UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

BALDOR ELECTRIC COMPANY

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

| | |

| BALDOR ELECTRIC COMPANY | |  |

| P. O. Box 2400 | |

| 5711 R. S. Boreham, Jr. Street | |

| Fort Smith, Arkansas 72902 | |

March 16, 2006

To our Shareholders:

You are cordially invited to attend Baldor’s 2006 Annual Shareholders’ Meeting.

On the following pages you will find the Notice of Meeting, which lists the matters to be conducted at the meeting, and the Proxy Statement. Our Shareholders’ Meeting will include a review of 2005 and a discussion of the opportunities and challenges ahead of us. We believe you will find it interesting.

This year there are two proposals for your consideration:

| | • | | Proposal 1 is the election of Directors. Your Board recommends you votefor this proposal. |

| | • | | Proposal 2 is the adoption of a new Equity Incentive Plan. If adopted, this Plan would be Baldor’s only plan under which benefits could be granted and no further benefits will be granted under any of the Company’s existing plans. Your Board recommends you votefor this proposal. |

All shareholders are invited to attend the meeting in person. However, to assure your representation at the meeting, you are urged to vote your proxy as soon as possible. Your vote is important. You can vote electronically over the Internet or by telephone. You may also vote by using a traditional proxy card and mailing it to us in the enclosed postage-paid return envelope. Detailed voting instructions can be found on your proxy card.

We appreciate your confidence in Baldor Electric Company.

|

| Sincerely, |

|

|

| John A. McFarland |

| Chairman |

BALDOR ELECTRIC COMPANY

NOTICE OF

2006 ANNUAL MEETING OF SHAREHOLDERS

| | | | | | | | | | | | |

| Date: | | Saturday, April 22, 2006 |

| |

| Time: | | 10:30 a.m., local time |

| |

| Location: | | Fort Smith Convention Center |

| | 55 South 7th Street |

| | Fort Smith, Arkansas |

| | |

| Items of Business: | | 1. | | To elect directors; |

| | |

| | 2. | | To consider and act upon a proposal to approve the Baldor Electric Company 2006 Equity Incentive Plan; and |

| | |

| | 3. | | To transact such other business as may properly come before the meeting and all adjournments thereof. |

| |

| Record Date: | | Only Baldor shareholders of record as of the close of business on March 8, 2006, are entitled to notice of, and to vote at, the 2006 Annual Shareholders’ Meeting and all adjournments (the “2006 Annual Meeting”). |

| |

| Annual Report: | | Baldor’s 2005 Annual Report to Shareholders (“2005 Annual Report”) for the fiscal year ended December 31, 2005, is available and may be included in the mailing of this Proxy Statement. This 2005 Annual Report is not a part of the proxy soliciting material. To request copies of any Baldor literature, please visit our website or contact us at: |

| | | |

| | | | Mail: | | Baldor Electric Company |

| | | | Phone: | | 479-646-4711 | | | | Attn: Shareholder Relations |

| | | | Fax: | | 479-648-5752 | | | | | | P O Box 2400 |

| | | | Website: | | www.baldor.com | | | | | | Fort Smith AR 72902 |

| | |

| Proxy Voting: | | | | Baldor’s shareholders of record can vote by one of the following methods and a proxy may be revoked as described in the following Proxy Statement: |

| | | | | |

| | | | | | 1. By telephone, | | | | |

| | | | | | 2. By Internet, or | | | | |

| | | | | | 3. By mail. | | | | |

|

| By order of the Board of Directors |

|

|

| Ronald E. Tucker |

| Secretary |

|

| March 16, 2006 |

TABLE OF CONTENTS

BALDOR ELECTRIC COMPANY

PROXY STATEMENT

2006 ANNUAL MEETING OF SHAREHOLDERS

Date, time, and place of meeting …The enclosed proxy is solicited on behalf of the Board of Directors of Baldor Electric Company (“Baldor”) for use at the 2006 Annual Meeting of its shareholders. The meeting will be held as follows:

| | | | | | |

| Time: | | 10:30 a.m., local time | | Location: | | Fort Smith Convention Center |

| | | | | | 55 South 7th Street |

| Date: | | Saturday, April 22, 2006 | | | | Fort Smith, Arkansas |

Company location and proxy mailing …Baldor’s principal executive offices are located at 5711 R. S. Boreham, Jr. Street, Fort Smith, Arkansas 72901. This Proxy Statement and the accompanying form of proxy are first being sent to our shareholders on or about March 16, 2006.

VOTING

Shareholders entitled to vote …Only the holders of record of Baldor’s common stock, par value $0.10 per share (the “Common Stock”), at the close of business on March 8, 2006, will be entitled to notice of and to vote at the 2006 Annual Meeting. There were 33,142,611 shares of Common Stock outstanding as of the close of business on March 8, 2006. Each share of Common Stock entitles the holder to one vote on each item of business to be presented for shareholder vote at the 2006 Annual Meeting.

Quorum …A majority of the issued and outstanding shares entitled to vote and represented in person or by proxy will constitute a quorum for the transaction of business at the 2006 Annual Meeting. Shares represented by properly executed proxies will be counted for determining whether a quorum exists. If a broker indicates on the proxy that it does not have discretionary authority to vote on a particular matter (a “broker non-vote”), the related shares will only be considered as present and entitled to vote for that particular matter.

Vote required …A plurality of votes cast is required for the election of directors on Proposal 1. The affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote is required for approval of Proposal 2. The effect of a vote against such proposals will be shares represented by: (1) proxies that direct that the shares be voted against or to abstain or to withhold a vote on a matter, (2) proxies that are marked to deny discretionary authority on other matters, and (3) broker non-votes deemed to be present.

Voting methods …You may vote your shares by telephone, over the Internet, or by mail as indicated on the attached proxy card. If you vote by telephone or Internet, you do not need to return your proxy card. If you choose to vote by mail, simply mark your proxy card, date and sign it, and return it in the enclosed postage-paid envelope.

Vote at the Annual Meeting …Your choice of voting method will not limit your right to vote at the 2006 Annual Meeting. If you are not a shareholder of record, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the meeting.

1

Voting by employee-participants …Baldor sponsors The Baldor Electric Company Employees’ Profit Sharing and Savings Plan (“The Profit Sharing and Savings Plan”). One of the ten investment options for employee-participants is the Baldor Stock Fund. Employee-participants individually have the right to direct the trustee of The Profit Sharing and Savings Plan how to vote the shares of Common Stock that are allocated to their individual accounts. Employee-participants may use the telephone, Internet, or mail to direct the trustee on how to vote their shares. Instructions on the various voting methods can be found on the employee-participants direction card. The Profit Sharing and Savings Plan and governing Trust Agreement require that: 1) the shares of Common Stock not yet allocated to the accounts of employee-participants will be votedFOR the proposal on which the vote is being taken; 2) the shares of Common Stock allocated to employee-participants where the direction card has been signed and returned without any direction will be voted in proportion to the shares in The Profit Sharing and Savings Plan that were voted by employee-participants; and 3) the shares of Common Stock allocated to employee-participants that are not voted will be voted in proportion to the shares in The Profit Sharing and Savings Plan that were voted by employee-participants.

Proxies …The persons named in the proxy are authorized to vote the shares of the shareholders giving the proxy for any nominee except those nominees with respect to whom authority has been withheld. All shares that have been properly voted and not revoked will be voted at the 2006 Annual Meeting in accordance with the instructions received. If the form of proxy is signed and returned without any direction, shares of Baldor’s Common Stock will be votedFOR the election of the Board’s slate of nominees andFOR Proposal 2. A shareholder may revoke a properly voted proxy at any time before it is exercised either by attending the meeting and voting in person or by notifying the Secretary of Baldor in writing at the address found on page 1 of this proxy statement under the caption “Company location and proxy mailing”.

Cost of proxy solicitation …Baldor will pay for the cost of the solicitation of proxies. Regular employees of Baldor, without additional compensation, may personally solicit proxies or use mail systems, facsimile, telephone, or other reasonable means to solicit proxies. Brokerage firms, banks, nominees, and others will be requested to forward proxy materials to the beneficial owners of Baldor’s Common Stock held of record by them. Currently, there is no plan to solicit proxies by specially engaged employees or other paid solicitors; however, this may be done if deemed necessary.

PROPOSAL 1 — ELECTION OF DIRECTORS

Baldor’s Restated Articles of Incorporation and Bylaws, as amended, provide for a classified Board of Directors. The Board is divided into three classes. Each class expires at different times. Three members are to be elected to the Board of Directors in 2006. Each member elected in 2006 will serve for a term of three years.

The persons named in the enclosed proxy intend to vote the proxy for the election of the three nominees named below as directors of Baldor. Each nominee listed below will be voted FOR unless the shareholder indicates on the proxy that the vote for any one or more of the nominees should be withheld or contrary directions are indicated.

The Board of Directors has no reason to doubt the availability of the nominees and each has indicated a willingness to serve if elected. If any nominee declines or is unable to serve, the Board of Directors, in its discretion, may either reduce the size of the Board or the proxies will be voted for a substitute nominee designated by the Board of Directors.

2

Information Regarding the Nominees for Directors

to be Elected in 2006 for Terms Ending in 2009

Merlin J. Augustine, Jr. ... Assistant Vice Chancellor of Finance and Administration and Director of Customer Relations at the University of Arkansas in Fayetteville; Founder and Chief Executive Officer of M&N Augustine Foundation for Human Development, Inc. established in 1992; Former Member of the Board of Arkansas Science and Technology Authority (term ended 2005);

John A. McFarland ... Baldor’s Chairman of the Board since January 2005, Chief Executive Officer since January 2000, President from 1996 through December 2004, Executive Vice President - Sales and Marketing during 1996, and Vice President - Sales from 1991 to 1996.

Robert L. Proost ... Financial Consultant and Lawyer; Former Director, Corporate Vice President, Chief Financial Officer, and Director of Administration of A.G. Edwards & Sons, Inc., a securities brokerage and investment banking firm which previously provided investment banking services to Baldor (retired 2001); Former Director, Vice President, and Chief Financial Officer of A.G. Edwards, Inc. (NYSE), and of various subsidiaries (retired 2001).

Information Regarding the Directors Who Are Not Nominees for Election

and Whose Terms Continue Beyond 2006

Jefferson W. Asher, Jr. ... Independent Management Consultant, providing assistance to corporations, attorneys, banking institutions, and other creditors, for more than five years; Director of OhCal Foods, Inc. since January 2005; Former Director of California Beach Restaurants, Inc. (term ended 2004); Former Director of Zing Wireless, Inc. (term ended 2005).

Richard E. Jaudes ... Partner at Thompson Coburn LLP, a law firm that provides legal counsel to Baldor.

Robert J. Messey ... Senior Vice President and Chief Financial Officer of Arch Coal, Inc. (NYSE), the nation’s second largest coal producer in the United States; Director of Stereotaxis, Inc. (NASDAQ) since May 2005.

R. L. Qualls ... Independent Business and Financial Consultant, providing assistance to corporations, including Baldor; Former Vice Chairman of the Board, Chief Executive Officer, and President (retired 2000); Director of Bank of the Ozarks, Inc. (NASDAQ) since 1997.

Barry K. Rogstad … Former President of the American Business Conference, a coalition of mid-size fast-growing firms, which promotes public policies to encourage growth, job creation, and a higher standard of living for all Americans, for more than five years (retired 2002); Former Partner and Chief Economist with Coopers and Lybrand.

3

General Information Regarding

Current Directors and Nominees for Election

| | | | | | |

Name | | Year of Birth | | Director Since | | Current Term

Expires |

Jefferson W. Asher, Jr. | | 1924 | | 1973 | | 2008 |

Merlin J. Augustine, Jr. | | 1943 | | 2000 | | 2006 |

Richard E. Jaudes | | 1943 | | 1999 | | 2008 |

John A. McFarland | | 1951 | | 1996 | | 2006 |

Robert J. Messey | | 1946 | | 1993 | | 2008 |

Robert L. Proost | | 1937 | | 1988 | | 2006 |

R. L. Qualls | | 1933 | | 1987 | | 2007 |

Barry K. Rogstad | | 1940 | | 2001 | | 2007 |

Information About the Board of Directors

and Committees of the Board

Board of Directors ... In April 2005, the Board of Directors established two new committees of the Board of Directors by realigning the responsibilities of four of the existing committees. The two new committees are the: (1) Nominating & Corporate Governance Committee (combination of the Nominating Committee and the Corporate Governance Committee); and (2) Compensation & Stock Option Committee (combination of the Compensation Committee and the Stock Option Committee). The membership and responsibilities of the current Committees of the Company’s Board of Directors are summarized below. Additional information regarding the responsibilities of each Committee is found in, and shall be governed by, the Company’s Bylaws, as amended, each Committee’s Charter, where applicable, specific directions of the Company’s Board of Directors, and certain mandated regulatory requirements. The Charters of Baldor’s Audit, Nominating & Corporate Governance, and Compensation & Stock Option Committees, as well as Baldor’s Corporate Governance Guidelines, are available at Baldor’s website at www.baldor.com. The information is also available in print to any shareholder who requests it.

Executive Committee ... Between meetings of the Board, the Executive Committee is empowered to act in lieu of the Board of Directors except on those matters for which the Board of Directors has specifically reserved authority to itself or as set forth in Baldor’s Bylaws, as amended. The Executive Committee administers the 1989 Stock Option Plan for Non-Employee Directors (the “1989 Plan”), the 1996 Stock Option Plan for Non-Employee Directors (the “1996 Plan”), and the Stock Option Plan for Non-Employee Directors (the “Director Plan”) that was approved by Baldor’s shareholders in 2001. The Executive Committee is currently comprised of one director who is an executive officer of Baldor and one non-management director who is an independent director.

Audit Committee ... The Audit Committee shall perform those duties and responsibilities as set out in the Charter of the Audit Committee. More information regarding the Audit Committee can be found in this proxy statement under the captions “The Audit Committee Report” and “Statement of Audit Committee Member Independence and Financial Expertise”. The Audit Committee is comprised of four independent directors.

Compensation & Stock Option Committee ... The Compensation & Stock Option Committee shall perform those duties and responsibilities as set out in the Charter of the Compensation & Stock Option

4

Committee, including the responsibility for approving the salary and contingent compensation arrangements for certain Named Executive Officers, approving any stock options granted to certain Named Executive Officers, having the exclusive authority to determine the persons eligible to participate and the amount, terms, and conditions of the equity awards made to each participant, and administering the Company’s various stock option plans except for those associated with the non-employee directors. The Compensation & Stock Option Committee is comprised of five independent directors.

Nominating & Corporate Governance Committee ... The Nominating & Corporate Governance Committee shall perform those duties and responsibilities as set out in the Charter of the Nominating & Corporate Governance Committee, including considering candidates for Board membership proposed by shareholders who have complied with the procedures set forth in the Company’s Bylaws, proposing a slate of directors for election by the shareholders at each annual meeting, proposing candidates to fill vacancies on the Board, and responsibility for the Company’s corporate governance guidelines and evaluation. The Nominating & Corporate Governance Committee is comprised of five independent directors.

Memberships, meetings, and attendance ... During the fiscal year ended December 31, 2005 (“fiscal year 2005”), the Board of Directors held four meetings. Each director attended at least 75% of the board meetings. It is Baldor’s practice that all directors attend the Company’s Annual Shareholders’ Meetings. All directors did attend the meeting held in 2005 except for one director who was absent for medical reasons. Below are the current committee memberships and other information about the committees of the Board of Directors.

| | | | | | | | | | |

Name | | Non-Management Directors | | Executive Committee | | Audit Committee | | Compensation &

Stock Option Committee | | Nominating & Corporate Governance

Committee |

Jefferson W. Asher, Jr. | | * | | | | * | | | | * |

Merlin J. Augustine, Jr. | | * | | | | | | * | | * |

Richard E. Jaudes | | * | | | | | | Chairman | | * |

John A. McFarland | | | | Chairman | | | | | | |

Robert J. Messey | | * | | | | Chairman | | * | | |

Robert L. Proost | | * | | | | * | | | | * |

R. L. Qualls | | Presiding Director | | * | | | | * | | Chairman |

Barry K. Rogstad | | * | | | | * | | * | | |

Meetings held during fiscal year 2005 | | 4 | | 5 | | 8 | | 4(a) | | 2(a) |

| (a) | Prior to the formation of this Committee, the predecessor committees each held two meetings in addition to these during fiscal year 2005. |

