UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08934

Voya Strategic Allocation Portfolios, Inc.

(Exact name of registrant as specified in charter)

| 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, AZ | 85258 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Incorporated, 300 East Lombard Street, Baltimore, MD 21201

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2022

| Strategic Allocation Funds-of-Funds | | ■ | Voya Strategic Allocation Moderate Portfolio |

| ■ | Voya Strategic Allocation Conservative Portfolio | | ■ | Voya Strategic Allocation Growth Portfolio |

As permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of each portfolio’s annual and semi-annual shareholder reports, like this annual report, are not sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on a website and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you need not take any action. You may elect to receive shareholder reports and other communications from your insurance carrier electronically by contacting them directly.

You may elect to receive all future reports in paper free of charge. If you received this document in the mail, please follow the instructions provided to elect to continue receiving paper copies of your shareholder reports. You can inform us that you wish to continue receiving paper copies by calling 1-866-345-5954. Your election to receive reports in paper will apply to all the funds in which you invest. |

This report is submitted for general information to shareholders of the Voya mutual funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully. |

INVESTMENT MANAGEMENT voyainvestments.com |  |

TABLE OF CONTENTS

| | 2 |

| | 8 |

| | 9 |

| | 10 |

| | 11 |

| | 12 |

| | 14 |

| | 15 |

| | 23 |

| | 31 |

| | 32 |

| | 35 |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the Portfolios’ website at www.voyainvestments.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Portfolios’ website at www.voyainvestments.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form NPORT-P. The Portfolios’ Forms NPORT-P are available on the SEC’s website at www.sec.gov. Each Portfolio’s complete schedule of portfolio holdings is available at: www.voyainvestments.com and without charge upon request from the Portfolio by calling Shareholder Services toll-free at (800) 992-0180.

(THIS PAGE INTENTIONALLY LEFT BLANK)

BENCHMARK DESCRIPTIONS

| Index | Description |

|---|

| Bloomberg U.S. Aggregate Bond Index (“Bloomberg U.S. Aggregate Bond”) | An index of publicly issued investment grade U.S. government, mortgage-backed, asset-backed and corporate debt securities. |

Russell 3000® Index | An index that measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. |

1

| VOYA STRATEGIC ALLOCATION PORTFOLIOS | PORTFOLIOS MANAGERS’ REPORT |

Voya Strategic Allocation Conservative Portfolio seeks to provide total return (i.e., income and capital growth, both realized and unrealized) consistent with preservation of capital. Voya Strategic Allocation Growth Portfolio seeks to provide capital appreciation. Voya Strategic Allocation Moderate Portfolio seeks to provide total return (i.e., income and capital appreciation, both realized and unrealized). Each Portfolio seeks to achieve its investment objective by investing in a combination of underlying funds which are actively managed funds or passively managed funds (index funds). Each Portfolio uses an asset allocation strategy (“Target Asset Allocation”) designed for investors seeking the risk profile applicable to that Portfolio. These Target Asset Allocations as of December 31, 2022 are set out in the table below. Voya Strategic Allocation Conservative Portfolio, Voya Strategic Allocation Growth Portfolio and Voya Strategic Allocation Moderate Portfolio (each a “Portfolio” and collectively, the “Portfolios”) are managed by Paul Zemsky, CFA and Chief Investment Officer, and Barbara Reinhard, CFA, Portfolio Managers of Voya Investment Management Co. LLC (“Voya IM”) — the Sub-Adviser.

Performance: For the year ended December 31, 2022, Voya Strategic Allocation Conservative Portfolio’s Class I shares provided a total return of -16.46% compared to the Bloomberg U.S. Aggregate Bond Index (“Bloomberg U.S. Aggregate Bond”) and the Voya Strategic Allocation Conservative Composite which returned -13.01% and -14.41%, respectively, for the same period. For the year ended December 31, 2022, Voya Strategic Allocation Moderate Portfolio’s Class I shares provided a total return of -18.16% compared to the Russell 3000® Index and the Voya Strategic Allocation Moderate Composite which returned -19.21% and -15.84%, respectively, for the same period. For the year ended December 31, 2022, Voya Strategic Allocation Growth Portfolio’s Class I shares provided a total return of -19.35% compared to the Russell 3000® Index and the Voya Strategic Allocation Growth Composite which returned -19.21% and -16.74%, respectively, for the same period.

Portfolio Specifics: For the twelve-month reporting period ended December 31, 2022, the Portfolios underperformed their respective strategic allocation benchmarks. Both tactical asset allocation and manager selection detracted. Voya Strategic Allocation Conservative and Voya Strategic Allocation Moderate Portfolios started the year with modest overweights to equities, while Voya Strategic Allocation Growth Portfolio was neutral relative to its strategic asset allocation. Within equities, the Portfolios favored US large and small-cap over US mid-cap and core US fixed income in varying degrees.

In January and February, the Portfolios lowered their allocations to high yield, taking advantage of the relatively stable credit markets as equities experienced sharp volatility. Also in February, the strategy reduced its US large-cap position and added to emerging market and developed international equities. The non-US equity markets offer less tech exposure and less long duration equity exposure which has shown to be more sensitive to rising US real yields.

In March, the Portfolios lowered their international equity exposure in favor of short-term Eurodollar futures, believing that international equities remain vulnerable to the economic fallout from the first major war in the Europe post-World War II. We believe recession risk in the Eurozone is rising quickly as war wages, gasoline prices continue to rise and an inflation problem is forcing the European Central Bank’s (ECB) hand to tighten financial conditions. In addition, slowing Chinese growth is a challenge for emerging markets (“EM”). Any stimulus to occur will likely not be enough to revive a slowing economy and to meeting Beijing’s growth target, in our opinion. We believe strong forward guidance by the US Federal Reserve to increase policy rates and a faster balance sheet roll-off than other central banks are US dollar positives.

As part of its annual review in early April, the Portfolios equity weightings were marginally reduced. US large cap equities were used as the source of the increase to core fixed income positions. Still, the Portfolios held modest overweights to US large cap equities overall. This was a drag over the quarter as both international developed and EM equities performed better after lagging in the first three months of the year. However, overweights to US assets helped within the fixed income segments of the Portfolios, as US aggregate bonds performed better than global bonds and significantly outperformed EM debt, which struggled due to those countries’ generally weaker growth outlook and a substantial strengthening in the dollar. In May, a new position in Japanese equities was initiated, funded by selling US large cap stocks. Japan is acting more defensive than the rest of the world given the Bank of Japan’s (BOJ) use of yield curve control, which, along with relatively cheap valuations, we believe makes their equity markets more attractive in this highly uncertain macro environment. In addition, during times of market stress, the Japanese yen serves as a safe haven for investors. Furthermore, the yen has fallen dramatically since the beginning of 2021 and has not been this cheap relative to the dollar since 2002 from both purchasing power parity and real effective exchange rate perspective. We believe this should help the nation’s export-oriented businesses and could support earnings.

In the third quarter, portfolio managers (PMs) increased US large cap and small cap equities. The large cap increase was funded by a reduction to international developed equites, as the United States continues to be our favorite region given the relatively insulated economic and geopolitical position, strong currency and generally healthier companies. Within the United States, small caps have retraced all their stimulus driven gains and now trade at a discount to large caps. Given the severely oversold conditions, there is potential for an unwind and small caps would disproportionally benefit from the bounce. Within fixed income, PMs lengthened duration across Portfolios by increasing exposure to long-term US government bonds and reducing short-term bonds and cash. We believe declining energy and core goods prices, reduced shelter costs, softening labor market and decreased domestic demand will pull inflation down to the 4—5% range by the middle of next year. The necessary drop in nominal gross domestic product (GDP) or expectation thereof should weigh heavily on long dated yields. As a result, we have extended duration in fixed income Portfolio and maintain our preference for high-quality credit. Finally, toward the end of the quarter, PMs closed the long Japan position, reallocating proceeds to US large cap. The BOJ has held firm in its policy of “unlimited” purchases of 10-year Japanese Government Bonds (JGBs) to keep the yield at or below 0.25%. As Treasury yields climb and the yen weakens, the BOJ seems to have only two options: eliminate or raise the yield cap or intervene in currency markets to support the weakening yen. The BOJ has chosen the latter for now, but we are skeptical of their ability to defend the yen while maintaining yield curve control.

