Exhibit 99.1

Exhibit 99.1

The PMI Group, Inc.

Cautionary Statement: Statements in this presentation that are not historical facts or that relate to future plans, events or performance are “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements relating to our business strategy and FGIC’s expansion opportunities. Many factors could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements.

Changes in economic conditions, including economic recessions or slowdowns, adverse changes in consumer confidence, declining housing values, higher unemployment rates, deteriorating borrower credit, changes in interest rates, or combinations of these factors, could affect the mortgage origination market, the demand for mortgage insurance and/or PMI’s insurance in force. Changes in economic conditions also could cause the number and severity of claims on policies issued by PMI to increase and this could adversely affect our financial condition and results of operations. The performance of our Australian subsidiary could be adversely affected by a weakening in the demand for housing, interest rate volatility, and/or an increase in claims. Events or developments affecting FGIC may cause our investment in FGIC not to contribute the earnings estimated. Other risks and uncertainties are discussed in our SEC filings, including our Form 10-Q for the period ended June 30, 2004. PMI undertakes no obligation to update forward-looking statements.

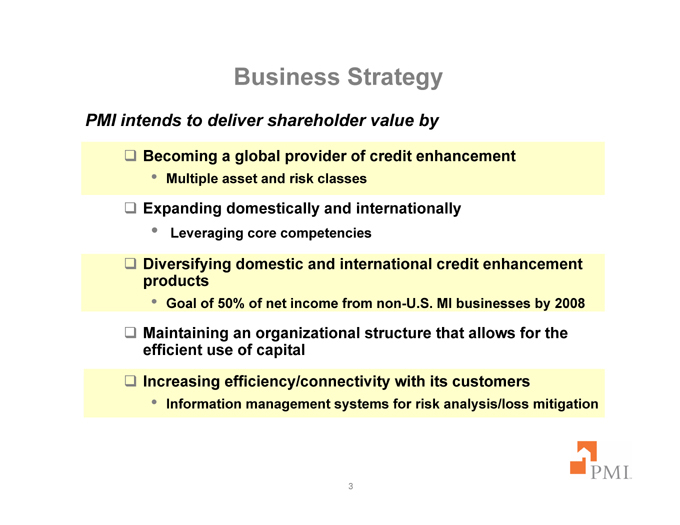

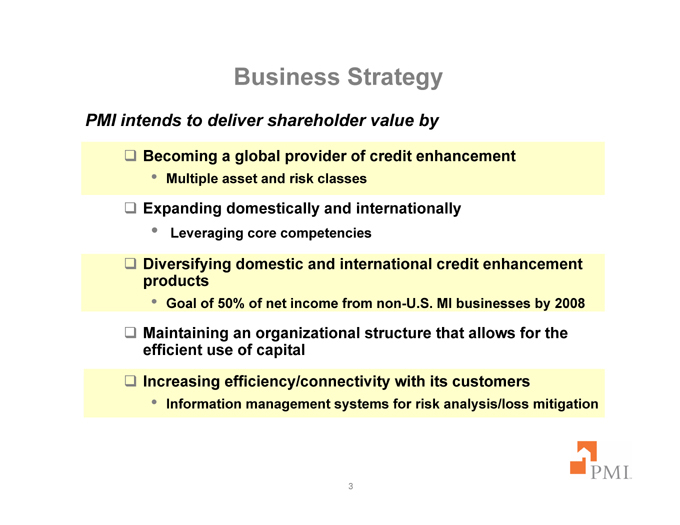

Business Strategy

PMI intends to deliver shareholder value by

Becoming a global provider of credit enhancement

Multiple asset and risk classes

Expanding domestically and internationally

Leveraging core competencies

Diversifying domestic and international credit enhancement products

Goal of 50% of net income from non-U.S. MI businesses by 2008

Maintaining an organizational structure that allows for the efficient use of capital

Increasing efficiency/connectivity with its customers

Information management systems for risk analysis/loss mitigation

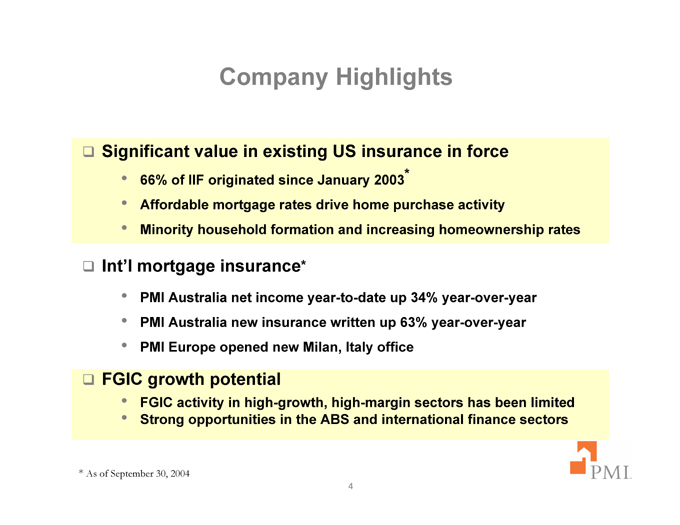

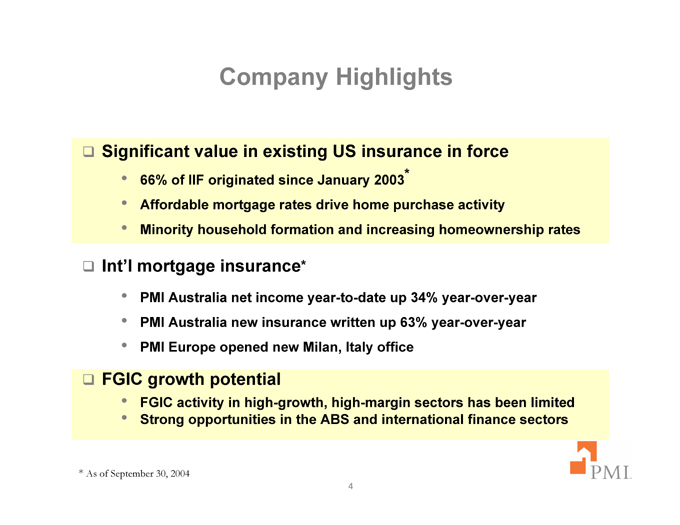

Company Highlights

Significant value in existing US insurance in force

66% of IIF originated since January 2003*

Affordable mortgage rates drive home purchase activity

Minority household formation and increasing homeownership rates

Int’l mortgage insurance*

PMI Australia net income year-to-date up 34% year-over-year

PMI Australia new insurance written up 63% year-over-year

PMI Europe opened new Milan, Italy office

FGIC growth potential

FGIC activity in high-growth, high-margin sectors has been limited

Strong opportunities in the ABS and international finance sectors

* As of September 30, 2004

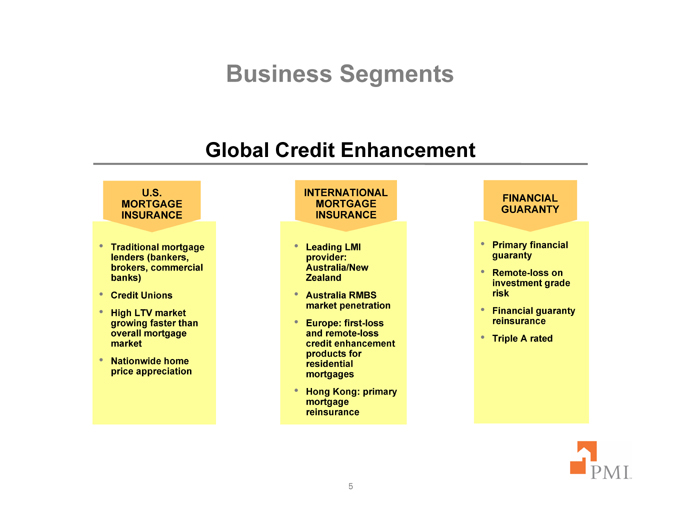

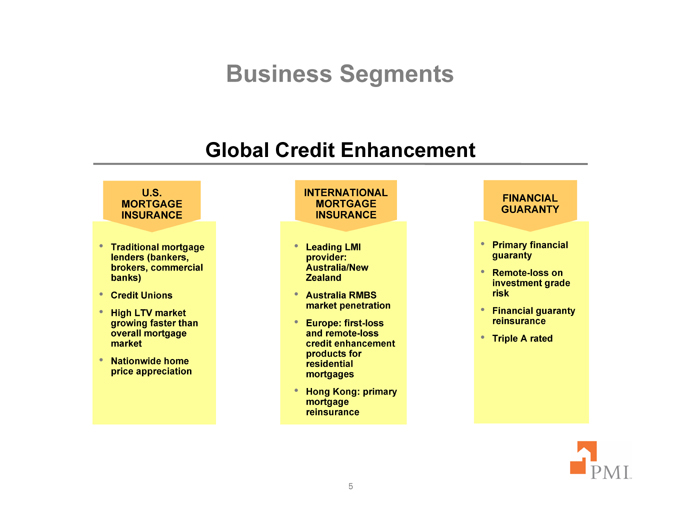

Business Segments

Global Credit Enhancement

U.S. MORTGAGE INSURANCE

Traditional mortgage lenders (bankers, brokers, commercial banks)

