Schedule 14A

(Rule 14A-101)

Information Required In Proxy Statement

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement ¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) x Definitive Proxy Statement ¨ Definitive Additional Materials ¨ Soliciting Material Under Rule 14a-12 |

Speedway Motorsports, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials:

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

5555 Concord Parkway South

Concord, North Carolina 28027

March 18, 2003

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders to be held at 9:00 a.m. on April 23, 2003, at Lowe’s Motor Speedway in Concord, North Carolina. We look forward to greeting personally those stockholders who are able to attend.

The accompanying formal Notice of Meeting and Proxy Statement describe the matters on which action will be taken at the meeting.

Whether or not you plan to attend the meeting on April 23, it is important that your shares be represented. To ensure that your vote is received and counted, please sign, date and mail the enclosed proxy at your earliest convenience. Your vote is important regardless of the number of shares you own.

On behalf of the Board of Directors

Sincerely,

O. BRUTON SMITH

Chairman and Chief Executive Officer

VOTING YOUR PROXY IS IMPORTANT

PLEASE SIGN AND DATE YOUR PROXY AND

RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE

SPEEDWAY MOTORSPORTS, INC.

NOTICE OF MEETING

Concord, NC

March 18, 2003

The Annual Meeting of Stockholders of Speedway Motorsports, Inc. (“SMI”) will be held at Lowe’s Motor Speedway, located at 5555 Concord Parkway South, Concord, North Carolina on April 23, 2003, at 9:00 a.m., for the following purposes as described in the accompanying Proxy Statement:

| | 1. | | To elect three (3) directors. |

| | 2. | | To consider and vote upon a proposal to ratify the selection by the Board of Directors of Deloitte & Touche LLP as the principal independent auditors of SMI and its subsidiaries for the year 2003. |

| | 3. | | To transact such other business as may properly come before the meeting. |

Only holders of record of SMI’s common stock at the close of business on February 24, 2003 will be entitled to vote at the meeting.

Whether or not you plan to attend the meeting, you are urged to complete, sign, date and return the enclosed proxy promptly in the envelope provided. Returning your proxy does not deprive you of your right to attend the meeting and to vote your shares in person.

MARYLAUREL E. WILKS

Secretary

Important Note: To vote shares of common stock at the Annual Meeting (other than in person at the meeting), a stockholder must return a proxy. The return envelope enclosed with the proxy card requires no postage if mailed in the United States of America.

SPEEDWAY MOTORSPORTS, INC.

PROXY STATEMENT

March 18, 2003

GENERAL

Introduction

The Annual Meeting of Stockholders of Speedway Motorsports, Inc. (“SMI”) will be held on April 23, 2003 at 9:00 a.m., at Lowe’s Motor Speedway, (the “Annual Meeting”), for the purposes set forth in the accompanying notice. SMI’s principal executive offices are located at Lowe’s Motor Speedway at 5555 Concord Parkway South, Concord, North Carolina, 28027. Only holders of record of common stock of SMI, par value $.01 per share, at the close of business on February 24, 2003 (the “Record Date”) will be entitled to notice of, and to vote at, such meeting. This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of proxies to be used at such meeting, and at any and all adjournments thereof, and is first being sent to stockholders on or about the date hereof. Proxies in the accompanying form, properly executed and duly returned and not revoked, will be voted at the meeting (including adjournments). Where a specification is made by means of the ballot provided in the proxies regarding any matter presented at the Annual Meeting, such proxies will be voted in accordance with such specification. If no specification is made, proxies will be voted (i) in favor of electing SMI’s three (3) nominees to the Board of Directors, and (ii) in favor of the selection of Deloitte & Touche LLP as the principal independent auditors of SMI for the year 2003.

Proxies should be sent to Wachovia Corporation, ATTN: Proxy Tabulation-NC1153, P.O. Box 217950, Charlotte, North Carolina, 28254-3555.

This Proxy Statement is being furnished by SMI to its stockholders of record as of February 24, 2003 in connection with the upcoming Annual Meeting.

1

Ownership of Capital Securities

The following table sets forth certain information regarding ownership of SMI’s common stock as of February 24, 2003, by (i) each person or entity known to SMI and its subsidiaries (collectively, the “Company”) who beneficially owns five percent or more of the common stock, (ii) each director and nominee to the Board of Directors of SMI, (iii) each executive officer of SMI (including the Chief Executive Officer), and (iv) all directors and executive officers of SMI as a group. Except as otherwise indicated below, each person named in the table has sole voting and investment power with respect to the securities beneficially owned by them as set forth opposite their name.

| | | Amount & Nature of Beneficial Ownership

| | | |

Beneficial Owner

| | | Percent

| |

O. Bruton Smith (1)(2) | | 29,000,000 | | 64.4 | % |

Sonic Financial Corporation (2) | | 23,700,000 | | 52.7 | |

Sterling Capital Management LLC group (3) | | 2,662,900 | | 6.3 | |

H.A. “Humpy” Wheeler (4)(10) | | 386,400 | | * | |

William R. Brooks (5)(10) | | 289,900 | | * | |

Edwin R. Clark (6)(10) | | 111,900 | | * | |

William P. Benton (7)(11) | | 111,000 | | * | |

Mark M. Gambill (8)(11) | | 134,200 | | * | |

Robert L. Rewey (9)(11) | | 10,000 | | * | |

Tom E. Smith (9)(11) | | 25,000 | | * | |

All directors and executive officers as a group (eight persons) (1) | | 30,068,400 | | 66.8 | % |

| (1) | | The shares of SMI’s common stock shown as owned by such person include, without limitation, all of the shares shown as owned by Sonic Financial Corporation (“Sonic Financial”) elsewhere in the table. Mr. O. Bruton Smith owns the substantial majority of Sonic Financial’s common stock. |

| (2) | | The address of such person is P.O. Box 18747, Charlotte, North Carolina, 28218. |

| (3) | | Sterling Capital Management LLC group includes the following persons who share voting and investment power with respect to the securities held by them as indicated above: Sterling Capital Management LLC, Sterling MGT, Inc., Eduardo A. Brea, Alexander W. McAlister, David M. Ralston, Brian R. Walton and Mark Whalen. The address of such persons is 4064 Colony Road, Suite 300, Charlotte, NC 28211. This information is as of December 31, 2002, the date of the group’s Schedule 13G filing with the Securities and Exchange Commission. |

| (4) | | All the shares shown as owned by Mr. Wheeler, other than 10,400 shares owned by him directly, underlie options granted by the Company. |

| (5) | | All the shares shown as owned by Mr. Brooks, other than 1,000 shares owned by him directly, underlie options granted by the Company. |

| (6) | | All the shares shown as owned by Mr. Clark, other than 6,000 shares owned by him directly, underlie options granted by the Company. |

| (7) | | All the shares shown as owned by Mr. Benton, other than 1,000 shares owned by him directly, underlie options granted by the Company. |

| (8) | | All the shares shown as owned by Mr. Gambill, other than 4,200 shares owned by him directly, underlie options granted by the Company. |

| (9) | | All the shares shown as owned by Mr. Rewey and Mr. Tom Smith underlie options granted by the Company. |

| (10) | | All such options are currently exercisable except for 21,250 shares granted to Mr. Wheeler, 21,250 shares granted to Mr. Brooks, and 10,000 shares granted to Mr. Clark. |

| (11) | | Amount does not include options to purchase 10,000 shares granted on January 2, 2003 that become exercisable on July 2, 2003. All other options are currently exercisable. |

2

For additional information concerning options granted to the Company’s executive officers, see “Executive Compensation” below.