During the final quarter of the year, late in October, PMs lessened the tactical underweight to US large cap equities by selling EM equities. This short-term tactical trade to underweight in EM equity and add to US large caps was due to increased tensions between Beijing and Washington related to Taiwan. However, by December, relations between the two superpowers seemed to improve such that an escalation of hostilities was much less likely. As a result, the brief EM equity underweight was closed by selling international developed equities. International developed equities were used as the source of funds because Europe looked increasingly unappealing after the strong rally in the first two months of the quarter and their still challenged fundamental outlook with the ECB struggling to contain inflation in the face of a gas embargo with Russia that

2

| PORTFOLIO MANAGERS’ REPORT | VOYA STRATEGIC ALLOCATION PORTFOLIOS |

is likely to continue for a multi-year period and local governments having spent their fiscal firepower on helping households meet their increased energy costs. Europe looks to have used a short-term patch to try and fix a long-term problem, which will likely pressure European equities in 2023. Additionally, the emerging and developing international stocks relationship looked to be making an important bottom that favored EM, as China reopens and refocuses on growth. Also, toward the end of the period, after strong returns from stocks in October and November, US large cap equities were decreased and US core bonds were increased, as recession risks accumulated, leading to concerns deteriorating earnings would drive a sell-off into year end. Within fixed income, Portfolios continue to hold long duration postures as a hedge against equity beta in the event of a risk-off flight to safety and given PM’s expectations a weak growth environment will weigh down the back-end of the yield curve.

During the full year period, tactical moves relative to our strategic benchmarks had a negative performance impact across the Portfolios.

Allocation to Underlying Funds were also a hurdle over the year for the Portfolios. Top performing underlying strategies for the year were Voya Large Cap Value Portfolio, Voya U.S. High Dividend Low Volatility Portfolio and Voya Multi-Manager Mid Cap Value Fund. Bottom performers include VY® T. Rowe Price Growth Equity Portfolio, Voya MidCap Opportunities Portfolio and Voya Multi-Manager International Equity Fund.

Current Strategy and Outlook: Inflation dominated the headlines in 2022, and its progression and policy makers’ responses will continue to be the principal global macro drivers in the year ahead. Although it remains unacceptably high, data suggests to use that it has peaked with meaningfully lower core goods and energy prices. Income sensitive components of the price Index baskets, such as shelter and services, are proving sticker given the still strong labor market and high personal income. However, we are beginning to see the effects of declining demand with wage gains cooling, which we expect will continue and contribute to a steady fall in inflation to the low single digits by the end of the year. However, we do not expect a shift in policy from the Fed or ECB. With more tightening in store and explicit declarations that there will be no rate cuts in 2023, a contraction in developed market growth seems likely and should cause top line revenues to fall. Additionally, the prolonged period of rising costs is likely to erode profit margins ahead, including those of US large cap companies, which have thus far been relatively successful in maintaining pricing power. In general, US stocks are not cheap, but they are well of peaks and seem, in our opinion, reasonable. On the other side of this year, however, we believe we will see moderate inflation, more normal interest rates and slow but positive growth, which should be good for equities. Until investors begin to price in that outcome, volatility will likely be high.

We think the bond bear market is over. Following one of the worst years on record, bonds now look attractive. Positive real yields across the interest rate curve offer attractive carry for the first time in years. We expect the hand-off from inflation risk to growth risk should pressure yields lower to the benefit of duration sensitive assets. Additionally, the volatility in rates and the correlation between stocks and bonds should normalize, as fixed income reassumes its place of ballast within multi-asset portfolios.

The US continues to be our favorite region. It is further along in the inflation fight and still more geopolitically insulated as compared to the Eurozone, which still faces an increased probability and expected magnitude of a decline in output. China’s move away from zero covid and the seeming relaxation of tensions with the United States from their boiling point are pluses for EM. While the dollar is less likely to be a challenge to international assets, it should retain its defensive properties in risk-off scenarios, providing motivation for keeping close to home for now.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

3

| VOYA STRATEGIC ALLOCATION PORTFOLIOS | PORTFOLIOS MANAGERS’ REPORT |

Annual Target Asset Allocations as of December 31, 2022(1)

(as a percentage of net assets)

Sub Asset Class

| | Conservative | | Moderate | | Growth |

|---|

| US Large Blend | | | 14.0 | % | | | 32.0 | % | | | 42.0 | % |

| US Large Growth | | | 6.0 | % | | | 7.0 | % | | | 5.0 | % |

| US Large Value | | | 8.0 | % | | | 7.0 | % | | | 5.0 | % |

| US Mid Cap Blend | | | 2.0 | % | | | 5.0 | % | | | 8.0 | % |

| US Small Cap | | | 4.0 | % | | | 5.0 | % | | | 7.0 | % |

| International | | | 2.0 | % | | | 3.0 | % | | | 8.0 | % |

| Emerging Markets | | | 2.0 | % | | | 2.0 | % | | | 3.0 | % |

| Core Fixed Income | | | 37.5 | % | | | 28.5 | % | | | 15.5 | % |

| High Yield | | | 5.0 | % | | | — | | | | — | |

| International Bonds | | | 4.0 | % | | | — | | | | — | |

| TIPS | | | 2.0 | % | | | 1.0 | % | | | 1.0 | % |

| Short Duration | | | 10.5 | % | | | 6.5 | % | | | 2.5 | % |

| Long Govt Bonds | | | 3.0 | % | | | 3.0 | % | | | 3.0 | % |

Total Equity | | | 38.0 | % | | | 61.0 | % | | | 78.0 | % |

Total Fixed Income | | | 62.0 | % | | | 39.0 | % | | | 22.0 | % |

| | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

(1) | | As these are target allocations, the actual allocations of each Portfolio’s assets may deviate from the percentages shown. Although the Portfolios expect to be fully invested at all times, they may maintain liquidity reserves to meet redemption requests. |

Portfolio holdings are subject to change daily.

4

| PORTFOLIO MANAGERS’ REPORT | VOYA STRATEGIC ALLOCATION

CONSERVATIVE PORTFOLIO |

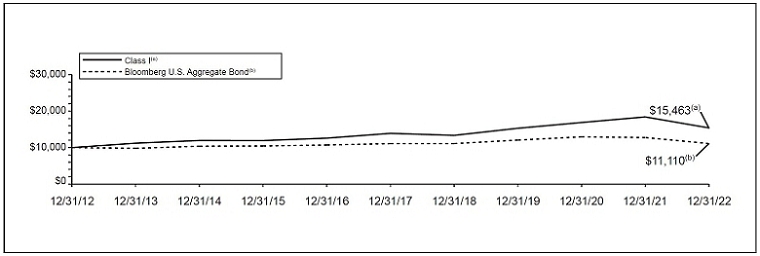

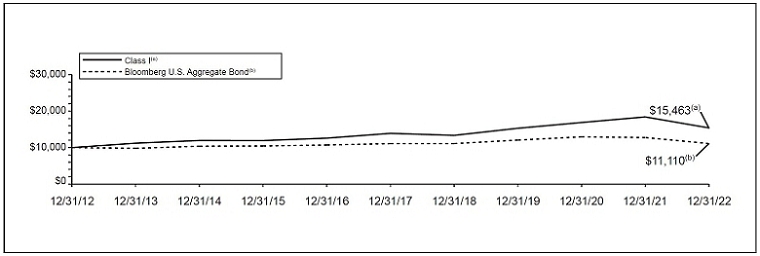

| Average Annual Total Returns for the Periods Ended December 31, 2022 | |

|---|

| | 1 Year | | | 5 Year | | | 10 Year | |

|---|

| Class I | | | –16.46 | % | | | 2.10 | % | | | 4.45 | % |

| Class S | | | –16.69 | % | | | 1.85 | % | | | 4.19 | % |

| Bloomberg U.S. Aggregate Bond | | | –13.01 | % | | | 0.02 | % | | | 1.06 | % |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Strategic Allocation Conservative Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other

