, President and Chief Financial Officer. Each milestone bonus was allocated as follows: $100,000 to the Chief Executive Officer and President and $50,000 to the Chief Financial Officer. |

| (5) | In 2003 and 2004 a portion of the total net bonus payments (after applicable tax and withholding) was applied to outstanding loans due to the Company as follows: Gary S. Kledzik applied zero in 2003 and $57,718 in 2004; David E. Mai applied $71,337 in 2003 and $44,423 in 2004; and John M. Philpott applied $53,503 in 2003 and $41,905 in 2004. |

Option Grants in 2004

The following table sets forth certain information as of December 31, 2004 and the year then ended concerning stock options granted to the named executive officers.

Option Grants in Last Fiscal Year |

| | | | | | | | | | |

| | | Number of | | % of Total | | | | | Potential Realizable |

| | | Securities | | Options | | | | | Value at Assumed |

| | | Underlying | | Granted to | | | | | Annual Rates of |

| | | Options | | Employees | | Exercise | | | Stock Price Appreciation |

| | | Granted | | During | Price | Expiration | | for Option Term |

Name | | (# of shares)(1) | the Year(2) | | ($/share) | Date | | 5% | | 10% |

| | | | | | | | | | | | |

| Gary S. Kledzik | | 200,000 | | 26.44% | | $ 2.45 | 01/26/14 | | $ 308,158 | | $ 780,934 |

| | | | | | | | | | | | |

| David E. Mai | | 100,000 | | 13.22% | | 2.45 | 01/26/14 | | 154,0179 | | 390,467 |

| | | | | | | | | | | | |

| John M. Philpott | | 75,000 | | 9.91% | | 2.45 | 01/26/14 | | 115,559 | | 291,850 |

| (1) | The options vest ratably over a period of four years and expire upon the earlier of (i) three months after termination of employment (or upon termination if terminated for cause), or (ii) ten years from the date of grant. The executive option grants are compensation for fiscal year 2003 granted in January 2004. |

Aggregated Option Exercises in Fiscal 2004 and Fiscal Year-End Option Values

The following table sets forth information as to the stock options exercised by the named executive officers for the year ended December 31, 2004 and the value of the options exercised at that date based on the difference between the market price of the stock and the exercise prices of the options.

Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values |

| | | | | | | | | | |

| | | | | | | Number of Securities Underlying | | Value of Unexercised |

| | | | | | | Unexercised Options at | | In-the-Money Options at |

| | | Shares Acquired | Value | December 31, 2004 (#) | | December 31, 2004 ($) (1) |

Name | | On Exercise (#) | Realized ($) | | Exercisable | Unexercisable | | Exercisable | | Unexercisable |

| | | | | | | | | | | | |

| Gary S. Kledzik | | ¾ | | $ ¾ | | 883,477 | 150,000 | | $ 18,000 | | $ ¾ |

| | | | | | | | | | | | |

| David E. Mai | | ¾ | | ¾ | | 497,338 | 75,000 | | 31,106 | | ¾ |

| | | | | | | | | | | | |

| John M. Philpott | | ¾ | | ¾ | | 181,480 | 56,250 | | 14,288 | | ¾ |

| (1) | Based on the difference between the closing price of the Common Stock as reported on theOTC Bulletin Board®, or OTCBB,as of December 31, 2004 of $1.00 and the exercise price of such options. |