Director Compensation ... Under the terms of the Director Plan, eligible directors received an option grant on April 18, 2005. Each grant included: (1) an option to purchase 3,240 shares of Baldor’s Common Stock having an exercise price of $24.81 (the composite closing price of the Common Stock on that date), and (2) an option to purchase 2,160 shares of Baldor’s Common Stock having an exercise price of $12.405 (50% of the composite closing price of the Common Stock on that date). The annual option grants become exercisable immediately and all options expire ten years after the grant date. Only non-employee directors are compensated for their services on the Board of Directors. A summary of the quarterly fees paid for board and committee service in effect at the end of fiscal year 2005 follows.

| | | | | | | | | | | | | | | |

| | | Director | | Executive Committee | | Audit Committee | | Compensation & Stock Option Committee (a) | | Nominating & Corporate Governance Committee (a) |

Chairman | | $ | 0 | | $ | 0 | | $ | 3,200 | | $ | 1,500 | | $ | 1,000 |

Member | | $ | 7,500 | | $ | 1,750 | | $ | 2,200 | | $ | 1,500 | | $ | 1,000 |

| (a) | Prior to the formation of this Committee, the quarterly fees paid for service on the predecessor committees was $1,200. |

5

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of March 8, 2006, regarding all persons known to Baldor to be the beneficial owners of more than five percent of Baldor’s Common Stock. The table also includes security ownership for each director of Baldor, each nominee for election as a director, each of the executive officers named in the Summary Compensation Table (the “Named Executive Officers”), and all executive officers and directors as a group.

| | | | | | |

Name | | Amount and Nature of

Beneficial Ownership | | | Percent of

Class (1) | |

The Baldor Electric Company Employees’ Profit Sharing and Savings Plan P. O. Box 2400 Fort Smith, Arkansas 72902 | | 2,538,617 | (2) | | 7.7 | % |

Lord, Abbett & Co. LLC 90 Hudson Street Jersey City, New Jersey 07302 | | 2,237,569 | (3) | | 6.8 | % |

T. Rowe Price Associates, Inc. 100 E. Pratt Street Baltimore, Maryland 21202 | | 2,075,640 | (4) | | 6.3 | % |

John A. McFarland | | 390,915 | (5) | | 1.2 | % |

R. L. Qualls | | 205,968 | (6) | | * | |

Charles H. Cramer | | 181,314 | (7) | | * | |

Gene J. Hagedorn | | 126,330 | (8) | | * | |

Jefferson W. Asher, Jr. | | 107,479 | (9) | | * | |

Robert L. Proost | | 99,260 | (10) | | * | |

Ronald E. Tucker | | 92,526 | (11) | | * | |

Randal G. Waltman | | 66,368 | (12) | | * | |

Robert J. Messey | | 65,206 | (13) | | * | |

Richard E. Jaudes | | 32,235 | (14) | | * | |

Barry K. Rogstad | | 28,000 | (15) | | * | |

Merlin J. Augustine, Jr. | | 27,527 | (16) | | * | |

All executive officers and directors as a group (19 persons) | | 1,713,599 | (17) | | 5.0 | % |

6

| (1) | Percentage is calculated in accordance with Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended. The numerator consists of the number of shares of Baldor’s Common Stock owned by each individual (including “options” defined on this page to include shares issuable upon exercise of stock options which are or will be exercisable within 60 days of March 8, 2006). The denominator consists of all issued and outstanding shares of Baldor’s Common Stock plus those shares that are issuable upon the exercise of stock options for that individual or group of individuals. |

| (2) | Based on correspondence dated March 9, 2006, received from the trustee of The Profit Sharing and Savings Plan, Participants in such Plan have sole voting and shared investment power over 2,538,617 shares. |

| (3) | Based on the Schedule 13G filed with the Securities and Exchange Commission dated December 30, 2005; sole voting and dispositive power over 2,237,569 shares. |

| (4) | Based on the Schedule 13G filed with the Securities and Exchange Commission dated December 31, 2005. These securities are owned by various individual and institutional investors including T. Rowe Price International and by the T. Rowe Price Mutual Funds (which owns 2,075,640 shares, representing 6.3% of the shares outstanding), which T. Rowe Price Associates, Inc. (Price Associates) serves as investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. |

| (5) | Sole voting and investment power over 66,316 shares; shared voting and investment power over 84,510 shares; sole voting and shared investment power over 32,089 shares in The Profit Sharing and Savings Plan; includes options to purchase 208,000 shares. |

| (6) | Sole voting and investment power over 171,766 shares; shared voting and investment power over 9,362 shares; includes options to purchase 24,840 shares. |

| (7) | Sole voting and investment power over 57,914 shares; shared voting and investment power over 37,651 shares; sole voting and shared investment power over 17,649 shares in The Profit Sharing and Savings Plan; includes options to purchase 68,100 shares. |

| (8) | Sole voting and investment power over 32,793 shares; shared voting and investment power over 25,405 shares; sole voting and shared investment power over 1,032 shares in The Profit Sharing and Savings Plan; includes options to purchase 67,100 shares. |

| (9) | Sole voting and investment power over 71,839 shares; includes options to purchase 35,640 shares. |

| (10) | Sole voting and investment power over 10,800 shares; shared voting and investment power over 42,020 shares; includes options to purchase 46,440 shares. |

| (11) | Sole voting and investment power over 6,429 shares; sole voting and shared investment power over 1,997 shares in The Profit Sharing and Savings Plan; includes options to purchase 84,100 shares. |

| (12) | Shared voting and investment power over 23,850 shares; sole voting and shared investment power over 5,518 shares in The Profit Sharing and Savings Plan; includes options to purchase 37,000 shares. |

| (13) | Sole voting and investment power over 362 shares; shared voting and investment power over 18,404 shares; includes options to purchase 46,440 shares. |

| (14) | Sole voting and investment power over 1,995 shares; includes options to purchase 30,240 shares. |

| (15) | Shared voting and investment power over 11,800 shares; includes options to purchase 16,200 shares. |

| (16) | Shared voting and investment power over 7,000 shares; includes options to purchase 20,527 shares. |

| (17) | Sole voting and investment power over 420,214 shares; shared voting and investment power over 332,150 shares; sole voting and shared investment power over 76,594 shares in The Profit Sharing and Savings Plan; includes options to purchase 884,641 shares. |

7

EXECUTIVE COMPENSATION

The following table sets forth certain information regarding compensation paid during each of Baldor’s last three fiscal years to each of Baldor’s Named Executive Officers.

Summary Compensation Table

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | Long Term Compensation | | |

| | | | | Annual Compensation | | Awards | | Payouts | | |

Name and Principal Position | | Year | | Salary | | Bonus | | Other Annual

Compensation | | Restricted

Stock

Award(s) | | Securities

Underlying

Options | | LTIP

Payouts | | All Other

Compensation (1) |

| | | | | ($) | | ($) | | ($) | | ($) | | (#) | | ($) | | ($) |

John A. McFarland Chairman and Chief Executive Officer | | 2005

2004

2003 | | 350,000

320,000

300,000 | | 520,680

351,392

284,122 | | 0

0

0 | | 0

0

0 | | 30,000

26,000

26,000 | | 0

0

0 | | 18,889

13,161

35,135 |

Ronald E. Tucker President, Chief Financial Officer and Secretary | | 2005

2004

2003 | | 200,000

150,000

120,000 | | 227,178

112,006

75,766 | | 0

0

0 | | 0

0

0 | | 15,000

14,300

14,300 | | 0

0

0 | | 17,864

9,642

15,199 |

Gene J. Hagedorn Vice President – Materials | | 2005

2004

2003 | | 140,000

135,000

130,000 | | 151,990

98,829

80,501 | | 0

0

0 | | 0

0

0 | | 6,000

6,500

6,500 | | 0

0

0 | | 17,839

12,111

19,890 |

Randal G. Waltman Vice President – Operations | | 2005

2004

2003 | | 130,000

125,000

120,000 | | 144,148

93,338

80,501 | | 0

0

0 | | 0

0

0 | | 6,000

6,500

6,500 | | 0

0

0 | | 17,527

11,664

19,760 |

Charles H. Cramer Vice President – Human Resources | | 2005

2004

2003 | | 135,000

130,000

130,000 | | 116,410

76,867

61,560 | | 0

0

0 | | 0

0

0 | | 6,000

6,500

6,500 | | 0

0

0 | | 17,764

11,472

22,069 |

| (1) | The amounts disclosed in this column for fiscal years 2005 and 2004 include contributions to Baldor’s Profit Sharing and Savings Plan, a defined contribution plan. The amounts disclosed in this column for fiscal year 2003 include: (a) contributions to The Profit Sharing and Savings Plan, and (b) premium payments on a split-dollar life insurance policy. The Profit Sharing and Savings Plan is comprised of two components: Profit Sharing and 401(k) Savings. The fiscal year 2005 amounts in this column represent Baldor contributions and payments made as follows: |

| | | | | | | | |

| | | (a) | | (b) | | |

Name | | Contributions

to the Profit

Sharing Plan | | Contributions

to the 401(k)

