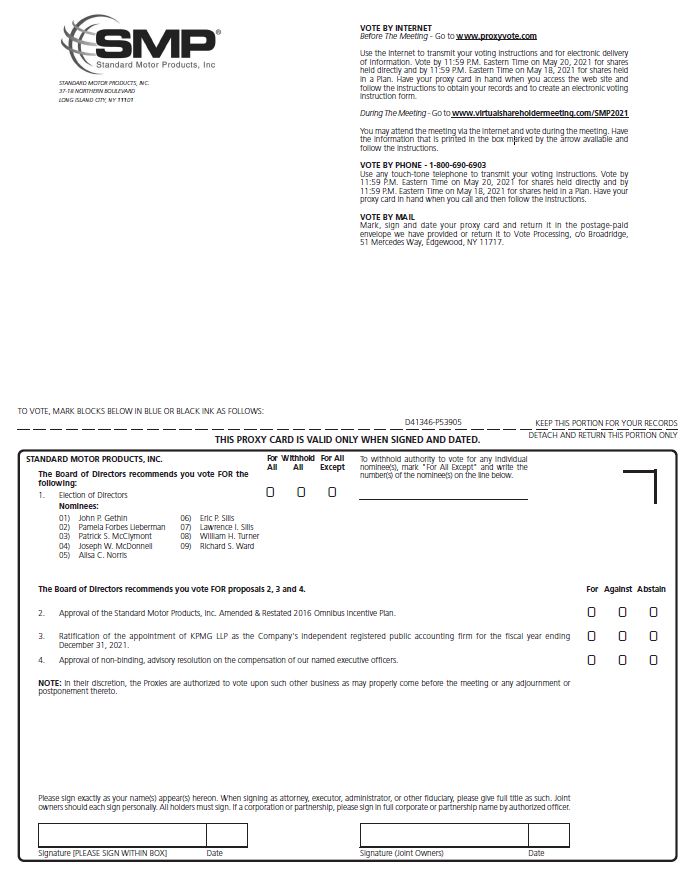

Proposal No. 1

Election of Directors

Our Board of Directors recommends that you vote “FOR ALL” of our director nominees.

At our Annual Meeting, our shareholders will have the opportunity to vote to elect nine directors to hold office until our next annual meeting of shareholders and until their successors are duly elected and qualified. All nominees are currently directors of the Company.

Our Board of Directors is currently comprised of ten members. In February 2021, Roger M. Widmann, our director and Chair of the Compensation and Management Development Committee (“Compensation Committee”), announced that he will retire at the end of his current term of office. Following Mr. Widmann’s decision, upon the recommendation of the Nominating and Corporate Governance Committee (“Governance Committee”), the Board of Directors decreased the size of the Board from ten to nine members, and appointed Alisa C. Norris to serve as Chair of the Compensation Committee, effective as of the date of our 2021 Annual Meeting.

Information Regarding Nominees

The following paragraphs provide information, as of the date of this Proxy Statement, about each nominee. In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that he or she should serve as a director, we also believe that all of our director nominees have a reputation for integrity, honesty and adherence to high ethical standards. Each nominee has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment to serve the Company and our Board. Finally, we value their significant experience on other public company boards of directors and board committees. Our nominees, collectively, possess diverse professional experiences and skills, including business leadership, automotive, finance and accounting, government and public policy, information technology and cyber security, supply chain management and logistics, and human capital management.

The Governance Committee reviews each candidate’s qualifications to determine whether the candidate possesses any of the specific qualities and skills that are desired in members of the Board, taking into account diversity in professional experience, skills and background, race, gender, disability, ethnicity, nationality, religion, and sexual orientation.

Each person listed below has consented to be named as a nominee and agreed to serve if elected. If any of those named are not available for election at the time of the Annual Meeting, discretionary authority will be exercised to vote for substitutes unless the Board chooses to reduce the number of directors. Management is not aware of any circumstances that would render any nominee listed below unavailable.

You may read more about the process our Governance Committee undertook to select our director nominees on page 24 under the heading “Nominating and Corporate Governance Committee.”

Lawrence I. Sills Chairman of the Board Age 81 Director Since 1986 | Mr. Sills has served as our Chairman of the Board since January 2021, and as a director of the Company since 1986. Mr. Sills has also served as our Executive Chairman of the Board from March 2016 to January 2021, Chairman of the Board from December 2000 to March 2016, Chief Executive Officer from December 2000 to March 2016, our President and Chief Operating Officer from 1986 to 2000, and our Vice President of Operations from 1983 to 1986. Mr. Sills is the father of Eric P. Sills, a director of the Company and our Chief Executive Officer and President. Mr. Sills holds an MBA from Harvard Business School and a BA from Dartmouth College. |

| | |

| | We believe Mr. Sills’ qualifications to serve as a director and our Chairman of the Board include his wealth of experience and the business understanding that Mr. Sills has obtained from over 50 years of working in various capacities at the Company and in the automotive industry. Mr. Sills’ knowledge of all aspects of the Company’s business and its history, position him well to serve as our Chairman. In addition, we believe Mr. Sills’ qualifications to sit on our Board include his and his family’s significant ownership interest in the Company, which serves to align his interests with the interests of our other shareholders, and the fact that he represents the third generation of the Sills family which established the Company in 1919. |

| | |

William H. Turner Presiding Independent Director Age 81 Director Since 1990 | Mr. Turner has served as our Presiding Independent Director since January 2006, and as a director of the Company since May 1990. Formerly, Mr. Turner served as a director of Ameriprise Financial, Inc., Volt Information Sciences, Inc., Franklin Electronic Publishers, Inc. and New Jersey Resources Corporation. In May 2015, Mr. Turner was elected as Chairman of the Board of Trustees of Bloomfield College, and since 1985, he has served as Chairman of the Board of Trustees of the International College, Beirut, Lebanon. From 2008 to 2010, Mr. Turner served as Acting Dean of the Business School at Montclair State University, and from 2004 to 2008, he served as the Dean of the College of Business at Stony Brook University. Mr. Turner served as the Senior Partner of Summus Ltd., a consulting firm, from 2002 to 2004. From 1997 to 2002, he served in various capacities at PNC Bank NJ, including President, Chief Executive Officer and Chairman Northeast Region. He was President and Co-Chief Executive Officer of Franklin Electronic Publishers, Inc. from 1996 to 1997. Prior to that time, he was the Vice Chairman of Chase Manhattan Bank and its predecessor, Chemical Banking Corporation. Mr. Turner completed the Advanced Management Program from Harvard Business School, and he holds an MBA from New York University and a BA from Trinity College. |

| | We believe Mr. Turner’s qualifications to serve as a director and our Presiding Independent Director include his extensive executive leadership and financial and managerial experience. His service as Chief Executive Officer and Vice Chairman at several banking institutions make him a valuable asset to our Board, and has provided him with a wealth of knowledge in dealing with financial and accounting matters. The depth and breadth of his exposure to complex financial issues at other large corporations, as well as the deep understanding of our Company that he has acquired from serving on our Board for more than 30 years, make him a valuable advisor. |

| | |

John P. Gethin Director Age 72 Director Since 2016 | Mr. Gethin has served as a director of the Company since March 2016, and as our Chief Operating Officer from 2000 to March 2016, and our President from 2000 to February 2015. From 1997 to 2000, Mr. Gethin served as our Senior Vice President of Operations. From 1998 to 2003, he served as the General Manager of our Temperature Control Division. From 1995 to 1997, Mr. Gethin was our Vice President and General Manager of EIS Brake Parts Division (a former business unit of ours). Mr. Gethin holds a BBA from Texas Christian University. |

| | |

| | We believe Mr. Gethin’s qualifications to serve as a director include his extensive knowledge of our Company, and in particular, his experience developing, directing and improving upon our organizational processes and operational efficiencies for more than 19 years. Mr. Gethin has also acquired extensive knowledge of the automotive aftermarket industry, having worked in the industry for more than 49 years. His ability to leverage his knowledge and experience to provide unique insight to our Board makes him well qualified to serve as a member of the Board. |

| | |

Pamela Forbes Lieberman Director Age 67 Director Since 2007 | Ms. Forbes Lieberman has served as a director of the Company since August 2007. Ms. Forbes Lieberman also serves as a director and Chair of the Audit Committee of John B. Sanfilippo & Son, Inc., a leading processor and distributor of nut products, and on the strategic advisory board of Morrow Sodali, LLC, a professional services firm. Previously, Ms. Forbes Lieberman served as a director of A.M. Castle & Co. and VWR Corporation. From March 2006 to August 2006, Ms. Forbes Lieberman served as the interim Chief Operating Officer of Entertainment Resource, Inc. Prior to such time, Ms. Forbes Lieberman served as President and Chief Executive Officer and member of the Board of Directors of TruServ Corporation (now known as True Value Company) and prior to that as TruServ’s Chief Operating Officer and Chief Financial Officer. Prior to joining TruServ, Ms. Forbes Lieberman held Chief Financial Officer positions at ShopTalk Inc., The Martin-Brower Company, LLC, and Fel-Pro, Inc. and served as an automotive industry consultant. Ms. Forbes Lieberman, a Certified Public Accountant, began her career at PricewaterhouseCoopers LLP. Ms. Forbes Lieberman holds an MBA from Kellogg School of Management, Northwestern University, and a BS from the University of Illinois. |

| | We believe Ms. Forbes Lieberman’s qualifications to serve as a director include her many years of executive experience, including serving as Chief Executive Officer, Chief Operating Officer and Chief Financial Officer for distribution and automotive companies. She brings demonstrated management ability at senior levels to the Board and insights into the operational requirements of a large company. In addition, her knowledge of public and financial accounting matters, logistics, and business strategy provides valuable insight to our Board. |

| | |

Patrick S. McClymont Director Age 51 Director Since 2017 | Mr. McClymont has served as a director of the Company since February 2017. Mr. McClymont also serves as the Executive Vice President and Chief Financial Officer of IMAX Corporation, and as a director of Volunteers of America, Greater New York Chapter. Prior to joining IMAX, Mr. McClymont served as the Executive Vice President and Chief Financial Officer of Sotheby’s from October 2013 to December 2015, and as a Partner and Managing Director of Goldman, Sachs & Co., where he was a member of the Investment Banking Division from 1998 to October 2013. Mr. McClymont holds a Master of Business Administration from The Amos Tuck School, Dartmouth College, and a BS, with distinction, from Cornell University. |

| | |

| | We believe Mr. McClymont’s qualifications to serve as a director include his expertise in financial matters and corporate strategy, as well as his business experience at public and private institutions in the areas of accounting, tax, treasury, finance, investor relations and risk management. His extensive knowledge in these areas, and his familiarity with the automotive industry, both domestically and abroad, make him a valuable advisor to our Board. |

| | |

Joseph W. McDonnell Director Age 69 Director Since 2012 | Mr. McDonnell has served as a director of the Company since October 2012. Mr. McDonnell is also a Professor of Public Policy and Management at the University of Southern Maine’s Edmund S. Muskie School of Public Service and a Faculty Fellow and member of the board of the University of Southern Maine’s Confucius Institute. Mr. McDonnell previously served at the University of Southern Maine as Provost and Vice President of Academic Affairs from August 2014 to August 2015, and as Dean of the College of Management and Human Service from July 2011 to August 2015. Prior to his work at the University of Southern Maine, he served as Interim Dean of the College of Business at Stony Brook University and as the President and Chief Executive Officer of the New York International Commerce Group, Inc., which provides services for companies doing business in China. Mr. McDonnell holds an Executive Program Certificate from Harvard Business School, a PhD in Communications from the University of Southern California, and an MA and BA from Stony Brook University. |

| | |

| | We believe Mr. McDonnell’s qualifications to serve as a director include his significant experience in academics focusing on business administration and the development of management-level personnel, as well as the various leadership positions he held at foreign and domestic companies prior to becoming an academic administrator. His expertise in doing business in China and in consulting management on various strategic initiatives provides valuable insight to our Board. |

Alisa C. Norris Director Age 51 Director Since 2012 | Ms. Norris has served as a director of the Company since October 2012. Ms. Norris also serves as a director of Vita-Mix Corporation and Healthy Bytes, Inc. From 2016 to 2020, Ms. Norris served as the Chief Marketing and Communications Officer at JDRF International, where she was responsible for marketing, communications and digital growth, leading the organization’s digital transformation. Prior to joining JDRF International, Ms. Norris served as the Chief Marketing Officer of R.R. Donnelley & Sons Company from 2013 to 2015, where she was responsible for all aspects of marketing and communications. Prior to joining R.R. Donnelley, Ms. Norris served as the Chief People Officer of Opera Solutions, LLC, a leading predictive analytics company, where she was responsible for global staff operations and human capital management. Prior to Opera Solutions, Ms. Norris served as a Senior Vice President and was a founding member of Zeborg, Inc., and as a strategy consultant for A.T. Kearney and Mitchell Madison Group. Ms. Norris holds an MBA from Harvard Business School and a BA from Trinity College, where she was Phi Beta Kappa. |

| | |

| | We believe Ms. Norris’ qualifications to serve as a director include her significant experience in defining and implementing corporate governance structures and growth strategies, and in developing and managing operational resources in the areas of marketing and communications. Her experience of more than 22 years of providing consulting services to financial services, information technology and media, and office technology firms makes her a valuable advisor to our Board. |

| | |

Eric P. Sills Director, Chief Executive Officer, President & Member of the Office of Chief Executive Age 52 Director Since 2016 | Mr. Sills has served as a director of the Company and our Chief Executive Officer since March 2016, and as our President since February 2015. Prior to serving as our President, Mr. Sills served as our Vice President Global Operations from January 2013 to February 2015, and our Vice President Engine Management Division from 2006 to January 2013. From 1991 to 2006, Mr. Sills served in various capacities in our Company, including as General Manager, LIC Operations, Director of Product Management, and Plant Manager, Oxygen Sensor Business Unit. He is the son of Lawrence I. Sills. Mr. Sills has completed an Advanced Management Program at Harvard Business School, and holds an MBA from Columbia University and a BA from Bowdoin College. |

| | |

| | We believe Mr. Sills’ qualifications to serve as a director include his extensive knowledge of our business and its operations, and the experience that he has acquired throughout his career, having served in a variety of senior management positions across our organization and as an executive officer. In addition, we believe Mr. Sills’ qualifications to serve as a director include his and his family’s significant ownership interest in the Company, which serves to align his interests with the interests of our other shareholders, and the fact that he represents the fourth generation of the Sills family which established the Company in 1919. |

Richard S. Ward Director Age 80 Director Since 2004 | Mr. Ward has served as a director of the Company since July 2004. Mr. Ward also serves as a member of the American Law Institute, the Association of General Counsel, and the Board of Trustees (Executive Committee) of the International College, Beirut, Lebanon. Mr. Ward is a private investor and legal consultant. In 2000, Mr. Ward served as Chairman of the Large, Complex Case Committee of the American Arbitration Association. From 1969 to 1998, he served in various legal and managerial capacities at ITT Corporation, including Executive Vice President, General Counsel and Corporate Secretary, and as a member of the ITT Management Committee. Previously, he served on the Boards of the American Arbitration Association, STC plc, a British telecommunications company, ITT Sheraton Corporation, First State Insurance Company, Boeing Industrial Technology Group Corporation, and Caesars World, Inc. Mr. Ward completed the Finance for Senior Executives program at Harvard Business School and holds an LLB from University of Virginia School of Law, and a BSME from Yale University. Mr. Ward is a member of the Bars of New York and Virginia, and is admitted to practice before the U.S. Court of International Trade and the U.S. Court of Appeals for the Federal Circuit. |

| | |

| | We believe Mr. Ward’s qualifications to serve as a director include his experience as an executive officer of an international engineering and manufacturing company, and his legal and corporate governance expertise. His knowledge of the complex legal and governance issues facing multi-national companies and his understanding of what makes businesses work effectively and efficiently provide valuable insight to our Board. |

Emeritus Directors of the Board of Directors

Arthur S. Sills and Peter J. Sills currently serve as emeritus members of the Board of Directors. Emeritus directors are invited to attend Board of Director meetings but do not have any voting rights. Emeritus directors may receive, at the discretion of the Board of Directors, compensation for their advisory services, reimbursement for meeting travel expenses, and coverage under our medical, dental and vision insurance plans.

Proposal No. 2

Approval of the Standard Motor Products, Inc. Amended and Restated 2016 Omnibus Incentive Plan

Our Board of Directors recommends you vote “FOR” the approval of the Standard Motor Products, Inc. Amended and Restated 2016 Omnibus Incentive Plan.

General

We are asking our shareholders to approve an amendment and restatement of the Standard Motor Products, Inc. 2016 Omnibus Incentive Plan (the “Plan”), which was approved by our Board of Directors on February 18, 2021. The Plan was originally approved by the Company’s shareholders and became effective on May 19, 2016. The Plan is the Company’s only plan for providing stock-based incentive compensation to our employees, directors and other eligible persons. The number of shares authorized for issuance under the Plan on its effective date was anticipated to fund awards for a five-year period, and as of December 31, 2020, there are 173,729 shares remaining for issuance thereunder. We are asking shareholders to approve an amendment and restatement of the Plan to (i) increase the number of shares available for issuance thereunder by 950,000 to fund awards for an additional five-year period, (ii) adjust the number of shares available for issuance to non-employee directors from 250,000 to 300,000, and (iii) revise the Plan in response to changes in applicable federal tax laws.

The following summary of certain material features of the amended and restated Plan, as approved by our Board of Directors, is subject to the specific provisions contained in the full text of the Plan, as set forth in Appendix A attached hereto.

Purpose of Plan

The Plan will allow the Company, under the direction of the Compensation Committee or those persons to whom administration of the Plan has been delegated or permitted by law (the Governance Committee will make recommendations to the Compensation Committee concerning non-employee directors), to make grants of stock options, restricted stock awards, restricted stock units, stock appreciation rights, performance shares, cash-based awards and other stock-based awards to employees, directors, consultants, agents, advisors and independent contractors. The purpose of these stock awards is to attract and retain talented employees, directors and other eligible persons and further align their interests and those of our shareholders by linking a portion of their compensation with the Company’s performance.

Key Terms

The following is a summary of the key provisions of the amended and restated Plan, as approved by our Board of Directors.

Plan Term: | May 19, 2016 to May 19, 2026. |

| | |

Eligible Participants: | All of our employees, directors, consultants, agents, advisors and independent contractors are eligible to receive awards under the Plan, provided they render services to the Company. The Compensation Committee will determine which individuals will participate in the Plan. As of April 9, 2021, there were approximately two hundred and seventy employees and seven non-employee directors who would be eligible to participate in the Plan. |

Shares Authorized: | If our shareholders approve this Proposal No. 2, 950,000 shares will be added to the Plan, and the total number of shares authorized for issuance under the Plan will be 2,050,000, subject to adjustment to reflect stock splits and other corporate events or transactions. Shares related to awards which terminate by expiration, forfeiture, cancellation, or otherwise without the issuance of such shares, which are settled in cash in lieu of shares, or which are exchanged with the Compensation Committee’s approval, prior to the issuance of shares, for awards not involving shares, shall be available again for grant under the Plan. In no event, however, will the following shares again become available for awards or increase the number of shares available for grant under the Plan: (i) shares tendered by the participant in payment of the exercise price of an option; (ii) shares withheld from exercised awards for tax withholding purposes; (iii) shares subject to a SAR that are not issued in connection with the settlement of that SAR; and (iv) shares repurchased by the Company with proceeds received from the exercise of an option. Of the shares available in the pool, the maximum number of shares that may be issued to non-employee directors is three hundred thousand (300,000) shares. |

| | |

Award Types: | (a) Non-qualified and incentive stock options; (b) Stock appreciation rights (“SARs”); (c) Restricted stock and restricted stock units; (d) Performance shares and performance units; (e) Cash-based awards; and (f) Other stock-based awards. |

| | |

Annual Share Limits on Awards: | (a) Options: The annual maximum aggregate number of shares subject to options granted to any one person is twenty-five thousand (25,000). (b) SARs: The annual maximum number of shares subject to SARs granted to any one person is twenty-five thousand (25,000). (c) Restricted Stock or Restricted Stock Units: The annual maximum aggregate grant with respect to awards of restricted stock or restricted stock units to any one person is ten thousand (10,000). (d) Performance Shares or Performance Units: The annual maximum aggregate award of performance units or performance shares that a person may receive is ten thousand (10,000) shares, or equal to the value of ten thousand (10,000) shares determined as of the date of grant, as applicable. (e) Cash-Based Awards: The annual maximum aggregate amount awarded or credited with respect to cash-based awards to any one person is the greater of one million dollars ($1,000,000) or the value of twenty-five thousand (25,000) shares determined as of the date of grant, as applicable. |

| | (f) Other Stock-Based Awards: The annual maximum aggregate grant with respect to other stock-based awards to any one person is twenty-five thousand (25,000) shares. (g) Non-employee director limits: The annual maximum aggregate grant with respect to awards to any non-employee director is ten thousand (10,000) shares. |

| | |

Vesting: | Vesting schedules will be determined by the Compensation Committee at the time that each award is granted, subject to the minimum vesting periods described below. (a) Options: The minimum vesting period for the grant of an option is three (3) years following the date of grant, provided that an option may partially vest after no less than one (1) year so long as the entire grant does not fully vest until at least three (3) years following the date of grant, except as the Compensation Committee may provide in the event of death, disability, involuntary termination without cause, retirement, or a change of control. (b) SARs: The minimum vesting period for the grant of a SAR is three (3) years following the date of grant, provided that a SAR may partially vest after no less than one (1) year so long as the entire grant does not fully vest until at least three (3) years following the date of grant, except as the Compensation Committee may provide in the event of death, disability, involuntary termination without cause, retirement, or a change of control. (c) Restricted Stock or Restricted Stock Units: The minimum vesting period for the grant of restricted stock or restricted stock units is three (3) years (which may be a cliff or graded vesting schedule) following the date of grant, provided that grants to non-employee directors or employees receiving long-term retention awards who are aged 65 or older may fully vest after no less than one (1) year. The Compensation Committee may also determine that the vesting schedule may be accelerated due to death, disability, involuntary termination without cause, retirement, or a change of control. (d) Performance Shares or Performance Units: Except as the Compensation Committee may provide in the event of death, disability, involuntary termination without cause, retirement, or a change of control, performance shares or performance units may not vest prior to the expiration of at least one (1) year of a performance period. The Compensation Committee may provide for the accelerated vesting of an award based on achievement of performance goals. (e) Other Stock-Based or Cash-Based Awards: The minimum vesting period for the grant of other stock-based awards is one (1) year, except as the Compensation Committee may provide in the event of death, disability, involuntary termination without cause, retirement, or a change of control. Notwithstanding the foregoing, unless otherwise provided by the Compensation Committee, any such awards granted as full value awards shall not be subject to a vesting schedule. For cash-based awards, the Compensation Committee may determine whether the award is subject to a vesting schedule. |

Award Terms: | Each option granted shall expire at such time as the Compensation Committee shall determine at the time of grant but shall not be exercisable later than the tenth (10th) anniversary date of its grant. The term of any SAR granted shall be determined by the Compensation Committee but shall not be exercisable later than the tenth (10th) anniversary date of its grant. |

| | |

Repricing Prohibited: | Options and SARs granted under the Plan may not be repriced, repurchased (including by cash buyout), replaced or regranted through cancellation or by lowering the option price of a previously granted option or the grant price of a previously granted SAR, without the approval of our shareholders. |

Non-employee Director Awards

If the Plan is approved by shareholders at the Annual Meeting, it is anticipated that each non-employee director will receive on the date of each annual meeting of shareholders an automatic restricted stock award of 1,000 shares and an additional award of Common Stock valued at $55,000, based on the fair market value of the Company’s Common Stock as of the date of the annual meeting of shareholders. The restricted stock awards will vest after one year, so long as the director remains continuously in office. Non-employee directors will also be eligible to receive other types of awards under the Plan, but such awards are discretionary. In the event of a change of control of the Company (as defined in the Plan), all of the shares of restricted stock will accelerate and become vested in full.

New Plan Benefits

Except as described below, the following table sets forth information concerning the benefits or amounts under the Plan that we can determine will be received by all current non-employee directors as a group on an annual basis.

| Name and Position | Dollar Value ($) | Number of Shares |

Non-employee directors as a group | Fair market value on date of grant | 7,000 |

Non-employee directors as a group | $385,000 | Fair market value on date of grant |

The information in the above table is limited to the annual automatic restricted stock awards and other stock awards to be granted to our non-employee directors in connection with the Annual Meeting. Future awards under the Plan to executive officers, employees or other eligible participants, and any future discretionary awards to non-employee directors in addition to those granted automatically, are discretionary and cannot be determined at this time. We therefore have not included any such awards in the table above.

Terms applicable to Stock Options and Stock Appreciation Rights

The exercise price of stock options or SARs granted under the Plan may not be less than the fair market value of our Common Stock on the date of grant (or, with respect to incentive stock options in the case of a holder of more than 10% of stock, 110% of fair market value). On the record date, the closing price of the Company’s Common Stock on the New York Stock Exchange was $42.48 per share. The Compensation Committee will determine at the time of grant the other terms and conditions applicable to such award, including exercisability and vesting, subject to the limitations described above.

Terms applicable to Grants of Restricted Stock, Restricted Stock Units, Performance Shares, Performance Share Units and Other Stock-Based or Cash-Based Awards

The Compensation Committee will determine the terms and conditions applicable to the granting of restricted stock, restricted stock units, performance shares, performance units and other stock-based or cash-based awards (including the grant of unrestricted shares). The Compensation Committee may make the grant, issuance, retention and/or vesting of restricted stock, restricted stock units, performance shares, performance units and other stock-based or cash-based awards contingent upon continued employment with the Company, the passage of time, or such performance criteria and the level of achievement as it deems appropriate.

Cash-Based Awards

The Compensation Committee, at any time and from time to time, may grant cash-based awards to participants in such amounts and upon such terms as the Compensation Committee may determine. The Compensation Committee may establish performance goals in its discretion in connection with the grant of any cash-based awards.

Transferability

Awards granted under the Plan are not transferable other than by will or the laws of descent and distribution, and no award shall be subject, in whole or in part, to attachment, execution, or levy of any kind. The Compensation Committee may establish such procedures as it deems appropriate for a participant to designate a beneficiary to whom any amounts payable or shares deliverable in the event of, or following, the participant’s death, may be provided.

Administration

The Compensation Committee will administer the Plan. Except as otherwise provided in the Plan, the Compensation Committee will have full and exclusive discretionary power to interpret the terms and the intent of the Plan and any award agreement or other agreement or document ancillary to or in connection with the Plan, to determine eligibility for awards and to adopt such rules, regulations, forms, instruments, and guidelines for administering the Plan as it may deem necessary or proper. Such authority shall include, but not be limited to, selecting award recipients, establishing all award terms and conditions, including the terms and conditions set forth in award agreements, granting awards as an alternative to or as the form of payment for grants or rights earned or due under compensation plans or arrangements of the Company, construing any ambiguous provision of the Plan or any award agreement, and, except as described below, adopting modifications and amendments to the Plan or any award agreement, including without limitation, any that are necessary to comply with the laws of the countries and other jurisdictions in which the Company, its affiliates, and/or its subsidiaries operate. All actions taken and all interpretations and determinations made by the Compensation Committee shall be final and binding upon the participants, the Company, and all other interested individuals.

The Compensation Committee may delegate such administrative duties or powers as it deems advisable to one or more of its members, the officers of the Company, its subsidiaries or affiliates, or its agents or advisors, and the Compensation Committee and such delegates may employ one or more individuals to render advice with respect to any such administrative duties or powers. In addition, the Compensation Committee may authorize one or more officers of the Company to do one or both of the following: (a) designate employees to be recipients of awards and (b) determine the size of any such awards; provided, however, (i) the Compensation Committee shall not delegate such responsibilities to any such officer for awards granted to an employee who is considered an insider (as defined in the Plan); (ii) the resolution providing such authorization sets forth the total number of awards such officer(s) may grant; and (iii) the officer(s) shall report periodically to the Compensation Committee regarding the nature and scope of the awards granted pursuant to the authority delegated.

Amendments

The Company’s Board of Directors may alter, amend, modify, suspend, or terminate the Plan and any related award agreement in whole or in part; provided, however, that (i) no options or SARs issued under the Plan will be re-priced, repurchased (including a cash buyout), replaced, or re-granted through cancellation, or by lowering the option price of a previously granted option or the grant price of a previously granted SAR; (ii) any amendment of the Plan must comply with the rules of the New York Stock Exchange; and (iii) no material amendment of the Plan shall be made without shareholder approval if shareholder approval is required by law, regulation, or stock exchange rule.

Adjustments

In the event of any corporate event or transaction (including, but not limited to, a change in the shares of the Company or the capitalization of the Company) such as a merger, consolidation, reorganization, recapitalization, separation, partial or complete liquidation, stock dividend, stock split, reverse stock split, split up, spin-off, or other distribution of stock or property of the Company, combination of shares, exchange of shares, dividend in kind, or other like change in capital structure, number of outstanding shares or distribution (other than normal cash dividends) to shareholders of the Company, or any similar corporate event or transaction, the Compensation Committee may approve, in its discretion, an adjustment of the number and kind of shares available for grant under the Plan or under particular forms of awards, the number and kind of shares subject to outstanding awards under the Plan, the exercise price or grant price of outstanding stock options and other awards, the Plan’s annual award limits, and other value determinations applicable to outstanding awards. The Compensation Committee may also make appropriate adjustments in the terms of any awards under the Plan to reflect or relate to such changes or distributions and to modify any other terms of outstanding awards, including modifications of performance goals and changes in the length of performance periods.

Change of Control

The Plan provides that in the event of a change of control of the Company, unless a replacement award (as described below) is provided to the participant, (i) outstanding options and SARs will become exercisable, (ii) outstanding awards subject to time-based vesting conditions shall vest in full and be free of restrictions, and (iii) the treatment of any other awards shall be as determined by the Compensation Committee in connection with the grant thereof, as reflected in the applicable award agreement. Notwithstanding the foregoing, if a replacement award is not provided to the participant, the Compensation Committee may, in its sole discretion, determine that any or all outstanding awards will be cancelled and terminated and a payment of cash made or shares of stock delivered to participants, equal in value to the cancelled award.

Any replacement award must (a) have a value at least equal to the value of the replaced award; (b) relate to publicly traded equity securities of the Company or its successor in the change of control (or a publicly traded affiliate thereof); and (iii) have other terms and conditions that are not less favorable to the participant than the terms and conditions of the replaced award. In addition, a replacement award must provide for accelerated vesting on termination of employment or other service other than for cause within two years after the change of control.

U.S. Tax Consequences

The following is a general summary as of the date of this Proxy Statement of certain United States federal income tax consequences to the Company and participants of awards granted under the Plan. The federal tax laws may change and the federal, state and local tax consequences for any participant will depend upon his or her individual circumstances. Each participant is encouraged to seek the advice of a qualified tax advisor regarding the tax consequences of participation in the Plan.

Non-Qualified Stock Options

A participant will realize no taxable income at the time a non-qualified stock option is granted under the Plan, but generally at the time such non-qualified stock option is exercised, the participant will realize ordinary income in an amount equal to the excess of the fair market value of the shares on the date of exercise over the stock option exercise price. Upon a disposition of such shares, the difference between the amount received and the fair market value on the date of exercise will generally be treated as a long-term or short-term capital gain or loss, depending on the holding period of the shares. The Company will generally be entitled to a deduction for federal income tax purposes at the same time and in the same amount as the participant is considered to have realized ordinary income in connection with the exercise of the non-qualified stock option.

Incentive Stock Options

A participant will realize no taxable income, and the Company will not be entitled to any related deduction, at the time any incentive stock option is granted. If certain employment and holding period conditions are satisfied, then no taxable income will result upon the exercise of such option and the Company will not be entitled to any deduction in connection with the exercise of such stock option. Upon disposition of the shares after expiration of the statutory holding periods, any gain realized by a participant will be taxed as long-term capital gain and any loss sustained will be long-term capital loss, and the Company will not be entitled to a deduction in respect to such disposition. While no ordinary taxable income is recognized at exercise (unless there is a “disqualifying disposition,” see below), the excess of the fair market value of the shares over the stock option exercise price is a preference item that is recognized for alternative minimum tax purposes.

Except in the event of death, if shares acquired by a participant upon the exercise of an incentive stock option are disposed of by such participant before the expiration of the statutory holding periods (i.e., a “disqualifying disposition”), such participant will be considered to have realized as compensation taxed as ordinary income in the year of such disposition an amount, not exceeding the gain realized on such disposition, equal to the difference between the stock option price and the fair market value of such shares on the date of exercise of such stock option. Generally, any gain realized on the disposition in excess of the amount treated as compensation or any loss realized on the disposition will constitute capital gain or loss, respectively. If a participant makes a “disqualifying disposition,” generally in the fiscal year of such “disqualifying disposition” the Company will be allowed a deduction for federal income tax purposes in an amount equal to the compensation realized by such participant. If a participant disposes of shares subject to an incentive stock option before two years after the option was granted, or before one year after the ISO was exercised, this is a disqualifying disposition.

Stock Appreciation Rights

A grant of a SAR (which can be settled in cash or the Company Common Stock) has no federal income tax consequences at the time of grant. Upon the exercise of SARs, the value received is generally taxable to the participant as ordinary income, and the Company generally will be entitled to a corresponding tax deduction.

Restricted Stock

A participant receiving restricted stock may be taxed in one of two ways: the participant (i) pays tax when the restrictions lapse (i.e., they become vested) or (ii) makes a special election to pay tax in the year the grant is made. At either time the value of the award for tax purposes is the excess of the fair market value of the shares at that time over the amount (if any) paid for the shares. The Company generally receives a tax deduction at the same time and for the same amount taxable to the participant. If a participant elects to be taxed at grant, then, when the restrictions lapse, there will be no further tax consequences attributable to the awarded stock until the participant disposes of the stock.

Restricted Stock Units

In general, no taxable income is realized upon the grant of a restricted stock unit award. The participant will generally include in ordinary income the fair market value of the restricted stock units at the time they vest. The Company generally will be entitled to a tax deduction at the time and in the amount that the participant recognizes ordinary income.

Performance Shares

The participant will not realize income when a performance share is granted, but will realize ordinary income when shares are transferred to him or her. The amount of such income will be equal to the fair market value of such transferred shares on the date of transfer. The Company generally will be entitled to a deduction for federal income tax purposes at the same time and in the same amount as the participant is considered to have realized ordinary income as a result of the transfer of shares.

Cash-Based Awards and Other Stock-Based Awards

The participant will recognize, as a general rule, ordinary income at the time of payment of cash or delivery of actual shares of Common Stock. Future appreciation on shares of Common Stock held beyond the ordinary income recognition event will be taxable at capital gains rates when the shares of Common Stock are sold. The Company, as a general rule, will be entitled to a tax deduction that corresponds in time and amount to the ordinary income recognized by the participant, and the Company will not be entitled to any tax deduction in respect of capital gain income recognized by the participant.

Proposal No. 3

Ratification of the Appointment of KPMG LLP

Our Board of Directors recommends you vote “FOR” the ratification of KPMG as the Company’s independent registered public accounting firm.

The Audit Committee of our Board of Directors plans to appoint KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm to audit the Company’s consolidated financial statements for the 2021 fiscal year. Although the Company is not required to seek shareholder approval of this appointment, the Board believes it to be sound corporate governance to do so and is asking shareholders to ratify the appointment of KPMG. If the appointment is not ratified, the Audit Committee will investigate the reasons for shareholder rejection and will reconsider the appointment. Representatives of KPMG are expected to attend the Annual Meeting where they will be available to respond to questions and, if they desire, to make a statement.

Audit and Non-Audit Fees

The following table presents fees for professional services rendered by KPMG in the fiscal years ended December 31, 2020 and 2019.

| | | 2020 | | | 2019 | |

| Audit fees | | $ | 1,554,250 | | | $ | 1,728,600 | |

Audit-related fees(1) | | | 21,500 | | | | 26,000 | |

Tax fees(2) | | | 412,500 | | | | 285,800 | |

| All other fees | |

| ─ | | |

| ─ | |

| Total | | $ | 1,988,250 | | | $ | 2,040,400 | |

| (1) | Audit-related fees consist principally of audits of payments related to certain employee benefits. |

| (2) | Tax fees consist primarily of U.S. and international tax compliance and planning. |

In accordance with its charter, the Audit Committee approves the compensation and terms of engagement of the Company’s independent auditors, including the pre-approval of all audit and non-audit service fees. All of the fees paid to the Company’s independent auditors described above were for services pre-approved by the Audit Committee.

Proposal No. 4

Advisory Vote on the Compensation

of Our Named Executive Officers

Our Board of Directors recommends you vote “FOR” the approval of the non-binding, advisory resolution approving the compensation of our named executive officers.

At our Annual Meeting, our shareholders will have the opportunity to vote, on an advisory (non-binding) basis, to approve the compensation of our named executive officers, as disclosed in this Proxy Statement (referred to as a “say-on-pay” vote). The say-on-pay vote is being provided pursuant to Section 14A of the Securities Exchange Act of 1934. The say-on-pay vote is an advisory vote that is not binding on the Company or the Board of Directors; however, the Board values the opinions of our shareholders and will consider the outcome of the vote when making future compensation decisions.

Our executive compensation program is designed to attract, motivate and retain individuals with the skills required to formulate and drive the Company’s strategic direction and achieve annual and long-term performance goals necessary to create shareholder value, while striving to avoid the use of highly leveraged incentives that may encourage overly risky short-term behavior on the part of executives. We believe that our executive compensation program is reasonable, competitive and focused on pay for performance principles, as described more fully in the “Compensation Discussion and Analysis” section, beginning on page 34 of this Proxy Statement.

Our Compensation Committee establishes, recommends and governs all of the compensation and benefits policies and actions for the Company’s named executive officers. We utilize a combination of base pay, annual incentives and long-term incentives. While we have generally targeted base pay to be in the median to 75% range, and each other component of executive compensation to be at or near the median range of similar-type compensation for our peer group, actual compensation of our named executive officers varies depending upon the achievement of pre-established performance goals. The annual cash incentive award is based on the achievement of both company-level financial performance and management performance, or management by objective goals (“MBO”). Actual award payouts may range from 0% to 200% of the target award amount, depending upon the level of achievement. Through stock ownership requirements and equity incentives, we also align the interests of our executives with those of our shareholders and the Company’s long-term interests. Our executive compensation policies have enabled us to attract and retain talented and experienced executives and have benefited the Company over time. We believe that the fiscal year 2020 compensation of each of our named executive officers was reasonable and appropriate, and aligned with the Company’s fiscal year 2020 results and achievement of the objectives of our executive compensation program.

The Company also has several governance policies in place to align executive compensation with shareholder interests and mitigate risks in its plans. These programs include stock ownership guidelines (including a mandatory post-vesting holding period, as described below), limited perquisites, use of tally sheets, and a claw back policy.

For the reasons discussed above, the Board of Directors unanimously recommends that shareholders vote in favor of the following non-binding resolution:

“RESOLVED, that the shareholders hereby APPROVE, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K and the other compensation disclosure rules of the Securities and Exchange Commission in the Company’s Proxy Statement for the 2021 Annual Meeting of Shareholders (which disclosure includes the Compensation Discussion and Analysis, the Summary Compensation Table for 2020 and other related tables and accompanying narrative).”

Security Ownership of Certain Beneficial Owners

and Management

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of April 9, 2021 by:

| • | each person who is known to the Company to be the beneficial owner of more than five percent of the Company’s Common Stock; |

| • | each director and nominee for director of the Company; |

| • | each executive officer named in the Summary Compensation Table below; and |

| • | all directors and executive officers as a group. |

Name and Address | | Amount and Nature of Beneficial Ownership | (1) | | Percentage of Class | |

BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | | | 3,202,510 | (2) | | | 14 | % |

The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | | | 1,327,479 | (3) | | | 5.8 | % |

Dimensional Fund Advisors LP Palisades West, Bldg. One 6300 Bee Cave Road Austin, TX 78746 | | | 1,316,311 | (4) | | | 5.8 | % |

| Lawrence I. Sills | | | 645,546 | (5) | | | 2.8 | % |

| Eric P. Sills | | | 172,901 | | | | * | |

| Richard S. Ward | | | 80,297 | | | | * | |

| William H. Turner | | | 80,124 | | | | * | |

| Roger M. Widmann | | | 69,156 | | | | * | |

| James J. Burke | | | 67,752 | | | | * | |

| Carmine J. Broccole | | | 67,460 | | | | * | |

| Dale Burks | | | 57,499 | | | | * | |

| Pamela Forbes Lieberman | | | 41,753 | | | | * | |

| John P. Gethin | | | 23,269 | | | | * | |

| Joseph W. McDonnell | | | 21,294 | | | | * | |

| Alisa C. Norris | | | 21,294 | | | | * | |

| Patrick S. McClymont | | | 12,715 | | | | * | |

| Nathan R. Iles | | | 9,090 | | | | * | |

| Directors and Officers as a group (18 persons) | | | 1,508,416 | | | | 6.6 | % |

| * | Represents beneficial ownership of less than one percent of the outstanding shares of Common Stock. |

| (1) | Applicable percentage of ownership is calculated by dividing (a) the total number of shares beneficially owned by the shareholder by (b) 22,833,298 which is the number shares of Common Stock outstanding as of April 9, 2021. Beneficial ownership is calculated based on the requirements of the Securities and Exchange Commission (“SEC”). Except as indicated in the footnotes to this table, the shareholder named in the table has sole voting power and sole investment power with respect to the shares set forth opposite such shareholder’s name. Unless otherwise indicated, the address of each individual listed in the table is c/o Standard Motor Products, Inc., 37-18 Northern Blvd., Long Island City, New York 11101. |

| (2) | The information for BlackRock, Inc. and certain of its affiliates (“BlackRock”) is based solely on an amendment to its Schedule 13G filed with the SEC on January 26, 2021, wherein BlackRock states that it beneficially owns an aggregate of 3,202,510 shares of our Common Stock; BlackRock states that it has sole voting power for 3,171,211 shares and sole investment power for 3,202,510 shares. |

| (3) | The information for The Vanguard Group and certain of its affiliates (“Vanguard”) is based solely on an amendment to its Schedule 13G filed with the SEC on February 10, 2021, wherein Vanguard states that it beneficially owns an aggregate of 1,327,479 shares of our Common Stock; Vanguard states that it has shared voting power for 25,924 shares, sole investment power for 1,286,260 shares and shared investment power for 41,219 shares. |

| (4) | The information for Dimensional Fund Advisors LP and certain of its affiliates (“Dimensional”) is based solely on an amendment to its Schedule 13G filed with the SEC on February16, 2021, wherein Dimensional states that it beneficially owns an aggregate of 1,316,311 shares of our Common Stock; Dimensional states that it has sole voting power for 1,258,017 shares and sole investment power for 1,316,311 shares. |

| (5) | Includes 2,812 shares of Common Stock owned by Mr. Sills’ wife. For shares of stock held by his wife, Lawrence I. Sills disclaims beneficial ownership of the shares so deemed “beneficially owned” by him within the meaning of Rule 13d-3 of the Exchange Act. |

Corporate Governance

The Company’s Board of Directors has adopted policies and procedures that the Board believes are in the best interests of the Company and its shareholders as well as compliant with the Sarbanes-Oxley Act of 2002, the rules and regulations of the SEC, and the listing standards of the New York Stock Exchange. In particular:

| • | The Board has adopted Corporate Governance Guidelines; |

| • | The Board has appointed a Presiding Independent Director, who is independent under the New York Stock Exchange standards and applicable SEC rules; |

| • | A majority of the Board and all members of the Audit Committee, Compensation and Management Development Committee, and Nominating and Corporate Governance Committee are independent under the New York Stock Exchange standards and applicable SEC rules; |

| • | The Board has adopted charters for each of the Committees of the Board and the Presiding Independent Director; |

| • | The Company’s Corporate Governance Guidelines provide that the independent directors meet periodically in executive session without management and that the Presiding Independent Director chairs the executive sessions; |

| • | Interested parties are able to make their concerns known to non-management directors or the Audit Committee by e-mail or by mail (see “Communications to the Board” section below); |

| • | The Company has a Corporate Code of Ethics that applies to all Company employees, officers and directors, and a Whistleblower Policy with a dedicated website and toll-free helpline that is operated by an independent third party and is available to any employee, supplier, customer, shareholder or other interested third party; and |

| • | The Company has established Stock Ownership Guidelines that apply to its independent directors and executive officers. |

Certain information relating to corporate governance matters can be viewed at

ir.smpcorp.com under “Governance Documents.” Copies of the Company’s (1) Corporate Governance Guidelines, (2) charters for the Audit Committee, Compensation Committee, Governance Committee, Strategic Planning Committee, and the Presiding Independent Director, and (3) Corporate Code of Ethics and Whistleblower Policy are available on the Company’s website.

Copies will also be provided to any shareholder free of charge upon written request to Carmine J. Broccole, Secretary of the Company, at 37-18 Northern Blvd., Long Island City, NY 11101 or via email at financial@smpcorp.com.

Meetings of the Board of Directors and its Committees

In 2020, the total number of meetings of the Board of Directors, including regularly scheduled and special meetings, was eight. All of our directors attended at least 75% of the total number of meetings of the Board and the Committees on which they served during 2020. The Company requires all Board members to attend its Annual Meeting of Shareholders. All directors were present at the 2020 Annual Meeting of Shareholders held on May 19, 2020, except for Roger M. Widmann who was absent due to a medical treatment.

The Board currently has four standing committees. The table below lists each committee, its composition and current chair. Each committee is comprised only of our independent directors, except that Mr. Gethin, a non-independent director, is a member of the Strategic Planning Committee.

| Name | Audit Committee | Compensation and Management Development Committee | Nominating and Corporate Governance Committee | Strategic Planning Committee |

Lawrence I. Sills | ─ | ─ | ─ | ─ |

William H. Turner | Chair | Member | Member | Member |

John P. Gethin | ─ | ─ | ─ | Member |

Pamela Forbes Lieberman | Member | Member | Member | Chair |

Patrick S. McClymont | Member | Member | Member | Member |

Joseph W. McDonnell | Member | Member | Member | Member |

Alisa C. Norris* | Member | Member | Member | Member |

Eric P. Sills | ─ | ─ | ─ | ─ |

Richard S. Ward | Member | Member | Chair | Member |

Roger M. Widmann* | Member | Chair | Member | Member |

*Roger M. Widmann will retire on the date of our 2021 Annual Meeting. The Board of Directors appointed Alisa C. Norris to become Chair of the Compensation Committee following Mr. Widmann’s retirement.

Audit Committee

The Audit Committee is responsible for: (1) recommending to the Board of Directors the engagement of the independent auditors of the Company; (2) reviewing with the independent auditors the scope and results of the Company’s audits; (3) pre-approving the professional services furnished by the independent auditors to the Company; (4) reviewing the independent auditors’ management letter with comments on the Company’s internal accounting control; and (5) reviewing management policies relating to risk assessment and risk management. The Audit Committee held four meetings in 2020.

The Board of Directors has determined that each Audit Committee member is financially literate and independent. In addition, the Board has determined that at least one member of the Audit Committee meets the New York Stock Exchange standard of having accounting or related financial management expertise. The Board has also determined that William H. Turner (the Audit Committee’s Chair), Pamela Forbes Lieberman, Patrick S. McClymont and Roger M. Widmann meet the SEC’s criteria for an “audit committee financial expert.”

Compensation and Management Development Committee (“Compensation Committee”)

The Compensation Committee’s functions are to: (1) approve the compensation packages of the Company’s executive officers; (2) administer the Company’s equity incentive plans and other benefit plans; (3) review the Company’s overall compensation policies and practices, including compensation-related risk assessments; (4) review the performance, training and development of Company management in achieving corporate goals and objectives; (5) oversee the Company’s management succession planning; and (6) oversee the Company’s strategies and policies relating to human capital management, including diversity, equity and inclusion. With respect to diversity and inclusion, the Compensation Committee is committed to ensuring that the Company’s management actively seeks candidates who are diverse in terms of race, gender or ethnicity when considering new hires and promotions for all positions, from entry-level to senior leadership. The Compensation Committee held two meetings in 2020.

The Compensation Committee has the exclusive authority and responsibility to determine all aspects of executive compensation packages. The Compensation Committee may, at its discretion, solicit the input of our Chief Executive Officer, or any independent consultant or advisor in satisfying its responsibilities. The Compensation Committee may also, at its discretion, form and delegate authority to subcommittees, or it may delegate authority to one or more designated members of the Board or to our executive officers.

Nominating and Corporate Governance Committee (“Governance Committee”)

The Governance Committee’s functions are to assist the Board in discharging and performing the duties and responsibilities of the Board with respect to corporate governance, including:

| • | the identification and recommendation to the Board of individuals qualified to become or continue as directors, including through succession planning to ensure the desired mix of experience, qualifications, attributes and skills of the individual members of the Board; |

| • | the continuous improvement in corporate governance policies and practices; |

| • | the annual assessment of the performance of the Board and each of its committees through questionnaires and one-on-one assessments with individual members of the Board; |

| • | the recommendation of members for each committee of the Board; |

| • | the compensation arrangements for members of the Board; |

| • | overseeing the Company’s commitment to corporate social responsibility matters, including environmental, social, and governance (ESG) matters; and |

| • | overseeing the Company’s enterprise risk management policies and procedures, including information security and compliance with applicable laws and regulations concerning privacy. |

The Governance Committee held four meetings in 2020. The Governance Committee has the exclusive authority and responsibility to review and recommend to the Board all aspects of director compensation. The Governance Committee may solicit, in its discretion, the input of an independent consultant or advisor in satisfying its responsibilities.

Qualifications for consideration as a director nominee vary according to the particular areas of expertise being sought to complement and enhance the existing board composition. In recommending candidates for election to the Board, the Governance Committee considers nominees recommended by directors, officers, employees, shareholders and others, using the same criteria to evaluate all candidates. The Governance Committee does not assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all prospective nominees. However, in making nominations, the Governance Committee seeks candidates who possess: (1) the highest level of integrity and ethical character; (2) a strong personal and professional reputation; (3) sound judgment; (4) financial literacy; (5) independence; (6) significant experience and proven superior performance in professional endeavors; (7) an appreciation for Board and team performance; (8) the commitment to devote the time necessary for Board activities; (9) skills in areas that will benefit the Board; and (10) the ability to make a long-term commitment to serve on the Board.

The Governance Committee reviews each candidate’s qualifications to determine whether the candidate possesses any of the specific qualities and skills that are desired in members of the Board, taking into account diversity in professional experience, skills and background, race, gender, disability, ethnicity, nationality, religion, and sexual orientation. In particular, the Governance Committee is committed to actively seeking candidates who are diverse in terms of race, gender or ethnicity when developing the pool of candidates to be considered as prospective nominees. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate. Upon selection of a qualified candidate, the Governance Committee recommends the candidate for consideration by the Board. The Governance Committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

Shareholders may propose director candidates for consideration by the Governance Committee. For shareholder candidates to be considered, written notice of such shareholder recommendation (a) must be provided to the Secretary of the Company not less than 45 days nor more than 75 days prior to the first anniversary of the record date for the preceding year’s annual meeting, and (b) must contain the name of any recommended candidate for director, together with a brief biographical sketch, a document indicating the candidate’s willingness to serve, if elected, and evidence of the nominating person’s ownership of Company stock. Both shareholder-proposed candidates and other candidates identified and evaluated by the Governance Committee must comply with the above procedure and meet the qualifications for directors, as outlined in the charter of the Governance Committee and the By-Laws of the Company. To recommend a prospective nominee for the Governance Committee’s consideration, a shareholder must submit the candidate’s name and qualifications to Carmine J. Broccole, Secretary of the Company, at 37-18 Northern Blvd., Long Island City, NY 11101.

Strategic Planning Committee

The Strategic Planning Committee’s functions are to assist the Board in discharging and performing its oversight role regarding the Company’s long-term strategic planning and to give guidance to management in creating the Company’s long-term strategic plans. The Strategic Planning Committee held two meetings in 2020.

In fulfilling its role, the Strategic Planning Committee shall, among other things, (1) assist in the development, adoption, and modification of the Company’s current and future strategy; (2) review and assess external developments and other factors affecting the automotive aftermarket and their impact on the Company’s strategy; (3) review and assess the Company’s core competencies with regard to expanding their implementation in attractive markets beyond the automobile aftermarket; and (4) review and advise the Board and management on corporate development and growth initiatives, including acquisitions, joint ventures and strategic alliances.

Board Leadership Structure

The business of the Company is managed under the direction of the Board of Directors of the Company in the interest of the shareholders. The Board delegates its authority to senior management for managing the everyday affairs of the Company. The Board requires that senior management review major actions and initiatives with the Board prior to implementation.

Lawrence I. Sills serves as our Chairman of the Board. As our Chairman, Lawrence I. Sills provides leadership to the Board, leads discussions of strategic issues for the Company, and works with the Board to define its structure and activities in fulfillment of its responsibilities.

Eric P. Sills serves as our Chief Executive Officer and President. As our Chief Executive Officer and President, Eric P. Sills focuses on the day-to-day operations of our business and the implementation of our business strategy to achieve our annual and long-term strategic, financial, organizational and management goals.

William H. Turner serves as our Presiding Independent Director. As our Presiding Independent Director, Mr. Turner serves as the principal liaison between the Chairman and the independent directors and presides at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors. The Presiding Independent Director has the authority to call meetings of the independent directors and retain outside counsel and other advisors to the extent necessary in the conduct of his duties and responsibilities. The Presiding Independent Director is expected to provide independent oversight of management, while fostering a cohesive Board that cooperates with the Chairman and Chief Executive Officer towards the ultimate goal of creating shareholder value. The Presiding Independent Director is nominated by the Governance Committee and approved by the independent directors of the Board every year, but a director may serve for one or more terms as Presiding Independent Director at the discretion of the Governance Committee. A copy of the charter of the Presiding Independent Director can be viewed at ir.smpcorp.com under “Governance Documents.”

The Board’s Annual Self-Evaluation

The Board of Directors conducts a self-evaluation on an annual basis that is designed to enhance the overall effectiveness of the Board and each of its committees. The evaluation covers the processes, structure, culture and performance of the Board and each of its committees, and the experience, qualifications, attributes and skills of the individual members of the Board. Information is gathered for evaluation through the use of a comprehensive written questionnaire distributed annually, and one-on-one assessments between the Presiding Independent Director and each director periodically over the course of the year. The evaluation process is overseen by the Presiding Independent Director and the Chair of the Governance Committee, who review the results of the evaluation with our independent directors in executive sessions at meetings of the Board. In addition, the Board may engage an independent consultant in connection with its self-evaluation process; however, the Board did not elect to do so in 2020. We believe that the Board’s annual self-evaluation reflects good corporate governance, and has strengthened our Board, each of its committees and individual director performance over time.

The Board’s Role in Risk Oversight

Our Board oversees an enterprise-wide approach to risk management. The Board’s role in the Company’s risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Company. In addition, the Board (or the appropriate Committee in the case of risks that are under the purview of a particular Committee) receives these reports to enable it to understand our risk identification, risk management and risk mitigation strategies as well as to consider what level of risk is appropriate for the Company.

The involvement of the Board in setting the Company’s business strategy is a key part of its assessment of management’s appetite for risk and also a determination of what constitutes an appropriate level of risk for the Company. As part of its risk oversight function, the Board reviews risk throughout the business, focusing on financial risk, legal/compliance risk and operational/strategic risk, as well as corporate social responsibility matters, including ESG.

While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the Audit Committee focuses on financial risk, including internal controls, and receives an annual risk assessment report from the Company’s internal auditors. The Governance Committee oversees information security risks and receives briefings from senior management on related matters at least semi-annually, and more frequently as circumstances warrant. In addition to setting compensation, the Compensation Committee strives to create incentives that encourage a level of risk-taking behavior that is consistent with the Company’s business strategy.

Communications to the Board

Shareholders and other interested parties may communicate with the Board or individual directors, including the Presiding Independent Director, pursuant to the procedures established by the Governance Committee from time to time. Correspondence intended for the Board or an individual director should be sent to the attention of the Secretary of the Company at 37-18 Northern Blvd., Long Island City, NY 11101, who will forward it to the members of the Governance Committee. The Governance Committee will have the discretion to distribute only such correspondence to the Board or individual members of the Board that the Governance Committee determines in good faith has a valid business purpose or is otherwise appropriate for the Board or individual member thereof to receive.

Code of Ethics and Corporate Social Responsibility

Our Company was founded in 1919 on the values of integrity, common decency and respect for others. These values continue to this day and are embodied in our Code of Ethics, which has been adopted by the Board of Directors of the Company to promote honest and ethical conduct, and propagate a culture of compliance from the top down. Through our Code of Ethics, we reinforce our commitment to our Company, our employees, our business partners and the communities within which we operate.

In February 2021, we published our inaugural Corporate Social Responsibility and Sustainability Report, in which we discuss some of the specific actions that we have taken to be environmental and socially responsible. Our sustainability report is available at ir.smpcorp.com under “Governance Documents” and is not incorporated by reference into this Proxy Statement.

We believe that our focus on these issues and our desire to be a good corporate citizen strengthens our culture and our company in several important ways, including through the creation of high employee satisfaction resulting in a skilled workforce with low employee turnover, high customer satisfaction resulting in decades-long customer relationships, the assessment and management of risk, the achievement of operating efficiencies and cost reductions, and improved relations with our stakeholders and communities within which we conduct our business.

We had several notable achievements in 2020 relating to environmental, social and governance matters, such as the following:

| • | We formed a multi-disciplinary leadership team comprised of our Chief Executive Officer and other executive officers to lead our efforts in this area. |

| • | We launched the SMPCares® initiative with the goal of positively impacting our communities through volunteerism, community outreach and philanthropy. Our efforts included blood drivers with the American Red Cross, fundraising for the March of Dimes, United Way, Salvation Army and many others, organization donations to local community organizations, hospitals, schools, shelters and universities, and scholarship awards, including our Women in Auto Care scholarship, which aims to empower women entering the automotive industry. |

| • | We formed a Diversity and Inclusion Taskforce focusing on developing strategies to recruit, train and retain a more diverse and inclusive workforce. |

| • | We expanded our product offerings to promote a greener car parc. |

| • | We prevented approximately 4,200 tons of waste from entering landfills, and we recycled approximately 18,200 gallons of used oil. |

| • | We prioritized employee health and safety, implementing enhanced cleaning procedures and screening protocols, providing protective equipment, establishing remote work arrangements, implementing an emergency employee relief fund, and other operations changes to keep our employees safe. |

| • | We established management performance, or management by objective (“MBO”), goals for fiscal year 2020 for all employees participating in our annual cash incentive bonus plan, which were designed to incorporate the same MBO goals of our executive officers and align our focus on environmental, social and governance initiatives, among others, from the top down. |

We are especially proud of our remanufacturing initiatives by which previously used automotive products are returned to same-as-new, or better, condition and performance. We remanufacture key product categories within our product portfolio, such as air conditioning compressors, diesel injectors and diesel pumps, resulting in the production of premium automotive products within these categories through processes that we believe save energy and reduce waste. We also manufacture and distribute components for the emission control systems of motor vehicles, such as evaporative emission pressure sensors, control solenoids and EGR valves. These components play a critical role in these important systems, which are designed to reduce emissions and improve fuel economy during vehicle operation. You may read more about our environmental initiatives by visiting ir.smpcorp.com under “Environmental & Social Responsibility─Corporate Initiatives”.

We are also proud of the positive impact that the Company and its employees have on our local communities through charitable giving and volunteerism. You may read more about our social initiatives, and our efforts to engage on a local level in the communities within which we operate, by visiting smpcares.smpcorp.com.

Our Corporate Code of Ethics is available at ir.smpcorp.com under “Governance Documents.”

Prohibition on Hedging or Pledging of Company Stock

All directors and employees, including officers, are expressly prohibited from hedging or engaging in any derivative transactions, such as “cashless” collars, forward contracts or equity swaps, to offset any decrease in the market value of the Company’s Common Stock. All directors and employees, including officers, are also expressly prohibited from pledging their shares of Common Stock.

Director Independence