Exhibit 99.2

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| | | | |

| | ) | | |

| In re: | | ) | | Chapter 11 |

| | ) | | |

| THE PMI GROUP, INC., a Delaware | | ) | | Case No. 11-13730 (BLS) |

| Corporation,1 | | ) | | |

| | ) | | |

Debtor. | | ) | | |

|

DISCLOSURE STATEMENT PURSUANT TO SECTION 1125 OF THE BANKRUPTCY CODE WITH RESPECT TO THE PLAN OF REORGANIZATION OF THE PMI GROUP, INC. |

Pauline K. Morgan (No. 3650)

Joseph M. Barry (No. 4221)

Kara Hammond Coyle (No. 4410)

Patrick A. Jackson (No. 4976)

YOUNG CONAWAY STARGATT & TAYLOR, LLP

Rodney Square

1000 North King Street

Wilmington, Delaware 19801

Telephone: (302) 571-6600

Counsel for the Debtor and Debtor in Possession

PLEASE NOTE THAT THIS DISCLOSURE STATEMENT HAS NOT YET BEEN APPROVED BY THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE UNDER SECTION 1125 OF THE BANKRUPTCY CODE FOR USE IN THE SOLICITATION OF ACCEPTANCES OF THE CHAPTER 11 PLAN DESCRIBED HEREIN. ACCORDINGLY, THE FILING AND DISTRIBUTION OF THIS DISCLOSURE STATEMENT IS NOT INTENDED, AND SHOULD NOT BE CONSTRUED, AS A SOLICITATION OF ACCEPTANCES OF SUCH PLAN. THE INFORMATION CONTAINED HEREIN SHOULD NOT BE RELIED UPON FOR ANY PURPOSE BEFORE A DETERMINATION BY THE BANKRUPTCY COURT THAT THIS DISCLOSURE STATEMENT CONTAINS “ADEQUATE INFORMATION” WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE.

| 1 | The last four digits of the Debtor’s federal tax identification number are 9675. The Debtor’s mailing address is P.O. Box 830, Alamo, California 94507 (Attn: L. Stephen Smith). |

TABLE OF CONTENTS

| | | | | | | | |

| | | | | | | Page | |

| |

ARTICLE I INTRODUCTION AND OVERVIEW | | | 1 | |

| | |

| A. | | Prefatory Statement and Definitions | | | 1 | |

| | |

| B. | | Introduction | | | 1 | |

| | |

| C. | | Disclaimers | | | 2 | |

| | |

| D. | | Plan Overview | | | 3 | |

| | |

| E. | | Eligibility to Vote | | | 10 | |

| | | |

| | 1. | | Who May Vote | | | 10 | |

| | | |

| | 2. | | How to Vote | | | 11 | |

| | | |

| | 3. | | Importance of Your Vote | | | 13 | |

| | |

| F. | | Special Notice of Third Party Release | | | 14 | |

| | |

| G. | | The Confirmation Hearing | | | 14 | |

| | | |

| | 1. | | Time and Place of the Confirmation Hearing | | | 14 | |

| | | |

| | 2. | | Objections to the Plan | | | 15 | |

| |

ARTICLE II BACKGROUND OF THE DEBTOR AND THE CHAPTER 11 CASE | | | 15 | |

| | |

| A. | | Overview of the Debtor’s Business | | | 15 | |

| | | |

| | 1. | | Corporate Structure | | | 16 | |

| | | |

| | 2. | | Regulatory Environment | | | 17 | |

| | |

| B. | | Summary of Assets and Liabilities | | | 17 | |

| | | |

| | 1. | | Principal Assets | | | 17 | |

| | | |

| | 2. | | Potential Cause of Action | | | 18 | |

| | | |

| | 3. | | Tax Attributes and Tax Sharing Agreement | | | 18 | |

| | | |

| | 4. | | Cost Allocation Agreement | | | 18 | |

| | | |

| | 5. | | Primary Prepetition Indebtedness | | | 19 | |

| | |

| C. | | Events Leading to Debtor’s Chapter 11 Filing | | | 20 | |

| | | |

| | 1. | | Economic Conditions | | | 20 | |

| | | |

| | 2. | | Exploration of an Extraordinary Transaction | | | 20 | |

| | | |

| | 3. | | Regulatory Control of MIC | | | 21 | |

| | | |

| | 4. | | Defaults under the Notes | | | 22 | |

| | |

| D. | | The Chapter 11 Case | | | 23 | |

| | | |

| | 1. | | Debtor in Possession Status | | | 23 | |

| | | |

| | 2. | | Entry of the Debtor’s First-Day Orders | | | 23 | |

i

| | | | | | | | |

| | | |

| | 3. | | The Trading Order | | | 23 | |

| | | |

| | 4. | | Appointment of the Official Committee of Unsecured Creditors | | | 25 | |

| | | |

| | 5. | | Retention of Professionals | | | 26 | |

| | | |

| | 6. | | Employment Contracts; Incentive Plan | | | 26 | |

| | | |

| | 7. | | Amendment and Assumption of CAA | | | 26 | |

| | | |

| | 8. | | Freeze of Pension Plan | | | 27 | |

| | | |

| | 9. | | Transfer of Sponsorship of 401(k) Plan | | | 27 | |

| | | |

| | 10. | | Rejection of Executory Contracts | | | 28 | |

| | | |

| | 11. | | Disposition of Assets | | | 28 | |

| | | |

| | 12. | | Extensions of Exclusivity and Removal Deadline | | | 28 | |

| | | |

| | 13. | | Schedules and Statement of Financial Affairs; Claims Bar Date and Aggregate Claims Asserted | | | 29 | |

| | | |

| | 14. | | Objections to Claims | | | 29 | |

| | | |

| | 15. | | Litigation Against MIC, Receiver and Special Deputy Receiver | | | 29 | |

| | | |

| | 16. | | Stipulation with MIC, Receiver and Special Deputy Receiver | | | 30 | |

| | | |

| | 17. | | Ancillary Issues Stipulation and Side Letter | | | 34 | |

| | | |

| | 18. | | Plan Sponsor Negotiations | | | 36 | |

| |

ARTICLE III SUMMARY OF THE PLAN | | | 38 | |

| | |

| A. | | Overview of Chapter 11 | | | 38 | |

| | |

| B. | | Classification of Claims and Interests | | | 40 | |

| | | |

| | 1. | | Introduction | | | 40 | |

| | | |

| | 2. | | Classification | | | 40 | |

| | | |

| | 3. | | Treatment | | | 41 | |

| | |

| C. | | Treatment of Unclassified Claims | | | 45 | |

| | | |

| | 1. | | Summary | | | 45 | |

| | | |

| | 2. | | Treatment of Administrative Expense Claims | | | 46 | |

| | | |

| | 3. | | Administrative Expense Claims Bar Date | | | 46 | |

| | | |

| | 4. | | Deadline for Professional Claims | | | 47 | |

| | | |

| | 5. | | Priority Tax Claims | | | 47 | |

| | | |

| | 6. | | U.S. Trustee Fees | | | 47 | |

| | | |

| | 7. | | Indenture Trustee Fees | | | 47 | |

| | |

| D. | | Means for Implementation of Plan | | | 48 | |

| | | |

| | 1. | | New Organizational Documents | | | 48 | |

| | | |

| | 2. | | Continued Corporate Existence | | | 48 | |

| | | |

| | 3. | | Sources of Consideration for Monetary Plan Distributions | | | 48 | |

ii

| | | | | | | | |

| | | |

| | 4. | | Vesting of Assets in the Reorganized Debtor | | | 48 | |

| | | |

| | 5. | | Authorization and Issuance of New Common Stock | | | 49 | |

| | | |

| | 6. | | Directors and Officers of the Reorganized Debtor | | | 53 | |

| | | |

| | 7. | | Section 1145 Exemption | | | 53 | |

| | | |

| | 8. | | Exemption from Certain Taxes and Fees | | | 53 | |

| | | |

| | 9. | | Cancellation of Notes | | | 53 | |

| | | |

| | 10. | | Corporate Action | | | 54 | |

| | | |

| | 11. | | Effectuating Documents; Further Transactions | | | 54 | |

| | |

| E. | | Treatment of Unexpired Leases and Executory Contracts | | | 54 | |

| | | |

| | 1. | | Rejection or Assumption of Remaining Executory Contracts and Unexpired Leases | | | 54 | |

| | | |

| | 2. | | Approval of Rejection or Assumption of Executory Contracts and Unexpired Leases | | | 55 | |

| | | |

| | 3. | | Inclusiveness | | | 55 | |

| | | |

| | 4. | | Cure of Defaults | | | 55 | |

| | | |

| | 5. | | Rejection Damage Claims | | | 56 | |

| | | |

| | 6. | | Continuing Obligations | | | 56 | |

| | | |

| | 7. | | Insurance Rights | | | 57 | |

| | |

| F. | | Provisions Regarding Distributions | | | 57 | |

| | | |

| | 1. | | Allowance Requirement | | | 57 | |

| | | |

| | 2. | | Record Date | | | 58 | |

| | | |

| | 3. | | Timeliness of Payments | | | 58 | |

| | | |

| | 4. | | Disbursing Agent | | | 58 | |

| | | |

| | 5. | | Rights and Powers of Disbursing Agent | | | 59 | |

| | | |

| | 6. | | Delivery of Distributions and Undeliverable or Unclaimed Distributions | | | 59 | |

| | | |

| | 7. | | Withholding and Reporting Requirements | | | 60 | |

| | | |

| | 8. | | Setoffs | | | 61 | |

| | | |

| | 9. | | Allocation of Plan Distributions Between Principal and Interest | | | 61 | |

| | | |

| | 10. | | Claims Paid or Payable by Third Parties | | | 61 | |

| | |

| G. | | Procedures for Claims Administration | | | 62 | |

| | | |

| | 1. | | Resolution of Disputed Claims | | | 62 | |

| | | |

| | 2. | | Disallowance of Claims | | | 64 | |

| | | |

| | 3. | | Amendments to Claims | | | 64 | |

| | |

| H. | | Conditions Precedent to Confirmation and Effectiveness of the Plan | | | 65 | |

