SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential, For Use of the Commission Only(as permitted by Rule 14a-6(e)(2)) |

¨ Definitive Proxy Statement | | |

¨ Definitive Additional Materials | | |

x Soliciting Material Pursuant to Rule 14a-12 | | |

SPS Technologies, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | 1. | | Title of each class of securities to which transaction applies: |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1. | | Amount previously paid: |

| | 2. | | Form, Schedule or Registration Statement No.: |

The Agreement and Plan of Merger related to the proposed merger of SPS Technologies, Inc. (“SPS”) with and into a wholly owned subsidiary of Precision Castparts Corp. (“PCC”) was filed today by SPS under cover of Form 8-K and is incorporated by reference into this filing.

Additional Information About This Transaction

PCC and SPS will file a proxy statement/prospectus and other documents regarding this transaction with the Securities and Exchange Commission. PCC and SPS will mail the proxy statement/prospectus to the SPS security holders. These documents will contain important information about this transaction, and we urge you to read these documents when they become available.

You may obtain copies of all documents filed with the Securities and Exchange Commission regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents free of charge from PCC at the PCC Corporate Center/Financial Documents section ofwww.precast.com or by contacting PCC Investor Relations at (503) 417-4850. They may also be obtained under Financial Information in the Investor Relations section ofwww.spstech.com or by contacting SPS Investor Relations at (215) 517-2001.

Participants in This Transaction

PCC and SPS and their respective directors and executive officers may be deemed participants in the solicitation of proxies from security holders in connection with this transaction. Information about the directors and executive officers of PCC and SPS and information about other persons who may be deemed participants in this transaction will be included in the proxy statement/prospectus. You can find information about PCC’s executive officers and directors in PCC’s proxy statement (DEF14A) filed with the SEC on July 7, 2003. You can find information about SPS’s officers and directors in their proxy statement (DEF14A) filed with the SEC on March 31, 2003. You can obtain free copies of these documents from the SEC, PCC, or SPS using the contact information above.

The following is a press release issued by SPS and PCC on August 18, 2003:

| Investor Contacts: | | | | |

Dwight Weber | | | | |

Precision Castparts Corp. (503) 417-4855 | | | | Filing pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 |

| | |

Margaret Zminda | | | | |

SPS Technologies, Inc. | | | | |

(215) 517-2010 | | | | |

| | |

| Financial Media Contacts: | | | | Filer and Subject Company: SPS |

Jim Lucas / Peter Mladina | | | | Technologies, Inc. |

Abernathy MacGregor Group | | | | |

(213) 630-6550 | | | | Exchange Act File Number: 1-4416 |

| | |

Steve Frankel | | | | |

Abernathy MacGregor Group | | | | |

(212) 371-5999 | | | | |

Precision Castparts to Acquire SPS Technologies in an Accretive Transaction Valued at $729 Million

Will Strengthen Core Aerospace Business, Create Opportunities for Cost-Saving Synergies

Portland, OR – August 18, 2003 – Precision Castparts Corp. (NYSE: PCP) has signed a definitive agreement to acquire SPS Technologies, Inc. (NYSE: ST), a supplier of fasteners and other metal products to the aerospace, automotive, and general industrial and other markets, in an accretive transaction valued at approximately $43.78 per SPS Technologies, Inc. (SPS) share as of the close of market on August 15, 2003, which represents a premium of 28% to SPS’s closing price. The total equity consideration including after-tax option payments is $575 million.

“This acquisition will strengthen Precision Castparts Corp.’s (PCC) core business as a leading supplier of complex metal products for aerospace customers and provide significant cost-saving synergies, right away and well into the future,” said Mark Donegan, PCC’s chairman and chief executive officer. “SPS, like PCC, operates manufacturing businesses that are well suited to PCC’s core competencies: enhancing efficiency and reducing costs in the manufacturing of complex metal components.

“We plan to extend our relentless drive for operational excellence and cost reductions to SPS’s operations,” said Donegan. “The combination of the two companies provides significant opportunities to enhance efficiencies, cost savings and processes. Consistent with PCC’s proven track record of attacking costs and increasing its market reach, the combined company gives us an additional avenue for continued growth.

“In addition, the acquisition will further diversify our business by enhancing exposure to new markets including automotive applications, which represented approximately one-quarter of SPS’s 2002 sales,” added Donegan.

SPS shareholders may elect to receive either cash or PCC stock as follows: $43.00 in cash per share, with the total cash consideration fixed at approximately $278 million, or at a fixed exchange ratio of 1.36 shares of PCC common stock, with a total stock consideration of approximately 8.8 million shares of PCC common stock, subject to proration to achieve an aggregate split of half cash and half stock. It is expected that SPS shareholders electing to receive PCC stock would receive shares on a tax-deferred basis. Based on the average closing price for PCC shares over the last month, the transaction implies a per share value of $43.06 per SPS share and a premium of 41% to SPS’s average closing price over the same period.

Accretive Transaction

PCC expects the acquisition to be immediately accretive on an EPS basis through reductions in duplicate corporate overhead, and it expects synergies and operational cost savings to generate additional EPS accretion in PCC’s fiscal 2005, the first full fiscal year of combined operations after closing.

PCC expects to achieve annual savings of approximately $20 to $25 million in the first 12 to 15 months following closing, with cost savings ultimately reaching $30 to $35 million annually. Not included in these estimates are additional revenue opportunities resulting from the combination of these two leaders in their respective markets.

PCC plans to fund the cash portion of the transaction and refinance most of SPS’s debt through a combination of new bank credit facilities and new senior notes. After the close of the acquisition, PCC will remain conservatively capitalized and committed to reducing debt and maintaining a strong credit profile.

“This transaction allows SPS’s shareholders to own, under favorable terms, a financially sound and operationally competitive company that is well positioned for long-term growth and for the inevitable upturn in the markets we both serve,” said John S. Thompson, SPS’s chief executive officer. “SPS has served aerospace for much of its 100-year history and is well positioned on the next generation of aircraft. The combination of PCC and SPS creates a company with the resources and commitment to ensure that all our operations will continue to serve our current and future customers well for many years to come.”

Integration Plans

PCC has a record of successfully integrating new businesses and is developing detailed integration plans to realize the benefit of expected cost reductions and synergies. After acquiring Wyman-Gordon for cash in November 1999, PCC achieved cost savings and increased the cash flow in that business well ahead of the anticipated schedule, which

allowed it to rapidly reduce debt after the acquisition. Under a PCC operating team led by Donegan, PCC significantly improved Wyman-Gordon’s operating margins, despite difficult aerospace industry conditions and a deflationary pricing environment.

The complementary nature of the two companies’ aerospace products is expected to enhance integration efforts and accelerate synergies.

The SPS acquisition, which has been approved by the boards of directors of both companies, is expected to close during the fourth quarter of calendar 2003, which is PCC’s third quarter of fiscal 2004. Closing is subject to various approvals, including the approval of regulatory authorities and 80% of SPS’s shareholders. Completion of the acquisition is not subject to financing contingencies or a vote of PCC shareholders.

Goldman, Sachs & Co. served as financial advisor for PCC. Credit Suisse First Boston served as SPS’s financial advisor. Commitments for acquisition financing were provided by Bank of America.

PCC / SPS MERGER AT-A-GLANCE

(Quarters ended June 29 and 30, 2003, for PCC and SPS, respectively, $ in millions)

| | | PCC

| | | SPS

| |

Revenues | | $ | 481.7 | | | $ | 214.2 | |

Operating Income | | $ | 67.9 | | | $ | 13.1 | |

Operating Margin | | | 14.1 | % | | | 6.1 | % |

Cash & Cash Equiv. | | $ | 35.0 | | | | 68.6 | |

Total Debt | | $ | 684.1 | | | $ | 222.6 | |

Debt/Capital Ratio | | | 38.1 | % | | | 37.8 | % |

Manufacturing Plants | | | 57 | | | | 35 | |

Employees | | | 11,400 | | | | 5,700 | |

PCC’s revenues for its fiscal year ended March 30, 2003 were $2,117.2 million. SPS’s revenues for its fiscal year ended December 31, 2002 were $830.3 million.

About the Companies

Precision Castparts Corp. is a worldwide, diversified manufacturer of complex metal components and products. It serves the aerospace, industrial gas turbine, fluid management, and general industrial and other markets. PCC is the market leader in manufacturing large, complex structural investment castings, airfoil castings, and forged components used in jet aircraft engines and industrial gas turbines.