service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

5

VOYA STRATEGIC ALLOCATION

MODERATE PORTFOLIO | PORTFOLIOS MANAGERS’ REPORT |

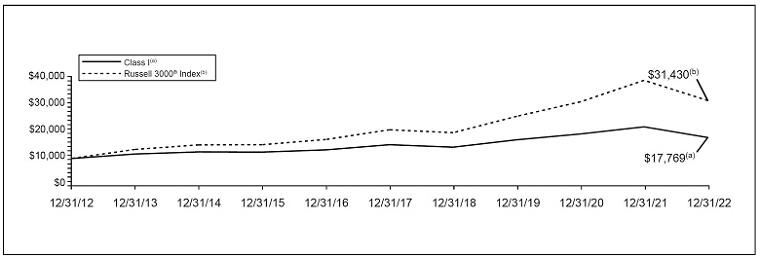

| Average Annual Total Returns for the Periods Ended December 31, 2022 |

|---|

| | 1 Year | | | 5 Year | | | 10 Year | |

|---|

| Class I | | | –18.16 | % | | | 3.31 | % | | | 5.92 | % |

| Class S | | | –18.34 | % | | | 3.05 | % | | | 5.65 | % |

Russell 3000® Index | | | –19.21 | % | | | 8.79 | % | | | 12.13 | % |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Strategic Allocation Moderate Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other

service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

6

| PORTFOLIO MANAGER’S REPORT | VOYA STRATEGIC ALLOCATION

GROWTH PORTFOLIO |

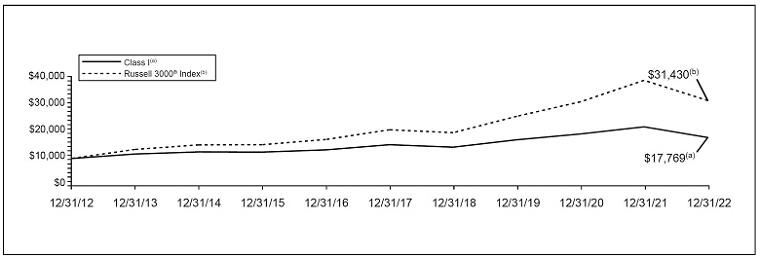

| Average Annual Total Returns for the Periods Ended December 31, 2022 |

|---|

| | 1 Year | | | 5 Year | | | 10 Year | |

|---|

| Class I | | | –19.35 | % | | | 4.05 | % | | | 7.08 | % |

| Class S | | | –19.55 | % | | | 3.79 | % | | | 6.80 | % |

Russell 3000® Index | | | –19.21 | % | | | 8.79 | % | | | 12.13 | % |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Strategic Allocation Growth Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other

service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

7

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED) As a shareholder of a Portfolio, you incur two types of costs: (1) transaction costs, including redemption fees, and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2022 through December 31, 2022. The Portfolios’ expenses are shown without the imposition of any charges which are, or may be, imposed under your variable annuity contract, variable life insurance policy, qualified pension, or retirement plan. Expenses would have been higher if such charges were included.

Actual Expenses

The left section of the table shown below, “Actual Portfolio Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The right section of the table shown below, “Hypothetical (5% return before expenses),” provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees, or exchange fees. Therefore, the hypothetical section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different mutual funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Actual Portfolio Return | | Hypothetical (5% return before expenses) |

|---|

| | Beginning

Account

Value

July 1,

2022 | | Ending

Account

Value

December 31,

2022 | | Annualized

Expense

Ratio* | | Expenses Paid

During the

Period Ended

December 31,

2022** | | Beginning

Account

Value

July 1,

2022 | | Ending

Account

Value

December 31,

2022 | | Annualized

Expense

Ratio* | | Expenses Paid

During the

Period Ended

December 31,

2022** |

|---|

Voya Strategic Allocation Conservative Portfolio |

| Class I | | $ | 1,000.00 | | | $ | 988.70 | | | | 0.30 | % | | $ | 1.50 | | | $ | 1,000.00 | | | $ | 1,023.69 | | | | 0.30 | % | | $ | 1.53 | |

| Class S | | | 1,000.00 | | | | 987.70 | | | | 0.55 | | | | 2.76 | | | | 1,000.00 | | | | 1,022.43 | | | | 0.55 | | | | 2.80 | |

Voya Strategic Allocation Moderate Portfolio |

| Class I | | $ | 1,000.00 | | | $ | 997.40 | | | | 0.33 | % | | $ | 1.66 | | | $ | 1,000.00 | | | $ | 1,023.54 | | | | 0.33 | % | | $ | 1.68 | |

| Class S | | | 1,000.00 | | | | 996.50 | | | | 0.58 | | | | 2.92 | | | | 1,000.00 | | | | 1,022.28 | | | | 0.58 | | | | 2.96 | |

Voya Strategic Allocation Growth Portfolio |

| Class I | | $ | 1,000.00 | | | $ | 1,008.40 | | | | 0.31 | % | | $ | 1.57 | | | $ | 1,000.00 | | | $ | 1,023.64 | | | | 0.31 | % | | $ | 1.58 | |

| Class S | | | 1,000.00 | | | | 1,006.80 | | | | 0.56 | | | | 2.83 | | | | 1,000.00 | | | | 1,022.38 | | | | 0.56 | | | | 2.85 | |

| * | | The annualized expense ratios do not include expenses of the underlying funds. |

| ** | | Expenses are equal to each Portfolio’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent fiscal half-year. |

8

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Shareholders of Voya Strategic Allocation Conservative Portfolio, Voya Strategic Allocation Moderate Portfolio and Voya Strategic Allocation Growth Portfolio and the Board of Directors of Voya Strategic Allocation Portfolios, Inc.

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Voya Strategic Allocation Conservative Portfolio, Voya Strategic Allocation Moderate Portfolio and Voya Strategic Allocation Growth Portfolio (collectively referred to as the “Portfolios”) (three of the portfolios constituting Voya Strategic Allocation Portfolios, Inc. (the “Company”)), including the portfolios of investments, as of December 31, 2022, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the three years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Portfolios (three of the portfolios constituting Voya Strategic Allocation Portfolios, Inc.) at December 31, 2022, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended and their financial highlights for each of the three years in the period then ended, in conformity with U.S. generally accepted accounting principles.

The financial highlights for each of the years in the two-year period ended December 31, 2019, were audited by another independent registered public accounting firm whose report, dated February 26, 2020, expressed an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on each of the Portfolios’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of the Company’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2022, by correspondence with the custodian, brokers and others; when replies were not received from brokers and others, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Voya investment companies since 2019.

