UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| | |

[ ] | | Preliminary Proxy Statement |

[ ] | | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

[X] | | Definitive Proxy Statement |

[ ] | | Definitive Additional Materials |

[ ] | | Soliciting Material Pursuant to [Section] 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

Artisan Partners Funds, Inc.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | [ ] | Fee paid previously with preliminary materials. |

| | [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

September 26, 2012

ARTISAN FUNDS

Dear Shareholder:

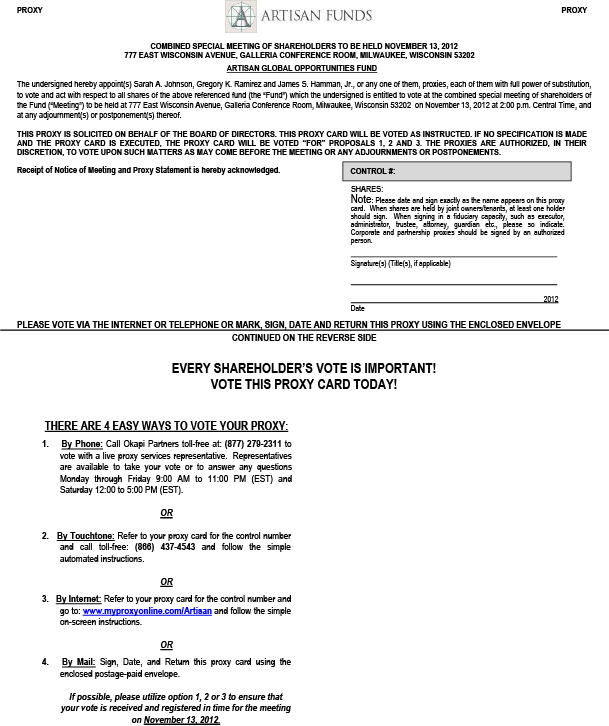

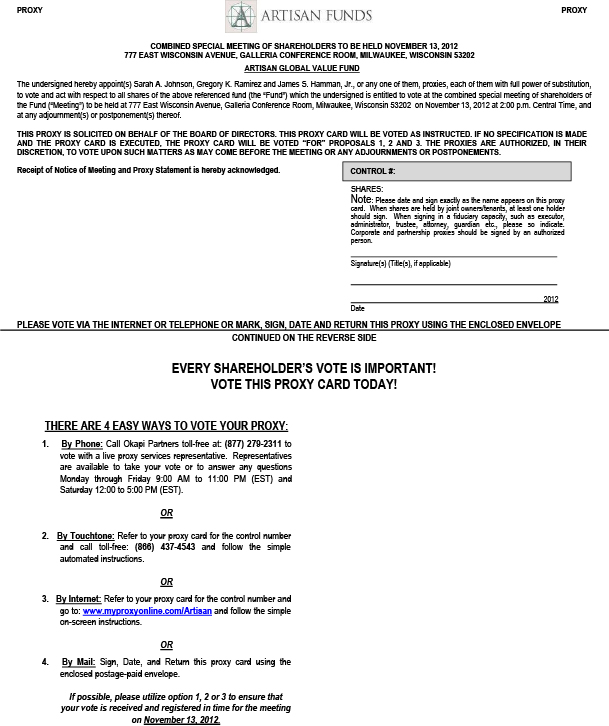

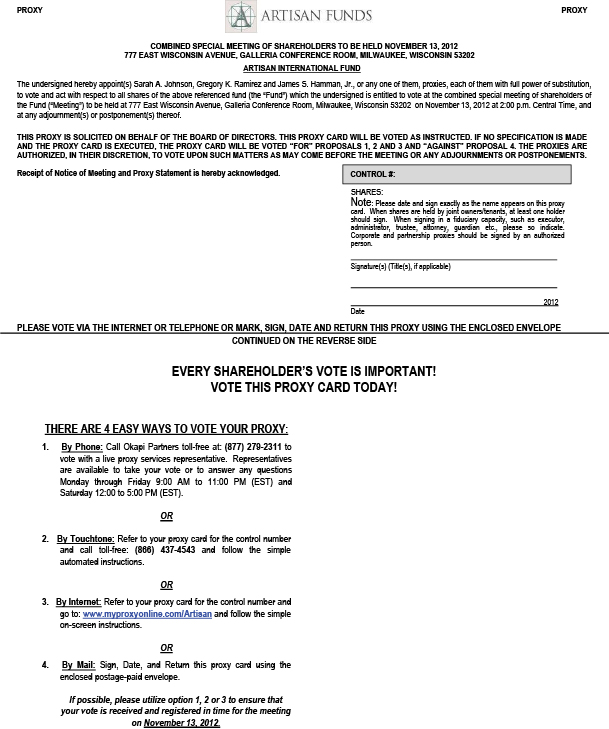

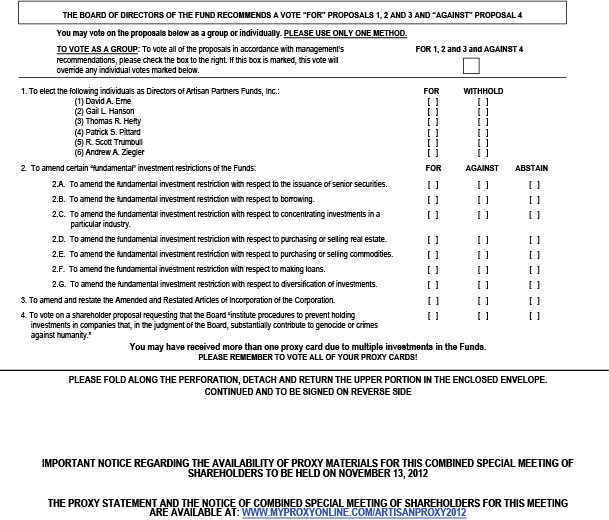

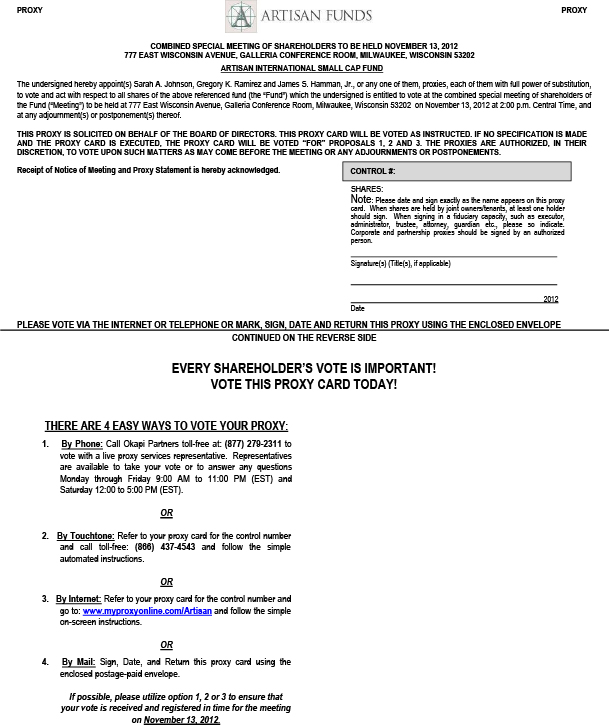

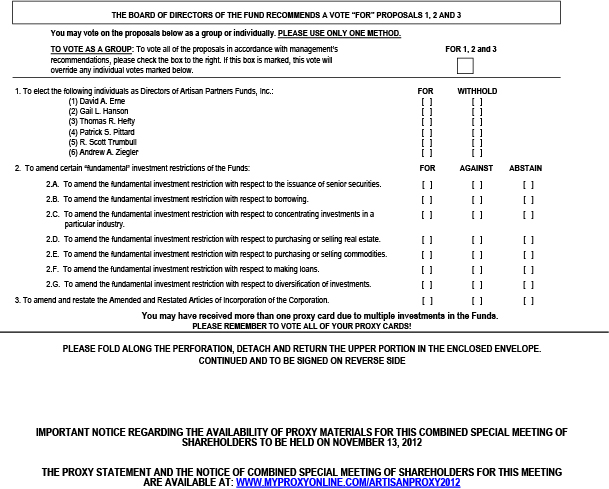

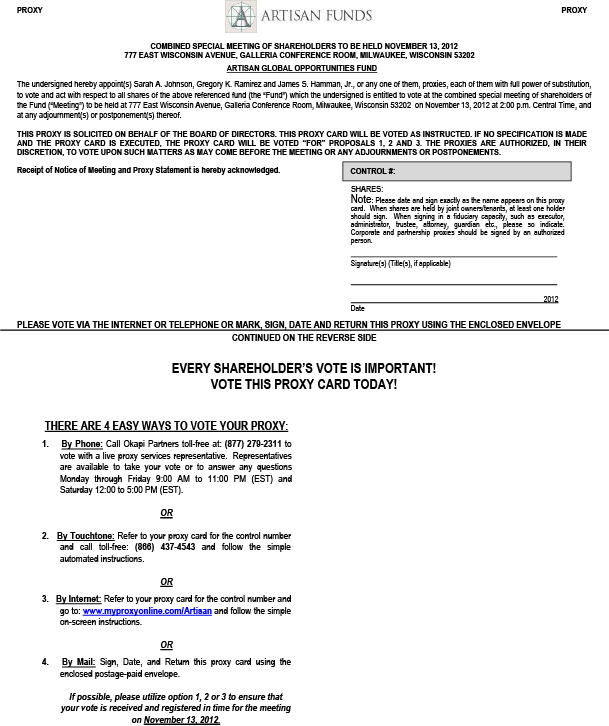

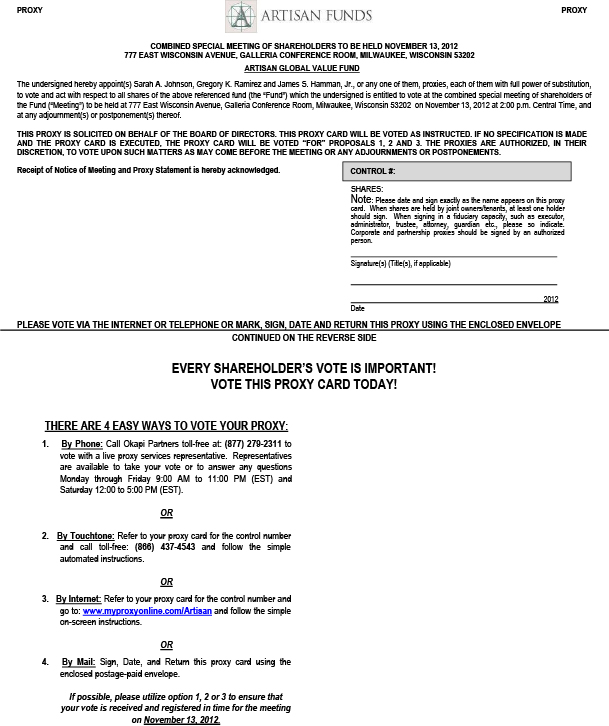

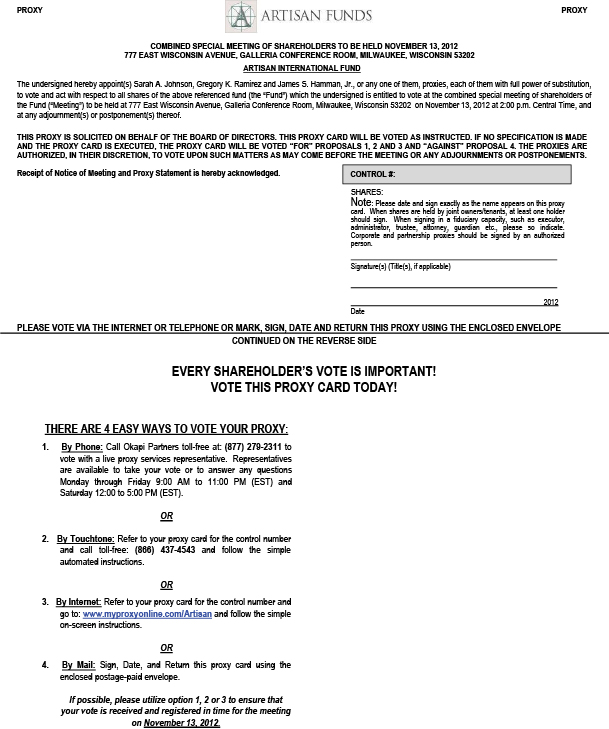

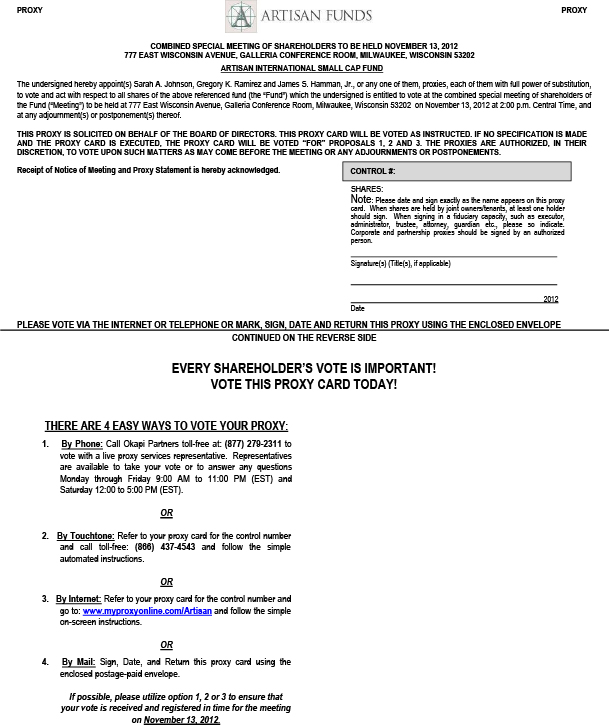

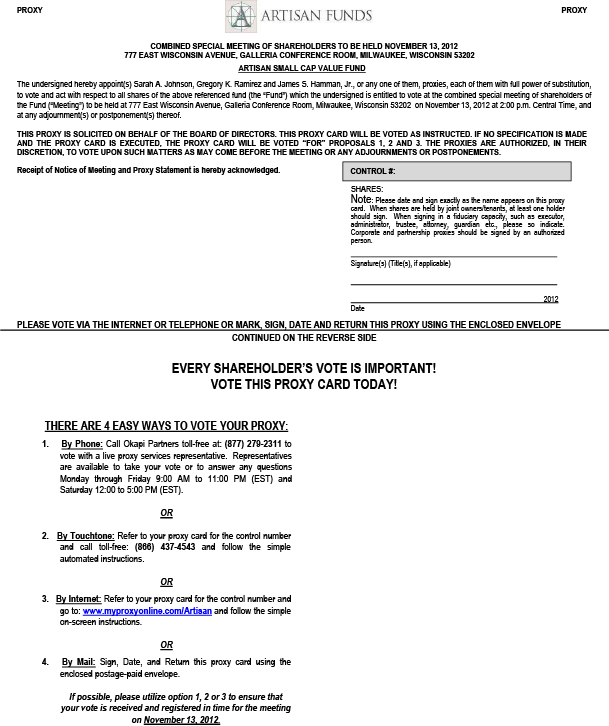

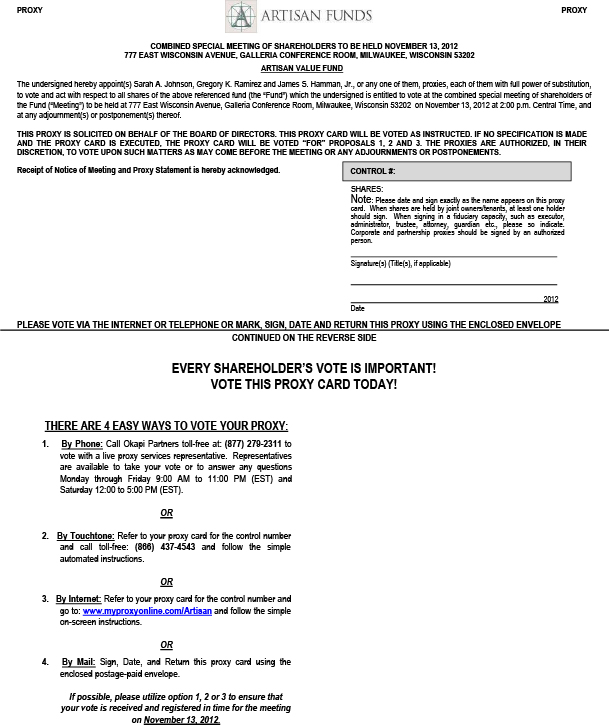

I am writing to you about a series of important proposals relating to Artisan Partners Funds, Inc. (“Artisan Funds” or the “Corporation”) and each of its respective series (each, a “Fund” and collectively, the “Funds”). By this joint proxy statement, we are asking you to consider and vote on four proposals: (1) to elect six directors of the Corporation, including one nominee who is not currently a Director; (2) to amend certain of the Funds’ “fundamental” investment restrictions; (3) to amend and restate the Articles of Incorporation of the Corporation; and (4) if you are a shareholder of Artisan International Fund, you are also being asked to consider a shareholder proposal requesting that the board of directors of the Corporation (the “Board”) institute certain procedures relating to the investments of Artisan International Fund.

