UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08928

HSBC INVESTOR PORTFOLIOS

(Exact name of registrant as specified in charter)

452 FIFTH AVENUE

NEW YORK, NY 10018

(Address of principal executive offices) (Zip code)

CITI FUND SERVICES

3435 STELZER ROAD

COLUMBUS, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-782-8183

Date of fiscal year end: October 31

Date of reporting period: October 31, 2008

Item 1. Reports to Stockholders.

HSBC Global Asset Management (USA) Inc.

October 31st, 2008

HSBC Investor LifeLine FundsTM

Annual Report

HSBC Investor Aggressive Growth Strategy Fund

HSBC Investor Growth Strategy Fund

HSBC Investor Moderate Growth Strategy Fund

HSBC Investor Conservative Growth Strategy Fund

|

Table of Contents |

|

|

|

HSBC Investor Lifeline Funds |

|

|

|

|

|

|

| |

1 |

| |

2 |

| |

3 |

| |

18 |

| |

21 |

| |

22 |

| |

23 |

| |

27 |

| |

31 |

| |

38 |

| |

39 |

| |

40 |

| |

|

| |

|

| |

42 |

| |

46 |

| |

52 |

| |

55 |

| |

57 |

| |

59 |

| |

60 |

| |

61 |

| |

63 |

| |

65 |

| |

69 |

| |

70 |

| |

78 |

| |

79 |

| |

81 |

| |

83 |

|

(This Page Intentionally Left Blank)

|

Barclays Capital U.S. Aggregate Index (formerly Lehman Brothers U.S. Aggregate Index) is an unmanaged index generally representative of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year.

Barclays Capital Intermediate U.S. Aggregate Index (formerly Lehman Bros. U.S. Intermerdiate Aggregate Index) is an unmanaged index generally representative of investment-grade issues with maturities between three- and ten-years.

Citigroup U.S. Domestic Three Month Treasury Bill Index is government guaranteed and offers a fixed rate of return. Return and principal of stocks and bonds will vary with market conditions. Treasury bills are less volatile than longer-term fixed-income securities and are guaranteed as to timely payment of principal and interest by the U.S. Government.

Citigroup U.S. High Yield Market Capped Index, the “U.S. High Yield Market Capped Index” uses the U.S. High-Yield Market Index as its foundation imposing a cap on the par amount of each issuer in order to limit the impact of large issuers while retaining the characteristics of the issuer’s distribution across different maturities. The U.S. High-Yield Market Index captures the performance of below-investments-grade debt issued by corporations domiciled in the United States or Canada.

Gross Domestic Product (GDP) is the measure of the market value of the goods and services produced by labor and property in the United States.

Morgan Stanley Capital International Europe, Australasia and Far East (“MSCI EAFE”) Index is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. As of June 2007 the MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

The Russell Universe - Russell is a recognized leader in consulting, multi-manager investing and institutional investment management. Our consultants advise clients on more than $2 trillion in assets. We deliver investment programs to over 2,000 clients in 44 countries. With more than $230 billion in assets in our funds, Russell researchers meet with over 4,000 investment managers around the world to evaluate their investment process.

Russell 1000® Growth Index is an unmanaged index which measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index is an unmanaged index which measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

Russell 2000® Index is an unmanaged index which easures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. The companies which comprise this index have high price-to-book ratios and higher forecasted growth values.

Russell 2500™ Growth Index is an unmanaged index which measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

Standard & Poor’s (“S&P 500”) 500 Index is an unmanaged index that is widely regarded as a gauge of the U.S. equities market, this index includes 500 leading companies in leading industries of the U.S. economy. The S&P 500 focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities.

Securities indexes assume reinvestment of all distributions and interest payments and do not take in account brokerage fees or expenses. Securities in the Fund do not match those in the indexes and performance of the Fund will differ. Investors cannot invest directly in an index.

|

Dear Shareholder,

Over the past eighteen months, the financial markets have experienced arguably the most difficult conditions in recent history. The underlying causes of the market’s significant and persistent downturn have had devastating effects on corporations around the world. The value of equity, fixed income and even money market securities has all been affected by the slowing economy, decreasing corporate earnings and the lack of available credit to support business operations. Many organizations with renowned histories of success and profitability are now seeking government relief in order to remain solvent. The result has been significant double-digit losses for U.S. and international market indices over the past year.

During this period of extreme volatility, the HSBC Investor Funds (the “Funds”) were committed to offering sound, long-term investment solutions to investors. Now, more than ever, the Funds are diligently seeking and working with investment sub-advisers who can assist in navigating through this market environment. Moreover, the Board of Trustees is also aware that the Funds’ ability to execute shareholder instructions in an accurate and timely manner is also an important part of a fund’s overall performance. In performing its oversight role, the Board continuously attempts to maintain the highest level of responsiveness to shareholders.

Recognizing its responsibility to shareholders, the Board considers a wide range of factors including relative expertise and the financial viability in selecting the Funds’ service providers. We believe that aligning the Funds’ interests with strong partners provides a tangible benefit to shareholders, now and in the future.

We understand that these are extremely challenging times in the financial markets. We remain committed to managing the HSBC Investor Funds in a prudent and consistent manner for long-term performance.

For further market insight and investment results for the Funds, please see our portfolio manager commentary in this Annual Report.

Thank you for your investment in the HSBC Investor Funds.

Sincerely,

Larry M. Robbins, Chairman, HSBC Investor Funds

|

|

1 | HSBC INVESTOR FAMILY OF FUNDS |

|

U.S. Economic Review

The 12-month period from November 1, 2007 through October 31, 2008 was extraordinarily challenging for the U.S. economy and the global financial system. Over the course of this period, a growing number of signs indicated that the health of the economy was deteriorating and the risk of a recession was rising. In addition, a number of financial institutions faced serious problems and incurred heavy financial losses that threatened their ability to operate.

These issues largely stemmed from the housing market’s prolonged downturn. Rising default rates on subprime mortgages during the period generated huge losses for a wide variety of global financial institutions, which had invested heavily in securities that were backed by those risky mortgages. The losses were so severe that they eventually resulted in the collapse of Bear Sterns, Lehman Brothers and others, the nationalization of Fannie Mae and Freddie Mac, the failure of some banks and the forced mergers of several financial institutions. In that environment, lenders became suspicious of borrowers’ financial health and significantly reduced their willingness to lend money. The result was a crisis that effectively froze the credit markets and depressed economic growth.

The economic slowdown and declining home prices were particularly hard on consumers, who account for approximately two-thirds of U.S. economic activity. Retail sales fell sharply, real personal incomes declined, unemployment rose to its highest levels in years and consumer confidence plummeted. Corporate profits declined and U.S. Gross Domestic Product1 growth fell during two of the past four quarters (through the third quarter of 2008).

Problems in the U.S. economy spread overseas, creating fears of a global economic downturn. Consensus 2009 forecasts for economic growth in Europe and Asia declined during the third quarter, driven lower by factors such as falling business activities and confidence.

