UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

OR

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-13664

THE PMI GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 3003 Oak Road Walnut Creek, California 94597 | | 94-3199675 |

| (State of Incorporation) | | (Address of principal executive offices) | | (I.R.S. Employer Identification No.) |

(925) 658-7878

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | New York Stock Exchange |

| Preferred Stock Purchase Rights | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definition of “large accelerated filer” and “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

Large accelerate filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller Reporting Company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting stock (common stock) held by non-affiliates of the registrant as of the close of business on June 29, 2007 was approximately $2.9 billion based on the closing sale price of the common stock on the New York Stock Exchange consolidated tape on that date. All executive officers and directors, and beneficial owners of 10% or more of the outstanding shares, of the registrant have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant.

Number of shares outstanding of registrant’s common stock, as of close of business on February 29, 2008: 81,212,154.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for registrant’s Annual Meeting of Stockholders to be held on May 15, 2008 are incorporated by reference into Items 10 through 14 of Part III.

TABLE OF CONTENTS

Cautionary Statement Regarding Forward-Looking Statements

Statements we make or incorporate by reference in this and other documents filed with the Securities and Exchange Commission that are not historical facts, that are preceded by, followed by or include the words “believes,” “expects,” “anticipates,” “estimates” or similar expressions, or that relate to future plans, events or performance are “forward-looking statements” within the meaning of the federal securities laws. When a forward-looking statement includes an underlying assumption, we caution that, while we believe the assumption to be reasonable and make it in good faith, assumed facts almost always vary from actual results, and the difference between assumed facts and actual results can be material. Where, in any forward-looking statement, we express an expectation or belief as to future results, there can be no assurance that the expectation or belief will result. Our actual results may differ materially from those expressed in our forward-looking statements. Forward-looking statements involve a number of risks or uncertainties including, but not limited to, the Risk Factors addressed in Item 1A below. Other risks are referred to from time to time in our periodic filings with the Securities and Exchange Commission.All of our forward-looking statements are qualified by and should be read in conjunction with our risk disclosures. Except as may be required by applicable law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

1

PART I

| A. | | Overview of Operations |

We provide financial products designed to reduce risk, lower costs and expand market access for residential mortgages, public finance obligations and asset-backed securities. Our products include:

| | • | | Mortgage insurance and reinsurance; |

| | • | | Structured finance solutions, which may take the form of mortgage insurance; and |

Through our U.S., International and Financial Guaranty segments, we offer these products across the credit spectrum and in a variety of countries.

Our mortgage insurance and structured finance products support the mortgage finance system by providing protection to mortgage lenders and investors in the event of borrower default. By protecting lenders and investors from credit losses, we help to ensure that mortgages are available to prospective homebuyers. Our financial guaranty products also support the infrastructure on which homeownership depends, including transportation, schools, hospitals, and utilities.

The significant weakening of the U.S. residential mortgage, housing, credit, and capital markets negatively affected our financial condition and results of operations in 2007. Our consolidated net loss was $915.3 million for the year ended December 31, 2007. We discuss the impact of the mortgage, housing, credit, and capital market declines on our operating segments in Items 1(B).U.S. Mortgage Insurance Operations, 1(C).International Operations and 1(D).Financial Guaranty, below. Our financial condition and results of operations for 2007 are discussed on both a consolidated and segment basis in Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operations, below.

U.S. Mortgage Insurance Operations. Our U.S. subsidiary, PMI Mortgage Insurance Co., including its affiliated U.S. companies, collectively referred to as PMI, is a leading U.S. residential mortgage insurer. PMI offers a variety of mortgage insurance and structured finance products to meet the capital and credit risk mitigation needs of its customers. We also own 50% of CMG Mortgage Insurance Company, or CMG MI, a joint venture that provides mortgage insurance exclusively to credit unions.

International Operations. Through our Australian subsidiaries (collectively, “PMI Australia”), we are one of the leading providers of mortgage insurance in Australia and New Zealand. PMI Australia provides credit enhancement products to lending institutions as well as credit enhancement for residential mortgage-backed securitizations. Our European subsidiaries (collectively, “PMI Europe”) offer mortgage insurance and mortgage credit enhancement products, including primary mortgage insurance, structured portfolio products and reinsurance products, primarily tailored to the European mortgage markets. Our Hong Kong subsidiary, PMI Asia, offers mortgage reinsurance to residential mortgage lenders and investors in Asian markets. PMI Canada, our Canadian mortgage insurer, began offering residential mortgage insurance products in 2007.

Financial Guaranty. We are the lead investor in FGIC Corporation, whose wholly-owned subsidiary, Financial Guaranty Insurance Company (“FGIC”), provides financial guaranty insurance for public finance and structured finance obligations. As a result of the deterioration of the credit and capital markets in 2007 and the downgrades of FGIC in 2008 to “A” by Standard & Poor’s, “AA” by Fitch and “A3” by Moody’s, FGIC has ceased writing new business, and we believe it is unlikely that FGIC will be able to write new financial guaranty business at its current ratings. As described further below, FGIC Corporation has proposed a significant restructuring of its insurance operations to the New York Insurance Department, including the organization of a

2

new financial guaranty insurer to be domiciled in New York to provide support for the global public finance and infrastructure obligations previously insured by FGIC and to write new business to serve those markets. We do not know what form such restructuring, if any, will ultimately take. Our surety company, PMI Guaranty Co., provides financial guaranty insurance, financial guaranty reinsurance and related credit enhancement products and services. We also have a substantial ownership stake in RAM Holdings Ltd., the parent company of RAM Reinsurance Company Ltd. (“RAM Re”), a Bermuda-based financial guaranty reinsurance company.

Financial Strength Ratings. Independent rating agencies have assigned our insurance subsidiaries the insurer financial strength ratings shown in the table below. These ratings are based on the rating agencies’ assessments of the financial risks associated with historical business activities and new business initiatives. In their assessments, the rating agencies model the adequacy of capital to withstand severe loss scenarios and review, among other things, corporate strategy, operational performance, available liquidity, the outlook for the relevant industry, and competitive position. The rating agencies can change or withdraw their ratings at any time.

| | | | | | | | |

| | | Insurer Financial Strength Ratings

(as of March 14, 2008) |

| | | Standard & Poor’s | | Fitch | | Moody’s | | DBRS |

PMI Mortgage Insurance Co. | | AA | | AA | | Aa2 | | AA |

PMI Insurance Co. | | AA | | AA | | Aa2 | | - |

PMI Australia | | AA | | AA | | Aa2 | | - |

PMI Canada | | - | | - | | - | | AA |

PMI Europe | | AA | | AA | | Aa3 | | - |

PMI Guaranty | | AA | | AA | | Aa3 | | - |

CMG MI | | AA- | | AA | | - | | - |

FGIC | | A | | AA | | A3 | | - |

RAM Re | | AAA | | - | | Aa3 | | - |

Many of our customers view the insurer financial strength ratings assigned to us as indicative of our strength as a counterparty. For example, the value of our credit enhancement products in capital markets transactions is determined in significant part by our applicable insurer financial strength ratings. In the United States, two of our largest customers, Fannie Mae and Freddie Mac (collectively, the “GSEs”), require eligible mortgage insurers such as PMI to be rated at a minimum of “AA-” or its equivalent by at least two of the national rating agencies. The GSEs also may limit the activities of eligible mortgage insurers who have been downgraded by one rating agency below “AA-” although they have stated that they will temporarily suspend imposition of such limitations provided that the downgraded insurer submits, and the GSE approves, a remediation plan. Accordingly, a ratings downgrade, or the announcement of a potential downgrade or other concern relating to the financial strength of our insurance subsidiaries could have a material adverse effect on our business prospects, our ability to compete, and our holding company debt ratings. A number of our insurance subsidiaries (PMI Australia, PMI Europe, PMI Guaranty, PMI Canada, CMG MI and, indirectly, PMI Asia) receive capital support from PMI and are, therefore, dependent in part upon the financial strength and ratings of PMI. Thus, the ratings or performance of our insurance subsidiaries who receive capital support from PMI would be adversely affected by a ratings downgrade of PMI. Ratings assigned to our holding company or its debt are set out below.

| | | | | | |

| | | Holding Company Ratings

(as of March 14, 2008) |

| | | Standard & Poor’s

Counterparty

Credit

Rating | | Fitch Senior

Unsecured

Debt

Rating | | Moody’s Senior

Unsecured

Debt

Rating |

The PMI Group, Inc. | | A | | A | | A1 |

For a discussion of recent rating agency actions with respect to our holding company’s ratings and subsidiaries’ insurer financial strength ratings and risk factors associated with these issues, see Item 1A.Risk

3

Factors—A downgrade of the financial strength ratings of our wholly-owned insurance subsidiaries wouldadversely affect our business and prospects and, consequently, our results of operations and financial conditionandRecent downgrades relating to FGIC and the placing of RAM Re on negative credit watch have adversely affected our financial condition and results of operations. Additional adverse rating agency actions with respect to FGIC or RAM Re could further harm our financial condition and results of operationsand Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Ratings, below.

