Q2 2021 EARNINGS PRESENTATION ACI WORLDWIDE August 5, 2021 Exhibit 99.2

2 Private Securities Litigation Reform Act of 1995 Safe Harbor for Forward-Looking Statements This presentation contains forward- looking statements based on current expectations that involve a number of risks and uncertainties. The forward- looking statements are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. A discussion of these forward-looking statements and risk factors that may affect them is set forth at the end of this presentation. The Company assumes no obligation to update any forward-looking statement in this presentation, except as required by law.

Quarter in Review Odilon Almeida President and Chief Executive Officer 3

Three-Pillar Strategy for the New ACI 4 • Revenues and EBITDA at high end of expectations • Significantly grew sales pipeline in the quarter • Signed strategic global alliance with Microsoft • Well-positioned to accelerate revenue growth in the second half of 2021 • Expect to attain “Rule of 40” for full year 2021 Drive organic growth through operational discipline and a strong sales culture FIT FOR GROWTH Focus R&D on growth-rich solutions supported by innovation FOCUSED ON GROWTH Accretive M&A to drive additional growth and value creation STEP CHANGE VALUE CREATION

Microsoft Global Alliance 5 Creates Industry Leading Payments Platform in the Cloud Capitalize on Growing Global Demand Accelerates and Expands ACI’s Cloud Offerings • Multi-year global alliance offering best-in-class payments in the cloud, via Microsoft Azure • Joint go-to-market and innovation collaboration • Benefits for financial institutions include: − Accelerated path to digital transformation − Increased speed-to-market through new services