Savings | | Split-Dollar

Life Insurance

Premiums | | Other |

| | | ($) | | ($) | | ($) | | ($) |

John A. McFarland | | 15,739 | | 3,150 | | 0 | | 0 |

Ronald E. Tucker | | 15,739 | | 2,125 | | 0 | | 0 |

Gene J. Hagedorn | | 15,739 | | 2,100 | | 0 | | 0 |

Randal G. Waltman | | 15,739 | | 1,788 | | 0 | | 0 |

Charles H. Cramer | | 15,739 | | 2,025 | | 0 | | 0 |

| (a) | Baldor makes a contribution to the profit sharing plan equal to 12% of pre-tax earnings for participating companies. The profit sharing contribution is allocated among eligible employees in proportion to their total compensation. Baldor makes matching contributions to the savings plan at a rate no greater than 25% of the first 6% of the participating employee’s compensation. Due to the limits on the total amount of Baldor and employee contributions, the above Named Executive Officers did not receive their full allocation amounts to The Profit Sharing and Savings Plan. |

| (b) | Prior to fiscal year 2004, Baldor maintained a split-dollar life insurance plan for all executive officers. Premium payments on the split-dollar life insurance policies varied according to age and insurance coverage for each executive officer. Prior to July 30, 2002: 1) Baldor made the premium payments on these policies, 2) each executive officer reimbursed Baldor for a portion of the premium that represented the full value attributable to term life coverage, and 3) amounts included as compensation for each Named Executive Officer were calculated using the interest-foregone method which more accurately reflected the benefit received by the participant. Due to requirements of the Sarbanes-Oxley Act of 2002 prohibiting loans to executive officers, the amounts included in this column for fiscal year 2003 for split-dollar life insurance premiums are the entire premiums paid by Baldor and reported as compensation by each executive officer. |

8

Option Grants in Last Fiscal Year

| | | | | | | | | | | | | | |

| | | Individual Grants | | |

Name | | Number of

Securities

Underlying

Options

Granted | | | % of Total

Options

Granted to

Employees in

Fiscal Year | | | Exercise

Price | | Market

Price

on

Grant

Date | | Expiration

Date | | Grant Date

Present

Value (1) |

| | | (#) | | | | | | ($/sh) | | ($/sh) | | | | ($) |

John A. McFarland | | 15,000

15,000 | (2)

(3) | | 2.2

2.2 | %

% | | 13.80

27.60 | | 27.60

27.60 | | 2/6/2015

2/6/2015 | | 198,150

49,200 |

Ronald E. Tucker | | 7,500

7,500 | (2)

(3) | | 1.1

1.1 | %

% | | 13.80

27.60 | | 27.60

27.60 | | 2/6/2015

2/6/2015 | | 99,075

24,600 |

Gene J. Hagedorn | | 3,000

3,000 | (2)

(3) | | 0.4

0.4 | %

% | | 13.80

27.60 | | 27.60

27.60 | | 2/6/2015

2/6/2015 | | 39,630

9,840 |

Randal G. Waltman | | 3,000

3,000 | (2)

(3) | | 0.4

0.4 | %

% | | 13.80

27.60 | | 27.60

27.60 | | 2/6/2015

2/6/2015 | | 39,630

9,840 |

Charles H. Cramer | | 3,000

3,000 | (2)

(3) | | 0.4

0.4 | %

% | | 13.80

27.60 | | 27.60

27.60 | | 2/6/2015

2/6/2015 | | 39,630

9,840 |

| (1) | Baldor used the Black-Scholes option pricing model to determine grant date present value. Calculations are based on a ten-year option term and the following weighted average variables assumptions: expected option life of 8 years; interest rate of 4.1%; annual dividend yield of 2.2%; and volatility of 1.0%. Because the present values are based on estimates and assumptions, the amounts reflected in this table may not be achieved. |

| (2) | Non-qualified options to purchase shares of restricted Common Stock of Baldor were granted at 50% of the composite closing price of the Common Stock on the date of grant with full vesting occurring on the fifth anniversary date. Vesting may be accelerated by early exercise or when certain events relating to change of Baldor’s ownership occur. Until vesting occurs, the restricted shares acquired on exercise of such options: (a) have dividend rights, (b) may be voted, (c) cannot be sold or transferred until they are vested, and (d) are forfeitable under certain circumstances. The options are 100% exercisable six months and one day following the grant date. |

| (3) | Incentive stock options to purchase shares of Common Stock of Baldor were granted at the composite closing price of the Common Stock on the date of grant and are 100% exercisable six months and one day following the grant date. |

Aggregated Option Exercises in Last Fiscal Year

and FY-End Option Values

| | | | | | | | | | | | |

Name | | Shares

Acquired on

Exercise | | Value

Realized (1) | | Number of Securities Underlying

Unexercised Options at FY-End (#) | | Value of Unexercised In-the-Money Options at FY-End ($) (2) |

| | | (#) | | ($) | | (Exercisable) | | (Unexercisable) | | (Exercisable) | | (Unexercisable) |

John A. McFarland | | 28,000 | | 366,843 | | 208,000 | | 0 | | 1,185,025 | | 0 |

Ronald E. Tucker | | 2,000 | | 24,930 | | 90,099 | | 0 | | 613,037 | | 0 |

Gene J. Hagedorn | | 6,000 | | 83,805 | | 76,433 | | 0 | | 566,861 | | 0 |

Randal G. Waltman | | 2,666 | | 16,639 | | 43,000 | | 0 | | 222,463 | | 0 |

Charles H. Cramer | | 6,000 | | 83,805 | | 80,499 | | 0 | | 639,412 | | 0 |

| (1) | Represents the difference between the option exercise price and the composite closing price of the Common Stock on the date of exercise multiplied by the number of shares acquired upon exercise. |

| (2) | Represents the difference between the $25.65 composite closing price of the Common Stock as reported by the New York Stock Exchange on December 30, 2005, the last trading day of fiscal year 2005, and the exercise price of the options multiplied by the number of shares of Common Stock underlying the options. The numbers shown reflect the value of options accumulated over a ten-year period. |

9

Compensation Committee Interlocks and Insider Participation

Baldor’s Board of Directors has a compensation committee of the Board designated as the Compensation & Stock Option Committee. The main responsibility of the Compensation & Stock Option Committee is to approve the salary and contingent compensation arrangements for the Named Executive Officers. The Executive Committee makes recommendations to the Board regarding salary and contingent compensation for other executive officers; however, the Board of Directors, as a whole, approves the salary and contingent compensation arrangements for other executive officers.

The Compensation & Stock Option Committee also approves any stock options granted to the Named Executive Officers. The Compensation & Stock Option Committee administers the 1987 Plan and the 1994 Plan, both Plans relating to employees. The Executive Committee administers the 1989 Plan, the 1996 Plan, and the Director Plan, all relating to non-employee directors. The 1987 Plan, the 1989 Plan, and the 1996 Plan have expired except for options outstanding.

The members of the Executive Committee and the Compensation & Stock Option Committee and summary descriptions of each committee, are listed in this proxy statement under the caption “Information About the Board of Directors and Committees of the Board”.

Of the directors, John A. McFarland was an executive officer of Baldor during fiscal year 2005, R. S. Boreham, Jr. was an executive officer of Baldor through 2004, and R. L. Qualls was an executive officer of Baldor through 2000. In fiscal year 2005, Dr. Qualls provided management consulting services for Baldor for which he was paid $72,000. These services were provided on an as-needed basis and there was no formal arrangement between Baldor and Dr. Qualls as to the terms of the consulting services. Mr. Boreham retired as Chairman of the Board effective the end of fiscal year 2004; however, Mr. Boreham continued to be an employee of the Company with an annual salary of $150,000 and a director of the Company but was not paid any director fees. There was no formal arrangement between Baldor and Mr. Boreham regarding his employment. Mr. Boreham passed away unexpectedly on February 5, 2006. Richard E. Jaudes, a member of the Board of Directors of the Company, is a partner at Thompson Coburn LLP, a law firm that provides legal counsel to the Company.

Change of Control Arrangements

Pursuant to agreements under the 1987 Plan and the 1994 Plan, outstanding restricted Common Stock of Baldor acquired by an early exercise of a non-qualified stock option will fully vest and be free of restrictions without the requirement of any further act by Baldor or the shareholder in the event of a “Change of Control” of Baldor as defined in those agreements.

Board Report on Executive Compensation

Baldor applies a consistent philosophy to compensation for all employees, including senior management. This philosophy is based on the premise that the achievements of Baldor result from the coordinated efforts of all individuals working toward common objectives. Baldor strives to achieve those objectives through teamwork that is focused on meeting the expectations of customers and shareholders.

Baldor’s Officers’ Compensation Plan (the “Plan”) is objective, formula driven, and has been consistently applied since 1973. The Plan is designed to ensure that an appropriate relationship exists between executive pay and the creation of shareholder value. The primary goals of the Plan are to ensure that total compensation is fair internally, is competitive externally, and offers performance motivation. The Plan combines annual base compensation with contingent compensation, both of which are based upon the individual officer’s performance and Baldor’s performance.

10

For 2005, the Company’s Compensation & Stock Option Committee approved a Bonus Plan for Executive Officers (the “Bonus Plan”), which was subsequently approved by the Company’s Board of Directors. This Bonus Plan provides for additional compensation to be paid to executive officers if certain planned Company goals are met.

For purposes of this report, total compensation is defined as salary plus contingent compensation plus bonus. Baldor believes that the goals of the Plan and the Bonus Plan are met by providing competitive compensation that will motivate and retain key employees.

Total compensation for all executive officers is established within the range of salaries and bonuses for persons holding similar positions at other comparably-sized manufacturing companies, utilizing independent salary survey data. The survey data is a composite of all manufacturing companies that are comparably sized based upon sales volume. The independent survey does not provide a detailed list of all participating companies; however, many of the participating companies are publicly traded, some of which are included in the Performance Graph. In general, the total compensation for all executive officers is expected to be slightly below the median for similar positions compared to the independent survey data. This is accomplished by establishing the annual base portion of compensation at the low end of the survey with the potential incentive portion being slightly above the median. This results in a greater emphasis being placed upon an individual officer’s performance and Baldor’s performance.

The total compensation individual officers may earn is subjective based upon the individual’s position, experience, and ability to affect Baldor’s performance. In establishing each officer’s annual base and potential contingent portion of compensation, additional consideration includes the individual’s past performance, initiative and achievement, and future potential, as well as Baldor’s performance.

The potential contingent compensation pool is based upon the sales and earnings performance of Baldor and the relative weights are 75% sales and 25% earnings. Compensation attributable to the sales component increases or decreases in relation to sales. Compensation attributable to the earnings component increases if earnings exceed a percentage of shareholders’ equity as determined by the Board of Directors and decreases if earnings are less than such amount. Each individual executive officer’s participation in the potential contingent compensation pool is determined as described above and is assigned such that if Baldor achieves its sales and earnings objectives, the salary and contingent compensation combined will be competitive with the industry and will remain consistent with Baldor’s philosophy and the Plan. The outcome of Baldor’s sales and earnings for fiscal year 2005 resulted in actual contingent compensation equaling 37% to 52% of total compensation for the Named Executive Officers.

The formula used in the Bonus Plan is based on the Company’s Sales and Profit Plan (the “Company Plan”). The Bonus Plan has two components each comprising 50% of the Bonus Plan formula: (1) Sales Goals and (2) Financial Performance (calculated as pre-tax earnings). For purposes of the Bonus Plan calculation, the base for the Bonus Plan is calculated as an individual’s base salary plus contingent compensation, the bonus base. The formula is constructed so a bonus, as a percent of the bonus base, will be paid for a component when that component’s goal of the approved Company Plan is met, up to an approved maximum. Each component pays a maximum bonus of 5% and no bonus is earned if the Company’s plan for the component is not met. For each component at or above the Company’s plan, the bonus for each component will be paid on a straight-line pro-rata basis from 2.5% up to the maximum bonus of 5%. The outcome of Baldor’s sales for fiscal year 2005 resulted in a bonus of 4.3% of the individual’s bonus base paid for the Sales Goals component. The outcome of Baldor’s pre-tax earnings for fiscal year 2005 resulted in a bonus of 3.8% of the individual’s bonus base paid for the Financial

11

Performance component. Of a 10% total maximum bonus achievable, the Company paid a total of 8.1% of the individual’s bonus base as a bonus. The total bonus for fiscal year 2005 equated to 7% of total compensation for the Named Executive Officers.

Baldor also maintains stock option plans to provide additional incentives to executive officers and other employees to work to maximize shareholder value. The Compensation & Stock Option Committee has granted incentive options to purchase shares of Common Stock of Baldor (at the composite closing price of the Common Stock on the date of grant) to executive officers and other employees. Non-qualified options to purchase shares of restricted stock (at 50% of the composite closing price of the Common Stock on the date of grant) have also been granted to executive officers and other employees. The number and type of options granted to each executive officer is subjective based upon individual performance, future potential, and ability to affect Baldor’s performance. Grants were made in fiscal year 2005 to Named Executive Officers and other employees to continue to encourage long-term growth and profitability.

The factors considered in determining the compensation package for the Chief Executive Officer (“CEO”) for fiscal year 2005 were the same as those described above for executive officers. The total compensation for the CEO is below the median of comparably sized manufacturing companies. This median was obtained from independent salary survey data that was utilized in the same manner for all executive officers. With 60% of the compensation at risk available in the form of performance contingent compensation and bonus, the CEO’s total compensation was competitive, reflected the increase in responsibilities and experience, and was reflective of Baldor’s performance. In fiscal year 2005, the CEO’s contingent compensation increased 48% as a result of Baldor’s performance.

Total stock option grants to the CEO represented 4.4% of the total options granted and included incentive stock options to purchase 15,000 shares of Common Stock and non-qualified stock options to purchase 15,000 shares of Common Stock. The number of options granted was subjective based upon the CEO’s ability to affect Baldor’s performance as well as individual performance and future potential.

Baldor’s Board of Directors, as a whole, determines the compensation of the Company’s executive officers except for the Named Executive Officers. The Compensation & Stock Option Committee of the Board of Directors is solely responsible for: (1) the evaluation and approval of the compensation for the Named Executive Officers; and (2) all employee equity programs, including stock option grants made to executive officers. The Board of Directors, as a whole, and the Board’s Executive Committee and Compensation & Stock Option Committee, as appropriate, reviewed the executive compensation policies in regards to Section 162(m) of the Internal Revenue Code of 1986, as amended, pertaining to Baldor’s $1,000,000 deductibility limitation for applicable compensation paid to Named Executive Officers. In fiscal year 2005, the deductibility of Baldor’s executive compensation was not affected by the limitation under Section 162(m).