Aggressive steps were taken during the period to stabilize the credit markets and respark the economy. For example, the Federal Reserve Board (the “Fed”) cut its target short-term interest rate, the federal funds rate, from 4.50% in November to 1.00% by the end of October in an effort to inject liquidity into the markets. The Fed also established and increased auction lending facilities. Additionally, the U.S. government began implementing a $700 billion financial bailout package, and helped engineer the rescue of several large financial institutions and guaranteed senior debt issued by banks. Governments in Europe and Asia adopted similar strategies to improve sentiment and ease the strains in their financial systems.

The weak economy did have some relatively positive consequences. Energy prices, which had risen sharply during the first half of the period as the price of oil soared to record highs, fell significantly during later months. Falling commodity prices also reduced inflationary pressures, giving central banks around the world a greater ability to target their monetary policy to support growth, liquidity and financial market stability.

Market Review

The U.S. stock market was extremely volatile during the period as investors reacted strongly to new developments in the economy, the housing sector and the financial markets. Investors during most of the period fled from stocks into assets that were perceived to be safer, such as high-quality government bonds and cash. The S&P 500 Index1 returned -36.08% for the 12-month period ended October 31, 2008. Small-company stocks, represented by the Russell 2000® Index1, returned

-34.16%.

Shares of financial services firms suffered particularly large declines during the period due to the turmoil in the credit and banking system and concerns that more problems could occur if the subprime mortgage crisis spread. Consumer discretionary stocks also posted significant losses as increasingly nervous consumers cut their spending on non-essential items. Investors also shunned shares of auto-related companies, which faced critical credit shortages and an uncertain future.

The energy sector posted strong returns during the first half of the period as the price of oil and other commodities rose, but lagged later in the period as oil prices fell sharply. Conversely, health care stocks outperformed the overall market, especially as economic conditions worsened during the final months of the period.

Foreign stocks also delivered negative returns, as banks worldwide suffered from their exposure to problem assets related to the mortgage industry and the outlook for global economic growth worsened. The MSCI EAFE Index1 of developed foreign stock markets returned -46.34% during the period. Emerging markets stocks also suffered as investors avoided the perceived riskiness of developing markets in favor of assets they believed to be more stable. Falling commodity prices during the second half of the period also hurt some emerging economies, which are heavily dependent on commodity exports.

The Barclays Capital U.S. Aggregate Index1, which tracks the broad fixed-income markets, returned 0.3% for the period. High-quality government bonds, such as those issued by the U.S. Treasury, performed well as investors seeking to avoid risk fled into these securities. The rally pushed yields for government bonds lower, particularly among short-term fixed-income securities. Investors favored shorter maturities as they focused on liquidity and safety during the period of heightened market volatility. Other types of fixed-income securities—including corporate bonds and high-yield bonds—performed poorly, as investors favored the stability of government-backed bonds and worried about companies’ ability to fulfill their debt obligations in a weak economic environment. As a result, the spread between yields on government securities and corporate bonds widened substantially.

|

|

1 | For additional information, please refer to the Glossary of Terms. |

|

|

HSBC INVESTOR FAMILY OF FUNDS | 2 |

|

HSBC Investor Aggressive Growth Strategy Fund |

Investment Concerns

Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

There are risks associated with investing in foreign companies, such as erratic market conditions, economic and political instability and fluctuations in currency and exchange rates.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Small capitalization funds typically carry additional risks, since smaller companies generally have a higher risk of failure and historically have experienced a greater degree of market volatility than average. There are risks associated with investing in a fund that invests in securities of foreign countries, such as erratic market conditions, economic and political instabilities and fluctuations in currency exchanges.

Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

The mortgage market in the U.S. recently experienced difficulties that may adversely affect the performance and market value of certain mortgage-related investments.

An investment in money market funds is not insured or guaranteed by the FDIC or any other government agency. Although the money market funds seek to preserve the value of your investment at $1.00.

The HSBC Investor Funds feature a number of funds that are structured as “master/feeder” funds. Under this two-tier structure, one fund (the “feeder fund”) invests all of its investable assets in a second fund (the “master fund”). The LifeLine Funds, through this master/feeder structure, provide an asset allocation option to investors who seek to diversify their investment across a variety of asset classes. Each LifeLine Fund provides an asset allocation option corresponding to different investment objectives and risk tolerances. Each LifeLine Fund is a feeder fund. However, unlike most feeder funds, a LifeLine Fund will not direct all of its assets to a single master fund. Instead, the LifeLine Fund will allocate its assets to different master funds in accordance with its asset allocation model. HSBC Global Asset Management (USA) Inc. (the “Adviser”), according to specific target allocations, invested each LifeLine Fund’s assets in some or all of the following master funds (“underlying Portfolios”):

HSBC Investor Growth Portfolio (“Growth Portfolio”); HSBC Investor Value Portfolio (“Value Portfolio”); HSBC Investor Opportunity Portfolio (“Small Cap Equity Portfolio”); HSBC Investor International Equity Portfolio (“International Equity Portfolio”); HSBC Investor Core Plus Fixed Income Portfolio (“Core Plus Fixed Income Portfolio”); HSBC Investor High Yield Fixed Income Portfolio (High Yield Fixed Income Fund); HSBC Investor Intermediate Duration Fixed Income Portfolio (“Intermediate Duration Fixed Income Portfolio”); and the HSBC Investor Money Market Fund (“Money Market Fund”).

|

|

3 | HSBC INVESTOR FAMILY OF FUNDS |

|

Portfolio Reviews |

During the last period, each LifeLine Fund invested in a different combination of the underlying Portfolios according to the various target percentage weightings selected by the Adviser, approximately as set forth in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underlying Portfolio |

| HSBC Investor |

| HSBC Investor |

| HSBC Investor |

| HSBC Investor |

| ||||

Prime Money Market Fund |

| 1 | % |

| 1 | % |

| 6 | % |

| 21 | % |

|

Core Plus Fixed Income Portfolio |

| None |

|

| 15 | % |

| 26 | % |

| 25 | % |

|

High Yield Fixed Income Portfolio |

| None |

|

| 2 | % |

| 5 | % |

| 8 | % |

|

Intermediate Duration Fixed Income Portfolio |

| None |

|

| None |

|

| None |

|

| 3 | % |

|

Growth Portfolio |

| 21 | % |

| 21 | % |

| 19 | % |

| 15 | % |

|

International Equity Portfolio |

| 23 | % |

| 20 | % |

| 15 | % |

| 10 | % |

|

Opportunity Portfolio |

| 34 | % |

| 20 | % |

| 11 | % |

| 4 | % |

|

Value Portfolio |

| 21 | % |

| 21 | % |

| 18 | % |

| 14 | % |

|

Total: |

| 100 | % |

| 100 | % |

| 100 | % |

| 100 | % |

|

|

|

HSBC INVESTOR FAMILY OF FUNDS | 4 |

|

Portfolio Reviews |

|

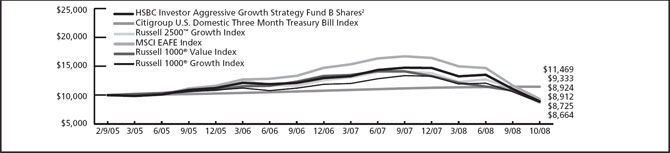

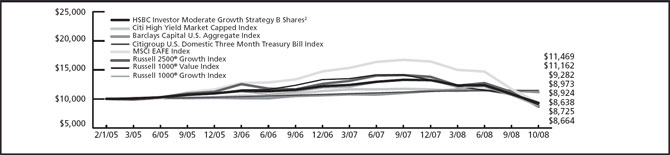

Value of a $10,000 Investment |

The charts above represent a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Funds’ benchmark and represents the reinvestment of dividends and capital gains in the Funds. The above Indexes and Benchmarks are for the period beginning 1/31/05.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fund Performance |

