UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| | |

[X] | | Preliminary Proxy Statement |

[ ] | | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

[ ] | | Definitive Proxy Statement |

[ ] | | Definitive Additional Materials |

[ ] | | Soliciting Material Pursuant to [Section] 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

Artisan Partners Funds, Inc.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1)and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | [ ] | Fee paid previously with preliminary materials. |

| | [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

September [16], 2013

ARTISAN FUNDS

Dear Shareholder:

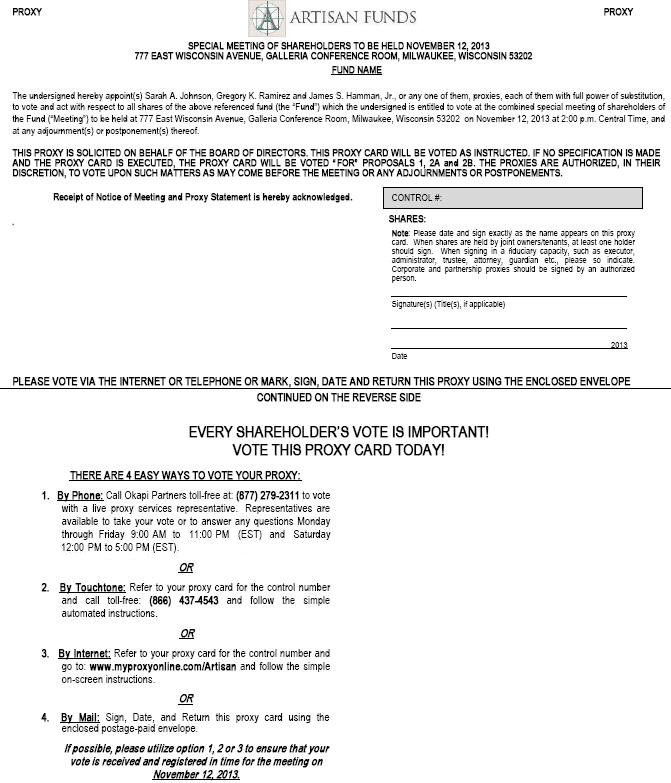

A special meeting of shareholders of Artisan Partners Funds, Inc. (“Artisan Funds” and each of its respective series, a “Fund”) will be held on November 12, 2013 to vote on several important proposals that affect the Funds. Please read the enclosed materials and cast your vote.

We are asking you to consider and vote on the following proposals: (1) to elect six directors of Artisan Funds, including one nominee who is not currently a director; (2)(a) to approve the amended and restated investment advisory agreement between Artisan Partners Limited Partnership (the “Investment Adviser”) and Artisan Funds on behalf of each Fund; and (2)(b) to approve a form of master subadvisory agreement between the Investment Adviser and certain affiliates.

Importantly, the board of directors of Artisan Funds has considered the proposals and determined that they are in the best interests of the Funds, and unanimously recommends that you vote “FOR” the proposals. However, before you vote, please read the full text of the enclosed proxy statement for an explanation of the proposals.

You can vote in one of four ways:

| | ¡ | | Over the Internet through the website listed on the proxy card, |

| | ¡ | | By telephone, using the toll-free number listed on the proxy card, |

| | ¡ | | By mail, using the enclosed proxy card — be sure to sign, date and return the proxy card in the enclosed postage-paid envelope, or |

| | ¡ | | In person at the shareholder meeting on November 12, 2013. |

We encourage you to vote over the Internet or by telephone using the voting control number that appears on your proxy card.

Your vote is extremely important. If you have questions, please call Okapi Partners, the proxy solicitor, toll-free at (877) 279-2311.

We appreciate your participation and prompt response in this matter and thank you for investing with Artisan Funds.

| | |

| | Sincerely, Eric R. Colson President |

ARTISAN FUNDS

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 12, 2013

| | |

Artisan Emerging Markets Fund | | Artisan International Small Cap Fund |

Artisan Global Equity Fund | | Artisan International Value Fund |

Artisan Global Opportunities Fund | | Artisan Mid Cap Fund |

Artisan Global Small Cap Fund | | Artisan Mid Cap Value Fund |

Artisan Global Value Fund | | Artisan Small Cap Fund |

Artisan International Fund | | Artisan Small Cap Value Fund |

| | Artisan Value Fund |

Notice is hereby given that a special meeting of shareholders (the “Meeting”) of Artisan Partners Funds, Inc. (“Artisan Funds” or the “Corporation”) and each of its respective series listed above (each, a “Fund” and collectively, the “Funds”) will be held at 777 East Wisconsin Avenue, Galleria Conference Room, Milwaukee, Wisconsin 53202 on November 12, 2013 at 2:00 p.m. Central Time for the purposes listed below:

| | |

Proposal Summary | | Fund(s) Voting on the Proposal |

| |

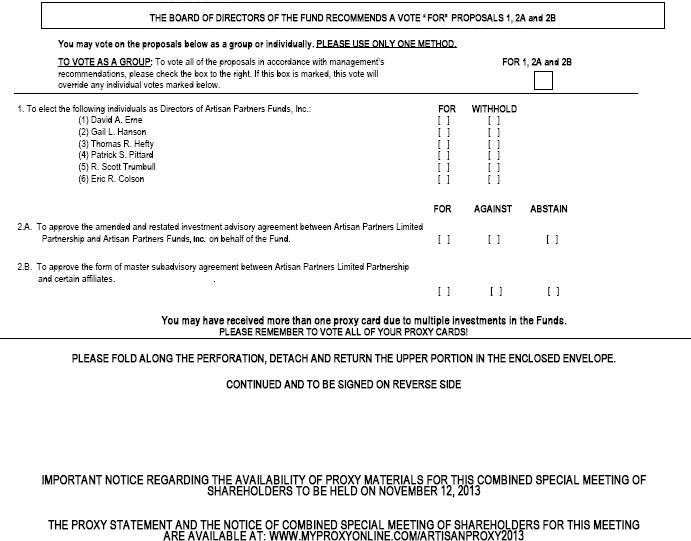

1. Election of Directors | | All Funds |

| |

2(a). Approval of amended and restated investment advisory agreement between Artisan Partners Limited Partnership and the Corporation on behalf of each Fund | | Each Fund will vote separately |

| |

2(b). Approval of form of master subadvisory agreement between the Investment Adviser and certain affiliates | | Each Fund will vote separately |

| |

3. Transact such other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof | | All Funds |

After careful consideration, the board of directors of the Corporation (the “Board” or the “Directors”) unanimously recommends that shareholders vote “FOR” Proposals 1, 2(a) and 2(b).

Shareholders of record at the close of business on September 6, 2013 are entitled to notice of, and to vote at, the Meeting, even if shareholders no longer own shares.

We call your attention to the accompanying proxy statement. You are requested to complete, date, and sign the enclosed proxy card and return it promptly in the envelope provided for that purpose. Your proxy card also provides instructions for voting by telephone or over the Internet if you wish to take advantage of these voting options. Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Fund(s) prior to the Meeting, or by voting in person at the Meeting. Please call Okapi Partners, the proxy solicitor, toll-free at (877) 279-2311 if you have any questions relating to attending the Meeting in person or your vote instructions.

| | |

| | By Order of the Board of Directors, Sarah A. Johnson Secretary |

i

QUESTIONS AND ANSWERS

The following “Questions and Answers” section is a summary and is not intended to be as detailed as the discussion found in the proxy materials. For this reason, the information is qualified in its entirety by reference to the enclosed proxy statement to shareholders (“Proxy Statement”).

| Q. | Why am I receiving this Proxy Statement? |

| A. | You are receiving these proxy materials because you have the right to vote on important proposals concerning Artisan Funds. Each of these proposals is described below. |

| Q. | What are the proposals about? |

| A. | This Proxy Statement presents two proposals. Shareholders of all Funds are being asked to vote on all proposals. |

Proposal 1

This proposal relates to the election of directors (each, a “Nominee”) to the Board of the Corporation. Andrew A. Ziegler, a current interested Director of the Corporation, has decided to retire as a Director by the end of 2013, and his retirement will create a vacancy on the Board. You are, therefore, being asked to elect one new successor Nominee, Eric R. Colson, who would be an interested Director of the Corporation and, because the terms of the incumbent Directors will terminate at the Meeting, you are also being asked to re-elect the incumbent Directors (the “Incumbent Director Nominees”), other than Mr. Ziegler. The Incumbent Director Nominees are David A. Erne, Gail L. Hanson, Thomas R. Hefty, Patrick S. Pittard and R. Scott Trumbull.The Board recommends that you vote “FOR” this Proposal 1. Shareholders of the Funds have the option of voting on the election of each Nominee separately.