| | | |

| | 1. | | Conditions Precedent to Confirmation of the Plan | | | 65 | |

iii

| | | | | | | | |

| | | |

| | 2. | | Conditions Precedent to Effectiveness of the Plan | | | 65 | |

| | | |

| | 3. | | Waiver of Conditions | | | 65 | |

| | |

| I. | | Modification, Revocation, or Withdrawal of Plan | | | 66 | |

| | | |

| | 1. | | Modification and Amendments | | | 66 | |

| | | |

| | 2. | | Effect of Confirmation on Modifications | | | 66 | |

| | | |

| | 3. | | Revocation or Withdrawal of Plan | | | 66 | |

| | | |

| | 4. | | No Admission of Liability | | | 66 | |

| | |

| J. | | Retention of Jurisdiction | | | 67 | |

| | | |

| | 1. | | Retention of Jurisdiction by the Court | | | 67 | |

| | |

| K. | | Discharge, Injunction, Releases and Related Provisions | | | 69 | |

| | | |

| | 1. | | Discharge of Claims and Terminations of Equity Interests | | | 69 | |

| | | |

| | 2. | | Injunction | | | 70 | |

| | | |

| | 3. | | Releases by the Debtor | | | 70 | |

| | | |

| | 4. | | Releases by Holders of Claims (Third Party Release) | | | 71 | |

| | | |

| | 5. | | Exculpation and Limitation of Liability | | | 71 | |

| | | |

| | 6. | | Waiver Of Statutory Limitation On Releases | | | 72 | |

| | | |

| | 7. | | Deemed Consent | | | 72 | |

| | | |

| | 8. | | No Waiver | | | 72 | |

| | | |

| | 9. | | Integral to Plan | | | 72 | |

| | |

| L. | | Miscellaneous Provisions | | | 73 | |

| | | |

| | 1. | | Immediate Binding Effect | | | 73 | |

| | | |

| | 2. | | Additional Documents | | | 73 | |

| | | |

| | 3. | | Payment of Statutory Fees | | | 73 | |

| | | |

| | 4. | | Dissolution of the Creditors’ Committee | | | 73 | |

| | | |

| | 5. | | Severability | | | 73 | |

| | | |

| | 6. | | Successors and Assigns | | | 74 | |

| | | |

| | 7. | | Notices | | | 74 | |

| | | |

| | 8. | | Further Assurances | | | 75 | |

| | | |

| | 9. | | No Liability for Solicitation or Participation | | | 76 | |

| | | |

| | 10. | | Terms of Injunctions or Stays | | | 76 | |

| | | |

| | 11. | | Entire Agreement | | | 76 | |

| | | |

| | 12. | | Preservation of Insurance | | | 76 | |

| | | |

| | 13. | | Closing of Case | | | 76 | |

| | | |

| | 14. | | Waiver of Estoppel Conflicts | | | 76 | |

iv

| | | | | | | | |

| |

ARTICLE IV RULE 9019, CRAMDOWN REQUESTS | | | 77 | |

| | | |

| | 1. | | Approval of All Compromises and Settlements Included in Plan | | | 77 | |

| | | |

| | 2. | | Cramdown of the Plan | | | 77 | |

| |

ARTICLE V CERTAIN FACTORS TO BE CONSIDERED REGARDING THE PLAN | | | 77 | |

| | |

| A. | | Certain Bankruptcy Law Considerations | | | 77 | |

| | | |

| | 1. | | Parties in Interest May Object To Debtor’s Classification of Claims and Equity Interests | | | 77 | |

| | | |

| | 2. | | The Debtor May Not Be Able to Secure Confirmation of the Plan | | | 78 | |

| | | |

| | 3. | | Nonconsensual Confirmation | | | 79 | |

| | | |

| | 4. | | Risk of Non-Occurrence of the Effective Date | | | 79 | |

| | | |

| | 5. | | Risk of Post-Effective Date Default | | | 79 | |

| | | |

| | 6. | | Amount or Classification of a Claim or Equity Interest May be Subject to Objection | | | 79 | |

| | | |

| | 7. | | Estimated Claim Amounts by Class May Not be Accurate | | | 79 | |

| | | |

| | 8. | | Validity of Votes Cast to Accept Plan Not Affected by Contingencies | | | 80 | |

| | | |

| | 9. | | Possible Limitations on Contract or Lease Rights and Protections | | | 80 | |

| | | |

| | 10. | | Jurisdictional Limitations Imposed by the McCarran-Ferguson Act | | | 80 | |

| | |

| B. | | Risk Factors Affecting the Reorganized Debtor | | | 81 | |

| | | |

| | 1. | | The Debtor May Not be Able to Identify and Pursue a Business That Will Generate Significant Value for the New Common Stock | | | 81 | |

| | | |

| | 2. | | Assumptions Regarding Value of Debtor’s Assets | | | 81 | |

| | | |

| | 3. | | The Debtor Might Have an Ownership Change or Not Qualify for the L5 Exception and be Subject to a Limitation on the Use of its NOLS | | | 81 | |

| | | |

| | 4. | | The IRS Could Challenge the Amount of the Reorganized Debtor’s NOLs or Other Tax Attributes, or Tax Laws, Regulations or Interpretations Could Change, Negatively Impacting the Reorganized Debtor’s NOLs or Other Tax Attributes | | | 82 | |

| | | |

| | 5. | | The Reorganized Debtor May Cease Providing Services Under the Amended CAA, in Which Case MIC May Provide Such Services | | | 82 | |

| | |

| C. | | Risk Factors That May Affect the Value of Securities to be Issued Under the Plan and/or Recoveries Under the Plan | | | 82 | |

| | | |

| | 1. | | A Liquid Trading Market for the New Common Stock May Not Develop | | | 82 | |

| | | |

| | 2. | | Neither the Estimated Valuation of the Reorganized Debtor and the New Common Stock nor the Estimated Recoveries to Holders of Allowed Claims are Intended to Represent the Private Sale Value of the New Common Stock | | | 83 | |

v

| | | | | | | | |

| |

ARTICLE VI CERTAIN SECURITIES LAW MATTERS | | | 83 | |

| | |

| A. | | Issuance of New Common Stock | | | 83 | |

| | |

| B. | | Transferability of New Common Stock Under Applicable Securities Laws | | | 83 | |

| |

ARTICLE VII FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN | | | 84 | |

| | |

| A. | | Certain Federal Income Tax Consequences to the Debtor | | | 85 | |

| | | |

| | 1. | | Cancellation of Indebtedness Income | | | 86 | |

| | | |

| | 2. | | Annual Section 382 Limitation on Use of NOLs and “Built-In” Losses and Deductions | | | 87 | |

| | |

| B. | | Certain Federal Income Tax Consequences to Holders of General Unsecured Claims, Senior Notes Claims, Subordinated Note Claims, Convenience Claims and Equity Interests | | | 89 | |

| | | |

| | 1. | | U.S. Holders | | | 89 | |

| | | |

| | 2. | | Non-U.S. Holders | | | 93 | |

| | | |

| | 3. | | Withholdable Payments to Foreign Financial Entities and Other Foreign Entities | | | 97 | |

| | | |

| | 4. | | Information Reporting and Backup Withholding | | | 97 | |

| |

ARTICLE VIII ACCEPTANCE AND CONFIRMATION OF THE PLAN; VOTING REQUIREMENTS | | | 98 | |

| | |

| A. | | Best Interests Test | | | 98 | |

| | |

| B. | | Financial Feasibility Test | | | 99 | |

| | |

| C. | | Acceptance by Impaired Classes | | | 99 | |

| |

ARTICLE IX RECOMMENDATION AND CONCLUSION | | | 101 | |

vi

EXHIBITS

Accompanying this Disclosure Statement are:

| | • | | A copy of the Plan (Exhibit A) |

| | • | | A copy of the Order approving the Disclosure Statement entered [ ], 2013 [D.I. ] (Exhibit B) |

| | • | | Analysis of recoveries under the Plan and a hypothetical liquidation of the Debtor under chapter 7 of the Bankruptcy Code (Exhibit C) |

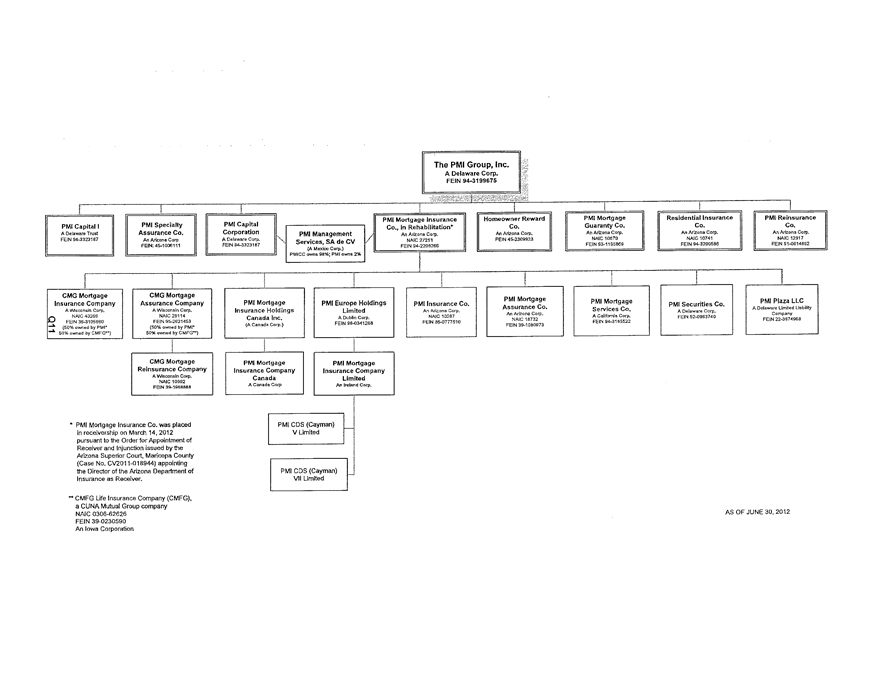

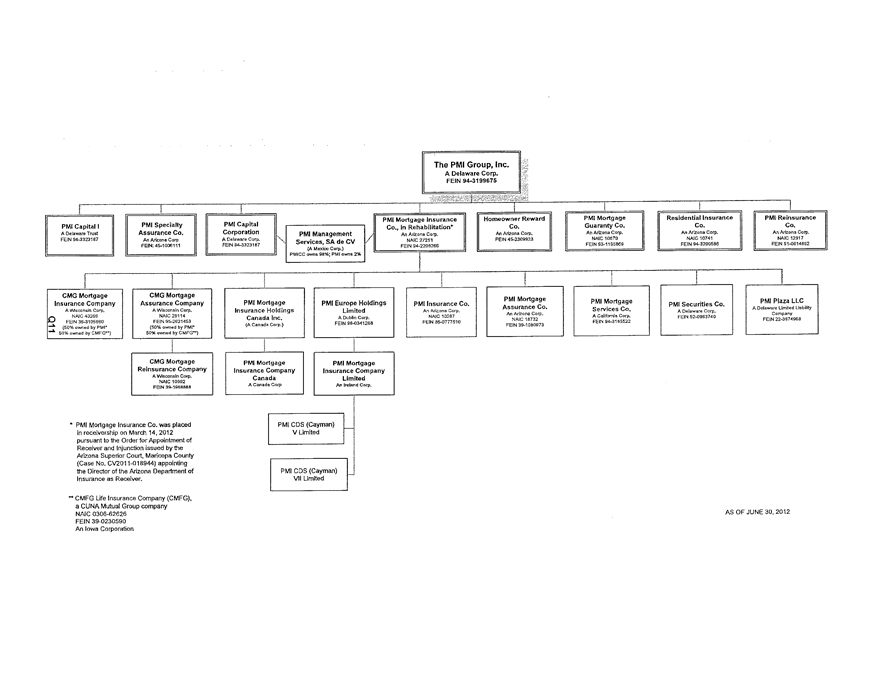

| | • | | Organizational Chart of the Debtor (Exhibit D) |

| | • | | A ballot for acceptance or rejection of the Plan for Holders of Impaired Claims entitled to vote to accept or reject the Plan |