Financial Review Scott Behrens Chief Financial Officer 6

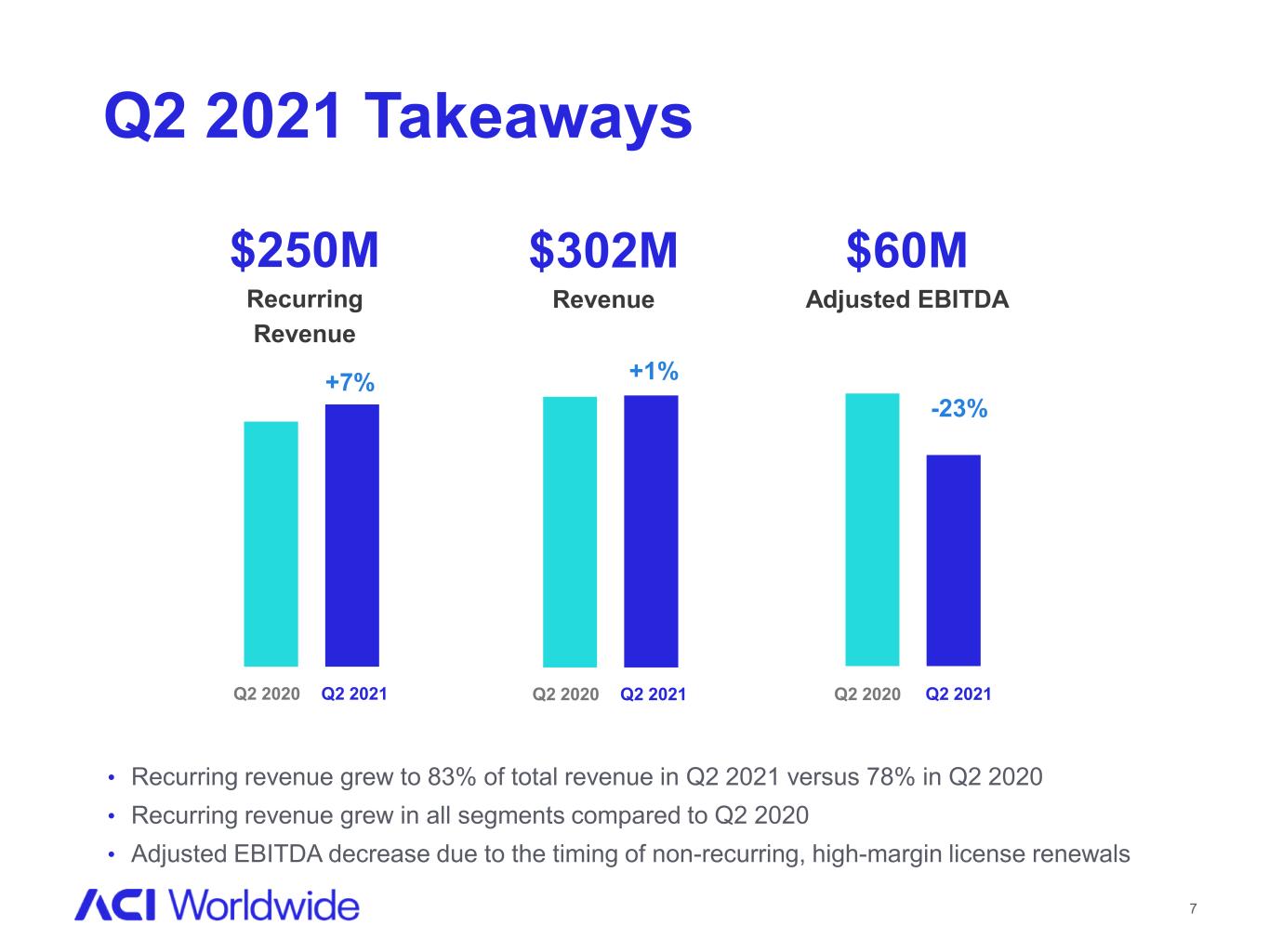

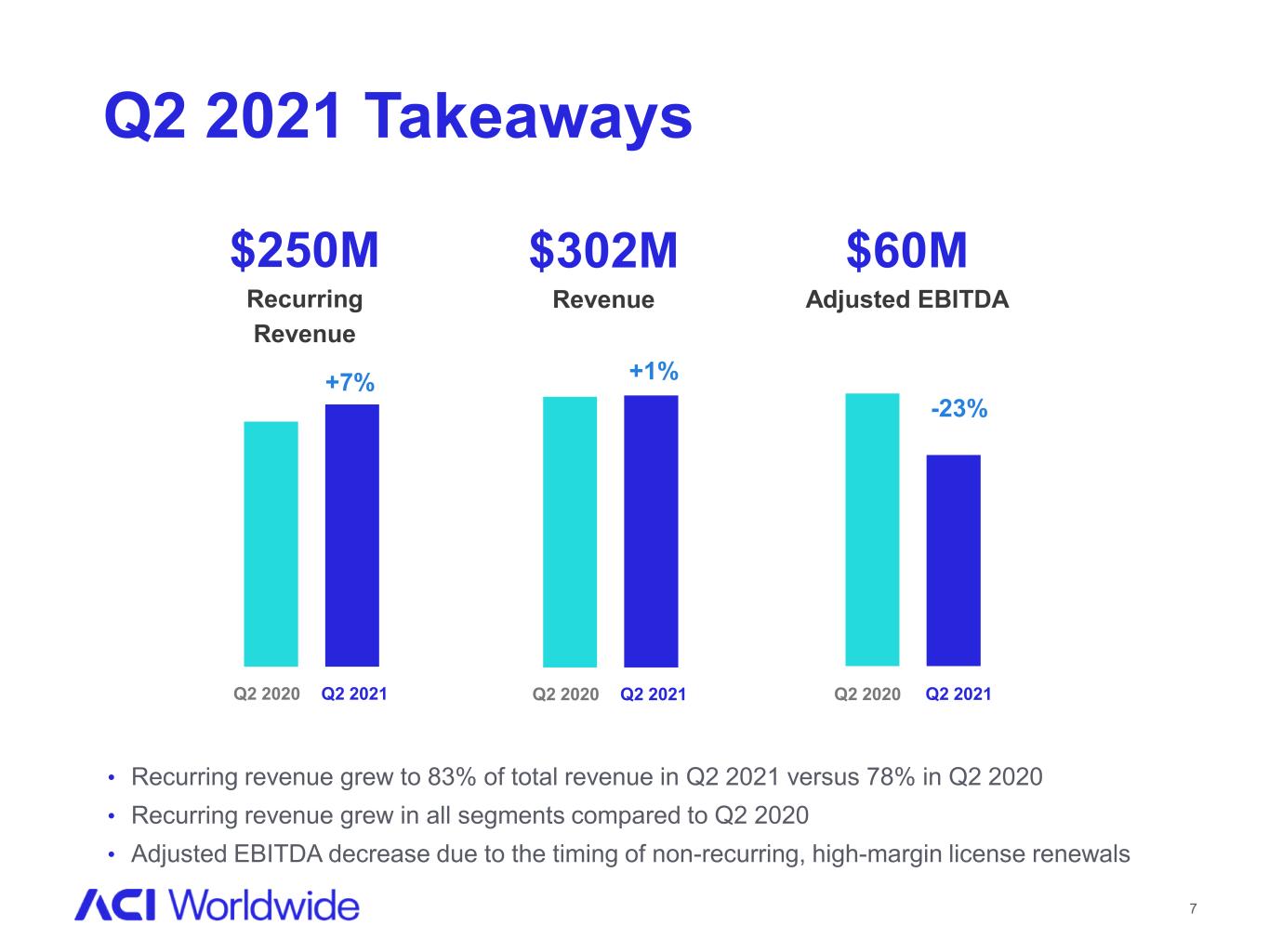

• Recurring revenue grew to 83% of total revenue in Q2 2021 versus 78% in Q2 2020 • Recurring revenue grew in all segments compared to Q2 2020 • Adjusted EBITDA decrease due to the timing of non-recurring, high-margin license renewals 7 Q2 2021 Takeaways $60M Adjusted EBITDA -23% Q2 2020 Q2 2021 +1% $302M Revenue Q2 2020 Q2 2021 +7% $250M Recurring Revenue Q2 2020 Q2 2021

Segment Results • Bank segment recurring revenue grew 2%, versus Q2 2020 • Merchant segment recurring revenue grew 5%, versus Q2 2020 • Biller segment recurring revenue grew 9%, versus Q2 2020 Debt and Liquidity • Ended quarter with $146 million in cash; approximately $474 million of available credit facility • Repurchased 1 million shares during the quarter • Paid down $25 million in debt during the quarter • Net debt leverage of 2.8x Introducing 2021 Revenue Guidance; Reiterating Adjusted EBITDA Guidance • 2021 revenue expected to be in a range of $1.335 billion to $1.345 billion • 2021 adjusted EBITDA expected to be in a range of $375 million to $385 million, with net adjusted EBITDA margin expansion • Q3 2021 revenue expected to be in a range of $310 million to $320 million and adjusted EBITDA in a range of $70 million to $80 million 8 Q2 2021 Takeaways

