ended September 30, 2004, the cost of FHLB advances, reverse repurchase agreements and other borrowings was 3.81%, 1.50% and 4.41%, respectively. The increased cost of funds on other borrowings is due to the increased short-term interest rates. At September 30, 2005, the federal funds rate was 3.93% compared to 1.94% at September 30, 2004. Total average interest-bearing liabilities increased from $1.2 billion at September 30, 2004 to $1.3 billion at September 30, 2005. The increase in average interest-bearing liabilities is due to an increase in average deposits of approximately $171.9 million as a result of the Company’s focus on checking growth, increased average FHLB advances of $40.7 million used to fund loan and investment securities growth and increased average Customer repurchase agreements of $18.5 million. Included in increased average deposits, were brokered CD’s which increased by $79.4 million in average balances when comparing the two periods. This increase was partially offset by a decrease in average reverse repurchase agreements of $61.1 million.

Net interest income was $48.8 million for the year ended September 30, 2005, as compared to $42.3 million for the year ended September 30, 2004. The net interest margin was 3.70% for the year ended September 30, 2005, compared to 3.64% for the year ended September 30, 2004.

The following table summarizes the average balance sheet and the related yields on interest-earning assets and deposits and borrowings for the year ended September 30, 2004 and 2005 (Dollars in thousands):

The Company’s provision for loan losses decreased from $1.8 million for the year ended September 30, 2004, to $1.7 million for the year ended September 30, 2005 primarily due to the risk factors related to the underlying portfolio. The allowance for loan losses as a percentage of loans was 1.25% at September 30, 2005 as compared to 1.39% at September 30, 2004. Loans delinquent 90 days or more were $2.6 million or 0.28% of total loans at September 30, 2005, compared to $5.9 million or 0.73% of total loans at September 30, 2004. The allowance for loan losses was 445% of loans delinquent 90 days or more at September 30, 2005, compared to 189% at September 30, 2004. Net charge-offs for the year ended September 30, 2005 were $1.0 million compared to $505,000 for the year ended September 30, 2004. Included in charge-offs for the year ended September 30, 2005 were two loans totaling $196,000 guaranteed by the Small Business Administration (SBA). The SBA has denied the guarantee. The Bank is appealing this decision. Management believes that the level of the allowance for loan losses at September 30, 2005 is adequate considering the composition of the loan portfolio, the portfolio’s loss experience, delinquency trends, current regional and local economic conditions and other factors at that date.

COASTAL FINANCIAL CORPORATION AND SUBSIDIARIES

Management’s Discussion and Analysis - Continued

Other Income

For the year ended September 30, 2005, other income was $12.5 million compared to $9.2 million for the year ended September 30, 2004. Fees and service charges from deposit accounts increased $2.4 million or 62.7% to $6.1 million for the year ended September 30, 2005, compared to $3.8 million for the year ended September 30, 2004. The majority of this increase is due to fee income from increased number of personal checking accounts. In fiscal 2005, checking account balances grew approximately 54%. During the year ended September 30, 2004, the Company securitized and concurrently sold $46.8 million of mortgage loans compared to $52.6 million for the year ended September 30, 2005. Gain on sale of loans was $1.2 million for the year ended September 30, 2005, compared to $1.5 million for the year ended September 30, 2004. Losses on sales of securities available for sale were $485,000 for the year ended September 30, 2005, compared to losses of $1.1 million for the year ended September 30, 2004. In addition, the Company had a gain on call of an investment security held to maturity called by the issuer of $160,000 for the year ended September 30, 2005 and $0 for the year ended September 30, 2004. Due to the increase in checking accounts, income from ATM and debit card transactions increased 60.6% from $954,000 in fiscal 2004 to $1.5 million in fiscal 2005.

General and Administrative Expenses

General and administrative expenses were $33.5 million for the year ended September 30, 2005 compared to $27.3 million for the year ended September 30, 2004. Salaries and employee benefits were $18.5 million for the year ended September 30, 2005, as compared to $16.1 million for the year ended September 30, 2004, an increase of 14.7%, primarily due to an increase in the number of banking Associates in business banking, Associates in the Company’s expanded hours call center, Associates in new branches and normal salary increases. The Company has added several Associates in a Banking Group that is focused on growing small to medium sized business banking relationships. Also, as a result of new branches, equipment purchased to improve Customer convenience and increased checking activity, net occupancy, furniture and fixtures and data processing expenses increased $843,000 and depreciation expense increased $582,000, when comparing the two periods. Marketing expenses were $905,000 for the year ended September 30, 2004, compared to $1.8 million for the year ended September 30, 2005. This is primarily attributed to the Bank’s “The Carolinas’ Best Totally Free Checking With A Gift” initiative; introduction of Penny Pavilion, the Bank’s free coin counting service; marketing of the Bank’s expanded banking hours, including Saturday banking at all Bank branches; and marketing of the Bank’s new branch in Wilmington, NC. The Bank’s “The Carolinas’ Best Totally Free Checking With A Gift” promotion involves significant direct mail advertising as well as direct media advertising. Expenses related to ATM and debit card transactions increased $409,000 or 64.9% when comparing fiscal 2004 to 2005. Other expense was $3.3 million for the year ended September 30, 2004 compared to $4.5 million for the year ended September 30, 2005. Other expense increased due to loss on write-off of signage related to the Bank’s re-branding efforts in conjunction with the initiation of “6 Day Branch Banking” of $122,000, increased costs incurred related to compliance with Sarbanes-Oxley of $428,000 and increased deposit account losses of $370,000. The increase in net deposit losses is directly attributed to the increased number of personal checking accounts.

