UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-08898

Buffalo High Yield Fund, Inc.

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

5420 W. 61st Place

Shawnee Mission, KS 66205

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Kent W. Gasaway

5420 W. 61st Place

Shawnee Mission, KS 66205

(Name and address of agent for service)

(Name and address of agent for service)

(913) 384-1513

Registrant's telephone number, including area code

Date of fiscal year end: March 31, 2007

Date of reporting period: March 31, 2007

Item 1. Report to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1)

I am pleased to announce that all the Buffalo Funds generated positive investment returns for the twelve months ending March 31, 2007. The accompanying portfolio management review provides a more detailed look at the results for each Fund. Total assets for the Buffalo Funds complex continue to grow steadily with over $3.3 billion of shareholder money entrusted in the Funds as of this writing.

Over the years a large portion of our shareholder base, and assets, have become associated with the Buffalo Funds for our skill in picking small and medium size growth stocks. I am very pleased to report that an increasing portion of our new shareholders over the past year have joined us after discovering the strong results and distinctive strategies of several of our other niche funds. In particular, we have seen strong interest and steady asset growth in the Buffalo Science & Technology and Buffalo Balanced Funds. More recently we have seen significant interest and growth in the Buffalo USA Global Fund.

This broadening interest in our other funds is particularly gratifying to our research and management teams that have worked so hard to make our funds successful. This hard work has resulted in positive performance (see the following fund-specific pages for more information) and favorable coverage of the Funds by the press and independent industry sources such as Morningstar and Lipper. For example, the Buffalo Balanced Fund recently received the 2007 Lipper Fund Award for the three-year, risk-adjusted performance record in its category of 298 funds in the mixed-asset target allocation moderate fund category. The Fund is managed by John Kornitzer, who took over management of the Fund in January 2003. I encourage investors that are looking for a value and income strategy to give this Fund a close look.

While “tech” sector funds have generally been out of favor with investors since the internet bust, our Science & Technology team has quietly and consistently outperformed their peers. I couldn’t be more proud of them and I encourage you to take a close look at this Fund. We remain convinced that technology and healthcare are growth industries and should represent a much bigger share of the U.S. economy in the coming years.

Next, it is exciting to see one of our specialty funds, the Buffalo USA Global Fund, gaining traction among investors. This Fund has been a strong long-term performer and we believe it can provide a great vehicle for investors to ride the globalization trend of U.S. based companies. We are particularly excited to see a greater number of small companies qualify for inclusion in this Fund (holdings must be U.S. companies which have at least 40% international revenues or profits). The rapid growth of global internet commerce and logistics has made it possible for smaller companies with great products and services to become multinational. As a result, we expect the Fund’s growth profile to gradually rise as well.

Finally, I would be remiss not to mention the strong launch of our newest product, the Buffalo Jayhawk China Fund, which commenced operations on December 18, 2006. As of this writing, the Fund has garnered $25 million of assets, has generated positive performance in the face of volatile Chinese markets and continues to attract attention. We are very proud to be associated with our well-respected sub-advisor, Jayhawk Capital Management, LLC and encourage investors to take a close look at this Fund for a small portion of their assets.

As always, we thank you for your business and support over the years. As fellow shareholders, you can be assured the Buffalo team is doing our best to look after your long-term best interests.

Sincerely,

Kent W. Gasaway

President

Buffalo Funds

Past performance does not guarantee future results. Mutual fund investing involves risk; loss of principal is possible. Please see the following Annual Report for the Funds’ holdings information.

2

PORTFOLIO MANAGEMENT REVIEW (Unaudited)

The 12 month period ending on March 31, 2007 was a rewarding one for our investors; the equity markets were generally favorable and all of the Buffalo Funds posted positive returns, with the Buffalo Large Cap, Micro Cap, Science & Technology, Small Cap and USA Global Funds beating their benchmarks. As of the end of March 2007, the economic momentum in the U.S. was slowing; housing, as we had predicted, is causing more pain than euphoria; and gasoline and oil prices crept back toward the high end of their recent ranges. The Federal Reserve has been stuck in neutral since their June 2006 increase in the Fed Funds rate as they try to tiptoe between the divergent forces of slowing economic growth and inflationary pressures. It’s a difficult proposition to correctly discern short-term economic prospects. However, you can be sure that we will continue to focus on the fundamental long-term prospects of our holdings and we believe that our emphasis on underlying secular growth trends to identify prospective investments should continue to benefit our shareholders throughout economic cycles. These companies should perform strongly in this environment, and we believe they could receive premium valuations relative to the overall market.

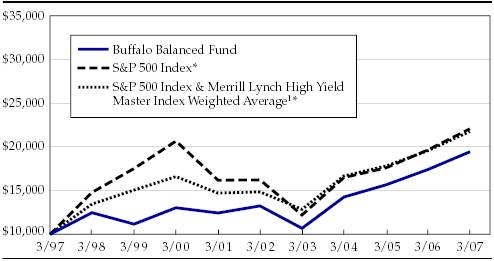

For the 1-year period ending March 31, 2007 the Buffalo Balanced Fund slightly underperformed the blended index we use for comparison purposes, which is a weighted average made up of 60% of the S&P 500 Index and 40% of the Merrill Lynch High Yield Master Index. The Fund also underperformed the S&P 500 Index, its broad-based index. The Fund was up 11.67% for the year, while our blended and broad-based indices were up 11.71% and 11.83%, respectively. See the Investment Results table for comparative performance information.

The Fund is run using a value and income strategy, and currently has approximately 61% of the portfolio invested in equities and 31% in bonds. This particular Fund does not use the firm’s trend-based strategy used for investing in growth stocks. The majority of equities chosen for this Fund are income and/or value oriented. The Fund looks for equities that increase their dividend at least every other year. We buy companies that have good cash flows, stock repurchases and rising earnings, and we look for shareholder friendliness and integrity of management.

For the year ending March 31, 2007, the Fund was helped by strong stock performance in the energy, financials and consumer staples sectors. Top performers included Marathon Oil Corp., ChevronTexaco Corp., JP Morgan Chase & Co., Bank of America Corp., Colgate-Palmolive Co. and Kellogg Co.

Bonds held in the Fund are primarily high yield corporate bonds, with some convertibles as well. We buy mostly unsecured, high yield bonds with ratings of BBB or lower, feeling that we can add value in that area because of our portfolio manager and research team’s depth and experience.

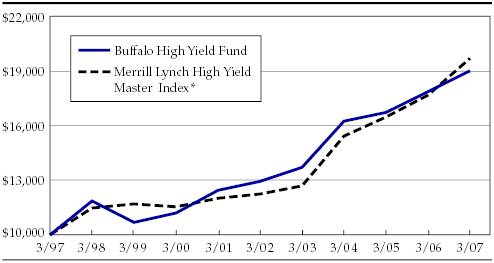

The Buffalo High Yield Fund underperformed the Merrill Lynch High Yield Master Index for the year. The Fund returned 6.42% compared to a return of 11.45% for the Merrill Lynch High Yield Master Index. See the Investment Results table for comparative performance information.

Given our long term strategy, there was no material change in the composition of the portfolio during the year. At year end, corporate bonds, convertibles and cash represented approximately 70%, 20% and 10% of the portfolio, respectively. The corporate bond segment is diversified across industries with a focus on companies that are not overly economically sensitive. Currently, gaming represents the largest industry within our corporate bond holdings and reflects our positive outlook on the sector, which is primarily driven by demographics and the aging of the baby boomers. Although there has been increased leverage buyout activity in this space (i.e. Harrah’s, Aztar, Station), we are confident that our gaming holdings should continue to perform well. Within the convertible segment, our strategy is similar to most of our equity portfolios at the Buffalo Funds, where we look for companies that should benefit from long-term trends. Our cash position is currently higher than we prefer but we remain disciplined with respect to price and plan to deploy the cash opportunistically.

3

(Continued)

In terms of credit quality, our corporate bonds are primarily rated in the single Bs by the rating agencies* but are names that we know very well, are extremely optimistic about, and whose corresponding common stocks we track closely. We continue to stay away from emerging market (and all foreign) bonds and most bonds issued in connection with leveraged buyouts, feeling that there could be severe problems with many of these investments in a decelerating economy.

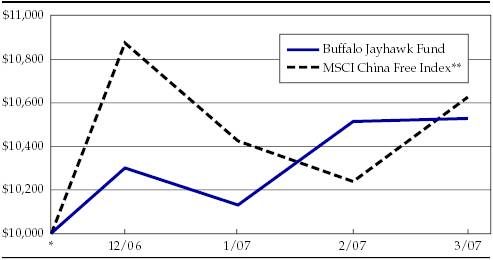

The Buffalo Jayhawk China Fund commenced operations on December 18, 2006, so a full year of data is not available. From its inception through March 31, 2007, the Fund returned 5.30% versus the MSCI China Free Index of 6.28%. For the first quarter of 2007, the Fund was up 2.13%, which compares favorably with the negative performance of the MSCI China Free Index of -2.30% for the quarter. See the Investment Results table for comparative performance information.**

The Fund’s sub-advisor, Jayhawk Capital Management, LLC, employs an investment strategy that is driven by a bottom-up stock and value focus. Therefore, during the quarter, the Fund’s performance was helped by our avoidance of high valuation stocks in overbought sectors of the stock market. The performance going back to inception includes the first several weeks of the Fund’s existence, when the Fund was moving from cash to being fully invested. The cash holdings in the Fund pulled down performance during a strong month for the Chinese market. The largest holdings of the portfolio tend to be in small capitalization stocks that we feel are deeply undervalued. During the sell-off in shares of Chinese companies in mid-February to early March, these stocks were defensive and stood up well to the selling. In addition, our avoidance of the big Chinese banks and life insurance companies also helped the Fund’s performance. The share prices of these companies declined as investors sold liquid, widely held and richly valued stocks.