As of December 31, 2007, our consolidated total assets were $5.1 billion, including our investment portfolio of $3.7 billion. Our consolidated shareholders’ equity was $2.5 billion as of December 31, 2007. See Item 8. Financial Statements and Supplementary Data—Note 17. Business Segments, for financial information regarding our business segments.

Our website address ishttp://www.pmigroup.com. Information on our website does not constitute part of this report. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports are available free of charge on our website via a hyperlink as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission.

The PMI Group is a Delaware corporation. Our principal executive offices are located at 3003 Oak Road, Walnut Creek, California 94597-2098, and our telephone number is (925) 658-7878.

| B. | | U.S. Mortgage Insurance Operations |

Through PMI, we provide residential mortgage insurance and structured finance products to mortgage lenders, capital market participants and investors throughout the United States. PMI is incorporated in Arizona, headquartered in Walnut Creek, California, and licensed in all 50 states, the District of Columbia, Puerto Rico, Guam, and the Virgin Islands. Under its monoline insurance licenses, PMI may only offer mortgage insurance covering first lien, one-to-four family residential mortgages.

Residential mortgage insurance protects mortgage lenders, and subsequent holders of insured mortgage loans, in the event of borrower default, by reducing and, in some instances, eliminating the resulting credit loss to the insured institution. By mitigating default risk, residential mortgage insurance facilitates the origination of “low down payment mortgages,” generally mortgages with down payments of less than 20% of the value of the homes. Mortgage insurance also reduces the capital that financial institutions are required to hold against low down payment mortgages and facilitates the sale of low down payment mortgage loans in the secondary mortgage market.

PMI’s residential mortgage insurance products most frequently provide first loss protection on loans held by portfolio lenders and insured loans sold to the GSEs or the “agency market”. PMI also offers structured finance products, in the form of mortgage insurance, to the GSEs and offers first loss and/or mezzanine loss credit enhancement of mortgage-backed securities issued by capital market participants other than the GSEs (the “non-agency market”). The size of the non-agency market decreased significantly over the course of 2007. The mortgage insurance and structured finance products PMI offers to meet the demands of the mortgage origination, agency and non-agency markets are described below.

The deterioration of the U.S. residential mortgage, housing, credit, and capital markets significantly impacted PMI in 2007. Section 7.Defaults and Claims, below, shows the higher delinquency rates, higher claims paid and higher loss reserves experienced by PMI in 2007. Section 6.Risk Management, below, discusses underwriting guidelines and pricing changes made by PMI. For a detailed review of PMI’s 2007 financial results, see Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operations – U.S. Mortgage Insurance Operations, below.

4

(a) Primary Mortgage Insurance

Primary insurance provides the insured with first-loss mortgage default protection on individual loans at specified coverage percentages. Our maximum obligation to an insured with respect to a claim is generally determined by multiplying the coverage percentage selected by the insured by the loss amount on the defaulted loan. The loss amount includes any unpaid loan balance, delinquent interest and certain expenses associated with the loan’s default and property foreclosure. In lieu of paying the coverage percentage of the loss amount on a defaulted loan, we generally may: (i) pay the full loss amount and take title to the mortgaged property, or (ii) in the event that the property is sold prior to settlement of the claim, pay the insured’s actual loss.

We offer primary mortgage insurance on a loan-by-loan basis to lenders through our “flow” channel. We also offer issuers of mortgage-backed securities (“MBS”) and portfolio investors primary mortgage insurance that covers large portfolios of mortgage loans. These structured finance products may provide regulatory capital relief and default protection to portfolio investors, including the GSEs, or may serve as credit enhancement for agency and non-agency MBS transactions.

PMI’s primary insurance in force and primary risk in force at December 31, 2007 were $123.6 billion and $31.0 billion, respectively. Primary insurance in force refers to the current principal balance of all outstanding mortgage loans with primary insurance coverage as of a given date. Primary risk in force is the aggregate dollar amount of each primary insured mortgage loan’s current principal balance multiplied by the insurance coverage percentage specified in the policy. The chart below shows our U.S. primary new insurance written, or NIW, for the years ended December 31, 2007, 2006 and 2005. NIW refers to the original principal balance of all loans that receive new primary mortgage insurance coverage during a given period.

| | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | 2005 | |

| | | (In millions) | |

Flow Channel | | $ | 37,584 | | 81 | % | | $ | 23,270 | | 72 | % | | $ | 28,194 | | 78 | % |

Structured Finance Channel | | $ | 8,549 | | 19 | % | | $ | 8,964 | | 28 | % | | $ | 7,740 | | 22 | % |

| | | | | | | | | | | | | | | | | | |

Total Primary NIW | | $ | 46,133 | | 100 | % | | $ | 32,234 | | 100 | % | | $ | 35,934 | | 100 | % |

| | | | | | | | | | | | | | | | | | |

Primary Flow Channel. Lenders purchase primary mortgage insurance through our flow channel to reduce default risk, to obtain capital relief and, most often, to facilitate the sale of their low down payment loans to the GSEs and other investors. The GSEs purchase residential mortgages from lenders and investors as part of their governmental mandate to provide liquidity in the secondary mortgage market. As the GSEs have traditionally been the principal purchasers of conforming mortgage loans, mortgage lenders have typically originated such loans in conformance with GSE guidelines for sellers and servicers. These guidelines reflect the GSEs’ own charter requirements which, among other things, allow the GSEs to purchase low down payment mortgage loans only if the lender: (i) secures mortgage insurance on those loans from an eligible insurer, such as PMI; (ii) retains a participation of not less than 10% in the mortgage; or (iii) agrees to repurchase or replace the mortgage in the event of a default under specified conditions. If the lender retains a participation in the mortgage or agrees to repurchase or replace the mortgage, banking regulations may increase the level of capital required to be held by the lender to reflect the lender’s increased obligations, which could in turn increase the lender’s cost of doing business.

The GSEs also have established approval requirements for eligible mortgage insurers. The approval requirements cover substantially all areas of PMI’s mortgage insurance operations and require disclosure of certain activities and new products to the GSEs. The requirements mandate that eligible mortgage insurers must maintain at least two of the following three ratings: “AA-” by Standard & Poor’s or Fitch, or “Aa3” by Moody’s. In addition, even if only one rating agency assigns a rating below “AA-” or “Aa3”, the GSEs may require that the affected mortgage insurer limit certain activities and practices in order to remain a GSE eligible mortgage

5

insurer. Such limitations could include the preclusion of offering captive reinsurance (described below) without the GSEs consent and maximum risk-to-capital ratios. The GSEs recently announced that they have temporarily suspended imposition of the additional requirements that would otherwise automatically be applicable upon a downgrade by one rating agency provided that the downgraded insurer submits, and the GSE subsequently approves, a remediation plan within certain timeframes.

Lenders that purchase mortgage insurance select specific coverage levels for insured loans. As a result of the GSEs’ coverage requirements, lenders generally select a coverage percentage that effectively reduces the ratio of the original loan amount to the value of the property, or LTV, to not more than 80%. We charge higher premium rates for higher coverage, as higher coverage percentages generally result in higher amounts paid per claim. Higher LTV loans generally have higher coverage percentages and higher average premiums. Refinanced mortgage loans we insure typically have lower LTVs, and therefore lower coverage percentages and premium rates, than purchase money mortgages due to the home price appreciation often associated with refinanced loans. Purchase money mortgages, which generally have higher LTVs, tend to have higher coverage percentages, or “deeper” coverage. Accordingly, the relative sizes of the purchase money and refinance mortgage origination markets influence the average LTV, coverage rate and premium of our NIW and insurance in force. The sizes of the U.S. mortgage origination market and its purchase money and refinance components are influenced by many economic factors, including interest rates and home prices.