| | • | | A notice setting forth: (i) the deadline for casting ballots either accepting or rejecting the Plan; (ii) the deadline for filing objections to confirmation of the Plan; and (iii) the date, time and location of the Confirmation Hearing |

vii

ARTICLE I

INTRODUCTION AND OVERVIEW

| | A. | Prefatory Statement and Definitions |

Pursuant to chapter 11 of the United States Code, 11 U.S.C. §§ 101-1532 (the “Bankruptcy Code”), The PMI Group, Inc. (referred to herein as “TPG,” the “Company,” or the “Debtor”) hereby submits this disclosure statement (the “Disclosure Statement”) in support of thePlan of Reorganization of The PMI Group, Inc. Pursuant to Chapter 11 of the United States Bankruptcy Code (as may be amended, the “Plan”). The definitions contained in the Bankruptcy Code are incorporated herein by this reference. The definitions set forth on Exhibit A to the Plan shall also apply to capitalized terms used herein that are not otherwise defined.

On November 23, 2011 (the “Petition Date”), the Debtor filed a voluntary petition under chapter 11 of the Bankruptcy Code, thereby commencing case number 11-13730 (BLS) (the “Chapter 11 Case”) currently pending before the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). Since filing for bankruptcy protection, the Debtor has continued to operate and manage its affairs as a debtor in possession pursuant to sections 1107 and 1008 of the Bankruptcy Code.

This Disclosure Statement, submitted in accordance with section 1125 of the Bankruptcy Code, contains information regarding the Plan proposed by the Debtor. A copy of the Plan is attached to this Disclosure Statement asExhibit A. This Disclosure Statement is being distributed to you for the purpose of enabling you to make an informed judgment about the Plan.

This Disclosure Statement contains information concerning, among other matters: (1) the Debtor’s background; (2) the assets available for distribution under the Plan; and (3) a summary of the Plan. The Debtor strongly encourages you to review carefully the contents of this Disclosure Statement and the Plan (including the exhibits to each) before making a decision to accept or reject the Plan. Particular attention should be paid to the provisions affecting or impairing your rights as a Creditor.

Following a hearing on [ ], 2013, the Bankruptcy Court approved this Disclosure Statement as containing sufficient information to enable a hypothetical reasonable investor to make an informed judgment about the Plan. A copy of the order approving the Disclosure Statement is attached hereto asExhibit B (the “Disclosure Statement Order”). Under section 1125 of the Bankruptcy Code, this approval enabled the Debtor to send you this Disclosure Statement and solicit your acceptance of the Plan. The Bankruptcy Court has not considered for approval the Plan itself or conducted a detailed investigation into the contents of this Disclosure Statement.

Your vote on the Plan is important. Absent acceptance of the Plan, there may be protracted delays or a chapter 7 liquidation. These alternatives may not provide for distribution of as much value to Holders of Allowed Claims as does the Plan.Accordingly, the Debtor urges you to accept the Plan by completing and returning the enclosed ballot(s) no later than [ ], 2013.

1

THIS DISCLOSURE STATEMENT WAS PREPARED BY THE DEBTOR’S PROFESSIONALS IN CONJUNCTION WITH, AND BASED ON INFORMATION PROVIDED BY, THE DEBTOR’S OFFICERS AND EMPLOYEES THROUGHOUT THE CHAPTER 11 CASE. THE DEBTOR IS SOLELY RESPONSIBLE FOR THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT. THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE FINANCIAL OR LEGAL ADVICE. CREDITORS OF THE DEBTOR SHOULD CONSULT THEIR OWN ADVISORS IF THEY HAVE QUESTIONS ABOUT THE PLAN OR THIS DISCLOSURE STATEMENT. A REFERENCE IN THIS DISCLOSURE STATEMENT TO A “SECTION” REFERS TO A SECTION OF THIS DISCLOSURE STATEMENT, UNLESS OTHERWISE INDICATED.

WHILE THIS DISCLOSURE STATEMENT DESCRIBES CERTAIN BACKGROUND MATTERS AND THE MATERIAL TERMS OF THE PLAN, IT IS INTENDED AS A SUMMARY DOCUMENT ONLY AND IS QUALIFIED IN ITS ENTIRETY BY REFERENCE TO THE PLAN AND THE EXHIBITS ATTACHED TO THE PLAN AND THIS DISCLOSURE STATEMENT. SIMILARLY, DESCRIPTIONS IN THIS DISCLOSURE STATEMENT OF PLEADINGS, ORDERS, AND PROCEEDINGS IN THE CHAPTER 11 CASE ARE QUALIFIED IN THEIR ENTIRETY BY REFERENCE TO THE RELEVANT DOCKET ITEMS. YOU SHOULD READ THE PLAN AND THE EXHIBITS TO OBTAIN A FULL UNDERSTANDING OF THEIR PROVISIONS. ADDITIONAL COPIES OF THIS DISCLOSURE STATEMENT AND THE EXHIBITS ATTACHED TO THIS DISCLOSURE STATEMENT, AS WELL AS ANY DOCKET ITEMS FROM THE CHAPTER 11 CASE, ARE AVAILABLE FOR INSPECTION DURING REGULAR BUSINESS HOURS AT THE OFFICE OF THE CLERK OF THE BANKRUPTCY COURT, UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE, 3RD FLOOR, 824 MARKET STREET, WILMINGTON, DELAWARE 19801. IN ADDITION, COPIES MAY BE OBTAINED FOR A CHARGE THROUGH DELAWARE DOCUMENT RETRIEVAL, 230 NORTH MARKET STREET, P.O. BOX 27, WILMINGTON, DELAWARE 19801, (302) 658-9971, OR VIEWED ON THE INTERNET AT THE BANKRUPTCY COURT’S WEBSITE (HTTP://WWW.DEB.USCOURTS.GOV) BY FOLLOWING THE DIRECTIONS FOR ACCESSING THE ECF SYSTEM ON SUCH WEBSITE. COPIES ARE ALSO AVAILABLE FREE OF CHARGE ON KURTZMAN CARSON CONSULTANTS’ DEDICATED WEB PAGE RELATED TO THE CHAPTER 11 CASE (HTTP://WWW.KCCLLC.NET/PMI).

THE STATEMENTS AND INFORMATION CONCERNING THE DEBTOR AND THE PLAN SET FORTH IN THIS DISCLOSURE STATEMENT CONSTITUTE THE ONLY STATEMENTS OR INFORMATION CONCERNING SUCH MATTERS THAT HAVE BEEN APPROVED BY THE BANKRUPTCY COURT FOR THE PURPOSE OF SOLICITING ACCEPTANCES OR REJECTIONS OF THE PLAN.HOWEVER, APPROVAL OF THIS DISCLOSURE STATEMENT BY THE BANKRUPTCY COURT DOESNOT CONSTITUTE A FINDING OF FACT OR CONCLUSION OF LAW BY

2

THE BANKRUPTCY COURT AS TO ANY FACTUAL OR LEGAL ASSERTION MADE BY THE DEBTOR HEREIN, NOR DOES IT MEAN THAT THE BANKRUPTCY COURT AGREES WITH ANY SUCH FACTUAL OR LEGAL ASSERTION MADE BY THE DEBTOR HEREIN, NOR DOES IT MEAN THAT THE BANKRUPTCY COURT RECOMMENDS ACCEPTANCE OR REJECTION OF THE PLAN.

THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE AS OF THE DATE HEREOF UNLESS ANOTHER TIME IS SPECIFIED HEREIN. NEITHER DELIVERY OF THIS DISCLOSURE STATEMENT NOR ANY EXCHANGE OF RIGHTS MADE IN CONNECTION WITH THE PLAN WILL UNDER ANY CIRCUMSTANCES CREATE AN IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE INFORMATION SET FORTH HEREIN SINCE THE DATE THIS DISCLOSURE STATEMENT AND THE MATERIALS RELIED UPON IN PREPARATION OF THIS DISCLOSURE STATEMENT WERE COMPILED. THE DEBTOR ASSUMES NO DUTY TO UPDATE OR SUPPLEMENT THE DISCLOSURES CONTAINED HEREIN AND DOES NOT INTEND TO UPDATE OR SUPPLEMENT THE DISCLOSURES, EXCEPT AS PROVIDED HEREIN AND TO THE EXTENT NECESSARY AT THE HEARING ON CONFIRMATION OF THE PLAN.

THIS DISCLOSURE STATEMENT MAY NOT BE RELIED ON FOR ANY PURPOSE OTHER THAN TO DETERMINE WHETHER TO VOTE IN FAVOR OF OR AGAINST THE PLAN. CERTAIN OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT IS BY ITS NATURE FORWARD-LOOKING AND CONTAINS ESTIMATES, ASSUMPTIONS AND PROJECTIONS THAT MAY BE MATERIALLY DIFFERENT FROM ACTUAL FUTURE RESULTS, INCLUDING THOSE ESTIMATES OF THE VALUE OF PROPERTY THAT WILL BE DISTRIBUTED TO THE HOLDERS OF CLAIMS, ESTIMATES OF THE PERCENTAGE RECOVERY OF THE VARIOUS TYPES OF CLAIMS, ESTIMATES OF THE AGGREGATE FINAL ALLOWED AMOUNTS OF THE VARIOUS TYPES OF CLAIMS, ESTIMATES OF THE PROCEEDS FROM THE SALE, LIQUIDATION, OR OTHER DISPOSITION OF THE DEBTOR’S ASSETS AND ESTIMATES OF THE EXPENSES THAT WILL BE INCURRED DURING THE ADMINISTRATION OF THE PLAN. THERE CAN BE NO ASSURANCE THAT ANY FORECASTED OR PROJECTED RESULTS CONTAINED HEREIN WILL BE REALIZED. ACTUAL RESULTS MAY VARY FROM THOSE SHOWN HEREIN, POSSIBLY BY MATERIAL AMOUNTS.

