QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

|

MIRAVANT MEDICAL TECHNOLOGIES

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Miravant Medical Technologies

336 Bollay Drive

Santa Barbara, California 93117

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 12, 2003

Notice is hereby given that the Annual Meeting of Stockholders of Miravant Medical Technologies (the "Company") will be held on Thursday, June 12, 2003, at 10:00 a.m., at The Radisson Hotel, 1111 East Cabrillo Boulevard, Santa Barbara, California, 93103, (805) 963-0744, for the following purposes:

- 1.

- To elect four Directors to serve until the 2004 Annual Meeting and until their successors are elected and qualified;

- 2.

- To ratify the appointment of Ernst & Young LLP, certified public accountants, as the Company's independent auditors for the fiscal year ending December 31, 2003; and

- 3.

- To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

These items are more fully described in the following pages. The Board of Directors has fixed the close of business onApril 28, 2003, as the record date for the determination of stockholders entitled to receive notice of and to vote at the meeting.Stockholders are reminded that shares cannot be voted unless the stockholder is present at the meeting or the signed proxy is returned or other arrangements are made to have the shares represented at the meeting.

Whether or not you expect to attend the meeting, please complete, date and sign the enclosed proxy and mail it promptly in the enclosed envelope.

| | | By Order of the Board of Directors |

|

|

|

| | | Joseph E. Nida

Secretary |

Santa Barbara, California

May 9, 2003

PLEASE SIGN AND RETURN THE ENCLOSED PROXY

TABLE OF CONTENTS

| | Page

|

|---|

| Proxy Statement | | 2 |

| Voting and Solicitation of Proxies | | 3 |

| Security Ownership of Certain Beneficial Owners and Management | | 5 |

| Board Meetings, Remuneration of Directors and Committees | | 6 |

| Report of the Audit Committee | | 7 |

| Executive Officers | | 8 |

| Compensation Committee Report on Executive Compensation | | 9 |

| Executive Compensation | | 12 |

| | Summary Compensation | | 12 |

| | Option Grants in 2002 | | 13 |

| | Aggregated Option Exercises in Fiscal 2002 | | 13 |

| | Stock Option Exchange Program | | 13 |

| | Employment Agreements | | 14 |

| | Employee Stock Option Plans | | 16 |

| Certain Relationships and Related Transactions | | 17 |

| Comparison of Total Stockholder Return | | 18 |

| Item No. 1—Election of Directors | | 19 |

Item No. 2—Proposal to Ratify Appointment of the Company's Independent

Public Accountants | | 21 |

| Compliance with Section 16(a) of the Securities Exchange Act of 1934 | | 22 |

| Other Matters | | 22 |

| Stockholder Proposals for the 2004 Proxy Statement | | 22 |

Miravant Medical Technologies

336 Bollay Drive

Santa Barbara, California 93117

PROXY STATEMENT

This Proxy Statement and the accompanying proxy card are first being mailed to stockholders on or about May 12, 2003 in connection with the solicitation of proxies on behalf of the Board of Directors (the "Board") of Miravant Medical Technologies (collectively with its subsidiaries, the "Company") for the 2003 Annual Meeting of Stockholders, to be held on Thursday, June 12, 2003, at 10:00 a.m. local time, at The Radisson Hotel, 1111 East Cabrillo Boulevard, Santa Barbara, California, or at any adjournment thereof. Proxies are solicited to give all stockholders of record at the close of business on April 28, 2003 an opportunity to vote on matters to be presented at the Annual Meeting. Shares can be voted at the meeting only if the stockholder is present or represented by proxy.

At the Annual Meeting, stockholders will be asked to consider and vote upon three items as follows:

ITEM NO. 1 To elect four Directors to serve until the 2004 Annual Meeting and until their successors are elected and qualified;

ITEM NO. 2 To ratify the appointment of Ernst & Young LLP, certified public accountants, as the Company's independent auditors for the fiscal year ending December 31, 2003; and

ITEM NO. 3 To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

��Any stockholder giving a proxy may revoke it at any time prior to its exercise at the Annual Meeting by giving notice of such revocation either personally or in writing to the Secretary of the Company at the Company's executive offices, by subsequently executing and delivering a later-dated proxy, or by voting in person at the Annual Meeting.

A copy of the Annual Report to Stockholders is included herewith but shall not constitute proxy solicitation materials.

The Board of Directors of the Company believes that the election of each of its director nominees in Item No. 1 and approval of Item No. 2 are in the best interests of the Company and its stockholders and unanimously recommends that the stockholders vote to elect each of the director nominees in Item No. 1 and vote FOR Item No. 2.

2

VOTING AND SOLICITATION OF PROXIES

Only holders of record at the close of business on April 28, 2003 (the "Record Date") of the Company's Common Stock, $.01 par value (the "Common Stock") will be entitled to vote at the Annual Meeting. On April 21, 2003, there were 24,272,305 shares of Common Stock outstanding. The holders of a majority of the outstanding shares of Common Stock present in person or by proxy and entitled to vote will constitute a quorum at the meeting. Broker non-votes (see below) will be counted toward the establishment of a quorum. On all matters to come before the Annual Meeting, each holder of Common Stock will be entitled to one vote for each share owned.

Please specify your choices on the items by marking the appropriate boxes on the enclosed proxy card and signing it. Shares represented by duly executed and unrevoked proxies in the enclosed form received by the Board will be voted at the Annual Meeting in accordance with the specifications made therein by the stockholders, unless authority to do so is withheld. If no specification is made, shares represented by duly executed and unrevoked proxies will be voted FOR the election as directors of the nominees listed in Item No. 1 and FOR Item No. 2, and with respect to any other matter that may properly come before the meeting, in the discretion of the proxy holder.

This proxy solicitation is being made by the Company. The Company intends to solicit proxies by use of the mail. In addition, solicitation of proxies may be made by personal and telephonic meetings with stockholders by directors, officers and regular employees of the Company. The cost of preparing, assembling and mailing the proxy materials will be borne by the Company.

Vote Required

The election of the director nominees pursuant to Item No. 1 requires a plurality of the votes cast in person or by proxy at the Annual Meeting. A plurality means that the nominees with the largest number of votes are elected as directors up to the maximum number of directors to be chosen at the meeting. Under Delaware law, the Company's Certificate of Incorporation and the Company's ByLaws, shares as to which a stockholder abstains or withholds from voting on the election of Directors, and shares as to which a broker indicates that it does not have discretionary authority to vote ("broker non-votes") on such nominees, will not affect the outcome of the election of directors.

If any stockholder gives notice at the meeting of his or her intention to cumulate votes in the election of directors, each stockholder will be entitled to cumulate his or her votes and give one nominee a number of votes equal to the number of directors to be elected, multiplied by the number of shares then held, or distribute the votes on the same principle among as many nominees as the stockholder deems fit. Stockholders voting by means of the accompanying proxy will be granting the proxy holders discretionary authority to vote their shares cumulatively, but such stockholders may not mark the proxy to cumulate their own votes. The Board of Directors does not presently intend to give notice to cumulate votes, but it may elect to do so in the event of a contested election or other, presently unexpected, circumstances. In the event of cumulative voting, the accompanying proxy authorizes the individuals named as proxy holders, in their discretion, to vote cumulatively and to distribute, in any manner, the votes to which each share is entitled in the election of directors, among the nominees for whom the authority to vote has not been withheld in the accompanying proxy.

The ratification of the appointment of Ernst & Young LLP as the independent auditors for the Company pursuant to Item No. 2 requires the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote. Under Delaware law, the Company's Certificate of Incorporation and the Company's ByLaws, abstentions on such proposals have the same legal effect as a vote against such proposals. Broker non-votes are not counted as shares represented and entitled to vote and therefore will not affect the outcome of the vote on such proposals.

3

A list of the stockholders of record as of the Record Date will be available for examination during ordinary business hours at least ten days prior to the Annual Meeting by any stockholder, for any purpose germane to the Annual Meeting at the Company's offices at 336 Bollay Drive, Santa Barbara, California 93117 (telephone (805) 685-9880), Attention: Shadean Runyen or John Philpott.

If you plan to attend the meeting, please mark the appropriate box on the proxy card. Stockholders whose shares are held of record by brokers or other institutions, will be admitted upon presentation of proper identification and proof of ownership (e.g., a brokers' statement) at the door.

4

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Common Stock as of April 21, 2003 by (i) each person known by the Company to own beneficially five percent or more of the outstanding shares of its Common Stock, (ii) each of the executive officers named in the Summary Compensation Table included herein, (iii) each director and nominee for director of the Company and (iv) all directors and named executive officers of the Company as a group.

Name

| | Number of Shares

Beneficially

Owned (1)(2)

| | Percentage

of Outstanding

Stock

|

|---|

| Gary S. Kledzik, Ph.D. (3) | | 2,047,472 | | 8.00% |

| St. Cloud Investment, Ltd. (4) | | 1,720,303 | | 6.82% |

| David E. Mai (3) | | 600,923 | | 2.38% |

| John M. Philpott (3) | | 269,449 | | 1.07% |

| Larry S. Barels (5) | | 269,250 | | 1.07% |

| Charles T. Foscue (6) | | 139,427 | | * |

| All directors and executive officers as a group (5 persons) | | 3,326,521 | | 13.30% |

- *

- Less than one percent.

- (1)

- Each person has sole voting and investment power over the Common Stock shown as beneficially owned, subject to community property laws where applicable and the information contained in the footnotes below.

- (2)

- Includes the following shares of Common Stock issuable upon exercise of options and/or warrants exercisable within 60 days of April 21, 2003: Dr. Kledzik—583,477 shares; St. Cloud Investments, Ltd.—233,532; Mr. Mai—274,048 shares; Mr. Philpott—103,199 shares; Mr. Barels—86,875 shares; Mr. Foscue—121,250 shares and directors and executive officers as a group—1,168,849 shares.

- (3)

- Included in the shares beneficially owned by each named executive officer are restricted shares approved in November 2002 by the Compensation Committee of the Board of Directors as part of a Stock Option Exchange Program. This program allowed these executives to exchange stock options that had an exercise price of greater than $5.00 for restricted Common Stock at a two-for-one-ratio. The restricted Common Stock will be fully vested by January 1, 2004. Dr. Kledzik exchanged 1,128,750 stock options for 564,375 shares of restricted Common Stock, Mr. Mai exchanged 578,750 stock options for 289,375 shares of restricted Common Stock, Mr. Philpott exchanged 317,500 stock options for 158,750 shares of restricted Common Stock.

- (4)

- According to the Schedule 13D filed with the SEC on March 10, 1999, St. Cloud Investments, Ltd. is a corporation organized under the laws of the British Virgin Islands and its principal business address is c/o Robert Tucker, 61 Purchase Street, Suite 2, Rye, New York 10580.

- (5)

- Excludes 5,500 shares of Common Stock to which Mr. Barels disclaims beneficial ownership. Such shares are held by his spouse and children.

- (6)

- Excludes 12,069 shares of Common Stock to which Mr. Foscue disclaims beneficial ownership. 11,521 of these shares are held by HAI Financial, Inc., of which Mr. Foscue is the Chairman, President and Chief Executive Officer and the remaining 548 shares are held in a pension plan for the benefit of Mr. Foscue.

5

BOARD MEETINGS, REMUNERATION OF DIRECTORS AND COMMITTEES

During 2002, the Board of Directors met on 4 occasions and also acted by written consent. Each director then in office attended in person or by telephone all of the Board of Director meetings and all of their respective Committee meetings.

Employees of the Company do not receive any additional compensation for serving the Company as members of the Board of Directors or any of its Committees. Directors who are not employees of the Company do not receive fees for board or committee meetings attended, but do receive an annual stock option grant under the Miravant Medical Technologies 2000 Stock Compensation Plan, or the 2000 Plan. The Company currently provides the non-employee directors with an automatic grant of nonstatutory stock options to purchase 7,500 shares of Common Stock on or about the first day of the fourth quarter of each year that a non-employee director serves on the Board of Directors. Each option vests upon the grant date and is granted at an option price equal to the fair market value of the Common Stock on the grant date. The options terminate on the earlier of 90 days from the date on which a director is no longer a member of the Board of Directors for any reason other than death, ten years from the date of grant or six months from the director's death. Non-employee directors are also eligible for discretionary awards. During the year ended December 31, 2002, the following non-employee directors were each automatically granted stock options to purchase 7,500 shares of Common Stock under the 2000 Plan: Charles T. Foscue and Larry S. Barels. The Company also issued each non-employee director a discretionary grant of 50,000 shares in February 2002 and 50,000 shares in November 2002 from the 2000 Plan, which were granted at an option price equal to the fair market value of the Common Stock on the grant date. The Company also reimburses directors for out-of-pocket expenses incurred in connection with attending Board and Committee meetings.

The Board has standing Audit and Compensation Committees. The Board does not currently have a standing nominating committee or a committee performing similar functions. The current members of each of the Board's Committees are listed below.

The Audit Committee

The Audit Committee, composed solely of outside directors, meets with the Company's independent accountants and management to discuss, recommend and review accounting principles, financial and accounting controls, the scope of the annual audit and other matters; advises the Board on matters related to accounting and auditing; and reviews management's selection of independent accountants. During 2000, the Audit Committee adopted a written charter approved by the Board. During fiscal year 2002, the members of the Audit Committee were Charles T. Foscue and Larry S. Barels. Each of the members of the Audit Committee is independent as defined under the current standards articulated by the National Association of Securities Dealers. During 2002, the Audit Committee met four times. In addition, the Chairman of the Audit Committee, Larry S. Barels, met quarterly with the Company's independent auditors and management.

The Compensation Committee

The Compensation Committee, composed solely of outside directors, reviews and takes action regarding terms of compensation, employment contracts and pension matters that concern executive officers of the Company. During fiscal year 2002, the members of the Compensation Committee were Charles T. Foscue and Larry S. Barels. During 2002, the Compensation Committee acted by written consent one time.

6

REPORT OF THE AUDIT COMMITTEE

The Securities and Exchange Commission rules require the Company to include in its proxy statement a report from the Audit Committee of the Board. The following report concerns the Committee's activities regarding oversight of the Company's financial reporting and auditing process.

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the consolidated financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Committee reviewed the audited consolidated financial statements in the Annual Report on Form 10-K with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the consolidated financial statements.

The Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited consolidated financial statements with accounting principles generally accepted in the United States, their judgments as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the Committee under generally accepted auditing standards. In addition, the Committee has discussed with the independent auditors the auditors' independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board and considered the compatibility of non-audit services with the auditors' independence.