| | |

BOARD OF DIRECTORS | | Compensation & Stock Option Committee |

| John A. McFarland Chairman | | Richard E. Jaudes Chairman |

| |

| Jefferson W. Asher, Jr. | | Merlin J. Augustine, Jr. |

| Merlin J. Augustine, Jr. | | Robert J. Messey |

| Richard E. Jaudes | | R. L. Qualls |

| Robert J. Messey | | Barry K. Rogstad |

| Robert L. Proost | | |

| R. L. Qualls | | |

| Barry K. Rogstad | | |

12

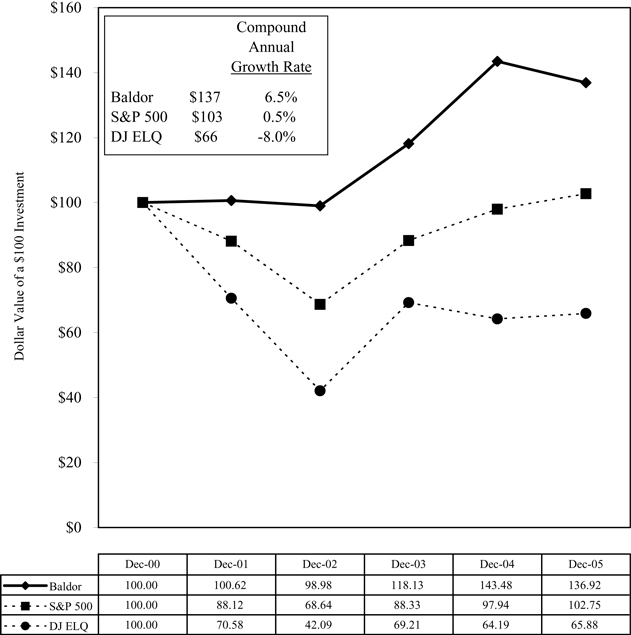

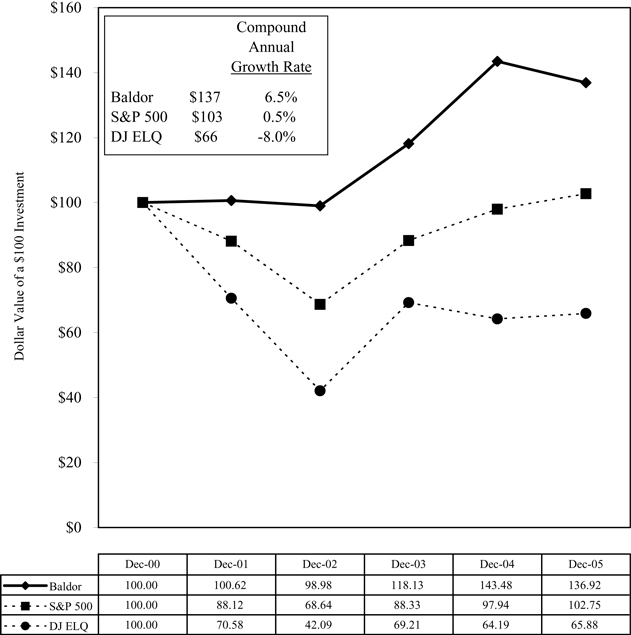

Performance Graph

Comparision of Five-Year Cumulative Total Return

Among Baldor Electric Company, the S&P 500 Index, and the

Dow Jones US Electrical Components & Equipment Group Index

Assumes $100 invested at year-end 2000 in

Baldor Electric Company, the S&P 500 Index, and the

Dow Jones US Electrical Components & Equipment Group Index

13

PROPOSAL 2:

TO CONSIDER AND ACT UPON A PROPOSAL TO ADOPT THE

BALDOR ELECTRIC COMPANY 2006 EQUITY INCENTIVE PLAN

On February 6, 2006, the Board of Directors of the Company approved the Baldor Electric Company 2006 Equity Incentive Plan (the “Equity Plan”) and directed that it be submitted to the shareholders for their approval. The Equity Plan will become effective as of April 22, 2006, subject to the approval at this Annual Meeting by the affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote.

The purpose of the Equity Plan is to encourage employees, directors and service providers of the Company and such subsidiaries of the Company (the “Participants”) as the Administrator designates, to acquire shares of common stock of the Company (“Common Stock”) or to receive monetary payments based on the value of such stock or based upon achieving certain goals on a basis mutually advantageous to such Participants and the Company and thus provide an incentive for the Participants to contribute to the success of the Company and align the interests of the Participants with the interests of the shareholders of the Company. Approximately 4,000 individuals will be eligible to participate in the Equity Plan.

Upon approval of the Equity Plan by the shareholders, all shares remaining available for issuance under the Baldor Electric Company 1994 Incentive Stock Plan, the Baldor Electric Company 1990 Stock Option Plan For District Managers and the Baldor Electric Company Stock Option Plan for Non-Employee Directors will no longer be available for issuance under such plans.

Your Board of Directors recommends a vote “FOR” this proposal.

A copy of the Equity Plan, as approved by the Company’s Board of Directors, is attached to this Proxy Statement as Exhibit “A”, and the following description is qualified in its entirety by reference to that Equity Plan.

General Information

Under the Equity Plan, the Board of Directors or one or more committees appointed by the Board, will act as the administrator of the Equity Plan (the “Administrator”). The Administrator has discretionary authority with respect to administering the Equity Plan subject to its terms, including the selection of persons eligible to participate in the Equity Plan and the granting of benefits in accordance with the Equity Plan.

No benefits have yet been awarded under the Equity Plan and none will be awarded prior to Shareholder approval of the Equity Plan. No more than 75,000 shares subject to stock options may be awarded in any calendar year to any participant. The maximum number of shares that can be issued under the Equity Plan is 3,000,000 (subject to adjustments in certain events as described below under “Amendment and Termination”). Such shares may be authorized and unissued shares or treasury shares. In view of the discretionary authority vested in the Administrator, it is impossible to estimate the number of shares that will be granted or awarded to any individual or group of individuals over the life of the Equity Plan. No benefits shall be awarded after the day preceding the tenth anniversary of the effective date of the Equity Plan.

14

Types of Benefits

Six types of benefits may be granted under the Equity Plan: Stock Appreciation Rights (“SARs”), Restricted Stock, Performance Awards, Incentive Stock Options (“ISOs”), Nonqualified Stock Options (“NQSOs”), and Stock Units. All of the benefits may be subject to additional provisions the Administrator deems appropriate and which will be set forth in an underlying award/grant agreement.

SARs …A SAR is the right to receive all or a portion of the difference between the fair market value of a share of Common Stock and the exercise price of the SAR established by the Administrator. At the time of grant, the Administrator may establish a maximum amount per share which will be payable upon exercise of a SAR. At the discretion of the Administrator, payment for SARs may be made in cash, shares of Common Stock, or in a combination thereof. SARs will be exercisable no later than ten years after the date they are granted.

Restricted Stock …Restricted Stock is Common Stock issued or transferred under the Equity Plan (other than upon exercise of stock options or Performance Awards) at any purchase price less than the fair market value or as a bonus, subject to restrictions determined by the Administrator. The purchase price, restrictions (including restrictions on sale or other disposition thereof) and the duration of the restrictions shall be determined by the Administrator.

Performance Awards …Performance Awards are Common Stock, monetary units or some combination thereof, to be issued without any payment therefor, in the event that certain performance goals established by the Administrator are achieved over a period of time designated by the Administrator, but in no event more than five years. In the event the performance goal is not achieved at the conclusion of the period, no payment shall be made to the participant. Actual payment of the award earned shall be in cash or in Common Stock or in a combination of both, as the Administrator determines.

ISOs …ISOs are stock options to purchase shares of Common Stock at not less than 100% of the fair market value of the shares on the date the option is granted. ISOs may be granted only to employees of the Company and its subsidiaries. The exercise price may be paid (a) by check or (b), in the discretion of the Administrator, by the delivery of shares of Common Stock of the Company owned by the participant for at least six months, or (c), in the discretion of the Administrator, by a combination of any of the foregoing, in the manner provided in the option agreement. The aggregate fair market value (determined as of the time an option is granted) of the stock with respect to which ISOs are exercisable for the first time by an optionee during any calendar year (under all option plans of the Company and its subsidiary Companies) shall not exceed $100,000.

NQSOs …NQSOs are nonqualified stock options to purchase shares of Common Stock at purchase prices established by the Administrator on the date the options are granted. The purchase price may be paid (a) by check or (b), in the discretion of the Administrator, by the delivery of shares of Common Stock of the Company owned by the participant for at least six months, or (c), in the discretion of the Administrator, by a combination of any of the foregoing, in the manner provided in the option agreement.

Stock Units …A Stock Unit represents the right to receive a share of Common Stock from the Company at a designated time in the future. The participant generally does not have the rights of a shareholder until receipt of the Common Stock. The Administrator may in its discretion provide for payments in cash, or adjustment in the number of Stock Units, equivalent to the dividends the participant would have received if the participant had been the owner of shares of Common Stock instead of the Stock Units.