The People’s Bank of China (PBoC) raised its benchmark one year lending and savings rates by 27 basis points to 6.39% and 2.79%, respectively. These increases were the first in a seven month hiatus and indicate the Chinese government’s decisiveness to tighten its still overheated economy. We expect the rate increases to continue albeit at an incremental level, not a drastic one. Commercial banks and real estate stocks are likely to be negatively affected; the Fund has virtually no exposure to these sectors.

The movement of China’s currency, the renminbi, has been carefully controlled by the government. Policy makers are afraid that if the currency, which most believe to be undervalued, rises too much, too quickly, it will result in China’s exports becoming less competitive. There appears to be no real pressure on export performance from the appreciating renminbi. China’s competitive position has barely changed over the last eight years. Appreciation against the dollar and yen has been more than offset by depreciation against the euro. The Chinese authorities are loath to see a fall in exports and a resulting steep decline in economic growth. Hence, we believe it is unlikely that the renminbi will be revalued quickly or steeply. The more likely scenario is that it will rise gradually by about 4-5% in 2007.

Although the Chinese government would like to see some slowing of the economy, it is not likely to want significant slowing. China, as it has done since economic liberalization began in 1979, must steer between the proverbial rock and hard place; overheating and recession. Two factors are seen to support growth in China’s economy. First, Beijing is not keen to let economic growth slip before the Olympics in 2008. Second, conventional thinking has it that any growth less than 6% will result in social instability. For these reasons, the Chinese government is forecasting 2007 GDP growth of 8%. Consensus economists’ forecast is for 9.7% GDP growth with perhaps only one economist going for 5-7% growth. Thus, while the Chinese economy may slow, we anticipate that it will not do so precipitously.

There are risks. One is that the full impact of tightening may coincide with a possible U.S. recession. This double blow may cause more serious economic slowing than expected, with the added risk that capital flows into the country might reverse. The common belief at the moment is that global liquidity is plentiful and should increasingly concentrate in Asia, in particular China. However the torrent of capital into China could easily become a trickle, especially if the key driver of the economy, exports, is undermined by a failing economy.

4

Yet, we believe these cyclical risks do not undermine the long-term growth story of China. In the short- and medium-term, we believe that the Fund is well positioned to weather a cyclical slowdown in China’s economy because of our value driven investment style. Many of our top ten holdings trade at single digit price earnings ratios for next year. We look for companies that we believe hold a dominant position in their sector and have specific competitive advantages, such as technology, influence or distribution channels. In addition, we select stocks that, in our opinion, have been wrongly analyzed using incorrect metrics and therefore, priced erroneously by the market.

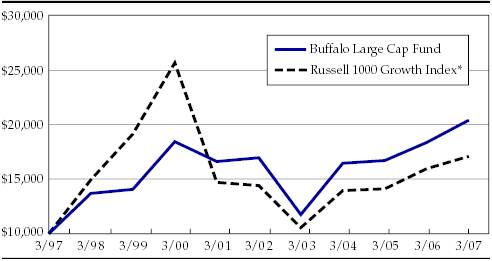

The Buffalo Large Cap Fund outperformed the Russell 1000 Growth Index for the year ending March 31, 2007. The Fund ended the fiscal year up 11.10% compared to 7.06% for the Russell 1000 Growth Index. See the Investment Results table for comparative performance information.

Three of the four top performing sectors in the Russell 1000 Growth Index were areas we were not invested in (energy, telecommunications and utilities) because of our focus on long-term growth, rather than cyclical industries. We were able to outperform due to stock selection within our target sectors which are driven by our strategy that first identifies long-term fundamental trends, and then identifies the potential beneficiary companies that we believe can sustain or grow their profit margins, have solid management teams and have the financial strength to weather difficult economic environments.

The Fund’s heaviest weighting was in the healthcare sector where strong stock selection made healthcare our most significant contributing sector. Consumer discretionary, materials and financials represented smaller portions of the portfolio, but were also strong contributors to performance.

Particular holdings that were noteworthy for the year include Marriott International, Inc., Baxter International, Inc. and Bayer AG. Marriott International, Inc. benefited from continued strength in REVPAR (revenue per available room), while Baxter benefited from its restructuring efforts. Bayer AG contributed to the Fund’s performance significantly as the company continues to transform itself from a commodity basic material supplier to a proprietary pharmaceutical company. On the downside, Motorola, Inc. turned in a poor performance as attempts to gain market share through price cutting impacted the company’s bottom line.

We expect economic growth to continue slowing in the coming months; an environment which is more conducive to the secular growth stocks in which we invest. The Fund has been positioned with limited exposure to the cyclical commodity and industrial sectors, and we have reduced the Fund’s exposure to consumer discretionary spending generally. With a somewhat slower growth outlook, we will continue to focus on companies that we believe should grow through any economic cycle. As always, valuation and the insight on prospective risk and reward it might provide, is an important component to our style of growth investing.

The style we adhere to in all our equity funds is “long-term investments in growth companies at a reasonable price”, so the outperformance by our Fund of the Russell 1000 Growth Index for the year is noteworthy, during a time when sectors which we typically underweight are outperforming. While large cap growth stocks have generally underperformed over the last 5 years, we believe that the prospects for them to continue to regain positive market leadership are favorable, given their relative fundamental stability in this time of slowing economic growth.

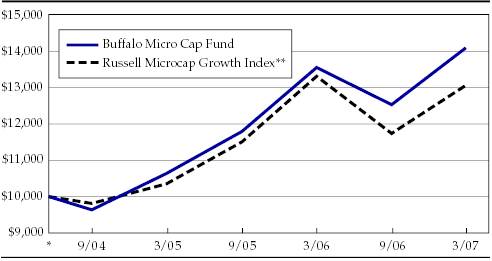

The Buffalo Micro Cap Fund outperformed its primary benchmark, the Russell Microcap Growth Index for the 1-year period ending March 31, 2007 as the Fund posted an annual return of 4.13% versus -1.96% for the benchmark. See the Investment Results table for comparative performance information. As a group, micro cap stocks as defined by the Russell Microcap Growth Index trailed small cap stocks as defined by the Russell 2000 Growth Index for the year.

5

(Continued)

The contributors to performance this year included Orient-Express Hotels Ltd. on general buyout news in the hotel sector, MarketAxess Holdings, Inc. (an electronic trading platform for corporate and high yield bonds) on increased volumes in the fixed-income area, and Align Technology, Inc. on expansion of the company’s penetration of the orthodontic market. Our more significant negative contributors to performance included Neurometrix, Inc., PDF Solutions, Inc. and Jupitermedia Corp.

We continue to find new ideas which fit nicely within the Fund’s limited capitalization mandate. However, the Fund is primarily available only to direct investors and certain retirement plans.

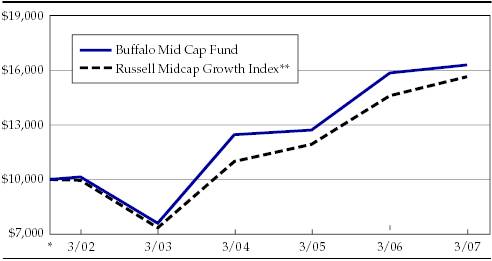

The Buffalo Mid Cap Fund underperformed the Russell Midcap Growth Index for the year, posting a return of 2.41% versus 6.90% for its benchmark. See the Investment Results table for comparative performance information. During the year, the Fund fought against headwinds from energy, materials and utilities, which were among the strongest sectors in the Russell Midcap Growth Index, each producing double-digit returns. Unfortunately, our individual stock picking didn’t make up for our sector positioning.

Technology was one of the weakest sectors in the Russell Midcap Growth Index, but we weren’t able to take advantage of this lull to make any serious relative performance headway with our heavier weighting. In addition, while we were overweight healthcare, our stock picks therein didn’t contribute significantly to overall performance. We generated solid results in the consumer discretionary sector, with strong performance by many of our retail stocks. However, for the year, our strongest names were scattered throughout the various sectors, with performances by Polo Ralph Lauren Corp., Shire Pharmaceuticals PLC and F5 Networks, Inc. being particularly noteworthy. Stocks which held us back included Jabil Circuit, Inc., Amylin Pharmaceuticals, Inc. and Chico’s FAS, Inc.

The Buffalo Science & Technology Fund outperformed the NASDAQ Composite Index for the 1-year period ending March 31, 2007. The Fund ended the fiscal year up 4.28% compared to 3.50% for the NASDAQ Composite Index. See the Investment Results table for comparative performance information.

We believe our portfolio construction has had the biggest impact on our long-term outperformance. The portfolio has benefited from our recognition that science and technology is not just information technology. We, like the Merriam-Webster Collegiate Encyclopedia, believe that technology is the “application of knowledge to the practical aims of human life or to changing and manipulating the human environment. Technology includes the use of materials, tools, techniques and sources of power to make life easier or more pleasant and work more productive.” We have also benefited by taking a broader interpretation of technology that includes information, healthcare and industrial technology, while our peers tend to have a higher concentration of information technology in their science and technology funds. We favor a broad universe and we feel we have the diverse skill sets within our firm that offer us the ability to go where we believe the opportunity is.

For the year ending March 31, 2007, the Fund was weighted approximately 37% healthcare and 53% technology. We continued to make minor adjustments to the Fund to reallocate capital to what we believed offered the best risk-adjusted return potential. We ended the year with 70 holdings, within our targeted range of 65-75 holdings. The Fund’s outperformance was due to our continued focus on investing in companies that are beneficiaries of long-term secular growth trends and our valuation discipline.

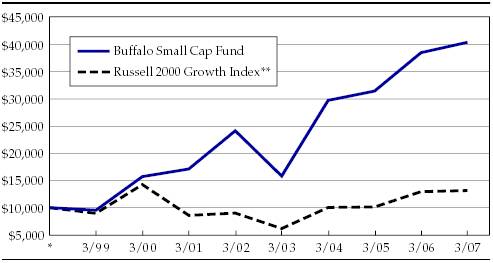

The Buffalo Small Cap Fund outperformed the Russell 2000 Growth Index for the 1-year period ending March 31, 2007. The Fund ended the fiscal year up 4.95% compared to 1.56% for the Russell 2000 Growth Index. See the Investment Results table for comparative performance information.