Credit Unions

High LTV market growing faster than overall mortgage market

Nationwide home price appreciation

INTERNATIONAL MORTGAGE INSURANCE

Leading LMI provider: Australia/New Zealand

Australia RMBS market penetration

Europe: first-loss and remote-loss credit enhancement products for residential mortgages

Hong Kong: primary mortgage reinsurance

FINANCIAL GUARANTY

Primary financial guaranty

Remote-loss on investment grade risk

Financial guaranty reinsurance

Triple A rated

US Mortgage Insurance

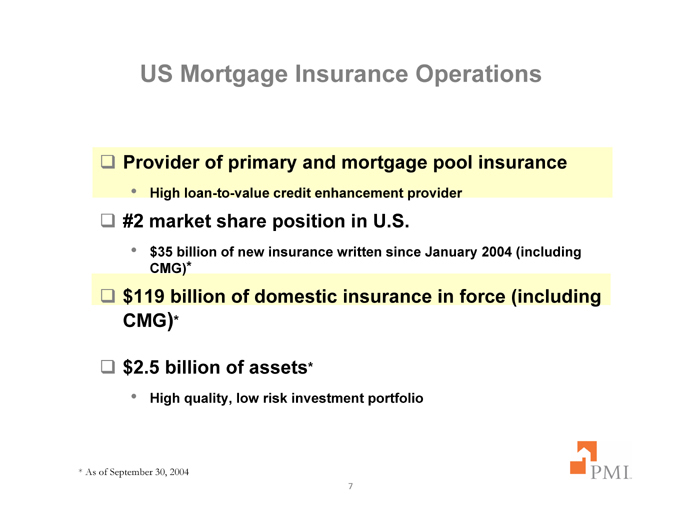

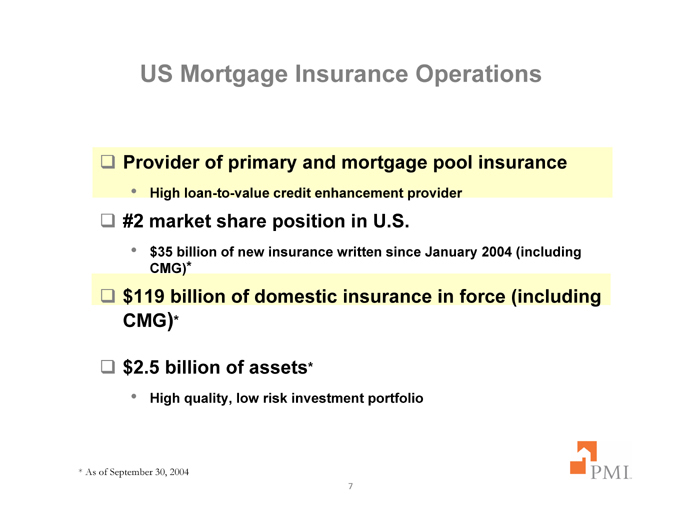

US Mortgage Insurance Operations

Provider of primary and mortgage pool insurance

High loan-to-value credit enhancement provider

#2 market share position in U.S.

