- CVX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Chevron (CVX) DEF 14ADefinitive proxy

Filed: 21 Mar 05, 12:00am

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

x Definitive Proxy Statement | ||

| ¨ Definitive Additional Materials | ||

| ¨ Soliciting Material Under Rule 14a-12 |

ChevronTexaco Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed |

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ Fee | paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notice of the 2005

Annual Meeting and the

2005 Proxy Statement

Notice of the 2005 Annual Meeting of Stockholders | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 3 | ||

| 3 | ||

| 3 | ||

| 3 | ||

| 4 | ||

| 4 | ||

| 5 | ||

| 6 | ||

| 6 | ||

| 10 | ||

| 10 | ||

• Current Board Committee Membership and 2004 Meetings and Functions | 10 | |

| 11 | ||

• Certain Business Relationships Between ChevronTexaco and Its Directors and Officers | 12 | |

| 12 | ||

| 12 | ||

| 13 | ||

| 15 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 21 | ||

| 21 | ||

| 21 | ||

| 21 | ||

| 22 | ||

| 22 | ||

| 22 | ||

| 22 | ||

| 22 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

Notice of the 2005

Annual Meeting of Stockholders

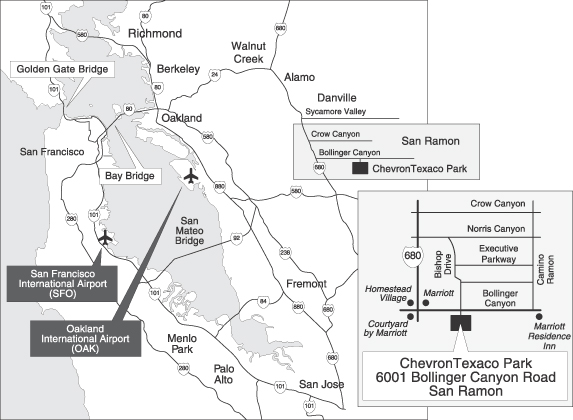

Meeting Date: | April 27, 2005 | |

Meeting Time: | 8:00 a.m., PDT | |

Location: | ChevronTexaco Park | |

| Building A Auditorium | ||

6001 Bollinger Canyon Road San Ramon, California 94583 | ||

Record Date: | March 1, 2005 | |

Agenda

| • | To elect 12 Directors; |

| • | To ratify the appointment of the independent registered public accounting firm; |

| • | To take action on the stockholder proposals; and |

| • | To transact any other business that may be properly brought before the Annual Meeting. |

Admission

All stockholders are invited to attend the Annual Meeting. You will need an admission ticket or proof of ownership of ChevronTexaco common stock (ChevronTexaco Stock), as well as a form of personal photo identification, to be admitted to the Annual Meeting.

We will hold the Annual Meeting at ChevronTexaco Park in San Ramon, California. Seating will be limited and on a first come basis. Please refer to page 5 of this Proxy Statement for information about attending the Annual Meeting.

Voting

Stockholders owning ChevronTexaco Stock at the close of business on the Record Date, or their legal proxy holders, are entitled to vote at the Annual Meeting. Please refer to page 3 of the Proxy Statement for an explanation of ChevronTexaco’s confidential voting procedures.

We are distributing this Proxy Statement, proxy form and ChevronTexaco’s 2004 Annual Report to stockholders on or about March 21, 2005.

By Order of the Board of Directors,

Lydia I. Beebe

Corporate Secretary

ChevronTexaco Corporation

6001 Bollinger Canyon Road

San Ramon, California 94583

March 21, 2005

2005 Proxy Statement

Your Board is providing you with these proxy materials in connection with the solicitation of proxies to be voted at our 2005 Annual Meeting of Stockholders and at any postponement or adjournment of the Annual Meeting. In this Proxy Statement, ChevronTexaco is referred to as “we,” “our,” “the Company” or “the Corporation.”

Your Board of Directors asks you to appoint David J. O’Reilly, Charles A. James and Lydia I. Beebe as your proxy holders to vote your shares at the Annual Meeting.You make this appointment by voting the enclosed proxy form using one of the voting methods described below.

If appointed by you, the proxy holders will vote your shares as you direct on the matters described in this Proxy Statement. In the absence of your direction, they will vote your shares as recommended by your Board.

Unless you otherwise indicate on the proxy form or through the telephone or Internet voting procedures, you also authorize your proxy holders to vote your shares on any matters not known by your Board at the time this Proxy Statement was printed and which, under ChevronTexaco’s By-Laws, may be properly presented for action at the Annual Meeting.

Your Board strongly encourages you to exercise your right to vote. Your vote is important. Voting early helps ensure that ChevronTexaco receives a quorum of shares necessary to hold the Annual Meeting without a second mailing.

Stockholders of record (you own shares in your own name) can vote by telephone, on the Internet or by mail as described below. Street name stockholders (you own shares in the name of a bank, broker or other holder of record) should refer to the proxy form or the information you received from the record holder to see which voting methods are available to you.

The telephone and Internet voting procedures are designed to authenticate you as a stockholder of record by use of a control number and to allow you to confirm that your voting instructions have been properly recorded. If you vote by telephone or on the Internet, you do not need to return your proxy form. Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. EDT on April 26, 2005.

Voting by Telephone. You may vote by proxy by using the toll-free number listed on the proxy form. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded.

Voting on the Internet. You may vote by proxy on the Internet. The Web site for Internet voting iswww.proxyvote.com. As with telephone voting, you can confirm that your instructions have been properly recorded. If you vote on the Internet, you can request electronic delivery of future proxy materials.

Voting by Mail. You may vote by proxy by signing, dating and returning your proxy forms in the preaddressed, postage-paid envelope provided.

Voting at the Annual Meeting. The method by which you vote your proxy form will not limit your

General Information(Continued)

right to vote at the Annual Meeting, if you decide to attend in person. Your Board recommends that you vote using one of the other voting methods as it is not practical for most stockholders to attend the Annual Meeting. If you are a street name stockholder, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting.

Revoking Your Voting Instructions to Your Proxy Holders. If you are a stockholder of record and you vote by proxy using the mail, the telephone, or the Internet, you may later revoke your proxy instructions by:

| — | sending a written statement to that effect to the Corporate Secretary; |

| — | submitting a proxy form with a later date and signed as your name appears on the stock account; |

| — | voting at a later time by telephone or the Internet; or |

| — | voting in person at the Annual Meeting. |

If you are a street name stockholder and you vote by proxy, you may later revoke your proxy instructions by informing the holder of record in accordance with that entity’s procedures.

VOTE REQUIRED AND METHOD OF COUNTING

At the close of business on the Record Date, there were 2,104,557,093 shares of ChevronTexaco Stock outstanding and entitled to vote at the Annual Meeting. Each outstanding share is entitled to one vote.

A quorum, which is a majority of the outstanding shares as of the Record Date, must be present to hold the Annual Meeting. A quorum is calculated based on the number of shares represented by the stockholders attending in person and by their proxy holders. If you indicatean abstention as your voting preference in all matters, your shares will be counted toward a quorum but will not be voted on any matter.

If you are a street name stockholder and don’t vote your shares, your broker can vote your shares at its discretion on any of the matters scheduled to come before the meeting, other than the stockholder proposals (Items 3 through 8 on the proxy form). If you don’t give your broker instructions on how to vote your shares on the stockholder proposals, your shares will not be voted on these matters and will be considered “broker nonvotes.”

If you don’t vote your shares that are held through the employee benefits plans, your trustee will vote your shares in accordance with the terms of the relevant plan.

The vote required and method of calculation are as follows for the various business matters to be considered at the Annual Meeting:

Item 1—Election of Directors

Each outstanding share of ChevronTexaco Stock is entitled to one vote for as many separate nominees as there are Directors to be elected. The nominees who receive the most votes for the number of positions to be filled are elected Directors. If you do not wish your shares to be voted for a particular nominee, you may so indicate in the space provided on the proxy form or withhold authority as prompted during the telephone or Internet voting instructions.

