UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Schedule 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A)

OF THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

| | | |

¨ | | Definitive Additional Materials | | ¨ | | Soliciting Material Pursuant to §240.14a-12 |

Speedway Motorsports, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

5555 CONCORD PARKWAY SOUTH

CONCORD, NORTH CAROLINA 28027

March 21, 2007

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders to be held at 9:00 a.m. on Wednesday, April 18, 2007, at Lowe’s Motor Speedway in Concord, North Carolina. We look forward to greeting personally those stockholders who are able to attend.

The accompanying formal Notice of Meeting and Proxy Statement describe the matters on which action will be taken at the meeting.

Whether or not you plan to attend the meeting on April 18, 2007, it is important that your shares be represented. To ensure that your vote is received and counted, please sign, date and mail the enclosed proxy at your earliest convenience. Your vote is important regardless of the number of shares you own.

On behalf of the Board of Directors

Sincerely,

O. Bruton Smith

Chairman and Chief Executive Officer

Voting Your Proxy Is Important

PLEASE SIGN AND DATE YOUR PROXY AND

RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE

Speedway Motorsports, Inc.

NOTICE OF MEETING

Concord, NC

March 21, 2007

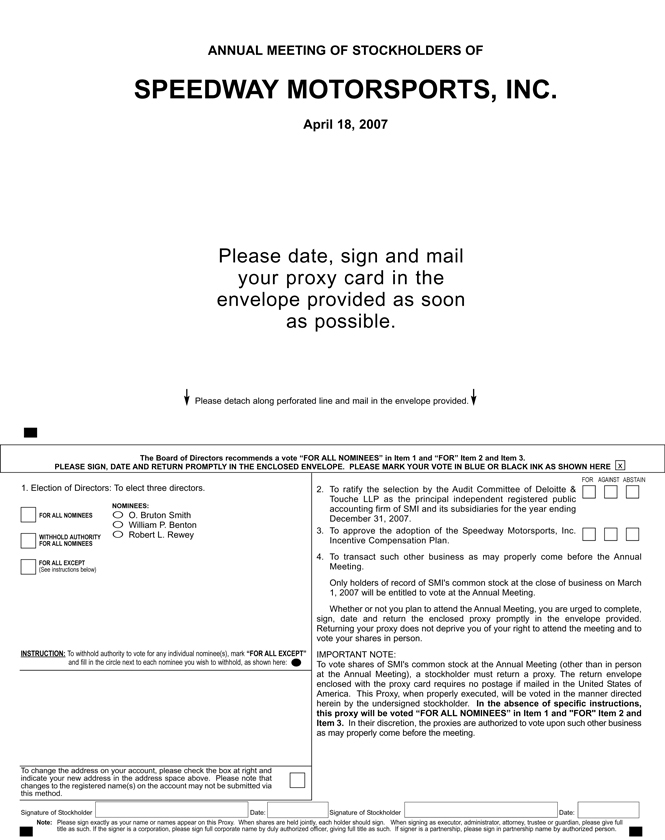

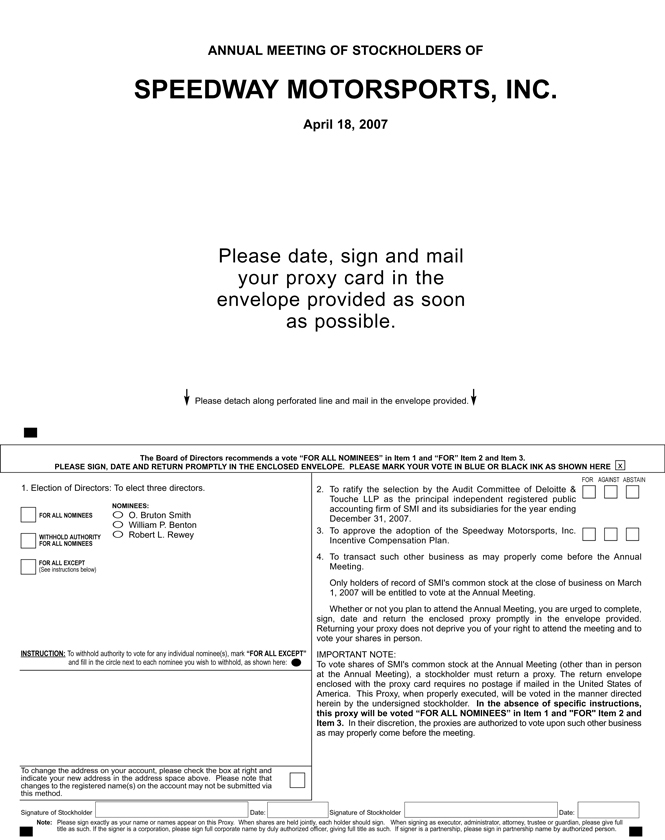

The Annual Meeting of Stockholders of Speedway Motorsports, Inc. (“SMI”) will be held at the Smith Tower located at Lowe’s Motor Speedway, 5555 Concord Parkway South, Concord, North Carolina on Wednesday, April 18, 2007, at 9:00 a.m. (the “Annual Meeting”) for the following purposes, as described in the accompanying Proxy Statement:

| 1. | To elect three directors. |

| 2. | To ratify the selection by the Audit Committee of Deloitte & Touche LLP as the principal independent registered public accounting firm of SMI and its subsidiaries for the year ending December 31, 2007. |

| 3. | To approve the adoption of the Speedway Motorsports, Inc. Incentive Compensation Plan. |

| 4. | To transact such other business as may properly come before the Annual Meeting. |

Only holders of record of SMI’s common stock at the close of business on March 1, 2007 will be entitled to vote at the Annual Meeting.

Whether or not you plan to attend the Annual Meeting, you are urged to complete, sign, date and return the enclosed proxy promptly in the envelope provided. Returning your proxy does not deprive you of your right to attend the meeting and to vote your shares in person.

J. Cary Tharrington IV

Secretary

IMPORTANT NOTE:To vote shares of SMI’s common stock at the Annual Meeting (other than in person at the Annual Meeting), a stockholder must return a proxy. The return envelope enclosed with the proxy card requires no postage if mailed in the United States of America.

GENERAL

INTRODUCTION

The Annual Meeting of Stockholders of Speedway Motorsports, Inc. (“SMI” or the “Company”) will be held on Wednesday, April 18, 2007 at 9:00 a.m., at the Smith Tower located at Lowe’s Motor Speedway, 5555 Concord Parkway South, Concord, North Carolina (the “Annual Meeting”), for the purposes set forth in the accompanying notice. Only holders of record of SMI’s common stock, par value $.01 per share (the “Common Stock”), at the close of business on March 1, 2007 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting. This Proxy Statement is furnished to stockholders in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) to be used at the Annual Meeting, and at any and all adjournments thereof, and is first being sent to stockholders on or about March 20, 2007. Proxies in the accompanying form, properly executed and duly returned and not revoked, will be voted at the Annual Meeting (including adjournments). Where a specification is made by means of the ballot provided in the proxies regarding any matter presented at the Annual Meeting, such proxies will be voted in accordance with such specification. If no specification is made, proxies will be voted (i) in favor of electing SMI’s three nominees to the Board, (ii) in favor of ratifying the selection by the Audit Committee of Deloitte & Touche LLP (“Deloitte & Touche”) as the principal independent registered public accounting firm (“auditors”) of SMI for the year ending December 31, 2007, (iii) in favor of approval of the Speedway Motorsports, Inc. Incentive Compensation Plan, and (iv) in the discretion of the proxy holders, on any other business as may properly come before the Annual Meeting. The Board currently knows of no other business that will be presented for consideration at the Annual Meeting.

Proxies should be sent to American Stock Transfer & Trust Company, 59 Maiden Lane, New York, NY 10038.

This Proxy Statement is being furnished by SMI to its stockholders of record as of March 1, 2007 in connection with the upcoming Annual Meeting.

REVOCATION OF PROXY

Stockholders who execute proxies may revoke them at any time before they are voted by (i) delivering a written notice to SMI’s Corporate Secretary, either at the Annual Meeting or prior to the meeting date at the Company’s offices at 5555 Concord Parkway South, Concord, North Carolina 28027, (ii) executing and delivering a later-dated proxy, or (iii) attending the Annual Meeting and voting in person.