Proposal 2(a)

This proposal relates to the approval of the amended and restated investment advisory agreement (the “Amended and Restated Advisory Agreement”) between Artisan Partners Limited Partnership (the “Investment Adviser”), the Funds’ investment adviser, and the Corporation on behalf of each Fund. The approval of the Amended and Restated Advisory Agreement is required in part as a result of certain anticipated changes to the indirect ownership of the Investment Adviser. In March 2013, in connection with its initial public offering (the “IPO”), Artisan Partners Asset Management Inc. (“APAM”) replaced Artisan Investment Corporation (“AIC”) as the general partner of

ii

Artisan Partners Holdings LP (“Artisan Holdings”), the parent company of the Investment Adviser. At the time of the IPO, AIC entered into a stockholders agreement (the “Stockholders Agreement”) with certain other shareholders of APAM that provided AIC’s designee on a three-person stockholders committee with control over a majority of the voting power of APAM. Therefore, the replacement of AIC by APAM as the general partner of Artisan Holdings did not result in a “change of control” of the Investment Adviser. However, it is expected that no later than March 12, 2014 (which is the first anniversary of the IPO), the AIC designee will be replaced by a new third member of the stockholders committee who will be selected by the other two members (currently, Eric R. Colson, President and Chief Executive Officer of APAM, and Daniel J. O’Keefe, a portfolio manager on the Investment Adviser’s Global Value team). At the time the AIC designee is replaced, AIC will surrender its designee’s authority to vote the shares of APAM subject to the Stockholders Agreement (the “Covered Shares”), and the three-person stockholders committee, acting by majority vote, will obtain the power to vote the Covered Shares (the “Transition”). The Transition will result in a change of control of the Investment Adviser, and therefore, an “assignment” of the current investment advisory agreements for each Fund (the “Current Advisory Agreements”).

Under the Investment Company Act of 1940, as amended (the “1940 Act”), an investment advisory agreement terminates automatically in the event of its assignment. Therefore, your Fund’s Current Advisory Agreement with the Investment Adviser is expected to terminate upon the completion of the Transition described above. Accordingly, you are being asked to approve the Amended and Restated Advisory Agreement with respect to your Fund to be effective upon shareholder approval and completion of the Transition (regardless of the order in which those events occur, although it is expected that the shareholder meeting will take place prior to completion of the Transition). Such approval will enable the Investment Adviser to continue to provide investment advisory services to the Funds without interruption. Certain other changes to the existing terms of the advisory arrangements are also being proposed to standardize, clarify and modernize various provisions of the Current Advisory Agreements. Shareholders of each Fund will vote separately.

If the Amended and Restated Advisory Agreement is approved, it will continue through June 30, 2015 and for subsequent one-year terms thereafter so long as such continuance is approved in a manner consistent with the 1940 Act. If the Amended and Restated Advisory Agreement is not approved for a Fund, the Board will evaluate other short- and long-term options permitted by law, which could include an interim investment advisory agreement of limited duration for that Fund.The Board recommends that you vote “FOR” this Proposal 2(a).

iii

Proposal 2(b)

This proposal relates to the approval of a form of master subadvisory agreement (the “Master Subadvisory Agreement”) between the Investment Adviser and certain affiliates. The approval of the Master Subadvisory Agreement is not required as a result of the IPO or the Transition. The Amended and Restated Advisory Agreement provides that the Investment Adviser may delegate any or all of its duties to one or more sub-advisers, including sub-advisers that are affiliated with the Investment Adviser. Currently, the Investment Adviser has not delegated any of its responsibilities to a sub-adviser, and it has no current plan to do so. The Investment Adviser may, however, in the future consider engaging asub-adviser that is controlled by or under common control with the Investment Adviser, for example, to give a Fund access to portfolio managers and investment personnel located in other offices of the Investment Adviser or its affiliates or to increase flexibility in assigning portfolio managers to a Fund.

The Master Subadvisory Agreement would apply only in instances where the Investment Adviser delegates duties to a sub-adviser that is controlled by or under common control with the Investment Adviser and only if, and when, the Investment Adviser and the Board determine that it would be in the best interests of a Fund to engage such a sub-adviser. Shareholders of each Fund will vote separately. Guidance issued by the staff of the Securities and Exchange Commission permits an investment adviser to a mutual fund to appoint a wholly-owned affiliate as sub-adviser without shareholder approval, provided, among other things, that (a) there is no reduction in the nature or level of services provided to a fund, (b) there is no increase in fees paid by funds for those services and (c) existing and prospective shareholders are informed of the arrangement. If the Master Subadvisory Agreement is not approved for a Fund, the Investment Adviser and the Board may nonetheless determine to appoint such sub-adviser without shareholder approval in reliance on such Securities and Exchange Commission staff guidance. The Master Subadvisory Agreement would not permit delegation to a sub-adviser that is not controlled by or under common control with the Investment Adviser without prior shareholder approval.The Board recommends that you vote “FOR” this Proposal 2(b).

| Q. | How did the IPO affect the Investment Adviser? |

| A. | The IPO did not result in any changes in the management or operation of the investment advisory functions performed by the Investment Adviser with respect to the Funds, including any changes in the personnel engaged in the day-to-day investment management of the Funds or the investment style, philosophy or strategy of the Funds. The IPO has not caused any reduction in the quality of services now provided to any of the Funds and has not had any |

iv

| | adverse effect on the Investment Adviser’s ability to fulfill its obligations to the Funds under the investment advisory agreements for the Funds. Although the IPO did not result in a change of control of the Investment Adviser, the Transition (as discussed below) will result in a change of control of the Investment Adviser. |

| Q. | How will the Transition affect the Investment Adviser? |

| A. | The Transition will not result in any changes in the management or operation of the investment advisory functions performed by the Investment Adviser with respect to the Funds, including any changes in the personnel engaged in the day-to-day investment management of the Funds or the investment style, philosophy or strategy of the Funds. |

| Q. | How does the Amended and Restated Advisory Agreement differ from your Fund’s Current Advisory Agreements? |

| A. | Given the need for new investment advisory agreements to replace the Current Advisory Agreements upon their termination, the Board and the Investment Adviser decided to take the opportunity to standardize, clarify and modernize various provisions of the Current Advisory Agreements. Because the Current Advisory Agreements, one for each of the thirteen series of Artisan Funds, were implemented at different times over the course of many years, the Current Advisory Agreements differ in some cases from Fund to Fund and some of the Current Advisory Agreements contain outdated provisions. The Directors believe that this standardization, and the combination of all the Current Advisory Agreements into a single Amended and Restated Advisory Agreement for all the Funds, will benefit the Funds by eliminating outdated provisions, making the administration of the Funds more efficient and providing more flexibility for the operations of the Funds, within the limits of applicable law. |

| Q. | Will your Fund’s total advisory fees change? |

| A. | There is no change in the rate of the advisory fees that each of the Funds will pay to the Investment Adviser under the Amended and Restated Advisory Agreement. |

| Q. | Will your Fund’s total expenses change? |

| A. | The Transition is not expected to result in any increase of your Fund’s total expenses. Under the proposed Amended and Restated Advisory Agreement, however, certain expenses relating to the determination of daily price computations currently borne by the Investment Adviser will be borne by the Funds. Specifically, expenses that are currently borne by the Investment |

v

| | Adviser and that total approximately $60,000 annually will be borne in the future by Artisan Emerging Markets Fund, Artisan Global Value Fund, Artisan International Fund, Artisan Small Cap Fund and Artisan Value Fund (the “Five Funds”). This change would increase the gross expense ratio of each of the Five Funds by less than 0.01%. |