Number of Shares Outstanding and Voting

SMI currently has authorized under its Certificate of Incorporation 200,000,000 shares of common stock, of which 42,363,868 shares are currently issued and outstanding and entitled to be voted at the Annual Meeting. At the meeting, holders of common stock will have one vote per share for an aggregate total of 42,363,868 votes. A quorum being present, directors will be elected by a plurality of votes cast, and the actions proposed in the remaining items referred to in the accompanying Notice of Meeting will become effective if a majority of the votes cast by shares entitled to vote is cast in favor thereof. Abstentions and broker non-votes will not be counted in determining the number of shares voted for any director-nominee or for any proposal, but will be counted for purposes of determining the presence of a quorum.

A holder of common stock who signs a proxy card may withhold votes as to any director-nominee by writing the name of such nominee in the space provided on the proxy card.

Revocation of Proxy

Stockholders who execute proxies may revoke them at any time before they are exercised by delivering a written notice to Marylaurel E. Wilks, Secretary of SMI, either at the Annual Meeting or prior to the meeting date at the Company’s offices at 5555 Concord Parkway South, Concord, North Carolina, 28027, by executing and delivering a later-dated proxy, or by attending the meeting and voting in person.

Expenses of Solicitation

The Company will pay the cost of solicitation of proxies, including the cost of assembling and mailing this Proxy Statement and the enclosed materials. In addition to mailings, proxies may be solicited personally, by telephone or electronically, by corporate officers and employees of the Company without additional compensation. The Company intends to request brokers and banks holding stock in their names or in the names of nominees to solicit proxies from customers owning such stock, where applicable, and will reimburse them for their reasonable expenses of mailing proxy materials to customers.

2004 Stockholder Proposals

In order for stockholder proposals intended to be presented at the 2004 Annual Meeting of Stockholders to be eligible for inclusion in the Company’s proxy statement and the form of proxy for such meeting, they must be received by the Company at its principal offices in Concord, North Carolina no later than November 19, 2003. Regarding stockholder proposals intended to be presented at the 2004 Annual Meeting but not included in SMI’s proxy statement, stockholders must give SMI advance notice of their proposals in order to be considered timely under SMI’s bylaws. The bylaws state that written notice of such proposals must be delivered to the principal executive office of SMI (i) in the case of an annual meeting that occurs within 30 days of the anniversary of the 2003 Annual Meeting, not less than 60 days nor more than 90 days prior to such anniversary date, and (ii) in the case of an annual meeting that is called for a date that is not within 30 days before or after the anniversary date of the 2003 Annual Meeting, or in the case of a special meeting of stockholders called for the purpose of electing directors, not later than the close of business on the tenth day following the day on which notice of the date of the meeting was mailed or public disclosure of the date of the meeting was made, whichever occurs first. All such proposals for which timely notice is not received in the manner described above will be ruled out of order at the meeting resulting in the proposal’s underlying business not being eligible for transaction at the meeting.

3

ELECTION OF DIRECTORS

Nominees for Election as Directors of SMI

Directors of SMI are elected at its Annual Meetings of Stockholders to serve staggered terms of three years and until their successors are elected and qualified. The Board of Directors of SMI (the “Board”) currently consists of eight (8) directors, three of whom must be elected at the 2003 Annual Meeting. The terms of Messrs. H.A. “Humpy” Wheeler, Edwin R. Clark and Tom E. Smith expire at the 2003 Annual Meeting; the terms of Messrs. O. Bruton Smith, William P. Benton and Robert L. Rewey expire at the 2004 Annual Meeting; and the terms of Messrs. William R. Brooks and Mark M. Gambill expire at the 2005 Annual Meeting. Messrs. H.A. “Humpy” Wheeler, Edwin R. Clark and Tom E. Smith are standing for reelection at the 2003 Annual Meeting.

It is intended that the proxies in the accompanying form will be voted at the meeting for the election to the Board of Directors of the following nominees, each of whom has consented to serve if elected: Messrs. H.A. “Humpy” Wheeler, Edwin R. Clark and Tom E. Smith each to serve a three year term until the 2006 Annual Meeting and until his successor shall be elected and shall qualify, except as otherwise provided in SMI’s Certificate of Incorporation and Bylaws. Each of the nominees are presently directors of SMI. If for any reason any nominee named above is not a candidate when the election occurs, it is intended that proxies in the accompanying form will be voted for the election of the other nominees named above and may be voted for any substitute nominee or, in lieu thereof, the Board of Directors may reduce the number of directors in accordance with SMI’s Certificate of Incorporation and Bylaws.

The name, age, present principal occupation or employment and the material occupations, positions, offices or employments for at least the past five years of each SMI director, director-nominee, executive officer and executive manager are set forth below.

O. Bruton Smith, 76, has been the Chairman and Chief Executive Officer of SMI since its organization in December 1994. Mr. Smith has served as the CEO and a director of Charlotte Motor Speedway, LLC, a wholly-owned subsidiary of SMI, and its predecessor entities (“CMS”) since 1975, which he originally founded in 1959. Mr. Smith has been the Chairman and CEO of Atlanta Motor Speedway, Inc. (“AMS”) since its acquisition in 1990, Texas Motor Speedway, Inc. (“TMS”) since its formation in 1995, Bristol Motor Speedway, Inc. (“BMS”) since its acquisition in January 1996, the subsidiary operating Infineon Raceway (“IR”) since its acquisition in November 1996, and the subsidiary operating Las Vegas Motor Speedway (“LVMS”) since its acquisition in December 1998. In addition, Mr. Smith serves as the CEO and a director, or in a similar capacity, for many of SMI’s other subsidiaries. Mr. Smith also is the Chairman, CEO, a director and controlling stockholder of Sonic Automotive, Inc. (“SAI”), (NYSE: symbol SAH), and serves as an officer or director of most of SAI’s operating subsidiaries. SAI is believed to be one of the ten largest automobile retail dealership groups in the United States and is engaged in the acquisition and operation of automobile dealerships. Mr. Smith also owns and operates Sonic Financial Corporation, a private business he controls, among other private businesses.

H.A. “Humpy” Wheeler, 64, has been the President, Chief Operating Officer and a director of SMI since its organization in December 1994. Mr. Wheeler was hired by CMS in 1975 and has been a director and General Manager of CMS since 1976. Mr. Wheeler was named President of CMS in 1980 and became a director of AMS upon its acquisition in 1990. He also has served as Vice President and a director of BMS since its acquisition and TMS since its formation. Mr. Wheeler also serves as an officer and director of several other SMI subsidiaries.

William R. Brooks, 53, has been Vice President, Treasurer, Chief Financial Officer and a director of SMI since its organization in December 1994. Mr. Brooks joined Sonic Financial from PriceWaterhouseCoopers in 1983, and has served as Vice President of CMS since before the organization of SMI, and has been Vice President and a director of AMS since its acquisition, and TMS since its formation. He has served as Vice President of BMS, LVMS and IR since their acquisition, and, prior to January 2001, had been a director of LVMS and IR. Mr. Brooks was the President and a director of Speedway Holdings, Inc., SMI’s financing subsidiary, and its predecessor entities since 1995 until its merger into SMI at the end of 2002. In addition, Mr. Brooks serves as an officer and a

4

director, or in a similar capacity, for many of SMI’s other subsidiaries. Mr. Brooks also has served as a director of SAI since its formation in 1997 and served as its Chief Financial Officer from February to April 1997.