|

|

| Average Annual |

| Expense |

| ||||||

As of October 31, 2008 |

| Inception |

| 1 |

| 3 |

| Since |

| Gross |

| Net |

|

HSBC Investor Aggressive Growth Strategy Fund Class A1 |

| 2/14/05 |

| -43.88 |

| -6.12 |

| -3.49 |

| 2.27 |

| 1.50 |

|

HSBC Investor Aggressive Growth Strategy Fund Class B2 |

| 2/9/05 |

| -43.56 |

| -5.82 |

| -3.05 |

| 3.02 |

| 2.25 |

|

HSBC Investor Aggressive Growth Strategy Fund Class C3 |

| 6/10/05 |

| -41.87 |

| -5.17 |

| -3.07 |

| 3.02 |

| 2.25 |

|

Standard & Poor’s 500 Index |

| — |

| -36.08 |

| -5.21 |

| N/A |

| N/A |

| N/A |

|

Aggressive Growth Blended Portfolio Index5 |

| — |

| -40.14 |

| -5.45 |

| N/A |

| N/A |

| N/A |

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect from March 1, 2008 through March 1, 2009.

During the year ended October 31, 2008, the respective Portfolios the Fund invests in received monies related to certain nonrecurring litigation settlements. Without the receipt of this payment, the returns for the applicable periods would have been lower.

|

|

1 | Reflects the maximum sales charge of 5.00%. |

|

|

2 | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. |

|

|

3 | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. |

|

|

4 | Reflects the expense ratio as reported in the prospectus dated February 28, 2008. |

|

|

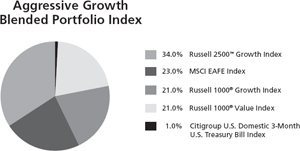

5 | The performance of the HSBC Investor Aggressive Growth Strategy Fund is compared to a Blended Portfolio Index, which is a hypothetical combination of broad-based indexes. The components of the Blended Portfolio Index and their weighting are as follows: The Citigroup U.S. Domestic Three-Month T-Bill Index (1%); Russell 1000® Growth Index (21%); Russell 1000® Value Index (21%); Russell 2500™ Growth Index (34%) and the MSCI EAFE Index (23%). These indices are unmanaged and do not reflect the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index. For a complete definition of the above referenced indices, please refer to the Glossary of Terms. |

|

|

5 | HSBC INVESTOR FAMILY OF FUNDS |

|

Portfolio Reviews |

|

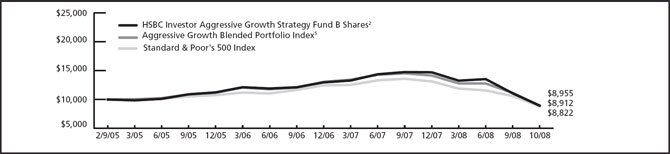

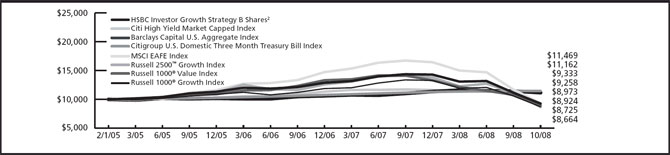

Value of a $10,000 Investment |

The charts above represent a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Funds’ benchmark and represents the reinvestment of dividends and capital gains in the Funds. The above Indexes and Benchmarks are for the period beginning 1/31/05.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fund Performance |

|

|

| Average Annual |

| Expense |

| ||||||

As of October 31, 2008 |

| Inception |

| 1 |

| 3 |

| Since |

| Gross |

| Net |

|

HSBC Investor Growth Strategy Fund Class A1 |

| 2/8/05 |

| -39.63 |

| -5.52 |

| -2.69 |

| 1.65 |

| 1.50 |

|

HSBC Investor Growth Strategy Fund Class B2 |

| 2/1/05 |

| -39.34 |

| -5.25 |

| -2.04 |

| 2.40 |

| 2.25 |

|

HSBC Investor Growth Strategy Fund Class C3 |

| 4/27/05 |

| -37.54 |

| -4.62 |

| -1.78 |

| 2.40 |

| 2.25 |

|

Standard & Poor’s 500 Index |

| — |

| -36.08 |

| -5.21 |

| N/A |

| N/A |

| N/A |

|

Growth Blended Portfolio Index5 |

| — |

| -34.39 |

| -3.86 |

| N/A |

| N/A |

| N/A |

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect from March 1, 2008 through March 1, 2009.

During the years ended October 31, 2007, and 2008, the respective Portfolios the Fund invests in received monies related to certain nonrecurring litigation settlements. Without the receipt of this payment, the returns for applicable periods would have been lower.

|

|

1 | Reflects the maximum sales charge of 5.00%. |

|

|

2 | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. |

|

|

3 | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. |

|

|

4 | Reflects the expense ratio as reported in the prospectus dated February 28, 2008. |

|

|

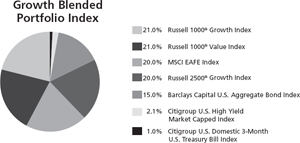

5 | The performance of the HSBC Investor Growth Strategy Fund is compared to a Blended Portfolio Index, which is a hypothetical combination of broad-based indexes. The components of the Blended Portfolio Index and their weighting are as follows: The Citigroup U.S. Domestic Three-Month T-Bill Index (1%); Barclays Capital U.S. Aggregate Index (formerly Lehman Brothers U.S. Aggregate Index) (15%); Citigroup U.S. High Yield Market Capped Index (2%); Russell 1000® Growth Index (21%); Russell 1000® Value Index (21%); Russell 2500™ Growth Index (20%) and the MSCI EAFE Index (20%). The stated performance for the Blended Index from April 30, 2006 to February 28, 2008 reflects a 2% allocation for the Merrill Lynch U.S. High Yield Master II Index. On February 29, 2008, the Merrill Lynch U.S. High Yield Master II Index was replaced with the Citigroup U.S. High Yield Market Capped Index. These indices are unmanaged and do not reflect the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index. For a complete definition of the above referenced indices, please refer to the Glossary of Terms. |