NUMBER OF SHARES OUTSTANDING AND VOTING

SMI currently has 200,000,000 shares of Common Stock authorized under its Certificate of Incorporation, of which 43,770,879 shares were issued and outstanding and entitled to be voted at the Annual Meeting on the Record Date. At the Annual Meeting, holders of Common Stock will have one vote per share for an aggregate total of 43,770,879 votes. In some cases, a nominee holding shares for a beneficial owner may not have discretionary authority to vote certain shares on a particular matter or otherwise may not vote such shares (a “broker non-vote”). These broker non-votes will be considered as present for purposes of determining a quorum, but are not entitled to vote. Abstentions will be treated as present for purposes of determining a quorum and entitled to vote. A quorum being present, directors will be elected by a plurality of votes cast, and the actions proposed in the remaining items referred to in the accompanying Notice of Meeting will become effective if a majority of the votes cast by shares entitled to vote is cast in favor thereof. Therefore, while both abstentions and broker non-votes will be counted for the purpose of determining the existence of a quorum, only abstentions will have the same effect as a negative vote on matters requiring a majority of votes cast by shares entitled to vote. Both abstentions and broker non-votes have no effect on the election of directors.

A holder of Common Stock who signs a proxy card may withhold votes as to any director-nominee by writing the name of such nominee in the space provided on the proxy card.

| | | | | | | | |

| | | Speedway Motorsports, Inc. | | | | | | |

| | | | | | 1 |

| | | | |

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table sets forth certain information regarding the beneficial ownership of Common Stock as of March 1, 2007 by (i) each person or entity known by SMI to beneficially own more than five percent of the Common Stock, (ii) each director and nominee to the Board, (iii) each executive officer of SMI listed in the Summary Compensation Table (“named executive officers”), and (iv) all directors and executive officers of SMI as a group. Except as otherwise indicated below, each person named in the table has sole voting and investment power with respect to the securities beneficially owned by them as set forth opposite their name. Unless otherwise noted, the address for the beneficial owners is 5555 Concord Parkway South, Concord, North Carolina 28027.

| | | | | |

| Beneficial Owner | | Amount & Nature of

Beneficial Ownership | | Percent | |

O. Bruton Smith(1) | | 29,000,800 | | 63.6 | % |

Sonic Financial Corporation(1) (2) | | 23,700,000 | | 52.0 | |

American Century Companies, Inc.(3) | | 2,438,010 | | 5.4 | |

H.A. Wheeler(4) | | 135,190 | | * | |

William R. Brooks(5) | | 233,780 | | * | |

Marcus G. Smith(6) | | 158,470 | | * | |

William P. Benton(7) | | 71,000 | | * | |

Mark M. Gambill(8) | | 114,200 | | * | |

James P. Holden(9) | | 30,000 | | * | |

Robert L. Rewey(9) | | 50,000 | | * | |

Tom E. Smith(10) | | 55,000 | | * | |

All directors and executive officers as a group (nine persons) | | 29,848,440 | | 65.5 | % |

| (1) | The shares of Common Stock shown as owned by Mr. O. Bruton Smith include all of the shares shown as owned by Sonic Financial Corporation (“Sonic Financial”) elsewhere in the table. Mr. O. Bruton Smith owns the substantial majority of Sonic Financial’s common stock. An aggregate of 14,350,000 shares have been pledged by Mr. Smith and/or Sonic Financial as security. |

| (2) | This entity’s address is P.O. Box 18747, Charlotte, North Carolina 28218. |

(3) | This entity’s address is 4500 Main Street, 9th Floor, Kansas City, MO 64111. This information is based on information contained in Schedule 13G filed with the Securities and Exchange Commission on February 13, 2007, by American Century Companies, Inc. (“ACC”) and American Century Investment Management, Inc. (“ACIM”). ACIM is an investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E) of the Securities Exchange Act of 1934, as amended. The filing indicates that ACC and ACIM each have sole voting control over 2,416,268 shares and sole dispositive power over 2,438,011 shares. |

| (4) | All shares shown as owned by Mr. Wheeler, other than 10,428 shares owned by him directly, underlie options granted by theCompany that are currently exercisable or exercisable within 60 days after the Record Date. |

| (5) | All shares shown as owned by Mr. Brooks, other than 24,200 shares owned by him directly, underlie options granted by the Company that are currently exercisable or exercisable within 60 days after the Record Date. |

| (6) | All shares shown as owned by Mr. Marcus G. Smith, other than 140 shares owned by him directly, underlie options granted by the Company that are currently exercisable or exercisable within 60 days after the Record Date. |

| (7) | All shares shown as owned by Mr. Benton, other than 1,000 shares owned by him directly, underlie options granted by the Company that are currently exercisable or exercisable within 60 days after the Record Date. |

| (8) | All shares shown as owned by Mr. Gambill, other than 4,000 shares owned by him directly, underlie options granted by the Company that are currently exercisable or exercisable within 60 days after the Record Date. Mr. Gambill disclaims beneficial ownership of 200 shares. |

| (9) | All shares shown as owned by Mr. Holden and Mr. Rewey underlie options granted by the Company that are currently exercisable or exercisable within 60 days after the Record Date. |

| (10) | All shares shown as owned by Mr. Tom E. Smith, other than 5,000 shares owned by him directly, underlie options granted by the Company that are currently exercisable or exercisable within 60 days after the Record Date. |

For additional information concerning options granted to the Company’s executive officers, see “Executive Compensation” below.

CORPORATE GOVERNANCE

The Company operates within a comprehensive plan of corporate governance for the purpose of defining responsibilities, setting high standards of professional and personal conduct and assuring compliance with such responsibilities and standards. The Company complies with the requirements of the Sarbanes-Oxley Act of 2002 and the New York Stock Exchange (“NYSE”) and regularly monitors developments in the area of corporate governance.

BOARD AND COMMITTEE MEMBER INDEPENDENCE

Because Mr. O. Bruton Smith holds more that 50% of the voting power of the Common Stock, SMI qualifies as a “controlled company” for purposes of the NYSE’s listing standards and is, therefore, not required to comply with the NYSE requirement that a listed company have a majority of independent directors. However, SMI is committed to having a majority of its Board membership be independent directors as evidenced by SMI’s Corporate Governance Guidelines. SMI’s non-management directors hold meetings, separate from management, at least four times a year. Those meetings are presided over by the Company’s Lead Independent Director, Mr. Tom E. Smith. In Mr. Tom E. Smith’s absence, the other independent directors will choose another independent director to preside over such meeting.

| | | | | | | | |

| | | | | | Speedway Motorsports, Inc. | | |

| 2 | | | | | |

| | | | |

The Board has determined that Messrs. Benton, Gambill, Holden, Rewey and Tom E. Smith are currently independent within the meaning of the NYSE’s current listing standards, and further that all members of its Audit Committee are independent in accordance with current SEC regulations. The Board’s determination was based upon its assessment of each director’s relationship with SMI and the materiality of that relationship in light of all relevant facts and circumstances both from the standpoint of the director in his individual capacity and the persons to which the director is related and organizations with which the director is affiliated. In reaching this determination, the Board has relied upon representations made by Messrs. Benton, Gambill, Holden, Rewey and Tom E. Smith in director questionnaires and discussions between the foregoing individuals and the Board and the Nominating/Corporate Governance Committee of the Board. The Board relied upon Categorical Standards for Director Independence, which the Board adopted to assist it in evaluating the independence of each of its directors. A copy of SMI’s Categorical Standards for Director Independence is available on our website at www.speedwaymotorsports.com. In concluding that Mr. Gambill is independent, the Board took into consideration Mr. Gambill’s service on the Board of Managers of SMISC, LLC, the Company’s equally-owned joint venture with International Speedway Corporation. The Board concluded that Mr. Gambill’s service on the SMISC, LLC Board of Managers did not compromise his independence. With respect to Mr. Tom E. Smith, the Board considered his service as a member of the Board of Directors of CT Communications, Inc., a sponsor at the Company’s subsidiary, Lowe’s Motor Speedway. The Board determined that the relationship was immaterial and that Mr. Tom E. Smith remains independent. With respect to Mr. Holden, the Board considered his service as a member of the Board of Directors of Sirius Satellite Radio, Inc., a sponsor of NASCAR and a contract party with the Company’s subsidiary, Performance Racing Network. The Board determined that the relationship was immaterial and that Mr. Holden remains independent. The Board also considered Mr. Benton’s and Mr. Rewey’s service on the Board of Directors of Sonic Automotive, Inc., a company controlled by Mr. O. Bruton Smith, and the Board concluded that such service did not compromise their independence. The Nominating/Corporate Governance Committee regularly reviews the independence of all independent directors on the Board and reports its findings to the Board, which then makes regular determinations as to director independence under applicable SEC and NYSE requirements.