Income Taxes

Income taxes were $7.6 million for the year ended September 30, 2004 compared to $9.0 million for the year ended September 30, 2005. The effective income tax rate as a percentage of pretax income was 34.0% and 34.4% for the years ended September 30, 2004 and 2005, respectively. The effective income tax rate differs from the statutory rate primarily due to income generated by bank-owned life insurance, municipal securities that are exempt from federal and certain state taxes, and the increase in the current fiscal year earnings over the comparable prior year earnings that are subject to higher incremental tax rates. The Company’s effective income tax rates take into consideration certain assumptions and estimates made by management. No assurance can be given that either the tax returns submitted by management or the income tax reported on the consolidated financial statements will not be adjusted by either adverse rulings by the U.S. Tax court, changes in the tax code, or assessments made by the Internal Revenue Service. The Company is subject to potential adverse adjustments, including but not limited to: an increase in the statutory federal or state income tax rates, the permanent non-deductibility of amounts currently considered deductible either now or in future periods, and the dependency on the generation of future taxable income, in order to ultimately realize deferred income tax assets.

Non-performing Assets

Non-performing assets were $3.6 million at September 30, 2006 compared to $3.5 million at September 30, 2005. Loans past due 90 days or more increased to $3.0 million at September 30, 2006, from $2.6 million at September 30, 2005. Real estate acquired through foreclosure decreased slightly from $818,000 at September 30, 2005, to $571,000 at September 30, 2006.

At September 30, 2005, impaired loans totaled $2.6 million. There were $3.5 million in impaired loans at September 30, 2006. Included in the allowance for loan losses at September 30, 2005 was $434,000 related to impaired loans compared to $235,000 at September 30, 2006. The average recorded investment in impaired loans for the year ended September 30, 2005 was $3.7 million compared to $2.8 million for the year ended September 30, 2006. Interest income recognized on impaired loans in fiscal 2005 was $292,000. Interest income recognized on impaired loans in fiscal 2006 was $168,000.

47

COASTAL FINANCIAL CORPORATION AND SUBSIDIARIES

Management’s Discussion and Analysis - Continued

Loans are reviewed on a regular basis and an allowance for uncollectible interest is established on loans where collection is questionable, generally when such loans become 90 days delinquent. Loan balances for which interest amounts have been reserved and all loans more than 90 days delinquent are placed on nonaccrual status. Typically, payments received on a nonaccrual loan are applied to the outstanding principal or recognized as interest based upon the collectability of the loan as determined by management.

Allowance for Loan Losses

The adequacy of the allowance is analyzed on a quarterly basis. For purposes of this analysis, adequacy is defined as a level of reserves sufficient to absorb probable losses inherent in the portfolio. The methodology employed for this analysis considers historical loan loss experience, the results of loan reviews, current economic conditions, and other qualitative and quantitative factors that warrant current consideration in determining an adequate allowance.

The evaluation of the allowance is segregated into general allocations and specific allocations. For general allocations, the portfolio is segregated into risk-similar segments for which historical loss ratios are calculated and adjusted for identified trends or changes in current portfolio characteristics. Historical loss ratios are calculated by product type for consumer loans (installment and revolving), mortgage loans, and commercial loans and may be adjusted for other risk factors. To allow for modeling error, a range of probable loss ratios is then derived for each segment. The resulting percentages are then applied to the dollar amounts of the loans in each segment to arrive at each segment’s range of probable loss levels.

Certain non-performing loans are individually assessed for impairment under SFAS 114 and assigned specific allocations. Other identified high-risk loans or credit relationships based on internal risk ratings are also individually assessed and assigned specific allocations.

The general allocation also includes a component for probable losses inherent in the portfolio, based on management’s analysis, that are not fully captured elsewhere in the allowance. This component serves to address the inherent estimation and imprecision risk in the methodology as well as address management’s evaluation of various factors or conditions not otherwise directly measured in the evaluation of the general and specific allocations. Such factors or conditions may include evaluation of current general economic and business conditions; geographic, collateral, or other concentrations; system, procedural, policy, or underwriting changes; experience of lending staff; entry into new markets or new product offerings; and results from internal and external portfolio examinations.

The allocation of the allowance to the respective loan segments is an approximation and not necessarily indicative of future losses or future allocations. The entire allowance is available to absorb losses occurring in the overall loan portfolio.

Assessing the adequacy of the allowance is a process that requires considerable judgment. Management’s methodology and judgments are based on the information currently available and includes numerous assumptions about current events, which we believe to be reasonable, but which may or may not be valid. Thus, there can be no assurance that loan losses in future periods will not exceed the current allowance amount or that future increases in the allowance will not be required. No assurance can be given that management’s ongoing evaluation of the loan portfolio in light of changing economic conditions and other relevant circumstances will not require significant future additions to the allowance, thus adversely affecting the operating results of the Company. Management believes that the current level of the allowance for loan losses is presently adequate considering the composition of the loan portfolio, the portfolio’s loss experience, delinquency trends, current regional and local economic conditions and other factors.

The allowance is also subject to examination and adequacy testing by regulatory agencies, which may consider such factors as the methodology used to determine adequacy and the size of the allowance relative to that of peer institutions, and other adequacy tests. In addition, such regulatory agencies could require the Company to adjust the allowance based on information available to them at the time of their examination.

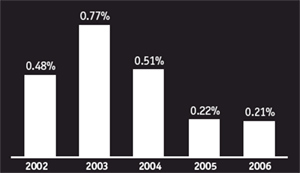

The Company established provisions for loan losses for the years ended September 30, 2004, 2005 and 2006, of $1.8 million, $1.7 million and $1.4 million, respectively. For the years ended September 30, 2004, 2005 and 2006, the Company had net charge-offs of $505,000, $1.0 million and $407,000, respectively. Net charge-offs as a percentage of average outstanding loans were ..07%, .12%, and .04% for fiscal years ended 2004, 2005 and 2006, respectively. At September 30, 2006, the Company had an allowance for loan losses of $12.7 million, which was 1.17% of net loans.