The following is a brief overview of the material provisions of the Plan and is qualified in its entirety by reference to the full text of the Plan. The Plan effectuates a stand-alone reorganization of the Debtor that maximizes recovery to Creditors. The Plan distributes substantially all of the Debtor’s cash to Holders of Allowed Claims.

The Plan provides that all Holders of Allowed Administrative Expense Claims and Allowed Priority Claims against the Debtor will be paid in full. Holders of Allowed Secured Claims against the Debtor generally will retain their Liens or receive the benefit of their collateral under the Plan. Moreover, on the Effective Date, or as soon as reasonably practicable

3

thereafter, in full and final satisfaction and discharge of and in exchange for their Claims, each Holder of an Allowed General Unsecured Claim, Allowed Senior Notes Claim or Allowed Subordinated Note Claim shall receive its Pro Rata Share of Creditor Cash and New Common Stock; provided, however, that receipt of Creditor Cash and New Common Stock by the Subordinated Note Claims is subject to certain conditions set forth in the Plan. Each Holder of an Allowed Convenience Class Claim shall receive 90% of the amount of its Allowed Convenience Claim in Cash on the Effective Date or as soon as reasonably practicable thereafter. Holders of Equity Interests will receive no distributions under the Plan.

The Plan proposes to fairly and efficiently restructure the Debtor’s liabilities and distribute the Debtor’s assets in a manner that will allow this Chapter 11 Case to be promptly concluded.

The Plan designates a series of Classes of Claims against the Debtor. Specifically, the Plan designates seven (7) Classes of Claims. These Classes take into account the differing nature of the various Claims and their relative priorities under the Bankruptcy Code and applicable non-bankruptcy law.

The following table (the “Plan Summary Table”) summarizes the classification and treatment of Claims (including certain unclassified Claims), along with the projected recoveries for each Class.THE PLAN SUMMARY TABLE IS INTENDED FOR ILLUSTRATIVE PURPOSES ONLY AND DOES NOT ADDRESS ALL ISSUES REGARDING CLASSIFICATION, TREATMENT, AND ULTIMATE RECOVERIES. THE PLAN SUMMARY TABLE IS NOT A SUBSTITUTE FOR A FULL REVIEW OF THIS DISCLOSURE STATEMENT AND THE PLAN IN THEIR ENTIRETY. IN ADDITION, NOTHING HEREIN IS INTENDED, NOR SHOULD IT BE CONSTRUED, AS AN ADMISSION BY THE DEBTOR AS TO THE ESTIMATED OR ALLOWED AMOUNT OF ANY CLAIM OR GROUP THEREOF, OR AS A GUARANTEE OR ASSURANCE OF A PARTICULAR RECOVERY, OR RANGE OF RECOVERIES, ON ANY ALLOWED CLAIM OR GROUP THEREOF. THE DEBTOR RESERVES ALL RIGHTS WITH RESPECT TO THE ESTIMATION AND ALLOWANCE OF CLAIMS.

4

| | | | | | | | |

Summary of Classification and Treatment of Claims and Equity Interests under the Plan |

CLASS | | DESCRIPTION | | ESTIMATED

ALLOWED

CLAIMS | | TREATMENT OF ALLOWED CLAIMS AND EQUITY INTERESTS WITHIN CLASS | | ANTICIPATED

RECOVERY2 |

n/a | | Administrative Expense Claims | | De Minimis | | Except with respect to Administrative Expense Claims that are Professional Claims, on the later of the Effective Date or the date on which an Administrative Expense Claim becomes an Allowed Administrative Expense Claim, or, in each such case, as soon as reasonably practicable thereafter, each Holder of an Allowed Administrative Expense Claim will receive, in full satisfaction, settlement, discharge and release of, and in exchange for, such Claim either (i) payment in full in Cash for the unpaid portion of such Allowed Administrative Expense Claim; or (ii) such other less favorable treatment as agreed to in writing by the Reorganized Debtor and such Holder;provided,however, that Administrative Expense Claims incurred by the Debtor in the ordinary course of business may be paid in the ordinary course of business in accordance with such applicable terms and conditions relating thereto in the discretion of the Reorganized Debtor without further notice to or order of the Bankruptcy Court;provided,further, that, if any such ordinary course expense is not billed, or a request for payment is not made, within ninety (90) days after the Effective Date, such ordinary course expense shall be barred and the Holder thereof shall not be entitled to a distribution pursuant to the Plan. | | 100% |

| 2 | The bases for the recovery estimates are discussed in the Liquidation Analysis attached asExhibit C hereto. |

5

| | | | | | | | |

Summary of Classification and Treatment of Claims and Equity Interests under the Plan |

CLASS | | DESCRIPTION | | ESTIMATED

ALLOWED

CLAIMS | | TREATMENT OF ALLOWED CLAIMS AND EQUITY INTERESTS WITHIN CLASS | | ANTICIPATED

RECOVERY2 |

n/a | | Priority Tax Claims | | $0.00 | | With respect to each Allowed Priority Tax Claim not paid prior to the Effective Date, the Disbursing Agent shall (i) pay such Claim in Cash as soon as reasonably practicable after the Effective Date, (ii) provide such other treatment agreed to by the Holder of such Allowed Priority Tax Claim and the Debtor (if before the Effective Date) or the Reorganized Debtor (on and after the Effective Date), as applicable, in writing, provided such treatment is no less favorable to the Debtor or the Reorganized Debtor than the treatment set forth in clause (i) of this sentence; or (iii) at the Disbursing Agent’s sole discretion, pay regular installment payments in Cash having a total value, as of the Effective Date (reflecting an interest rate determined as of the Effective Date under Section 511(a) of the Bankruptcy Code), equal to such Allowed Priority Tax Claim, over a period not later than five (5) years after the Petition Date. | | 100% |

1 | | Priority Non-Tax Claims | | $0.00 | | Unimpaired; deemed to accept. Except to the extent that a Holder of an Allowed Priority Non-Tax Claim agrees to less favorable treatment, each Holder of such Allowed Priority Non-Tax Claim shall be paid in full in Cash on the Effective Date or as soon as reasonably practicable thereafter;provided,however, that Class 1 Claims incurred by the Debtor in the ordinary course of business may be paid in the ordinary course of business in accordance with the terms and conditions of any agreements relating thereto in the discretion of the Disbursing Agent without further notice to or order of the Bankruptcy Court. | | 100% |

6

| | | | | | | | |

Summary of Classification and Treatment of Claims and Equity Interests under the Plan |

CLASS | | DESCRIPTION | | ESTIMATED

ALLOWED

CLAIMS | | TREATMENT OF ALLOWED CLAIMS AND EQUITY INTERESTS WITHIN CLASS | | ANTICIPATED

RECOVERY2 |

2 | | Secured Claims | | $0.00 | | Impaired; entitled to vote. Except to the extent that a Holder of an Allowed Secured Claim agrees to less favorable treatment, each Holder of such Allowed Secured Claim shall, on the Effective Date or as soon as reasonably practicable thereafter, at the sole option of the Disbursing Agent, (i) be paid in full in Cash, including the payment of any interest or fees required by Bankruptcy Code Section 506(b), (ii) receive the property securing any such Allowed Secured Claim, or (iii) be treated in any other manner such that the Allowed Secured Claim shall be rendered unimpaired;provided,however, that Class 2 Claims incurred by the Debtor in the ordinary course of business may be paid in the ordinary course of business in accordance with the terms and conditions of any agreements relating thereto in the discretion of the Disbursing Agent without further notice to or order of the Bankruptcy Court. Each Holder of an Allowed Secured Claim shall retain the Liens securing its Allowed Secured Claim as of the Effective Date until full and final payment of such Allowed Secured Claim is made as provided herein. On the full payment or other satisfaction of such obligations, the Liens securing such Allowed Secured Claim shall be deemed released, terminated and extinguished, in each case without further notice to or order of the Bankruptcy Court, act or action under applicable law, regulation, order, or rule or the vote, consent, authorization or approval of any Entity. | | 100% or Value of

Collateral |

7

| | | | | | | | |

Summary of Classification and Treatment of Claims and Equity Interests under the Plan |

CLASS | | DESCRIPTION | | ESTIMATED

ALLOWED

CLAIMS | | TREATMENT OF ALLOWED CLAIMS AND EQUITY INTERESTS WITHIN CLASS | | ANTICIPATED

RECOVERY2 |

3 | | General Unsecured Claims | | $6.3 million to

$10.3 million3 | | Impaired; entitled to vote. Except to the extent that a Holder of an Allowed General Unsecured Claim agrees to less favorable treatment, in full and final satisfaction, settlement, release and discharge of and in exchange for each Allowed General Unsecured Claim, on the later of (a) the Effective Date and (b) the date on which such General Unsecured Claim becomes Allowed, or as soon as practicable thereafter, each Holder of an Allowed General Unsecured Claim shall receive its Pro Rata Share of the (i) Creditor Cash; and (ii) New Common Stock distributed to Holders of Allowed General Unsecured Claims, Senior Notes Claims, and Subordinated Note Claims pursuant to the Plan. Unless otherwise provided by an order of the Bankruptcy Court, no fees or penalties of any kind shall be paid to the Holders of Allowed General Unsecured Claims. | | 26% to 27% |

4 | | Senior Note Claims | | $691.0 million | | Impaired; entitled to vote. In full and final satisfaction, settlement, release, and discharge of and in exchange for each Allowed Senior Notes Claim, on the Effective Date or as soon as practicable thereafter, each Holder of such Allowed Senior Notes Claim shall receive its Pro Rata Share of the (i) Creditor Cash; and (ii) New Common Stock distributed to Holders of Allowed General Unsecured Claims, Senior Notes Claims, and Subordinated Note Claims pursuant to the Plan. In addition, the Senior Notes Indenture Trustee shall receive redistributions of Creditor Cash and New Common Stock from the Subordinated Note Indenture Trustee in accordance with the Subordination Provisions. | | 29% |

| 3 | The estimated allowed amount of General Unsecured Claims includes a $5,150,211.75 Claim filed by the Internal Revenue Service (See Section III.B.3(c) infra). |

8

| | | | | | | | |

Summary of Classification and Treatment of Claims and Equity Interests under the Plan |

