UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

CHEVRON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Proxy Season 2022

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 This presentation contains forward-looking statements relating to Chevron’s operations and energy transition plans that are based on management’s current expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words or phrases such as “anticipates,” “expects,” “intends,” “plans,” “targets,” “advances,” “commits,” “drives,” “aims,” “forecasts,” “projects,” “believes,” “approaches,” “seeks,” “schedules,” “estimates,” “positions,” “pursues,” “may,” “can,” “could,” “should,” “will,” “budgets,” “outlook,” “trends,” “guidance,” “focus,” “on track,” “goals,” “objectives,” “strategies,” “opportunities,” “poised,” “potential,” “ambitions,” “aspires” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond the company’s control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Unless legally required, Chevron undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changing crude oil and natural gas prices and demand for the company's products, and production curtailments due to market conditions; crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries and other producing countries; technological advancements; changes to government policies in the countries in which the company operates; public health crises, such as pandemics (including coronavirus (COVID-19)) and epidemics, and any related government policies and actions; disruptions in the company's global supply chain, including supply chain constraints and escalation of the costs of goods and services; changing economic, regulatory and political environments in the various countries in which the company operates; general domestic and international economic, market and political conditions, including the military conflict between Russian and Ukraine and the global response to such conflict; changing refining, marketing and chemicals margins; actions of competitors or regulators; timing of exploration expenses; timing of crude oil liftings; the competitiveness of alternate-energy sources or product substitutes; development of large carbon capture and offset markets; the results of operations and financial condition of the company’s suppliers, vendors, partners and equity affiliates, particularly during the COVID-19 pandemic; the inability or failure of the company’s joint-venture partners to fund their share of operations and development activities; the potential failure to achieve expected net production from existing and future crude oil and natural gas development projects; potential delays in the development, construction or start-up of planned projects; the potential disruption or interruption of the company’s operations due to war, accidents, political events, civil unrest, severe weather, cyber threats, terrorist acts, or other natural or human causes beyond the company’s control; the potential liability for remedial actions or assessments under existing or future environmental regulations and litigation; significant operational, investment or product changes undertaken or required by existing or future environmental statutes and regulations, including international agreements and national or regional legislation and regulatory measures to limit or reduce greenhouse gas emissions; the potential liability resulting from pending or future litigation; the company’s future acquisitions or dispositions of assets or shares or the delay or failure of such transactions to close based on required closing conditions; the potential for gains and losses from asset dispositions or impairments; government mandated sales, divestitures, recapitalizations, taxes and tax audits, tariffs, sanctions, changes in fiscal terms or restrictions on scope of company operations; foreign currency movements compared with the U.S. dollar; material reductions in corporate liquidity and access to debt markets; the receipt of required Board authorizations to implement capital allocation strategies, including future stock repurchase programs and dividend payments; the effects of changed accounting rules under generally accepted accounting principles promulgated by rule-setting bodies; the company’s ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry; and the factors set forth under the heading “Risk Factors” on pages 20 through 25 of the company’s 2021 Annual Report on Form 10-K and in other subsequent filings with the U.S. Securities and Exchange Commission. Other unpredictable or unknown factors not discussed in this presentation could also have material adverse effects on forward-looking statements. As used in this presentation, the term “Chevron” and such terms as “the company,” “the corporation,” “our,” “we,” “us” and “its” may refer to Chevron Corporation, one or more of its consolidated subsidiaries, or to all of them taken as a whole. All of these terms are used for convenience only and are not intended as a precise description of any of the separate companies, each of which manages its own affairs. Cautionary statement