Premium payments may be paid to us on a monthly, annual or single premium basis. Monthly payment plans represented 93.5% of NIW in 2007, 96.4% of NIW in 2006 and 94.1% of NIW in 2005. As of December 31, 2007, monthly plans represented 92.9% of our U.S. primary risk in force compared to 93.5% at December 31, 2006 and 93.1% at December 31, 2005. Single premium plans represented substantially all of the remaining NIW and primary risk in force. Single premium plan payments may be refundable if coverage is canceled by the insured, which generally occurs when the loan is repaid, the loan amortizes to a sufficiently low amount or the value of the property has increased sufficiently.

Depending upon the loan, the premium payments for flow primary mortgage insurance coverage may ultimately be borne by the insured (“Lender Paid MI”) or by the insured’s customer, the mortgage borrower (“Borrower Paid MI”). In either case, the payment of premiums to us is the responsibility of the insured. PMI’s primary insurance rates for Borrower Paid MI are based on rates that we have filed with the various state insurance departments. To establish these rates, we utilize pricing models that consider a number of variables, including coverage percentages, loan and property attributes, and borrower risk characteristics. Because Lender Paid MI products are frequently designed to meet the needs of a lender’s particular loan program, we attempt to calibrate our Lender Paid MI pricing to a loan program’s specific borrower and loan-type risk characteristics. In addition, as a significant percentage of Lender Paid MI is processed through our electronic delivery channels, lenders’ use of Lender Paid MI serves to increase our efficiency and reduce our policy acquisition costs. Lender Paid MI represented 20.1% of flow NIW in 2007, 17.5% in 2006 and 16.7% in 2005.

Primary mortgage insurance is renewable at the option of the insured at the premium rate fixed when the insurance on the loan was initially issued. As a result, increased claims from policies originated in a particular year cannot be offset by renewal premium increases on policies in force. We may not cancel mortgage insurance coverage except in the event of nonpayment of premiums or certain material violations of PMI’s master policies. With respect to our flow channel, the insured or the loan’s mortgage servicer generally may cancel mortgage insurance coverage at any time. In addition, the GSEs’ guidelines generally provide that a borrower’s written request to cancel Borrower Paid MI should be honored if the borrower has a satisfactory payment record and the principal balance is not greater than 80% of the original value of the property or, in some instances, the current value of the property. The Homeowners Protection Act of 1998 also provides for the automatic termination of Borrower Paid MI on most loans when the LTV ratio (based upon the loan’s amortization schedule) reaches 78%, and provides for cancellation of Borrower Paid MI upon a borrower’s request when the LTV ratio reaches 80%, upon satisfaction of conditions set forth in the statute.

6

Structured Finance Channel. We provide credit enhancement solutions to agency and non-agency MBS issuers as well as portfolio investors. While the terms vary, our structured finance products generally insure a large group of pre-existing loans or loans to be originated in the future whose attributes will conform to the terms of the negotiated agreement. A structured finance product can include primary insurance (first loss), modified pool insurance which may be subject to deductibles and which is discussed below, or both. Premiums for structured finance coverage are paid and borne by the issuers or investors.

Most non-agency MBS transactions do not utilize mortgage insurance. Instead, non-agency MBS issuers often use other third party credit enhancement products, such as financial guaranty insurance, or, most often, forego all third party credit enhancement products by using over-collateralized structures. As a result, we compete against both MBS transactions that forego third party credit enhancement and third party credit enhancers, such as other mortgage insurers and financial guarantors. The extent to which we may bid upon, and if successful participate in, non-agency MBS transactions is subject to a number of factors, including:

| | • | | The size of the non-agency MBS market. As a result of deterioration in the housing, mortgage, credit, and capital markets, we expect the size of the non-agency MBS market to be significantly diminished in 2008. |

| | • | | The attractiveness of mortgage insurance relative to other forms of external credit enhancement. |

| | • | | The attractiveness of mortgage insurance relative to the use of internal credit enhancement structures, which depends in large part on the interest rates offered to investors purchasing the various tranches of an MBS. |

| | • | | Our perceived strength as a counterparty, our financial strength ratings, and the amount of credit for losses that rating agencies give to our mortgage insurance products. |

| | • | | Continued MBS product innovation, which may involve credit or interest rate swap instruments, over-collateralized executions and other forms of credit enhancement that do not require mortgage insurance. PMI’s monoline insurance licenses prohibit it from offering credit enhancement products other than residential mortgage insurance. |

All of the above factors are affected by domestic and international economic and financial conditions including, but not limited to, levels of liquidity in the U.S. and international capital markets, interest rates, home price appreciation, employment levels, and the relative attractiveness of non-agency MBS compared to other debt securities. Because economic factors and the diverse array of competitors in the capital markets affect our opportunities to write mortgage insurance for structured transactions, PMI’s NIW from structured finance can vary significantly from year to year. We expect that PMI’s opportunities to participate in structured finance transactions will be limited in 2008 as a result of the projected smaller non-agency MBS market this year.

In the future, PMI’s opportunities to participate in structured finance transactions will be impacted by the implementation in the United States of Basel II, the Basel Committee on Banking Supervision’s proposal to implement a new international capital accord. Basel II will affect the capital treatment provided to mortgage insurance by domestic and international banks in both their origination and securitization activities. The Basel II provisions related to residential mortgages and mortgage insurance could alter the competitive positions of mortgage insurers. The U.S. banking regulators have also stated that in 2008 they will propose optional regulations for mid-size and small banks that reflect the standardized approach under Basel II. No date has been announced for the publication of these regulations. Finally, the Basel Committee has proposed a further review of international capital accords.

In addition to MBS issuances, we offer primary mortgage insurance on large groups of loans that lenders and investors intend to hold in their portfolios. In these instances, the lender or investor purchases mortgage insurance to achieve capital relief, liquidity or to receive protection against default risk.

We utilize risk-based pricing models to establish premium rates for our structured finance transactions business. These models consider variables relating to the structure of the transaction, real estate loss scenarios,

7

and the loans within the insured portfolio, including coverage levels selected by the insured, loan and property attributes, and borrower risk characteristics.

(b) Pool Insurance

Modified Pool Insurance. We currently offer modified pool insurance products that may be attractive to agency and non-agency MBS issuers, investors and lenders seeking credit enhancement for MBS transactions, regulatory capital relief or the reduction of mortgage default risk. Modified pool insurance may be used in tandem with primary mortgage insurance or may be placed on loans that do not require primary insurance. The extent of coverage of modified pool products varies. Some products provide first loss protection by covering losses (up to a loan-level benefit limit) on individual loans held within the pool of insured loans up to a stated aggregate loss limit (“stop loss limit”) for the entire pool. Some modified pool products offer mezzanine-level coverage by providing for claims payments only after a predetermined cumulative claims level, or deductible, is reached. Such mezzanine-level coverage generally also includes a stop loss limit.

To date, PMI has issued modified pool insurance principally to the GSEs as supplemental coverage and to lenders and other capital markets participants. As of December 31, 2007, PMI had $2.9 billion of modified pool risk in force, representing 8.3% of PMI’s total risk in force. With respect to modified pool coverage, we calculate risk in force by subtracting the deductible and claims paid, if any, from the applicable stop loss limit. In later coverage years, loan terminations within the covered pool may also reduce the pool’s risk in force. Unless otherwise noted, primary insurance statistics in this report do not include pool insurance.

Other Pool Insurance. Prior to 2002, PMI offered certain traditional pool insurance products, referred to principally as GSE Pool or Old Pool, to lenders, the GSEs and the non-agency market. As of December 31, 2007, other pool insurance represented 1.8% of PMI’s total risk in force and 17.7% of PMI’s total pool risk in force (including modified pool).

