QuickLinks -- Click here to rapidly navigate through this document

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of December 2002

Commission

File Number

33-88608

Legrand

(Translation of registrant's name into English)

82, rue Robespierre—BP 37

93170 Bagnolet Cedex

France

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ý Form 40-F o

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No ý

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant Legrand has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: January 24, 2003 | | LEGRAND

Registrant |

|

|

By: |

/s/ FRANÇOIS GRAPPOTTE

Name: François Grappotte

Title: Director and Chairman and

Chief Executive Officer |

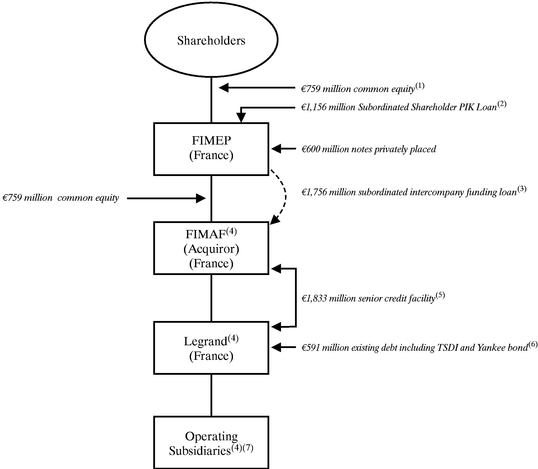

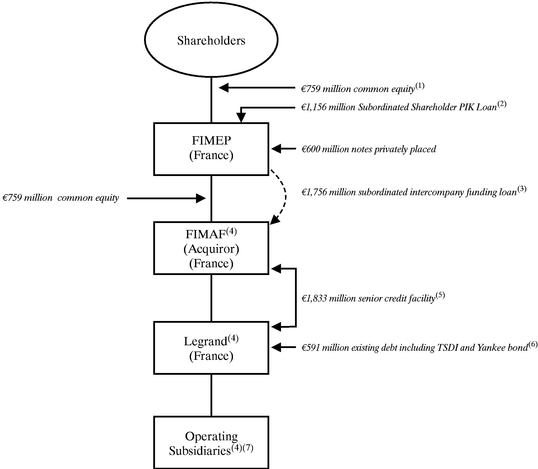

On January 22, 2003, FIMEP S.A., our indirect parent company, commenced a private placement of high yield notes (the "notes"). The proceeds of this private placement are to be used to refinance a mezzanine loan incurred to fund the acquisition of Legrand by FIMAF S.A.S., a wholly-owned subsidiary of FIMEP S.A., and related transactions.

Disclosure with respect to Legrand is contained in the document for the private placement of the notes and is included in this filing. References in this disclosure to "we", "our" and "us" and other similar terms refer to Legrand and its subsidiaries.

The summary unauditedpro forma consolidated financial information of FIMEP and the unauditedpro forma financial information of FIMEP included elsewhere in this document have been prepared in accordance with US GAAP. Unless otherwise indicated, all other financial information has been prepared in accordance with French GAAP. French GAAP differs in certain significant respects from US GAAP. For a discussion of the principal differences between French GAAP and US GAAP as they apply to the Group, see "I. G. Operating and Financial Review and Prospects," note 28 to the audited consolidated financial statements of Legrand and note 27 to the unaudited consolidated financial statements of Legrand.

Any securities offered will not be or have not been registered under the Securities Act of 1933 and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

Any securities offered will not be offered to the public in France. The document for the private placement has not been submitted to the clearance procedure of the FrenchCommission des Opérations de Bourse.

TABLE OF CONTENTS

| I. | | INFORMATION CONCERNING LEGRAND S.A. | | |

| | | A. | | MARKET AND INDUSTRY DATA | | 1 |

| | | B. | | INTELLECTUAL PROPERTY | | 1 |

| | | C. | | DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS | | 2 |

| | | D. | | SUMMARY BUSINESS DESCRIPTION | | 4 |

| | | E. | | RISK FACTORS RELATING TO OUR BUSINESS | | 10 |

| | | F. | | SELECTED HISTORICAL CONSOLIDATED FINANCIAL INFORMATION | | 19 |

| | | G. | | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | | 22 |

| | | H. | | OUR BUSINESS | | 59 |

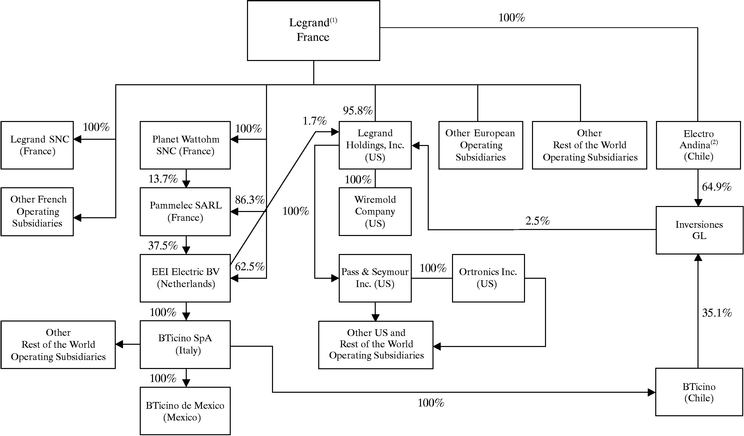

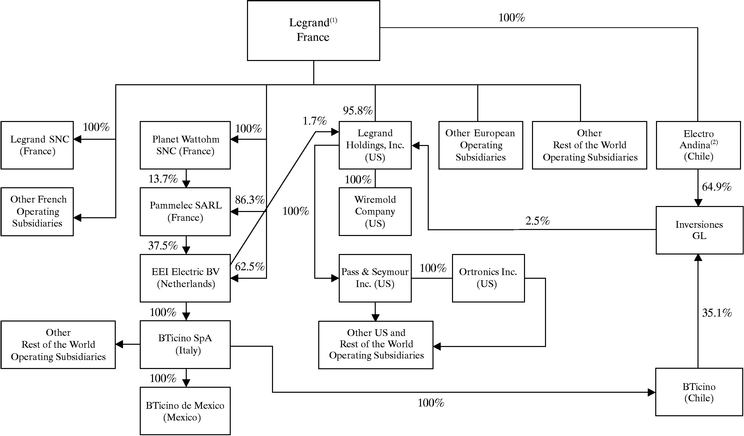

| | | I. | | OUR HISTORY AND GROUP STRUCTURE | | 80 |

| | | J. | | MANAGEMENT OF LEGRAND | | 82 |

| | | K. | | CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | 85 |

| | | L. | | CORPORATE GOVERNANCE | | 85 |

II. |

|

INFORMATION CONCERNING THE ACQUISITION, FIMAF SAS, FIMEP SA AND LUMINA PARENT |

|

|

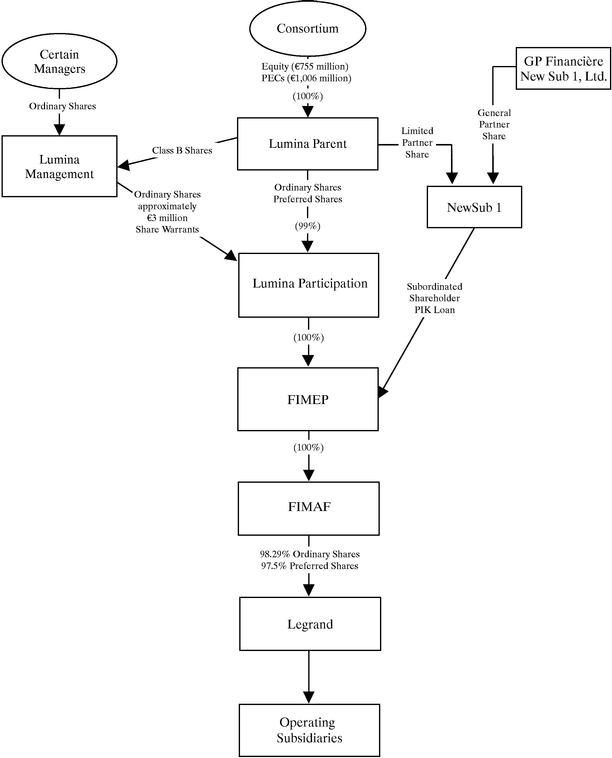

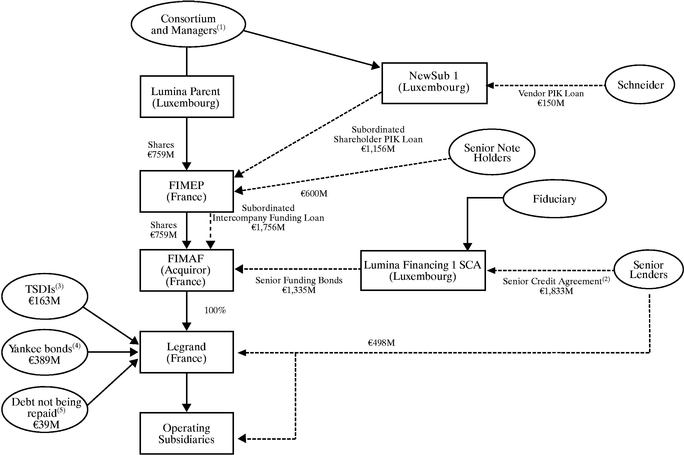

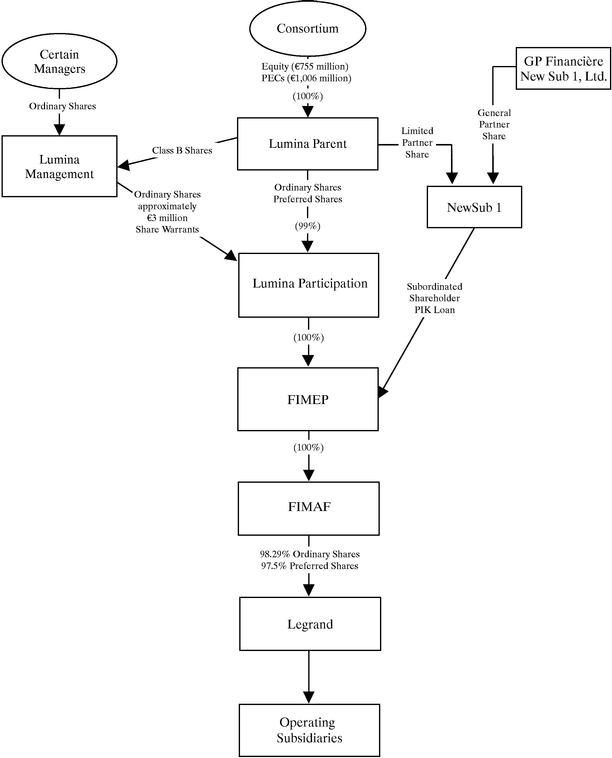

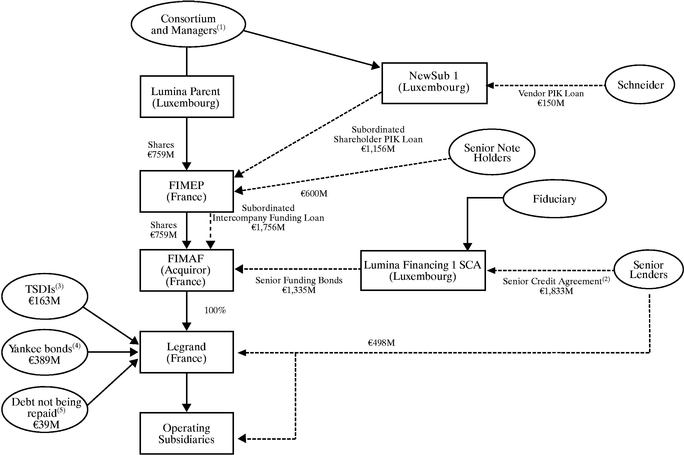

| | | A. | | OVERVIEW OF THE ACQUISITION AND RELATED TRANSACTIONS | | 89 |

| | | B. | | SUMMARY CORPORATE AND FINANCING STRUCTURE | | 91 |

| | | C. | | SUMMARY UNAUDITEDPRO FORMA CONSOLIDATED FINANCIAL INFORMATION | | 92 |

| | | D. | | THE ACQUISITION | | 94 |

| | | E. | | CAPITALIZATION | | 97 |

| | | F. | | UNAUDITEDPRO FORMA CONSOLIDATED FINANCIAL INFORMATION | | 99 |

| | | G. | | SHAREHOLDERS | | 110 |

| | | H. | | INVESTORS' AGREEMENTS | | 113 |

| | | I. | | MANAGEMENT OF LUMINA PARENT | | 117 |

| | | J. | | CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | 123 |

| | | K. | | CORPORATE GOVERNANCE | | 124 |

| | | L. | | OTHER INFORMATION | | 129 |

| | | M. | | SUMMARY OF GROUP COMMITMENTS | | 129 |

III. |

|

INDEBTEDNESS OF THE GROUP |

|

|

| | | A. | | THE STRUCTURE OF FIMEP'S INDEBTEDNESS | | 130 |

| | | B. | | DESCRIPTION OF OTHER INDEBTEDNESS | | 131 |

| | | C. | | PRO FORMA LIQUIDITY AND CAPITAL RESOURCES | | 149 |

| | | D. | | RISK FACTORS RELATING TO INDEBTEDNESS | | 153 |

IV. |

|

DEFINITIONS |

|

156 |

i

I. INFORMATION CONCERNING LEGRAND S.A.

A. MARKET AND INDUSTRY DATA

This document contains information about our markets and our competitive position therein, including market sizes and market share information. We are not aware of any exhaustive industry or market reports that cover or address the market for products and systems for low-voltage electrical installations and information networks in buildings. Therefore, we assemble information on our markets through our subsidiaries, which in turn compile information on our local markets annually. They derive that information from formal and informal contacts with industry professionals (such as professional associations), trade data from electrical products distributors, building statistics and macroeconomic data (such as gross domestic product or consumption of electricity). We estimate our position in our markets based on the market data referred to above and our actual sales in the relevant market through October of the relevant year and estimated through completion of that year. Although we have commenced compiling market share data for the year 2002, we have not yet completed the process. Accordingly, unless otherwise stated, market size and market share data contained in this document is for the year 2001.

We believe that the market share information contained in this document provides fair and adequate estimates of the size of our markets and fairly reflects our competitive position within these markets. However, our internal company surveys and management estimates have not been verified by an independent expert, and we cannot guarantee that a third party using different methods to assemble, analyze or compute market data would obtain or generate the same results. In addition, our competitors may define our markets differently than we do.

B. INTELLECTUAL PROPERTY

Legrand, BTdin, BTicino, Creo, DLPass, DPX, Galea, LabelMo, Lexic, Living International Light, Megatiker, Mosaic 45, My Home, Neptune, Net Clear (and design), Omizzy, Ortronics, Pial, Plexo 555, Quincino, RJ45, Sagane, Sfera, Structura, Tenara, Trademaster, Walker (logo), Walker Systems (logo), Wiremold (logo) and XL-Pro are brands under which we market our products in France, Italy, the United States and the rest of the world. Legrand®, BTicino®, Cabstop®, Dlpass®, Hypra®, Fibermo®, Mighty Mo®, Net Clear®, Ortronics®, Ortronics Open Systems Architecture®, V500 Raceway®, Walker Systems®, Tracjack Wiremold® (logo) and Wiremold Systems® (word mark) are registered trademarks in the United States.

1

C. DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This document includes forward-looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms "believes," "estimates," "anticipates," "expects," "intends," "may," "will" or "should" or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this document and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual financial condition, actual results of operations and cash flows, and the development of the industry in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this document. In addition, even if our financial condition, results of operations and cash flows, and the development of the industry in which we operate, are consistent with the forward-looking statements contained in this document, those results or developments may not be indicative of results or developments in subsequent periods. Important factors that could cause those differences include, but are not limited to:

- •

- adverse economic conditions affecting the building sector;

- •

- existing or future regulations and standards in the markets where we operate;

- •

- intense competition in the markets in which we operate;

- •

- pricing pressure in our main markets;

- •

- cost of production materials;

- •

- potential environmental liability and capital costs of compliance with applicable laws and regulations;

- •

- potential claims relating to asbestos;

- •

- diverse political, legal, economic and other conditions in France, Italy, the United States and the other markets in which we operate;

- •

- fluctuation in currency exchange and interest rates;

- •

- potential products liability;

- •

- interests of our shareholders;

- •

- ability to protect intellectual property;

- •

- reliance on our distributors;

- •

- ability to attract and retain quality personnel;

- •

- ability to successfully integrate business acquisitions;

- •

- ability to effectively manage our inventory;

- •

- ability to comply with labor and employment laws and regulations;

- •

- unfunded liabilities arising from pension plans and other post-retirement benefits;

- •

- any material disruption of our operations due to industrial actions;

2

- •

- possible liability of certain of our operating and holding companies for the debts of their subsidiaries;

- •

- changes to tax laws; and

- •

- our substantial leverage and ability to meet significant debt service obligations.