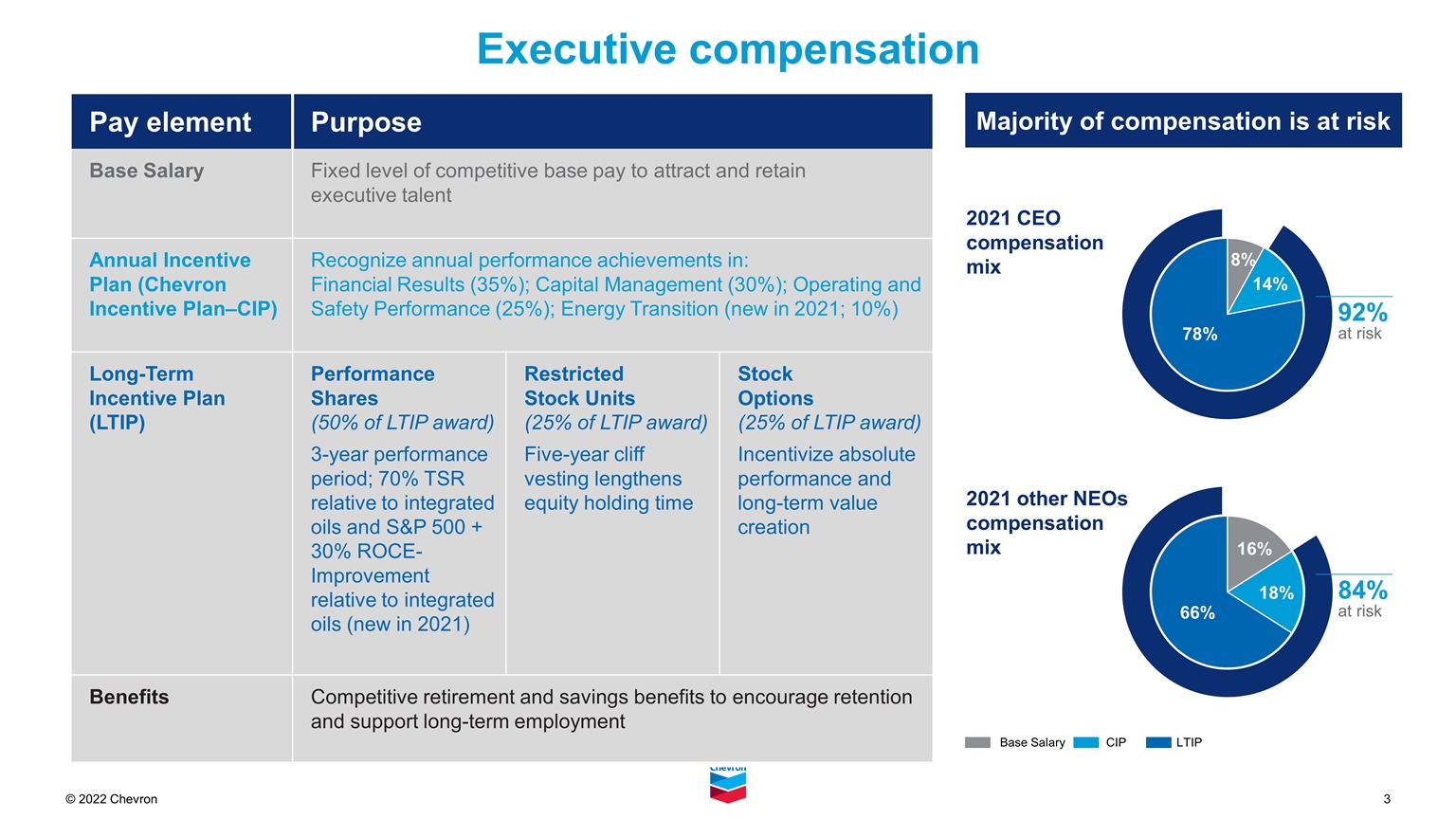

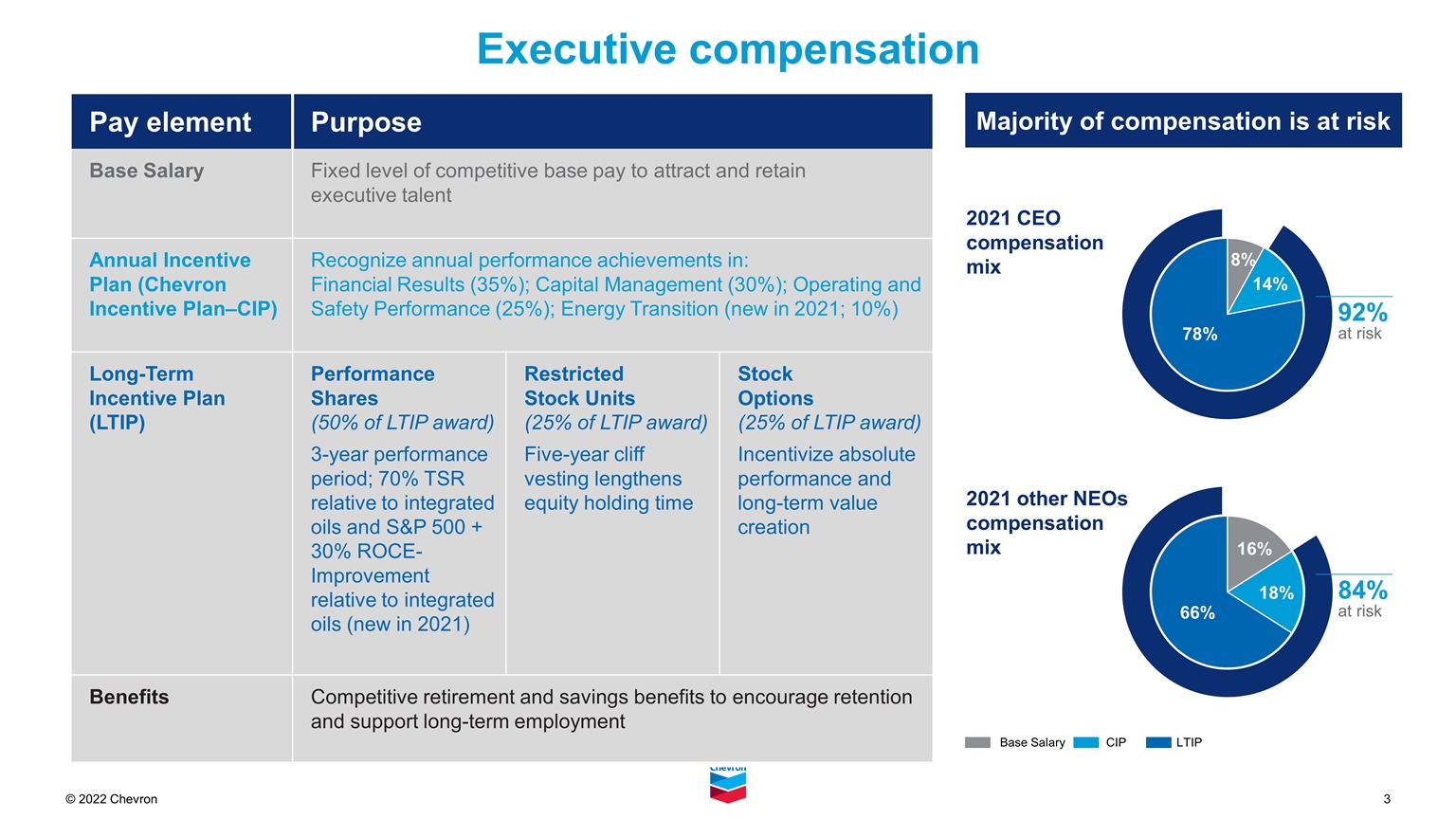

Pay element Purpose Base Salary Fixed level of competitive base pay to attract and retain executive talent Annual Incentive Plan (Chevron Incentive Plan–CIP) Recognize annual performance achievements in: Financial Results (35%); Capital Management (30%); Operating and Safety Performance (25%); Energy Transition (new in 2021; 10%) Long-Term Incentive Plan (LTIP) Performance Shares (50% of LTIP award) 3-year performance period; 70% TSR relative to integrated oils and S&P 500 + 30% ROCE-Improvement relative to integrated oils (new in 2021) Restricted Stock Units (25% of LTIP award) Five-year cliff vesting lengthens equity holding time Stock Options (25% of LTIP award) Incentivize absolute performance and long-term value creation Benefits Competitive retirement and savings benefits to encourage retention and support long-term employment Executive compensation Majority of compensation is at risk 2021 CEO compensation mix 2021 other NEOs compensation mix Base Salary CIP LTIP 92% at risk 84% at risk