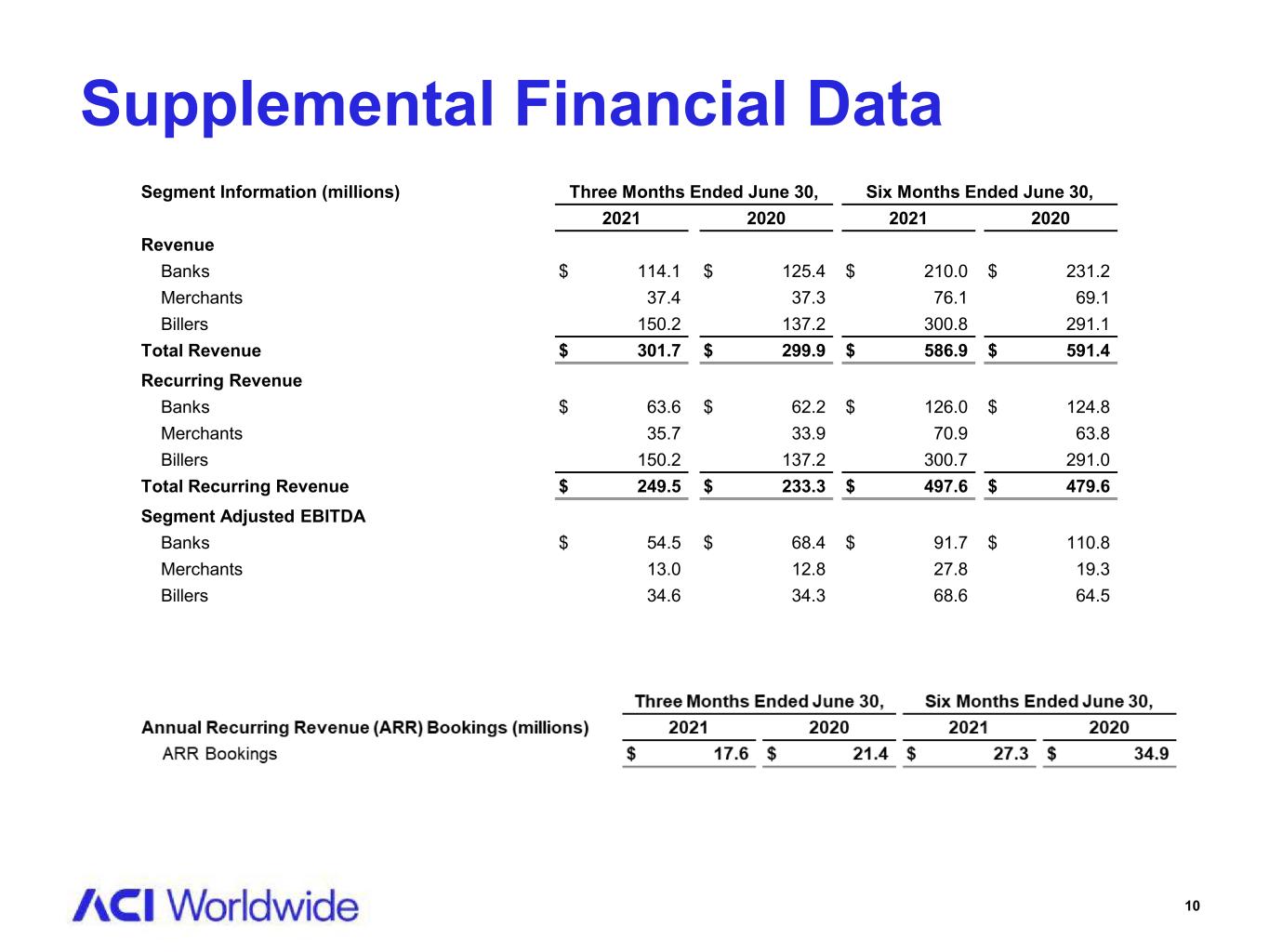

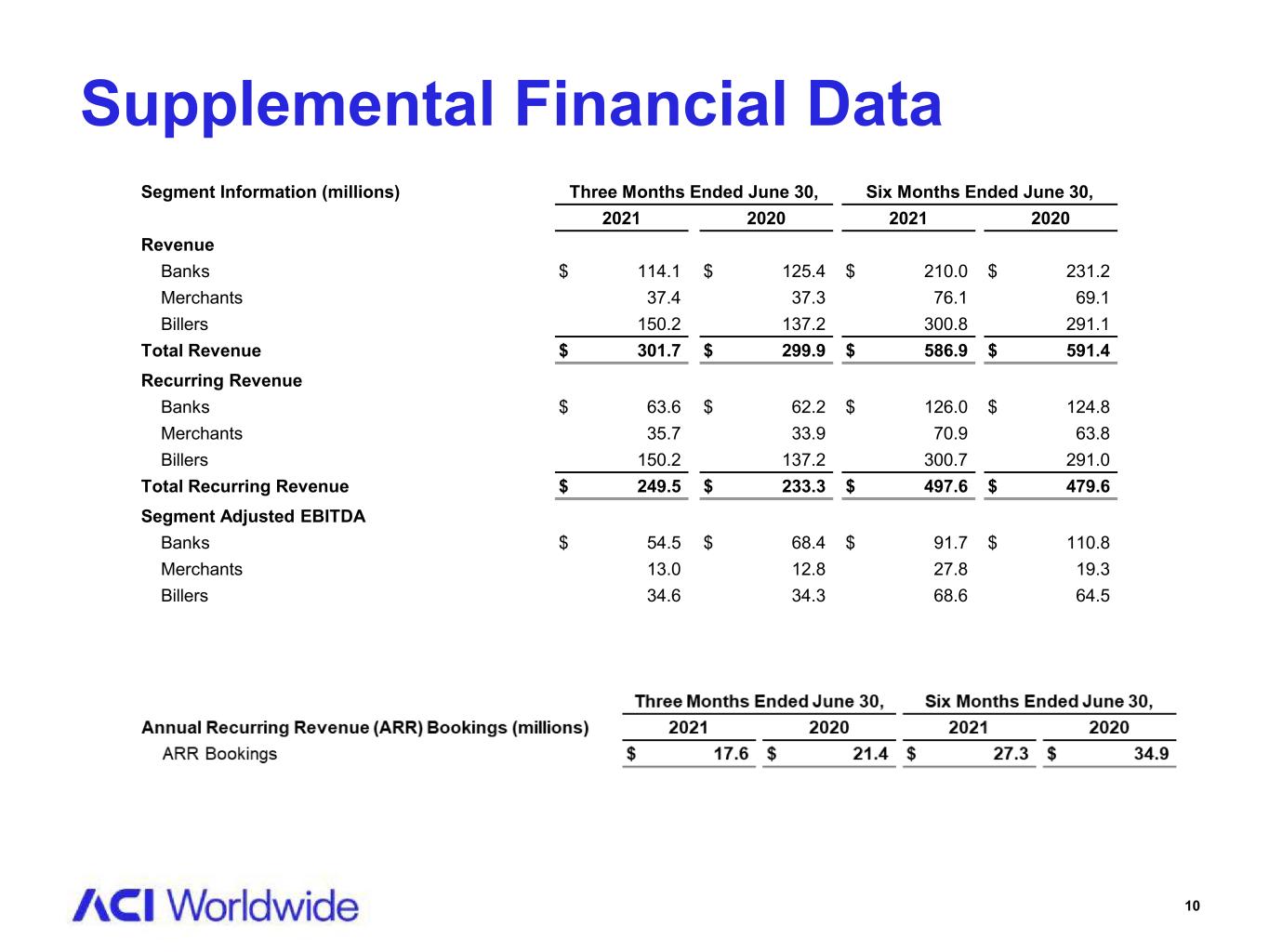

10 Segment Information (millions) Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Revenue Banks $ 114.1 $ 125.4 $ 210.0 $ 231.2 Merchants 37.4 37.3 76.1 69.1 Billers 150.2 137.2 300.8 291.1 Total Revenue $ 301.7 $ 299.9 $ 586.9 $ 591.4 Recurring Revenue Banks $ 63.6 $ 62.2 $ 126.0 $ 124.8 Merchants 35.7 33.9 70.9 63.8 Billers 150.2 137.2 300.7 291.0 Total Recurring Revenue $ 249.5 $ 233.3 $ 497.6 $ 479.6 Segment Adjusted EBITDA Banks $ 54.5 $ 68.4 $ 91.7 $ 110.8 Merchants 13.0 12.8 27.8 19.3 Billers 34.6 34.3 68.6 64.5 Supplemental Financial Data