Employment Agreements

The Company and Dr. Kledzik are parties to an employment agreement effective December 31, 1989, as amended (the "CEO Employment Agreement"), pursuant to which Dr. Kledzik serves as Chief Executive Officer for the Company. The CEO Employment Agreement provides for an initial employment term of one year, renewed for successive one-year terms, unless Dr. Kledzik notifies the Company in writing at least 30 days in advance of, or the Company notifies Dr. Kledzik in writing 30 days before or after, December 31 of each year. Under the terms of the CEO Employment Agreement, Dr. Kledzik is entitled to an annual salary as determined by the Compensation Committee of the Board of Directors from time to time. Dr. Kledzik's 2005 annual salary is $384,313. As of December 31, 2004, in connection with the CEO Employment Agreement and other stock option plans, Dr. Kledzik has received options to purchase a total of 1,392,943 shares of Common Stock at exercise prices ranging from $0.03 to $2.00 per share with a weighted average price of $1.14 per share. Unexercised options for 883,477 shares have vested, 150,000 shares are unvested and 359,466 shares have been exercised in prior years. Options generally vest ratably over a period of one to four years from the date of grant. The CEO Employment Agreement provides that Dr. Kledzik shall perform his duties at the Company's designated facility in Santa Barbara, California. If the CEO Employment Agreement is terminated other than at Dr. Kledzik's option or by the Company for other than cause, then the Company shall pay Dr. Kledzik severance compensation in an amount equal to the product of his monthly base salary multiplied by the greater of: (i) the number of months remaining under the term of the CEO Employment Agreement; or (ii) six. If the Company terminates Dr. Kledzik's employment for cause or Dr. Kledzik terminates his employment, he is not entitled to severance pay. "Cause" is defined in the CEO Employment Agreement to be personal dishonesty, incompetence, willful misconduct, breach of fiduciary duty involving personal profit, intentional failure to perform stated duties, willful violation of any law, rule or regulation (other than minor traffic violations) or material breach of any provision of the CEO Employment Agreement or any other agreement between Dr. Kledzik and the Company.

The Company and Mr. Mai are parties to an employment agreement effective February 1, 1991, as amended (the "Employment Agreement"), pursuant to which Mr. Mai serves as President of the Company. The Employment Agreement provides for an initial employment term of one year, renewed for successive one-year terms, unless Mr. Mai notifies the Company in writing at least 30 days in advance of, or the Company notifies Mr. Mai in writing 30 days before or after, January 1st of each year. Under the terms of the Employment Agreement, Mr. Mai is entitled to an annual salary as determined by the Compensation Committee from time to time. Mr. Mai's 2005 annual salary is $295,625. As of December 31, 2004, in connection with the Employment Agreement and other stock option plans, Mr. Mai has received options to purchase a total of 609,838 shares of Common Stock at exercise prices ranging from $0.67 to $2.00 per share with a weighted average price of $1.30 per share. Unexercised options for 497,338 shares have vested, 75,000 shares are unvested and 37,500 shares have been exercised in prior years. The options generally vest ratably over a period of one to four years from the date of grant. The remaining terms and conditions of Mr. Mai's Employment Agreement are substantially identical to those in Dr. Kledzik's agreement, except that if the Employment Agreement is terminated other than at Mr. Mai's option or by the Company for other than cause, then the Company shall pay Mr. Mai severance compensation in an amount equal to one week's salary for each six month employment period, beginning six months after the effective date of the Employment Agreement.

The Company and Mr. Philpott are parties to an employment agreement effective March 20, 1995, as amended (the "CFO Employment Agreement"), pursuant to which Mr. Philpott serves as Chief Financial Officer of the Company. The CFO Employment Agreement provides for an initial employment term of one year, renewed for successive one-year terms, unless Mr. Philpott notifies the Company in writing at least 30 days in advance of, or the Company notifies Mr. Philpott in writing 30 days before or after, March 20 of each year. Under the terms of the CFO Employment Agreement, Mr. Philpott is entitled to an annual salary as determined by the Company from time to time. Mr. Philpott's 2005 annual salary is $206,938. As of December 31, 2004,from the Company's 2000 Stock Compensation Plan, Mr. Philpott has received options to purchase a total of 245,230 shares of Common Stock at exercise prices ranging from $0.91 to $1.35 per share with a weighted average price of$1.65 per share. Unexercisedoptions for 181,480 shares have vested, 56,250 shares are unvested and 7,500 shares have been exercised in prior years. The options generally vest ratably over a period of one to four years from the date of grant. The remaining terms and conditions of Mr. Philpott's CFO Employment Agreement are substantially identical to those in Dr. Kledzik's agreement, except that if the CFO Employment Agreement is terminated other than at Mr. Philpott's option or by the Company for other than cause, then the Company shall pay Mr. Philpott severance compensation in an amount equal to one week's salary for each six month employment period, beginning six months after the effective date of the Employment Agreement.