| A. | The enclosed proxy is being solicited for use at the special meeting of shareholders to be held on November 12, 2013 (the “Meeting”) at 777 East Wisconsin Avenue, Galleria Conference Room, Milwaukee, Wisconsin 53202 at 2:00 p.m. Central Time, and, if the Meeting is adjourned or postponed, at any postponed or adjourned session, for the purposes stated in the Notice of Special Meeting of Shareholders. |

| Q. | Who will bear the costs of soliciting proxies and the Meeting? |

| A. | The Investment Adviser will be responsible for 100% of the cost of the Meeting and any adjournment(s) or postponement(s) thereof, including the costs of retaining Okapi Partners, preparing and mailing the notice, Proxy Statement and proxy, and the solicitation of proxies, including reimbursement to broker-dealers and others who forwarded proxy materials to their clients. |

| Q. | How does the Board suggest that I vote? |

| A. | After careful consideration,the Board unanimously recommends that you vote “FOR” Proposals 1, 2(a) and 2(b). Please see the sections of the proxy materials discussing each proposal for a discussion of the Board’s considerations in making such recommendations. |

| Q. | Why am I receiving information about Funds I do not own? |

| A. | Proposals 1, 2(a) and 2(b) are relevant to all of the Funds, and management of the Funds has concluded that it is cost-effective to hold the Meeting concurrently for all of the Funds. Shares of all the Funds will vote in the aggregate and not separately by Fund with respect to Proposal 1 (election of Directors). Shares of the Funds will vote separately by Fund on Proposal 2(a) (amended and restated investment advisory agreement) and Proposal 2(b) (form of master subadvisory agreement). |

vi

| Q. | What vote is required to approve the proposals? |

| A. | With respect to Proposal 1, the election of Directors, an affirmative vote of the holders of a plurality of the Corporation’s shares present at the Meeting, either in person or by proxy, is required to elect each individual nominated as a Director. |

To be approved with respect to a particular Fund, each of Proposals 2(a) and 2(b) must be approved by a “vote of a majority of the outstanding voting securities” of that Fund. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the voting securities of a Fund entitled to vote on the proposal present at the Meeting or represented by proxy, if more than 50% of the Fund’s outstanding voting securities are present or represented by proxy; or (ii) more than 50% of the outstanding voting securities of the Fund entitled to vote on the proposal.

| Q. | How do I place my vote? |

| A. | You may provide a Fund with your vote by mail using the enclosed proxy card, over the Internet by following the instructions on the proxy card, by telephone using the toll-free number listed on the proxy card, or in person at the Meeting. You may use the enclosed postage-paid envelope to mail your proxy card. Please follow the enclosed instructions to utilize any of these voting methods. If you need more information on how to vote, or if you have any questions, please call Okapi Partners, the proxy solicitor, toll-free at(877) 279-2311. |

| Q. | Whom do I call if I have questions? |

| A. | We will be happy to answer your questions about this proxy solicitation. If you have questions, please call Okapi Partners, the proxy solicitor, toll-free at (877) 279-2311. |

Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Fund(s) prior to the Meeting, or by voting in person at the Meeting.

PROMPT VOTING IS REQUESTED

vii

TABLE OF CONTENTS

viii

APPENDICES

ix

ARTISAN FUNDS

PROXY STATEMENT SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 12, 2013

This Proxy Statement and enclosed notice and proxy card are being furnished in connection with the solicitation of proxies by the Board of Directors of Artisan Funds. The proxies are being solicited for use at a special meeting of shareholders of the Corporation to be held at 2:00 p.m. on November 12, 2013 at 777 East Wisconsin Avenue, Galleria Conference Room, Milwaukee, Wisconsin 53202 Central Time, and at any and all adjournments or postponements thereof.

This Proxy Statement and the accompanying notice and the proxy card are being first mailed to shareholders on or about September [16], 2013.

The Board has determined that the use of this Proxy Statement for the Meeting is in the best interests of each Fund and its shareholders in light of the similar matters being considered and voted on by the shareholders of the Funds. You are entitled to vote at the Meeting of each Fund of which you are a shareholder as of the close of business on September 6, 2013 (the “Record Date”), even if you no longer own shares.

If you have any questions about the proposals or about voting, please call Okapi Partners, the proxy solicitor, at (877) 279-2311.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING TO BE HELD ON NOVEMBER 12, 2013

This Proxy Statement and the accompanying Notice of Special Meeting of Shareholders are available at the website listed on your proxy card. In addition, shareholders can find important information about each Fund in the Fund’s most recent shareholder reports, which are available, without charge, by writing to the Corporation, by calling (800) 344-1770, or at www.artisanfunds.com.

1

PROPOSAL 1

ELECTION OF DIRECTORS

The Board has proposed the following six Nominees for election by shareholders, each to hold office for an indefinite term until the next annual meeting of shareholders and until his or her successor is elected and qualified or until his or her earlier resignation or removal: David A. Erne, Gail L. Hanson, Thomas R. Hefty, Patrick S. Pittard, R. Scott Trumbull and Eric R. Colson. Messrs. Erne, Hefty, Pittard, Trumbull and Ms. Hanson are collectively referred to herein as the “Incumbent Director Nominees.” Each of the Nominees has consented to serve as a Director. Certain biographical and other information relating to the Nominees, including each Nominee’s experience, qualifications, attributes and skills for Board membership, is set forth below. Five of the Nominees would be Independent Directors (meaning that they would not be considered “interested persons” as defined in the 1940 Act) and one of the Nominees, Mr. Colson, would be an Interested Director (meaning that he is considered an “interested person” as defined in the 1940 Act) of the Corporation due to the fact that he is Chief Executive Officer and President of the Corporation, and Managing Director, Chief Executive Officer and President of the Investment Adviser. Messrs. Erne, Hefty, Pittard and Trumbull and Ms. Hanson are Independent Director incumbents who were previously elected by shareholders in 2012. On August 13, 2013, the members of the Corporation’s governance and nominating committee (described below) nominated the Incumbent Director Nominees and Mr. Colson, and also on August 13, 2013, the Board voted to submit the Incumbent Director Nominees and Mr. Colson to a vote of shareholders of the Corporation. The Board knows of no reason why any of these Nominees would be unable to serve.

Reason for the Proposal

Andrew A. Ziegler, a current interested Director of the Corporation, has decided to retire as a Director by the end of 2013, and his retirement will create a vacancy on the Board. To fill such vacancy, the Board has nominated and submitted to a vote of shareholders of the Corporation Mr. Colson, to serve as an Interested Director. Further, the Board has considered it appropriate that all of the current Directors, other than Mr. Ziegler, stand for re-election because the Corporation’s Bylaws indicate that when a shareholder meeting is called for the purpose of electing directors the entire board shall stand for election by the shareholders of the Corporation.

Information about the Board and the Nominees

The Board has overall responsibility for the conduct of the affairs of the Corporation. The Board’s role is one of oversight, rather than active management. This oversight extends to the Corporation’s risk management processes. Those processes are

2

embedded in the responsibilities of officers of the Corporation. Senior officers of the Corporation, including the president, chief financial officer, general counsel and chief compliance officer, report directly to the full Board on a variety of matters at regular meetings of the Board. During the fiscal year ended September 30, 2012, the Board met 6 times and each Incumbent Director Nominee who was then a member of the Board was present for at least 75% of the aggregate number of meetings of the Board and committees on which he or she served. Mr. Trumbull was appointed to the Board effective November 13, 2012, and therefore did not attend any Board or committee meetings during the fiscal year ended September 30, 2012.

The Board’s leadership structure features Independent Directors serving as Independent Chair and as chairmen of the audit and governance and nominating committees. This structure is reviewed by the Board regularly and the Board believes it to be appropriate and effective. All Independent Directors are members of the audit and governance and nominating committees. Inclusion of Independent Directors in the audit and governance and nominating committees allows all such Directors to participate in the full range of the Board’s oversight duties, including oversight of risk management processes.