(c) Captive Reinsurance

Mortgage insurers including PMI offer products to lenders that are designed to allow them to participate in the risks and rewards of the mortgage insurance business. Many of the major mortgage lenders have established affiliated captive reinsurance companies. Under a captive reinsurance agreement, PMI reinsures a portion of its risk written on loans originated by a certain lender with the captive reinsurance company affiliated with such lender. In return, a commensurate amount of PMI’s gross premiums received is ceded to the captive reinsurance company less, in some instances, a ceding commission paid to us for underwriting and administering the business. Ceded premiums, as well as capital deposits required of the captive reinsurer, are held in a bankruptcy-remote trust for our benefit to secure the payment of potential future claims. Captive reinsurers must comply with applicable insurance regulations and must adhere to minimum risk-to-capital ratios, which consider only eligible assets held in trust specifically for our benefit. If during predetermined reporting periods, the value of assets in the trust is less than that required under the minimum capital requirement, the captive reinsurer must deposit additional amounts into the trust account. Dividends from the trust accounts are only permissible once specified capital ratios are exceeded. In addition to adherence to minimum capital ratios, some captive reinsurance agreements disallow any dividends until book years have been reinsured for a minimum time period, typically three years. Because captive trust assets are not segregated by book or policy year, ceded premiums deposited into a trust in one year may be used to pay claims on policies reinsured by the captive in prior or later book years. As of December 31, 2007, assets in captive trust accounts held for the benefit of PMI totaled approximately $700 million.

PMI’s captive reinsurance agreements primarily provide for excess-of-loss reinsurance, in which PMI retains a first loss position on a defined set of mortgage insurance risk, reinsures a second loss layer of this risk with the captive reinsurance company and retains the remaining risk above the second loss layer up to the maximum coverage level. The GSEs’ eligibility requirements for approved mortgage insurers have been

8

temporarily amended, with respect to business written on or after June 1, 2008, to prohibit cessions of gross risk or gross premium cedes greater than 25% to captive reinsurers. PMI also offers quota share captive reinsurance agreements under which the captive reinsurance company assumes apro rata share of all losses in return for apro rata share of the premiums collected, less a ceding commission. Captive reinsurance agreements decrease the possibility of PMI incurring unacceptably high levels of losses in times of economic stress. In addition, certain rating agency capital models recognize the trust balances of the captive reinsurers and, thus, also recognize the reinsurance value and transfer of risk criteria of captive reinsurance. Typically only flow Borrower Paid MI is subject to captive reinsurance agreements. The captive reinsurance agreements must comply with both federal and state statutes and regulations, including the Real Estate Settlement Procedures Act of 1974, as well as criteria established by the GSEs.

In 2007, we received $1.2 million in claim payments from captive trusts. We expect this amount to increase in 2008 and increase substantially in 2009. See Item 1A.Risk Factors—The U.S. mortgage insurance industry and PMI are subject to regulatory risk and have been subject to scrutiny relating to the use of captive reinsurance arrangements and other products and services,and Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operations—U.S. Mortgage Insurance Operations, Premiums written and earned, below.

(d) Other Risk-Sharing Products

In addition to captive reinsurance, we offer other risk-sharing products, including layered co-insurance, a primary insurance program under which the insured retains liability for losses between certain levels of aggregate losses. Layered co-insurance is primarily targeted to affordable housing programs. We also offer various products designed for, and in cooperation with, the GSEs and lenders that involve some aspect of risk-sharing.

(e) Joint Venture—CMG Mortgage Insurance Company

CMG Mortgage Insurance Company and its affiliates (collectively “CMG MI”) offer mortgage insurance for loans originated by credit unions. CMG MI is a joint venture, equally owned by PMI and CUNA Mutual Investment Corporation (“CMIC”). CMIC is part of the CUNA Mutual Group, which provides insurance and financial services to credit unions and their members. Both PMI and CMIC provide services to CMG MI. As of December 31, 2007, CMG MI had $18.9 billion of primary insurance in force and $4.7 billion of primary risk in force. CMG MI’s financial results are reported in our consolidated financial statements under the equity method of accounting in accordance with U.S. generally accepted accounting principles or GAAP. CMG MI’s operating results are not included in our results shown in Part II of this Report on Form 10-K, unless otherwise noted.

Under the terms of the restated joint venture agreement effective as of June 1, 2003, CMIC has the right on September 8, 2015, or earlier under certain limited conditions, to require PMI to sell, and PMI has the right to require CMIC to purchase, PMI’s interest in CMG MI for an amount equal to the then current fair market value of PMI’s interest. PMI and CMIC have also entered into a capital support agreement, which is subject to certain limitations, for the benefit of CMG MI in order to maintain CMG MI’s insurer financial strength rating at “AA-” by Standard & Poor’s and “AA” by Fitch. CMG MI is a GSE eligible mortgage insurer.

U.S. Private Mortgage Insurance Industry

The U.S. private mortgage insurance industry presently consists of eight active mortgage insurers: PMI; CMG MI; Mortgage Guaranty Insurance Corporation, or MGIC; Genworth Mortgage Insurance Corporation, an affiliate of Genworth Financial, Inc.; United Guaranty Residential Insurance Company, an affiliate of American International Group, Inc.; Radian Guaranty Inc., or Radian; Republic Mortgage Insurance Co., an affiliate of Old Republic International; and Triad Guaranty Insurance Corp. Assured Guaranty Mortgage Insurance Company, a subsidiary of Assured Guaranty Ltd., is also licensed to offer mortgage insurance in the U.S. Other companies may also be considering offering mortgage insurance.

9

U.S. and State Government Agencies

PMI and other private mortgage insurers compete with federal and state government agencies that sponsor their own mortgage insurance programs. The private mortgage insurers’ principal government competitor is the Federal Housing Administration, or FHA, and to a lesser degree, the Veterans Administration, or VA. The following table shows the relative mortgage insurance market share of FHA/VA and private mortgage insurers over the past five years.

| | | | | | | | | | | | | | | |

| | | Federal Government and

Private Mortgage Insurance

Market Share (Based on NIW) | |

| | | Year Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

FHA/VA | | 20.1 | % | | 22.7 | % | | 23.5 | % | | 32.8 | % | | 36.4 | % |

Private Mortgage Insurance | | 79.9 | % | | 77.3 | % | | 76.5 | % | | 67.2 | % | | 63.6 | % |

| | | | | | | | | | | | | | | |

Total | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | | | | | | | |

| Source: | | Inside Mortgage Finance (based upon primary NIW but includes certain insurance written that we classify as pool insurance) |

The sizes of the FHA/VA and private mortgage insurance markets are impacted by, among other things, the maximum loan amounts that FHA and VA can insure. The size of the private mortgage insurance market is also influenced by GSE conforming loan limits, the maximum loan amount that the GSEs may purchase. In February 2008, Congress passed an economic stimulus package that included a provision that will temporarily raise the GSE conforming loan limits to allow the GSEs to purchase and/or guarantee certain “jumbo” mortgages originated between July 1, 2007 and December 31, 2008. The legislation temporarily increases the maximum conforming loan limit from $417,000 to $729,750. Because the legislation also includes a cap of 125 percent of the median home price for an area, the GSE conforming loan limit will remain at $417,000 in markets where the median home price is $333,600 or less. This increase will expire at the end of 2008 unless extended by new legislation.

The legislation also temporarily raised the FHA base loan limit ("floor") to 65% of the current GSE limit or $271,050, and temporarily raised the FHA maximum loan limit from $362,750 to $729,750. Permanent changes to FHA loan limits, as well as lower minimum down payment requirements, are being considered by Congress. These changes, if adopted, could significantly expand FHA’s mortgage insurance program. Further increases in the amount that the FHA and VA can insure could cause future demand for private mortgage insurance to decrease. We and other private mortgage insurers also face competition in several states from state-supported mortgage insurance funds.

Fannie Mae and Freddie Mac — The GSEs

Mortgage insurers, including PMI, compete with the GSEs when the GSEs seek to assume mortgage default risk that could be covered by mortgage insurance. The GSEs have introduced programs that allow lenders to purchase reduced mortgage insurance coverage.

Federal Home Loan Banks

The Federal Home Loan Banks, or FHLBs, purchase single-family conventional mortgage loans originated by participating financial institutions. Typically, mortgage insurance coverage is placed on these loans when the LTV exceeds 80%.

Financial Institutions and Mortgage Lenders

During the last several years, the private mortgage insurance industry faced increasing competition from the home equity lending operations of financial institutions and other mortgage lenders who structured their high

10

LTV residential lending in such a way that mortgage insurance was not required. Certain lenders originated mortgages that had a first mortgage lien with an LTV of 80%, and a second mortgage lien ranging from 5% to 20% LTV. These loans are commonly referred to as simultaneous seconds, “piggybacks,” 80/10/10, 80/20 or 80/15/5 loans. Since the first mortgage is only an 80% LTV, the GSEs do not require mortgage insurance with respect to either mortgage when acquiring only the first mortgage, even though the combined LTV exceeds 80%. These products grew in popularity between 2003 and early 2006 due to a number of factors, including low interest rates, rapid home price appreciation rates and an increased focus by lenders on home equity lending. The increased popularity and use of these and other similar products reduced the available market for primary mortgage insurance. In 2007, origination of these products declined dramatically, primarily as a result of the diminished demand in the capital markets for these products and new underwriting standards issued by bank and thrift regulators.