Boston, Massachusetts

February 28, 2023

9

STATEMENTS OF ASSETS AND LIABILITIES AS OF DECEMBER 31, 2022

| | Voya

Strategic

Allocation

Conservative

Portfolio | | Voya

Strategic

Allocation

Moderate

Portfolio | | Voya

Strategic

Allocation

Growth

Portfolio |

|---|

ASSETS: | | | | | | | | | | | | |

| Investments in affiliated underlying funds at fair value* | | $ | 52,551,137 | | | $ | 108,118,816 | | | $ | 117,728,066 | |

| Investments in unaffiliated underlying funds at fair value** | | | 3,930,873 | | | | 3,361,033 | | | | 3,589,929 | |

| Cash | | | 66,433 | | | | 85,794 | | | | 112,364 | |

| Cash collateral for futures contracts | | | — | | | | 226,193 | | | | 231,917 | |

| Receivables: | | | | | | | | | | | | |

| Investments in affiliated underlying funds sold | | | — | | | | 199,264 | | | | — | |

| Fund shares sold | | | 6,219 | | | | 131 | | | | 70,070 | |

| Interest | | | 628 | | | | 1,072 | | | | — | |

| Variation margin on futures contracts | | | — | | | | 6,728 | | | | 7,960 | |

| Prepaid expenses | | | 311 | | | | 597 | | | | 643 | |

| Reimbursement due from Investment Adviser | | | 2,753 | | | | — | | | | 3,832 | |

| Other assets | | | 6,406 | | | | 11,599 | | | | 11,327 | |

| Total assets | | | 56,564,760 | | | | 112,011,227 | | | | 121,756,108 | |

LIABILITIES: | | | | | | | | | | | | |

| Payable for investments in affiliated underlying funds purchased | | | 6,015 | | | | — | | | | 40,627 | |

| Payable for fund shares redeemed | | | 207 | | | | 199,394 | | | | 29,443 | |

| Payable for investment management fees | | | 9,541 | | | | 18,104 | | | | 19,674 | |

| Payable for distribution and shareholder service fees | | | 636 | | | | 261 | | | | 469 | |

| Payable for directors fees | | | 158 | | | | 307 | | | | 328 | |

| Payable to directors under the deferred compensation plan (Note 6) | | | 6,406 | | | | 11,599 | | | | 11,327 | |

| Other accrued expenses and liabilities | | | 24,875 | | | | 35,524 | | | | 38,038 | |

| Total liabilities | | | 47,838 | | | | 265,189 | | | | 139,906 | |

NET ASSETS | | $ | 56,516,922 | | | $ | 111,746,038 | | | $ | 121,616,202 | |

NET ASSETS WERE COMPRISED OF: | | | | | | | | | | | | |

| Paid-in capital | | $ | 61,996,090 | | | $ | 118,275,260 | | | $ | 124,793,370 | |

| Total distributable loss | | | (5,479,168 | ) | | | (6,529,222 | ) | | | (3,177,168 | ) |

NET ASSETS | | $ | 56,516,922 | | | $ | 111,746,038 | | | $ | 121,616,202 | |

| * Cost of investments in affiliated underlying funds | | $ | 57,959,414 | | | $ | 119,238,640 | | | $ | 127,100,259 | |

| ** Cost of investments in unaffiliated underlying funds | | $ | 4,566,785 | | | $ | 4,207,670 | | | $ | 4,493,410 | |

| | | | | | | | | | | | | |

Class I | | | | | | | | | | | | |

| Net assets | | $ | 53,576,938 | | | $ | 110,540,763 | | | $ | 119,443,839 | |

| Shares authorized | | | 100,000,000 | | | | 100,000,000 | | | | 100,000,000 | |

| Par value | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | |

| Shares outstanding | | | 5,086,400 | | | | 9,544,602 | | | | 9,955,146 | |

| Net asset value and redemption price per share | | $ | 10.53 | | | $ | 11.58 | | | $ | 12.00 | |

| | | | | | | | | | | | | |

Class S | | | | | | | | | | | | |

| Net assets | | $ | 2,939,984 | | | $ | 1,205,275 | | | $ | 2,172,363 | |

| Shares authorized | | | 100,000,000 | | | | 100,000,000 | | | | 100,000,000 | |

| Par value | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | |

| Shares outstanding | | | 282,285 | | | | 104,709 | | | | 183,284 | |

| Net asset value and redemption price per share | | $ | 10.41 | | | $ | 11.51 | | | $ | 11.85 | |

See Accompanying Notes to Financial Statements

10

STATEMENTS OF OPERATIONS FOR THE YEAR ENDED DECEMBER 31, 2022

| | Voya

Strategic

Allocation

Conservative

Portfolio | | Voya

Strategic

Allocation

Moderate

Portfolio | | Voya

Strategic

Allocation

Growth

Portfolio |

|---|

INVESTMENT INCOME: | | | | | | | | | | | | |

| Dividends from affiliated underlying funds | | $ | 1,210,522 | | | $ | 1,942,955 | | | $ | 1,795,150 | |

| Dividends from unaffiliated underlying funds | | | 129,012 | | | | 168,309 | | | | 178,702 | |

| Interest | | | 1,023 | | | | 5,671 | | | | 3,669 | |

| Total investment income | | | 1,340,557 | | | | 2,116,935 | | | | 1,977,521 | |

EXPENSES: | | | | | | | | | | | | |

| Investment management fees | | | 124,786 | | | | 237,042 | | | | 256,240 | |

| Distribution and shareholder service fees: | | | | | | | | | | | | |

| Class S | | | 8,142 | | | | 3,398 | | | | 5,962 | |

| Transfer agent fees: | | | | | | | | | | | | |

| Class I | | | 48,946 | | | | 94,654 | | | | 113,299 | |

| Class S | | | 2,652 | | | | 1,058 | | | | 2,100 | |

| Shareholder reporting expense | | | 7,300 | | | | 11,680 | | | | 14,949 | |

| Registration fees | | | 65 | | | | 53 | | | | — | |

| Professional fees | | | 11,680 | | | | 29,200 | | | | 34,630 | |

| Custody and accounting expense | | | 12,775 | | | | 15,330 | | | | 16,425 | |

| Directors fees | | | 1,585 | | | | 3,068 | | | | 3,286 | |

| Miscellaneous expense | | | 8,735 | | | | 10,966 | | | | 8,722 | |

| Interest expense | | | 162 | | | | — | | | | — | |

| Total expenses | | | 226,828 | | | | 406,449 | | | | 455,613 | |

| Waived and reimbursed fees | | | (26,371 | ) | | | — | | | | (39,028 | ) |

| Net expenses | | | 200,457 | | | | 406,449 | | | | 416,585 | |

| Net investment income | | | 1,140,100 | | | | 1,710,486 | | | | 1,560,936 | |

REALIZED AND UNREALIZED GAIN (LOSS): | | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | | |

| Sale of affiliated underlying funds | | | (3,423,151 | ) | | | (7,638,105 | ) | | | (8,156,333 | ) |

| Sale of unaffiliated underlying funds | | | 1,225,279 | | | | 1,228,137 | | | | 1,814,711 | |

| Capital gain distributions from affiliated underlying funds | | | 3,380,772 | | | | 12,512,170 | | | | 14,133,984 | |

| Futures | | | — | | | | 149,897 | | | | 193,971 | |

| Net realized gain | | | 1,182,900 | | | | 6,252,099 | | | | 7,986,333 | |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | |

| Affiliated underlying funds | | | (12,074,179 | ) | | | (30,880,725 | ) | | | (35,288,001 | ) |

| Unaffiliated underlying funds | | | (2,320,786 | ) | | | (3,055,901 | ) | | | (4,275,161 | ) |

| Futures | | | — | | | | 21,976 | | | | 30,514 | |

| Net change in unrealized appreciation (depreciation) | | | (14,394,965 | ) | | | (33,914,650 | ) | | | (39,532,648 | ) |

| Net realized and unrealized loss | | | (13,212,065 | ) | | | (27,662,551 | ) | | | (31,546,315 | ) |

Decrease in net assets resulting from operations | | $ | (12,071,965 | ) | | $ | (25,952,065 | ) | | $ | (29,985,379 | ) |