CORPORATE GOVERNANCE GUIDELINES

The Company has adopted a set of Corporate Governance Guidelines, including specifications for director qualification and responsibility. A copy of these guidelines is available onour website at www.speedwaymotorsports.com. You may also obtain a printed copy upon request to the Company.

CODE OF BUSINESS CONDUCT AND ETHICS

The Board has adopted a Code of Business Conduct and Ethics that applies to our employees, directors and officers, including our chief executive officer, chief operating officer, chief financial officer and treasurer and chief accounting officer. A copy of the Code of Business Conduct and Ethics is available on our website at www.speedwaymotorsports.com. We post any amendments to the Code of Business Conduct and Ethics, as well as any waivers that are required to be disclosed by SEC or NYSE rules, on our website. You may also obtain a printed copy upon request to the Company.

COMMUNICATIONS TO THE BOARD

Stockholders and other parties interested in communicating with the Board as a group may do so by writing to the Chairman of the Board at “c/o J. Cary Tharrington IV, Vice President and General Counsel, Speedway Motorsports, Inc., 5401 E. Independence Blvd., Charlotte, NC 28212.” The Company’s General Counsel will review all such correspondence and will make such correspondence available regularly to the Board. Any correspondence relating to accounting, internal controls or auditing matters will be immediately brought to the attention of the members of the Company’s Audit Committee for consideration in accordance with established procedures. Communications intended for non-management directors should be directed to the Chairman of the Nominating/Corporate Governance Committee at the address above.

ELECTION OF DIRECTORS

NOMINEES FOR ELECTION AS DIRECTORS OF SMI

Directors of SMI are elected at the Annual Meetings of Stockholders to serve staggered terms of three years and until their successors are elected and qualified. The Board currently consists of nine directors. The terms of Messrs. O. Bruton Smith, William P. Benton and Robert L. Rewey expire at the Annual Meeting. The terms of Messrs. William R. Brooks, Mark M. Gambill and James P. Holden expire at the 2008 Annual Meeting. The terms of Messrs. H.A. Wheeler, Marcus G. Smith and Tom E. Smith expire at the 2009 Annual Meeting. Messrs. O. Bruton Smith, William P. Benton and Robert L. Rewey are standing for reelection at the Annual Meeting.

It is intended that the proxies in the accompanying form will be voted at the Annual Meeting for the election to the Board of the following nominees, each of whom has consented if elected to serve a three-year term until the 2010 Annual Meeting: Messrs. O. Bruton Smith, William P. Benton, and Robert L. Rewey. Each director-nominee will serve until the end of their term and until their successor is elected and

| | | | | | | | |

| | | Speedway Motorsports, Inc. | | | | | | |

| | | | | | 3 |

| | | | |

qualified, except as otherwise provided in SMI’s Certificate of Incorporation and Bylaws. If for any reason any nominee named above is not a candidate when the election occurs, it is intended that proxies in the accompanying form will be voted for the election of the other nominees named above and may be voted for any substitute nominee or, in lieu thereof, the Board may reduce the number of directors in accordance with SMI’s Certificate of Incorporation and Bylaws.

DIRECTORS, DIRECTOR-NOMINEES, EXECUTIVE OFFICERS AND GENERAL MANAGERS

The name, age, present principal occupation or employment and the principal occupations, positions, offices or employments for at least the past five years of each SMI director, director-nominee, executive officer and general manager are set forth below.

DIRECTORS, DIRECTOR-NOMINEES AND EXECUTIVE OFFICERS

O. Bruton Smith, 80, has been the Chairman and Chief Executive Officer of SMI since its organization in 1994. Mr. Smith has served as the CEO and a board member of Charlotte Motor Speedway, LLC, a wholly owned subsidiary of SMI, and its predecessor entities (“CMS”) since 1975, which he originally founded in 1959. Mr. Smith has been the CEO of Atlanta Motor Speedway LLC (“AMS”) since its acquisition in 1990, Texas Motor Speedway, Inc. (“TMS”) since its formation in 1995, Bristol Motor Speedway LLC (“BMS”) since its acquisition in 1996, the subsidiary operating Infineon Raceway (“IR”) since its acquisition in 1996, and the subsidiary operating Las Vegas Motor Speedway (“LVMS”) since its acquisition in 1998. In addition, Mr. Smith serves as the CEO and a director, or in a similar capacity, for many of SMI’s other subsidiaries. Mr. Smith also is the Chairman, CEO, a director and controlling stockholder of Sonic Automotive, Inc. (“SAI”) (NYSE:SAH). Mr. Smith also owns and operates Sonic Financial Corporation (“Sonic Financial”), a private business which owns a majority of the Company’s common stock, among other things. Mr. Smith is standing for reelection as a director at the Annual Meeting.

H.A. Wheeler, 68, has been the President, Chief Operating Officer and a director of SMI since its organization in 1994. Mr. Wheeler was hired by CMS in 1975 and has been General Manager of CMS since 1976. Mr. Wheeler was named President of CMS in 1980. He also has served as Vice President and a director of BMS since its acquisition and TMS since its formation. Mr. Wheeler also serves as an officer of several other SMI subsidiaries.

William R. Brooks, 57, has been Vice President, Treasurer, Chief Financial Officer and a director of SMI since its organization in 1994. In February 2004, Mr. Brooks became an Executive Vice President of SMI. Mr. Brooks joined Sonic Financial from PriceWaterhouseCoopers in 1983, has served as Vice President of CMS since before the organization of SMI and has been Vice President and a director of AMS since its acquisition and TMS since its formation. He has served as Vice President of BMS, LVMS and IR since their acquisition. In addition, Mr. Brooks serves as an officer and a director, or in a similar capacity, for many of SMI’s subsidiaries. At Sonic Financial, Mr. Brooks was promoted from manager to controller in 1985 and again to Chief Financial Officer in 1989. Mr. Brooks also has served as a director of SAI since its formation in 1997.

Marcus G. Smith, 33, became a director of SMI in 2004 and Executive Vice President of National Sales and Marketing for SMI in February 2004. Prior to that appointment, Mr. Smith served as Vice President of Business Development for SMI since 2001. Mr. Smith joined the Company in 1996 as a sales associate at Lowe’s Motor Speedway and was named Manager of New Business Development in 1999. Mr. Marcus G. Smith is the son of Mr. O. Bruton Smith. In addition, Mr. Smith serves as a member of the Board of Managers of SMISC, LLC, an equally-owned merchandising joint venture between the Company and International Speedway Corporation.

William P. Benton, 83, became a director of SMI in 1995. Mr. Benton retired from Ford Motor Company as Vice President of Marketing worldwide after a distinguished 37-year career with the company. During that time, Mr. Benton held the following major positions: Vice President/General Manager of Lincoln/Mercury Division, Vice President/General Manager of Ford Division, four years in Europe as Group Vice President of Ford of Europe and a member of the company’s Product Planning Committee, responsible for all products of the company worldwide. Most recently, Mr. Benton was Vice Chairman of Wells Rich Greene and Executive Director of Ogilvy & Mather Worldwide in New York until 1992. In addition, Mr. Benton serves as a director of SAI and Allied Holdings, Inc. Mr. Benton is standing for reelection as a director at the Annual Meeting.

Mark M. Gambill, 56, became a director of SMI in 1995. Mr. Gambill worked for Wheat First Securities from 1972, including serving as chairman of the underwriting committee, until it was sold to First Union Corporation (now Wachovia Corporation) in 1998. Mr. Gambill was President of Wheat First Butcher Singer at the time of sale. Mr. Gambill left First Union in 1999. Mr. Gambill is currently Managing Member of Cary Street Partners, a financial advisory and wealth

| | | | | | | | |

| | | | | | Speedway Motorsports, Inc. | | |

| 4 | | | | | |

| | | | |

management firm. In addition, Mr. Gambill serves as a member of the Board of Managers of SMISC, LLC, an equally-owned merchandising joint venture between the Company and International Speedway Corporation.

James P. Holden, 55, became a director of SMI in 2004. Mr. Holden retired in 2000 after completing 27 distinguished years in the auto industry, including 19 years with DaimlerChrysler, and its predecessor, Chrysler Corp. Highlights of his career include being named President of DaimlerChrysler in 1999 and Chief Executive Officer in June 2000. Mr. Holden served in various positions during his career at Chrysler, including Executive Vice President of Sales and Marketing responsible for directing all of the automaker’s sales, fleet and marketing organizations in the United States, Mexico and Canada, including Mopar parts operations. In addition, he serves as a director of Sirius Satellite Radio, Inc.