Edwin R. Clark, 48, became Vice President and General Manager of AMS in 1992 and was promoted to President and General Manager of AMS in 1995. Prior to that appointment, he had been Vice President of Events of CMS since 1981. Mr. Clark became Executive Vice President of SMI upon its organization in December 1994, and has been a director of SMI since 1995.

William P. Benton, 79, became a director of SMI in 1995. Mr. Benton retired from Ford Motor Company as its Vice President of Marketing worldwide after a 37-year career with the company. During that time, Mr. Benton held the following major positions: Vice President/General Manager of Lincoln/Mercury Division; Vice President/General Manager Ford Division; four years in Europe as Group Vice President Ford of Europe; and a member of the company’s Product Planning Committee, responsible for all products of the company worldwide. Most recently, Mr. Benton was Vice Chairman of Wells Rich Greene and Executive Director of Olgivy & Mather Worldwide in New York. In addition, Mr. Benton serves as a director of SAI and Allied Holdings, Inc.

Mark M. Gambill, 52, became a director of SMI in 1995. Mr. Gambill worked for Wheat First Securities from 1972 until it was sold to First Union (now Wachovia Corporation) in 1998. Mr. Gambill was the President of Wheat First Butcher Singer at the time of the sale. Mr. Gambill left First Union as President of Wheat First Union in 1999 to devote more time to family and personal interests. He is currently Managing Director of Cary Street Partners, a financial advisory firm. In addition, he serves as a director of the Noland Company and NTC Communications.

Robert L. Rewey,64, became a director of SMI in 2001. Mr. Rewey recently retired from Ford Motor Company after a distinguished 38-year career with Ford, most recently serving as Group Vice President of North American Operations & Global Consumer Services. Mr. Rewey managed numerous areas within Ford since 1963, also serving as Vice President of Sales, Marketing and Customer Service. Mr. Rewey also serves as a director of SAI and LoJack Corporation.

Tom E. Smith, 61, became a director of SMI in 2001. Mr. Smith retired from Food Lion Stores, Inc. in 1999, after a distinguished 29-year career with that company, including serving as its Chief Executive Officer and President. A native of Salisbury, North Carolina, Mr. Smith serves as a director of CT Communications, Inc. and Farmer and Merchants Bank.

M. Jeffrey Byrd, 53, has served as Vice President and General Manager of BMS since its acquisition in 1996, and became President of BMS in 2003. Prior to working at BMS, Mr. Byrd had been continuously employed by RJR Nabisco for 23 years in various sports marketing positions, most recently as Vice President of Business Development for its Sports Marketing Enterprises affiliate.

William E. Gossage, 44, became Vice President and General Manager of TMS in 1995. Before that appointment, he was Vice President of Public Relations at CMS from 1989 to 1995. Mr. Gossage previously worked with Miller Brewing Company in its motorsports public relations program and served in various public relations and managerial capacities at two other NASCAR-sanctioned speedways.

Steve Page, 48, has served as President and General Manager of IR since its acquisition in 1996. Prior to being hired by SMI, Mr. Page had been continuously employed for several years as President of Brenda Raceway Corporation, which owned and operated IR before its acquisition by the Company. Mr. Page also spent eleven years working for the Oakland A’s baseball franchise in various marketing positions.

R. Christopher Powell, 43, has served as Executive Vice President and General Manager of LVMS since its acquisition in 1998. Mr. Powell also serves as Vice President of several other SMI subsidiaries, and was Vice President of Speedway Holdings, Inc. until its merger into SMI at the end of 2002. Mr. Powell spent eleven years working for Sports Marketing Enterprises, a division of R. J. Reynolds Tobacco Co. (“RJR”). Since 1994, he

5

served as manager of media relations and publicity on the NASCAR Winston Cup program. Mr. Powell’s previous duties include publicity and event operations on other RJR initiatives, including NHRA Drag Racing and the Vantage and Nabisco golf sponsorships.

Committees of the Board of Directors and Meetings

There are three standing committees of the Board of Directors of SMI: the Audit Committee, the Nominating/Governance Committee, and the Compensation Committee. The Audit Committee currently is comprised of Messrs. William P. Benton, Mark M. Gambill and Tom E. Smith. The Nominating/Governance Committee is comprised of Messers. Robert L. Rewey and Tom E. Smith. The Compensation Committee is comprised of Messrs. William P. Benton, Mark M. Gambill and Robert L. Rewey. All Committee members are independent as defined by the applicable and proposed listing standards of the New York Stock Exchange and the Sarbanes-Oxley Act of 2002.

Audit Committee.The Audit Committee, which held five meetings in 2002, is responsible for the appointment of the Company’s independent auditors, reviews and approves the scope of the annual audit, reviews the conclusions of the auditors and reports the findings and recommendations thereof to the Board of Directors, reviews with the Company’s auditors the adequacy of the Company’s system of internal control and procedures and the role of management in connection therewith, reviews transactions between the Company and its officers, directors and principal stockholders, reviews and discusses with management and the independent auditors the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, approves non-audit services rendered by the auditors, and performs such other functions and exercises such other powers as the Board of Directors from time to time may determine.

The following is the Audit Committee Report for the year ended December 31, 2002.

Audit Committee Report

In accordance with its written charter adopted in 2000, which was revised and restated in December 2002 for the additional responsibilities ensuing from the recently enacted Sarbanes-Oxley Act of 2002 and proposed New York Stock Exchange listing standards, by the Company’s Board of Directors, the Audit Committee of the Board (the “Audit Committee”) assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. A copy of the Audit Committee charter is attached hereto as an appendix. During fiscal 2002, the Audit Committee met five times, and the Audit Committee chair, as representative of the Audit Committee, discussed the interim financial information contained in each quarterly earnings announcement with the Company’s Chief Financial Officer and independent auditors prior to public release.

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors’ independence consistent with Independence Standards Board No. 1, “Independence Discussions with Audit Committees”, discussed with the auditors any relationships or services that might impact their objectivity and independence and satisfied itself as to the auditors’ independence. The Audit Committee also discussed and reviewed with management and the independent auditors the quality and adequacy of the Company’s internal controls, and discussed and reviewed with management the effectiveness of the Company’s disclosure controls and procedures used for periodic public reporting. The Audit Committee reviewed with the independent auditors their audit plans, audit scope, and identification of audit risks.

The Audit Committee discussed and reviewed with the independent auditors all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees”, with and without management present, discussed and reviewed the results of the independent auditors’ examination of the Company’s financial statements, and reviewed the audited financial statements of the Company as of and for the year ended December 31, 2002 with management and the independent auditors.

6

Management is responsible for the Company’s financial reporting process including its system of internal control, disclosure controls and procedures, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. The Company’s independent auditors are responsible for auditing those financial statements. The Audit Committee’s responsibility is to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews or procedures. The members of the Audit Committee are not employees of the Company and they may or may not be experts in the fields of accounting or auditing. Therefore, the Audit Committee has relied, without independent verification, on (a) management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and (b) the representations of the independent auditors appearing in the auditors’ report on the Company’s financial statements. The Audit Committee’s oversight does not provide the Audit Committee with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations.