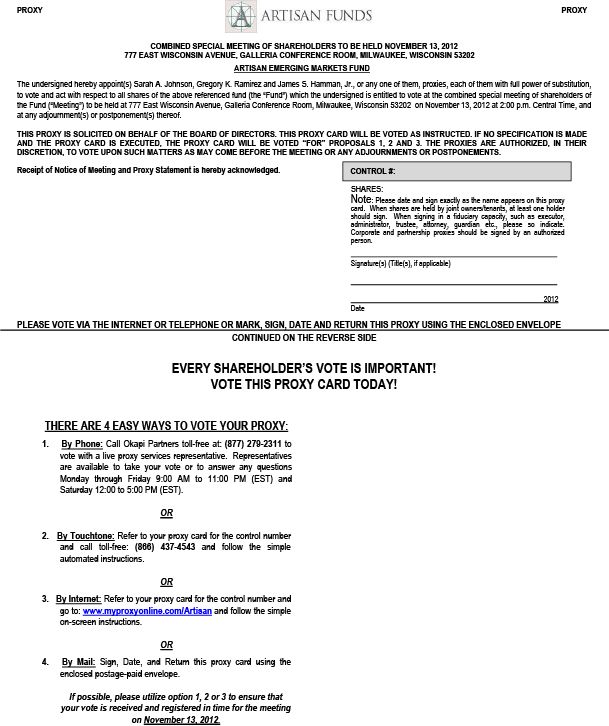

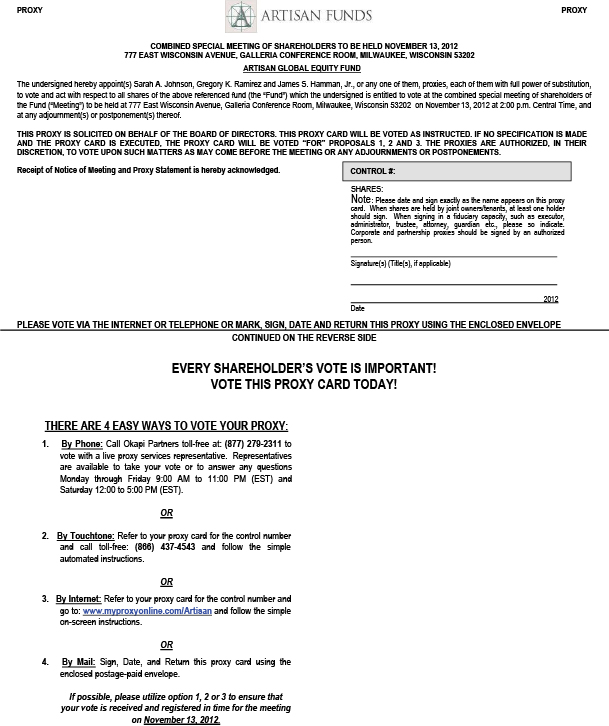

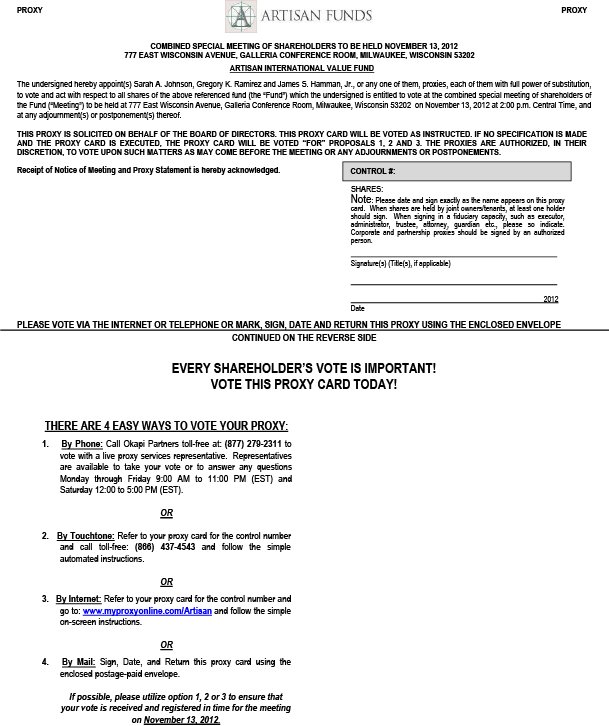

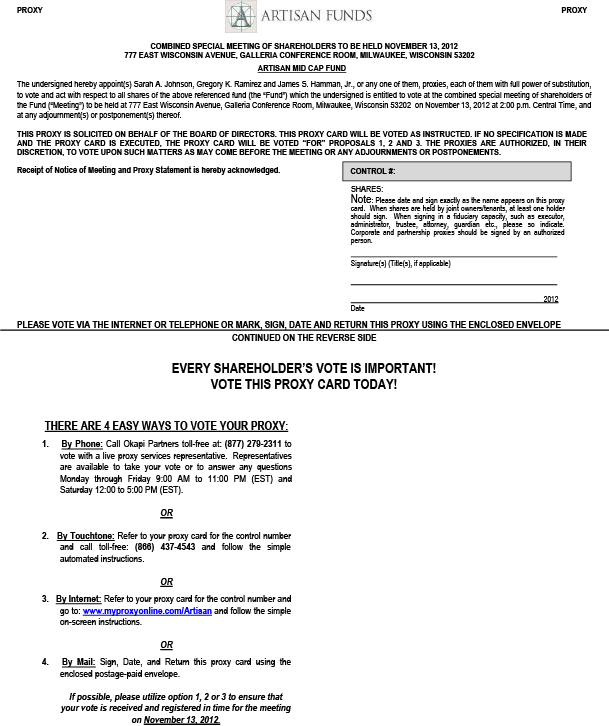

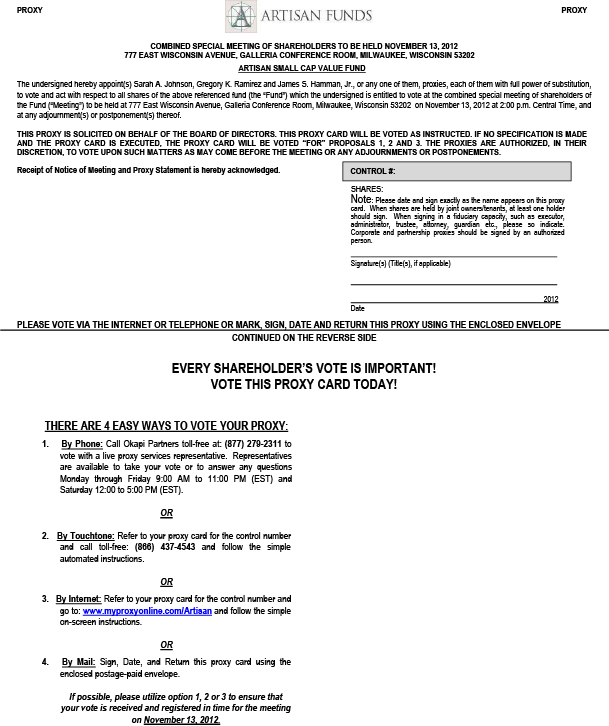

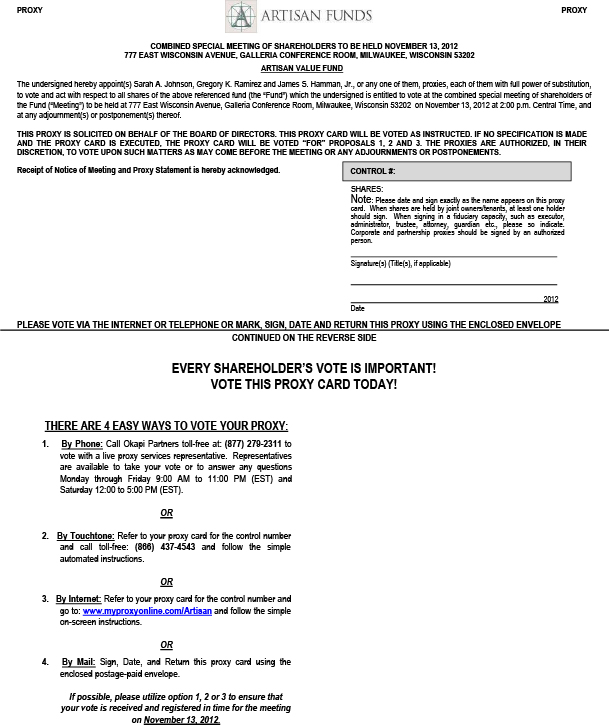

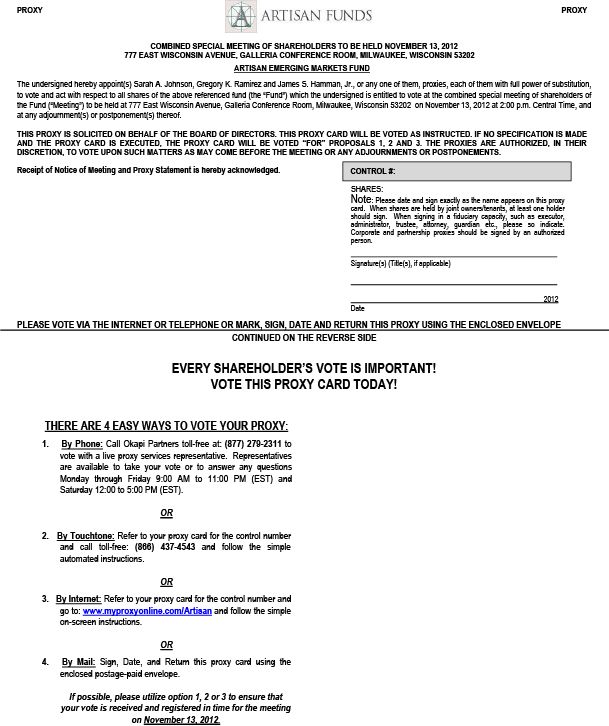

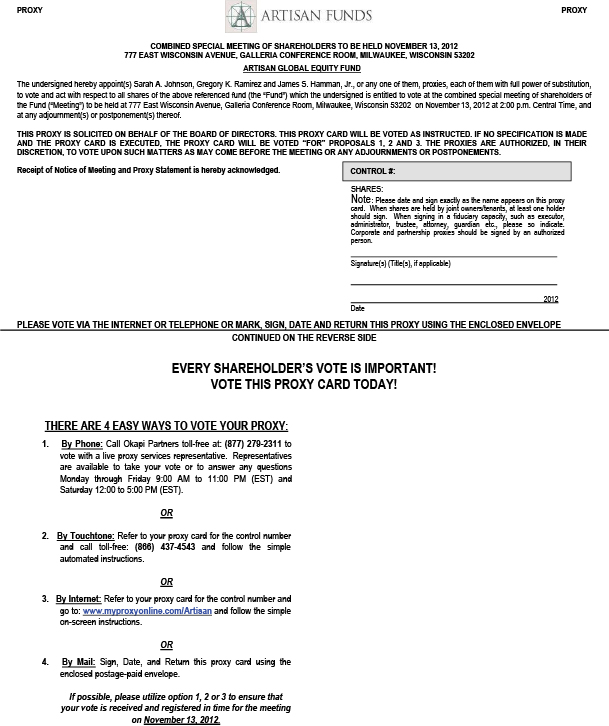

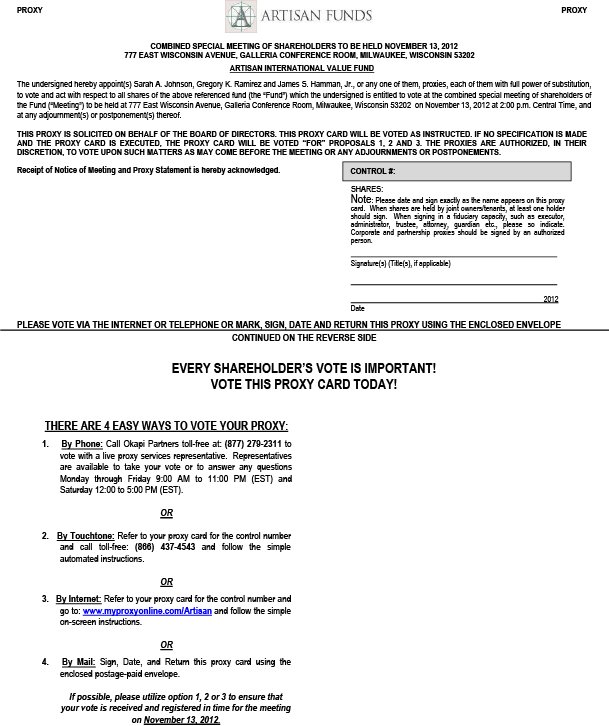

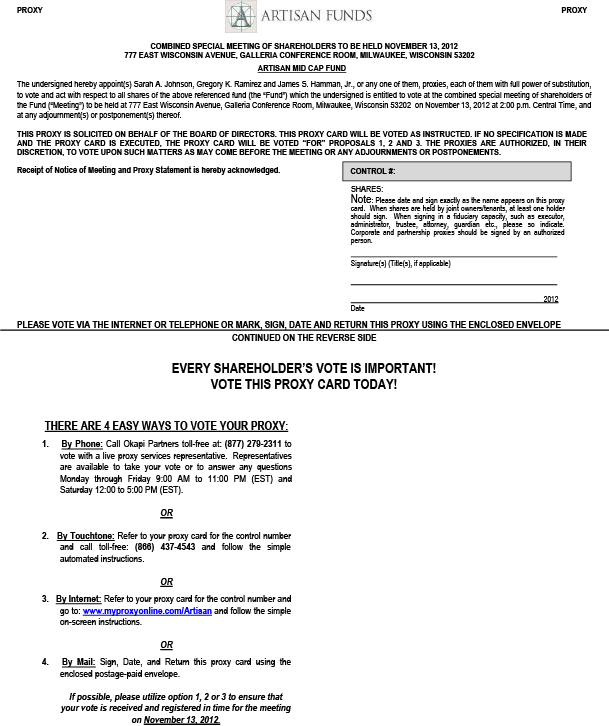

A combined special meeting of shareholders (the “Meeting”) of the Funds has been scheduled for November 13, 2012 to vote on these matters. If you are a shareholder of record of any of the Funds as of the close of business on September 14, 2012, you are entitled to vote at the Meeting and any adjournment(s) or postponement(s) of the Meeting, even if you no longer own your shares.

Pursuant to these materials, you are being asked to vote on proposals for the Funds, as noted above.For the reasons discussed in the enclosed materials, the Board recommends that you vote “FOR” Proposals 1, 2, and 3 and “AGAINST” Proposal 4.

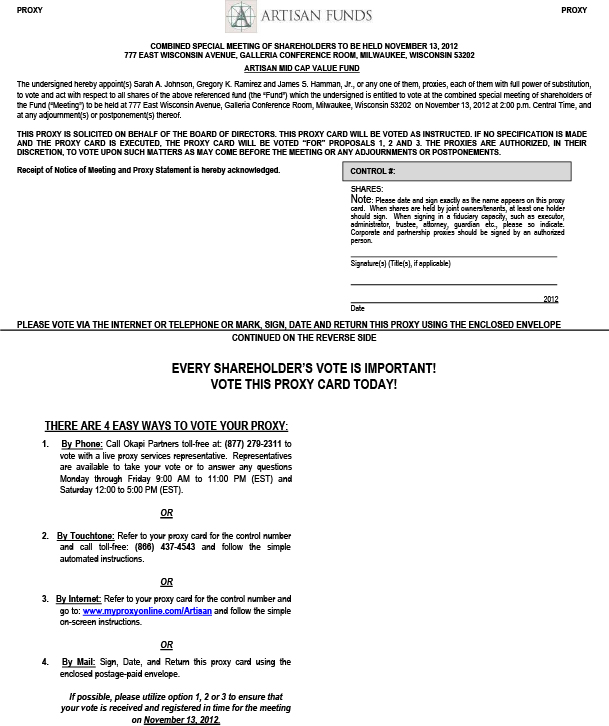

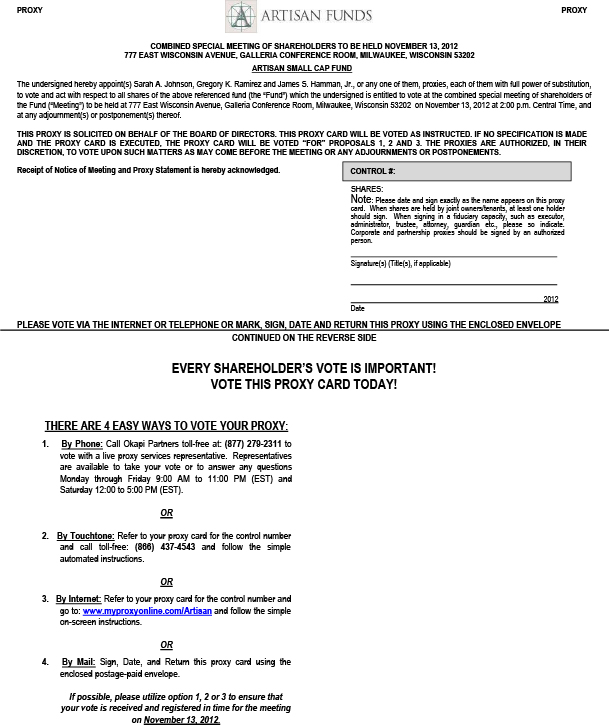

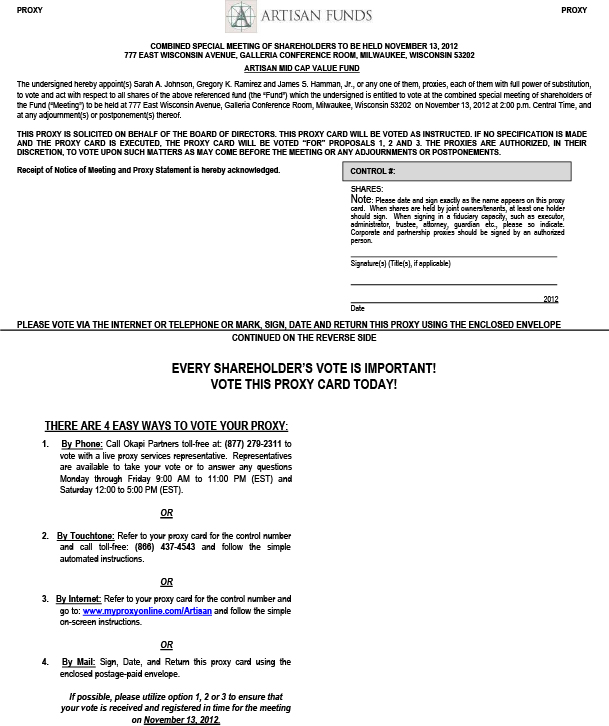

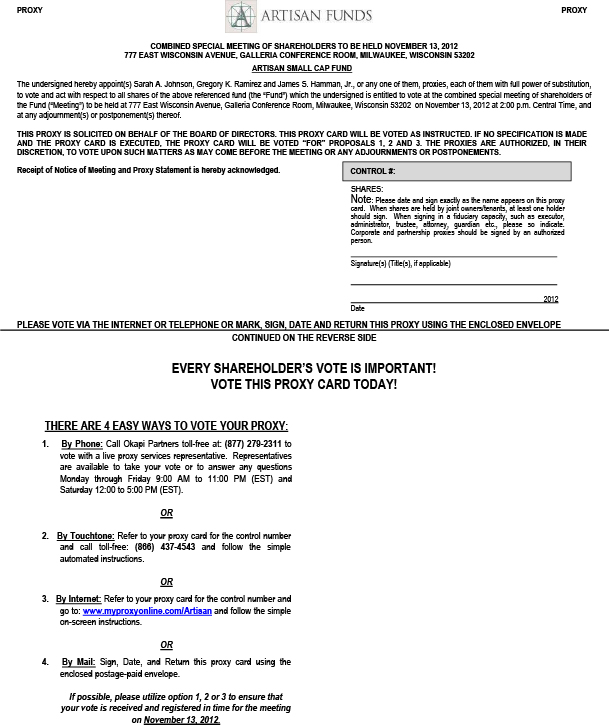

You can vote in one of four ways:

| | ¡ | | Over the Internet through the website listed on the proxy card, |

| | ¡ | | By telephone, using the toll-free number listed on the proxy card, |

| | ¡ | | By mail, using the enclosed proxy card — be sure to sign, date and return the proxy card in the enclosed postage-paid envelope, or |

| | ¡ | | In person at the shareholder meeting on November 13, 2012. |

We encourage you to vote over the Internet or by telephone using the voting control number that appears on your proxy card.

Your vote is extremely important. Shareholder meetings of the Funds do not occur often, so we ask that you take the time to carefully consider and vote on these important proposals. Please read the enclosed information carefully before voting. If you have questions, please call Okapi Partners, the Funds’ proxy solicitor, toll-free at (877) 279-2311.

Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Fund(s) prior to the Meeting, or by voting in person at the Meeting.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

Sincerely,

/s/ Eric R. Colson

Eric R. Colson

President

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY CARD IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

QUESTIONS AND ANSWERS

The following “Questions and Answers” section is a summary and is not intended to be as detailed as the discussion found in the proxy materials. For this reason, the information is qualified in its entirety by reference to the enclosed joint proxy statement to shareholders (“Joint Proxy Statement”).

| Q. | Why am I receiving this Joint Proxy Statement? |

| A. | You are receiving these proxy materials — that include the Joint Proxy Statement and your proxy card — because you have the right to vote on important proposals concerning Artisan Partners Funds, Inc. (“Artisan Funds” or the “Corporation”) and its series (each, a “Fund” and collectively, the “Funds”). Each of these proposals is described below. |

| Q. | What are the proposals about? |

| A. | This proxy statement presents four proposals. Shareholders of all Funds are being asked to vote on the first three proposals and shareholders of Artisan International Fund are being asked to vote on all four proposals. |

Proposal 1

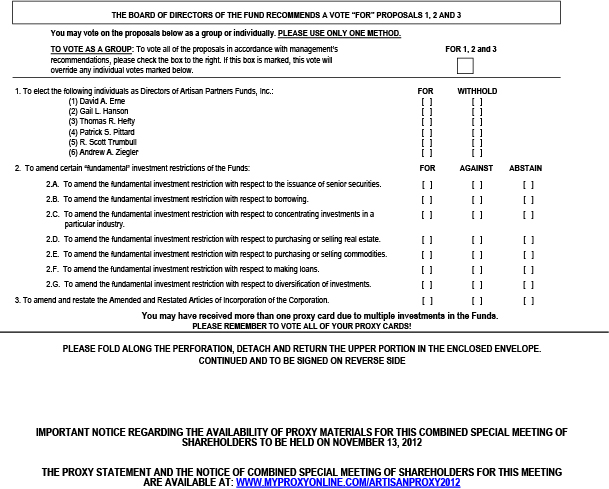

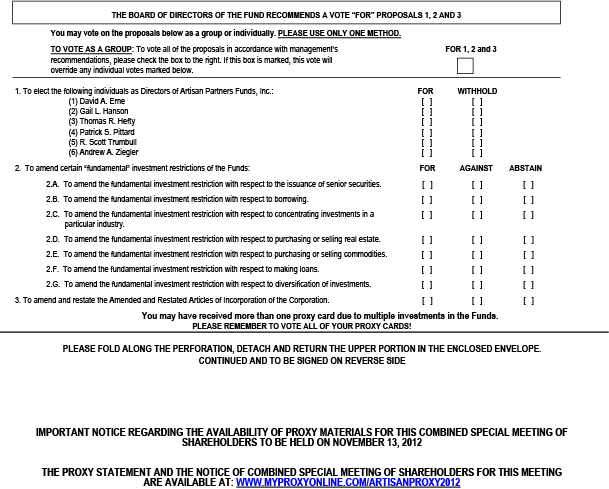

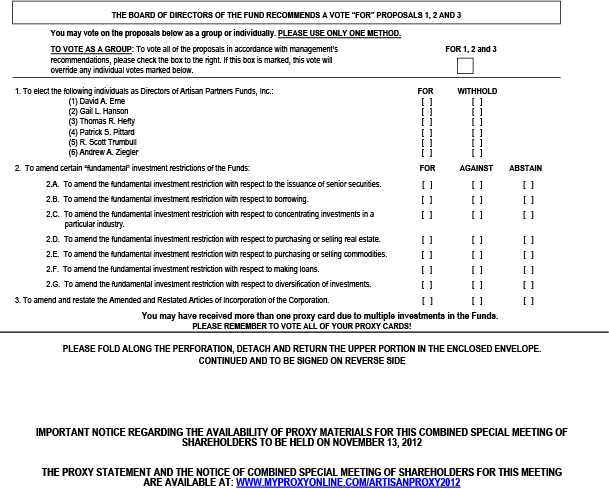

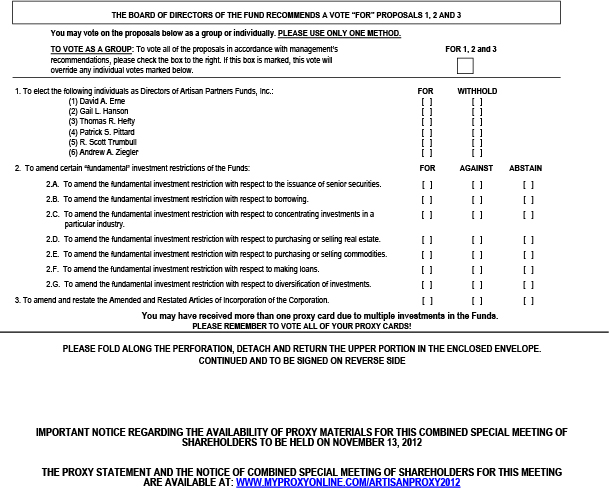

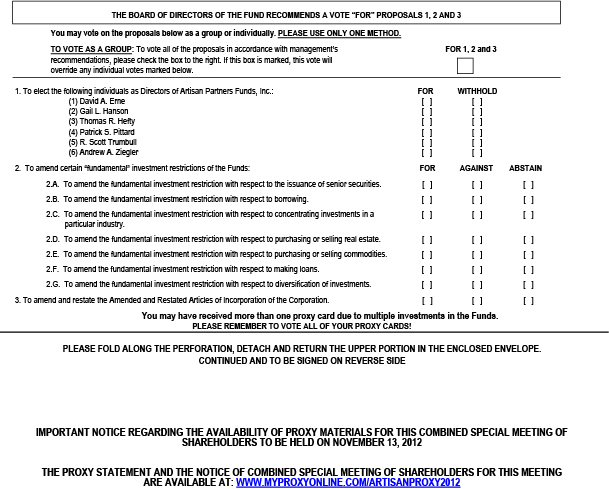

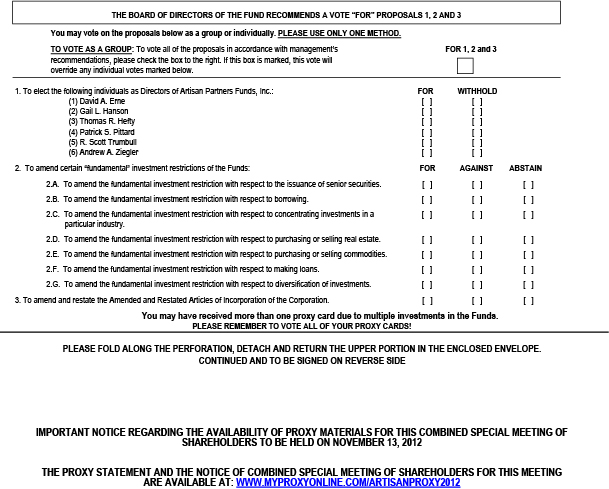

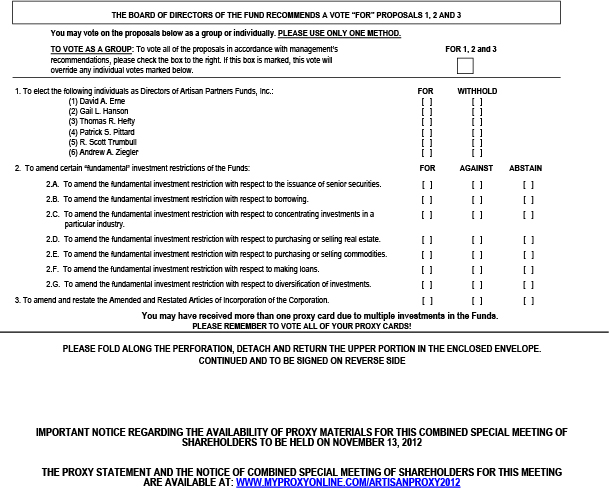

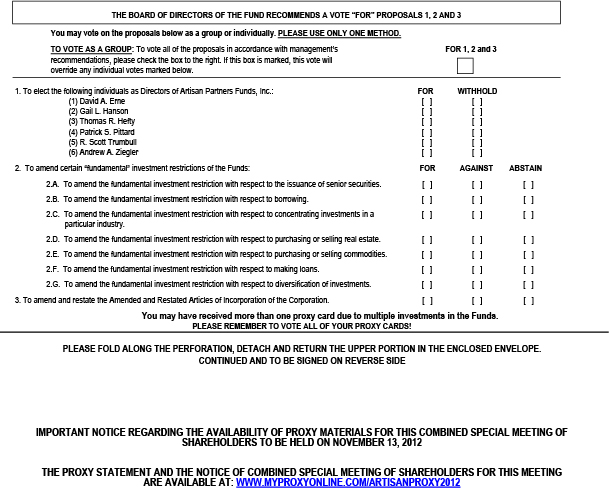

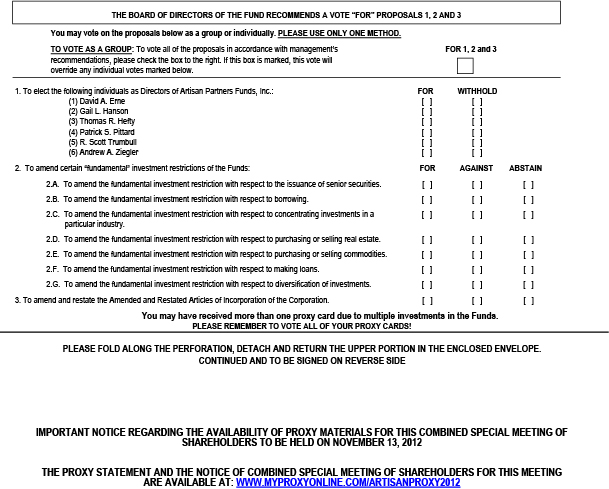

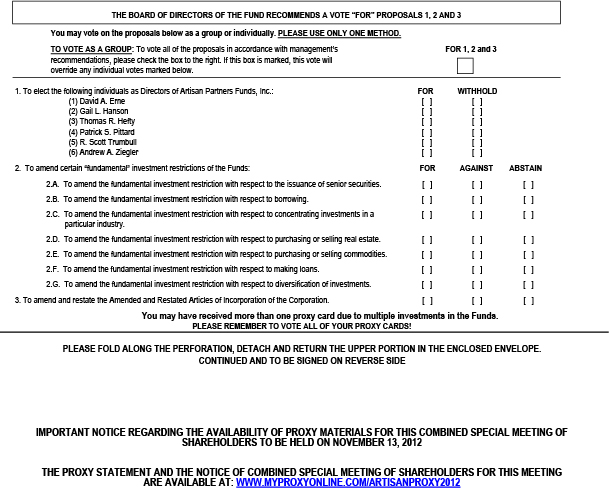

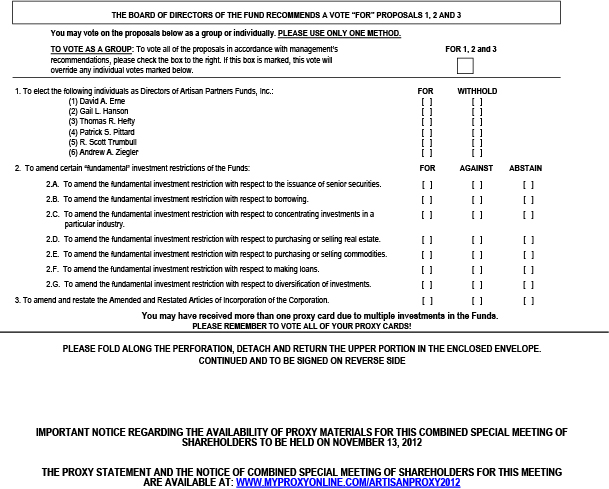

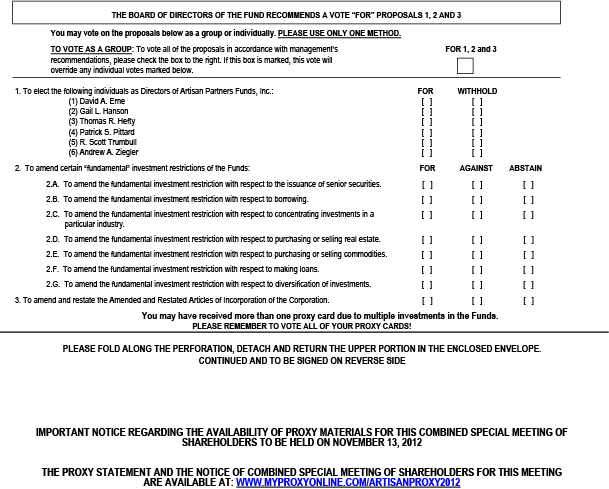

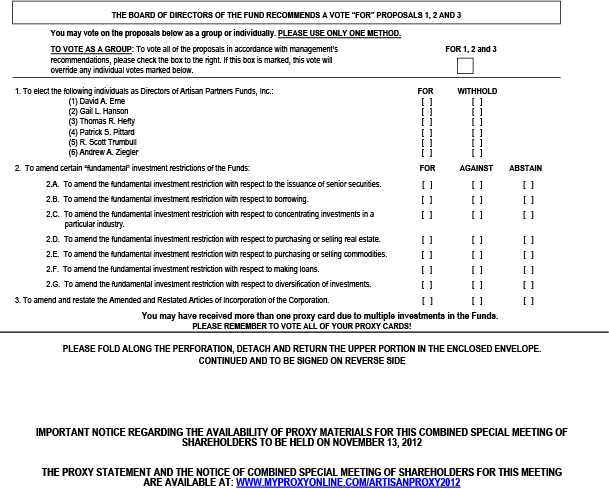

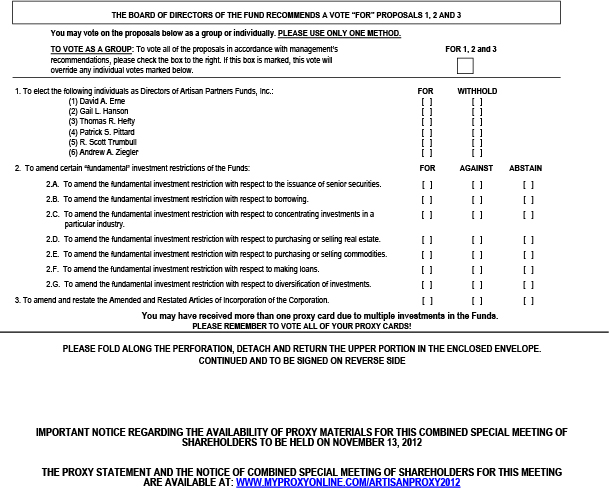

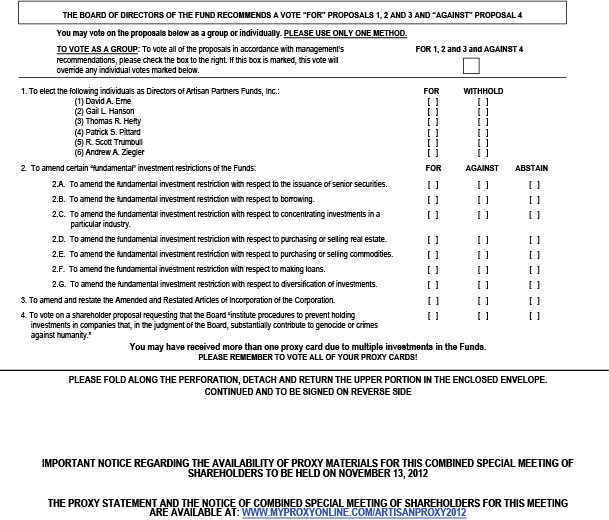

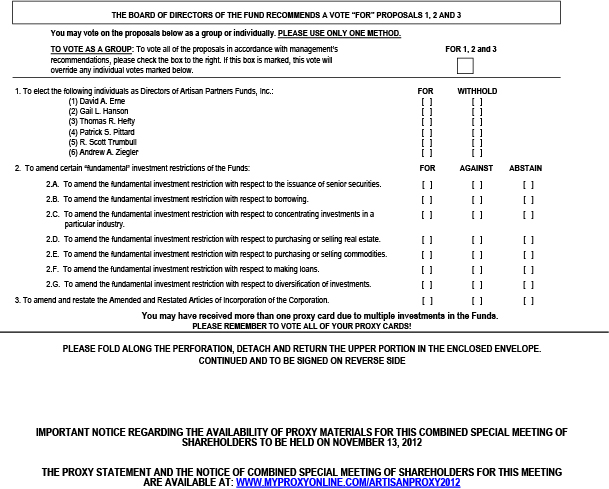

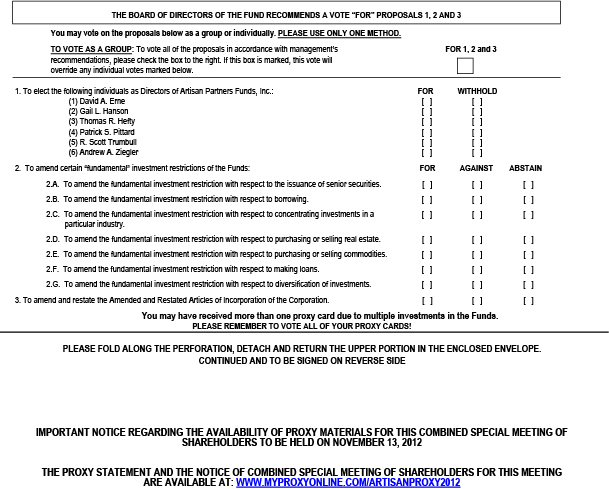

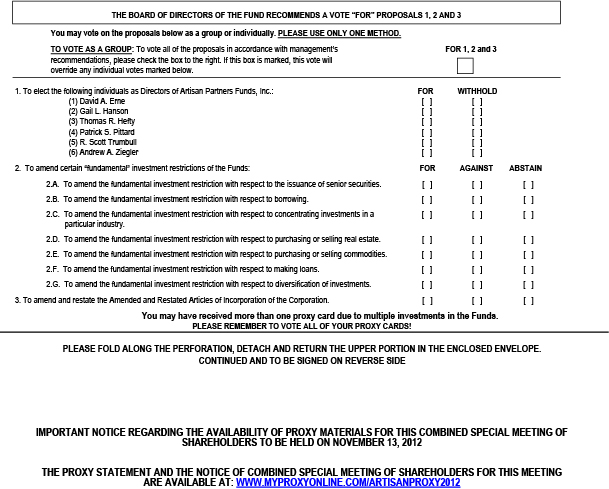

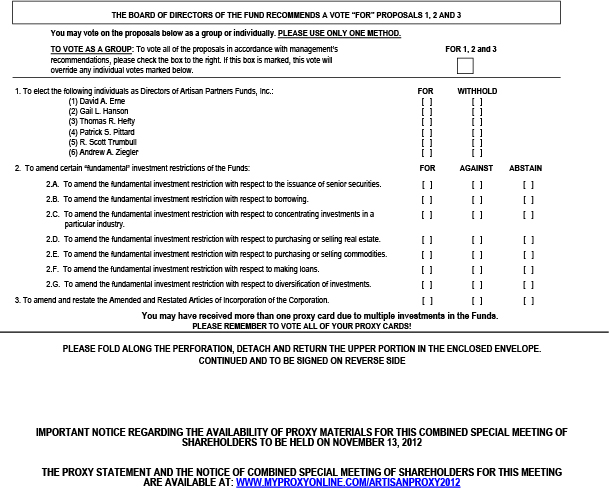

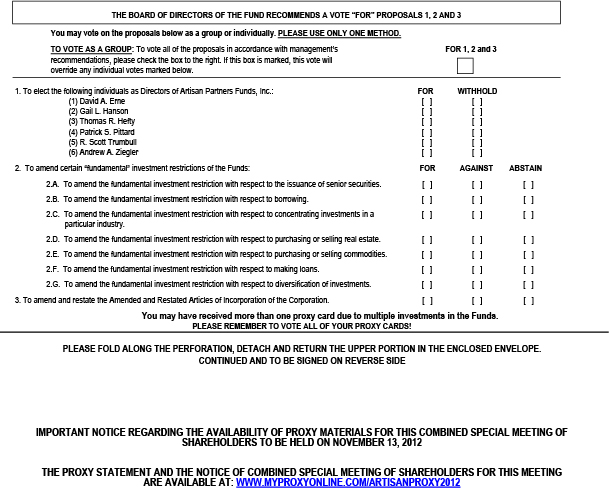

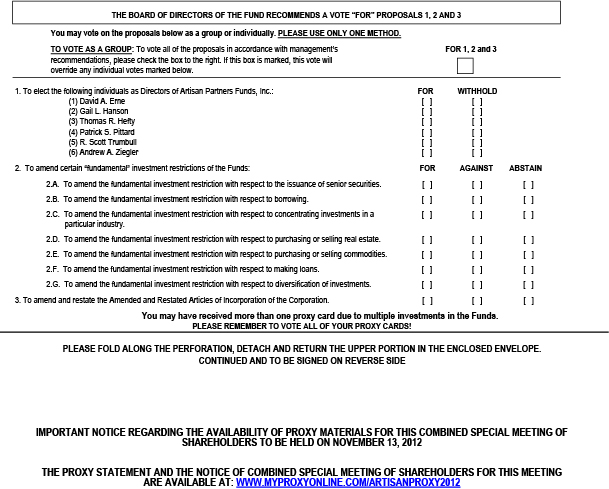

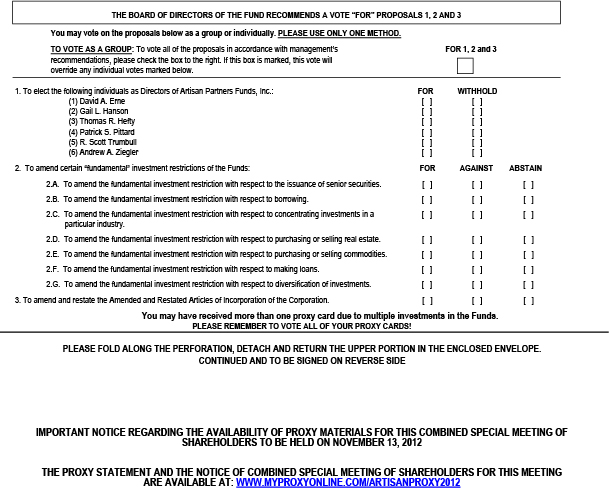

This proposal relates to the election of directors (each, a “Nominee”) to the board of directors (the “Board” or the “Directors”) of the Corporation. Pursuant to the bylaws of the Corporation, a Director must retire from the Board as of the end of the calendar year in which he or she attains the age of 72. As a result, Howard B. Witt, one of the incumbent Directors, must retire at the end of the 2012 calendar year, and his retirement will create a vacancy on the Board. You are, therefore, being asked to elect one new successor Nominee, R. Scott Trumbull, and, because the terms of the incumbent Directors will terminate at the Meeting, you are also being asked to elect the incumbent Directors, other than Mr. Witt. The incumbent Director Nominees are David A. Erne, Gail L. Hanson, Thomas R. Hefty, Patrick S. Pittard and Andrew A. Ziegler.For the reasons discussed in the Joint Proxy Statement, the Board recommends that you vote “FOR” this Proposal 1. Shareholders of the Funds have the option of voting on the election of each Nominee separately.

Proposal 2

This proposal relates to the proposed amendment of certain “fundamental” investment restrictions of each Fund. The proposed changes to the fundamental investment restrictions are intended to provide the Funds’ portfolio managers and the Board increased flexibility to respond to market,

i

industry and regulatory changes, and to reduce administrative and compliance burdens by simplifying and, in one instance, making uniform the fundamental investment restrictions across all Funds. Artisan Partners Limited Partnership (the “Investment Adviser”), the Funds’ investment adviser, and Artisan Partners UK LLP (“Artisan UK”), the sub-adviser to Artisan Global Equity Fund, have no present intention of changing the way that the Funds are managed if these proposals are approved.For the reasons discussed in the Joint Proxy Statement, the Board recommends that you vote “FOR” this Proposal 2. Shareholders of a Fund have the option of voting on the amendment of each “fundamental” investment restriction of such Fund separately.

Proposal 3

This proposal relates to a proposed amendment and restatement of the Amended and Restated Articles of Incorporation of the Corporation (the “Second Amended and Restated Articles”). The proposed changes are intended to make the administration of the Funds more efficient and provide more flexibility for the operations of the Funds, within the limits of applicable law.For the reasons discussed in the Joint Proxy Statement, the Board recommends that you vote “FOR” this Proposal 3.

Proposal 4

This proposal relates to a proposal submitted by a shareholder of Artisan International Fund (the “Shareholder Proposal”). The Shareholder Proposal asks shareholders of Artisan International Fund to vote on a resolution requesting that the Board institute “procedures to prevent holding investments in companies that, in the judgment of the Board, substantially contribute to genocide or crimes against humanity.” None of the Board, Artisan International Fund or the Investment Adviser is responsible for the content of the Shareholder Proposal or the supporting statements included in these proxy materials. Only shareholders of Artisan International Fund may vote on the Shareholder Proposal.For the reasons discussed in the Joint Proxy Statement, the Board recommends that you vote “AGAINST” the Shareholder Proposal.

| Q. | Why change the fundamental investment restrictions? |

| A. | The proposed changes are meant to modernize and standardize the Funds’ fundamental investment restrictions and are designed to meet fully the requirements of the Investment Company Act of 1940, as amended (the “1940 Act”), and the rules and regulations thereunder while providing the portfolio managers and Directors increased flexibility to respond to market, industry and regulatory changes. Also, the proposed changes are meant to |

ii

| | reduce administrative and compliance burdens by simplifying and, in one instance, making uniform the fundamental investment restrictions across all Funds. |

| Q. | Why amend and restate the Amended and Restated Articles of Incorporation? |

| A. | The Second Amended and Restated Articles are meant to modernize the Corporation’s current Amended and Restated Articles of Incorporation, while also incorporating all previous amendments. It is anticipated that the overall effect of these changes will be to make the administration of the Funds more efficient and provide more flexibility for the operations of the Funds, within the limits of applicable law. Adoption of the Second Amended and Restated Articles will not alter the Directors’ existing fiduciary obligations to act with due care and in the best interests of the shareholders, nor will your Funds’ current investments and investment objectives and policies change by virtue of the adoption of the Second Amended and Restated Articles. |

| A. | The enclosed proxy is being solicited for use at the combined special meeting of shareholders to be held on November 13, 2012 (the “Meeting”) at 777 East Wisconsin Avenue, Galleria Conference Room, Milwaukee, Wisconsin 53202 at 2:00 p.m. Central Time, and, if the Meeting is adjourned or postponed, at any later meetings, for the purposes stated in the Notice of Combined Special Meeting of Shareholders. |

| Q. | How does the Board suggest that I vote? |

| A. | After careful consideration,the Board unanimously recommends that you vote “FOR” Proposals 1, 2 and 3 and “AGAINST” Proposal 4. Please see the sections of the proxy materials discussing each proposal for a discussion of the Board’s considerations in making such recommendations. |

| Q. | Why am I receiving information about Funds I do not own? |

| A. | Proposals 1, 2 and 3 are relevant to all of the Funds, and management of the Funds has concluded that it is cost-effective to hold the Meeting concurrently for all of the Funds. Shares of all the Funds will vote in the aggregate and not separately by Fund with respect to Proposal 1 (election of Directors) and Proposal 3 (amendment and restatement of Amended and Restated Articles of Incorporation). Shares of the Funds will vote separately by Fund on each of the sub-proposals in Proposal 2 (amendment of certain fundamental investment restrictions). An unfavorable vote on Proposal 2 by the |

iii

| | shareholders of one Fund will not affect the implementation of a comparable proposal by another Fund if such proposal is approved by shareholders of that Fund. Only shares of Artisan International Fund will vote on Proposal 4 (Shareholder Proposal). |

| Q. | What vote is required to approve the proposals? |

| A. | With respect to Proposal 1, the election of Directors, an affirmative vote of the holders of a plurality of the Corporation’s shares present at the meeting in person or by proxy is required to elect each individual nominated as a Director. Proposal 1 will be voted on by all shareholders of the Corporation. |

To be approved with respect to a particular Fund, Proposal 2 must be approved by a “vote of a majority of the outstanding voting securities” of that Fund. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the voting securities of a Fund entitled to vote on the proposal present at the Meeting or represented by proxy, if more than 50% of the Fund’s outstanding voting securities are present or represented by proxy; or (ii) more than 50% of the outstanding voting securities of the Fund entitled to vote on the proposal.

With respect to Proposal 3, the amendment and restatement of the Amended and Restated Articles of Incorporation, and Proposal 4, the Shareholder Proposal, each proposal must receive the affirmative vote of a majority of the votes cast at the Meeting. Proposal 3 will be voted on by all shareholders of the Corporation. Only shareholders of Artisan International Fund may vote on Proposal 4.

| Q. | Will my vote make a difference? |

| A. | Yes! Your vote is needed to ensure that the proposals can be acted upon. We encourage all shareholders to participate in the governance of their Fund(s). Additionally, you will help save the costs of any further solicitations by providing your immediate response on the enclosed proxy card, over the Internet or by telephone. |

| Q. | If I am a small investor, why should I vote? |

| A. | You should vote because every vote is important. If numerous shareholders just like you fail to vote, the Funds may not receive enough votes to go forward with the Meeting. If this happens, the Funds will need to solicit votes again. This may delay the Meeting and the approval of the proposals and generate unnecessary costs. |

iv

| Q. | How do I place my vote? |

| A. | You may provide a Fund with your vote by mail using the enclosed proxy card, over the Internet by following the instructions on the proxy card, by telephone using the toll-free number listed on the proxy card, or in person at the Meeting. You may use the enclosed postage-paid envelope to mail your proxy card. Please follow the enclosed instructions to utilize any of these voting methods. If you need more information on how to vote, or if you have any questions, please call Okapi Partners, the Funds’ proxy solicitor, toll-free at (877) 279-2311. |

| Q. | Whom do I call if I have questions? |

| A. | We will be happy to answer your questions about this proxy solicitation. If you have questions, please call Okapi Partners, the Funds’ proxy solicitor, toll-free at (877) 279-2311. |

Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Fund(s) prior to the Meeting, or by voting in person at the Meeting.

PROMPT VOTING IS REQUESTED.

v

ARTISAN FUNDS

NOTICE OF COMBINED SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 13, 2012

Notice is hereby given that a combined special meeting of shareholders (the “Meeting”) of Artisan Partners Funds, Inc. (“Artisan Funds” or the “Corporation”) and each of its respective series listed on the attached list (each, a “Fund” and collectively, the “Funds”) will be held at 777 East Wisconsin Avenue, Galleria Conference Room, Milwaukee, Wisconsin 53202 on November 13, 2012 at 2:00 p.m. Central Time for the purposes listed below:

| | |

Proposal Summary | | Fund(s) Voting on the Proposal |

| |

1. Election of Directors. | | All Funds. |

| |

2. Amendment of certain “fundamental” investment restrictions of the Funds. | | Each Fund will vote separately on a Fund-by-Fund, sub-proposal-by-sub-proposal basis. |

| |

3. Amendment and restatement of the Amended and Restated Articles of Incorporation of the Corporation. | | All Funds. |

| |

4. Shareholder proposal requesting that the Board “institute procedures to prevent holding investments in companies that, in the judgment of the Board, substantially contribute to genocide or crimes against humanity.” | | Artisan International Fund. |

| |

5. Transact such other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. | | All Funds. |

After careful consideration, the board of directors of the Corporation (the “Board” or the “Directors”) unanimously recommends that shareholders vote “FOR” Proposals 1, 2, and 3, and “AGAINST” Proposal 4.

Shareholders of record at the close of business on September 14, 2012 are entitled to notice of, and to vote at, the Meeting, even if shareholders no longer own shares.

We call your attention to the accompanying joint proxy statement. You are requested to complete, date, and sign the enclosed proxy card and return it promptly in the envelope provided for that purpose. Your proxy card also provides instructions for voting by telephone or over the Internet if you wish to take advantage of these voting options. Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Fund(s) prior to the Meeting, or by voting in person at the Meeting. Please call Okapi Partners, the Funds’ proxy solicitor, toll-free at (877) 279-2311 if you have any questions relating to attending the Meeting in person or your vote instructions.

By Order of the Board of Directors,

/s/ Sarah A. Johnson

Sarah A. Johnson

Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING TO BE HELD ON NOVEMBER 13, 2012

This Joint Proxy Statement and the accompanying Notice of Combined Special Meeting of Shareholders are available at the website listed on your proxy card. In addition, shareholders can find important information about each Fund in the Fund’s annual report, dated September 30, 2011, including financial reports for the fiscal year ended September 30, 2011, and in the Fund’s semi-annual report, dated March 31, 2012. You may obtain copies of these reports without charge by writing to the Corporation, by calling (800) 344-1770, or at www.artisanfunds.com.

YOUR VOTE IS VERY IMPORTANT TO US REGARDLESS OF THE NUMBER OF VOTES YOU HOLD. SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. IT IS IMPORTANT THAT YOUR PROXY CARD BE RETURNED PROMPTLY.

FOR YOUR CONVENIENCE, YOU MAY ALSO VOTE BY TELEPHONE OR OVER THE INTERNET BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD. IF YOU VOTE BY TELEPHONE OR OVER THE INTERNET, PLEASE DO NOT RETURN YOUR PROXY CARD UNLESS YOU ELECT TO CHANGE YOUR VOTE.

FUNDS PARTICIPATING IN THE MEETING ON NOVEMBER 13, 2012

Artisan Emerging Markets Fund

Artisan Global Equity Fund

Artisan Global Opportunities Fund

Artisan Global Value Fund

Artisan International Fund

Artisan International Small Cap Fund

Artisan International Value Fund

Artisan Mid Cap Fund

Artisan Mid Cap Value Fund

Artisan Small Cap Fund

Artisan Small Cap Value Fund

Artisan Value Fund

TABLE OF CONTENTS

APPENDICES

ARTISAN FUNDS

JOINT PROXY STATEMENT COMBINED SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 13, 2012

This joint proxy statement (“Joint Proxy Statement”) and enclosed notice and proxy card are being furnished in connection with the solicitation of proxies by the board of directors (the “Board” or the “Directors”) of Artisan Partners Funds, Inc. (“Artisan Funds” or the “Corporation”). The proxies are being solicited for use at a combined special meeting of shareholders of the Corporation to be held at 777 East Wisconsin Avenue, Galleria Conference Room, Milwaukee, Wisconsin 53202 on November 13, 2012 at 2:00 p.m. Central Time, and at any and all adjournments or postponements thereof (the “Meeting”).

The Board has called the Meeting and is soliciting proxies from shareholders of each series of the Corporation listed in the accompanying notice to this Joint Proxy Statement (each, a “Fund” and collectively, the “Funds”) for the purposes listed below:

| | |

Proposal Summary | | Fund(s) Voting on the Proposal |

| | |

1. Election of Directors. | | All Funds. |

| | |

2. Amendment of certain “fundamental” investment restrictions of the Funds. | | Each Fund will vote separately on a Fund-by-Fund, sub-proposal-by-sub-proposal basis. |

| | |

3. Amendment and restatement of the Amended and Restated Articles of Incorporation of the Corporation. | | All Funds. |

| | |

4. Shareholder proposal requesting that the Board “institute procedures to prevent holding investments in companies that, in the judgment of the Board, substantially contribute to genocide or crimes against humanity.” | | Artisan International Fund. |

| | |

5. Transact such other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. | | All Funds. |

This Joint Proxy Statement and the accompanying notice and the proxy card are being first mailed to shareholders on or about September 26, 2012.

The Board has determined that the use of this Joint Proxy Statement for the Meeting is in the best interests of each Fund and its shareholders in light of the similar matters being considered and voted on by the shareholders of the Funds. You are entitled to vote at the Meeting of each Fund of which you are a shareholder as of the close of business on September 14, 2012 (the “Record Date”) even if you no longer own shares.

If you have any questions about the proposals or about voting, please call Okapi Partners, the Funds’ proxy solicitor, at (877) 279-2311.

1

OVERVIEW OF THE PROPOSALS

Proposal 1

Election of Directors

The Corporation’s bylaws provide that each Director must retire as of the end of the calendar year in which he or she attains the age of 72. As a result, Howard B. Witt, an incumbent Director, must retire by the end of the 2012 calendar year, and his retirement will create a vacancy on the Board. You are, therefore, being asked to elect one new successor nominee, R. Scott Trumbull, and, because the terms of the incumbent Directors will terminate at the Meeting, you are also being asked to elect the incumbent Directors, other than Mr. Witt. The incumbent Director Nominees are David A. Erne, Gail L. Hanson, Thomas R. Hefty, Patrick S. Pittard and Andrew A. Ziegler. As discussed in greater detail below, the Board has unanimously determined to recommend a vote “FOR” this proposal.