Off-Balance Sheet Arrangements

In the normal course of operations, the Company engages in a variety of financial transactions that, in accordance with generally accepted accounting principles, are not recorded in the financial statements, or are recorded in amounts that differ from the notional amounts. These transactions involve, to varying degrees, elements of credit, interest rate, and liquidity risk. Such transactions are used

48

COASTAL FINANCIAL CORPORATION AND SUBSIDIARIES

Management’s Discussion and Analysis - Continued

by the Company for general corporate purposes or for Customer needs. Corporate purpose transactions are used to help manage credit, interest rate, and liquidity risk or to optimize capital. Customer transactions are used to manage Customers’ requests for funding.

The Company’s off-balance sheet arrangements, which principally include lending commitments and derivatives are described below.

Lending Commitments. Lending commitments include loan commitments, standby letters of credit and unused business and personal credit card lines. These instruments are not recorded in the consolidated statements of financial condition until funds are advanced under the commitments. The Company provides these lending commitments to Customers in the normal course of business.

Loan commitments for residential housing and land totaled $23.3 million. For retail Customers, loan commitments are generally lines of credit secured by residential property. At September 30, 2006 retail loan commitments totaled $55.5 million. Standby letters of credit are conditional commitments to guarantee performance, typically contract or financial integrity, of a Customer to a third party and totaled $11.4 million at September 30, 2006. Commercial lines of credit and unused business and personal credit card lines, which totaled $135.6 million at September 30, 2006, are generally for short-term borrowings.

The Company applies essentially the same credit policies and standards as it does in the lending process when making these commitments.

Derivatives. In accordance with SFAS No. 133, the Company records derivatives at fair value, as either assets or liabilities, on the consolidated balance sheet. Derivative transactions are measured in terms of the notional amount, but this amount is not recorded on the balance sheet and is not, when viewed in isolation, a meaningful measure of the risk profile of the instrument. The notional amount is not exchanged, but is used only as the basis upon which interest and other payments are calculated.

At September 30, 2006, the fair value of derivative assets totaled $31,000, net. The related notional amounts, which are not recorded on the consolidated balance sheet, totaled $5.6 million for the derivative assets and $4.0 million for the derivative liabilities. (See Note 23 of the Notes to Consolidated Financial Statements).

Interest Rate Risk Disclosure

The Bank’s Asset Liability Management Committee (“ALCO”) monitors and considers methods of managing exposure to interest rate risk. The ALCO consists of members of the Board of Directors and Senior Leadership of the Company and meets quarterly. The Bank’s exposure to interest rate risk is reviewed on at least a quarterly basis by the ALCO. Interest rate risk exposure is measured using interest rate sensitivity analysis to determine the Bank’s change in net portfolio value in the event of hypothetical changes in interest rates. The ALCO is charged with the responsibility to maintain the level of sensitivity of the Bank’s net portfolio value within Board approved limits.

Net portfolio value (NPV) represents the market value of portfolio equity and is equal to the market value of assets minus the market value of liabilities, with adjustments made for off-balance sheet items over a range of assumed changes in market interest rates. The Bank’s Board of Directors has adopted an interest rate risk policy which establishes maximum allowable decreases in NPV in the event of a sudden and sustained one hundred to four hundred basis point increase or decrease in market interest rates. The following table presents the Bank’s projected change in NPV as computed by the OTS for the various rate shock levels as of September 30, 2006.

| | | | | | | | | | | | | | | | |

Change in Interest Rates | | | Board Limit

Minimum NPV

Ratio | | Board Limit

Maximum

Declinein NPV | Market Value

Of Assets

9/30/06 | | Market Value

Portfolio Equity

9/30/06 | | | NPV

Ratio |

| | |

| |

| |

|

| | |

|

300 basis point rise | | | 5.00 | % | | 400 BPS | | $ | 1,658,193 | | $ | 176,374 | | | 10.64 | % |

200 basis point rise | | | 6.00 | % | | 300 BPS | | $ | 1,679,009 | | $ | 187,916 | | | 11.19 | % |

100 basis point rise | | | 6.00 | % | | 250 BPS | | $ | 1,698,259 | | $ | 196,866 | | | 11.59 | % |

No Change | | | 6.00 | % | | | | $ | 1,715,670 | | $ | 203,444 | | | 11.86 | % |

100 basis point decline | | | 6.00 | % | | 250 BPS | | $ | 1,733,420 | | $ | 209,896 | | | 12.11 | % |

200 basis point decline | | | 6.00 | % | | 300 BPS | | $ | 1,747,920 | | $ | 212,466 | | | 12.18 | % |

300 basis point decline | | | 6.00 | % | | 350 BPS | | | N/A | | | N/A | | | N/A | |

The preceding table indicates that at September 30, 2006, in the event of a sudden and sustained increase in prevailing market interest rates, the Bank’s NPV would be expected to decrease, and that in the event of a sudden decrease in prevailing market interest rates, the Bank’s NPV would be expected to increase minimally. At September 30, 2006, the Bank’s estimated changes in NPV were within the limits established by the Board of Directors.

49

COASTAL FINANCIAL CORPORATION AND SUBSIDIARIES

Management’s Discussion and Analysis - Continued

Computation of prospective effects of hypothetical interest rate changes are based on numerous assumptions, including relative levels of market interest rates, loan prepayments and deposit decay, and should not be relied upon as indicative of actual results. Further, the computations do not contemplate any actions the ALCO could undertake in response to sudden changes in interest rates.