Robert L. Rewey, 68, became a director of SMI in 2001. Mr. Rewey retired from Ford Motor Company in 2001 after a distinguished 38-year career with Ford, most recently serving as Group Vice President of North American Operations & Global Consumer Services. Mr. Rewey managed numerous areas within Ford since 1963, also serving as Vice President of Sales, Marketing and Customer Service. Mr. Rewey also serves as a director of SAI, LoJack Corporation, Dealer Tire, LLC and Reading Group, LLC. Mr. Rewey is standing for reelection as a director at the Annual Meeting.

Tom E. Smith, 65, became a director of SMI in 2001. Mr. Smith retired from Food Lion Stores, Inc. in 1999, after a distinguished 29-year career with that company, including serving as Chief Executive Officer and President. A native of Salisbury, North Carolina, Mr. Smith serves as a director of CT Communications, Inc. and Farmer and Merchants Bank.

GENERAL MANAGERS

M. Jeffrey Byrd, 57, has served as Vice President and General Manager of BMS since its acquisition in 1996, and became President of BMS in 2003. Prior to working at BMS, Mr. Byrd had been continuously employed by RJR Nabisco for 23 years in various sports marketing positions in managerial capacities.

Edwin R. Clark, 52, became Vice President and General Manager of AMS in 1992 and was promoted to President and General Manager of AMS in 1995. Prior to that appointment, he had been Vice President of Events of CMS since 1981. Mr. Clark became Executive Vice President of SMI upon its organization in 1994 and was a director of SMI from 1995 to 2004.

William E. Gossage, 48, became Vice President and General Manager of TMS in 1995. Prior to that appointment, he wasVice President of Public Relations at CMS from 1989 to 1995. In February 2004, Mr. Gossage became President of TMS. Mr. Gossage previously worked with Miller Brewing Company in its motorsports public relations program and served in various public relations and managerial capacities at two other NASCAR-sanctioned speedways.

Steve Page, 52, has served as President and General Manager of IR since its acquisition in 1996. Prior to being hired by SMI, Mr. Page had been continuously employed for several years as President of Brenda Raceway Corporation, which owned and operated IR before acquisition by the Company. Mr. Page also spent 11 years working for the Oakland A’s baseball franchise in various marketing positions.

R. Christopher Powell, 47, has served as Vice President and General Manager of LVMS since its acquisition in 1998. Mr. Powell also serves as Vice President of several other SMI subsidiaries. Mr. Powell spent 11 years working for Sports Marketing Enterprises, a division of RJR Tobacco Co. (“RJR”). From 1994 to 1998, he served as manager of media relations and publicity on RJR’s NASCAR Winston Cup program. Mr. Powell’s previous duties included publicity and event operations on other RJR initiatives, including NHRA Drag Racing and the Vantage and Nabisco golf sponsorships.

COMMITTEES OF THE BOARD AND BOARD MEETINGS

GENERAL. There are three standing committees of the Board: the Audit Committee, Nominating/Corporate Governance Committee and Compensation Committee. The Audit Committee is currently comprised of Messrs. Mark M. Gambill (Chairman), James P. Holden and Tom E. Smith. The Nominating/Corporate Governance Committee is currently comprised of Messrs. Tom E. Smith (Chairman), William P. Benton and Robert L. Rewey. The Compensation Committee is currently comprised of Messrs. William P. Benton (Chairman), Mark M. Gambill, James P. Holden and Robert L. Rewey. The Board has found that all Committee members are independent as defined by the applicable listing standards of the NYSE, the applicable rules of the SEC, and the Company’s Categorical Standards for Director Independence.

AUDIT COMMITTEE. The Audit Committee, which held 11 meetings in 2006, is responsible for the selection of the Company’s independent registered public accounting firm, reviews and approves the scope of the annual audit, approves annual audit fees and services, reviews the conclusions of the auditors and reports the findings and recommendations thereof to the Board, reviews with the Company’s auditors the effectiveness of the Company’s system of internal control and procedures and the associated role of management, reviews

| | | | | | | | |

| | | Speedway Motorsports, Inc. | | | | | | |

| | | | | | 5 |

| | | | |

transactions between the Company and its officers, directors and principal stockholders, reviews and discusses with management and the auditors the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and interim financial information contained in quarterly earnings announcements, approves non-audit fees and services rendered by the auditors and performs such other functions and exercises such other powers as the Board from time to time may determine. The Audit Committee operates under a formal charter that governs its duties and conduct. A copy of the charter is available on our website at www.speedwaymotorsports.com. You may also obtain a printed copy upon request to the Company.

Based on the representations made by Mr. Gambill and discussions between Mr. Gambill and other members of the Board, the Board has, in its business judgment, determined that Mr. Gambill is an “audit committee financial expert” in accordance with current SEC regulations. The Board based this determination primarily on Mr. Gambill’s experience as the former President of Wheat First Securities and as the current Managing Member of Cary Street Partners. Both of these positions required Mr. Gambill to be extensively involved in analyzing public company financial statements when supervising the investment banking and research analyst operations and as chairman of the underwriting committee of Wheat First Securities and in managing Cary Street Partners.

The following is the Audit Committee Report for the year ended December 31, 2006.

AUDIT COMMITTEE REPORT

In accordance with its written charter, the Audit Committee of the Board (the “Audit Committee”) assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent registered public accounting firm a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors’ independence, consistent with Independence Standards Board Standard No. 1 “Independence Discussions with Audit Committees,” as amended or supplemented, discussed with the independent registered public accounting firm any relationships or services that might impact their objectivity and independence and satisfied itself as to the auditors’ independence. The Audit Committee also discussed and reviewed with management, and the independent registered public accounting firm, the quality and adequacy of the Company’s internal controls, and discussed and reviewed with management the effectiveness of the Company’sdisclosure controls and procedures used for periodic public reporting. The Audit Committee reviewed with the independent registered public accounting firm their audit plans, audit scope and identification of audit risks.

The Audit Committee discussed and reviewed with the independent registered public accounting firm all communications required by generally accepted auditing standards and the Public Company Accounting Oversight Board (United States), including those described in Statement on Auditing Standards No. 61, as amended or supplemented, “Codification of Statements of Accounting Standards,” and those required by Regulation S-X Rule 2-07, with and without management present, discussed and reviewed the results of the independent registered public accounting firm’s audit of the Company’s financial statements and reviewed the Company’s audited financial statements as of and for the year ended December 31, 2006 with management and the independent registered public accounting firm.

Management is responsible for the Company’s financial reporting process, including its system of internal controls, disclosure controls and procedures and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles in the United States of America. The Company’s independent registered public accounting firm is responsible for auditing those financial statements. The Audit Committee’s responsibility is to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews or procedures. The members of the Audit Committee are not employees of the Company, and they may or may not be experts in the fields of accounting or auditing. Therefore, the Audit Committee has relied, without independent verification, on (a) management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and (b) the representations of the independent registered public accounting firm appearing in the auditors’ report on the Company’s financial statements. The Audit Committee’s oversight does not provide the Audit Committee with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting and auditing standards and applicable laws and regulations.

Based on the above-mentioned review and discussions with management and the independent registered public accounting firm, the Audit Committee recommended to the Board that the Company’s audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended

| | | | | | | | |

| | | | | | Speedway Motorsports, Inc. | | |

| 6 | | | | | |

| | | | |

December 31, 2006, for filing with the SEC. The Audit Committee also recommended the reappointment of the independent registered public accounting firm of Deloitte & Touche LLP for the fiscal year ending December 31, 2007.

AUDIT COMMITTEE

Mark M. Gambill, Chairman and Audit Committee Financial Expert

James P. Holden

Tom E. Smith

SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. The Audit Committee has selected the firm of Deloitte & Touche LLP to serve as the principal independent registered public accounting firm of the Company for the fiscal year ending December 31, 2007. Deloitte & Touche LLP has acted in such capacity for the Company since 1994.

Representatives of Deloitte & Touche will attend the Annual Meeting. They will have an opportunity to make a statement if they so desire and to respond to appropriate questions.

Stockholder ratification of the Audit Committee’s selection of Deloitte & Touche LLP as our principal independent registered public accounting firm is not required by our Bylaws or otherwise. The Board is submitting the selection of Deloitte & Touche LLP to the stockholders for ratification and will reconsider whether to retain Deloitte & Touche LLP if the stockholders fail to ratify the Audit Committee’s selection. In addition, even if the stockholders ratify the selection of Deloitte & Touche LLP, the Audit Committee may in its discretion select a different independent accounting firm at any time during the year if the Audit Committee determines that a change is in the best interests of SMI.