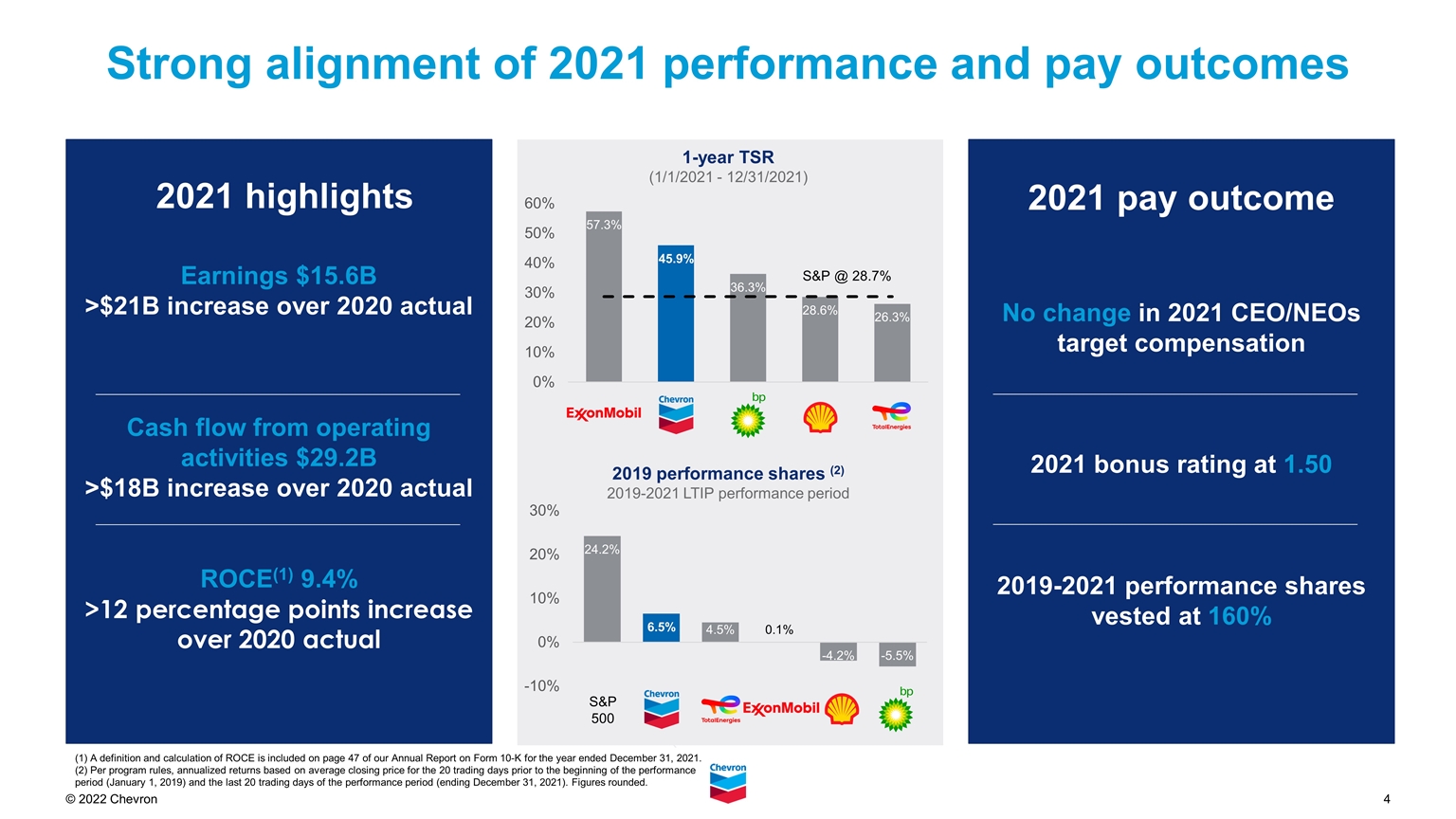

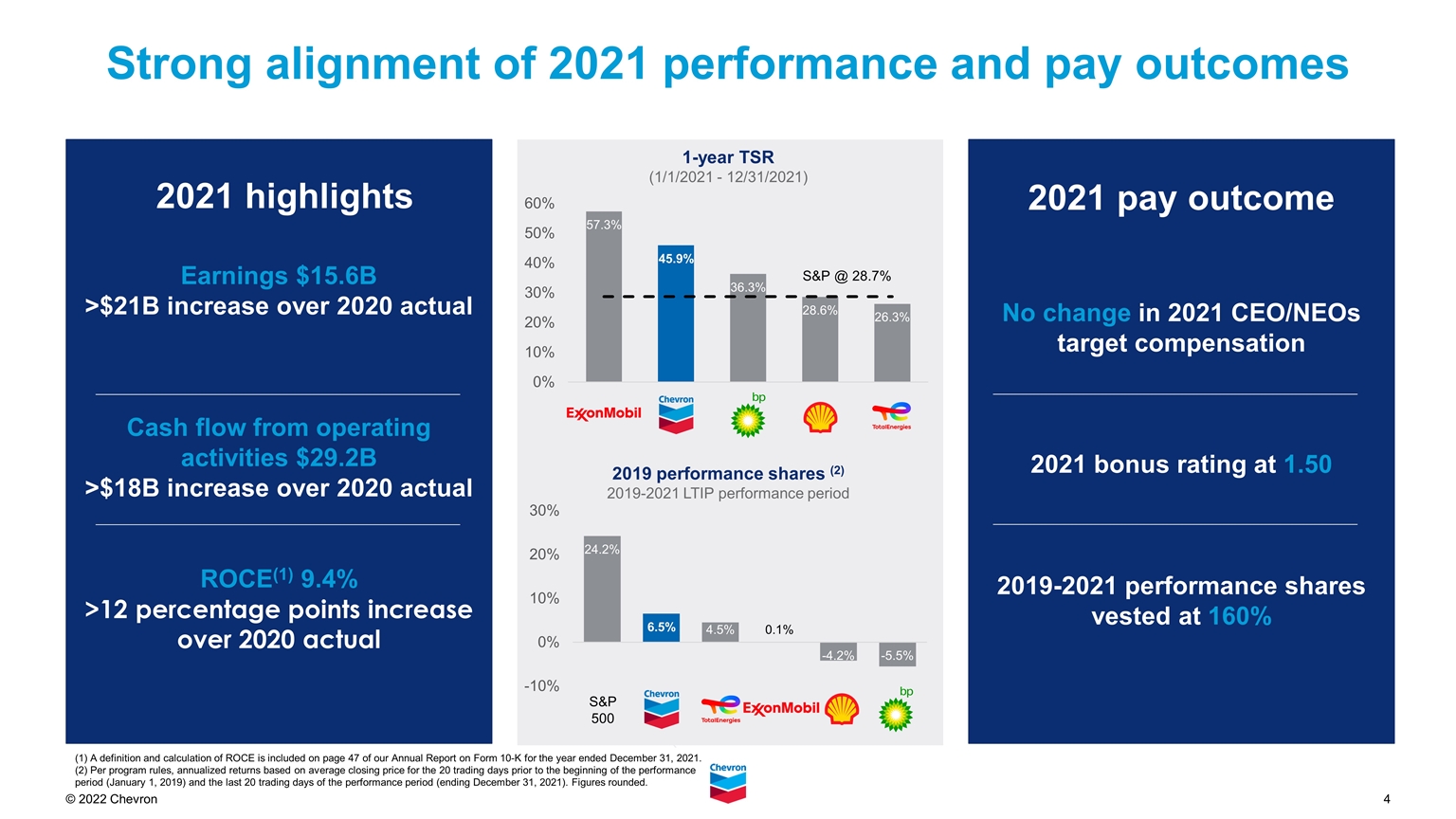

Strong alignment of 2021 performance and pay outcomes No change in 2021 CEO/NEOs target compensation 2021 bonus rating at 1.50 2019-2021 performance shares vested at 160% Earnings $15.6B >$21B increase over 2020 actual Cash flow from operating activities $29.2B >$18B increase over 2020 actual ROCE(1) 9.4% >12 percentage points increase over 2020 actual S&P 500 S&P @ 28.7% 2019 performance shares (2) 2019-2021 LTIP performance period 1-year TSR (1/1/2021 - 12/31/2021) 2021 highlights 2021 pay outcome (1) A definition and calculation of ROCE is included on page 47 of our Annual Report on Form 10-K for the year ended December 31, 2021. (2) Per program rules, annualized returns based on average closing price for the 20 trading days prior to the beginning of the performance period (January 1, 2019) and the last 20 trading days of the performance period (ending December 31, 2021). Figures rounded.