See Accompanying Notes to Financial Statements

11

STATEMENTS OF CHANGES IN NET ASSETS

| | Voya Strategic Allocation

Conservative Portfolio | | Voya Strategic Allocation

Moderate Portfolio |

|---|

| | Year Ended

December 31,

2022 | | Year Ended

December 31,

2021 | | Year Ended

December 31,

2022 | | Year Ended

December 31,

2021 |

|---|

FROM OPERATIONS: | | | | | | | | | | | | | | | | |

| Net investment income | | $ | 1,140,100 | | | $ | 1,478,827 | | | $ | 1,710,486 | | | $ | 2,223,479 | |

| Net realized gain | | | 1,182,900 | | | | 5,785,686 | | | | 6,252,099 | | | | 13,903,477 | |

| Net change in unrealized appreciation (depreciation) | | | (14,394,965 | ) | | | (799,073 | ) | | | (33,914,650 | ) | | | 1,786,848 | |

| Increase (decrease) in net assets resulting from operations | | | (12,071,965 | ) | | | 6,465,440 | | | | (25,952,065 | ) | | | 17,913,804 | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

| Total distributions (excluding return of capital): | | | | | | | | | | | | | | | | |

| Class I | | | (7,001,681 | ) | | | (1,965,059 | ) | | | (15,985,509 | ) | | | (7,361,065 | ) |

| Class S | | | (369,519 | ) | | | (98,241 | ) | | | (178,171 | ) | | | (80,773 | ) |

| Total distributions | | | (7,371,200 | ) | | | (2,063,300 | ) | | | (16,163,680 | ) | | | (7,441,838 | ) |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Net proceeds from sale of shares | | | 6,086,984 | | | | 8,546,135 | | | | 4,444,559 | | | | 7,909,864 | |

| Reinvestment of distributions | | | 7,371,200 | | | | 2,063,300 | | | | 16,163,680 | | | | 7,441,838 | |

| | | | 13,458,184 | | | | 10,609,435 | | | | 20,608,239 | | | | 15,351,702 | |

| Cost of shares redeemed | | | (12,720,367 | ) | | | (10,344,216 | ) | | | (11,713,539 | ) | | | (13,343,829 | ) |

| Net increase in net assets resulting from capital share transactions | | | 737,817 | | | | 265,219 | | | | 8,894,700 | | | | 2,007,873 | |

| Net increase (decrease) in net assets | | | (18,705,348 | ) | | | 4,667,359 | | | | (33,221,045 | ) | | | 12,479,839 | |

NET ASSETS: | | | | | | | | | | | | | | | | |

| Beginning of year or period | | | 75,222,270 | | | | 70,554,911 | | | | 144,967,083 | | | | 132,487,244 | |

| End of year or period | | $ | 56,516,922 | | | $ | 75,222,270 | | | $ | 111,746,038 | | | $ | 144,967,083 | |

See Accompanying Notes to Financial Statements

12

STATEMENTS OF CHANGES IN NET ASSETS

| | Voya Strategic Allocation

Growth Portfolio |

|---|

| | Year Ended

December 31,

2022 | | Year Ended

December 31,

2021 |

|---|

FROM OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 1,560,936 | | | $ | 2,043,930 | |

| Net realized gain | | | 7,986,333 | | | | 18,890,159 | |

| Net change in unrealized appreciation (depreciation) | | | (39,532,648 | ) | | | 3,161,747 | |

| Increase (decrease) in net assets resulting from operations | | | (29,985,379 | ) | | | 24,095,836 | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Total distributions (excluding return of capital): | | | | | | | | |

| Class I | | | (20,520,510 | ) | | | (5,750,466 | ) |

| Class S | | | (376,391 | ) | | | (104,047 | ) |

| Total distributions | | | (20,896,901 | ) | | | (5,854,513 | ) |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Net proceeds from sale of shares | | | 6,061,692 | | | | 6,920,238 | |

| Reinvestment of distributions | | | 20,896,901 | | | | 5,854,513 | |

| | | | 26,958,593 | | | | 12,774,751 | |

| Cost of shares redeemed | | | (11,912,836 | ) | | | (16,951,362 | ) |

| Net increase (decrease) in net assets resulting from capital share transactions | | | 15,045,757 | | | | (4,176,611 | ) |

| Net increase (decrease) in net assets | | | (35,836,523 | ) | | | 14,064,712 | |

NET ASSETS: | | | | | | | | |

| Beginning of year or period | | | 157,452,725 | | | | 143,388,013 | |

| End of year or period | | $ | 121,616,202 | | | $ | 157,452,725 | |

See Accompanying Notes to Financial Statements

13

Selected data for a share of beneficial interest outstanding throughout each year or period.

| | | | Income (loss)

from investment

operations | | | | Less distributions | | | | | | | | | | Ratios to average

net assets | | Supplemental

data |

| | | Net asset

value,

beginning

of year

or period | | Net

investment

income

(loss) | | Net

realized

and

unrealized

gain (loss) | | Total from

investment

operations | | From net

investment

income | | From net

realized

gains | | From

return of

capital | | Total

distributions | | Payment by

affiliate | | Net asset

value,

end of

year or

period | | Total

Return(1) | | Expenses

before

reductions/

additions(2)(3)(4) | | Expenses

net of fee

waivers

and/or

recoupments

if any(2)(3)(4) | | Expenses

net of all

reductions/

additions(2)(3)(4) | | Net

investment

income

(loss)(2)(3) | | Net assets,

end of

year or

period | | Portfolio

turnover

rate |

| Year or period ended | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | (%) | | (%) | | (%) | | (%) | | (%) | | ($000’s) | | (%) |

Voya Strategic Allocation Conservative Portfolio |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12-31-22 | | | 14.26 | | | | 0.21 | • | | | (2.51 | ) | | | (2.30 | ) | | | 0.44 | | | | 0.99 | | | | — | | | | 1.43 | | | | — | | | | 10.53 | | | | (16.46 | ) | | | 0.34 | | | | 0.30 | | | | 0.30 | | | | 1.81 | | | | 53,577 | | | | 74 | |

| 12-31-21 | | | 13.45 | | | | 0.28 | • | | | 0.92 | | | | 1.20 | | | | 0.36 | | | | 0.03 | | | | — | | | | 0.39 | | | | — | | | | 14.26 | | | | 9.14 | | | | 0.36 | | | | 0.28 | | | | 0.28 | | | | 2.01 | | | | 71,425 | | | | 44 | |

| 12-31-20 | | | 13.02 | | | | 0.30 | • | | | 0.91 | | | | 1.21 | | | | 0.33 | | | | 0.45 | | | | — | | | | 0.78 | | | | — | | | | 13.45 | | | | 10.45 | | | | 0.40 | | | | 0.27 | | | | 0.27 | | | | 2.44 | | | | 66,933 | | | | 71 | |

| 12-31-19 | | | 12.34 | | | | 0.33 | | | | 1.41 | | | | 1.74 | | | | 0.36 | | | | 0.70 | | | | — | | | | 1.06 | | | | — | | | | 13.02 | | | | 14.82 | | | | 0.30 | | | | 0.26 | | | | 0.26 | | | | 2.53 | | | | 60,959 | | | | 74 | |

| 12-31-18 | | | 13.51 | | | | 0.29 | • | | | (0.80 | ) | | | (0.51 | ) | | | 0.36 | | | | 0.30 | | | | — | | | | 0.66 | | | | — | | | | 12.34 | | | | (4.03 | ) | | | 0.31 | | | | 0.26 | | | | 0.26 | | | | 2.26 | | | | 56,221 | | | | 60 | |

