Exhibit 99

BALDOR ELECTRIC COMPANY REPORTS 19% SALES INCREASE, 104% EARNINGS INCREASE AND RECORD OPERATING MARGIN FOR THIRD QUARTER 2010

Fort Smith, Arkansas – October 27, 2010 - Baldor Electric Company (NYSE:BEZ) markets, designs and manufactures industrial electric motors, mechanical power transmission products, drives and generators. Today, Baldor announced unaudited results for third quarter and year-to-date 2010.

John McFarland, Chairman and CEO, commented, “Sales for third quarter 2010 were $453.7 million, a 19% increase from third quarter 2009 sales of $380.4 million. For the same period, net income increased 104% to $25.7 million from $12.6 million, and diluted earnings per share increased to $0.54 from $0.27.”

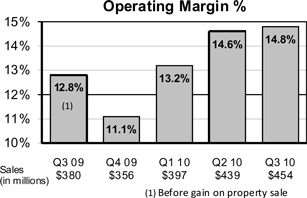

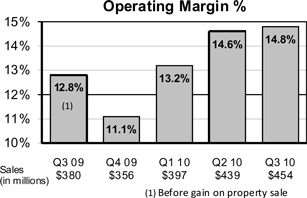

“The 14.8% operating margin we achieved this quarter is an all-time record for Baldor. This margin compares to 12.8% one year ago and 14.6% last quarter. Over the last several years, we’ve made a number of significant productivity improvements throughout the Company. As a result, we believe we will have further margin expansion in 2011.”

McFarland added, “We are pleased with the strong sales growth year over year and sequentially. Double-digit incoming order growth rates throughout third quarter have continued into October, and our backlog is nearly $200 million. Even with fewer selling days in the fourth quarter compared to the third, we expect fourth quarter 2010 year-over-year sales growth of 20-25%.”

Income Statement (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 3rd Quarter | | | Year-To-Date | |

| | | 2010 | | | 2009 | | | %

Chg | | | 2010 | | | 2009 | | | %

Chg | |

| (in thousands except per share data) | | Oct 2, 2010 | | | Oct 3, 2009 | | | | Oct 2, 2010 | | | Oct 3, 2009 | | |

Net sales | | $ | 453,732 | | | $ | 380,448 | | | | 19 | % | | $ | 1,290,684 | | | $ | 1,167,660 | | | | 11 | % |

Cost of sales | | | 313,146 | | | | 265,479 | | | | | | | | 892,592 | | | | 827,365 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 140,586 | | | | 114,969 | | | | 22 | % | | | 398,092 | | | | 340,295 | | | | 17 | % |

SG&A | | | 73,548 | | | | 66,096 | | | | | | | | 214,317 | | | | 202,161 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating profit before gain on property sale(1) | | | 67,038 | | | | 48,873 | | | | 37 | % | | | 183,775 | | | | 138,134 | | | | 33 | % |

Gain on property sale | | | — | | | | 3,721 | | | | | | | | — | | | | 3,721 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating Profit | | | 67,038 | | | | 52,594 | | | | | | | | 183,775 | | | | 141,855 | | | | | |

Other income (expense), net | | | 130 | | | | (44 | ) | | | | | | | 1,051 | | | | (377 | ) | | | | |

Gain on debt modification | | | — | | | | — | | | | | | | | — | | | | 35,740 | | | | | |

Debt discount amortization | | | (2,484 | ) | | | (2,484 | ) | | | | | | | (7,452 | ) | | | (4,968 | ) | | | | |

Interest expense | | | (25,941 | ) | | | (29,796 | ) | | | | | | | (79,661 | ) | | | (80,655 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 38,743 | | | | 20,270 | | | | | | | | 97,713 | | | | 91,595 | | | | | |

Income taxes | | | 13,084 | | | | 7,678 | | | | | | | | 34,218 | | | | 34,787 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 25,659 | | | $ | 12,592 | | | | 104 | % | | $ | 63,495 | | | $ | 56,808 | | | | 12 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net earnings per share – diluted | | $ | 0.54 | | | $ | 0.27 | | | | | | | $ | 1.34 | | | $ | 1.22 | | | | | |

Less net gain on debt modification(1) | | | — | | | | — | | | | | | | | — | | | | (0.47 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net earnings per share – diluted excluding net gain on debt modification(1) | | $ | 0.54 | | | $ | 0.27 | | | | 100 | % | | $ | 1.34 | | | $ | 0.75 | | | | 79 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Avg shares outstanding - diluted | | | 47,642 | | | | 46,992 | | | | | | | | 47,480 | | | | 46,743 | | | | | |

| | | | | | |

Dividends per share | | $ | 0.17 | | | $ | 0.17 | | | | 0 | % | | $ | 0.51 | | | $ | 0.51 | | | | 0 | % |

BALDOR ELECTRIC COMPANY THIRD QUARTER 2010 RESULTS – Page 2

Q… How were sales during the quarter?

Sales by Product

| | | | | | | | | | | | |

| (in thousands) | | Q3 10

Net Sales | | | % of

Total

Sales | | | Net Sales %

Chg Q3 10

v Q3 09 | |

Motors | | $ | 283,000 | | | | 62 | % | | | 18 | % |

Mechanical Power Transmission | | | 139,000 | | | | 31 | % | | | 26 | % |

Drives and Generators | | | 32,000 | | | | 7 | % | | | 9 | % |

| | | |

International Sales | | | 76,000 | | | | 17 | % | | | 21 | % |

While all product lines had positive sales growth for the quarter, mechanical power transmission products had the strongest growth with a 26% year-over-year increase. Premium-efficient motors had a 32% sales increase from last year, bringing them up to 19% of total motor sales for the quarter.