The Committee discussed with the Company's independent auditors the overall scope and plans for their respective audit. The Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company's internal controls and the overall quality of the Company's financial reporting. The Committee discussed with the independent auditors the procedures required under SAS 61. The Committee held four meetings during fiscal year 2002. In addition, the Chairman of the Audit Committee, Larry S. Barels, met quarterly with the Company's independent auditors and management.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors (and the Board has approved) that the audited consolidated financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission. The Committee has also recommended, subject to stockholder approval, the selection of the Company's independent auditors for the fiscal year ending December 31, 2003.

| | | Audit Committee |

|

|

Larry S. Barels, Audit Committee Chair

Charles T. Foscue |

|

|

March 24, 2003 |

7

EXECUTIVE OFFICERS

The names, ages and certain additional information (if not set out in Item No. 1) of the current executive officers of the Company are as follows:

Name

| | Age

| | Position

|

|---|

| Gary S. Kledzik, Ph.D. | | 53 | | Chairman of the Board and Chief Executive Officer |

| David E. Mai | | 58 | | President and Director |

| John M. Philpott | | 42 | | Chief Financial Officer, Treasurer and Assistant Secretary |

Biographical information about Dr. Kledzik and Mr. Mai is set forth in Item No. 1.

John M. Philpott has served as Chief Financial Officer since December 1995. From March 1995 to November 1995, Mr. Philpott had served as Controller. Prior to joining the Company, Mr. Philpott was a Senior Manager with Ernst & Young LLP, which he joined in 1986. Mr. Philpott is a Certified Public Accountant in the State of California. He holds a B.S. degree in Accounting and Management Information Systems from California State University, Northridge.

8

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee (the "Committee"), composed entirely of outside directors, is responsible for the oversight and administration of executive compensation. The Committee also reviews the Company's overall compensation program as reported to the Committee by management. In establishing the Company's executive compensation program, the Committee takes into account the significance of the position to the Company, stockholder value, current market data and compensation trends for comparable companies and geographic locations, compares corporate performance to that of other companies in the same industry, gauges achievement of corporate and individual objectives and accomplishments and considers the overall effectiveness of the program in measuring and rewarding desired performance levels. These principles have been adhered to by developing incentive pay programs which provide competitive compensation and reflect the Company's performance. Both short-term and long-term incentive compensation are based on Company performance, achievement of specific milestones and the value received by stockholders. Since the Company is in the pre-commercialization stage, the use of traditional performance standards (such as revenue growth, operating income, profit levels and return on equity) is difficult and sometimes not appropriate in evaluating the performance of the executive officers on a year-to-year basis. In particular, the unique nature of the biotechnology industry, specifically the absence of commercial revenues and the fact that the Company's stock performance is often more a consequence of large market forces than that of actual Company achievements, makes it difficult to tie financial performance objectives to standard financial consideration. The Committee believes the compensation of the Company's executive officers is in the low to middle range of compensation data compiled for comparable companies.

Compensation Philosophy

The Committee bases the executive compensation program on the following principles which reflect the value created for stockholders while supporting the Company's strategic business goals:

- •

- Compensation should encourage increased stockholder value;

- •

- Compensation levels for executive officers are benchmarked to the outside market, utilizing information from general industry surveys;

- •

- Total compensation opportunity is targeted to the mid-range from comparable public companies with incremental amounts which may be earned above that level depending upon corporate and individual performance. The Committee considers it essential to the vitality of the Company that the total compensation opportunity for executive officers remain competitive in order to attract and retain the talent needed to manage and build the Company's business; and

- •

- Incentive compensation is designed to reinforce the achievement of both short-term and long-term strategic business goals and objectives of the Company.

Compensation Measurement

The Company's executive compensation is composed of three components, base salary, short-term incentives and long-term incentives, each of which is intended to serve the overall compensation philosophy.

Base Salary. The Company's salary levels are intended to be consistent with competitive pay practices and level of responsibility, with salary increases reflecting competitive trends, the overall financial position and performance of the Company, general economic conditions, as well as a number of factors relating to the particular individual, including the performance of the individual executive, and level of experience, ability and knowledge of the job.

9

Short-Term Incentives. The Compensation Committee has the ability to award cash or stock-based, short-term incentive compensation to executives under the 2000 Plan based on the executive's level of responsibility, potential contribution, the success of the Company and competitive conditions. Although no such awards have been granted under the 2000 Plan to date, the executive's actual award would generally be determined following the end of the fiscal year based on the Company's achievement of its goals and an assessment of the executive's individual performance. Although generally the Company currently does not award short-term cash incentive compensation to its executives, the Committee may in the future award cash or stock bonuses based on the achievement of target levels of growth or other performance objectives established in consultation with senior management.

Long-Term Incentives. The Committee may award long-term incentive stock compensation based upon the achievement of the Company's research and development program goals, strategic alliance collaboration goals, capital fundings and the performance of the Common Stock on the applicable trading system. Under the Company's employment agreements and the 2000 Plan, stock options and other stock awards are granted from time to time to reward key employee's contributions and as an incentive for future contributions. Such grants of awards are based primarily on a key employee's past and potential contribution to the Company's accomplishments and growth. Under the 2000 Plan, the exercise price of stock options must equal or exceed the fair market value of the Common Stock on the date of grant and no stock options granted to executive officers in 2002 were granted with an exercise price below fair market value. Generally, the options under the 2000 Plan vest over a term of one to four years and generally employees must continue to be employed by the Company for such options to vest.

The stock option grants are designed to align the interests of the executive officers with those of the stockholders and provide each individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the Company.

2002 Compensation for the Chief Executive Officer. In setting the 2002 salary and incentive award levels for the Chief Executive Officer, the Committee reviewed the Company's achievements in 2001 and the clinical results of the Company's Phase III clinical trial, which was known in January 2002. The Committee also considered the Chief Executive Officer's leadership in continuing to strategically position the Company for the development and commercialization of drugs and devices for use in photodynamic therapy in the treatment of a number of disease indications. Some of the achievements during 2001 include:

- •

- Completed the one-year follow-up in our Phase III clinical trials for the treatment of wet age-related macular degeneration;

- •

- During the last quarter of 2000, the Company began discussions with Pharmacia Corporation to establish an additional funding arrangement, which was subsequently completed in May 2001. This funding arrangement provided for up to an additional $20.0 million in future funding to the Company under certain terms and conditions;

- •

- Developed a topical formulation to be used in various dermatology indications, including psoriasis;

- •

- Prepared, submitted and had accepted by the Food and Drug Administration, or FDA, an Investigational New Drug application for psoriasis and other dermatology diseases;

- •

- Began Phase I for psoriasis;

- •

- Advanced development programs of new photosensitivity drugs for use in ophthalmology, oncology, dermatology and cardiovascular disease;

- •

- Presented preclinical and clinical data at leading cardiology and ophthalmology meetings; and

- •

- Managed the Company below the approved budget.

