UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08932

Artisan Funds, Inc.

(Exact name of registrant as specified in charter)

875 East Wisconsin Avenue, Suite 800

Milwaukee, WI 53202

(Address of principal executive offices) (Zip Code)

| | |

| Janet D. Olsen | | Cameron S. Avery |

| Artisan Funds, Inc. | | Bell, Boyd & Lloyd LLC |

| 875 East Wisconsin Avenue, #800 | | Three First National Plaza, #3100 |

| Milwaukee, Wisconsin 53202 | | Chicago, IL 60602 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (414) 390-6100

Date of fiscal year end: 09/30/04

Date of reporting period: 09/30/04

Item 1. Reports to Shareholders.

ANNUAL

REPORT

SEPTEMBER 30, 2004

ARTISAN INTERNATIONAL FUND

ARTISAN INTERNATIONAL SMALL CAP FUND

ARTISAN INTERNATIONAL VALUE FUND

ARTISAN MID CAP FUND

ARTISAN MID CAP VALUE FUND

ARTISAN SMALL CAP FUND

ARTISAN SMALL CAP VALUE FUND

Artisan Funds, Inc.

INVESTOR SHARES

ARTISAN FUNDS

P.O. BOX 8412

BOSTON, MA 02266-8412

This report and the audited financial statements contained herein are provided for the general information of the shareholders of Artisan Funds. This report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. For more complete information on any Fund, including fees and expenses, please call 800.344.1770 or visit our website at www.artisanfunds.com for a free prospectus. Read it carefully before you invest or send money.

Company discussions are for illustration only and are not intended as recommendations of individual stocks. The discussions present information about the companies believed to be accurate, and the views of the portfolio manager(s), as of September 30, 2004. That information and those views may change, and the Funds disclaim any obligation to advise shareholders of any such changes. Artisan International Fund and Artisan Mid Cap Fund offer institutional classes of shares for institutional investors meeting certain minimum investment requirements. A report on each institutional class is available under separate cover.

Artisan Funds offered through Artisan Distributors LLC, member NASD.

TABLE OF CONTENTS

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/04)

| | | | | | | | | | | | |

| | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan International Fund (inception 12/28/95) | | 18.04 | % | | 5.54 | % | | 3.73 | % | | 11.93 | % |

Artisan International Small Cap Fund (inception 12/21/01) | | 22.66 | | | NA | | | NA | | | 21.15 | |

Artisan International Value Fund (inception 9/23/02) | | 32.81 | | | NA | | | NA | | | 37.49 | |

Artisan Mid Cap Fund (inception 6/27/97) | | 13.02 | | | 8.44 | | | 11.45 | | | 18.22 | |

Artisan Mid Cap Value Fund (inception 3/28/01) | | 29.60 | | | 20.41 | | | NA | | | 14.28 | |

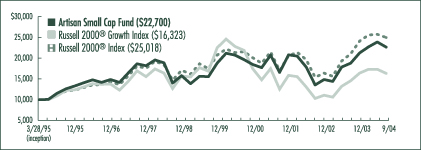

Artisan Small Cap Fund (inception 3/28/95) | | 20.67 | | | 11.06 | | | 7.89 | | | 9.00 | |

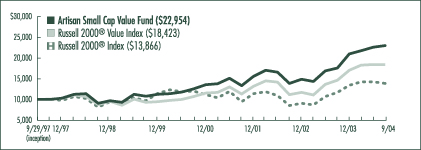

Artisan Small Cap Value Fund (inception 9/29/97) | | 30.76 | | | 19.86 | | | 16.30 | | | 12.60 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in a Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The performance information shown for Artisan International Fund, Artisan International Small Cap Fund and Artisan International Value Fund does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. The performance of Artisan International Value Fund and Artisan Mid Cap Value Fund reflects Artisan Partners’ undertaking to limit each Fund’s expenses, which may be terminated at any time, has been in effect since each Fund’s inception, and has had a material impact on each Fund’s performance, which would have been lower in its absence. Artisan International Small Cap Fund’s investments in initial public offerings (IPOs) made a material contribution to the Fund’s performance. IPO investments are not an integral component of the Fund’s investment process and may not be available in the future.

Artisan International, International Small Cap & International Value Funds: International investments involve special risks, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems and higher transaction costs. These risks typically are greater in emerging markets. Artisan International and International Small Cap Funds invest in growth stocks, which may underperform other asset types during a given period. Artisan International Small Cap Fund invests in the stocks of smaller companies, which tend to be more volatile and less liquid than those of larger companies, have underperformed the stocks of larger companies during some periods and tend to have a shorter history of operations than larger companies. Artisan International Value Fund invests in value stocks, which may underperform other asset types during a given period. In addition, the Fund may invest a significant portion of its assets in small and medium-sized companies, which tend to be more volatile and less liquid than those of large companies, have underperformed the stocks of larger companies during some periods and tend to have a shorter history of operations than larger companies.

Artisan Mid Cap & Mid Cap Value Funds: Stocks of medium-sized companies tend to be more volatile than those of larger companies and have underperformed the stocks of small and large companies during some periods. Artisan Mid Cap Fund invests primarily in growth stocks, which may underperform other asset types during a given period. Artisan Mid Cap Value Fund invests primarily in value stocks, which may underperform other asset types during a given period.

Artisan Small Cap & Small Cap Value Funds: Stocks of smaller companies tend to be more volatile and less liquid than those of larger companies, have underperformed the stocks of larger companies during some periods and tend to have a shorter history of operations than larger companies. Artisan Small Cap Fund invests primarily in growth stocks, which may underperform other asset types during a given period. Artisan Small Cap Value Fund invests primarily in value stocks, which may underperform other asset types during a given period.

ARTISAN INTERNATIONAL FUND (ARTIX)

| | |

| HIGHLIGHTS | | |

• During the twelve months ended September 30, 2004, Artisan International Fund produced a strong absolute return, but underperformed its benchmark, the MSCI EAFE® Index. • Our decision to invest in a select group

of emerging market stocks contributed | | strongly to performance compared to the benchmark. • The financials sector was a positive contributor to our return, but our average stock underperformed the benchmark sector return. |

| | | |

| INVESTMENT APPROACH | | |

| We use a bottom-up investment process to construct a portfolio of international growth companies of all market capitalizations. The investment team conducts its own fundamental analysis with particular emphasis on: | | 1) well-managed companies focused on increasing shareholder value; 2) sustainable growth prospects; 3) reasonable valuations; or 4) dominant or increasing market shares or direct exposure to an identified theme. |

| | | |

| PERFORMANCE REVIEW | | |

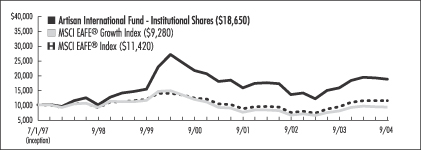

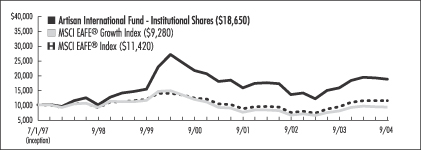

| From the Fund’s inception through September 30, 2004, Artisan International Fund has outpaced the MSCI EAFE® Index by a wide margin. |

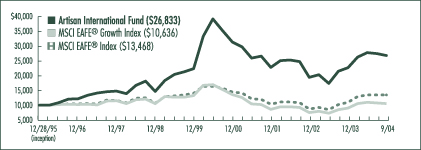

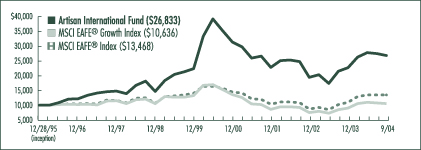

GROWTH OF AN ASSUMED $10,000 INVESTMENT (12/28/95 to 9/30/04)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/04)

| | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan International Fund | | 18.04 | % | | 5.54 | % | | 3.73 | % | | 11.93 | % |

MSCI EAFE® Growth Index | | 16.66 | | | 7.12 | | | -4.37 | | | 0.71 | |

MSCI EAFE® Index | | 22.08 | | | 9.12 | | | -0.85 | | | 3.46 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. See page 81 for a description of each index.

02

TWO

INVESTING ENVIRONMENT

During the twelve months ended September 30, 2004, international equity markets recorded strong gains, outpacing their domestic counterparts. Returns for U.S. investors were enhanced by a weak dollar, which led to profitable currency conversions when local currencies were translated into U.S. dollars at the cheaper rate. Small-caps as a group performed better than large-caps, and value stocks outperformed growth stocks by a wide margin.