PRINCIPAL ACCOUNTING FIRM FEES AND SERVICES. The following table shows the aggregate fees billed or expected to be billed to the Company by Deloitte & Touche for the fiscal years ended December 31, 2006 and 2005:

| | | | | | |

| | | 2006 | | 2005 |

Audit Fees(1) | | $ | 930,000 | | $ | 796,000 |

Audit-Related Fees(2) | | | – | | | – |

Tax Fees(3) | | | 38,000 | | | 48,000 |

All Other Fees(4) | | | – | | | – |

| (1) | This fee category consists of services for: (i) the audit of our annual financial statements and review of our quarterly financial statements in 2006 and 2005, (ii) the audit of the effectiveness of our internal control over financial reporting for Sarbanes-Oxley Act Section 404 compliance in 2006 and 2005, and (iii) services normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings, including services associated with SEC staff reviews, SEC registration statements, other documents filed with the SEC, and documents issued in connection withsecurities offerings (e.g., comfort letters and consents) in 2006 and 2005. |

| (2) | This fee category consists of assurance and related services by Deloitte & Touche that are reasonably related to performing the audit and review of our financial statements and are not reported above under “Audit Fees.” The services for these fees include services associated with the audit of our Sarbanes-Oxley Section 404 compliance in 2006 and 2005. There were no audit-related fees in 2006 or 2005. |

| (3) | This fee category consists of professional services rendered by Deloitte & Touche for tax return preparation, tax compliance, tax planning and tax advice in 2006 and 2005. |

| (4) | All other fees consist of fees billed for services other than the services reported in other categories. There were no other fees in 2006 or 2005. |

The Audit Committee has considered whether the non-audit services provided were compatible with maintaining the principal independent registered public accounting firm’s independence, and believes that such services and related fees, due to, among other things, the nature and scope of the services provided and the fact that different Deloitte & Touche personnel provided audit and non-audit services, have not impaired the independence of the Company’s principal independent registered public accounting firm. All services provided by Deloitte & Touche in 2006 and 2005 were pre-approved by the Audit Committee.

Generally, before an independent auditor is engaged by the Company to render audit or non-audit services, the engagement is approved early each calendar year by the Audit Committee. Any subsequent changes in audit, audit-related, tax or other services to be provided by such independent auditor due to changes in scope of work, terms, conditions or fees of the engagement must be pre-approved by the Audit Committee or by one of its members who has been delegated such authority. This delegation of pre-approval authority extends to audit and non-audit services not proscribed by applicable laws and regulations to be rendered by Deloitte & Touche. Such members inform the Audit Committee of any pre-approval decisions at the Committee’s next scheduled meeting. For calendar years 2006 and 2005, the Audit Committee delegated this authority to the Chairman of the Audit Committee. For 2007, non-audit services can only be approved under this delegation of authority for services of a scope and for fees comparable to those described above with respect to 2006. Requests or applications to provide services that require specific approval by the Audit Committee will be submitted to the Audit Committee by both such independent auditor and the Chief Financial Officer of the Company and must be consistent with applicable SEC regulations and NYSE listing standards regarding auditor independence.

NOMINATING/CORPORATE GOVERNANCE COMMITTEE. The Nominating/Corporate Governance Committee, which held two

| | | | | | | | |

| | | Speedway Motorsports, Inc. | | | | | | |

| | | | | | 7 |

| | | | |

meetings in 2006, assists the Board in identifying and recommending individuals qualified to become members of the Board, monitors and reviews corporate governance issues and develops and recommends to the Board corporate governance principles applicable to the Board, the Company and its business strategy and operations. Messrs. O. Bruton Smith, William P. Benton and Robert L. Rewey were recommended to the Board as director-nominees to stand for election at the Annual Meeting by the Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee operates under a formal charter that governs its duties and conduct. A copy of the charter is available on our website at www.speedwaymotorsports.com. You may also obtain a printed copy upon request to the Company. The Chairman of the Nominating/Corporate Governance Committee, Mr. Tom E. Smith, is the Lead Independent Director, and is (unless absent) the person who presides over the regularly scheduled meetings of the Company’s independent directors.

DIRECTOR NOMINATION CRITERIA AND PROCESS

Directors may be nominated by the Board in accordance with the Company’s Certificate of Incorporation or By-laws. The procedures used by the Nominating/Corporate Governance Committee to identify and evaluate nominees for director positions involve members of the committee drawing on their contacts in the business community and directly soliciting, interviewing and reviewing director questionnaire responses of prospective nominees. The Company’s Nominating/Corporate Governance Committee will review all nominees for the Board in accordance with the Committee’s charter. Given the size and resources of the Nominating/Corporate Governance Committee as well as the number of Company stockholders, the Board believes the committee could not thoroughly review the number of Board nominations that would likely be received if the committee accepted unsolicited nominations from stockholders. Accordingly, it is the Nominating/Corporate Governance Committee’s policy not to accept unsolicited nominations to the Board from stockholders.

The assessment of a nominee’s qualifications will include, at a minimum, a review of Board member criteria listed in the Company’s Corporate Governance Guidelines, including among other things, the following:

| | • | | Ability to use sound judgment; |

| | • | | Substantive knowledge in areas of importance to the Company (such as accounting or finance, business or management, industry knowledge, customer-based perspective, sponsorship relationships, strategic planning and leadership); |

| | • | | Diversity (background and experience); |

| | • | | Skills (financial literacy and/or financial expertise for members of the Audit Committee, management or consulting experience for members of the CompensationCommittee, leadership or strategic planning for members of the Nominating/Corporate Governance Committee); |

| | • | | Service on the boards of directors of other public companies; |

| | • | | Integrity, honesty, fairness, independence; |

| | • | | Thorough understanding of the Company’s business; |

| | • | | Independence under NYSE and SEC criteria; and |

| | • | | Such other factors as the Nominating/Corporate Governance Committee concludes are pertinent in light of the Board’s current needs at the time such director is nominated. |

The Nominating/Corporate Governance Committee will select qualified nominees and review its recommendations with the full Board, which will decide whether to invite the nominee to join the Board. The Board believes that its membership should reflect a diversity of experience and perspectives. The Board intends that each director contribute knowledge, experience and skill in at least one area of importance to the Company. Nominees should neither have nor appear to have a conflict of interest that would impair the nominee’s ability to represent the interests of all Company stockholders and to otherwise fulfill the stated responsibilities of a director. A nominee should also be able to work well with other directors and executives of the Company, should have independent opinions and be willing to state them in a constructive manner and be willing to comply with other guidelines as adopted by the Board.

COMPENSATION COMMITTEE. The Compensation Committee, which held five meetings in 2006, administers certain compensation and employee benefit plans of the Company, reviews and determines executive officer compensation, including annual salaries, bonus performance goals, bonus plan allocations, stock option grants and other benefits of all executive officers and other senior officers of the Company. The Compensation Committee administers the 1994 Stock Option Plan, the 2004 Stock Incentive Plan and the Employee Stock Purchase Plan. The Compensation Committee will also administer the Company’s Incentive Compensation Plan with respect to the Company’s executive officers if approved at the Annual Meeting. The Compensation Committee periodically reviews the Company’s executive development and succession planning and executive compensation programs. The Compensation Committee also takes action to modify programs that yield payments or benefits not closely related to Company or executive performance. The policy of the Compensation Committee’s program for executive officers is to link pay to business strategy and performance in a manner which is effective in attracting, retaining and rewarding key executives while also providing performance incentives and awarding equity-based compensation to align the long-term

| | | | | | | | |

| | | | | | Speedway Motorsports, Inc. | | |

| 8 | | | | | |

| | | | |

interests of executive officers and other management with those of Company stockholders. It is the Compensation Committee’s objective to offer salaries and incentive performance pay opportunities that are competitive in the marketplace. The Compensation Committee operates under a formal charter that governs its duties and conduct. A copy of the charter is available on our website at www.speedwaymotorsports.com. You may also obtain a printed copy upon request to the Company.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Messrs. William P. Benton, Mark M. Gambill, James P. Holden and Robert L. Rewey served on the Company’s Compensation Committee in 2006. No member of the Compensation Committee was an officer or employee of the Company.