CLASS | | DESCRIPTION | | ESTIMATED

ALLOWED

CLAIMS | | TREATMENT OF ALLOWED CLAIMS AND EQUITY INTERESTS WITHIN CLASS | | ANTICIPATED

RECOVERY2 |

5 | | Subordinated Note Claims | | $52.9 million | | Impaired; entitled to vote. In full and final satisfaction, settlement, release, and discharge of and in exchange for each Allowed Subordinated Note Claim, on the Effective Date or as soon as practicable thereafter, each Holder of such Allowed Subordinated Note Claim shall receive its Pro Rata Share of the (i) Creditor Cash; and (ii) New Common Stock distributed to Holders of Allowed General Unsecured Claims, Senior Notes Claims, and Subordinated Note Claims pursuant to the Plan;provided,however, that any distribution of New Common Stock and Creditor Cash to Holders of Allowed Subordinated Note Claims shall be redistributed to the Senior Notes Indenture Trustee for the benefit of Holders of Allowed Senior Note Claims in accordance with the Subordination Provisions. | | 0% due to

Subordination

Provisions |

6 | | Convenience Claims4 | | $100,000 | | Impaired; entitled to vote. Except to the extent that a Holder of an Allowed Convenience Claim agrees to less favorable treatment, each Holder of an Allowed Convenience Claim shall be paid 90% of the amount of its Allowed Convenience Claim in Cash on the Effective Date or as soon as reasonably practicable thereafter. | | 90% |

7 | | Equity Interests | | N/A | | Impaired; deemed to reject. The Holders of Equity Interests shall receive no distribution. On the Effective Date, all existing Equity Interests in the Debtor shall be deemed cancelled, null and void and of no force and effect. | | 0% |

THE TREATMENT AND DISTRIBUTIONS, IF ANY, PROVIDED TO HOLDERS OF ALLOWED CLAIMS PURSUANT TO THE PLAN WILL BE IN FULL AND COMPLETE SATISFACTION OF ALL LEGAL, EQUITABLE, OR CONTRACTUAL RIGHTS REPRESENTED BY SUCH CLAIMS.

| 4 | A Convenience Claim is a General Unsecured Claim in an amount equal to or less than $50,000, or with respect to which, the Holder thereof voluntarily reduces its General Unsecured Claims, in their entirety, to $50,000. |

9

Pursuant to the provisions of the Bankruptcy Code, only classes of claims or interests that are “impaired” under a plan may vote to accept or reject such plan. Generally, a claim or interest is impaired under a plan if the holder’s legal, equitable or contractual rights are changed under such plan. In addition, if the holders of claims or interests in an impaired class do not receive or retain any property under a plan on account of such claims or interests, such impaired class is deemed to have rejected the plan under § 1126(g) of the Bankruptcy Code and, therefore, such holders do not need to vote on the plan.

With respect to the Plan, a Claim or Equity Interest must be “Allowed” for purposes of voting in order for such creditor to have the right to vote. Generally, for voting purposes, a Claim or Equity Interest is deemed “Allowed” absent an objection to the Claim or Equity Interest if (i) a Proof of Claim was timely filed, or (ii) if no Proof of Claim was filed, the Claim or Equity Interest is identified in the Debtor’s Schedules as other than “disputed,” “contingent,” or “unliquidated,” and an amount of the Claim or Equity Interest is specified in the Schedules, in which case the Claim or Equity Interest will be deemed Allowed for the specified amount. In either case, when an objection to a Claim or Equity Interest is filed, the holder of such Claim or Equity Interest cannot vote unless the Bankruptcy Court, after notice and hearing, either overrules the objection, or deems the Claim or Equity Interest to be Allowed for voting purposes.

In connection with the Plan, therefore:

| | • | | Claims in Class 1 (Priority Non-Tax Claims) are unimpaired; accordingly, Holders of such Claims are conclusively presumed to have accepted the Plan. |

| | • | | Claims in Classes 3 (General Unsecured Claims), 4 (Senior Notes Claims), 5 (Subordinated Note Claims), and 6 (Convenience Claims) are impaired; accordingly, Holders of such Claims are entitled to vote to accept or reject the Plan. |

| | • | | Claims in Class 2 (Secured Claims) may be impaired; accordingly, Holders of such Claims are entitled to vote to accept or reject the Plan. |

| | • | | Equity Interests in Class 7 are impaired, but will not retain or receive any property under the Plan; accordingly, Holders of Equity Interests are conclusively presumed to have rejected the Plan. |

The Bankruptcy Code defines “acceptance” of a plan by (a) a class of claims as acceptance by creditors in that class that hold at least two-thirds in dollar amount and more than one-half in number of the claims that cast ballots for acceptance or rejection of the plan and (b) a class of interests as acceptance by holders in the class that hold at least two-thirds of the number of interests that cast ballots for acceptance or rejection of the plan.Your vote on the Plan is important. The Bankruptcy Code requires as a condition to confirmation of a plan of

10

reorganization that each class that is impaired and entitled to vote under a plan vote to accept such plan, unless the provisions of Section 1129(b) of the Bankruptcy Code are met. In view of the deemed rejection of the Plan by Class 7, the Debtor will request confirmation of the Plan pursuant to Section 1129(b) of the Bankruptcy Code as to such Class, as well as with respect to any Class of Claims entitled to vote on the Plan that rejects the Plan. Section 1129(b) of the Bankruptcy Code permits the confirmation of a plan of reorganization notwithstanding the non-acceptance of a plan by one or more impaired classes of claims or equity interests, so long as at least one impaired class of claims or interests votes to accept the plan. Under that section, a plan may be confirmed by a bankruptcy court if it does not “discriminate unfairly” and is “fair and equitable” with respect to each non-accepting class.

If you are entitled to vote to accept or reject the Plan, a Ballot is enclosed for the purpose of voting on the Plan. If you hold Claims in more than one Class and you are entitled to vote Claims in more than one Class, you will receive separate Ballots that must be used to vote in each separate Class. This Disclosure Statement, the Exhibits attached hereto, the documents incorporated herein by reference, the Plan and the related documents are the only materials the Debtor is providing to creditors for their use in determining whether to vote to accept or reject the Plan, and such materials may not be relied upon or used for any purpose other than to vote to accept or reject the Plan. Unless otherwise directed in your solicitation package, mail your completed Ballot(s) to the Debtor’s claims, noticing and balloting agent (the “Balloting Agent”) at the address below:

The PMI Group Ballot Processing

c/o KCC

599 Lexington Avenue, 39th Floor

New York, NY 10022

BALLOTS MUST BE COMPLETED AND RECEIVED NO LATER THAN THE VOTING DEADLINE OF 4:00 P.M. (PREVAILING EASTERN TIME) ON [ ], 2013. ANY BALLOT THAT IS NOT EXECUTED BY A DULY AUTHORIZED PERSON WILL NOT BE COUNTED. ANY BALLOT THAT IS EXECUTED BY THE HOLDER OF AN ALLOWED CLAIM BUT THAT DOES NOT INDICATE AN ACCEPTANCE OR REJECTION OF THE PLAN WILL NOT BE COUNTED. FACSIMILE, EMAIL OR ELECTRONICALLY TRANSMITTED BALLOTS WILL NOT BE ACCEPTED. IF A HOLDER OF A CLAIM SHOULD CAST MORE THAN ONE BALLOT VOTING THE SAME CLAIM PRIOR TO THE VOTING DEADLINE, ONLY THE LAST-DATED TIMELY BALLOT RECEIVED BY THE BALLOTING AGENT WILL BE COUNTED. ADDITIONALLY, YOU MAY NOT SPLIT YOUR VOTES FOR YOUR CLAIMS WITHIN A PARTICULAR CLASS UNDER THE PLAN EITHER TO ACCEPT OR REJECT THE PLAN. THEREFORE, A BALLOT OR A GROUP OF BALLOTS WITHIN A PLAN CLASS RECEIVED FROM A SINGLE CREDITOR THAT PARTIALLY REJECTS AND PARTIALLY ACCEPTS THE PLAN WILL NOT BE COUNTED.

11

Pursuant to the Disclosure Statement Order, the Bankruptcy Court has fixed 4:00 p.m. (Prevailing Eastern Time) on [ ], 2013 (the “Voting Record Date”), as the time and date for the determination of Persons who are entitled to receive a copy of this Disclosure Statement and all of the related materials and to vote whether to accept or reject the Plan. Accordingly, only Holders of record of Claims as of the Voting Record Date that are entitled to vote on the Plan, will receive a Ballot and may vote on the Plan.

Unless the Bankruptcy Court permits you to do so after notice and hearing to determine whether sufficient cause exists to permit the change, you may not change your vote after the voting deadline passes.DO NOT RETURN ANY DEBT INSTRUMENTS OR OTHER SECURITIES WITH YOUR BALLOT. DO NOT RETURN BALLOTS TO THE BANKRUPTCY COURT.

IF YOU BELIEVE THAT YOU ARE A HOLDER OF A CLAIM IN A VOTING CLASS FOR WHICH YOU DID NOT RECEIVE A BALLOT, IF YOUR BALLOT IS DAMAGED OR LOST, OR IF YOU HAVE QUESTIONS CONCERNING VOTING PROCEDURES, PLEASE CONTACT KURTZMAN CARSON CONSULTANTS AT (866) 381-9100. PLEASE NOTE THAT KURTZMAN CARSON CONSULTANTS CANNOT PROVIDE YOU WITH LEGAL ADVICE.

If you did not receive a Ballot and believe that you are entitled to vote on the Plan, you must either (a) obtain a Ballot by contacting the Balloting Agent as set forth above and timely submit such Ballot by the Voting Deadline, or (b) file a Motion pursuant to Rule 3018 of the Bankruptcy Rules with the Bankruptcy Court for the temporary allowance of your Claim for voting purposes by [ ], 2013 at 4:00 p.m. (Prevailing Eastern Time), or you will not be entitled to vote to accept or reject the Plan.

THE DEBTOR AND THE REORGANIZED DEBTOR, AS APPLICABLE, IN ALL EVENTS RESERVE THE RIGHT THROUGH THE CLAIM RECONCILIATION PROCESS TO OBJECT TO OR SEEK TO DISALLOW ANY CLAIM FOR DISTRIBUTION PURPOSES UNDER THE PLAN, EVEN IF THE HOLDER OF SUCH CLAIM VOTED TO ACCEPT OR REJECT THE PLAN.

All properly completed Ballots received prior to the Voting Deadline will be counted for purposes of determining whether a voting Class of Impaired Claims has accepted the Plan. The Balloting Agent will prepare and file with the Bankruptcy Court a certification of the results of the balloting with respect to the Class entitled to vote.