10

While acknowledging the importance of the above mentioned achievements, due to the negative results of the Company's Phase III clinical trial and the subsequent immediate decrease in the Company's stock price, the Committee felt it was in the best interest of the Company to preserve cash balances and reduce overall cash usage and thus determined to keep his and all employees salaries the same as 2001 and implement a short-term cost restructuring program, which included a temporary reduction in pay. In addition, the Committee approved the utilization of long-term equity compensation, such as stock options and restricted shares to help make up for the temporary salary reductions and for the lack of salary increases in 2002. Based on the above, in 2002 the Committee did not increase the Chief Executive Officer's salary, it remained the same as 2001 which was $384,313, however, for a period of 10 weeks the Chief Executive Officer took a reduction of pay by 50%, which amounted to approximately $37,000. The Committee determined to forego any short-term incentive award to the Chief Executive Officer for 2002. With respect to long-term incentives, however, the Committee approved the grant to the Chief Executive Officer of 500,000 stock options under the 2000 Plan priced at the fair market value on the grant date and vesting at the rate of 50% a year and 18,477 stock options under the 2000 Plan priced at the fair market value on the grant date, which will fully vest one year from the date of grant. In addition, in November 2002, the Compensation Committee approved a Stock Option Exchange Program for the senior executive officers of the Company. This program allowed these senior executive officers to exchange stock options that had an exercise price of greater than $5.00 for restricted Common Stock at a two-for-one ratio. Pursuant to this program, the Chief Executive Officer exchanged 1,128,750 stock options for 564,375 shares of Common Stock, which will be fully vested by January 1, 2004.

Section 162(m) Implications for Executive Compensation. It is the responsibility of the Committee to address the issues raised by Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), which makes certain "non-performance-based" compensation to certain executives of the Company in excess of $1,000,000 non-deductible to the Company. To qualify as "performance-based" under Section 162(m), compensation payments must be made pursuant to a plan, by a committee of at least two "outside" directors (as defined in the regulations promulgated under the Code) and must be based on achieving objective performance goals. In addition, the material terms of the plan must be disclosed to and approved by stockholders, and the outside directors or the Committee, as applicable, must certify that the performance goals were achieved before payments can be awarded.

The Committee, in planning for the future of the Company, has considered the impact of Section 162(m) and has taken several steps which are designed to minimize its effect to the extent practicable while maintaining competitive compensation practices. The Committee expects to continue to examine the effects of Section 162(m) and to monitor the level of compensation paid to the Company's executive officers in order to take any steps which may be appropriate in response to the provisions of Section 162(m) to the extent practicable while maintaining competitive compensation practices.

| | | Compensation Committee |

|

|

Larry S. Barels

Charles T. Foscue |

11

EXECUTIVE COMPENSATION

Summary Compensation

The following table summarizes all compensation paid to the Company's Chief Executive Officer and to the Company's other most highly compensated executive officers other than the Chief Executive Officer, whose total annual salary exceeded $100,000 for services rendered in all capacities to the Company during the fiscal years ended December 31, 2002, 2001 and 2000 (collectively, the "named executive officers").

Summary Compensation Table

| |

| | Annual Compensation

| | Long-Term

Compensation

Awards

|

|---|

Name and Principal Position

| | Year

| | Salary(1)

| | Bonus

| | Restricted Stock

(# of Shares)(2)

| | Securities

Underlying Options

(# of Shares)(3)

|

|---|

Gary S. Kledzik, Ph.D

Chairman of the Board and Chief Executive Officer | | 2002

2001

2000 | | $

| 347,359

384,313

357,500 | | $

| —

—

— | | 564,375

—

— | | 518,477

200,000

200,000 |

David E. Mai

Director and President |

|

2002

2001

2000 |

|

$

|

267,199

295,625

275,000 |

|

$

|

—

—

— |

|

289,375

—

— |

|

359,838

100,000

100,000 |

John M. Philpott

Chief Financial Officer, Treasurer and Assistant Secretary |

|

2002

2001

2000 |

|

$

|

198,979

206,938

192,500 |

|

$

|

—

—

— |

|

158,750

—

— |

|

162,730

75,000

75,000 |

- (1)

- In February 2002, the Company implemented a cost restructuring program, which consisted of a temporary reduction of pay for all employees and executives of the Company for a period of approximately ten weeks. The reduced wages for this period were exchanged for stock options at a two-for-one ratio, with an exercise price of $1.35. The Chief Executive Officer and President each took a 50% salary reduction during this period, which amounted to reduced wages of approximately $37,000 and $28,000, respectively, and stock options granted of 18,477 shares and 14,213 shares, respectively. The Chief Financial Officer took a 20% salary reduction, consistent with all the other employees of the Company, which amounted to reduced wages of approximately $8,000 and stock options granted of 3,980 shares.

- (2)

- In November 2002, the Compensation Committee of the Board of Directors approved a Stock Option Exchange Program. This program allowed eligible employees to exchange stock options that had an exercise price of greater than $5.00 for restricted Common Stock at a two-for-one ratio. The restricted Common Stock will be fully vested by January 1, 2004. Dr. Kledzik exchanged 1,128,750 stock options for 564,375 shares of restricted Common Stock, Mr. Mai exchanged 578,750 stock options for 289,375 shares of restricted Common Stock, Mr. Philpott exchanged 317,500 stock options for 158,750 shares of restricted Common Stock.

- (3)

- The options vest over a period of one to four years and expire upon the earlier of (i) three months after termination of employment (or upon termination if terminated for cause), or (ii) ten years from the date of grant.

12

Option Grants in 2002

The following table sets forth certain information as of December 31, 2002 and the year then ended concerning stock options granted to the named executive officers.

Option Grants in Last Fiscal Year

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

|---|

| | Number of

Securities

Underlying

Options Granted

(# of shares)(1)

| |

| | Weighted

Average

Exercise

Price

($/share)

| |

|

|---|

| | % of Total

Options Granted

to Employees

During the Year

| |

|

|---|

| | Expiration

Date

|

|---|

Name

| | 5%

| | 10%

|

|---|

| Gary S. Kledzik | | 518,477 | | 15.67 | % | $ | 0.98 | | 02/22/12 | | $ | 178,571 | | $ | 469,485 |

| David E. Mai | | 359,838 | | 10.87 | % | | 0.93 | | 02/22/12 | | | 209,866 | | | 531,842 |

| John M. Philpott | | 162,730 | | 4.92 | % | | 0.92 | | 02/22/12 | | | 94,231 | | | 238,799 |

- (1)

- The options vest over a period of one to two years and expire upon the earlier of (i) three months after termination of employment (or upon termination if terminated for cause), or (ii) ten years from the date of grant.

Aggregated Option Exercises in Fiscal 2002 and Fiscal Year-End Option Values

The following table sets forth information as to the stock options exercised by the named executive officers for the year ended December 31, 2002 and the value of the options exercised at that date based on the difference between the market price of the stock and the exercise prices of the options.

Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| |

| |

| | Number of

Securities Underlying Unexercised Options at December 31, 2002 (#)

| | Value of Unexercised In-the-Money Options at December 31, 2002 ($) (1)

|

|---|

Name

| | Shares Acquired

On Exercise (#)

| | Value

Realized ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Gary S. Kledzik | | — | | $ | — | | 490,000 | | 343,477 | | $ | 44,590 | | $ | 31,256 |

| David E. Mai | | — | | | — | | 228,374 | | 243,964 | | | 20,782 | | | 22,201 |

| John M. Philpott | | — | | | — | | 59,531 | | 103,199 | | | 5,417 | | | 9,391 |

- (1)

- Based on the difference between the closing price of the Common Stock as reported on the OTC Bulletin Board®, or OTCBB, as of December 31, 2002 of $0.91 and the exercise price of such options.