$35 billion of new insurance written since January 2004 (including CMG)*

$119 billion of domestic insurance in force (including CMG)*

$2.5 billion of assets*

High quality, low risk investment portfolio

* As of September 30, 2004

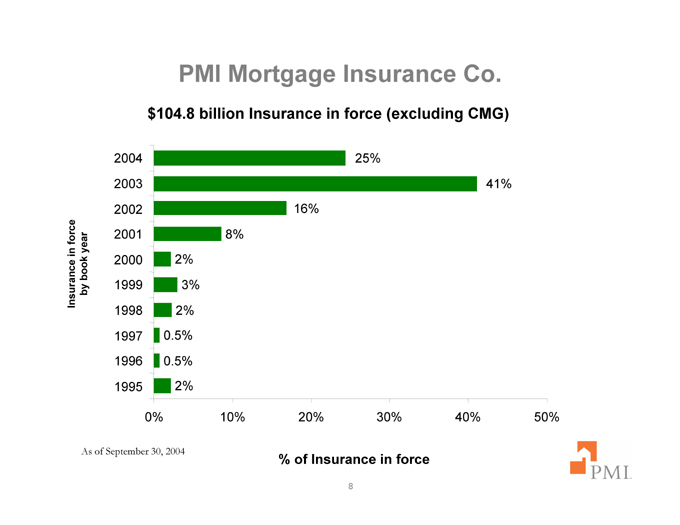

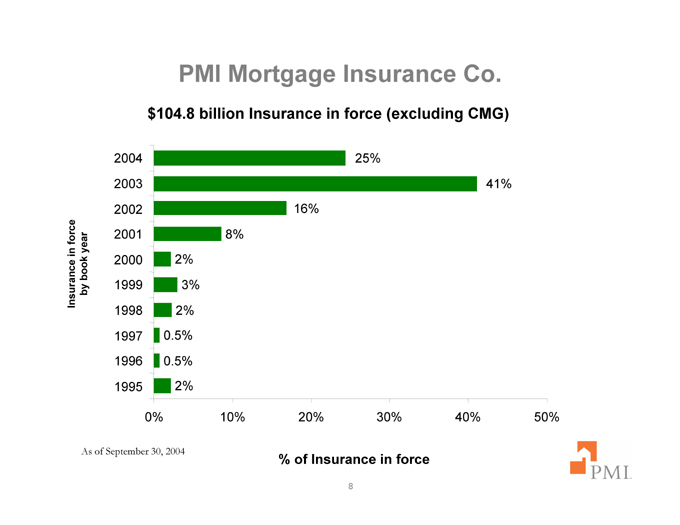

PMI Mortgage Insurance Co.

$104.8 billion Insurance in force (excluding CMG)

2004

25%

2003

41%

16%

2002

2001

8%

Insurance in force by book year

2%

2000

1999

3%

1998

2%

0.5%

1997

1996

0.5%

2%

1995

40%

30%

20%

10%

0%

50%

% of Insurance in force

As of September 30, 2004

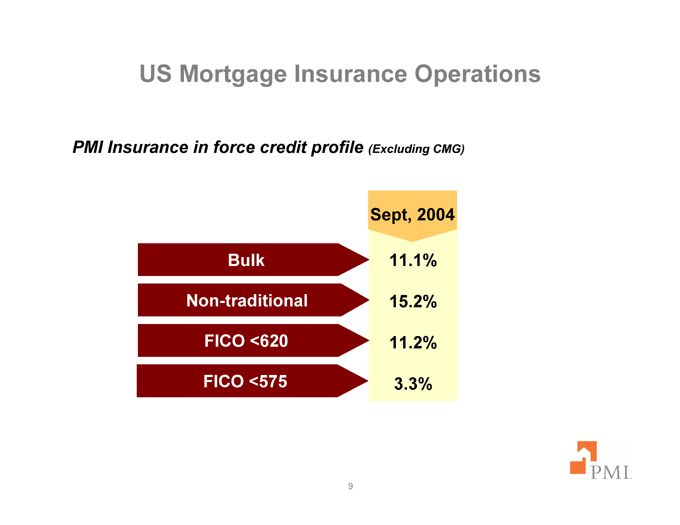

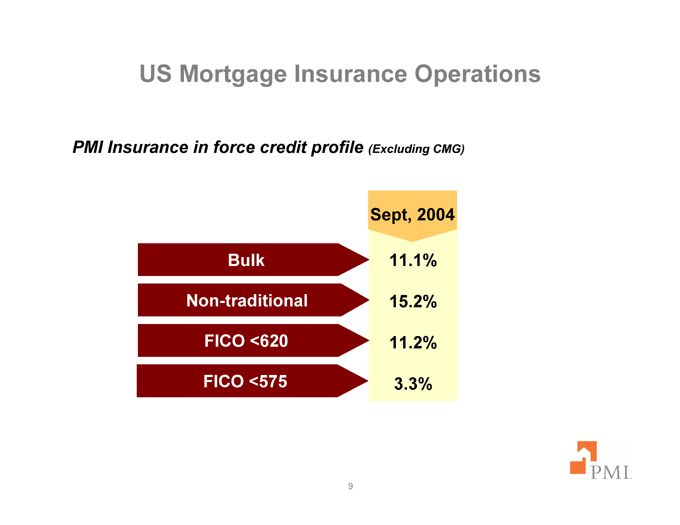

US Mortgage Insurance Operations

PMI Insurance in force credit profile (Excluding CMG)