HOLDERS OF CLAIMS VOTING TO ACCEPT THE PLAN, WHO DID NOT EXERCISE THE OPT-OUT PROVISION INCLUDED ON THE BALLOT, WILL BE DEEMED TO HAVE GRANTED THE THIRD PARTY RELEASE PROVIDED FOR IN SECTION 12.4 OF THE PLAN AND DESCRIBED BELOW. HOLDERS WHO DO NOT DESIRE TO GRANT THE THIRD PARTY RELEASE SHOULD GOVERN THEMSELVES ACCORDINGLY.

The Debtor has proposed that the Bankruptcy Court approve procedures regarding temporary allowance of certain Claims for voting purposes only. Specifically, the Debtor has

12

requested that any Holder of a Secured Claim in Class 2, a General Unsecured Claim in Class 3, a Senior Notes Claim in Class 4, a Subordinated Note Claim in Class 5 or a Convenience Claim in Class 6 whose Claim is (a) asserted as wholly unliquidated or wholly contingent in a timely Proof of Claim, (b) asserted in an untimely Proof of Claim that has not been allowed by the Court as timely on or before the Voting Record Date, (c) asserted in a Proof of Claim as to which an objection to the entirety of the Claim is pending as of the Voting Record Date, or (d) listed in the Schedules as contingent, unliquidated or disputed or as zero or unknown in amount, and not asserted in a timely Proof of Claim in a manner other than as wholly unliquidated or wholly contingent (collectively, the “Disputed Claimants”) not be permitted to vote on the Plan unless they file a motion seeking to be allowed to vote on the Plan pursuant to Bankruptcy Rule 3018(a) (a “Rule 3018 Motion”). All Disputed Claimants will receive a copy of the Notice of Non-Voting Status and Temporary Allowance Procedures with Respect to Claims Held by Disputed Claimants (the “Notice of Disputed Claim Status”) in lieu of a Ballot. The Notice of Disputed Claim Status will inform the Disputed Claimants that if they wish to dispute their status as a Disputed Claimant and to seek the right to vote on the Plan, they must: (a) request temporary allowance of their claim for voting purposes on or before [ ], 2013 at 4:00 p.m. (Prevailing Eastern Time), by filing a Rule 3018 Motion with the Bankruptcy Court; (b) request a provisional ballot from the Balloting Agent (The PMI Group Ballot Processing, c/o KCC, 599 Lexington Avenue, 39th Floor, New York, NY 10022, Telephone: (866) 381-9100), and (c) on or before [ ], 2013 at 4:00 p.m. (Prevailing Eastern Time), complete and return the provisional ballot according to the instructions contained on the ballot. If and to the extent that the Debtor and each such Disputed Claimant are unable to resolve the issues raised by the Rule 3018 Motion prior to the Voting Deadline, then the Debtor will request that the Bankruptcy Court determine, at a hearing to be held in advance of the Confirmation Hearing, whether the provisional ballot should be counted as a vote on the Plan.

The Debtor reserves the right to object to any Proof of Claim after the Voting Record Date. With respect to any such objection, the Debtor may request, on notice, that any vote cast by the Holder of the subject claim not be counted in determining whether the requirements of Section 1126(c) of the Bankruptcy Code have been met. In the absence of any such request, the Holder of the subject claim will be entitled to vote or receive notice, as applicable under the Disclosure Statement Order, in accordance with its Proof of Claim.

Nothing in the solicitation procedures affects the right of the Debtor or the Reorganized Debtor to object to any Proof of Claim on any ground or for any purpose prior to the applicable Claims Objection Deadline established by the Plan.

| | 3. | Importance of Your Vote |

YOUR VOTE IS IMPORTANT. ONLY THOSE CREDITORS WHO ACTUALLY VOTE ARE COUNTED FOR PURPOSES OF DETERMINING WHETHER A CLASS HAS VOTED TO ACCEPT THE PLAN. YOUR FAILURE TO VOTE WILL LEAVE TO OTHERS THE DECISION TO ACCEPT OR REJECT THE PLAN.

THE DEBTOR AND THE CREDITORS’ COMMITTEE BELIEVE THAT CONFIRMATION OF THE PLAN IS IN THE BEST INTERESTS OF ALL HOLDERS OF CLAIMS AND RECOMMEND THAT ALL HOLDERS OF CLAIMS ENTITLED TO VOTE ON THE PLAN VOTE TO ACCEPT THE PLAN.

13

| | F. | Special Notice of Third Party Release |

THE PLAN PROVIDES THAT, AS OF THE EFFECTIVE DATE, TO THE FULLEST EXTENT PERMITTED UNDER APPLICABLE LAW, FOR GOOD AND VALUABLE CONSIDERATION, THE ADEQUACY OF WHICH IS HEREBY CONFIRMED, EACH PRESENT AND FORMER HOLDER OF A CLAIM WHO VOTED IN FAVOR OF THE PLAN AND DID NOT EXERCISE THE OPT-OUT PROVISION INCLUDED ON THE BALLOT, WILL BE DEEMED TO RELEASE AND FOREVER WAIVE AND DISCHARGE ANY AND ALL CLAIMS, OBLIGATIONS, SUITS, JUDGMENTS, DAMAGES, DEMANDS, DEBTS, RIGHTS, CAUSES OF ACTION AND LIABILITIES (OTHER THAN THE RIGHTS TO ENFORCE THE DEBTOR’S OR THE REORGANIZED DEBTOR’S OBLIGATIONS UNDER ANY ORDER OF THE BANKRUPTCY COURT, THE PLAN AND THE SECURITIES, CONTRACTS, INSTRUMENTS, RELEASES AND OTHER AGREEMENTS AND DOCUMENTS DELIVERED THEREUNDER), WHETHER LIQUIDATED OR UNLIQUIDATED, FIXED OR CONTINGENT, MATURED OR UNMATURED, KNOWN OR UNKNOWN, FORESEEN OR UNFORESEEN, THEN EXISTING OR THEREAFTER ARISING, IN LAW, EQUITY OR OTHERWISE THAT ARE BASED IN WHOLE OR IN PART ON ANY ACT, OMISSION, TRANSACTION, EVENT OR OTHER OCCURRENCE TAKING PLACE ON OR PRIOR TO THE EFFECTIVE DATE IN ANY WAY RELATING TO THE DEBTOR, THE CHAPTER 11 CASE, OR THE PLAN AGAINST ANY CREDITOR RELEASEE, EXCEPT FOR ACTS CONSTITUTING FRAUD, WILLFUL MISCONDUCT OR GROSS NEGLIGENCE AS DETERMINED BY A FINAL ORDER.

Parties who do not desire to grant the Third Party Release should govern themselves accordingly by exercising the opt-out provision on the Ballot.

| | G. | The Confirmation Hearing |

Section 1128(a) of the Bankruptcy Code requires the Bankruptcy Court, after notice, to hold a confirmation hearing. Section 1128(b) of the Bankruptcy Code provides that any party in interest may object to confirmation of the Plan.

| | 1. | Time and Place of the Confirmation Hearing |

Pursuant to Section 1128 of the Bankruptcy Code and Rule 3017(c) of the Bankruptcy Rules, the Bankruptcy Court has scheduled the Confirmation Hearing to commence on[ ], 2013, at [ ] .m. (Prevailing Eastern Time) before the Honorable Brendan Linehan Shannon, of the United States Bankruptcy Court for the District of Delaware, 824 North Market Street, 6th Floor, Courtroom No. 1, Wilmington, Delaware 19801. A notice setting forth the time and date of the Confirmation Hearing has been included along with this Disclosure Statement. The Confirmation Hearing may be adjourned from time to time by the Bankruptcy Court without further notice, except for an announcement of such adjourned hearing date by the Bankruptcy Court in open court at such hearing.

14

Any objection to confirmation of the Plan must be in writing; must comply with the Bankruptcy Code, Bankruptcy Rules, and the Local Rules of the Bankruptcy Court; and must be filed with the United States Bankruptcy Court for the District of Delaware, and served upon the following parties, so as to be received no later than[ ], 2013 at 4:00 p.m. (Prevailing Eastern Time): (a) Joseph M. Barry and Kara Hammond Coyle, Young Conaway Stargatt & Taylor LLP, 1000 North King Street, Rodney Square, Wilmington, Delaware 19801 (counsel for the Debtor), (b) Anthony Princi and Jordan Wishnew, Morrison & Foerster LLP, 1290 Avenue of the Americas, New York, New York 10104 (counsel for the Creditors’ Committee), and (c) David L. Buchbinder, Office of the United States Trustee, 844 King Street, Suite 2207, Wilmington, Delaware 19801.

FOR THE REASONS SET FORTH BELOW, THE DEBTOR AND THE CREDITORS’ COMMITTEE5 URGE YOU TO RETURN YOUR BALLOT TO “ACCEPT” THE PLAN.

ARTICLE II

BACKGROUND OF THE DEBTOR AND THE CHAPTER 11 CASE

| | A. | Overview of the Debtor’s Business |

The Debtor, a Delaware corporation founded in 1972, is an insurance holding company whose stock had, until October 21, 2011, been publicly-traded on the New York Stock Exchange.6 Through its principal regulated subsidiary, PMI Mortgage Insurance Co. (“MIC”), and its affiliated companies (collectively, “PMI”), the Debtor provided residential mortgage insurance in the United States. Mortgage insurance provides loss protection to mortgage lenders and investors in the event of borrower defaults.

As discussed in more detail herein, the Debtor’s primary assets that will accrue to the benefit of Holders of Allowed Claims consist of approximately $200 million in Cash, the Tax Attributes (as defined herein) and the Principal Regulated Reinsurance Subsidiaries. As discussed in section II(C)(3) herein, MIC is currently subject to the Receivership Order (as defined below). As a result, any value the Debtor may have hoped to realize on account of its equity stake in MIC is highly speculative.

| 5 | The Creditors’ Committee supports the Plan; however, the Subordinated Note Indenture Trustee abstained from voting on whether to support the Plan. |

| 6 | The New York Stock Exchange halted trading in the Debtor’s common stock on October 21, 2011, and subsequently delisted it. The stock now trades over the counter under the ticker “PPMIQ.” |

15

As of the Petition Date, the Debtor was the ultimate parent entity of twenty-three (23) direct or indirect wholly-owned subsidiaries (each, a “Subsidiary” and, collectively, the “Subsidiaries”).7 Prior to the Chapter 11 filing, the Debtor had divided its business into three segments: U.S. Mortgage Insurance Operations, International Operations, and “Corporate/Other.”

| | (a) | U.S. Mortgage Insurance Operations |

As of the Petition Date, MIC, formerly the Debtor’s main operating entity, was the 100% owner of PMI Insurance Co. (“PIC”) and PMI Mortgage Assurance Co. (“PMAC”), as well as other direct and indirect subsidiaries. MIC, PIC and PMAC are insurance companies regulated by the State of Arizona and licensed throughout the United States, Puerto Rico, Guam and the Virgin Islands. Prior to the events described below, MIC and its affiliates offered a broad range of mortgage insurance products to mortgage lenders and investors throughout the United States.