SPS Technologies is a leading producer of high-strength fasteners and precision components for the aerospace, automotive and industrial markets, superalloys and specialty metals in ingot and powder form, waxes, metalworking tools and magnetic products.

Webcast of Conference Call:

Mark Donegan, PCC’s chairman and chief executive officer, and Bill Larsson, PCC’s chief financial officer, will discuss today’s announcement with analysts and investors on a Webcast conference call this morning, August 18, at 10:00 A.M. Eastern Time. To listen to the live broadcast, go to:http://www.veracast.com/pcc/conference_call_081803/main_08182003.cfm, the PCC Corporate Center/Corporate Presentations section atwww.precast.com, or the Investor Relations section of the SPS website atwww.spstech.com. A copy of this press release and the conference call slide presentation are also available at both company’s web sites. To request these documents by phone, please call PCC’s Investor Relations at (503) 417-4850 or SPS Investor Relations at (215) 517-2001.

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements include those that refer to our expectations about this transaction with SPS, including those statements that refer to the expected benefits of the transaction to our shareholders, the anticipated synergy benefits, and the expected impact of this transaction on our financial results. These forward-looking statements are based on management’s current expectations and beliefs and are subject to a number of risks, uncertainties, and assumptions that could cause actual results to differ materially from those we describe in the forward-looking statements. The risks, uncertainties, and assumptions include the possibility that we will be unable to fully realize the benefits we anticipate from the acquisition; the challenges of achieving anticipated synergies; the possibility that we will incur costs or difficulties related to the integration of our businesses greater than those we expect; the ability to maintain customer relationships after the merger; our ability to retain and motivate key employees of both organizations; the difficulty of keeping expense growth and integration costs at modest levels while increasing revenues; the challenges of integration and restructuring associated with the transaction; the ability to obtain necessary shareholder and regulatory approvals; the possibility that the acquisition may not close or that PCC or SPS may be required to modify some aspect of the acquisition transaction to obtain regulatory approvals; and other risks that are described from time to time in our Securities and Exchange Commission reports.

Additional Information About This Transaction

PCC and SPS will file a proxy statement/prospectus and other documents regarding this transaction with the Securities and Exchange Commission. PCC and SPS will mail the proxy statement/prospectus to the SPS security holders. These documents will contain important information about this transaction, and we urge you to read these documents when they become available.

You may obtain copies of all documents filed with the Securities and Exchange Commission regarding this transaction, free of charge, at the SEC’s website

(www.sec.gov). You may also obtain these documents free of charge from PCC at the PCC Corporate Center/Financial Documents section ofwww.precast.com or by contacting PCC Investor Relations at (503) 417-4850. They may also be obtained under Financial Information in the Investor Relations section ofwww.spstech.com or by contacting SPS Investor Relations at (215) 517-2001.

Participants in This Transaction

PCC and SPS and their respective directors and executive officers may be deemed participants in the solicitation of proxies from security holders in connection with this transaction. Information about the directors and executive officers of PCC and SPS and information about other persons who may be deemed participants in this transaction will be included in the proxy statement/prospectus. You can find information about PCC’s executive officers and directors in PCC’s proxy statement (DEF14A) filed with the SEC on July 7, 2003. You can find information about SPS’s officers and directors in their proxy statement (DEF14A) filed with the SEC on March 31, 2003. You can obtain free copies of these documents from the SEC, PCC, or SPS using the contact information above.

The following is a slide presentation that was made publicly available on August 18, 2003 in connection with the conference call/webcast regarding the proposed merger:

Acquisition of SPS Technologies

August 18, 2003

Filing pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Filer and Subject Company: SPS Technologies, Inc.

Exchange Act File Number: 1-4416

[LOGO]

[LOGO]

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements include those that refer to our expectations about this transaction with SPS, including those statements that refer to the expected benefits of the transaction to our shareholders, the anticipated synergy benefits, and the expected impact of this transaction on our financial results. These forward-looking statements are based on management’s current expectations and beliefs and are subject to a number of risks, uncertainties, and assumptions that could cause actual results to differ materially from those we describe in the forward-looking statements. The risks, uncertainties, and assumptions include the possibility that we will be unable to fully realize the benefits we anticipate from the acquisition; the challenges of achieving anticipated synergies; the possibility that we will incur costs or difficulties related to the integration of our businesses greater than those we expect; the ability to maintain customer relationships after the merger; our ability to retain and motivate key employees of both organizations; the difficulty of keeping expense growth and integration costs at modest levels while increasing revenues; the challenges of integration and restructuring associated with the transaction; the ability to obtain necessary shareholder and regulatory approvals; the possibility that the acquisition may not close or that PCC or SPS may be required to modify some aspect of the acquisition transaction to obtain regulatory approvals; and other risks that are described from time to time in our Securities and Exchange Commission reports.

2

[LOGO]

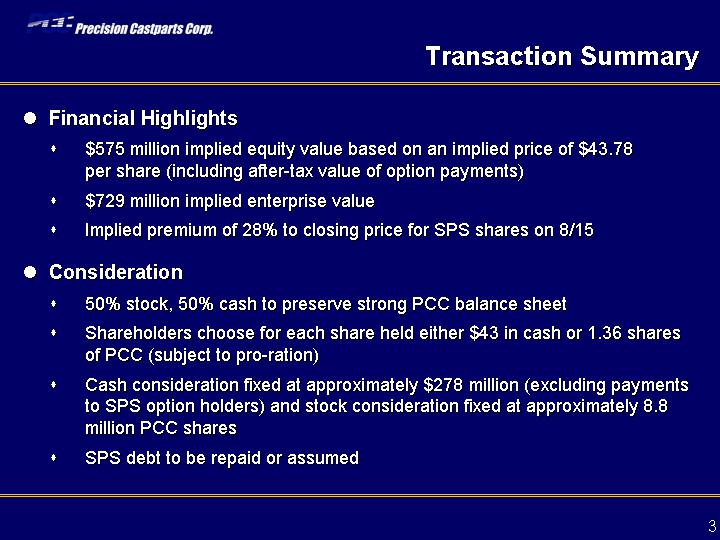

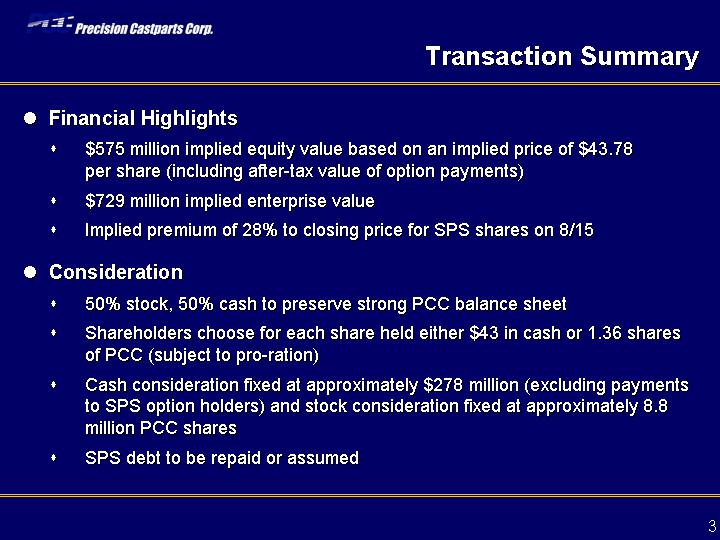

Transaction Summary

| | ¨ | | $575 million implied equity value based on an implied price of $43.78 per share (including after-tax value of option payments) |

| | ¨ | | $729 million implied enterprise value |

| | ¨ | | Implied premium of 28% to closing price for SPS shares on 8/15 |

| | ¨ | | 50% stock, 50% cash to preserve strong PCC balance sheet |

| | ¨ | | Shareholders choose for each share held either $43 in cash or 1.36 shares of PCC (subject to pro-ration) |

| | ¨ | | Cash consideration fixed at approximately $278 million (excluding payments to SPS option holders) and stock consideration fixed at approximately 8.8 million PCC shares |

| | ¨ | | SPS debt to be repaid or assumed |

3

[LOGO]