Stock Option Exchange Program

In November 2002, the Compensation Committee of the Board of Directors approved a Stock Option Exchange Program. This program was approved as a retention tool as well as a means to reduce the overhang resulting from the total stock options outstanding. This program allowed the senior executive officers of the Company to exchange stock options that had an exercise price of greater than $5.00 for restricted Common Stock at a two-for-one ratio. The restricted Common Stock will be fully vested by January 1, 2004. The Company's senior executive officers were included in this program. The Chief Executive Officer exchanged 1,128,750 stock options for 564,375 shares of Common Stock, the President exchanged 578,750 stock options for 289,375 shares of Common Stock, the Chief Financial Officer

13

exchanged 317,500 stock options for 158,750 shares of Common Stock. The effects of the Stock Option Exchange Program, as required to be disclosed herein, are set forth in the following table:

Ten-Year Option/SAR Amendments

Name

| | Date(1)

| | Number of

Securities

Underlying

Options/SARs

Amended or

Cancelled (#)

| | Number of

Restricted

Securities

Exchanged for

Amended or

Cancelled

Options/SARs(#)

| | Market Price

of Restricted

Securities at

Time of

Amendment

($/share) (2)

| | Weighted

Average Exercise

Price of

Options/SARs at

Time of

Amendment

($/share)

| | New

Exercise

Price

($/share)

| | Length of

Original

Option Term

Remaining at

Date of

Amendment(6)

|

|---|

| Gary S. Kledzik | | 11/18/02 | | 1,128,750 | | 564,375 | | $ | 0.45 | | $ | 20.10 | | — | (3) | — |

| David E. Mai | | 11/18/02 | | 578,750 | | 289,375 | | $ | 0.45 | | $ | 19.81 | | — | (4) | — |

| John M. Philpott | | 11/18/02 | | 317,500 | | 158,750 | | $ | 0.45 | | $ | 15.94 | | — | (5) | — |

- (1)

- This is the date the stock options were cancelled, however, although the applicable participants currently have beneficial ownership over the shares, the restricted shares were not issued on this date and will be issued pursuant to the applicable vesting schedule established under the program.

- (2)

- Based on the closing price of the Common Stock as reported on the OTCBB as of November 18, 2002.

- (3)

- With respect to Dr. Kledzik: 1,128,750 stock options were cancelled and exchanged for 564,375 restricted shares, of which 282,187 restricted shares were issued on December 17, 2002 and the per share price was $0.45. With respect to Dr. Kledzik's remaining 282,188 restricted shares scheduled to vest by January 1, 2004, the per share exercise price will be the fair market value of the Company's common stock on such vesting date.

- (4)

- The per share price of the restricted stock will be the fair market value of the Company's common stock on the applicable vesting and issuance dates. With respect to Mr. Mai: 578,750 stock options were cancelled and exchanged for 289,375 restricted shares. The restricted shares will vest by January 1, 2004.

- (5)

- The per share price of the restricted stock will be the fair market value of the Company's common stock on the applicable vesting and issuance dates. With respect to Mr. Philpott: 317,500 stock options were cancelled and exchanged for 158,750 restricted shares. The restricted shares will vest by January 1, 2004.

- (6)

- With respect to the length of the original option term remaining for the stock options cancelled, because the options were made in multiple grants, each officer had a range of dates as follows: Dr. Kledzik—December 31, 2004 to January 12, 2011; Mr. Mai—December 31, 2004 to January 12, 2011; and Mr. Philpott—November 20, 1995 to January 12, 2011.

The Stock Option Exchange Program and the disclosure set forth in the chart above have been approved by Charles T. Foscue and Larry S. Barels, the members of the Compensation Committee at the Board of Directors.

Employment Agreements

The Company and Dr. Kledzik are parties to an employment agreement effective December 31, 1989, as amended (the "CEO Employment Agreement"), pursuant to which Dr. Kledzik serves as Chief Executive Officer for the Company and its subsidiaries. The CEO Employment Agreement provides for an initial employment term of one year, renewed for successive one-year terms, unless Dr. Kledzik notifies the Company in writing at least 30 days in advance of, or the Company notifies Dr. Kledzik in writing 30 days before or after, December 31 of each year. Under the terms of the CEO Employment Agreement, Dr. Kledzik is entitled to an annual salary as determined by the Compensation Committee of the Board of Directors from time to time. The current annual salary is $384,313. As of December 31, 2002, in connection with the CEO Employment Agreement and other stock option plans, Dr. Kledzik has received options to purchase a total of 1,192,943 shares of Common Stock at exercise prices ranging from $0.03 to

14

$2.00 per share with a weighted average price of $0.92 per share. In addition, an extension of the expiration date for an additional three years for certain stock option grants expiring during 2002 issued in connection with the CEO Employment Agreement was approved by the Compensation Committee during 2002. Options for 849,466 shares have vested, of which 359,466 have been exercised. Options generally vest ratably over a period of one to four years from the date of grant. The CEO Employment Agreement provides that Dr. Kledzik shall perform his duties at the Company's designated facility in Santa Barbara, California. If the CEO Employment Agreement is terminated other than at Dr. Kledzik's option or by the Company for other than cause, then the Company shall pay Dr. Kledzik severance compensation in an amount equal to the product of his monthly base salary multiplied by the greater of: (i) the number of months remaining under the term of the CEO Employment Agreement; or (ii) six. If the Company terminates Dr. Kledzik's employment for cause or Dr. Kledzik terminates his employment, he is not entitled to severance pay. "Cause" is defined in the CEO Employment Agreement to be personal dishonesty, incompetence, willful misconduct, breach of fiduciary duty involving personal profit, intentional failure to perform stated duties, willful violation of any law, rule or regulation (other than minor traffic violations) or material breach of any provision of the CEO Employment Agreement or any other agreement between Dr. Kledzik and the Company. In addition, in connection with the execution of the CEO Employment Agreement, Dr. Kledzik executed and delivered the Company's standard form Intellectual Property and Confidentiality Agreement providing for the assignment to the Company of inventions and intellectual property created or enhanced during Dr. Kledzik's employment and providing for the protection of confidential information.

The Company and Mr. Mai are parties to an employment agreement effective February 1, 1991, as amended (the "Employment Agreement"), pursuant to which Mr. Mai serves as President of the Company and its subsidiaries. The Employment Agreement provides for an initial employment term of one year, renewed for successive one-year terms, unless Mr. Mai notifies the Company in writing at least 30 days in advance of, or the Company notifies Mr. Mai in writing 30 days before or after, January 1st of each year. Under the terms of the Employment Agreement, Mr. Mai is entitled to an annual salary as determined by the Compensation Committee from time to time. The current annual salary is $295,625. As of December 31, 2002, in connection with the Employment Agreement and other stock option plans, Mr. Mai has received options to purchase a total of 509,838 shares of Common Stock at exercise prices ranging from $0.67 to $2.00 per share with a weighted average price of $1.07 per share. In addition, an extension of the expiration date for an additional three years for certain stock option grants expiring during 2002 issued in connection with Mr. Mai's Employment Agreement was approved by the Compensation Committee during 2002. Options for 265,874 shares have vested, of which 37,500 shares have been exercised. The options generally vest ratably over a period of one to four years from the date of grant. The remaining terms and conditions of Mr. Mai's Employment Agreement are substantially identical to those in Dr. Kledzik's agreement, except that if the Employment Agreement is terminated other than at Mr. Mai's option or by the Company for other than cause, then the Company shall pay Mr. Mai severance compensation in an amount equal to one week's salary for each six month employment period, beginning six months after the effective date of the Employment Agreement.

