2

Forward Looking Statements

CAUTIONARY STATEMENTS

Under the Private Securities Litigation Reform Act of 1995

Statements in this presentation that are not historical, including but not limited to those regarding the consummation of the proposed transaction between Stanley and Black & Decker and the realization of synergies in

connection therewith, are “forward looking statements” and, as such, are subject to risk and uncertainty.

Stanley’s and Black & Decker’s ability to deliver the results as described in this presentation is based on current expectations and involves inherent risks and uncertainties, including factors listed below and other factors

that could delay, divert, or change any of them, and could cause actual outcomes and results to differ materially from current expectations. In addition to the risks, uncertainties and other factors discussed in this

presentation, the risks, uncertainties and other factors that could cause or contribute to actual results differing materially from those expressed or implied in the forward looking statements include, without limitation, those

set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and other sections of Stanley’s and Black &

Decker’s Annual Reports on Form 10-K and any material changes thereto set forth in any subsequent Quarterly Reports on Form 10-Q, those contained in Stanley’s and Black & Decker’s other filings with the Securities

and Exchange Commission, and those set forth below.

These factors include but are not limited to the risk that regulatory and stockholder approvals of the transaction are not obtained on the proposed terms and schedule; the future business operations of Stanley or Black &

Decker will not be successful; the risk that the proposed transaction between Stanley and Black & Decker will not be consummated; the risk that Stanley and Black & Decker will not realize any or all of the anticipated

benefits from the transaction; the risk that cost synergy, customer retention and revenue expansion goals for the transaction will not be met and that disruptions from the transaction will harm relationships with customers,

employees and suppliers; the risk that unexpected costs will be incurred; the outcome of litigation (including with respect to the transaction) and regulatory proceedings to which Stanley or Black & Decker may be a party;

pricing pressure and other changes within competitive markets; the continued consolidation of customers particularly in consumer channels; inventory management pressures on Stanley’s and Black & Decker’s

customers; the impact the tightened credit markets may have on Stanley or Black & Decker or customers or suppliers; the extent to which Stanley or Black & Decker has to write off accounts receivable or assets or

experiences supply chain disruptions in connection with bankruptcy filings by customers or suppliers; increasing competition; changes in laws, regulations and policies that affect Stanley or Black & Decker, including, but

not limited to trade, monetary, tax and fiscal policies and laws; the timing and extent of any inflation or deflation in 2009 and beyond; currency exchange fluctuations; the impact of dollar/foreign currency exchange and

interest rates on the competitiveness of products and Stanley’s and Black & Decker’s debt programs; the strength of the U.S. and European economies; the extent to which world-wide markets associated with

homebuilding and remodeling continue to deteriorate; the impact of events that cause or may cause disruption in Stanley’s or Black & Decker’s manufacturing, distribution and sales networks such as war, terrorist

activities, and political unrest; and recessionary or expansive trends in the economies of the world in which Stanley or Black & Decker operates, including but not limited to the extent and duration of the current recession

in the US economy.

Neither Stanley nor Black & Decker undertake any obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise after the date hereof.

Additional Information

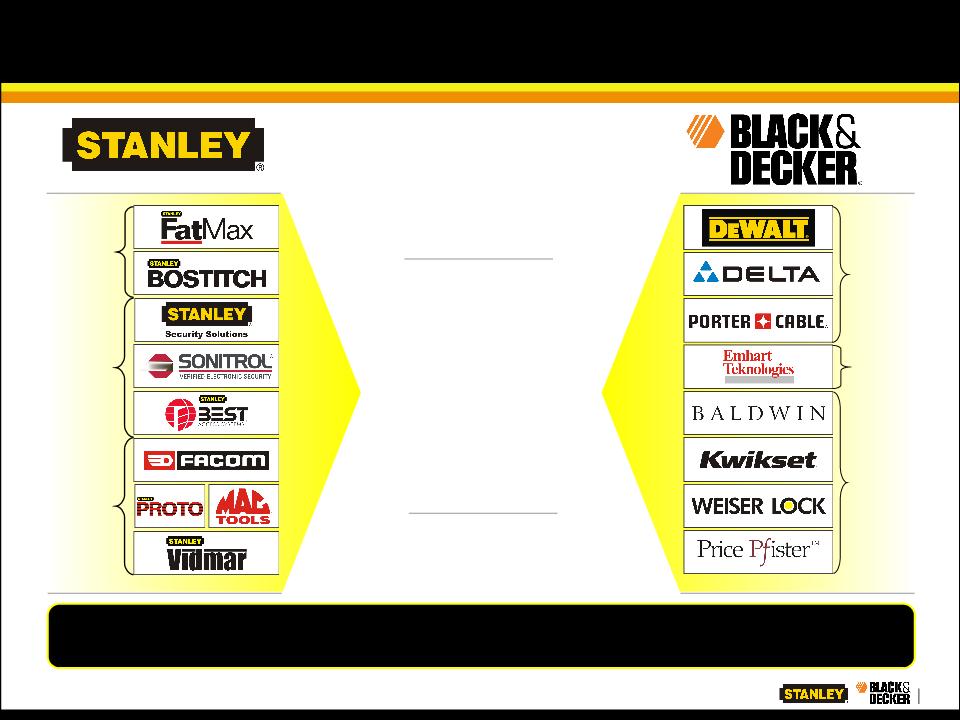

The proposed transaction involving Stanley and Black & Decker will be submitted to the respective stockholders of Stanley and Black & Decker for their consideration. In connection with the proposed transaction,

Stanley will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include a joint proxy statement of Stanley and Black & Decker that will also constitute a prospectus

of Stanley. Investors and security holders are urged to read the joint proxy statement/prospectus and any other relevant documents filed with the SEC when they become available, because they will

contain important information. Investors and security holders may obtain a free copy of the joint proxy statement/prospectus and other documents (when available) that Stanley and Black & Decker file with the SEC at

the SEC’s website at www.sec.gov and Stanley’s website related to the transaction at www.stanleyblackanddecker.com. In addition, these documents may be obtained from Stanley or Black & Decker free of charge by

directing a request to Investor Relations, The Stanley Works, 1000 Stanley Drive, New Britain, CT 06053, or to Investor Relations, The Black & Decker Corporation, 701 E. Joppa Road, Towson, Maryland 21286,

respectively. Stanley, Black & Decker and certain of their respective directors and executive officers may be deemed to be participants in the proposed transaction under the rules of the SEC. Investors and security

holders may obtain information regarding the names, affiliations and interests of Stanley’s directors and executive officers in Stanley’s Annual Report on Form 10-K for the year ended January 3, 2009, which was filed

with the SEC on February 26, 2009, and its proxy statement for its 2009 Annual Meeting, which was filed with the SEC on March 20, 2009. Investors and security holders may obtain information regarding the names,

affiliations and interests of Black & Decker’s directors and executive officers in Black & Decker’s Annual Report on Form 10-K for the year ended December 31, 2008, which was filed with the SEC on February 17, 2009,

and its proxy statement for its 2009 Annual Meeting, which was filed with the SEC on March 16, 2009. These documents can be obtained free of charge from the sources listed above. Additional information regarding

the interests of these individuals will also be included in the joint proxy statement/prospectus regarding the proposed transaction when it becomes available.

Non-Solicitation

A registration statement relating to the securities to be issued by Stanley in the proposed transaction will be filed with the SEC, and Stanley will not issue, sell or accept offers to buy such securities prior to the time such

registration statement becomes effective. This document shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of such securities, in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction.