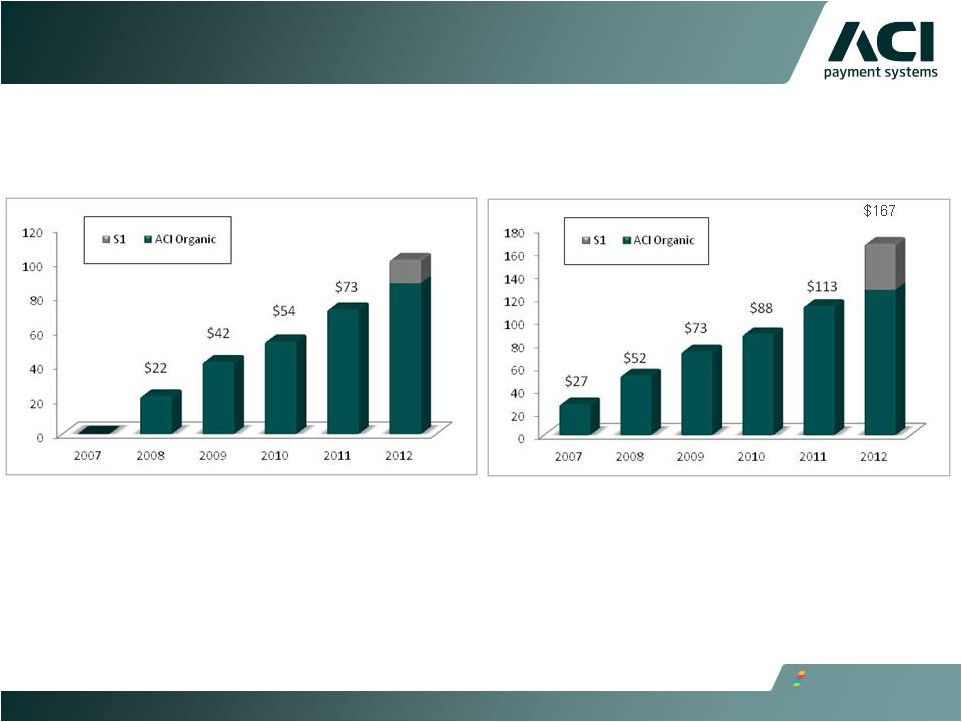

Forward-Looking Statements This presentation contains forward-looking statements based on current expectations that involve a number of risks and uncertainties. Generally, forward-looking statements do not relate strictly to historical or current facts and may include words or phrases such as “believes,” “ will,” “expects,” “anticipates,” “intends,” and words and phrases of similar impact. The forward-looking statements are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this presentation include, but are not limited to, statements regarding: • Expectations and assumptions regarding the recent acquisition of S1 relating to (i) creating a worldwide industry leader in financial and payments software serving FIs, processors and merchant retailers, (ii) creating compelling pro forma financials, (iii) complementary products and customers expand breadth and features/ functions, (iv) enhanced global product capabilities to expand growth opportunities and (v) greater scale and cost synergies to drive margin expansion and earnings accretion; • Expectations related to 2012 customer trends including expectations and assumptions regarding (i) growth in global retail and wholesale transaction volumes, (ii) investment in robust, scalable architecture with enhanced straight-through processing capabilities to reduce errors and prevent fraud, (iii) replacement of existing systems with robust, scalable third-party vendors, (iv) upgrade existing systems to manage risk and reduce cross-border payments costs, (v) simplification of vendor relationships and (vi) vendors poised to capitalize on existing customer relationships leading to cross-selling opportunities; • The company’s 12-month and 60-month backlog estimates and assumptions, including our belief that backlog from monthly recurring revenues and project go-lives will continue to drive current quarter GAAP revenue and lead to predictable performance; and • Expectations and assumptions regarding (i) ACI/S1 combined 2012 financial guidance related to revenue, operating income and adjusted EBITDA and (ii) expectations and assumptions regarding other factors impacting our 2012 financial guidance. 19 |