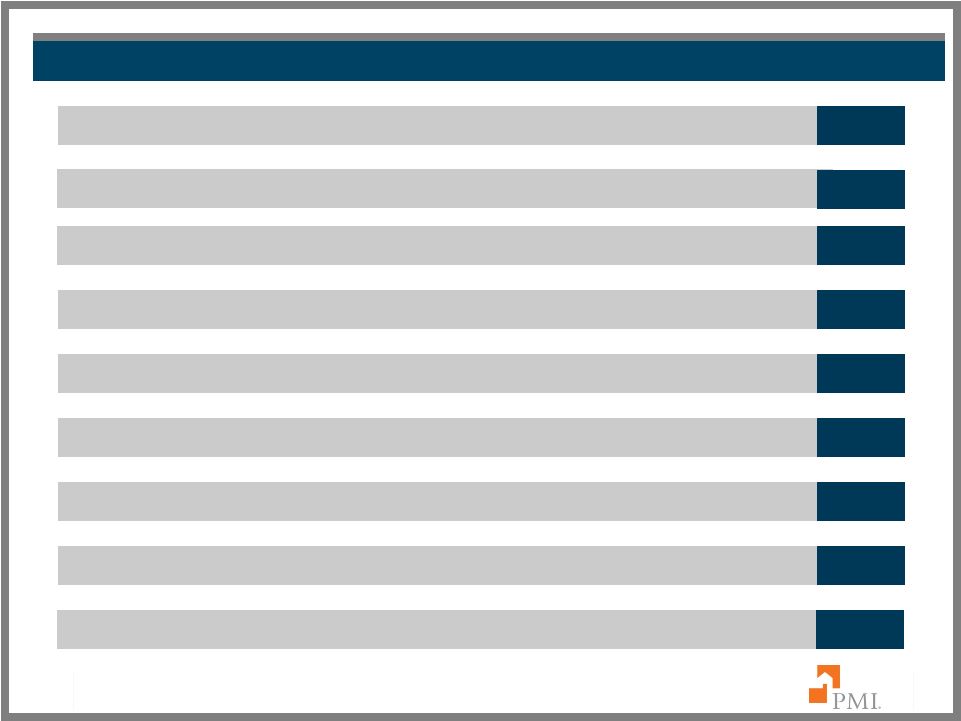

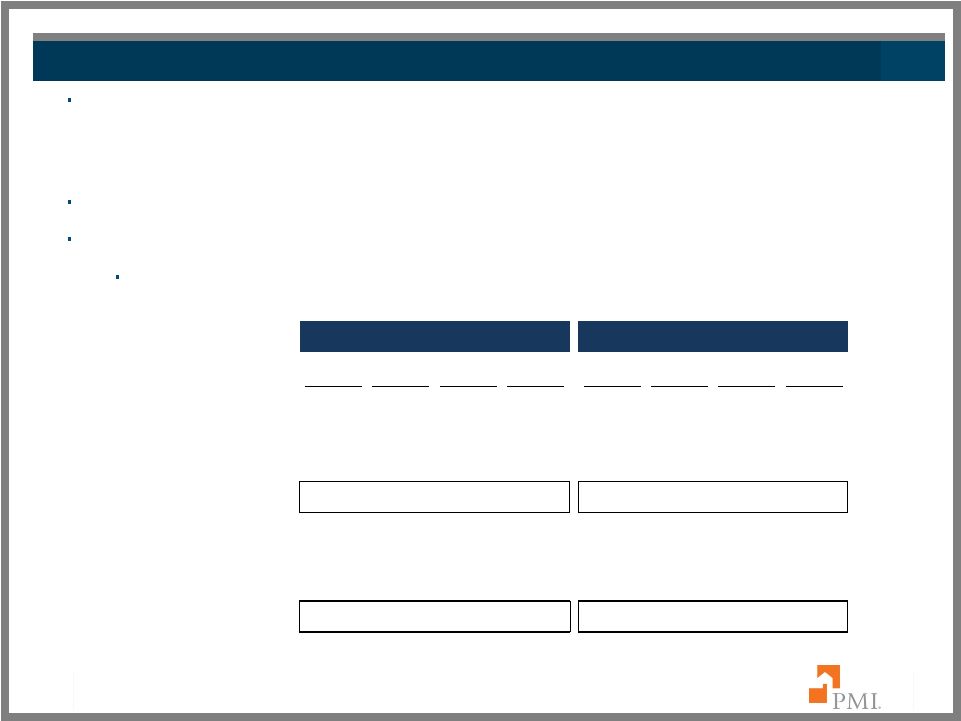

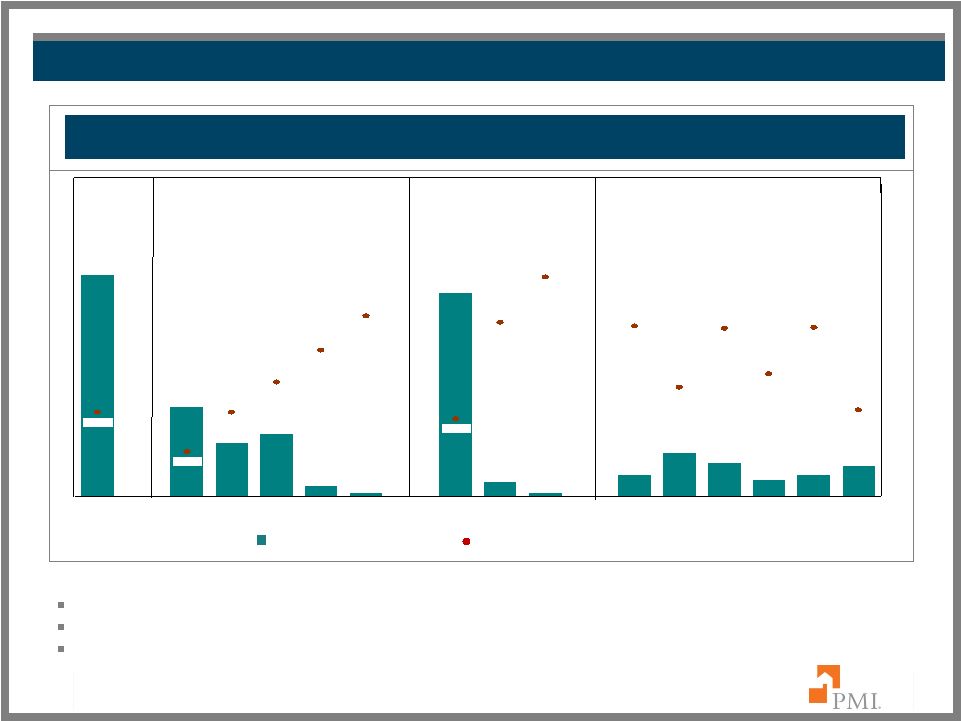

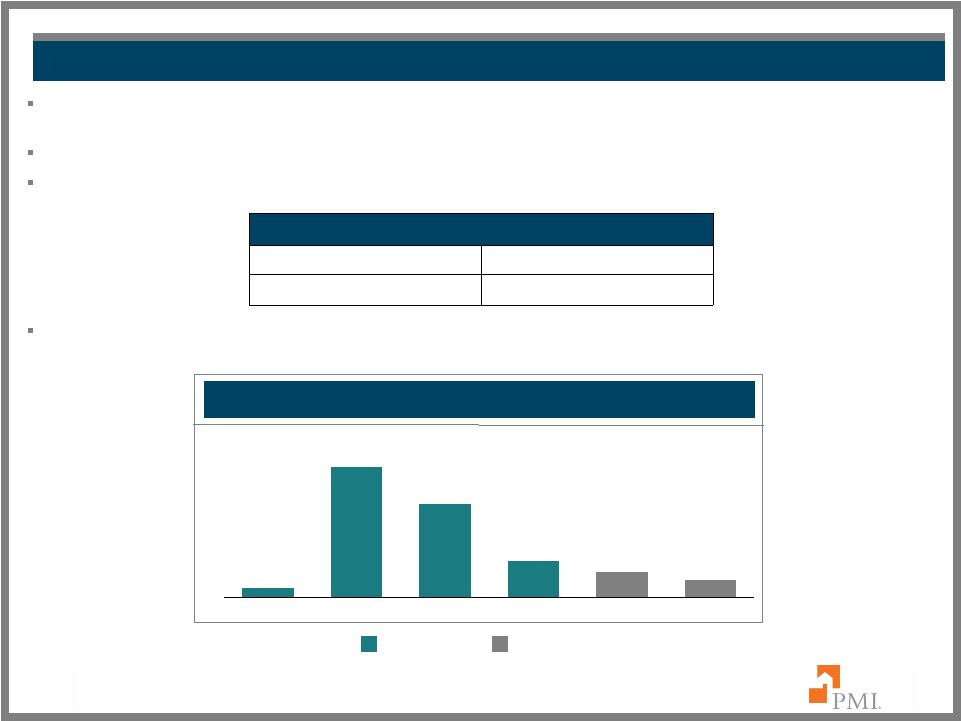

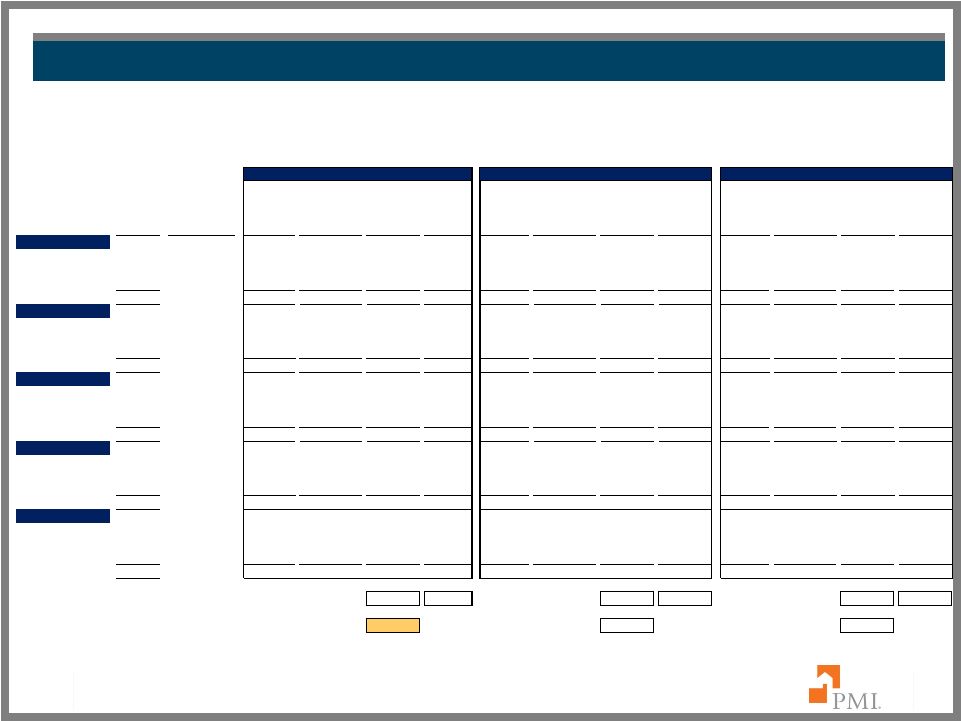

Primary Reserves per Notice of Default 8 Our U.S. Mortgage Insurance Operations (“PMI”) reports a loan in default when a borrower has missed two consecutive monthly payments which could be as early as 31 days after the first missed payment. Alternate convention counts a loan in default only at sixty days after the first missed payment. The table compares PMI’s ‘As Reported’ with the ‘>= 60 days’ convention (1) . At December 31, 2010, PMI’s primary reserves per NOD of $21,646 would have been $23,955 under the ‘>=60 days’ convention. Note: NOD is Notice of Default. Due to rounding, the sum of categories may not equal the total. (1) Days delinquent is based on the number of days a borrower is delinquent as of the date when the NOD is reported to us, not as of month end. We typically receive NOD reporting from servicers between the 20th and 25th of each month. (2) Adjusted Primary Reserves + LAE represents an allocation of loss reserves based on the age of a notice of default. 1st Qtr. 2nd Qtr. 3rd Qtr. 4th Qtr. 1st Qtr. 2nd Qtr. 3rd Qtr. 4th Qtr. NODs by Days Delinquent <=59 22,637 22,079 22,670 21,762 18,822 17,916 18,578 18,283 >=60 94,866 104,351 118,591 129,164 128,426 120,515 113,313 109,195 Total: 117,503 126,431 141,261 150,925 147,248 138,431 131,891 127,478 Primary Reserves + LAE ($'s 000s) 2,445,200 $ 2,560,400 $ 2,694,400 $ 2,931,100 $ 2,924,400 $ 2,896,300 $ 2,803,900 $ 2,759,400 $ Adjusted Primary Reserves + LAE ($'s 000s) (2) 2,240,127 $ 2,360,382 $ 2,489,028 $ 2,733,954 $ 2,776,501 $ 2,755,520 $ 2,657,918 $ 2,615,736 $ Reserves Per NOD As Reported $20,810 $20,252 $19,074 $19,421 $19,860 $20,922 $21,259 $21,646 >=60 days $23,614 $22,620 $20,988 $21,167 $21,619 $22,865 $23,456 $23,955 Delinquency Rate Primary Policies in Force 768,441 745,551 725,029 705,417 683,888 666,204 647,319 629,154 Primary Default Rate As Reported 15.29% 16.96% 19.48% 21.40% 21.53% 20.78% 20.37% 20.26% >+ 60 Days 12.35% 14.00% 16.36% 18.31% 18.78% 18.09% 17.50% 17.36% 2009 2010 |