UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant S Filed by a Party other than the Registrant £ |

| |

| Check the appropriate box: |

| |

| £ Preliminary Proxy Statement |

| |

| £Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| S Definitive Proxy Statement |

| |

| £ Definitive Additional Materials |

| |

| £ Soliciting Material Pursuant to Sec.240.14a-12 |

| |

| THE BANK OF KENTUCKY FINANCIAL CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| |

| S No fee required. |

| |

| £ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) Title of each class of securities to which transaction applies: |

| |

| |

| (2) Aggregate number of securities to which transaction applies: |

| |

| |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| |

| (4) Proposed maximum aggregate value of transaction: |

| |

| |

| (5) Total fee paid: |

| |

| |

| £ Fee paid previously with preliminary materials. |

| |

| £ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) Amount Previously Paid: |

| |

| |

| (2) Form, Schedule or Registration Statement No.: |

| |

| |

| (3) Filing Party: |

| |

| |

| (4) Date Filed: |

| |

| |

THE BANK OF KENTUCKY FINANCIAL CORPORATION

111 Lookout Farm Drive

Crestview Hills, Kentucky 41017

(859) 371-2340

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 20, 2012

Notice is hereby given that the Annual Meeting of Stockholders of The Bank of Kentucky Financial Corporation (“BKFC”) will be held at the Hilton Cincinnati Airport, 7373 Turfway Road, Florence, Kentucky 41042, on April 20, 2012, at 5:00 p.m., Eastern Daylight Saving Time (the “Annual Meeting”), for the following purposes:

| (1) | To elect nine directors of BKFC for terms expiring in 2013; |

| (2) | To ratify the selection of Crowe Horwath LLP as the independent registered public accounting firm of BKFC for the current fiscal year; |

| (3) | To approve, on a non-binding, advisory basis, the compensation of BKFC’s executive officers; |

| (4) | To vote, on a non-binding, advisory basis, on the frequency of future advisory votes to approve BKFC’s executive compensation program; |

| (5) | To approve the adoption of BKFC’s 2012 Stock Incentive Plan; and |

| (6) | To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

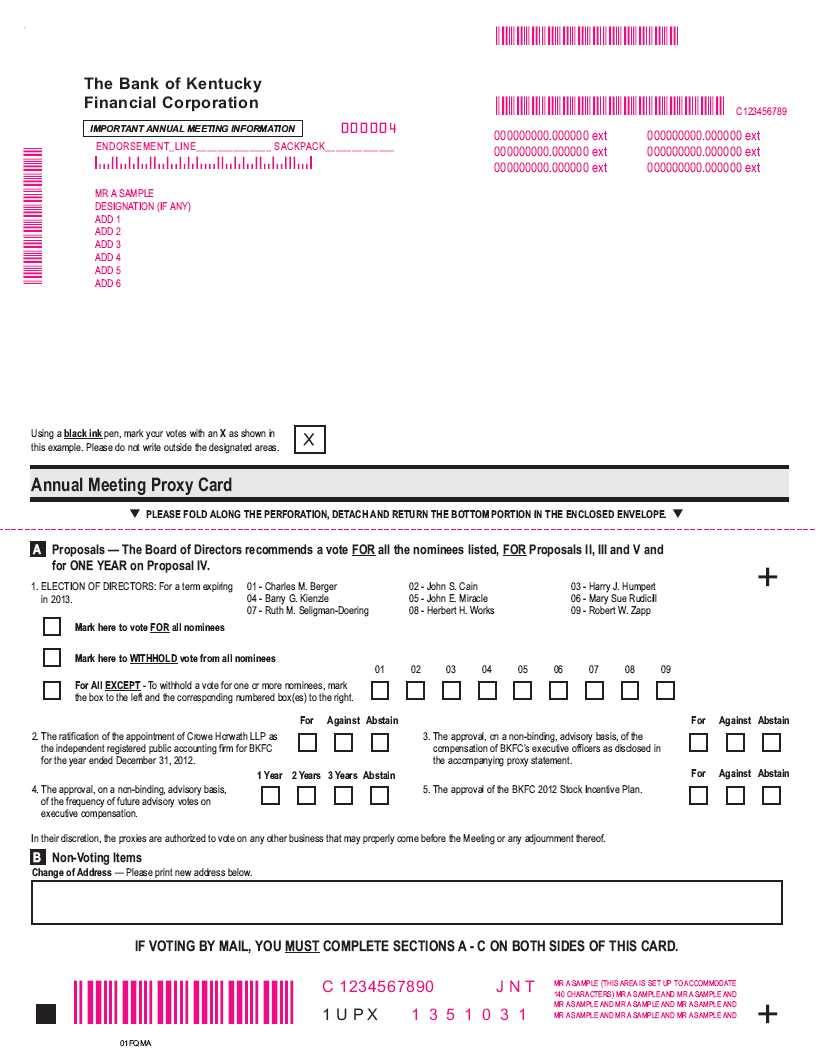

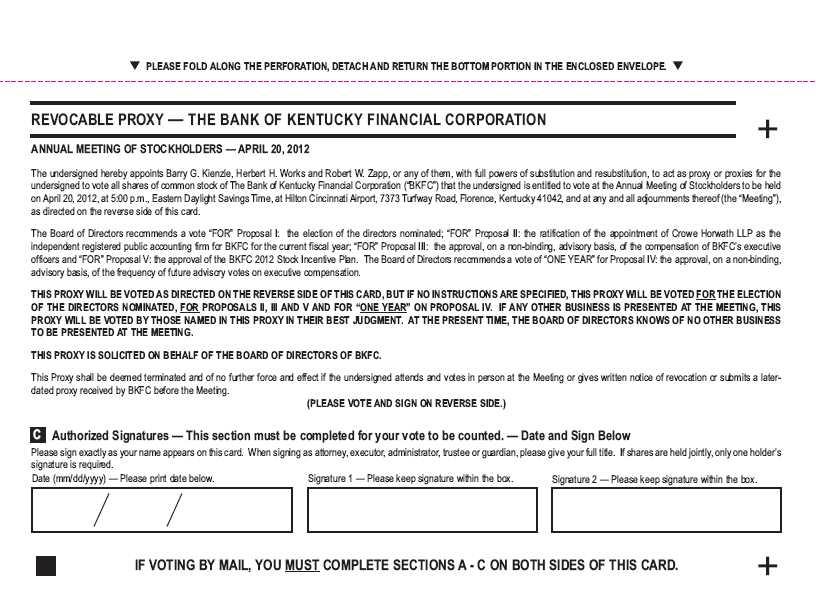

Enclosed with this Notice is a Proxy Statement, Proxy Card and business reply postage-paid envelope (collectively, “Proxy Materials”). The foregoing matters are described in more detail in the enclosed Proxy Statement.

Important notice regarding the availability of Proxy Materials for the Annual Meeting of Stockholders: This Proxy Statement and Proxy Card are available on our website at www.bankofky.com under the “Investor Relations” link by clicking “SEC Filings” or by going directly tohttps://www.bankofky.com/investor-relations/annual-report.aspx

Only BKFC’s stockholders of record at the close of business on March 2, 2012, will be entitled to receive notice of, and to vote at, the Annual Meeting.

BKFC’s Proxy Statement accompanies this notice of the Annual Meeting. Financial and other information about BKFC is contained in the enclosed Annual Report to Stockholders for the fiscal year ended December 31, 2011.

You are cordially invited to attend the meeting in person. Your participation in these matters is important, regardless of the number of shares you own. Whether or not you expect to attend the Annual Meeting, we urge you to consider the accompanying Proxy Statement carefully and tosign, date and promptly return the enclosed proxy so that your shares may be voted in accordance with your wishes and the presence of a quorum may be assured. The giving of a proxy does not affect your right to vote in person in the event you attend the Annual Meeting. Any stockholder who executes such a proxy may revoke it at any time before it is exercised.

| By Order of the Board of Directors |

| |

| Herbert H. Works, Secretary |

Crestview Hills, Kentucky

March 16, 2012

THE BANK OF KENTUCKY FINANCIAL CORPORATION

111 Lookout Farm Drive

Crestview Hills, Kentucky 41017

(859) 371-2340

PROXY STATEMENT

The Board of Directors of The Bank of Kentucky Financial Corporation, a Kentucky corporation (“BKFC”), is soliciting your proxy on the proxy card enclosed with this Proxy Statement. Your proxy will be voted at the 2012 Annual Meeting of Stockholders of BKFC to be held at the Hilton Cincinnati Airport, 7373 Turfway Road, Florence, Kentucky 41042, on April 20, 2012, at 5:00 p.m., Eastern Daylight Saving Time, and at any adjournment or postponement thereof (the “Annual Meeting”). The shares represented by the proxies received, properly dated and executed and not revoked will be voted at the Annual Meeting in accordance with the instructions of the stockholders. A proxy may be revoked at any time before it is exercised by:

| · | delivering a written notice of revocation to BKFC, Attention: Secretary; |

| · | delivering a duly executed proxy bearing a later date to BKFC; or |

| · | attending the Annual Meeting and voting in person. |

Proxies may be solicited by the directors, officers and other employees of BKFC in person or by telephone, telecopy, telegraph or mail without additional compensation. The cost of soliciting proxies will be borne by BKFC.

This Proxy Statement is first being mailed to stockholders of BKFC on or about March 19, 2012. This Proxy Statement and a sample of the form of proxy card sent to stockholders by BKFC are available at:https://www.bankofky.com/investor-relations/annual-report.aspx

VOTING SECURITIES

Only stockholders of record as of 5:00 p.m., Eastern Daylight Saving Time on March 2, 2012, which is the “Record Date,” will be entitled to vote at the Annual Meeting and will be entitled to cast one vote for each common share of BKFC (each “Share”) owned. BKFC’s records disclose that, as of the Record Date, there were 7,451,035 votes entitled to be cast at the Annual Meeting.

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspector of election (the “Inspector”) with the assistance of BKFC’s transfer agent. The Inspector will also determine whether or not a quorum is present. The presence, in person or by proxy, of a majority of the issued and outstanding Shares entitled to vote at the Annual Meeting is necessary to establish a quorum at the Annual Meeting. Abstentions and broker non-votes (“Non-Votes”) will be counted by the Inspector for purposes of determining the presence or absence of a quorum, but are not counted as votes cast at the meeting. Abstentions occur when the authority to vote on any particular matter submitted to the stockholders for a vote is withheld. Non-Votes occur when brokers who hold their customers’ shares in street name submit proxies for such shares on some matters, but not others. Generally, this would occur when brokers have not received any instructions from their customers. In these cases, the brokers, as the holders of record, are permitted to vote on “routine” matters, which typically include the ratification of the independent registered public accounting firm, but not on non-routine matters. Brokers are not permitted to vote on the election of directors without instructions from their customers.

Each properly executed proxy received prior to the Annual Meeting and not revoked will be voted as specified thereon or, in the absence of specific instructions to the contrary, will be voted:

FOR the election of Charles M. Berger, John S. Cain, Harry J. Humpert, Barry G. Kienzle, John E. Miracle, Mary Sue Rudicill, Ruth M. Seligman-Doering, Herbert H. Works and Robert W. Zapp as directors of BKFC for terms expiring in 2013;

FOR the ratification of the selection of Crowe Horwath LLP (“Crowe Horwath”) as the independent registered public accounting firm of BKFC for the current fiscal year;

FOR the approval, on a non-binding, advisory basis, of the compensation of BKFC’s executive officers;

FOR a vote of “one year” for the vote, on a non-binding, advisory basis, on the frequency of future advisory votes on executive compensation; and

FOR the adoption of BKFC’s 2012 Stock Incentive Plan.

The Board of Directors recommends a vote “FOR” each of these proposals.

VOTE REQUIRED

Election of Directors

At the Annual Meeting, nine directors are to be elected for terms expiring in 2013. The nine nominees receiving the greatest number of votes will be elected as directors of BKFC for terms expiring in 2013. Broker Non-Votes and abstentions are not counted toward the election of directors or toward the election of the individual nominees specified on the proxy. Because the election of directors has been determined to be a “non-routine” matter, the ability of your bank or broker to vote a Non-Vote in the election of directors on a discretionary basis is not permitted.Thus, if you hold your Shares in street name and you do not instruct your bank or broker how to vote in the election of directors, your Shares will be considered Non-Votes and no votes will be cast on your behalf with respect to the election of directors.

Ratification of Selection of Independent Registered Public Accounting Firm

The affirmative vote of the holders of a majority of the votes cast in person or by proxy at the Annual Meeting is necessary to ratify the selection of Crowe Horwath as the independent registered public accounting firm of BKFC for the current fiscal year. An abstention is not counted toward the ratification of the selection of Crowe Horwath as the independent registered public accounting firm, and the effect of an abstention is the same as a vote “against” the ratification. With respect to Non-Votes relating to the ratification of the selection of Crowe Horwath as the independent registered public accounting firm, such person’s Shares will be voted FOR the ratification of the selection of Crowe Horwath as the independent registered public accounting firm and will not be considered Non-Votes because the ratification of auditors has been determined to be a “routine” matter upon which your bank or broker has the authority to vote uninstructed Shares.

Advisory Vote on Executive Compensation

The affirmative vote of the holders of a majority of the votes cast in person or by proxy at the Annual Meeting is necessary to approve, on a non-binding, advisory basis, the proposal regarding the compensation of BKFC’s executive officers. Non-Votes and abstentions are not counted toward the non-binding, advisory vote regarding the compensation of BKFC’s executive officers. Thus, the effect of an abstention or a Non-Vote is the same as an “against” vote.

Advisory Vote on the Frequency of the Advisory Vote on Executive Compensation

The vote, on a non-binding, advisory basis, on the frequency of the advisory vote to approve BKFC’s executive compensation program will be determined by a plurality of votes cast. Non-Votes and abstentions are not counted toward the non-binding, advisory proposal regarding the frequency of the advisory vote on BKFC’s executive compensation program.

Adoption of the 2012 Stock Incentive Plan

The affirmative vote of the holders of a majority of the votes cast in person or by proxy at the Annual Meeting is required to approve the proposal to adopt the 2012 Stock Incentive Plan. Non-Votes and abstentions are not counted toward the vote to approve the 2012 Stock Incentive Plan. Thus, the effect of an abstention or a Non-Vote is the same as an “against” vote.

CORPORATE GOVERNANCE

BKFC periodically reviews its corporate governance policies and procedures to ensure that it reports results with accuracy and transparency and maintains compliance with the laws, rules and regulations that govern the operation of BKFC and its wholly-owned subsidiary, The Bank of Kentucky, Inc. (the “Bank”). As part of this periodic corporate governance review, the Board of Directors reviews and adopts corporate governance policies and practices for BKFC, as appropriate.

Code of Ethics

All BKFC and Bank employees and directors, including BKFC’s principal executive officer, principal financial officer and principal accounting officer or persons performing similar functions, are required to abide by the Bank’s Code of Ethics (the “Code of Ethics”). Accordingly, BKFC does not maintain a separate code of ethics applicable solely to its principal executive officer, principal financial officer and/or its principal accounting officer or persons performing similar functions. The BKFC Board of Directors believes that this Code of Ethics substantially conforms to the code of ethics required by the rules and regulations of the Securities and Exchange Commission (the “SEC”). The Code of Ethics requires that the Bank’s directors, executive officers and employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in the Bank’s best interest. Under the terms of the Code of Ethics, directors, executive officers and employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the Code of Ethics.

BKFC will provide a copy of the Code of Ethics without charge to any person upon written request to BKFC at its principal executive office at 111 Lookout Farm Drive, Crestview Hills, Kentucky 41017, Attention: President.