Based on the above-mentioned review and discussions with management and the independent auditors, the Audit Committee recommended to the Board that the Company’s audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2002, for filing with the Securities and Exchange Commission (“SEC”). The Audit Committee also recommended the reappointment, subject to stockholder approval, of the independent auditors and the Board concurred with such recommendation.

Audit Committee

Mark M. Gambill, Chairman

William P. Benton

Tom E. Smith

Nominating/Governance Committee. The Nominating/Governance Committee was established and its written charter adopted in 2002 by the Company’s Board of Directors. The Nominating/Governance Committee, which held one meeting in 2002, assists the Board in identifying and recommending individuals qualified to become members of the Board of Directors, monitors and reviews corporate governance issues, and develops and recommends to the Board of Directors corporate governance principles applicable to the Board, the Company and its business strategy and operations. Messrs. Wheeler, Clark and Tom E. Smith were recommended to the Board as director-nominees to stand for election at the Annual Meeting by the Nominating/Governance Committee, except that Mr. Tom E. Smith did not participate in the Committee’s deliberations with respect to his own nomination. It is the policy of the Nominating/Governance Committee not to accept unsolicited nominations to the Board of Directors from stockholders.

Compensation Committee. The Compensation Committee, which held one meeting in 2002, administers certain compensation and employee benefit plans of the Company, annually reviews and determines executive officer compensation, including annual salaries, bonus performance goals, bonus plan allocations, stock option grants and other benefits, direct and indirect, of all executive officers and other senior officers of the Company. Mr. Smith, the Company’s Chief Executive Officer, resigned from the Compensation Committee in December 2002. Mr. Robert L. Rewey was appointed to the Compensation Committee in February 2003. The Compensation Committee administers the 1994 Stock Option Plan and the Employee Stock Purchase Plan, and periodically reviews the Company’s executive development and succession planning and executive compensation programs. The Compensation Committee also takes action to modify programs that yield payments or benefits not closely related to Company or executive performance. The policy of the Compensation Committee’s program for executive officers is to link pay to business strategy and performance in a manner which is effective in attracting, retaining and rewarding key executives while also providing performance incentives and awarding equity-based compensation to align the long-term interests of executive officers with those of Company stockholders. It is the Compensation Committee’s objective to offer salaries and incentive performance pay opportunities that are competitive in the marketplace.

During 2002, there were five meetings of the Board of Directors of SMI, with all directors attending at least 75% of all Board and Committee meetings.

7

SELECTION OF INDEPENDENT AUDITORS

The Board of Directors has selected the firm of Deloitte & Touche LLP to serve as the principal independent auditors of the Company for the year 2003. Deloitte & Touche LLP has acted in such capacity for the Company since 1994. This selection is submitted for approval by the stockholders at the Annual Meeting.

Representatives of Deloitte & Touche will attend the Annual Meeting. They will have an opportunity to make a statement if they so desire, and to respond to appropriate questions.

Principal Accounting Firm Fees

Audit Fees. Aggregate fees billed by Deloitte & Touche for professional services rendered for their audit of the Company’s consolidated annual financial statements, and reviews of the consolidated financial statements included in the Company’s Quarterly Reports on Form 10-Q, for fiscal year 2002 were $277,000.

Financial Information Systems Design and Implementation Fees. There were no professional services rendered by Deloitte & Touche for information technology services relating to financial information systems design and implementation in fiscal year 2002.

All Other Fees. Aggregate fees billed by Deloitte & Touche for all other services rendered to the Company, including principally tax planning and compliance services, and attestation services for consents related to SEC registration statements, in fiscal year 2002 were $296,000.

The Audit Committee has considered whether the non-audit services provided were compatible with maintaining the principal auditor’s independence, and believes that such services and related fees, due to, among other things, the nature and scope of the services provided and the fact that different Deloitte & Touche personnel provided audit and non-audit services, have not impaired the independence of the Company’s principal auditors.

MANAGEMENT

Directors of SMI

For information with respect to the Board of Directors of SMI, see “Election of Directors”.

Executive Officers of SMI

Messrs. O. Bruton Smith, H.A. “Humpy” Wheeler, William R. Brooks and Edwin R. Clark are the executive officers of SMI. Each executive officer serves as such until his successor is elected and qualified. No executive officer of SMI was selected pursuant to any arrangement or understanding with any person other than SMI. For further information with respect to Messrs. Smith, Wheeler, Brooks and Clark as officers of SMI, see “Election of Directors”.

EXECUTIVE COMPENSATION

Compensation Committee Report

The following is an explanation of the Company’s executive officer compensation program as in effect for 2002.

2002 Officer Compensation Program

The 2002 executive officer compensation program of the Company had three primary components: (i) base salary, (ii) short-term incentives under the Company’s executive bonus plan, and (iii) long-term incentives which consisted solely of stock option grants made under the 1994 Stock Option Plan (for officers other than the Chief Executive Officer). Executive officers (including the Chief Executive Officer) were also eligible in 2002 to participate in various benefit plans similar to those provided to other employees of the Company. Such benefit plans are intended to provide a safety net of coverage against various events, such as death, disability and retirement.

8

Base salaries (including that of the Chief Executive Officer) were established on the basis of non-quantitative factors such as positions of responsibility and authority, years of service and annual performance evaluations. They were targeted to be competitive principally in relation to other motorsports racing companies (such as some of those included in the Peer Group Index in the performance graph elsewhere herein), although the Compensation Committee also considered the base salaries of certain other amusement, sports and recreation companies not included in the Peer Group Index because the Compensation Committee considered those to be relatively comparable industries.

The Company’s executive bonus plan established a potential bonus pool for the payment of year-end bonuses to Company officers and other key personnel based on 2002 performance and operating results. Under this plan, aggressive revenue and profit target levels were established by the Compensation Committee as incentives for superior individual, group and Company performance. Each executive officer was eligible to receive a discretionary bonus based upon individually established subjective performance goals. The Compensation Committee approved cash incentive bonuses in amounts ranging from 0.20% to 0.64% of the Company’s 2002 pretax income from continuing operations.

Awards of stock options under SMI’s 1994 Stock Option Plan are based on a number of factors in the discretion of the Compensation Committee, including various subjective factors primarily relating to the responsibilities of the individual officers for and contribution to the Company’s operating results (in relation to the Company’s other optionees), their expected future contributions and the levels of stock options currently held by the executive officers individually and in the aggregate. Stock option awards to executive officers have been at then-current market prices in order to align a portion of an executive’s net worth with the returns to the Company’s stockholders. For details concerning the grant of options to the executive officers named in the Summary Compensation Table below, see “Executive Compensation—Fiscal Year-End Option Values”.

As noted above, the Company’s compensation policy is primarily based upon the practice of pay-for-performance. Section 162(m) of the Internal Revenue Code of 1986 as amended, imposes a limitation on the deductibility of nonperformance-based compensation in excess of $1 million paid to named executive officers. The Committee currently believes that, generally, the Company should be able to continue to manage its executive compensation program to preserve federal income tax deductions. However, the Compensation Committee also must approach executive compensation in a manner which will attract, motivate and retain key personnel whose performance increases the value of the Company. Accordingly, the Compensation Committee may, from time to time, exercise its discretion to award compensation that may not be deductible under Section 162(m) when, in its judgment, such award would be in the interests of the Company.

Chief Executive Officer Compensation

The Committee annually reviews and approves the compensation of Mr. Smith, the Company’s Chief Executive Officer. Mr. Smith also participates in the executive bonus plan, with his bonus tied to corporate revenue and profit goals. His maximum possible bonus is 2.5% of the Company’s 2002 pretax income from continuing operations. Mr. Smith received a $650,000 bonus for fiscal 2002 based on the Company’s improved revenue and income from continuing operations over fiscal 2001 in a difficult economy and business environment. The Committee believes that Mr. Smith is paid a reasonable salary. Mr. Smith is the only employee of the Company not eligible for stock options. Since he is a significant stockholder in the Company, his rewards as Chief Executive Officer reflect increases in value enjoyed by all other stockholders.

Compensation Committee

William P. Benton, Chairman

Mark M. Gambill

Robert L. Rewey

9

Compensation of Officers

The following table sets forth compensation paid by or on behalf of the Company to its Chief Executive Officer and other executive officers for services rendered during the Company’s fiscal years ended December 31, 2002, 2001 and 2000:

Summary Compensation Table

| | | Year

| | Annual Compensation (1)

| | | Long-Term Compensation Awards

| | All Other Compensation (4)

|

| | | | | Number of Shares Underlying Options (3)

| |

Name and Principal Position

| | | Salary

| | Bonus (2)

| | Other Annual Compensation

| | | |

O. Bruton Smith | | 2002 | | $ | 375,000 | | $ | 650,000 | | $ | 84,400 | (5) | | — | | | -0- |

Chairman and Chief | | 2001 | | | 375,000 | | | 600,000 | | | 75,450 | (5) | | — | | | -0- |

Executive Officer of SMI | | 2000 | | | 375,000 | | | -0- | | | 69,924 | (5) | | — | | | -0- |

|

H.A. “Humpy” Wheeler | | 2002 | | | 275,000 | | | 600,000 | | | (6 | ) | | 21,250 | | $ | 5,700 |

President and Chief | | 2001 | | | 275,000 | | | 600,000 | | | (6 | ) | | 20,000 | | | 2,700 |

Operating Officer of SMI; | | 2000 | | | 275,000 | | | 600,000 | | | (6 | ) | | — | | | 2,700 |

President and General | | | | | | | | | | | | | | | | | |

Manager of CMS | | | | | | | | | | | | | | | | | |

|

William R. Brooks | | 2002 | | | 200,000 | | | 400,000 | | | (6 | ) | | 21,250 | | | 5,700 |

Vice President, Treasurer and | | 2001 | | | 200,000 | | | 300,000 | | | (6 | ) | | 20,000 | | | 2,700 |

Chief Financial Officer of SMI | | 2000 | | | 200,000 | | | 300,000 | | | (6 | ) | | — | | | 2,700 |

|

Edwin R. Clark | | 2002 | | | 125,000 | | | 200,000 | | | (6 | ) | | 10,000 | | | 5,700 |

Executive Vice President | | 2001 | | | 125,000 | | | 200,000 | | | (6 | ) | | 20,000 | | | 2,700 |

of SMI; President and | | 2000 | | | 117,000 | | | 190,000 | | | (6 | ) | | — | | | 2,700 |

General Manager of AMS | | | | | | | | | | | | | | | | | |

| (1) | | Does not include the dollar value of perquisites and other personal benefits. |

| (2) | | The amounts shown are cash bonuses earned in the specified year and paid in the first quarter of the following year. |

| (3) | | The 1994 Stock Option Plan was adopted in December 1994. No options were granted to the Company’s executive officers in 2000. |

| (4) | | Includes Company match to 401(k) plan. |

| (5) | | Amount represents share of split-dollar insurance premium treated as compensation to Mr. Smith. See “O. Bruton Smith Life Insurance Arrangements”. Mr. Smith also received certain perquisites and other personal benefits totaling not more than $50,000. |

| (6) | | The aggregate amount of perquisites and other personal benefits received did not exceed the lesser of $50,000 or 10% of the total annual salary and bonus reported for such executive officer. |

10

Option Grants in 2002

The following table sets forth information regarding all options to acquire shares of common stock granted to the named executive officers during 2002.

Option Grants in Last Fiscal Year

| | | Number of Securities Underlying Options Granted (#)

| | Percent of Total Options Granted to Employees in Fiscal Year

| | Exercise Price ($/Sh)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

Name

| | | | | | 0% ($)

| | 5% ($)

| | 10% ($)

|

H.A. “Humpy” Wheeler | | 21,250(1)(3) | | 6.1% | | $ | 26.36(2) | | 12/11/2012 | | -0- | | $ | 352,300 | | $ | 892,700 |

William R. Brooks | | 21,250(1)(3) | | 6.1% | | | 26.36(2) | | 12/11/2012 | | -0- | | | 352,300 | | | 892,700 |

Edwin R. Clark | | 10,000(1)(3) | | 2.9% | | | 26.36(2) | | 12/11/2012 | | -0- | | | 165,800 | | | 420,100 |

| (1) | | These options were granted under the 1994 Stock Option Plan and are exercisable beginning on June 11, 2003. The Plan provides a reload feature whereby if the purchase price paid upon option exercise is paid in whole or part in shares of common stock owned by the optionee, the Company shall grant the optionee, on the date of such exercise, an additional option to purchase the number of shares of common stock equal to the number of shares tendered in payment of the original option. |

| (2) | | The exercise price was based on the closing market price of the common stock at the date of grant. |

| (3) | | Does not include rights to purchase 500 shares of common stock under the SMI Employee Stock Purchase Plan that were granted in 2002 at a purchase price which is 90% of the lesser of fair market value per share of common stock on grant date or exercise date. |

Fiscal Year-End Option Values

The following table sets forth information concerning outstanding options to purchase common stock held by executive officers of the Company at December 31, 2002.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

Name

| | Shares Acquired On Option Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End (#) Exercisable/Unexercisable

| | Value of Unexercised In-the-Money Options at Fiscal Year-End ($)(1) Exercisable/Unexercisable

|

H.A. “Humpy” Wheeler (2) | | 121,204 | | $2,880,700 | | 403,400 / 21,250 | | $6,935,600 / -0- |

William R. Brooks (2) | | 42,400 | | 1,061,400 | | 267,600 / 21,250 | | 1,703,900 / -0- |

Edwin R. Clark (2) | | 7,611 | | 143,100 | | 95,889 / 10,000 | | 960,400 / -0- |

| (1) | | Year-end value is based on the December 31, 2002 closing sales price for SMI’s common stock of $25.78 per share, less the applicable aggregate option exercise price(s) of in-the-money options, multiplied by the number of unexercised in-the-money options which are exercisable and unexercisable, respectively. |

| (2) | | Does not include rights to purchase 500 shares of common stock under the SMI Employee Stock Purchase Plan that were granted in 2002 at a purchase price which is 90% of the lesser of fair market value per share of common stock on grant date or exercise date. |

11

O. Bruton Smith Life Insurance Arrangements

In 1995, the Compensation Committee (excluding O. Bruton Smith) approved the establishment of a “split-dollar” life insurance plan for the benefit of Mr. Smith. Pursuant to such plan, the Company entered into split-dollar insurance agreements whereby split-dollar life insurance policies in the total face amount of $18,690,000 (individually, a “Policy” or together the “Policies”) would be purchased and held in trust for the benefit of Mr. Smith’s lineal descendants. Prior to July 30, 2002, the Company had agreed to pay the annual (or shorter period) premium payments on the Policies. As of July 30, 2002, the Company indicated to Mr. Smith that it would no longer make payments under these arrangements for his benefit.

