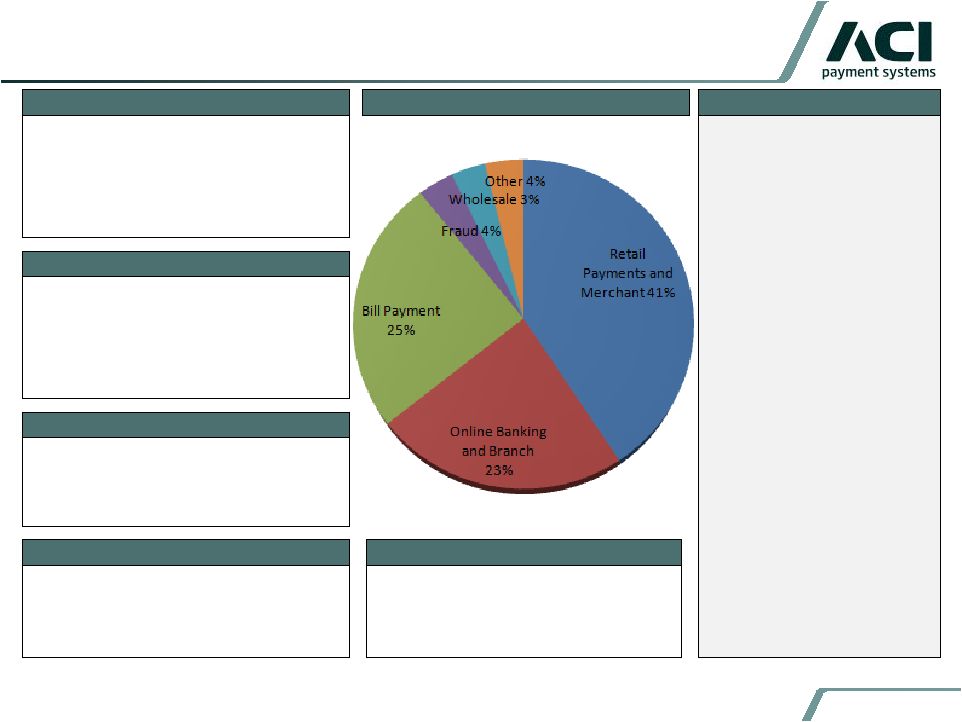

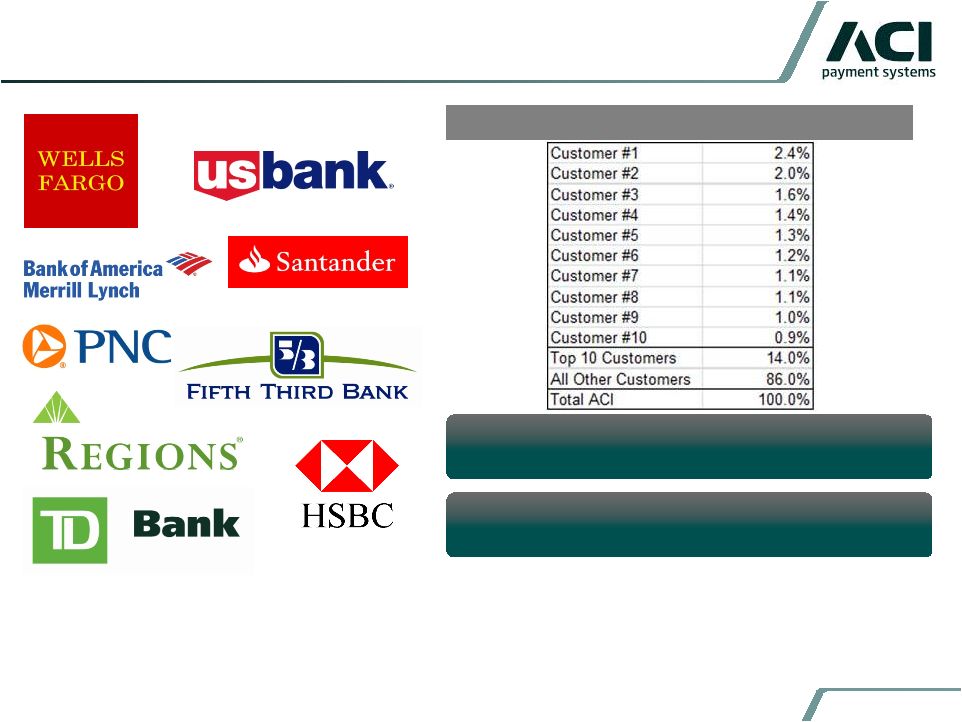

Spring 2014 ACI is a Leading Provider of Electronic Payments and Transaction Banking Solutions • Tools to prevent payment transaction fraud and enterprise financial crimes • Case management Fraud • Internet-based electronic bill payment and presentment • Transaction-based, hosted services for banks and billers • Automated collection application Bill Pay / Collections • Consumer and Business Internet Banking, Mobile, Trade Finance and Branch Automation sold to large banks globally as license or hosted subscription services • Consumer and small biz Internet and mobile banking sold to US community FIs and credit unions as hosted, subscription Online Banking • Software sold to global banks that enables the providing of treasury services to large corporates • High value wire transfers, Low Value Bulk Payments and SWIFT messaging Wholesale Payments • Software sold directly to banks and payment processors • Solutions help authenticate, authorize, acquire, clear and settle electronic consumer payments • Payments acquiring and authorization solution for retailers Retail Payments 1 Financial Insights - Worldwide Payments Market Sizing 2012 and 3rd Party Consultant Note: Revenue figures represent Pro Forma FY 2013 GAAP Revenue on a pro forma basis for the ORCC and OPAY acquisitions. ACI Product Family Revenue % Highlights In a highly fragmented market, we control 6% of the market spend¹ Software facilitates over 120 billion consumer transaction per year; scales to thousands per second ~1/3 of all domestic SWIFT transactions Enables over $13 trillion in payments each day Software designed for “Five nines availability” 2/3 of all Fed wires 4 |