The Bank also uses interest rate sensitivity gap analysis to monitor the relationship between the maturity and repricing of its interest-earning assets and interest-bearing liabilities. Interest rate sensitivity gap is defined as the difference between the amount of interest-earning assets maturing or repricing within a specific time period and the amount of interest-bearing liabilities maturing or repricing within the same time period. A gap is considered positive when the amount of interest-rate-sensitive assets exceeds the amount of interest-rate-sensitive liabilities. Generally, during a period of rising rates, a positive gap would result in an increase in net interest income. Conversely, during a period of falling interest rates, a positive gap would result in a decrease in net interest income. It is ALCO’s goal to maintain reasonable balance between exposure to interest rate fluctuations and earnings.

Recently Adopted Accounting Pronouncements

In December 2004, the Financial Accounting Standards Board issued Statement of Financial Accounting Standard No. 123R, Share-Based Payment which revised SFAS No. 123, Accounting for Stock-Based Compensation. This Statement supersedes APB Opinion No. 25, Accounting for Stock Issued to Employees, and related implementation guidance and amends SFAS No. 95, Statement of Cash Flows. It requires that all stock-based compensation now be measured at fair value and recognized as expense in the income statement. This Statement also clarifies and expands guidance on measuring fair value of stock compensation, requires estimation of forfeitures when determining expense, and requires that excess tax benefits be shown as financing cash inflows versus a reduction of taxes paid in the Statement of Cash Flows. Various other changes are also required. The Company adopted this Statement effective beginning October 1, 2005. The Company experienced no significant effect on its financial statements as a result of the adoption of this Statement. The adoption of this pronouncement and its effects on the consolidated financial statements of the Company are more fully described in Note 1(p) in the Notes to Consolidated Financial Statements.

On November 10, 2005, the FASB issued FASB Staff Position (FSP) FAS 123R-3,Transition Election Related to Accounting for the Effects of Share-Based Payment Awards(FSP FAS 123R-3). This FSP provides a practical transition election related to accounting for the tax effects of share-based payment awards to employees. An entity shall follow either the transition guidance for additional paid-in capital pool in SFAS 123R or the alternative transition method described in a one-time election to adopt the transition method described in this FSP. The Company may take up to one year from its initial adoption of SFAS 123R to evaluate its available alternatives and makes its one-time election. Effective October 1, 2006, the Company adopted the alternative transition method under FSP FAS 123R-3. Adoption of this FSP is not expected to have a significant impact on the Company’s financial position and is expected to increase fully diluted earnings per share by approximately $.01. In addition, the effects of applying this FSP will be reported as a change in accounting principle in accordance with FASB Statement No. 154 “Accounting Changes and Error Corrections” in the year of adoption. The adoption of this pronouncement and its effects on the consolidated financial statements of the Company are more fully described in Note 1(p) in the Notes to Consolidated Financial Statements.

Recently Issued Accounting Pronouncements

In May 2005, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 154, “Accounting for Changes and Error Corrections – a replacement of Accounting Principles Board Opinion No. 20 and FASB Statement No. 3 (FAS 154),” which eliminates the requirement to reflect changes in accounting principles as cumulative adjustments to net income in the period of change and requires retrospective application to prior periods’ financial statements for voluntary changes in accounting principle, unless it is impracticable to determine either the period-specific effects or the cumulative effect of the change. If it is impracticable to determine the cumulative effect of the change to all prior periods, FAS 154 requires the new accounting principle to be adopted prospectively. For new accounting pronouncements, the transition guidance in the pronouncement should be followed. Retrospective application refers to the application of a different accounting principle to previously issued financial statements as if that principle had always been used. FAS 154 did not change the guidance for reporting corrections of errors, changes in estimates or for justification of a change in accounting principle on the basis of preferability. FAS 154 is effective for accounting changes made in fiscal years beginning after December 15, 2005 (October 1, 2006 for the Company). The Company does not expect the adoption of FAS 154 to have a material effect on the results of operations or statement of condition.

In February 2006, the FASB issued SFAS No. 155, “Accounting for Certain Hybrid Financial Instruments” an amendment of FASB Statements No. 133 and 140 (FAS 155). FAS 155 permits fair value re-measurement for any hybrid financial instrument that contains an embedded derivative that otherwise would require bifurcation, clarifies which interest only-strips and principal-only strips are not subject to the requirements of Statement 133, establishes a requirement to evaluate interests in securitized financial assets to identify

50

COASTAL FINANCIAL CORPORATION AND SUBSIDIARIES

Management’s Discussion and Analysis - Continued

interests that are freestanding derivatives or that are hybrid financial instruments that contain an embedded derivative requiring bifurcation, clarifies that concentrations of credit risk in the form of subordination are not embedded derivatives, and amends Statement 140 to eliminate the prohibition on a qualifying special purpose entity from holding a derivative financial instrument that pertains to a beneficial interest other than another derivative financial instrument. FAS 155 is effective for all financial instruments acquired or issued after the beginning of an entity’s first fiscal year that begins after September 15, 2006 (October 1, 2006 for the Company). The Company does not expect the adoption of FAS 155 to have a material effect on the results of operations or statement of condition.

In March 2006, FASB issued SFAS No. 156 “Accounting for Servicing of Financials Assets” an amendment of FASB Statement No. 140 (FAS 140 and FAS 156). FAS 140 establishes, among other things, the accounting for all separately recognized servicing assets and servicing liabilities. This Statement amends FAS 140 to require that all separately recognized servicing assets and servicing liabilities be initially measured at fair value, if practicable. This Statement permits, but does not require, the subsequent measurement of separately recognized servicing assets and servicing liabilities at fair value. Under this Statement, an entity can elect subsequent fair value measurement to account for its separately recognized servicing assets and servicing liabilities. Adoption of this Statement is required as of the beginning of the first fiscal year that begins after September 15, 2006. Upon adoption, the Company will apply the requirements for recognition and initial measurement of servicing assets and servicing liabilities prospectively to all transactions. The Company will adopt FAS 156 for the fiscal year beginning October 1, 2006 and currently has not determined if it will adopt FAS 156 using the fair value election.