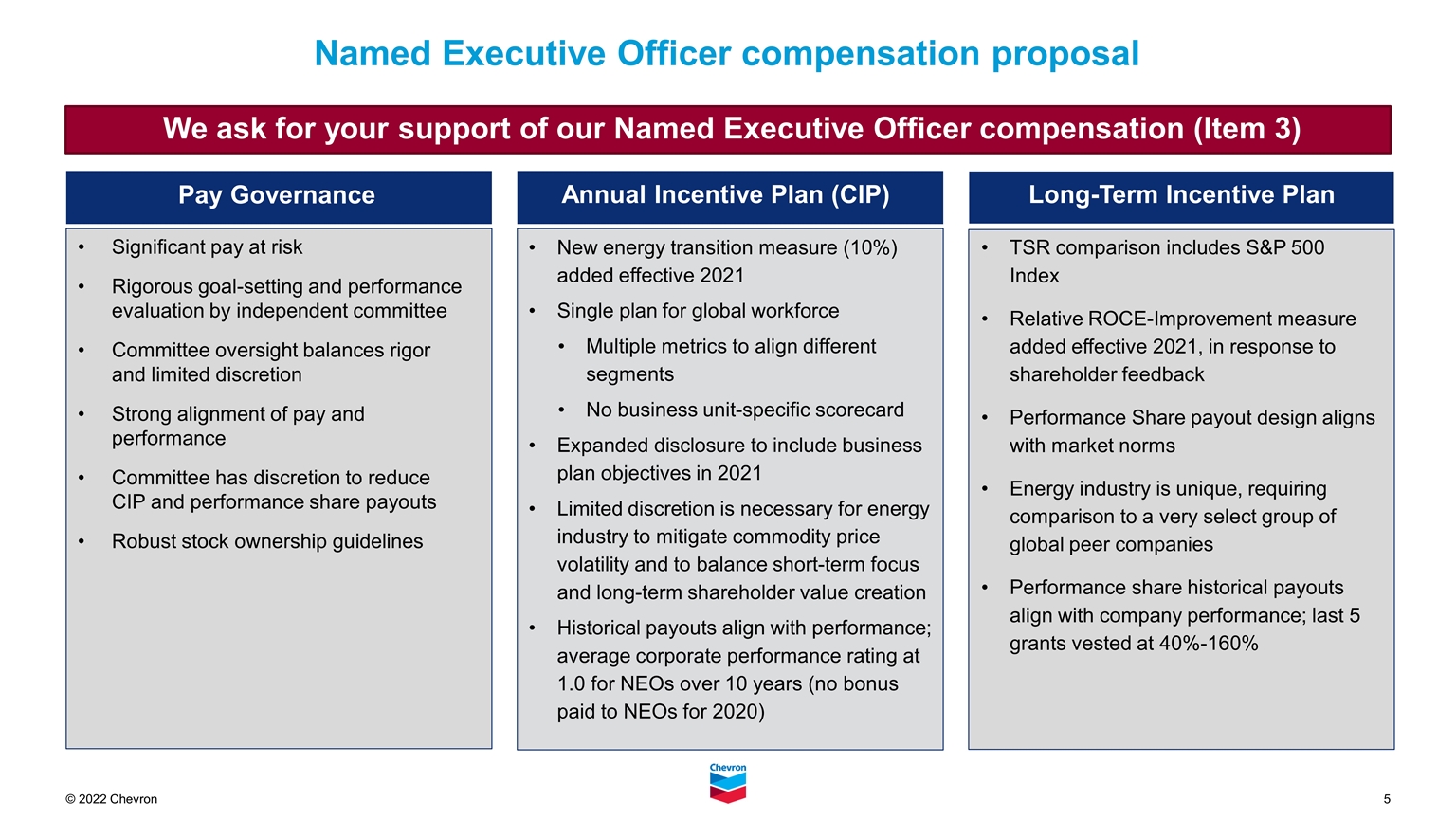

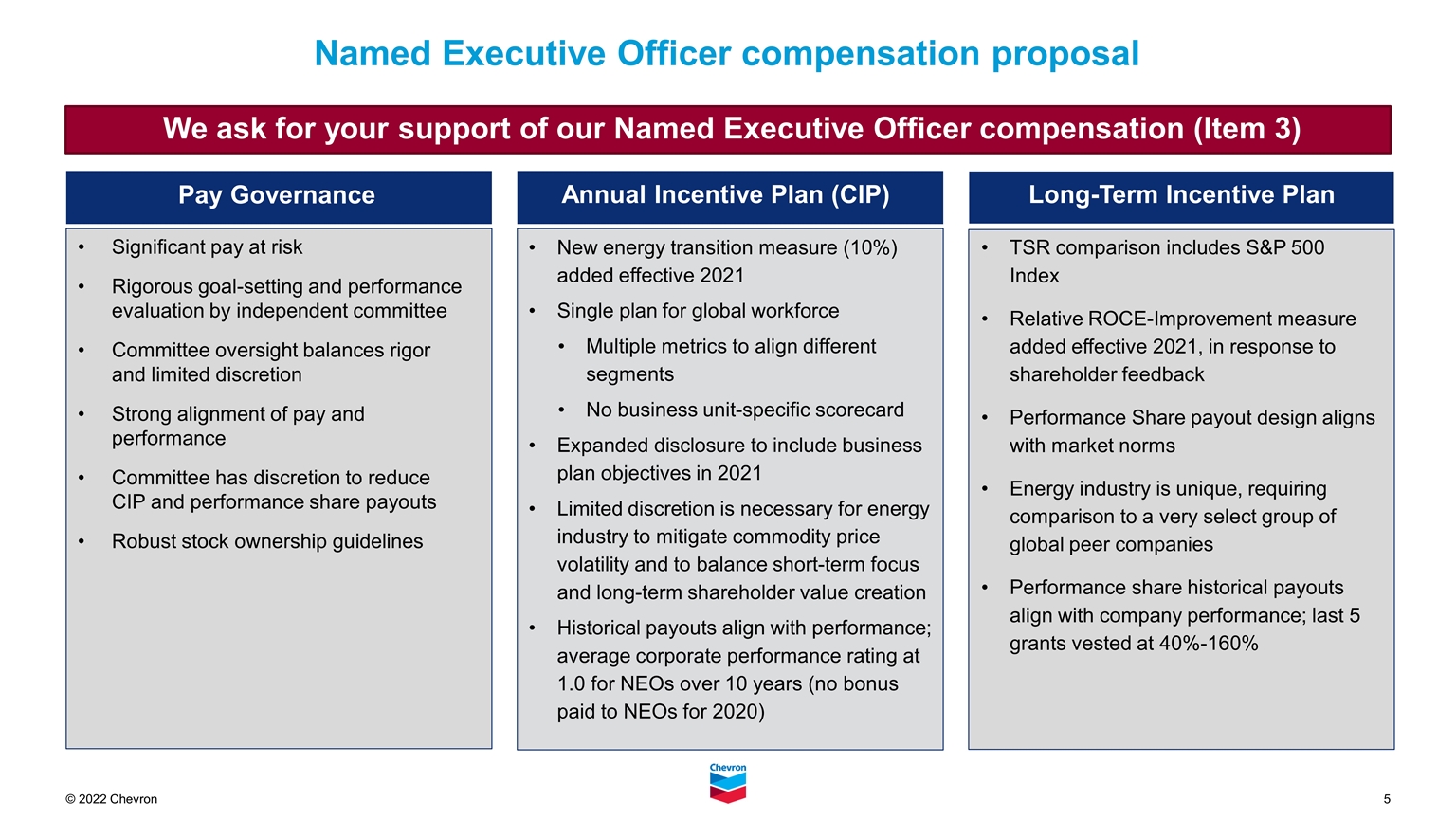

Significant pay at risk Rigorous goal-setting and performance evaluation by independent committee Committee oversight balances rigor and limited discretion Strong alignment of pay and performance Committee has discretion to reduce CIP and performance share payouts Robust stock ownership guidelines New energy transition measure (10%) added effective 2021 Single plan for global workforce Multiple metrics to align different segments No business unit-specific scorecard Expanded disclosure to include business plan objectives in 2021 Limited discretion is necessary for energy industry to mitigate commodity price volatility and to balance short-term focus and long-term shareholder value creation Historical payouts align with performance; average corporate performance rating at 1.0 for NEOs over 10 years (no bonus paid to NEOs for 2020) Annual Incentive Plan (CIP) Long-Term Incentive Plan Pay Governance Named Executive Officer compensation proposal TSR comparison includes S&P 500 Index Relative ROCE-Improvement measure added effective 2021, in response to shareholder feedback Performance Share payout design aligns with market norms Energy industry is unique, requiring comparison to a very select group of global peer companies Performance share historical payouts align with company performance; last 5 grants vested at 40%-160% We ask for your support of our Named Executive Officer compensation (Item 3)