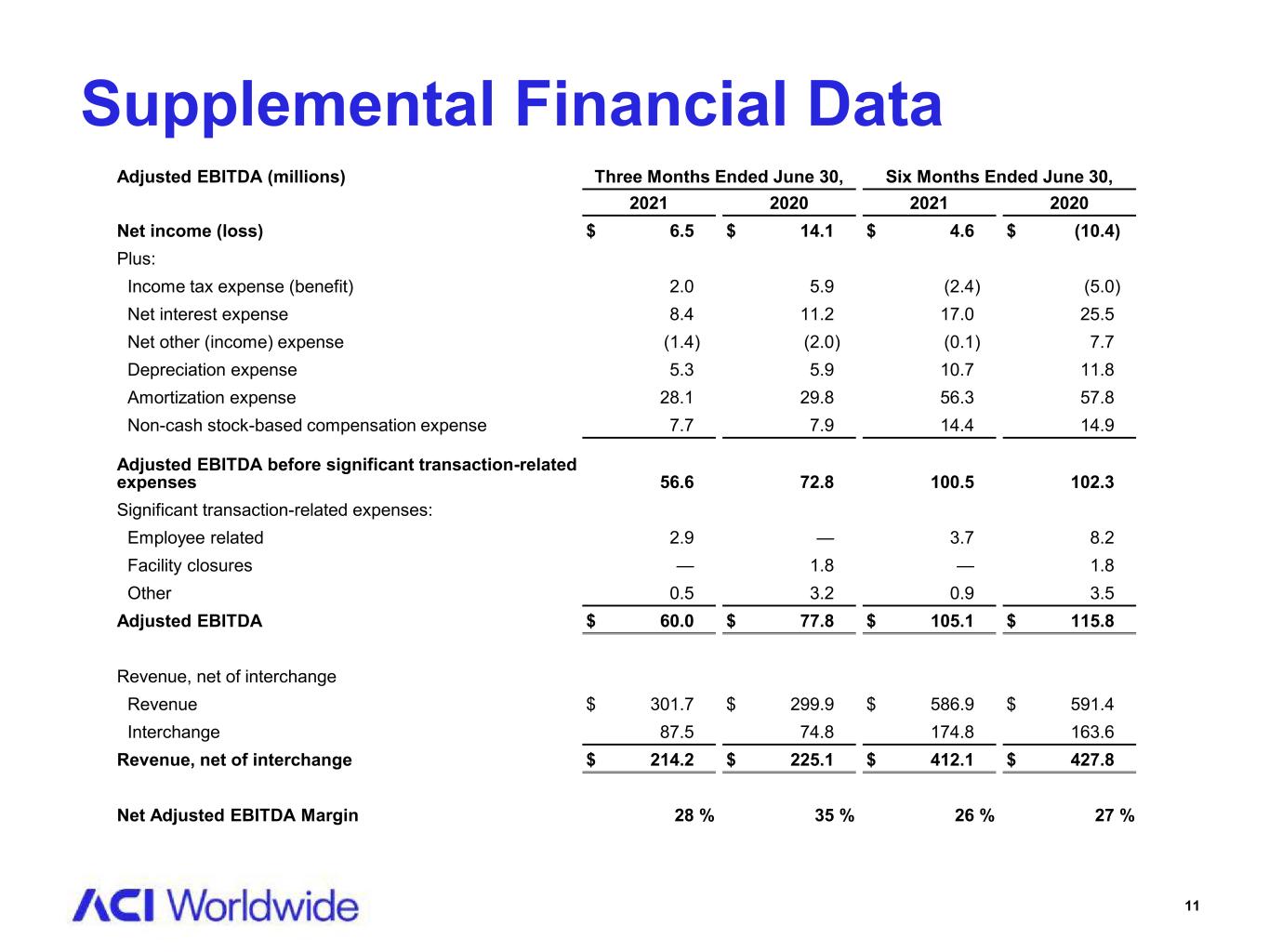

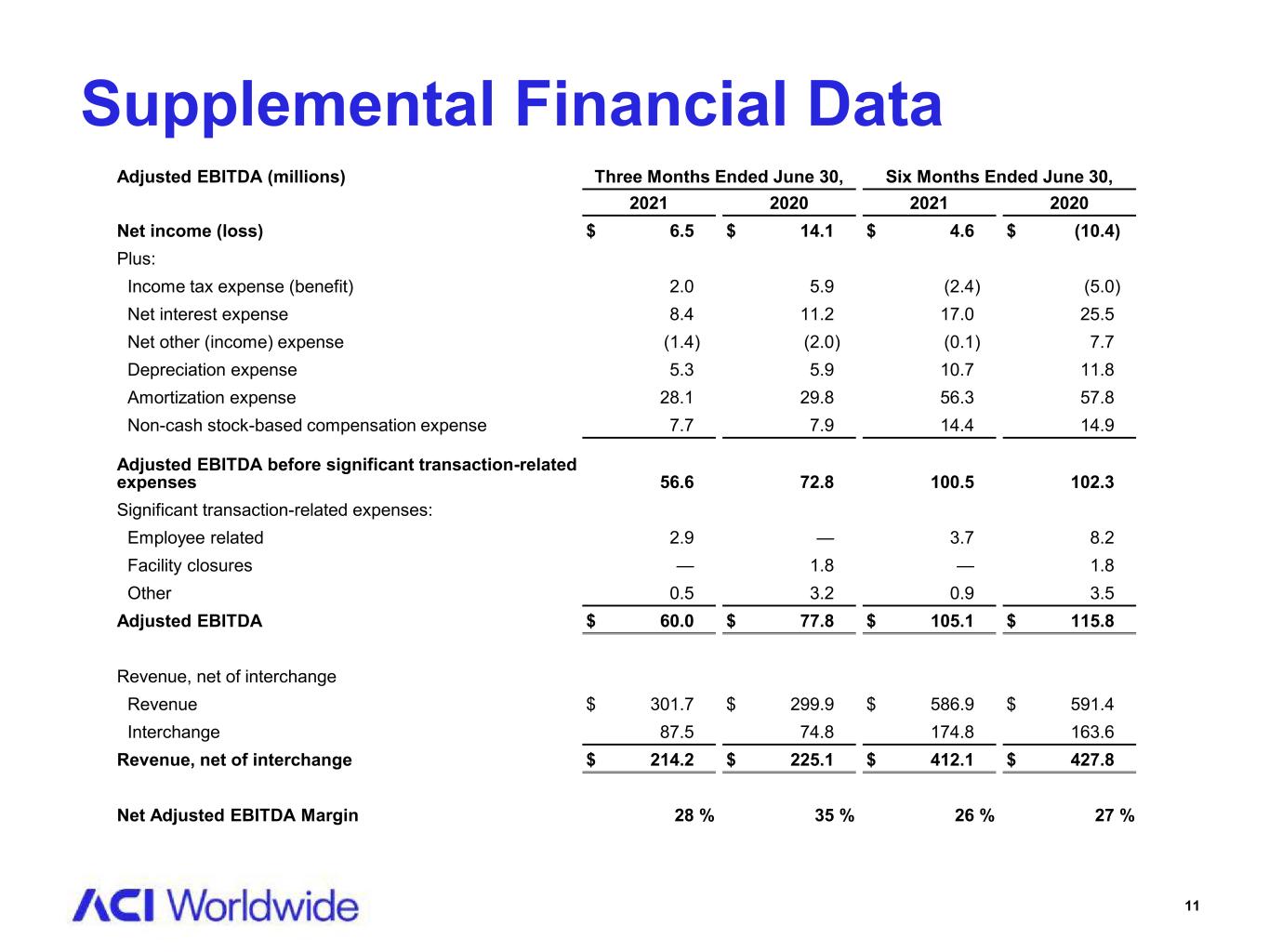

11 Supplemental Financial Data Adjusted EBITDA (millions) Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Net income (loss) $ 6.5 $ 14.1 $ 4.6 $ (10.4) Plus: Income tax expense (benefit) 2.0 5.9 (2.4) (5.0) Net interest expense 8.4 11.2 17.0 25.5 Net other (income) expense (1.4) (2.0) (0.1) 7.7 Depreciation expense 5.3 5.9 10.7 11.8 Amortization expense 28.1 29.8 56.3 57.8 Non-cash stock-based compensation expense 7.7 7.9 14.4 14.9 Adjusted EBITDA before significant transaction-related expenses 56.6 72.8 100.5 102.3 Significant transaction-related expenses: Employee related 2.9 — 3.7 8.2 Facility closures — 1.8 — 1.8 Other 0.5 3.2 0.9 3.5 Adjusted EBITDA $ 60.0 $ 77.8 $ 105.1 $ 115.8 Revenue, net of interchange Revenue $ 301.7 $ 299.9 $ 586.9 $ 591.4 Interchange 87.5 74.8 174.8 163.6 Revenue, net of interchange $ 214.2 $ 225.1 $ 412.1 $ 427.8 Net Adjusted EBITDA Margin 28 % 35 % 26 % 27 %