Sept, 2004

11.1%

15.2%

11.2%

3.3%

Bulk

Non-traditional

FICO <620

FICO <575

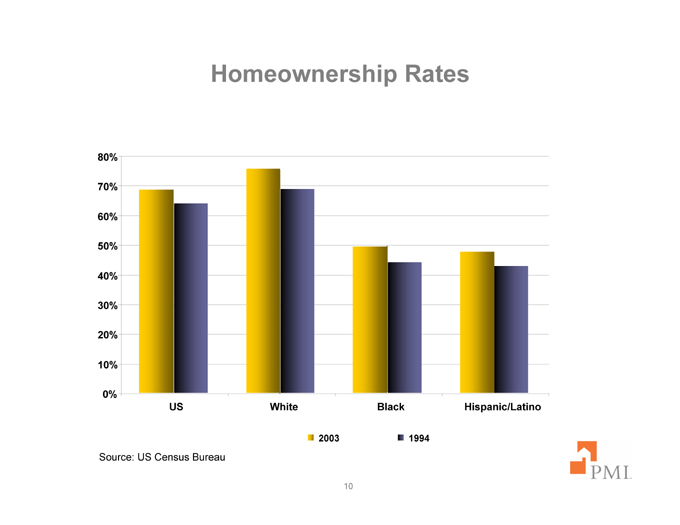

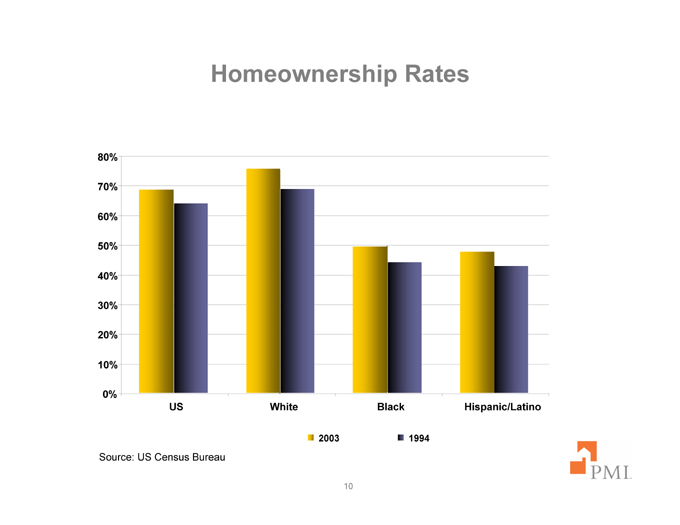

Homeownership Rates

80%

70%

60%

50%

40%

30%

20%

10%

0%

US

White

Black

Hispanic/Latino

2003

1994

Source: US Census Bureau

International Mortgage Insurance

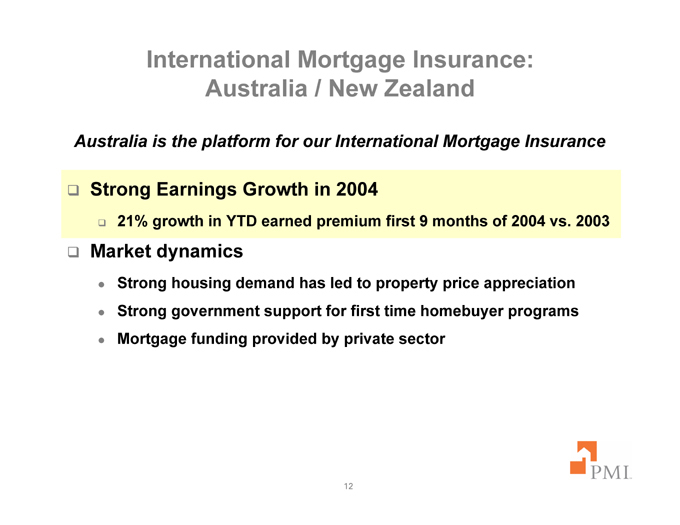

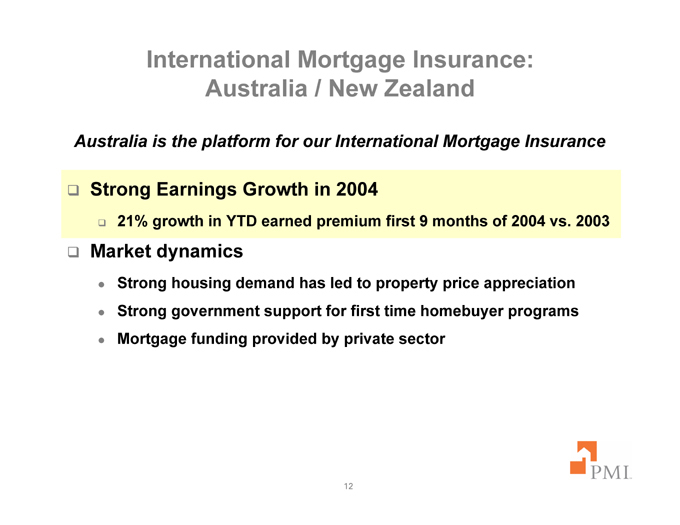

International Mortgage Insurance:

Australia / New Zealand

Australia is the platform for our International Mortgage Insurance

Strong Earnings Growth in 2004

21% growth in YTD earned premium first 9 months of 2004 vs. 2003

Market dynamics