The Company and Mr. Philpott are parties to an employment agreement effective March 20, 1995, as amended (the "CFO Employment Agreement"), pursuant to which Mr. Philpott serves as Chief Financial Officer of the Company and its subsidiaries. The CFO Employment Agreement provides for an initial employment term of one year, renewed for successive one-year terms, unless Mr. Philpott notifies the Company in writing at least 30 days in advance of, or the Company notifies Mr. Philpott in writing 30 days before or after, March 20 of each year. Under the terms of the CFO Employment Agreement, Mr. Philpott is entitled to an annual salary as determined by the Company from time to time. The current annual salary is $206,938. As of December 31, 2002, from the Company's 2000 Stock Compensation Plan, Mr. Philpott has received options to purchase a total of 170,230 shares of Common Stock at exercise prices ranging from $0.91 to $1.35 per share with a weighted average price of $0.92 per share. Options for 67,031 shares have vested, of which 7,500 shares have been exercised. The options generally vest ratably over a period of

15

one to four years from the date of grant. The remaining terms and conditions of Mr. Philpott's CFO Employment Agreement are substantially identical to those in Dr. Kledzik's agreement, except that if the CFO Employment Agreement is terminated other than at Mr. Philpott's option or by the Company for other than cause, then the Company shall pay Mr. Philpott severance compensation in an amount equal to one week's salary for each six month employment period, beginning six months after the effective date of the Employment Agreement.

Employee Stock Option Plans

The Company has had six stock-based compensation plans which are described below: the 1989 Plan, the 1992 Plan, the 1994 Plan, the 1996 Plan or, as a group, the Prior Plans, the Miravant Medical Technologies 2000 Stock Compensation Plan or the 2000 Plan and the Non-Employee Directors Stock Option Plan or the Directors' Plan.

The Prior Plans provided for the grant of both incentive stock options and non-statutory stock options. Stock options were granted under these plans to certain employees, corporate officers, non-employee directors and consultants. The purchase price of incentive stock options must equal or exceed the fair market value of the Common Stock at the grant date and the purchase price of non-statutory stock options may be less than fair market value of the Common Stock at grant date. Effective June 14, 2000, the Prior Plans were superseded with the adoption of the 2000 Plan except to the extent of options outstanding under the Prior Plans. The Company has allocated 300,000 shares, 750,000 shares, 600,000 shares and 4,000,000 shares for the 1989 Plan, the 1992 Plan, the 1994 Plan and the 1996 Plan, respectively. The outstanding shares granted under the Prior Plans generally vest in equal annual installments over four years beginning one year from the grant date and expire ten years from the original grant date. No further grants will be issued from the Prior Plans.

The 2000 Plan provides for awards which include incentive stock options, non-qualified stock options, restricted shares, stock appreciation rights, performance shares, stock payments and dividend equivalent rights. Included in the 2000 Plan is an employee stock purchase program which has not yet been implemented. Officers, key employees, directors and independent contractors or agents of the Company may be eligible to participate in the 2000 Plan, except that incentive stock options may only be granted to employees of the Company. The 2000 Plan supersedes and replaces the Prior Plans and the Directors' Plan, except to the extent of options outstanding under those plans. The purchase price for awards granted from the 2000 Plan may not be less than the fair market value at the date of grant. The maximum amount of shares that could be awarded under the 2000 Plan over its term is 8,000,000 shares, of which approximately 5,843,514 shares have been granted or issued and 1,042,499 shares have been cancelled netting 4,801,015 shares, which were granted or issued under the 2000 Plan as of December 31, 2002. Awards granted under the 2000 Plan expire on the date determined by the Plan Administrators as evidenced by the award agreement, but shall not expire later than ten years from the date the award is granted except for grants of restricted shares which expire at the end of a specified period if the specified service or performance conditions have not been met.

16

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Executive Loans

In December 1997, the Compensation Committee of the Board of Directors recommended, and subsequently approved, non-recourse equity loans in varying amounts for the Company's Chief Executive Officer, President and Chief Financial Officer. The notes, which accrue interest at a fixed rate of 5.8% and are payable in five years, were made specifically for the purpose of exercising options to acquire the Company's Common Stock and for paying the related option exercise price and payroll taxes. The notes are collateralized by the underlying shares acquired upon exercise. As of December 31, 2002, the total balance of these loans was $156,000. Additionally, from 1998 through 2002, the Board of Directors have approved other secured loans made to the Company's Chief Executive Officer and President; these loans accrue interest at fixed rates between 4.7% and 5.9% and as of December 31, 2002 and 2001, had a total balance of $914,000 and $675,000, respectively. The loans the Company has made to officers over the years are either unsecured, or secured by stock or stock options. As a result of recent legislation, no future loans to executive officers have been approved since June 2002.