In September 2006, the FASB issued SFAS No. 157 (FAS 157), “Fair Value Measurements”, which defines fair value, establishes guidlines for measuring fair value and expands disclosure regarding fair value measurements. FAS 157 does not require any new fair value measurements, but rather eliminates inconsistencies found in various prior accounting pronouncements. FAS 157 is effective for fiscal years beginning after November 15, 2007 (October 1, 2008 for the Company). The Company is currently not in a position to determine the effect of adopting this standard on its consolidated financial statements.

In July 2006, The FASB issued Interpretation No. 48 (FIN 48), “Accounting for Uncertainty in Income Taxes,” which clarifies the accounting for uncertainty in income taxes recognized in the financial statements in accordance with FASB Statement No. 109, “Accounting for Income Taxes.” FIN 48 provides guidance on the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN 48 also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosures and transition. FIN 48 is effective for fiscal years beginning after December 15, 2006 (October 1, 2007 for the Company). The Company is currently evaluating the impact of this standard on its results of operations and statement of condition.

In September 2006, the Securities and Exchange Commission (SEC) Office of the Chief Accountant and Divisions of Corporation Finance and Investment Management released Staff Accounting Bulletin No. 108 (SAB 108), “Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements,” that provides interpretive guidance on how the effects of the carryover or reversal of prior year misstatements should be considered in quantifying a current year misstatement. The SEC staff believes that registrants should quantify errors using both a balance sheet and an income statement approach to evaluate whether either approach results in quantifying a misstatement that, when all relevant quantitative and qualitative factors are considered, is material. SAB 108 is effective for fiscal years ending after November 15, 2006 (September 30, 2007 for the Company). The Company is currently evaluating the impact of this standard on its results of operations and statement of condition.

Capital Standards and Regulatory Matters

The Bank’s capital standards include: (1) a leverage limit requiring all OTS chartered financial institutions to maintain core capital in an amount not less than 4% of the financial institution’s total assets; (2) a tangible capital requirement of not less than 1.5% of total assets; and (3) a risk-based capital requirement of not less than 8.0% of risk weighted assets. For further information concerning the Bank’s capital standards, refer to Note 14 of the Notes to the Consolidated Financial Statements.

Effects of Inflation and Changing Prices

The consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles which require the measurement of financial position and results of operations in terms of historical dollars, without consideration of change in the relative purchasing power over time due to inflation. Unlike most industrial companies, virtually all of the assets and liabilities of a financial institution are monetary in nature. As a result, interest rates have a more significant impact on a financial institution’s performance than the effect of inflation. Interest rates do not necessarily change in the same magnitude as the price of goods and services.