The following table lists the Nominees, their names and ages, the date each first was elected or appointed to office (as applicable), their principal business occupations during the last five years and other directorships held in any publicly-traded company or any registered investment company, as well as the experience, qualifications, attributes and skills that each possess for Board membership. There are 13 Funds, all of which are overseen by the Board (and would be overseen by Mr. Colson, if elected). The address of each Nominee is c/o Artisan Funds, 875 East Wisconsin Avenue, Suite 800, Milwaukee, Wisconsin 53202. Correspondence intended for a current Director or Nominee may be sent to this address.

| | | | | | | | | | |

Name and

Age at

May 31,

2013 | | Position(s)

Held with the

Corporation | | Date First

Elected or

Appointed

to Office | | Principal

Occupation(s)

During Past 5

Years | | Other

Directorships

Held by Nominee | | Experience,

Qualifications,

Attributes and

Skills for Board

Membership |

Nominees who are not “interested persons” of the Corporation: |

| David A. Erne, 70 | | Director and Independent Chair of the Board | | Director since 3/27/95; Independent Chair since 2/4/05 | | Of counsel to the law firm Reinhart Boerner Van Deuren s.c., Milwaukee, WI. | | Former Trustee, Northwestern Mutual Life Insurance Company (individual life insurance, disability insurance and annuity company). | | Significant board experience; legal training and practice. |

3

| | | | | | | | | | |

Name and

Age at

May 31,

2013 | | Position(s)

Held with the

Corporation | | Date First

Elected or

Appointed

to Office | | Principal

Occupation(s)

During Past 5

Years | | Other

Directorships

Held by Nominee | | Experience,

Qualifications,

Attributes and

Skills for Board

Membership |

| Gail L. Hanson, 57 | | Director | | 1/1/12 | | Chief Financial Officer, Aurora Health Care (not for profit health care provider); from September 2004 to February 2011, Deputy Executive Director, State of Wisconsin Investment Board. | | Director, Northwestern Mutual Series Fund, Inc. (investment company) (28 portfolios). | | Significant executive experience including service as chief financial officer and service as deputy executive director of a state investment board; certified financial analyst and certified public accountant; audit committee financial expert. |

| Thomas R. Hefty, 65 | | Director | | 3/27/95 | | Retired; from January 2007 to February 2008, President, Kern Family Foundation (private, grant-making organization); until December 2006, of counsel to the law firm Reinhart Boerner Van Deuren s.c., Milwaukee, WI; until December 2006, Adjunct Professor, Department of Business and Economics, Ripon College; until December 2002, Chairman of the Board and Chief Executive Officer of Cobalt Corporation (provider of managed care and specialty business services). | | None. | | Significant board experience; significant executive experience including past service as the chief executive officer of a public company; legal training and practice; audit committee financial expert. |

4

| | | | | | | | | | |

Name and

Age at

May 31,

2013 | | Position(s)

Held with the

Corporation | | Date First

Elected or

Appointed

to Office | | Principal

Occupation(s)

During Past 5

Years | | Other

Directorships

Held by Nominee | | Experience,

Qualifications,

Attributes and

Skills for Board

Membership |

| Patrick S. Pittard, 67 | | Director | | 8/9/01 | | Distinguished Executive in Residence (teaching position), University of Georgia; until December 2012, Chairman and Chief Executive Officer, ACT Bridge, Inc. (enterprise talent management firm); until October 2001, Chairman of the Board, President and Chief Executive Officer of Heidrick & Struggles International, Inc. (executive search firm). | | Director, Lincoln National Corporation (insurance and investment management company); former Director, Cbeyond, Inc. (telecommu-nications company, formerly Cbeyond Commun-ications, Inc.). | | Significant board experience; significant executive experience including past service as chief executive officer of a public company. |

| R. Scott Trumbull, 64 | | Director | | 11/13/12 | | Chairman, Chief Executive Officer and Director, Franklin Electric Co., Inc. (manufacturer of water and fuel pumping systems). | | Director, Health Care REIT (investor in health care real estate). | | Significant board experience; significant executive experience including service as chief executive officer of a public company and service as non-executive chairman of a privately held company. |

5

| | | | | | | | | | |

Name and

Age at

May 31,

2013 | | Position(s)

Held with the

Corporation | | Date First

Elected or

Appointed

to Office | | Principal

Occupation(s)

During Past 5

Years | | Other

Directorships

Held by Nominee | | Experience,

Qualifications,

Attributes and

Skills for Board

Membership |

Nominee who is an “interested person” of the Corporation: |

| Eric R. Colson, 44* | | President and Chief Executive Officer | | 2/9/10 | | President and Chief Executive Officer of Artisan Partners Asset Management Inc. (“APAM”) (since March 2013); Managing Director, Chief Executive Officer (since January 2010) and President (since April 2013) of the Investment Adviser; prior thereto, Managing Director and Chief Operating Officer – Investment Operations of the Investment Adviser. | | Director, APAM. | | Continuing service as President and Chief Executive Officer of the Corporation and President, Chief Executive Officer and Managing Director of the Investment Adviser. |

* Mr. Colson is an “interested person” of the Corporation, as defined in the 1940 Act, because he is President and Chief Executive Officer of the Corporation and a Managing Director, President and Chief Executive Officer of the Investment Adviser. Mr. Colson also serves as President and Chief Executive Officer of Artisan Investments GP LLC (the general partner of the Investment Adviser) and Artisan Partners Holdings LP (the parent company of the Investment Adviser) and President, Chief Executive Officer and Director of APAM (the general partner of Artisan Partners Holdings LP). From time to time, Mr. Colson may make investments in the Investment Adviser or its parents or the subsidiaries of either.

Additional Information on Proposal 1

Additional information on Proposal 1, including information on the principal officers of the Corporation, Nominee ownership of Fund shares, Board compensation, committees and meetings of the Board and Artisan Funds’ independent registered public accounting firm, is included in Appendix C.

Required Vote

The six persons receiving the affirmative vote of a plurality of shares present at the Meeting, either in person or by proxy, if a quorum is present, shall be elected.

Board Recommendation on Proposal 1

The Directors unanimously recommend that shareholders of the Funds vote “FOR” the election of each Nominee.

6

PROPOSALS 2(A) AND 2(B)

PROPOSAL 2(a) – APPROVAL OF AMENDED AND RESTATED INVESTMENT ADVISORY AGREEMENT (EFFECTIVE UPON SHAREHOLDER APPROVAL AND THE COMPLETION OF THE TRANSITION)

PROPOSAL 2(b) – APPROVAL OF FORM OF MASTER SUBADVISORY AGREEMENT

The Board has approved, and is recommending to shareholders of each Fund that they approve, Proposal 2(a) relating to the Amended and Restated Advisory Agreement between the Investment Adviser and the Corporation on behalf of each Fund. The Board also has approved, and is recommending to shareholders of each Fund that they approve, Proposal 2(b) relating to the form of Master Subadvisory Agreement between the Investment Adviser and certain affiliates.

Background

The approval of the Amended and Restated Advisory Agreement is required in part as a result of certain anticipated changes to the indirect ownership of the Investment Adviser. In March 2013, in connection with its IPO, Artisan Partners Asset Management Inc. (“APAM”) replaced Artisan Investment Corporation (“AIC”) as the general partner of Artisan Partners Holdings LP (“Artisan Holdings”), the parent company of the Investment Adviser. At the time of the IPO, AIC entered into a stockholders agreement (the “Stockholders Agreement”) with certain other shareholders of APAM that provided AIC’s designee with control over a majority of the voting power of APAM. Therefore, the replacement of AIC by APAM as the general partner of Artisan Holdings did not result in a “change of control” of the Investment Adviser. However, it is expected that no later than March 12, 2014 (which is the first anniversary of the IPO), the AIC designee will be replaced by a new third member of the stockholders committee who will be selected by the other two members (currently, Eric R. Colson, President and Chief Executive Officer of APAM, and Daniel J. O’Keefe, a portfolio manager on the Investment Adviser’s Global Value team). At the time the AIC designee is replaced, AIC will surrender its designee’s authority to vote the shares of APAM common stock subject to the Stockholders Agreement (the “Covered Shares”), and the three-person stockholders committee, acting by majority vote, will obtain the power to vote the Covered Shares (the “Transition”). The Transition will result in a change of control of the Investment Adviser, and therefore, an “assignment” of the Current Advisory Agreements for each Fund. Under the Investment Company Act of 1940, as amended (the “1940 Act”), an investment advisory agreement terminates automatically in the event of its assignment. Therefore, your Fund’s Current Advisory Agreement with the Investment Adviser is expected to terminate upon the completion of the Transition described above. Accordingly, you are being asked to approve the Amended and Restated Advisory Agreement with respect to your Fund to be effective upon shareholder approval and