The strong stock market returns over the fiscal year as a whole masked the fact that sentiment was quite different in the first half of the fiscal year than in the second half. The first half of the year seemed to reflect a synchronized global economic recovery aided by a favorable interest rate environment. The second half of the fiscal year was marked by uncertainty as the outlook for the global economy became less clear. Perhaps the initial thread of doubt that entered investors’ minds was the prospect of rising interest rates in the U.S., driven by a pick up in inflation. Other concerns included slowing economic growth in China, continued turmoil in Iraq and terrorist activity such as the Madrid attack and Russian school tragedy.

With all of those factors weighing on investors’ minds, the spike in oil prices had a dampening effect on the markets. On the other hand, rising energy prices had a very positive effect on energy stocks, which were among the leading performers in the MSCI EAFE® Index. Oil wasn’t the only commodity that saw price increases throughout the year. Generally rising commodities prices gave a boost to the materials sector, making it a leading performer. The technology sector was the worst performing sector in our benchmark, followed by consumer staples and telecommunications. Most of the other sectors generated returns roughly on par with the index average.

On a regional basis many emerging markets, led by markets in Latin America, turned in very strong returns. Europe and the Far East (excluding Japan) also performed well. Japan was a laggard among developed markets, but still managed to turn in low double-digit returns.

PERFORMANCE DISCUSSION

In the Fund, every sector contributed positively to performance, but our largest gains compared to the benchmark were in technology, telecommunications and energy. Our returns in the financials and consumer sectors, although positive, were below the benchmark. Regionally, Japan and our emerging markets stocks contributed positively compared to our benchmark index, while Europe detracted from relative results, due in part to our lower exposure to the U.K.

TOP 10 HOLDINGS

| | | | | |

| Company Name | | Country | | % | |

Telefonaktiebolaget LM Ericsson | | Sweden | | 3.2 | % |

Fortis | | Netherlands | | 3.0 | |

UBS AG | | Switzerland | | 2.9 | |

Kingfisher PLC | | United Kingdom | | 2.8 | |

Tesco PLC | | United Kingdom | | 2.7 | |

ITV PLC | | United Kingdom | | 2.6 | |

Honda Motor Co., Ltd. | | Japan | | 2.4 | |

Nestle S.A. | | Switzerland | | 2.1 | |

EnCana Corporation | | Canada | | 2.1 | |

Allianz AG | | Germany | | 2.1 | |

Total | | | | 25.9 | % |

As a percentage of total net assets as of 9/30/04. Top 10 Holdings are determined by issuer.

SECTOR REVIEW

We focused on just a few select industry-leading technology companies last year. The decision to limit the number of names we owned in the area enhanced our relative return in a tough period for the group. Performance also was boosted by a price gain of more than 100% from Telefonaktiebolaget LM Ericsson (Ericsson), a Swedish manufacturer of wireless communications equipment. Ericsson underwent a significant restructuring program driven by a new CEO and management team that aggressively pushed through cost cutting goals ahead of expectations. That led to a strong increase in profitability, which drove up the company’s share price. Unfortunately, we were not immune to the general softness in the sector as our position in ASML Holding N.V. declined. ASML softened in anticipation of a potential industry-wide slowdown in semiconductor equipment orders. We used the weakness to add to our holdings.

Our holdings in the telecommunications sector outpaced the benchmark sector return despite a less favorable contribution from currency translation gains. Leading the way were Telenor ASA, Cesky Telecom, A.S., and

03

THREE

Chunghwa Telecom Co., Ltd. All three stocks reported good revenue growth.

Supply concerns and strong demand were the driving factors behind the high price of oil, which provided a stiff tailwind for performance in the energy sector. We were underweighted in the energy sector, but our stocks advanced even more than the lofty index sector return. China’s seemingly insatiable demand for energy led us to purchase Sinopec, China’s largest oil refiner, and CNOOC, which controls offshore gas assets. Both stocks produced meaningful gains and we sold both during the period. We also sold Spanish oil company Repsol YPF, S.A. Its earnings and production were strong, but we elected to secure our gains as we thought its upside had decreased. We used some of the proceeds from those sales to buy two Italian companies: Saipem S.p.A. (oil services) and ENI S.p.A. (oil and gas exploration). Two other very solid gainers were Russian oil company Lukoil and Brazilian oil company Petroleo Brasileiro S.A. (Petrobras). One catalyst behind Lukoil’s ascent was the Russian government’s decision to sell its stake in the company.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/03 | | | 9/30/04 | |

Consumer Discretionary | | 24.9 | % | | 23.9 | % |

Consumer Staples | | 16.5 | | | 11.9 | |

Energy | | 4.7 | | | 8.2 | |

Financials | | 24.2 | | | 26.8 | |

Healthcare | | 6.9 | | | 4.5 | |

Industrials | | 3.4 | | | 4.7 | |

Information Technology | | 1.9 | | | 6.4 | |

Materials | | 7.4 | | | 4.8 | |

Telecommunication Services | | 7.9 | | | 6.9 | |

Utilities | | 0.3 | | | 0.7 | |

Other assets less liabilities | | 1.9 | | | 1.2 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets as of 9/30/03 and 9/30/04, respectively.

Our financial holdings were a contributor to our underperformance during the fiscal year. As the year wore on, the potential for higher interest rates around the world and concerns about the rate of growth of the Japanese economy weighed on our positions. We used softness late in the period to build our holdings in several stocks that we purchased earlier in the fiscal year: Orix, Bank of Yokohama and Credit Saison. We continue to hold Japanese brokerage company Nikko Cordial Corp., which hurt the Fund’s return. It was pressured by Citigroup’s announced reduction of its stake in the company. One of the better performers in the sector was Belgian financial services company Fortis, which benefited from lower loss provisions and an improved capital structure following the initial public offering of its U.S. insurance unit Assurant. Japanese consumer finance company Promise Co., Ltd. also did very well.

In the materials sector we were primarily hurt by the performance of Rhodia S.A., although Clariant AG was also weak. Rhodia management was trying to restructure, but the slow pace of progress relative to financing and liquidity concerns increased the risk and we closed out the position. Clariant was hurt by low cost competition in some of its product areas. Imperial Chemical Industries PLC was a bright spot. It disposed of a food ingredients unit in a continued restructuring effort and reported strong earnings growth.

Within the consumer sectors, the media industry is our largest overweight compared to the benchmark. A few of the leading performers in the Fund were French outdoor advertising company JC Decaux, Spanish media company Promotora de Informaciones, S.A. (Prisa) and Spanish language broadcaster Grupo Televisa S.A. JC Decaux improved profitability and was the subject of merger speculation. Prisa benefited from solid sales growth. Televisa announced a restructuring of its holding company, which eliminated a potential overhang on the stock without diluting earnings. One media holding that trailed during the last part of the year was British Sky Broadcasting (BSkyB), a pay TV operator. BSkyB’s shares came under pressure when it announced an unexpected change in strategy, aimed at boosting subscriber growth, which may lead to lower profitability in the short-term.

The performance of food caterer Compass Group and food retailer Carrefour was a disappointment. Compass dropped late in the period after management unexpectedly announced that future cash flows would be lower than expected due to new payment terms with suppliers primarily in the U.K. Carrefour released a weak sales report and we sold our position based on the slower growth prospects.

04

FOUR

COUNTRY REVIEW

Overall, our country allocations contributed strongly to relative performance. One of the chief reasons was our underweight position in Japan, which weakened amid indications of a cooling Chinese economy and declining exports. However, economic figures at the end of the period showed that household consumption continued to strengthen, employment improved and business confidence reached its highest level since the burst of the asset bubble in 1991. Our emerging markets stocks were another source of positive relative gains as they outpaced the Index overall.

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/03 | | | 9/30/04 | |

Europe | | 74.6 | % | | 65.6 | % |

Asia/Pacific | | 13.8 | | | 25.0 | |

Latin America | | 6.8 | | | 5.3 | |

North America | | 2.9 | | | 2.9 | |

As a percentage of total net assets as of 9/30/03 and 9/30/04, respectively.

TOP 5 COUNTRY ALLOCATIONS

| | | |

| Country | | % | |

Japan | | 18.5 | % |

United Kingdom | | 16.7 | |

Switzerland | | 11.5 | |

Germany | | 7.9 | |

Spain | | 5.4 | |

As a percentage of total net assets as of 9/30/04.