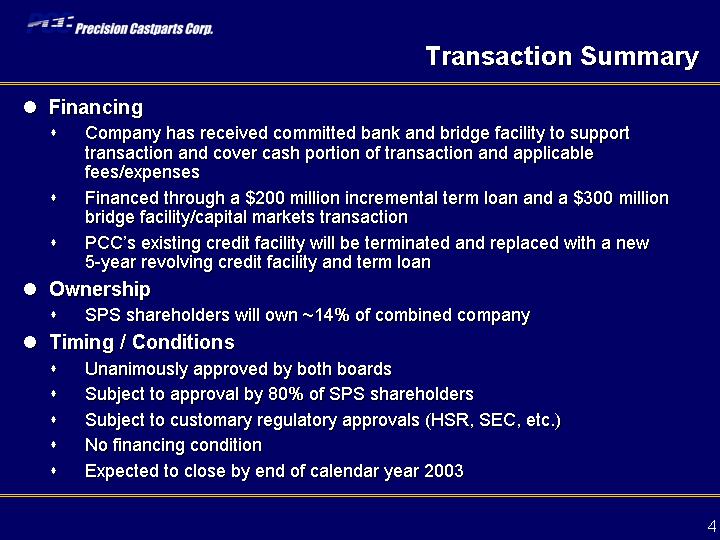

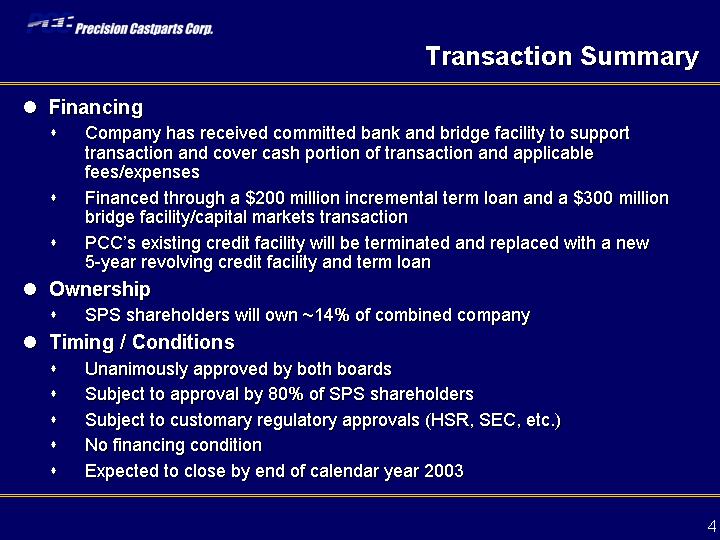

Transaction Summary

| | ¨ | | Company has received committed bank and bridge facility to support transaction and cover cash portion of transaction and applicable fees/expenses |

| | ¨ | | Financed through a $200 million incremental term loan and a $300 million bridge facility/capital markets transaction |

| | ¨ | | PCC’s existing credit facility will be terminated and replaced with a new 5-year revolving credit facility and term loan |

| | • | | SPS shareholders will own ~14% of combined company |

| | • | | Unanimously approved by both boards |

| | • | | Subject to approval by 80% of SPS shareholders |

| | • | | Subject to customary regulatory approvals (HSR, SEC, etc.) |

| | • | | Expected to close by end of calendar year 2003 |

4

[LOGO]

PCC Acquisition Strategy

| | • | | SPS Fits with PCC’s Acquisition Criteria |

| | ¨ | | Publicly traded company |

| | ¨ | | Strong financial systems |

| | ¨ | | $500-$800 million in annual sales |

| | ¨ | | Strong aerospace business |

| | ¨ | | Enhances diversification |

| | ¨ | | Excellent synergy opportunities |

| | ¨ | | Builds on Wyman-Gordon experience |

5

[LOGO]

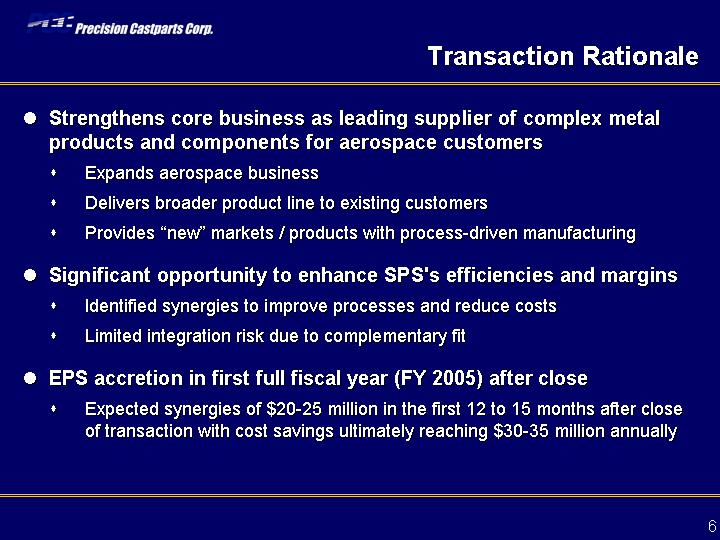

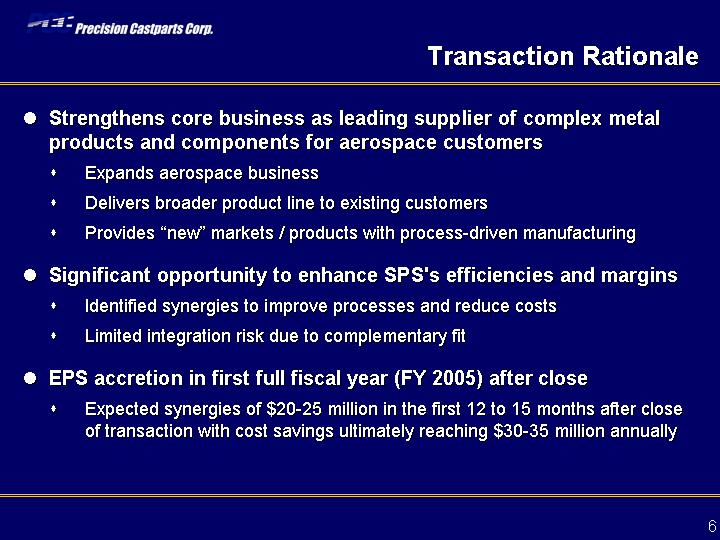

Transaction Rationale

| | • | | Strengthens core business as leading supplier of complex metal products and components for aerospace customers |

| | ¨ | | Expands aerospace business |

| | ¨ | | Delivers broader product line to existing customers |

| | ¨ | | Provides “new” markets / products with process-driven manufacturing |

| | • | | Significant opportunity to enhance SPS’s efficiencies and margins |

| | ¨ | | Identified synergies to improve processes and reduce costs |

| | ¨ | | Limited integration risk due to complementary fit |

| | • | | EPS accretion in first full fiscal year (FY 2005) after close |

| | ¨ | | Expected synergies of $20-25 million in the first 12 to 15 months after close of transaction with cost savings ultimately reaching $30-35 million annually |

6

[LOGO]

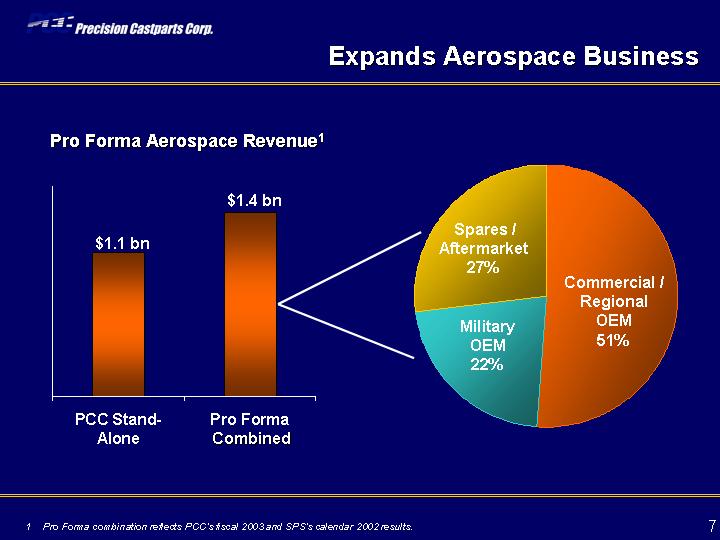

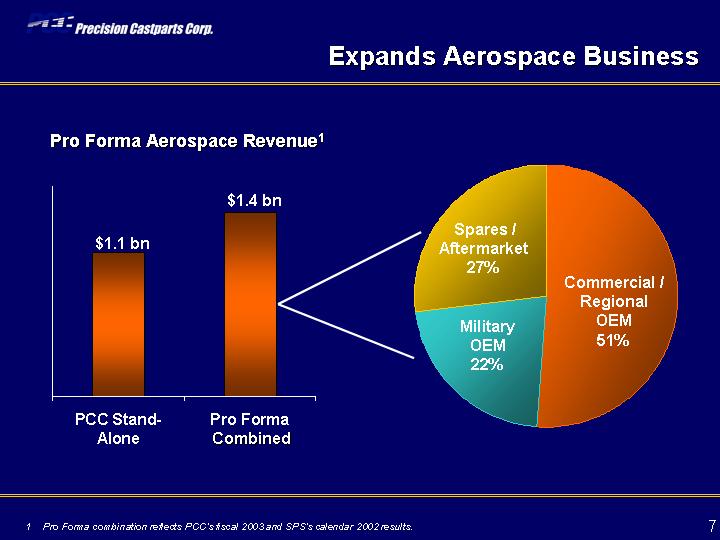

Expands Aerospace Business

Pro Forma Aerospace Revenue1

[CHART]