7

completion of the Transition (regardless of the order in which those events occur, although it is expected that the shareholder meeting will take place prior to completion of the Transition). Such approval will enable the Investment Adviser to continue to provide investment advisory services to the Funds without interruption. Certain other changes to the existing terms of the advisory arrangements are also being proposed to standardize, clarify and modernize various provisions of the Current Advisory Agreements. Shareholders of each Fund will vote separately. If the Amended and Restated Advisory Agreement is approved, it will continue through June 30, 2015 and for subsequent one-year terms thereafter so long as such continuance is approved in a manner consistent with the 1940 Act. If the Amended and Restated Advisory Agreement is not approved for a Fund, the Board will evaluate other short- and long-term options permitted by law, which could include an interim investment advisory agreement of limited duration for that Fund.

The approval of the Master Subadvisory Agreement is not required as a result of the IPO or the Transition. The Amended and Restated Advisory Agreement provides that the Investment Adviser may delegate any or all of its duties to one or more sub-advisers, including sub-advisers that are affiliated with the Investment Adviser. Currently, the Investment Adviser has not delegated any of its responsibilities to a sub-adviser, and it has no current plan to do so. The Investment Adviser may, however, in the future consider engaging a sub-adviser that is controlled by or under common control with the Investment Adviser, for example, to give a Fund access to portfolio managers and investment personnel located in other offices of the Investment Adviser or its affiliates or to increase flexibility in assigning portfolio managers to a Fund. The Master Subadvisory Agreement would apply only in instances where the Investment Adviser delegates duties to a sub-adviser that is controlled by or under common control with the Investment Adviser and only if, and when, the Investment Adviser and the Board determine that it would be in the best interests of a Fund to engage such a sub-adviser. Shareholders of each Fund will vote separately. Guidance issued by the staff of the Securities and Exchange Commission permits an investment adviser to a mutual fund to appoint a wholly-owned affiliate as sub-adviser without shareholder approval, provided, among other things, that (a) there is no reduction in the nature or level of services provided to a fund, (b) there is no increase in fees paid by funds for those services and (c) existing and prospective shareholders are informed of the arrangement. If the Master Subadvisory Agreement is not approved for a Fund, the Investment Adviser and the Board may nonetheless determine to appoint such sub-adviser without shareholder approval in reliance on such Securities and Exchange Commission staff guidance. The Master Subadvisory Agreement would not permit delegation to a sub-adviser that is not controlled by or under common control with the Investment Adviser without prior shareholder approval.

The remainder of this section includes more detail on each of Proposal 2(a) and Proposal 2(b), including additional information on the terms of the Current Advisory Agreements, the Amended and Restated Advisory Agreement and the Master Subadvisory Agreement. The section concludes with the Board’s recommendations.

8

Information Regarding the Investment Adviser

The Investment Adviser serves as the investment adviser to the Funds pursuant to the Current Advisory Agreements. The Investment Adviser is a limited partnership organized under the laws of Delaware. The Investment Adviser’s general partner is Artisan Investments GP LLC (“Artisan Investments”), a Delaware limited liability company whose sole member is Artisan Holdings. The Investment Adviser and Artisan Investments are wholly-owned subsidiaries of Artisan Holdings, a limited partnership organized under the laws of Delaware. Artisan Holdings, together with Artisan Investments, controls a 100% interest in the Investment Adviser. Prior to the IPO, AIC, a Wisconsin corporation 100% controlled by Andrew A. Ziegler and Carlene M. Ziegler, who are married to each other, was the sole general partner of Artisan Holdings. At the time of the IPO, APAM replaced AIC as the general partner of Artisan Holdings. The principal business address of each of these entities is 875 East Wisconsin Avenue, Suite 800, Milwaukee, Wisconsin 53202.

Additional information regarding the Investment Adviser and its officers and directors is set forth in Appendix F. Information regarding other funds with investment objectives similar to those of an Artisan Fund for which the Investment Adviser acts assub-adviser is set forth in Appendix G.

Information Regarding the Transition

On March 12, 2013, APAM closed the initial public offering of its Class A common stock. In connection with the IPO, APAM and Artisan Holdings entered into a series of transactions and agreements designed to create a capital structure that would preserve the ability to conduct business through a partnership (Artisan Holdings), while permitting the partnership to raise additional capital and provide access to liquidity through a public company (APAM). At the time of the IPO, APAM replaced AIC as the general partner of Artisan Holdings. APAM conducts its business activities through its operating subsidiaries, namely (with respect to the Funds), the Investment Adviser and Artisan Partners Distributors LLC (“Distributors”), the Funds’ principal distributor, which are each wholly-owned subsidiaries of Artisan Holdings.

In connection with the IPO, AIC and each employee-partner of Artisan Holdings entered into the Stockholders Agreement pursuant to which they granted the right to vote the Covered Shares (which shares constitute a majority of the voting power of APAM) to a three-person stockholders committee. Pursuant to the Stockholders Agreement, Mr. Ziegler, as the AIC “designee” on the committee, has the sole right, in consultation with the other members of the committee, to determine how to vote the Covered Shares. As a result, the stockholders committee, and initially solely Mr. Ziegler, is able to elect all of the members of APAM’s board of directors (subject to the obligation of the stockholders committee under the terms of the Stockholders Agreement to vote in support of certain nominees) and thereby control APAM’s management and affairs. Consequently, AIC retained control of the Investment

9

Adviser. However, Mr. Ziegler, as the AIC “designee”, will be replaced by a new third member of the stockholders committee, and AIC will cease to have the right to determine how to vote the Covered Shares, upon the earliest to occur of (i) Mr. Ziegler’s death or disability, (ii) the voluntary termination of Mr. Ziegler’s employment with APAM, including by reason of the scheduled expiration of his employment on March 12, 2014 (which is the first anniversary of the IPO) and (iii) 180 days after the effective date of Mr. Ziegler’s involuntary termination of employment with APAM. When AIC no longer has the right to determine how to vote the Covered Shares, AIC will no longer control the Investment Adviser. Accordingly, it is expected that the Investment Adviser will undergo a change of control no later than March 12, 2014. Under the 1940 Act, each of the investment advisory agreements between the Funds and the Investment Adviser will terminate automatically in the event of their assignment, as defined in the 1940 Act. An assignment occurs under the 1940 Act if the Investment Adviser undergoes a change of control as recognized by the 1940 Act. Upon the occurrence of such an assignment, the Investment Adviser could continue to act as adviser to any such Fund only if the Board and Fund’s shareholders approve a new investment advisory agreement. Accordingly, your Fund’s investment advisory agreement with the Investment Adviser will automatically terminate at the time of the Transition, and your Fund’s shareholders must approve the Amended and Restated Advisory Agreement between the Investment Adviser and the Corporation on behalf of your Fund for the Investment Adviser to continue in that capacity.

The new third member of the stockholders committee will be selected by the other two members (currently, Eric R. Colson, President and Chief Executive Officer of APAM, and Daniel J. O’Keefe, a portfolio manager on the Investment Adviser’s Global Value team). Pursuant to the terms of the Stockholders Agreement, any future vacancy on the stockholders committee will be filled by a joint decision of the two remaining members, provided that the chief executive officer of APAM will automatically fill the vacancy if he or she is a holder of any Covered Shares and not already a member of the stockholders committee. If the remaining members of the stockholders committee cannot agree on a third member or if there are fewer than two remaining members, then vacancies will be filled by the vote of holders of the Covered Shares from among candidates nominated by the five largest holders of the Covered Shares, other than AIC. In all cases, members of the stockholders committee must (i) be employees of APAM or one of its subsidiaries and (ii) holders of Covered Shares.