Class S | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12-31-22 | | | 14.11 | | | | 0.18 | • | | | (2.49 | ) | | | (2.31 | ) | | | 0.40 | | | | 0.99 | | | | — | | | | 1.39 | | | | — | | | | 10.41 | | | | (16.69 | ) | | | 0.59 | | | | 0.55 | | | | 0.55 | | | | 1.57 | | | | 2,940 | | | | 74 | |

| 12-31-21 | | | 13.31 | | | | 0.24 | • | | | 0.92 | | | | 1.16 | | | | 0.33 | | | | 0.03 | | | | — | | | | 0.36 | | | | — | | | | 14.11 | | | | 8.91 | | | | 0.61 | | | | 0.53 | | | | 0.53 | | | | 1.76 | | | | 3,797 | | | | 44 | |

| 12-31-20 | | | 12.89 | | | | 0.30 | | | | 0.87 | | | | 1.17 | | | | 0.30 | | | | 0.45 | | | | — | | | | 0.75 | | | | — | | | | 13.31 | | | | 10.19 | | | | 0.65 | | | | 0.52 | | | | 0.52 | | | | 2.20 | | | | 3,622 | | | | 71 | |

| 12-31-19 | | | 12.23 | | | | 0.30 | • | | | 1.39 | | | | 1.69 | | | | 0.33 | | | | 0.70 | | | | — | | | | 1.03 | | | | — | | | | 12.89 | | | | 14.47 | | | | 0.55 | | | | 0.51 | | | | 0.51 | | | | 2.36 | | | | 3,572 | | | | 74 | |

| 12-31-18 | | | 13.39 | | | | 0.26 | • | | | (0.80 | ) | | | (0.54 | ) | | | 0.32 | | | | 0.30 | | | | — | | | | 0.62 | | | | — | | | | 12.23 | | | | (4.25 | ) | | | 0.56 | | | | 0.51 | | | | 0.51 | | | | 2.02 | | | | 2,670 | | | | 60 | |

Voya Strategic Allocation Moderate Portfolio |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12-31-22 | | | 16.36 | | | | 0.18 | • | | | (3.10 | ) | | | (2.92 | ) | | | 0.43 | | | | 1.43 | | | | — | | | | 1.86 | | | | — | | | | 11.58 | | | | (18.16 | ) | | | 0.33 | | | | 0.33 | | | | 0.33 | | | | 1.40 | | | | 110,541 | | | | 63 | |

| 12-31-21 | | | 15.21 | | | | 0.25 | • | | | 1.77 | | | | 2.02 | | | | 0.37 | | | | 0.50 | | | | — | | | | 0.87 | | | | — | | | | 16.36 | | | | 13.84 | | | | 0.33 | | | | 0.33 | | | | 0.33 | | | | 1.60 | | | | 143,341 | | | | 44 | |

| 12-31-20 | | | 14.62 | | | | 0.30 | | | | 1.31 | | | | 1.61 | | | | 0.33 | | | | 0.69 | | | | — | | | | 1.02 | | | | — | | | | 15.21 | | | | 12.73 | | | | 0.37 | | | | 0.30 | | | | 0.30 | | | | 2.08 | | | | 131,004 | | | | 53 | |

| 12-31-19 | | | 13.59 | | | | 0.29 | • | | | 2.18 | | | | 2.47 | | | | 0.41 | | | | 1.03 | | | | — | | | | 1.44 | | | | — | | | | 14.62 | | | | 19.26 | | | | 0.30 | | | | 0.28 | | | | 0.28 | | | | 2.07 | | | | 126,475 | | | | 57 | |

| 12-31-18 | | | 14.80 | | | | 0.29 | • | | | (1.16 | ) | | | (0.87 | ) | | | 0.34 | | | | — | | | | — | | | | 0.34 | | | | — | | | | 13.59 | | | | (6.05 | ) | | | 0.28 | | | | 0.25 | | | | 0.25 | | | | 1.96 | | | | 117,049 | | | | 48 | |

Class S | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12-31-22 | | | 16.26 | | | | 0.15 | • | | | (3.08 | ) | | | (2.93 | ) | | | 0.39 | | | | 1.43 | | | | — | | | | 1.82 | | | | — | | | | 11.51 | | | | (18.34 | ) | | | 0.58 | | | | 0.58 | | | | 0.58 | | | | 1.13 | | | | 1,205 | | | | 63 | |

| 12-31-21 | | | 15.12 | | | | 0.21 | • | | | 1.76 | | | | 1.97 | | | | 0.33 | | | | 0.50 | | | | — | | | | 0.83 | | | | — | | | | 16.26 | | | | 13.55 | | | | 0.58 | | | | 0.58 | | | | 0.58 | | | | 1.34 | | | | 1,626 | | | | 44 | |

| 12-31-20 | | | 14.52 | | | | 0.24 | • | | | 1.33 | | | | 1.57 | | | | 0.28 | | | | 0.69 | | | | — | | | | 0.97 | | | | — | | | | 15.12 | | | | 12.46 | | | | 0.62 | | | | 0.55 | | | | 0.55 | | | | 1.74 | | | | 1,483 | | | | 53 | |

| 12-31-19 | | | 13.50 | | | | 0.26 | | | | 2.16 | | | | 2.42 | | | | 0.37 | | | | 1.03 | | | | — | | | | 1.40 | | | | — | | | | 14.52 | | | | 18.94 | | | | 0.55 | | | | 0.53 | | | | 0.53 | | | | 1.81 | | | | 1,885 | | | | 57 | |

| 12-31-18 | | | 14.71 | | | | 0.25 | • | | | (1.16 | ) | | | (0.91 | ) | | | 0.30 | | | | — | | | | — | | | | 0.30 | | | | — | | | | 13.50 | | | | (6.31 | ) | | | 0.53 | | | | 0.50 | | | | 0.50 | | | | 1.69 | | | | 1,725 | | | | 48 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Voya Strategic Allocation Growth Portfolio |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12-31-22 | | | 17.81 | | | | 0.16 | • | | | (3.57 | ) | | | (3.41 | ) | | | 0.48 | | | | 1.92 | | | | — | | | | 2.40 | | | | — | | | | 12.00 | | | | (19.35 | ) | | | 0.34 | | | | 0.31 | | | | 0.31 | | | | 1.19 | | | | 119,444 | | | | 58 | |

| 12-31-21 | | | 15.80 | | | | 0.23 | • | | | 2.44 | | | | 2.67 | | | | 0.33 | | | | 0.33 | | | | — | | | | 0.66 | | | | — | | | | 17.81 | | | | 17.35 | | | | 0.36 | | | | 0.32 | | | | 0.32 | | | | 1.35 | | | | 154,678 | | | | 42 | |

| 12-31-20 | | | 15.62 | | | | 0.26 | • | | | 1.49 | | | | 1.75 | | | | 0.32 | | | | 1.25 | | | | — | | | | 1.57 | | | | — | | | | 15.80 | | | | 14.40 | | | | 0.39 | | | | 0.29 | | | | 0.29 | | | | 1.87 | | | | 140,657 | | | | 56 | |

| 12-31-19 | | | 14.40 | | | | 0.28 | | | | 2.79 | | | | 3.07 | | | | 0.43 | | | | 1.42 | | | | — | | | | 1.85 | | | | — | | | | 15.62 | | | | 22.84 | | | | 0.30 | | | | 0.26 | | | | 0.26 | | | | 1.76 | | | | 130,989 | | | | 66 | |

| 12-31-18 | | | 16.03 | | | | 0.28 | • | | | (1.58 | ) | | | (1.30 | ) | | | 0.33 | | | | — | | | | — | | | | 0.33 | | | | — | | | | 14.40 | | | | (8.32 | ) | | | 0.27 | | | | 0.23 | | | | 0.23 | | | | 1.77 | | | | 114,461 | | | | 45 | |