Relative to the Russell 2000 Growth Index, the Fund’s sector weightings detracted somewhat from our relative performance for the year. Our zero weighting in the energy and materials sectors probably hindered us the most; however, this was offset by our individual stock selection.

6

Healthcare and consumer discretionary were the Fund’s biggest sector contributors due to the Fund’s heavier weighting and stock selection within the sectors. In the consumer discretionary sector, WMS Industrials, Inc. and Gamestop Corp. were strong performers with solid weightings. Gamestop is benefiting from the rollout of new video gaming consoles and software, while WMS Industrials, Inc. is benefiting from market share gains in its primary casino markets. In healthcare, Immucor, Inc. was among the top performers. Stock selection generally provided positive relative performance with other holdings such as Dolby Laboratories, Inc. and Heidrick & Struggles International, Inc. enhancing the performance.

The Buffalo USA Global Fund outperformed the Russell 1000 Growth Index and Russell 3000 Growth Index for the year ending March 31, 2007. The Fund ended the fiscal year up 11.86% compared to returns of 7.06% and 6.53% for the Russell 1000 Growth Index and Russell 3000 Growth Index, respectively. See the Investment Results table for comparative performance information.

The Fund invests in U.S. based companies that are particularly well positioned to benefit from global economic growth. We are not particularly constrained in this Fund, investing in growth companies from a broad spectrum of market capitalizations, industries and geographic exposures. Using this approach, shareholders gain exposure to much of the dynamic growth endemic to an increasingly globally based economy. The main constraint on the Fund is a requirement to focus its investments on U.S. based companies with a large foreign revenue and income component.

The Fund’s outperformance this year was almost entirely driven by stock selection as our more heavily weighted sectors were out of favor with the rest of the market. Consumer discretionary and healthcare were the top contributing sectors to our performance. The Fund’s other significant weighting is in technology, which underperformed somewhat.

Particular holdings that were noteworthy for the year include Abbott Laboratories and Las Vegas Sands Corp. Abbott Laboratories benefited from a continuing move to a more growth focused healthcare portfolio, including European approval of its Xience stent and a positive reception for the clinical trial results of a fully bioabsorbable drug eluting stent. Las Vegas Sands Corp. benefited from significant strength in its Macau properties and expansion of its base of global casino and resort opportunities. One of the stocks that didn’t fair as well was Molex, Inc. due to concerns of inventory build-up and future demand for electronic products.

We continue to see expansion of global trade and development that we anticipate should benefit this Fund. We fully anticipate that US companies with valuable intellectual property should continue to prosper in this environment. It’s worth noting that if the dollar weakens relative to other currencies, we anticipate that the companies in which this Fund invests should be that much more competitive globally.

Sincerely,

|  |  |

John C. Kornitzer President | Kent W. Gasaway Sr. Vice President | Robert Male Sr. Vice President |

|  | |

Grant P. Sarris Sr. Vice President | William J. Kornitzer III Sr. Vice President |

* According to S&P, “an obligation rated ‘B’ is more vulnerable to nonpayment than obligations rated ‘BB’, but the obligor currently has the capacity to meet its financial commitment on the obligation. Adverse business, financial, or economic conditions will likely impair the obligor’s capacity or willingness to meet its financial commitment on the obligation.”

** The Fund has recently commenced operations and, therefore, has a short performance history. The performance shown for the Fund may not be indicative of, nor is it a guarantee of, the Fund’s long-term performance.

7

Buffalo Balanced Fund

Hypothetical Growth of a $10,000 Investment

* unmanaged indices

1 The performance figure shown for comparison purposes is a weighted average made up of 60% of the S&P 500 Index and 40% of the Merrill Lynch High Yield Master Index.

The S&P 500 Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure broad domestic securities markets.

The Merrill Lynch High Yield Master Index is an unmanaged index comprised of over 1,200 high yield bonds representative of the high yield bond market as a whole.

Buffalo High Yield Fund

Hypothetical Growth of a $10,000 Investment

* unmanaged bond index

The Merrill Lynch High Yield Master Index is an unmanaged index comprised of over 1,200 high yield bonds representative of the high yield bond market as a whole.

Buffalo Jayhawk China Fund

Hypothetical Growth of a $10,000 Investment

* 12/18/06 inception

** unmanaged stock index

The MSCI China Free Index is a capitalization weighted index that measures the performance of stocks from the country of China.

Buffalo Large Cap Fund

Hypothetical Growth of a $10,000 Investment

* unmanaged stock index

The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Index consists of the 1,000 largest companies in the Russell 3000 Index.

Buffalo Micro Cap Fund

Hypothetical Growth of a $10,000 Investment

* 5/21/04 inception

** unmanaged stock index

The Russell Microcap Growth Index measures the performance of those Russell Microcap companies with higher price-to-book ratios and higher forecasted growth values. The Russell Microcap Index consists of the smallest 1,000 companies in the small-cap Russell 2000 Index plus the next 1,000 securities.

8

Buffalo Mid Cap Fund

Hypothetical Growth of a $10,000 Investment

* 12/17/01 inception

** unmanaged stock index

The Russell Midcap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap Index consists of the 800 smallest companies in the Russell 1000 Index.

Buffalo Science & Technology Fund

Hypothetical Growth of a $10,000 Investment

* 4/16/01 inception

** unmanaged stock index

The NASDAQ Composite Index is a broad-based capitalization-weighted index of stocks in all three NASDAQ tiers: Global Select, Global Market and Capital Market.

Buffalo Small Cap Fund

Hypothetical Growth of a $10,000 Investment

* 4/14/98 inception

** unmanaged stock index

The Russell 2000 Growth Index measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Buffalo USA Global Fund

Hypothetical Growth of a $10,000 Investment

* unmanaged stock index

The Russell 3000 Growth Index measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Index consists of the 3,000 largest companies based on total market capitalization.

9

| Total Returns as of March 31, 2007 (Unaudited) | ||||||||

| AVERAGE ANNUAL | ||||||||

| GROSS EXPENSE RATIO | THREE MONTHS | ONE YEAR | FIVE YEARS | TEN YEARS | SINCE INCEPTION | |||

| Buffalo Balanced Fund (inception date 8/12/94) | 1.03% | 0.69% | 11.67% | 7.99% | 6.88% | 8.09% | ||

| S&P 500 Index | N/A | 0.64% | 11.83% | 6.27% | 8.20% | 11.24% | ||

| S&P 500 Index & Merrill Lynch High Yield | ||||||||

| Master Index Weighted Average(1) | N/A | 1.46% | 11.71% | 7.89% | 7.96% | 10.23% | ||

| Lipper Balanced Funds Index | N/A | 1.56% | 9.76% | 6.71% | 7.55% | 8.83% | ||

| Buffalo High Yield Fund (inception date 5/19/95) | 1.02% | 2.08% | 6.42% | 8.01% | 6.65% | 8.14% | ||

| Merrill Lynch High Yield Master Index | N/A | 2.67% | 11.45% | 10.00% | 7.03% | 7.62% | ||

| Lipper High Yield Bond Funds Index | N/A | 2.71% | 10.33% | 9.57% | 5.27% | 6.15% | ||

| Buffalo Jayhawk China Fund (inception date 12/18/06) | 1.84% | (4) | 2.13% | N/A | N/A | N/A | 5.30% | (3) |

| MSCI China Free Index | N/A | -2.30% | N/A | N/A | N/A | 6.28% | (3) | |

| Buffalo Large Cap Fund (inception date 5/19/95) | 1.04% | (4) | 3.90% | 11.10% | 3.77% | 7.40% | 10.29% | |

| Russell 1000 Growth Index(2) | N/A | 1.19% | 7.06% | 3.48% | 5.51% | 8.26% | ||

| S&P 500 Index | N/A | 0.64% | 11.83% | 6.27% | 8.20% | 10.71% | ||

| Lipper Large-Cap Growth Fund Index | N/A | 1.02% | 3.39% | 2.75% | 4.89% | 7.38% | ||

| Buffalo Micro Cap Fund (inception date 5/21/04) | 1.51% | (4) | 2.23% | 4.13% | N/A | N/A | 12.76% | |

| Russell Microcap Growth Index(2) | N/A | 0.64% | -1.96% | N/A | N/A | 9.81% | ||

| Russell 2000 Index | N/A | 1.95% | 5.91% | N/A | N/A | 15.70% | ||

| Lipper Micro-Cap Funds Index | N/A | 2.31% | 2.75% | N/A | N/A | 13.71% | ||

| Buffalo Mid Cap Fund (inception date 12/17/01) | 1.02% | 3.46% | 2.41% | 9.98% | N/A | 9.66% | ||

| Russell Midcap Growth Index(2) | N/A | 3.96% | 6.90% | 9.45% | N/A | 8.83% | ||

| S&P Midcap 400 Index | N/A | 5.80% | 8.44% | 10.70% | N/A | 11.95% | ||

| Lipper Mid-Cap Growth Funds Index | N/A | 4.74% | 6.22% | 7.70% | N/A | 7.07% | ||

| Buffalo Science & Technology Fund( inception date 4/16/01) | 1.03% | 2.67% | 4.28% | 7.06% | N/A | 6.21% | ||

| NASDAQ Composite Index(2) | N/A | 0.26% | 3.50% | 5.59% | N/A | 4.07% | ||

| S&P 500 Index | N/A | 0.64% | 11.83% | 6.27% | N/A | 4.98% | ||

| Lipper Science & Technology Funds Index | N/A | 1.43% | 1.16% | 2.55% | N/A | -1.03% | ||

| Buffalo Small Cap Fund (inception date 4/14/98) | 1.01% | 3.93% | 4.95% | 10.86% | N/A | 16.87% | ||

| Russell 2000 Growth Index(2) | N/A | 2.48% | 1.56% | 7.88% | N/A | 2.95% | ||

| S&P Smallcap 600 Index | N/A | 3.21% | 5.29% | 11.69% | N/A | 9.13% | ||

| Lipper Small-Cap Growth Funds Index | N/A | 3.41% | 1.96% | 7.26% | N/A | 5.51% | ||

| Buffalo USA Global Fund (inception date 5/19/95) | 1.04% | 3.95% | 11.86% | 5.09% | 8.59% | 11.08% | ||

| Russell 3000 Growth Index(2) | N/A | 1.29% | 6.53% | 3.81% | 5.54% | 8.19% | ||

| Russell 1000 Growth Index | N/A | 1.19% | 7.06% | 3.48% | 5.51% | 8.26% | ||

| S&P 500 Index | N/A | 0.64% | 11.83% | 6.27% | 8.20% | 10.71% | ||

| Lipper Multi-Cap Growth Fund Index | N/A | 1.50% | 4.81% | 5.77% | 6.94% | 8.62% | ||

(1) The performance figure shown for comparison purposes is a weighted average made up of 60% of the S&P 500 Index and 40% of the Merrill Lynch U.S. Domestic Master Index.