The IPO and related reorganization transactions did not result in any changes in the management or operation of the investment advisory functions performed by the Investment Adviser with respect to the Funds, including any changes in the personnel engaged in the day-to-day investment management of the Funds or the investment style, philosophy or strategy of the Funds. Neither the IPO nor the related reorganization transactions has caused any reduction in the quality of services now provided to any of the Funds or had any adverse effect on the Investment Adviser’s ability to fulfill its obligations to the Funds under the investment advisory agreements for the Funds.

10

Furthermore, the Transition will not result in any changes in the management or operation of the investment advisory functions performed by the Investment Adviser with respect to the Funds, including any changes in the personnel engaged in theday-to-day investment management of the Funds or the investment style, philosophy or strategy of the Funds.

Current Investment Advisory Agreements

The Current Advisory Agreements are between the Investment Adviser and the Corporation on behalf of each Fund. The Current Advisory Agreements, except for Artisan Global Small Cap Fund’s agreement, were most recently approved by the Board at a meeting held on November 13, 2012. Artisan Global Small Cap Fund’s Current Advisory Agreement was most recently approved by the Board at a meeting held on February 12, 2013. Additional information regarding the Current Advisory Agreements is provided in Appendix D.

Comparison of the Current Investment Advisory Agreements and the Amended and Restated Investment Advisory Agreement

Given the need for new investment advisory agreements to replace the Current Advisory Agreements upon their termination, the Board and the Investment Adviser decided to take the opportunity to standardize, clarify and modernize various provisions of the Current Advisory Agreements. Because the Current Advisory Agreements, one for each of the thirteen series of Artisan Funds, were implemented at different times over the course of many years, the Current Advisory Agreements differ in some cases from Fund to Fund and some of the Current Advisory Agreements contain outdated provisions. The Board believes that this standardization, and the combination of all the Current Advisory Agreements into a single Amended and Restated Advisory Agreement for all the Funds, will benefit the Funds by eliminating outdated provisions, making the administration of the Funds more efficient and providing more flexibility for the operations of the Funds, within the limits of applicable law. There is no change in the rate of the advisory fees that the Funds will pay to the Investment Adviser under the Amended and Restated Advisory Agreement.

The Board has approved, and is recommending to shareholders of each Fund that they approve, the Amended and Restated Advisory Agreement to be effective upon shareholder approval and completion of the Transition. A copy of the Amended and Restated Advisory Agreement is provided in Appendix E. Except as described below, the terms of the proposed Amended and Restated Advisory Agreement are substantively identical to those of the Current Advisory Agreements. The terms of the Amended and Restated Advisory Agreement and a summary of the material differences between the Current Advisory Agreements and the Amended and Restated Advisory Agreement are described below. The Amended and Restated Advisory Agreement is qualified in its entirety by reference to Appendix E. For convenience of reference, and except when noting differences between the Current Advisory

11

Agreements and the Amended and Restated Advisory Agreement, the agreements are collectively referred to herein as the “Advisory Agreements.”

Engagement of the Investment Adviser. The Advisory Agreements provide that the Investment Adviser will provide certain investment advisory services.

The Current Advisory Agreements provide that the Investment Adviser shall manage the investment and reinvestment of the assets of the Funds, subject to the supervision of the Board. The Amended and Restated Advisory Agreement clarifies that the Investment Adviser shall manage such assets subject to such policies as the Board may determine.

The Advisory Agreements similarly provide that the Investment Adviser shall give due consideration to the investment policies and restrictions and the other statements concerning each Fund in the Corporation’s articles of incorporation and bylaws, registration statements under the 1940 Act and the Securities Act of 1933, as amended, and to the provisions of the Internal Revenue Code, as applicable to each Fund as a regulated investment company.

The Amended and Restated Advisory Agreement further clarifies that, as part of such investment program, the Investment Adviser is authorized to make the decisions to buy or sell portfolio investments for the Funds. Some of the Current Advisory Agreements provide that the Investment Adviser is authorized to make decisions to buy or sell securities, options and futures contracts. Other Current Advisory Agreements provide that the Investment Adviser is authorized to make decisions to buy or sell securities, options and futures contracts and other instruments. The use of “portfolio investments” in the Amended and Restated Advisory Agreement, a broader term encompassing all of the financial instruments provided for in the Current Advisory Agreements, is intended to give the Investment Adviser increased flexibility with respect to a variety of modern financial instruments. This investment flexibility could, in the future, assist each Fund in achieving its investment objective.

With respect to portfolio brokerage, the Current Advisory Agreements simply reference the relevant statutory standard under Section 28(e) of the Securities Exchange Act of 1934. The Amended and Restated Advisory Agreement recites the standard in full and provides, among other things, that in effecting a security or other transaction for a Fund the Investment Adviser shall seek to obtain best execution for the Fund, taking into account all factors that the Investment Adviser deems relevant.

12

Sub-advisers. The Amended and Restated Advisory Agreement expressly provides that the Investment Adviser may, subject to the oversight of the Investment Adviser and provided that the Investment Adviser (not any Fund) bears any additional costs for such subadvisory services, delegate to one or more sub-advisers any of the Investment Adviser’s duties under the agreement with respect to any Fund.

None of the Current Advisory Agreements, except for Artisan Global Small Cap Fund’s and Artisan Global Equity Fund’s agreements, addresses delegation of responsibilities. The Investment Adviser has no current plans to delegate responsibilities to any sub-adviser.

The Amended and Restated Advisory Agreement provides that no such delegation of responsibilities will relieve the Investment Adviser of its obligations under the agreement.

Further, the Amended and Restated Advisory Agreement provides that the retention or termination of any sub-adviser shall be approved in advance by the Board in conformity with the requirements of the 1940 Act and the shareholders of the Fund if required under any applicable provisions of the 1940 Act and the rules and regulations under the 1940 Act, subject to any applicable guidance or interpretation of the SEC or its staff. The Amended and Restated Advisory Agreement explicitly permits the Investment Adviser to operate in a manner consistent with regulatory guidance and interpretations, which may provide advantages and operational flexibility from time to time.

Expenses to be Paid by the Investment Adviser. The Advisory Agreements provide that the Investment Adviser, at its own expense, shall furnish to each Fund office space and all necessary office facilities, equipment and personnel for managing each Fund. The Advisory Agreements also provide that the Investment Adviser shall assume other expenses incurred by it in connection with managing the assets of each Fund, such as marketing shares of the Funds and all expenses of placement of securities orders and related bookkeeping.

The Amended and Restated Advisory Agreement clarifies that the Investment Adviser will assume all expenses of marketing shares of each Fund to the extent that such expenses exceed amounts paid under any plan of distribution of shares pursuant to Section 12(b) of the 1940 Act. The Funds have not currently adopted a distribution plan pursuant to Section 12(b) of the 1940 Act and have no current intention to do so. The Amended and Restated Advisory Agreement also clarifies that the Investment Adviser and the Funds will each assume a portion of all fees, dues and other expenses related to membership of the Funds in any trade association or the like, as

13

may be determined by the Board from time to time. Currently, each of the Investment Adviser and the Funds assume one-half of all such fees, dues and other expenses. Although there is no present intention to allocate such expenses in a different manner if the Amended and Restated Advisory Agreement is adopted, the Amended and Restated Advisory Agreement provides the Board with the flexibility to change this allocation. Lastly, the Amended and Restated Advisory Agreement clarifies that the Investment Adviser will not assume any expenses of or for any Fund not otherwise expressly assumed by the Investment Adviser in the agreement.

Expenses to be Paid by the Funds. The Amended and Restated Advisory Agreement provides that the Funds shall pay all expenses of their operations not specifically assumed by the Investment Adviser, including, among other things, all charges for the safekeeping and servicing of its cash, securities and other property, all charges of legal counsel and independent accountants, all compensation of directors other than those affiliated with the Investment Adviser and all expenses incurred in connection with their services to the Funds, all expenses of shareholder meetings, all expenses of printing and mailing copies of the prospectuses, and all taxes and fees payable to federal, state or other governmental agencies, domestic or foreign. The Current Advisory Agreements contain similar terms, except that some of the Current Advisory Agreements do not clarify that the Funds shall pay all expenses of their operations not specifically assumed by the Investment Adviser.