In addition, we and other private mortgage insurers compete with financial institutions, primarily commercial banks and thrifts, when they retain risk on all or a portion of their high LTV mortgage portfolios rather than obtain insurance for this risk. Our use of captive reinsurance with certain lenders with whom we do business (see Section 1—Captive Reinsurance, above) also negatively impacts our premiums earned.

Structured Finance — Competitors

In order to participate in structured finance transactions, we must compete against other mortgage insurers as well as other credit enhancement providers. In addition, the design and use of MBS structures that do not include external credit enhancement negatively affects the private mortgage insurance market and our NIW.

Our U.S. customers are primarily mortgage lenders, depository institutions, commercial banks, investors (including the GSEs), the FHLBs, and other capital market participants. In 2007, PMI’s top ten customers generated 52.0% of PMI’s premiums earned compared to 43.9% in 2006. The beneficiary under PMI’s master policies is the owner of the insured loan. The GSEs, as major purchasers of conventional mortgage loans in the U.S., are the beneficiaries of a substantial portion of PMI’s mortgage insurance coverage. If the slowdown in the non-agency MBS market continues in 2008, the GSEs will likely become beneficiaries of an even greater portion of PMI’s mortgage insurance coverage.

| 4. | | Sales and Product Development |

We employ a sales force located throughout the U.S. to directly sell products and services to lenders. Our U.S. sales force is comprised entirely of PMI employees who receive compensation consisting of a base salary and incentive compensation tied to performance objectives. PMI’s product development and structured finance departments have primary responsibility for the creation of new products.

11

Primary Risk in Force. The composition of PMI’s primary risk in force is summarized in the table below. The table is based upon information available to PMI at the date of policy origination.

| | | | | | | | | | | | | | | | | | | | |

| | | As of December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Primary Risk in Force (in millions) | | $ | 30,967 | | | $ | 25,711 | | | $ | 24,971 | | | $ | 25,505 | | | $ | 24,668 | |

Loan and Borrower Characteristics as Percentages of Primary Risk in Force | | | | | | | | | | | | | | | | | | | | |

LTV: | | | | | | | | | | | | | | | | | | | | |

Above 97.0% LTV | | | 24.6 | % | | | 17.6 | % | | | 14.3 | % | | | 11.9 | % | | | 8.6 | % |

95.01% to 97.0% LTV | | | 3.8 | % | | | 4.6 | % | | | 5.3 | % | | | 6.6 | % | | | 7.4 | % |

90.01% to 95.0% LTV | | | 29.5 | % | | | 31.0 | % | | | 33.7 | % | | | 36.4 | % | | | 37.6 | % |

85.01% to 90% LTV | | | 35.0 | % | | | 37.9 | % | | | 37.4 | % | | | 35.9 | % | | | 37.0 | % |

85.00% LTV and below | | | 7.1 | % | | | 8.9 | % | | | 9.3 | % | | | 9.2 | % | | | 9.4 | % |

| | | | | |

Loan Type*: | | | | | | | | | | | | | | | | | | | | |

Fixed | | | 87.2 | % | | | 81.3 | % | | | 80.4 | % | | | 85.5 | % | | | 90.4 | % |

ARMs (excluding 2/28 Hybrid ARMs) | | | 9.5 | % | | | 12.5 | % | | | 13.7 | % | | | 11.7 | % | | | 8.7 | % |

2/28 Hybrid ARMs | | | 3.3 | % | | | 6.2 | % | | | 5.9 | % | | | 2.8 | % | | | 0.9 | % |

| | | | | |

Less-than-A Quality (less than 620 FICO) | | | 8.1 | % | | | 8.0 | % | | | 9.3 | % | | | 10.9 | % | | | 11.9 | % |

Alt-A | | | 22.8 | % | | | 19.9 | % | | | 17.2 | % | | | 12.7 | % | | | 8.7 | % |

Interest Only | | | 14.2 | % | | | 9.9 | % | | | 6.2 | % | | | n.m. | | | | n.m. | |

Payment Option ARMs | | | 3.8 | % | | | 4.5 | % | | | 3.5 | % | | | n.m. | | | | n.m. | |

| | | | | |

Property Type: | | | | | | | | | | | | | | | | | | | | |

Single-family detached | | | 82.8 | % | | | 82.7 | % | | | 83.8 | % | | | 84.7 | % | | | 85.8 | % |

Condominium, townhouse, cooperative | | | 12.8 | % | | | 11.9 | % | | | 11.5 | % | | | 10.7 | % | | | 10.0 | % |

Multi-family dwelling and other | | | 4.4 | % | | | 5.4 | % | | | 4.7 | % | | | 4.6 | % | | | 4.2 | % |

| | | | | |

Occupancy Status: | | | | | | | | | | | | | | | | | | | | |

Primary residence | | | 88.6 | % | | | 88.8 | % | | | 91.0 | % | | | 93.2 | % | | | 94.8 | % |

Second home | | | 4.3 | % | | | 3.9 | % | | | 3.4 | % | | | 2.7 | % | | | 2.2 | % |

Non-owner occupied | | | 7.1 | % | | | 7.3 | % | | | 5.6 | % | | | 4.1 | % | | | 3.0 | % |

| | | | | |

Loan Amount: | | | | | | | | | | | | | | | | | | | | |

$100,000 or less | | | 14.6 | % | | | 17.9 | % | | | 19.5 | % | | | 20.5 | % | | | 21.9 | % |

Over $100,000 and up to $250,000 | | | 53.3 | % | | | 56.4 | % | | | 59.1 | % | | | 61.9 | % | | | 63.3 | % |

Over $250,000 | | | 32.1 | % | | | 25.7 | % | | | 21.4 | % | | | 17.6 | % | | | 14.8 | % |

| | | | | |

GSE conforming loans** | | | 91.7 | % | | | 91.7 | % | | | 91.8 | % | | | 93.3 | % | | | 93.9 | % |

| | | | | |

Non-conforming loans** | | | 8.3 | % | | | 8.3 | % | | | 8.2 | % | | | 6.7 | % | | | 6.1 | % |

| | | | | |

Average primary loan size(in thousands) | | $ | 155.0 | | | $ | 142.5 | | | $ | 136.0 | | | $ | 131.1 | | | $ | 127.3 | |

| * | | Loans types are not mutually exclusive and, therefore, do not total 100%. |

| ** | | GSE conforming loans have principal balances that do not exceed the maximum single-family principal balance loan limit eligible for purchase by the GSEs. Non-conforming loans have principal balances that exceed the GSE loan limits. |

| | • | | High LTV Loans. LTV is the ratio of the original loan amount to the value of the property. In our experience, as LTV ratios increase, the associated default and claim rates generally increase as well. In particular, Above-97s, mortgages with LTVs exceeding 97%, have higher default and claim rates than mortgages with lower LTVs. |