In Europe, the U.K. was a solid performer and our underweight position hurt performance. Its economy grew at a fast pace, leading to several interest rate increases by the Bank of England. In Continental Europe, there were improvements in domestic consumption and manufacturing, but economic growth was not on par with the U.K.

FUND CHANGES

We continued to focus on our long-term investment themes throughout the year. As a result, the changes to our regional allocations and sector weights were primarily due to individual security decisions. On a regional basis, the extension of our themes to the Pacific resulted in a marked increase to our Japanese exposure and smaller increases to Singapore and China. Our emerging markets exposure also increased with the addition of a few select stocks. As a result, the Fund’s allocation to Europe fell and for the first time in a considerable period we are underweighted in European stocks compared to our benchmark. The country weights within the region that fell the most were Germany, Switzerland and the U.K.

We reduced our weighting in consumer staples and healthcare during the fiscal year and increased financials and energy. The change in consumer staples was due to the sale of Carrefour and significant reductions in Henkel KGaA, Diageo PLC and Nestle S.A. Other consumer transactions included the sales of British retailer Next PLC after it reached our price target and Dutch publisher Wolters Kluwer N.V. in favor of better alternatives. We used some of the capital to purchase PagesJaunes S.A., France’s leading telephone directories publisher, and Pearson, which publishes the Financial Times and is strong in higher education publishing.

In healthcare, we sold both Novartis AG and Sanofi-Synthelabo S.A., which got into a bidding war to buy Aventis S.A. We used proceeds from those sales to partially fund the additions in energy and Japanese financials discussed above.

FUND STATISTICS

| | |

Net Assets | | $ 9.8 billion |

Number of Holdings | | 119 |

Weighted Average Market Cap | | $ 26.1 billion |

Weighted Average Growth Rate (3-5 yr) | | 11.0% |

Weighted Harmonic Average P/E (2004E) | | 16.3X |

Source: FactSet/Artisan Partners. All statistics are as of 9/30/04.

05

FIVE

ARTISAN INTERNATIONAL SMALL CAP FUND (ARTJX)

| | |

| HIGHLIGHTS | | |

• During the twelve months ended September 30, 2004, Artisan International Small Cap Fund produced a strong absolute return, but underperformed the MSCI EAFE Small Cap® Index. | | • The two strongest contributors to Fund performance compared to the benchmark were the telecommunication services and industrials sectors. • Our stocks in the consumer discretionary sector trailed the benchmark sector return. |

| | | |

| INVESTMENT APPROACH | | |

| We use a bottom-up investment process to construct a portfolio of smaller international growth companies. The investment team conducts its own fundamental analysis with particular emphasis on: | | 1) well-managed companies focused on increasing shareholder value; 2) sustainable growth prospects; 3) reasonable valuations; or 4) strong or increasing market shares or direct exposure to an identified theme. |

| | | |

| PERFORMANCE SUMMARY | | |

| Artisan International Small Cap Fund performed roughly in line with the MSCI EAFE Small Cap® Index since its inception, which generally has been a favorable period for small-cap stocks. |

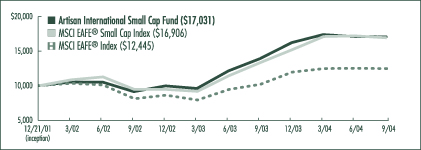

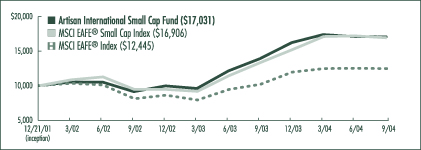

GROWTH OF AN ASSUMED $10,000 INVESTMENT (12/21/01 to 9/30/04)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/04)

| | | | | | |

| Fund / Index | | 1-Year | | | Since

Inception | |

Artisan International Small Cap Fund | | 22.66 | % | | 21.15 | % |

MSCI EAFE® Small Cap Index | | 26.88 | | | 20.83 | |

MSCI EAFE® Index | | 22.08 | | | 8.20 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. The Fund’s investments in initial public offerings (IPOs) made a material contribution to the Fund’s performance. IPO investments are not an integral component of the Fund’s investment process and may not be available in the future. See page 81 for a description of each index.

06

SIX

MARKET OVERVIEW

During the twelve months ended September 30, 2004, international small-cap stocks recorded strong gains, generally outpacing their domestic counterparts. Returns for U.S. investors were enhanced by a relatively weak dollar, which led to profitable currency conversions when local currencies were translated into U.S. dollars at the cheaper rate.

During the first half of the year, it appeared – for the first time since the 1980s – as though we were in the midst of a synchronized global economic recovery. Relatively low interest rates around the world promoted economic growth, which contributed to the strong performance of riskier assets such as small-cap stocks. Unfortunately, sentiment during the second half was quite different. The second half of the fiscal year was marked by uncertainty as the outlook for the global economy became less clear. Perhaps the initial thread of doubt that entered investors’ minds was the prospect of rising interest rates in the U.S., driven by an increase in inflation. Other concerns included slowing economic growth in China, continued turmoil in Iraq and terrorist activity such as the Madrid attack and Russian school tragedy.

With all of those factors in mind, a rise in oil prices had a dampening effect on the markets. On the other hand, it had an extremely positive effect on small-cap energy stocks, although they represent a small portion of the MSCI EAFE® Small Cap Index. Other strong performers included the materials sector, as commodity prices rose during the year, and the utilities, financials and consumer discretionary sectors. The technology sector was the worst performing sector in our benchmark followed by consumer staples and telecommunications. On a regional basis, Japan was a laggard among developed markets (although it still produced positive returns), while several European markets, including the U.K., Spain and Sweden, outperformed.

PERFORMANCE DISCUSSION

We achieved our largest performance gains when compared to our benchmark in the industrials, telecommunications and healthcare sectors. The technology sector also contributed positively compared to the benchmark, but it was mainly because we have limited our exposure to the area. The consumer sectors were the source of our biggest negative contribution relative to the benchmark.

TOP 10 HOLDINGS

| | | | | |

| Company Name | | Country | | % | |

Banco Latinoamericano de Exportaciones, S.A., E Shares | | Panama | | 4.6 | % |

AO VimpelCom (ADR) | | Russia | | 3.4 | |

Fraser & Neave Limited | | Singapore | | 3.0 | |

Stada Arzneimittel AG | | Germany | | 2.5 | |

Clarins S.A. | | France | | 2.5 | |

Sulzer AG | | Switzerland | | 2.3 | |

Gruppo Editoriale L’Espresso S.p.A. | | Italy | | 2.3 | |

John Fairfax Holdings Limited | | Australia | | 2.2 | |

Wienerberger AG | | Austria | | 2.2 | |

Elekta AB, B shares | | Sweden | | 2.1 | |

Total | | | | 27.1 | % |

As a percentage of total net assets as of 9/30/04. Top 10 Holdings are determined by issuer.

SECTOR REVIEW

Our gains in the industrials sector were primarily due to strong security selection. Among the leaders were diversified Swiss industrial company Sulzer AG, South Korean shipbuilder Samsung Heavy Industries Co. Ltd. and Swiss drink carton maker SIG Holding AG. Each company had positive fundamental news. Sulzer divested certain non-strategic businesses, improved profitability and generated solid sales growth. Samsung Heavy Industries benefited from an upturn in demand that pushed its industry near capacity, which provided an opportunity to raise prices. We sold Samsung into its share price strength. SIG Holding sold its packaging business as part of a restructuring program to focus on its drink cartons and plastic bottles business.

The main contributor in the healthcare sector was Swiss dental implant manufacturer Straumann AG, which advanced more than 100%. Its earnings and sales rose firmly and it maintained a high level of profitability. Germany

07

SEVEN

and the U.S. were two markets that drove its robust financial gains, as demand was solid in both countries. Given our significant gains in the stock, we elected to trim back our position late in the fiscal year. U.K. diagnostics and life sciences company Amersham PLC was another strong performer. It received a takeover offer from GE very early in our fiscal year that was a premium to the share price at the time of the announcement. Elekta AB, a Swedish manufacturer of radiation surgery equipment, rose as profits and sales increased due to demand for its products. German pharmaceutical company Stada Arzneimittel AG was one stock in the area that had a negative impact on returns. It fell due to German healthcare reform, which required drug companies to pay a rebate on certain drugs. We used the weakness to add to our position.

Our holdings in the telecommunications sector significantly outpaced the benchmark sector return. Our best performer was Russian wireless provider AO VimpelCom. It advanced as subscriber growth in Russia’s growing mobile market accelerated and profitability improved due to limited marketing expenditures. Microcell Telecommunications, a Canadian wireless company, increased, in part, after a debt refinancing and rights offering, which alleviated the market’s capital concerns. We sold our position into the share price strength. Telekom Austria AG was also sold after recording a solid gain.

Our allocation to the consumer staples sector hurt results during the fiscal year as it underperformed the index return. Weakness at Russian juice and dairy producer Wimm-Bill-Dann Foods OJSC further dampened results. Belgian food retailer Colruyt N.V. and Lianhua Supermarket Holdings Limited, a Chinese supermarket operator, were two strong performers in the area. Colruyt showed strong same store sales growth due to its pricing advantage and differentiated business model. Lianhua also reported strong sales growth. We sold Lianhua into the strength.

Among our consumer discretionary holdings, several media stocks performed very well including Sogecable S.A., a dominant Spanish pay television provider; Gestevision Telecinco SA, a Spanish television broadcaster; and JC Decaux S.A., a French outdoor advertiser. However, those gains were not enough to offset losses at luxury boat maker Rodriguez Group and Thai real estate company Land & Houses Public Company Limited. Rodriguez Group declined early in our fiscal year following a report of lower than expected sales and we sold our position in favor of better alternatives. Rising development costs and lower than expected housing revenues hurt Land & Houses.

COUNTRY REVIEW

Our country allocations detracted from performance during the fiscal year. Our position in a number of emerging markets stocks was the main reason for the shortfall. The stocks we held in those countries, though they advanced over 19% as a group, underperformed the MSCI EAFE® Small Cap Index and did not benefit from the same positive currency translation contribution as many other markets.

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/03 | | | 9/30/04 | |

Europe | | 63.8 | % | | 56.5 | % |

Asia/Pacific | | 21.0 | | | 25.1 | |

Latin America | | 7.2 | | | 8.3 | |

North America | | 4.8 | | | 3.5 | |

As a percentage of total net assets as of 9/30/03 and 9/30/04, respectively.

TOP 5 COUNTRY ALLOCATIONS

| | | |

| Country | | % | |

Switzerland | | 12.3 | % |

France | | 9.2 | |

United Kingdom | | 7.4 | |

Japan | | 5.6 | |

Russia | | 4.6 | |

As a percentage of total net assets as of 9/30/04.

The Fund’s underweight position in Japan, which trailed most other markets, offset some of the disadvantage. We will add names in Japan, but only when we are confident of their growth prospects and comfortable with their cost. The additions will not be based on an overriding macroeconomic assumption.

08

EIGHT

In Europe, our security selection was broadly positive as our average stock outpaced the average European stock in our benchmark. However, we were not optimally aligned to the best performing countries in the region, which hurt on a local and currency adjusted basis. The U.K. economy grew at a fast pace, leading to several interest rate increases by the Bank of England. In Continental Europe, there were improvements in domestic consumption and manufacturing.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/03 | | | 9/30/04 | |

Consumer Discretionary | | 29.4 | % | | 27.6 | % |

Consumer Staples | | 21.1 | | | 11.6 | |

Energy | | 1.5 | | | 5.2 | |

Financials | | 13.0 | | | 13.9 | |

Healthcare | | 11.2 | | | 8.0 | |

Industrials | | 8.2 | | | 13.1 | |

Information Technology | | 1.5 | | | 3.3 | |

Materials | | 3.1 | | | 3.1 | |

Telecommunication Services | | 7.8 | | | 5.8 | |

Utilities | | — | | | 1.8 | |

Other assets less liabilities | | 3.2 | | | 6.6 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets as of 9/30/03 and 9/30/04, respectively.

FUND CHANGES

The one significant change to the portfolio during our fiscal year was a reduction in our exposure to the consumer sectors, mainly consumer staples. Our exposure to the healthcare sector also fell with the sales of Amersham and Nobel Biocare Holding AG. We used the capital from transactions in those sectors to purchase stocks in the technology, industrials and energy sectors. On a regional basis, the extension of our themes to the Pacific resulted in an increased exposure to Japan, Hong Kong, Thailand and South Korea. As a result, the Fund’s allocation to Europe decreased.

Within the consumer sectors, in addition to those stocks already mentioned, we trimmed or sold several beverage companies, food retailers, food products companies and select other holdings. Among our beverage stocks, we sold Baron de Lay S.A., Davide Campari Milano S.p.A., Grupo Modelo S.A. de C.V. and Koninklijke Grolsch N.V. In the food retail and food products areas, we closed out our positions in Laurus N.V., Seiyu Ltd., Chipita International S.A. and Wimm-Bill-Dann. Elsewhere, Agfa Gevaert N.V., a leading international imaging company, was undergoing a restructuring put in place by new management. It struggled during the period and we became concerned that the poor stock price performance, driven by pricing pressures and higher raw material costs, could continue and sold our position. We also sold Italian luxury goods company Bulgari and Japanese retailer Don Quijote Co.

In technology, we were cautious to add only those companies that we believed were of the highest quality and relative weakness in the sector provided an opportunity to add three stocks at more favorable prices. We purchased Sify Ltd., India’s premier Internet company; Logitech International S.A., a leading company in the computer and gaming peripherals market; and Fine Tec, which manufactures superconducting materials. The two largest purchases in the industrials sector were Austria-based Wienerberger, the world’s largest producer of bricks and SONAE SGPS S.A., which manufactures wood products among other operations.

At the beginning of our fiscal year, we only had one position in the energy sector, Precision Drilling Corporation. However, we added two service and equipment providers, Smedvig ASA and John Wood Group PLC, because we believed that there was a lack of investment in exploration spending that could create demand for their services.

FUND STATISTICS

| | |

Net Assets | | $ 515.0 million |

Number of Holdings | | 67 |

Median Market Cap | | $ 1.3 billion |

Weighted Average Market Cap | | $ 1.9 billion |

Weighted Average Growth Rate (3-5 yr) | | 13.7% |

Weighted Harmonic Average P/E (2004E) | | 16.6X |

Source: FactSet/Artisan Partners. All statistics are as of 9/30/04.

09

NINE

ARTISAN INTERNATIONAL VALUE FUND (ARTKX)

| | |

| HIGHLIGHTS | | |

• During the twelve months ended September 30, 2004, Artisan International Value Fund outperformed the MSCI EAFE® and MSCI EAFE® Value Indices. | | • The Fund’s return was driven by the strength of the team’s security selection. • Two consumer companies negatively influenced performance during the fiscal year. |

| | | |

| INVESTMENT APPROACH | | |

| We use a bottom-up investment process to construct a portfolio of undervalued non-U.S. companies. We conduct our own in-depth fundamental research with the goal of investing in companies at prices that reflect a significant discount to our estimate of economic | | value. Attention is also given to a company’s balance sheet, historic returns on its capital and management team. Assessing the tradeoffs among these factors is at the heart of our investment process. |

| | | |

| PERFORMANCE REVIEW | | |

Since inception, the net asset value of Artisan International Value Fund has increased by 90.19% on a cumulative basis and 37.49% on an annualized basis, outperforming our benchmarks. |

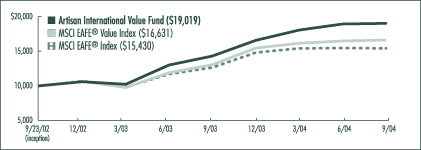

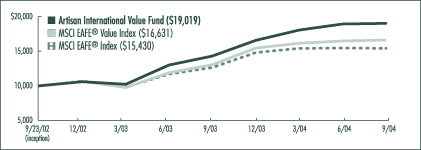

GROWTH OF AN ASSUMED $10,000 INVESTMENT (9/23/02 to 9/30/04)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/04)

| | | | | | |

| Fund / Index | | 1-Year | | | Since

Inception | |

Artisan International Value Fund | | 32.81 | % | | 37.49 | % |

MSCI EAFE® Value Index | | 27.54 | | | 28.65 | |

MSCI EAFE® Index | | 22.08 | | | 23.96 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. The Fund’s performance reflects Artisan Partners’ undertaking to limit the Fund’s expenses, which may be terminated at any time, has been in effect since the Fund’s inception, and has had a material impact on the Fund’s performance, which would have been lower in its absence. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 81 for a description of each index.