(2) This is a new index that has been chosen because the Portfolio Managers believe it is the most appropriate broad-based securities index to be used for comparative purposes given the investment growth-oriented strategy. The securities index that has historically been shown for comparative purposes is also shown, but may be excluded for future shareholder reports and prospectuses.

(3) Cumulative since inception date 12/18/06.

(4) The gross expense ratio shown is from the prospectus dated 7/28/06. Please refer to the financial highlights section for the most current gross expense ratio.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.buffalofunds.com.

10

The Buffalo Balanced, Jayhawk China, Large Cap, Mid Cap, Science & Technology and USA Global Funds impose a 2.00% redemption fee on shares held for less than 60 days and the Buffalo High Yield, Micro Cap and Small Cap Funds impose a 2.00% redemption fee on shares held less than 180 days. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

The Funds’ returns shown do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of shares. The benchmark returns shown, excluding the Lipper Indices, reflect the reinvestment of dividends and capital gains but do not reflect the deduction of any investment management fees, other expenses or taxes. The performance of the Lipper Indices is presented net of the Funds’ fees and expenses; however, applicable sales charges are not taken into consideration. One cannot invest directly in an index.

The S&P 500 Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure broad domestic securities markets. The Merrill Lynch High Yield Master Index is an unmanaged index comprised of over 1,200 high yield bonds representative of high yield bond markets as a whole. The Lipper Balanced Funds Index is an unmanaged, net asset value weighted index of the 30 largest balanced mutual funds. The Lipper High Yield Bond Funds Index is a widely recognized index of the 30 largest mutual funds that invest primarily in high yield bonds. The MSCI China Free Index is a capitalization weighted index that measures the performance of stocks from the country of China. The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Index consists of the 1,000 largest companies in the Russell 3000 Index. The Lipper Large-Cap Growth Funds Index is an unmanaged, equally weighted performance index of the 30 largest qualifying mutual funds (based on net assets) in the Lipper Large-Cap classification. The Russell Microcap Growth Index measures the performance of those Russell Microcap companies with higher price-to-book ratios and higher forecasted growth values. The Russell Microcap Index consists of the smallest 1,000 companies in the small-cap Russell 2000 Index plus the next 1,000 securities. The Russell 2000 Index consists of the smallest 2,000 securities in the Russell 3000 Index, representing approximately 8% of the Russell 3000 total market capitalization. The Lipper Micro-Cap Funds Index is an unmanaged equally weighted performance index of the 30 largest qualifying mutual funds (based on net assets) in the Lipper Micro-Cap classification. The Russell Midcap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap Index consists of the 800 smallest companies in the Russell 1000 Index. The S&P Midcap 400 Index consists of 400 domestic stocks chosen for market size, liquidity and industry group representation. It is a market-weighted index with each stock affecting the index in proportion to its market value. The Lipper Mid-Cap Growth Funds Index is an unmanaged, equally weighted performance index of the 30 largest qualifying mutual funds (based on net assets) in the Lipper Mid-Cap classification. The NASDAQ Composite Index is a broad-based capitalization-weighted index of stocks in all three NASDAQ tiers: Global Select, Global Market and Capital Market. The Lipper Science & Technology Funds Index is an unmanaged, equally weighted performance index of the 30 largest qualifying mutual funds (based on net assets) in the Lipper Science and Technology classification. The Russell 2000 Growth Index measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values. The S&P Smallcap 600 Index consists of 600 domestic stocks chosen for market size, liquidity, bid-asked spread, ownership, share turnover and number of no-trade days and industry group representation. The Lipper Small-Cap Growth Funds Index is an unmanaged, equally weighted performance index of the 30 largest qualifying mutual funds (based on net assets) in the Lipper Small-Cap classification. The Russell 3000 Growth Index measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Index consists of the 3,000 largest U.S. companies based on total market capitalization. The Lipper Multi-Cap Growth Funds Index is an unmanaged, equally weighted performance index of the 30 largest qualifying mutual funds (based on net assets) in the Lipper Multi-Cap Growth classification.

A Lipper Fund Award is awarded to one fund in each Lipper classification for achieving the strongest trend of consistent risk-adjusted performance against its classification peers over a three-year period. Although Lipper makes reasonable efforts to ensue the accuracy and reliability of the data contained herein, the accuracy is not guaranteed. Lipper Analytical Services, Inc. is an independent mutual fund research and rating service.

References to specific securities should not be construed as recommendations by the Funds or their Advisor. Please refer to the schedule of investments in the report for Fund holdings information.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest to pretax income. A basis point is a value equaling one one-hundredth of a percent (1/100 of 1%). The price to earnings (P/E) ratio reflects the multiple of earnings at which a stock sells.

Please refer to the prospectus for special risks associated with investing in the Buffalo Funds, including, but not limited to, risks involved with investments in science and technology, foreign, lower- or non-rated securities and smaller companies.

Must be preceded or accompanied by a current prospectus.

Quasar Distributors, LLC, distributor. 5/07

11

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs (including redemption fees) and (2) ongoing costs, including management fees and other Fund specific expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (10/1/06 – 3/31/07). This information is unaudited.

ACTUAL EXPENSES

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period. Although the Funds charge no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. You will be charged a redemption fee equal to 2.00 % of the net amount of the redemption if you redeem your shares of the Buffalo Balanced, Jayhawk China, Large Cap, Mid Cap, Science & Technology and USA Global Funds within 60 days of purchase. The Buffalo High Yield, Small Cap and Micro Cap Funds will charge a redemption fee equal to 2.00% of the net amount of the redemption if you redeem your shares within 180 days of purchase. To the extent a Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes management fees, registration fees and other expenses. However, the example below does not include portfolio trading commissions and related expenses and other extraordinary expen ses as determined under U.S. generally accepted accounting principles.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in our Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the tables is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning di fferent funds. In addition, if these transactional costs were included, your costs would have been higher.

BUFFALO BALANCED FUND | BEGINNING ACCOUNT VALUE OCTOBER 1, 2006 | ENDING ACCOUNT VALUE MARCH 31, 2007 | EXPENSES PAID DURING PERIOD OCTOBER 1, 2006 - MARCH 31, 2007* |

Actual | $1,000.00 | $1,060.20 | $5.29 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,019.80 | $5.19 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.03%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. | |||

BUFFALO HIGH YIELD FUND | BEGINNING ACCOUNT VALUE OCTOBER 1, 2006 | ENDING ACCOUNT VALUE MARCH 31, 2007 | EXPENSES PAID DURING PERIOD OCTOBER 1, 2006 - MARCH 31, 2007* |

Actual | $1,000.00 | $1,050.70 | $5.21 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,019.85 | $5.14 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.02%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. | |||

12

BUFFALO JAYHAWK CHINA FUND | BEGINNING ACCOUNT VALUE DECEMBER 18, 2006* | ENDING ACCOUNT VALUE MARCH 31, 2007 | EXPENSES PAID DURING PERIOD DECEMBER 18, 2006 - MARCH 31, 2007* |

Actual | $1,000.00 | $1,053.00 | $6.23 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,008.04 | $6.09 |

* Commencement of operations. | |||

** Expenses are equal to the Fund’s annualized expense ratio of 2.15%, multiplied by the average account value over the period, multiplied by 103/365 to reflect the period since commencement of operations. | |||

BUFFALO LARGE CAP FUND | BEGINNING ACCOUNT VALUE OCTOBER 1, 2006 | ENDING ACCOUNT VALUE MARCH 31, 2007 | EXPENSES PAID DURING PERIOD OCTOBER 1, 2006 - MARCH 31, 2007* |

Actual | $1,000.00 | $1,074.70 | $5.43 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,019.70 | $5.29 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.05%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. | |||

BUFFALO MICRO CAP FUND | BEGINNING ACCOUNT VALUE OCTOBER 1, 2006 | ENDING ACCOUNT VALUE MARCH 31, 2007 | EXPENSES PAID DURING PERIOD OCTOBER 1, 2006 - MARCH 31, 2007* |

Actual | $1,000.00 | $1,125.60 | $7.90 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,017.50 | $7.49 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.49%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. | |||

BUFFALO MID CAP FUND | BEGINNING ACCOUNT VALUE OCTOBER 1, 2006 | ENDING ACCOUNT VALUE MARCH 31, 2007 | EXPENSES PAID DURING PERIOD OCTOBER 1, 2006 - MARCH 31, 2007* |

Actual | $1,000.00 | $1,088.90 | $5.31 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,019.85 | $5.14 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.02%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. | |||

BUFFALO SCIENCE & TECHNOLOGY FUND | BEGINNING ACCOUNT VALUE OCTOBER 1, 2006 | ENDING ACCOUNT VALUE MARCH 31, 2007 | EXPENSES PAID DURING PERIOD OCTOBER 1, 2006 - MARCH 31, 2007* |

Actual | $1,000.00 | $1,063.80 | $5.30 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,019.80 | $5.19 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.03%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. | |||