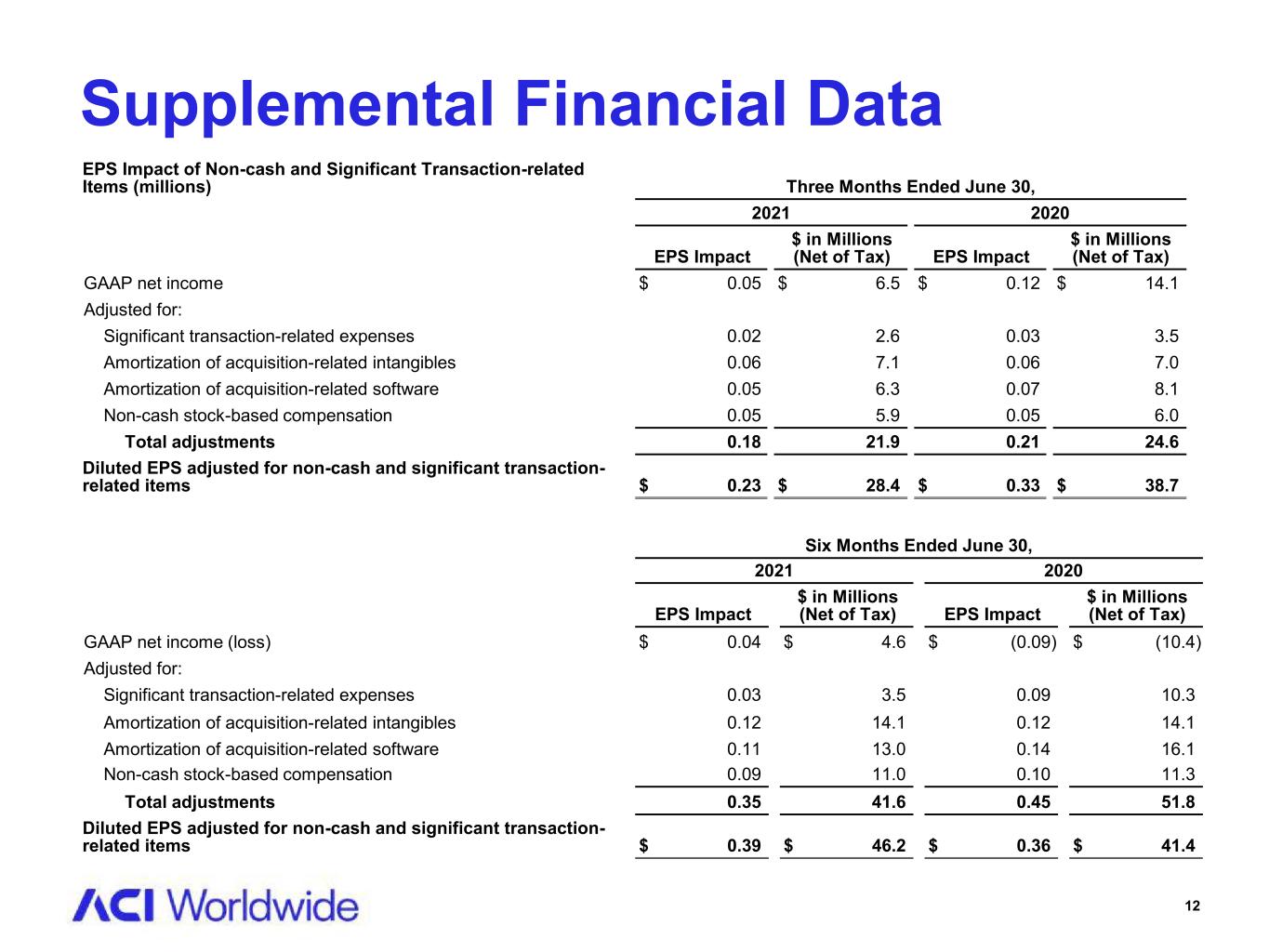

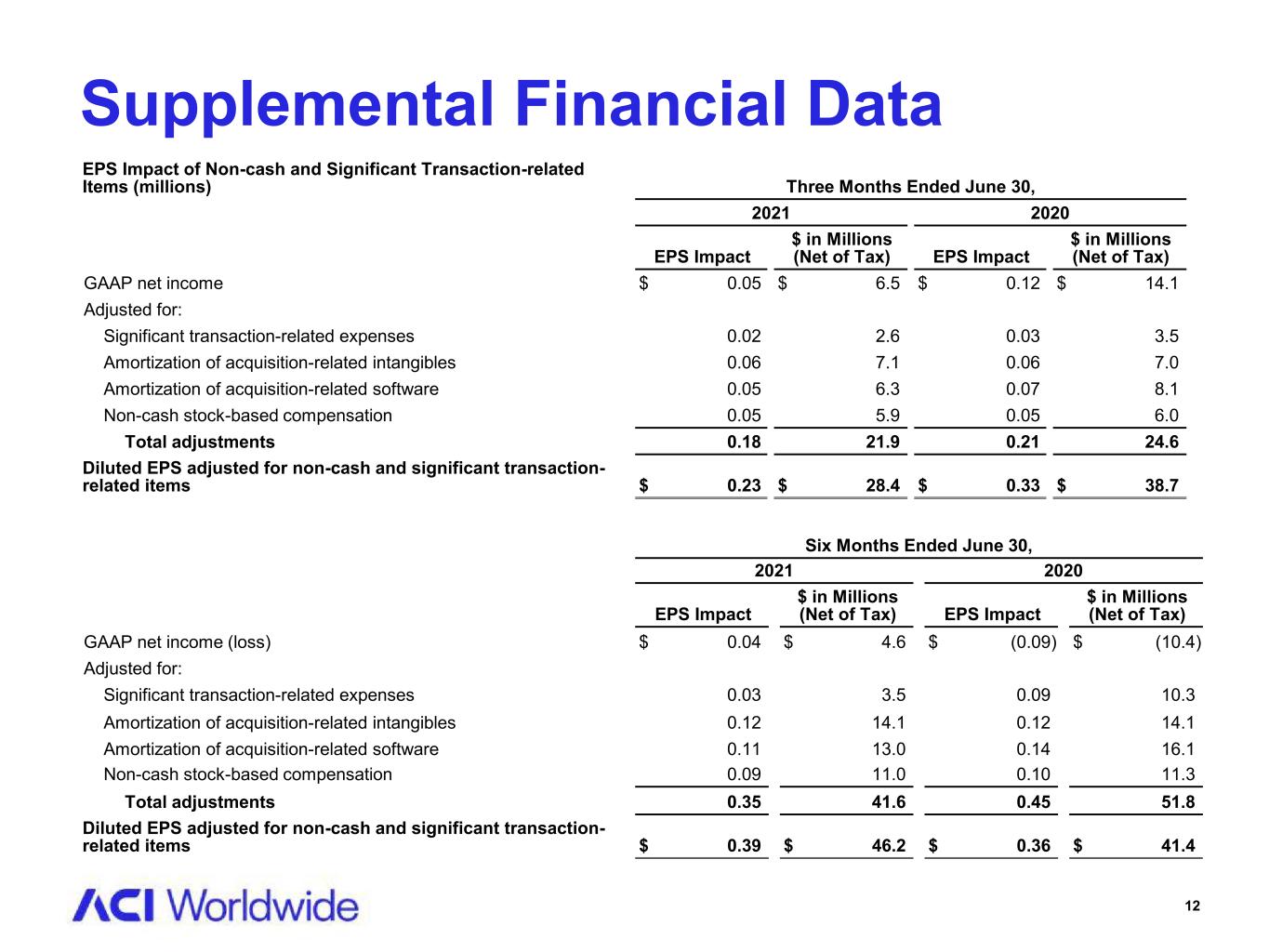

12 EPS Impact of Non-cash and Significant Transaction-related Items (millions) Three Months Ended June 30, 2021 2020 EPS Impact $ in Millions (Net of Tax) EPS Impact $ in Millions (Net of Tax) GAAP net income $ 0.05 $ 6.5 $ 0.12 $ 14.1 Adjusted for: Significant transaction-related expenses 0.02 2.6 0.03 3.5 Amortization of acquisition-related intangibles 0.06 7.1 0.06 7.0 Amortization of acquisition-related software 0.05 6.3 0.07 8.1 Non-cash stock-based compensation 0.05 5.9 0.05 6.0 Total adjustments 0.18 21.9 0.21 24.6 Diluted EPS adjusted for non-cash and significant transaction- related items $ 0.23 $ 28.4 $ 0.33 $ 38.7 Supplemental Financial Data Six Months Ended June 30, 2021 2020 EPS Impact $ in Millions (Net of Tax) EPS Impact $ in Millions (Net of Tax) GAAP net income (loss) $ 0.04 $ 4.6 $ (0.09) $ (10.4) Adjusted for: Significant transaction-related expenses 0.03 3.5 0.09 10.3 Amortization of acquisition-related intangibles 0.12 14.1 0.12 14.1 Amortization of acquisition-related software 0.11 13.0 0.14 16.1 Non-cash stock-based compensation 0.09 11.0 0.10 11.3 Total adjustments 0.35 41.6 0.45 51.8 Diluted EPS adjusted for non-cash and significant transaction- related items $ 0.39 $ 46.2 $ 0.36 $ 41.4

13 To supplement our financial results presented on a GAAP basis, we use the non-GAAP measures indicated in the tables, which exclude significant transaction related expenses, as well as other significant non-cash expenses such as depreciation, amortization, and non-cash compensation, that we believe are helpful in understanding our past financial performance and our future results. The presentation of these non-GAAP financial measures should be considered in addition to our GAAP results and are not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. Management generally compensates for limitations in the use of non-GAAP financial measures by relying on comparable GAAP financial measures and providing investors with a reconciliation of non-GAAP financial measures only in addition to and in conjunction with results presented in accordance with GAAP. We believe that these non-GAAP financial measures reflect an additional way to view aspects of our operations that, when viewed with our GAAP results, provide a more complete understanding of factors and trends affecting our business. Certain non-GAAP measures include: • Adjusted EBITDA: net income (loss) plus income tax expense (benefit), net interest income (expense), net other income (expense), depreciation, amortization, and non-cash compensation, as well as significant transaction related expenses. Adjusted EBITDA should be considered in addition to, rather than as a substitute for, net income (loss). • Net Adjusted EBITDA Margin: Adjusted EBITDA divided by revenue net of pass through interchange revenue. Net Adjusted EBITDA Margin should be considered in addition to, rather than as a substitute for, net income (loss). • Diluted EPS adjusted for non-cash and significant transaction related items: diluted EPS plus tax effected significant transaction related items, amortization of acquired intangibles and software, and non-cash stock-based compensation. Diluted EPS adjusted for non-cash and significant transaction related items should be considered in addition to, rather than as a substitute for, diluted EPS. • Recurring Revenue: revenue from software as a service and platform service fees and maintenance fees. Recurring revenue should be considered in addition to, rather than as a substitute for, total revenue. Non-GAAP Financial Measures