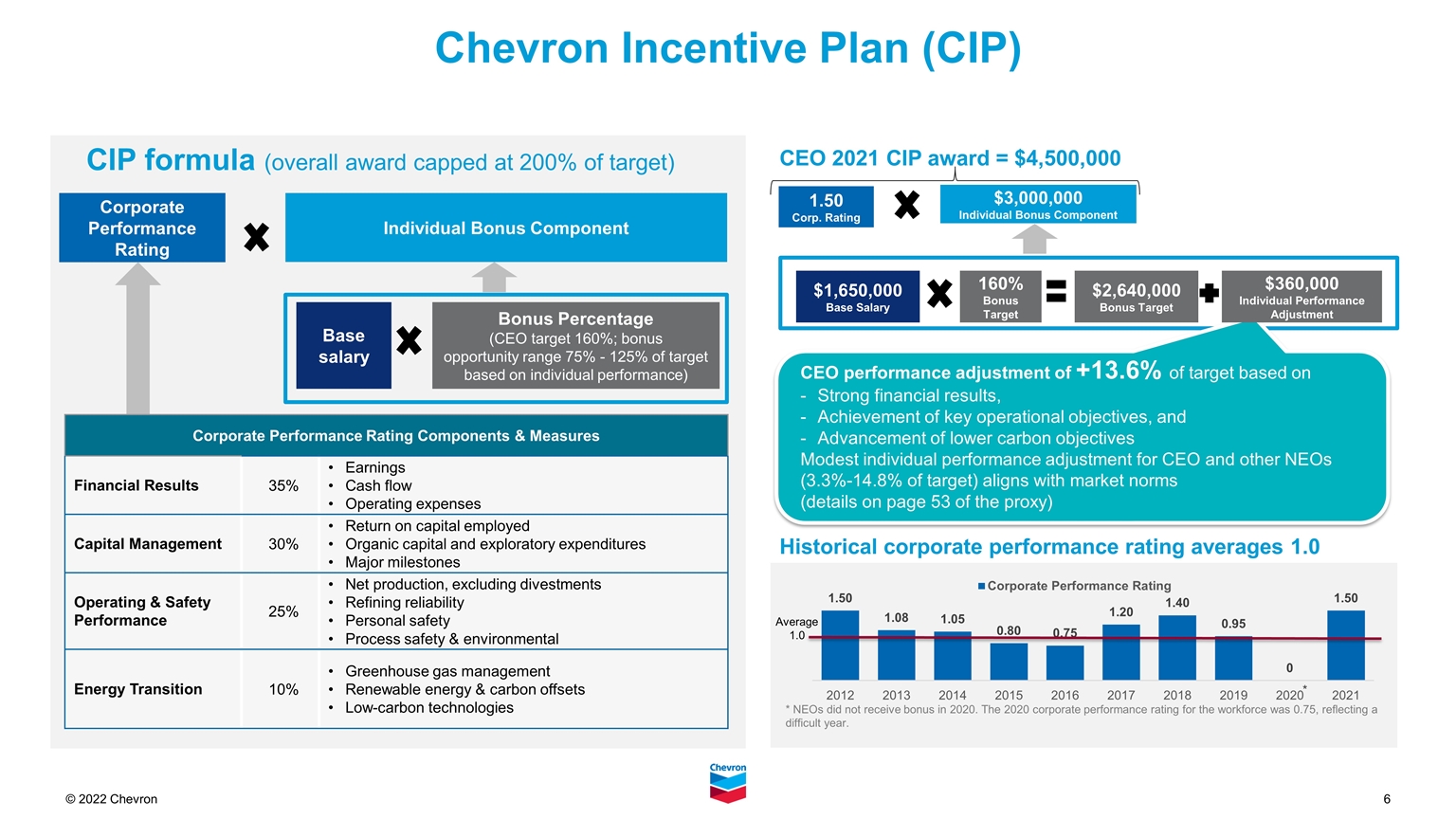

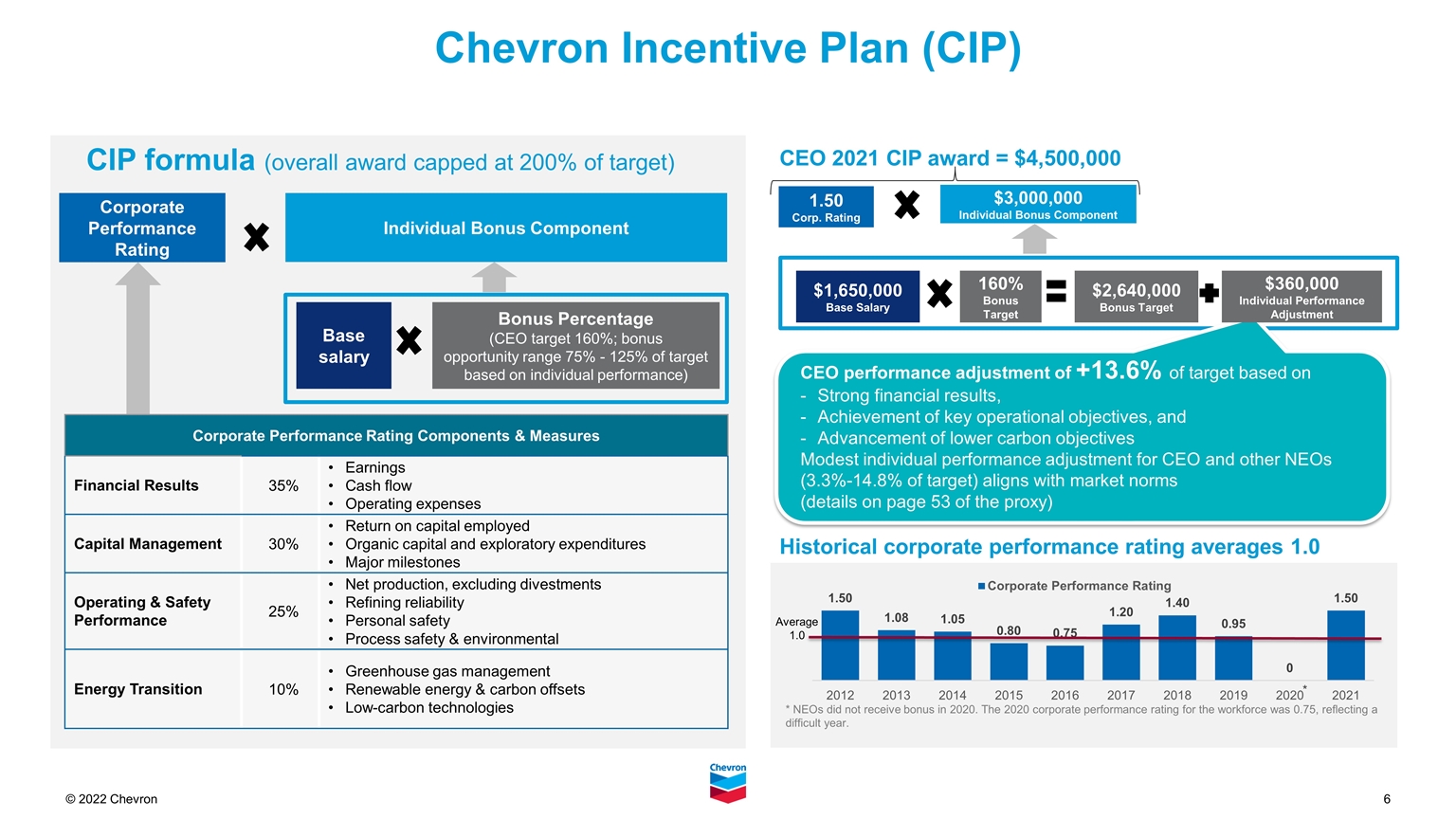

Chevron Incentive Plan (CIP) Corporate Performance Rating CIP formula (overall award capped at 200% of target) Base salary Bonus Percentage (CEO target 160%; bonus opportunity range 75% - 125% of target based on individual performance) Individual Bonus Component Corporate Performance Rating Components & Measures Financial Results 35% Earnings Cash flow Operating expenses Capital Management 30% Return on capital employed Organic capital and exploratory expenditures Major milestones Operating & Safety Performance 25% Net production, excluding divestments Refining reliability Personal safety Process safety & environmental Energy Transition 10% Greenhouse gas management Renewable energy & carbon offsets Low-carbon technologies CEO 2021 CIP award = $4,500,000 Historical corporate performance rating averages 1.0 1.50 Corp. Rating $3,000,000 Individual Bonus Component $1,650,000 Base Salary 160% Bonus Target * * NEOs did not receive bonus in 2020. The 2020 corporate performance rating for the workforce was 0.75, reflecting a difficult year. $2,640,000 Bonus Target $360,000 Individual Performance Adjustment CEO performance adjustment of +13.6% of target based on Strong financial results, Achievement of key operational objectives, and Advancement of lower carbon objectives Modest individual performance adjustment for CEO and other NEOs (3.3%-14.8% of target) aligns with market norms (details on page 53 of the proxy) Average 1.0

Strong governance Ronald D. Sugar Lead Director Retired Chairman and CEO, Northrop Grumman Corporation (2, 3) John B. Frank Vice Chairman, Oaktree Capital Group, LLC (1) Alice P. Gast President, Imperial College London (2, 4) Enrique Hernandez, Jr. Executive Chairman, Inter-Con Security Systems, Inc. (3, 4) Charles W. Moorman Senior Advisor to Amtrak Retired Chairman and CEO, Norfolk Southern Corporation (2, 3) Dambisa F. Moyo Co-principal, Versaca Investments (1) D. James Umpleby III Chairman and CEO, Caterpillar Inc. (2, 4) Debra Reed-Klages Retired Chairman, CEO, and President, Sempra Energy (1) Board of Directors Committees of the Board: (1)Audit: Debra Reed-Klages, Chair (2)Board Nominating and Governance: Wanda M. Austin, Chair (3) Management Compensation: Charles W. Moorman, Chair (4) Public Policy and Sustainability: Enrique Hernandez, Jr., Chair CEO/senior executive/leader of significant operations Science/technology/engineering/research/academia Government/regulatory/legal/public policy Finance/financial disclosure/financial accounting Global business/international affairs Environmental Leading business transformation Qualifications/experience table: ••••••• ••••••• ••••• • • ••• • • • • • • • Jon M. Huntsman Jr. Vice Chair Policy, Ford Motor Company (3, 4) ••••• • ••• • • •••• ••••••• Michael K. Wirth Chairman and CEO Former Vice Chairman of the Board and Executive Vice President of Midstream & Development, Chevron Marillyn A. Hewson Retired Chairman, CEO, and President, Lockheed Martin Corporation (1) ••••••• •••• •• ••••• •• •••• Wanda M. Austin Retired President and CEO, The Aerospace Corporation (2, 3)