The Board of Directors - Leadership Structure

BKFC’s leadership structure is currently organized such that the positions of Chairman of the Board of Directors and the President and Chief Executive Officer (“CEO”) (the principal executive officer) of BKFC are filled by two different persons (currently Mr. Rodney S. Cain and Mr. Robert W. Zapp, respectively). Under BKFC’s Bylaws, the Chairman of the Board presides at all meetings of the stockholders and of the Board of Directors and is authorized to sign records thereof. In contrast, under BKFC’s Bylaws, the President and CEO’s actions remain subject to the control of the Board of Directors. The President and CEO’s duties include general supervision and control of all of the business and affairs of BKFC, as well as the authority to sign deeds, mortgages, bonds, contracts or other instruments which the Board of Directors has authorized to be executed (unless the Board of Directors expressly designates otherwise). However, in the absence of the Chairman of the Board, the President and CEO is authorized to perform all of the duties of the Chairman of the Board. BKFC’s Bylaws do not expressly prohibit the same person from serving as both Chairman of the Board and President and CEO. Although Mr. Rodney S. Cain is a significant stockholder of BKFC, owning approximately 10.7% of the outstanding Shares of BKFC, the Board believes that in his capacity as Chairman he is able to provide sufficient oversight of BKFC management, enabling the President and CEO to focus on leading the day-to-day operations of BKFC and allowing the Chairman to lead the entire Board in overall strategy decisions and corporate governance. On January 20, 2012, Mr. Rodney S. Cain provided notice of his intention not to stand for re-election to the Board of Directors of BKFC and the Bank when his current term expires at the Annual Meeting. Therefore, after the Annual Meeting when Mr. Rodney S. Cain’s term expires, the Board of Directors will consider the appointment of a new Chairman.

The Board of Directors - Risk Management

Oversight of risk management is central to the role of the Board of Directors. Currently, BKFC’s Audit Committee has primary responsibility for overseeing BKFC’s risk management processes, including those relating to litigation and compliance risk, on behalf of the full Board of Directors. The Audit Committee evaluates BKFC’s risk assessment and risk management policies and inquires about significant risks and exposures, if any, and the steps taken to monitor and minimize such risks. The Compensation Committee is chiefly responsible for compensation-related risks. The report of the Compensation Committee is set forth in this Proxy Statement under the heading “Compensation Committee Report on Executive and Employee Compensation” below. The committees also receive regular reports from management regarding BKFC’s risks and report regularly to the full Board of Directors concerning risk. In accordance with applicable SEC rules, the Compensation Committee conducts a risk based assessment of the BKFC compensation plans, policies and practices to determine whether such plans, policies and practices create risks that are reasonably likely to have a material adverse effect on BKFC. Based on this assessment, the Compensation Committee has concluded that the BKFC compensation plans, policies and practices do not create risks that are reasonably likely to have a material adverse effect on BKFC. As part of its assessment, the Compensation Committee evaluated BKFC’s compensation plans and programs to determine their propensity to cause undue risk taking by employees, including senior executive officers, relative to the level of risk associated with BKFC’s business model and operations. The Compensation Committee believes that BKFC does not use highly leveraged short-term incentives that encourage high risk behavior at the expense or detriment of long-term value and which are reasonably likely to create a material adverse effect. The Compensation Committee completed its assessment in 2011 as part of its obligation to oversee the compensation risk assessment process for BKFC.

The Board of Directors - Independence

The Board of Directors has determined that each director, other than Robert W. Zapp, is independent within the meaning of Rule 5605(a)(2) of the NASDAQ Stock Market (“NASDAQ”). In making this determination, the Board of Directors was aware of and considered the loan and deposit relationships with directors and their related interests which the Bank enters into in the ordinary course of its business, and the lease and other arrangements which are disclosed under “Certain Relationships and Related Transactions” in this Proxy Statement. Mr. Rodney S. Cain’s independence was not evaluated due to his decision not to stand for re-election; however, last year’s evaluation determined that Mr. Rodney S. Cain was not independent.

Meetings and Committees of the Board of Directors

The Board of Directors of BKFC met 12 times for regularly scheduled and special meetings during the fiscal year ended December 31, 2011. The Board of Directors of the Bank also met 12 times for regularly scheduled and special meetings during the fiscal year ended December 31, 2011. Each director attended at least 75% of the aggregate of the total meetings of the Boards of Directors and the total meetings of the committees on which he or she served.

Compensation Committee

The Compensation Committee of BKFC consisted of Dr. Miracle, Mr. Works and Ms. Rudicill in 2011, each of whom was “independent” as that term is defined in NASDAQ Rule 5605(a)(2). The Compensation Committee met 4 times in 2011. The Compensation Committee has a written charter, which is filed herewith. The Compensation Committee of BKFC also serves as the Compensation Committee for the Bank.

The Compensation Committee is responsible for making recommendations to the Board of Directors regarding compensation, options and incentive compensation awards and plans, and other forms of compensation for the President and CEO and the Treasurer and Assistant Secretary as described in this Proxy Statement. The Compensation Committee makes its recommendations to the Board of Directors, which has final approval of the compensation package for the President and CEO and the Treasurer and Assistant Secretary. Further, the President and CEO makes recommendations to the Compensation Committee regarding the compensation of the Treasurer and Assistant Secretary, subject to the Board of Directors’ final approval of the compensation package for the Treasurer and Assistant Secretary. Mr. Rodney S. Cain and Mr. Works are members of the Board of Directors and receive no compensation for serving as officers of BKFC, but receive the same compensation as other members of the Board of Directors. To date, no compensation consultant has been engaged by the Compensation Committee, Board of Directors or management to assist with establishing executive compensation. The Compensation Committee also prepares the Compensation Committee Report for inclusion in the BKFC Proxy Statement. The report of the Compensation Committee is set forth in this Proxy Statement under the heading “Compensation Committee Report on Executive and Employee Compensation.”

Audit Committee

The Audit Committee of BKFC consisted of Messrs. Humpert and Kienzle and Ms. Rudicill in 2011, each of whom was “independent” as that term is defined in NASDAQ Rule 5605(a)(2) and met the criteria for independence set forth in Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has determined that each Audit Committee member is financially literate and has determined that Mr. Kienzle is an “audit committee financial expert” as defined under SEC rules and regulations by virtue of his background and experience, as described in his biography under the heading “Proposal No. 1: Election of Directors.” The Audit Committee met 16 times in 2011. The Audit Committee of BKFC also serves as the Audit Committee for the Bank. The responsibilities of the Audit Committee include the following:

| · | retaining an independent registered public accounting firm to conduct the annual audit of BKFC’s consolidated financial statements and internal control over financial reporting; |

| · | reviewing the proposed scope of the audits of the independent registered public accounting firm and BKFC’s internal auditors; |

| · | reviewing the results of the audits performed by the independent registered public accounting firm and BKFC’s internal auditors; |

| · | reviewing BKFC’s accounting and financial controls with the independent registered public accounting firm and BKFC’s internal audit, financial and accounting staff; |

| · | overseeing the accounting and financial reporting processes of BKFC and its subsidiary; |

| · | instituting procedures for the receipt, retention and treatment of complaints received by BKFC regarding accounting, internal accounting controls or auditing matters; and |

| · | assisting the Board of Directors in the oversight of: |

| · | the integrity of BKFC’s consolidated financial statements and the effectiveness of BKFC’s internal control over financial reporting; |

| · | the performance of BKFC’s independent registered public accounting firm and internal auditors; |

| · | the independent registered public accounting firm’s and internal auditors’ qualifications and independence; and |

| · | the legal compliance and ethics programs established by management and the full Board of Directors. |

The Audit Committee will also carry out any other responsibilities delegated to the Audit Committee by the full Board of Directors. The report of the Audit Committee required by the rules of the SEC is included in this Proxy Statement. See “Proposal No. 2: Ratification of Independent Registered Public Accounting Firm — Audit Committee Report.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of BKFC, which was formed on August 19, 2011, consisted of Dr. Miracle, Ms. Seligman-Doering and Messrs. Humpert, Kienzle and Berger in 2011, each of whom was “independent” as that term is defined in NASDAQ Rule 5605(a)(2). The Nominating and Corporate Governance Committee met one time after being formed in August of 2011. The Nominating and Corporate Governance Committee has a written charter, which is filed herewith. The Nominating and Corporate Governance Committee of BKFC also serves as the Nominating and Corporate Governance Committee for the Bank.

Prior to August 19, 2011, BKFC did not have a committee performing the function of a nominating committee. The nominating process and the selection of persons to serve as members of the Board of Directors was carried out in accordance with NASDAQ listing standards and certain director nomination procedures adopted by the Board of Directors in September 2008. These procedures required that the independent members of the Board of Directors (the “Independent Directors”) evaluate the desirability of, and recommend to, the full Board of Directors any changes in the size and composition of the Board of Directors.

The Nominating and Corporate Governance Committee, taking over the duties of the Independent Directors, is responsible for identifying qualified candidates to become members of the Board of Directors, selecting nominees to be considered as candidates and advising the Board of Directors of the nominees recommended to stand for election as directors, recommending any candidates to fill vacancies, recommending nominees to serve on each committee of the Board of Directors and developing and recommending to the Board of Directors a set of corporate governance guidelines and principles applicable to BKFC and its subsidiaries and providing oversight and review with respect to such matters. The Nominating and Corporate Governance Committee also evaluates the size and composition of the Board of Directors, reviews and amends the authority given to each committee of the Board of Directors and retains and terminates, as appropriate, any search firm used to identify director candidates.

Director Nomination Process

In its deliberations, the Nominating and Corporate Governance Committee considers, among other things, the candidate’s judgment, skill, experience with other organizations of comparable purpose, complexity and size, as well as demonstrated leadership skills, the need for independence and involvement in community, business and civic affairs. While the Nominating and Corporate Governance Committee does not have a formal policy with regard to the consideration of diversity in identifying director nominee candidates, the nomination procedures adopted by the Board of Directors and contained in the Nominating and Corporate Governance Committee’s charter requires that the Nominating and Corporate Governance Committee evaluate a broad array of criteria, as well as the overall mix of such criteria, when considering director nominees. The Nominating and Corporate Governance Committee considers a wide range of viewpoints, backgrounds, skills and experience in identifying director nominee candidates.

Any nominee for director chosen by the Board of Directors, upon the recommendation of the Nominating and Corporate Governance Committee, must be highly qualified with regard to some or all the attributes listed above. In searching for qualified director candidates to fill vacancies, the Board of Directors and Nominating and Corporate Governance Committee solicits its then current directors for the names of potential qualified candidates. Moreover, the Board of Directors may ask its directors to pursue their own business contacts for the names of potential qualified candidates. The Nominating and Corporate Governance Committee would then consider the potential pool of director candidates, select the top candidate based on the candidates’ qualifications and the Board of Directors’ needs and conduct a thorough investigation of the proposed candidate’s background to ensure there is no past history that would cause the candidate not to be qualified to serve as a director of BKFC.

BKFC’s By-Laws set forth procedures that must be followed by stockholders seeking to make nominations for directors. In accordance with Section 3.3 of the By-Laws, nominees for election as directors may be proposed only by the directors or by a stockholder entitled to vote for directors if such stockholder has submitted a written nomination to the Secretary of BKFC by the later of the November 30th immediately preceding the annual meeting of stockholders or the sixtieth day before the first anniversary of the most recent annual meeting of stockholders held for the election of directors (unless the annual meeting is not held on or before the thirty-first day following such anniversary, in which case such written notice must be submitted no later than the close of business on the seventh day following the day on which the notice of the annual meeting is mailed to stockholders). Each such written nomination must state the name, age, business or residence address of the nominee, principal occupation or employment of the nominee, number of Shares owned either beneficially or of record by each such nominee and length of time such Shares have been owned. In the event a stockholder has submitted a proposed nominee, the Board of Directors and the Nominating and Corporate Governance Committee would consider the proposed nominee, along with any other proposed nominees recommended by individual directors, in the same manner in which the Board of Directors and the Nominating and Corporate Governance Committee would evaluate nominees for director recommended by the Board of Directors.

Compensation Committee Interlocks and Insider Participation

Dr. Miracle, Mr. Works and Ms. Rudicill serve on the Compensation Committee. None of the members of the Compensation Committee are, or have been, an employee or officer of BKFC or the Bank, other than Mr. Works who serves as Secretary but receives no compensation for his role as Secretary. During fiscal year 2011, no member of the Compensation Committee had any relationship with BKFC or the Bank requiring disclosure under Item 404 of Regulation S-K. None of the executive officers serves on the board of directors or compensation committee of a company that has an executive officer serving on BKFC’s Board of Directors or Compensation Committee.

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of BKFC’s Shares as of March 16, 2012 by:

| · | any person who is known to BKFC to own beneficially more than 5% of BKFC’s Shares; |

| · | each of BKFC’s directors; |

| · | the Chief Executive Officer and Treasurer of BKFC (together, the “Named Executive Officers,” as there were no other “executive officers” as defined by SEC regulation who received a total annual compensation package in excess of $100,000 for fiscal year 2011); and |

| · | all current Named Executive Officers and directors as a group. |

All Shares are owned with sole voting and investment power by each person listed, unless otherwise indicated by a footnote. The Shares subject to options currently exercisable or exercisable within 60 days of March 15, 2012 are deemed outstanding for calculating the percentage of outstanding Shares of the person holding those options, but are not deemed outstanding for calculating the percentage of any other person. The address of each beneficial owner is c/o BKFC, at 111 Lookout Farm Drive, Crestview Hills, Kentucky 41017, unless otherwise indicated by footnote. As of March 16, 2012, there were 7,451,035 Shares outstanding, each Share entitled to one vote.

| Name and Address | | | Amount and

Nature of

Beneficial

Ownership | | | | Percentage of

Shares

Outstanding | |

| Directors & Executive Officers | | | | | | | | |

| Charles M. Berger | | | 43,243 | (1) | | | * | |

| Rodney S. Cain | | | 797,822 | (2) | | | 10.70 | % |

| John S. Cain | | | 83,808 | (3) | | | 1.12 | % |

| Harry J. Humpert | | | 41,703 | (4) | | | * | |

| Barry G. Kienzle | | | 16,080 | (5) | | | * | |

| John E. Miracle | | | 163,084 | (6) | | | 2.19 | % |

| Mary Sue Rudicill | | | 80,680 | (7) | | | 1.08 | % |

| Ruth M. Seligman-Doering | | | 114,080 | (8) | | | 1.53 | % |

| Herbert H. Works | | | 39,615 | (9) | | | * | |

| Robert W. Zapp | | | 204,636 | (10) | | | 2.73 | % |

| Martin J Gerrety | | | 19,896 | (11) | | | * | |

| | | | | | | | | |

| All directors, nominees and executive officers of BKFC as a group (10 persons) | | | 1,604,647 | | | | 21.26 | % |

| | | | | | | | | |

| Beneficial Owners Holding More than 5% | | | | | | | | |

| The R.C. Durr Foundation Inc.(12) | | | 538,000 | | | | 7.22 | % |

| Wellington Management Company, LLP(13) | | | 590,122 | | | | 7.92 | % |

____________

| (1) | Includes 3,628 Shares held jointly by Mr. Berger and his spouse; 6,709 Shares held by Mr. Berger’s spouse; 15,000 Shares held by Berger-Collins L.L.C., of which Mr. Berger is the managing member; and 6,000 Shares that may be acquired upon the exercise of options. |

| (2) | Includes 791,822 Shares owned jointly by Mr. Rodney S. Cain and his spouse and 6,000 Shares that may be acquired upon the exercise of options. This information is based on a Schedule 13G filed by Mr. Rodney S. Cain on February 7, 2012. |

| (3) | Includes 35,072 Shares held in trusts for each of Mr. John Cain’s children and 40,703 Shares held in joint tenancy with his wife. 15,040 shares are held as collateral for a loan from the Bank. |

| (4) | Includes 15,798 Shares owned by Mr. Humpert’s wife and 4,500 Shares that may be acquired upon the exercise of options. |

| (5) | Includes 3,785 Shares owned by Mr. Kienzle’s spouse and 4,500 Shares that may be acquired upon the exercise of options. |

| (6) | Includes 35,996 Shares owned by Dr. Miracle’s spouse; 4,225 Shares owned jointly by Dr. Miracle and his wife; 1,093 Shares owned by Dr. Miracle’s grandchild; and 6,000 Shares that may be acquired upon the exercise of options. |

| (7) | Includes 10,740 Shares owned jointly by Ms. Rudicill and her spouse; 13,500 Shares owned by Belleview Sand and Gravel, Inc., of which Ms. Rudicill is Chairman and which is owned by Ms. Rudicill and her spouse; and 6,000 Shares that may be acquired upon the exercise of options. |

| (8) | Includes 1,251 Shares held in trust, of which Ms. Seligman-Doering is the trustee, and 6,000 Shares that may be acquired upon the exercise of options. |

| (9) | Includes 2,000 Shares owned by Boone-Kenton Lumber, of which Mr. Works is the President and owner, and 6,000 Shares that may be acquired upon the exercise of options. |

| (10) | Includes 43,715 Shares owned jointly by Mr. Zapp and his spouse; 2,748 Shares held by Mr. Zapp’s spouse as custodian for Mr. Zapp’s daughter; 40,377 Shares owned by Mr. Zapp’s spouse; and 34,930 Shares that may be acquired upon the exercise of options. |

| (11) | Includes 3,366 Shares held by Mr. Gerrety’s spouse and 15,980 Shares that may be acquired upon the exercise of options. |

| (12) | This information is based on a Schedule 13G filed by The R.C. Durr Foundation Inc. (the “Foundation”) on February 7, 2012. The Foundation has sole voting power of all of the shares. The address of the Foundation is 541 Buttermilk Pike, Suite 544, Covington, Kentucky 41017. |

| (13) | This information is based on a Schedule 13G filed by Wellington Management Company, LLP (“Wellington Management”) on February 14, 2012. As of February 14, 2012, Wellington Management shared dispositive power over 590,122 of these Shares and shared voting power over 560,627 of these Shares. Wellington Management, in its capacity as investment adviser, may be deemed to beneficially own 590,122 Shares which are held of record by clients of Wellington Management. The address for Wellington Management is 280 Congress Street, Boston, MA 02210. |

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Nine directors, representing all of the current directors of BKFC, except for Mr. Rodney S. Cain who has elected not to run for re-election as disclosed on a Form 8-K filed with the SEC on January 25, 2012, are to be elected at the Annual Meeting to serve until the annual meeting of stockholders in 2013 or until their respective successors are elected or appointed. The terms of all of BKFC’s directors will expire immediately prior to the election of directors at this Annual Meeting.

If any nominee is unable to stand for election, the proxies will be voted for such substitute as the Board of Directors recommends. As of the date of mailing this Proxy Statement, the Board of Directors knows of no reason why any nominee would be unable to serve if elected. On January 20, 2012, Mr. Rodney S. Cain, the current Chairman of the Board, informed the Board of Directors of BKFC that he does not intend to stand for re-election after his term expires at the Annual Meeting. Although the Board of Directors intends to elect a new Chairman to fill the vacancy that will be left by Mr. Rodney S. Cain, such determination has not been made. As a result of Mr. Cain’s intention not to stand for re-election, the size of the Board will be reduced to nine.

Information regarding the nominees for election and continuing directors is provided below. The age indicated for each individual is as of March 15, 2012. Unless otherwise stated, the indicated period of service as a director includes service as a director of the Bank. There are no family relationships among directors or executive officers of BKFC other than the relationship between John and Rodney S. Cain. John S. Cain, a member of the Board of Directors of both BKFC and the Bank, is the son of Rodney S. Cain, the current Chairman of the Board of Directors of both BKFC and the Bank. Each nominee to the Board of Directors was recommended by the Nominating and Corporate Governance Committee and approved by the Board of Directors.

Nominees for the Board of Directors

| Name | Age | Position(s) Held |

| Charles M. Berger | 59 | Director |

| John S. Cain | 48 | Director |

| Harry J. Humpert | 86 | Director |

| Barry G. Kienzle | 60 | Director |

| John E. Miracle | 69 | Director |

| Mary Sue Rudicill | 68 | Director |

| Ruth M. Seligman-Doering | 71 | Director |

| Herbert H. Works | 83 | Secretary and Director |

| Robert W. Zapp | 60 | President, CEO and Director |

Charles M. Berger has served as a director of both BKFC and the Bank since April 2002. He currently is chair of the Nominating and Corporate Governance Committee and serves as a member of the Executive, Trust and IT Committees of the Bank. Since 1975, Mr. Berger has been employed by Chas. H. Biltz Insurance Agency, Inc., an independent insurance agency based in Covington, Kentucky that offers commercial and personal insurance products and solutions and employee benefits services, and has served as its President since 1994. In such capacity, Mr. Berger has extensive experience in the financial services industry, overseeing the day-to-day operations of the Chas. H. Biltz Insurance Agency and its 28 employees in representing national and regional insurance carriers in offering a variety of products and services. He received his Bachelor of Science degree in business from Northern Kentucky University in 1975. As a result of these and other professional experiences, the Board of Directors has concluded that Mr. Berger should serve as a director because of his general business, risk management, finance and accounting, compliance, corporate governance and entrepreneurial experience, as well as his experience in the financial services industry and corporate management experience and skills.

John S. Cain has served as a director of both BKFC and the Bank since August 2010 and is a member of the IT Committee of the Bank. Mr. John Cain is the President of Wiseway Supply, a privately held electrical, plumbing and lighting supplies company based in Florence, Kentucky, and, as President, has been responsible for the day-to-day operations and strategic decisions of the family business since 1994. In 2011, Mr. John S. Cain co-founded and serves on the Board of Managers and Credit Committee for Alliance Business Lending, LLC, an asset-based lender. Prior to that, Mr. John Cain was an internal auditor and financial analyst for Procter & Gamble Company. He obtained his undergraduate degree from the University of Kentucky in 1986 and received his Juris Doctor from Northern Kentucky University in 1993. Raised in Kentucky, Mr. John Cain is heavily involved in the community, contributing his talents to many local organizations. He currently serves on the Board of Directors for Governor’s Scholars, is past Chair of the Northern Kentucky Chamber of Commerce and is a current member of Tri-County Economic Development Corporation. Mr. John Cain was chosen to be a director due to his community leadership, management skills and entrepreneurial experiences. Mr. John Cain brings to our board in-depth knowledge and experiences with various members of the community, his expertise on financial matters, as well as a perspective on making decisions necessary for growth and success.

Harry J. Humpert has served as a director of BKFC and the Bank since 1995, is currently the Chair of the Community Reinvestment Act (“CRA”) Committee of the Bank, and serves as a member of the Nominating and Corporate Governance, Executive and Audit Committees of the Bank and BKFC. Mr. Humpert is the President of Humpert Enterprises, Inc., a company that operates Klingenberg’s Hardware and Paint in Covington, Kentucky and has been employed by that company for the last 50 years. Mr. Humpert served as chairman of the board of directors of Burnett Savings Bank in Covington, Kentucky until the institution was purchased by the Bank of Kentucky in 1995. He received his Bachelor of Science degree in business administration from the University of Dayton. As a result of these and other professional experiences, the Board of Directors has concluded that Mr. Humpert should serve as a director because of his corporate management skills and experience, his experience in the financial services industry, as well as his general business, sales, good judgment and integrity, and entrepreneurial experience.

Barry G. Kienzle was appointed by the Board of Directors in February 2007, and is currently the Chair of the Audit Committee of both BKFC and the Bank and serves as a member of the Nominating and Corporate Governance Committee. Mr. Kienzle also serves as a member of the Trust Committee and IT Committee of the Bank. Since 1987, Mr. Kienzle has been employed as the Senior Vice President and Chief Financial Officer (“CFO”) of Paul Hemmer Companies, a real estate development and construction firm based in Fort Mitchell, Kentucky. Mr. Kienzle is also a member of the board of directors of the Paul Hemmer Company and serves as a director for affiliated entities Paul Hemmer Development Co. III and Paul Hemmer Development Co IV. Mr. Kienzle is a member of the Ohio Society of CPAs and the American Institute of CPAs and maintains an inactive Ohio CPA license. As a result of these and other professional experiences, the Board of Directors has concluded that Mr. Kienzle should serve as a director because of his general business, finance and accounting, audit, compliance, corporate governance and corporate management experience, as well as his experience in the real estate industry. Mr. Kienzle’s experience as a CFO provides him with an in-depth understanding of generally accepted accounting principles and the application of such principles to various accounting estimates, accruals and reserves.

John E. Miracle, D.M.D., has served as a director of BKFC since its inception in 1994 and of the Bank since 1991. He is currently a member of the Compensation and Nominating and Corporate Governance Committees for BKFC and the Trust Committee for the Bank. Dr. Miracle had a private dental practice for 30 years and retired from practice in September 1999. As a result of these and other professional experiences, the Board of Directors has concluded that Dr. Miracle should serve as a director because of his general business and entrepreneurial experience. Through his long-term service on the Board of Directors of BKFC and the Bank, Dr. Miracle brings to our Board an in-depth knowledge of the business of the Bank and BKFC.

Mary Sue Rudicill has served as a director of BKFC since its inception in 1994 and of the Bank since 1991 and is presently a member of the BKFC Audit and Compensation Committees. She is also a member of the Audit, CRA and Compliance Committees of the Bank. Ms. Rudicill has a background in accounting and finance, serving as an auditor and a member of the board of directors of Boone State Bank & Trust Company from 1971 to 1986. Ms. Rudicill is presently, and has served for the past 17 years as, the Chairperson of Belleview Sand and Gravel, Inc. and Gravelview Trucking Company, family owned businesses based in Burlington, Kentucky that supply sand, gravel, concrete, aggregates and masonry products throughout northern Kentucky. As Chairperson, Ms. Rudicill oversees all aspects of the business, finance and operations of Belleview Sand and Gravel, Inc. and Gravelview Trucking Company, which have a total of 20 employees. As a result of these and other professional experiences, including the experience and skills acquired by Ms. Rudicill during her long-term service on the boards of directors of financial services institutions, the Board of Directors has concluded that Ms. Rudicill should serve as a director because of her corporate management skills and experience, as well as her general business, sales, corporate governance, accounting and finance, audit and entrepreneurial experience.

Ruth M. Seligman-Doering has served as a director of BKFC since its inception in 1994 and of the Bank since its inception in 1990 and is presently a member of the Nominating and Corporate Governance Committee of BKFC, chair of the Trust Committee of the Bank and a member of the CRA and IT Committees of the Bank. Ms. Seligman-Doering is director of Charles Seligman Distributing Company, Inc., a family owned beverage wholesaler and distributor based in Walton, Kentucky and has also been its President and CEO since 1992, overseeing all aspects of its day-to-day operations and approximately 125 employees. As a result of these and other professional experiences, the Board of Directors has concluded that Ms. Seligman-Doering should serve as a director because of her corporate management skills and experience, as well as her general business, sales, corporate governance and entrepreneurial experience.

Herbert H. Works has served as a director of BKFC since its inception in 1994 and a director of the Bank since 1992. Since 2003, Mr. Works has served as the Secretary of both BKFC and the Bank, and he currently serves as a member of the Compensation Committee of BKFC and as a member of the Executive and IT Committees of the Bank. Mr. Works is the President of Boone-Kenton Lumber Company, located in Erlanger, Kentucky, which provides lumber and related products and services for the building industry. Mr. Works has been employed by that company for the last 27 years where he has overseen all aspects of its business and operations. As a result of these and other professional experiences, including the experience and skills acquired by Mr. Works during his service as Secretary of BKFC, the Board of Directors has concluded that Mr. Works should serve as a director because of his general business, corporate management, sales and entrepreneurial experience.

Robert W. Zapp has served as a director of BKFC since its inception in 1994 and a director of the Bank since its inception in 1990. Mr. Zapp is the President and CEO of the Bank and BKFC and has served in that capacity since each of their inceptions. Prior to that, Mr. Zapp was the President of Fifth Third Bank of Kenton County, formerly Security Bank, and resigned as President of such institution in order to participate in the organization of the Bank. Prior to that, Mr. Zapp served as the Executive Vice President over lending and on the board of directors for Boone State Bank in northern Kentucky. As a result of these and other professional experiences, including the experience and skills acquired by Mr. Zapp during his service in various management positions within BKFC and the Bank, as well as his extensive experience in the financial services industry, the Board of Directors has concluded that Mr. Zapp should serve as a director because of his general business, risk management, corporate governance, corporate management, bank regulatory, legal and public company experience.

Recommendation of the Board of Directors

The Board of Directors recommends a vote “FOR” the election of all nominees named above.

PROPOSAL NO. 2: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors has selected Crowe Horwath as the independent registered public accounting firm of BKFC and the Bank for the current fiscal year. Crowe Horwath has been the auditor of BKFC since 1995. In the event that ratification of this selection of the independent registered public accounting firm is not approved by a majority of the Shares voting thereon, the Audit Committee will review its future selection of auditors.

Management expects that a representative of Crowe Horwath will be present at the Annual Meeting, will have the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Required Vote

The affirmative vote of the holders of a majority of the votes cast in person or by proxy at the Annual Meeting is necessary to ratify the selection of Crowe Horwath as the independent registered public accounting firm of BKFC for the current fiscal year. The effect of an abstention or a Non-Vote is the same as an “against” vote. If, however, a stockholder has signed and dated a proxy in the form of the enclosed proxy, but has not voted on the ratification of the selection of Crowe Horwath as the independent registered public accounting firm by marking the appropriate box on the proxy, such person’s Shares will be voted FOR the ratification of the selection of Crowe Horwath as the independent registered public accounting firm and will not be considered Non-Votes.

Recommendation of the Board of Directors

The Board of Directors recommends a vote “FOR” the ratification of the selection of Crowe Horwath as the independent registered public accounting firm of BKFC for the current fiscal year.

Aggregate fees for professional services rendered for BKFC and the Bank by Crowe Horwath for the years ended December 31, 2011 and 2010 are described below. The Audit Committee charter adopted by the Board of Directors of BKFC establishes procedures with respect to the pre-approval by the Audit Committee of the engagement of accountants to render audit or non-audit services. The written charter of the Audit Committee is filed herewith. All auditing services and non-audit services provided by Crowe Horwath for the years ended December 31, 2011 and 2010 have been approved by the Audit Committee.

Audit Fees

The aggregate fees billed for professional services rendered for the audit of the BKFC annual consolidated financial statements as of and for the years ended December 31, 2011 and 2010, the audit of management’s assertion on internal control over financial reporting as of December 31, 2011 and 2010, and the reviews of the financial statements included in the BKFC Quarterly Reports on Form 10-Q filed during the fiscal years ended December 31, 2011 and 2010 were $282,705 and $313,575, respectively, which were paid or expected to be paid to Crowe Horwath. The 2011 and 2010 audit fees included required Housing and Urban Development audit and related examiner review of Crowe Horwath’s working papers. The 2011 audit fees included procedures associated with the registration of BKFC’s TARP warrants. The 2010 audit fees included procedures associated with BKFC’s underwritten common stock offering.

Audit-Related Fees

The aggregate fees billed to BKFC for assurance related services by Crowe Horwath for the fiscal year ended December 31, 2010 was $12,750. The 2010 fees included assistance with an SEC comment letter and consultation related to acquisition accounting. No audit-related fees were billed by Crowe Horwath for the fiscal year ended December 31, 2011.

Tax Fees

The aggregate fees billed for tax services by Crowe Horwath for the fiscal year ended December 31, 2010 was $500. No fees were billed by Crowe Horwath for tax services for the fiscal year ended December 31, 2011.

All Other Fees

No fees were billed by Crowe Horwath for any other professional services not otherwise described above for the fiscal years ended December 31, 2010 and 2011.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee is responsible for appointing and reviewing the work of the independent registered public accounting firm and setting the independent registered public accounting firm’s compensation. In accordance with its charter, the Audit Committee reviews and pre-approves all audit services and permitted non-audit services provided by the independent registered public accounting firm to BKFC or the Bank and ensures that the independent registered public accounting firm is not engaged to perform the specific non-audit services prohibited by law, rule or regulation. During the year ended December 31, 2011, all services were approved in advance by the Audit Committee in compliance with these procedures.

Audit Committee Report

BKFC’s management is responsible for BKFC’s internal control over financial reporting and for preparation of BKFC’s consolidated financial statements in accordance with generally accepted accounting principles. The independent registered public accounting firm is responsible for performing an independent audit of BKFC’s internal control over financial reporting and consolidated financial statements and issuing an opinion on the effectiveness of internal control over financial reporting and conformity of those financial statements with generally accepted accounting principles. The Audit Committee oversees BKFC’s internal control over financial reporting on behalf of the Board of Directors.

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that BKFC’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (“Communication With Audit Committees”), including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of the disclosures in the financial statements.

In addition, the Audit Committee has received written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the auditors’ independence from BKFC and its management. In concluding that the auditors are independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the auditors were compatible with its independence.

The Audit Committee discussed with BKFC’s independent registered public accounting firm the overall scope and plans for its audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of its audit, its evaluation of BKFC’s consolidated financial statements and internal control over financial reporting, and the overall quality of BKFC’s financial reporting process and required communications discussed above.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of BKFC’s management, which has the primary responsibility for the financial statements and reports, and of the independent auditors who, in their report, express an opinion on the conformity of BKFC’s financial statements to generally accepted accounting principles. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent auditors do not assure that BKFC’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of BKFC’s consolidated financial statements has been carried out in accordance with the standards of the Public Company Accounting Oversight Board or that BKFC’s independent auditors are in fact “independent.”

In reliance on the reviews and discussions referenced above, the Audit Committee recommends to the Board of Directors, and the Board has approved, that the audited consolidated financial statements be included in BKFC’s Annual Report on Form 10-K for the year ended December 31, 2011 for filing with the SEC. Subject to stockholder ratification, the Audit Committee has selected BKFC’s independent registered public accounting firm for the fiscal year ending December 31, 2012.

AUDIT COMMITTEE

Harry J. Humpert

Barry G. Kienzle

Mary Sue Rudicill

PROPOSAL NO. 3: ADVISORY VOTE ON EXECUTIVE COMPENSATION

As required by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), BKFC’s Board of Directors is providing stockholders with the opportunity to cast an advisory vote on its compensation program at the 2012 Annual Meeting. This vote will not be binding on or overrule any decisions by BKFC’s Board of Directors, will not create or imply any additional fiduciary duty on the part of the Board, and will not restrict or limit the ability of BKFC’s stockholders to make proposals for inclusion in proxy materials related to executive compensation. However, the Compensation Committee has taken, and will take, into account the outcome of the vote when considering future executive compensation arrangements.

Therefore, stockholders are being given the opportunity to vote on a non-binding, advisory resolution at the Annual Meeting to approve BKFC’s executive compensation policies and procedures as described below under “Compensation Discussion and Analysis” and tabular disclosure of Named Executive Officer compensation as described below under “Executive Compensation.” This proposal, commonly known as a “say-on-pay” proposal, gives stockholders the opportunity to endorse or not endorse BKFC’s executive pay program.

The objective of BKFC’s compensation policies and procedures is to retain and reward experienced, highly qualified executives critical to BKFC’s long-term success and to link their success to that of BKFC. The Board of Directors believes that BKFC’s compensation policies and procedures achieve this objective.

Resolution to be Approved

The holders of a majority of the votes cast in person or by proxy at the Annual Meeting are asked to approve the following resolution:

“Resolved, that the stockholders approve, on an advisory basis, the compensation of The Bank of Kentucky Financial Corporation’s executives as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission.”

This is an advisory vote only, and neither BKFC nor the Board of Directors will be bound to take action based upon the outcome. The Compensation Committee will consider the vote of the stockholders when considering future executive compensation arrangements.

Required Vote

The affirmative vote of the holders of a majority of the votes cast in person or by proxy at the Annual Meeting is necessary to approve the non-binding, advisory resolution relating to BKFC’s executive compensation policies and procedures. The effect of an abstention or a Non-Vote is the same as an “against” vote. If, however, a stockholder has signed and dated a proxy in the form of the enclosed proxy, but has not voted for the approval of the non-binding, advisory resolution relating to BKFC’s executive compensation policies and procedures by marking the appropriate box on the proxy, such person’s Shares will be voted FOR the approval of the non-binding, advisory resolution relating to BKFC’s executive compensation policies and procedures and will not be considered Non-Votes.

Recommendation of the Board of Directors

The Board of Directors recommends a vote “FOR” the approval of the non-binding, advisory resolution relating to BKFC’s executive compensation policies and procedures.

PROPOSAL NO. 4: ADVISORY VOTE ON THE FREQUENCY OF THE ADVISORY VOTE ON

EXECUTIVE COMPENSATION

The Dodd-Frank Act requires that publicly traded companies seek a non-binding stockholder vote on the frequency of the advisory stockholder vote to approve BKFC’s executive compensation program (as set forth in Proposal No. 3). The statutory alternatives on which the stockholders must vote for the frequency of the advisory vote on executive compensation are every one year, every two or every three years.

The Board of Directors values highly regular and frequent input from BKFC’s stockholders on important issues such as executive compensation. The Compensation Committee and Board of Directors evaluate and approve the compensation programs for executive officers annually, which are disclosed each year in the proxy statement. Accordingly, the Board of Directors recommends that the stockholders vote in favor of an annual advisory vote on executive compensation.

Resolution to be Approved

“Resolved, that the option of once every one year, two years or three years that receives the highest number of votes cast for this resolution will be determined to be the preferred frequency with which BKFC is to hold a stockholder vote to approve the compensation of the named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission.”

This is an advisory vote only, and neither BKFC nor the Board of Directors will be bound to take action based upon the outcome. The Compensation Committee will consider the vote of the stockholders when considering the frequency of the advisory vote on executive compensation arrangements.

Required Vote

The frequency for the advisory vote on executive compensation (that is, every one year, every two years or every three years) that receives the plurality vote of the Shares represented in person or proxy at the Annual Meeting will be the frequency recommended by the stockholders. If a stockholder has signed and dated a proxy in the form of the enclosed proxy, but has not voted for the frequency of the non-binding, advisory vote on BKFC’s executive compensation policies by marking the appropriate box on the proxy, such person’s Shares will be voted FOR the frequency of the non-binding, advisory vote on BKFC’s executive compensation to occur every year.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote in favor of an annual advisory vote to approve BKFC’s executive compensation program.

PROPOSAL NO. 5: APPROVAL OF 2012 STOCK INCENTIVE PLAN

The discussion that follows describes the material terms of the proposed 2012 Stock Incentive Plan, which we are asking our stockholders to approve. The summary is subject, in all respects, to the actual terms of the 2012 Stock Incentive Plan. The 2012 Stock Incentive Plan is summarized below and the full text of the 2012 Stock Incentive Plan is attached to this proxy statement asAppendix A. Because this is a summary, it may not contain all the information that may be important to you. You should readAppendix A carefully before you decide how to vote on this proposal.

On March 16, 2012, our Board of Directors adopted, subject to stockholder approval, the 2012 Stock Incentive Plan. The purpose of the 2012 Stock Incentive Plan is to assist BKFC in recruiting and retaining qualified employees, directors and independent contractors of BKFC and its affiliates and to align the interests of eligible 2012 Stock Incentive Plan participants with those of BKFC and its stockholders.

We currently award stock options under the 2007 Stock Option and Incentive Plan (the “2007 Stock Option Plan”). As of March 1, 2012, we had approximately 1,041,155 shares remaining available for future option awards under the 2007 Stock Option Plan. Pursuant to the 2012 Stock Incentive Plan, no further stock option awards will be made pursuant to the 2007 Stock Option Plan following stockholder approval of the 2012 Stock Incentive Plan. The 2012 Stock Incentive Plan permits BKFC to have significant flexibility in determining the types and specific terms of awards made to participants. This flexibility will allow BKFC to make future awards based on then-current objectives for aligning compensation with stockholder value.

Share Limitations

The 2012 Stock Incentive Plan authorizes the grant of incentive stock options (“ISOs”), nonqualified stock options, stock appreciation rights, restricted stock, restricted stock units, performance shares and performance units. See “Awards” below. A maximum of one million Shares may be issued under the 2012 Stock Incentive Plan, of which (a) no more than 750,000 Shares may be issued as ISOs; (b) no more than 250,000 Shares may be issued as nonqualified stock options; (c) no more than 400,000 Shares may be issued pursuant to restricted stock; and (d) no more than 400,000 Shares may be issued pursuant to restricted stock units.

In addition, under the 2012 Stock Incentive Plan, in a given calendar year, no participant may (a) be granted stock options and tandem stock appreciation rights that are related to stock options for more than 25,000 Shares; (b) receive Shares pursuant to the grant of any freestanding SARs for more than a total of 25,000 Shares;(c) receive awards of performance shares in excess of 10,000 Shares; (d) receive performance share units of more than 10,000 Shares or (e) receive awards paid in cash having an aggregate dollar value in excess of $250,000.

Each Share issued or transferred pursuant to an award of options or stock appreciation rights will reduce the aggregate plan limit of one million Shares by one Share. Each Share issued or transferred (and in the case of restricted stock, restricted stock units, performance shares and performance units, released from all substantial risk of forfeiture) pursuant to an award other than options or stock appreciation right will reduce the aggregate plan limit of one million Shares by 2.50 Shares.

The following are not included in calculating the Share limitations set forth above: (i) awards that are settled in cash and (ii) any Shares subject to an award under the 2012 Stock Incentive Plan if the award is forfeited, cancelled, terminated, expired or lapsed for any reason without the issuance of Shares underlying the award. Any Shares that again become available for issuance pursuant to this paragraph shall be added back to the aggregate Plan limit in the same manner such Shares were originally deducted from the aggregate Plan limit. The number of Shares reserved for issuance under the 2012 Stock Incentive Plan and the terms of awards may be adjusted in the event of an adjustment in the capital structure of BKFC or a related entity (due to a merger, stock split, stock dividend or similar event). On March 15, 2012, the closing sales price of BKFC Common Stock as reported on the NASDAQ was $25.86 per share.

Purpose and Eligibility

The purpose of the 2012 Stock Incentive Plan is to assist BKFC in (i) attracting and retaining employees and directors of, and independent contractors to, BKFC; (ii) motivating such individuals by means of performance-related incentives to achieve longer-range performance goals and (iii) enabling such individuals to participate in the long-term growth and financial success of BKFC. In this regard, the 2012 Stock Incentive Plan is considered to be a “top hat” plan that is limited to a select group of management or highly compensated employees, directors and independent contractors of BKFC and its subsidiaries being eligible, subject to certain exceptions, if selected, to participate in the 2012 Stock Incentive Plan.

Administration

The 2012 Stock Incentive Plan is administered by the Compensation Committee (the “Committee”). Under the terms of the 2012 Stock Incentive Plan, the Compensation Committee has sole authority to take any action with respect to the 2012 Stock Incentive Plan, including, without limitation, the authority to determine the type and amount of awards and the selection of eligible participants. In certain circumstances, the Compensation Committee may delegate to a subcommittee of the Compensation Committee or one or more senior executive officers of BKFC the authority to grant awards to individuals who are not officers or directors for purposes of Section 16 of the Exchange Act or “covered employees” for purposes of the Internal Revenue Code (the “Code”) Section 162(m).

Awards

Options granted under the 2012 Stock Incentive Plan may be ISOs or nonqualified stock options. A stock option entitles the participant upon exercise to purchase Shares from BKFC at the option price. The option price is determined by the Compensation Committee at the time of grant and must not be less than (a) 100% of the closing price of BKFC Shares on the date of grant (110% of the closing price in the case of ISOs for more than 10% stockholders) and (b) the par value per share of BKFC Shares. Unless an individual award agreement provides otherwise, the option price may be paid by the participant in cash or cash equivalents, and, when permitted by the Compensation Committee and applicable law and regulations, with Shares, or with a combination of cash and Shares. Options are subject to restrictions on exercise following termination of employment or service. The option term may not exceed ten (10) years (or five (5) years with respect to ISOs for more than 10% stockholders). The maximum compensation payable pursuant to an option is equal to the number of shares granted (or exercised) multiplied by the difference between the fair market value of the Shares on the date of exercise and the option price.

Stock appreciation rights (“SARs”) may be granted under the 2012 Stock Incentive Plan to the holder of an option with respect to all or a portion of the Shares subject to the related option (a “Tandam SAR”) or may be granted separately to a participant. The consideration to be received by the holder of a SAR may be paid in cash, Shares (valued at fair market value on the date of the SAR exercise), or a combination of cash and Shares, as determined by the Compensation Committee. Upon exercise of a SAR, the holder of the SAR is entitled to receive payment from BKFC in an amount determined by multiplying (a) the difference between the fair market value of a Share on the date of exercise over the base price per share of such SAR by (b) the number of Shares with respect to which the SAR is being exercised. The base price may be no less than 100% of the fair market value per share of the BKFC Shares on the date the SAR is granted. No SAR may be exercised more than 10 years after it was granted, or such shorter period as may apply to related options in the case of tandem SARs.

The Compensation Committee may also grant awards to eligible participants consisting of restricted stock or restricted stock units that are subject to certain conditions, which conditions must be met in order for the restricted award to vest and be earned (in whole or in part), and no longer be subject to forfeiture. These conditions may include, but are not limited to, attainment of performance objectives during a certain period of time. Restricted stock awards are payable in Shares. Restricted stock units may be payable in cash or whole Shares, or partly in cash and partly in whole Shares, as determined by the Compensation Committee.

The Compensation Committee may also grant awards, consisting of performance shares and/or performance units, to participants. An award of a performance share is a grant of a right to receive Shares or the cash value thereof, or a combination thereof, which is contingent upon the achievement of performance or other objectives during a specified period and which has a value on the date of grant equal to the fair market value of a Share. An award of a performance unit is a grant of a right to receive Shares or a designated dollar value amount of Shares, or a combination thereof, which is contingent upon the achievement of performance or other objectives during a specified period, and which has an initial value established by the Compensation Committee at the time of grant. A performance award may be settled in cash, Shares or a combination thereof, as determined by the Compensation Committee.

Dividend and Dividend Equivalents

The Compensation Committee may, in its sole discretion, provide that awards (other than options and SARs) granted under the 2012 Stock Incentive Plan earn dividends or dividend equivalents. Such dividends or dividend equivalents may be paid currently or may be credited to a participant’s account, subject to such restrictions and conditions as the Compensation Committee may establish.

Amendment and Termination

The 2012 Stock Incentive Plan and awards may be amended or terminated at any time by the Board of Directors, subject to the following conditions: (a) stockholder approval is required of any 2012 Stock Incentive Plan amendment if required by applicable law, rule or regulation; and (b) an amendment or termination of an award may not materially adversely affect the rights of an award participant without the participant’s consent. In addition, except for anti-dilution adjustments made under the 2012 Stock Incentive Plan, the option price for any outstanding option or base price of any outstanding SAR granted under the 2012 Stock Incentive Plan may not be decreased after the date of grant, nor may any outstanding option or SAR granted under the 2012 Stock Incentive Plan be surrendered to BKFC as consideration for the grant of a new option or SAR with a lower exercise or base price than the original option or SAR, as the case may be, without stockholder approval. The Compensation Committee has the authority to make adjustments to awards upon the occurrence of certain unusual or nonrecurring events, if the Compensation Committee determines that such adjustments are appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the 2012 Stock Incentive Plan or necessary or appropriate to comply with applicable laws, rules or regulations.

Transferability

ISOs are not transferable other than by will or the laws of intestate succession or, in the Compensation Committee’s discretion, as may otherwise be permitted in accordance with Code Section 422 and related regulations. Nonqualified options and SARs are not transferable other than by will or the laws of intestate succession, except as may be permitted by the Compensation Committee in a manner consistent with applicable law, including the registration provisions of the Securities Act of 1933, as amended. Restricted stock and restricted stock units that have not vested are not transferable, and performance units and performance shares that have not been earned are not transferable other than by will or the laws of intestate succession.

Performance-Based Compensation—Code Section 162(m) Requirements

The 2012 Stock Incentive Plan is structured to comply with the requirements imposed by Code Section 162(m) and related regulations in order to preserve, to the extent practicable, BKFC’s tax deduction for awards made under the 2012 Stock Incentive Plan to covered employees. Code Section 162(m) generally will not allow an employer to take a deduction for compensation paid to covered employees (generally, the Named Executive Officers) of a publicly held corporation in excess of $1,000,000 unless the compensation is exempt from the $1,000,000 limitation because it qualifies as performance-based compensation.