Strong housing demand has led to property price appreciation

Strong government support for first time homebuyer programs

Mortgage funding provided by private sector

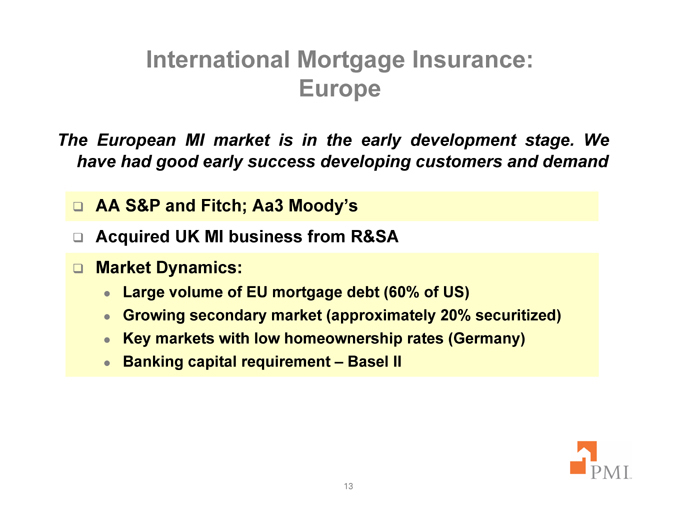

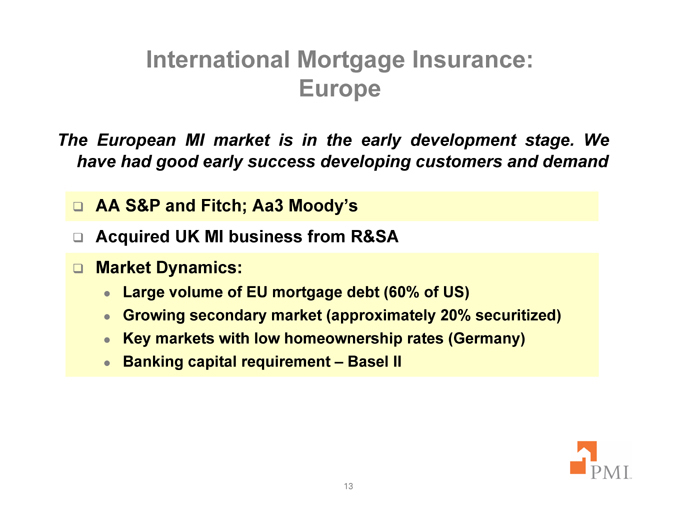

International Mortgage Insurance:

Europe

The European MI market is in the early development stage. We have had good early success developing customers and demand

AA S&P and Fitch; Aa3 Moody’s

Acquired UK MI business from R&SA

Market Dynamics:

Large volume of EU mortgage debt (60% of US)

Growing secondary market (approximately 20% securitized)

Key markets with low homeownership rates (Germany)

