Acquisition of Newell Tools OCTOBER 12, 2016

2 Cautionary Statements Stanley Black & Decker makes forward-looking statements in this presentation which represent its expectations or beliefs about future events and financial performance. Forward-looking statements are identifiable by words such as "believe," "anticipate," "expect," "intend," "plan," "will," "may" and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. Forward looking statements made in this presentation, include, but are not limited to, statements concerning: the consummation of the acquisition; Newell Tools’ business complementing and expanding Stanley Black & Decker’s existing operations; cost savings and synergies, and revenue synergies; and accretion to earnings per share. You are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are not guarantees of future events and involve risks, uncertainties and other known and unknown factors that may cause actual results and performance to be materially different from any future results or performance expressed or implied by such forward-looking statements, including, but not limited to, the failure to consummate, or a delay in the consummation of, the transaction for various reasons; failure to successfully integrate the Newell Tools business and achieve expected cost and revenue synergies; or the acquisition-related charges being greater than anticipated. Forward-looking statements made herein are also subject to risks and uncertainties, described in: Stanley Black & Decker's 2015 Annual Report on Form 10-K, its subsequently filed Quarterly Reports on Form 10-Q; and other filings Stanley Black & Decker makes with the Securities and Exchange Commission. In addition, actual results could differ materially from those suggested by the forward-looking statements, and therefore you should not place undue reliance on the forward-looking statements. Stanley Black & Decker makes no commitment to revise or update any forward- looking statements to reflect events or circumstances occurring or existing after the date of any forward-looking statement.

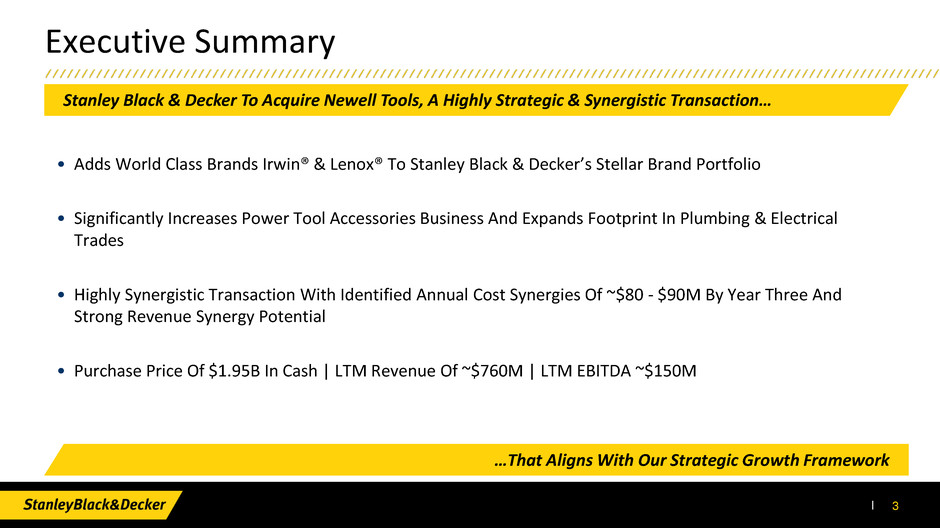

3 Executive Summary • Adds World Class Brands Irwin® & Lenox® To Stanley Black & Decker’s Stellar Brand Portfolio • Significantly Increases Power Tool Accessories Business And Expands Footprint In Plumbing & Electrical Trades • Highly Synergistic Transaction With Identified Annual Cost Synergies Of ~$80 - $90M By Year Three And Strong Revenue Synergy Potential • Purchase Price Of $1.95B In Cash | LTM Revenue Of ~$760M | LTM EBITDA ~$150M Stanley Black & Decker To Acquire Newell Tools, A Highly Strategic & Synergistic Transaction… …That Aligns With Our Strategic Growth Framework