10

TEN

INVESTING ENVIRONMENT

Worldwide, most equity markets performed well over the last twelve months. The largest European markets—U.K., France and Germany—all increased by more than 25%. The Japanese market did not perform as well, but was up 11%. Asian markets (excluding Japan) increased by an average of 25% and Latin American markets averaged an increase of nearly 43%.

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/03 | | | 9/30/04 | |

Europe | | 65.4 | % | | 70.1 | % |

Asia/Pacific | | 22.1 | | | 20.2 | |

Latin America | | 4.3 | | | 1.8 | |

North America | | 2.3 | | | 2.0 | |

As a percentage of total net assets as of 9/30/03 and 9/30/04, respectively.

TOP 5 COUNTRY ALLOCATIONS

| | | |

| Country | | % | |

United Kingdom | | 31.1 | % |

Switzerland | | 12.8 | |

Netherlands | | 7.2 | |

Italy | | 7.1 | |

France | | 7.0 | |

As a percentage of total net assets as of 9/30/04.

PERFORMANCE DISCUSSION

As we have written on a number of occasions, we are value investors and our sole focus is the purchase of shares in companies that are selling at a meaningful discount to our estimate of economic value. This process is a constant one and does not change based on any prevailing macroeconomic or stock market trend. Over time, we believe our success will be a function of how effectively we value companies, and how disciplined we are at buying them at a discount to fair value, and selling them when they approach fair value. Nevertheless, our performance can be influenced by macroeconomic factors as well as stock market trends over which we have no control. For example, although we do not generally try to manage the Fund’s exposure to currencies, foreign currency movements do influence total return. Over the past year, the euro, the British pound, the Swiss franc and the Japanese yen all appreciated versus the U.S. dollar. There are many reasons for the dollar’s weak performance, including a growing federal budget deficit, low interest rates, inflation concerns and a sizable current account deficit. In any event, the strength of foreign currencies versus the dollar had a sizable positive impact on performance.

In addition, we note that smaller companies have tended to outperform larger companies over the past year. The MSCI EAFE® Small Cap Index returned 26.88% while the MSCI EAFE® Index returned 22.08%. Our quarterly weighted average market cap ranged from $7.0 billion to $11.8 billion during the fiscal year compared to the weighted average market cap range of $39.0 billion to $46.1 billion for the MSCI EAFE® Index, highlighting the fact that we own more medium-sized companies on a relative basis than the Index. This was arguably a positive influence on our performance for the year. However, we do not focus on company size as an investment criteria. We invest in companies of all sizes based on valuation and company fundamentals. We believe that smaller companies outperformed large companies in the past year because their valuations were more depressed at the beginning of the year, exactly the reason for their presence in our portfolio.

In terms of company specifics, there were a number of stocks that had a significant impact on the Fund’s total return during the period.

| • | Cementir S.p.A. is an Italian cement producer with operations in Italy and Turkey. In August, it announced the acquisition of the largest cement producer in Denmark. The acquisition was expected to further diversify the company’s operations and put to use its significant cash resources. Investors viewed the transaction very favorably because it appeared likely to increase the company’s earnings per share. The stock price rose significantly as a result, contributing meaningfully to the Fund’s growth in NAV during the fiscal year. |

| • | Ichiyoshi Securities Co., Ltd. is a Japanese brokerage firm that has benefited from the recent bull market in Japan. Over the last twelve months, its share price has increased dramatically and it was a significant contributor to our results during the period. |

11

ELEVEN

| • | Givaudan S.A. is the world’s largest producer of flavors and fragrances. Management of Givaudan has produced consistent, albeit modest revenue growth combined with shareholder-oriented share repurchases and special cash dividends. Its share price appreciation and dividend payments were an important driver behind the Fund’s return. |

| • | Aventis S.A.’s share price increased by over 40% largely due to a hostile takeover bid from fellow French pharmaceutical company Sanofi-Synthelabo S.A. |

| • | Hunter Douglas N.V., a leading manufacturer of window coverings, continued to generate attractive earnings and cash flow growth. In addition, the company announced a 50 million euro share buyback program, equivalent to about 3% of its shares outstanding. This action demonstrated management’s commitment to return more of the company’s cash flow to shareholders and these developments helped to drive Hunter Douglas’ share price up toward a multi-year high. |

TOP 10 HOLDINGS

| | | | | |

| Company Name | | Country | | % | |

Cementir S.p.A. Cementerie del Tirreno | | Italy | | 5.4 | % |

Diageo PLC | | United Kingdom | | 5.3 | |

Euronext NV | | France | | 4.1 | |

Unilever PLC (ADR) | | United Kingdom | | 3.8 | |

Wolters Kluwer N.V. | | Netherlands | | 3.7 | |

Benfield Group PLC | | United Kingdom | | 3.3 | |

Countrywide PLC | | United Kingdom | | 3.2 | |

Guoco Group, Ltd. | | Hong Kong | | 3.2 | |

Vodafone Group PLC (ADR) | | United Kingdom | | 3.2 | |

Givaudan S.A. | | Switzerland | | 3.1 | |

Total | | | | 38.3 | % |

As a percentage of total net assets as of 9/30/04. Top 10 Holdings are determined by issuer.

There were two companies that had a meaningful negative impact on the portfolio in the last twelve months.

| • | MFI Furniture PLC is the U.K.’s largest retailer of kitchen and bedroom furniture, with a market share in excess of 30%. Its retail business has suffered from an increased level of competition. In addition, a failed installation of operating software caused delivery and other service problems that have pushed the division into operating losses. |

| • | Unilever PLC is an Anglo-Dutch consumer products company. After rising significantly from our initial purchase price, shares ended lower due to disappointing sales and earnings. The company’s operating issues appeared to be part of a trend in the packaged consumer goods industry as many of its peers also reported similarly disappointing results. |

FUND CHANGES

Since our semi-annual report on March 31, 2004, we acquired shares in several companies, including Benfield Group, Countrywide PLC, Tate & Lyle PLC, Clariant AS, Vodafone Group PLC and Admiral Group PLC. A brief discussion of each of these companies is provided below.

Benfield is the world’s fourth largest reinsurance broker. We think insurance brokerage is a terrific business characterized by high profit margins and strong cash flow generation. We believe our initial purchase price was significantly below the intrinsic value of this high quality business. Moreover, we were impressed with CEO Grahame Chilton, who is a substantial shareholder, and liked that the employees of the company owned over 50% of the shares outstanding. We believed that this level of ownership aligned the interests of the company’s employees with our interests as shareholders.

Countrywide PLC owns the U.K.’s largest chain of residential real estate brokers. In our view, CEO Harry Hill has expanded the value of this franchise by effectively cross selling a number of financial service products. Countrywide sells mortgages, homeowner’s insurance and life insurance. Importantly, the company takes none of the risk behind these products, but simply collects a commission and passes the business on to third parties. It also effectively leverages its relationship with the underwriting banks by retaining the real estate appraisal services. There are numerous other attractions to this company, not the least of which is the fact that we started buying the shares at what we believed was a significant discount to its economic value.

12

TWELVE

Tate & Lyle is a U.K.-based manufacturer of sugars and starches. Tate’s businesses, in our view, are largely mature and face a myriad of challenges. At the time of purchase, we believed those businesses were fairly priced. However, we thought that value could be created by Tate’s ownership of a no-calorie sweetener, sucralose, sold under the Splenda® brand name. In addition to being about 400 times sweeter than sugar, Splenda® is temperature stable and therefore can be used for cooking.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/03 | | | 9/30/04 | |

Consumer Discretionary | | 18.9 | % | | 18.2 | % |

Consumer Staples | | 16.3 | | | 17.1 | |

Energy | | 2.1 | | | 0.4 | |

Financials | | 25.1 | | | 23.0 | |

Healthcare | | 7.6 | | | 2.6 | |

Industrials | | 12.1 | | | 10.8 | |

Information Technology | | — | | | — | |

Materials | | 4.6 | | | 14.5 | |

Telecommunication Services | | 7.4 | | | 6.5 | |

Utilities | | — | | | 1.0 | |

Other assets less liabilities | | 5.9 | | | 5.9 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets as of 9/30/03 and 9/30/04, respectively.

Clariant is a Switzerland-based specialty chemical company that was in the midst of a restructuring program. Over the last decade, prior management used debt to make several acquisitions and then failed to earn an appropriate return. As a result, earnings declined and the company was forced to restructure its balance sheet. With the financial risk reduced, we believed management had the flexibility to improve profitability.

Vodafone Group is the world’s largest provider of mobile phone services. With strong market positions in the U.K., Germany, Japan, Italy, France and the U.S. (as well as other markets), Vodafone has a global footprint that is unmatched by any of its competitors. The quality of the company’s assets combined with attractive mobile industry growth endeared investors to Vodafone’s stock, resulting in a lofty (often absurd) valuation. As is often the case, the growth implied by such a valuation did not materialize and Vodafone’s stock declined significantly from its bubble-era peak. This stock price decline drove the valuation to a level that we found attractive. Just as important as the valuation, however, was the recent shift in management strategy. Recently, the CEO has signaled to the market that Vodafone is unlikely to make any more major acquisitions and that the company’s free cash flow increasingly will be used for dividends and stock buybacks.

Admiral Group PLC is a U.K.-based direct seller of auto insurance. Admiral has an intriguing business model. It either sells policies that are co-insured by other companies or sells them to reinsurers. Admiral does keep some of the underwriting profits from the policies it sells, but more importantly, it keeps all of the profits from any ancillary services that can be sold to the entire group of policyholders. We purchased Admiral because of its high profitability, rapid growth, management’s significant share ownership, and because it was trading at a price that we thought did not reflect its profitability and growth prospects.

FUND STATISTICS

| | |

Net Assets | | $ 217.5 million |

Number of Holdings | | 45 |

Median Market Cap | | $ 2.0 billion |

Weighted Average Market Cap | | $ 11.8 billion |

Median P/B Value | | 2.2X |

Weighted Harmonic Average P/E (2004E) | | 14.2X |

Source: FactSet/Artisan Partners. All statistics are as of 9/30/04.

We sold five companies since our last report. Jyske Bank, Cable & Wireless PLC, Tower Limited and Aventis S.A. were sold after each reached our assessment of economic value. We sold our shares in Gurit-Heberlein because we felt that management had made too many acquisitions in too many different businesses. Despite a decline in our assessment of Gurit’s economic value, the Fund still earned a significant positive return from its investment.

13

THIRTEEN

ARTISAN MID CAP FUND (ARTMX)

| | |

| HIGHLIGHTS | | |

• During the twelve months ended September 30, 2004, Artisan Mid Cap Fund underperformed the Russell Midcap® Index and was slightly behind the Russell Midcap® Growth Index. | | • Our security selection in the consumer sectors was a leading contributor to performance compared to both benchmarks. • The performance of our stocks in the producer durables sector was a drag on relative returns. |

| | | |

| INVESTMENT APPROACH | | |

| We use a bottom-up investment process to identify well-managed mid-sized companies whose growth and profit potential are not yet fully recognized by investors. Specifically, we spend most of our time answering three questions about a company before we will invest in it: | | 1) Does the company exhibit franchise characteristics? 2) Is the company positioned for long-term growth and at an early stage in its profit cycle? 3) Is the stock of the company trading at a reasonable discount to our estimate of its private market value? |

| | | |

| PERFORMANCE REVIEW | | |

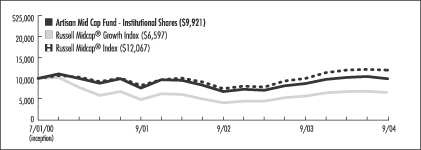

| Artisan Mid Cap Fund has outperformed both benchmark indices for the five years ended September 30, 2004 and from the Fund’s inception through September 30, 2004. |

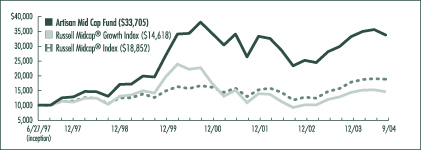

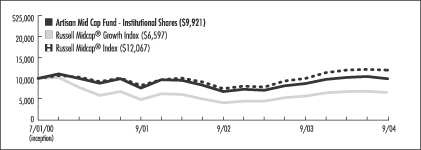

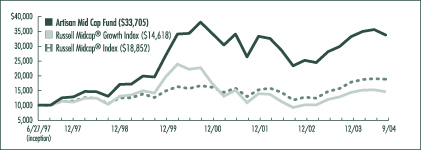

GROWTH OF AN ASSUMED $10,000 INVESTMENT (6/27/97 to 9/30/04)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/04)

| | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan Mid Cap Fund | | 13.02 | % | | 8.44 | % | | 11.45 | % | | 18.22 | % |

Russell Midcap® Growth Index | | 13.68 | | | 10.09 | | | 0.63 | | | 5.37 | |

Russell Midcap® Index | | 20.55 | | | 13.32 | | | 8.26 | | | 9.13 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 81 for a description of each index.

14

FOURTEEN

INVESTING ENVIRONMENT

Our fiscal year ended September 30, 2004 was a good period to own mid-cap stocks as they outpaced their small- and large-cap brethren. However, a simple analysis of returns by quarter reveals that stocks of all sizes saw gains moderate throughout the period and ultimately tail off at the end of the fiscal year. Over the course of a twelve-month time frame there could be a variety of reasons to point to that might explain the performance trend, but we think the most important influence was probably economic growth. During the fiscal year, economic growth slowed and expectations for future growth moderated. Two factors that contributed to the moderation were rising commodities prices, particularly oil, and market participants’ expectation for higher interest rates, driven in part by a pick up in inflation.

Throughout the period, one of the high-level assumptions that impacted our investment decisions was that broad economic growth would inevitably slow, but continue at a moderate pace. We felt the best way to capitalize on that assumption was to tilt the Fund toward companies more sensitive to business spending than consumer spending and toward larger, more established franchises. Consequently, we were pleased to see that business investment and hiring stepped up during the year. Our tilt away from the consumer was based on the belief that the benefits of tax cuts and a favorable interest rate environment would dissipate over time, but that didn’t happen to the extent we expected. The consumer remained fairly resilient throughout the period as confidence readings and spending were both healthy.

In our benchmarks, two sectors that advanced strongly were energy and materials, which came as no surprise given the rise in oil prices and other commodities. Most other sectors recorded solid double-digit gains, with technology the main laggard.

PERFORMANCE DISCUSSION

In the Fund, our security selection was strong relative to the Russell Midcap® Growth Index, although we were not optimally aligned to the best performing sectors. On a sector basis the largest contributor to Fund performance was the consumer discretionary sector, but a number of stocks in the materials, energy and transportation sectors also recorded strong gains. The weakest parts of the portfolio were the technology and producer durables sectors.

TOP 10 HOLDINGS

| | | |

| Company Name | | % | |

Aetna Inc. | | 1.6 | % |

Weatherford International Ltd. | | 1.5 | |

Caremark Rx, Inc. | | 1.5 | |

Smith International, Inc. | | 1.5 | |

EchoStar Communications Corporation | | 1.4 | |

Diebold, Incorporated | | 1.4 | |

MGIC Investment Corporation | | 1.4 | |

CIT Group Inc. | | 1.4 | |

Jabil Circuit, Inc. | | 1.4 | |

Precision Castparts Corp. | | 1.3 | |

Total | | 14.4 | % |

As a percentage of total net assets as of 9/30/04. Top 10 Holdings are determined by issuer.

In the consumer discretionary sector, two of our better performers were Robert Half International Inc. and Iron Mountain Incorporated, which benefited from the pick up in hiring. Robert Half is one of the world’s largest temporary and permanent staffing providers and Iron Mountain, a new addition early in the period, is the global leader in records and information management. We tend to think about these stocks as payroll related and tied to business spending, but our benchmark classifies them as consumer-oriented. Other meaningful gainers in the sector were outdoor advertiser Lamar Advertising Company, global Internet media company Yahoo! Inc., warehouse club operator Costco Wholesale Corporation and teen apparel retailer American Eagle Outfitters, Inc. Each company reported strong improvements in its business, but we would make special mention of American Eagle. Its share price

15

FIFTEEN

increased over 80%, rising steadily throughout our fiscal year. Among the factors that contributed to the stock’s ascent was good sales momentum driven by improved merchandise.

In a strong period for energy and materials stocks, our performance in each sector outpaced the growth benchmark sector return. Within the energy sector our best performers were Smith International, Inc. (a leading provider of drilling bits to the oil and gas industries), Weatherford International Ltd. (a top provider of oil and gas services) and EOG Resources, Inc. (an independent oil and gas driller). Smith produced solid results because it was able to push through some price increases due to robust demand for spending on exploration and production. In addition, the company took advantage of price declines to repurchase shares. Weatherford also instituted pricing increases and had good earnings, which were supported by better operating profitability as the company cut costs. EOG was purchased during the period with some very good initial returns. We were attracted to EOG’s strong return on investment, driven by a tight control over costs and history of successful reserve additions.

In the materials sector, our leading gainers were Smurfit Stone Container Corporation and Precision Castparts Corp. Smurfit is a container and packaging company and it benefited as demand for its products increased steadily throughout the period. Precision Castparts, a metal components manufacturer for the aerospace industry, was a new purchase. It gained market share, realized meaningful cost savings from an acquisition

FUND STATISTICS

| | |

Net Assets | | $ 5.1 billion |

Number of Holdings | | 116 |

Median Market Cap | | $ 5.2 billion |

Weighted Average Market Cap | | $ 8.3 billion |

Weighted Average Growth Rate (3-5 yr) | | 16.8% |

Weighted Harmonic Average P/E (2004E) | | 22.2X |

Source: FactSet/Artisan Partners. All statistics are as of 9/30/04.

and strategically divested units to focus on its core end markets, which showed strength.

Overall, transportation stocks posted positive, although not robust, returns in our benchmarks. Three of our holdings recorded impressive gains leading to a strong performance contribution. Expeditors International of Washington, Inc., a global logistics provider; FedEx Corporation, the recognized leader in global express delivery; and PACCAR Inc., a producer of heavy-duty and medium-duty trucks, each advanced more than 30%. All three companies reported excellent earnings growth driven by healthy demand for their services.

Compared to the Russell Midcap® Growth Index, the performance of our technology holdings was mildly better and our exposure to the sector was fairly similar. On balance this meant that we held a slight advantage relative to the Index. However, the story was considerably different versus the Russell Midcap® Index where we had a meaningfully larger exposure to technology and our stocks were weaker. In our opinion, this meant that investors were generally more concerned about valuation and risk than growth. While we were frustrated by that sentiment, we are growth investors and it did not deter our long-term strategy.

Some of the holdings that had a negative impact on performance included Seagate Technology, a hard disk drive manufacturer; Agere Systems Inc., an integrated circuits manufacturer; Broadcom Corporation, an integrated semiconductor developer and Vishay Intertechnology, Inc., a passive electronic components manufacturer. Seagate was pressured by pricing concerns. Agere, Broadcom and Vishay were under particular strain late in the fiscal year as a variety of data pointed to excess supply and moderating demand for their products. We sold Agere and Vishay. The positions we held in technology that had strong showings during the year and offset some of the weakness in those names were enterprise communications systems provider Avaya Inc., personal computer manufacturer Apple Computer, Inc., digital imaging company Adobe

16

SIXTEEN

Systems Incorporated and storage semiconductor producer PMC-Sierra, Inc. We sold Apple and PMC-Sierra into the share price strength.

Danaher Corporation, a diversified industrial and consumer products company, was a standout performer in the producer durables sector. It produced profitability levels that were near historically high levels and announced acquisitions that were expected to add to earnings. However, Danaher’s performance gains were offset by several of our technology-related producer durables. Among those that declined were KLA-Tencor Corporation, Andrew Corporation, Lam Research Corporation and Novellus Systems, Inc., which we ultimately sold. Lam Research is a semiconductor equipment manufacturer that we purchased during the fiscal year. Its share price weakness provided us with an opportunity to initiate our position.

FUND CHANGES

Throughout the fiscal year and at its close, our portfolio was tilted toward companies sensitive to business spending. We also had a skew toward companies at the larger end of our market capitalization range. The sector

| | | | | | |

| SECTOR DIVERSIFICATION | | | | | | |

| Sector | | 9/30/03 | | | 9/30/04 | |

Auto & Transportation | | 5.2 | % | | 4.0 | % |

Consumer Discretionary | | 24.1 | | | 24.9 | |

Consumer Staples | | 1.6 | | | 2.1 | |

Financial Services | | 12.4 | | | 10.3 | |

Healthcare | | 13.3 | | | 16.6 | |

Integrated Oils | | — | | | — | |

Materials & Processing | | 3.0 | | | 8.1 | |

Other | | 0.4 | | | 2.4 | |

Other Energy | | 4.8 | | | 5.0 | |

Producer Durables | | 7.8 | | | 8.1 | |

Technology | | 22.2 | | | 14.9 | |

Utilities | | 0.7 | | | 0.9 | |

Other assets less liabilities | | 4.5 | | | 2.7 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets as of 9/30/03 and 9/30/04, respectively.

positioning of the Fund changed the most during the year in technology, financial services, healthcare and materials.

The decrease in our technology weighting was due in part to the weak performance of the group when compared to the other sectors, but we also made a few select sales in addition to those discussed above. We sold Nortel Networks Corporation, Rockwell Automation Inc., Veritas Software Corporation and BEA Systems, Inc. to realize gains. We sold McAfee, Inc. (formerly Network Associates, Inc.) and Amdocs Limited in favor of other alternatives. Partially offsetting the sales were investments in Jabil Circuit, Inc. (electronic manufacturing services), Macromedia, Inc. (develops software to deliver content on the Internet) and TIBCO Software Inc. (integration software provider).

Our position in financial services is lower because we believed that the next move for interest rates would be higher and financial stocks have historically been sensitive to moves in rates. Thus when stocks such as T. Rowe Price Group, Inc., Platinum Underwriters Holdings, Ltd., Fiserv, Inc. and SEI Investments Company reached our target prices, we sold them and redeployed most of the capital into other areas.

The healthcare and materials sectors saw the largest increases as a percentage of portfolio assets. Neither change was the result of a broader view about the sectors. Our investment discipline led us to a number of quality franchises in those areas, including healthcare benefits provider Aetna Inc., which was our largest holding at the end of the period, radiation therapy systems producer Varian Medical Systems, Inc., foodservice products provider Ecolab Inc., gas and chemicals distributor Air Products and Chemicals, Inc. and Precision Castparts.

17

SEVENTEEN

ARTISAN MID CAP VALUE FUND (ARTQX)

| | |

| HIGHLIGHTS | | |

• For the twelve months ended September 30, 2004, Artisan Mid Cap Value Fund outperformed the Russell Midcap® and Russell Midcap® Value Indices. • The strongest contributors to our relative performance were our overweight position and | | security selection in the energy sector and our security selection in financial services. • Our consumer discretionary and transportation stocks hurt our performance during the period. |

| | | |

| INVESTMENT APPROACH | | |

| Our goal is to invest in companies that are priced below our estimate of the value of the business and that provide a controlled level of risk. It is important to complement stock price value with a company that is financially strong and possesses favorable economics. Our focus is on individual companies, rather than on economic or market trends. | | The Fund often finds investment opportunities in companies that are in the midst of a turnaround, are in transition, are experiencing declining earnings and/or have earnings short-falls. |

| | | |

| PERFORMANCE REVIEW | | |

| Artisan Mid Cap Value Fund has outperformed the Russell Midcap® and Russell Midcap® Value Indices over the trailing one and three-year periods ended September 30, 2004 and from the Fund’s inception through September 30, 2004. |

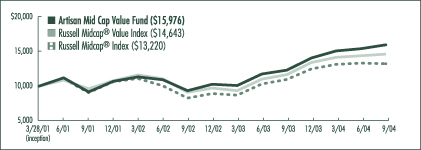

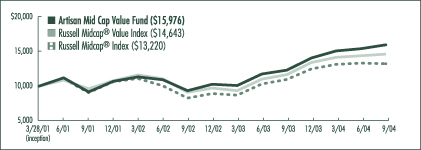

GROWTH OF AN ASSUMED $10,000 INVESTMENT (3/28/01 to 9/30/04)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/04)

| | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | Since

Inception | |

Artisan Mid Cap Value Fund | | 29.60 | % | | 20.41 | % | | 14.28 | % |

Russell Midcap® Value Index | | 25.62 | | | 15.07 | | | 11.48 | |

Russell Midcap® Index | | 20.55 | | | 13.32 | | | 8.28 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The Fund’s performance reflects Artisan Partners’ undertaking to limit the Fund’s expenses, which may be terminated at any time, has been in effect since the Fund’s inception, and has had a material impact on the Fund’s performance, which would have been lower in its absence. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 81 for a description of each index.