12

| | • | | Fixed, Adjustable Rate and 2/28 Hybrid Mortgages. We consider a loan an adjustable rate mortgage, or ARM, if its interest rate may be adjusted prior to the loan’s fifth anniversary. Based on our experience, the delinquency and claim rates of ARMs are generally higher than in the case of fixed rate loans. We consider a 2/28 Hybrid ARM a loan whose interest rate is fixed for an initial two year period and floats thereafter. PMI insured 2/28 Hybrid ARMs through its structured finance channel. 2/28 Hybrid ARMs have experienced higher default rates than other ARMs products. The higher default rates have been evident during these loans’ initial interest rate periods and are not necessarily related to rate resets. We believe that approximately 1% of PMI’s primary risk in force consists of 2/28 Hybrid ARMs that will reset in 2008. |

| | • | | Less-than-A Quality and Alt-A Loans. We insure less-than-A quality loans and Alt-A loans through our primary flow and structured finance channels. We define less-than-A quality loans to include loans with FICO scores generally less than 620. We define Alt-A loans as loans where the borrower’s FICO score is 620 or higherand the borrower requests and is given the option of providing reduced documentation verifying the borrower’s income, assets, deposit information, and/or employment. The default and claim rates of less-than-A quality and Alt-A loans exceed PMI’s average rates. |

| | • | | Interest Only Loans. Borrowers with interest only loans, also known as deferred amortization loans, do not reduce principal during the initial deferral period (usually between two and ten years) and therefore do not accumulate equity through loan amortization during the initial deferral period. The significant majority of interest only loans insured by PMI have initial deferral periods of ten years. Interest only loans have more exposure to declining home prices than amortizing loans. We believe that less than one half of 1% of PMI’s primary risk in force consists of interest only loans whose initial deferral period will end in 2008. |

| | • | | Payment Option ARMs. With a payment option ARM, a borrower generally has an option every month to make a payment consisting of principal and interest, interest only, or an amount established by the lender that may be less than the interest owed. Depending on prevailing interest rates and payment amounts, monthly payments may not be sufficient to fully cover interest due, in which case the shortfall is added to the principal amount of the loan in a manner known as “negative amortization.” While generally the amount of negative amortization allowed under the loan is capped, borrowers with payment option ARMs may choose not to reduce principal during the early years of the loan and may increase the principal amount owed. Typically, no later than the loan’s fifth anniversary the loan is “recast” as fully-amortizing with a loan balance equal to the principal then outstanding. Accordingly, like interest only loans, payment option ARMs have more exposure to declining home prices than amortizing loans. In addition, these loans may have interest rate risks similar to traditional ARMs. |

| | • | | Layered Risk. PMI insures loans that may possess one or more of the above characteristics. For example: |

| | • | | Approximately 2.9% of PMI’s primary risk in force consists of Above-97s with FICO scores below 620. |

| | • | | Approximately 0.3% of PMI’s primary risk in force consists of 2/28 Hybrid ARMs that are also Above-97s. |

| | • | | Approximately 0.5% of PMI’s primary risk in force consists of 2/28 Hybrid ARMs with FICO scores below 620. |

| | • | | Approximately 4.0% of PMI’s primary risk in force consists of Alt-A loans that are also Above-97s. |

| | • | | Approximately 4.5% of PMI’s primary risk in force consists of interest only loans that are also Above-97s. |

| | • | | Approximately 0.2% of PMI’s primary risk in force consists of interest only loans with FICO scores below 620. |

This “layering” of risk has, in recent experience, further increased the risk of borrower default.

13

| | • | | Average Primary Loan Size. As the table above shows, our average insured loan size increased each year since 2003. These increases were primarily caused by home price appreciation. As of December 31, 2007, the average primary loan size of PMI’s California and Florida insured loans were $301,386 and $177,999, respectively. Because our premium rates are based in part upon the size of the insured loan, higher average loan sizes favorably impact premiums written and earned. Our obligation to an insured with respect to a claim is generally determined by multiplying the stated coverage percentage by the loss amount, which includes any unpaid principal and interest. Accordingly, higher insured loan balances could negatively affect our average claim sizes. In February 2008, the GSE maximum conforming loan limit was temporarily raised from $417,000 to $729,750. This increase could cause our average loan size to increase in the future. |

We believe that the increases in Above-97s, Alt-A loans and interest only loans as percentages of PMI’s risk in force in 2007, and the increase in average primary loan size, reflect higher concentrations of these types of loans as percentages of both the mortgage origination market and the private mortgage insurance market in the first half of 2007. See Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operations—U.S. Mortgage Insurance Operations, Credit and portfolio characteristics below. In 2007, PMI’s average premium rate increased primarily as a result of its primary portfolio containing higher percentages of Above-97s and Alt-A loans. However, there can be no assurance that the premiums earned and the associated investment income will prove adequate to compensate for future losses from these loans.

The following table shows U.S. primary risk in force by FICO score:

| | | | | | | | | |

| | | Percentage of

Primary Risk

in Force by

FICO Score

As of December 31, | |

| | | 2007 | | | 2006 | | | 2005 | |

FICO Score: | | | | | | | | | |

Less than 575 | | 2.2 | % | | 2.1 | % | | 2.5 | % |

575—619 | | 5.9 | % | | 5.9 | % | | 6.8 | % |

620—679 | | 33.1 | % | | 34.7 | % | | 34.6 | % |

680—719 | | 25.1 | % | | 24.5 | % | | 24.1 | % |

720 and above | | 32.7 | % | | 31.5 | % | | 30.6 | % |

Unreported | | 1.0 | % | | 1.3 | % | | 1.4 | % |

| | | | | | | | | |

Total | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | |

Pool Risk in Force. The following table shows components of PMI’s pool risk in force as of December 31 for the last five years.

| | | | | | | | | | | | | | | |

| | | Pool Risk in Force (in millions) |

| | | As of December 31, |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

Modified Pool | | $ | 2,851.9 | | $ | 2,527.0 | | $ | 1,809.6 | | $ | 1,517.1 | | $ | 1,390.9 |

Old Pool | | | 277.8 | | | 346.7 | | | 420.6 | | | 501.7 | | | 656.8 |

Other Traditional Pool | | | 225.6 | | | 230.6 | | | 242.8 | | | 266.8 | | | 325.2 |

GSE Pool | | | 109.0 | | | 112.2 | | | 116.0 | | | 122.2 | | | 485.3 |

| | | | | | | | | | | | | | | |

Total Pool Risk in Force | | $ | 3,464.3 | | $ | 3,216.5 | | $ | 2,589.0 | | $ | 2,407.8 | | $ | 2,858.2 |

| | | | | | | | | | | | | | | |

14

The two tables below show the operation of stop loss limits and deductibles in the calculation of PMI’s modified pool risk in force. The first table presents data for the portion of PMI’s modified pool portfolio that is subject to deductibles. The second table presents similar data for the portion of PMI’s modified pool portfolio that is not subject to deductibles. The data in the tables below are organized by book year (the year in which the risk was written) and represent in each case the aggregate of modified pool transactions written during the applicable book year.

| | | | | | | | | | | | | | | | |

| | | Modified Pool (with Deductibles) by Book Year | |

| | | 2007(1) | | | 2006 | | | 2005 | | | 2004 & Prior | |

| | | (In millions) | |

Original Insurance In Force | | $ | 8,782 | | | $ | 18,913 | | | $ | 13,234 | | | $ | 35,500 | |

Current Insurance In Force* | | $ | 8,325 | | | $ | 15,301 | | | $ | 7,839 | | | $ | 8,953 | |

Stop Loss Limit | | $ | 265 | | | $ | 643 | | | $ | 367 | | | $ | 1,315 | |

Original Deductible Amount | | $ | 77 | | | $ | 136 | | | $ | 78 | | | $ | 266 | |

Risk In Force* (Stop loss less original deductible amount) | | $ | 188 | | | $ | 507 | | | $ | 289 | | | $ | 1,049 | |

Losses Applicable to Deductible* | | $ | 0 | | | $ | 2 | | | $ | 5 | | | $ | 82 | |

Current Deductible Balance* | | $ | 77 | | | $ | 134 | | | $ | 73 | | | $ | 184 | |

Claims Paid to Date* | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | |

Average Loan Level Coverage Percent | | | 24.0 | % | | | 24.1 | % | | | 25.2 | % | | | 24.9 | % |

| |

| | | Modified Pool (without Deductibles) by Book Year | |

| | | 2007(2) | | | 2006 | | | 2005 | | | 2004 & Prior | |

| | | (In millions) | |

Original Insurance In Force | | $ | 0 | | | $ | 8,442 | | | $ | 2,577 | | | $ | 16,375 | |

Current Insurance In Force* | | $ | 0 | | | $ | 5,798 | | | $ | 1,604 | | | $ | 2,774 | |

Stop Loss Limit | | $ | 0 | | | $ | 317 | | | $ | 54 | | | $ | 483 | |

Claims Paid to Date* | | $ | 0 | | | $ | 2 | | | $ | 2 | | | $ | 31 | |

Risk In Force* (Stop loss less claims paid) | | $ | 0 | | | $ | 315 | | | $ | 52 | | | $ | 452 | |

Average Loan Level Coverage Percent | | | N/A | | | | 27.2 | % | | | 24.6 | % | | | 26.1 | % |

| * | | As of December 31, 2007. |

| (1) | | Excludes one hybrid transaction in which PMI Guaranty Co. also participated and for which PMI has established loss reserves. |

| (2) | | We did not write any modified pool business (without deductible) for 2007 book year. |