14 This presentation contains forward-looking statements based on current expectations that involve a number of risks and uncertainties. Generally, forward-looking statements do not relate strictly to historical or current facts and may include words or phrases such as “believes,” “will,” “expects,” “anticipates,” “intends,” and words and phrases of similar impact. The forward-looking statements are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this presentation include, but are not limited to, statements regarding (i) significant growth in sales pipeline, (ii) a strategic global alliance with Microsoft, (iii) accelerating revenue growth in the second half of 2021, (iv) attainment of the “Rule of 40” for full year 2021, and (v) full year 2021 and Q3, 2021 financial guidance for revenue and adjusted EBITDA. All of the foregoing forward-looking statements are expressly qualified by the risk factors discussed in our filings with the Securities and Exchange Commission. Such factors include, but are not limited to, the COVID-19 pandemic, increased competition, business interruptions or failure of our information technology and communication systems, may be subjected to security breaches or viruses, our ability to attract and retain senior management personnel and skilled technical employees, new members of senior management coupled with our headquarters relocation, future acquisitions, strategic partnerships and investments, integration of and achieving benefits from the Speedpay acquisition, implementation and success of our new Three Pillar strategy, impact if we convert some or all on-premise licenses from fixed-term to subscription model, anti-takeover provisions, exposure to credit or operating risks arising from certain payment funding methods, customer reluctance to switch to a new vendor, our ability to adequately defend our intellectual property, litigation, our offshore software development activities, risks from operating internationally, including fluctuations in currency exchange rates, adverse changes in the global economy, compliance of our products with applicable legislation, governmental regulations and industry standards, the complexity of our products and services and the risk that they may contain hidden defects, complex regulations applicable to our payments business, our compliance with privacy regulations, exposure to unknown tax liabilities, consolidations and failures in the financial services industry, volatility in our stock price, demand for our products, failure to obtain renewals of customer contracts or to obtain such renewals on favorable terms, delay or cancellation of customer projects or inaccurate project completion estimates, impairment of our goodwill or intangible assets, the accuracy of management’s backlog estimates, the cyclical nature of our revenue and earnings and the accuracy of forecasts due to the concentration of revenue- generating activity during the final weeks of each quarter, restrictions and other financial covenants in our debt agreements, our existing levels of debt, potential adverse effects from the impending replacement of LIBOR, events outside of our control including natural disasters, wars, and outbreaks of disease. For a detailed discussion of these risk factors, parties that are relying on the forward-looking statements should review our filings with the Securities and Exchange Commission, including our most recently filed Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. Forward Looking Statements