Banking capital requirement – Basel II

Financial Guaranty

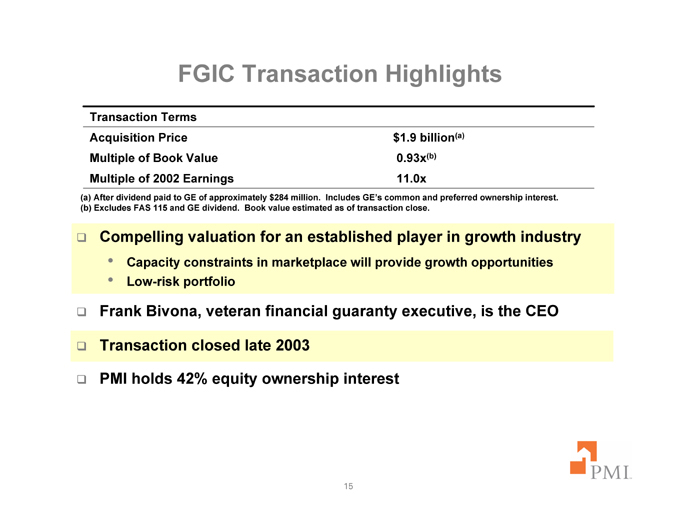

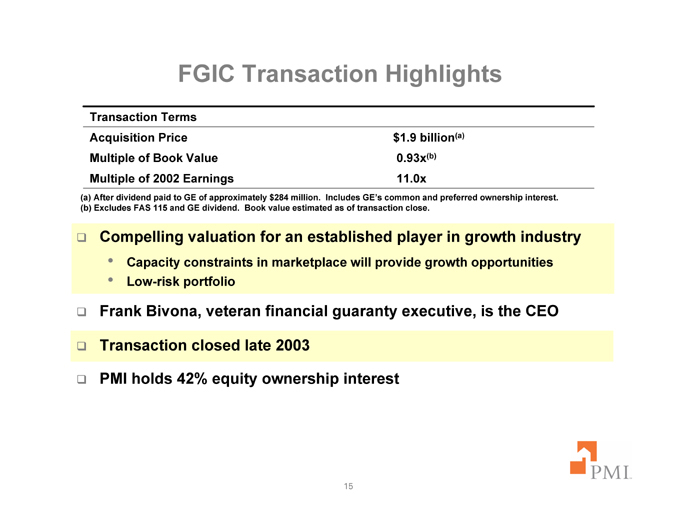

FGIC Transaction Highlights

Transaction Terms

Acquisition Price

Multiple of Book Value

Multiple of 2002 Earnings

$1.9 billion(a)

0.93x(b)

11.0x

(a) After dividend paid to GE of approximately $284 million. Includes GE’s common and preferred ownership interest.

(b) Excludes FAS 115 and GE dividend. Book value estimated as of transaction close.