Proposal 2

Approval of Amendment of Certain Fundamental Investment Restrictions

You are being asked to approve the modernization and standardization of the investment restrictions of the Funds through the amendment of certain “fundamental” investment restrictions. The proposed restrictions are designed to meet fully the requirements of the Investment Company Act of 1940, as amended (the “1940 Act”), and the rules and regulations thereunder, while providing the Funds’ portfolio managers and the Directors increased flexibility to respond to market, industry and regulatory changes. Also, the proposed restrictions are intended to modernize the restrictions to current standards and to reduce administrative and compliance burdens by simplifying and, in one instance, making uniform certain fundamental investment restrictions across all Funds. As to sub-proposals 2.A. through 2.G., the shareholders of each Fund will vote separately on a Fund-by-Fund and sub-proposal-by-sub-proposal basis. Therefore, should a change to a fundamental investment restriction not be approved for a Fund, such Fund’s current fundamental investment restriction with respect to that issue would continue to apply. As discussed in greater detail below, the Board has unanimously determined to recommend a vote “FOR” this proposal.

Proposal 3

Adoption of Second Amended and Restated Articles of Incorporation of the Corporation

You are being asked to approve the amendment and restatement of the Amended and Restated Articles of Incorporation of the Corporation (the “Second Amended and Restated Articles”). The Board believes that it is in the best interests of

2

shareholders to modernize the Funds’ current Amended and Restated Articles of Incorporation (the “Amended and Restated Articles”) and incorporate all previous amendments. It is anticipated that the overall effect of these changes will be to make the administration of the Funds more efficient and provide more flexibility for the operations of the Funds, within the limits of applicable law. Adoption of the Second Amended and Restated Articles will not alter the Directors’ existing fiduciary obligations to act with due care and in the best interests of the shareholders, nor will your Fund’s current investments and investment objectives and policies change by virtue of the adoption of the Second Amended and Restated Articles. If the Second Amended and Restated Articles are not approved by the shareholders, the current Amended and Restated Articles and all previous amendments will remain in effect. As discussed in greater detail below, the Board has unanimously determined to recommend a vote “FOR” this proposal.

Proposal 4

Shareholder Proposal

Shareholders of Artisan International Fund are being asked to consider a shareholder proposal requesting that the Board “institute procedures to prevent holding investments in companies that, in the judgment of the Board, substantially contribute to genocide or crimes against humanity” (the “Shareholder Proposal”). Proposal 4 was submitted by a shareholder of Artisan International Fund. Neither Artisan International Fund nor Artisan Partners Limited Partnership (the “Investment Adviser”), the Funds’ investment adviser, is responsible for the content of the Shareholder Proposal or the supporting statements. As discussed in greater detail below, the Board has unanimously determined to recommend that shareholders vote “AGAINST” this proposal.

THE BOARD, INCLUDING THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF EACH NOMINEE, “FOR” THE APPROVAL OF THE CHANGES TO THE FUNDS’ FUNDAMENTAL INVESTMENT RESTRICTIONS, “FOR” THE APPROVAL OF THE PROPOSED AMENDMENT AND RESTATEMENT OF THE FUNDS’ AMENDED AND RESTATED ARTICLES AND “AGAINST” THE SHAREHOLDER PROPOSAL. SHAREHOLDERS OF THE FUNDS HAVE THE OPTION OF VOTING ON THE ELECTION OF EACH NOMINEE AND SHAREHOLDERS OF EACH FUND HAVE THE OPTION OF VOTING ON THE AMENDMENT OF EACH “FUNDAMENTAL” INVESTMENT RESTRICTION OF SUCH FUND SEPARATELY. UNMARKED, PROPERLY SIGNED AND DATED PROXY CARDS WILL BE SO VOTED.

3

PROPOSAL 1 – ELECTION OF DIRECTORS

The Board has proposed the following six nominees for election by shareholders (each a “Nominee”), each to hold office for an indefinite term until the next annual meeting of shareholders and until his or her successor is elected and qualified or until his or her earlier resignation or removal: David A. Erne, Gail L. Hanson, Thomas R. Hefty, Patrick S. Pittard, Andrew A. Ziegler and R. Scott Trumbull. Messrs. Erne, Hefty, Pittard and Ziegler and Ms. Hanson are collectively referred to herein as the “Incumbent Director Nominees.” Each of the Nominees has consented to serve or continue to serve, as the case may be, as a Director. Certain biographical and other information relating to the Nominees, including each Nominee’s experience, qualifications, attributes and skills for Board membership, is set forth below. Five of the Nominees would be Independent Directors (meaning that they would not be considered “interested persons” as defined in the 1940 Act) and one of the Nominees would be an Interested Director (meaning that he is considered an “interested person” as defined in the 1940 Act) of the Corporation due to the fact that he is a Managing Director of the Investment Adviser and an officer of Artisan Investments GP LLC, the general partner of the Investment Adviser. Messrs. Erne and Hefty are Independent Director incumbents who were previously elected by shareholders, and Ms. Hanson and Mr. Pittard are Independent Director incumbents who were previously appointed by the Board and are standing for election by shareholders for the first time. Mr. Ziegler is an Interested Director incumbent who was previously elected by shareholders. Mr. Trumbull would be an Independent Director, if elected. On August 14, 2012, the members of the Corporation’s governance and nominating committee (described below) nominated the Incumbent Director Nominees and Mr. Trumbull, and on August 14, 2012, the Board voted to submit the Incumbent Director Nominees and Mr. Trumbull to a vote of shareholders of the Corporation. The Board knows of no reason why any of these Nominees would be unable to serve.

Reason for the Proposal

Pursuant to the Corporation’s bylaws, a Director must retire from the Board as of the end of the calendar year in which he or she attains the age of 72. As a result, one Director, Howard B. Witt, must retire by the end of the 2012 calendar year, and his retirement will create a vacancy on the Board.

Section 16(a) of the 1940 Act provides that no person shall serve as a director of a registered investment company unless elected to that office by the holders of the outstanding voting securities of such company, at an annual or a special meeting duly called for that purpose; except that vacancies occurring between such meetings may be filled in any otherwise legal manner if immediately after filling any such vacancy at least two-thirds of the directors then holding office shall have been elected to such office by the shareholders of the company at such an annual or special meeting.

4

Of the six incumbent Directors, four (Messrs. Erne, Hefty, Witt and Ziegler) were elected by shareholders in 1995. Ms. Hanson and Mr. Pittard were appointed to the Corporation’s Board without a vote of shareholders, as permitted by Section 16(a) of the 1940 Act. It is necessary to hold a shareholder meeting for the purpose of electing Mr. Trumbull to the Board. As a result, under the Wisconsin Business Corporation Law, the terms of all the Incumbent Director Nominees and Mr. Witt will expire at this Meeting, and the Board has considered it appropriate that all of the current Directors, other than Mr. Witt, stand for election by the shareholders.

Information About the Board and the Nominees

The Board has overall responsibility for the conduct of the affairs of the Corporation. Mr. Erne, Independent Chair of the Board, is an Independent Director. The Board’s role is one of oversight, rather than active management. This oversight extends to the Corporation’s risk management processes. Those processes are embedded in the responsibilities of officers of the Corporation. Senior officers of the Corporation, including the president, chief financial officer, general counsel and chief compliance officer, report directly to the full Board on a variety of matters at regular meetings of the Board. During the fiscal year ended September 30, 2011, the Board met 7 times and each Incumbent Director Nominee who was then a member of the Board was present for at least 75% of the aggregate number of meetings of the Board and committees on which he or she served. Ms. Hanson was appointed to the Board effective January 1, 2012, and therefore did not attend any Board or committee meetings during the fiscal year ended September 30, 2011.

The Board’s leadership structure features Independent Directors serving as Independent Chair and as chairmen of the audit and governance and nominating committees. This structure is reviewed by the Board regularly and the Board believes it to be appropriate and effective. All Independent Directors are members of the audit and governance and nominating committees. Inclusion of Independent Directors in the audit and governance and nominating committees allows all such Directors to participate in the full range of the Board’s oversight duties, including oversight of risk management processes.

The following table lists the Nominees and the current Directors, their names and ages, the date each first was elected or appointed to office (as applicable), their principal business occupations during the last five years and other directorships held in any publicly-traded company or any registered investment company, as well as the experience, qualifications, attributes and skills that each possess for Board membership. There are 12 Funds, all of which are overseen by the Board (and would be overseen by Mr. Trumbull, if elected).

5

The address of each Nominee is c/o Artisan Funds, 875 E. Wisconsin Avenue, Suite 800, Milwaukee, Wisconsin 53202. Correspondence intended for a current Director may be sent to this address.

| | | | | | | | | | |

Name and Age at

December 31,

2011 | | Position(s)

Held with the

Corporation | | Date First

Elected or

Appointed to

Office | | Principal

Occupation(s)

During

Past 5 Years | | Other

Directorships

Held by

Nominee | | Experience,

Qualifications,

Attributes and

Skills for Board

Membership |

Nominees who are not “interested persons” of the Corporation: |

David A. Erne, 68 | | Director and Independent Chair of the Board | | Director since 3/27/95; Independent Chair since 2/4/05 | | Of counsel to the law firm Reinhart Boerner Van Deuren s.c., Milwaukee, WI. | | Trustee, Northwestern Mutual Life Insurance Company (individual life insurance, disability insurance and annuity company). | | Significant board experience; legal training and practice. |

Gail L. Hanson, 56 | | Director | | 1/1/12 | | Chief Financial Officer and Senior Vice President, Aurora Health Care (not for profit health care provider); from September 2004 to February 2011, Deputy Executive Director, State of Wisconsin Investment Board. | | Director, Northwestern Mutual Series Fund, Inc. (individual life insurance and investment company) (28 portfolios). | | Significant executive experience, including service as chief financial officer and service as deputy executive director of a state investment board; certified financial analyst and certified public accountant; audit committee financial expert. |

6

| | | | | | | | | | |

Name and Age at

December 31,

2011 | | Position(s)

Held with the

Corporation | | Date First

Elected or

Appointed to

Office | | Principal

Occupation(s)

During

Past 5 Years | | Other

Directorships

Held by

Nominee | | Experience,

Qualifications,

Attributes and

Skills for Board

Membership |

| Thomas R. Hefty, 64 | | Director | | 3/27/95 | | Retired; from January 2007 to February 2008, President, Kern Family Foundation (private, grant-making organization); until December 2006, of counsel to the law firm Reinhart Boerner Van Deuren s.c., Milwaukee, WI; until December 2006, Adjunct Professor, Department of Business and Economics, Ripon College; until December 2002, Chairman of the Board and Chief Executive Officer of Cobalt Corporation (provider of managed care and specialty business services). | | None. | | Significant board experience; significant executive experience, including past service as the chief executive officer of a public company; legal training and practice; audit committee financial expert. |

| Patrick S. Pittard, 66 | | Director | | 8/9/01 | | Chairman and Chief Executive Officer, ACT Bridge, Inc. (enterprise talent management firm); Distinguished Executive in Residence (teaching position), University of Georgia; until October 2001, Chairman of the Board, President and Chief Executive Officer of Heidrick & Struggles International, Inc. (executive search firm). | | Director, Lincoln National Corporation (insurance and investment management company). | | Significant board experience; significant executive experience, including past service as chief executive officer of a public company. |

7

| | | | | | | | | | |

Name and Age at

December 31,

2011 | | Position(s)

Held with the

Corporation | | Date First

Elected or

Appointed to

Office | | Principal

Occupation(s)

During

Past 5 Years | | Other

Directorships

Held by

Nominee | | Experience,

Qualifications,

Attributes and

Skills for Board

Membership |

R. Scott Trumbull, 63 | | None | | N/A | | Chairman and Chief Executive Officer, Franklin Electric Co., Inc. (manufacturer of water and fuel pumping systems). | | Director, Health Care REIT (investor in health care real estate). | | Significant board experience; significant executive experience including service as chief executive officer of a public company and service as non-executive chairman of a privately held company. |

Nominee who is an “interested person” of the Corporation: |

Andrew A. Ziegler, 54* | | Director | | 1/5/95 | | Executive Chairman (since January 2010) and Managing Director of the Investment Adviser; until February 2010, President and Chief Executive Officer of the Corporation. | | None. | | Continuing service as the Executive Chairman of the Investment Adviser and past service as Chief Executive Officer of the Investment Adviser; past service as Chief Executive Officer and President of the Corporation; significant board experience; and legal training and practice. |

| * | Mr. Ziegler is an “interested person” of the Corporation, as defined in the 1940 Act, because he is a Managing Director of the Investment Adviser and an officer of Artisan Investments GP (the general partner of the Investment Adviser). Mr. Ziegler and Carlene M. Ziegler (who are married to each other) control the Investment Adviser. From time to time, Mr. Ziegler may make investments in the Investment Adviser or its parents or the subsidiaries of either. |

If the Nominees are elected, Mr. Erne would remain Independent Chair.