Class S | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12-31-22 | | | 17.61 | | | | 0.12 | • | | | (3.52 | ) | | | (3.40 | ) | | | 0.44 | | | | 1.92 | | | | — | | | | 2.36 | | | | — | | | | 11.85 | | | | (19.55 | ) | | | 0.59 | | | | 0.56 | | | | 0.56 | | | | 0.93 | | | | 2,172 | | | | 58 | |

| 12-31-21 | | | 15.64 | | | | 0.18 | • | | | 2.41 | | | | 2.59 | | | | 0.29 | | | | 0.33 | | | | — | | | | 0.62 | | | | — | | | | 17.61 | | | | 16.98 | | | | 0.61 | | | | 0.57 | | | | 0.57 | | | | 1.05 | | | | 2,775 | | | | 42 | |

| 12-31-20 | | | 15.46 | | | | 0.22 | • | | | 1.48 | | | | 1.70 | | | | 0.27 | | | | 1.25 | | | | — | | | | 1.52 | | | | — | | | | 15.64 | | | | 14.16 | | | | 0.64 | | | | 0.54 | | | | 0.54 | | | | 1.57 | | | | 2,731 | | | | 56 | |

| 12-31-19 | | | 14.27 | | | | 0.22 | • | | | 2.77 | | | | 2.99 | | | | 0.38 | | | | 1.42 | | | | — | | | | 1.80 | | | | — | | | | 15.46 | | | | 22.49 | | | | 0.55 | | | | 0.51 | | | | 0.51 | | | | 1.45 | | | | 2,968 | | | | 66 | |

| 12-31-18 | | | 15.88 | | | | 0.24 | • | | | (1.56 | ) | | | (1.32 | ) | | | 0.29 | | | | — | | | | — | | | | 0.29 | | | | — | | | | 14.27 | | | | (8.50 | ) | | | 0.52 | | | | 0.48 | | | | 0.48 | | | | 1.53 | | | | 2,799 | | | | 45 | |

(1) | | Total return is calculated assuming reinvestment of all dividends, capital gain distributions and return of capital distributions, if any, at net asset value and does not reflect the effect of insurance contract charges. Total return for periods less than one year is not annualized. |

(2) | | Annualized for periods less than one year. |

(3) | | Ratios reflect operating expenses of a Portfolio. Expenses before reductions/additions do not reflect amounts reimbursed or recouped by the Investment Adviser and/or Distributor or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by a Portfolio during periods when reimbursements or reductions occur. |

| | Expenses net of fee waivers reflect expenses after reimbursement by the Investment Adviser and/or Distributor or recoupment of previously reimbursed fees by the Investment Adviser, but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions/additions represent the net expenses paid by a Portfolio. Net investment income (loss) is net of all such additions or reductions. |

(4) | | Ratios do not include expenses of underlying funds and do not include fees and expenses charged under the variable annuity contract or variable life insurance policy. |

| • | | Calculated using average number of shares outstanding throughout the year or period. |

See Accompanying Notes to Financial Statements

14

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022

NOTE 1 — ORGANIZATION

Voya Strategic Allocation Portfolios, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company. The Company was incorporated under the laws of Maryland on October 14, 1994. There are three active separate investment series (each a “Portfolio” and collectively the “Portfolios”) that comprise the Company: Voya Strategic Allocation Conservative Portfolio (“Strategic Allocation Conservative”), Voya Strategic Allocation Moderate Portfolio (“Strategic Allocation Moderate”), and Voya Strategic Allocation Growth Portfolio (“Strategic Allocation Growth”), each a diversified series of the Company. Each Portfolio currently seeks to achieve its investment objective by investing primarily in other investment companies (“Underlying Funds”) and each uses asset allocation strategies to determine how to invest in the Underlying Funds. The investment objective of the Portfolios is described in the respective Portfolio’s Prospectus.

The classes of shares included in this report are: Class I and Class S. With the exception of class specific matters, each class has equal voting rights as to voting privileges. For class specific proposals, only the applicable class would have voting privileges. The two classes differ principally in the applicable distribution and service fees, as well as differences in the amount of waiver of fees and reimbursement of expenses, if any. Generally, shareholders of each class also bear certain expenses that pertain to that particular class. All shareholders are allocated the common expenses of a portfolio and earn income and realized gains/losses from a portfolio pro rata based on the daily ending net assets of each class, without distinction between share classes. Expenses that are specific to a portfolio or a class are charged directly to that portfolio or class. Other operating expenses shared by several portfolios are generally allocated among those portfolios based on average net assets. Distributions are determined separately for each class based on income and expenses allocated to each class. Realized gain distributions are allocated to each class pro rata based on the shares outstanding of each class on the date of distribution. Differences in per share dividend rates generally result from differences in separate class expenses, including distribution and shareholder service fees, if any, as well as differences in the amount of waiver of fees and reimbursement of expenses between the separate classes, if any.

Voya Investments, LLC (“Voya Investments” or the “Investment Adviser”), an Arizona limited liability company, serves as the Investment Adviser to the Portfolios. Voya Investment Management Co. LLC (“Voya IM” or the “Sub-

Adviser”), a Delaware limited liability company, serves as the Sub-Adviser to the Portfolios. Voya Investments Distributor, LLC (“VID” or the “Distributor”), a Delaware limited liability company, serves as the principal underwriter to the Portfolios.

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies are consistently followed by the Portfolios in the preparation of their financial statements. Each Portfolio is considered an investment company under U.S. generally accepted accounting principles (“GAAP”) and follows the accounting and reporting guidance applicable to investment companies.

A. Security Valuation. Each Portfolio is open for business every day the New York Stock Exchange (“NYSE”) opens for regular trading (each such day, a “Business Day”). The net asset value (“NAV”) per share for each class of each Portfolio is determined each Business Day as of the close of the regular trading session (“Market Close”), as determined by the Consolidated Tape Association (“CTA”), the central distributor of transaction prices for exchange-traded securities (normally 4:00 p.m. Eastern time unless otherwise designated by the CTA). The NAV per share of each class of each Portfolio is calculated by taking the value of the Portfolio’s assets attributable to that class, subtracting the Portfolio’s liabilities attributable to that class, and dividing by the number of shares of that class that are outstanding. On days when a Portfolio is closed for business, Portfolio shares will not be priced and a Portfolio does not transact purchase and redemption orders. To the extent a Portfolio’s assets are traded in other markets on days when a Portfolio does not price its shares, the value of a Portfolio’s assets will likely change and you will not be able to purchase or redeem shares of a Portfolio.

Portfolio securities for which market quotations are readily available are valued at market value. Investments in open-end registered investment companies that do not trade on an exchange are valued at the end of day NAV per share. The prospectuses of the open-end registered investment companies in which each Portfolio may invest explain the circumstances under which they will use fair value pricing and the effects of using fair value pricing. Foreign securities’ prices are converted into U.S. dollar amounts using the applicable exchange rates as of Market Close.

When a market quotation for a portfolio security is not readily available or is deemed unreliable (for example when trading has been halted or there are unexpected market closures or other material events that would suggest that the market quotation is unreliable) and for purposes of determining the value of other Portfolio assets, the asset is priced at its fair value. The Board has

15

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

designated the Investment Adviser, as the valuation designee, to make fair value determinations in good faith. In determining the fair value of each Portfolio’s assets, the Investment Adviser, pursuant to its fair valuation policy, may consider inputs from pricing service providers, broker-dealers, or each Portfolio’s sub-adviser(s). Issuer specific events, transaction price, position size, nature and duration of restrictions on disposition of the security, market trends, bid/ask quotes of brokers and other market data may be reviewed in the course of making a good faith determination of an asset’s fair value. Because trading hours for certain foreign securities end before Market Close, closing market quotations may become unreliable. The prices of foreign securities will generally be adjusted based on inputs from an independent pricing service that are intended to reflect valuation changes through the NYSE close. Because of the inherent uncertainties of fair valuation, the values used to determine each Portfolio’s NAV may materially differ from the value received upon actual sale of those investments. Thus, fair valuation may have an unintended dilutive or accretive effect on the value of shareholders’ investments in each Portfolio.

The Portfolios’ financial instruments are valued at the close of the NYSE and are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 — quoted prices (unadjusted) in active markets for identical financial instruments that the portfolio can access at the reporting date.

Level 2 — inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads).