Upon payment of the death benefit or upon the surrender of a Policy for its cash value, the Company will receive an amount equal to the Company’s Split-Dollar Interest (as defined below). The Company’s Split-Dollar Interest equals, in the case of the payment of the death benefit, the cumulative payments made by the Company towards the premiums under a Policy less any portion of such payments charged as compensation to Mr. Smith (the “Reimbursable Payment”). The Company’s Split-Dollar Interest equals, in the case of surrender of a Policy for its cash value, the lesser of (i) the net cash value of such Policy or (ii) the Reimbursable Payment.

In the event a Policy is surrendered or terminated prior to his death, Mr. Smith has agreed to reimburse the Company for the positive amount, if any, by which the Reimbursable Payment exceeds the net cash value of such Policy. Mr. Smith’s promise is evidenced by a promissory note in favor of the Company, which note includes a limited guaranty by Sonic Financial whereby Sonic Financial will permit amounts owed by Mr. Smith to the Company to be offset by amounts owed to Sonic Financial by AMS.

Compensation Committee Interlocks and Insider Participation

Messrs. William P. Benton, Mark M. Gambill and O. Bruton Smith served on the Company’s Compensation Committee in 2002. Mr. Smith, Chief Executive Officer of the Company, resigned from the Compensation Committee in December 2002.

Prior to July 30, 2002, the Company paid the annual (or shorter period) premiums on split-dollar life insurance policies for the benefit of Mr. Smith, and has made certain loans or cash advances to Mr. Smith and his affiliates. See “Executive Compensation—O. Bruton Smith Life Insurance Arrangements” and “Certain Transactions”.

Mr. O. Bruton Smith is the only officer of SMI to have served on the compensation committee of another entity during 2002. He served as a member of the Board of Directors and the Compensation Committee for SAI during 2002. Mr. Smith, as the Chief Executive Officer of SAI, received aggregate salary and other annual compensation of $1,581,000 from SAI during 2002. Mr. Brooks, Mr. Benton and Mr. Rewey each served as a member of the Board of Directors for SAI during 2002. Mr. Benton also served as a member of the Compensation Committee for SAI during 2002.

Director Compensation

Members of the Board of Directors who are not employees of the Company received options to purchase shares of SMI’s common stock in 2002 under the Company’s Formula Stock Option Plan. In particular, Messrs. Benton, Gambill, Rewey and Smith each received options to purchase 10,000 shares at an exercise price of $25.65 per share under the Formula Plan. Beginning in fiscal 2003, each non-employee director will receive (i) an annual cash retainer of $25,000 for so long as the non-employee director serves as a director of the Company, (ii) $1,500 for each Board of Directors and Committee meeting attended, and (iii) an annual cash retainer of $5,000 to each respective Chairman of the Audit, Nominating/Governance and Compensation Committees, and the Lead Independent Director. The Company also reimburses all directors for their expenses incurred in connection with their activities as directors of SMI. Directors who are also employees of the Company receive no additional compensation for serving on the Board of Directors. For additional information concerning the Formula Stock Option Plan for SMI’s Independent Directors, see Note 10 to the Consolidated Financial Statements in the Company’s Report on Form 10-K for the year ended December 31, 2002.

12

Stockholder Return Performance Graph

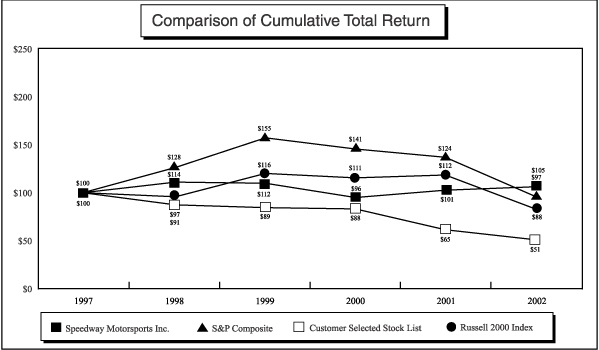

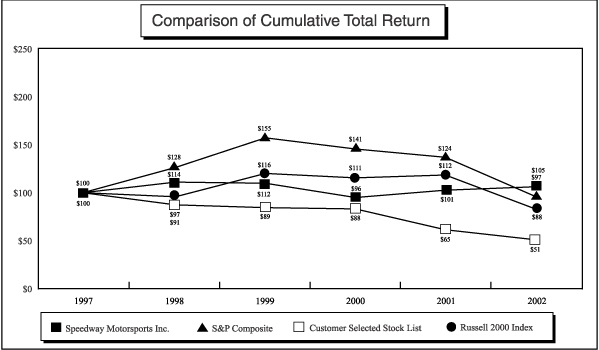

Set forth below is a line graph comparing the cumulative stockholder return on SMI’s common stock against the cumulative total return of each of the Standard & Poor’s 500 Stock Index, the Russell 2000 Stock Index, and a Peer Group Index for the period December 31, 1997 through December 31, 2002. The Russell 2000 Index was included because management believes, as a small-cap index, it more closely represents companies with market capitalization similar to the Company’s than the Standard & Poor’s 500 Stock Index. The companies used in the Peer Group Index in 1998 consist of International Speedway Corporation, Walt Disney Co., Dover Downs Entertainment and Action Performance; and in 2000 through 2002 also include Championship Auto Racing Teams, which are all publicly traded companies known by the Company to be involved in the amusement, sports and recreation industries. The graph assumes that $100 was invested on December 31, 1997 in each of SMI’s common stock, the Standard & Poor’s 500 Stock Index, the Russell 2000 Index, and the Peer Group Index companies and that all dividends were reinvested.

13

CERTAIN TRANSACTIONS

At December 31, 2002, CMS had a note receivable for $954,000 including accrued interest, due from a partnership in which Mr. O. Bruton Smith, the Company’s Chairman and Chief Executive Officer, is a partner. The note is collateralized by certain land owned by the partnership. The Board of Directors, including SMI’s Independent Directors, have reviewed this transaction and determined it an appropriate use of available Company funds based on interest rates at the original transaction date and the underlying note collateral and creditworthiness of the Company’s Chairman and his partnership.

At December 31, 2002, the Company had approximately $9.0 million, including accrued interest, due from Mr. Smith. The highest aggregate amount outstanding in 2002 was $9.0 million. The amount due represents premiums paid by the Company under the split-dollar life insurance trust arrangement on behalf of Mr. Smith (see “O. Bruton Smith Life Insurance Arrangements”), cash advances and expenses paid by the Company on behalf of the Chairman. The Board of Directors, including SMI’s independent directors, have reviewed this compensatory arrangement and determined it an appropriate use of available Company funds based on interest rates at the time of transaction and creditworthiness of the Chairman. As of July 30, 2002, the Company indicated to Mr. Smith that it would no longer make payments under the split-dollar life insurance trust arrangements for his benefit.