Employee Stock Option Plans

The Company has six stock-based compensation plans which are described below: the 1989 Plan, the 1992 Plan, the 1994 Plan, the 1996 Plan or, as a group, the Prior Plans, the Miravant Medical Technologies 2000 Stock Compensation Plan or the 2000 Plan and the Non-Employee Directors Stock Option Plan or the Directors’ Plan.

The Prior Plans provided for the grant of both incentive stock options and non-statutory stock options. Stock options were granted under these plans to certain employees, corporate officers, non-employee directors and consultants. Effective June 14, 2000, the Prior Plans were superseded with the adoption of the 2000 Plan except to the extent of options outstanding under the Prior Plans. No further grants will be issued from the Prior Plans. As of April 15, 2005, there were866,904 shares outstanding under the Prior Plans.

The 2000 Plan provides for awards which include incentive stock options, non-qualified stock options, restricted shares, stock appreciation rights, performance shares, stock payments and dividend equivalent rights. Included in the 2000 Plan is an employee stock purchase program which has not yet been implemented. Officers, key employees, directors and independent contractors or agents of the Company may be eligible to participate in the 2000 Plan, except that incentive stock options may only be granted to employees of the Company. The 2000 Plan supersedes and replaces the Prior Plans and the Directors’ Plan, except to the extent of options outstanding under those plans. The purchase price for awards granted from the 2000 Plan may not be less than the fair market value at the date of grant. The maximum amount of shares that could be awarded under the 2000 Plan over its term is 10,000,000 shares, of which approximately 7,337,061 shares are outstanding under the 2000 Plan as of April 15, 2005. Awards granted under the 2000 Plan expire on the date determined by the Plan Administrators as evidenced by the award agreement, but shall not expire later than ten years from the date the award is granted except for grants of restricted shares which expire at the end of a specified period if the specified service or performance conditions have not been met.

Equity Compensation Plan Information

The following table gives information about our Common Stock that may be issued upon the exercise of options, warrants and rights under all of our existing equity compensation plans as of April 15, 2005.

Plan Category | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights | (b) Weighted average exercise price of outstanding options, warrants and rights | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column(a)) |

Equity compensation plans approved by security holders(1)(2) | 5,441,764 | $ 2.45 | 2,662,939 |

Equity compensation plans not approved by security holders(3) | 302,000 | $ 0.97 | — |

Total | 5,743,764 | $ 2.37 | 2,662,939 |

| (1) | These plans include: The 2000 Stock Compensation Plan, or 2000 Plan, the1989 Plan, the 1992 Plan, the 1994 Plan and the 1996 Plan, or the Prior Plans. The 2000 Plan has superseded the Prior Plans. |

| (2) | As of April 15, 2005, of the 5,441,764 stock options outstanding, the number of stock options outstanding from the Prior Plans was 866,904 shares and the number of stock options outstanding from the 2000 Plan was 4,643,610 shares. |

| (3) | Over time warrants to purchase shares of our Common Stock have been issued to various consultants for services which were not issued from a stockholder approved equity compensation plan. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Preferred Stock Financing

Pursuant to the terms of a securities purchase agreement the Company entered into with Advanced Cardiovascular Systems, Inc., a wholly owned subsidiary of Guidant Corporation, or ACS, on July 1, 2004, we issued an aggregate of 1,112,966 shares of our Series A-1 Convertible Preferred Stock to ACS in consideration of aggregate payments of approximately $3,000,000.

Executive Loans

In October 1996, the Board of Directors approved personal loans to the Chief Executive Officer, President and Chief Financial Officer. As of December 31, 2004, the balance of these loans was zero, as these loans were fully repaid during 2004.

In December 1997, the Compensation Committee of the Board of Directors approved non-recourse equity loans in varying amounts for the Company’s Chief Executive Officer, President and Chief Financial Officer. The notes, which accrue interest at a fixed rate of 5.8%, were provided specifically for the purpose of exercising options to acquire the Company’s Common Stock and for paying the related option exercise price and payroll taxes. The notes are collateralized by the underlying shares acquired upon exercise. During 2004, partial repayments of these loans were made in the amount of $58,000. As of December 31, 2004, the total balance of these loans including accrued interest were $115,000.

Additionally, from 1998 through 2002, the Board of Directors approved other secured loans made to the Company’s Chief Executive Officer and President; these loans accrue interest at fixed rates between 4.7% and 5.9% and as of December 31, 2004, had a total balance of $1.0 million. No future loans to executive officers have been approved after June 2002.

The loans the Company has made to officers and certain loans made to employees over the years are either unsecured, or secured by stock or stock options. The value of the stock and options securing these notes has declined significantly from the date of loan issuance due to declines in the Company’s stock price. Due to the decline in stock and option value and due to certain other factors affecting the collectability of these loans, the Company maintained a reserve for these loans to officers and employees in the amount of $709,000, during the year ended December 31, 2004. During 2004, the reserve was reduced by $92,000 to reflect officer and employee repayments of $290,000 in loans that were previously partially reserved for. As of December 31, 2004, the aggregate balance of these loans to officers and employees, net of reserves, is $524,000.

Corporate Secretary

In July 1996, a partner in a law firm used by the Company for outside legal counsel was elected by the Board of Directors to serve as Secretary of the Company. In connection with general legal services provided by the law firm, the Company was billed $96,000, $150,000 and $47,000 for the years ended December 31, 2004, 2003 and 2002, respectively. From 1996 through December 31, 2004, this individual’s law firm has received stock options to purchase a total of 176,250 shares of Common Stock with an average exercise price of $11.65 for his services as acting in-house legal counsel and Secretary of Miravant. In addition, in January 2004, theCompensation Committee of the Board of Directors approved a Stock Option Exchange Program for a non-employee director and the Corporate Secretary of the Company. This program allowed these individuals to exchange stock options that had an exercise price of greater than $5.00 for restricted Common Stock at a two for one ratio. Mr. Nida exchanged 107,500 stock options for 53,750 shares of restricted Common Stock. The restricted Common Stock was fully vested on the date of exchange.