MIC was also a 50% owner of interests in CMG Mortgage Insurance Company and CMG Mortgage Assurance Company, as well as its subsidiary CMG Reinsurance Company (collectively, “CMG”), each of which is an insurance company regulated by the State of Wisconsin. CMG provides mortgage insurance exclusively to credit unions.

On February 8, 2013, MIC made public the proposed sale of PMAC, CMG and certain other assets to Arch U.S. MIC Services Inc. and Arch Capital Group (US) Inc. The sale is subject to Arizona Court and regulatory approvals.

The Debtor is the 100% owner of PMI Reinsurance Co., PMI Mortgage Guaranty Co., and Residential Insurance Co., the Debtor’s principal reinsurance subsidiaries (collectively, the “Principal Regulated Reinsurance Subsidiaries”), which are regulated by the State of Arizona. Certain states limit the amount of risk a mortgage insurer may retain on a single loan to 25% of the indebtedness to the insured, and, as a result, the portion of such insurance in excess of 25% (“deep coverage”) must be reinsured. To minimize reliance on third party reinsurance companies and to permit PMI to retain the premiums (and related risk) on deep coverage business, the Debtor formed the Principal Regulated Reinsurance Subsidiaries to provide reinsurance of such deep coverage to MIC. As discussed in section II.D.16(c) herein, the Principal Regulated Reinsurance Subsidiaries have terminated all of their reinsurance policies.

| | (b) | International Operations |

PMI Mortgage Insurance Holdings Canada Inc. (“PMI Holdings Canada”), as well as PMI Europe Holdings Limited and its direct subsidiaries (collectively, “PMI Europe”), each a subsidiary of MIC as of the Petition Date, formed the international operations segment of the Debtor’s enterprise. PMI Holdings Canada, through its former subsidiary, PMI Mortgage Insurance Company Canada (“PMI Canada”), offered residential mortgage insurance products

| 7 | A chart depicting the corporate structure of the Debtor and its non-debtor affiliates as of the Petition Date is attached hereto asExhibit D. |

16

in Canada in 2007 and 2008, whereas PMI Europe offered mortgage insurance and mortgage credit enhancement products, tailored primarily to the European mortgage markets, through 2008. Currently, neither PMI Holdings Canada nor PMI Europe is writing new business.

On October 5, 2012, MIC submitted for approval to the Arizona Court the proposed sale of PMI Canada to Genworth Financial Mortgage Insurance Company Canada. The Arizona Court issued an order approving the transaction on October 30, 2012 and MIC subsequently completed the sale.

| | (c) | Corporate/Other Segment |

The Debtor’s “Corporate/Other” segment consisted of, among other things, contract underwriting operations (which were discontinued in April 2009), former investments in FGIC Corporation (which the Debtor sold in the third quarter of 2010), RAM Re (which was sold in the fourth quarter of 2009), and equity in earnings or losses from investments in certain limited partnerships.

The Debtor’s insurance company subsidiaries are subject to comprehensive, detailed regulation by state insurance departments whose primary goal is to safeguard insurers’ solvency for the protection of policyholders. Though their scope varies, state insurance laws generally grant broad powers to supervisory agencies and officials to examine and investigate insurance companies and to enforce rules or exercise discretion touching almost every aspect of an insurance company’s business.

With respect to insurance holding companies such as the Debtor, all states have enacted legislation that requires each insurance company in a holding company system to register with the insurance regulatory authority of its state of domicile and to furnish to such regulatory authority financial and other information concerning the operations of, and the interrelationships and transactions among, companies within the holding company system that may materially affect the operations, management or financial condition of the insurers within the system. The states also regulate transactions between insurance companies and their parents and non-insurer affiliates.

The Debtor is treated as an insurance holding company under the laws of the State of Arizona. The Arizona insurance laws govern, among other things, certain transactions in the Debtor’s common stock and certain transactions between or among the Debtor and its domestic and international subsidiaries. In addition, all material transactions involving MIC, PIC, and/or PMAC, and any of their affiliates, are subject to prior approval of the Arizona Department of Insurance (the “ADI”), and may be disapproved if they are not found to be “fair and reasonable.”

| | B. | Summary of Assets and Liabilities |

As of the Petition Date, the Debtor’s principal assets consisted of, among other things, approximately $165 million in cash, the value of the Debtor’s equity interests in its subsidiaries, including MIC and the Principal Regulated Reinsurance Subsidiaries, and the Tax Attributes described below.

17

As of the date hereof, the Debtor holds approximately $200 million in cash. The Principal Regulated Reinsurance Subsidiaries hold approximately $5 million in cash and have no material liabilities.

| | 2. | Potential Cause of Action |

As a result of the 2008 sale of PMI Mortgage Insurance Australia (Holdings) Pty Limited (“PMI Australia”) to QBE Holdings (AAP) Pty Limited (“QBE Holdings”), the Debtor holds a claim and/or receivable of approximately $2.5 million (the “QBE Claim”) against QBE Holdings and/or its parent QBE Insurance Group Limited (together with QBE Holdings, “QBE”).SeeArticle II.B.16(f) herein.

| | 3. | Tax Attributes and Tax Sharing Agreement |

The Debtor and the Subsidiaries (including MIC) constitute a consolidated tax group (the “Consolidated Group”) for Federal income tax purposes. Under applicable federal Treasury Regulations, the Debtor, as the “common parent” of the “affiliated group” of corporations, files a consolidated Federal income tax return on behalf of itself and the Subsidiaries. The applicable federal Treasury Regulations address, in various respects, the treatment of net operating loss carry forwards (“NOLs”) and other similar tax attributes.

As of December 31, 2011, the Consolidated Group had access to, for Federal income tax purposes, NOLs of approximately $2.2 billion and income tax credits (the “Tax Credits,” and together with the NOLs and other tax attributes, the “Tax Attributes”) of approximately $195 million.

As of the Petition Date, the rights and obligations of the members of the Consolidated Group with respect to the Tax Attributes were governed by that certain Tax Sharing Agreement, dated as of April 10, 1995 (as amended from time-to-time, the “Tax Sharing Agreement”), by and among the Debtor, MIC and certain other Subsidiaries. As detailed further below, the Tax Sharing Agreement has been amended pursuant to the Stipulation (as defined below) between the Debtor, the Creditors’ Committee, MIC, the Receiver and the Special Deputy Receiver. The Debtor and its subsidiaries (excluding MIC and its direct and indirect subsidiaries) retained sole use of approximately $1.2 billion in NOLs.8

| | 4. | Cost Allocation Agreement |

On January 1, 1996, the Debtor and MIC entered into a Cost Allocation Agreement, which was subsequently amended on September 3, 2003 and April 13, 2006, and amended and restated as of January 1, 2012 (as so amended and amended and restated, the “CAA”). The CAA governed a shared services arrangement between the Debtor and MIC, pursuant to which MIC provided the Debtor with certain accounting, auditing, legal, investment,

| 8 | As discussed in Section VII.A.1 herein, the Debtor believes the value of the Tax Attributes will be reduced as a result of cancellation of indebtedness income. |

18

personnel and other administrative services, as well as the use of certain of MIC’s facilities, on an allocated cost basis. The CAA, as discussed below, was amended and restated during the Chapter 11 Case and further amended and restated pursuant to the Stipulation (as defined below).

| | 5. | Primary Prepetition Indebtedness |

Pursuant to indentures entered into between 2003 and 2010, the Debtor is obligated on various issues of outstanding bonds (the “Notes”) in the aggregate approximate amount of $737 million. Each outstanding series and the approximate principal amounts owing are as follows:

| | | | |

SERIES | | PRINCIPAL OUTSTANDING AS OF

THE PETITION DATE | |

6.000% SENIOR NOTES, DUE SEPTEMBER 15, 2016 | | $ | 250,000,000 | |

6.625% SENIOR NOTES, DUE SEPTEMBER 15, 2036 | | $ | 150,000,000 | |

8.309% JUNIOR SUBORDINATED DEFERRABLE INTEREST DEBENTURES, SERIES A, DUE FEBRUARY 1, 2027 | | $ | 51,593,000 | |

4.50% CONVERTIBLE SENIOR NOTES, DUE APRIL 15, 2020 | | $ | 285,000,000 | |

| | (a) | 6.000% and 6.625% Senior Notes |

In September 2006, the Debtor issued $250 million in principal amount of 6.000% Senior Notes, due September 15, 2016 (the “6.000% Senior Notes”) and $150 million in principal amount of 6.625% Senior Notes, due September 15, 2036 (the “6.625% Senior Notes”). The 6.000% Senior Notes and the 6.625% Senior Notes bear interest at the rates of 6.000% and 6.625% per annum, respectively, payable semi-annually in arrears on March 15 and September 15 of each year. The Debtor made all scheduled interest payments on the 6.000% Senior Notes and the 6.625% Senior Notes through and including September 2011.

| | (b) | 8.309% Junior Subordinated Deferrable Interest Debentures, Series A |

The Debtor entered into a Junior Subordinated Indenture dated February 4, 1997, pursuant to which the Debtor issued unsecured Junior Subordinated Deferrable Interest Debentures in a principal amount of $100 million. In 2001, Junior Subordinated Deferrable Interest Debentures in the amount of $51.5 million were repurchased on the open market. The Junior Subordinated Deferrable Interest Debentures bear interest at the rate of 8.309% per annum, payable semi-annually in arrears on February 1 and August 1, and mature on February 1, 2027. The Junior Subordinated Deferrable Interest Debentures are contractually subordinated to all senior indebtedness of the Debtor. The Debtor paid all scheduled interest through August 2011 under the Junior Subordinated Deferrable Interest Debentures.