There are minor differences among the Current Advisory Agreements relating to which expenses are assumed by the Investment Adviser versus the Funds. For example, the Current Advisory Agreements for Artisan International Fund and Artisan Small Cap Fund provide that expenses related to maintaining registration of the Funds under the 1933 Act (not including typesetting and printing expenses) are assumed by the Investment Adviser, whereas the other Funds’ Current Advisory Agreements state that the Funds will bear all expenses of maintaining the registration of the Funds under the 1933 Act and the 1940 Act. The Amended and Restated Advisory Agreement resolves this difference by clarifying that all registration expenses, whether under the 1933 Act or 1940 Act, are assumed by the Funds. This will not result in any increase of expenses to Artisan International Fund or Artisan Small Cap Fund because such Funds have historically borne all registration expenses (i.e., filing fees). All filing fees applicable to open-end investment companies such as the Funds are payable pursuant to Rule 24f-2 under the 1940 Act, and the Funds and the Investment Adviser have regarded these filing fees as expenses under the 1940 Act rather than under the 1933 Act.

Further, under the Amended and Restated Advisory Agreement, certain expenses relating to the determination of daily price computations currently borne by the Investment Adviser are being reallocated to the Funds. The

14

Current Advisory Agreements for Artisan Emerging Markets Fund, Artisan Global Value Fund, Artisan International Fund, Artisan Small Cap Fund and Artisan Value Fund (the “Five Funds”) provide that some or all expenses in determination of daily price computations are borne by the Investment Adviser. The Current Advisory Agreements for the eight other Funds already allocate such expenses to those Funds, although in practice the Investment Adviser has paid such expenses. The Amended and Restated Advisory Agreement clarifies that all expenses associated with daily price computations, including pricing services will be in the valuation of securities, will be paid by the Funds.

If approved, the reallocation to the Five Funds of the expenses in determination of daily price computations would result in a total additional cost to the Five Funds in the aggregate of approximately $60,000 annually (at current rates), representing an increase in the gross expense ratio of each of the Five Funds of less than 0.01%.

Limitation of Expenses of the Funds. The Current Advisory Agreements for Artisan International Fund and Artisan Small Cap Fund contain a provision limiting the expenses of those Funds under state law requirements. The Amended and Restated Advisory Agreement does not contain such provision because those state law requirements are no longer effective due to their preemption by the National Securities Markets Improvement Act of 1996. This change will not result in any increase of expenses to Artisan International Fund and Artisan Small Cap Fund.

Compensation of the Investment Adviser. As noted above, there is no change in the rate of the advisory fees that the Funds will pay to the Investment Adviser under the Amended and Restated Advisory Agreement. The Advisory Agreements provide that the Funds will pay the Investment Adviser a monthly fee with respect to each Fund on such Fund’s average daily net assets. The Amended and Restated Advisory Agreement adds that if the Investment Adviser serves for less than the whole of a month, its compensation will be prorated. The current fee schedule for each Fund is provided in Appendix D.

Services of the Investment Adviser Not Exclusive. The Advisory Agreements provide that the services of the Investment Adviser are not to be deemed exclusive, and the Investment Adviser is free to render similar services to others so long as its services under the agreement are not impaired by such other activities. The Amended and Restated Advisory Agreement adds that such provision applies to the Investment Adviser and any person controlled by or under common control with the Investment Adviser. This clarification is intended to capture any sub-adviser(s) retained by the Investment Adviser or any internal functions of the Investment Adviser that may, in the future, be performed by affiliated entities.

15

Limitation of Liability. The Advisory Agreements contain substantially identical provisions, which provide that the Investment Adviser is not liable to a Fund or to any shareholder of a Fund for any act or omission in the course of, or in connection with, rendering services under the agreement, unless there is willful misfeasance, bad faith or gross negligence on the part of the Investment Adviser or reckless disregard of its obligations and duties under the agreement.

Duration and Renewal. The Amended and Restated Advisory Agreement clarifies that the agreement shall continue in effect through June 30, 2015. The Advisory Agreements similarly provide that the agreement shall continue in effect thereafter from year to year only so long as such continuance is specifically approved at least annually by a majority of those directors who are not interested persons of the Corporation or the Investment Adviser and by either the Board or vote of a majority of shareholders of such Funds.

The Amended and Restated Advisory Agreement further clarifies that, if continuance of the agreement is submitted to shareholders of a Fund for their approval, and such shareholders fail to approve such continuance, the Investment Adviser may continue to serve as such in a manner consistent with the 1940 Act and the rules and regulations under the 1940 Act, subject to any applicable guidance or interpretation of the SEC or its staff. This clarification permits the Funds and the Investment Adviser to operate in a manner consistent with regulatory guidance and interpretations, which may provide advantages and operational flexibility from time to time.

Termination. The Advisory Agreements provide that the agreement may be terminated with respect to any Fund at any time by the Board or vote of a majority of the shareholders of such Fund upon 60 days’ written notice to the Investment Adviser, or by the Investment Adviser at any time upon 60 days’ written notice to the Corporation. The Advisory Agreements also require that the agreement terminate automatically in the event of its assignment.

The Amended and Restated Advisory Agreement clarifies that no delegation of responsibilities by the Investment Adviser to a sub-adviser, as discussed under “Engagement of Investment Adviser” above, shall be deemed to constitute an assignment.

Further, because the Current Advisory Agreements have been combined into a single Amended and Restated Advisory Agreement, the Amended and Restated Advisory Agreement adds that termination of the agreement with respect to any one Fund shall not be deemed to terminate the agreement with respect to any other Fund. The Amended and Restated Advisory Agreement also clarifies that the agreement may be terminated without payment of any penalty with written notice delivered or mailed by registered mail, postage prepaid.

16

Non-Liability of Directors and Shareholders. The Current Advisory Agreements for Artisan International Fund, Artisan Mid Cap Fund, Artisan Small Cap Fund and Artisan Small Cap Value Fund contain a provision relating to non-liability of directors and shareholders for obligations of the Corporation. The Amended and Restated Advisory Agreement does not contain this language. The Wisconsin Business Corporation Law provides that shareholders are not liable for a corporation’s obligations. Thus, the lack of a provision in this regard does not result in any heightened liability of shareholders under the Amended and Restated Advisory Agreement.

Amendment. The Amended and Restated Advisory Agreement provides that the agreement may not be amended orally, but only by an instrument in writing signed by the party against which enforcement of the amendment is sought.

The Current Advisory Agreements for Artisan International Fund, Artisan International Small Cap Fund, Artisan International Value Fund, Artisan Mid Cap Fund, Artisan Mid Cap Value Fund, Artisan Small Cap Fund and Artisan Small Cap Value Fund require the vote of a majority of the outstanding shares of a Fund, in addition to the vote of a majority of those directors who are not “interested persons” under the 1940 Act, in order to amend the agreement. The Current Advisory Agreements for the other Funds provide that if shareholder approval is required under the 1940 Act, then an amendment shall become effective only after it is approved by a vote of a majority of the outstanding shares of a Fund, in addition to the vote of a majority of those directors who are not “interested persons” under the 1940 Act; otherwise, a written amendment of the agreement is subject to the approval of the affirmative vote of a majority of those directors who are not “interested persons” under the 1940 Act. The Amended and Restated Advisory Agreement clarifies that no amendment shall become effective until approved in a manner consistent with the 1940 Act (including, if necessary, shareholder approval), the rules and regulations thereunder and any applicable guidance or interpretation of the SEC or its staff. The Amended and Restated Advisory Agreement explicitly permits the Funds and the Investment Adviser to operate in a manner consistent with regulatory guidance and interpretations, which may provide advantages and operational flexibility from time to time.

Other Updating Changes. In connection with the preparation of a single Amended and Restated Advisory Agreement for all Funds, there are certain other non-material updating changes reflected in the agreement.