1 Pro Forma combination reflects PCC’s fiscal 2003 and SPS’s calendar 2002 results. | | 7 |

[LOGO]

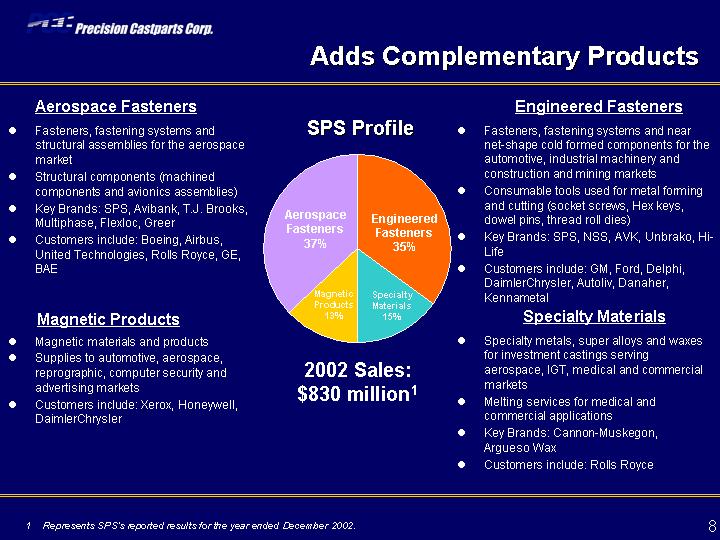

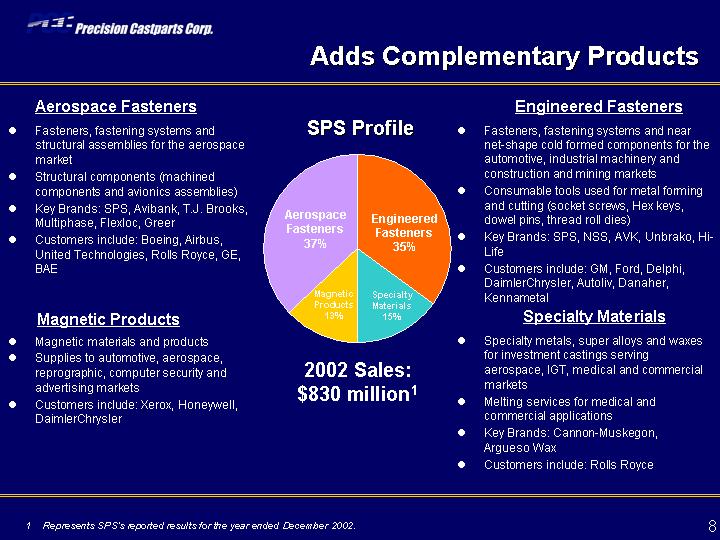

Adds Complementary Products

Aerospace Fasteners

| • | | Fasteners, fastening systems and structural assemblies for the aerospace market |

| • | | Structural components (machined components and avionics assemblies) |

| • | | Key Brands: SPS, Avibank, T.J. Brooks, Multiphase, Flexloc, Greer |

| • | | Customers include: Boeing, Airbus, United Technologies, Rolls Royce, GE, BAE |

Magnetic Products

| • | | Magnetic materials and products |

| • | | Supplies to automotive, aerospace, reprographic, computer security and advertising markets |

| • | | Customers include: Xerox, Honeywell, DaimlerChrysler |

SPS Profile

[CHART]

2002 Sales:

$830 million1

Engineered Fasteners

| • | | Fasteners, fastening systems and near net-shape cold formed components for the automotive, industrial machinery and construction and mining markets |

| • | | Consumable tools used for metal forming and cutting (socket screws, Hex keys, dowel pins, thread roll dies) |

| • | | Key Brands: SPS, NSS, AVK, Unbrako, Hi-Life |

| • | | Customers include: GM, Ford, Delphi, DaimlerChrysler, Autoliv, Danaher, Kennametal |

Specialty Materials

| • | | Specialty metals, super alloys and waxes for investment castings serving aerospace, IGT, medical and commercial markets |

| • | | Melting services for medical and commercial applications |

| • | | Key Brands: Cannon-Muskegon, Argueso Wax |

| • | | Customers include: Rolls Royce |

| 1 | | Represents SPS’s reported results for the year ended December 2002. |

8

[LOGO]

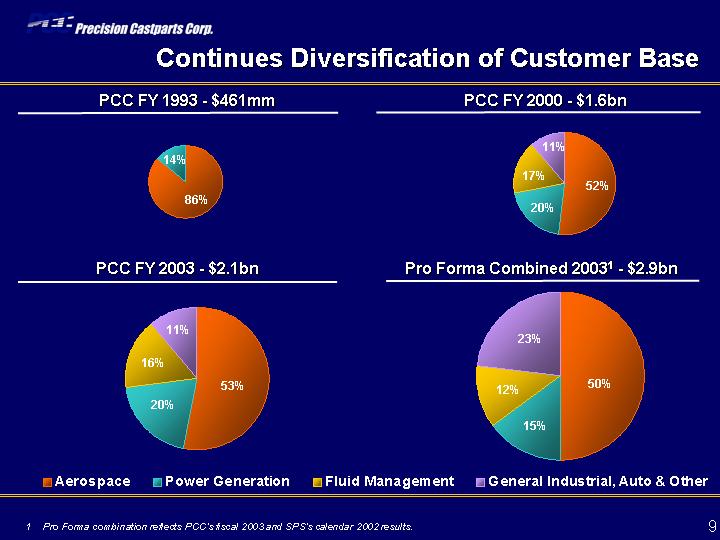

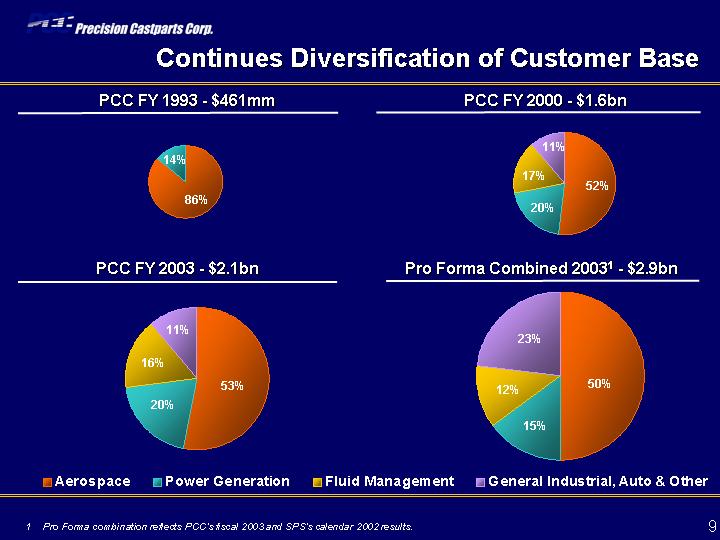

Continues Diversification of Customer Base

[CHART]

| 1 | | Pro Forma combination reflects PCC’s fiscal 2003 and SPS’s calendar 2002 results. |

9

[LOGO]