We urge you to read this document, including the sections entitled "Risk Factors Relating to Our Business," "Operating and Financial Review and Prospects" and "Our Business," for a more complete discussion of the factors that could affect our future performance and the industry in which we operate.

3

D. SUMMARY BUSINESS DESCRIPTION

Our Business

We are one of the world's leading international manufacturers of products and systems for low-voltage electrical installations and information networks used in residential, commercial and industrial buildings. We are a "pure-play" operator, focused on developing, manufacturing and marketing a complete range of low-voltage electrical equipment—to the exclusion, for example, of electricity generation or transmission, bulbs and cables. We began operating more than 75 years ago and market our products under widely recognized brand names, including Legrand and BTicino. We are headquartered in Limoges, France with manufacturing and/or distribution subsidiaries and offices in over 55 countries, and we sell our products in more than 160 national markets. Our key markets are France, Italy and the United States, which accounted for more than 60% of our net sales (by destination) in each of our last three fiscal years and in the nine month period ended September 30, 2002.

Based on sales of products which are the same as or similar to those offered in our catalogs, we estimate the aggregate worldwide market for those products to be approximately €50 billion. Although we face competition from a number of large, multinational operators, the worldwide market remains highly fragmented, with more than 50% of worldwide net sales made by small, often local, competitors, each with less than a 1% market share. Based on our 2001 net sales, we believe that we have an approximate 6% share of the worldwide market. We estimate that Europe represents approximately 35% of the worldwide market, that the United States and Canada together represent 35%, and that Asia and the remaining countries in the world represent 20% and 10%, respectively. In our principal geographic markets, including France, Italy and the United States, we have leading market positions in key families of products.

We manufacture more than 130,000 catalog items grouped into approximately 80 product families. We are increasingly focused on providing our customers with integrated systems and total solutions across our product groupings. We serve the following five principal business areas:

- •

- End-user power control. We believe that we have a leading position in the worldwide market for the manufacture of end-user power control products. For example, we believe we are the global market leader in switches and sockets with an estimated market share of approximately 18% based on our net sales in 2001. We also believe that we are the only manufacturer of end-user power control products that addresses all major standards in the world. End-user power control products include switches, power sockets and other products that enable end users to control the flow of electricity at home or in the workplace, including thermostats, dimmers, infrared switches and other building automation products.

- •

- Power protection products. We believe that we are one of the principal manufacturers of power protection products for the European and South American markets. Power protection products include fuses, circuit breakers, distribution boards, electrical cabinets and other products that protect individuals, appliances and electrical systems from power surges.

- •

- Power distribution and wire management. We believe that we are a leading manufacturer of power distribution and wire management products. For example, we believe we are the global market leader in cable management systems with an estimated market share of approximately 16% based on our net sales in 2001. Power distribution and wire management products include baseboards, trunking and ducting, cable routing systems and other products that provide safe distribution of electricity and information in buildings.

4

- •

- VDI, communications and security. We believe that we are one of the principal manufacturers of several voice, data and image applications (known as VDI), communications and security product families for the European market. For example, we are the European market leader in audio and video entry phones with an estimated market share of approximately 20% based on our net sales in 2001. The VDI, communications and security product category includes VDI for computer and telephone systems as well as audio and video entry phones, fire and intruder alarm systems, smoke, water, heat and motion detectors and emergency lighting equipment.

- •

- Industrial electrical products. We believe that we have strong market positions for a number of our industrial electrical products in the French and Italian markets. Industrial electrical products include heavy-duty sockets and electrical cabinets, technical alarms, transformers, signaling and controlling devices and other electrical products designed specifically for industrial applications.

More than 95% of our net sales in 2001 were made to electrical hardware and equipment distributors. These distributors in turn sell our products principally to electricians and building contractors, as well as to retail hardware stores. As a result, demand for our products is determined principally by demand from electricians and building contractors, with end users and specifiers, such as architects and engineering companies, also influencing demand. Our marketing focus is therefore on consistently providing customers with a full range of reliable products and systems within a broader "push and pull" strategy. On the "push" side, we maintain a close relationship with electrical hardware and equipment distributors, focusing on product availability, just-in-time delivery and simplifying and expediting ordering, stocking and dispatching our products. On the "pull" side of this strategy, we seek to develop and sustain demand for our products by actively promoting them to electricians, building contractors, specifiers and end users, focusing on providing training, practical technical guides and business software applications and ensuring reliable and readily available product supplies.

5

Our Key Strengths

We believe that we benefit from the following competitive strengths:

Leading global market positions

We are one of the world's leading international manufacturers of products and systems for low-voltage electrical installations and information networks in buildings, with offices, production facilities and/or distribution subsidiaries in over 55 countries and sales to more than 160 national markets. By focusing on a "pure-play" strategy and developing and maintaining our strong brands, we have established a worldwide market presence and powerful local positions in a number of geographic markets for key product families. For example, in end-user power control, we believe that we offer the only product range that addresses all major standards in the world, and we estimate that we held approximately 18% of the world market in switches and sockets in 2001. Similarly, in cable management systems, we estimate that we held approximately 16% of the world market in 2001, while in audio and video entry phones, we estimate that we held approximately 20% of the European market in 2001. The strength of our global presence and our established local relationships with industry players enhance our ability to launch new products in existing markets, to respond quickly to changing local needs and to play a proactive role in the development of new products and value-added solutions across our geographic markets.

High and stable EBITDA margins

We benefit from high and stable EBITDA margins. Our reported EBITDA margins for 2001 and the nine months ended September 30, 2002 were 20.3% and 21.0%, respectively, and, since 1991, our annual EBITDA margins have averaged 21.7% (with annual EBITDA margins ranging from 19.8% for the year ended December 31, 1991 to 23.2% for the year ended December 31, 1994). We attribute the relative stability of those EBITDA margins to the diversity of our geographic, product and end-user markets (which include both the new construction and the renovation markets).

Barriers to entry

We believe our market positions benefit from significant barriers to entry. These include: (i) customer loyalty and preference for well-recognized brands, particularly those associated with reliability, quality and ease of installation and use; (ii) customer preference for a comprehensive range of products which can be easily integrated into systems and which helps reduce the cost, delay and risk involved in purchasing from multiple suppliers; (iii) differing local electrical standards, regulations, aesthetic preferences and installation features, which require new entrants to develop local market knowledge and establish relationships with numerous local wholesale distributors, architects, builders, electricians and end users; and (iv) technological expertise required to develop and enhance innovative products and solutions.

Strong brand recognition and product loyalty

We have two key global brands, Legrand and BTicino, a multitude of leading local brands and numerous products which benefit from strong market positions. We believe that our brand and product loyalty are key strengths. We maintain and leverage brand recognition and product loyalty by employing our "push and pull" marketing strategy, maintaining close contact with electricians, building contractors and architects, and focusing on the quality, reliability and safety of our products and systems, together with the ease and speed of installation and maintenance. We believe that the strength of our brands and products has been a barrier to entry and has helped us to maintain leading market positions. It also facilitates new product launches and market initiatives in areas where we have less established market positions.

6

Extensive product range

Our extensive product range of more than 130,000 catalog items enables us to offer (often in the form of integrated systems and solutions) a significant proportion of all products necessary to install low-voltage electrical installations and information network systems in buildings. This product breadth, in turn, enables our customers (electricians and building contractors) to avoid the additional cost, delay and risk which may be involved in purchasing from multiple suppliers. In addition, we are one of the few manufacturers that offers products adapted to most principal national markets, where variations in product installation methods, end-user preferences and regulatory requirements applicable to installation and functionality cause significant differences in products.

Technological leadership

We commit significant resources to product research and development and have a proven track record of developing new and enhanced products with improved functionality and reliability. During our last five fiscal years, we have spent 4% to 5% of our net sales on research and development (4.4% for 2001 and 4.5% for the first three quarters of 2002) and dedicated close to one-third of our capital expenditure to support new products. In 2001, approximately 37% of our net sales were generated by products less than five years old, with sales of those products representing approximately 53% of our net sales in Spain, 41% of our net sales in Italy, 40% of our net sales in France, 25% of our net sales in each of Germany and the United States (excluding Ortronics which exclusively sells VDI products that generally evolve more quickly than our other products) and 19% of our net sales in the United Kingdom. We also have developed proprietary automated manufacturing processes (such as custom-designed molds, machine tools and automated assembly equipment) which help to reduce our operating costs and improve our profitability.