ATTENDANCE AT BOARD AND COMMITTEE MEETINGS. During 2006, there were five meetings of the Board, with all directors attending at least 75% of all Board meetings and 75% of all meetings held by committees of the Board on which they served. We do not have any policy regarding director attendance at Annual Meetings of stockholders, and we did not retain a record of directors’ attendance at any of our past Annual Meetings.

EXECUTIVE COMPENSATION – COMPENSATION DISCUSSION AND ANALYSIS

2006 EXECUTIVE OFFICER COMPENSATION PROGRAM

The Company’s objectives with respect to compensation of its executive officers are to: (1) link executive compensation to the Company’s business strategy execution and performance; (2) offer compensation designed to attract, retain and reward key executive officers; (3) offer salary, cash bonus and incentive compensation pay opportunities that are competitive in the marketplace and recognize achievement of the Company’s business strategy objectives; and (4) provide performance incentives and equity-based compensation to align the long-term interests of executive officers with those of the Company’s stockholders.

The Company’s executive compensation program is designed to reward successful achievement of the Company’s objectives, which we believe will return value to the stockholders. The Company’s objectives include: revenue growth; operating earnings growth; earnings per share growth; increased shareholder return through dividends and share repurchases; and growth of return on average equity.

The Company has four executive officers: Mr. O. Bruton Smith, the Company’s Chairman and Chief Executive Officer,Mr. H.A. Wheeler, the Company’s President and Chief Operating Officer, Mr. William R. Brooks, the Company’s Executive Vice President and Chief Financial Officer, and Mr. Marcus G. Smith, the Company’s Executive Vice President of National Sales and Marketing. The Company’s executive compensation program is comprised of two components: annual cash compensation, paid in the form of annual salary, performance-based discretionary bonuses, and sales commissions; and long-term compensation, paid historically in the form of options to purchase the Company’s Common Stock. Messrs. O. Bruton Smith, Wheeler and Brooks are paid an annual base salary and an annual performance-based discretionary bonus. Mr. Marcus G. Smith is paid an annual base salary and a sales commission pursuant to a commission compensation agreement with the Company. Messrs. Wheeler, Brooks and Marcus G. Smith also receive long-term compensation in the form of options to purchase the Company’s Common Stock. The Company has chosen to compensate Mr. Marcus G. Smith through a sales commission arrangement because it believes that is the most effective way to increase consolidated marketing, sponsorship and advertising sales.

In the future, the Compensation Committee retains the right to offer its executive officers restricted shares of the Company’s Common Stock and other forms of equity compensation in lieu of, or in conjunction with, stock options.

None of the Company’s executive officers have an employment agreement, severance agreement or any retirement plans other than a 401(k) Plan that is available to all employees (except for Mr. Wheeler’s deferred compensation agreement described below). None of the Company’s executive officers have any agreement pursuant to which there is an accelerated vesting of outstanding equity awards in the event of termination of employment.

The Company’s executive compensation tends to favor current cash payment in the form of annual salary, performance-based discretionary bonuses based upon certain objective criteria (including return on average equity, earnings per share, and other performance and operating metrics), and sales commissions (in the case of Mr. Marcus G. Smith) because of the Company’s high earnings, margins and cash flows. The Company does believe that a certain level of equity compensation is required to align executive officer interests with those of stockholders, and the Compensation Committee believes the Company’s executive officer compensation program adequately achieves this goal. The Company also considers the effects of Statement of Financial Accounting Standards (“SFAS”) No. 123R, Share-Based Compensation, which requires the Company to currently expense an estimated future value of equity compensation, and concluded that cash compensation was significantly more cost effective

| | | | | | | | |

| | | Speedway Motorsports, Inc. | | | | | | |

| | | | | | 9 |

| | | | |

than stock options or restricted share awards of a size significant enough to be effective motivational tools. Retention and long-term focus of the Company’s executive officers has not historically been an area of concern, evidenced by the more than 25-year average tenure of the current executive officers of the Company and its predecessors.

The Compensation Committee and the Board have approved the Speedway Motorsports, Inc. Incentive Compensation Plan, which is designed to replace the discretionary bonus payments with specifically defined objective performance-based incentive compensation for reasons described below. The Incentive Compensation Plan is being submitted for stockholder approval at the 2007 Annual Meeting of Stockholders.

The Compensation Committee typically reviews and adjusts base salaries and awards of cash bonuses and equity-based compensation in December of each year. Mr. O. Bruton Smith and Mr. Brooks present the Compensation Committee with a forecast of the Company’s performance for the current year (all major race events are concluded by the first weekend of November), recommendations regarding proposals on compensation including recommended base salaries, recommended discretionary bonus payments, and management’s rationale for such recommendations. Mr. O. Bruton Smith does not make any recommendation regarding his own compensation. The Compensation Committee considered these recommendations in determining executive officer compensation for 2006. Mr. Brooks presents the Compensation Committee with information regarding sales by Mr. Marcus G. Smith, which allows the Compensation Committee to calculate the sales commission due to him. Equity-based compensation awards have historically been priced at the Compensation Committee’s December meeting based upon the closing market price of the Company’s Common Stock on the day of the meeting. It is possible that some or all of this process will be conducted in February of the succeeding year if the Incentive Compensation Plan is approved by stockholders. Regardless, equity-based compensation will be priced based upon the closing market price of the Company’s Common Stock for that particular meeting date.

ANNUAL CASH COMPENSATION

Annual cash compensation for the Company’s executive officers consists of a base salary, a discretionary bonus based upon certain objective criteria (including return on average equity, earnings per share, and performance and operating metrics), and sales commissions in the case of Mr. Marcus G. Smith. Executive officer cash compensation has historically been weighted in favor of the majority of such compensation being awarded in the form of a discretionarycash bonus dependent upon the Company’s and each executive officer’s performance for the particular year. The annual cash compensation paid by the Company to its executive officers during 2006 was set in an amount the Compensation Committee determined to be an adequate reward for the Company’s and the executive officer’s performance. The 2006 annual cash compensation was also targeted to be competitive in relation to other similar companies such as those included in the Peer Group Index in the performance graph included in the Company’s Annual Report on Form 10-K. The Compensation Committee also considered the compensation of executives of Penn National Gaming, Inc., Six Flags, Inc., Cedar Fair, L.P., Yankee Candle Co., Inc., Interactive Data Corp., and Fair Isaac Corp., which are other entertainment oriented or high performing companies which were considered to have financial characteristics similar to the Company or to be in relatively comparable industries. The Compensation Committee did not utilize the services of an independent consulting firm in determining the annual base salary paid to executive officers in 2006. The Compensation Committee did utilize the services of Pearl Meyer, an independent consultant, to assist the Committee in reviewing the Company’s executive compensation programs. The independent consulting firm did not provide any personal services for any of the Company’s executive officers.

ANNUAL SALARY

The base salaries of the Company’s executive officers and adjustments to executive officers’ base salaries are generally based upon a subjective evaluation of the executive officer’s performance by the Compensation Committee. The Compensation Committee’s evaluation is based upon non-quantitative factors such as the current responsibilities of each executive officer, the compensation of similarly situated executive officers of comparable companies, the performance of each executive officer during the prior calendar year, the Company’s performance during the prior calendar year, and management’s recommendations submitted to the Compensation Committee by the Chairman and Chief Executive Officer, and the Chief Financial Officer. In December 2005, the base salaries of the executive officers for 2006 were established using the referenced criteria. Mr. O. Bruton Smith’s base salary for 2006 was $600,000. Mr. Wheeler’s base salary for 2006 was $400,000. Mr. Brooks base salary for 2006 was $450,000. Mr. Marcus G. Smith’s base salary for 2006 was $225,000. These base salaries remain unchanged for 2007.

CASH BONUSES AND COMMISSION BASED COMPENSATION

Each of the Company’s executive officers, except for Marcus G. Smith, was awarded a discretionary bonus by the Compensation Committee, based upon a review of the

| | | | | | | | |

| | | | | | Speedway Motorsports, Inc. | | |

| 10 | | | | | |

| | | | |

objective performance of the Company including timely and effective capital expenditures; event management and promotion; earnings per share; return on equity, balance sheet composition and management; re-structuring of the Company’s credit facility to allow for greater flexibility and future expansion; management of the Company’s share repurchase and dividend programs; and recommendations submitted by the Chairman and Chief Executive Officer and the Chief Financial Officer. In addition, with respect to the Chief Executive Officer, the Compensation Committee considers whether Mr. Smith met his obligation to repay certain debt owed to the Company. Repayment of such debt by Mr. Smith will not alone result in a bonus payment as other criteria focused on Company performance must be met before a bonus payment will be made. The annual cash bonus paid to Mr. O. Bruton Smith for 2006 was $1,450,000. The annual cash bonuses paid to Mr. Wheeler and Mr. Brooks were $700,000 each. Mr. Marcus G. Smith’s sales commission was awarded based upon his sales efforts pursuant to his compensation arrangement with the Company, which for 2006 was $801,000.