BUFFALO SMALL CAP FUND | BEGINNING ACCOUNT VALUE OCTOBER 1, 2006 | ENDING ACCOUNT VALUE MARCH 31, 2007 | EXPENSES PAID DURING PERIOD OCTOBER 1, 2006 - MARCH 31, 2007* |

Actual | $1,000.00 | $1,118.90 | $5.28 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,019.95 | $5.04 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. | |||

BUFFALO USA GLOBAL FUND | BEGINNING ACCOUNT VALUE OCTOBER 1, 2006 | ENDING ACCOUNT VALUE MARCH 31, 2007 | EXPENSES PAID DURING PERIOD OCTOBER 1, 2006 - MARCH 31, 2007* |

Actual | $1,000.00 | $1,103.20 | $5.45 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,019.75 | $5.24 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.04%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. | |||

13

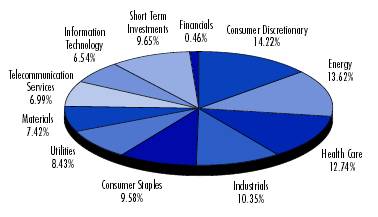

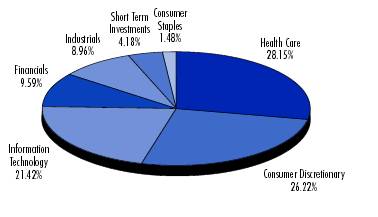

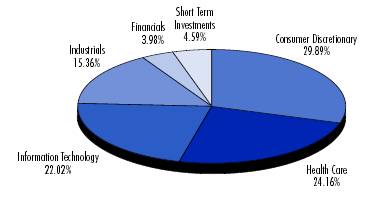

Percentages represent market value as a percentage of total investments as of March 31, 2007.

BUFFALO BALANCED FUND | BUFFALO LARGE CAP FUND |

|  |

BUFFALO HIGH YIELD FUND | BUFFALO MICRO CAP FUND |

|  |

BUFFALO JAYHAWK CHINA FUND | |

|

14

BUFFALO MID CAP FUND | BUFFALO SMALL CAP FUND |

|  |

BUFFALO SCIENCE & TECHNOLOGY FUND | BUFFALO USA GLOBAL FUND |

|  |

15

SCHEDULE OF INVESTMENTS

March 31, 2007

SHARES | MARKET VALUE | |

COMMON STOCKS — 61.20% | ||

CONSUMER DISCRETIONARY — 2.06% | ||

Auto Components — 0.43% | ||

| 31,500 | Modine Manufacturing Co. | $ 721,350 |

Hotels, Restaurants & Leisure — 1.02% | ||

| 20,000 | Harrah’s Entertainment, Inc. | 1,689,000 |

Leisure Equipment & Products — 0.61% | ||

| 45,000 | Eastman Kodak Co. | 1,015,200 |

Total Consumer Discretionary | 3,425,550 | |

CONSUMER STAPLES — 9.66% | ||

Beverages — 3.26% | ||

| 80,000 | The Coca-Cola Co. | 3,840,000 |

| 25,000 | PepsiCo, Inc. | 1,589,000 |

5,429,000 | ||

Food & Staples Retailing — 1.13% | ||

| 35,000 | Costco Wholesale Corp. | 1,884,400 |

Food Products — 3.65% | ||

| 70,000 | ConAgra Foods, Inc. | 1,743,700 |

| 25,000 | Del Monte Foods Co. | 287,000 |

| 30,000 | General Mills, Inc. | 1,746,600 |

| 20,000 | Kellogg Co. | 1,028,600 |

| 25,000 | Wm. Wrigley Jr. Co. | 1,273,250 |

6,079,150 | ||

Household Products — 1.62% | ||

| 30,000 | Colgate-Palmolive Co. | 2,003,700 |

| 10,000 | Kimberly-Clark Corp. | 684,900 |

2,688,600 | ||

Total Consumer Staples | 16,081,150 | |

ENERGY — 21.01% | ||

Energy Equipment & Services — 2.05% | ||

| 50,000 | Patterson-UTI Energy, Inc. | 1,122,000 |

| 20,000 | Schlumberger Ltd. | 1,382,000 |

| 20,000 | Weatherford International Ltd.(a) | 902,000 |

3,406,000 | ||

Oil & Gas — 18.96% | ||

| 50,000 | Anadarko Petroleum Corp. | 2,149,000 |

| 30,000 | Apache Corp. | 2,121,000 |

| 50,000 | BP PLC, ADR | 3,237,500 |

| 70,000 | ChevronTexaco Corp. | 5,177,200 |

| 90,000 | ConocoPhillips | 6,151,500 |

| 39,800 | Exxon Mobil Corp. | 3,002,910 |

| 40,000 | Frontier Oil Corp. | 1,305,600 |

| 30,000 | Hess Corp. | 1,664,100 |

| 35,000 | Marathon Oil Corp. | 3,459,050 |

| 43,000 | Suncor Energy, Inc. | 3,283,050 |

31,550,910 | ||

Total Energy | 34,956,910 | |

16

SHARES | MARKET VALUE | |

FINANCIALS — 8.76% | ||

Commercial Banks — 1.28% | ||

| 15,000 | Marshall & Ilsley Corp. | $ 694,650 |

| 10,000 | Northern Trust Corp. | 601,400 |

| 20,000 | Wilmington Trust Corp. | 843,400 |

2,139,450 | ||

Diversified Financial Services — 3.05% | ||

| 80,000 | Citigroup, Inc. | 4,107,200 |

| 20,000 | JPMorgan Chase & Co. | 967,600 |

5,074,800 | ||

Insurance — 4.43% | ||

| 50,000 | The Allstate Corp. | 3,003,000 |

| 41,000 | The Chubb Corp. | 2,118,470 |

| 53,000 | Cincinnati Financial Corp. | 2,247,200 |

7,368,670 | ||

Total Financials | 14,582,920 | |

HEALTH CARE — 5.64% | ||

Health Care Equipment & Supplies — 0.63% | ||

| 20,000 | Baxter International, Inc. | 1,053,400 |

Pharmaceuticals — 5.01% | ||

| 60,000 | Abbott Laboratories | 3,348,000 |

| 25,000 | Eli Lilly & Co. | 1,342,750 |

| 25,000 | GlaxoSmithKline PLC, ADR | 1,381,500 |

| 20,000 | Johnson & Johnson | 1,205,200 |

| 21,000 | Wyeth | 1,050,630 |

8,328,080 | ||

Total Health Care | 9,381,480 | |

INDUSTRIALS — 8.19% | ||

Aerospace & Defense — 2.88% | ||

| 20,000 | Lockheed Martin Corp. | 1,940,400 |

| 20,000 | Northrop Grumman Corp. | 1,484,400 |

| 21,000 | United Technologies Corp. | 1,365,000 |

4,789,800 | ||

Airlines — 0.26% | ||

| 30,000 | Southwest Airlines Co. | 441,000 |

Commercial Services & Supplies — 2.73% | ||

| 100,000 | Pitney Bowes, Inc. | 4,539,000 |

Industrial Conglomerates — 2.32% | ||

| 100,000 | General Electric Co. | 3,536,000 |

| 5,300 | ITT Corp. | 319,696 |

3,855,696 | ||

Total Industrials | 13,625,496 | |

INFORMATION TECHNOLOGY — 5.41% | ||

Semiconductor & Semiconductor Equipment — 3.40% | ||

| 100,000 | Applied Materials, Inc. | 1,832,000 |

| 200,000 | Intel Corp. | 3,826,000 |

5,658,000 | ||

17

SCHEDULE OF INVESTMENTS

March 31, 2007

(Continued)