|

|

HSBC INVESTOR FAMILY OF FUNDS | 6 |

|

Portfolio Reviews |

|

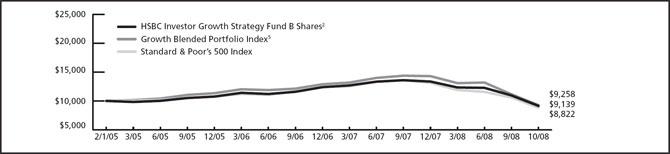

Value of a $10,000 Investment |

The charts above represent a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Funds’ benchmark and represents the reinvestment of dividends and capital gains in the Funds. The above Indexes and Benchmarks are for the period beginning 1/31/05.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fund Performance |

|

|

| Average Annual |

| Expense |

| ||||||

As of October 31, 2008 |

| Inception |

| 1 |

| 3 |

| Since |

| Gross |

| Net |

|

HSBC Investor Moderate Growth Strategy Fund Class A1 |

| 2/3/05 |

| -34.12 |

| -4.62 |

| -2.49 |

| 1.60 |

| 1.50 |

|

HSBC Investor Moderate Growth Strategy Fund Class B2 |

| 2/1/05 |

| -33.79 |

| -4.33 |

| -1.97 |

| 2.35 |

| 2.25 |

|

HSBC Investor Moderate Growth Strategy Fund Class C3 |

| 6/10/05 |

| -31.74 |

| -3.69 |

| -2.48 |

| 2.35 |

| 2.25 |

|

Standard & Poor’s 500 Index |

| — |

| -36.08 |

| -5.21 |

| N/A |

| N/A |

| N/A |

|

Moderate Growth Blended Portfolio Index5 |

| — |

| -27.70 |

| -2.28 |

| N/A |

| N/A |

| N/A |

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect from March 1, 2008 through March 1, 2009.

During the years ended October 31, 2007 and 2008, the respective Portfolios the Fund invests in received monies related to certain nonrecurring litigation settlements. Without the receipt of this payment, the returns for applicable periods would have been lower.

|

|

1 | Reflects the maximum sales charge of 5.00%. |

|

|

2 | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. |

|

|

3 | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. |

|

|

4 | Reflects the expense ratio as reported in the prospectus dated February 28, 2008. |

|

|

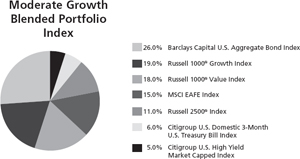

5 | The performance of the HSBC Investor Moderate Growth Strategy Fund is compared to a Blended Portfolio Index, which is a hypothetical combination of broad-based indexes. The components of the Blended Portfolio Index and their weighting are as follows: The Citigroup U.S. Domestic Three-Month T-Bill Index (6%); Citigroup U.S. High Yield Market Capped Index (5%); Barclays Capital U.S. Aggregate Index (formerly Lehman Brothers U.S. Aggregate Index) (26%); Russell 1000® Growth Index (19%); Russell 1000® Value Index (18%); Russell 2500™ Growth Index (11%) and the MSCI EAFE Index (15%). The stated performance for the Blended Index from April 30, 2006 to February 28, 2008 reflects a 5% allocation for the Merrill Lynch U.S. High Yield Master II Index. On February 29, 2008, the Merrill Lynch U.S. High Yield Master II Index was replaced with the Citigroup U.S. High Yield Market Capped Index. These indices are unmanaged and do not reflect the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index. For a complete definition of the above referenced indices, please refer to the Glossary of Terms. |

|

|

7 | HSBC INVESTOR FAMILY OF FUNDS |

|

Portfolio Reviews |

|

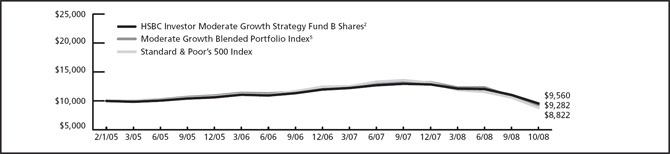

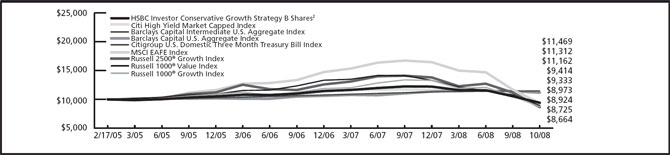

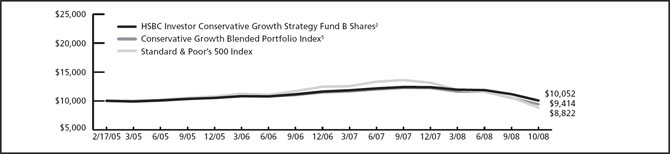

Value of a $10,000 Investment |

The charts above represent a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Funds’ benchmark and represents the reinvestment of dividends and capital gains in the Funds. The above Indexes and Benchmarks are for the period beginning 1/31/05.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fund Performance |

|

|

| Average Annual |

| Expense |

| ||||||

As of October 31, 2008 |

| Inception |

| 1 |

| 3 |

| Since |

| Gross |

| Net |

|

HSBC Investor Conservative Growth Strategy Fund Class A1 |

| 2/23/05 |

| -26.99 |

| -3.30 |

| -1.93 |

| 2.06 |

| 1.50 |

|

HSBC Investor Conservative Growth Strategy Fund Class B2 |

| 2/17/05 |

| -26.69 |

| -2.92 |

| -1.62 |

| 2.81 |

| 2.25 |

|

HSBC Investor Conservative Growth Strategy Fund Class C3 |

| 4/19/05 |

| -24.47 |

| -2.16 |

| -0.72 |

| 2.81 |

| 2.25 |

|

Standard & Poor’s 500 Index |

| — |

| -36.08 |

| -5.21 |

| N/A |

| N/A |

| N/A |

|

Conservative Growth Blended Portfolio Index5 |

| — |

| -20.06 |

| -0.54 |

| N/A |

| N/A |

| N/A |

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect from March 1, 2008 through March 1, 2009.

During the years ended October 31, 2007 and 2008, the respective Portfolios the Fund invests in received monies related to certain nonrecurring litigation settlements. Without the receipt of this payment, the returns for applicable periods would have been lower.

|

|

1 | Reflects the maximum sales charge of 5.00%. |

|

|

2 | Reflects the applicable contingent deferred sales charge, maximum of 4.00%. |

|

|

3 | Reflects the applicable contingent deferred sales charge, maximum of 1.00%. |

|

|

4 | Reflects the expense ratio as reported in the prospectus dated February 28, 2008. |

|

|

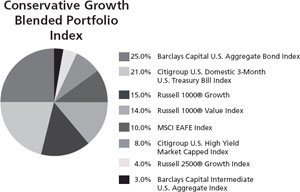

5 | The performance of the HSBC Investor Conservative Growth Strategy Fund is compared to a Blended Portfolio Index, which is a hypothetical combination of broad-based indexes. The components of the Blended Portfolio Index and their weighting are as follows: The Citigroup U.S. Domestic 3-Month T-Bill Index (21%); Citigroup U.S. High Yield Market Capped Index (8%); Barclays Capital U.S. Aggregate Index (formerly Lehman Bros. U.S. Aggregate Index) (25%); Barclays Capital U.S. Interm. Aggregate Index (formerly Lehman Bros. U.S. Interm. Aggregate Index) (3%); Russell 1000® Growth Index (15%); Russell 1000® Value Index (14%); Russell 2500™ Growth Index (4%) and the MSCI EAFE Index (10%). The stated performance for the Blended Index from April 30, 2006 to February 28, 2008 reflects an 8% allocation for the Merrill Lynch U.S. High Yield Master II Index. On February 29, 2008, the Merrill Lynch U.S. High Yield Master II Index was replaced with the Citigroup U.S. High Yield Market Capped Index. These indices are unmanaged and do not reflect the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index. For a complete definition of the above referenced indices, please refer to the Glossary of Terms. |