LONG-TERM EQUITY COMPENSATION

The Compensation Committee believes that an appropriate level of equity-based compensation is part of a balanced and effective compensation program designed to align the interests of executive officers with those of stockholders. The Compensation Committee believes that the level of equity-based compensation awarded to the Company’s executive officers is adequate to align those officers’ interests with the interests of the Company’s stockholders, especially considering the executive officers’ lengthy tenure with the Company and its predecessors. The Company’s long-term compensation program has historically been based principally upon awards of options to purchase the Company’s Common Stock under the Speedway Motorsports, Inc. 1994 Stock Option Plan (the “Stock Option Plan”) and the Speedway Motorsports, Inc. 2004 Stock Incentive Plan (the “Stock Incentive Plan”). Awards of equity-based compensation are based upon a subjective evaluation of the executive’s performance by the Compensation Committee and management’s recommendations submitted to the Compensation Committee by the Chairman and Chief Executive Officer and the Chief Financial Officer. The Compensation Committee’s evaluation considers a number of non-quantitative factors, including the responsibilities of the individual officers for, and contribution to, the Company’s operating results (in relation to other recipients of SMI equity awards), and their expected future contributions. The Compensation Committee also considers whether prior awards of equity-based compensation were sufficient in deciding the amount of equity-based compensation to award in a particular year. In December 2006, the Compensation Committee awarded options to purchase shares of the Company’s Common Stock under theStock Incentive Plan to the named executive officers as follows: 20,000 shares to each of Messrs. Wheeler, Brooks, and Marcus G. Smith. For additional details concerning the options granted to, and held by, the executive officers during the 2006 calendar year, see the “2006 Grants of Plan Based Awards” and “2006 Outstanding Equity Awards at Fiscal Year-End” tables that follow. Mr. O. Bruton Smith, the Company’s majority shareholder, was not awarded any equity-based compensation principally due to his large existing equity stake in the Company. The Compensation Committee concluded that additional equity-based compensation to Mr. O. Bruton Smith would not further the goals of the Company’s executive compensation policies in light of Mr. Smith’s majority ownership of the Company’s stock.

OTHER BENEFIT PLANS

Executive officers of the Company (including the Chief Executive Officer) were also eligible in 2006 to participate in various benefit plans similar to those provided to other employees of the Company. These benefit plans are intended to provide a safety net of coverage for various events, such as death, disability and retirement.

Senior level highly compensated Company employees including the executive officers of the Company were also eligible to participate in the Speedway Motorsports, Inc. Deferred Compensation Plan (the “Deferred Plan”) during the 2006 calendar year. Under the Deferred Plan, eligible employees could elect to defer up to 75% of their annual base salary and up to 100% of their annual cash bonus or commission payments. The Company in its sole discretion may match deferred compensation contributions of executive officers and all other eligible participants. To date, no matching contributions have been made. Contributions by participants in the Deferred Plan, including the executive officers, may be invested in several different investment funds offered by the third-party administrator of the Deferred Plan, with earnings on such amounts determined by the actual market performance of the investment funds selected by the participant. To date, no named executive officer has participated in the Deferred Plan.

The Company has no defined benefit retirement plans. However, Mr. Wheeler is a participant in a deferred compensation plan established years prior to the Company’s initial public offering. Under this plan, Mr. Wheeler is eligible to receive $12,500 per month for a ten year period commencing upon retirement.

FEDERAL INCOME TAX CONSIDERATIONS

As the Company’s assets, earnings and cash flows have grown, the amount of compensation required to fairly and adequately compensate its executive officers has grown

| | | | | | | | |

| | | Speedway Motorsports, Inc. | | | | | | |

| | | | | | 11 |

| | | | |

such that rewarding executive officers with discretionary cash bonuses based partly on objective criteria does not sufficiently address issues arising under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The Code imposes a limitation on the deductibility of annual compensation in excess of $1 million that is not performance-based, and which does not otherwise comply with the Code. The Compensation Committee and the Board have approved the Speedway Motorsports, Inc. Incentive Compensation Plan which is designed to replace the discretionary bonus payments with specifically defined objective performance-based incentive compensation. The Incentive Compensation Plan is being submitted for stockholder approval at the 2007 Annual Meeting of Stockholders. Executive officer compensation attributable to the exercise of stock options granted under the Stock Option Plan and Stock Incentive Plan should qualify as fully deductible performance-based compensation. The Compensation Committee currently intends to continue to manage the Company’s executive compensation program in a manner that will preserve federal income tax deductions. However, the Compensation Committee also must approach executive compensation in a manner which will attract, motivate and retain key personnel whose performance increasesthe value of the Company. Accordingly, the Compensation Committee may from time to time exercise its discretion to award compensation that may not be deductible under Section 162(m) of the Code when in its judgment such award would be in the interests of the Company. The Compensation Committee exercised such discretion in 2006 with respect to the award of discretionary bonuses to the executive officers as discussed above, a portion of which will not be deductible due to the Code Section 162(m) limitation.

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with management and, based on their review and discussions, recommended to the Board of Directors that the Compensation Discussion and Analysis should be included in Speedway Motorsports, Inc.’s Annual Report on Form 10-K for the fiscal year ended December 31, 2006 and Proxy Statement.

William P. Benton, Chairman

Robert L. Rewey

Mark M. Gambill

James P. Holden

| | | | | | | | |

| | | | | | Speedway Motorsports, Inc. | | |

| 12 | | | | | |

| | | | |

EXECUTIVE OFFICER COMPENSATION

The following table sets forth compensation paid by or on behalf of SMI to the Company’s Chief Executive Officer, Chief Financial Officer and other named executive officers for services rendered during the fiscal year ended December 31, 2006:

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary ($) | | Bonus ($)(1) | | Stock

Awards ($) | | Option

Awards ($)(2) | | Non-Equity

Incentive Plan

Compensation(4) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($) | | All Other

Compensation

($)(3) | | Total ($) |

O. Bruton Smith,

Chairman and Chief Executive Officer | | 2006 | | $ | 600,000 | | $ | 1,450,000 | | – | | | – | | – | | – | | | – | | $ | 2,050,000 |

H.A. Wheeler,

President and Chief Operating Officer | | 2006 | | | 400,000 | | | 700,000 | | – | | $ | 76,517 | | – | | – | | $ | 9,616 | | | 1,186,133 |

William R. Brooks, Executive Vice President and Chief Financial Officer | | 2006 | | | 450,000 | | | 700,000 | | – | | | 76,517 | | – | | – | | | 6,081 | | | 1,232,598 |

Marcus G. Smith, Executive Vice President of National Sales and Marketing | | 2006 | | | 225,000 | | | 801,000 | | – | | | 76,517 | | – | | – | | | 9,469 | | | 1,111,986 |

| (1) | Amounts shown are cash bonuses earned in the year specified and paid in the first quarter of the following year, except that Mr. O. Bruton Smith’s cash bonus was paid in the fourth quarter of the year specified. Mr. Marcus G. Smith’s payment was based upon his sales commission arrangement with the Company. |

| (2) | Stock options were granted pursuant to the 2004 Stock Incentive Plan which was adopted in April 2004 upon stockholder approval at the 2004 Annual Meeting. The amounts in the Option Awards column reflect the dollar amount recognized by the Company for financial statement reporting purposes for the year ended December 31, 2006, in accordance with SFAS No. 123R, and includes amounts for options granted in 2005 and 2006. See Note 11 to the Consolidated Financial Statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2006 for additional information on this plan and regarding stock option valuation. |

| (3) | Includes Company match to 401(k) Plan and Company contribution to employee benefits plans available to all employees. The aggregate amount of perquisites received did not exceed $10,000 in the aggregate for any named executive officer. |

The following table sets forth information regarding all individual grants of plan-based awards granted to named executive officers for the fiscal year ending December 31, 2006:

2006 Grants of Plan-Based Awards

| | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Grant

Date | | Estimated Future Payouts Under

Non-Equity Incentive Plan Awards | | Estimated Future Payouts Under

Equity Incentive Plan Awards | | All Other

Stock

Awards:

Number

of Shares

of Stock

or Units (#) | | All Other

Option

Awards:

Number of

Securities

Underlying

Options (#) | | Exercise

or Base

Price of

Option

Awards

($/Sh) | | Full Grant Date Fair Value ($)(2) |

| | | Threshold ($) | | Target ($) | | Maximum

($) | | Threshold

(#) | | Target

(#) | | Maximum

(#) | | | | |

O. Bruton Smith,

Chairman and Chief Executive Officer | | – | | – | | – | | – | | – | | – | | – | | – | | – | | | – | | | – |

H.A. Wheeler,

President and Chief Operating Officer | | 12/5/06 | | – | | – | | – | | – | | – | | – | | – | | 20,000 | | $ | 39.13 | | $ | 265,417 |

William R. Brooks,

Executive Vice President and Chief Financial Officer | | 12/5/06 | | – | | – | | – | | �� | | – | | – | | – | | 20,000 | | | 39.13 | | | 265,417 |

Marcus G. Smith,

Executive Vice President of National Sales and Marketing | | 12/5/06 | | – | | – | | – | | – | | – | | – | | – | | 20,000 | | | 39.13 | | | 265,417 |

| (1) | All options were granted pursuant to the 2004 Stock Incentive Plan. The exercise price was the closing market price of the Company’s Common Stock on the NYSE on the grant date. The options vest in one-third installments over a three-year period. |

| (2) | Grant date fair value calculated in accordance with SFAS No. 123R. See Note 11 to the Consolidated Financial Statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2006 regarding stock option valuation. |

| | | | | | | | |

| | | Speedway Motorsports, Inc. | | | | | | |

| | | | | | 13 |

| | | | |

The following table sets forth information regarding outstanding equity awards held by named executive officers at the end of the fiscal year ending December 31, 2006:

2006 Outstanding Equity Awards at Fiscal Year-End

| | | | | | | | | | | | | | | | | | | |

| | | Option Awards | | Stock Awards |

| Name | | Number of Securities

Underlying

Unexercised

Options (#) Exercisable | | Number of

Securities

Underlying

Unexercised

Options (#) Unexercisable | | | Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#) | | Option

Exercise

Price ($) | | Option

Expiration

Date | | Number of

Shares or

Units of

Stock That

Have Not

Vested (#) | | Market

Value of

Shares or

Units of

Stock That

Have Not

Vested ($) | | Equity

Incentive

Plan

Awards:

Number of

Unearned

Shares,

Units or

Other Rights

That Have

Not Vested (#) | | Equity

Incentive

Plan

Awards:

Market or

Payout

Value of

Unearned

Shares,

Units or

Other Rights

That Have

Not Vested ($) |

O. Bruton Smith, Chairman and Chief Executive Officer | | – | | – | | | – | | – | | – | | – | | – | | – | | – |

H.A. Wheeler, President and Chief Operating Officer | | 50,000

10,178

21,250

20,000

20,000

3,334 | | 6,666

20,000 | (1)

(2) | | – | | 29.13

18.85

26.36

29.64

37.00

38.97

38.97

39.13 | | 12/13/2009

10/1/2011

12/11/2012

12/9/2013

12/8/2014

12/7/2015

12/7/2015

12/5/2016 | | – | | – | | – | | – |

William R. Brooks, Executive Vice President and Chief Financial Officer | | 50,000

20,000

21,250

20,000

95,000

3,334 | | 6,666

20,000 | (1)

(2) | | – | | 29.13

18.85

26.36

29.64

37.00

38.97

38.97

39.13 | | 12/13/2009

10/1/2011

12/11/2012

12/9/2013

12/8/2014

12/7/2015

12/7/2015

12/5/2016 | | – | | – | | – | | – |

Marcus G. Smith, Executive Vice President of National Sales and Marketing | | 10,000

20,000

10,000

20,000

95,000

3,334 | | 6,666

20,000 | (1)

(2) | | – | | 41.13

18.85

26.36

29.64

37.00

38.97

38.97

39.13 | | 5/5/2009

10/1/2011

12/11/2012

12/9/2013

12/8/2014

12/7/2015

12/7/2015

12/5/2016 | | – | | – | | – | | – |

| (1) | These options become exercisable as follows: 3,333 on December 7, 2007, and 3,333 on December 7, 2008. |

| (2) | These options become exercisable as follows: 6,667 on December 5, 2007, 6,666 on December 5, 2008, and 6,667 on December 5, 2009. |

| | | | | | | | |

| | | | | | Speedway Motorsports, Inc. | | |

| 14 | | | | | |

| | | | |

The following table sets forth information concerning option exercises by named executive officers during the fiscal year ending December 31, 2006:

2006 Option Exercises and Stock Vested

| | | | | | | | | | |

| | | Option Awards | | Stock Awards |

| Name | | Number of Shares Acquired on Exercise (#) | | | Value Realized on Exercise ($) | | Number of Shares Acquired on Vesting (#) | | Value Realized on Vesting ($) |

O. Bruton Smith,

Chairman and Chief Executive Officer | | – | | | | – | | – | | – |

H.A. Wheeler,

President and Chief Operating Officer | | – | | | | – | | – | | – |

William R. Brooks,

Executive Vice President and Chief Financial Officer | | 80,000 | (1) | | $ | 1,209,197 | | – | | – |

Marcus G. Smith,

Executive Vice President of National Sales and Marketing | | – | | | | – | | – | | – |

| (1) | Options granted in 1996 pursuant to the 1994 Stock Option Plan. |

2006 Nonqualified Deferred Compensation

| | | | | | | | | | | | |

| Name | | Executive

Contributions in Last FY ($) | | Registrant

Contributions in Last FY ($) | | Aggregate Earnings in Last FY ($) | | Aggregate Withdrawals/ Distributions ($) | | Aggregate Balance at Last FYE ($) | |

O. Bruton Smith,

Chairman and Chief Executive Officer | | – | | – | | – | | – | | | – | |

H.A. Wheeler,

President and Chief Operating Officer | | – | | – | | – | | – | | $ | 1,500,000 | (1) |

William R. Brooks,

Executive Vice President and Chief Financial Officer | | – | | – | | – | | – | | | – | |

Marcus G. Smith,

Executive Vice President of National Sales and Marketing | | – | | – | | – | | – | | | – | |

| (1) | Deferred compensation pursuant to the Charlotte Motor Speedway, Inc. Deferred Compensation Plan and Agreement between Charlotte Motor Speedway, Inc. and Mr. Wheeler, dated March 1, 1990 (the “CMS Plan”). Under the Agreement, Mr. Wheeler is eligible to receive, upon his retirement from the Company, $12,500 per month for a ten year period. There are no earnings on the amount Mr. Wheeler is entitled to receive under the CMS Plan, and no further deferral is permitted. |

| | | | | | | | |

| | | Speedway Motorsports, Inc. | | | | | | |

| | | | | | 15 |

| | | | |

DIRECTOR COMPENSATION

2006 Director Compensation

| | | | | | | | | | | | | | | | | |

| Name | | Fees

Earned or Paid in Cash ($) | | Stock Awards ($) | | Option Awards ($)(6) | | Non-Equity Incentive Plan Compensation ($) | | Change in Pension Value and Nonqualified Deferred Compensation Earnings | | All Other Compensation ($) | | Total ($) |

William P. Benton(1) | | $ | 48,000 | | – | | $ | 98,943 | | – | | – | | – | | $ | 146,943 |

Mark M. Gambill(2) | | | 60,000 | | – | | | 98,943 | | – | | – | | – | | | 158,943 |

James P. Holden(3) | | | 55,000 | | – | | | 98,943 | | – | | – | | – | | | 153,943 |

Robert L. Rewey(4) | | | 43,000 | | – | | | 98,943 | | – | | – | | – | | | 141,943 |

Tom E. Smith(5) | | | 60,500 | | – | | | 98,943 | | – | | – | | – | | | 159,443 |

| (1) | As of December 31, 2006, Mr. Benton held options to acquire 70,000 shares of the Company’s Common Stock. |

| (2) | As of December 31, 2006, Mr. Gambill held options to acquire 110,000 shares of the Company’s Common Stock. |

| (3) | As of December 31, 2006, Mr. Holden held options to acquire 30,000 shares of the Company’s Common Stock. |

| (4) | As of December 31, 2006, Mr. Rewey held options to acquire 50,000 shares of the Company’s Common Stock. |

| (5) | As of December 31, 2006, Mr. Smith held options to acquire 50,000 shares of the Company’s Common Stock. |

| (6) | The full grant date fair value for these options was $98,943 as calculated in accordance with SFAS No. 123R. |