SHARES OR FACE AMOUNT | MARKET VALUE | |

INFORMATION TECHNOLOGY (Continued) | ||

Software — 2.01% | ||

| 120,000 | Microsoft Corp. | $ 3,344,400 |

Total Information Technology | 9,002,400 | |

UTILITIES — 0.47% | ||

Electric Utilities — 0.47% | ||

| 20,000 | OGE Energy Corp. | 776,000 |

Total Utilities | 776,000 | |

TOTAL COMMON STOCKS | 101,831,906 | |

(COST $76,997,406) | ||

CORPORATE BONDS — 24.37% | ||

CONSUMER DISCRETIONARY — 6.67% | ||

Automobiles — 2.40% | ||

| Ford Motor Credit Company | ||

| $ 4,000,000 | 7.375%, 10/28/2009 | 3,994,944 |

Hotels, Restaurants & Leisure — 0.60% | ||

| Circus Circus | ||

| 1,000,000 | 7.625%, 07/15/2013 | 1,000,000 |

Leisure Equipment & Products — 1.02% | ||

| Eastman Kodak Co. | ||

| 1,000,000 | 7.250%, 11/15/2013 | 1,015,000 |

| Mikohn Gaming Corp. | ||

| 692,000 | 11.875%, 08/15/2008 | 685,080 |

1,700,080 | ||

Media — 0.07% | ||

| Fisher Communications, Inc. | ||

| 100,000 | 8.625%, 09/15/2014 | 107,625 |

Specialty Retail — 0.61% | ||

| FTD, Inc. | ||

| 1,000,000 | 7.750%, 02/15/2014 | 1,012,500 |

Textiles, Apparel & Luxury Goods — 1.97% | ||

| Interface, Inc. | ||

| 3,000,000 | 9.500%, 02/01/2014 | 3,277,500 |

Total Consumer Discretionary | 11,092,649 | |

CONSUMER STAPLES — 1.23% | ||

Personal Products — 1.23% | ||

| Elizabeth Arden, Inc. | ||

| 2,000,000 | 7.750%, 01/15/2014 | 2,050,000 |

Total Consumer Staples | 2,050,000 | |

18

FACE AMOUNT | MARKET VALUE | |

ENERGY — 6.09% | ||

Oil & Gas — 6.09% | ||

| Giant Industries, Inc. | ||

| $ 4,000,000 | 8.000%, 05/15/2014 | $ 4,340,000 |

| Swift Energy Co. | ||

| 500,000 | 9.375%, 05/01/2012 | 526,250 |

| United Refining Co. | ||

| 5,000,000 | 10.500%, 08/15/2012 | 5,262,500 |

Total Energy | 10,128,750 | |

HEALTH CARE — 5.09% | ||

Health Care Equipment & Supplies — 0.09% | ||

| Inverness Medical Innovations, Inc. | ||

| 150,000 | 8.750%, 02/15/2012 | 157,125 |

Health Care Providers & Services — 2.48% | ||

| Carriage Services, Inc. | ||

| 3,000,000 | 7.875%, 01/15/2015 | 3,097,500 |

| Psychiatric Solutions, Inc. | ||

| 1,000,000 | 7.750%, 07/15/2015 | 1,020,000 |

4,117,500 | ||

Pharmaceuticals — 2.52% | ||

| Warner Chilcott Corp. | ||

| 4,000,000 | 8.750%, 02/01/2015 | 4,190,000 |

Total Health Care | 8,464,625 | |

INDUSTRIALS — 3.41% | ||

Commercial Services & Supplies — 2.78% | ||

| Greenbrier Companies, Inc. | ||

| 1,500,000 | 8.375%, 05/15/2015 | 1,530,000 |

| Iron Mountain, Inc. | ||

| 3,000,000 | 8.625%, 04/01/2013 | 3,102,000 |

4,632,000 | ||

Diversified Manufacturing — 0.63% | ||

| Blount, Inc. | ||

| 1,000,000 | 8.875%, 08/01/2012 | 1,040,000 |

Total Industrials | 5,672,000 | |

MATERIALS — 1.88% | ||

Metals & Mining — 1.88% | ||

| Chaparral Steel Co. | ||

| 2,800,000 | 10.000%, 07/15/2013 | 3,136,000 |

Total Materials | 3,136,000 | |

TOTAL CORPORATE BONDS | 40,544,024 | |

(COST $38,481,854) | ||

19

SCHEDULE OF INVESTMENTS

March 31, 2007

(Continued)

SHARES OR FACE AMOUNT | MARKET VALUE | |

CONVERTIBLE BONDS — 6.94% | ||

CONSUMER DISCRETIONARY — 4.87% | ||

Hotels, Restaurants & Leisure — 0.57% | ||

| Magna Entertainment Corp. | ||

| $ 1,000,000 | 7.250%, 12/15/2009 | $ 950,000 |

Media — 4.30% | ||

| Lions Gate Entertainment Corp. | ||

| 3,500,000 | 2.938%, 10/15/2024 | 3,985,625 |

| 3,000,000 | 3.625%, 03/15/2025 | 3,168,750 |

7,154,375 | ||

Total Consumer Discretionary | 8,104,375 | |

HEALTH CARE — 2.07% | ||

Biotechnology — 2.07% | ||

| Amylin Pharmaceuticals, Inc. | ||

| 2,700,000 | 2.500%, 04/15/2011 | 3,445,875 |

Total Healthcare | 3,445,875 | |

TOTAL CONVERTIBLE BONDS | 11,550,250 | |

(COST $10,177,291) | ||

SHORT TERM INVESTMENTS — 6.99% | ||

INVESTMENT COMPANY — 0.40% | ||

| 676,028 | SEI Daily Income Trust Treasury II Fund — Class B | 676,028 |

Total Investment Company | 676,028 | |

U.S. TREASURY OBLIGATIONS — 6.59% | ||

Public Finance, Taxation, And Monetary Policy — 6.59% | ||

| $ 5,332,000 | 4.830%, 04/05/2007 | 5,329,114 |

| 5,639,000 | 4.950%, 04/12/2007 | 5,630,596 |

Total U.S. Treasury Obligations | 10,959,710 | |

TOTAL SHORT TERM INVESTMENTS | 11,635,738 | |

(COST $11,635,738) | ||

TOTAL INVESTMENTS — 99.50% | 165,561,918 | |

(COST $137,292,289) | ||

Other Assets in Excess of Liabilities — 0.50% | 834,601 | |

TOTAL NET ASSETS — 100.00 % | $ 166,396,519 | |

ADR — American Depository Receipt

PLC — Public Limited Company

(a) Non-Income Producing

The accompanying notes are an integral part of these financial statements.

20

SCHEDULE OF INVESTMENTS

March 31, 2007

SHARES OR FACE AMOUNT | MARKET VALUE | |

COMMON STOCKS — 0.23% | ||

ENERGY — 0.23% | ||

Energy Equipment & Services — 0.23% | ||

| 17,025 | Eagle Geophysical, Inc.(a)(b) | $ 414,984 |

Total Energy | 414,984 | |

TOTAL COMMON STOCKS | 414,984 | |

(COST $0) | ||

CONVERTIBLE PREFERRED STOCKS — 3.23% | ||

FINANCIALS — 3.23% | ||

Commercial Banks — 3.23% | ||

| 118,200 | Boston Private Capital Trust I | 5,865,675 |

Total Financials | 5,865,675 | |

TOTAL CONVERTIBLE PREFERRED STOCKS | 5,865,675 | |

(COST $5,842,000) | ||

PREFERRED STOCKS — 0.00% | ||

CONSUMER DISCRETIONARY — 0.00% | ||

Media — 0.00% | ||

| 7,250 | Adelphia Communications Corp.(a)(d) | 3,625 |

Total Consumer Discretionary | 3,625 | |

TOTAL PREFERRED STOCKS | 3,625 | |

(COST $719,125) | ||

CORPORATE BONDS — 68.59% | ||

CONSUMER DISCRETIONARY — 38.73% | ||

Automobiles — 3.41% | ||

| Ford Motor Credit Company | ||

| $ 4,700,000 | 7.375%, 10/28/2009 | 4,694,059 |

| General Motors Acceptance Corp. | ||

| 1,495,000 | 6.875%, 08/28/2012 | 1,490,632 |

6,184,691 | ||

Hotels, Restaurants & Leisure — 12.61% | ||

| Circus Circus | ||

| 3,100,000 | 7.625%, 07/15/2013 | 3,100,000 |

| Isle of Capri Casinos | ||

| 4,025,000 | 7.000%, 03/01/2014 | 3,964,625 |

| Las Vegas Sands Corp. | ||

| 925,000 | 6.375%, 02/15/2015 | 888,000 |

| Mandalay Resort Group | ||

| 460,000 | 10.250%, 08/01/2007 | 468,050 |

| MGM Mirage | ||

| 180,000 | 8.375%, 02/01/2011 | 190,350 |

| Park Place Entertainment Corp. | ||

| 300,000 | 8.875%, 09/15/2008 | 313,500 |

| 595,000 | 8.125%, 05/15/2011 | 632,931 |

21

SCHEDULE OF INVESTMENTS

March 31, 2007

(Continued)

FACE AMOUNT | MARKET VALUE | |

CONSUMER DISCRETIONARY (Continued) | ||

Hotels, Restaurants & Leisure (continued) | ||

| Penn National Gaming, Inc. | ||

| $ 1,480,000 | 6.750%, 03/01/2015 | $ 1,443,000 |

| Pinnacle Entertainment, Inc. | ||

| 2,570,000 | 8.250%, 03/15/2012 | 2,659,950 |

| Royal Caribbean Cruises Ltd. | ||

| 3,930,000 | 7.500%, 10/15/2027 | 3,860,749 |

| Trump Entertainment Resorts, Inc. | ||

| 5,275,000 | 8.500%, 06/01/2015 | 5,354,125 |

22,875,280 | ||

Household Durables — 4.63% | ||

| Jarden Corp. | ||

| 2,200,000 | 9.750%, 05/01/2012 | 2,318,250 |

| 900,000 | 7.500%, 05/01/2017 | 913,500 |

| Rent-A-Center, Inc. | ||

| 5,100,000 | 7.500% 05/01/2010 | 5,163,750 |

8,395,500 | ||

Leisure Equipment & Products — 1.75% | ||

| Mikohn Gaming Corp. | ||

| 3,211,000 | 11.875%, 08/15/2008 | 3,178,890 |

3,178,890 | ||

Media — 0.94% | ||

| Fisher Communications, Inc. | ||

| 175,000 | 8.625%, 09/15/2014 | 188,344 |

| XM Satellite Radio, Inc. | ||

| 1,500,000 | 9.750%, 05/01/2014 | 1,520,625 |

1,708,969 | ||

Specialty Retail — 6.94% | ||

| Autonation, Inc. | ||

| 100,000 | 7.000%, 04/15/2014 | 101,500 |

| Central Garden and Pet Co. | ||

| 4,500,000 | 9.125%, 02/01/2013 | 4,713,750 |

| FTD, Inc. | ||

| 4,000,000 | 7.750%, 02/15/2014 | 4,050,000 |

| Group 1 Automotive, Inc. | ||

| 900,000 | 8.250%, 08/15/2013 | 938,250 |

| GSC Holdings Corp. | ||

| 1,770,000 | 8.000%, 10/01/2012 | 1,885,050 |

| United Auto Group, Inc. | ||

| 900,000 | 7.750%, 12/15/2016 (Acquired 11/30/2006 and 12/01/2006, Cost $905,063)(c) | 913,500 |