17

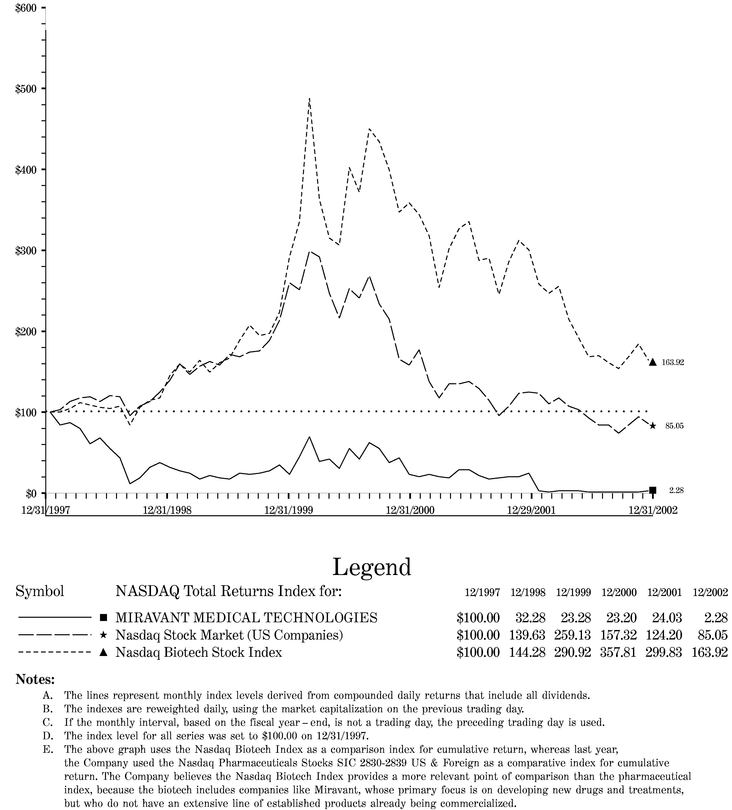

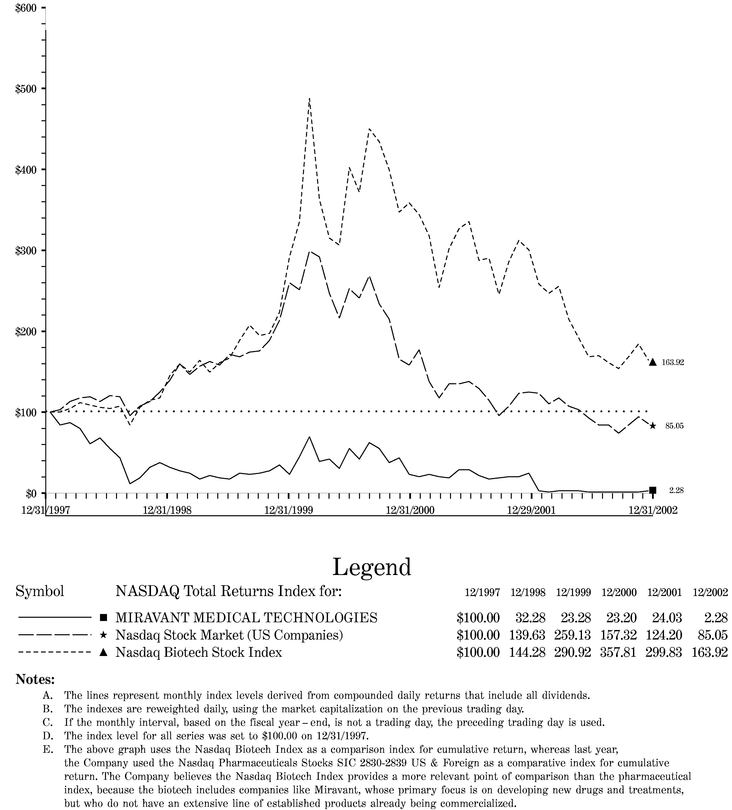

COMPARISON OF TOTAL STOCKHOLDER RETURN

The graph below compares the cumulative total stockholder return on the Common Stock with the cumulative total return on the Nasdaq Market Index and a peer group made up of the companies included in the Nasdaq Biotech Index over the period indicated (assuming the investment of $100 in the Company's Common Stock on December 31, 1997, and reinvestment of any dividends). In accordance with Securities and Exchange Commission, or SEC, regulations, the stockholder return for each entity in the peer group index has been weighted on the basis of market capitalization as of each monthly measurement date set forth on the graph. Stockholders are cautioned against drawing any conclusions from the data contained therein, as past results are not necessarily indicative of future performance. The other indices are included for comparative purposes only and do not necessarily reflect management's opinion that such indices are an appropriate measure of the relative performance of the Common Stock.

We were notified by Nasdaq on July 11, 2002 that our Common Stock would be delisted and begin trading on the OTC Bulletin Board®, or OTCBB, effective as of the opening of business on July 12, 2002. The OTCBB is a regulated quotation service that displays real-time quotes, last-sale prices and volume information in over-the-counter equity securities. OTCBB securities are traded by a community of market makers that enter quotes and trade reports. Our Common Stock trades under the ticker symbol MRVT and can be viewed at www.otcbb.com. Management continues to review our ability to regain our listing status with Nasdaq, however, there are no guarantees we will be able to raise the additional capital needed or to increase the current trading price of our Common Stock to allow us to meet the relisting requirements for the Nasdaq National Market or Nasdaq Small Cap Market on a timely basis, if at all.

18

ITEM NO. 1

ELECTION OF DIRECTORS

The ByLaws of the Company authorize not more than nine nor less than four members of the Board of Directors and, effective April 25, 2002, fix the number of members at four until changed. Unless otherwise instructed, proxy holders will vote the proxies received by them for the election of the Company's four nominees named below, each to serve until the next Annual Meeting of Stockholders and until the director's successor is elected and qualified. If any stockholder gives notice in accordance with the Company's Certificate of Incorporation and applicable law of his or her intention to cumulate votes, then all stockholders may cumulate votes. If such notice is given, the proxy holders will vote the proxies received by them cumulatively in their discretion.

The following four persons nominated to be elected to serve as Directors until the 2004 Annual Meeting of Stockholders and until their successors are elected and qualified:LARRY S. BARELS; CHARLES T. FOSCUE; GARY S. KLEDZIK, Ph.D. and DAVID E. MAI.

If any nominee is unable to or declines to serve as a director at the time of the Annual Meeting, the proxy holders will vote the shares which they represent for a nominee designated by the present Board of Directors to fill the vacancy, unless the Board, to the extent permitted, reduces the number of directors. It is not presently expected that any nominee will be unable or will decline to serve as a director.

Names of the nominees and certain information about each of them are set forth below.

Larry S. Barels, Age 54

Mr. Barels has served as a director of the Company since November 1998. Mr. Barels has been Principal of Pacific Capital Resources, his own consulting practice, from 1996 to the present. Since June 1999, Mr. Barels has been the Chairman of the Board for Driveway Corporation and from November 1998 to June 1999, he served as the President and Chief Executive Officer. From 1995 to 1997, Mr. Barels was the Chairman of Software.com, Inc., a company that develops internet and intranet-based messaging server software. From 1997 to 2001, Mr. Barels has been a partner and advisor to Vantage Point Venture Partners. From 1985 through 1995, Mr. Barels was the Chairman and Chief Executive Officer of Wavefront Technologies, a company involved in digital image manipulation and computer animation. Currently, Mr. Barels is a director of Miramar Systems and MSC Software. Mr. Barels holds a B.A. degree from Brigham Young University in Communications.

Charles T. Foscue, Age 54

Mr. Foscue has served as a director of the Company since July 1996. Mr. Foscue is a founder, Chairman, President and Chief Executive Officer of HAI and has held those positions since the inception of HAI in 1979. HAI serves as a corporate financial consultant in the areas of mergers and acquisitions, public and private financings, strategic planning and financial analysis. HAI and Mr. Foscue have been advisors to the Company since 1991 and have been involved in the Company's private and public financings from 1991 to the present. Prior to founding HAI, Mr. Foscue was Vice President of Marketing for Tri-Chem, Inc. Mr. Foscue holds a B.A. degree in Economics from the University of North Carolina and an M.B.A. degree from Harvard University, Graduate School of Business.

19

Gary S. Kledzik, Ph.D., Age 53

Dr. Kledzik is a founder of the Company and has served as a director since its inception in June 1989. He served as President of the Company from June 1989 to May 1996. He has been Chairman of the Board of Directors since July 1991 and Chief Executive Officer since September 1992. Prior to joining the Company, Dr. Kledzik was Vice President of the Glenn Foundation for Medical Research. His previous experience includes serving as Research and General Manager for an Ortho Diagnostic Systems, Inc. division of Johnson & Johnson and Vice President of Immulok, Inc., a cancer and infectious disease biotechnology company which he co-founded and which was acquired by Johnson & Johnson in 1983. Dr. Kledzik holds a B.S. in Biology and a Ph.D. in Physiology from Michigan State University.