Sales of all products to domestic OEMs were up 24% for the quarter, and sales to domestic distributors were up 20%. The majority of our distributor customers continue to have low inventory levels.

International sales improved during the quarter with double-digit growth in Europe, Latin America, and Canada and flat sales in Asia-Pacific.

Q… Are you still experiencing raw material shortages?

No, the problems we had obtaining certain raw materials during second quarter 2010 have been corrected. However, while we are no longer experiencing shortages, the price of copper has been rising steadily for several months. If copper prices remain at these high levels, we anticipate a price increase at the beginning of 2011.

Q… Are you on track to meet your debt reduction goal for 2010?

We are on track to meet our goal of a minimum $75 million in debt reduction this year. During the quarter, we reduced debt by $13 million, bringing our year-to-date reduction to $55 million. As we continue to de-lever, we are seeing the impact of lower interest expense on our earnings.

Q… How are your inventories and accounts receivable?

Our inventories increased from second quarter and are flat compared to one year ago. We are working on ways to reduce our raw materials and work-in-process inventories, but we don’t intend to materially decrease our finished goods inventories any further.

We have further improved the time it takes to collect our receivables by nearly 2 days from second quarter 2010 and by 3 days from one year ago.

Selected Financial Data (unaudited)

| | | | | | | | |

| (in thousands) | | Q3 2010 | | | Q2 2010 | |

Cash | | $ | 16,765 | | | $ | 16,360 | |

Net receivables | | | 283,894 | | | | 282,217 | |

Inventories | | | 288,674 | | | | 270,249 | |

Total assets | | | 2,689,015 | | | | 2,663,334 | |

Total current liabilities | | | 234,727 | | | | 230,830 | |

Total outstanding debt | | | 1,150,082 | | | | 1,163,129 | |

Shareholders’ equity | | | 986,590 | | | | 955,195 | |

| |

| | | YTD | |

| | | Q3 2010 | | | Q3 2009 | |

Cash flows from operations | | $ | 82,478 | | | $ | 151,749 | |

Depreciation & amortization | | | 52,009 | | | | 53,509 | |

Capital Expenditures | | | 24,474 | | | | 27,808 | |

BALDOR ELECTRIC COMPANY THIRD QUARTER 2010 RESULTS – Page 3

Q… Are you ready for the December 19, 2010 implementation of the Energy Independence and Security Act?

Yes, we are. On December 19, we will be required to produce mostly premium-efficient motors in the 1 to 500 horsepower range instead of standard-efficient motors. To prepare for this, we started adjusting our production to more premium-efficient motors a few months ago, and our manufacturing facilities are handling the transition very smoothly. As a result of our early preparation and a handful of additional OEM orders for the standard-efficient motors, we don’t expect to carry a large excess of standard-efficient motor inventory into 2011.

Customers continue to transition to premium-efficient motors in advance of the December 19 implementation date. Sales of premium-efficient motors increased to 19% of motor sales this quarter.

Q… What is your outlook for the fourth quarter?

Fourth quarter sales and operating margin tend to be less than third quarter due to the number of holidays. Based on our strong, double-digit incoming order rates and current backlog of orders, we anticipate fourth quarter sales of $425-$445 million, a year-over-year growth rate of 20-25%.

Q… When is your next public update?

A conference call will be held Thursday, October 28, 2010, at 10:00 a.m. CT (11:00 a.m. ET). Participants may listen to the discussion through the Company’s website atwww.baldor.com or by calling 800-895-8003. A replay will be available through Thursday, November 11, 2010 and can be accessed by calling 800-633-8284 (reservation 21484130).

Over the next two months, Baldor will make presentations at the following conferences:

| | • | | Robert W. Baird & Co. 2010 Industrial Conference in Chicago on November 10, 2010. The presentation will be held at 12:40 p.m. CT, and the webcast will be accessible on our website atwww.baldor.com |

| | • | | RBC Capital Markets’ Transportation and Industrials Conference in Miami on December 1, 2010. The presentation will be held at 10:25 a.m. CT, and the webcast will be accessible on our website atwww.baldor.com |

| | • | | Gabelli & Company’s Best Ideas Conference in New York on December 2, 2010. |

For more information contact:

| | | | |

| John McFarland, Chairman and CEO | | Phone: | | 479-648-5769 |

| Ron Tucker, President and COO | | Website: | | www.baldor.com |

| Tracy Long, Vice President Investor Relations | | Email: | | Investorinfo@baldor.com |

| (1) | Non-GAAP Financial Measures. Baldor reports its financial results in accordance with U.S. generally accepted accounting principles (“GAAP”). However, management believes that certain non-GAAP performance measures provide financial statement users meaningful comparisons between current and prior period results, as well as important information regarding performance trends. Certain items discussed in this press release are considered non-GAAP measures. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported results. |

Forward Looking Statement

This document contains statements that are forward-looking, i.e. not historical facts. The forward-looking statements contained in this document (including “estimate”, “believe”, “think”, “will”, “intend”, “expect”, “may”, “could”, “plan”, “anticipate”, “would”, “depend”, “predict”, “can”, “if”, “assume”, “continue”, “ongoing” or any grammatical forms of these words or other similar words) are based on the Company’s current expectations and some of them are subject to risks and uncertainties. Accordingly, you are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. The factors that might cause such differences include, among others, the following: (i) changes in economic conditions, (ii) developments or new initiatives by our competitors in the markets in which we compete, (iii) fluctuations in the costs of select raw materials, (iv) the success in increasing sales and maintaining or improving the operating margins of the Company, and (v) other factors including those identified in the Company’s filings made from time-to-time with the Securities and Exchange Commission. These statements should be read in conjunction with Baldor’s most recent annual report (as well as the Company’s Form 10-K and other reports filed with the Securities and Exchange Commission) containing a discussion of the Company’s business and of various factors that may affect it.