Strong and incentivized management

The eleven members of Legrand's senior management responsible for day-to-day operations of Legrand have, on average, more than 20 years of experience in the low-voltage products and related industries. Our management team is led by François Grappotte, Chairman and Chief Executive Officer of Legrand, Olivier Bazil, Vice Chairman and Chief Operating Officer of Legrand, and Gilles Schnepp, Chief Operating Officer of Legrand, who have been with Legrand for 20, 30 and 14 years, respectively. They have a proven track record of managing organic growth as well as successfully completing and integrating acquisitions. In addition, together with the other members of the management team, they have a significant equity stake in our business following the Acquisition.

Strong sponsorship

We expect to benefit from the expertise, relationships and investment experience of Kohlberg Kravis Roberts & Co. L.P. ("KKR") and Wendel Investissement ("Wendel").

KKR is a leading investment firm with significant investment experience in the electrical products and related industries. Over the past 26 years, KKR has invested approximately $18 billion in over 100 acquisitions with a total value in excess of $100 billion. KKR's investments in related industries include Amphenol Corporation, a global designer, manufacturer and marketer of connectors, cable and interconnect systems and Zumtobel AG, a European manufacturer of lighting components, fittings and systems for the commercial, industrial, and public sector markets.

Wendel, aEuronext Paris-listed investment company, was formed pursuant to a merger ofCompagnie Générale d'Industrie et de Participations S.A. and Marine-Wendel S.A. Wendel has a market capitalization in excess of €1.4 billion as of January 15, 2003. Wendel's investments include Cap Gemini Ernst & Young, Valeo, Bureau Veritas, bioMerieux, Trader Classified Media, Oranje Nassau and Wheelabrator Allevard.

The other equity investors in the Acquisition include WestLB AG, HSBC Private Equity Ltd., equity funds managed by affiliates of The Goldman Sachs Group Inc., the Verspieren and Decoster families (the founding families of Legrand) and certain members of the management of Legrand.

7

Our Strategy

Our objective is to continue to achieve profitable revenue growth and improvements in operating efficiency. The key components of our strategy are as follows:

Continuously broaden and enhance our product range

We maintain a firm commitment to new product development. Since 1996, we have undertaken a number of significant new product range launches, including the Galea, Creo, Tenara, Structura, Sagane, Living International and Light ranges of switches and sockets, the Lexic and BTdin ranges of circuit breakers, cabinets and enclosures, the DPX and Megatiker lines of molded case circuit breakers, the BTnet range of VDI products and the Sfera line of video house porters. In addition to launching new product ranges, we intend to regularly enhance our existing product ranges to offer improved quality and performance as well as new functionality, and to adapt existing products to evolving local standards and additional national markets.

We also aim to capitalize on cross-selling opportunities. For example, we are seeking to increase our presence in the VDI and domotics markets, the latter of which comprises long-distance control systems for home appliances. Increasing sales of these systems would provide us with opportunities to sell not only control equipment, but also related equipment such as wire management products, switches and sockets, in integrated systems.

We are also increasingly focused on developing new products that share the same platform or operating mechanism and can be easily adapted to local markets. For example, our Galea, Creo, Tenara and Structura switches and sockets are designed for use across the principal ten European countries influenced by German standards by sharing the same operating mechanisms but using different cover plates.

Continue to put marketing and customer service first

Maintaining, expanding and leveraging our brand and product loyalty are central to our strategy. We intend to leverage brand loyalty in both established and less established markets to roll-out new products and market initiatives. We intend to do so by, among other things, providing training to electricians and building contractors locally and at our Innoval international training center in Limoges, France in programs designed to expand installers' expertise and to introduce new Legrand products and installation methods. We also will continue providing practical and detailed technical guides, including through on-line sites and business software applications. In addition, we generate loyalty among electricians and contractors by providing reliable product supplies.

Continue to achieve profitable revenue growth

We intend to leverage our competitive advantages to continue to achieve profitable organic revenue growth within our existing geographic markets and to penetrate new geographic markets. We believe that both less-developed and developed regions of the world offer attractive revenue growth opportunities arising out of the installation of electrical equipment and information networks in new buildings, the upgrading of traditional applications and the introduction of new applications to increase safety, comfort and energy savings, and the ongoing development of communications technology. In addition to focusing on organic growth, we intend to continue to pursue selective acquisitions, with a focus on smaller complementary acquisitions, such as local manufacturers that give us access to new technologies, complementary product lines or geographic market opportunities or give rise to synergies with our existing operations.

8

Continue to improve operating efficiency

We remain committed to improving our operating efficiency. For example, we aim to decrease the number of our product platforms in order to reduce manufacturing costs. Our goal is to establish product platforms which can be used to produce a number of different products which share common components. In addition, we aim to increase the percentage of raw materials we purchase at the group level from the current 40% to 60% of our total purchases. We intend to implement this strategy where we judge that cost savings can be achieved without loss of quality. As part of a company-wide organizational initiative that we launched in 2001, we also intend to increasingly implement a "make or buy" analysis on a group-wide basis, and will consider outsourcing production where we judge that cost savings can be achieved without losing key intellectual property expertise or quality. In addition, we will consider selectively relocating production activities to existing facilities located in countries with lower production costs, as we have done with relocations to Hungary and China.

Focus on de-leveraging

One of our key priorities is to reduce our debt levels. To do so, we will aim to maximize our cash flows available for debt reduction through (i) management of capital expenditure in line with our capital exenditure goals described elsewhere in this document, (ii) an ongoing focus on management of our working capital and (iii) implementation of the initiatives to improve operating efficiency described above.

9

E. RISK FACTORS RELATING TO OUR BUSINESS

Adverse economic conditions affecting the building sector might adversely affect us.

Demand for our products is determined principally by the extent to which electricians and building contractors request our products from distributors, which in turn is primarily determined by the rate of construction of new residential, commercial and industrial buildings and the levels of activity relating to the renovation and maintenance of existing buildings. Activity levels in the construction, renovation and maintenance sectors are sensitive to changes in general economic conditions. Recent worldwide adverse economic conditions have had a negative impact on the construction industry and consequently on demand for products and systems for low-voltage electrical installations and information networks in buildings. As is customary for our business and our industry, we do not typically have a significant backlog of customer orders which would help us to accurately predict future demand for our products.

Our profitability is particulary vulnerable to a downturn in sales volume due to our significant fixed cost base. Consequently, generalized or localized downturns in the economies in which we offer our products could have an adverse effect on our business, financial condition, results of operations and cash flows. In addition, if worldwide adverse economic conditions continue and the effect of such downturn is more severe or longer in duration than generally expected, our ability to generate cash flows sufficient to reduce our debt, or, in certain circumstances, to service our debt, could be impaired.

Existing or future regulations and standards in the markets where we operate could adversely affect us.

Our products, which are sold in more than 160 national markets, are subject to regulation in each of those markets, as well as to various supranational regulations. Those regulations include trade restrictions, tariffs, tax regimes and product safety standards. Changes to any of these regulations or standards and their applicability to our business could lead to lower sales and increased operating costs, which could result in lower profitability and earnings. For example, the application of existing or new trade restrictions or tariffs to our products could lead to a decline in our export sales, which in turn would cause us to record lower net sales.

In addition, our products are subject to quality and safety controls and regulations, and are governed by both national and supranational standards, such as EU directives, and product norms and standards adopted by international organizations such as the European Committee for Electrotechnical Standardization and the International Electrotechnical Commission. The quality and safety standards to which we are subject may change or may be applied more stringently, and we may be required to ensure that our products comply with any such new, potentially more stringent, product norms and standards. To do so, we may be required to make capital expenditures or implement other measures.

We cannot estimate reliably the amount and timing of all future expenditures related to complying with any of these regulations or standards, in part because of the difficulty in assessing the nature of regulations in jurisdictions in which we do not yet have material operations and future regulations in jurisdictions in which we presently have material operations. We cannot assure you that we have been or will be at all times in complete compliance with all such regulatory requirements or standards, that we will not incur material costs or liabilities in order to ensure compliance with such regulatory requirements in the future and that we will be able to fund any such future liabilities.

10

Intense competition may adversely affect our ability to sell our products and could reduce our market share.