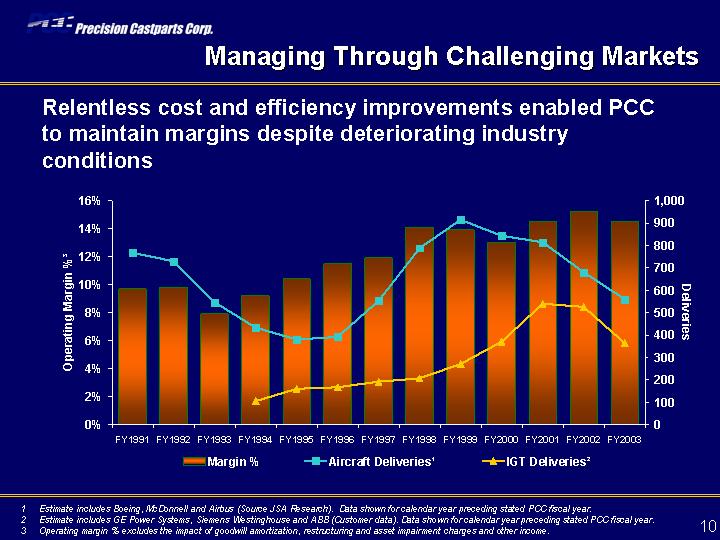

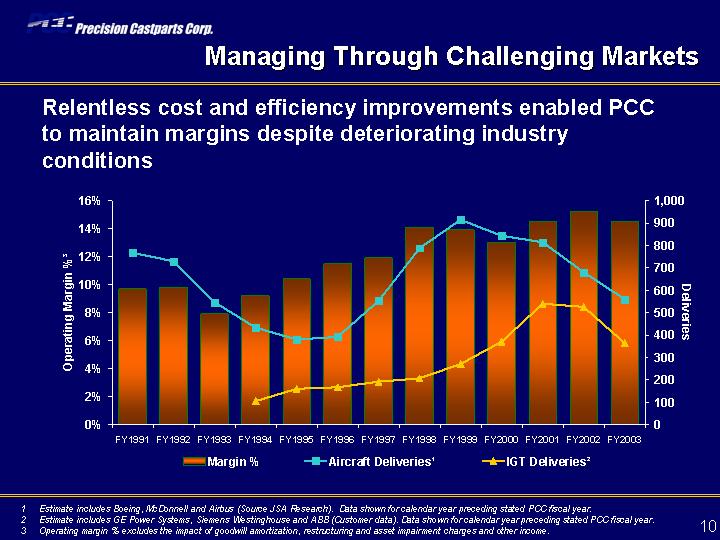

Managing Through Challenging Markets

Relentless cost and efficiency improvements enabled PCC to maintain margins despite deteriorating industry conditions

[GRAPH]

| 1 | | Estimate includes Boeing, McDonnell and Airbus (Source JSA Research). Data shown for calendar year preceding stated PCC fiscal year. |

| 2 | | Estimate includes GE Power Systems, Siemens Westinghouse and ABB (Customer data). Data shown for calendar year preceding stated PCC fiscal year. |

| 3 | | Operating margin % excludes the impact of goodwill amortization, restructuring and asset impairment charges and other income. |

10

[LOGO]

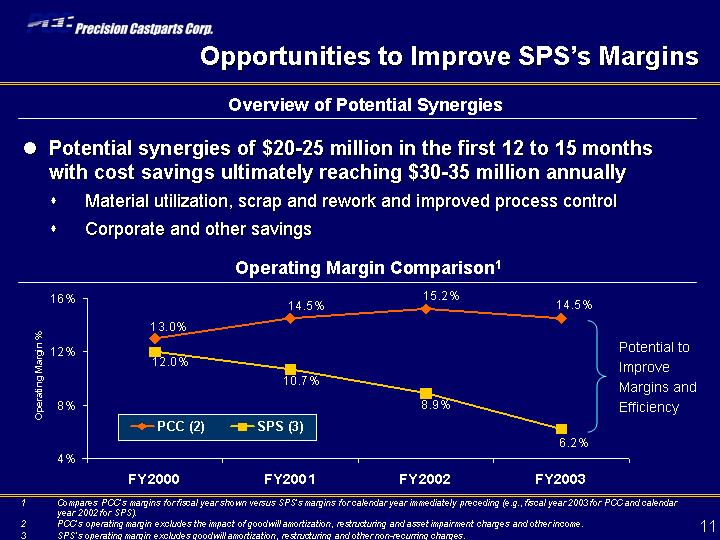

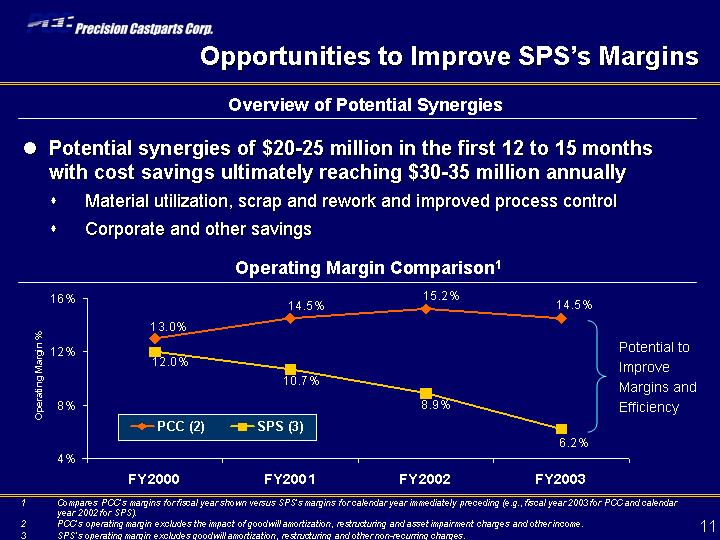

Opportunities to Improve SPS’s Margins

Overview of Potential Synergies

| • | | Potential synergies of $20-25 million in the first 12 to 15 months with cost savings ultimately reaching $30-35 million annually |

| | ¨ | | Material utilization, scrap and rework and improved process control |

| | ¨ | | Corporate and other savings |

Operating Margin Comparison1

[GRAPH]

| 1 | | Compares PCC’s margins for fiscal year shown versus SPS’s margins for calendar year immediately preceding (e.g., fiscal year 2003 for PCC and calendar year 2002 for SPS). |

| 2 | | PCC’s operating margin excludes the impact of goodwill amortization, restructuring and asset impairment charges and other income. |

| 3 | | SPS’s operating margin excludes goodwill amortization, restructuring and other non-recurring charges. |

11

[LOGO]

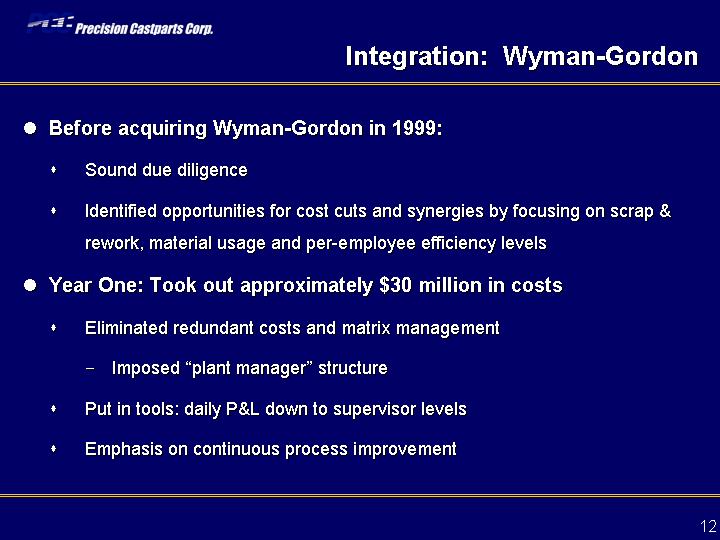

Integration: Wyman-Gordon

| • | | Before acquiring Wyman-Gordon in 1999: |

| | ¨ | | Identified opportunities for cost cuts and synergies by focusing on scrap & rework, material usage and per-employee efficiency levels |

| • | | Year One: Took out approximately $30 million in costs |

| | ¨ | | Eliminated redundant costs and matrix management |

| | – | | Imposed “plant manager” structure |

| | ¨ | | Put in tools: daily P&L down to supervisor levels |

| | ¨ | | Emphasis on continuous process improvement |

12

[LOGO]