The Company has made loans to, and paid certain expenses on behalf of, Sonic Financial Corporation, a Company affiliate through common ownership by the Company’s Chairman and Chief Executive Officer for various corporate purposes. At December 31, 2002, the Company had approximately $6.2 million, including accrued interest, due from Sonic Financial. The highest aggregate amount outstanding in 2002 was $8.9 million. The Board of Directors, including SMI’s independent directors, have reviewed these transactions and determined them to be an appropriate use of available Company funds based on interest rates at the time of transaction and creditworthiness of Sonic Financial and the Company’s Chairman.

The amounts due from affiliates discussed in the preceding three paragraphs all bear interest at 1% over prime, are payable on demand, and the Company does not anticipate or require repayment before 2004.

At December 31, 2002, the Company had loaned approximately $295,000 to a corporation affiliated with the Company through common ownership by Mr. Smith. The highest aggregate amount outstanding in 2002 was $464,000. From time to time, the Company makes cash advances for various corporate purposes on behalf of the affiliate. The amount due is non-interest bearing, is payable on demand, is collateralized by certain personal property, and the Company does not anticipate or require repayment before 2004. The Board of Directors, including SMI’s independent directors, have reviewed these transactions and determined them to be an appropriate use of available Company funds based on the underlying collateral and creditworthiness of the Company’s Chairman and affiliate.

Sonic Financial, an affiliate of the Company through common ownership by Mr. Smith, has made several loans and cash advances to AMS prior to 1996 for the AMS acquisition and other expenses. Such loans and advances stood at approximately $2.6 million at December 31, 2002. Of such amount, approximately $1.8 million bears interest at 3.83% per annum. The remainder of the amount bears interest at 1% over prime. The Company believes that the terms of these loans and advances are more favorable than those that could be obtained in an arm’s-length transaction with an unrelated third party.

600 Racing, Inc. and SMI Properties (“SMIP”), wholly-owned subsidiaries of the Company, each lease an office and warehouse facility from Chartown, an affiliate of the Company through common ownership by Mr. Smith, under annually renewable lease agreements. Rent expense in 2002 for 600 Racing approximated $197,000 and for SMIP approximated $195,000. The leases contain terms more favorable to the Company than would be obtained from unaffiliated third parties. Additionally, a special committee of independent and disinterested SMI directors on the Company’s behalf evaluated these leases, assisted by independent counsel and real estate experts, and concluded the leases are in the best interests of the Company and its stockholders. The economic

14

terms of the leases were based on several factors, including projected earnings capacity of 600 Racing and SMIP, the quality, age, condition and location of the facilities, and rent paid for comparable commercial properties.

In 2002, LVMS purchased new vehicles for employee use from Nevada Dodge, a subsidiary of SAI, for approximately $734,000. The Company believes the purchase terms approximate market value and are no less favorable than could be obtained in an arm’s-length transaction from an unrelated third party.

Oil-Chem Research Corporation (“Oil-Chem”), a wholly-owned subsidiary of the Company, sold z-Max oil lubricant product to certain SAI dealerships for resale to service customers of the dealerships in the ordinary course of business. Total purchases from Oil-Chem by SAI dealerships in 2002 approximated $1,841,000. At December 31, 2002, Oil-Chem had $83,000 due from SAI. These sales occurred on terms no less favorable than could be obtained in an arm’s-length transaction from an unrelated third party.

SAI and its dealerships frequently purchase various apparel items, which are screenprinted or embroidered with SAI and dealership logos, for its employees as part of internal marketing and sales promotions. SAI and its dealerships purchase such items from several companies similar to WMI. Total purchases from WMI by SAI and its dealerships in 2002 approximated $405,000. The Company believes these sales occurred on terms no less favorable than could be obtained in an arm’s-length transaction with an unrelated third party.

For additional information concerning certain transactions in which Mr. Smith has an interest, see “Compensation Committee Interlocks and Insider Participation”.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires SMI’s executive officers, directors and persons who own more than ten percent (10%) of SMI’s common stock to file initial reports of ownership and changes in ownership with the SEC. Additionally, SEC regulations require that SMI identify any individuals for whom one of the referenced reports was not filed on a timely basis during the most recent fiscal year or prior fiscal years. To SMI’s knowledge, based solely on a review of reports furnished to it, all Section 16(a) filing requirements applicable to its executive officers, directors and more than 10% beneficial owners were complied with except that, Ms. Marylaurel E. Wilks inadvertently filed one-day late a Form 4 Statement of Change of Beneficial Ownership on December 17, 2002, the filing of which was triggered by the granting of 5,000 stock options pursuant to the 1994 Stock Option Plan.

OTHER MATTERS

In the event that any matters other than those referred to in the accompanying Notice should properly come before and be considered at the Annual Meeting, it is intended that proxies in the accompanying form will be voted thereon in accordance with the judgment of the person or persons voting such proxies.

15

Appendix

SPEEDWAY MOTORSPORTS, INC.

Charter of the Audit Committee of the Board of Directors

As adopted on December 11, 2002

The Committee is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities. The Committee’s primary purposes are to:

| | (a) | | Monitor the integrity of the Company’s financial statements, financial reporting process, systems of internal controls and finance, accounting, regulatory and legal compliance; |

| | (b) | | Select, evaluate and replace, as needed, the Company’s independent auditors; |

| | (c) | | Monitor the independence, qualifications and performance of the Company’s independent auditors and internal auditing department; |

| | (d) | | Provide an avenue of communication among the independent auditors, management, internal auditing and the Board of Directors; |

| | (e) | | Review areas of potential significant financial risk to the Company; |

| | (f) | | Monitor the Company’s compliance with legal and regulatory requirements; and |

| | (g) | | Report to the Board of Directors. |

The Committee also produces an annual report required by Securities and Exchange Commission (“SEC”) rules, which is included in the Company’s proxy statement for its Annual Meeting of Stockholders. The Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities, and it has direct access to the independent auditors as well as any person in the Company. The Committee has the authority to retain, at the Company’s expense, special legal, accounting, or other consultants or experts it deems necessary to carry out its duties. The Company will provide for appropriate funding, as determined by the Committee, for payment of compensation to any such advisors and to the independent auditors.

| II. Committee Composition and Meetings | | |

The Committee consists of three or more directors, each of whom shall be independent. To be considered independent, a member of the Committee

| | (a) | | may not, other than in his or her capacity as a member of the Committee, the Board of Directors, or any other committee of the Board of Directors, |

| | (i) | | accept any consulting, advisory or other compensatory fee from the Company; or |

| | (ii) | | be an affiliated person of the Company or any subsidiary of the Company; and |

| | (b) | | must meet the independence requirements of the New York Stock Exchange. |

All members of the Committee shall have a basic understanding of finance and accounting and be able to read and understand financial statements. The Committee chairman must have accounting or related financial management expertise.

Committee members are appointed by the Board of Directors. The members of the Committee will designate a Chairman by majority vote of the Committee membership.

The Committee meets at least four times annually, or more frequently as circumstances dictate. The Chairman of the Committee, in consultation with the members of the Committee, will determine the frequency and length of Committee meetings. The Chairman of the Committee, in consultation with appropriate members of the Committee and management, will develop the Committee’s agenda. The Chairman of the Committee should prepare and/or approve an agenda in advance of each meeting.

The Committee meets privately in executive session at least annually with management, the director of the internal auditing department, the independent auditors, and as a committee to discuss any matters that the Committee or any of these groups believe should be discussed.