The market for our products is highly competitive in terms of pricing, product and service quality, new product development and introduction time. Our competitors range from highly specialized local small or medium-sized companies to divisions of large-scale conglomerates, such as Schneider, ABB Asea Brown Boveri Ltd., Siemens A.G., General Electric Company, Matsushita Group, Hubbell Inc., Thomas & Betts Corp., Eaton Corp., Gewiss SpA., and Cooper Industries, Inc., which may have superior financial and marketing resources compared to us due to their size. Competitors may be able to launch products with superior capabilities or at lower prices, to integrate products and systems, to secure long-term agreements with some of our customers or to acquire companies targeted for acquisition by us. We may lose business if we do not match the prices, technologies or quality offered by our competitors or if we do not take advantage of new business opportunities through acquisitions, which could lead to a decline in our sales or profitability. Furthermore, we must commit resources before launching a new or upgraded product line, which, if not as successful as expected, might not generate anticipated sales despite the expenses incurred.

In particular, large-scale competitors may be better positioned to develop superior product features and technological innovations or to exploit the market trend toward combining traditional lighting equipment with computerized systems that operate applications such as light, ventilation, heating, air conditioning or alarms or other security systems. These competitors may be better able to fund investment in product development in order to offer high technology electrical equipment and we may be required to obtain financing on disadvantageous terms to fund the required investments in order to compete with the new products launched by these competitors. In addition, as the market for our products evolves towards combined packages of traditional lighting equipment and computerized systems, increased competition from new entrants may lead to a decline in our sales, a loss of market share or an increase in our costs, such as sales and marketing expenses and research and development costs.

Any increase in competition in our markets, or any activities by our competitors, including the activities mentioned above and others, could lead to a decline in our sales and/or an increase in our costs, which could have an adverse effect on our business, financial condition, results of operations and cash flows.

Pricing pressures in our main markets may adversely affect us.

We typically manufacture products close to or within the market in which they are sold. As a consequence, we realize approximately 85% of our net sales through subsidiaries located in Western European countries and, to a lesser extent, in the United States and Canada. Production costs in those countries are generally higher, in particular labor costs and costs of real estate, compared to production costs in other economies. Consequently, in markets where demand is driven more by price than end-user appeal or product features, imports of lower-cost products manufactured in other countries and sold at lower prices, including counterfeited products, may lead to decreases in our market share, or decrease the average selling price of our products, or both.

For example, in the United Kingdom, where we generated three percent of our net sales in 2001, we believe that the market for products and systems for low-voltage electrical installations and information networks in buildings has become relatively commoditized, with competition based on price rather than product features or end-user appeal. As a result, a significant proportion of the switches and sockets sold in the United Kingdom is now manufactured in China, where producers can manufacture products at significantly lower production costs. If other geographic markets experience similar trends, we would be at a competitive disadvantage.

11

To a lesser extent, our profitability in countries where our products benefit from relatively higher gross margins could also be adversely affected by imports from neighboring countries with the same product standards but in which the same or similar products are sold at lower prices.

These factors may cause our sales to decline, which could have an adverse effect on our business, financial condition, results of operations and cash flows.

We may be adversely affected by increases in our cost of production materials.

Approximately €910 million of our cost of goods sold in 2001 (out of a total of €1,748 million) related to production materials. Production materials are divided into raw materials (including mainly plastics and metals), which accounted for approximately €400 million of purchases in 2001, and other types of production materials, such as parts, components and semi-finished and finished products, which accounted for approximately €510 million of purchases in 2001. Increases in our cost of production materials may not necessarily be passed on to our customers through price increases. Our costs could increase without an equivalent increase in sales, which in turn could affect our profitability and cash flows.

We may incur environmental liability and capital costs in connection with our past, present and future operations.

Our activities, like those of similar companies, are subject to extensive and increasingly stringent environmental laws and regulations in each jurisdiction where we operate. These laws and regulations impose increasingly stringent environmental obligations regarding, among other things, air emissions, asbestos, noise, the protection of employee health and safety, the use and handling of hazardous waste or materials, waste disposal practices and the remediation of environmental contamination.

We may be required to pay potentially significant fines or damages as a result of past, present or future violations of applicable environmental laws and regulations even if these violations occurred prior to the acquisition of companies or operations by us. Courts or regulatory authorities may also require, and third parties may seek to require, us to undertake investigations, remedial activities or both regarding either current or historical contamination at current facilities, former facilities or offsite disposal facilities. Courts or regulatory authorities may also require, and third parties may seek to require, us to curtail operations or close facilities temporarily or permanently in connection with applicable environmental laws and regulations. We could also become subject to claims for personal injury, property damage or violations of environmental law. Any of these actions may harm our reputation and adversely affect our financial condition, results of operations and cash flows. We have made and will continue to make capital and other expenditures to comply with applicable environmental laws as they continue to change. If we are unable to recover these expenditures through higher prices, our profitability or cash flows could decline.

Moreover, regulatory authorities could suspend our operations if we fail to comply with relevant regulations, and may not renew the permits or authorizations we require to operate. They also could mandate upgrades or changes to our manufacturing facilities that could result in significant costs to us.

12

We may incur liability and cost in connection with potential claims relating to asbestos.

In the second half of 2001, approximately 180 current and former employees of BTicino, our primary Italian subsidiary, commenced two class actions and three individual suits against the Italian social security agency for early retirement payments citing alleged exposure to asbestos during the manufacture of products at our Torre del Greco facility. BTicino, as the employer, is a party to the suit, as is customary under Italian law. Pursuant to Italian law, if the employees prove long-term (at least 10 years) exposure to asbestos, they may be entitled to retire early and, as a result, could receive higher retirement payments over the course of their retirement. Although the early retirement payments would be payable by the Italian social security agency, we cannot assure you that the Italian social security agency will not seek a contribution from us for all or a portion of the payments. Further, should the employees be successful in their claim for early retirement payments, they could commence personal injury claims relating to damages they could allege to have suffered. Should the employees proceed with such claims, we could incur significant costs defending against such claims and could be required to pay potentially significant damage awards. Our potential exposure in Italy would depend, among other things, on the type and scope of asbestos damage claims. As a result, we cannot estimate our potential exposure with respect to asbestos claims, and there can be no assurance that such claims will not, individually or in the aggregate, have a material adverse effect on our business, financial condition and cash flows.

Diverse political, legal, economic and other factors affecting the markets in which we operate could adversely affect us.

We have production and/or distribution subsidiaries and offices in over 55 countries. We sell our products in more than 160 national markets. As a consequence, our business is subject to risks related to differing political, legal, regulatory and economic conditions and regulations. These risks include, among others:

- •

- fluctuations in currency exchange rates (including the dollar/euro exchange rate) and currency devaluations;

- •

- restrictions on the repatriation of capital;

- •

- differences and unexpected changes in regulatory environments, including environmental, health and safety, local planning, zoning and labor laws, rules and regulations;

- •

- the introduction or application of more stringent product norms and standards and associated costs;

- •

- varying tax regimes which could adversely affect our results of operations or cash flows, including regulations relating to transfer pricing and withholding taxes on remittances and other payments by our subsidiaries and joint ventures;

- •

- exposure to different legal standards and enforcement mechanisms and the associated cost of compliance therewith;

- •

- difficulties in attracting and retaining qualified management and employees or rationalizing our workforce;

- •

- tariffs, duties, export controls and other trade barriers;

- •

- longer accounts receivable payment cycles and difficulties in collecting accounts receivable;

- •

- limited legal protection and enforcement of intellectual property rights;

- •

- insufficient provisions for retirement obligations;

- •

- recessionary trends, inflation and instability of the financial markets;

13

- •

- higher interest rates; and

- •

- political instability and the possibility of wars.

We cannot assure you that we will be able to develop and implement systems, policies and practices to effectively insure against or manage these risks or that we will be able to ensure compliance with all the applicable regulations without incurring additional costs. If we are not able to do so, our business, financial condition, results of operations and cash flows could be adversely affected.

Unfavorable currency exchange rate and interest rate fluctuations could adversely affect us.

Foreign exchange

We have foreign currency denominated assets, liabilities, revenues and costs. To prepare our consolidated financial statements we must translate those assets, liabilities, revenues and expenses into euro at then-applicable exchange rates. Consequently, increases and decreases in the value of the euro versus these other currencies will affect the amount of these items in our consolidated financial statements, even if their value has not changed in their original currency. These translations could result in significant changes to our results of operations from period to period.

In addition, to the extent that we incur expenses that are not denominated in the same currency as related revenues, exchange rate fluctuations could cause our expenses to increase as a percentage of net sales, affecting our profitability and cash flows. Whenever we believe it appropriate, we seek to achieve natural hedges by matching funding costs to operating revenues in each of the major currencies in which we operate. However, these activities are not always sufficient to protect us against the consequences of a significant fluctuation in exchange rates on our results of operations and cash flows.