Item 2—Ratification of Independent Registered Public Accounting Firm; Items 3 through 8—Stockholder Proposals

These proposals are approved if the number of shares voted in favor of each exceeds the number of shares voted against.

2

General Information(Continued)

Any shares not voted on any item (whether by abstention, broker nonvote, or otherwise) will have no impact on that particular item.

ChevronTexaco has a confidential voting policy to protect our stockholders’ voting privacy. Under this policy, ballots, proxy forms and voting instructions returned to brokerage firms, banks and other holders of record are treated as confidential. Only the proxy solicitor, the proxy tabulator and the Inspector of Election have access to the ballots, proxy forms and voting instructions. Anyone who processes or inspects the ballots, proxy forms and voting instructions signs a pledge to treat them as confidential. None of these persons is a ChevronTexaco Director, officer or employee.

The proxy solicitor and the proxy tabulator will disclose information taken from the ballots, proxy forms and voting instructions only in the event of a proxy contest or as otherwise required by law.

METHOD AND COST OF SOLICITING AND TABULATING VOTES

ChevronTexaco has retained ADP Investor Communication Services to assist in distributing these proxy materials. Georgeson Shareholder Communications, Inc., will act as our solicitor in soliciting votes at an estimated cost of $25,000 plus its reasonable out-of-pocket expenses. ChevronTexaco employees, personally or by telephone, may solicit your proxy voting instructions.

ChevronTexaco will reimburse brokerage firms, banks and other holders of record for their reasonable out-of-pocket expenses for forwarding these proxy materials to you.

ADP Investor Communication Services will be the proxy tabulator and IVS Associates, Inc. will act as the Inspector of Election.

We have adopted a procedure approved by the Securities and Exchange Commission (SEC) called “householding.” Under this procedure, stockholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of the Annual Report and Proxy Statement. This procedure will reduce our printing costs and postage fees.

Stockholders who participate in householding will continue to receive separate proxy forms. Householding will not affect your dividend check mailings.

If you or another stockholder of record with whom you share an address wish to receive a separate Annual Report or Proxy Statement, we will promptly deliver it to you if you request it by writing to: ChevronTexaco Corporation, Corporate Secretary, 6001 Bollinger Canyon Road, San Ramon, California 94583. If you or another stockholder of record with whom you share an address wish to receive a separate Annual Report or Proxy Statement in the future, you may telephone toll-free 1-800-542-1061 or write to ADP, Attention Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

If you are a street name stockholder, you can request householding by contacting the holder of record.

ELECTRONIC ACCESS TO PROXY STATEMENT AND ANNUAL REPORT

The Notice of Annual Meeting and Proxy Statement and the 2004 Annual Report on Form 10-K are available on ChevronTexaco’s Web site atwww.chevrontexaco.com.

Instead of receiving paper copies of the Annual Report and Proxy Statement in the mail, you can

3

General Information(Concluded)

elect to receive an e-mail that will provide an electronic link to these documents. Opting to receive your proxy materials online will save us the cost of producing and mailing documents to your home or business and also gives you an electronic link to the proxy voting site.

If you are a stockholder of record, you may vote on the Internet atwww.proxyvote.com. Simply follow the prompts for enrolling in the electronic proxy delivery service. You may also enroll in the electronic delivery service by marking the appropriate box on your proxy form, or at any time in the future by going directly towww.icsdelivery.com/cvx.

If you are a street name stockholder, you may also have the opportunity to receive copies of the Annual Report and Proxy Statement electronically. Please check the information provided in the proxy materials mailed to you by the holder of record concerning the availability of this service.

If you choose to view future Proxy Statements and Annual Reports on the Internet, you will receive a proxy form in the mail with instructions containing the Internet address of those materials. Your choice will remain in effect until you call the Mellon Investor Services’ toll-free number and tell them otherwise. You do not have to elect Internet access each year, and you may request a paper copy of the Proxy Statement or Annual Report at any time.

STOCKHOLDER ACCOUNT MAINTENANCE

Our transfer agent is Mellon Investor Services. All communications concerning accounts of stockholders of record, including address changes, name changes, inquiries about the requirements to transfer shares and similar issues can be handled by calling the ChevronTexaco Stockholder Services’ toll-free number, 1-800-368-8357, or by contacting Mellon Investor Services through their Web site atwww.melloninvestor.com.

In addition, you can access your account through Mellon Investor Services’ Web site. You can view your current balance, access your account history, sell shares or request a certificate for shares held in the ChevronTexaco Investor Services Program and obtain current and historical stock prices. To access your account on the Internet, visitwww.melloninvestor.com/isd and enter your social security number or Investor ID and your PIN. These can be found on your account statement or dividend check stub.

Your Board does not know of any other matter that will be presented for consideration at the Annual Meeting. If any other matter does properly come before the Annual Meeting, your proxy holders will vote on it as they think best unless you direct otherwise in your proxy instruction.

4

Only stockholders or their legal proxy holders are invited to attend the Annual Meeting. The meeting will be held at ChevronTexaco Park, Building A Auditorium, 6001 Bollinger Canyon Road, San Ramon, California. An admission ticket, which is required for entry into the Annual Meeting, is attached to your proxy form if you are a stockholder of record. If you plan to attend the Annual Meeting, please vote your proxy but keep the admission ticket and bring it to the Annual Meeting. If you vote electronically, an admission ticket will be available for you at the meeting.

If you are a street name stockholder and you plan to attend the Annual Meeting, you must present proof of your ownership of ChevronTexaco Stock, such as a bank or brokerage account statement, and a form of personal photo identification to receive an admission ticket and be admitted to the Annual Meeting. If you vote electronically, an admission ticket will be sent to you. You can also obtain anadmission ticket in advance by mailing a written request, along with proof of your ownership of ChevronTexaco Stock, to: ChevronTexaco Corporation, Corporate Secretary, 6001 Bollinger Canyon Road, San Ramon, CA 94583.

If you arrive at the meeting without an admission ticket, we will admit you if we are able to verify that you are a stockholder. Employee stockholders should bring their Company ID to the Annual Meeting.

We will have listening devices available at the Annual Meeting for stockholders with impaired hearing. If you require other special accommodations due to a disability, please identify your specific need in writing to the Corporate Secretary by April 20, 2005.

No cameras, recording equipment, electronic devices, including cell phones, large bags, briefcases or packages will be permitted in the Annual Meeting.

5

(Item 1 on the proxy form)

Your Board is nominating 12 individuals for election as Directors. Of the 12 nominees, 11 are current Directors. Dr. Sugar is standing for election by the stockholders for the first time. A report by the Board Nominating and Governance Committee beginning on page 13 of this Proxy Statement and the Corporate Governance Guidelines beginning on page 22 describe the processes used to determine the qualifications and independence of each nominee and the effectiveness of the Board and its committees.

The persons named as proxy holders on the proxy form will vote your sharesFORthe 12 nominees unless you withhold authority in the spaces provided on the proxy form or as prompted during the telephone or Internet voting instructions. All Directors are elected annually. They serve for a one-year term and until their successors are elected.

If any nominee is unable to serve as a Director, which we do not anticipate, the Board by resolution may reduce the number of Directors or choose a substitute.

Detailed information on each nominee is provided below.

As a result of the merger transaction between Chevron and Texaco on October 9, 2001, Texaco became a subsidiary of Chevron and Chevron changed its name to ChevronTexaco Corporation. Following the merger, the Board was reconstituted to include directors from both Chevron and Texaco. The Board service described below includes service as a Director of either Chevron or Texaco, as and if applicable, before the merger.

Your Board unanimously recommends a vote FOR each of these nominees.

SAMUEL H. ARMACOST

Director since 1982

Mr. Armacost, age 65, has been Chairman of SRI International, formerly Stanford Research Institute, an independent research, technology development and commercialization organization, since 1998.

Prior Positions Held: Mr. Armacost was a Managing Director of Weiss, Peck & Greer L.L.C. from 1990 until 1998. He was Managing Director of Merrill Lynch Capital Markets from 1987 until 1990. He was President, Director and Chief Executive Officer of BankAmerica Corporation from 1981 until 1986.