8

Principal Officers of the Corporation

The Board elects the officers of the Corporation, provided that the chief compliance officer must be approved by a majority of the Independent Directors. Each officer holds office for one year and until the election and qualification of his or her successor, or until he or she sooner dies, resigns, or is removed or disqualified. The Board may remove any officer, with or without cause, at any time, provided that a majority of the Independent Directors must approve the removal of the chief compliance officer. The following table lists the names and ages of the officers, the positions held with the Corporation, the date each first was elected to office, their principal business occupations during the past five years, and any directorships held in a public company or registered investment company. The business address of each officer is 875 E. Wisconsin Avenue, Suite 800, Milwaukee, Wisconsin 53202. None of the officers listed below receives compensation from any of the Funds.

| | | | | | | | |

Name and Age

at December 31,

2011 | | Position(s) Held

with the

Corporation | | Date First

Elected to

Office | | Principal Occupation(s)

During Past 5 Years | | Other Directorships

Held by Officer |

| Eric R. Colson, 42 | | President and Chief Executive Officer | | 2/9/10 | | Managing Director and Chief Executive Officer of the Investment Adviser since January 2010; prior thereto, Managing Director and Chief Operating Officer – Investment Operations of the Investment Adviser. | | None. |

| Gregory K. Ramirez, 41 | | Chief Financial Officer, Vice President and Treasurer | | 2/8/11 | | Managing Director and since March 2010, Chief Accounting Officer of the Investment Adviser; Vice President, Treasurer and Chief Financial Officer of Artisan Partners Distributors LLC (the “Distributor”) since July 2012; until February 2011, Assistant Secretary and Assistant Treasurer of the Corporation; until July 2012, Assistant Treasurer of the Distributor. | | None. |

| Sarah A. Johnson, 39 | | General Counsel, Vice President and Secretary | | 2/8/11 | | Managing Director (since March 2010), Chief Compliance Officer (since January 2012) and Associate Counsel of the Investment Adviser; Vice President and Secretary of the Distributor since July 2012; until February 2011, Assistant Secretary of the Corporation. | | None. |

9

| | | | | | | | |

Name and Age

at December 31,

2011 | | Position(s) Held

with the

Corporation | | Date First

Elected to

Office | | Principal Occupation(s)

During Past 5 Years | | Other Directorships

Held by Officer |

| Brooke J. Billick, 58 | | Chief Compliance Officer | | 8/19/04 | | Chief Compliance Officer – U.S. Mutual Funds and Associate Counsel of the Investment Adviser; until January 2012, Chief Compliance Officer of the Investment Adviser and the Distributor. | | None. |

| James S. Hamman, Jr., 42 | | Vice President and Assistant Secretary | | 2/8/11 | | Associate Counsel of the Investment Adviser since March 2010; from January 2008 – February 2010, Principal of Elite Investment Partners, LLC; prior thereto, Executive Vice President, General Counsel and Secretary of Calamos Asset Management, Inc. | | None. |

| Stephen W. Hlavach, 43 | | Assistant Treasurer | | 2/14/12 | | Tax Director of the Investment Adviser since January 2011; prior thereto, Tax Lead, Mergers & Acquisitions of The Boeing Company. | | None. |

| Shannon K. Jagodinski, 34 | | Assistant Treasurer | | 2/14/12 | | Senior Manager of Investment Accounting of the Investment Adviser. | | None. |

Nominee Ownership of Fund Shares

The following table illustrates the dollar range of shares of each Fund beneficially owned (as determined pursuant to Rule 16a-1(a)(2) under the 1934 Act) by each current Director and Nominee as of July 31, 2012. The dollar range for the securities represented in the table was determined using the net asset value of a share of each Fund as of the close of business on July 31, 2012.

10

| | | | | | | | | | | | |

Fund | | Nominees who are not “interested persons” of the

Corporation | | Nominee who is

an “interested

person” of the

Corporation |

| | | David A. Erne | | Gail L. Hanson | | Thomas R. Hefty | | Patrick S. Pittard | | R. Scott Trumbull | | Andrew A. Ziegler |

| Artisan Emerging Markets Fund* | | Over $100,00 | | $10,001-50,000 | | None | | None | | None | | Over $100,000 |

| Artisan Global Equity Fund* | | None | | $50,001-100,000 | | None | | None | | None | | Over $100,000 |

| Artisan Global Opportunities Fund* | | None | | None | | None | | None | | None | | Over $100,000 |

| Artisan Global Value Fund* | | Over $100,000 | | $10,001-50,000 | | None | | Over $100,000 | | None | | Over $100,000 |

| Artisan International Fund* | | Over $100,000 | | $10,001-50,000 | | Over $100,000 | | $50,001-100,000 | | None | | Over $100,000 |

| Artisan International Small Cap Fund* | | Over $100,000 | | None | | None | | None | | None | | Over $100,000 |

| Artisan International Value Fund* | | Over $100,000 | | None | | None | | Over $100,000 | | None | | Over $100,000 |

| Artisan Mid Cap Fund* | | Over $100,000 | | $50,001- 100,000 | | Over $100,000 | | $10,001-50,000 | | None | | Over $100,000 |

| Artisan Mid Cap Value Fund* | | Over $100,000 | | $10,001-50,000 | | None | | Over $100,000 | | None | | Over $100,000 |

| Artisan Small Cap Fund* | | Over $100,000 | | $50,001-100,000 | | Over $100,000 | | $10,001-50,000 | | None | | Over $100,000 |

| Artisan Small Cap Value Fund* | | Over $100,000 | | $50,001-100,000 | | Over $100,000 | | $10,001-50,000 | | None | | Over $100,000 |

| Artisan Value Fund* | | Over $100,000 | | None | | Over $100,000 | | Over $100,000 | | None | | Over $100,000 |

| Aggregate Artisan Fund Complex | | Over $100,000 | | Over $100,000 | | Over $100,000 | | Over $100,000 | | None | | Over $100,000 |

| * | Reflects beneficial ownership of Investor Shares of Artisan Global Equity Fund, Artisan Global Opportunities Fund, Artisan Global Value Fund, Artisan International Fund, Artisan International Small Cap Fund, Artisan International Value Fund, Artisan Mid Cap Fund, Artisan Mid Cap Value Fund, Artisan Small Cap Fund, Artisan Small Cap Value Fund, and Artisan Value Fund, Institutional Shares of Artisan Emerging Markets Fund, Artisan International Fund, Artisan International Value Fund, Artisan Mid Cap Fund and Artisan Value Fund, and Advisor Shares of Artisan Emerging Markets Fund. As of July 31, 2012, no Nominee or current Director beneficially owned Institutional Shares of Artisan Global Value Fund, Artisan Global Opportunities Fund, Artisan Mid Cap Value Fund, Artisan Small Cap Fund or Artisan Small Cap Value Fund. |

11

None of the Nominees who would be Independent Directors of the Corporation or their immediate family members, had any interest in the Investment Adviser or the Distributor, or any person controlling, controlled by or under common control with such persons. For this purpose, “immediate family member” includes a Nominee’s spouse, children residing in a Nominee’s household and dependents of a Nominee.

Board Compensation

The following table sets forth the aggregate compensation paid by the Funds to each Incumbent Director Nominee for the fiscal year ended September 30, 2011.

| | | | | | | | |

| Name of Nominee | | Aggregate

Compensation

Received from the

Funds | | Pension or

Retirement

Benefits Accrued

(as Part of the

Funds’ Expenses) | | Estimated Annual

Benefits Upon

Retirement | | Total

Compensation

from the Funds

and the Fund

Complex |

Andrew A. Ziegler | | $ 0 | | $ 0 | | $ 0 | | $ 0 |

David A. Erne | | $250,000 | | $ 0 | | $ 0 | | $250,000 |

Gail L. Hanson1 | | — | | — | | — | | — |

Thomas R. Hefty | | $220,000 | | $ 0 | | $ 0 | | $220,000 |

Patrick S. Pittard | | $190,000 | | $ 0 | | $ 0 | | $190,000 |

1Given that Ms. Hanson became a Director of the Corporation effective January 1, 2012, she did not receive any compensation from the Funds for the fiscal year ended September 30, 2011.

Committees and Meetings of the Board

The Board has an audit committee and a governance and nominating committee. The audit and the governance and nominating committees are composed solely of Independent Directors. In addition, the Board has appointed a valuation committee. The following table identifies the members of those committees, the number of meetings of each committee held during the fiscal year ended September 30, 2011, and the function of each committee:

| | | | | | |

| Committee | | Members of

Committee | | Number

of

Meetings | | Principal Functions of Committee |

Governance and

Nominating

Committee | | David A. Erne

Thomas R. Hefty Patrick S. Pittard* Howard B. Witt Gail L. Hanson** | | 3 | | The governance and nominating committee makes recommendations to the Board regarding Board committees and committee assignments, the composition of the Board, candidates for election as Independent Directors and compensation of Directors who are not affiliated persons of the Investment Adviser, and oversees the process for evaluating the functioning of the Board. Pursuant to procedures and policies adopted under its charter, the governance and nominating committee will consider shareholder recommendations regarding candidates for election as Directors. |

12

| | | | | | |

| Committee | | Members of Committee | | Number

of

Meetings | | Principal Functions of Committee |

| Audit Committee | | David A. Erne

Thomas R. Hefty* Patrick S. Pittard Howard B. Witt Gail L. Hanson** | | 4 | | The audit committee selects the independent auditors; meets with the independent auditors and management to review the scope and the results of the audits of the Funds’ financial statements; confirms the independence of the independent auditors; reviews with the independent auditors and management the effectiveness and adequacy of the Funds’ internal controls; pre-approves the audit and certain non-audit services provided by the independent auditors; and reviews legal and regulatory matters. |

| Valuation Committee | | James S. Hamman, Jr.***

Shannon K. Jagodinski*** Sarah A. Johnson Janet D. Olsen Gregory K. Ramirez Lawrence A. Totsky | | 113**** | | The valuation committee is responsible for determining, in accordance with the Funds’ valuation procedures, a fair value for any portfolio security for which no reliable market quotations are available or for which the valuation procedures do not produce a fair value. |

| | * | Chairman of committee. Mr. Pittard was elected chairman of the governance and nominating committee effective as of August 14, 2012. Prior thereto, Mr. Witt served as chairman of the committee. |

| ** | Ms. Hanson was appointed to the governance and nominating committee and the audit committee effective February 13, 2012. Because Ms. Hanson became an independent director of the Corporation effective January 1, 2012, she did not participate in meetings of the audit committee and governance and nominating committee for the fiscal year ended September 30, 2011. |

| *** | Mr. Hamman and Ms. Jagodinski were appointed to the valuation committee effective February 8, 2011. |

| **** | The number shown represents the number of valuation actions taken by the committee, not the number of times the committee met. |

Governance and Nominating Committee. The governance and nominating committee operates pursuant to a written charter, which was most recently amended on May 8, 2012 and is included in Appendix C. The Committee will consider candidates recommended by shareholders. Shareholders wishing to recommend a candidate for election to the Board (“Nominating Shareholder”) may do so by submitting a recommendation in writing and delivering a hard copy with the shareholder’s original signature to the attention of the secretary of the Corporation at the address of the principal executive offices of the Corporation. The recommendation should include (i) the class or series and number of all shares of each Fund owned beneficially or of record by the Nominating Shareholder at the time the recommendation is submitted and the dates on which such shares were acquired, specifying the number of shares owned beneficially; (ii) a full listing of the proposed candidate’s education, experience, current employment, date of birth, business and residence addresses, and the names

13

and addresses of at least three professional references; (iii) information as to whether the candidate is or may be an “interested person” (as defined in the 1940 Act) of the Fund, the Investment Adviser or the Distributor, and, if believed not to be an “interested person,” information regarding the candidate that will be sufficient for the Fund to make such determination; (iv) the written and signed consent of the candidate to be named as a nominee and to serve as a director, if elected; (v) a description of all arrangements or understandings between the Nominating Shareholder, the candidate and/or any other person or persons (including their names) pursuant to which the recommendation is being made, and if none, a statement to that effect; (vi) the class or series and number of all shares of each Fund owned of record or beneficially by the candidate, as reported by the candidate; and (vii) such other information that would be helpful to the Committee in evaluating the candidate.

When evaluating a candidate as a potential nominee to serve as an Independent Director of the Corporation, whether the candidate is nominated by other members of the Board, a shareholder or the management of the Corporation, the governance and nominating committee may consider, among other factors, (a) whether or not the candidate is an “interested person” of the Funds or an affiliate (as defined in the 1940 Act); (b) whether or not the candidate clearly recognizes that the role of the Directors is to represent the interests of the shareholders; (c) relevant business and industry experience, as well as compatibility with other Directors with respect to business philosophy and personal style; and (d) the effect of the Corporation’s retirement policy on the potential length of service of any candidate. Additionally, final candidates will undergo an in-person interview and be required to complete a standardized questionnaire, and may be subject to a more extensive background check.

The governance and nominating committee takes the overall diversity of the Board into account when considering and evaluating candidates for Independent Director. While the committee has not adopted a specific policy on diversity or a particular definition of diversity, when considering candidates, the committee generally considers the manner in which each candidate’s business experience, background, race, gender and national origin are complementary to the existing Independent Directors’ attributes.

Mr. Pittard was originally recommended to the Board for approval as an Independent Director by Interested Directors. Ms. Hanson and Mr. Trumbull were originally recommended to the Board for approval as Independent Directors by Independent Directors.

Shareholder Communications. The Board has adopted procedures by which shareholders may send communications to the Board. Shareholders may mail written communications to the attention of the Board, or specified individual Directors, c/o Secretary of Artisan Funds, 875 East Wisconsin Avenue, Suite 800, Milwaukee, Wisconsin 53202.

14

Independent Registered Public Accounting Firm

Ernst & Young LLP (“Ernst & Young”), located at 155 N. Wacker Drive, Chicago, Illinois 60606, serves as the Funds’ independent registered public accounting firm. The Funds know of no direct or indirect financial interest of Ernst & Young in any of the Funds. Representatives of Ernst & Young are not expected to be present at the Meeting, but will have the opportunity to make a statement if they wish, and will be available should any matter arise requiring their presence.

Aggregate fees billed to the Corporation for professional services rendered by Ernst & Young are summarized in the table below. The table summarizes fees billed (or to be billed) by Ernst & Young for work performed relating to each applicable period identified below.

Fees:

| | | | | | | | |

| | | Fiscal Year Ended

September 30, 2011 | | | Fiscal Year Ended

September 30, 2010 | |

Audit Fees (a) | | $ | 257,900 | | | $ | 238,000 | |

Audit-Related Fees (b) | | $ | 48,800 | | | $ | 45,700 | |

Tax Fees (c) | | $ | 212,450 | | | $ | 203,000 | |

All Other Fees (d) | | $ | — | | | | — | |

(a) “Audit Fees” include amounts for professional services rendered by Ernst & Young for the audit of the Corporation’s annual financial statements and services that are normally provided by Ernst & Young in connection with statutory and regulatory filings or engagements, including for 2011, portions of which had not been billed as of September 30, 2011 and fees billed for consents issued in conjunction with the Corporation’s post-effective amendments to the Funds’ registration statements filed for each of the last two fiscal years. The fees billed during the fiscal year ended September 30, 2011 also include consents issued in conjunction with the Corporation’s post-effective amendments to the Funds’ registration statements filed in connection with the initial offering of institutional shares of Artisan Global Opportunities Fund and Artisan Value Fund.

(b) “Audit-Related Fees” include amounts for assurance and related services by Ernst & Young that are reasonably related to the performance of the audit of the Corporation’s financial statements. Audit-related fees have not been reported under the item “audit fees” in the chart above.

The fees billed by Ernst & Young during the fiscal years ended September 30, 2011 and September 30, 2010 include fees incurred for services for review procedures performed in conjunction with the semi-annual reports to shareholders as of March 31, 2011 and March 31, 2010.

(c) “Tax Fees” include amounts for professional services rendered by Ernst & Young for tax compliance, tax advice and tax planning.

15

The fees shown in the table above for the fiscal year ended September 30, 2011 include fees for (1) the review and preparation of the Funds’ income tax returns for the fiscal year ended September 30, 2011, which had not been billed as of September 30, 2011; (2) the review of excise tax calculations and preparation of excise tax returns for the calendar year ended December 31, 2011, which also had not been billed as of September 30, 2011; (3) the use of a PFIC database supplied by Ernst & Young for the fiscal year ended September 30, 2010 and the excise year ended December 31, 2010, and the semiannual period ended March 31, 2011; and (4) the use of a Qualified Foreign Corporation (QFC) Database supplied by Ernst & Young for the calendar year ended December 31, 2010.