Interest rates

We are exposed to risks associated with the effect of changing interest rates. We manage this risk by using a combination of fixed and variable rate debt and through hedging arrangements. Changes in interest rates could result in gains and losses related to our derivative arrangements and could significantly affect our future results of operations.

Additional risks arising out of our use of derivative instruments include the risk that a counterparty to a derivative arrangement could default on its obligations, that a counterparty could terminate the arrangement for cause, that we could be required to post cash-collateral to cover liabilities arising from interest rate movements and that we may have to pay costs, such as transaction fees or breakage costs, if we terminate an arrangement.

The swap agreements related to the TSDIs and the Yankee bonds provide that the swap counterparty may demand that Legrand post collateral equal to Legrand's net liability under the relevant swap determined on a mark-to-market basis pursuant to the terms of the relevant collateral arrangements.

Legrand has restricted cash of €150 million, of which €76 million has been posted as collateral under the TSDI derivative arrangements and pledged to the swap counterparty. The remaining €74 million is on deposit in an account pursuant to the terms of the Senior Credit Agreement to fund obligations in relation to the TSDIs and related swap arrangements. It is possible that we may be required to provide additional cash collateral in excess of amounts on deposit. We may not have sufficient funds available from other sources to satisfy those cash collateralization obligations.

Failure to comply with cash collateralization obligations would result in a default under either the TSDI related swap arrangements or the Yankee bond swap arrangements, as applicable, and would cause a cross-default under the Senior Credit Agreement.

14

Our products could contain defects, fail to operate properly or cause harm to persons and property, which could have an adverse effect on us.

Regardless of testing, our products might not operate properly or might contain errors and defects, particularly when the first products of a new range or enhanced products are introduced. Such errors and defects could cause injury to persons and/or damage to property and equipment. These accidents could result in claims, loss of revenues, warranty costs, costs associated with product recalls, litigation, delay in market acceptance or harm to our reputation for safety and quality. We cannot guarantee that we will not face material product liability claims or product recalls in the future, or that we will be able to successfully dispose of any such claims or effect any such product recalls within acceptable costs. Moreover, a material product liability claim or product recall, even if successfully concluded at nominal cost, could have a material adverse effect on our reputation for safety and quality. Any successful product liability claims or product recalls could have an adverse effect on our business, financial condition, results of operations and cash flows.

We may not be able to protect our intellectual property against competitors or to maintain its value.

Our future success depends to an extent on the development and maintenance of our intellectual property rights, particularly our Legrand and BTicino names. Third parties may infringe our intellectual property rights, and we may expend significant resources monitoring, protecting and enforcing our rights. If we fail to protect or enforce our intellectual property rights, our competitive position could suffer, which could have an adverse effect on our business, financial condition, results of operations and cash flows.

Furthermore, we cannot assure you that our activities will not infringe on the proprietary rights of third parties. If we were to infringe the proprietary rights of third parties, we could be subject to claims for damages and could be prevented from using the contested intellectual property.

We may be adversely affected by our reliance on our two largest distributors.

We derive a significant portion of our revenues from sales to our two largest distributors—Sonepar and Rexel. Our sales to each of Sonepar and Rexel represented approximately 15%, 15% and 13% of our net sales during the fiscal years 1999, 2000 and 2001, respectively.

We, like our competitors, enter into short-term agreements with our distributors. As a result, our customers have no long-term contractual obligation to purchase our products. However, we have built a relationship with each of Sonepar and Rexel over more than forty years. We believe that any risk associated with dependency upon them should be mitigated by the mutually beneficial nature of our relationships and by our strong brand and product loyalty (which we believe should lead contractors and end users to seek our products through other distribution channels if our relationship with either of Sonepar or Rexel were to cease). Due to the nature of our relationship with these distributors, we often have significant receivables outstanding from Sonepar and Rexel which we might not be able to recover were either of them to become bankrupt or insolvent. We cannot guarantee that we will continue to maintain our relationship with Sonepar and Rexel or that in the event that these relationships were terminated, contractors and end-users would continue to purchase our products through alternative distribution channels. The loss of our relationship with Sonepar and/or Rexel could have a material adverse effect on our business, financial condition, results of operations and cash flows.

15

The loss of key personnel would have an adverse effect on us.

Our continued success is dependent on the ongoing services of our executive officers and other key employees and our ability to continue to attract, motivate and retain highly qualified personnel. In particular, our ability to effectively integrate businesses that we acquire will depend on our ability to retain key officers and employees, including those of recently acquired businesses. The loss of the services of these individuals could adversely affect our ability to retain key customers, to continue to develop important product improvements or to implement our strategies. This could have an adverse effect on our business, financial condition, results of operations and cash flows.

Our acquisition strategy may not be successful.

Our growth strategy relies in part on the acquisition of local manufacturers that provide new technologies, new product lines, access to new markets and/or synergies with our existing operations. We may not successfully identify appropriate candidates, consummate transactions on terms satisfactory to us, integrating acquired businesses, technologies or products, effectively managing newly acquired operations or realizing cost savings anticipated in connection with the transactions. Furthermore, we may be unable to arrange financing for acquired businesses (including acquisition financing) on favorable terms and we may elect to fund acquisitions with cash otherwise allocated for other uses in our existing operations. We also may experience problems in integrating acquired businesses, including possible inconsistencies in systems and procedures (including accounting systems and controls), policies and business cultures, the diversion of management attention from day-to-day business, the departure of key employees and the assumption of liabilities, such as environmental liabilities. Any of the foregoing could have a significant negative impact on our business, financial condition, results of operations and cash flows.

We may face difficulties managing our inventory.

In order to simplify management of our increasing number of products, we have implemented a number of inventory management initiatives and have increased the number of standardized components used in our products. Our future efforts to de-leverage will depend, in part, on our continuing ability to implement improvements in management of working capital, including inventory reduction programs. If our inventory management initiatives are unsuccessful, we might face unavailability of products, a deterioration in the quality of our customer service or increases in the cost of maintaining and carrying inventory. Failure to successfully manage our inventory would have an adverse effect on our business, financial condition, results of operation and cash flows.

We are subject to stringent labor and employment laws in certain jurisdictions in which we operate.

Labor and employment laws are relatively stringent in certain jurisdictions where we operate and, in some cases, grant significant job protection to certain employees and temporary employees, including rights on termination of employment. In certain countries where we operate our employees are members of unions or are represented by a works' council where required by law. We may be required to consult and seek the consent or advice of the representatives of these unions and/or respective works' councils. These regulations and laws coupled with the need to consult with the relevant unions or works' councils could have a significant impact on our operations.

16

We may have unfunded liabilities with respect to our pension plans and other post-retirement benefits.

We have obligations to our employees relating to retirement and other end of contract indemnities in the majority of the countries where we operate. In France, retirement indemnities arise pursuant to labor agreements, internal conventions and applicable local law requirements. As of September 30, 2002, French retirement indemnities and the pensions to be paid to the French members of our senior management responsible for day-to-day operations pursuant to specific employment agreements which are neither funded nor covered by insurance policies amounted to approximately €18 million. Pursuant to the relevant provisions of French law, there is no legal requirement to maintain assets to fund these liabilities. Although we believe that we maintain insurance coverage sufficient and customary for businesses that are similar to ours, there can be no assurances that we will continue to maintain this insurance policy in the future or that the insurance policy will be sufficient to cover our retirement and end of contract obligations and indemnities in the future.

In the United States and the United Kingdom, liabilities arise pursuant to labor agreements, pension schemes and plans, and other employee benefit plans. As of September 30, 2002, such liabilities, including those related to post-retirement benefits other than pensions, were underfunded by approximately €30 million in the aggregate determined on an ongoing, rather than a termination basis. Although we do not intend at this time to terminate any of these pension plans or schemes, in the event they were to be terminated the liabilities associated therewith would be significantly higher. With respect to the pension plans or schemes which we are not required by applicable law to fund, such liabilities will be satisfied from our general assets and cash flow.

In Italy, pension plans and post-retirement benefit liabilities arise pursuant to national collective bargaining agreements. As of September 30, 2002, retirement and end of contract indemnities in Italy, which were fully provided for, had an aggregate value of €43 million.

In countries other than France, the United States, the United Kingdom and Italy, retirement and end of contract indemnities arise pursuant to applicable local law requirements and various pension arrangements, and are in the aggregate equal to €23 million as of September 30, 2002.

If the amounts under our end of contract indemnities and post-retirement benefits were to become due and payable and the insurance and annuity contracts and other plan assets that we have entered into with respect to these liabilities, to the extent that such contracts or such other plan assets have been entered into, were not sufficient to cover such liabilities, we could be required to make significant payments with respect to such end of contract indemnities and post-retirement benefits to our employees. Any such payments could have an adverse effect on our business, financial condition, results of operations and cash flows.

Strikes or other industrial actions could disrupt our operations or make it more costly to operate our facilities.

We are exposed to the risk of strikes and other industrial actions. Although we believe that our relations with our employees are good, we have experienced in the past minor labor disturbances and we cannot assure you that we will not experience industrial action, strikes or work stoppages in the future. Any such action could disrupt our operations, possibly for a significant period of time, result in increased wages and benefits become payable or otherwise have a material adverse effect on our business, financial condition, results of operations and cash flows.

17

Certain of our operating and holding companies may be liable for the repayment of the debts of their subsidiaries.

We operate our business through a series of holding and operating companies world-wide. We seek to organize our subsidiaries in corporate forms that are tax-efficient and otherwise facilitate the efficient management of our operations. Certain of our subsidiaries are organized in such a way that their parent companies and holding companies may be liable for the liabilities of these subsidiaries. In some of these jurisdictions, a court order commencing proceedings against such a subsidiary may extend to the parent or holding company of the subsidiary, in some cases automatically. For example, one of our material French subsidiaries, Legrand SNC, is a wholly-owned subsidiary of Legrand and is asociété en nom collectif ("SNC"). An SNC is a legal entity consisting of two or more partners (individuals or legal entities) where each partner is personally jointly and severally liable for the liabilities of the entity. In the event that Legrand SNC becomes unable to pay its debts out of its available assets, the court order commencing bankruptcy proceedings against Legrand SNC would automatically extend to Legrand, potentially enabling the creditors of Legrand SNC to be paid out of the assets of Legrand. Similar insolvency laws apply to our primary Italian subsidiary, BTicino SpA.

Changes to tax laws could affect our results of operations and cashflows.

Changes in the effective tax rate applicable to our subsidiaries resulting either from changes in tax laws applicable to our operations, or future acquisitions and/or restructurings that impact the tax treatment of our group, could have a negative impact on our results of operations or cash flows. The French tax authorities discussed last year potential significant changes to existing tax rules, which would preclude the deduction of all or part of the interest charges incurred under debt to finance the acquisition of shares of other companies. The changes were however not enacted in the Finance Act for 2003 published on December 30, 2002, and there has been no further indication as to if and when the French tax authorities may seek to have such changes enacted. It also cannot be ascertained with certainty whether any of these changes would apply to the Acquisition.

18

F. SELECTED HISTORICAL CONSOLIDATED FINANCIAL INFORMATION

The following table sets out selected historical consolidated financial information for Legrand. The selected historical financial data as of December 31, 1999, 2000 and 2001 and for each of the years then ended have been derived from the audited consolidated financial statements of Legrand. The selected historical financial data as of December 31, 1997 and 1998 and for each of the years then ended have been derived from the audited consolidated financial statements of Legrand for the respective periods, which are not included herein. The selected historical financial data as of September 30, 2001 and 2002 and for each of the nine-month periods then ended have been derived from the unaudited consolidated financial statements of Legrand. In the opinion of management, the unaudited consolidated financial statements of Legrand have been prepared on a basis consistent with the audited consolidated financial statements of Legrand and include all adjustments, consisting of only normal recurring accruals, which management considers necessary for the fair presentation of Legrand's consolidated results of operations and cash flows for the nine-months ended September 30, 2001 and 2002. The consolidated results of operations for the interim periods are not necessarily indicative of the results to be expected for the entire year, or any future period.

Legrand prepares its consolidated financial statements in accordance with French GAAP, which differ in certain significant respects from US GAAP. See note 28 to the audited consolidated financial statements of Legrand and the notes to the unaudited consolidated financial statements of Legrand for a description of the principal differences between French GAAP and US GAAP as they relate to Legrand, and a reconciliation of net income and shareholders' equity for the periods and as of the dates therein indicated.

Legrand's consolidated financial statements and selected historical consolidated financial information are reported in euro. Legrand's consolidated financial statements for periods prior to January 1, 2001 were originally prepared in French francs prior to their conversion into euro. These French franc amounts have been converted into euro at the official conversion rate set on January 1, 1999 of Fr 6.55957 = €1.00. The comparative financial statements reported in euro as of and for the years ended December 31, 1999 and 2000 depict the same trends as would have been presented if Legrand had continued to present financial statements in French francs. Comparative financial information for periods prior to January 1, 1999 are not comparable to the financial statements of other companies reporting in euro and that restated amounts from a different currency than the French franc, and do not depict the same trends as would have been presented had Legrand used the euro as its functional currency for periods prior to January 1, 1999. The use of this official conversion rate mentioned above, does not take into account the fact that the value of the French franc may have been different before January 1, 1999.

The selected historical consolidated financial information should be read in conjunction with the "Operating and Financial Review and Prospects" and the historical audited consolidated financial statements and unaudited consolidated financial statements of Legrand.

19

| | Year ended December 31,

| | Nine months ended September 30,

| |

|---|

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2001

| | 2002

| |

|---|

| | (€ in millions)

| |

|---|

| Consolidated Statement of Income Data | | | | | | | | | | | | | | | |

| French GAAP | | | | | | | | | | | | | | | |

| Net sales | | 1,985 | | 2,177 | | 2,300 | | 2,799 | | 3,096 | | 2,332 | | 2,256 | |

| Cost of goods sold | | (1,123 | ) | (1,205 | ) | (1,265 | ) | (1,539 | ) | (1,748 | ) | (1,300 | ) | (1,244 | ) |

| Administrative and selling expenses | | (442 | ) | (503 | ) | (558 | ) | (677 | ) | (775 | ) | (586 | ) | (577 | ) |

| Research and development expenses | | (94 | ) | (102 | ) | (110 | ) | (123 | ) | (136 | ) | (98 | ) | (102 | ) |

| Other operating income (expenses) | | — | | 2 | | 17 | | (2 | ) | — | | (3 | ) | (4 | ) |

| Amortization of goodwill | | (13 | ) | (18 | ) | (17 | ) | (29 | ) | (47 | ) | (35 | ) | (46 | ) |

| Operating income | | 313 | | 351 | | 367 | | 429 | | 390 | | 310 | | 283 | |

| Interest income (expense) | | (30 | ) | (30 | ) | (27 | ) | (64 | ) | (92 | ) | (69 | ) | (42 | ) |

| Expenses related to the takeover bid for shares(1) | | — | | — | | — | | — | | (18 | ) | (19 | ) | (2 | ) |

| Net income attributable to Legrand | | 162 | | 193 | | 204 | | 235 | | 176 | | 150 | | 159 | |

| US GAAP | | | | | | | | | | | | | | | |

| Net sales | | 1,959 | | 2,151 | | 2,275 | | 2,768 | | 3,057 | | 2,303 | | 2,227 | |

| Cost of goods sold | | (1,121 | ) | (1,203 | ) | (1,263 | ) | (1,537 | ) | (1,749 | ) | (1,298 | ) | (1,253 | ) |

| Administrative and selling expenses | | (442 | ) | (503 | ) | (558 | ) | (677 | ) | (775 | ) | (586 | ) | (579 | ) |

| Research and development expenses | | (94 | ) | (102 | ) | (110 | ) | (123 | ) | (136 | ) | (98 | ) | (102 | ) |

| Other operating income (expenses)(2) | | 3 | | 8 | | 12 | | 4 | | (13 | ) | (23 | ) | 5 | |

| Amortization/impairment of goodwill | | (13 | ) | (18 | ) | (17 | ) | (29 | ) | (47 | ) | (35 | ) | (13 | ) |

| Operating income | | 284 | | 333 | | 339 | | 406 | | 337 | | 263 | | 285 | |

| Net income attributable to Legrand | | 153 | | 185 | | 196 | | 225 | | 144 | | 115 | | 159 | |

| Consolidated Balance Sheet Data (as of end of period) | | | | | | | | | | | | | | | |

| French GAAP | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | 335 | | 211 | | 304 | | 380 | | 531 | | 463 | | 398 | |

| Marketable securities | | 630 | | 654 | | 612 | | 569 | | 603 | | 585 | | 367 | |

| Working capital(3) | | 1,022 | | 953 | | 996 | | 546 | | 440 | | 449 | | 615 | |

| Total assets | | 2,985 | | 3,092 | | 3,370 | | 4,819 | | 5,270 | | 5,160 | | 4,499 | |

| Total debt(4) | | 1,250 | | 1,223 | | 1,283 | | 2,480 | | 2,526 | | 2,535 | | 1,849 | |