Compelling valuation for an established player in growth industry

Capacity constraints in marketplace will provide growth opportunities

Low-risk portfolio

Frank Bivona, veteran financial guaranty executive, is the CEO

Transaction closed late 2003

PMI holds 42% equity ownership interest

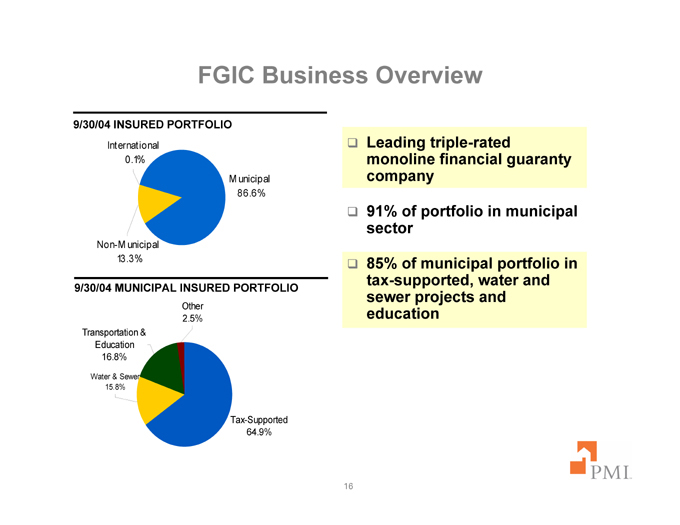

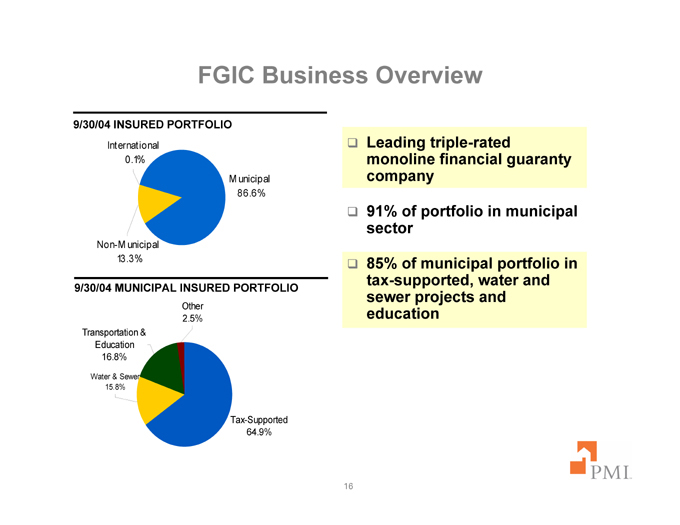

FGIC Business Overview

9/30/04 INSURED PORTFOLIO

International 0.1%

Non-Municipal 13.3%

Municipal 86.6%

9/30/04 MUNICIPAL INSURED PORTFOLIO

Other 2.5%

Transportation & Education 16.8%

Water & Sewer 15.8%

Tax-Supported 64.9%

Leading triple-rated monoline financial guaranty company

91% of portfolio in municipal sector

85% of municipal portfolio in tax-supported, water and sewer projects and education

FGIC Opportunities

Potential for broad-based expansion into diverse MBS and selected ABS sectors

Capacity-constrained sectors offer unique opportunity for ‘newcomer’ FGIC

Expansion of FGIC’s international business operations

Western Europe’s structured finance and public finance

Followed by Australia and Japan

Strategic cooperation with The PMI Group

Joint product development and marketing

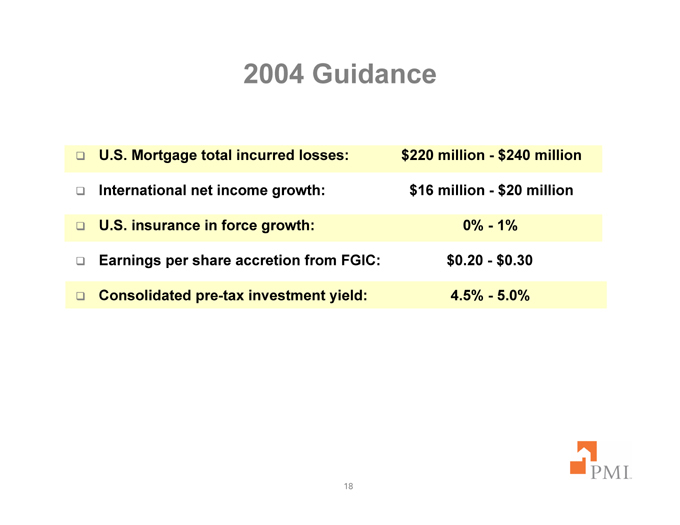

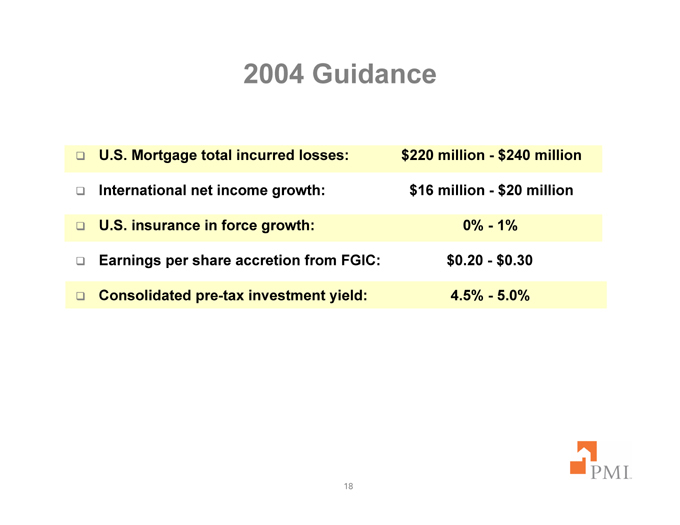

2004 Guidance

U.S. Mortgage total incurred losses: $220 million - $240 million

International net income growth: $16 million - $20 million

U.S. insurance in force growth: 0% - 1%

Earnings per share accretion from FGIC: $0.20 - $0.30

Consolidated pre-tax investment yield: 4.5% - 5.0%

Contact

GLEN CORSO

Group Senior Vice President

925-658-6429

CORPORATE CAPITAL MANAGEMENT AND CORPORATE RELATIONS

The PMI Group, Inc.

3003 Oak Road

Walnut Creek, CA 94597