15

Amendment and Termination

The Board of Directors may terminate or amend the Equity Plan at any time or from time to time without shareholder approval, including amendments that enlarge the type and value of benefits available under the Equity Plan. However, the Board of Directors may not, without shareholder approval, increase the maximum number of shares that may be issued under the Equity Plan (except for appropriate adjustments as stated below), and may not make amendments required to be approved by shareholders pursuant to federal income tax or securities laws.

If the Company shall at any time change the number of issued shares of Common Stock without new consideration to the Company (such as by stock dividends or stock splits), the total number of shares reserved for issuance under this Plan and the number of shares covered by each outstanding benefit shall be adjusted so that the aggregate consideration payable to the Company, if any, and the value of each such benefit shall not be changed. Benefits may also contain provisions for their continuation or for other equitable adjustments after changes in the Common Stock resulting from reorganization, sale, merger, consolidation, issuance of stock rights or warrants, or similar occurrence.

Federal Tax Consequences

Under the Omnibus Reconciliation Act of 1993 (the “Act”), certain compensation payments in excess of $1 million are not deductible by the Company for Federal Income Tax purposes. The limitation on deductibility applies with respect to that portion of a compensation payment for a taxable year in excess of $1 million to either the chief executive officer of the corporation or any one of the other four highest paid executives. Certain performance-based compensation is not subject to the cap on deductibility. Stock options can qualify for this performance-based exception, but only if they are granted at fair market value, the total number of shares that can be granted to an executive for any period is stated in the Equity Plan, and shareholder and Board approval is obtained. Tax consequences of the various types of benefits are described below.

SARs and NQSOs …A participant will not realize any income at the time a NQSO or a SAR is granted, nor will the Company be entitled to a deduction at that time. Upon exercise of a NQSO or SAR, the participant will recognize ordinary income: (a) in the case of an exercise of a NQSO (whether the NQSO price is paid in cash or by the surrender of previously owned common stock), in an amount equal to the difference between the option price and the fair market value of the shares to which the NQSO pertains; and (b) in the case of an exercise of a SAR, in an amount equal to the sum of the fair market value of the shares and any cash received on the exercise. In the event that a participant cannot sell shares acquired on exercise of a NQSO or SAR without incurring liability under Section 16(b) of the Securities Exchange Act of 1934, the taxable event described above will be delayed until six months after acquisition of the shares, or the first day on which the sale of such property no longer subjects the person to liability under Section 16(b) of the Securities Exchange Act of 1934, whichever is earlier. The Company is generally entitled to a tax deduction in an amount equal to the amount of ordinary income realized by the participant.

ISO …A participant will not realize any income, nor will the Company be entitled to a deduction, at the time an ISO is granted. If a participant does not dispose of the shares acquired on the exercise of an ISO within one year after the transfer of such shares to him and within two years from the date the ISO was granted to him, for federal income tax purposes: (a) the participant will not recognize any income at the time of exercise of his ISO; (b) the amount by which the fair market value (determined without regard to short swing profit restrictions) of the shares at the time of exercise exceeds the exercise price is an item of tax preference subject to the alternative minimum tax on individuals; and (c) the difference between the ISO price and the amount realized upon sale of the shares of the participant will be treated as long-term capital gain or loss. The Company will not be entitled to a deduction upon the exercise of an ISO.

16

Except in the case of a disposition following the death of a participant and certain other very limited exceptions, if the stock acquired pursuant to an ISO is not held for the minimum periods described above, the excess of the fair market value of the stock at the time of exercise over the amount paid for the stock generally will be taxed as ordinary income to the participant in the year of disposition. The Company is generally entitled to a deduction for federal income tax purposes at the time, and in the amount in which income is taxed to the participant as ordinary income by reason of the sale of stock acquired upon the exercise of an ISO.

Restricted Stock … Restricted Stock may be subject to a substantial risk of forfeiture for the period of time specified in the award. Unless a grantee of Restricted Stock makes an election under Section 83(b) of the Internal Revenue Code as described below, the grantee generally is not required to recognize income for federal income tax purposes at the time of the award of the Restricted Stock. Instead, on the date the substantial risk of forfeiture ends, the grantee will be required to recognize ordinary income in an amount equal to the fair market value of the shares on such date. If a grantee makes a Section 83(b) election to recognize ordinary income on the date the Restricted Stock is granted, the grantee will recognize ordinary income equal to the fair market value of the shares on the date of grant. In such case, the grantee will not be required to recognize additional ordinary income when the substantial risk of forfeiture ends. The Company generally is entitled to a tax deduction equal to the income realized in the year in which the grantee is required to report such income.

Performance Awards and Stock Units …A participant will not realize any income, nor will the Company be entitled to a deduction, at the time a Performance Award or Stock Unit is granted. A participant will realize income as a result of a Performance Award or Stock Unit at the time the award is issued or paid. The amount of income realized by the participant will be equal to the fair market value of the shares on the date of issuance, in the case of a stock award, or the amount of cash paid, in the event of a cash award. The Company will be entitled to a tax deduction equal to the income realized in the year of such issuance or payment.

The last reported sale price of the Company’s Common Stock on the New York Stock Exchange on March 8, 2006, was $31.54.

17

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors of Baldor oversees Baldor’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited financial statements in the Annual Report with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements. The Audit Committee makes the following statements:

| | • | | The Audit Committee is governed by a formal written charter; |

| | • | | The Audit Committee is comprised of directors that Baldor’s Board of Directors has determined to be “independent” and has at least one member that meets the requirement of an “audit committee financial expert” (1); |

| | • | | The Audit Committee has reviewed and discussed the quarterly and annual audited financial statements with management; |

| | • | | The Audit Committee has discussed with the independent registered public accounting firm the matters required by Statement on Auditing Standards No. 61, Communications with Audit Committees; |

| | • | | The Audit Committee has received from the independent registered public accounting firm the required written communication and discussed with them their independence as required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees; |

| | • | | The Audit Committee has considered the compatibility of non-audit services with the independence of the independent registered public accounting firm; and |

| | • | | The Audit Committee, based on the above reviews and discussions, recommended to the Board of Directors that the audited financial statements be included in Baldor’s Annual Report on Form 10-K for filing with the Securities and Exchange Commission. |

| (1) | A detailed determination of member independency and financial expertise is included in this Proxy Statement under the sub-caption “Statement of Audit Committee Member Independence and Financial Expertise”. |

|

Audit Committee |

Robert J. Messey Chairman |

|

Jefferson W. Asher, Jr. |

Robert L. Proost |

Barry K. Rogstad |

18

STATEMENT OF DIRECTOR INDEPENDENCE

The Board has determined that each of Baldor’s directors, except for Baldor’s Chairman and CEO John McFarland, is “independent” under the standards Section 303A.02 of the Listed Company Manual of the New York Stock Exchange (the “NYSE”). Annually Baldor requires each director and nominee to complete a questionnaire. The majority of questions in the questionnaire requests that the individual disclose to Baldor specific information relating to the individual’s relationship with Baldor. The Board has considered the relationships disclosed in the questionnaires, including those disclosed under “Compensation Committee Interlocks and Insider Participation”. In addition to the NYSE requirements for independence, the Board considers the nature of the relationship and the dollar amounts involved in making its determination of director independence.