|

|

HSBC INVESTOR FAMILY OF FUNDS | 8 |

|

Portfolio Reviews |

|

|

|

|

Standardized Performance Benchmark Indices for the |

| 1 |

|

Citigroup U.S. Domestic 3-Month U.S. Treasury Bill Index |

| 2.31 |

|

Citigroup U.S. High Yield Market Capped Index |

| -24.05 |

|

Barclays Capital U.S. Aggregate Index |

| 0.30 |

|

Barclays Capital Intermediate U.S. Aggregate Index |

| 1.48 |

|

MSCI EAFE Index |

| -46.34 |

|

Russell 1000® Growth Index |

| -36.95 |

|

Russell 1000® Value Index |

| -36.80 |

|

Russell 2500™ Growth Index |

| -41.00 |

|

Citigroup U.S. Domestic 3-Month U.S. Treasury Bill Index is government guaranteed and offers a fixed rate of return. Return and principal of stocks and bonds will vary with market conditions. Treasury bills are less volatile than longer-term fixed-income securities and are guaranteed as to timely payment of principal and interest by the U.S. Government.

Citigroup U.S. High Yield Market Capped Index uses the U.S. High-Yield Market Index as its foundation imposing a cap on the par amount of each issuer in order to limit the impact of large issuers while retaining the characteristics of the issuer’s distribution across different maturities. The U.S. High-Yield Market Index captures the performance of below-investments-grade debt issued by corporations domiciled in the United States or Canada.

Barclays Capital U.S. Aggregate Index (formerly Lehman Brothers U.S. Aggregate Index) is an unmanaged index generally representative of the investment-grade debt issues with at least one year to final maturity.

Barclays Capital Intermediate U.S. Aggregate Index (formerly Lehman Brothers Intermediate U.S. Aggregate Index) is an unmanaged index market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year.

Morgan Stanley Capital International Europe, Australasia and Far East Index (MSCI EAFE) is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. As of June 2007 the MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

Russell 1000® Growth Index is an unmanaged index which measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index is an unmanaged index which measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

Russell 2500™ Growth Index is an unmanaged index which measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

|

|

9 | HSBC INVESTOR FAMILY OF FUNDS |

|

|

| Portfolio Reviews |

| |

HSBC Investor Prime Money Market Fund | Moody’s and Standard & Poor’s |

| has assigned an “Aaa” and “AAAm” |

| rating to the HSBC Investor Prime |

by John Chiodi | Money Market Fund.1 |

Senior Portfolio Manager | |

Investment Concerns

An investment in the fund is not insured or guaranteed by the FDIC or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund.

The money markets experienced a turbulent environment during the 12-month period under review, as rising defaults on subprime mortgages brought on a credit and liquidity crisis. The Federal Reserve Board (the “Fed”) attempted to address the financial system’s problems by lowering its target short-term interest rate from 4.50% to 1.00% between November 2007 and October 2008, causing yields on money market securities to decline.

We sought to protect shareholders’ principal in this uncertain environment. In particular, we sacrificed some yield in exchange for increased liquidity during periods of extreme stress in the money markets. We favored intermediate-term assets to help offset the effect of falling rates on the Fund’s yield while also meeting our conservative liquidity goals. As the markets settled somewhat during the fiscal third quarter, we took advantage of strategic opportunities to capture higher yields available on longer-term securities. Additionally, we took advantage of a program by the U.S. Treasury to insure money market funds.†

We also looked to safeguard shareholder assets by increasing our position in government securities. This strategy also reduced the Fund’s yield, but provided greater security as the credit and liquidity crisis roiled the money markets.*

|

|

* | Portfolio composition is subject to change. |

|

|

† | On October 7, 2008 and December 4, 2008 the Fund participated in the Treasury Money Market Guarantee Program and related extension. The Program is for shareholders as of September 19, 2008 and generally covers the lesser of the amount that the shareholder held on September 19 or the amount they hold on the date the fund needs to utilize the guarantee. If a shareholder closes their account with the Fund or broker dealer after September 19, any future investment in the Fund will not be guaranteed. The extended guarantee is through April 30, 2009, but may be further extended at the Treasury’s discretion. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

|

|

HSBC INVESTOR FAMILY OF FUNDS | 10 |

|

Portfolio Reviews |

HSBC Investor Core Plus Fixed Income Portfolio |

by Halbis Capital Management (USA) Inc., U.S. Core Fixed Income Team |

The HSBC Investor Fixed Income Fund (the “Portfolio”) seeks to maximize total return, consistent with reasonable risk. The “total return” sought by the Fund consists of income earned on investments, plus capital appreciation, if any, which generally arises from decreases in interest rates or improving credit fundamentals for a particular sector or security. The Portfolio employs Halbis Capital Management (USA) Inc. as subadviser to the Portfolio.

Investment Concerns

Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

The mortgage market in the U.S. recently experienced difficulties that may adversely affect the performance and market value of certain mortgage-related investments.

Market Commentary

The period was marked by a worsening of the credit crisis, which led to the failure of several financial institutions as well as federal bailouts for select banks and insurers. Liquidity in the credit markets and money markets evaporated in that environment, which led to a standstill in investment activity. Investors during the period favored the relative safety of Treasury securities and shunned all other fixed-income securities. Sector exposure in anything other than Treasury securities resulted in negative returns.

The main driver of the Fund’s underperformance relative to its benchmarks was its overweight positions in mortgage-backed and corporate securities. Our strategy of emphasizing various types of “spread” bonds—bonds that offer higher yields than Treasuries—is designed to provide shareholders with greater income over time. Although these securities offered attractive yields relative to Treasury bonds, they performed poorly as investors flocked to Treasuries and avoided other sectors of the bond market.*

For much of the period, the Fund focused on intermediate-term securities and maintained a duration slightly longer than that of its benchmarks. That strategy benefited the fund as such securities offered more attractive yields shorter-term issues.*

|

|

* | Portfolio composition is subject to change. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

|

|

11 | HSBC INVESTOR FAMILY OF FUNDS |

|

Portfolio Reviews |

HSBC Investor High Yield Fixed Income Portfolio |

by Halbis Capital Management (USA) Inc., High Yield Team |

The HSBC Investor High Yield Fixed Income Portfolio (the “Portfolio”) seeks to provide a high level of current income and capital appreciation. HSBC Global Asset Management (USA) Inc. serves as investment adviser to the Fund. The Halbis High Yield Team provides the day to day management of the portfolio. The Team’s philosophy is focused on delivering sustainable value added performance in the high yield fixed income market. The investment approach is a combination of top-down sector/ industry selection and bottom-up security/quality selection. The team rotates sectors and themes within the high yield universe during different market environments seeking to add value, endeavoring to take advantage of market inefficiencies in order to outperform in both up and down markets. The Portfolio employs Halbis Capital Management (USA) Inc. as subadviser to the Portfolio.