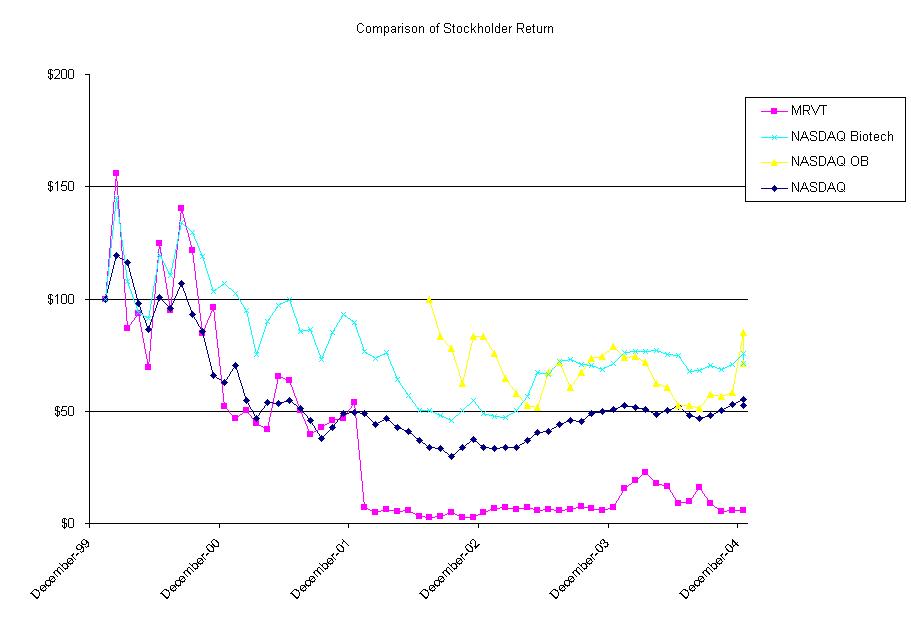

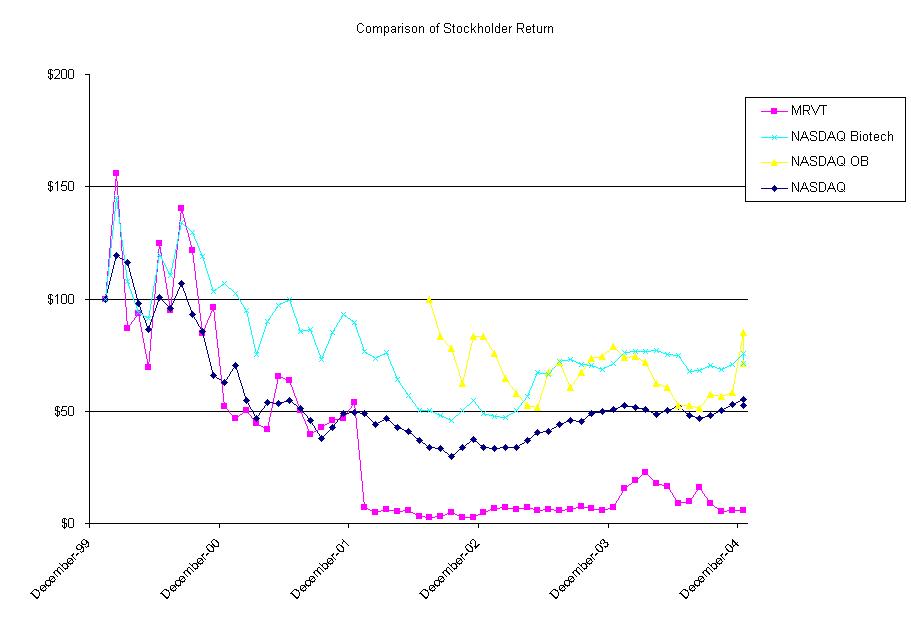

COMPARISON OF TOTAL STOCKHOLDER RETURN

The graph below compares the cumulative total stockholder return on the Common Stock with the cumulative total return on the Nasdaq Market Index and a peer group made up of the companies included in the Nasdaq Biotech Index over the period indicated (assuming the investment of $100 in the Company's Common Stock on December 31, 1999, and reinvestment of any dividends). In accordance with Securities and Exchange Commission, or SEC, regulations, the stockholder return for each entity in the peer group index has been weighted on the basis of market capitalization as of each monthly measurement date set forth on the graph. Stockholders are cautioned against drawing any conclusions from the data contained therein, as past results are not necessarily indicative of future performance. The other indices are included for comparative purposes only and do not necessarily reflect management's opinion that such indices are an appropriate measure of the relative performance of the Common Stock.

Effective as of the opening of business on July 12, 2002, our Common Stock was delisted from Nasdaq and began trading on theOTC Bulletin Board®, or OTCBB. The OTCBB is a regulated quotation service that displays real-time quotes, last-sale prices and volume information in over-the-counter equity securities. OTCBB securities are traded by a community of market makers that enter quotes and trade reports. Our Common Stock trades under the ticker symbol MRVT and can be viewed at www.otcbb.com.

ITEM NO. 1 ELECTION OF DIRECTORS |

The Bylaws of the Company authorize not more than nine nor less than four members of the Board of Directors and, effective April 25, 2002, fix the number of members at six until changed. Unless otherwise instructed, proxy holders will vote the proxies received by them for the election of the Company's six nominees named below, each to serve until the next Annual Meeting of Stockholders and until the director's successor is elected and qualified. If any stockholder gives notice in accordance with the Company's Certificate of Incorporation and applicable law of his or her intention to cumulate votes, then all stockholders may cumulate votes. If such notice is given, the proxy holders will vote the proxies received by them cumulatively in their discretion.