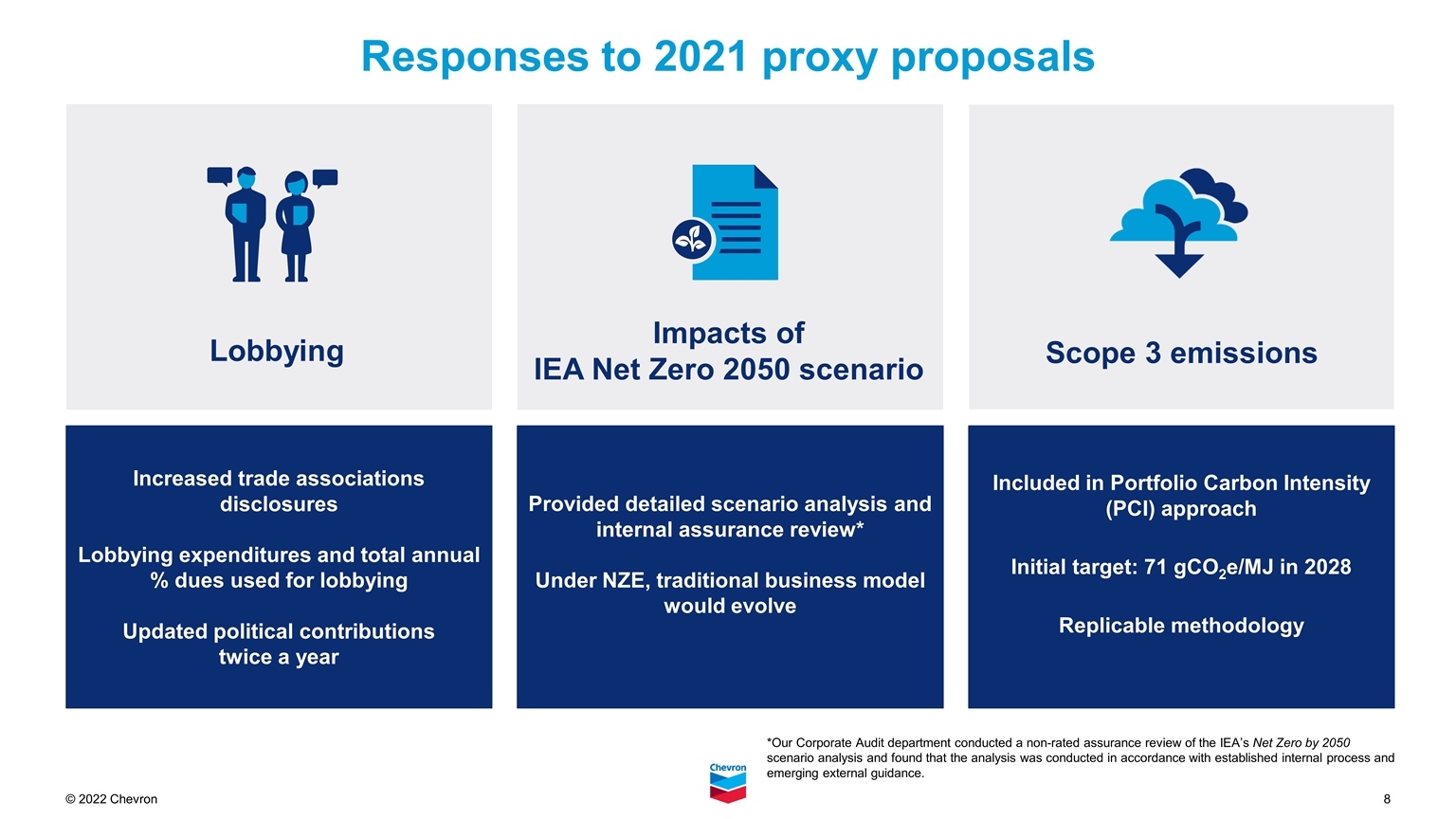

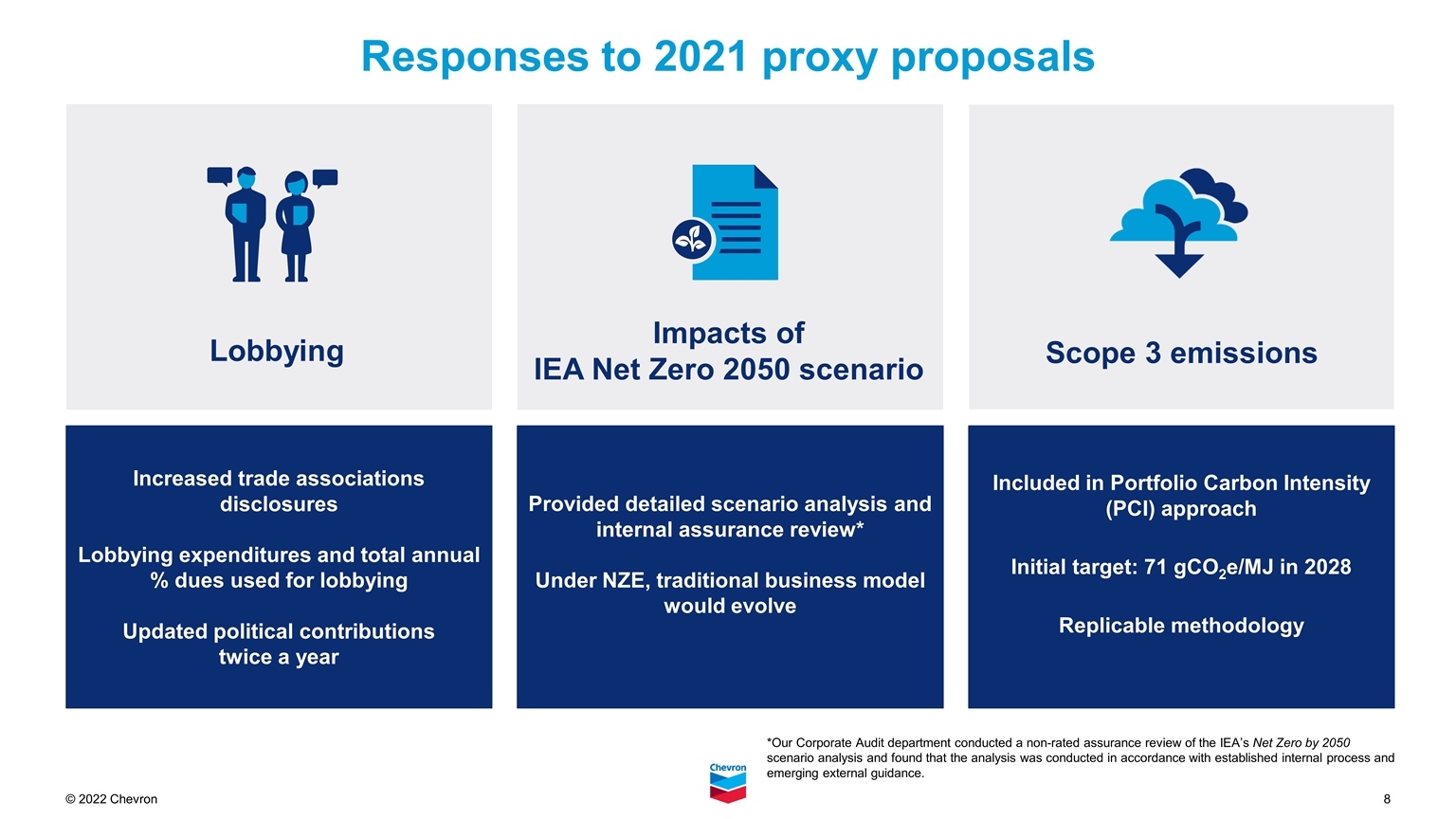

Increased trade associations disclosures Lobbying expenditures and total annual % dues used for lobbying Updated political contributions twice a year Provided detailed scenario analysis and internal assurance review* Under NZE, traditional business model would evolve Impacts of IEA Net Zero 2050 scenario Included in Portfolio Carbon Intensity (PCI) approach Initial target: 71 gCO2e/MJ in 2028 Replicable methodology Scope 3 emissions Lobbying Responses to 2021 proxy proposals *Our Corporate Audit department conducted a non-rated assurance review of the IEA’s Net Zero by 2050 scenario analysis and found that the analysis was conducted in accordance with established internal process and emerging external guidance.

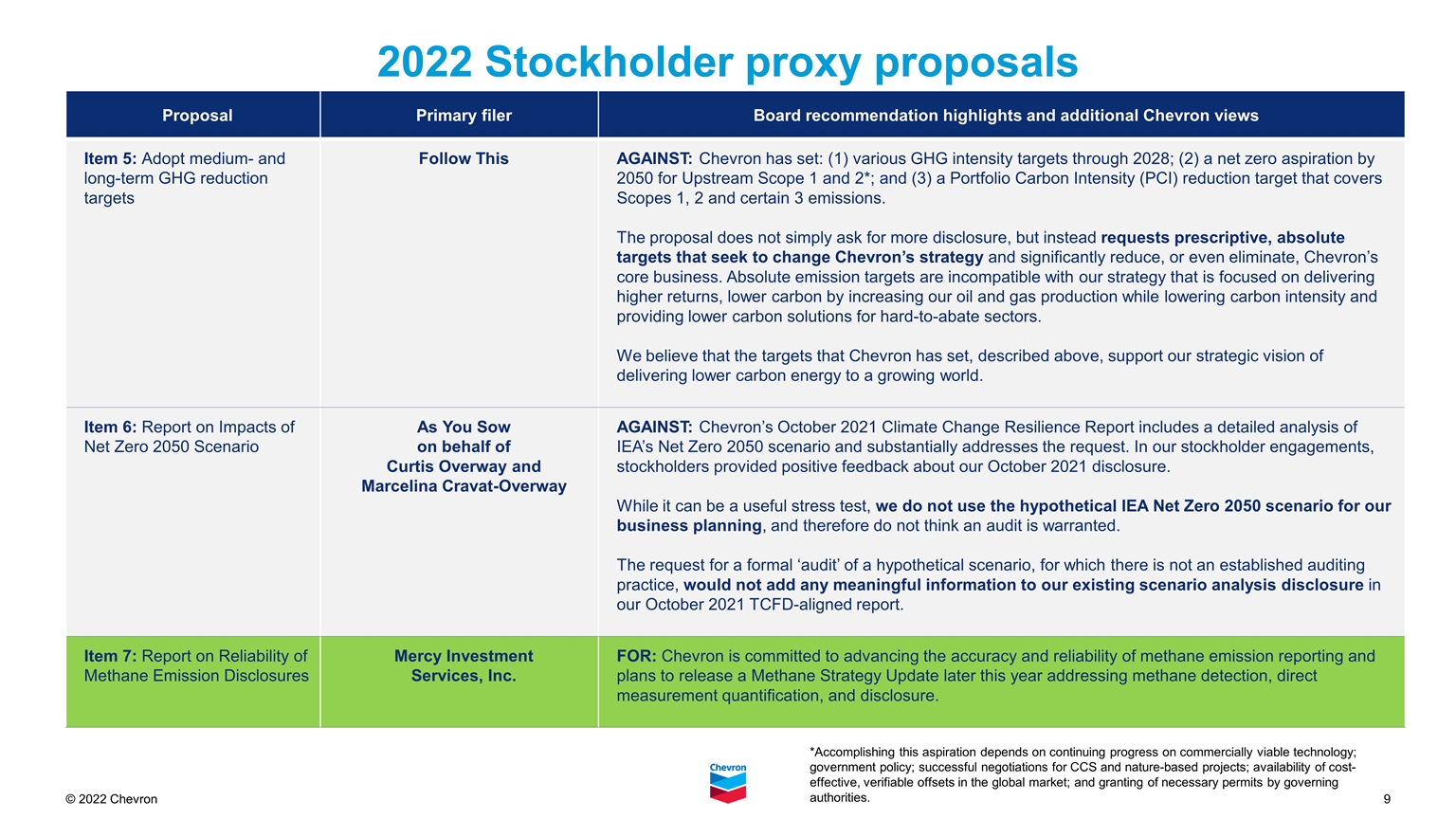

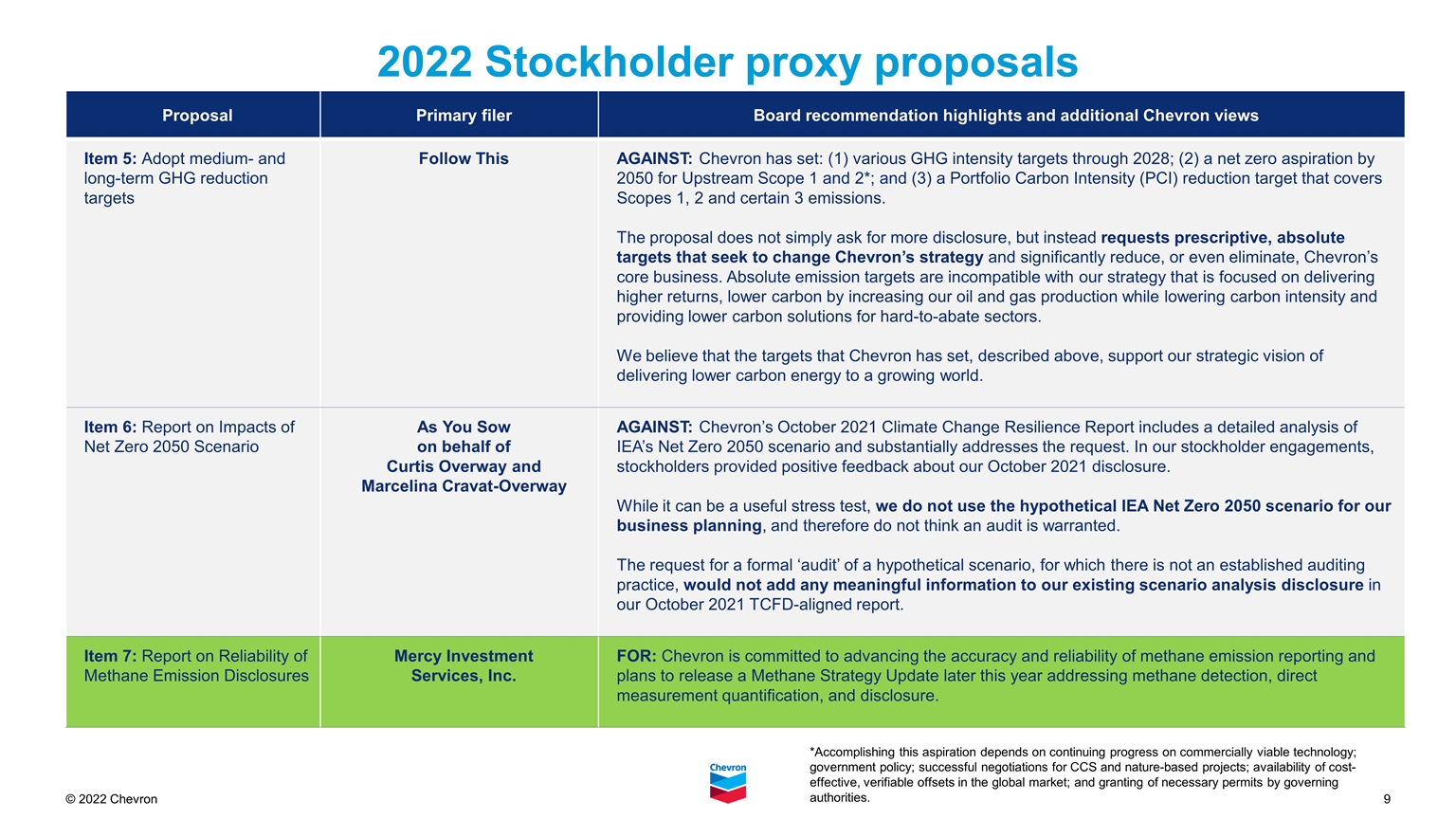

2022 Stockholder proxy proposals Proposal Primary filer Board recommendation highlights and additional Chevron views Item 5: Adopt medium- and long-term GHG reduction targets Follow This AGAINST: Chevron has set: (1) various GHG intensity targets through 2028; (2) a net zero aspiration by 2050 for Upstream Scope 1 and 2*; and (3) a Portfolio Carbon Intensity (PCI) reduction target that covers Scopes 1, 2 and certain 3 emissions. The proposal does not simply ask for more disclosure, but instead requests prescriptive, absolute targets that seek to change Chevron’s strategy and significantly reduce, or even eliminate, Chevron’s core business. Absolute emission targets are incompatible with our strategy that is focused on delivering higher returns, lower carbon by increasing our oil and gas production while lowering carbon intensity and providing lower carbon solutions for hard-to-abate sectors. We believe that the targets that Chevron has set, described above, support our strategic vision of delivering lower carbon energy to a growing world. Item 6: Report on Impacts of Net Zero 2050 Scenario As You Sow on behalf of Curtis Overway and Marcelina Cravat-Overway AGAINST: Chevron’s October 2021 Climate Change Resilience Report includes a detailed analysis of IEA’s Net Zero 2050 scenario and substantially addresses the request. In our stockholder engagements, stockholders provided positive feedback about our October 2021 disclosure. While it can be a useful stress test, we do not use the hypothetical IEA Net Zero 2050 scenario for our business planning, and therefore do not think an audit is warranted. The request for a formal ‘audit’ of a hypothetical scenario, for which there is not an established auditing practice, would not add any meaningful information to our existing scenario analysis disclosure in our October 2021 TCFD-aligned report. Item 7: Report on Reliability of Methane Emission Disclosures Mercy Investment Services, Inc. FOR: Chevron is committed to advancing the accuracy and reliability of methane emission reporting and plans to release a Methane Strategy Update later this year addressing methane detection, direct measurement quantification, and disclosure. *Accomplishing this aspiration depends on continuing progress on commercially viable technology; government policy; successful negotiations for CCS and nature-based projects; availability of cost-effective, verifiable offsets in the global market; and granting of necessary permits by governing authorities.