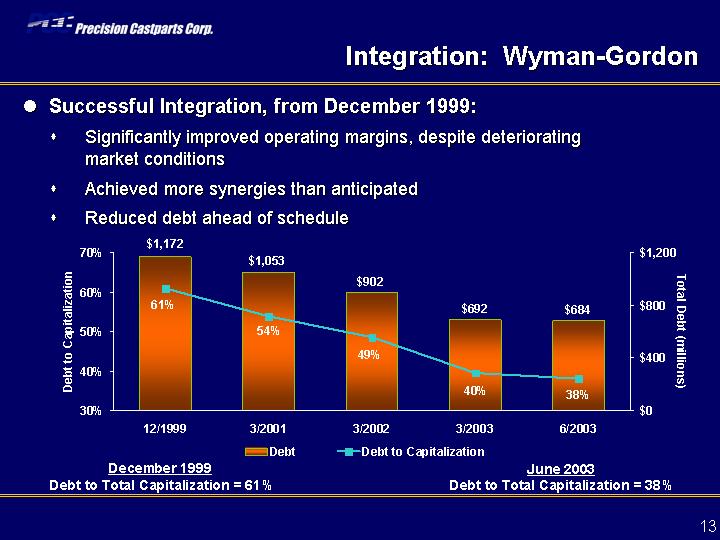

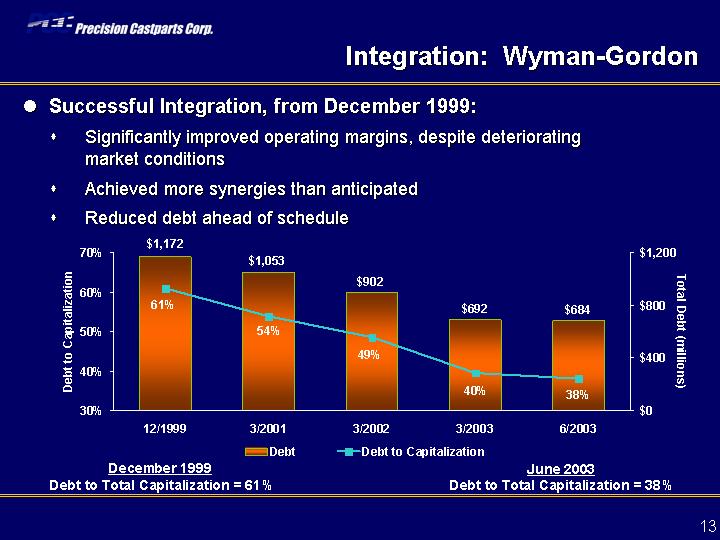

Integration: Wyman-Gordon

| | • | | Successful Integration, from December 1999: |

| | ¨ | | Significantly improved operating margins, despite deteriorating market conditions |

| | ¨ | | Achieved more synergies than anticipated |

| | ¨ | | Reduced debt ahead of schedule |

[BAR CHART]

December 1999

| | | | June 2003

|

| Debt to Total Capitalization = 61% | | | | Debt to Total Capitalization = 38% |

13

LOGO]

PCC Strategy Summary

| | • | | Expands aerospace business |

| | • | | Complementary to PCC’s manufacturing processes and customers |

| | • | | Provides diversification into new markets |

| | • | | Creates opportunities for further international expansion |

| | • | | Offers opportunities to improve SPS’s margins and to use cost advantage to increase revenue |

CONTINUED DRIVE FOR IMPROVED

OPERATIONAL PERFORMANCE

14

[LOGO]

Appendix:

Overview of Combined Company

15

[LOGO]

Combined Company Highlights

| | • | | Global, diversified manufacturer of complex metal components and products with leading market positions |

| | • | | Market leader in large structural castings, airfoil castings, structural forgings, fasteners and extruded pipe |

| | • | | Pro forma combined revenues of $2.9 billion1 |

| | • | | Over 90 manufacturing plants worldwide |

| 1 | | Pro Forma combination reflects PCC’s fiscal 2003 and SPS’s calendar 2002 results. |

16

[LOGO]

Financial Highlights

(Quarters ended June 29 and 30, 2003, for PCC and SPS, respectively, $ in millions)

| | | PCC

| | | SPS

| |

Revenues | | $ | 481.7 | | | $ | 214.2 | |

Operating Income | | $ | 67.9 | | | $ | 13.1 | |

Operating Margin | | | 14.1 | % | | | 6.1 | % |

Cash & Cash Equiv. | | $ | 35.0 | | | $ | 68.6 | |

Total Debt | | $ | 684.1 | | | $ | 222.6 | |

Debt/Capital Ratio | | | 38.1 | % | | | 37.8 | % |

Manufacturing Plants | | | 57 | | | | 35 | |

Employees | | | 11,400 | | | | 5,700 | |

PCC’s revenues for its fiscal year ended March 30, 2003 were $2,117.2 million. SPS’s revenues for its fiscal year ended December 31, 2002 were $830.3 million

17

[LOGO]

Appendix:

Overview of PCC

18

[LOGO]

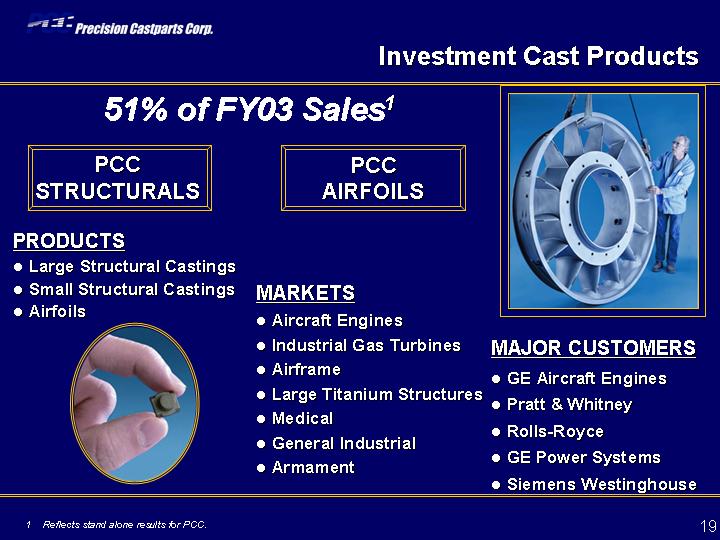

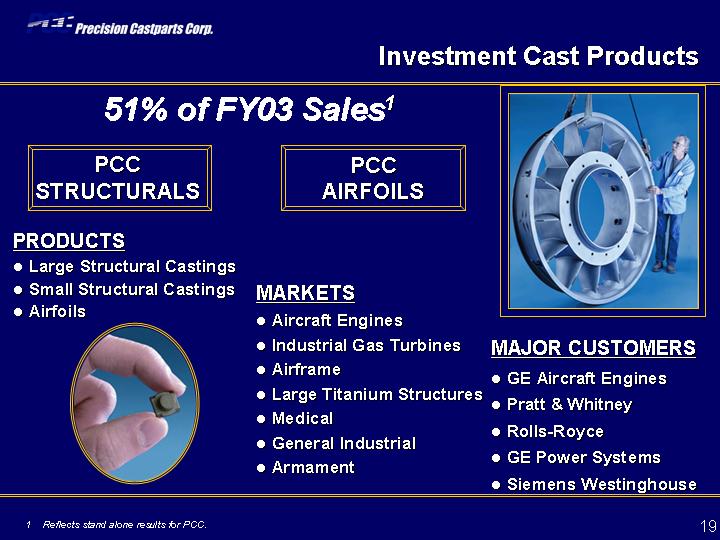

Investment Cast Products

51% of FY03 Sales1

PCC

STRUCTURALS

PCC

AIRFOILS

[LOGO]

PRODUCTS

| • | | Large Structural Castings |

| • | | Small Structural Castings |

[LOGO]

MARKETS

| • | | Industrial Gas Turbines |

| • | | Large Titanium Structures |

MAJOR CUSTOMERS

| 1 | | Reflects stand alone results for PCC. |

19

[LOGO]

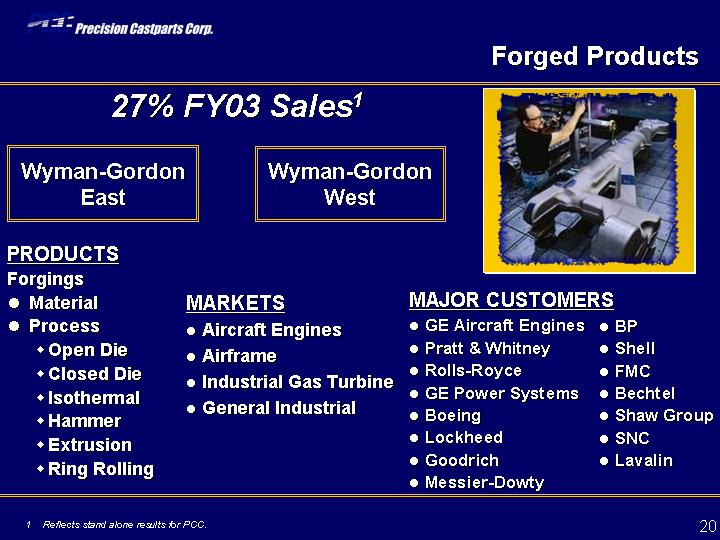

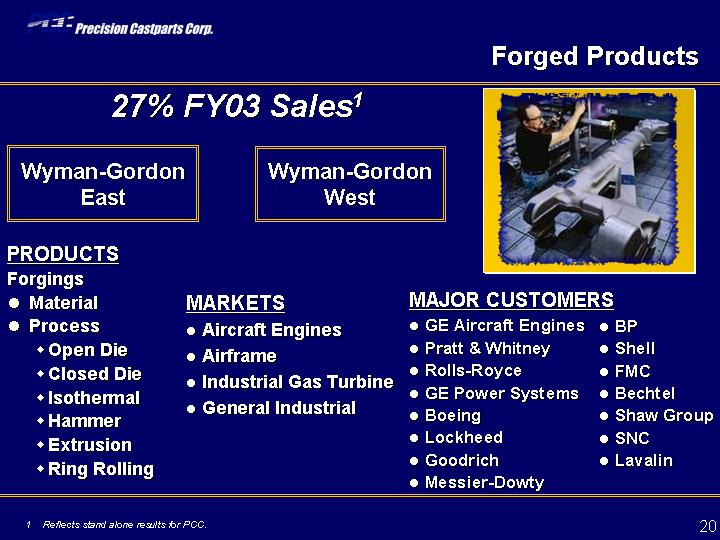

Forged Products

27% FY03 Sales1

Wyman-Gordon East

Wyman-Gordon West

[LOGO]