The following six persons nominated to be elected to serve as Directors until the 2006 Annual Meeting of Stockholders and until their successors are elected and qualified:CHARLES T. FOSCUE; BARRY JOHNSON, GARY S. KLEDZIK, Ph.D., MICHAEL KHOURY, DAVID E. MAI and ROBERT J. SUTCLIFFE.

If any nominee is unable to or declines to serve as a director at the time of the Annual Meeting, the proxy holders will vote the shares which they represent for a nominee designated by the present Board of Directors to fill the vacancy, unless the Board, to the extent permitted, reduces the number of directors. It is not presently expected that any nominee will be unable or will decline to serve as a director.

Names of the nominees and certain information about each of them are set forth below.

Charles T. Foscue, Age 56

Mr. Foscue has served as a director of the Company since July 1996. Mr. Foscue is a founder, Chairman, President and Chief Executive Officer of HAI and has held those positions since the inception of HAI in 1979. HAI serves as a corporate financial consultant in the areas of mergers and acquisitions, public and private financings, strategic planning and financial analysis. HAI and Mr. Foscue have been advisors to the Company since 1991 and have been involved in the Company's private and public financings from 1991 to the present. Prior to founding HAI, Mr. Foscue was Vice President of Marketing for Tri-Chem, Inc. Mr. Foscue holds a B.A. degree in Economics from the University of North Carolina and an M.B.A. degree from Harvard University, Graduate School of Business.

Barry Johnson, Age 41

Mr. Johnson has served as a director of the Company since November 2003. Mr. Johnson is the founder of Progressive Analysis - a medical research company studying the long-term effects of Pain Management Devices on post-operative and chronic orthopedic patients. Mr. Johnson is presently the Chief Executive Officer of MedPartners, management/consulting firm for physician owned medical equipment companies. Mr. Johnson is the founder of Pronalysis, a medical consulting and billing Management Company. Mr. Johnson is presently the president of Progressive Motion, a medical device distributing company with offices throughout the United States. Mr. Johnson is also the Chief Executive Officer of Barry Johnson Enterprises, Inc., a company that consults, manages and instructs medical professionals on starting their own businesses. Mr. Johnson is also the founder of Urgent Ortho, a surgical assisting personnel provider to hospitals. Mr. Johnson holds a B.S. degree from the University of Mississippi in Economics, Financial Management and Marketing. Mr. Johnson completed his post graduate studies with Dunn & Bradstreet in Financial Management and Dean Witter in Business Economic Strategy.

Gary S. Kledzik, Ph.D., Age 55

Dr. Kledzik is a founder of the Company and has served as a director since its inception in June 1989. He served as President of the Company from June 1989 to May 1996. He has been Chairman of the Board of Directors since July 1991 and Chief Executive Officer since September 1992. Prior to joining the Company, Dr. Kledzik was Vice President of the Glenn Foundation for Medical Research. His previous experience includes serving as Research and General Manager for an Ortho Diagnostic Systems, Inc. division of Johnson & Johnson and Vice President of Immulok, Inc., a cancer and infectious disease biotechnology company which he co-founded and which was acquired by Johnson & Johnson in 1983. Dr. Kledzik holds a B.S. in Biology and a Ph.D. in Physiology from Michigan State University.

Michael Khoury, Age 51

Mr. Khoury has served as a director of the Company since January 2005. Mr. Khoury joined Deloitte & Touche in 1989 and served as Senior Manager until 1993. From 1993 to 1998 Mr. Khoury served first as President, then as CEO of First National Mortgage Exchange. He was Senior Vice President at IMC Mortgage, a consumer finance company, from 1998 to 1999. In 1999 he became CEO of InterScore, a consulting firm that he sold in 2000 to Ballantyne, a consulting firm focused on Enterprise Resource Planning systems, where he remained as a Senior Vice President until 2003. Since then, Mr. Khoury has been a consultant to a private investment group. Mr. Khoury holds a B.S. in Mathematics from the American University of Beirut, an MFA from New York University, and an MBA from UCLA. He is a CPA and a Fulbright Scholar. He currently serves as Director on the Boards of SourcingLink, Inc., and Neurome, Inc.