Investment Concerns

Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of rising interest rates. High yield bonds are subject to greater risks than investment grade bonds, such as the increased risk of default because of the lower credit quality of the issues.

Market Commentary

High-yield bonds performed poorly during the period under review, which was characterized by a severe economic slowdown and a deepening credit crisis that led to unprecedented moves by the U.S. government to attempt to shore up the economy and the financial system. Investors in that environment flocked to Treasury securities with extremely high levels of liquidity and safety, and shunned high-yield bonds due to fears that the companies issuing such bonds would default on their obligations. In addition, liquidity in the high-yield market was often extremely tight, making it difficult to buy and sell securities.

The Fund’s performance remained relatively in line or slightly under its benchmark indices during the period which was the result of several key strategies. Our decision to underweight the homebuilding, building products and financial sectors contributed to strong relative performance, as these industries suffered due to the weak economy, the credit crisis and the prolonged downturn in the housing market. We also overweighted the energy and utilities sectors. Energy prices soared during the first half of the period, and energy companies remained healthy despite a downturn in energy prices during the second half of the period. Additionally, we increased the Fund’s overall credit quality whenever possible. That benefited performance as investors favored higher-quality bonds.*

The Fund’s relatively large position in bonds of gaming companies dampened performance somewhat. As the economic environment deteriorated throughout the period, consumers cut back on their discretionary spending—hurting revenues among companies in the gaming sector.*

|

|

* | Portfolio composition is subject to change. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

|

|

HSBC INVESTOR FAMILY OF FUNDS | 12 |

|

Portfolio Reviews |

HSBC Investor Intermediate Duration Fixed Income Portfolio |

by Halbis Capital Management (USA) Inc., U.S. Core Fixed Income Team |

The HSBC Investor Intermediate Duration Fixed Income Portfolio (the “Portfolio”) seeks to maximize total return, consistent with reasonable risk. The “total return” sought by the Fund consists of income earned on investments, plus capital appreciation, if any, which generally arises from decreases in interest rates or improving credit fundamentals for a particular sector or security. Under normal market conditions, the Portfolio invest at least 80% of its net assets in fixed income securities. The Portfolio expects to maintain an average portfolio duration with respect to fixed income securities of 3 to 6 years. The Portfolio employs Halbis Capital Management (USA) Inc. as subadviser to the Portfolio.

Investment Concerns

Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

The mortgage market in the U.S. recently experienced difficulties that may adversely affect the performance and market value of certain mortgage-related investments.

Market Commentary

The collapse of the subprime mortgage market led to the failure of several financial institutions during the period as the credit market dried up and lending activity froze. Other financial institutions, including banks and insurers, were rescued by federal bailouts. In that environment, investors fled to high-quality issues, favoring Treasury bonds over other securities in the fixed-income market.

The Fund underperformed its benchmarks in large part due to its focus on sectors other than Treasuries. Our strategy of emphasizing various types of “spread” bonds—bonds that offer higher yields than Treasuries—is designed to provide shareholders with greater income over time. However, such issues significantly underperformed during the period as investors shunned any fixed-income securities outside of the Treasury market.*

As investors sought liquidity and relative safety in short-term Treasury issues, the yield curve steepened and longer-term securities offered higher yields. The Fund maintained a duration slightly longer than that of its benchmarks. That strategy benefited the fund as such securities offered higher yields than shorter-term issues.*

|

|

* | Portfolio composition is subject to change. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

|

|

13 | HSBC INVESTOR FAMILY OF FUNDS |

|

Portfolio Reviews |

HSBC Investor Growth Portfolio |

by Clark J. Winslow, Chief Executive Officer/Portfolio Manager |

The HSBC Investor Growth Portfolio (the “Portfolio”) seeks long-term growth of capital by investing primarily in U.S. and foreign equity securities of high quality companies with market capitalization generally in excess of $2 billion, which the subadviser believes have the potential to generate superior levels of long-term profitability and growth. Effective May 12, 2008, Winslow Capital Management Inc, replaced Waddell & Reed Investment Management Company (Waddell & Reed) as subadviser.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Market Commentary

The subprime mortgage crisis continued to worsen during the period, forcing the federal government to bail out several failing financial institutions. That environment had a significantly negative impact on both the domestic and international equity markets.

The Fund’s returns relative to the benchmark benefited from its overweight position in the health care sector. Health care stocks outperformed the market as a whole—especially during the three months through September, which were among the most difficult of the 12-month period under review. Stock selection among financial services shares also benefited performance relative to the benchmark, despite the poor performance of the overall sector throughout the period.*

Stock selection in the consumer staples and technology sectors hurt performance relative to the benchmark. The Fund’s holdings in the energy sector hurt relative returns as well. Oil prices declined steeply off of July highs, and investors sold energy shares as a result.*

It is clear that the global economic outlook is negative. However, we see valuations for many companies at levels similar to those we encountered in late 2002 and early 2003. We remain focused on implementing our investment discipline: we will continue to focus on companies with strong potential future earnings growth, attractive absolute valuations, favorable risk/reward and downside protection, and catalysts/ inflection points to improve /sustain profitability or recognize value.

|

|

* | Portfolio composition is subject to change. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

|

|

HSBC INVESTOR FAMILY OF FUNDS | 14 |

|

Portfolio Reviews |

HSBC Investor International Equity Portfolio |

by Kevin F. Simms |

Co-CIO International Value Equities and Director of Research – Global and International Value Equities AllianceBernstein Investment Research and Management |

The HSBC Investor International Equity Portfolio (the “Portfolio”) seek to provide their shareholders with long-term growth of capital and future income by investing at least 80% of its net assets in equity securities of companies organized and domiciled in developed nations outside the United States or for which the principal trading market is outside the United States, including Europe, Canada, Australia and the Far East. The Portfolio may invest up to 20% of its assets in equity securities of companies in emerging markets. The Portfolio employs AllianceBernstein L.P. (“AllianceBernstein”), a unit of AllianceBernstein Investment Research and Management as subadviser.

Investment Concerns

There are risks associated with investing in foreign companies, such as erratic market conditions, economic and political instability and fluctuations in currency and exchange rates.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Market Commentary

Investor worries about slowing global economic growth and further repercussions from the subprime mortgage crisis dominated financial markets during the period under review, contributing to the Fund’s negative performance. The U.S. and U.K. housing markets continued to decline, and banks worldwide suffered from exposure to problem assets related to the mortgage industry. Global stocks declined during the period as prospects for economic growth fell sharply.

The Fund’s sector selection hurt relative returns, due primarily to underweight positions in shares of consumer staples, medical and utilities firms. The Fund’s overweight position in financials also dragged on returns, as these companies suffered some of the period’s largest losses.*

Security selection weighed on the Fund’s performance relative to its benchmark. Key detractors included shares of U.K. banks with significant exposure to that country’s housing market. Meanwhile, softening consumer spending hurt performance among shares of certain automakers in the Fund’s portfolio. Those events cascaded through the supply chain, eventually weakening shares of some materials firms in the Fund’s portfolio.