19

| | (c) | 4.50% Convertible Senior Notes |

In the second quarter of 2010, the Debtor completed a concurrent public offering of equity and debt, including the sale of $285 million aggregate principal amount of 4.50% Convertible Senior Notes due April 15, 2020 (the “4.50% Convertible Senior Notes”), which bear interest at the rate of 4.50% per annum, payable semi-annually in arrears on April 15 and October 15. The proceeds of this offering were contributed to MIC in exchange for surplus notes of like principal amount (the “Surplus Notes”). The Debtor made all scheduled interest payments on the 4.50% Convertible Senior Notes through October 2011.

| | C. | Events Leading to Debtor’s Chapter 11 Filing |

Mortgage insurance coverage, such as the coverage issued by MIC, has several attributes that make mortgage insurance companies like MIC more susceptible to the cyclical nature of the economy in general, and the housing and labor markets in particular, than many other types of insurance companies. Mortgage insurance is generally renewable at the option of the insured at the premium rate fixed when the insurance on the loan was initially issued. As a result, losses from increased claims from policies originated in a particular year cannot be offset by renewal premium increases on policies in force. Because MIC recognizes its losses when it receives notices of default, the period over which MIC generates losses can be prolonged. In addition, MIC may not cancel the insurance coverage it issues except in the event of nonpayment of premiums or certain violations of MIC’s master policies. The average life of a MIC mortgage insurance policy generally has ranged from approximately four to ten years and may span a significant portion of an economic or real estate cycle. As a result, the loss ratios, which are the ratios of an insurer’s incurred losses to premiums earned, of MIC and the mortgage insurance industry are particularly affected by the cyclical nature of the U.S. economy and housing and labor markets.

As a result of high unemployment in the United States and depressed housing prices, and the related slow economic recovery (as compared to previous recoveries) in U.S. residential mortgage and housing markets, MIC’s loss experience leading up to the Petition Date was significantly higher than originally anticipated.

Historically, the Debtor’s primary source of revenue has been dividends paid by its subsidiaries. As detailed below, the ADI has the right to prohibit the Debtor’s regulated insurance subsidiaries from issuing dividends and has, in fact, so prohibited them. The Debtor has not received a dividend payment from any of its subsidiaries since 2007.

| | 2. | Exploration of an Extraordinary Transaction |

In the second half of 2011, the Debtor explored a transaction (an “Extraordinary Transaction”) that would have involved utilizing PMAC as the vehicle to write new mortgage insurance nationwide. As noted above, PMAC is a wholly-owned subsidiary of MIC and is licensed to write mortgage insurance in all fifty states. The Debtor contemplated that, as part of the Extraordinary Transaction, (i) the Debtor would contribute Cash or its Principal Regulated Reinsurance Companies to MIC in exchange for equity of PMAC, (ii) MIC would transfer its

20

operating platform (including its information technology systems) to PMAC in exchange for equity of PMAC, and (iii) a new investor or investors would invest significant new capital in exchange for an equity interest in PMAC. Management of the Debtor believed that the Extraordinary Transaction had the potential of significantly enhancing the value of the Debtor for the benefit of its creditors. In addition, management of the Debtor believed that the Extraordinary Transaction offered the prospect of generating significant additional value for MIC and its policyholders through MIC’s retained equity interest in PMAC and, accordingly, that the Extraordinary Transaction would be viewed favorably by the ADI, as the principal regulator of MIC, and Fannie Mae and Freddie Mac (collectively, the “GSEs”), who were MIC’s largest policyholders.

In connection with the Extraordinary Transaction, the Debtor’s management and financial advisors met with potential investors, a number of whom signed confidentiality agreements and engaged in due diligence. In addition, the Debtor and MIC met with representatives of the GSEs and of the Federal Housing Finance Agency, as conservator of the GSEs, in furtherance of the Extraordinary Transaction being explored and to seek their approval thereof. Throughout this process, the Debtor and MIC pursued discussions with the Director of the ADI (the “ADI Director”) regarding the benefits of the Extraordinary Transaction to policyholders of MIC that could accrue from MIC’s interest in PMAC. The Debtor believed an Extraordinary Transaction that had the prospect of generating significant additional value for the Debtor and its creditors continued to be a realistic possibility until the ADI Director assumed exclusive power of management and control over MIC pursuant to the Interim Possessory Order, as described below.

| | 3. | Regulatory Control of MIC |

On August 15, 2011, MIC filed with ADI its statutory financial statement for the period ended June 30, 2011. In it, MIC disclosed its policyholders’ position of $258 million compared to a required minimum policyholders’ position of $578 million, resulting in a policyholders’ position deficit of $320 million. PIC’s policyholders’ position was also reported as deficient by approximately $45 million.

On August 19, 2011, the ADI Director, the Debtor’s principal regulator, issued an order (the “Arizona Supervision Order”) placing MIC and PIC (the “Principal Regulated Insurance Subsidiaries”) under supervision pursuant to § 20-169 of the Arizona Revised Statutes. The Arizona Supervision Order appointed Truitte D. Todd of Tharp and Associates as supervisor of the Principal Regulated Insurance Subsidiaries, and required them to cease writing new mortgage commitments in all states as of the date thereof, but permitted the issuance of new mortgage insurance policies under pending commitments through the close of business on September 16, 2011.

In addition to prohibiting the Principal Regulated Insurance Subsidiaries from writing new business, the Arizona Supervision Order further prohibited the Principal Regulated Insurance Subsidiaries from making interest payments to the Debtor on the Surplus Notes and, without the prior approval of the ADI Director, from entering into affiliate transactions (including an Extraordinary Transaction, as contemplated above).

21

The Arizona Supervision Order further provided that if, within sixty days, the Principal Regulated Insurance Subsidiaries failed to abate the ADI Director’s determination that supervision of such entities was required under § 20-169 of the Arizona Revised Statutes, the ADI Director could commence a conservatorship proceeding.

After entry of the Arizona Supervision Order, the Debtor worked diligently with the Supervisor and the ADI Director to continue to investigate restructuring alternatives, including implementing an Extraordinary Transaction as described above, and to abate the ADI Director’s finding.

On October 20, 2011, the ADI Director assumed exclusive power of management and control over the Debtor’s Principal Regulated Insurance Subsidiaries pursuant to an interim Order Directing Full and Exclusive Control of Insurer (the “Interim Possessory Order”) issued by the Superior Court of the State of Arizona in and for the County of Maricopa (the “Arizona Court”) on an ex parte basis pursuant to § 20-172 of the Arizona Revised Statutes. Also on October 20, 2011, the ADI Director (i) entered an order (the “Reinsurance Supervisory Order”) placing the Principal Regulated Reinsurance Subsidiaries under supervision pursuant to § 20-169 of the Arizona Revised Statutes, and (ii) filed a Verified Complaint for Appointment of a Receiver and Injunction with the Arizona Court seeking, among other things, the appointment of a permanent receiver for MIC.

The Debtor filed a motion to vacate the Interim Possessory Order on October 28, 2011, which was denied by the Superior Court of the State of Arizona on or about November 22, 2011. On February 3, 2012, the Debtor consented to the appointment of the ADI Director as receiver for MIC pursuant to a Consent to Receivership and Stipulation filed with the Arizona Court (the “Receivership Stipulation”). On March 14, 2012, the Arizona Court entered an order (the “Receivership Order”) appointing the Receiver as receiver for MIC.

As detailed further below, pursuant to the Stipulation (as defined below), the Reinsurance Supervisory Order was abated as of December 18, 2012.

| | 4. | Defaults under the Notes |

Under the Supplemental Indenture dated as of April 30, 2010 for the Debtor’s 4.50% Convertible Senior Notes, the commencement of an insolvency proceeding with respect to a “Significant Subsidiary” of the Debtor, including MIC, constituted an event of default accelerating maturity of the 4.50% Convertible Senior Notes if uncured for sixty (60) consecutive days.

In addition, as a result of the delisting of the Debtor’s stock from the New York Stock Exchange, which constituted a “Fundamental Change” as defined in the Supplemental Indenture, each holder of the 4.50% Convertible Senior Notes has the right, at such holder’s option, to require the Debtor to repurchase for cash such holder’s notes at 100% of the principal amount thereof, plus accrued and unpaid interest, and Debtor’s failure to repurchase the notes would constitute an additional event of default under the Supplemental Indenture, permitting acceleration of the maturity of the 4.50% Convertible Senior Notes.

22

The Indenture for the Debtor’s 6.000% Senior Notes and 6.625% Senior Notes contained cross-default provisions with the 4.50% Convertible Senior Notes, so that if the latter were accelerated and not discharged (or did not have such acceleration rescinded or annulled) within a period of 30 days after notice by the Senior Notes Indenture Trustee or the holders of the 6.000% Senior Notes and/or 6.625% Senior Notes, an event of default would also exist with respect to the 6.000% Senior Notes and 6.625% Senior Notes, as applicable, and the holders of each such series of notes could accelerate the maturity of such notes.

In anticipation of the impending bond defaults, repurchase demands, and acceleration of maturities on November 23, 2011, the Debtor filed for chapter 11 protection in order to preserve its remaining business operations and explore a potential reorganization. As discussed below, during the Chapter 11 Case, the Debtor has worked diligently to protect, preserve, monetize and maximize the assets of its estate.

| | 1. | Debtor in Possession Status |

Since filing for bankruptcy protection, the Debtor has continued to operate as a debtor in possession subject to the supervision of the Bankruptcy Court and in accordance with the Bankruptcy Code. The Debtor is authorized to operate in the ordinary course of business. Transactions outside of the ordinary course of business must be approved by the Bankruptcy Court.

| | 2. | Entry of the Debtor’s First-Day Orders |

Concurrent with filing its bankruptcy petition, the Debtor filed several emergency motions (the “First-Day Motions”) with the Bankruptcy Court that were intended to facilitate the Debtor’s transition into, and operation in, chapter 11 with a minimum of interruption or disruption to its business, or loss of productivity or value. Pursuant to the First-Day Motions, the Debtor sought and obtained the following relief from the Bankruptcy Court: (i) approval of the appointment of Kurtzman Carson Consultants LLC as Balloting Agent in the Chapter 11 Case [D.I. 20]; (ii) authority to maintain its prepetition cash management system and bank accounts, and a grant of administrative expense status to shared services (as discussed above) arising post-petition [D.I. 21 & 103]; (iii) authority to remit and pay certain taxes [D.I. 22 & 102]; and (iv) authority to pay employee obligations and to continue employee benefits plans and programs post-petition [D.I. 24 & 101].

In addition to filing the First-Day Motions set forth above, the Debtor also filed theDebtor’s Motion for Emergency Interim and Final Orders Pursuant to Sections 105, 362 and 541 of the Bankruptcy Code and Bankruptcy Rule 3001 Establishing Procedures for (I) Transfers of Claims, (II) Transfers of Equity Securities, (III) Taking or Implementing Certain Other Actions Affecting the Interest of the Debtor in the Tax Attributes, and (IV) Scheduling a

| 9 | Capitalized terms used in this section II.D.3 but not otherwise defined herein shall have the meanings ascribed to such terms in the Trading Order. |

23

Final Hearing [D.I. 7] (the “Trading Motion”). On February 7, 2012, the Bankruptcy Court entered a final order approving the Motion [D.I. 154] (the “Trading Order”). The purpose of the Trading Order is to preserve the Debtor’s NOLs.