Public Company Directorships: Callaway Golf Company; Del Monte Foods Company; Exponent, Inc.; Franklin Resources Inc.

Other Directorships and Memberships: Bay Area Council; the Advisory Council of the California Academy of Sciences; Bay Area Scientific Infrastructure Consortium.

ROBERT E. DENHAM

Director since 2004

Mr. Denham, age 59, has been a Partner of Munger, Tolles & Olson LLP, a law firm, since 1998 and from 1973-1991.

Prior Positions Held: Mr. Denham was Chairman and Chief Executive Officer of Salomon Inc. from 1992-1997. In 1991, he was General Counsel of Salomon and its subsidiary, Salomon Brothers.

Public Company Directorships: Lucent Technologies Inc.; Wesco Financial Corporation; Fomento Economico Mexicano, S.A. de C.V.

Other Directorships and Memberships: Financial Accounting Foundation; MacArthur Foundation; U.S. Trust Company.

6

Election of Directors(Continued)

ROBERT J. EATON

Director since 2000

Mr. Eaton, age 65, is the retired Chairman of the Board of Management of DaimlerChrysler AG, a

manufacturer of automobiles.

Prior Positions Held: Mr. Eaton was the Chairman of the Board of Management of DaimlerChrysler AG from 1998 until 2000. He was Chairman of the Board and Chief Executive Officer of Chrysler Corporation from 1993 until 1998. He was Vice-Chairman and Chief Operating Officer of Chrysler Corporation from 1992 until 1993.

Other Directorships and Memberships: Fellow, Society of Automotive Engineers; Fellow, Engineering Society of Detroit; National Academy of Engineering.

SAM GINN

Director since 1989

Mr. Ginn, age 67, is a private investor and the retired Chairman of Vodafone, a worldwide wireless telecommunications company.

Prior Positions Held: Mr. Ginn was Chairman of Vodafone AirTouch, Plc. from 1999 to 2000, Chairman of the Board and Chief Executive Officer of AirTouch Communications, Inc., from 1993 until 1999. He was Chairman of the Board, President and Chief Executive Officer of Pacific Telesis Group from 1988 until 1994.

Other Directorships and Memberships: The Business Council; Hoover Institute Board of Overseers; Templeton Emerging Markets Investment Trust Plc; Yosemite Fund.

AMBASSADOR CARLA

ANDERSON HILLS

Lead Director; Director from 1977 through 1988 and since 1993

Ambassador Hills, age 71, has been Chairman and Chief Executive Officer of Hills & Company International Consultants, a company giving advice on investment, trade and risk issues abroad, since 1993.

Prior Positions Held: Ambassador Hills served as United States Trade Representative from 1989 to 1993. She was Secretary of the United States Department of Housing and Urban Development from 1975 until 1977.

Public Company Directorships: American International Group, Inc.; Lucent Technologies Inc.; Time Warner Inc.

Other Directorships and Memberships: Vice-Chair, Council on Foreign Relations; Vice-Chair, Inter-American Dialogue; Chair, National Committee on U.S.-China Relations; The Council of the Americas; Trustee, Institute for International Economics; Trustee, U.S.-China Business Council; Trustee, Americas Society; Trustee, Center for Strategic and International Studies.

7

Election of Directors(Continued)

FRANKLYN G. JENIFER

Director since 1993

Dr. Jenifer, age 65, has been the President of The University of Texas at Dallas, a doctoral- level institution, since 1994.

Prior Positions Held: Dr. Jenifer was President of Howard University from 1990 to 1994. Prior to that, he was Chancellor of the Massachusetts Board of Regents of Higher Education from 1986 until 1990. From 1979 until 1986, he was Vice-Chancellor of the New Jersey Department of Higher Education.

Other Directorships and Memberships: Monitoring Committee for the Louisiana Desegregation Settlement Agreement; Board Directors Alliance for Higher Education; Trustee, Texas Health Research Institute; Trustee, Universities Research Association, Inc.; President’s Advisory Council, Dallas Center for the Performing Arts; Dallas Citizens Council; Advisory Council, Jacob’s Ladder.

SENATOR SAM NUNN

Director since 1997

Senator Nunn, age 66, is Co-Chairman and Chief Executive Officer of the Nuclear Threat Initiative (NTI), a charitable organization.

Prior Positions Held: Senator Nunn was a partner of King & Spalding, a law firm, from 1997 through 2003. He served as U.S. Senator from Georgia from 1972 through 1996. During his tenure in the U.S. Senate, he served as Chairman of the Senate Armed Services Committee and the Permanent Subcommittee on Investigations. He also served on the Intelligence and Small Business Committees.

Public Company Directorships: The Coca-Cola Company; Dell Inc.; General Electric Company; Internet Security Systems, Inc.; and Scientific-Atlanta, Inc.

Other Directorships and Memberships: a distinguished professor in the Sam Nunn School of International Affairs at Georgia Tech; Chairman, Center for Strategic and International Studies.

DAVID J. O’REILLY

Director since 1998

Mr. O’Reilly, age 58, has been Chairman of the Board and Chief Executive Officer of ChevronTexaco since the completion of the merger between Chevron and Texaco in October 2001 and, prior to the merger, held the same positions with Chevron since January 2000.

Prior Positions Held: Mr. O’Reilly was Vice-Chairman of the Board of Chevron from 1998 until 1999. He was a Vice-President of Chevron from 1991 until 1998. He was President of Chevron Products Company, from 1994 until 1998. He was a Senior Vice-President and Chief Operating Officer of Chevron Chemical Company from 1989 until 1991.

Other Directorships and Memberships: American Petroleum Institute; Eisenhower Fellowships Board of Trustees; the Institute for International Economics; The Business Council; The Business Roundtable; JPMorgan International Council; World Economic Forum’s International Business Council; the Trilateral Commission; the National Petroleum Council; the American Society of Corporate Executives.

8

Election of Directors(Concluded)

PETER J. ROBERTSON

Director since 2002

Mr. Robertson, age 58, has been Vice-Chairman of the Board of ChevronTexaco since 2002.

Prior Positions Held: Mr. Robertson was Vice-President of Chevron from 1994 until 2001. He was President of Chevron Overseas Petroleum Inc. from 2000 until 2001. He was the Vice-President responsible for Chevron’s North American exploration and production operations from 1997 until 2000. From 1994 until 1997, he was the Vice-President responsible for strategic planning.

Other Directorships and Memberships: Vice-Chairman, U.S. Energy Association; U.S.-Saudi Arabian Business Council; U.S.-Russian Business Council; American Petroleum Institute; International House at Berkeley; United Way of San Francisco Bay Area.

CHARLES R. SHOEMATE

Director since 1998

Mr. Shoemate, age 65, is the retired Chairman, President and Chief Executive Officer of Bestfoods, a manufacturer of food products.

Prior Positions Held: Mr. Shoemate was Chairman of the Board and Chief Executive Officer of Bestfoods, formerly CPC International, from 1990 until 2000. He was elected President and a member of the Board of Directors of Bestfoods in 1988.

Public Company Directorships: CIGNA Corporation; International Paper Company.

RONALD D. SUGAR

Director nominee in 2005

Dr. Sugar, age 56, has been Chairman of the Board, Chief Executive Officer and President of Northrop Grumman Corporation, a global defense company, since 2003.

Prior Positions Held: Dr. Sugar was President and Chief Operating Officer of Northrop Grumman Corporation from 2001 until 2003. He was President and Chief Operating Officer of Litton Industries, Inc., from 2000 until 2001. He was previously President and Chief Operating Officer of TRW Aerospace and Information Systems.

Other Directorships and Memberships: Aerospace Industries Association; American Institute of Aeronautics and Astronautics; Association of the United States Army; Boys & Girls Clubs of America; Los Angeles Philharmonic Association; National Academy of Engineering; Royal Aeronautical Society; University of Southern California.

CARL WARE

Director since 2001

Mr. Ware, age 61, has been a Senior Advisor to the CEO of The Coca-Cola Company, a manufacturer of beverages, since 2003.

Prior Positions Held: Mr. Ware was an Executive Vice-President, Global Public Affairs and Administration, of The Coca-Cola Company from 2000 until February 2003. He was President of The Coca-Cola Company’s Africa Group, with operational responsibility for 50 countries in sub-Saharan Africa from 1991 until 2000.

Public Company Directorships: Coca-Cola Bottling Co. Consolidated; Cummins Inc.

Other Directorships and Memberships: Atlanta Falcons; Board of Trustees of Clark Atlanta University; PGA TOUR Golf Course Properties, Inc.

9

Your Board held 8 regularly scheduled Board meetings, 2 special Board meetings and 22 Board committee meetings in 2004. All Directors attended 85 percent or more of the Board meetings and Board committee meetings on which they served during 2004.

ChevronTexaco’s policy regarding Directors’attendance at the Annual Meeting was adopted in 2004 and is described in the Corporate Governance Guidelines on page 25 of this Proxy Statement under the heading Board Agenda and Meetings. Ten Directors attended the 2004 Annual Meeting.

CURRENT BOARD COMMITTEE MEMBERSHIP AND 2004 MEETINGS AND FUNCTIONS

Committees and Current Membership | 2004 Meetings and Committee Functions | |

AUDIT

Robert E. Denham† Sam Ginn*† Franklyn G. Jenifer Charles R. Shoemate† | Meetings: 10

• Selects the independent registered public accounting firm for endorsement by the Board and ratification by the stockholders • Reviews reports of independent and internal auditors • Reviews and approves the scope and cost of all services (including non-audit services) provided by the independent registered public accounting firm • Monitors the effectiveness of the audit process and financial reporting • Reviews the adequacy of financial and operating controls • Monitors the corporate compliance program • Evaluates the effectiveness of the Committee | |

BOARD NOMINATING AND GOVERNANCE

Samuel H. Armacost Carla A. Hills* Sam Nunn Carl Ware | Meetings: 5

• Reviews ChevronTexaco’s Corporate Governance Guidelines and practices and recommends changes as appropriate • Evaluates the effectiveness of the Board and its Committees and recommends changes to improve Board, Board committee and individual Director effectiveness • Assesses the size and composition of the Board • Recommends prospective director nominees • Periodically reviews and recommends changes as appropriate in the Restated Certificate of Incorporation, By-Laws and other Board-adopted governance provisions | |

MANAGEMENT COMPENSATION

Samuel H. Armacost* Robert J. Eaton Carla A. Hills J. Bennett Johnston | Meetings: 4

• Reviews and approves salaries and other compensation matters for executive officers • Administers incentive compensation and equity-based plans of the Corporation, including the Employee Savings Investment Plan (ESIP) Restoration Plan, Management Incentive, Long-Term Incentive, and Deferred Compensation Plans for Management Employees • Evaluates the effectiveness of the Committee | |

PUBLIC POLICY

Robert J. Eaton J. Bennett Johnston* Sam Nunn Carl Ware | Meetings: 3

• Identifies, monitors and evaluates international social, political and environmental issues • Recommends to the Board policies and strategies concerning such issues | |

* Committee Chairperson (Sen. Johnston is not standing for reelection to the Board. Sen. Nunn will be Chairman of the Public Policy Committee following the Annual Meeting.) † Audit Committee Financial Expert as determined by the Board within the applicable regulatory definition | ||

The Audit, Board Nominating and Governance and Management Compensation Committees are each constituted and operated in accordance with the rules of the New York Stock Exchange (NYSE). In addition, the Audit Committee is a separately-designated standing Audit Committee established in accordance withSection 3(a)(58)(A) of the Securities Exchange Act of 1934. Each member of the Audit Committee is independent and financially literate as defined in the rules of the NYSE and Rule 10A-3(b)(1)(ii) under the Securities Exchange Act of 1934.

10

Board Operations(Continued)

The Board has affirmatively determined that, as to each current, non-employee Director (Mr. Armacost, Mr. Denham, Mr. Eaton, Mr. Ginn, Ambassador Hills, Dr. Jenifer, Sen. Nunn, Mr. Shoemate and Mr. Ware) and new Director nominee (Dr. Sugar), no material relationship exists that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, and that each current, non-employee Director and new Director nominee qualifies as “independent” in accordance with the Corporate Governance Rules of the NYSE.

In making its independence determinations, the Board has considered that ChevronTexaco engages in business with companies for which certain of our Directors serve as directors or otherwise have a business relationship. The Board considered these relationships and determined that, based on the information available to the Corporation, none of those relationships were material.

In making its independence determinations, the Board also has considered that Mr. Denham is a partner of the law firm of Munger, Tolles & Olson LLP, which provided legal services to ChevronTexaco until March 17, 2004, prior to Mr. Denham’s election to the ChevronTexaco Board of Directors on April 28, 2004. Total fees paid to Munger, Tolles & Olson LLP by ChevronTexaco and its subsidiaries in 2004 was $5,979, all of which was paid prior to March 17, 2004 and was for services rendered solely in 2003. This amount represented less than .01 percent of the law firm’s gross revenues in 2004. Total fees paid in 2003 were $36,105, representing less than .1 percent of the law firm’s gross revenues for that period, and total fees paid in 2002 were $53,237, representing less than .1 percent of the law firm’s gross revenues for that period. Munger, Tolles & Olson LLP does not currently provide, nor do we expect it to provide, legal services for ChevronTexaco in 2005 and beyond. Based on these facts, the Board has determined that thisrelationship is not material and does not affect Mr. Denham’s independence.

In making its independence determinations, the Board also has considered that Mr. Eaton is a member and unpaid President of a non-profit organization that receives royalty payments under an oil and gas lease in which a subsidiary of ChevronTexaco owns a minority non-operating working interest. ChevronTexaco’s non-operating working interest in the lease is passive, so that the royalty payments received by the non-profit organization are based on the oil and gas produced under the lease regardless of whether ChevronTexaco owns a non-operating working interest in the lease. Moreover, the Board considered the fact that the amount of royalties attributable to the non-operating working interest owned by ChevronTexaco was less than an amount that would require disclosure of contributions to tax exempt organizations under the NYSE Corporate Governance Rules and less than would render Mr. Eaton non-independent if the tax exempt organization were a for-profit company and Mr. Eaton were an executive officer of it. In addition, in his capacity as President of the non-profit organization, Mr. Eaton has recused himself from any matters involving ChevronTexaco, all of which have been conducted on an arm’s-length basis. Based on these facts, the Board has determined that this relationship is not material and does not affect Mr. Eaton’s independence.

In making its independence determinations, the Board also has considered that the Corporation has contributed to the Yosemite Fund a total of $1,050,000 in 2002, $50,000 in each of 2003 and 2004, and $100,000 thus far in 2005, with $50,000 pledged for the remainder of 2005. Mr. Ginn is a member of the Board of Trustees and the Council of Directors of the Yosemite Fund. The Yosemite Fund is the primary non-profit fundraising organization for Yosemite National Park. The Board noted that these contributions were consistent with the Corporation’s commitment to environmental stewardship and that the Corporation’s annual contributions

11

Board Operations(Continued)

represented 21 percent of the Yosemite Fund’s gross revenues in 2002, less than 1 percent in 2003 and less than 1 percent in 2004. Based on these facts, the Board has determined that this relationship is not material and does not affect Mr. Ginn’s independence.

CERTAIN BUSINESS RELATIONSHIPS BETWEEN CHEVRONTEXACO AND ITS DIRECTORS AND OFFICERS

Mr. Denham is a partner of the law firm of Munger, Tolles & Olson LLP, which provided legal services to ChevronTexaco until March 17, 2004, prior to Mr. Denham’s election to the ChevronTexaco Board of Directors on April 28, 2004. Total fees paid to Munger, Tolles & Olson LLP by ChevronTexaco and its subsidiaries in 2004 was $5,979, all of which was paid prior to March 17, 2004, and was for services rendered solely in 2003. Munger, Tolles & Olson LLP does not currently provide, nor do we expect it to provide, legal services for ChevronTexaco in 2005 and beyond.