PRODUCTS

Forgings

MARKETS

MAJOR CUSTOMERS

| 1 | | Reflects stand alone results for PCC. |

20

[LOGO]

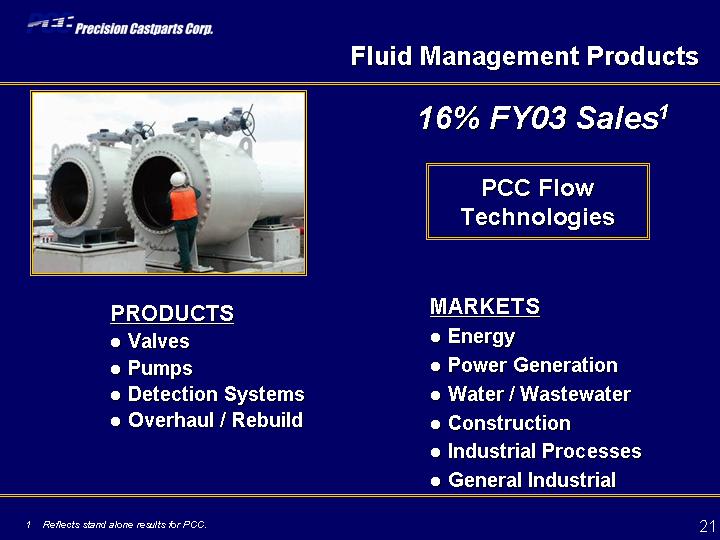

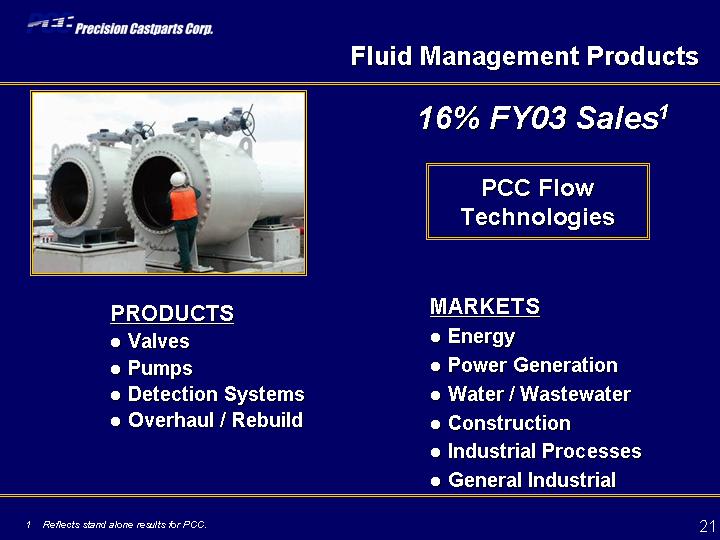

Fluid Management Products

16% FY03 Sales1

PCC Flow Technologies

[LOGO]

PRODUCTS

MARKETS

| 1 | | Reflects stand alone results for PCC. |

21

[LOGO]

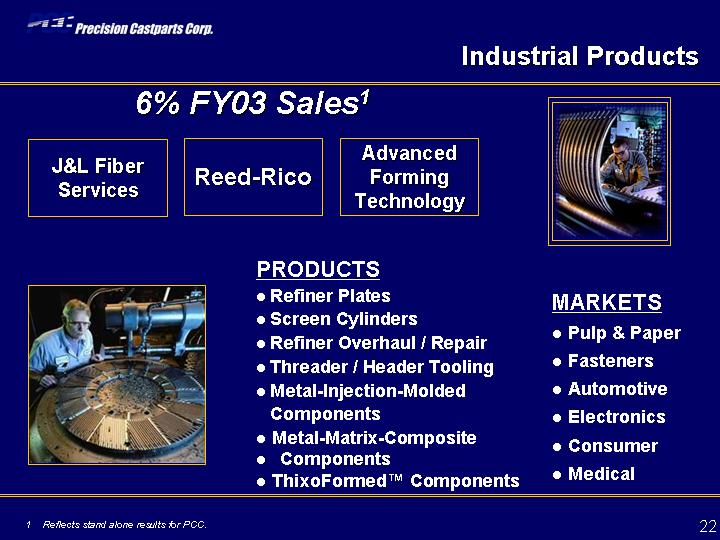

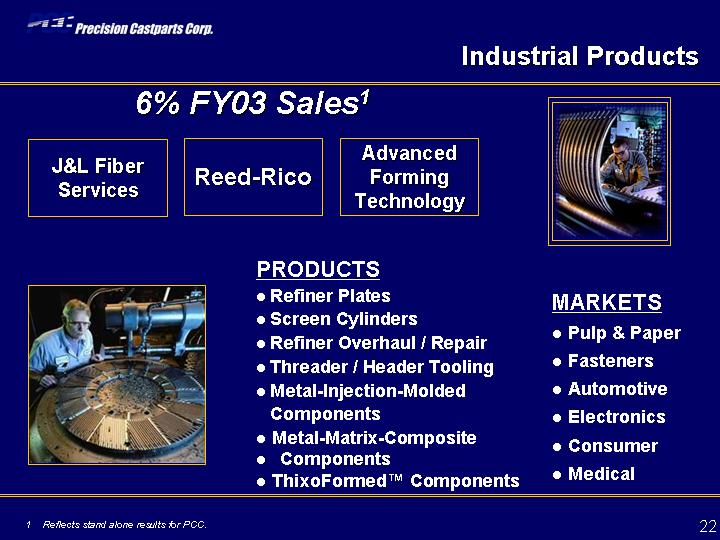

Industrial Products

6% FY03 Sales1

J&L Fiber Services

Reed-Rico

Advanced Forming Technology

[LOGO]

[LOGO]

PRODUCTS

| • | | Refiner Overhaul / Repair |

| • | | Threader / Header Tooling |

| • | | Metal-Injection-Molded Components |

| • | | ThixoFormed™ Components |

MARKETS

| 1 | | Reflects stand alone results for PCC. |

22

[LOGO]

Additional Information

Additional Information About This Transaction

PCC and SPS will file a proxy statement/prospectus and other documents regarding this transaction with the Securities and Exchange Commission. PCC and SPS will mail the proxy statement/prospectus to the SPS security holders. These documents will contain important information about this transaction, and we urge you to read these documents when they become available.

You may obtain copies of all documents filed with the Securities and Exchange Commission regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents free of charge from PCC at the PCC Corporate Center/Financial Documents section of www.precast.com or by contacting PCC Investor Relations at (503) 417-4850. They may also be obtained under Financial Information in the Investor Relations section of www.spstech.com or by contacting SPS Investor Relations at (215) 517-2001.

Participants in This Transaction

PCC and SPS and their respective directors and executive officers may be deemed participants in the solicitation of proxies from security holders in connection with this transaction. Information about the directors and executive officers of PCC and SPS and information about other persons who may be deemed participants in this transaction will be included in the proxy statement/prospectus. You can find information about PCC’s executive officers and directors in PCC’s proxy statement (DEF14A) filed with the SEC on July 7, 2003. You can find information about SPS’s officers and directors in their proxy statement (DEF14A) filed with the SEC on March 31, 2003. You can obtain free copies of these documents from the SEC, PCC, or SPS using the contact information above.