Level 3 — unobservable inputs (including the portfolio’s own assumptions in determining fair value).

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants

would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

A table summarizing each Portfolio’s investments under these levels of classification is included within each Portfolio of Investments.

Each investment asset or liability of a Portfolio is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Quoted prices in active markets for identical securities are classified as “Level 1,” inputs other than quoted prices for an asset or liability that are observable are classified as “Level 2” and significant unobservable inputs, including the Sub-Adviser’s or Pricing Committee’s judgment about the assumptions that a market participant would use in pricing an asset or liability are classified as “Level 3.” The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Short-term securities of sufficient credit quality are generally considered to be Level 2 securities under applicable accounting rules. The Portfolios classify each of their investments in the Underlying Funds as Level 1, without consideration as to the classification level of the specific investments held by the Underlying Funds. A table summarizing each Portfolio’s investments under these levels of classification is included within the Portfolio of Investments.

GAAP requires a reconciliation of the beginning to ending balances for reported fair values that presents changes attributable to total realized and unrealized gains or losses, purchases and sales, and transfers in or out of the Level 3 category during the period. A reconciliation of Level 3 investments within the Portfolio of Investments is presented only when a Portfolio has a significant amount of Level 3 investments.

B. Securities Transactions and Revenue Recognition. Security transactions are accounted for on the trade date. Dividend income received from the Underlying Funds is recognized on the ex-dividend date and is recorded as dividends from underlying funds in the Statements of Operations. Capital gain distributions received from the Underlying Funds are recognized on the ex-dividend date and are recorded on the Statements of Operations as such. Realized gains and losses are reported on the basis of identified cost of securities sold.

16

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

C. Distributions to Shareholders. The Portfolios record distributions to their shareholders on the ex-dividend date. Dividends from net investment income and capital gain distributions, if any, are declared and paid annually by the Portfolios. The Portfolios may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code. The characteristics of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from U.S. GAAP for investment companies.

D. Federal Income Taxes. It is the policy of each Portfolio to comply with the requirements of subchapter M of the Internal Revenue Code and related excise tax provisions applicable to regulated investment companies and to distribute substantially all of its net investment income and any net realized capital gains to its shareholders. Therefore, no federal income tax provision is required. Management has considered the sustainability of the Portfolios’ tax positions taken on federal income tax returns for all open tax years in making this determination. No capital gain distributions shall be made until any capital loss carryforwards have been fully utilized.

The Portfolios may utilize equalization accounting for tax purposes, whereby a portion of redemption payments are treated as distributions of income or gain.

E. Use of Estimates. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

F. Risk Exposures and the Use of Derivative Instruments. Each Portfolio’s investment strategies permit it to enter into various types of derivatives contracts, including, but not limited to, futures contracts. In doing so, a Portfolio will employ strategies in differing combinations to permit it to increase or decrease the level of risk, or change the level or types of exposure to risk factors. This may allow a Portfolio to pursue its objectives more quickly and efficiently than if it were to make direct purchases or sales of securities capable of affecting a similar response to market or credit factors.

In pursuit of its investment objectives, a Portfolio may seek to increase or decrease its exposure to the following market or credit risk factors:

Equity Risk. Stock prices may be volatile or have reduced liquidity in response to real or perceived impacts of factors including, but not limited to, economic conditions, changes in market interest rates, and political events. Stock markets tend to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds or other asset classes during some periods. Additionally, legislative, regulatory or tax policies or developments in these areas may adversely impact the investment techniques available to a manager, add to costs and impair the ability of a Portfolio to achieve its investment objectives.

Risks of Investing in Derivatives. Each Portfolio’s use of derivatives can result in losses due to unanticipated changes in the market or credit risk factors and the overall market. In instances where a Portfolio is using derivatives to decrease, or hedge, exposures to market or credit risk factors for securities held by a Portfolio, there are also risks that those derivatives may not perform as expected resulting in losses for the combined or hedged positions.

Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in market interest rates and liquidity and volatility risk. The amounts required to purchase certain derivatives may be small relative to the magnitude of exposure assumed by a Portfolio. Therefore, the purchase of certain derivatives may have an economic leveraging effect on a Portfolio and exaggerate any increase or decrease in the NAV. Derivatives may not perform as expected, so a Portfolio may not realize the intended benefits. When used for hedging purposes, the change in value of a derivative may not correlate as expected with the currency, security or other risk being hedged. When used as an alternative or substitute for direct cash investments, the return provided by the derivative may not provide the same return as direct cash investment. In addition, given their complexity, derivatives expose a Portfolio to the risk of improper valuation.

Generally, derivatives are sophisticated financial instruments whose performance is derived, at least in part, from the performance of an underlying asset or assets. Derivatives include, among other things, swap agreements, options, forwards and futures. Investments in derivatives are generally negotiated over-the-counter (“OTC”), with a single counterparty and as a result are subject to credit risks related to the counterparty’s ability or willingness to perform its obligations; any deterioration in the counterparty’s creditworthiness could adversely affect the value of the derivative. In addition, derivatives and their

17

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

underlying securities may experience periods of illiquidity which could cause a Portfolio to hold a security it might otherwise sell, or to sell a security it otherwise might hold at inopportune times or at an unanticipated price. A manager might imperfectly judge the direction of the market. For instance, if a derivative is used as a hedge to offset investment risk in another security, the hedge might not correlate to the market’s movements and may have unexpected or undesired results such as a loss or a reduction in gains.

G. Futures Contracts. Each Portfolio may enter into futures contracts involving foreign currency, interest rates, securities and security indices. A futures contract is a commitment to buy or sell a specific amount of a financial instrument at a negotiated price on a stipulated future date. Each Portfolio may buy and sell futures contracts. Futures contracts traded on a commodities or futures exchange will be valued at the final settlement price or official closing price on the principal exchange as reported by such principal exchange at its trading session ending at, or most recently prior to, the time when the Portfolio’s assets are valued.

Upon entering into a futures contract, each Portfolio is required to deposit either cash or securities (initial margin) in an amount equal to a certain percentage of the contract value. Subsequent payments (variation margin) are made or received by the Portfolio each day. The variation margin payments are equal to the daily changes in the contract value and are recorded as unrealized gains and losses and, if any, shown as variation margin receivable or payable on futures contracts on the Statement of Assets and Liabilities.

Open futures contracts are reported on a table following each Portfolio’s Portfolio of Investments. Securities held in collateralized accounts to cover initial margin requirements on open futures contracts, if any, are footnoted in the Portfolio of Investments. Cash collateral held by the broker to cover initial margin requirements on open futures contracts are noted in the Statements of Assets and Liabilities. The net change in unrealized appreciation and depreciation is reported in the Statements of Operations. Realized gains (losses) are reported in the Statements of Operations at the closing or expiration of futures contracts.

Futures contracts are exposed to the market risk factor of the underlying financial instrument. During the year ended December 31, 2022, the Portfolios used futures to enact tactical positions and to provide the Portfolios with greater liquidity. Strategic Allocation Moderate and Strategic Allocation Growth had purchased and sold futures contracts on various equity indices. Strategic Allocation Moderate and Strategic Allocation Growth also purchased

futures contracts on Eurodollars and U.S. Treasury Notes. Futures contracts are purchased to provide immediate market exposure proportionate to the size of the Portfolio’s respective cash flows and residual cash balances in order to decrease potential tracking error if the cash remained uninvested in the market. Additional associated risks of entering into futures contracts include the possibility that there may be an illiquid market where the Portfolios are unable to liquidate the contract or enter into an offsetting position and, if used for hedging purposes, the risk that the price of the contract will correlate imperfectly with the prices of the Portfolios’ securities. With futures, there is minimal counterparty credit risk to the Portfolios since futures are exchange traded and the exchange’s clearinghouse, as counterparty to all exchange traded futures, guarantees the futures against default.