12,602,050 | ||

Textiles, Apparel & Luxury Goods — 7.45% | ||

| Interface, Inc. | ||

| 2,250,000 | 10.375%, 02/01/2010 | 2,491,875 |

| 3,570,000 | 9.500%, 02/01/2014 | 3,900,225 |

| Oxford Industries, Inc. | ||

| 3,650,000 | 8.875%, 06/01/2011 | 3,796,000 |

| Phillips Van-Heusen | ||

| 3,120,000 | 7.750%, 11/15/2023 | 3,322,800 |

13,510,900 | ||

22

FACE AMOUNT | MARKET VALUE | |

CONSUMER DISCRETIONARY (Continued) | ||

Wireless Telecommunication Services — 1.00% | ||

| Rogers Wireless, Inc. | ||

| $ 1,665,000 | 7.500%, 03/15/2015 | $ 1,812,769 |

Total Consumer Discretionary | 70,269,049 | |

CONSUMER STAPLES — 4.06% | ||

Food Products — 1.58% | ||

| Pilgrims Pride Corp. | ||

| 2,900,000 | 8.375%, 05/01/2017 | 2,878,250 |

Household Products — 1.35% | ||

| Prestige Brands, Inc. | ||

| 2,350,000 | 9.250%, 04/15/2012 | 2,444,000 |

Personal Products — 1.13% | ||

| Elizabeth Arden, Inc. | ||

| 2,000,000 | 7.750%, 01/15/2014 | 2,050,000 |

Total Consumer Staples | 7,372,250 | |

ENERGY — 9.04% | ||

Oil & Gas — 9.04% | ||

| Giant Industries, Inc. | ||

| 4,615,000 | 8.000%, 05/15/2014 | 5,007,275 |

| Inergy L.P./Inergy Finance Corp. | ||

| 3,600,000 | 6.875%, 12/15/2014 | 3,564,000 |

| The Premcor Refining Group, Inc. | ||

| 450,000 | 9.500%, 02/01/2013 | 486,121 |

| 2,530,000 | 7.500%, 06/15/2015 | 2,614,568 |

| Swift Energy Co. | ||

| 300,000 | 9.375%, 05/01/2012 | 315,750 |

| United Refining Co. | ||

| 4,200,000 | 10.500%, 08/15/2012 | 4,420,500 |

Total Energy | 16,408,214 | |

FINANCIALS — 0.84% | ||

Capital Markets — 0.84% | ||

| E*Trade Financial Corp. | ||

| 1,400,000 | 7.875%, 12/01/2015 | 1,517,250 |

Total Financials | 1,517,250 | |

HEALTH CARE — 3.69% | ||

Health Care Equipment & Supplies — 0.39% | ||

| Inverness Medical Innovations, Inc. | ||

| 680,000 | 8.750%, 02/15/2012 | 712,300 |

Health Care Providers & Services — 1.03% | ||

| Carriage Services, Inc. | ||

| 1,800,000 | 7.875%, 01/15/2015 | 1,858,500 |

Pharmaceuticals — 2.27% | ||

| Warner Chilcott Corp. | ||

| 3,936,000 | 8.750%, 02/01/2015 | 4,122,960 |

Total Health Care | 6,693,760 | |

23

SCHEDULE OF INVESTMENTS

March 31, 2007

(Continued)

FACE AMOUNT | MARKET VALUE | |

INDUSTRIALS — 10.76% | ||

Aerospace & Defense — 0.07% | ||

| Transdigm, Inc. | ||

| $ 125,000 | 7.750%, 07/15/2014 (Acquired 01/31/2007, Cost $126,250)(c) | $ 129,687 |

Commercial Services & Supplies — 10.06% | ||

| Allied Waste North America | ||

| 867,000 | 9.250%, 09/01/2012 | 919,020 |

| 3,600,000 | 7.875%, 04/15/2013 | 3,753,000 |

| Education Management LLC | ||

| 2,500,000 | 8.750%, 06/01/2014 | 2,643,750 |

| FTI Consulting, Inc. | ||

| 100,000 | 7.750%, 10/01/2016 | 105,500 |

| Greenbrier Companies, Inc. | ||

| 2,715,000 | 8.375%, 05/15/2015 | 2,769,300 |

| Iron Mountain, Inc. | ||

| 1,350,000 | 8.625%, 04/01/2013 | 1,395,900 |

| 4,875,000 | 7.750%, 01/15/2015 | 4,996,875 |

| Mobile Mini, Inc. | ||

| 822,000 | 9.500%, 07/01/2013 | 883,650 |

| Williams Scotsman, Inc. | ||

| 750,000 | 8.500%, 10/01/2015 | 789,375 |

18,256,370 | ||

Diversified Manufacturing — 0.63% | ||

| American Railcar Industries, Inc. | ||

| 200,000 | 7.500%, 03/01/2014 (Acquired 02/23/2007, Cost $200,000)(c) | 206,500 |

| Blount, Inc. | ||

| 900,000 | 8.875%, 08/01/2012 | 936,000 |

1,142,500 | ||

Total Industrials | 19,528,557 | |

MATERIALS — 1.47% | ||

Construction Materials — 1.47% | ||

| U.S. Concrete, Inc. | ||

| 2,615,000 | 8.375%, 04/01/2014 | 2,667,300 |

Total Materials | 2,667,300 | |

TOTAL CORPORATE BONDS | 124,456,380 | |

(COST $119,502,557) | ||

24

FACE AMOUNT | MARKET VALUE | |

CONVERTIBLE BONDS — 17.22% | ||

CONSUMER DISCRETIONARY — 7.62% | ||

Leisure Equipment & Products — 3.54% | ||

| WMS Industries, Inc. | ||

| $ 3,140,000 | 2.750%, 07/15/2010 | $ 6,417,375 |

Media — 4.08% | ||

| Lions Gate Entertainment Corp. | ||

| 6,500,000 | 2.938%, 10/15/2024 | 7,401,875 |

Total Consumer Discretionary | 13,819,250 | |

ENERGY — 0.09% | ||

Energy Equipment & Services — 0.09% | ||

| Moran Energy, Inc. | ||

| 161,000 | 8.750%, 01/15/2008 | 167,440 |

Total Energy | 167,440 | |

HEALTH CARE — 3.54% | ||

Biotechnology — 3.54% | ||

| Amylin Pharmaceuticals, Inc. | ||

| 5,040,000 | 2.500%, 04/15/2011 | 6,432,300 |

Total Health Care | 6,432,300 | |

INDUSTRIALS — 3.32% | ||

Airlines — 3.32% | ||

| JetBlue Airways Corp. | ||

| 6,030,000 | 3.750%, 03/15/2035 | 6,022,463 |

Total Industrials | 6,022,463 | |

INFORMATION TECHNOLOGY — 2.65% | ||

Semiconductor & Semiconductor Equipment — 2.65% | ||

| Fairchild Semiconductor International | ||

| 4,830,000 | 5.000%, 11/01/2008 | 4,799,812 |

Total Information Technology | 4,799,812 | |

TOTAL CONVERTIBLE BONDS | 31,241,265 | |

(COST $25,545,870) | ||

25

SCHEDULE OF INVESTMENTS

March 31, 2007

(Continued)

SHARES OR FACE AMOUNT | MARKET VALUE | |

SHORT TERM INVESTMENTS — 8.89% | ||

INVESTMENT COMPANY — 0.55% | ||

| 1,000,503 | SEI Daily Income Trust Treasury II Fund — Class B | $ 1,000,503 |

Total Investment Company | 1,000,503 | |

U.S. TREASURY OBLIGATIONS — 8.34% | ||

Public Finance, Taxation, And Monetary Policy — 8.34% | ||

| $ 7,420,000 | 4.830%, 04/05/2007 | 7,415,946 |

| 7,581,000 | 4.950%, 04/12/2007 | 7,569,714 |

| 148,000 | 4.824%, 04/19/2007 | 147,642 |

Total U.S. Treasury Obligations | 15,133,302 | |

TOTAL SHORT TERM INVESTMENTS | 16,133,805 | |

(COST $16,133,805) | ||

TOTAL INVESTMENTS — 98.16% | 178,115,734 | |

(COST $167,743,357) | ||

Other Assets in Excess of Liabilities — 1.84% | 3,343,582 | |

TOTAL NET ASSETS — 100.00% | $ 181,459,316 | |

(a) Non-Income Producing

(b) Fair valued security. The total value of these securities amounted to $414,984 (0.23% of net assets) at March 31, 2007.

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. The total value of these securities amounted to $1,249,687 (0.69% of net assets) at March 31, 2007.

(d) Security is in default at March 31, 2007.

The accompanying notes are an integral part of these financial statements.

26

SCHEDULE OF INVESTMENTS

March 31, 2007

SHARES | MARKET VALUE | |

COMMON STOCKS — 84.93% | ||

CONSUMER DISCRETIONARY — 13.37% | ||

Auto Components — 5.47% | ||

| 3,465,000 | Launch Tech Company Ltd. — Class H | $ 1,108,658 |

| 25,000 | Wonder Auto Technology, Inc.(a) | 171,250 |

1,279,908 | ||

Distributors — 1.31% | ||

| 92,000 | China Resources Enterprise Ltd. | 307,314 |

Media — 1.79% | ||

| 3,235,000 | HC International, Inc.(a) | 418,168 |

Textiles, Apparel & Luxury Goods — 4.80% | ||

| 466,000 | Bauhaus International Holdings Ltd. | 113,316 |

| 6,736,000 | Tack Fat Group International Ltd. | 1,008,654 |

1,121,970 | ||

Total Consumer Discretionary | 3,127,360 | |

CONSUMER STAPLES — 9.00% | ||

Food Products — 9.00% | ||

| 2,628,000 | China Green Holdings Ltd. | 2,021,409 |

| 114,000 | COFCO International Ltd. | 85,352 |

Total Consumer Staples | 2,106,761 | |

ENERGY — 12.81% | ||

Oil & Gas — 10.71% | ||

| 958,000 | China Petroleum & Chemical Corp. — Class H | 810,441 |

| 972,000 | CNOOC Ltd.(a) | 852,140 |

| 710,000 | PetroChina Company Ltd. | 842,350 |

2,504,931 | ||

Coal & Consumable Fuels — 2.10% | ||

| 203,000 | China Shenhua Energy Co. — Class H | 491,035 |

Total Energy | 2,995,966 | |

FINANCIALS — 0.43% | ||

Real Estate — 0.43% | ||

| 240,000 | Beijing Capital Land Ltd. — Class H | 101,056 |

Total Financials | 101,056 | |

HEALTH CARE — 11.98% | ||

Health Care Equipment & Supplies — 8.45% | ||

| 4,905,000 | Golden Meditech Company Ltd.(a) | 1,977,443 |

Pharmaceuticals — 3.53% | ||

| 2,742,000 | Hua Han Bio-Pharmaceutical Holdings Ltd. — Class H | 824,688 |

Total Health Care | 2,802,131 | |

27

SCHEDULE OF INVESTMENTS

March 31, 2007

(Continued)

SHARES | MARKET VALUE | |

INDUSTRIALS — 9.73% | ||

Transportation — 2.64% | ||

| 1,586,000 | China Shipping Container Lines Company Ltd. — Class H(a) | $ 617,066 |

Airlines — 0.43% | ||

| 222,000 | China Southern Airlines Company Ltd. — Class H(a) | 101,432 |

Chemicals — 0.43% | ||

| 182,000 | Sinofert Holdings Ltd. | 100,626 |

Commercial Services & Supplies — 4.89% | ||

| 7,548,000 | Jolimark Holdings Ltd.(a) | 1,144,734 |

Construction & Engineering — 0.84% | ||

| 54,000 | Baoye Group Company Ltd. — Class H | 88,600 |

| 204,000 | Cosco International Holdings Ltd. | 107,307 |

195,907 | ||

Transportation Infrastructure — 0.50% | ||

| 118,000 | Beijing Capital International Airport Company Ltd. — Class H | 117,192 |

Total Industrials | 2,276,957 | |

INFORMATION TECHNOLOGY — 6.15% | ||

Electronic Equipment & Instruments — 3.75% | ||

| 3,704,000 | Kwang Sung Electronics H.K. | 876,995 |

Internet Software & Services — 0.66% | ||

| 198,000 | China Lotsynergy Holding Ltd.(a) | 57,777 |

| 1,386,000 | China.com, Inc.(a) | 97,562 |

155,339 | ||

Software — 1.74% | ||

| 45,000 | CDC Corp. — Class A(a) | 406,800 |

Total Information Technology | 1,439,134 | |

MATERIALS — 6.97% | ||

Metals & Mining — 6.97% | ||

| 734,000 | Jiangxi Copper Company Ltd. — Class H | 888,672 |

| 544,000 | Yanzhou Coal Mining Company Ltd. — Class H | 520,781 |

| 380,000 | Zijin Mining Group Co., Ltd. — Class H | 221,284 |

Total Materials | 1,630,737 | |

TELECOMMUNICATION SERVICES — 6.57% | ||

Diversified Telecommunication Services — 1.72% | ||

| 820,000 | China Telecom Corp. Ltd. — Class H | 402,995 |

Wireless Telecommunication Services — 4.85% | ||

| 86,000 | China Mobile Ltd. | 782,018 |

| 244,000 | China Unicom Ltd. | 351,627 |

1,133,645 | ||

Total Telecommunication Services | 1,536,640 | |

28

SHARES | MARKET VALUE | |

UTILITIES — 7.92% | ||

Electric Utilities — 7.92% | ||

| 614,000 | Datang International Power Generation Company Ltd. — Class H | $ 581,506 |

| 1,418,000 | Huadian Power International Corp. Ltd. — Class H | 508,146 |

| 876,000 | Huaneng Power International, Inc. — Class H | 762,373 |

Total Utilities | 1,852,025 | |

TOTAL COMMON STOCKS | 19,868,767 | |

(COST $18,864,808) | ||

SHORT TERM INVESTMENT — 9.07% | ||

INVESTMENT COMPANY — 9.07% | ||

| 2,122,936 | SEI Daily Income Trust Treasury II Fund — Class B | 2,122,936 |

Total Investment Company | 2,122,936 | |

TOTAL SHORT TERM INVESTMENT | 2,122,936 | |

(COST $2,122,936) | ||

TOTAL INVESTMENTS — 94.00% | 21,991,703 | |

(COST $20,987,744) | ||

Other Assets in Excess of Liabilities — 6.00% | 1,404,167 | |

TOTAL NET ASSETS — 100.00% | $ 23,395,870 | |

(a) Non-Income Producing

As of March 31, 2007, the country diversification was as follows:

| MARKET VALUE | PERCENTAGE | |||||

| China | $ | 9,622,346 | 41.13% | |||

| Hong Kong | 10,246,421 | 43.80% | ||||

| Total Common Stocks | 19,868,767 | 84.93% | ||||

| Total Short Term Investments | 2,122,936 | 9.07% | ||||

| Total Investments | 21,991,703 | 94.00% | ||||

| Other Assets in Excess of Liabilities | 1,404,167 | 6.00% | ||||

| TOTAL NET ASSETS | $ | 23,395,870 | 100.00% | |||

The accompanying notes are an integral part of these financial statements.

29

SCHEDULE OF INVESTMENTS

March 31, 2007

SHARES | MARKET VALUE | |

COMMON STOCKS — 98.40% | ||

CONSUMER DISCRETIONARY — 13.53% | ||

Hotels, Restaurants & Leisure — 4.33% | ||

| 28,100 | Marriott International, Inc. — Class A | $ 1,375,776 |

| 13,700 | Starwood Hotels & Resorts Worldwide, Inc. | 888,445 |

2,264,221 | ||

Internet & Catalog Retail — 1.05% | ||

| 16,600 | eBay, Inc.(a) | 550,290 |

Media — 8.15% | ||

| 83,500 | Time Warner, Inc. | 1,646,620 |

| 34,250 | Viacom Inc. — Class B(a) | 1,408,017 |

| 35,000 | The Walt Disney Co. | 1,205,050 |

4,259,687 | ||

Total Consumer Discretionary | 7,074,198 | |

CONSUMER STAPLES — 7.23% | ||

Beverages — 1.66% | ||

| 13,700 | PepsiCo, Inc. | 870,772 |

Food & Staples Retailing — 5.57% | ||

| 45,200 | CVS Caremark Corp. | 1,543,128 |

| 13,000 | Walgreen Co. | 596,570 |

| 17,200 | Whole Foods Market, Inc. | 771,420 |

2,911,118 | ||

Total Consumer Staples | 3,781,890 | |

FINANCIALS — 17.48% | ||

Capital Markets — 4.08% | ||

| 3,700 | The Goldman Sachs Group, Inc. | 764,531 |

| 17,400 | Morgan Stanley | 1,370,424 |

2,134,955 | ||

Commercial Banks — 3.04% | ||

| 26,400 | Northern Trust Corp. | 1,587,696 |

Diversified Financial Services — 7.80% | ||

| 19,500 | American Express Co. | 1,099,800 |

| 8,800 | Franklin Resources, Inc. | 1,063,304 |

| 10,800 | Legg Mason, Inc. | 1,017,468 |

| 19,000 | T. Rowe Price Group, Inc. | 896,610 |

4,077,182 | ||

Insurance — 2.56% | ||

| 22,400 | Principal Financial Group, Inc. | 1,341,088 |

Total Financials | 9,140,921 | |

HEALTH CARE — 31.98% | ||

Biotechnology — 4.53% | ||

| 11,800 | Gilead Sciences, Inc.(a) | 902,700 |

| 40,200 | MedImmune, Inc.(a) | 1,462,878 |

2,365,578 | ||

30

SHARES | MARKET VALUE | |

HEALTH CARE (Continued) | ||

Health Care Equipment & Supplies — 5.03% | ||

| 31,500 | Baxter International, Inc. | $ 1,659,105 |

| 12,200 | C.R. Bard, Inc. | 970,022 |

2,629,127 | ||

Health Care Providers & Services — 5.02% | ||

| 21,900 | Medco Health Solutions, Inc.(a) | 1,588,407 |

| 20,800 | Quest Diagnostics, Inc. | 1,037,296 |

2,625,703 | ||

Pharmaceuticals — 17.40% | ||

| 25,800 | Abbott Laboratories | 1,439,640 |

| 40,100 | Bayer AG, ADR | 2,565,197 |

| 57,100 | Schering-Plough Corp. | 1,456,621 |

| 42,100 | Teva Pharmaceutical Industries, Ltd., ADR | 1,575,803 |

| 41,200 | Wyeth | 2,061,236 |

9,098,497 | ||

Total Health Care | 16,718,905 | |

INDUSTRIALS — 6.81% | ||

Air Freight & Logistics — 3.37% | ||

| 16,400 | FedEx Corp. | 1,761,852 |

Commercial Services & Supplies — 3.44% | ||

| 21,000 | Automatic Data Processing, Inc. | 1,016,400 |

| 29,022 | First Data Corp. | 780,692 |

1,797,092 | ||

Total Industrials | 3,558,944 | |

INFORMATION TECHNOLOGY — 21.37% | ||

Communications Equipment — 8.19% | ||

| 37,500 | Cisco Systems, Inc.(a) | 957,375 |

| 103,700 | Corning, Inc.(a) | 2,358,138 |

| 54,700 | Motorola, Inc. | 966,549 |

4,282,062 | ||

Internet Software & Services — 1.29% | ||

| 21,500 | Yahoo!, Inc.(a) | 672,735 |

Semiconductor & Semiconductor Equipment — 8.38% | ||

| 60,700 | Altera Corp.(a) | 1,213,393 |

| 65,800 | Applied Materials, Inc. | 1,205,456 |

| 46,200 | Intel Corp. | 883,806 |

| 35,900 | Texas Instruments, Inc. | 1,080,590 |

4,383,245 | ||

Software — 3.51% | ||

| 39,500 | Microsoft Corp. | 1,100,865 |

| 42,400 | Symantec Corp.(a) | 733,520 |

1,834,385 | ||

Total Information Technology | 11,172,427 | |

TOTAL COMMON STOCKS | 51,447,285 | |

(COST $39,324,064) | ||

31

SCHEDULE OF INVESTMENTS

March 31, 2007

(Continued)

SHARES | MARKET VALUE | |

SHORT TERM INVESTMENT — 1.58% | ||

INVESTMENT COMPANY — 1.58% | ||

| 825,705 | SEI Daily Income Trust Treasury II Fund — Class B | $ 825,705 |

Total Investment Company | 825,705 | |

TOTAL SHORT TERM INVESTMENT | 825,705 | |

(COST $825,705) | ||

TOTAL INVESTMENTS — 99.98% | 52,272,990 | |

(COST $40,149,769) | ||