23

[LOGO]

24

The following are materials provided to employees of SPS and PCC on August 18, 2003:

| | | | | Filing pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 |

| | |

| | | | | Filer and Subject Company: SPS Technologies, Inc. Exchange Act File Number: 1-4416 |

To our employees:

Today we are announcing important news: Precision Castparts Corp. (PCC) has agreed to acquire SPS Technologies, Inc. (SPS) in a merger transaction.

SPS will strengthen PCC’s leadership as a supplier of complex metal products. Together, we will be an even more important player in aerospace. We will be better able to compete for customers such as automotive manufacturers. And, we will be well positioned for long-term growth and for the inevitable upturn in our markets.

While our products are different, we share many customers. The combined company, with a broader array of products, will be able to meet more of the needs of our customers. More than half of our sales will still be to aerospace customers. SPS has served aerospace for much of its 100-year history and is well positioned with the newest generation of commercial aircraft.

Our companies’ successes reflect the contributions and dedication of more than 17,000 people in over 90 plants. In the face of today’s business conditions, we all need to keep working hard to help improve performance and reduce costs. Together we can build a stronger base to grow our businesses. We appreciate your understanding and support.

The two companies will combine when the transaction is approved by regulators and SPS’s shareholders. This will take several months. In the meantime, we ask all of you to stay focused on your jobs and the needs of our customers – now, as much as any time, we all can make a difference through our dedication and teamwork. We will provide you with more information as we have more progress to report.

Mark Donegan Chairman and Chief Executive Officer Precision Castparts Corp. | | John S. Thompson Chief Executive Officer SPS Technologies, Inc. |

Additional Information About This Transaction

PCC and SPS will file a proxy statement/prospectus and other documents regarding this transaction with the Securities and Exchange Commission. PCC and SPS will mail the proxy statement/prospectus to the SPS security holders. These documents will contain important information about this transaction, and we urge you to read these documents when they become available.

You may obtain copies of all documents filed with the Securities and Exchange Commission regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents free of charge from PCC at the PCC Corporate Center/Financial Documents section ofwww.precast.com or by contacting PCC Investor Relations at (503) 417-4850. They may also be obtained under Financial Information in the Investor Relations section ofwww.spstech.com or by contacting SPS Investor Relations at (215) 517-2001.

Participants in This Transaction

PCC and SPS and their respective directors and executive officers may be deemed participants in the solicitation of proxies from security holders in connection with this transaction. Information about the directors and executive officers of PCC and SPS and information about other persons who may be deemed participants in this transaction will be included in the proxy statement/prospectus. You can find information about PCC’s executive officers and directors in PCC’s proxy statement (DEF14A) filed with the SEC on July 7, 2003. You can find information about SPS’s officers and directors in their proxy statement (DEF14A) filed with the SEC on March 31, 2003. You can obtain free copies of these documents from the SEC, PCC, or SPS using the contact information above.

| | | | | Filing pursuant to Rule 14a-12

under the Securities Exchange Act

of 1934 |

| | |

| | | | | Filer and Subject Company: SPS

Technologies, Inc. Exchange Act File Number: 1-4416 |

| Q. | | Why are Precision Castparts Corp. (PCC) and SPS Technologies, Inc. (SPS) merging? |

| A. | | This acquisition strengthens PCC’s core business as a leading supplier of complex metal products for aerospace customers and provides significant cost-saving synergies. Our two companies offer complementary aerospace products and rankings of first or second in most of their respective markets served. SPS further diversifies PCC’s revenues by providing exposure to new markets including automotive manufacturers. With an improved cost structure, SPS will be able to attack its markets more aggressively and grow its businesses. SPS operates manufacturing businesses that are well suited to PCC’s core competencies: enhancing efficiency and reducing costs in the manufacturing of complex metal components. |

| Q. | | What happens to management at the group and plant levels at SPS? How many people will be laid off? When? Where? What will happen to duplicate positions? |

| A. | | First, nothing can happen until the acquisition is completed, which requires regulatory and shareholder approval. There will be duplicate positions in the corporate offices, and we expect that many – but not all – of SPS’s corporate positions will be eliminated. Beyond that, PCC will continue to look at staffing to sales ratios at individual SPS facilities. PCC’s first priority is to get to know the businesses and plants better as quickly as possible. Decisions on staffing will be made only after review of profitability and business growth prospects for each facility. Although PCC is very focused on taking costs out of its operations, that often means making processes more efficient to build a stronger base to grow the business, not just reducing head count. |

| Q. | | Will the Company change its name? |

PCC re’cognizes the value of SPS’s brand names. Most of the business names will stay the same as they are now. Over time, plant signs and stationery will add a line identifying the business as a “PCC Company.”

| Q. | | Will any facilities be shut down or sold? Which ones? |

| A. | | It is difficult to tell at this point. First, nothing can happen until the acquisition is completed, which will require regulatory and shareholder approval. Further, as with staffing decisions, PCC’s first priority is to get to know the businesses and plants better as quickly as possible. Decisions on closing or selling facilities will be made only after a review of each facility’s profitability and business growth prospects. |

| Q. | | The Companies have been clear there will be cost cutting. Who primarily will be affected? |

| A. | | Again, apart from duplications in corporate positions, it is premature to talk about “who” will be affected. PCC’s first priority is to get to know the businesses and plants better as quickly as possible. Although PCC is very focused on taking costs out of its operations, cost cutting can come in ways other than staffing reductions. PCC will be aggressively pursuing cost cutting alternatives across the board, including better purchasing leverage, reductions in material usage and scrap, and productivity improvements. |

| Q. | | What can employees expect in the interim? |

| A. | | First, nothing can happen until the acquisition is completed, which will require regulatory and shareholder approval. Before the closing, employees can expect members of PCC’s division management teams to be visiting SPS’s plants and reviewing plant operations to begin identifying operational goals for improved cost efficiencies and performance. PCC’s first priority is to get to know the businesses and plants better as quickly as possible. Goals and objectives will be communicated to employees in a number of ways, including employee meetings. |

| Q. | | Will contracts with key customers be affected by the merger? |

| A. | | It is PCC’s goal to confirm and strengthen contractual relationships with key customers. |

| Q. | | Will employees have to relocate as a result of the merger? |

| A. | | There may be opportunities in the future for some employees to transfer to other PCC facilities, but there is no plan to require relocations of SPS employees as a result of the merger. |

| Q. | | Will there be opportunities for both Companies’ employees in terms of jobs and relocation? |

| A. | | It is too early to know what specific opportunities might be available. However, PCC has a history of notifying employees of some opportunities for salaried positions across its divisions and of encouraging employees to look at career advancement opportunities at other divisions. |

| Q. | | Will the wages change? Will the benefits change? |

| A. | | PCC’s practice is to offer wages that are competitive in its individual business markets. In most respects, benefits will be comparable to SPS’s. Medical benefit costs, of course, are a problem for all employers today and it is a challenge to keep them affordable for both the company and employees, though in general SPS’s medical benefits are similar to PCC’s. |

| Q. | | What happens to employee’s pensions? Will the matching for their 401(k) remain the same? |

| A. | | We expect these plans to continue. |

| Q. | | Will there be severance if employees are laid off? |

| A. | | PCC is still reviewing the programs and practices at the various SPS locations and has not made any decisions about changes or modifications to those programs or practices. |

Additional Information About This Transaction

PCC and SPS will file a proxy statement/prospectus and other documents regarding this transaction with the Securities and Exchange Commission. PCC and SPS will mail the proxy statement/prospectus to the SPS security holders. These documents will contain important information about this transaction, and we urge you to read these documents when they become available.

You may obtain copies of all documents filed with the Securities and Exchange Commission regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents free of charge from PCC at the PCC Corporate Center/Financial Documents section ofwww.precast.com or by contacting PCC Investor Relations at (503) 417-4850. They may also be obtained under Financial Information in the Investor Relations section ofwww.spstech.com or by contacting SPS Investor Relations at (215) 517-2001.

Participants in This Transaction

PCC and SPS and their respective directors and executive officers may be deemed participants in the solicitation of proxies from security holders in connection with this transaction. Information about the directors and executive officers of PCC and SPS and information about other persons who may be deemed participants in this transaction will be included in the proxy statement/prospectus. You can find information about PCC’s executive officers and directors in PCC’s proxy statement (DEF14A) filed with the SEC on July 7, 2003. You can find information about SPS’s officers and directors in their proxy statement (DEF14A) filed with the SEC on March 31, 2003. You can obtain free copies of these documents from the SEC, PCC, or SPS using the contact information above.