BUSINESS CONDUCT AND ETHICS CODE

The Corporation has adopted a code of business conduct and ethics for directors, officers (including the Company’s Chief Executive Officer, Chief Financial Officer and Comptroller) and employees, known as the Business Conduct and Ethics Code. The code is available on the Corporation’s Internet Web site at www.chevrontexaco.com. The Corporation intends to post any amendments to the code on the Corporation’s Web site.

The Audit Committee assists your Board in fulfilling its responsibility to oversee management’s implementation of ChevronTexaco’s financial reporting process. Its charter can be viewed on the ChevronTexaco Web site atwww.chevrontexaco.com. In discharging its oversight role, the Audit Committee reviewed and discussed the audited financial statements contained in the 2004Annual Report on Form 10-K with ChevronTexaco’s management and its independent registered public accounting firm. Management is responsible for the financial statements and the reporting process, including the system of disclosure controls and internal control over financial reporting. The independent registered public accounting firm is responsible for expressing an opinion on:

| • | the conformity of ChevronTexaco’s financial statements with accounting principles generally accepted in the United States; and |

| • | Management’s assessment of and the effectiveness of the Company’s internal control over financial reporting. |

The Audit Committee met privately with the independent registered public accounting firm and discussed issues deemed significant by the accounting firm, including those required by Statements on Auditing Standards No. 61 and No. 90 (Audit Committee Communications), as amended. In addition, the Audit Committee discussed with the independent registered public accounting firm its independence from ChevronTexaco and its management and received the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and considered whether the provision of nonaudit services was compatible with maintaining the accounting firm’s independence.

In reliance on the reviews and discussions outlined above, the Audit Committee has recommended to your Board that the audited financial statements be included in ChevronTexaco’s Annual Report on Form 10-K for the year ended December 31, 2004, for filing with the SEC.

Respectfully submitted on March 2, 2005, by the members of the Audit Committee of your Board:

Sam Ginn, Chairperson

Robert E. Denham

Franklyn G. Jenifer

Charles R. Shoemate

12

Board Operations(Continued)

BOARD NOMINATING AND GOVERNANCE COMMITTEE REPORT

The Board Nominating and Governance Committee is responsible for defining and assessing qualifications for Board membership, identifying qualified Director candidates, assisting the Board in organizing itself to discharge its duties and responsibilities and ensuring proper attention and effective responses to stockholder concerns regarding corporate governance. The Committee is composed entirely of independent Directors and operates under a written charter. Its charter can be viewed on the ChevronTexaco Web site atwww.chevrontexaco.com. The Committee submits this report to stockholders to report on its role and corporate governance practices at ChevronTexaco in 2004.

When making recommendations to the Board about individuals to be nominated for election by the stockholders to the Board, the Committee followed Board membership qualifications and nomination procedures that are identified in our Corporate Governance Guidelines. Generally, the membership qualifications are that an individual have:

| • | the highest professional and personal ethics and values, consistent with the ChevronTexaco Way and the Business Conduct and Ethics Code, which is available on the ChevronTexaco Web site atwww.chevrontexaco.com; |

| • | broad experience at the policy-making level in business, government, education, technology or public interest; |

| • | the ability to provide insights and practical wisdom based on their experience and expertise; |

| • | a commitment to enhancing stockholder value; |

| • | sufficient time to effectively carry out their Director’s duties; their service on other boardsof public companies should be limited to a reasonable number; and |

| • | independence; at least a majority of the Board must consist of independent Directors, as defined by the NYSE. |

The Committee uses a skills and qualifications matrix to evaluate potential candidates in order to insure that the overall Board maintains a balance of knowledge, experience and diversity. The Committee carefully reviews all Director candidates, including current Directors, in light of these qualifications based on the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Committee considers diversity, age, skills and such other factors as it deems appropriate, given the current needs of the Board and the Company to maintain a balance of knowledge, experience and capability.

The Committee regularly reviews a broad list of potential Director candidates it has assembled from a variety of sources. Board members periodically suggest possible candidates. Candidates are recommended by stockholders. The process for a stockholder to submit a Director candidate is described in our Corporate Governance Guidelines under theSelection of New Directors heading. From time to time, the Committee may engage a third party to assist in identifying potential candidates. In 2004, the Committee did not receive any candidate suggestions from beneficial owners of more than 5 percent of the Company’s common stock. Dr. Ronald D. Sugar, who has been nominated for election to the Board of Directors at the 2005 Annual Meeting, was first brought to the Committee’s attention by a third-party consultant.

In 2004, the Committee assessed the size and composition of the Board in light of operating requirements and existing social attitudes and trends and recommended a reduction in the size of the Board from 14 members to 12 members. The Committee evaluated and recommended 12

13

Board Operations(Continued)

candidates for election as Directors at the 2004 Annual Meeting. It determined the 10 non-employee Director nominees met the Board’s definition of independence, none having a material relationship with the Company. In making its independence determination, the Board adhered to all of the specific tests for independence included in the NYSE listing standards. The Committee made recommendations to the Board on the Board committee assignments and committee chairperson positions and recommended the addition of another “Audit Committee financial expert” to the Audit Committee.

The Committee plays a leadership role in shaping ChevronTexaco’s corporate governance. In 2004, the Committee recommended, and the Board established, a Lead Director position. The Committee Chairperson is the Lead Director. As discussed in the Corporate Governance Guidelines, she chaired the executive sessions of the non-employee and independent Directors and consulted with the Chairman on agendas for Board meetings and other matters pertinent to the Company and the Board.

In 2004, the Committee reviewed the progress that the Company made in implementing suggested changes identified in the Committee’s 2003 Corporate Governance Self-Assessment. The Committee noted that all of the suggested changes had been addressed by the Board or a Board committee and improvement had been made in virtually all areas. The corporate governance improvements adopted include a stricter definition of director independence, expansion of the Board and Board committee performance effectiveness evaluation, an annual executive session of only independent Directors in addition to the regular executive sessions, an annual meeting attendance policy for Directors and the submission of an offer of resignation if a Director’s principal occupation changes. The Committee recommended to the Board amendments to the Corporate Governance Guidelines to reflect these changes. TheCorporate Governance Guidelines are available in this proxy statement beginning on page 22 or on the Company’s Web site atwww.chevrontexaco.com. The Committee determined that ChevronTexaco operates under many corporate governance best practices.

Other areas of corporate governance that the Committee reviewed in 2004 were the non- employee Directors’ compensation program, the Company’s governing documents and stockholder protections and the Board responses to the corporate governance stockholder proposals received for the 2004 Annual Meeting.

The Committee received interested-party communications including stockholder inquiries directed to non-employee Directors. Interested parties wishing to communicate their concerns or questions about ChevronTexaco to the Chairperson of the Committee or any other non-employee Directors may do so by U.S. mail addressed to Non-Employee Directors, c/o Office of the Corporate Secretary, ChevronTexaco Corporation, 6001 Bollinger Canyon Road, San Ramon, CA 94583. The Corporate Secretary will compile the communications, summarize lengthy or repetitive communications and forward them to the appropriate Committee Chairperson.

The Committee believes that ChevronTexaco has strong fundamental corporate governance practices firmly in place. Corporate governance self-assessment is an ongoing process, and the Committee periodically updates the corporate governance practices to enable ChevronTexaco to maintain its position at the forefront of corporate governance best practices.

Respectfully submitted on February 23, 2005 by members of the Board Nominating and Governance Committee of your Board:

Carla A. Hills, Chairperson

Samuel H. Armacost

Sam Nunn

Carl Ware

14

Board Operations(Continued)

MANAGEMENT COMPENSATION COMMITTEE REPORT

The Committee, which is responsible for ChevronTexaco’s executive compensation program, is composed entirely of “independent outside directors,” as defined under section 162(m) of the Internal Revenue Code, and are independent under the applicable rules of the NYSE.

The Committee seeks and receives advice from independent external compensation consultants. ChevronTexaco’s compensation staff provides additional counsel, data and analysis as requested by the Committee. The Committee’s outside consultant is retained by the Committee as necessary to make presentations during the year and to conduct an annual review of ChevronTexaco’s competitive compensation position.

In 2004, the Committee initiated a comprehensive review of all ChevronTexaco executive compensation and benefit programs, which was then reviewed with the full Board. The review included an analysis of the potential economic impact to the Corporation for all cash, equity and benefit programs for the named executive officers under various economic growth scenarios and included impact projections at various future retirement dates. These projections were compared with external benchmarks, and the analysis was reviewed by the Committee’s independent consultant. Based on the consultant’s review and opinion, the Committee believes the ChevronTexaco executive plans are appropriate and deemed not to be excessive within either the peer group of oil competitors or the larger group of general industry competitors used for benchmarking.

The Committee continues to review the ChevronTexaco executive compensation and benefit programs with respect to the provisions of the Sarbanes-Oxley Act and the NYSE listing requirements. The Management Compensation Committee charter (published on theChevronTexaco Web site atwww.chevrontexaco.com) is reviewed annually to insure that Committee actions are in alignment with the compensation philosophy and objectives stated below, as well as all applicable reporting and compliance requirements. The Committee believes it is functioning within the parameters of, and the ChevronTexaco programs are in compliance with, all applicable rules, regulations and requirements.

Compensation Philosophy and Objectives

The Committee’s general compensation philosophy is that total cash compensation should vary with ChevronTexaco’s performance in achieving financial and nonfinancial objectives and that any long-term incentive compensation should be closely aligned with stockholders’ interests. The Committee also believes in using a common philosophy for all employees in its consideration of the design and implementation of executive programs.

The Committee specifically believes that compensation philosophy and programs of ChevronTexaco should:

| • | link rewards to business results and stockholder returns; |

| • | encourage creation of long-term stockholder value and achievement of strategic objectives; |

| • | target management salary range structure and award opportunities at the market median, with opportunity to pay in the upper or lower quartile for superior or below average performance results; |

| Ø | market defined as major oils (primary) and other large capital intensive businesses (secondary) |

| • | maintain an appropriate balance between base salary, short-term and long-term incentive opportunities, with more compensation at risk at the higher salary grades; |

15

Board Operations(Continued)

| • | attract and retain the highest caliber personnel on a long-term basis; and |

| • | provide motivational programs to focus on long-term retention needs through pay management, leadership development and growth opportunities. |

The Committee considers the compensation structures of other major companies in the oil industry when determining executive compensation target levels, such as: Amerada Hess, BP, ConocoPhillips, Exxon Mobil, Marathon, Occidental, Sunoco, Unocal and Shell US. In addition, the Company’s competitive position is reviewed against approximately 20 major capital-intensive international companies spanning a wide range of industries. The general industry comparators were chosen because of similar business characteristics as well as relatively equivalent scope and complexity of operations.

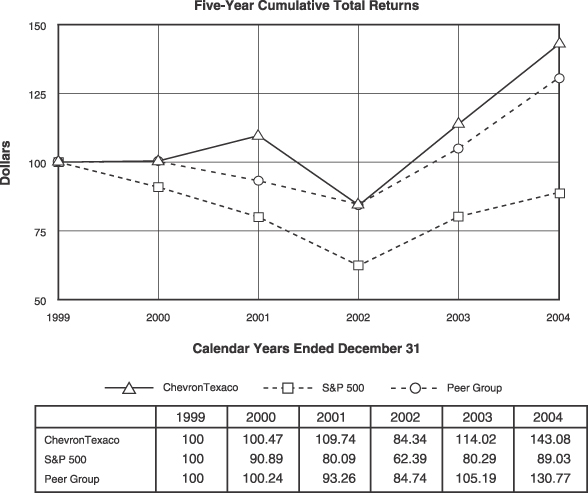

A smaller targeted group of large, global oil companies listed on the performance graph on page 30, who are the primary competition in the marketplace where ChevronTexaco operates, are believed to be a more relevant competitor peer group for determining relative Total Stockholder Return (TSR), which is stock price appreciation plus dividends on a reinvested basis. Royal Dutch Petroleum Company is used on the TSR competitor group in place of Shell US because Shell US is not a publicly traded company.

Key Elements of Executive Compensation

ChevronTexaco’s executive compensation program consists of three key elements: Base Pay, Short-Term Incentives and Long-Term Incentives. For senior executives, the Committee believes short-term and long-term incentive pay, linked to ChevronTexaco’s financial performance, should represent half or more of their total compensation opportunity.

No specific formula is used to weigh the various performance factors used in determining theamount of compensation or the allocation of compensation to base salary, bonus and long-term incentives. The weight given each factor with respect to each element of compensation is within the discretion and judgment of the Committee. The Committee considers the appropriateness of the entire package, including the impact on employee benefits, when evaluating each element of compensation. The appropriateness is then tested against both energy industry peers and the general industry benchmarks based on data supplied by the Committee’s outside consultant.

Base Pay

| • | Average executive base salaries are benchmarked to similar type positions of the nine oil competitors. When establishing the salary structure, the Committee also reviews non-oil pay information. This analysis is provided by its external consultant to ensure compensation opportunity is appropriate on a broad industry basis and with respect to local or geographic competitive markets. |

| • | Actual salaries vary by individual and are based on sustained performance toward achievement of ChevronTexaco’s goals, objectives and strategic intents. The Committee reviews and approves corporate goals and objectives relevant to the compensation of the CEO and other executive officers. |

| • | At least annually the Committee evaluates the CEO’s performance in light of such goals and objectives, leads a discussion of all independent Directors with respect to the evaluation, makes compensation recommendations to the full Board for ratification and communicates the results to the CEO. |

| • | Executive salaries and proposed changes are reviewed annually and approved by the Committee, with ratification by the full Board. The Committee also considers experience and current salary compared to market rates when considering salary actions. |

16

Board Operations(Continued)

Short-Term Incentive (Management Incentive Plan)

| • | The Management Incentive Plan (MIP) is an annual cash incentive plan which links awards to performance results of the prior year. Individual target awards vary by salary grade and are based on the competitive annual bonus practices of the nine oil competitors, with reference to the award levels of the general industry comparator group. In any given year, actual individual awards vary from zero to 200 percent of target or more, reflecting ChevronTexaco’s business results and performance at the business unit and individual level. |

| • | Awards are based on the Committee’s assessments of performance versus objectives and performance versus the peer competitor group. An individual’s actual award is based on three components, with each component weighted equally. The components are: corporate results, operating company/Strategic Business Unit (SBU)/staff results and a Leadership Performance Factor (LPF). The LPF is based on personal contribution in achieving business results and leadership behaviors demonstrated in achieving the results. Although a formula of specifically weighted factors is not used to determine the total MIP fund available or the reporting unit ratings, the corporate component is heavily influenced by financial metrics while the reporting unit ratings are a balance of financial and operational metrics. |

| • | Corporate, operating company and SBU financial and strategic objectives are set at the beginning of each year. Financial objectives are developed for: earnings, Return On Capital Employed (ROCE), cash flow, operating expense and other key operating measures. Relative TSR and non-financial measures such as safety and reliability are also included in the evaluation process. Results are measured against internal objectives and against external oil competitor results. |

| • | An individual’s key job responsibilities and objectives are also established at the beginning of each year. Individual objectives include achievement of business unit financial goals as well as targets related to business operations (e.g., refinery throughput, production volumes, product quality, safety, environmental performance, etc.). Performance assessments are also made on other factors, including diversity, leadership, teamwork, communication, developing employees, creativity and innovation, and building partnerships. |

| • | The corporate performance assessment is the same for all MIP participants. Individuals will have different operating company, SBU and leadership performance assessments. |

Long-Term Incentive (Long-Term Incentive Plan)

| • | The Long-Term Incentive Plan (LTIP) is designed to align the interests of executives with stockholders and to provide each executive with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the business. Individual grants vary by salary grade, and are based on valuations of grants made by the nine oil competitors. These valuations are provided by the Committee’s external consultant. Review of general industry grant levels is also done for calibration. Grants are typically in the form of non-qualified stock options and performance shares which are redeemable in cash. Each year a limited number of above standard or below standard awards may be granted on a case-by-case basis to certain individuals when performance merits. The Committee may also make restricted stock unit grants to key management employees for retention purposes as warranted by business conditions. |

| • | Non-Qualified Stock Options (NQSOs) are awarded at market price on the day of grant, vest one-third after one year, two-thirds after |

17

Board Operations(Continued)

two years and 100 percent after three years. Options have a ten-year term. Their ultimate value depends entirely on appreciation of ChevronTexaco Stock. The Committee does not grant discounted options or reprice outstanding options. |

| • | Performance Shares have an ultimate value (denominated in shares of ChevronTexaco Stock) tied to TSR as compared to that of the TSR peer group competitors. Performance shares have a three-year vesting period, with a performance modifier based on relative TSR ranking that can vary from zero percent to 200 percent, as determined by the Committee. |

Corporate Officer Stock Ownership

Because the Committee believes in linking the interests of management and stockholders, the Board approved stock ownership guidelines for ChevronTexaco executives in 2001, based on a multiple of base salary: CEO 5 times; Vice Chairman, Executive Vice Presidents and Chief Financial Officer 4 times; all other corporate officers 2 times. Executives are expected to achieve targets within 5 years of assuming their position. The CEO and all other named executives achieved their individual ownership guidelines prior to year-end 2004, or two years ahead of the Committee’s recommended timeline. ChevronTexaco Executive Officers as a whole own over 5 times base salary.

Tax Deductibility of Executive Compensation

Under Section 162(m) of the Internal Revenue Code, ChevronTexaco generally receives an annual federal income tax deduction for compensation paid to the CEO and other four most highly paid executives only if the compensation is less than $1 million or is performance-based. The awards granted under both the MIP and the LTIP, including the material terms and performance goals as approved by stockholders, qualify as performance-based compensation and thus arefully tax-deductible for ChevronTexaco. The MIP performance-based criteria were reaffirmed by stockholders in 2002, and the LTIP plan was re-approved in April 2004. The Committee intends to continue seeking a tax deduction for all executive compensation, to the extent it is in the best interest of ChevronTexaco and its stockholders.

2004 CEO Compensation

Executive level salary ranges are adjusted, as necessary, to maintain competitiveness with the competitor group. Individual salaries are maintained within the appropriate range for each position, including the CEO position, and are reviewed annually. In determining a competitive base salary for Mr. O’Reilly, the Committee considered his level of responsibility and contributions to the success of ChevronTexaco, the size and complexity of the business and his relative compensation position with respect to the peer group, both within the oil industry and general industry.

Specifically, the Committee considered such factors as the excellent financial performance in 2003, the significant year-on-year improvement in key operating measures against the oil competitor group and that Mr. O’Reilly’s base salary had been below the average for both the oil industry comparator group as well as the general industry comparator group. Based on these factors and recommendations by the Committee’s consultant, the Committee increased Mr. O’Reilly’s base salary in 2004 by 10.7 percent to $1,550,000, to position him at the average for CEOs within both the energy industry comparator group and the general industry group.

ChevronTexaco’s MIP has the same award determination rules for all participants. The CEO award is based solely on Corporation and individual performance. The MIP awards granted to Mr. O’Reilly and to the other four highest-paid officers for the past three performance years are

18

Board Operations(Concluded)

presented in the Summary Compensation Table on page 26. In making these awards, the Committee considered:

| • | the record financial results; |

| • | the significant year-over-year improvement in relative position versus our peer competitors in key financial measures; |

| • | the outstanding sustained progress in closing the ROCE gap against the leading LTIP competitor and achieving the lead position; and |

| • | meeting the aggressive strategic portfolio objectives begun in late 2003. |

ChevronTexaco’s LTIP has the same grant determination rules for all LTIP participants. Grants to Mr. O’Reilly and the other four highest-paid officers are presented in the compensation tables on pages 26 and 27. Based on data provided by its outside consultant, the Committee believes this grant is reasonable and well within competitive practice for his level of responsibilities. The current grant value for Mr. O’Reilly positions him below theaverage of the nine oil industry group and well below the median and average of the general industry benchmark companies.

Within the framework described above for base salary, annual bonus and long-term incentive grants, the Committee tries to maintain a competitive position for each of the three key components (base salary, annual bonus and long-term incentives) with the vast majority of Mr. O’Reilly’s total compensation based on variable, performance-based results. Based on the data supplied by the Committee’s outside consultant, the Company’s relative performance and his own performance, the Committee believes Mr. O’Reilly’s total compensation is appropriate.

Respectfully submitted on January 25, 2005, by members of the Management Compensation Committee of your Board:

Samuel H. Armacost, Chairperson

Robert J. Eaton

Carla A. Hills

J. Bennett Johnston

19

ChevronTexaco believes that non-employee Directors’ compensation should provide total compensation that is competitive, links rewards to business results and stockholder returns and facilitates increased ownership of ChevronTexaco Stock.

ChevronTexaco does not have a retirement plan for non-employee Directors. ChevronTexaco’s Executive Officers are not paid additional compensation for their services as Directors.

Current compensation reflects the Company’s September 10, 2004, two-for-one stock split. The compensation for non-employee Directors granted under the ChevronTexaco Corporation Non-Employee Directors’ Equity Compensation and Deferral Plan includes the following stock and cash elements:

| • | 800 shares of restricted ChevronTexaco Stock are granted on the date of the Annual Meeting. Dividends attributable to the restricted shares may be paid in cash or used by the Director to purchase additional shares of restricted ChevronTexaco Stock. Restricted stock awards are subject to forfeiture if a non-employee Director does not serve as a ChevronTexaco Director for a minimum of five years after the award is granted. However, such forfeiture does not apply if a Director dies, reaches mandatory retirement age, becomes disabled, changes primary occupation or enters government service. |

| • | 2,000 stock units plus an additional number of stock units representing $25,000 worth of ChevronTexaco Stock are granted on the date of the Annual Meeting. Each stock unit represents a right to receive a share of ChevronTexaco Stock. Stock units receive dividend equivalents that are reinvested into additional stock units. Shares of ChevronTexaco Stock will be distributed in satisfaction of outstanding stock units in one to 10 annual installments, at the Director’s discretion, following the time that the Director’s status as Director terminates. Stock units are not subject to forfeiture. |

| • | $75,000 annual retainer. |

| • | $10,000 additional annual retainer for each Board Committee chairperson. |

DEFERRALS OF CASH COMPENSATION

The ChevronTexaco Corporation Non-Employee Directors’ Equity Compensation and Deferral Plan provides an opportunity for non-employee Directors to defer payment of their directors’ fees. Under the plan, a non-employee Director may defer receipt of all or any portion of the annual cash retainers. Deferrals may be credited into accounts tracked with reference to any of the investment fund options available to participants in the ChevronTexaco Employee Savings Investment Plan, including a ChevronTexaco Stock fund. Distribution from the plan is in cash except for amounts valued with reference to a ChevronTexaco Stock fund, which are distributed in shares of ChevronTexaco Stock.

Any deferred amounts unpaid at the time of a Director’s death are distributed to the Director’s beneficiary.

Directors may elect to receive retainer stock options in lieu of all or any portion of their annual cash retainers. Directors who make this election will receive an option for that number of shares of ChevronTexaco Stock determined by dividing the amount of the cash retainer subject to the election by the Black-Scholes value of an option for a share of ChevronTexaco Stock granted at fair market value on the date of grant. The option exercise price per share will be the fair market value of a share of ChevronTexaco Stock on the date of grant. Retainer stock options become exercisable on the first anniversary of the date of grant and have a term of 10 years.

Non-employee Directors are reimbursed for out-of-pocket expenses that they incur in connection with the business and affairs of ChevronTexaco.

20

DIRECTORS’ AND EXECUTIVE OFFICERS’ STOCK OWNERSHIP

The following table shows the ownership interest in ChevronTexaco Stock as of February 28, 2005 for each non-employee Director and nominee, each of our five most highly paid executive officers in 2004 and all non-employee Directors and nominee and all executive officers as a group. No non-employee Director or nominee or executive officer owns 1 percent or more of the outstanding shares of ChevronTexaco Stock, nor do the non-employee Directors and nominee and executive officers as a group.