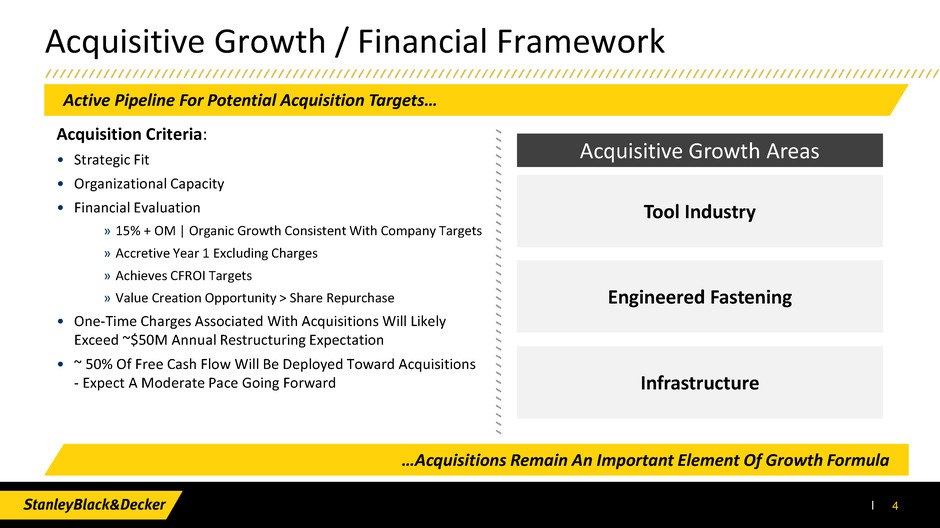

Acquisition Criteria: • Strategic Fit • Organizational Capacity • Financial Evaluation » 15% + OM | Organic Growth Consistent With Company Targets » Accretive Year 1 Excluding Charges » Achieves CFROI Targets » Value Creation Opportunity > Share Repurchase • One-Time Charges Associated With Acquisitions Will Likely Exceed ~$50M Annual Restructuring Expectation • ~ 50% Of Free Cash Flow Will Be Deployed Toward Acquisitions - Expect A Moderate Pace Going Forward 4 Acquisitive Growth / Financial Framework Active Pipeline For Potential Acquisition Targets… …Acquisitions Remain An Important Element Of Growth Formula Engineered Fastening Infrastructure Tool Industry Acquisitive Growth Areas

Product & Regional Sales Mix Primary Brands Company Overview • ~$760M Manufacturer Of Hand Tools & Power Tool Accessories • Global Footprint With Majority Of Sales In North America • Diverse & Complementary Product Line • Strong Presence In Electrical & Plumbing Trades Newell Tools: Overview 5 Highly Attractive Asset – Strong Brands, Complementary Products, New Channels N. America 60% APAC 11% LAG 15% EMEA 14% Drilling 25% Bandsaw 18%Linear Edge 20% Other HTs 7% Cutting / Circ Saw 12% Pliers & Holding 18% ~60% Of Revenue ~40% Of Revenue

Newell Tools: Brand Summary & Sample Products 6 ~60%* ~40%* Hand Tools ~5%* Accessories ~35%* Hand Tools ~33%* Accessories ~27%* *Represents Percent Of Consolidated Revenue Saw Blades, Metal & Wood Drilling Accessories Pliers, Holding & Clamping Tools, & Saws Band Saw Blades, Hole Saws & Linear Edge Cutting Accessories Hand Saws, Snips & Screwdrivers

Acquisition Summary 7 Transaction Details Financial Information Newell Tools Overview • Currently Owned By Newell Brands • Leading Global Provider Of Premium Industrial Cutting, Hand Tools & Power Tool Accessories • Rich History Dating Back To 1884 (Irwin® & Lenox® Brands Acquired In 2002/2003) • LTM Revenues Of ~$760M And LTM EBITDA Of ~$150M EPS Accretion (Ex. 1-Time Charges) & CFROI • EPS Accretion: Year 1 ~$0.15 | Year 3 ~$0.50 • CFROI: ~12% By Year 5 Timing • Subject To Customary Closing Conditions, Including Regulatory Approval • Transaction Expected To Close In First Half Of 2017 Acquisition Related Charges • ~$125 - $140M Restructuring And Other 1-Time Charges, Primarily Incurred In Years 1 & 2 • Inventory Step-Up Of ~$40M • Annual Intangible Amortization ~$50M Deal Structure & Purchase Price • 100% Acquisition | Mix Of Stock And Asset Purchase • $1.95B Cash Purchase Price Synergies • ~$80 - $90M Of Total Annual Cost Synergies • Realized By Year 3 Strategic Rationale • Expand Leadership Position In Global Tools & Storage Industry | Leverage Industry Expertise To Drive Cost & Revenue Synergy Opportunities • Strong Global Brand Presences: Irwin® & Lenox® • Complementary Product Lines With Emphasis In Hand Tools & Power Tool Accessories

Synergy Overview 8 Footprint Consolidation & Overhead Reductions Rationalizing Manufacturing & Distribution Logistics Annual Synergies: ~$20M Other Operation Synergies Leveraging Insourcing & Material Purchase Opportunities Annual Synergies: ~$10M Retail Channel Partner Programs & Portfolio Management MiUSA Expansion Industrial Channel Expand Product Distribution Points Leverage Irwin®| Lenox® Mobile Conversion Program Functional Efficiencies Optimizing Teams, Systems & Discretionary Spend Annual Synergies: ~$50 - $60M Brand & Product Expansion Lenox® Power Tools DEWALT® & Stanley Accessories Lenox® & Irwin® Storage Significant Annual Cost Synergies Identified Of ~$80 - $90M… …Leveraging Brands, Channels & Service Level Improvements Presents Meaningful Revenue Synergy Opportunities Identified Annual Cost Synergies Potential Revenue Opportunities Geographic Expansion

Summary Enhances Existing Strong Brand Portfolio With Addition Of Irwin® & Lenox® Brands Increases Global Cross-Branding Opportunities For Tools & Storage Business Acquisition Consistent With Longstanding Growth Framework To Enhance Leadership Position Within Tools Industry EPS Accretion, Ex-Charges, Of ~$0.15 Per Share Expected In Year One And ~$0.50 Per Share In Year Three 9

THANK YOU!