The Fund’s investment in shares of certain securities enhanced its relative performance. Such securities included a major Japanese utility, a French financial services firm and a global energy company.*

|

|

* | Portfolio composition is subject to change. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

|

|

15 | HSBC INVESTOR FAMILY OF FUNDS |

|

Portfolio Reviews |

HSBC Investor Opportunity Portfolio |

by William A. Muggia |

President–Chief Investment Officer |

The HSBC Investor Opportunity Fund (“the Fund”) seeks to provide its shareholders with long-term growth of capital by investing in equity securities of small cap companies. The Portfolio may also invest in bonds, notes, commercial paper, U.S. Government securities, and foreign securities. Small cap companies generally are defined as those that have market capitalizations within the range of market capitalizations represented in the Russell 2500™ Growth Index1. The Portfolio may also invest in equity securities of larger, more established companies if they are expected to show increased earnings. The Portfolio employs Westfield Capital Management Company, LLC as subadviser.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Market Commentary

The fallout from the subprime mortgage crisis intensified during the 12 months under review, leading to larger credit and liquidity crises in the financial markets. Fears of U.S. and global recessions grew as a result, particularly toward the end of the period. Stocks of almost all kinds posted heavy losses.

The Fund benefited from holding a larger position than its benchmark in the health care sector. The Fund did not have a bullish view on the sector as a whole, but managed to identify a number of attractive investments in sub-sectors such as biotechnology and health care equipment, and those holdings helped relative performance. The Fund also held an underweight position in consumer discretionary stocks. Consumer discretionary proved to be the second-worst performing sector during the period, following only the financial services sector, so the Fund’s underweight position benefited relative performance.*

Stock selection within the industrial sector was the greatest drag on the Fund’s relative performance during the period. We believe that the pace of development in foreign countries would continue to increase, making shares of building and construction firms attractive. But stocks of such companies suffered as the economic woes in the United States spread globally. Stock selection in the financial services sector also weighed on returns relative to the benchmark.

The economic realities are grim, but we believe that this is largely reflected in stocks. Valuation levels of US stocks are well below their ten-year averages. Stocks have traded down as an asset class, with little regard for company specific prospects or fundamentals. We believe that once the financial markets have stabilized, we will look back on this period as an opportunity to invest in high quality growth companies trading at very attractive historical valuations. We remain focused on company fundamentals and are committed to upgrading quality in the portfolio wherever possible.

|

|

1 | For additional information, please refer to the Glossary of Terms. |

|

|

* | Portfolio composition is subject to change. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

|

|

HSBC INVESTOR FAMILY OF FUNDS | 16 |

|

Portfolio Reviews |

HSBC Investor Value Portfolio |

by Jon D. Bosse, CFA |

NWQ Investment Management Company, LLC |

The HSBC Investor Value Portfolio (the “Portfolio”) seeks long-term growth of capital and income by investing primarily in U.S. and foreign companies with large and medium capitalizations that the subadviser believes possess opportunities underappreciated or misperceived by the market. The Portfolio employs NWQ Investment Management Company, LLC (“NWQ”) as subadviser.

Investment Concerns

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the Portfolio changes.

Market Commentary

U.S and Global Equity markets experienced significant declines during the period under review, with most of the decline occurring during the last weeks. This has been an unprecedented period and one of the most challenging investment environments in our country’s history. Given the crisis of confidence, the U.S. Government took decisive action regarding the fate of many companies. The U.S. Government has either: assumed control of companies; sponsored/engineered “takeovers;” or allowed companies to fail. In many cases, such events might signal a bottom and thereby provide a floor in equity valuations. However, the magnitude of recent events and continued economic deterioration combined with the realization that a company’s financial well-being could quickly evaporate, have heightened investor fears and market volatility. The U.S. Treasury/the Federal Reserve Board (as well as Central Banks broadly) have begun implementing broad and meaningful financial rescue measures in order to stabilize global markets.

There were few places to “hide” during the period under review; and most of the Fund’s holdings declined. The credit markets dysfunction has led to fear and panic, particularly within the financial sector. While the Fund was underweighted in the financial sector (relative to the Russell 1000® Value Index1), the sector adversely impacted absolute and relative performance. The Fund’s positions within the materials/processing sector adversely impacted the portfolio. These stocks came under pressure as commodity prices declined amid a deteriorating outlook for global growth. Oil and gas prices declined during the latter part of the period adversely affecting the Fund’s energy holdings. We would like to note that we reduced the energy position in Fund during the first half of the period — at higher share prices. Finally, the Fund’s consumer discretionary sector, primarily media, adversely impacted the portfolio. There were positive contributors during the period. One of the Fund’s health care companies, as well as the Fund’s railroad holding, appreciated during the period. Consumer staples contributed positively to the portfolio.*

It is clear that the global economic outlook is negative. However, we see valuations for many companies at levels similar to those we encountered in late 2002 and early 2003. We remain focused on implementing our investment discipline: we will continue to focus on companies with attractive absolute valuations, favorable risk/reward and downside protection, and catalysts/inflection points to improve/sustain profitability or recognize value.

It is clear that the global economic outlook is negative. However, we see valuations for many companies at levels similar to those we encountered in late 2002 and early 2003. We remain focused on implementing our investment discipline: we will continue to focus on companies with attractive absolute valuations, favorable risk/reward and downside protection, and catalysts/ inflection points to improve /sustain profitability or recognize value.

|

|

1 | For additional information, please refer to the Glossary of Terms. |

|

|

* | Portfolio composition is subject to change. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

