EXHIBIT 99

| | |

| Date: | | October 12, 2006 |

| |

| Subject: | | Baldor Electric Company |

| | 3rd Quarter and YTD 2006 Results and Discussion |

| |

| Page: | | 1 of 2 |

Fort Smith, Arkansas – Baldor Electric Company (NYSE:BEZ) markets, designs, and manufactures industrial electric motors, drives, and generators and is based in Fort Smith, Arkansas. Today Baldor announced unaudited results of the third quarter and first nine months of 2006.

| | | | | | | | | | | | | | | | | | |

| | | 3rd Quarter | | | | | Year-To-Date | | | |

| | | 2006 | | 2005 | | | | | 2006 | | 2005 | | | |

| (in thousands except per share data) | | Sept 30 2006 | | Oct 1 2005 | | % Chg. | | | Sept 30 2006 | | Oct 1 2005 | | % Chg. | |

Net Sales | | $ | 212,905 | | $ | 190,019 | | 12 | % | | $ | 610,826 | | $ | 538,907 | | 13 | % |

Cost of Sales | | | 158,318 | | | 140,193 | | | | | | 450,175 | | | 399,414 | | | |

| | | | | | | | | | | | | | | | | | |

Gross Profit | | | 54,587 | | | 49,826 | | 10 | % | | | 160,651 | | | 139,493 | | 14 | % |

SG&A | | | 33,890 | | | 31,532 | | | | | | 99,956 | | | 90,377 | | | |

| | | | | | | | | | | | | | | | | | |

Operating Profit | | | 20,697 | | | 18,294 | | 13 | % | | | 60,695 | | | 49,116 | | 24 | % |

Other Expense | | | 1,224 | | | 524 | | | | | | 3,727 | | | 1,605 | | | |

| | | | | | | | | | | | | | | | | | |

Earnings Before Income Taxes | | | 19,473 | | | 17,770 | | 10 | % | | | 56,968 | | | 47,511 | | 20 | % |

Income Taxes | | | 7,291 | | | 6,609 | | | | | | 21,022 | | | 17,617 | | | |

| | | | | | | | | | | | | | | | | | |

Net Earnings | | $ | 12,182 | | $ | 11,161 | | 9 | % | | $ | 35,946 | | $ | 29,894 | | 20 | % |

| | | | | | | | | | | | | | | | | | |

Earnings Per Share – Diluted | | $ | 0.37 | | $ | 0.33 | | 13 | % | | $ | 1.09 | | $ | 0.89 | | 22 | % |

Dividends Per Share | | $ | 0.17 | | $ | 0.16 | | 6 | % | | $ | 0.50 | | $ | 0.46 | | 9 | % |

Average Shares Outstanding | | | 32,627 | | | 33,728 | | | | | | 32,989 | | | 33,762 | | | |

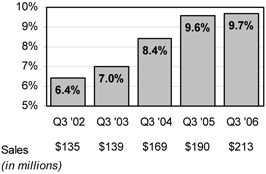

John McFarland, Chairman and CEO, commented on the Company’s results, “We are pleased to announce record sales of $213 million for the 3rd quarter of 2006, a 12% increase over last year. Net earnings increased 9% and earnings per share increased 13% to $0.37. Our operating margin increased to 9.7% for the quarter.”

“During the quarter we moved into a new manufacturing facility in Columbus, Mississippi. This facility will support the growth of our large motor business (60-1500 horsepower), which has grown over 20% per year for the last two years. During the quarter we produced less than half the motors we expected to produce in the new facility. This shortfall reduced operating profits by approximately $2,000,000 and net earnings by $0.035 per diluted share. Production has been increasing and has recently returned to pre-move levels. We believe we are gaining share in larger motors and this facility will allow us to improve productivity and increase output.”