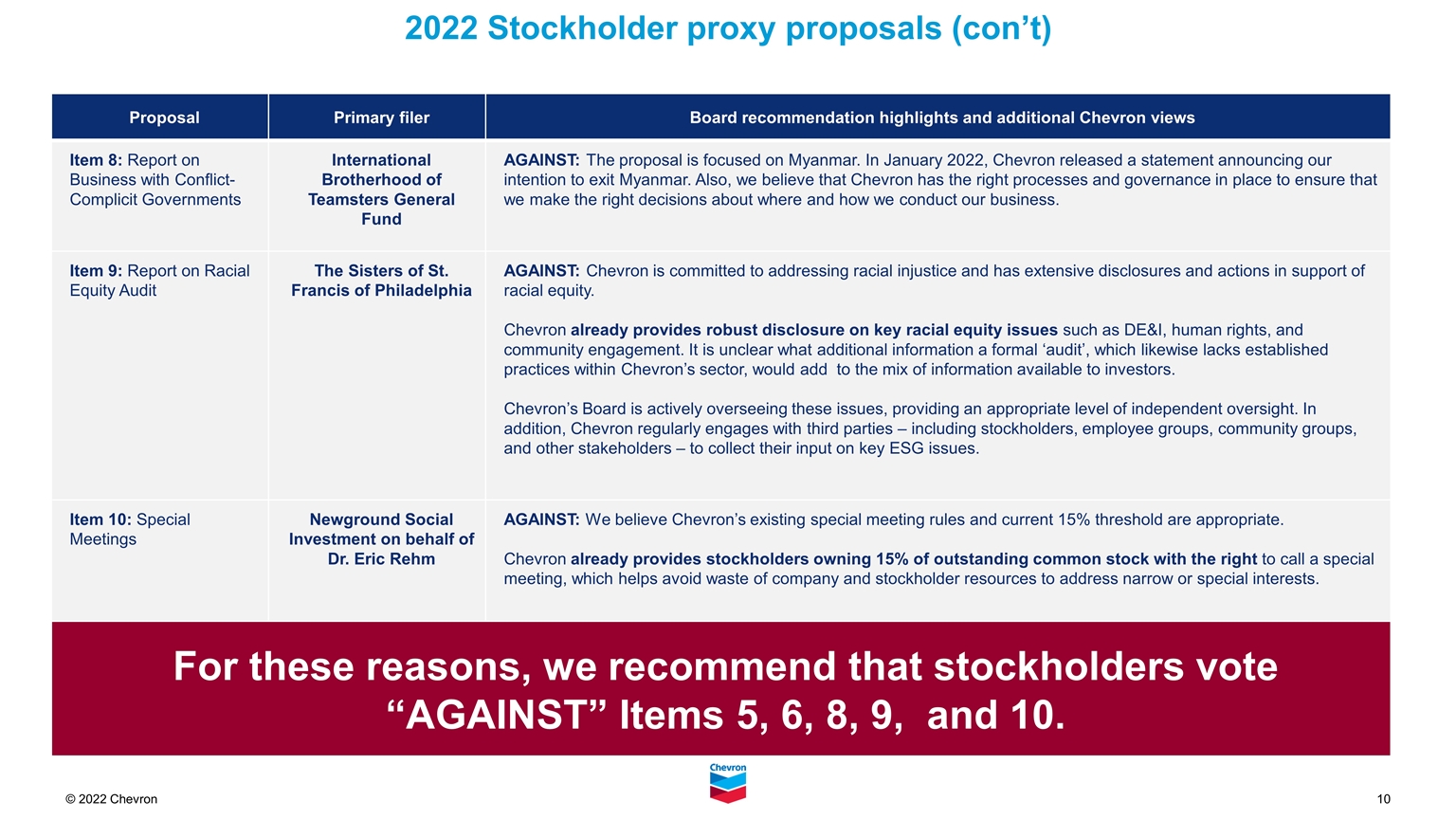

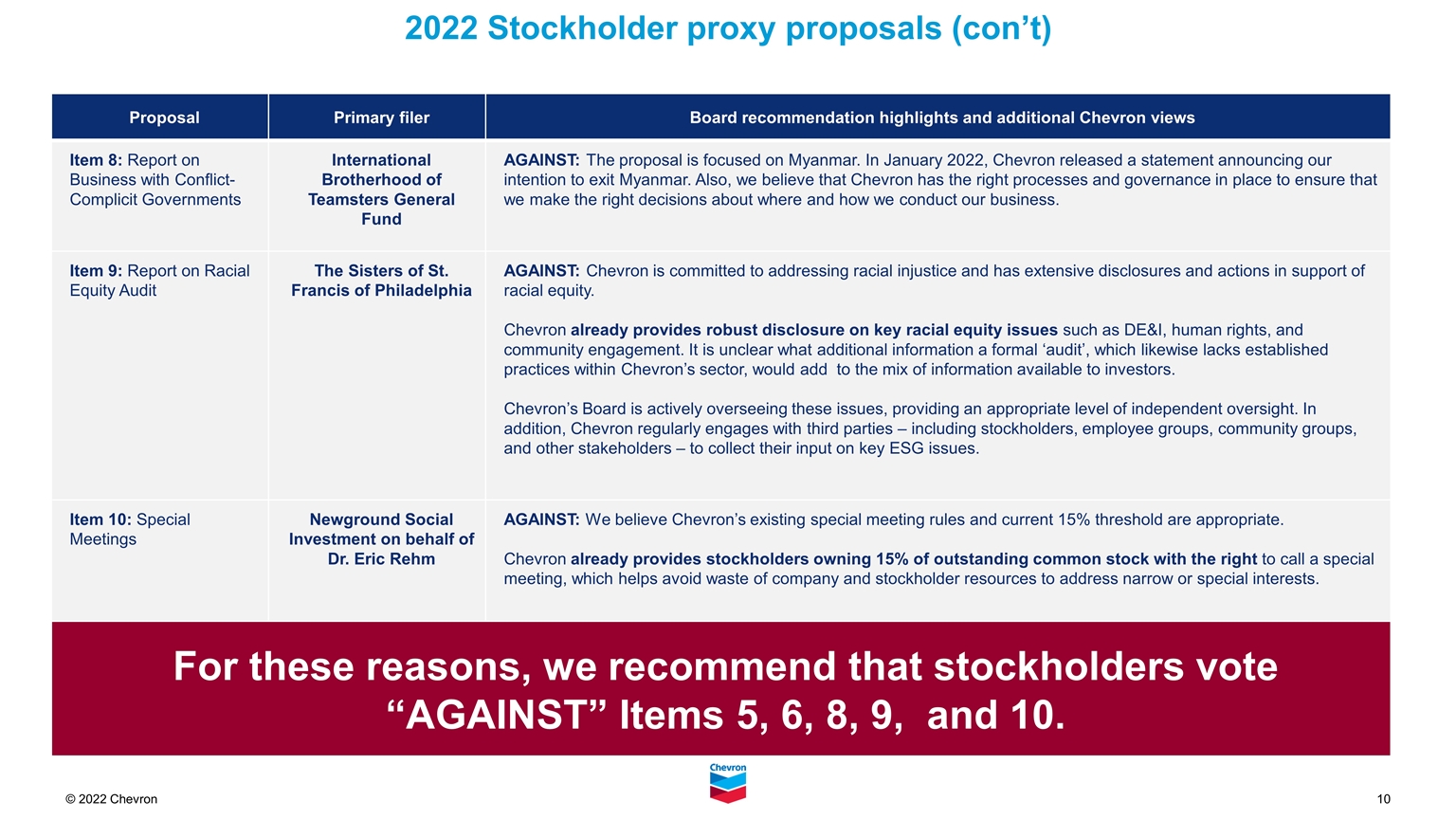

2022 Stockholder proxy proposals (con’t) Proposal Primary filer Board recommendation highlights and additional Chevron views Item 8: Report on Business with Conflict-Complicit Governments International Brotherhood of Teamsters General Fund AGAINST: The proposal is focused on Myanmar. In January 2022, Chevron released a statement announcing our intention to exit Myanmar. Also, we believe that Chevron has the right processes and governance in place to ensure that we make the right decisions about where and how we conduct our business. Item 9: Report on Racial Equity Audit The Sisters of St. Francis of Philadelphia AGAINST: Chevron is committed to addressing racial injustice and has extensive disclosures and actions in support of racial equity. Chevron already provides robust disclosure on key racial equity issues such as DE&I, human rights, and community engagement. It is unclear what additional information a formal ‘audit’, which likewise lacks established practices within Chevron’s sector, would add to the mix of information available to investors. Chevron’s Board is actively overseeing these issues, providing an appropriate level of independent oversight. In addition, Chevron regularly engages with third parties – including stockholders, employee groups, community groups, and other stakeholders – to collect their input on key ESG issues. Item 10: Special Meetings Newground Social Investment on behalf of Dr. Eric Rehm AGAINST: We believe Chevron’s existing special meeting rules and current 15% threshold are appropriate. Chevron already provides stockholders owning 15% of outstanding common stock with the right to call a special meeting, which helps avoid waste of company and stockholder resources to address narrow or special interests. For these reasons, we recommend that stockholders vote “AGAINST” Items 5, 6, 8, 9, and 10.