David E. Mai, Age 58

Mr. Mai has served as President of the Company since May 1996, President of Miravant Cardiovascular, Inc. from September 1992 to June 2001, President of Miravant Pharmaceuticals, Inc. since July 1996 and President of Miravant Systems, Inc. since June 1997. Mr. Mai served as Vice President of Corporate Development for the Company from March 1994 until May 1996. Mr. Mai became associated with the Company in July 1990 as a consultant assisting with technology and business development. He joined the Company in 1991, serving as New Product Program Manager from February 1991 to July 1992 and as Clinical Research Manager from July 1992 to September 1992. Prior to joining the Company, Mr. Mai was Director of the Intravascular Ultrasound Division of Diasonics Corporation from 1988 to 1989. Previously, Mr. Mai served as Director of Strategic Marketing for Boston Scientific Corporation's Advanced Technologies Division, Vice President of Stanco Medical and Sales Engineer with Hewlett-Packard Medical Electronics. Mr. Mai holds a B.S. degree in Biology from the University of Hawaii.

THE BOARD OF DIRECTORS UNANAMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE ELECTION OF THE FOUR NOMINEES FOR DIRECTOR NAMED IN THIS PROXY STATEMENT.

20

ITEM NO. 2

PROPOSAL TO RATIFY APPOINTMENT OF

THE COMPANY'S INDEPENDENT PUBLIC ACCOUNTANTS

Subject to ratification by the stockholders, the Audit Committee of the Board of Directors has reappointed Ernst & Young LLP as independent auditors to audit the consolidated financial statements of the Company for the current fiscal year. Fees for the last annual audit, including quarterly reviews, were approximately $80,000. All other fees were approximately $47,000; including audit related services of $29,000 and non-audit services of $18,000. Audit related services generally include fees for pension and statutory audits, accounting consultations and SEC registration statements. Non-audit services primarily relate to fees for tax related services. The Audit Committee does not consider the non-audit related services provided by Ernst & Young LLP during 2002 as incompatible with Ernst & Young LLP maintaining its independence.

Representatives of the firm Ernst & Young LLP are expected to be present at the Annual Meeting and will have an opportunity to make a statement if they do so desire and will be available to respond to appropriate questions.

THE BOARD OF DIRECTORS UNANAMOUSLY

RECOMMENDS A VOTE IN FAVOR OF THIS ITEM.

21

COMPLIANCE WITH SECTION 16(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's directors and executive officers, and any persons who own more than ten percent of the Common Stock, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock. Such persons are required by the SEC regulations to furnish the Company with copies of all Section 16(a) forms filed.

To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the year ended December 31, 2002, all such Section 16(a) filing requirements were complied with, except for late filings of certain Form 4's reporting stock options granted during 2002 for Larry S. Barels and Charles T. Foscue, the Company's non-employee outside directors and for the cancellation of certain stock options in exchange for restricted Common Stock and stock options granted during 2002 for Gary S. Kledzik, David E. Mai and John M. Philpott, the Company's named executive officers.

OTHER MATTERS

The Company is unaware of any other matters to be presented at the Annual Meeting, but if any other matters should properly come before the Meeting, it is intended that the persons named in the accompanying proxy will vote the proxy in accordance with their judgment.

STOCKHOLDER PROPOSALS FOR THE 2004 PROXY STATEMENT

Any stockholder satisfying the SEC requirements and wishing to submit a proposal to be included in the Proxy Statement for the Company's 2004 Annual Meeting of Stockholders should submit the proposal in writing to Secretary, Miravant Medical Technologies, 336 Bollay Drive, Santa Barbara, California 93117 no later than January 12, 2004, in order for such proposal to be considered for inclusion in the Proxy Statement and all other conditions for such inclusion must be satisfied. Additionally, management proxy holders for the Company's 2004 Annual Meeting will have discretionary authority to vote on any stockholder proposal that is presented at such Annual Meeting, but that is not included in the Company's Proxy Statement, unless notice of such proposal is received by the Secretary on or before March 29, 2004.

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING,

PLEASE SIGN THE PROXY AND RETURN IT IN

THE ENCLOSED STAMPED ENVELOPE

Santa Barbara, California

May 9, 2003

| | | By Order of the Board of Directors |

|

|

|

| | | Joseph E. Nida

Secretary |

22

- - DETACH PROXY CARD HERE -

ANNUAL MEETING OF STOCKHOLDERS

MIRAVANT MEDICAL TECHNOLOGIES

PROXY SOLICITED BY THE BOARD OF DIRECTORS FOR THE ANNUAL MEETING

OF STOCKHOLDERS—JUNE 12, 2003

The undersigned hereby appoints Gary S. Kledzik, Ph.D. and John M. Philpott, and each of them the true and lawful attorneys in fact, agents and proxies, each with full power of substitution, to attend the annual meeting of stockholders of Miravant Medical Technologies (the "Company") to be held June 12, 2003, at 10:00 a.m. at The Radisson Hotel, Santa Barbara, California, and/or at any adjournment of the annual meeting, and to vote in the manner indicated below all shares of Common Stock which the undersigned would be entitled to vote if personally present, all in accordance with and as more fully described in the Notice of Annual Meeting and accompanying Proxy Statement, receipt of which is hereby acknowledged.

(Continued, and to be marked, dated and signed, on the other side)

- DETACH PROXY CARD HERE -

1. |

ELECTION OF DIRECTORS |

o FOR all nominees listed below

(except as marked below) |

|

o WITHHOLD AUTHORITY

to vote for all nominees listed below |

Nominees: 01 Larry S. Barels, 02 Charles T. Foscue, 03 Gary S. Kledzik, Ph.D. and 04 David E. Mai

(To withhold authority to vote for an individual write that nominee's name on space provided below.) |

|

2. |

TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY'S INDEPENDENT AUDITORS FOR THE 2003 FISCAL YEAR. |

|

o FOR o AGAINST o ABSTAIN |

3. |

IN THEIR DISCRETION, ON SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE ANNUAL MEETING OR ANY ADJOURNMENT THEREOF. |

|

|

PLEASE SIGN, DATE AND RETURN THIS PROXY IN THE ENCLOSED POSTAGE PRE-PAID ENVELOPE |

|

|

o I/WE PLAN TO ATTEND THE MEETING. If you plan to attend the meeting, please mark the box. |

|

|

|

|

IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE NOMINEES LISTED IN ITEM 1, FOR ITEM 2 AND, WITH RESPECT TO ANY OTHER MATTERS THAT PROPERLY COME BEFORE THE MEETING, IN THE DISCRETION OF THE PROXY HOLDERS. |

|

|

|

|

Date , 2003 |

|

|

|

|

(signature) |

|

|

|

|

(signature, if jointly held) |

|

|

|

|

Please mark, date and sign as your name appears below and return in the enclosed envelope. If acting as executor, administrator, trustee or guardian, state your full title and authority when signing. If the signer is a corporation, please sign the full corporation name, by a duly authorized officer. If shares are held jointly, each stockholder named should sign.

|

Please Detach Here

- You Must Detach This Portion of the Proxy Card -

Before Returning it in the Enclosed Envelope

QuickLinks

NOTICE OF ANNUAL MEETING OF STOCKHOLDERSTABLE OF CONTENTSPROXY STATEMENTVOTING AND SOLICITATION OF PROXIESSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTBOARD MEETINGS, REMUNERATION OF DIRECTORS AND COMMITTEESREPORT OF THE AUDIT COMMITTEEEXECUTIVE OFFICERSCOMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATIONEXECUTIVE COMPENSATIONCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSCOMPARISON OF TOTAL STOCKHOLDER RETURNCOMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934OTHER MATTERSSTOCKHOLDER PROPOSALS FOR THE 2004 PROXY STATEMENT