18

EIGHTEEN

INVESTING ENVIRONMENT

For our fiscal year ended September 30, 2004, mid-cap stocks were the best performing market capitalization group in the U.S. Given that mid-caps have historically been overlooked in favor of small- and large-cap stocks, it was satisfying to see the group receive some attention. Despite their advantage relative to small- and large-cap stocks, companies of all sizes and styles actually performed very well as economic developments throughout the period were fairly solid. Most notably, after some poor readings early in the fiscal year, there was a definite pick up in hiring that produced optimism about consumer spending and profitability improved at many companies around the market. Unfortunately, concerns about rising interest rates and a sizeable increase in the price of oil later in the fiscal year dampened that optimism and raised doubt about the level and sustainability of economic growth.

The increase in oil and natural gas prices was a driving force behind the performance of the energy sector, which was among the leaders in the Russell Midcap® Value Index. Market commentators and headline writers pointed to a variety of reasons for the upward pressure on oil prices and, while the explanations may or may not have been correct, we thought there was too much attention paid to short-term issues and too little focus on longer-term views. Elsewhere, the strength of commodity prices drove materials stocks to very strong gains and the continued low level of interest rates supported financials. The worst performing sector in the Index for the fiscal year as a whole was healthcare, although technology stocks fell the most at the end of our fiscal year. For the year ended September 30, 2004, no sector recorded a negative return in the mid-cap space.

PERFORMANCE DISCUSSION

The Fund received its largest performance contributions from the energy and financials sectors. In both areas, our security selection was strong. In the energy sector, we also

benefited from our overweight position compared to the Russell Midcap® Value Index. Additional areas of strength compared to the Index were the technology and consumer staples sectors. Our returns from our transportation and consumer discretionary stocks, though positive, were not as strong as those of the Index sectors.

TOP 10 HOLDINGS

| | | |

| Company Name | | % | |

The Student Loan Corporation | | 4.7 | % |

Apache Corporation | | 4.3 | |

EOG Resources, Inc. | | 4.2 | |

Furniture Brands International, Inc. | | 3.6 | |

White Mountains Insurance Group, Ltd. | | 3.5 | |

Countrywide Financial Corporation | | 3.5 | |

XTO Energy Inc. | | 3.3 | |

Alleghany Corporation | | 3.2 | |

Old Republic International Corporation | | 3.2 | |

Liz Claiborne Inc. | | 3.0 | |

Total | | 36.5 | % |

As a percentage of total net assets as of 9/30/04. Top 10 Holdings are determined by issuer.

The absolute performance gain of our stocks in the energy sector was very strong as several of our holdings outperformed the benchmark sector return. We have had an overweight position in energy for some time based on those companies’ strong cash flow and earnings potential over the long-term. In the short-term, market participants have priced the majority of the group higher due to high oil and natural gas prices. Given the impact of geopolitical influences and other economic wildcards, we have never believed that it was worthwhile to focus on the short-term outlook for energy prices. Analyzing the long-term outlook is no easy task, but we believed there was enough information available regarding supply and demand factors to determine a long-run normalized price range for natural gas (and potentially oil). It was our assessment of the normalized price level that drove our valuation thought process and our conviction that it was possible to invest in energy rather

19

NINETEEN

than merely speculate about commodity prices. It was also the reason we continued to see value in many of our stocks through the upswing.

During the period, our strongest performing energy stock was XTO Energy Inc. XTO continued its development strategy of purchasing producing properties and raised cash to fund additional acquisitions through an equity offering, all while posting strong financial results. EOG Resources, Inc. was another meaningful gainer. It benefited from the positive prospects of its central Texas drilling program and raised production and reserve estimates. Newfield Exploration Company and Diamond Offshore Drilling, Inc., though smaller positions than XTO and EOG, also added to returns. Newfield entered into a drilling agreement with energy giants Exxon Mobil and BP, which demonstrated the potential of its Gulf of Mexico assets. Diamond Offshore Drilling signed a number of new contracts for its fleet of rigs and improved pricing.

In the financials sector, our leading performer was mortgage lender Countrywide Financial Corporation. It experienced some volatility in its share price during our fiscal year as a temporary rise in long-term interest rates slowed demand for mortgage refinancings, but it continued to gain market share and grew its mortgage servicing portfolio. We pared back our exposure to the company during the fiscal year as its market capitalization moved outside of our range. Alleghany Corporation, an insurer, was another strong gainer. During the period, it announced the sale of a profitable investment. We achieved additional positive contributions compared to our benchmark from Concord EFS, Inc. and Loews Corporation.

FUND STATISTICS

| | |

Net Assets | | $ 312.3 million |

Number of Holdings | | 49 |

Median Market Cap | | $ 2.9 billion |

Weighted Average Market Cap | | $ 5.0 billion |

Weighted Harmonic Average P/E (2004E) | | 14.2X |

Source: FactSet/Artisan Partners. All statistics are as of 9/30/04.

Our excess performance compared to the benchmark in the technology sector was primarily due to our low weight in the group. We had little or no exposure to technology stocks for much of the fiscal year because we believed that many were overvalued. That sensitivity to valuation provided positive returns. However, late in the period when many technology companies were being beaten down, we found an opportunity to build small positions in select companies. We added BMC Software, Inc., infrastructure systems software; Siebel Systems, Inc., eBusiness applications; Synopsys, Inc., electronic design automation software; Bearingpoint, Inc., technology consulting; and National Semiconductor Corporation, semiconductor products manufacturer. Additionally, although not technically classified as technology stocks, we bought into two stocks we would define as technology related: SunGard Data Systems Inc., which provides technology services and solutions to the financial services industry, and Convergys Corporation, which is a provider of outsourced, integrated billing software.

In the consumer staples sector, we benefited from the strength of Tyson Foods, Inc., Dial Corporation and Hormel Foods Corporation. Tyson, the world’s largest meat processor, encountered numerous distractions, but management continued to execute its business strategy. Consumer products company Dial was purchased by German consumer products company Henkel KGaA. Hormel, a meat and poultry processor, profited in part from a rebound in turkey prices. We sold all three stocks into share price strength.

Our underperformance in the transportation and consumer discretionary sectors can be attributed to weakness in select holdings. Swift Transportation Co., Inc., one of the largest publicly held truckload carriers, fell due to higher fuel costs and news of a regulatory review of driver log documentation.

In the consumer discretionary sector, we were hurt by poor results from three of our purchases: Rent-A-Center, Inc., AutoZone, Inc. and

20

TWENTY

Blockbuster Inc. Rent-A-Center is a rent-to-own merchandise retailer with a leading market share. It fell due to weak demand. AutoZone, which is an automotive parts retailer, was hurt by poor sales results. Video rental chain Blockbuster announced the terms of its split-off from Viacom Inc. (its majority owner), which included a new debt facility that created concern. Blockbuster was also hurt by competition from mail rentals, video on demand and discounted DVD sales.

FUND CHANGES

In the early part of our fiscal year, we felt handcuffed by the valuations of many stocks in the market and limited in our buying opportunities. However, late in the period interest rate fears and higher oil prices appeared to generate some headline risk in the market, leading to some volatility in certain industries. Whereas many investors fear volatility, we welcomed it with a sigh of relief because it created opportunities for us to initiate new positions when price declines moved several stocks into our buying range. We already noted several of our purchases in the technology sector, but pressure on healthcare and consumer discretionary stocks also led us to several purchases in those sectors.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/03 | | | 9/30/04 | |

Auto & Transportation | | 3.7 | % | | 3.5 | % |

Consumer Discretionary | | 14.6 | | | 22.9 | |

Consumer Staples | | 10.2 | | | 1.3 | |

Financial Services | | 33.5 | | | 29.3 | |

Healthcare | | 0.7 | | | 5.7 | |

Integrated Oils | | — | | | — | |

Materials & Processing | | 6.2 | | | 5.0 | |

Other | | 1.5 | | | 0.3 | |

Other Energy | | 14.1 | | | 18.3 | |

Producer Durables | | 3.5 | | | — | |

Technology | | 1.5 | | | 6.0 | |

Utilities | | 4.8 | | | 1.5 | |

Other assets less liabilities | | 5.7 | | | 6.2 | |

Total | | 100.0 | % | | 100.0 | % |

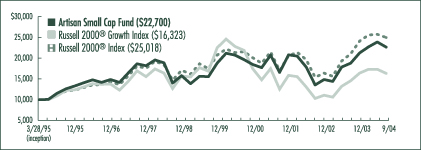

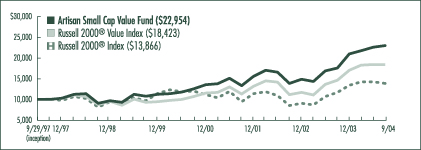

As a percentage of total net assets as of 9/30/03 and 9/30/04, respectively.