51

Board of Directors

| |

Coastal Financial Corporation |

| |

| E. Lawton Benton |

| President |

| C.L. Benton & Sons, Inc. |

| |

| G. David Bishop |

| Managing Director |

| White Harvest Trading Co., LLC |

| |

| J. Robert Calliham |

| President and Chief Executive Officer |

| Smith, Sapp, Bookhout, Crumpler & |

| Calliham, P.A. |

| |

| James T. Clemmons |

| Chairman |

| Coastal Financial Corporation |

| |

| James P. Creel |

| President |

| Creel Corporation |

| |

| James. H. Dusenbury |

| Retired – Attorney |

| Dusenbury and Clarkson Law Firm |

| |

| Michael C. Gerald |

| President and Chief Executive Officer |

| Coastal Financial Corporation |

| |

| William O. Marsh |

| President |

| Palmetto Chevrolet |

| |

| Frank A. Thompson, II |

| President |

| Peoples Underwriters, Inc. |

| |

| W. Cecil Worsley, III |

| President and Chief Executive Officer |

| Worsley Companies |

| |

Coastal Federal Bank |

| |

| E. Lawton Benton |

| President |

| C.L. Benton & Sons, Inc. |

| |

| G. David Bishop |

| Managing Director |

| White Harvest Trading Co., LLC |

| |

| J. Robert Calliham |

| President and Chief Executive Officer |

| Smith, Sapp, Bookhout, Crumpler & |

| Calliham, P.A. |

| |

| James T. Clemmons |

| Chairman |

| Coastal Federal Bank |

| |

| James P. Creel |

| President |

| Creel Corporation |

| |

| James. H. Dusenbury |

| Retired – Attorney |

| Dusenbury and Clarkson Law Firm |

| |

| Michael C. Gerald |

| President and Chief Executive Officer |

| Coastal Federal Bank |

| |

| William O. Marsh |

| President |

| Palmetto Chevrolet |

| |

| Frank A. Thompson, II |

| President |

| Peoples Underwriters, Inc. |

| |

| W. Cecil Worsley, III |

| President and Chief Executive Officer |

| Worsley Companies |

| |

Coastal Planners Holding Corporation |

| |

| James T. Clemmons |

| Chairman |

| Coastal Financial Corporation |

| |

| Michael C. Gerald |

| President and Chief Executive Officer |

| Coastal Financial Corporation |

| |

| Jerry L. Rexroad, CPA |

| Chief Financial Officer |

| Coastal Planners Holding Corporation |

52

COASTAL FINANCIAL CORPORATION

Leadership Group

| Sherri Adams |

| Branch Manager |

| North Myrtle Beach Branch |

| |

| Ginger Allen |

| AVP Underwriter Group Leader |

| |

| Tony Ambuhl |

| AVP Commercial Banking Officer |

| |

| Phillip Ammons |

| VP Community Banking Leader |

| |

| Donna Bailey |

| AVP Branch Operations Specialist |

| |

| Randy Baker |

| VP Network Services |

| Group Leader |

| |

| Jeffrey Benjamin |

| SVP Credit Administration |

| Group Leader |

| |

| April Benton |

| Staffing Group Leader |

| |

| Steven Brockmann |

| AVP Investment Rep-CIS |

| |

| Cynthia Buffington |

| AVP Item Processing |

| Group Leader |

| |

| Ronnie Burbank |

| VP Sr. Banking Leader |

| |

| Anne Caldwell |

| VP - Deposit Servicing |

| Group Leader |

| |

| Marie Canady |

| Mortgage Specialist |

| Group Leader |

| |

| Tamra Cannon |

| AVP Sr. Branch Manager |

| |

| Christopher Carbone |

| VP Senior Business Banking Officer |

| |

| Shonda Chestnut |

| AVP Loan Officer II |

| |

| Christopher Clark |

| AVP Business Banking Officer |

| |

| Deanna Cooke |

| AVP Fiserv Applications Support |

| Group Leader |

| |

| Susan J. Cooke |

| SVP Adminstrative Services |

| Group Leader |

| Corporate Secretary |

| |

| Marshall Cooper |

| AVP Sr. Banking Leader |

|

| Benjamin Corley |

| Sr. Branch Manager |

| Southport Branch |

| |

| Joe Cox |

| VP Community Banking Leader |

| |

| John Creamer |

| VP Investment Rep-CIS |

| |

| Perry L. Dalton |

| Service Leader |

| Oak Street Branch |

| |

| Gwendolyn Davis |

| Branch Manager |

| Murrells Inlet Branch |

| |

| Deborah Dillard |

| Branch Manager |

| Sunset Beach Branch |

| |

| Robert D. Douglas |

| EVP Human Resources |

| Group Leader |

| |

| Tiffany Dudley |

| AVP Electronic Banking |

| Group Leader |

| |

| Trina Dusenbury |

| SVP Residential Banking |

| Operations Group Leader |

| |

| Brandon Edens |

| AVP Sr. Branch Manager |

| |

| Michael Evans |

| VP Loan Review Group Leader |

| |

| Rita Fecteau |

| VP Accounting Group Leader |

| |

| Patricia Floyd |

| VP Branch Development |

| Coordinator |

| |

| Daniel Fogle |

| VP Community Banking Leader |

| |

| Joel Foster |

| SVP Loan Administration |

| Group Leader |

| |

| William Gehman |

| SVP Corporate Controller |

| |

| Mary Geist |

| VP IT Administration |

| |

| Michael C. Gerald |

| President & CEO |

| |

| Jimmy R. Graham |

| EVP Chief Operations Officer |

|

| E. Haden Hamilton Jr. |

| President -CIS |

| |

| Don Hamilton |

| VP Residential Brokerage Leader |

| |

| Kathy Hane |

| AVP Sr. Branch Manager |

| |

| Lauren Henson |

| SVP Dean Of CFU |

| |

| Jennifer Henthorn |

| Branch Manager |

| Southport Branch |

| |

| Mike Hill |

| VP Investment Rep-CIS |

| |

| Debra Hinson |

| VP Operations Group Leader-CIS |

| |

| Christopher Hipp |

| Branch Manager |

| Stephen’s Crossroads Branch |

| |

| Glenn Humbert |

| SVP NC Banking Group Leader |

| |

| Cameron Jackson |

| AVP Consumer Loan Administrator |

| |

| Mike Jackson |

| VP Sr. Banking Leader |

| |

| Lisa James |

| SVP Operations Group Leader |

| |

| Wendy Johnson |

| Branch Manager |

| Loris Branch |

| |

| Jennifer Julian |

| AVP Facility Services |

| Group Leader |

| |

| Ruthie Kearns |

| SVP Community Relations Officer |

| |

| Alvin Kennedy |

| Branch Manager |

| Hwy 544 West Branch |

| |

| Kara Kessinger |

| President-CRETP |

| |

| Eric Keys |

| VP - Sr. Commercial Banking Leader |

| |

| Linwood Koonce Jr |

| AVP Banking Closing Group Leader |

53

COASTAL FINANCIAL CORPORATION

Leadership Group - Continued

| |

| Louis LaBruce |

| VP Sr. Banking Leader |

| |

| Justin Lee |

| AVP Commercial/Residential Officer |

| |

| Edward Loehr Jr. |

| VP Budgeting & Treasury |

| |

| Mary Lundy |

| Branch Manager |

| Shallotte Branch |

| |

| Kathleen Lutes |

| AVP Secondary Marketing |

| Group Leader |

| |

| Leslie Lydon |

| VP Residential Banking Sales |

| |

| Patsy Madden |

| Residential Loan Servicing |

| Group Leader |

| |

| Michael Mauney |

| VP Collections Group Leader |

| |

| Amy McLaurin |

| AVP Sr. Banking Leader |

| |

| Carol Mercolini |

| Branch Manager |

| Surfside Branch |

| |

| Janice Metz |

| AVP Advertising Officer |

| |

| Joy Metz |

| Sales Leader |

| Oak Street Branch |

| |

| Abigail Mishoe |

| AVP Residential Banking Officer |

| |

| Phyllis Monarch |

| Branch Manager |

| North Conway Branch |

| |

| Leslie Morse |

| Commercial/Consumer Loan |

| Servicing Group Leader |

| |

| Lynn Murray |

| SVP Checking Acct Product |

| Development & Managment Officer |

| |

| Deborah Orobello |

| Branch Manager |

| Little River Branch |

| |

| Bruce Patonay |

| Sr. Branch Manager |

| Dunes Branch |

| |

| Charles Page |

| VP Commercial Banking Officer |

|

| Dan Rettig |

| AVP Security Officer |

| |

| Jerry L. Rexroad |

| EVP Chief Financial Officer |

| |

| David Roe |

| SVP Business Banking Leader |

| |

| Eulette Sauls |

| AVP Information Management |

| Group Leader |

| |

| Sherry G. Schoolfield |

| VP Compliance Officer |

| |

| Douglas E. Shaffer |

| SVP Horry County Banking |

| Group Leader |

| |

| Steven J. Sherry |

| EVP Marketing Group Leader |

| |

| Joseph Shumbo |

| AVP Residential Banking Officer |

| |

| Leeann Slack |

| Operations Leader |

| Oak Street Branch |

| |

| Dawn Small |

| AVP Branch Operations Leader |

| |

| J. Marcus Smith Jr. |

| SVP Internal Audit |

| Group Leader |

| |

| Marcus Smith |

| AVP Commercial Banking Officer |

| |

| Phillip Stalvey |

| EVP Banking Group Leader |

| |

| Allison Stout |

| Electronic Banking Business Services |

| Leader |

| |

| Annette Stroud |

| Sr. Branch Manager |

| Carolina Forest Branch |

| |

| Charlene Sullivan |

| Branch Manager |

| Socastee Branch |

| |

| Sandra Szarek |

| AVP Commercial Loan Servicing |

| Group Leader |

| |

| Andrea Taiani |

| Customer Service Group Leader |

|

| James Talerico |

| AVP Sr. Business Banking Officer |

| |

| Gary Thompson |

| VP Financial Reporting & |

| Compliance Leader |

| |

| Matthew Towns |

| VP Credit Administration |

| |

| Audrey Waldron |

| Branch Manager |

| Oak Island Branch |

| |

| Douglas Walters |

| VP Residential Banking Officer |

| |

| Brian White |

| SVP Chief Information Officer |

| |

| Theresa Whitley |

| Construction Group Leader |

| |

| Josh Wise |

| AVP Business Banking Loan |

| Administrator |

| |

| Sandra R. Zanfini |

| AVP Corp. Support Group Leader |

| Asst. Corporate Secretary |

54

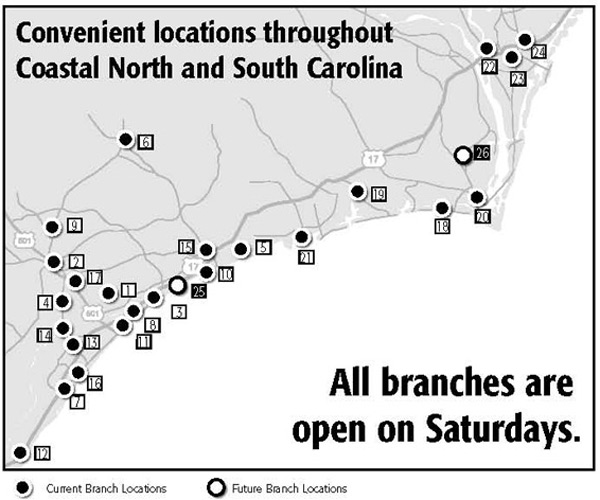

Branch Locations

| |

| Coastal Federal Bank |

| |

| Carolina Forest Branch |

| 3894 Renee Drive |

| Myrtle Beach, SC 29579 |

| 843.205.2016 |

| |

| Conway Branch |

| 310 Wright Boulevard |

| Conway, SC 29526 |

| 843.205.2005 |

| |

| Dunes Branch |

| 7500 North Kings Highway |

| Myrtle Beach, SC 29572 |

| 843.205.2001 |

| |

| Highway 544 West Branch |

| 1571 Hwy 544 |

| Conway, SC 29526 |

| 843.205.2023 |

| |

| Little River Branch |

| 1602 Highway 17 |

| Little River, SC 29566 |

| 843.205.2014 |

| |

| Loris Branch |

| 3610 Broad Street |

| Loris, SC 29569 |

| 843.205.2018 |

| |

| Murrells Inlet Branch |

| 3348 Highway 17 South |

| & Inlet Crossing |

| Murrells Inlet, SC 29576 |

| 843.205.2008 |

| |

| North Conway Branch |

| 2600 Main Street |

| Conway, SC 29526 |

| 843.205.2017 |

| |

| North Myrtle Beach Branch |

| 521 Main Street |

| North Myrtle Beach, SC 29582 |

| 843.205.2002 |

| |

| Oak Island Branch |

| 8001 East Oak Island Drive |

| Oak Island, NC 28465 |

| 843.205.2036 |

| 910.201.1481 |

|

| Oak Street Branch |

| 2619 Oak Street |

| Myrtle Beach, SC 29577-3129 |

| 843.205.2000 |

| |

| Pawleys Island Branch |

| Coastal Federal Town Center |

| 11403 Ocean Highway |

| Pawleys Island, SC 29585 |

| 843.205.2020 |

| |

| SayeBrook Branch |

| 201 Chartwell Court |

| Myrtle Beach, SC 29588 |

| 843.205.2024 |

| |

| Shallotte Branch |

| 200 Smith Avenue |

| Shallotte, NC 28470 |

| 843.205.2035 |

| 910.754.6186 |

| |

| Socastee Branch |

| 4801 Socastee Boulevard |