STATEMENT OF AUDIT COMMITTEE MEMBER

INDEPENDENCE AND FINANCIAL EXPERTISE

Baldor’s Board of Directors, as a whole, strongly believes that the Audit Committee and its function are extremely important to the integrity of Baldor. The independence of each member of the Audit Committee is critically reviewed for the following requirements:

| | • | | There is not, and has not been in the last five years, any known family relationship between any member of the Audit Committee and any other member of the Board of Directors or any employee of Baldor. |

| | • | | No member of the Audit Committee accepts compensation from Baldor other than for board service and committee membership service. |

| | • | | Members of the Audit Committee are appointed because of their qualifications of being “financially literate” and knowledgeable of securities regulations. |

The current members of Baldor’s Audit Committee are listed below:

|

| Robert J. Messey Chairman |

| Jefferson W. Asher, Jr. |

| Robert L. Proost |

| Barry K. Rogstad |

Baldor’s Board of Directors has paid close attention to the independency and financial literacy of the members of Baldor’s Audit Committee. All members of this Committee are appointed, in substantial part, because they are financially astute, having the experience, education, and ability to read and understand financial information and regulations. Based on the facts including those mentioned above, the Board of Directors has determined that each member of the Audit Committee named above:

| | 1. | has no relationship which would interfere with the exercise of independent judgment as an Audit Committee member; |

| | 2. | provides services and qualifications that are in the best interests of Baldor and its shareholders; |

| | 3. | is “independent” so that the member’s participation on Baldor’s Audit Committee complies with the requirements of the Sarbanes-Oxley Act of 2002 and Section 3.03 of the Listed Company Manual of the New York Stock Exchange; and |

| | 4. | has been determined to be an “audit committee financial expert” having met the requirements of such designation as required by the Sarbanes-Oxley Act of 2002 and similar requirements of Section 3.03 of the Listed Company Manual of the New York Stock Exchange. |

19

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Baldor is presently utilizing the services of Ernst & Young LLP, an independent registered public accounting firm that has been Baldor’s independent auditor since 1972. The Audit Committee will consider the reappointment of Ernst & Young LLP as Baldor’s independent registered public accounting firm for the fiscal year ending December 30, 2006, at Baldor’s next regular Audit Committee meeting in April. Representatives of Ernst & Young LLP will be present at the 2006 Annual Meeting with an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions. The Audit Committee considered whether the provision of non-audit services by its auditors is compatible with maintaining its auditor’s independence. Under its Charter, the Audit Committee:

| | 1. | shall pre-approve all audit and non-audit services provided by the independent registered public accounting firm, or any other audit firm, and shall not engage the independent registered public accounting firm to perform the specific non-audit services proscribed by law or regulation; and |

| | 2. | may delegate pre-approval authority to a member of the Committee. The decisions of any Committee member to whom pre-approval authority is delegated must be presented to the full Committee at its next scheduled meeting. |

The Audit Committee has adopted policies and procedures for the pre-approval of all audit and non-audit services to be performed by the independent registered public accounting firm of the Company. The Audit Committee Charter provides that the Committee must approve, in advance, all audit services to be performed by the independent registered public accounting firm. During fiscal year 2005, the Company’s independent registered public accounting firm performed non-audit work at a cost of $1,058 (representing less than 1% of total fees paid) that was not pre-approved by the Audit Committee prior to the engagement. This matter was brought to the Audit Committee’s attention, and based on the services provided and the de minimus amounts involved, the Audit Committee determined this did not impair the independence of the independent registered public accounting firm.

A summary of the fees associated with the services performed by Ernst & Young LLP for fiscal years 2005 and 2004 follows. Audit fees include fees related to: (a) the annual audit of the consolidated financial statements and disclosures and reviews of the financial statements and disclosures included in quarterly reports on Form 10-Q ($480,000 for 2005 and $220,000 for 2004), (b) Sarbanes-Oxley Act Section 404 Attestations ($390,000 for 2005 and $434,100 for 2004), and (c) statutory audits required for foreign affiliates ($100,800 for 2005 and $100,800 for 2004). Audit-related fees principally include agreed upon procedures and accounting consultations. Tax fees include: (a) U.S. tax planning ($35,000 for 2005 and $35,000 for 2004), and (b) tax compliance for foreign affiliates ($17,969 for 2005 and $10,495 for 2004).

| | | | | | |

Type of Fee | | 2005 Fees | | 2004 Fees |

Audit | | $ | 970,800 | | $ | 754,900 |

Audit-Related | | $ | 18,500 | | $ | 66,800 |

Tax | | $ | 52,969 | | $ | 45,495 |

All Other | | $ | 0 | | $ | 0 |

20

CODE OF ETHICS

The Board of Directors has adopted: 1) a Code of Ethics for Certain Executives that applies specifically to Baldor’s chief executive officer, chief financial officer, and treasurer; and 2) a Code of Ethics and Business Conduct that applies to all Baldor associates including directors, officers, employees, and affiliates. Both of these Codes are available for viewing on Baldor’s website at www.baldor.com. These codes are also available in print to any shareholder who requests it. Any amendments to, or waivers from, the Code of Ethics for Certain Executives will also be posted on Baldor’s website.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Based solely on our review, all of Baldor’s reporting persons complied with all filing requirements applicable to them with respect to transactions during fiscal year 2005.

COMMUNICATIONS TO THE BOARD OF DIRECTORS

Baldor’s non-management directors meet at various times throughout the year. The Presiding Director of these meetings is determined annually by the non-management directors on a rotating basis. Director R. L. Qualls is currently the Presiding Director. Shareholders may communicate directly with Baldor’s Board of Directors or non-management directors directly by submitting correspondence or contacting Bryant Dooly, Baldor’s Director of Audit Services. All communications received will be forwarded to the appropriate Directors.

| | | | |

| Attn: | | Bryant Dooly | | Baldor Electric Company |

| | Director –Audit Services | | P O Box 2400 |

| Phone: | | 479-646-4711 | | 5711 R S Boreham Jr St |

| Fax: | �� | 479-648-5752 | | Fort Smith AR 72902 |

SHAREHOLDER PROPOSALS and NOMINATIONS

Baldor has a Nominating & Corporate Governance Committee comprised of three independent directors, determined pursuant to the rules of the New York Stock Exchange (see additional information in this Proxy Statement under the caption “Information About the Board of Directors and Committees of the Board”).

Any shareholder of Baldor eligible to vote in an election may make shareholder proposals and nominations for the 2007 Annual Meeting. In order to be considered for inclusion in the 2007 Proxy Statement and considered at the 2007 Annual Meeting to be held in 2007, all shareholder proposals, nominations, and notifications must: (1) comply with Baldor’s Bylaws, as amended, and (2) be appropriately received by the Secretary of Baldor on or after September 19, 2006, and on or before November 18, 2006.

The Nominating & Corporate Governance Committee of Baldor’s Board of Directors will consider candidates for Board membership proposed by shareholders who have complied with these procedures. The Nominating & Corporate Governance Committee evaluates all nominees, including current directors who may be up for re-election, based on several different professional criteria. This criteria includes knowledge of business, industry, and economic environment, educational background, professional

21

experience, and willingness and availability to serve as a director of the Company. The Nominating & Corporate Governance Committee also considers the make-up of the Board of Directors as a whole in terms of the professional diversity represented by various occupations. Nominations recommended by the Nominating & Corporate Governance Committee to the Board of Directors are made based on professional criteria.

OTHER MATTERS

The Board of Directors knows of no other matters to be presented for consideration at the meeting by the Board of Directors or by shareholders who have requested inclusion of proposals in the Proxy Statement. If any other matter shall properly come before the meeting, the persons named in the accompanying form of proxy intend to vote on such matters in accordance with their judgment.

March 16, 2006

22

EXHIBIT “A”

BALDOR ELECTRIC COMPANY

2006 EQUITY INCENTIVE PLAN

The purpose of the Baldor Electric Company 2006 Equity Incentive Plan (the “Plan”) is to encourage employees, directors and service providers of Baldor Electric Company (the “Company”) and such subsidiaries of the Company (the “Participants”) as the Administrator designates, to acquire shares of common stock of the Company (“Common Stock”) or to receive monetary payments based on the value of such stock or based upon achieving certain goals on a basis mutually advantageous to such Participants and the Company and thus provide an incentive for the Participants to contribute to the success of the Company and align the interests of the Participants with the interests of the shareholders of the Company.

The Plan shall be administered by the Board of Directors of the Company or any Committee appointed by the Board of Directors (the “Administrator”).

The authority to select persons eligible to participate in the Plan, to grant benefits in accordance with the Plan, and to establish the timing, pricing, amount and other terms and conditions of such grants (which need not be uniform with respect to the various participants or with respect to different grants to the same participant), may be exercised by the Administrator in its sole discretion.

Subject to the provisions of the Plan, the Administrator shall have exclusive authority to interpret and administer the Plan, to establish appropriate rules relating to the Plan, to delegate some or all of its authority under the Plan and to take all such steps and make all such determinations in connection with the Plan and the benefits granted pursuant to the Plan as it may deem necessary or advisable.

The Board of Directors in its discretion may delegate and assign specified duties and authority of the Administrator to any other committee and retain the other duties and authority of the Administrator to itself. Also, the Board of Directors in its discretion may appoint a separate committee of outside directors to make awards that satisfy the requirements of Section 162(m) of the Internal Revenue Code, or (inclusively) any other tax or securities law.

| 3. | Shares Reserved Under the Plan |