15

The following two tables show the composition of PMI’s modified pool portfolio by book year based upon the effective date of coverage. Because modified pool stop loss limits and deductibles operate across a pool of loans, we show the composition of PMI’s modified pool portfolio in the tables below on an insurance in force (“IIF”) rather than risk in force basis. The table immediately below shows the composition of the portion of PMI’s modified pool portfolio that is subject to deductibles.

| | | | | | | | | | | | | | | | |

| | | Modified Pool (with Deductibles) | |

| | | As of December 31, 2007 for Book Year | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 &

Prior | |

Modified Pool (with Deductibles) IIF(in millions) | | $ | 8,325 | | | $ | 15,301 | | | $ | 7,839 | | | $ | 8,953 | |

| | | | |

Credit Score as percentages of above IIF*** | | | | | | | | | | | | | | | | |

Less than 575 | | | 1.7 | % | | | 0.5 | % | | | 0.1 | % | | | 4.2 | % |

575—619 | | | 3.5 | % | | | 1.2 | % | | | 0.8 | % | | | 9.1 | % |

620—679 | | | 34.7 | % | | | 37.9 | % | | | 24.1 | % | | | 24.2 | % |

680—719 | | | 34.2 | % | | | 33.6 | % | | | 31.7 | % | | | 18.9 | % |

720 and above | | | 25.9 | % | | | 26.8 | % | | | 43.3 | % | | | 43.6 | % |

| | | | |

Loan Type as percentages of above IIF | | | | | | | | | | | | | | | | |

Fixed Rate | | | 95.0 | % | | | 98.7 | % | | | 80.4 | % | | | 94.5 | % |

ARMs | | | 5.0 | % | | | 1.3 | % | | | 19.6 | % | | | 3.5 | % |

2/28 Hybrid ARMs | | | 0.0 | % | | | n.m. | | | | n.m. | | | | 0.0 | % |

| | | | |

Specific Portfolio Characteristics* as percentages of above IIF | | | | | | | | | | | | | | | | |

Alt-A Loans | | | 68.3 | % | | | 72.8 | % | | | 69.5 | % | | | 40.6 | % |

Interest Only Loans | | | 44.1 | % | | | 37.5 | % | | | 37.9 | % | | | 9.9 | % |

California Loans | | | 19.3 | % | | | 16.2 | % | | | 17.9 | % | | | 12.9 | % |

Florida Loans | | | 9.5 | % | | | 11.4 | % | | | 12.3 | % | | | 6.2 | % |

Auto States** Loans | | | 9.2 | % | | | 9.5 | % | | | 9.4 | % | | | 13.1 | % |

Above 97s | | | 7.4 | % | | | 0.4 | % | | | 0.6 | % | | | 0.9 | % |

| | | | |

Avg Loan Size | | $ | 207,481 | | | $ | 189,907 | | | $ | 177,194 | | | $ | 128,341 | |

Avg LTV | | | 81 | % | | | 79 | % | | | 79 | % | | | 75 | % |

Avg FICO | | | 688 | | | | 693 | | | | 709 | | | | 690 | |

| * | | Specific portfolio characteristics are not necessarily mutually exclusive. |

| ** | | Auto States include Michigan, Indiana, Ohio, and Illinois. |

| *** | | May not total due to unreported FICO scores. |

16

The table below shows the composition of the portion of PMI’s modified pool portfolio that is not subject to deductibles.

| | | | | | | | | | | | | | |

| | | Modified Pool (Without Deductibles) | |

| | | As of December 31, 2007 for Book Year | |

| | | 2007 | | 2006 | | | 2005 | | | 2004

& Prior | |

Modified Pool (without Deductibles) IIF (in millions) | | 0 | | $ | 5,798 | | | $ | 1,604 | | | $ | 2,774 | |

| | | |

Credit Score as percentages of above IIF*** | | | | | | | | | | | | |

Less than 575 | | N/A | | | 7.9 | % | | | 0.0 | % | | | 0.4 | % |

575—619 | | N/A | | | 17.1 | % | | | 0.4 | % | | | 1.6 | % |

620—679 | | N/A | | | 43.5 | % | | | 20.6 | % | | | 33.7 | % |

680—719 | | N/A | | | 20.2 | % | | | 29.8 | % | | | 27.5 | % |

720 and above | | N/A | | | 11.3 | % | | | 48.0 | % | | | 29.1 | % |

| | | | |

Loan Type as percentages of above IIF | | | | | | | | | | | | | | |

Fixed Rate | | N/A | | | 34.9 | % | | | 98.4 | % | | | 88.5 | % |

ARMs | | N/A | | | 64.6 | % | | | 1.6 | % | | | 9.2 | % |

2/28 Hybrid ARMs | | N/A | | | 0.5 | % | | | 0.0 | % | | | 0.0 | % |

| | | | |

Specific Portfolio Characteristics* as percentages

of above IIF | | | | | | | | | | | | | | |

Above 97s | | N/A | | | 36.1 | % | | | 0.1 | % | | | 2.8 | % |

Auto States** Loans | | N/A | | | 15.7 | % | | | 4.3 | % | | | 6.4 | % |

California Loans | | N/A | | | 10.5 | % | | | 21.0 | % | | | 20.5 | % |

Florida Loans | | N/A | | | 9.0 | % | | | 7.5 | % | | | 7.5 | % |

Alt-A Loans | | N/A | | | 7.6 | % | | | 71.1 | % | | | 73.9 | % |

Interest Only Loans | | N/A | | | 6.7 | % | | | 46.5 | % | | | 6.7 | % |

| | | | |

Avg Loan Size | | N/A | | $ | 156,958 | | | $ | 198,959 | | | $ | 129,516 | |

Avg LTV | | N/A | | | 93 | % | | | 76 | % | | | 78 | % |

Avg FICO | | N/A | | | 651 | | | | 718 | | | | 694 | |

| * | | Specific portfolio characteristics are not necessarily mutually exclusive. |

| ** | | Auto States include Michigan, Indiana, Ohio, and Illinois. |

| *** | | May not total due to unreported FICO scores. |

We believe that the risk reduction features of our modified pool products, which may include deductibles and stop loss limits, mitigate our risk of loss from the loans insured. In addition, with the exception of 2006 (non-deductibles), the average LTVs of loans insured by PMI’s modified pool products are typically significantly below LTV averages for PMI’s primary portfolio. While we have not established loss reserves with respect to modified pool with deductibles, we have established reserves with respect to PMI’s modified pool (non-deductible) portfolio. (See Section 7.Defaults and Claims—Pool Claims,below.)

17

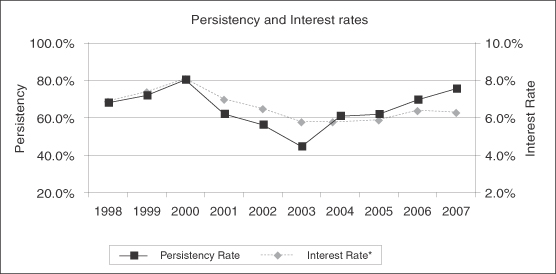

Persistency; Policy Cancellations. A significant percentage of PMI’s premiums earned is generated by insurance policies written in previous years. Consequently, the level of policy cancellations and resulting length of time that insurance remains in force are key determinants of PMI’s revenues and net income. One measure of the impact of policy cancellations on insurance in force is our persistency rate, which is based upon the percentage of primary insurance in force at the beginning of a 12-month period that remains in force at the end of that period. The following graph and table show average annual mortgage interest rates and PMI’s primary portfolio persistency rates from 1998 to 2007.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1998 | | | 1999 | | | 2000 | | | 2001 | | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | |

Interest Rate* | | 6.9 | % | | 7.4 | % | | 8.1 | % | | 7.0 | % | | 6.5 | % | | 5.8 | % | | 5.8 | % | | 5.9 | % | | 6.4 | % | | 6.3 | % |

Persistency Rate | | 68.0 | % | | 71.9 | % | | 80.3 | % | | 62.0 | % | | 56.2 | % | | 44.6 | % | | 60.9 | % | | 61.9 | % | | 69.6 | % | | 75.5 | % |

| * | | Average annual thirty-year fixed mortgage interest rate derived from Freddie Mac data. |

As shown by the above graph and table, low or declining interest rate environments are major factors in shortening the length of time our primary insurance in force has remained in effect. Between 2001 and 2003, declining interest rates resulted in heavy mortgage refinance activity, causing PMI’s policy cancellations to increase, thereby negatively impacting earned premiums. In 2004 through 2007, the persistency rate improved partly as a result of stabilizing or increasing interest rates.