For ease of reference, a new “Definitions” section has been added to the agreement. This new section provides definitions for certain terms in the agreement, such as “a majority of the outstanding shares of the Fund” and “affiliated person.”

17

Newly added Schedule A, which may be amended from time to time to add new funds offered by the fund complex, lists all of the Funds and their annual fee rates.

Terms of the Form of Master Subadvisory Agreement

The Board has approved, and is recommending to shareholders of each Fund that they approve, the Master Subadvisory Agreement. The Master Subadvisory Agreement would be entered into only with a sub-adviser that is controlled by or under common control with the Investment Adviser (a “Related Sub-Adviser”) and only if, and when, the Investment Adviser and the Board determine that it would be in the best interests of a Fund to engage such sub-adviser. If the Master Subadvisory Agreement is not approved for a Fund, the Investment Adviser and the Board may nonetheless determine to appoint a Related Sub-Adviser without shareholder approval in reliance on applicable guidance from the SEC and its staff. Currently, the Investment Adviser has not delegated any of its responsibilities to any sub-adviser, and it has no current plan to do so. A copy of the Master Subadvisory Agreement is provided in Appendix H. The material terms of the Master Subadvisory Agreement are described below. The Master Subadvisory Agreement is qualified in its entirety by reference to Appendix H.

Duties as Sub-adviser. The Master Subadvisory Agreement provides that, subject to the supervision of the Investment Adviser and to such policies as the Board may determine, the sub-adviser will provide such services for all or that portion of any Fund, as agreed upon from time to time by the Investment Adviser and the sub-adviser.

The Master Subadvisory Agreement further provides that the sub-adviser will perform its duties and obligations under the agreement, subject to certain understandings, including, but not limited to, that the sub-adviser: (i) may be authorized to make the decisions to buy and sell portfolio investments, to place each Fund’s portfolio transactions with broker-dealers and to negotiate the terms of such transactions, including brokerage commissions on brokerage transactions, on behalf of each Fund; (ii) will act in conformity with the written instructions and directions of the Investment Adviser and the Board, as may be determined from time to time; (iii) will at all times comply with and maintain policies and procedures reasonably designed to ensure its compliance with applicable laws or regulations; (iv) will provide the Investment Adviser and the Funds’ custodian with information relating to all transactions for the account of the Funds that have been placed by the sub-adviser; and (v) will provide the Board with periodic and special reports as the Board may reasonably request.

Compensation of the Sub-adviser. The Master Subadvisory Agreement provides that the Investment Adviser will pay the sub-adviser a monthly fee with respect to each Fund on such Fund’s average daily net assets. The fee

18

schedule for each Fund would be set forth on Schedule A of the agreement. Schedule A of the agreement adds that if the sub-adviser serves for less than the whole of a month, its compensation will be prorated.

Fee Waivers and Expense Limitations. The Master Subadvisory Agreement provides that if, for any fiscal year of a Fund, the amount of the advisory fee which a Fund would otherwise be obligated to pay to the Investment Adviser is reduced as a result of a contractual or voluntary fee waiver or expense limitation put into place by the Investment Adviser, the fee payable to the sub-adviser would be thus reduced proportionately.

Expenses to be Paid by the Sub-adviser. The Master Subadvisory Agreement provides that the sub-adviser will be responsible for its own expenses in the performance of its duties under the agreement, but the sub-adviser will not be responsible for the expenses of the Investment Adviser or any Fund. Further, the sub-adviser agrees that it has no claim against any Fund with respect to its compensation under the agreement, and that it will look only to the Investment Adviser for payment of its expenses.

Limitation of Liability of the Sub-adviser. The Master Subadvisory Agreement provides that the sub-adviser is not liable to the Investment Adviser, the Corporation or to any shareholder of a Fund for any act or omission in the course of, or in connection with, rendering services under the agreement, unless there is willful misfeasance, bad faith or gross negligence on the part of the sub-adviser or reckless disregard of its obligations and duties under the agreement.

Duration and Renewal. The Master Subadvisory Agreement provides that the agreement is effective upon the date of the mutual agreement of the Investment Adviser and the sub-adviser to add a Fund to Schedule A of the agreement. The Master Subadvisory Agreement shall continue in effect for two years from its addition to Schedule A and thereafter from year to year only so long as such continuance is specifically approved at least annually by a majority of those directors who are not interested persons of the Corporation, the Investment Adviser or the sub-adviser and by either the Board or vote of a majority of shareholders of such Funds.

The Master Subadvisory Agreement further provides that, if continuance of the agreement is submitted to shareholders of a Fund for their approval, and such shareholders fail to approve such continuance, the sub-adviser may continue to serve as sub-adviser in a manner consistent with the 1940 Act and the rules and regulations under the 1940 Act, subject to any applicable guidance or interpretation of the SEC or its staff. This clause permits the Investment Adviser, the Funds and the sub-adviser to operate in a manner consistent with regulatory guidance and interpretations, which may provide advantages and operational flexibility from time to time.

19

Termination. The Master Subadvisory Agreement provides that the agreement may be terminated with respect to any Fund at any time, without the payment of any penalty, by the Board or vote of a majority of the shareholders of such Fund upon 60 days’ written notice to the sub-adviser, or by the Investment Adviser or the sub-adviser at any time upon 60 days’ written notice to the other party and such Fund. The Master Subadvisory Agreement requires that the agreement terminate automatically in the event of its assignment or upon termination of the advisory agreement between the Investment Adviser and the Corporation. The termination of the Master Subadvisory Agreement with respect to any one Fund shall not be deemed to terminate the agreement with respect to any other Fund.

The Master Subadvisory Agreement also provides that if the agreement is terminated with respect to the sub-adviser, the Investment Adviser will assume the duties and responsibilities of the sub-adviser unless and until another sub-adviser is appointed to perform such duties and responsibilities.

Amendment. The Master Subadvisory Agreement provides that the agreement may not be amended orally, but only by an instrument in writing signed by the party against which enforcement of the amendment is sought.

The agreement adds that no amendment shall become effective until approved in a manner consistent with the 1940 Act (including, if necessary, shareholder approval), the rules and regulations thereunder and any applicable guidance or interpretation of the SEC or its staff. The Master Subadvisory Agreement explicitly permits the Funds and the sub-adviser to operate in a manner consistent with regulatory guidance and interpretations, which may provide advantages and operational flexibility from time to time.

Other Provisions. As noted above, the Master Subadvisory Agreement would not permit delegation to a sub-adviser that is not controlled by or under common control with the Investment Adviser without prior shareholder approval.

Approval of the Amended and Restated Investment Advisory Agreement by the Board and Approval of the Form of Master Subadvisory Agreement by the Board

At an in person meeting of the Board held on August 13, 2013, at which a majority of the Directors, including a majority of the Directors who are not “interested persons” of the Corporation or the Investment Adviser (the “Independent Directors”), were present, the Board considered and unanimously approved the Amended and Restated Advisory Agreement. At the meeting, the Board also considered and unanimously approved the Master Subadvisory Agreement. On the basis of the considerations discussed below, the Board concluded that the approval of the Amended and Restated Advisory Agreement and the Master Subadvisory Agreement would be in the best interests of each Fund.

20

The Board is recommending to shareholders of each Fund that they approve the Amended and Restated Advisory Agreement and the Master Subadvisory Agreement. The Amended and Restated Advisory Agreement would be effective upon shareholder approval and the completion of the Transition. The Amended and Restated Advisory Agreement would continue in effect through June 30, 2015. The Master Subadvisory Agreement would be entered into only with a sub-adviser that is controlled by or under common control with the Investment Adviser if and when the Investment Adviser and the Board determine that it would be in the best interests of a Fund to engage such sub-adviser.

Board Considerations in Approving the Amended and Restated Investment Advisory Agreement

In determining to approve the Amended and Restated Advisory Agreement between the Investment Adviser and the Corporation on behalf of each Fund, the Directors considered and reviewed all the information provided to them in connection with this matter by the Investment Adviser prior to and at their August 13, 2013 meeting, including the information described in this proxy statement. In all of their deliberations, the Independent Directors were advised by independent counsel to the Independent Directors.