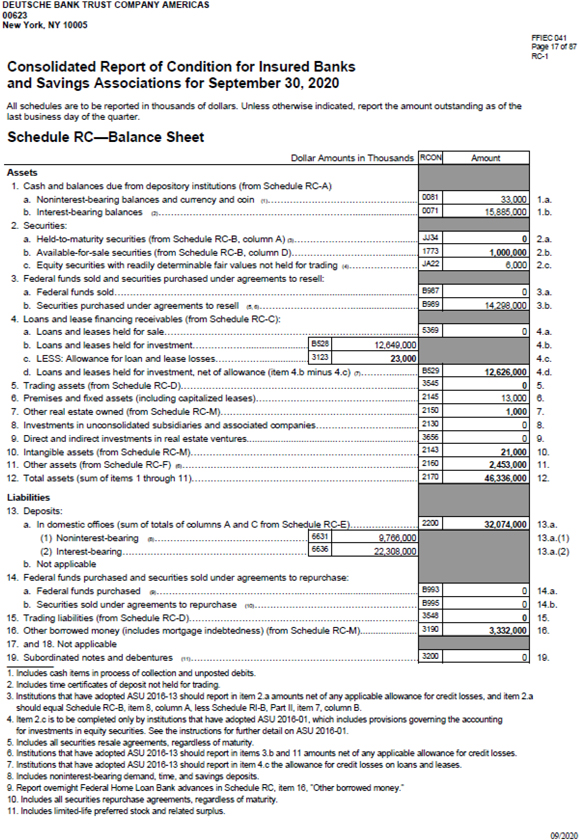

DEUTSCHE BANK TRUST COMPANY AMERICAS 00623 New York, NY 10005 FF1KE41 Pjge-7c4nr HC-1 Consolidated Report of Condition for Insured Banks and Savings Associations for September 30, 2020 All schedules are to be reported in thousands of dollars. Unless otherwise indicated, report the amount outstanding as of the last business day cf the quarter. Schedule RC—Balance Sheet Dollar Amounts in Thousands fcCON| Amotmt Assets Cash and balances due from depository institutions (from Schedule RC-A) Noninterest-bearing balances and currency and coin 0031 33.000 1.a. Interest-bearing balances m . 15,335000 l.b. 2_ Securities: Held-to-maturity securities (from Schedule RC-B, column A) m. 0 2.a. Available-for-sale securities (from Schedule RC-B, column D} 1773 1r000,000 2.b. Equity securities with readi ly determinable fai r values net held far tradi ng hi - JA22 6,DM 2.c. Federal funds sold and securities purchased under agreements to resell: Federal funds sold Ba~ 0 3.a. Securities purchased under agreements to reselI ah. BSE9 Jj42j200. 3.b. Loans and lease financing receivables (from Schedule RC-C): Loans and leases held far sale | 0 4.a. Loans and leases held far investment 5525 12,649,000 4. b. LESS: Allowance for loan and lease losses 3123 23,000 4.c. Loans and leases held far investment, net of allowance (item 4.b minus 4.c) m.. 5525 12,626,000 4.d. Trading assets (from Schedule RC-D) 0. 5. 0. Premises and fixed assets (including capitalized leases} 2145 13.000 6. Other real estate owned (from Schedule RC-M) 2150 1,000 7. Investments in unconsolidated subsidiaries and associated companies 21-30 0 B. Direct and indirect investments in real estate ventures 3656 0 g. Intangible assets (from Schedule RC-M) 2143 21,000 10. Other assets (from Scbed ule RC-F) m. 2160 2,453,000 11. Total assets (sum of items 1 through 11) 2170 46^338000 12. Liabilities Deposits: In domestic offices (sum of totals of columns A and C from Schedu le RC-E). 22M | 32,074,000 13.a. (1} Noninterest-bearing « 5631 9,736,000 13.a.(1) (2) Interest-bearing. 5636 22,308,000 13.a.(2) Not applicable Federal frinds purchased and securities sold under agreements to repurchase: Federal funds purchased « B—3 0 14.a. Securities sold under agreements to repurchase m B95e 0 14.b. Trading liabilities (from Schedule RC-D) 3543 0 15. 10. Other borrowed money (includes mortgage indebtedness) (from Schedule RC-M) 3,332,000 10. 17. and 18. Not applicable Subordinated notes and debentures nq 32133 | 0 19. Mudes cash terns in process of collectcn and unposted debts- Encodes time certificates cf depcst net held for trading. Institutions that: Gnave adopted ASU 2016-13 should report: in item 2.a amounts net of any applicable albwarce fcr credit losses, and item 2.a should equal Schedule RC-B- item 3, hAiito A. less Schedule Rl-B, Part II, item 7, column B. hem 2.c is to be completed or y by institetans that have accpted ASU 2016-01, wrier induces provisions governing the accounting for “vestments in equ ty securities See the instructions for furtner detail on ASU 2016-01. Gndudes a securities resae agreements regandless of maturty. S. nstitutens that “awe accpted ASU 2016-13 shoufe resort in items 3.b and 11 amounts ret cf ary appi cable allowance ‘”or cred t losses. 7 nstitutens that “awe accpted ASU 2016-13 shoiic resort in item 4 c the alowa”ce fcr credit losses om loans arc [eases. 3. Encodes reninterestMsearing cemand, time and savings oeposits. ft. Report overnight Feceral Home Loan Bank advances in SchecUe RC, item 16. ‘Other bcxrewed money.’ 10. Indudes all securities repurchase agreements, regardess cr maturity. 11 - Indudes mted- ire preferred stock and reated surpfis. 09.2020