Exhibit 99.2

Visa Inc. is a global payments technology company that connects consumers, businesses, financial institutions and governments in more than 200 countries and territories, enabling them to use digital currency instead of cash and checks.

Our business primarily consists of the following:

We provide transaction-based services to our financial institution customers through VisaNet, our secure, centralized and global processing platform. In addition, we provide value-added services including risk management, loyalty, dispute management and debit issuer processing.

We develop and manage payment product platforms, which our financial institution clients use to offer consumers greater choice in how they pay—pay before with prepaid, pay now with debit or pay later with credit.

We own and manage the Visa brand, which provides the assurance of acceptance at millions of merchant outlets and 1.6 million ATMs in more than 200 countries and territories worldwide1.

We continually look at how we can use our network breadth and payment expertise to extend the value of digital currency, so more people can use Visa in more ways and more places around the world. For example, with the Visa mobile platform, we are helping accelerate the convergence of nearly 1.8 billion Visa cards and 4 billion mobile phone connections2.

What Visa Is

Visa is a payments network, providing processing services for credit, debit and prepaid payment transactions.

Our network—VisaNet—connects merchant acquiring entities with issuing banks

so that they can authorize and settle electronic payments efficiently over a central system.

We promote the Visa brand to assure consumers that the familiar Visa logo represents acceptance worldwide, convenience, security, protection from fraud and other features.

What Visa Is Not

Visa does not issue cards, set cardholder fees or interest rates, or make loans to cardholders. These are exclusively the responsibility of the issuing financial institution. In the overwhelming majority of circumstances, Visa does not interact directly with consumers or merchants. Customer relationships are managed directly by the financial institution.

Visa is not just a “credit card company.” Over the past 20-plus years, Visa has rapidly evolved beyond its credit roots to offer a broader range of payment products (credit, debit, prepaid) and transaction processing.

Today, the majority of global payments transactions on Visa’s network are on debit products.

1 As of September 30, 2009 and as reported by our financial institution customers, and therefore may be subject to change. Includes merchant outlets and ATMs in the Visa Europe territory.

2 Number of Visa cards as of September 30, 2009. Mobile statistics based on study conducted by the International Telecommunication Union January 2009.

In the U.S., payments volume on our issuers’ Visa-branded cards is nearly evenly split between credit and debit; we reported U.S. debit payments volume eclipsing that of credit for the first time in April 2009. As of the four quarters ending December 31, 2009, more than 70 percent of Visa payments transactions in the U.S. are on debit products.

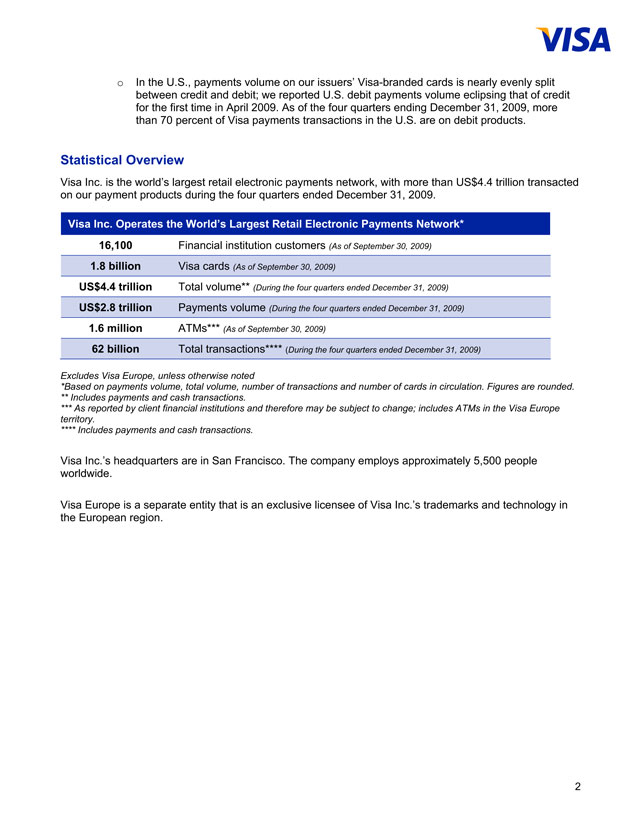

Statistical Overview

Visa Inc. is the world’s largest retail electronic payments network, with more than US$4.4 trillion transacted on our payment products during the four quarters ended December 31, 2009.

Visa Inc. Operates the World’s Largest Retail Electronic Payments Network*

| | |

16,100 | | Financial institution customers (As of September 30, 2009) |

1.8 billion | | Visa cards (As of September 30, 2009) |

| | | |

US$4.4 trillion | | Total volume** (During the four quarters ended December 31, 2009) |

| | | |

US$2.8 trillion | | Payments volume (During the four quarters ended December 31, 2009) |

| | | |

1.6 million | | ATMs*** (As of September 30, 2009) |

| | | |

62 billion | | Total transactions**** (During the four quarters ended December 31, 2009) |

| | | |

Excludes Visa Europe, unless otherwise noted

*Based on payments volume, total volume, number of transactions and number of cards in circulation. Figures are rounded.

** Includes payments and cash transactions.

*** As reported by client financial institutions and therefore may be subject to change; includes A TMs in the Visa Europe

territory.

**** Includes payments and cash transactions.

Visa Inc.’s headquarters are in San Francisco. The company employs approximately 5,500 people worldwide.

Visa Europe is a separate entity that is an exclusive licensee of Visa Inc.’s trademarks and technology in the European region.