In addition to interest rates, we believe that refinance activity is influenced by levels of home price appreciation, consumer behavior and the availability of certain alternative loan products. We believe that higher levels of home price appreciation and increasing consumer acceptance of refinance transactions contributed to higher levels of refinance activity between 2001 and 2006. We also believe that alternative loan products, such as interest only loans and payment option ARMs, encouraged refinancing in recent years. In 2007, declining or moderating home price appreciation and the diminished availability of alternative loan products positively impacted PMI’s persistency rate.

Risk Management Approach

We utilize proprietary and other statistical models to measure and predict loan performance based on the historical prepayment and loss experience of loans. We analyze performance based on borrower, loan and

18

property characteristics, along with geographic factors, through historic economic and real estate cycles. We use the outputs from these models to develop and refine how we price our coverage and in the establishment of national and regional underwriting guidelines to control the concentrations of risk in PMI’s portfolio. In developing guidelines, we also take into account the GSEs’ underwriting guidelines. Historically, our underwriting guidelines have generally allowed us to place mortgage insurance coverage on any mortgage loan accepted by the GSEs’ automated underwriting systems for purchase by the GSEs. However, underwriting guideline changes described below limit in some cases PMI’s coverage on such loans.

We continually monitor risk concentrations in our portfolio using various statistical tools. Among these are the pmiAURAsm System and the PMI U.S. Market Risk Indexsm. The pmiAURAsm System is a proprietary risk scoring tool we developed over 19 years ago that assigns a unique risk score to each loan in PMI’s portfolio corresponding to the predicted likelihood of an insured loan going to claim based on demographic, geographic, economic, and loan specific characteristics. The PMI U.S. Market Risk Indexsm is a proprietary statistical model that predicts the probability of a decline in home prices two years from the quarter of issuance in the Metropolitan Statistical Areas in the United States based on local, historical home price appreciation, changes in the local labor markets and local home affordability. We publish the output of this model on a quarterly basis. During 2007, as part of our normal review process, we revised and re-estimated the variables in the model to adapt it to changes in the housing market.

2007 Underwriting Guidelines and Pricing Changes

We review PMI’s portfolio on an on-going basis. Based upon our continuing review of PMI’s portfolio and the significant weakening of the mortgage, housing and credit markets, we have initiated a number of underwriting guidelines and pricing actions. In late 2006, we issued guideline changes designed to preclude future coverage of 2/28 Hybrid ARMs through PMI’s primary structured finance channels. During the course of 2007, we refined PMI’s structured finance pricing and underwriting policies. In the third quarter of 2007, we amended certain PMI lender paid policies to reduce future coverage of Above-97s and Alt-A loans. Effective October 1, 2007, we instituted tighter underwriting guidelines and higher borrower paid pricing with respect to Above-97s. Effective January 1, 2008, we tightened PMI’s borrower paid underwriting guidelines with respect to Alt-A loans. These initiatives, and changes in both the mortgage origination and mortgage insurance markets in the second half of 2007, reduced the percentage of Above-97s and Alt-A loans in PMI’s NIW in the third and fourth quarters of 2007.

Effective March 1, 2008, we further tightened underwriting guidelines with respect to Alt-A loans and eliminated future coverage of Above-97s through our primary flow channel. Effective March 1, 2008, we also instituted loan to value and loan product limitations with respect to loans originated in certain distressed markets. We expect PMI’s NIW to be lower in 2008 than 2007 in part because of these guideline changes and limitations.

Underwriting Process

To obtain mortgage insurance on an individual mortgage loan, a customer submits an application to us. If the loan is approved for mortgage insurance, we issue a commitment to the customer. During the last several years, advances in technology have enabled us to offer customers the option of electronic submission of applications and supporting documentation, as well as electronic receipt of insurance commitments and certificates. Customer use of our electronic delivery options accounted for approximately 83% of PMI’s new policies issued in the primary flow channel in 2007, compared to approximately 79% in 2006 and 75% in 2005.

More than 86% of PMI’s flow NIW is underwritten pursuant to a delegated underwriting program that allows approved lenders, subject to periodic quality-control audits, to determine whether loans meet program guidelines and are thus eligible for mortgage insurance. Delegated underwriting enables us to meet mortgage lenders’ demands for immediate insurance coverage of certain loans. If PMI determines that a lender participating in the program commits us to insure a loan that fails to meet all of the approved underwriting guidelines, subject to certain exceptions, PMI has the right to exclude or rescind the coverage on the loan. PMI

19

may also suspend or terminate the insured’s ability to extend coverage to new loans if it determines that the insured has not been complying with approved underwriting guidelines. In 2007, as a result of a significant variance from our quality control standards, we terminated the delegated underwriting program made available to a large customer. Flow customers that are not approved to participate in the delegated program generally must submit to us an application for each loan, supported by various documents sufficient to satisfy applicable underwriting guidelines.

Structured Finance Transactions. Structured finance transactions (including both primary and modified pool insurance) generally involve our bidding for a customer’s delivery to us of a portfolio of loans that have been previously underwritten and closed under one or more loan programs. While we do not re-underwrite all previously underwritten loans, we evaluate each transaction on a loan-by-loan basis and as a portfolio. In the loan-by-loan review, we analyze the characteristics of each loan and compare them to forecasts of performance generated by proprietary performance and pricing models. In the portfolio review, we analyze the aggregate risk characteristics of the portfolio as a whole. We also review the applicable servicer ratings and origination practices as well as the risks and potential mitigating factors inherent in the proposed coverage structure, which may include, among other things, coverage limits, stop loss limits and deductibles.

In some structured finance transactions, we provide commitments for the future delivery of insurance coverage. The same processes described above are used to review an indicative portfolio of loans. Our commitments are contingent upon review of the actual loans delivered and typically allow for adjustments if the characteristics of the actual delivery vary materially from those of the indicative portfolio.

Contract Underwriting

Contract underwriting services are provided by our wholly-owned subsidiary, PMI Mortgage Services Co., or MSC. MSC provides contract underwriting services on mortgage loans for which PMI provides mortgage insurance and on mortgage loans for which PMI does not provide insurance. MSC also performs the contract underwriting activities of CMG MI.

As a part of its contract underwriting services, MSC provides to its customers monetary and other remedies, including loan indemnifications under certain circumstances, in the event that MSC fails to properly underwrite a mortgage loan. These remedies are separate from the insurance coverage provided by PMI. Contract underwriting remedies were $7.1 million in 2007 compared to $12.4 million in 2006.

New policies processed by MSC contract underwriters in 2007 declined to 10.8% of PMI’s primary NIW from 14.8% in 2006. The number of contract underwriters utilized by MSC also decreased in 2007.

Defaults. Our claims process begins with notification by the insured or servicer to us of a default on an insured loan. “Default” is defined in PMI’s primary master policies as the borrower’s failure to pay when due an amount equal to the scheduled monthly mortgage payment under the terms of the mortgage. Generally, the master policies require an insured to notify us of a default no later than the last business day of the month following the month in which the borrower becomes three monthly payments in default. For reporting and internal tracking purposes, we do not consider a loan to be in default for the purposes of reporting defaults and default rates until a loan has been delinquent for two consecutive monthly payments. Depending upon its scheduled payment date, a loan delinquent for two consecutive payments could be reported to us between the 31st and 60th day after the first missed payment. Borrowers default for a variety of reasons, including a reduction of income, unemployment, divorce, illness, inability to manage credit, rising interest rate levels and declining home prices.

20

Borrowers may cure defaults by making all of the delinquent loan payments or by selling the property in full satisfaction of all amounts due under the mortgage. The rate at which defaults cure (the “cure rate”) is influenced by the borrowers’ financial resources, regional housing and economic conditions and, recently, the speed with which loan servicers process delinquencies. Because PMI’s loss reserves are based upon its default inventory, delinquent loans that cure are no longer included in PMI’s loss reserves. PMI’s cure rate declined in 2007 as a result of, among other things, weakening home prices and other economic conditions and a slowdown in the time to resolution of defaults (either through cure or claim payment) attributable to significant backlogs in workout activity by loan servicers attempting to resolve delinquencies and prevent foreclosures. PMI partners with lenders and servicers to work with borrowers to cure defaults through repayment plans, loan modifications and short sales.