| Total liabilities | | 1,933 | | 1,969 | | 2,109 | | 3,425 | | 3,483 | | 3,397 | | 2,725 | |

| Capital stock | | 42 | | 42 | | 54 | | 53 | | 56 | | 56 | | 56 | |

| Total shareholders' equity | | 1,040 | | 1,113 | | 1,254 | | 1,385 | | 1,777 | | 1,754 | | 1,764 | |

| US GAAP | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | 335 | | 211 | | 304 | | 380 | | 531 | | 463 | | 398 | |

| Marketable securities | | 630 | | 654 | | 612 | | 515 | | 815 | | 832 | | 517 | |

| Working capital(3) | | 1,022 | | 953 | | 999 | | 495 | | 657 | | 704 | | 776 | |

| Total assets | | 3,415 | | 3,551 | | 3,911 | | 5,373 | | 5,952 | | 5,859 | | 5,302 | |

| Total debt(4) | | 1,565 | | 1,562 | | 1,647 | | 2,877 | | 2,962 | | 3,078 | | 2,474 | |

| Total liabilities | | 2,539 | | 2,608 | | 2,629 | | 3,968 | | 4,165 | | 4,083 | | 3,509 | |

| Capital stock | | 42 | | 42 | | 54 | | 53 | | 56 | | 56 | | 56 | |

| Total shareholders' equity | | 1,081 | | 1,142 | | 1,275 | | 1,396 | | 1,777 | | 1,767 | | 1,783 | |

20

| | Year ended December 31,

| | Nine months ended September 30,

| |

|---|

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2001

| | 2002

| |

|---|

| | (€ in millions, except ratios)

| |

|---|

Other Consolidated Financial Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| French GAAP | | | | | | | | | | | | | | | |

| Depreciation and amortization | | (142 | ) | (149 | ) | (158 | ) | (194 | ) | (240 | ) | (176 | ) | (191 | ) |

| EBITDA(5) | | 455 | | 500 | | 525 | | 623 | | 630 | | 486 | | 474 | |

| Net cash provided from operating activities | | 298 | | 295 | | 342 | | 244 | | 407 | | 240 | | 343 | |

| Net cash provided by (used in) investing activities | | (281 | ) | (334 | ) | (170 | ) | (1,061 | ) | (181 | ) | (125 | ) | 234 | |

| Net cash provided by (used in) financing activities | | 70 | | (79 | ) | (80 | ) | 892 | | (74 | ) | (21 | ) | (680 | ) |

| Ratio of earnings to fixed charges(5) | | 3.23 | | 3.69 | | 4.03 | | 3.23 | | 2.21 | | 2.57 | | 2.37 | |

| Capital expenditures | | (151 | ) | (191 | ) | (213 | ) | (234 | ) | (189 | ) | (141 | ) | (111 | ) |

| US GAAP | | | | | | | | | | | | | | | |

| Depreciation and amortization | | (142 | ) | (149 | ) | (158 | ) | (194 | ) | (243 | ) | (180 | ) | (158 | ) |

| EBITDA(6) | | 434 | | 482 | | 497 | | 600 | | 580 | | 443 | | 443 | |

| Ratio of earnings to fixed charges(7) | | 4.00 | | 4.47 | | 5.06 | | 3.75 | | 2.40 | | 3.16 | | 2.69 | |

- (1)

- Represents one-time expenses associated with the public takeover bid for Legrand by Schneider. These are expenses are comprised primarily of fees and bank costs associated directly with the takeover bid. Please refer to notes 17 and 26, respectively, of the audited and unaudited consolidated financial statements of Legrand. For US GAAP purposes, these expenses were reclassified to "Other operating expenses."

- (2)

- Includes historical one-time expenses associated with the public takeover bid for Legrand by Schneider. See note (1) above.

- (3)

- Working capital is calculated as current assets less current liabilities.

- (4)

- Total debt is calculated as the sum of short-term borrowings, long-term borrowings and subordinated securities (TSDIs).

- (5)

- For the purposes of computing the French GAAP ratio of earnings to fixed charges, (i) earnings consist of French GAAP income before taxes, minority interests and equity in earnings of investees, plus equity in earnings of investees and fixed charges, less capitalized interest, and (ii) fixed charges consist of total French GAAP interest costs (whether expensed or capitalized), including discounts provided to customers, plus interest expense of equity investees and interest included in rental expenses.

- (6)

- EBITDA means operating income plus depreciation of tangible assets and amortization of intangible assets. EBITDA is not a measurement of performance under GAAP and you should not consider EBITDA as an alternative to (a) operating income or net income (as determined in accordance with generally accepted accounting principles) as a measure of our operating performance, (b) cash flows from operating, investing and financing activities (as determined in accordance with generally accepted accounting principles) as a measure of our ability to meet cash needs or (c) any other measures of performance under GAAP. We believe that EBITDA is a measure commonly reported and widely used by investors and other interested parties as a measure of a company's operating performance and debt servicing ability because it assists in comparing performance on a consistent basis without regard to depreciation and amortization, which can vary significantly depending upon accounting methods (particularly when acquisitions are involved) or non operating factors (such as historical cost). Accordingly, this information has been disclosed in this document to permit a more complete and comprehensive analysis of our operating performance relative to other companies and of our debt servicing ability. Because all companies do not calculate EBITDA identically, our presentation of EBITDA may not be comparable to similarly titled measures of other companies.

- (7)

- For purposes of computing the US GAAP ratio of earnings to fixed charges, (i) earnings consist of US GAAP income before taxes, minority interests and equity in earnings of investees plus distributed income of equity investees, fixed charges and amortization of capitalized interest, less capitalized interest, and (ii) fixed charges consist of total US GAAP interest costs (whether expensed or capitalized) plus interest included in rental expenses.

21

G. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

Since January 1, 2001, we have prepared and published our financial statements in euro. The consolidated financial statements for 1999 and 2000 were originally prepared in French francs, and have subsequently been converted into euro. The French franc amounts were converted into euro at the official exchange rate set on January 1, 1999 of Fr 6.55957 = €1.00. Percentage changes between items in 1999 and 2000 discussed in this document may not correspond precisely to the percentage changes between such items prior to their conversion into euro due to the rounding adjustments occurring on conversion.

The following discussion and analysis should be read in conjunction with our audited consolidated financial statements and unaudited consolidated financial statements, prepared in conformity with French GAAP. Unless otherwise indicated, all amounts in this discussion and analysis are presented on a French GAAP basis. French GAAP differs in certain significant respects from US GAAP. Refer to note 28 to our audited consolidated financial statements and note 27 to our unaudited consolidated financial statements for a description of the principal differences between French GAAP and US GAAP as they relate to us, and a reconciliation of net income and shareholders' equity for the periods and as of the dates therein indicated.

Overview

Operating Results

Introduction

Our management analyzes our financial condition and results of operations on the basis of five geographic, segments, based on region of production and not on where we sell our products. They are:

- •

- France,

- •

- Italy,

- •

- Rest of Europe,

- •

- United States and Canada, and

- •

- Rest of the World.

For most purposes, we organize our management structure and internal controls on the basis of our geographic segments or national markets, rather than by product type or class, because local economic conditions are the principal factors affecting our sales and market performance.

For information about our major subsidiaries located in these segments, see the list of principal consolidated subsidiaries in the introduction to the notes to our unaudited consolidated financial statements.

For information on the impact of fluctuations in exchange rates on our consolidated results, see "—Variations in Exchange Rates" below.

22

The table below shows a breakdown of our net sales and operating income by segment in 1999, 2000 and 2001 and the nine months ended September 30, 2001 and 2002:

| | Year ended December 31,

| | Nine months ended September 30,

|

|---|

| | 1999

| | 2000

| | 2001

| | 2001

| | 2002

|

|---|

| | €

| | %

| | €

| | %

| | €

| | %

| | €

| | %

| | €

| | %

|

|---|

| | (€ in millions, except percentages)

|

|---|

| Net sales by subsidiaries located in: | | | | | | | | | | | | | | | | | | | | |

| France | | 894 | | 38.9 | | 927 | | 33.1 | | 942 | | 30.4 | | 701 | | 30.1 | | 687 | | 30.5 |

| Italy | | 497 | | 21.6 | | 550 | | 19.7 | | 563 | | 18.2 | | 427 | | 18.3 | | 435 | | 19.3 |

| Rest of Europe(1) | | 375 | | 16.3 | | 439 | | 15.7 | | 509 | | 16.4 | | 378 | | 16.2 | | 375 | | 16.6 |