Balance Sheet Summary

| | | | | | |

| (in thousands) | | Sept 30 2006 | | Oct 1 2005 |

Cash & Marketable Securities | | $ | 39,978 | | $ | 48,387 |

Trade Receivables – net | | | 130,410 | | | 118,375 |

Inventories | | | 113,348 | | | 114,710 |

Working Capital | | | 207,006 | | | 218,351 |

Total Debt | | | 105,462 | | | 99,418 |

Shareholders’ Equity | | | 304,030 | | | 295,811 |

Cash Flow from Operations (YTD) | | $ | 39,127 | | $ | 36,986 |

Operating Margins

(continued on page 2)

| | | | |

Date: | | October 12, 2006 | | |

Subject: | | Baldor Electric Company | | |

| | 3rd Quarter and YTD 2006 | | |

| | Results and Discussion | | |

Page: | | 2 of 2 | | |

For more information contact

| | | | |

| Baldor Electric Company | | Phone: | | 479-646-4711 |

| P O Box 2400 | | Fax: | | 479-648-5752 |

| Fort Smith, Arkansas 72902 | | Website: | | www.baldor.com |

| John A. McFarland | | Chairman & CEO |

| Ronald E. Tucker | | President, CFO & Secretary |

| Tracy L. Long | | VP Investor Relations & Assistant Secretary |

The following are answers to questions recently asked by shareholders.

Q … Where did your sales growth come from during the quarter?

The industrial motor business, which increased 18% for the quarter, continued to be strong and made up 80% of our sales. Growth in the motor business was across most basic industry applications including pumps, blowers, compressors and industrial HVAC. We also saw continued improvement in farm machinery, hoists and food processing equipment. Large motors and Super-E® motors both grew in excess of 20%. Year-to-date, motor sales are up 18%.

Drives sales, which comprised 14% of sales for the quarter, were up 17%. This was due to increased demand for motion control products, particularly in Europe. On a year-to-date basis, drives sales are up 6%.

Generator sales declined 37% due to decreased military and hurricane-related demand during this quarter. Military and hurricane-related generator sales, which amounted to $8.6 million in the 3rd quarter 2005, are unpredictable. Sales of all other industrial generators were up 19% during the 3rd quarter and 14% for the year.

Q …How are you dealing with higher material prices?

We continue to invest in equipment and improved product designs so we consume less material and maintain the motor performance our customers expect. We also implemented a 7% price increase on motors during August.

Q …How will you continue to improve your operating margin?

We expect to continue making incremental margin improvement due to higher productivity, design improvements, control of SG&A, and sales growth. In addition to the new Columbus facility, we made several other important investments.

We now have implemented Shop Floor Display in three of our plants. Shop Floor Display allows employees to review their orders, workflow and instructions on a work-center monitor rather than on paper reports. This breakthrough provides more timely and accurate information to the production floor resulting in higher productivity and improved quality. We are also working to attain ISO certification, an international quality standard, in all of our facilities. Five of our facilities are now ISO 9001 certified and all remaining facilities will be certified by the end of 2006.

Q …How was your cash flow during the quarter?

Operating cash flows remained strong during the quarter. Increased inventory turns and faster collection of receivables allowed us to pay down another $10 million in debt.

Q …How does business look for the 4th quarter?

We expect to have record 4th quarter sales and record sales for the year. Orders continue to be above the previous year, although the rate of growth has slowed in the last 4 weeks.

Q …When will you make your next public presentation?

The Company will hold an Analyst Meeting in Boston on October 17, 2006. Management will also make presentations at the Baird Industrial Conference in Chicago on November 7 and the Bear Stearns Capital Goods Conference in New York City on November 28. Additionally, management will make presentations at Better Investing Investor Fairs in Harrisburg, PA on October 28 and Seattle, WA on November 17. For more information on attending any of these events, please contact the company atinvestorinfo@baldor.com.

This document contains statements that are forward-looking, i.e. not historical facts. The forward-looking statements contained in this document (“optimistic”, “will”, “continue”, “expect”, “believe”, “should”) are based on the Company’s current expectations and some of them are subject to risks and uncertainties. Accordingly, you are cautioned that any such forward looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward looking statements as a result of various factors. The factors that might cause such differences include, among others, the following: (i) changes in economic conditions, (ii) developments or new initiatives by our competitors in the markets in which we compete, (iii) fluctuations in the costs of select raw materials, (iv) the success in increasing sales and maintaining or improving the operating margins of the Company, and (v) other factors including those identified in the Company’s filings made from time-to-time with the Securities and Exchange Commission. These statements should be read in conjunction with the Company’s most recent annual report (as well as the Company’s Form 10-K and other reports filed with the Securities and Exchange Commission) containing a discussion of the Company’s business and of various factors that may affect it.