|

|

17 | HSBC INVESTOR FAMILY OF FUNDS |

|

Portfolio Composition* |

October 31, 2008 |

(Unaudited) |

|

|

|

|

|

HSBC Investor Core Plus Fixed Income Portfolio |

|

|

|

|

|

|

|

|

|

Investment Allocation |

| Percentage of Investments at Value |

| |

U.S. Government and Government Agency Obligations |

| 33.4 | % |

|

Corporate Obligations |

| 29.5 | % |

|

Asset Backed Securities |

| 19.4 | % |

|

Commercial Mortgage Backed Securities |

| 8.8 | % |

|

Collateralized Mortgage Obligations |

| 4.5 | % |

|

Cash and Equivalents |

| 2.1 | % |

|

Municipal Bonds |

| 1.8 | % |

|

Foreign Bonds |

| 0.4 | % |

|

Certificates of Deposit |

| 0.1 | % |

|

Total |

| 100.0 | % |

|

|

|

|

|

|

HSBC Investor High Yield Fixed Income Portfolio |

|

|

|

|

|

|

|

|

|

Investment Allocation |

| Percentage of Investments at Value |

| |

Corporate Obligations |

| 100.0 | % |

|

Common Stock |

| 0.0 | % |

|

Total |

| 100.0 | % |

|

|

|

|

|

|

HSBC Investor Intermediate Duration Fixed Income Portfolio |

|

|

|

|

|

|

|

|

|

Investment Allocation |

| Percentage of Investments at Value |

| |

U.S. Government and Government Agency Obligations |

| 42.6 | % |

|

Corporate Obligations |

| 21.2 | % |

|

Asset Backed Securities |

| 15.4 | % |

|

Cash and Equivalents |

| 9.8 | % |

|

Commercial Mortgage Backed Securities |

| 5.7 | % |

|

Collateralized Mortgage Obligations |

| 4.0 | % |

|

Municipal Bonds |

| 0.4 | % |

|

Foreign Bonds |

| 0.4 | % |

|

Certificates of Deposit |

| 0.5 | % |

|

Total |

| 100.0 | % |

|

|

|

|

|

|

HSBC Investor Growth Portfolio |

|

|

|

|

|

|

|

|

|

Investment Allocation |

| Percentage of Investments at Value |

| |

Biotechnology |

| 7.8 | % |

|

Retail |

| 7.2 | % |

|

Software Services |

| 7.2 | % |

|

Industrial Conglomerates |

| 6.8 | % |

|

Medical Services & Distributors |

| 6.7 | % |

|

Medical Products |

| 6.6 | % |

|

Cash and Equivalents |

| 5.6 | % |

|

Telecommunication |

| 5.3 | % |

|

Hardware & Peripherals |

| 4.4 | % |

|

Credit Card |

| 4.2 | % |

|

Communication Equipment |

| 3.4 | % |

|

Railroad |

| 3.3 | % |

|

Agriculture |

| 3.0 | % |

|

Investment Management |

| 2.5 | % |

|

Internet |

| 2.3 | % |

|

Retail Pharmacy |

| 2.3 | % |

|

Aerospace & Defense |

| 2.3 | % |

|

Oil & Gas Drill & Equipment |

| 2.1 | % |

|

Pharmaceuticals |

| 2.1 | % |

|

Engineering & Construction |

| 2.0 | % |

|

Distribution & Wholesale |

| 1.8 | % |

|

Household Products |

| 1.5 | % |

|

Exchanges |

| 1.5 | % |

|

Oil & Gas Exploration & Production |

| 1.4 | % |

|

Transportation |

| 1.3 | % |

|

Computer Storage |

| 1.1 | % |

|

Solar |

| 1.0 | % |

|

Travel & Leisure |

| 1.0 | % |

|

Electric, Gas & Water |

| 0.8 | % |

|

Coal |

| 0.8 | % |

|

Business Services |

| 0.7 | % |

|

Total |

| 100.0 | % |

|

|

|

|

|

|

HSBC International Equity Portfolio |

|

|

|

|

|

|

|

|

|

Investment Allocation |

| Percentage of Investments at Value |

| |

Europe |

| 66.9 | % |

|

Japan |

| 18.6 | % |

|

Australia & Far East |

| 6.2 | % |

|

Canada |

| 5.1 | % |

|

Cash and Equivalents |

| 2.4 | % |

|

Other |

| 0.8 | % |

|

Total |

| 100.0 | % |

|

|

|

HSBC INVESTOR FAMILY OF FUNDS | 18 |

|

Portfolio Reviews |

Portfolio Composition* |

October 31, 2008 |

(Unaudited) |

|

|

|

|

|

HSBC Investor Opportunity Portfolio |

|

|

|

|

|

|

|

|

|

Investment Allocation |

| Percentage of Investments at Value |

| |

Computer Software |

| 14.9 | % |

|

Pharmaceuticals |

| 12.6 | % |

|

Oil & Gas |

| 9.4 | % |

|

Health Care |

| 8.1 | % |

|

Consumer Products |

| 8.0 | % |

|

Industrial Manufacturing |

| 5.7 | % |

|

Financial Services |

| 5.4 | % |

|

Biotechnology |

| 5.2 | % |

|

Education |

| 4.7 | % |

|

Retail |

| 4.7 | % |

|

Cash and Equivalents |

| 3.7 | % |

|

Telecommunications |

| 3.1 | % |

|

Diversified Manufacturing Operations |

| 2.6 | % |

|

Transportation |

| 2.3 | % |

|

Business Services |

| 2.3 | % |

|

Utilities |

| 1.4 | % |

|

Aerospace & Defense |

| 1.4 | % |

|

Internet Related |

| 1.4 | % |

|

Media |

| 1.3 | % |

|

Homebuilders |

| 1.3 | % |

|

Electronic Components & Semiconductors |

| 0.5 | % |

|

Total |

| 100.0 | % |

|

|

|

|

|

|

HSBC Investor Value Portfolio |

|

|

|

|

|

|

|

|

|

Investment Allocation |

| Percentage of Investments at Value |

| |

Oil & Gas |

| 11.8 | % |

|

Cash and Equivalents |

| 9.7 | % |

|

Computer Software |

| 9.2 | % |

|

Insurance |

| 7.3 | % |

|

Telecommunications |

| 6.6 | % |

|

Media |

| 6.4 | % |

|

Metals & Mining |

| 6.4 | % |

|

Consumer Products |

| 6.0 | % |

|

Pharmaceuticals |

| 5.9 | % |

|

Aerospace & Defense |

| 5.4 | % |

|

Tobacco |

| 4.5 | % |

|

Financial Services |

| 4.2 | % |

|

Business Services |

| 3.5 | % |

|

Banking |

| 3.4 | % |

|

Conglomerates |

| 2.5 | % |

|

Diversified Manufacturing Operations |

| 2.4 | % |

|

Transportation |

| 2.4 | % |

|

Energy |

| 1.6 | % |

|

Paper & Related Products |

| 0.8 | % |

|

Total |

| 100.0 | % |

|

|

|

* | Portfolio composition is subject to change. |

|

|

19 | HSBC INVESTOR FAMILY OF FUNDS |

(This Page Intentionally Left Blank)

HSBC INVESTOR LIFELINE FUNDS

Statements of Assets and Liabilities—As of October 31, 2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aggressive |

| Growth |

| Moderate |

| Conservative |

| ||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments in Affiliated Portfolios |

| $ | 7,993,224 |

| $ | 24,179,015 |

| $ | 26,458,188 |

| $ | 7,559,224 |

|

Investments in Affiliated Fund, at value(a) |

|

| 74,513 |

|

| 230,718 |

|

| 1,629,963 |

|

| 1,974,707 |

|

|

|

|

|

|

| ||||||||

Total Investments |

|

| 8,067,737 |

|

| 24,409,733 |

|

| 28,088,151 |

|

| 9,533,931 |

|

|

|

|

|

|

| ||||||||

Receivable for capital shares issued |

|

| 3,851 |

|

| 7,077 |

|

| 5,624 |

|

| 7,500 |

|

Reclaims receivable |

|

| 2,950 |

|

| 10,161 |

|

| 7,960 |

|

| 239 |

|

Receivable from Investment Adviser |

|

| 9,045 |

|

| 10,157 |

|

| — |

|

| 5,118 |

|

Prepaid expenses and other assets |

|

| 5,593 |

|

| 4,609 |

|

| 5,367 |

|

| 3,808 |