| Myrtle Beach, SC 29575 |

| 843.205.2007 |

| |

| Southport Branch |

| 4956-1 Long Beach Road SE |

| Southport, NC 28461 |

| 843.205.2032 |

| 910.454.4173 |

| |

| Stephens Crossroads Branch |

| 2496 Highway 9 East |

| Highways 9 and 57 |

| Little River, SC 29566 |

| 843.205.2013 |

| |

| Sunset Beach Branch |

| 1625 Seaside Road SW |

| Sunset Beach, NC 28468 |

| 843.205.2012 |

| 910.579.8160 |

|

| Surfside Branch |

| 112 Highway 17 South |

| & Glenns Bay Road |

| Surfside Beach, SC 29575 |

| 843.205.2003 |

| |

| Waccamaw Medical Park Branch |

| 112 Waccamaw Medical Park Drive |

| Conway, SC 29526 |

| 843.205.2009 |

| |

| 38th Avenue Branch (BI-LO) |

| 1245 38th Avenue North |

| Myrtle Beach, SC 29577 |

| 843.205.2041 |

| |

| Wilmington Branch |

| 4320 17th Street Extension |

| Wilmington, NC 28412 |

| 843.205.2034 |

| 910.392.2265 |

| |

| Wilmington Branch |

| 5710 Oleander Drive, Suite 209 |

| Wilmington, NC 28403 |

| 843.205.2031 |

| 910.313.1161 |

| |

| Wilmington Branch |

| 109 Market Street |

| Wilmington, NC 28401 |

| 843.205.2033 |

| 910.763.2372 |

55

Corporate Information

Common Stock and Dividend Information

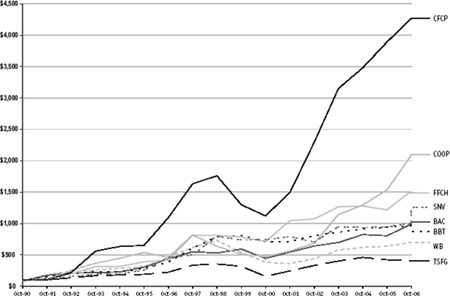

The common stock of Coastal Financial Corporation is quoted through the Nasdaq Stock Market under the symbol CFCP. For information contact the Stockholder Relations office.

As of November 30, 2006, the Corporation had 1,137 stockholders and 21,701,967 shares of Common Stock outstanding. This does not reflect the number of persons or entities who hold stock in nominee or “street name.”

The Company’s ability to pay dividends depends primarily on the ability of Coastal Federal Bank to pay dividends to the Company. See Notes 14, 15, and 19 of the Notes to Consolidated Financial Statements for further information.

Market Price of Common Stock

The table below reflects the high and low bid stock prices published by Nasdaq for each quarter. Such prices may reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not necessarily represent actual transactions. The prices have been adjusted retroactive to reflect stock dividends.

| | | | | | | | | | |

| | HIGH | | LOW | | CASH | |

| | BID | | BID | | DIVIDEND | |

| | | | | | | | | | |

Fiscal Year 2006: | | | | | | | | | | |

First Quarter | | $ | 15.20 | | $ | 12.75 | | $ | 0.045 | |

Second Quarter | | | 14.50 | | | 12.55 | | | 0.045 | |

Third Quarter | | | 14.12 | | | 12.23 | | | 0.045 | |

Fourth Quarter | | | 13.64 | | | 11.55 | | | — | |

| | | | | | | | | | |

Note: On October 3, 2006, the Company declared a $0.05 per share cash dividend payable November 3, 2006 to stockholders of record as of October 20, 2006. |

| | | | | | | | | | |

Fiscal Year 2005: | | | | | | | | | | |

First Quarter | | $ | 14.39 | | $ | 10.15 | | $ | 0.037 | |

Second Quarter | | | 14.91 | | | 10.18 | | | 0.037 | |

Third Quarter | | | 11.67 | | | 10.52 | | | 0.041 | |

Fourth Quarter | | | 11.84 | | | 10.65 | | | 0.041 | |

|

Form 10-K | | | | | | | | | | |

A copy of Coastal Financial Corporation’s Annual Report on Form 10-K, as filed with the Securities Exchange Commission for the year ended September 30, 2006, may be obtained or viewed on www.coastalfederal.com by clicking on Investor Services.

Annual Meeting of Stockholders

The Annual Meeting of Stockholders of Coastal Financial Corporation will be held at Ocean Reef Resort, 7100 North Ocean Boulevard, Myrtle Beach, South Carolina, on Monday, January 29, 2007 at 2:00 p.m., Eastern Standard Time.

Additional Information

If you are receiving duplicate mailing of stockholder reports due to multiple accounts, we can consolidate the mailings without affecting your account registration. To do this, or for additional information, contact the Stockholder Relations Office, at the Corporate address shown below.

|

Corporate Offices |

Coastal Financial Corporation |

2619 Oak Street |

Myrtle Beach, South Carolina 29577 |

843.205.2000 |

|

Transfer Agent and Registrar |

Registrar and Transfer Company |

P.O. Box 1010 |

Cranford, NJ 07016 |

1.800.866.1340 Ext. 2514 |

|

Independent Registered Public Accounting Firm |

KPMG LLP |

150 Fayetteville Street Mall |

Suite 1200 |

Raleigh, NC 27601 |

|

Special Counsel |

Muldoon Murphy & Aguggia LLP |

5101 Wisconsin Avenue |

Washington, DC 20016 |

|

Stockholder Relations Officer |

Susan J. Cooke |

Coastal Financial Corporation |

2619 Oak Street |

Myrtle Beach, South Carolina 29577 |

843.205.2000 |

Coastal Financial Corporation is an equal opportunity employer and pledges equal opportunities without regard to religion, citizenship, race, color, creed, sex, age, national origin, disability or status as a disabled or Vietnam-Era veteran.

| | |

| | Securities and investment advisory services offered exclusively through Raymond James Financial Services, Inc., member NASD/SIPC, an independent broker/dealer, and are not insured by the FDIC or any other bank insurance, are not deposits or obligations of the bank, are not guaranteed by the bank, and are subject to risk, including the possible loss of principal. |

| |

| | Coastal Investor Services is a division of Coastal Federal Bank. |

56