Name ("•" denotes a non-employee Director or nominee) | Shares Beneficially Owned (1) | Stock Units (2) | Total (3) | ||||

Samuel H. Armacost• | 25,856 | (4) | 8,356 | 34,212 | |||

Robert E. Denham• | 5,219 | 3,745 | 8,964 | ||||

Robert J. Eaton• | 15,132 | (4) | 14,106 | 29,238 | |||

Sam Ginn• | 11,666 | 17,807 | 29,473 | ||||

Carla A. Hills• | 12,224 | 8,356 | 20,580 | ||||

Franklyn G. Jenifer• | 12,789 | 19,139 | 31,928 | ||||

J. Bennett Johnston• | 7,368 | 24,390 | 31,758 | ||||

George L. Kirkland | 301,734 | 17,350 | 319,084 | ||||

Sam Nunn• | 10,239 | 19,489 | 29,728 | ||||

David J. O'Reilly | 1,594,616 | 85,424 | 1,680,040 | ||||

Peter J. Robertson | 634,228 | 47,473 | 681,701 | ||||

Charles R. Shoemate• | 11,576 | 17,870 | 29,446 | ||||

Ronald D. Sugar• | 0 | 0 | 0 | ||||

Carl Ware• | 7,773 | 8,356 | 16,129 | ||||

John S. Watson | 296,413 | 52,958 | 349,371 | ||||

Patricia A. Woertz | 394,643 | (4) | 48,624 | 443,267 | |||

Non-employee Directors and nominee and | 3,918,806 | 484,025 | 4,402,831 | ||||

(1) In accordance with SEC rules, amounts shown include shares that may be acquired upon exercise of stock options that are currently exercisable or will become exercisable within 60 days as follows: 7,048 shares for Mr. Eaton, 275,400 shares for Mr. Kirkland, 7,048 shares for Sen. Nunn, 1,507,199 shares for Mr. O’Reilly, 579,132 shares for Mr. Robertson, 2,820 shares for Mr. Ware, 281,066 shares for Mr. Watson, 389,666 shares for Ms. Woertz, and 3,436,127 shares for all Directors and all executive officers as a group. For executive officers, the amounts shown include shares held for them in trust under the Employee Savings Investment Plan or the Texaco Supplemental Thrift Plan. For non-employee Directors, the amounts shown include shares of restricted ChevronTexaco Stock awarded under the ChevronTexaco Corporation Non-Employee Directors’ Equity Compensation and Deferral Plan.

(2) Stock units do not carry voting rights and may not be sold. They do, however, represent the equivalent of economic ownership of ChevronTexaco Stock, since the value of each unit is measured by the price of ChevronTexaco Stock. For non-employee Directors, these are stock units awarded under the ChevronTexaco Corporation Non-Employee Directors’ Equity Compensation and Deferral Plan and the Texaco Inc. Director and Employee Deferral Plan and may ultimately be paid in shares of ChevronTexaco Stock. For executive officers, these include stock units awarded under the LTIP or deferred under the ChevronTexaco Deferred Compensation Plan for Management Employees and may ultimately be paid in shares of ChevronTexaco Stock. Also for executive officers, these include stock units under the ESIP Restoration Plan that will ultimately be paid in cash.

(3) Amounts shown include the individual’s shares beneficially owned as described in Note 1 plus the individual’s stock units owned as described in Note 2.

(4) Includes the following number of shares held in the name of family members: Mr. Armacost, 2,200 shares; Mr. Eaton, 3,080; and Ms. Woertz, 200 shares.

| |||||||

21

Corporate Governance Guidelines

These guidelines are available on the Corporation’s Web site at www.chevrontexaco.com and are available in print to any stockholder who requests it.

These guidelines have been approved by the ChevronTexaco Board of Directors. The guidelines, in conjunction with the Restated Certificate of Incorporation, By-Laws and Board Committee charters, form the framework for governance of the Corporation.

ROLE OF THE BOARD OF DIRECTORS

The Board of Directors oversees and provides policy guidance on the business and affairs of the Corporation. It monitors overall corporate performance, the integrity of the Corporation’s financial controls and the effectiveness of its legal compliance programs. The Board oversees management and plans for the succession of key executives. The Board oversees the Corporation’s strategic and business planning process. This is generally a year-round process culminating in a day-long Board review of the Corporation’s updated Corporate Strategic Plan, its business plan, the next year’s capital expenditures budget plus key financial and supplemental objectives.

Members of the Board of Directors should have the highest professional and personal ethics and values, consistent with The ChevronTexaco Way. They should have broad experience at the policy-making level in business, government, education, technology or public interest. They should be able to provide insights and practical wisdom based on their experience and expertise. They should be committed to enhancing stockholder value and should have sufficient time to effectively carry out their duties. Their service on other boards of public companies should be limited to a reasonable number.

The Board Nominating and Governance Committee annually reviews the appropriateskills and characteristics required of Board members in the context of the current composition of the Board, the operating requirements of the Corporation and the long-term interests of the stockholders. In conducting this assessment, the Committee considers diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board and the Corporation, to maintain a balance of knowledge, experience and capability.

A majority of the Board consists of independent Directors, as defined by the New York Stock Exchange. To be considered “independent,” a Director must be determined by the Board, after recommendation by the Board Nominating and Governance Committee and due deliberation, to have no material relations with the Corporation other than as a Director. In making its determination concerning the absence of a material relationship, the Board adheres to all of the specific tests for independence included in the New York Stock Exchange listing standards.

Directors are elected annually by the stockholders at the Annual Meeting. The Board of Directors proposes a slate of nominees for consideration each year. Between Annual Meetings, the Board may elect Directors to serve until the next Annual Meeting. The Board Nominating and Governance Committee identifies, investigates and recommends prospective directors to the Board with the goal of creating a balance of knowledge, experience and diversity. Stockholders may recommend a nominee by writing to the Corporate Secretary specifying the nominee’s name and the qualifications for Board membership. All recommendations are brought to the attention of the Board Nominating and Governance Committee.

22

Corporate Governance Guidelines(Continued)

The By-Laws provide that the number of Directors is determined by the Board. The Board’s size is assessed at least annually by the Board Nominating and Governance Committee and changes are recommended to the Board when appropriate. If any nominee is unable to serve as a Director, the Board may reduce the number of Directors or choose a substitute.

Directors serve for a one-year term and until their successors are elected. They stand for election based on the Corporation’s performance record, which is set forth in the Corporation’s annual report and proxy statement.

Directors limit their other board memberships to a number which permits them, given their individual circumstances, to responsibly perform all of their Director duties. The Board Nominating and Governance Committee reviews and concurs in the election of any employee Director to outside, for-profit board positions.

Non-employee Directors may not stand for re-election after reaching age 72. Employee Directors may not serve as Directors once their employment with the Corporation ends. Mandatory retirement for employee Directors is age 65. A Non-Employee Director shall submit to the Board Nominating and Governance Committee a letter of resignation if his or her principal occupation or business association changes substantially during his or her tenure as a Director. The Board Nominating and Governance Committee will review and recommend to the Board the action, if any, to be taken with respect to the resignation.

NUMBER AND COMPOSITION OF BOARD COMMITTEES

The Board has four committees: Audit, Board Nominating and Governance, Management Compensation and Public Policy. All Committees are comprised solely of non-employee Directors and members of the Audit, Board Nominating and Governance and Management Compensation committees are independent Directors, as defined by the New York Stock Exchange. In addition, all Audit Committee members meet the requirement that they may not directly or indirectly receive any compensation from the Corporation other than their Directors’ compensation.

Each committee is chaired by an independent Director who determines the agenda, the frequency and length of the meetings and who has unlimited access to management, information and independent advisors, as necessary and appropriate. Each non-employee Director generally serves on one or two committees. Committee members serve staggered terms enabling Directors to rotate periodically to different committees. Four- to six-year terms for committee chairpersons facilitate rotation of committee chairpersons while preserving experienced leadership.