The Committee, or the Committee chairman, should communicate with management and the independent auditors quarterly to review the Company’s financial statements and significant findings based upon the auditors limited review procedures.

| III. | | Committee Duties and Responsibilities |

A. Financial Review Procedures.

| | 1. | | The Committee reviews and reassesses the adequacy of this Charter at least annually, submits this Charter to the Board of Directors for approval and has it published at least once every three years in accordance with SEC regulations. |

| | 2. | | The Committee reviews the Company’s annual audited financial statements prior to filing or distribution, including the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” This review includes a discussion with management and independent auditors of significant issues regarding accounting principles, practices and judgments. |

A-2

| | 3. | | The Committee reviews with management and the independent auditors the Company’s quarterly financial results prior to the release of earnings and the Company’s quarterly financial statements prior to filing or distribution, including the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” A majority of the Committee members may represent the entire Committee for purposes of this review. |

| | 4. | | The Committee reviews and approves any significant changes to the Company’s accounting principles and any items required to be communicated by the independent auditors in accordance with AICPA Statement of Auditing Standards No. 61. |

| | 5. | | In consultation with management, the independent auditors, and the internal auditors, the Committee considers the integrity of the Company’s financial reporting processes and controls. The Committee discusses significant financial risk exposures and the steps management has taken to monitor, assess, manage and report such exposures as well as the guidelines and policies of management that govern the process by which risk assessment and management are undertaken. The Committee also reviews significant findings prepared by the independent auditors and the internal audit, if and when established, together with management’s responses including the status of previous recommendations. |

| | 6. | | The Committee, to the extent it deems appropriate, reviews and discusses earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies. |

| | 7. | | The Committee meets separately, at least quarterly, with each of management, the Company’s internal auditors (or other personnel responsible for the internal audit function) and the independent auditors. |

| | 8. | | The Committee reviews with the independent auditors any audit issues and management���s response. |

| | 9. | | As appropriate, the Committee obtains advice and assistance from outside legal, accounting or other advisors. |

| | 1. | | The Committee, in its capacity as a committee of the Board of Directors, is directly responsible, and has sole authority, for the appointment, compensation, termination and oversight of the work of the independent auditors of the Company (including resolution of any disagreements between management and the independent auditors regarding financial reporting) for the purpose of preparing or issuing an audit report or related work. |

| | 2. | | The independent auditors are responsible ultimately to the Committee and report directly to the Committee. |

A-3

| | 3. | | The Committee reviews the independence, qualifications and performance of the auditors and will employ or terminate the Company’s independent auditor (subject, if applicable, to stockholder ratification) as the Committee, in its sole discretion, determines from time to time but no less than annually. |

| | 4. | | The Committee requires that the independent auditors submit to the Committee annually a written report delineating all relationships between the auditors and the Company, and reviews and discusses with the independent auditors all significant relationships they have with the Company that could impair the auditors’ independence. |

| | 5. | | The Committee requires that the independent auditors submit to the Committee annually, and then reviews, a written report describing |

| | (a) | | the independent auditor’s internal quality-control procedures; and |

| | (b) | | any material issues raised by its most recent internal quality-control review, or peer review, of the auditor or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the independent auditor, and any steps taken to deal with any such issues. |

| | 6. | | The Committee reviews the independent auditors’ audit plan and discusses with the independent auditor its scope, staffing, locations, reliance upon management, and internal audit and general audit approach. |

| C. | | Legal Compliance and Internal Audit. |

| | 1. | | At least annually, the Committee reviews with the Company’s counsel any legal matters that could have a significant impact on the Company’s financial statements, the Company’s compliance with applicable laws and regulations, and inquiries received from regulators or governmental agencies. |

| | 2. | | The Committee reviews the budget, plan, changes in plan, activities, organizational structure and qualifications of internal audit, as needed. |

| | 3. | | The Committee reviews the appointment, performance and replacement of the senior internal audit executive as needed. Internal audit is responsible to senior management, but also has direct reporting responsibility to the Committee. |

| | 4. | | The Committee reviews reports prepared by internal audit together with management’s response and follow-up to these reports. |

| D. | | Other Audit Committee Responsibilities. |

| | 1. | | The Committee annually prepares a report to shareholders as required by the SEC, which is included in the Company’s annual proxy statement. |

A-4

| | 2. | | The Committee ensures that the Board of Directors annually prepares and submits a written affirmation that it has reviewed the adequacy of this Charter, as required by the New York Stock Exchange. |

| | 3. | | The Committee shall establish, and publish as appropriate, procedures for |

| | (a) | | the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters; and |

| | (b) | | the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

| | 4. | | The Committee will set clear hiring policies for employees or former employees of the independent auditors. |

| | 5. | | The Committee shall evaluate annually its performance and report the results thereof to the Board of Directors. Such annual evaluation shall include a review of: (A) major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company’s selection or application of accounting principles, and major issues as to the adequacy of the Company’s internal controls and any special audit steps adopted in light of material control deficiencies; (B) analyses prepared by management and/or the independent auditors setting forth significant financial reporting issues and judgments made in connection with the preparation of the financial statements, including analyses of the effects of alternative GAAP methods on the financial statements; (C) the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the financial statements of the Company; and (D) earnings press releases (paying particular attention to any use of “pro forma” or “adjusted” non-GAAP, information), as well as financial information and earnings guidance provided to analysts and rating agencies. |

| | 6. | | The Committee performs any other activities consistent with this Charter and the Company’s by-laws, and governing law, as the Committee or the Board of Directors deems necessary or appropriate. |

| | 7. | | The Committee maintains minutes of its meetings and periodically reports to the Board of Directors on significant results of the foregoing activities. |

A-5

SPEEDWAY MOTORSPORTS, INC.

P R O X Y

Concord, North Carolina

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Mr. O. Bruton Smith and Mr. William R. Brooks as Proxies, each with the power to appoint his substitute, and hereby authorizes them to represent and vote, as designated below, all the shares of the common stock of Speedway Motorsports, Inc. held of record by the undersigned on February 24, 2003 at the Annual Meeting of Stockholders to be held on April 23, 2003 or any adjournment thereof.

1. ELECTION OF DIRECTORS

Nominees: Mr. H.A. “Humpy” Wheeler, Mr. Edwin R. Clark and Mr. Tom E. Smith (Mark only one of the following boxes).

¨ VOTE FORall nominees listed above, except vote withheld as to the following nominee(s) (if any): | | ¨ VOTE WITHHELDas to all nominees. |

2. SELECTION OF AUDITORS

To ratify the selection of Deloitte & Touche LLP as the principal independent auditors of SMI and its subsidiaries for the year 2003 (Mark only one of the following boxes).

¨ FOR ¨ AGAINST ¨ ABSTAIN

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before this meeting. In the absence of any instructions from the undersigned, the Proxies will vote “For” the election of all the nominees listed under Item 1 and “For” Item 2.

PLEASE MARK, SIGN BELOW, DATE AND RETURN THIS

PROXY PROMPTLY IN THE ENVELOPE FURNISHED.

Please sign exactly as name appears below.

When shares are held by joint tenants, both should sign. When signing as attorney, as executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.

Shares

Dated , 2003

Signature

Signature if held jointly

¨ Please mark here if you intend to attend the Meeting of Stockholders.