David E. Mai, Age 60

Mr. Mai has served as President of the Company since May 1996, President of Miravant Cardiovascular, Inc. from September 1992 to June 2001, President of Miravant Pharmaceuticals, Inc. since July 1996 and President of Miravant Systems, Inc. since June 1997. Mr. Mai served as Vice President of Corporate Development for the Company from March 1994 until May 1996. Mr. Mai became associated with the Company in July 1990 as a consultant assisting with technology and business development. He joined the Company in 1991, serving as New Product Program Manager from February 1991 to July 1992 and as Clinical Research Manager from July 1992 to September 1992. Prior to joining the Company, Mr. Mai was Director of the Intravascular Ultrasound Division of Diasonics Corporation from 1988 to 1989. Previously, Mr. Mai served as Director of Strategic Marketing for Boston Scientific Corporation's Advanced Technologies Division, Vice President of Stanco Medical and Sales Engineer with Hewlett-Packard Medical Electronics. Mr. Mai holds a B.S. degree in Biology from the University of Hawaii.

Robert J. Sutcliffe, Age 53

Mr. Sutcliffe has served as a director of the Company since January 2005.Mr. Sutcliffe is a venture lawyer and business advisor, based in Los Angeles. He is the Managing Director of Craftsman Capital Advisors LLC, and specializes in representation of entrepreneurs and venture investors in the technology, biotechnology, hospitality, entertainment and fashion industries. He was a Partner and Chairman of the corporate practice group in the Los Angeles office of Brobeck, Phleger & Harrison, where his practice focused on venture capital, corporations and securities until 1989. He then served as Congressional Chief of Staff to his law school classmate, the Honorable Christopher Cox of California (Chairman of the House Policy Committee and the Select Committee on Homeland Security) and subsequently was a Director, Chief Operating Officer and General Counsel for International Medication Systems Limited, a Southern California-based manufacturer of pharmaceuticals and drug delivery devices. Mr. Sutcliffe also served as a director, President and CEO of Digital Gene Technologies, Inc., a genomics-based drug discovery and development company based in La Jolla, California, a company he founded in 1995 with his brother, Dr. J. Gregor Sutcliffe, a noted neuroscientist at The Scripps Research Institute. Mr. Sutcliffe is a founding Director of Neurome, Inc., a La Jolla-based discovery-stage biotechnology company that seeks therapeutic solutions to neurodegenerative diseases, including Alzheimer's disease, Amyotrophic Lateral Sclerosis (ALS), Parkinson's Disease and Huntington's disease. Mr. Sutcliffe is a graduate of UCLA and Harvard Law School.

Dr. Kledzik and Messrs. Foscue, Johnson and Mai are standing for reelection. Mr. Khoury and Mr. Sutcliffe, who joined our Board of Directors in January 2005, were introduced to us through our Corporate Secretary and after evaluation and several interviews with executive management and the Board of Directors, Mr. Khoury and Mr. Sutcliffe were appointed by the Board to fill vacant directorships.

THE BOARD OF DIRECTORS UNANAMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE ELECTION OF THE SIX NOMINEES FOR DIRECTOR NAMED IN THIS PROXY STATEMENT.

ITEM NO. 2 APPROVAL OF AN AMENDMENT TO THE COMPANY'S EXISTING CERTIFICATE OF INCORPORATION |

General

The Company's Board of Directors unanimously adopted resolutions declaring the advisability of, approving and recommending to the Company's stockholders for their approval, a proposed amendment to the Company's Certificate of Incorporation to increase the authorized number of shares of Common Stock from 75,000,000 to 100,000,000. The amendment will have the effect of increasing the number of shares of Common Stock that are available for issuance by the Company. The rights and privileges of holders of shares of Common Stock will remain the same after the amendment. A copy of the proposed Amended and Restated Certificate of Incorporation is included as Appendix A to this proxy statement.