The fees shown in the table above for the fiscal year ended September 30, 2010 include fees for (1) the review and preparation of the Funds’ income tax returns for the fiscal year ended September 30, 2010; (2) the review of excise tax calculations and preparation of excise tax returns for the calendar year ended December 31, 2010; (3) the use of a PFIC database supplied by Ernst & Young for the fiscal year ended September 30, 2009 and the excise year ended December 31, 2009, and the semiannual period ended March 31, 2010; and (4) the use of a Qualified Foreign Corporation (QFC) Database supplied by Ernst & Young for the calendar year ended December 31, 2009.

(d) None.

During its regularly scheduled periodic meetings, the Corporation’s audit committee considers any requests to pre-approve any audit, audit-related, tax and other services to be provided by the principal accountants of the Corporation. The audit committee has authorized its chairman to exercise that authority in the intervals between meetings; and the chairman presents any such pre-approvals to the audit committee at its next regularly scheduled meeting. Under paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X, pre-approval of non-audit services may be waived provided that: 1) the aggregate fees for all such services provided constitutes no more than five percent of the total amount of fees paid by the Corporation to its principal accountant during the fiscal year in which services are provided, 2) such services were not recognized by the Corporation at the time of engagement as non-audit services and 3) such services are promptly brought to the attention of the audit committee of the Corporation and approved prior to the completion of the audit.

No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

Less than 50% of the hours expended on Ernst & Young’s engagement to audit the Corporation’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

16

The aggregate fees for the fiscal years ended September 30, 2011 and September 30, 2010 by Ernst & Young for non-audit services rendered to the Corporation are shown in the table above and described in (b) – (d) above. For the Corporation’s fiscal years ended September 30, 2011 and September 30, 2010, Ernst & Young served as the Corporation’s principal accountant and provided no services and billed no fees for non-audit services rendered to the Investment Adviser or entities controlling, controlled by or under common control with the Investment Adviser.

The audit committee has considered whether the provision of non-audit services that were rendered to the Investment Adviser, and any entity controlling, controlled by or under common control with the Investment Adviser that provides ongoing services to the Corporation that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence. The provisions of Rule 2-01(c)(7) were effective on May 6, 2003. No such services were rendered on or after May 6, 2003.

BOARD RECOMMENDATION ON PROPOSAL 1

THE DIRECTORS UNANIMOUSLY RECOMMEND THAT SHAREHOLDERS OF THE FUNDS VOTE “FOR” THE ELECTION OF EACH NOMINEE

17

PROPOSAL 2 – APPROVAL OF THE AMENDMENT OF CERTAIN FUNDAMENTAL INVESTMENT RESTRICTIONS

As described in the following sub-proposals, the Directors also recommend that the shareholders of the Funds approve the modernization and standardization of the fundamental investment restrictions of the Funds through the amendment of certain restrictions as described below. The proposed restrictions are designed to meet fully the requirements of the 1940 Act, and the rules and regulations thereunder while providing the portfolio managers and the Directors increased flexibility to respond to market, industry and regulatory changes. Also, the proposed restrictions are intended to modernize the restrictions to current standards and to reduce administrative and compliance burdens by simplifying and, in one instance, making uniform certain fundamental investment restrictions across all Funds. As to sub-proposals 2.A. through 2.G., the shareholders of each Fund will vote separately on a Fund-by-Fund and sub-proposal-by-sub-proposal basis.

Background

The 1940 Act requires registered investment companies like the Funds to adopt “fundamental” investment restrictions governing certain of their investment practices. Investment companies may also voluntarily designate restrictions relating to other investment practices as “fundamental.” Fundamental investment restrictions can be changed only by a “vote of a majority of the outstanding voting securities” (as that term is defined in the 1940 Act) of a Fund.

The differences between the current and proposed fundamental investment restrictions of the Funds are discussed below. The Investment Adviser believes that the fundamental investment restrictions as proposed to be amended preserve important investor protections while providing flexibility to respond to changing markets, new investment opportunities and future changes in applicable law. The proposed amendments will also simplify the process of monitoring compliance with the fundamental investment restrictions across the fund complex. Although the proposed fundamental investment restrictions will provide greater flexibility to the Investment Adviser in managing the Funds’ current and proposed investments, the Investment Adviser has indicated that it has no present intention to change the investment strategy of any Fund if the sub-proposals are approved.

| | 2.A. | AMEND FUNDAMENTAL INVESTMENT RESTRICTION WITH RESPECT TO ISSUANCE OF SENIOR SECURITIES |

Affected Funds: All Funds

The 1940 Act requires the Funds to state the extent to which they may issue senior securities. Under Section 18(f)(1) of the 1940 Act, an open-end investment company may not issue senior securities, except that it may borrow from banks, for

18

any purpose, up to 331/3% of its total assets (including the amount borrowed). Generally, a “senior security” means any bond, debenture, note or similar instrument or obligation having priority over a fund’s common shares for purposes of distributions and the payment of dividends. Under the 1940 Act, a senior security does not include any promissory note or evidence of indebtedness where such loan is for temporary purposes only and in an amount not exceeding 5% of the value of the total assets of the fund at the time the loan is made (a loan is presumed to be for temporary purposes if it is repaid within 60 days and is not extended or renewed). Further, the Securities and Exchange Commission (“SEC”) and/or its staff has indicated that certain investment practices may raise senior security issues unless a fund takes appropriate steps to segregate assets against, or cover, its obligations.

The Funds’ current fundamental investment restriction with respect to issuance of senior securities is as follows:

A Fund may not issue any senior security except to the extent permitted under the Investment Company Act of 1940.

If this sub-proposal is approved, the Funds’ new fundamental investment restriction with respect to issuance of senior securities would read:

A Fund may not issue any class of securities that is senior to the Fund’s shares of beneficial interest, except to the extent a Fund is permitted to borrow money or otherwise to the extent consistent with applicable law.

The Directors recommend that the Funds amend their restriction to allow each Fund to issue any class of securities which is senior to the Fund’s shares of beneficial interest to the extent a Fund is permitted to borrow money or to the extent permitted under applicable law. The proposed amendment would have the effect of conforming the Funds’ restriction more closely to the statutory and regulatory requirements, as they exist from time to time, without incurring the time and expense of obtaining shareholder approval to change the restriction as those requirements change. Further, the proposed amendment specifically notes the Funds’ existing ability to borrow in plain English. The Funds do not believe the change to be material, and the Investment Adviser has indicated that it has no present intention to change the investment strategy of any Fund if this change were approved.

| | 2.B. | AMEND FUNDAMENTAL INVESTMENT RESTRICTION WITH RESPECT TO BORROWING |

Affected Funds: All Funds

The 1940 Act requires the Funds to state the extent to which they may borrow money. The 1940 Act generally permits a fund to borrow money in amounts of up to 33 1/3% of its total assets from banks for any purpose. The 1940 Act requires that

19

after any borrowing from a bank a fund shall maintain an asset coverage of at least 300% for all of the fund’s borrowings, and, in the event that such asset coverage shall at any time fall below 300%, a fund must, within three days thereafter (not including Sundays and holidays), reduce the amount of its borrowings to an extent that the asset coverage of all of the fund’s borrowings shall be at least 300%. In addition, a fund may borrow up to 5% of its total assets from banks or other lenders for temporary purposes (a loan is presumed to be for temporary purposes if it is repaid within 60 days and is not extended or renewed).

The Funds’ (other than Artisan Global Opportunities Fund’s) current fundamental investment restriction with respect to borrowing is as follows:

A Fund may not borrow (including entering into reverse repurchase agreements), except that it may (a) borrow up to 33 1/3% of its total assets, taken at market value at the time of such borrowing, as a temporary measure for extraordinary or emergency purposes, but not to increase portfolio income and (b) enter into transactions in options, futures, and options on futures. A Fund will not purchase securities when total borrowings by the Fund are greater than 5% of its net asset value.

Artisan Global Opportunities Fund’s current fundamental investment restriction with respect to borrowing is as follows:

A Fund may not borrow (including entering into reverse repurchase agreements), except that it may (a) borrow up to 33 1/3% of its total assets, taken at market value at the time of such borrowing, as a temporary measure for extraordinary or emergency purposes, but not to increase portfolio income and (b) enter into transactions in options, futures, and options on futures.

If this sub-proposal is approved, the Funds’ new fundamental investment restriction with respect to borrowing would read:

A Fund may not borrow money except under the following circumstances: (a) a Fund may borrow money from banks so long as after such a transaction, the total assets (including the amount borrowed) less liabilities other than debt obligations, represent at least 300% of outstanding debt obligations; (b) a Fund may also borrow amounts equal to an additional 5% of its total assets without regard to the foregoing limitation for temporary purposes, such as for the clearance and settlement of portfolio transactions and to meet shareholder redemption requests; and (c) a Fund may enter into transactions that are technically borrowings under the Investment Company Act of 1940, as amended, because they involve the sale of a security coupled with an agreement to repurchase that security (e.g., reverse repurchase agreements, dollar rolls and other similar investment techniques) without

20

regard to the asset coverage restriction described in (a) above, so long as and to the extent that a Fund earmarks and maintains liquid securities equal in value to its obligations in respect of these transactions.

The following disclosure in the Funds’ Statement of Additional Information (“SAI”) would further clarify the Funds’ investment restriction with respect to borrowing. This language would not be part of the fundamental investment restriction:

For purposes of the investment restriction above, borrowing shall not be considered to include (without limitation): investments in derivative instruments, such as options, futures contracts, options on futures contracts, forward commitments and swaps, short sales and roll transactions made in accordance with a Fund’s investment policies.

The Directors recommend that the Funds amend their restriction to allow each Fund to borrow money to the extent permitted under applicable law. The proposed amendment would have the effect of conforming the Funds’ restriction more closely to the statutory and regulatory requirements. In addition, the proposed amendment will reduce administrative and compliance burdens by simplifying and making uniform the Funds’ fundamental investment restrictions with respect to borrowing money. Furthermore, the proposed amendment would clarify the Funds’ current understanding with respect to certain transactions that may technically be considered borrowings. The Funds do not believe the change to be material, and the Investment Adviser has indicated that it has no present intention to change the investment strategy of any Fund if this change were approved.

| | 2.C. | AMEND FUNDAMENTAL INVESTMENT RESTRICTION WITH RESPECT TO CONCENTRATING INVESTMENTS IN A PARTICULAR INDUSTRY |

Affected Funds: All Funds

The 1940 Act requires the Funds to state the extent, if any, to which they concentrate investments in a particular industry or group of industries. While the 1940 Act does not define what constitutes “concentration” in an industry, the staff of the SEC takes the position that, in general, investments of more than 25% of a fund’s assets in an industry constitutes concentration. If a fund’s policy is not to concentrate, it may not invest more than 25% of its assets in an industry or group of industries.

The Funds’ current fundamental investment restriction with respect to concentrating investments in a particular industry is as follows:

A Fund may not invest in a security if more than 25% of its net assets (taken at market value at the time of a particular purchase) would be invested in the securities of issuers in any particular industry, except that this restriction does not apply to securities issued or guaranteed by the U.S. Government or its agencies or instrumentalities.

21

If this sub-proposal is approved, the Funds’ new fundamental investment restriction with respect to concentrating investments in a particular industry would read:

A Fund may not invest more than 25% of its total assets (taken at market value at the time of a particular purchase) in the securities of one or more issuers in any particular industry (excluding the U.S. Government or its agencies or instrumentalities).

Currently, the Funds’ fundamental investment restriction on concentrating investments in a particular industry restricts the Funds’ ability to concentrate more than 25% of its “net” assets, as opposed to “total” assets. The Directors recommend that the Funds’ current fundamental investment restriction with respect to concentration be amended to make clear that the restriction applies to total assets. This change is intended to give the Funds increased flexibility to respond to market and industry conditions while continuing to comply with SEC guidance. The Funds do not believe the change to be material, and the Investment Adviser has indicated that it has no present intention to change the investment strategy of any Fund if this change were approved.

| | 2.D. | AMEND FUNDAMENTAL INVESTMENT RESTRICTION WITH RESPECT TO PURCHASING OR SELLING REAL ESTATE |

Affected Funds: All Funds

The 1940 Act requires the Funds to state a fundamental investment restriction regarding the purchase and sale of real estate.

The Funds’ current fundamental investment restriction with respect to purchasing or selling real estate is as follows:

A Fund may not purchase or sell real estate (although it may purchase securities secured by real estate or interests therein, or securities issued by companies which invest in real estate or interests therein), commodities, or commodity contracts, except that it may enter into (a) futures and options on futures and (b) forward contracts.

If this sub-proposal is approved, the Funds’ new fundamental investment restriction with respect to purchasing or selling real estate would read:

A Fund may not purchase or sell real estate, although it may purchase securities of issuers that deal in real estate, including securities of real estate investment trusts, and may purchase securities that are secured by interests in real estate. A Fund reserves the freedom of action to hold and to sell real estate acquired as a result of the ownership of securities.

22

Currently, the Funds’ fundamental investment restriction with respect to real estate is combined with the Funds’ fundamental investment restriction with respect to commodities, which can lead to confusion. The proposed new fundamental investment restriction only addresses the Funds’ purchase and sale of real estate, which will reduce administrative and compliance burdens by simplifying the Funds’ fundamental investment restriction with respect to real estate. In addition, the Funds’ current fundamental investment restriction restricts a Fund’s ability to sell real estate even when the Funds acquire ownership of the real estate as a result of permissible investments. For instance, it is possible that a Fund could, as a result of an investment in debt securities of a company that deals in real estate, come to hold an interest in real estate if the issuer were to default on its debt obligations. Accordingly, the Directors recommend that this restriction be modified to allow the holding and sale of real estate when ownership of real estate results from the exercise of a Fund’s rights as a holder of securities of real estate issuers. The Funds do not believe the change to be material, and the Investment Adviser has indicated that it has no present intention to change the investment strategy of any Fund if this change were approved.

| | 2.E. | AMEND FUNDAMENTAL INVESTMENT RESTRICTION WITH RESPECT TO PURCHASING OR SELLING COMMODITIES |

Affected Funds: All Funds

The 1940 Act requires the Funds to state a fundamental investment restriction regarding the purchase and sale of commodities.

The Funds’ current fundamental investment restriction with respect to purchasing or selling commodities is as follows:

A Fund may not purchase or sell real estate (although it may purchase securities secured by real estate or interests therein, or securities issued by companies which invest in real estate or interests therein), commodities, or commodity contracts, except that it may enter into (a) futures and options on futures and (b) forward contracts.

In addition, the following disclosure in the Funds’ SAI further clarifies the restriction. This language is not part of the fundamental investment restriction:

For purposes of [the] investment restriction [above], at the time of the establishment of the restriction, swap contracts on financial instruments, interest rates or currency exchange rates were not within the understanding of the terms “commodities” or “commodity contracts,” and notwithstanding any federal legislation or regulatory action by the Commodity Futures Trading Commission (“CFTC”) that subject such swaps to regulation by the CFTC, the Fund will not consider such instruments to be commodities or commodity contracts for purposes of this restriction.

23

If this sub-proposal is approved, the Funds’ new fundamental investment restriction with respect to purchasing or selling commodities would read: