Year End 2013 Earnings Conference Call February 14, 2014 EXHIBIT 99.3

Safe Harbor Statement 2 The information contained herein is as of the date of this presentation. Many factors may impact forward-looking statements including, but not limited to, the following: impact of regulation by the FERC, MPSC, NRC and other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals or new legislation; impact of electric and natural gas utility restructuring in Michigan, including legislative amendments and Customer Choice programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation and thefts of electricity and natural gas and high levels of uncollectible accounts receivable; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; health, safety, financial, environmental and regulatory risks associated with ownership and operation of nuclear facilities; changes in the cost and availability of coal and other raw materials, purchased power and natural gas; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; volatility in the short-term natural gas storage markets impacting third- party storage revenues; volatility in commodity markets impacting the results of our energy trading operations; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant construction projects; changes in and application of federal, state and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; the cost of protecting assets against, or damage due to, terrorism or cyber attacks; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy and other business issues; binding arbitration, litigation and related appeals; and the risks discussed in our public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause our results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward- looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This presentation should also be read in conjunction with the “Forward-Looking Statements” sections in each of DTE Energy’s and DTE Electric’s 2012 Forms 10-K and 2013 Forms 10-Q (which sections are incorporated herein by reference), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric.

Participants • Gerry Anderson – Chairman and CEO • Peter Oleksiak – Senior Vice President and CFO • Anastasia Minor – Executive Director, Investor Relations 3

• 2013 Accomplishments • Long-Term Growth Update • Financial Update 4

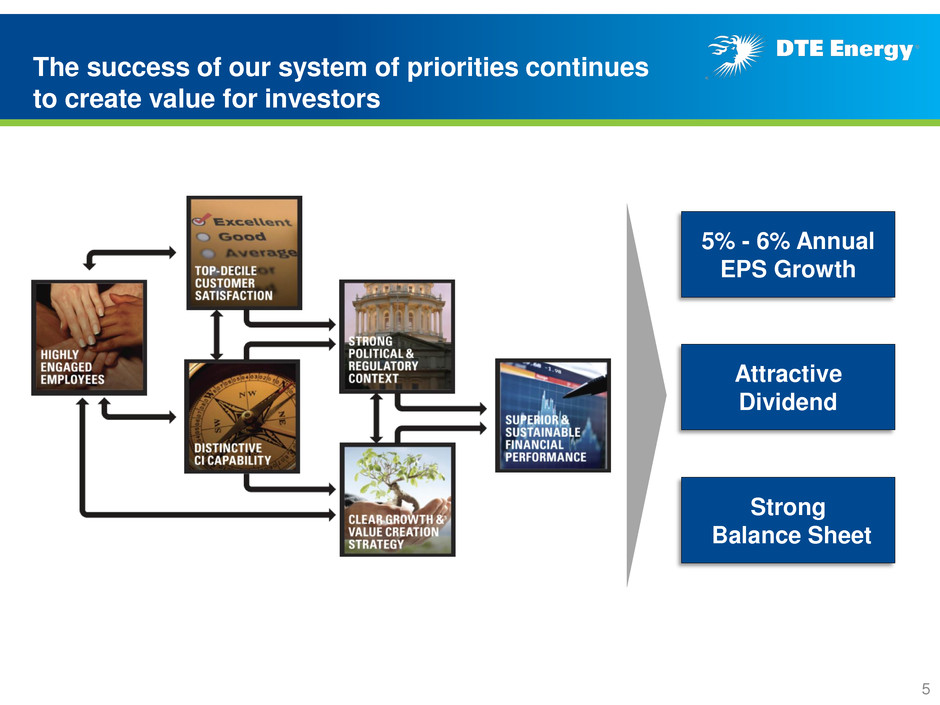

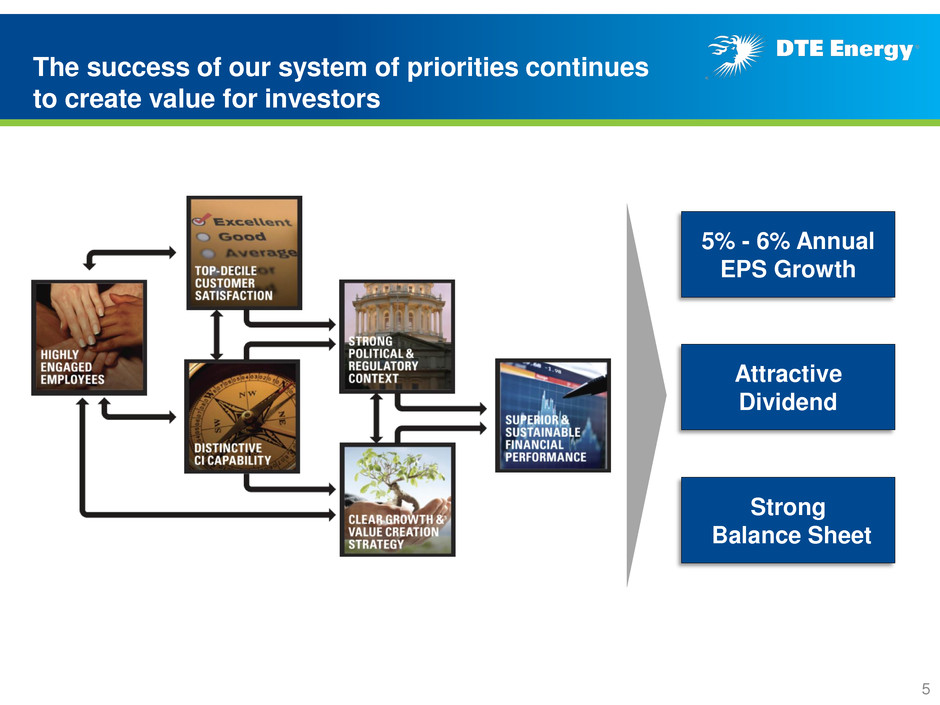

The success of our system of priorities continues to create value for investors 5% - 6% Annual EPS Growth Attractive Dividend Strong Balance Sheet 5

2013 Accomplishments • Distinctive Continuous Improvement (CI) capability o O&M expense at 2003 levels o CI program recognized by London Process Excellence Network o Reduced renewable energy surcharge 85% due to operational efficiencies Continuous Improvement Employee Engagement Customer Satisfaction • Higher employee engagement o Seventh consecutive year of improved Gallup scores – moved from 78th to 85th percentile* in 2013 o Received Gallup Great Workplace Award o Achieved best safety record in DTE’s history • Both utilities top quartile in J.D. Power customer satisfaction rankings** • Reduced complaints to the Michigan Public Service Commission (MPSC) by over 60% since 2006 • Incremental $50 million investment in system reliability * Source: 2013 Gallup Overall Company Ranking ** Source: J.D. Power and Associates 2013 Gas/Electric Utility Residential Customer Satisfaction StudySM 6

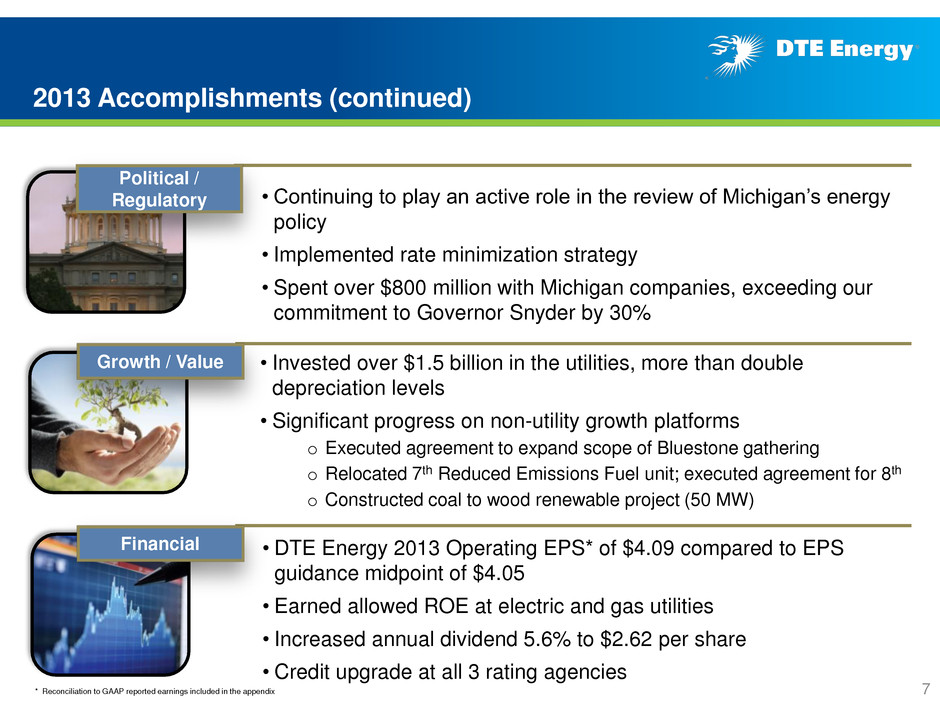

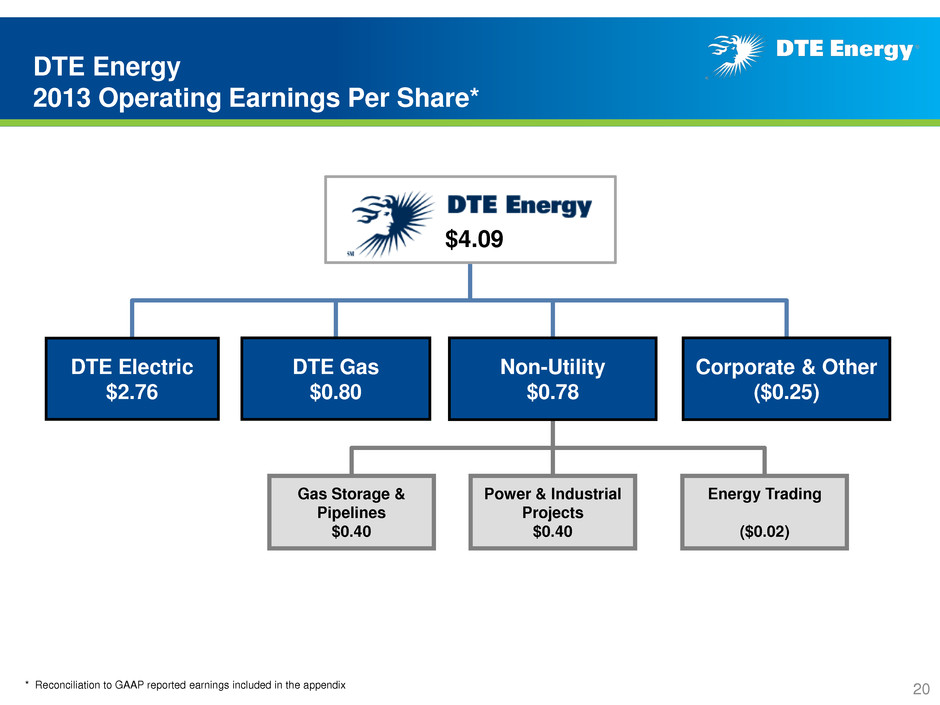

Financial Growth / Value • DTE Energy 2013 Operating EPS* of $4.09 compared to EPS guidance midpoint of $4.05 • Earned allowed ROE at electric and gas utilities • Increased annual dividend 5.6% to $2.62 per share • Credit upgrade at all 3 rating agencies • Invested over $1.5 billion in the utilities, more than double depreciation levels • Significant progress on non-utility growth platforms o Executed agreement to expand scope of Bluestone gathering o Relocated 7th Reduced Emissions Fuel unit; executed agreement for 8th o Constructed coal to wood renewable project (50 MW) Political / Regulatory • Continuing to play an active role in the review of Michigan’s energy policy • Implemented rate minimization strategy • Spent over $800 million with Michigan companies, exceeding our commitment to Governor Snyder by 30% 2013 Accomplishments (continued) * Reconciliation to GAAP reported earnings included in the appendix 7

• 2013 Accomplishments • Long-Term Growth Update • Financial Update 8

2008A 2009A 2010A 2011A 2012A 2013A 2014E 2015E 2016E 2017E 2018E $3.33 $4.09 $3.75 $3.64 $2.12 $2.24 $2.35 $2.48 $2.12 * Reconciliation to GAAP reported earnings included in the appendix We remain committed to delivering 5% to 6% operating EPS* growth (dollars) Operating EPS* 7.2% CAGR 2008-2014 Dividend per share 5.4% CAGR 2009-2013 (Annualized) $2.83 $3.94 $4.30 Guidance Midpoint Aspiration of over $1 billion in operating earnings by 2018 $2.62 9

DTE Energy has many catalysts for strong future growth opportunities Constructive REGULATORY environment Michigan’s economic recovery Long-term non-utility growth Long-term utility growth 10

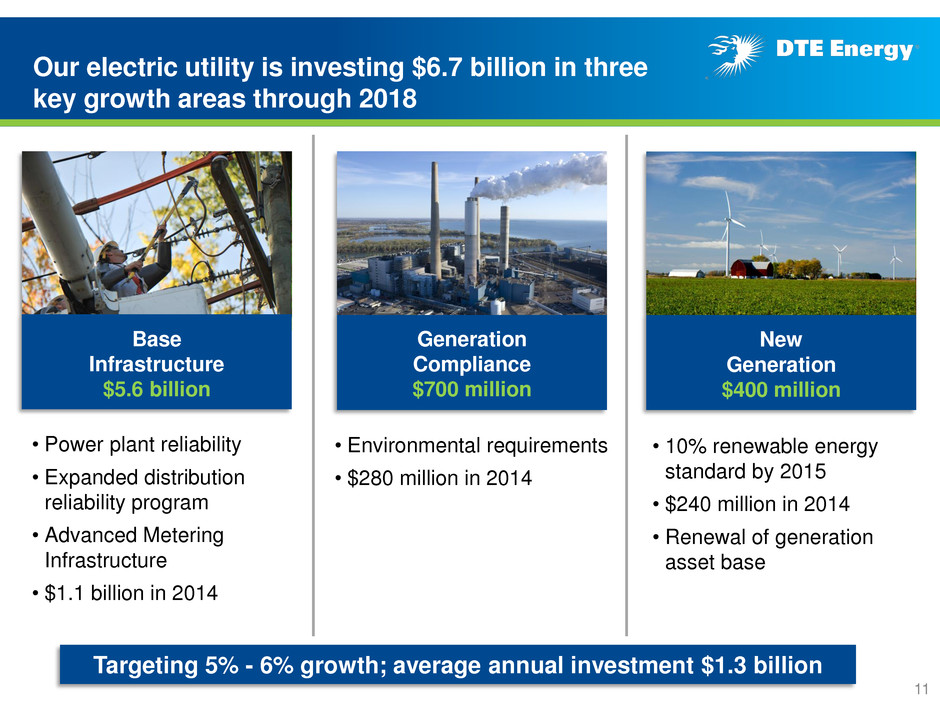

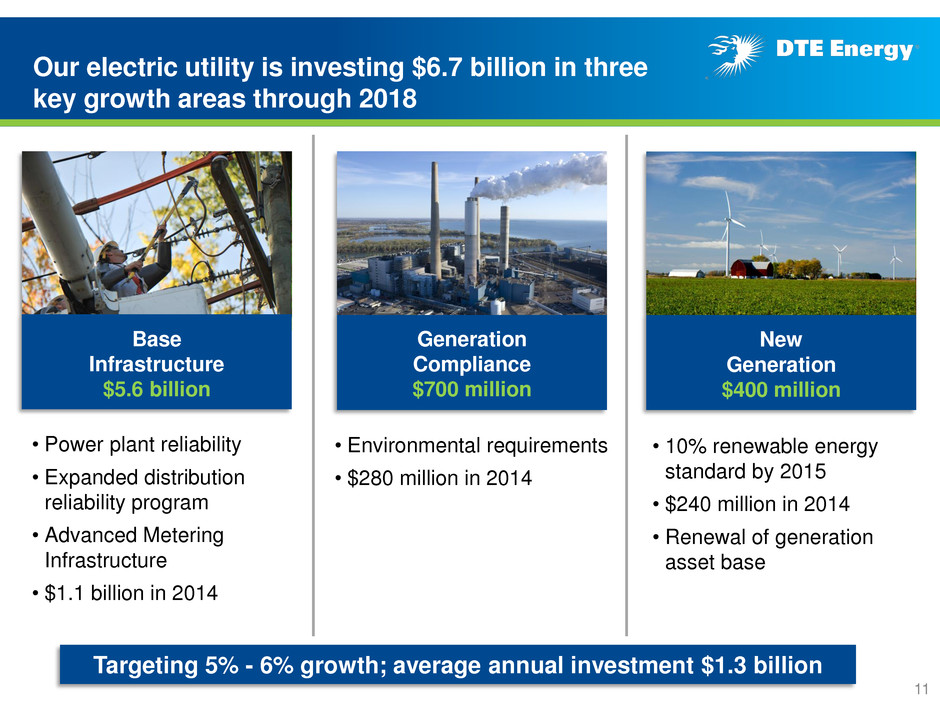

Our electric utility is investing $6.7 billion in three key growth areas through 2018 • Environmental requirements • $280 million in 2014 • Power plant reliability • Expanded distribution reliability program • Advanced Metering Infrastructure • $1.1 billion in 2014 • 10% renewable energy standard by 2015 • $240 million in 2014 • Renewal of generation asset base Base Infrastructure $5.6 billion Generation Compliance $700 million New Generation $400 million Targeting 5% - 6% growth; average annual investment $1.3 billion 11

Our gas utility is making $1.2 billion of reliability and pipeline integrity investments through 2018 • Capital recovered through the Infrastructure Recovery Mechanism • ~4,000 miles of distribution main to be replaced • $90 million investment in 2014 • Strengthen and expand distribution system • Continued long-term investment in infrastructure • $150 million investment in 2014 Targeting 5% - 6% growth Main Renewal, Meter Move-Out & Pipeline Integrity $500 million Base Infrastructure $700 million 12

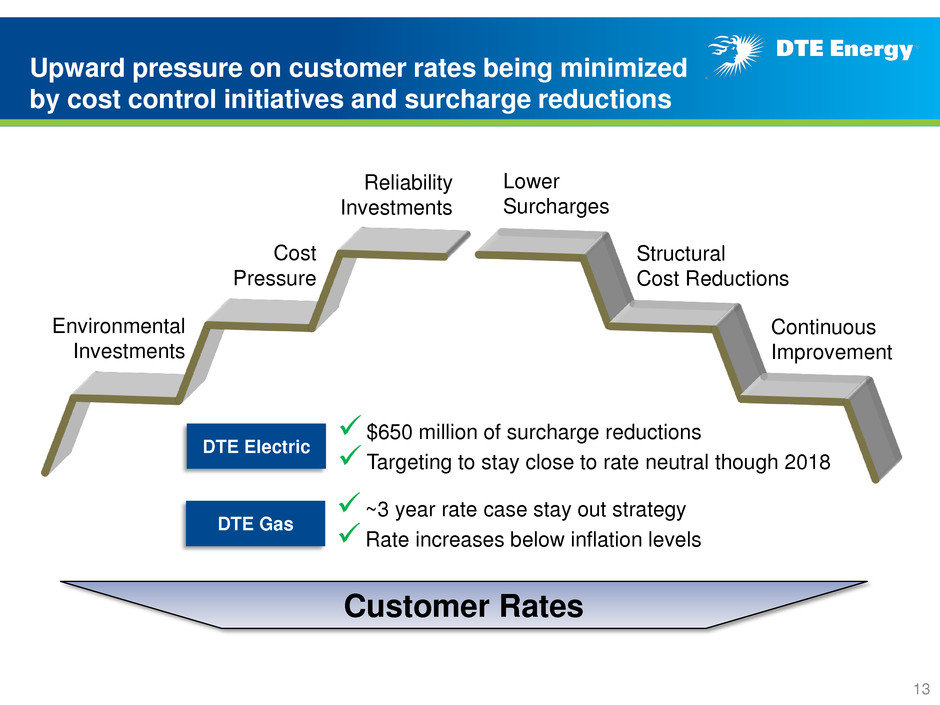

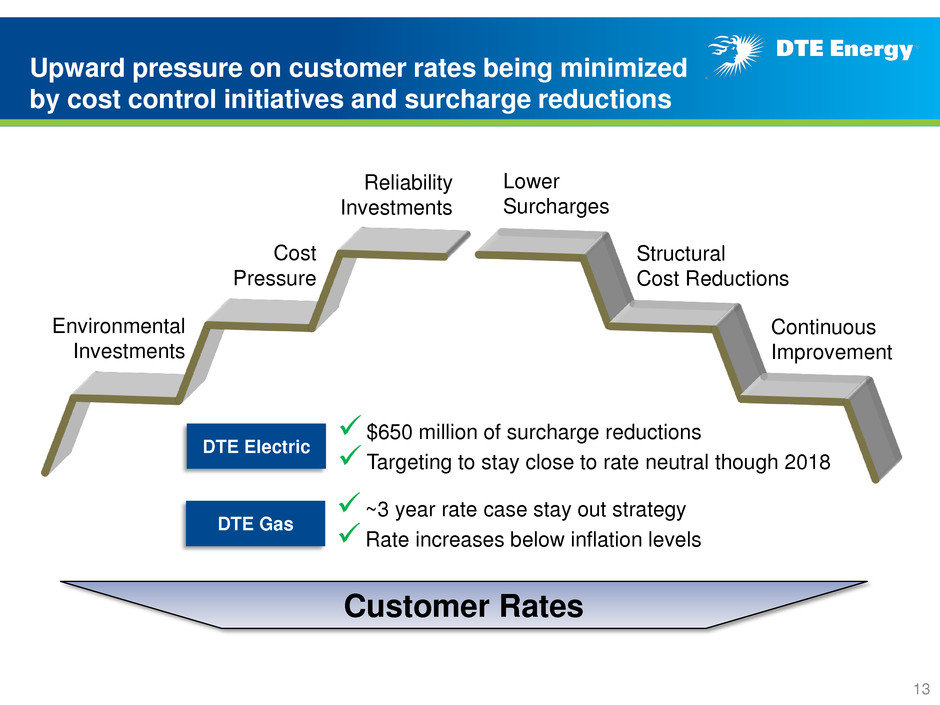

Upward pressure on customer rates being minimized by cost control initiatives and surcharge reductions Lower Surcharges Structural Cost Reductions Continuous Improvement Reliability Investments Cost Pressure Environmental Investments Customer Rates $650 million of surcharge reductions Targeting to stay close to rate neutral though 2018 DTE Electric ~3 year rate case stay out strategy Rate increases below inflation levels DTE Gas 13

Gas Storage & Pipelines is developing an asset portfolio with multiple growth platforms Pipeline Gathering Storage 14

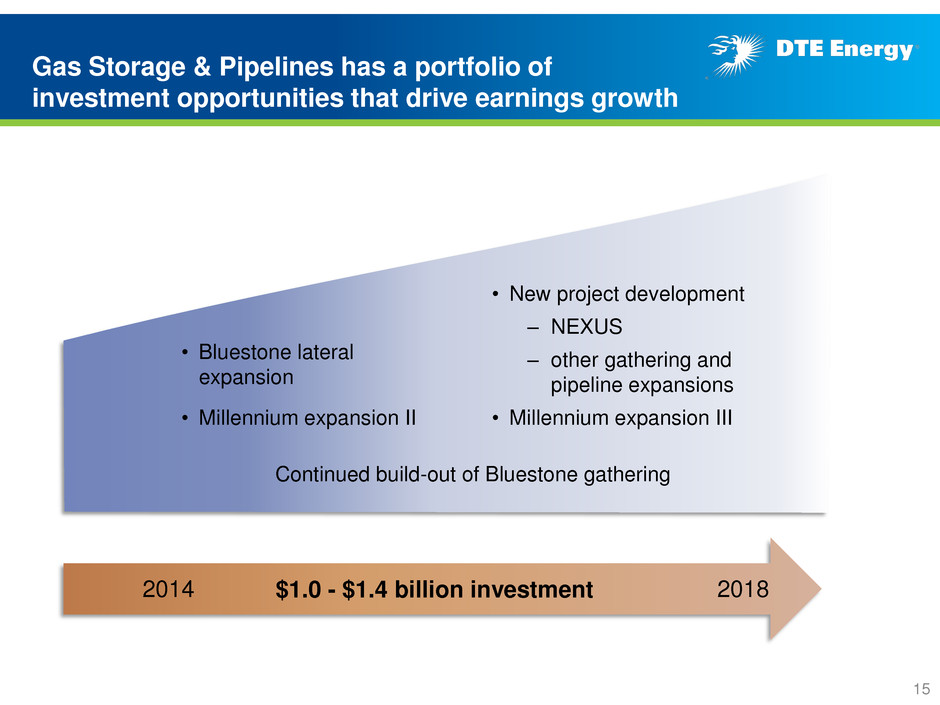

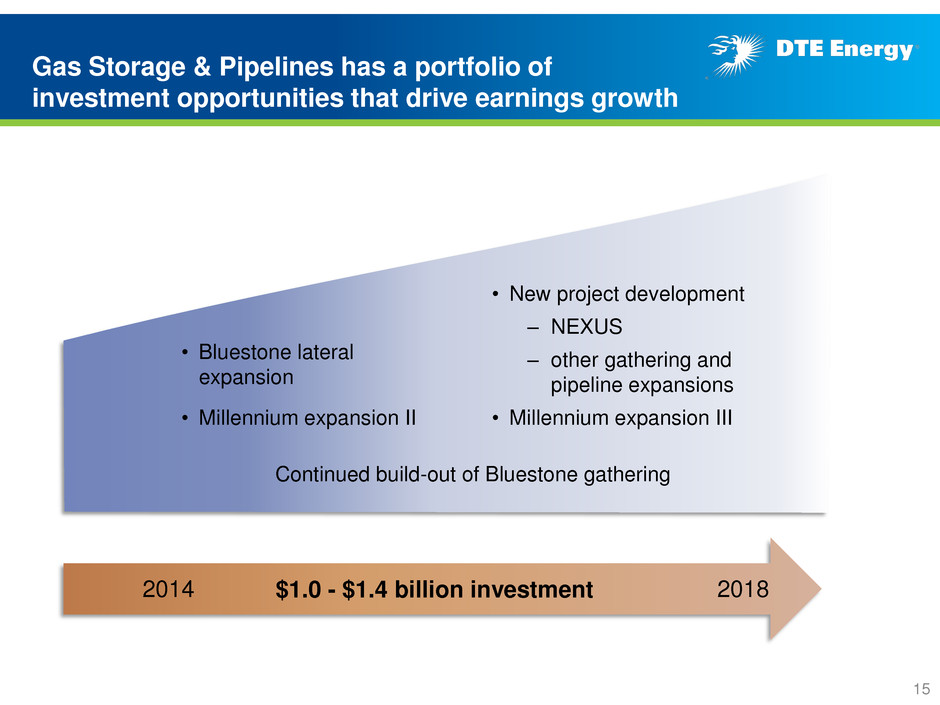

Gas Storage & Pipelines has a portfolio of investment opportunities that drive earnings growth • Bluestone lateral expansion • Millennium expansion II Continued build-out of Bluestone gathering • New project development ‒ NEXUS ‒ other gathering and pipeline expansions • Millennium expansion III 2014 2018 $1.0 - $1.4 billion investment 15

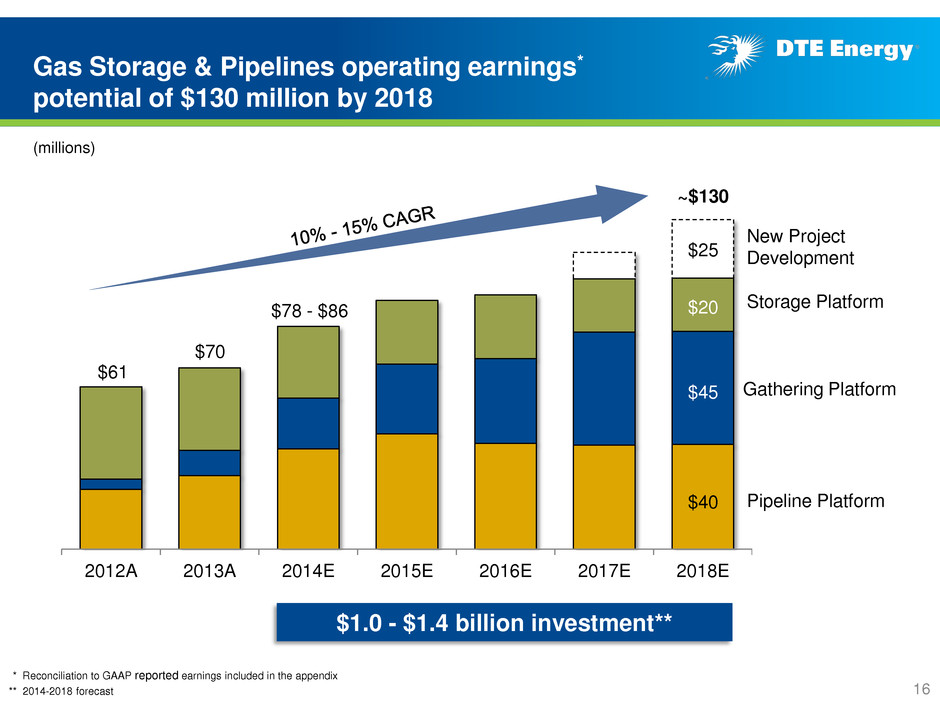

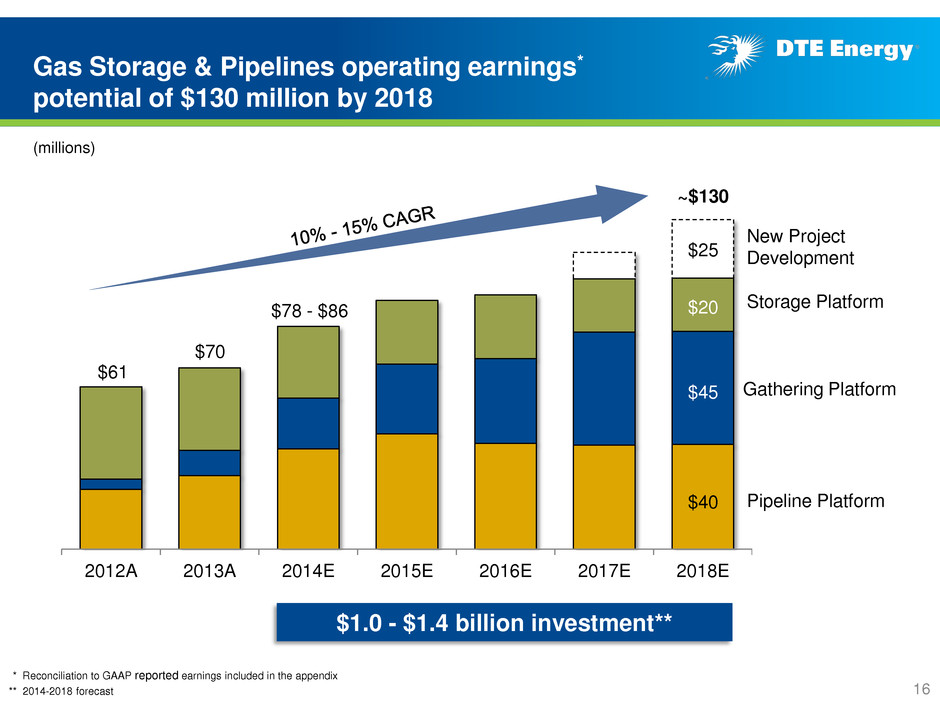

2012A 2013A 2014E 2015E 2016E 2017E 2018E $78 - $86 Gas Storage & Pipelines operating earnings* potential of $130 million by 2018 * Reconciliation to GAAP reported earnings included in the appendix (millions) Pipeline Platform Gathering Platform Storage Platform New Project Development $1.0 - $1.3 billion investment $70 ~$130 $40 $45 $20 $25 $1.0 - $1.4 billion investment** 16 $61 ** 2014-2018 forecast

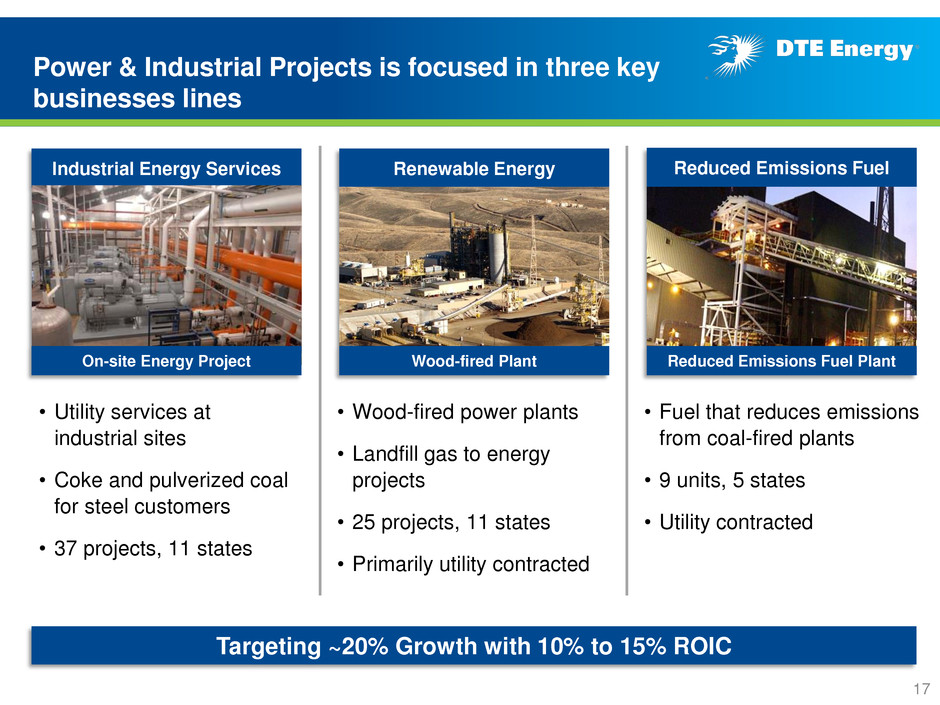

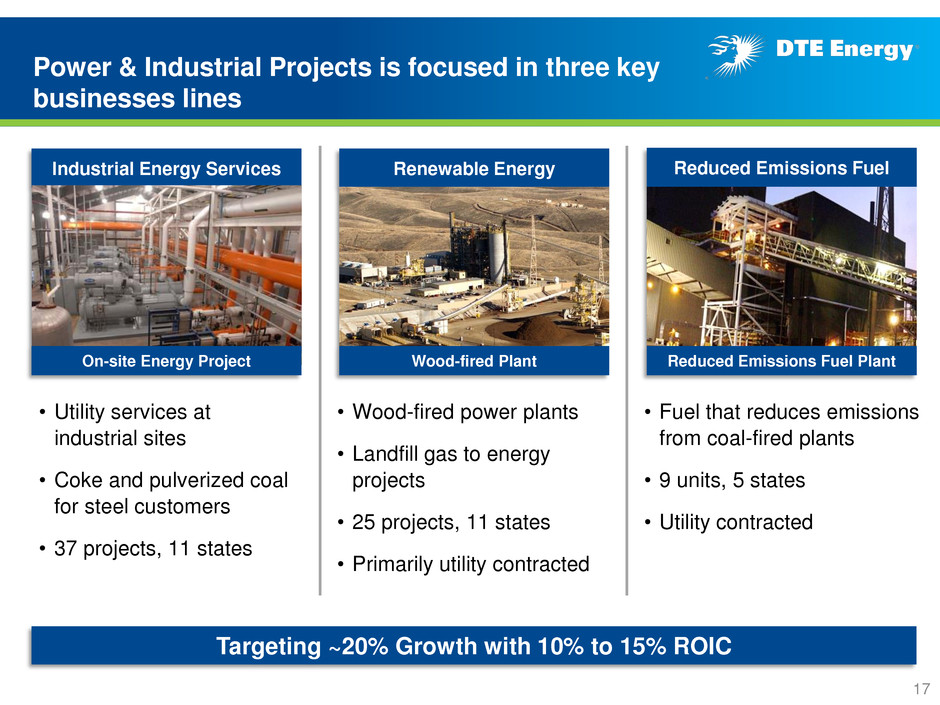

Power & Industrial Projects is focused in three key businesses lines Wood-fired Plant Cassville, WI • Fuel that reduces emissions from coal-fired plants • 9 units, 5 states • Utility contracted • Utility services at industrial sites • Coke and pulverized coal for steel customers • 37 projects, 11 states • Wood-fired power plants • Landfill gas to energy projects • 25 projects, 11 states • Primarily utility contracted Targeting ~20% Growth with 10% to 15% ROIC Industrial Energy Services On-site Energy Project Renewable Energy Wood-fired Plant Reduced Emissions Fuel Reduced Emissions Fuel Plant 17

2012A 2013A 2014E 2015E 2016E 2017E 2018E Power & Industrial Projects is targeting $155 million of operating earnings* by 2018 through growth in each of its business lines ~$155 (millions) $35 $70 $85 ($65) $30 $70 New Project Development / Acquisitions Renewable Energy Reduced Emissions Fuel Industrial Energy Services Corporate allocations, interest, overheads $75 - $85 $600 - $800 million investment** 18 $52 * Reconciliation to GAAP reported earnings included in the appendix ** 2014-2018 forecast

• 2013 Accomplishments • Long-Term Growth Update • Financial Update 19

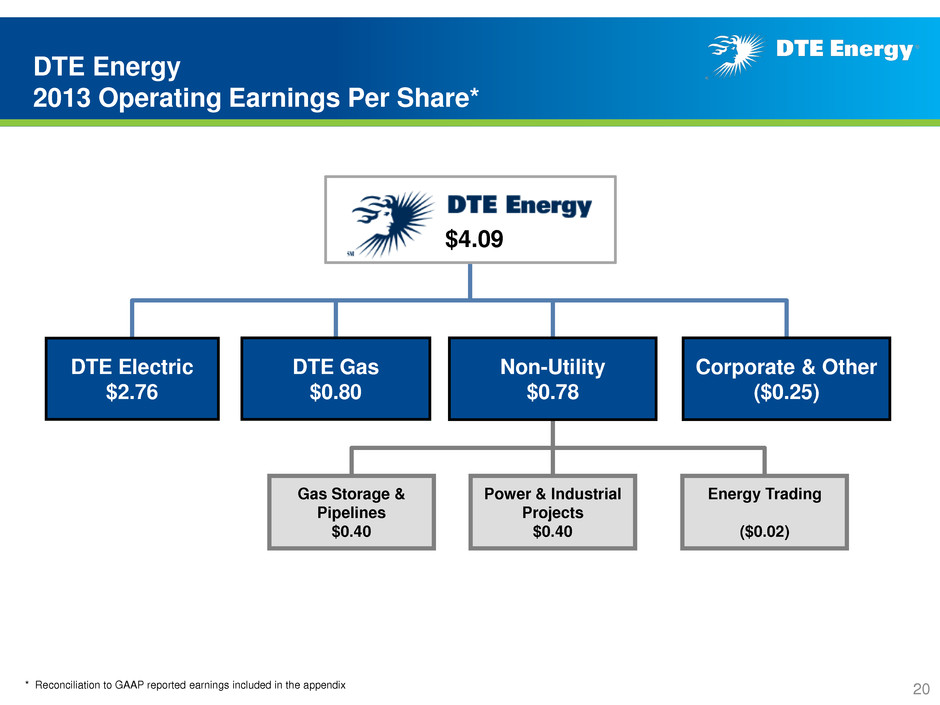

DTE Energy 2013 Operating Earnings Per Share* Gas Storage & Pipelines $0.40 Power & Industrial Projects $0.40 * Reconciliation to GAAP reported earnings included in the appendix Energy Trading ($0.02) Corporate & Other ($0.25) DTE Gas $0.80 Non-Utility $0.78 DTE Electric $2.76 $4.09 20

DTE Electric 483$ 484$ 1$ DTE Gas 115 143 28 Gas Storage & Pipelines 61 70 9 Power & Industrial Projects 52 70 18 Energy Trading 12 (3) (15) Corporate & Other (47) (44) 3 DTE Energy 676$ 720$ 44$ Operating EPS 3.94$ 4.09$ 0.15$ Avg. Shares Outstanding 172 175 DTE Energy 2013 Operating Earnings Variance Operating Earnings* (millions, except EPS) 2012 2013 Change * Reconciliation to GAAP reported earnings included in the appendix DTE Electric • Return to near normal weather in 2013 and higher storm expense, offset by lower benefits expense and increased temperature normal sales volumes DTE Gas • Higher due to colder weather in 2013 Non-Utility • Gas Storage & Pipelines driven by growth across the pipeline platforms, partially offset by lower storage earni gs • Power & Industrial Projects higher due to earnings for Reduced Emissions Fuel and on-site energy project portfolio acquisition in 4Q 2012 • Energy Trading lower due to timing related items Corporate & Other • Favorable due to lower taxes and interest expense Drivers 21

Energy Trading mark-to-market (MTM) operating earnings adjustment is timing related and will substantially reverse in 2014 (millions) * Subject to changes in market prices ** Majority of 2014 reversal occurs in 1Q 22 MTM timing reverses when contracts settle* • Operating adjustment pertains to pipeline contracts in the Northeast that are economically hedged • The accounting for these transactions requires two of the three components to be marked-to-market causing a misalignment during a period of sharp natural gas price increases • Over the life of these multi-year transactions, cash, economic income and accounting income are equivalent $55 2013 MTM Operating Adjustment 2014 Reversal** 2015 Reversal ($40) ($15) Producer Pipeline Customer Mark-to- market No mark-to- market Mark-to- market Components of natural gas sale transaction

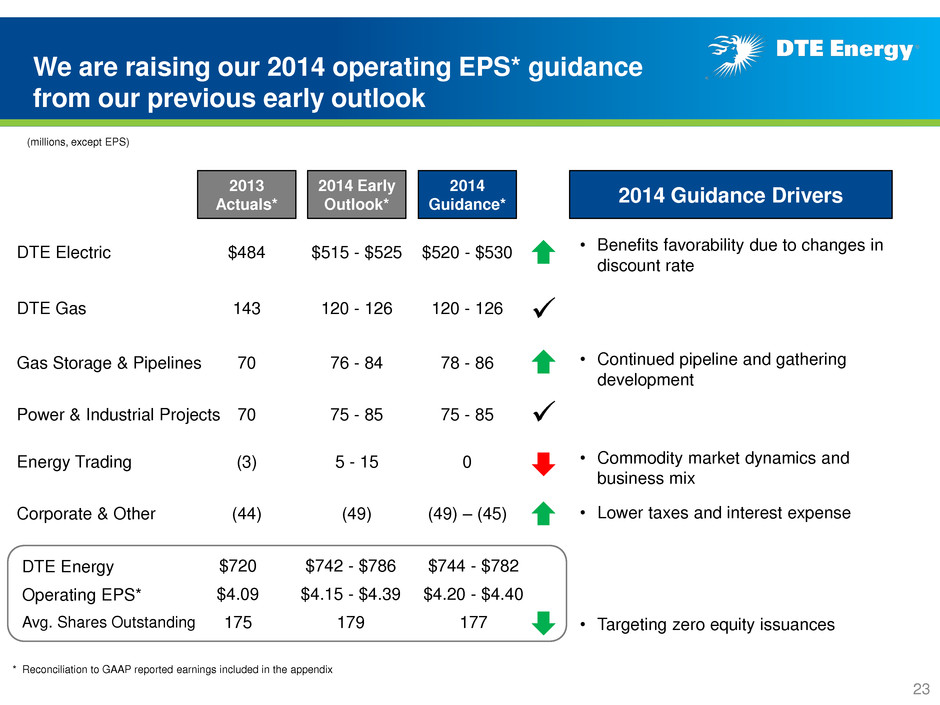

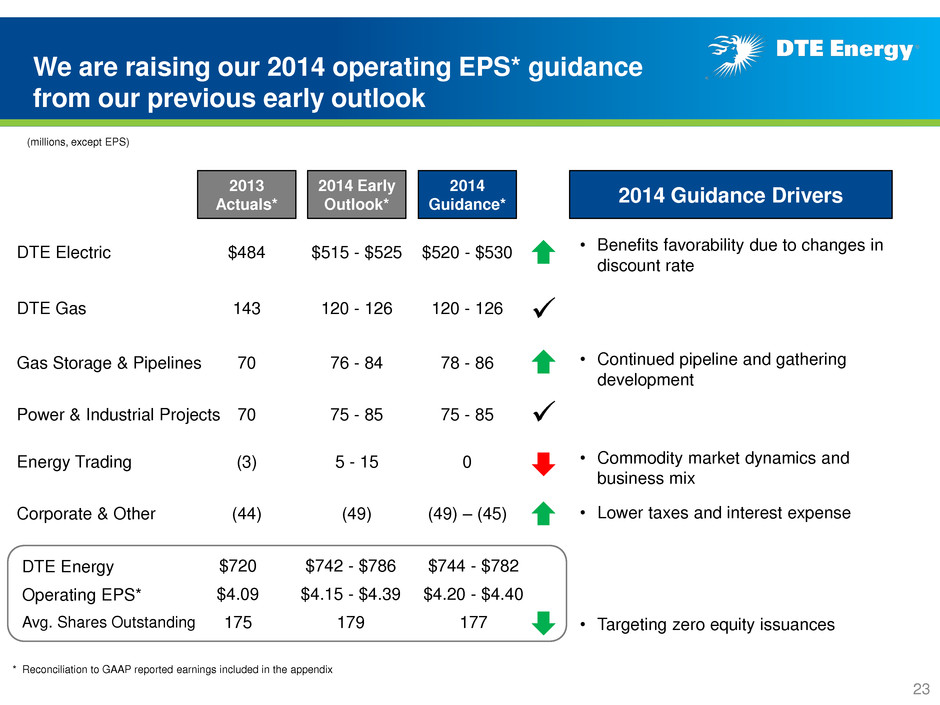

We are raising our 2014 operating EPS* guidance from our previous early outlook 2014 Guidance Drivers 2014 Early Outlook* (millions, except EPS) DTE Electric $484 $515 - $525 DTE Gas 143 120 - 126 Gas Storage & Pipelines 70 76 - 84 Power & Industrial Projects 70 75 - 85 Energy Trading (3) 5 - 15 Corporate & Other (44) (49) DTE Energy Operating EPS* Avg. Shares Outstanding $720 $4.09 175 $742 - $786 $4.15 - $4.39 179 $744 - $782 $4.20 - $4.40 177 * Reconciliation to GAAP reported earnings included in the appendix • Commodity market dynamics and business mix 2013 Actuals* 2014 Guidance* $520 - $530 120 - 126 78 - 86 75 - 85 0 (49) – (45) • Benefits favorability due to changes in discount rate • Continued pipeline and gathering development • Lower taxes and interest expense • Targeting zero equity issuances 23

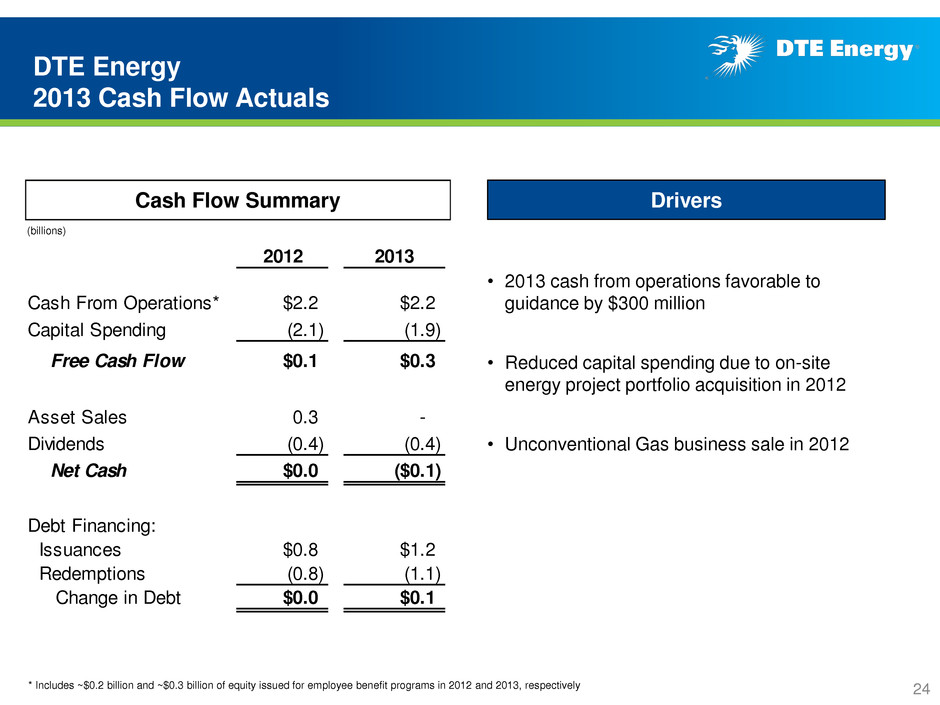

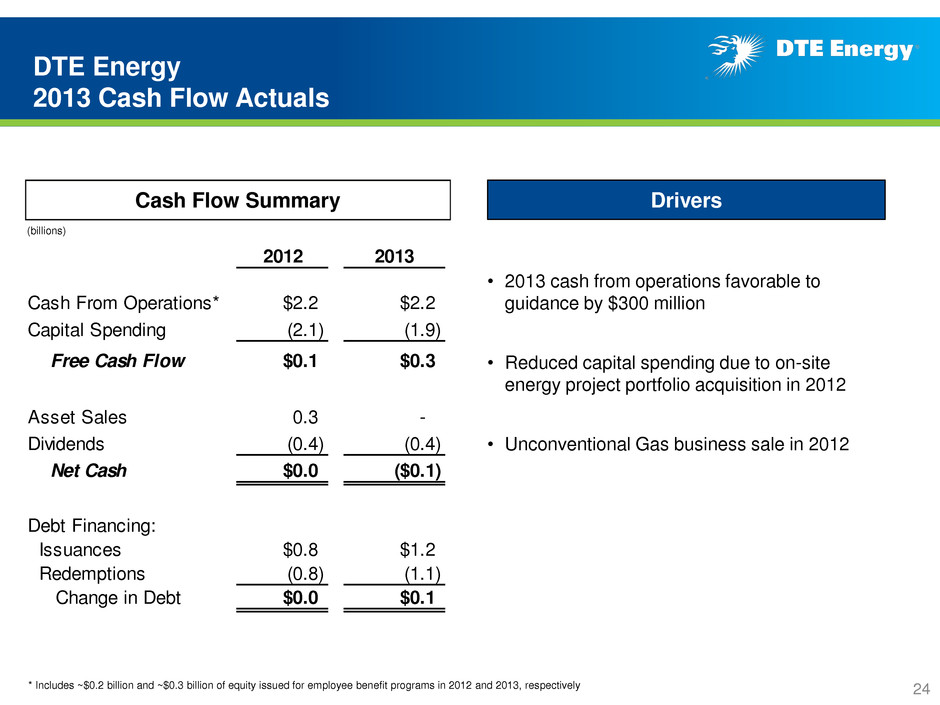

2012 2013 Cash From Operations* $2.2 $2.2 Capital Spending (2.1) (1.9) Free Cash Flow $0.1 $0.3 Asset Sales 0.3 - Dividends (0.4) (0.4) Net Cash $0.0 ($0.1) Debt Financing: Issuances $0.8 $1.2 Redemptions (0.8) (1.1) Change in Debt $0.0 $0.1 DTE Energy 2013 Cash Flow Actuals Cash Flow Summary (billions) • 2013 cash from operations favorable to guidance by $300 million • Reduced capital spending due to on-site energy project portfolio acquisition in 2012 • Unconventional Gas business sale in 2012 Drivers * Includes ~$0.2 billion and ~$0.3 billion of equity issued for employee benefit programs in 2012 and 2013, respectively 24

2013 2014 Actual Guidance Cash From Operations* $2.2 $1.6 Capital Spending (1.9) (2.3) Free Cash Flow $0.3 ($0.7) Asset Sales - - Dividends (0.4) (0.5) Net Cash ($0.1) ($1.2) Debt Financing: Issuances $1.2 $2.1 Redemptions (1.1) (0.9) Change in Debt $0.1 $1.2 DTE Energy 2014 Cash Flow Guidance Cash Flow Summary (billions) * Includes ~$0.3 billion and $0 of equity issued for employee benefit programs in 2013 and 2014, respectively • 2014 cash from operations decreases due to lower utility surcharge collections than 2013 and higher cash contributions to employee benefit plans • Capital expenditures higher due to increased environmental and renewable energy spending at DTE Electric and growth spending at the non-utilities Drivers 25

2013 2014E * Debt excludes securitization, a portion of DTE Gas’ short-term debt, and considers 50% of the Junior Subordinated Notes as equity Leverage* Funds from Operations / Debt* 2013 2014E 49% 52% Target 50% - 52% 23% 22% Target 20% - 22% Strong balance sheet remains a key priority and supports growth • Targeting zero equity issuances in 2014 – Annual issuances of $200 million to $300 million in 2015 and 2016 • $1.6 billion of available liquidity as of December 31, 2013 • Recent credit upgrades by all 3 rating agencies – Moody’s upgraded DTE in January 2014 26

Our business strategy is fundamental to how we create value for our investors Utility growth plan driven by environmental and renewable energy investments Meaningful, transparent, low-risk growth opportunities in non-utility businesses provide diversity in earnings and geography Constructive regulatory structure and continued cost savings enable utilities to earn their authorized returns Program in place to achieve operational excellence and customer satisfaction that are distinctive in our industry Maintain 60% - 70% dividend payout target and strong BBB credit rating 5% - 6% Annual EPS Growth Attractive Dividend Strong Balance Sheet 27

Contact Us DTE Energy Investor Relations www.dteenergy.com/investors (313) 235-8030 28

Appendix

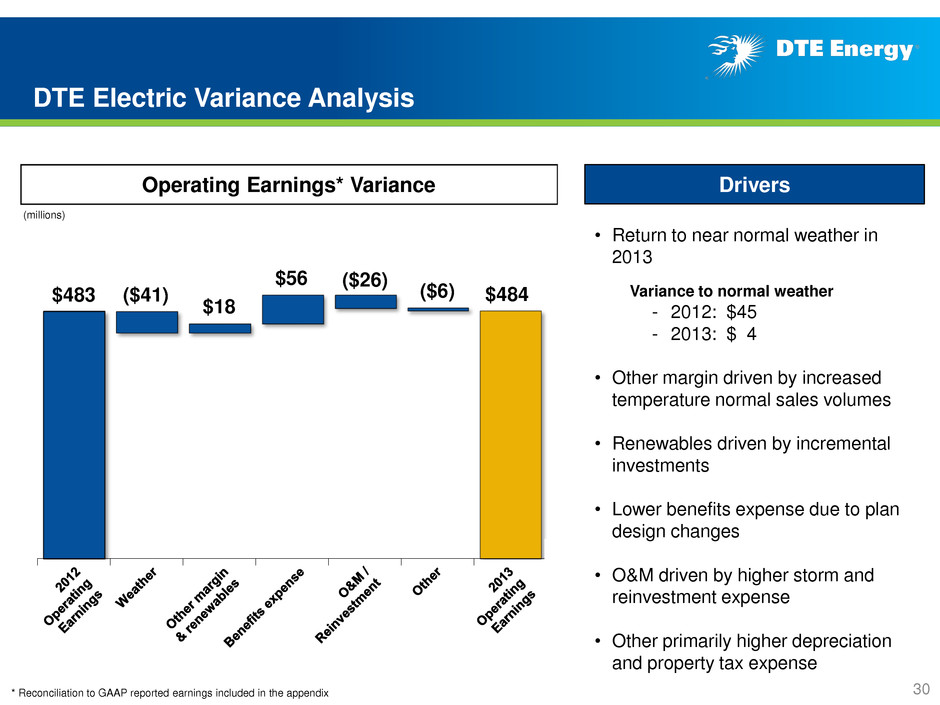

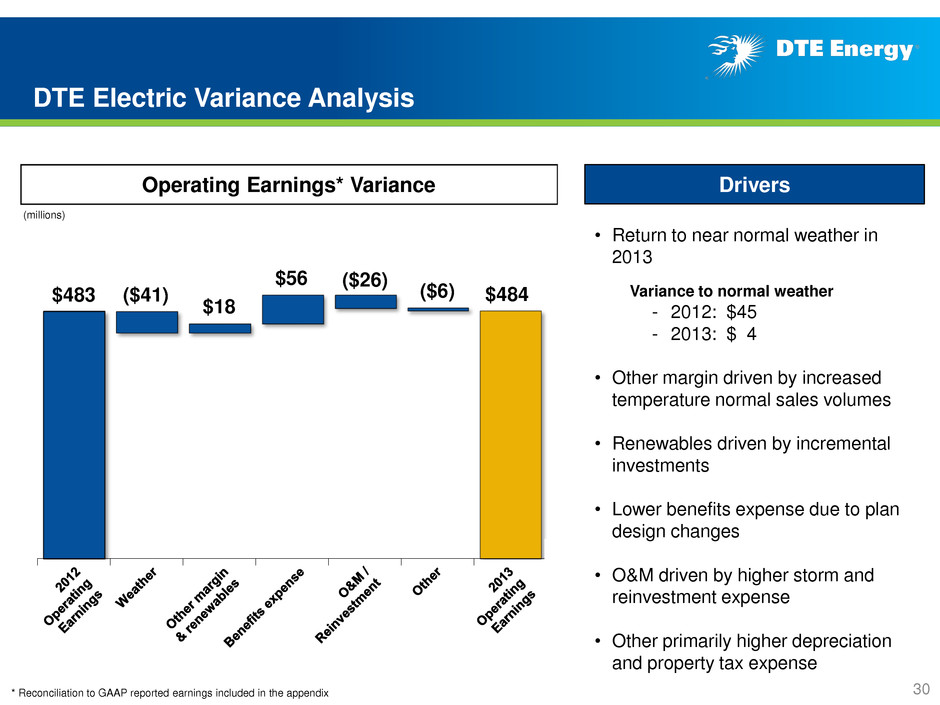

DTE Electric Variance Analysis * Reconciliation to GAAP reported earnings included in the appendix $483 ($41) (millions) ($26) $18 Drivers Operating Earnings* Variance $484 • Return to near normal weather in 2013 Variance to normal weather - 2012: $45 - 2013: $ 4 • Other margin driven by increased temperature normal sales volumes • Renewables driven by incremental investments • Lower benefits expense due to plan design changes • O&M driven by higher storm and reinvestment expense • Other primarily higher depreciation and property tax expense $56 ($6) 30

DTE Gas Variance Analysis * Reconciliation to GAAP reported earnings included in the appendix $115 (millions) • Colder than normal weather in 2013 Variance to normal weather - 2012: ($28) - 2013: $17 • Lower benefits expense due to plan design changes • One-time items include 2012 lean initiatives and 2Q 2012 revenue decoupler true-up • O&M reinvestment in gas distribution reliability projects; other includes higher depreciation and property tax expense $143 Drivers Operating Earnings* Variance $45 ($19) ($10) $12 31

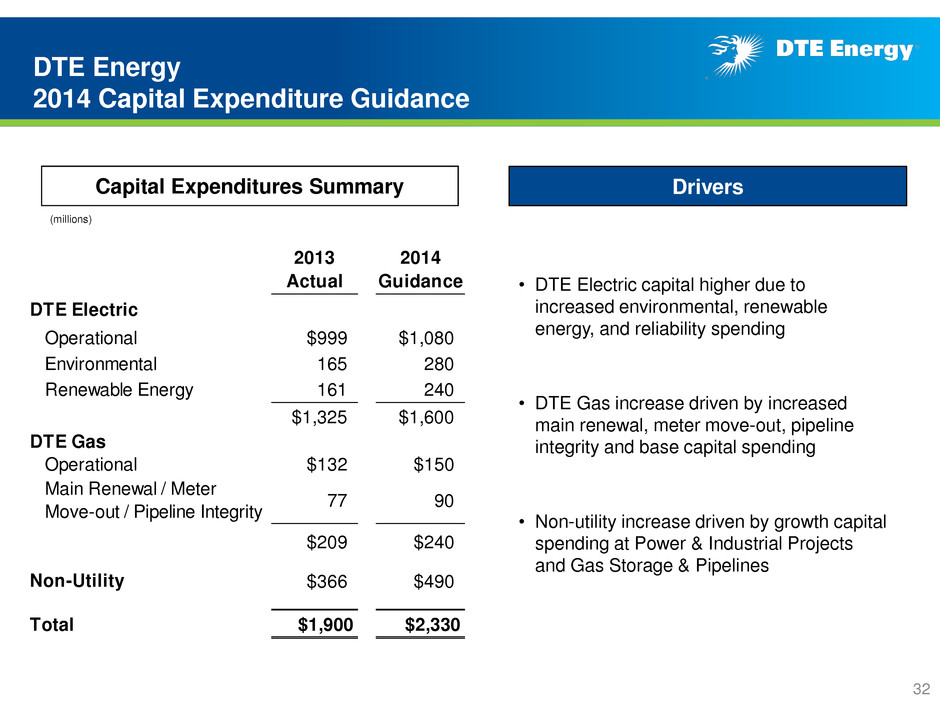

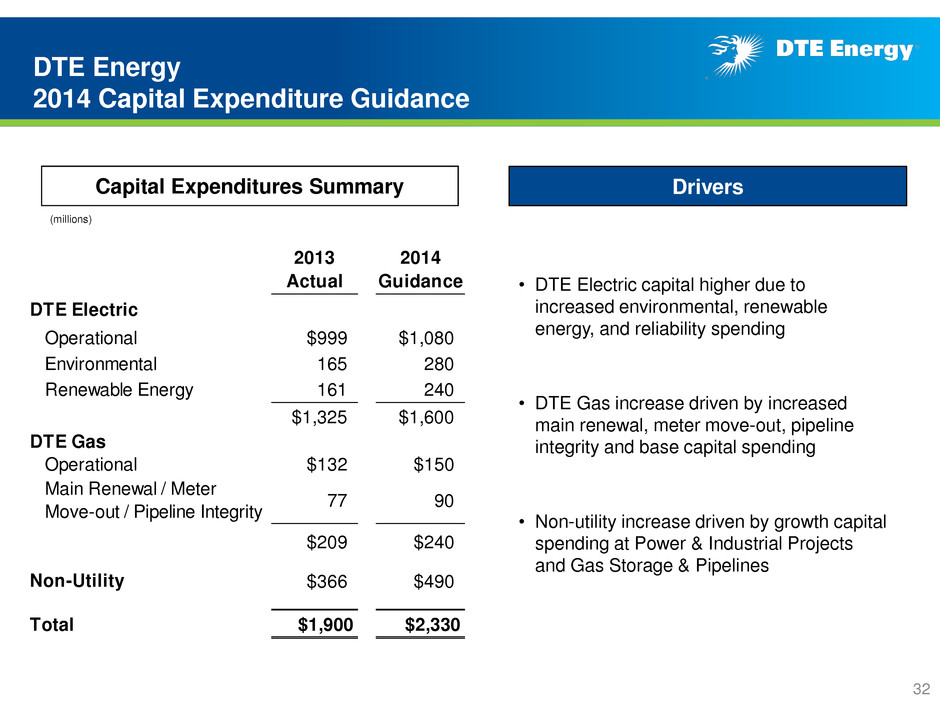

DTE Energy 2014 Capital Expenditure Guidance 2013 2014 Actual Guidance DTE Electric Operational $999 $1,080 Environmental 165 280 Renewable Energy 161 240 $1,325 $1,600 DTE Gas Operational $132 $150 Main Renewal / Meter Move-out / Pipeline Integrity 77 90 $209 $240 $366 $490 Total $1,900 $2,330 Non-Utility Capital Expenditures Summary (millions) • DTE Electric capital higher due to increased environmental, renewable energy, and reliability spending • DTE Gas increase driven by increased main renewal, meter move-out, pipeline integrity and base capital spending • Non-utility increase driven by growth capital spending at Power & Industrial Projects and Gas Storage & Pipelines Drivers 32

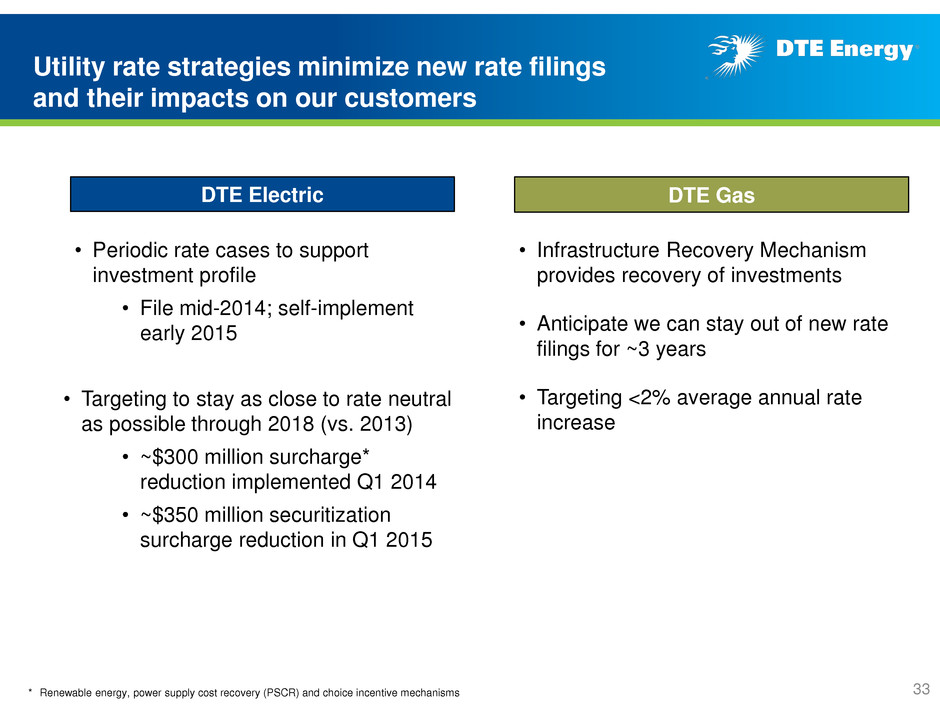

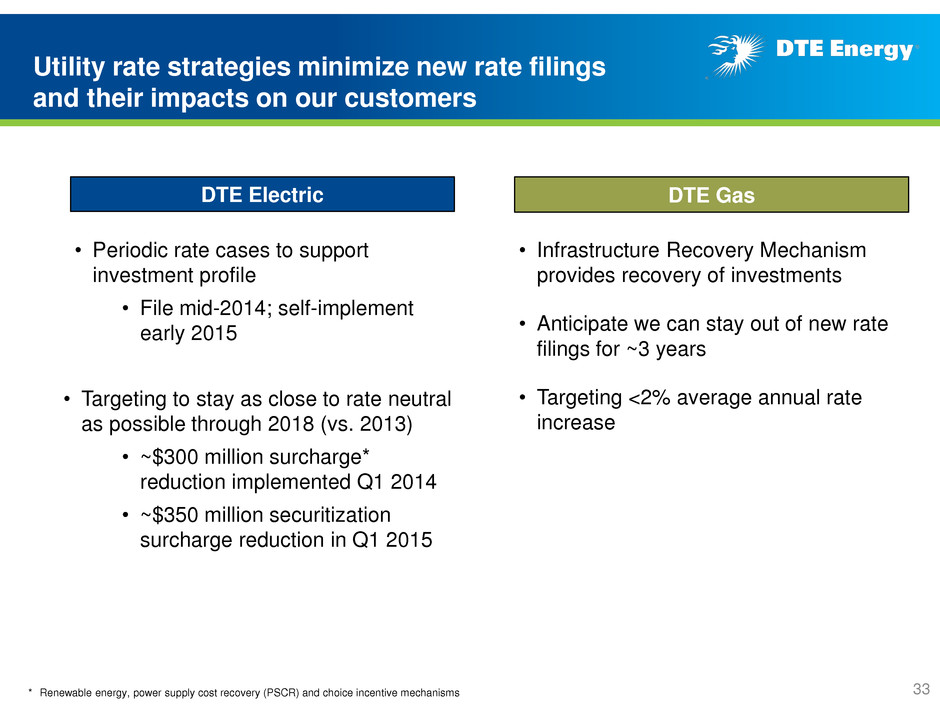

Utility rate strategies minimize new rate filings and their impacts on our customers DTE Electric DTE Gas • Periodic rate cases to support investment profile • File mid-2014; self-implement early 2015 • Targeting to stay as close to rate neutral as possible through 2018 (vs. 2013) • ~$300 million surcharge* reduction implemented Q1 2014 • ~$350 million securitization surcharge reduction in Q1 2015 • Infrastructure Recovery Mechanism provides recovery of investments • Anticipate we can stay out of new rate filings for ~3 years • Targeting <2% average annual rate increase * Renewable energy, power supply cost recovery (PSCR) and choice incentive mechanisms 33

Bluestone Pipeline • 0.6 Bcf/d to Millennium and Tennessee pipelines; 0.3 Bcf/d expansion in 2014 Millennium Pipeline • 1Q 2014 0.3 Bcf/d expansion; total capacity over 0.8 Bcf/d Vector Pipeline • 1.3 Bcf/d from Chicago to Dawn, Ontario Proposed NEXUS Pipeline • 1 Bcf/d from western Marcellus and central / northern Utica shale Bluestone Gathering • Long-term agreement with Southwestern in Marcellus shale Michigan Gathering • Lateral additions ongoing New Developments • Working with interested parties in Marcellus, Utica and Michigan shales Gas Storage & Pipelines platforms drive growth through new projects and expansions Pipeline Platform Bluestone Pipeline Targeting 10% to 15% Growth with 10% to 12% ROIC Michigan Storage • 91 Bcf of working capacity • Strategically located between Chicago and Dawn trading hubs Bluestone Gathering Gathering Platform Washington 10 Storage Platform 34

Pipeline Assets Capacity / d In-Service Millennium Pipeline 0.5 Bcf Expansion #1 and #2 0.3 Bcf 2014 Expansion #3 0.2 - 0.5 Bcf 2016 - 2017 Total Planned Capacity 1.0 - 1.3 Bcf Bluestone Pipeline (bi-directional) 0.6 Bcf Northward Expansion 0.3 Bcf 2014 Total Planned Capacity 0.9 Bcf Vector Pipeline 1.3 Bcf NEXUS-related Expansion TBD 2017+ Total Planned Capacity 1.3 Bcf + Proposed NEXUS Pipeline 1.0 Bcf 2017 Gas Storage & Pipelines assets have expansion opportunities to accommodate increased demand 35

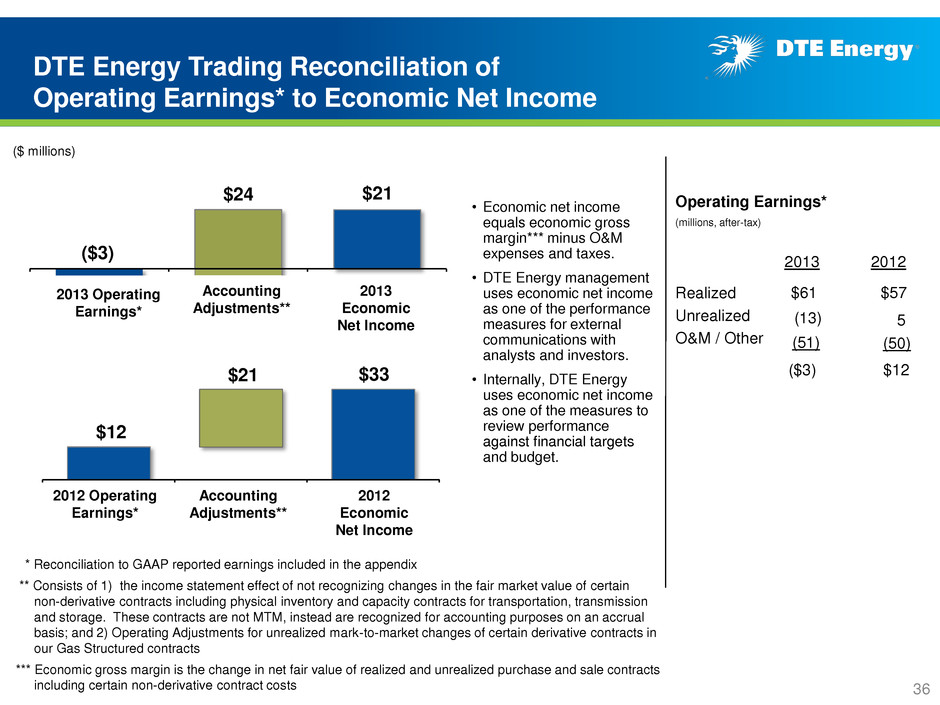

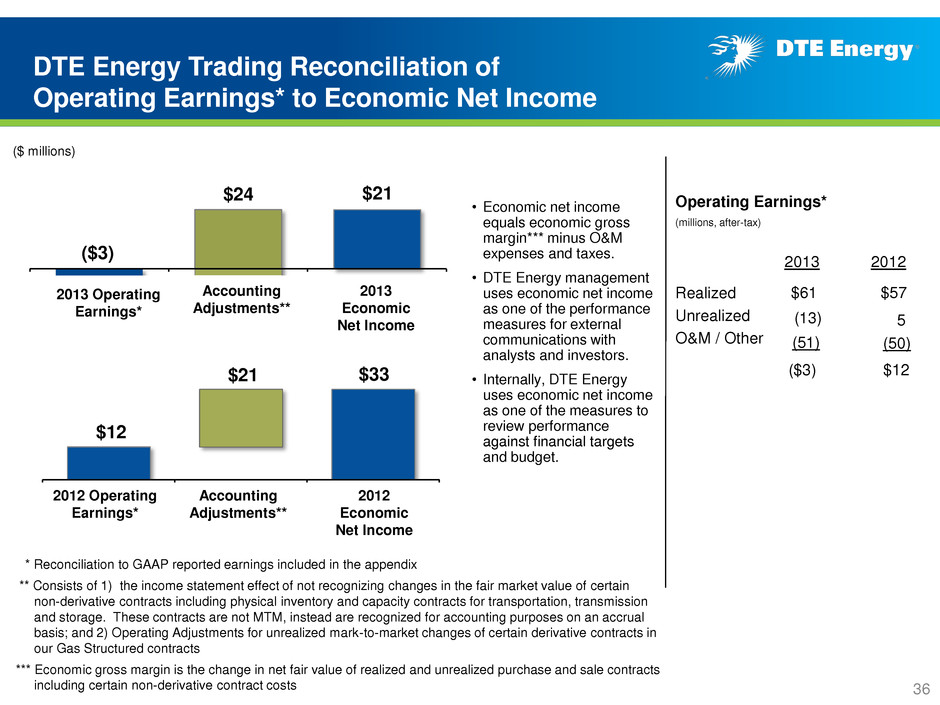

DTE Energy Trading Reconciliation of Operating Earnings* to Economic Net Income ** Consists of 1) the income statement effect of not recognizing changes in the fair market value of certain non-derivative contracts including physical inventory and capacity contracts for transportation, transmission and storage. These contracts are not MTM, instead are recognized for accounting purposes on an accrual basis; and 2) Operating Adjustments for unrealized mark-to-market changes of certain derivative contracts in our Gas Structured contracts 2013 Economic Net Income Accounting Adjustments** 2013 Operating Earnings* $12 $33 • Economic net income equals economic gross margin*** minus O&M expenses and taxes. • DTE Energy management uses economic net income as one of the performance measures for external communications with analysts and investors. • Internally, DTE Energy uses economic net income as one of the measures to review performance against financial targets and budget. * Reconciliation to GAAP reported earnings included in the appendix *** Economic gross margin is the change in net fair value of realized and unrealized purchase and sale contracts including certain non-derivative contract costs Operating Earnings* Realized Unrealized O&M / Other 2012 2013 $57 $61 (13) 5 (50) (51) (millions, after-tax) $12 ($3) 2012 Operating Earnings* 2012 Economic Net Income Accounting Adjustments** $21 ($3) $24 $21 ($ millions) 36

2013 Reconciliation of Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2013 DTE Energy DTE Electric DTE Gas Gas Storage and Pipelines Power and Industrial Projects Energy Trading Corporate and Other Reported Earnings 3.76$ 2.76$ 0.80$ 0.40$ 0.38$ (0.33)$ (0.25)$ Asset impairment 0.02 - - - 0.02 - - Mark to market transactions 0.31 - - - - 0.31 - Operating Earnings 4.09$ 2.76$ 0.80$ 0.40$ 0.40$ (0.02)$ (0.25)$ EPS 2013 DTE Energy DTE Electric DTE Gas Gas Storage and Pipelines Power and Industrial Projects Energy Trading Corporate and Other Reported Earnings 661$ 484$ 143$ 70$ 66$ (58)$ (44)$ Asset impairment 4 - - - 4 - - Mark to market transactions 55 - - - - 55 - Operating Earnings 720$ 484$ 143$ 70$ 70$ (3)$ (44)$ Net Income ($ millions) 37

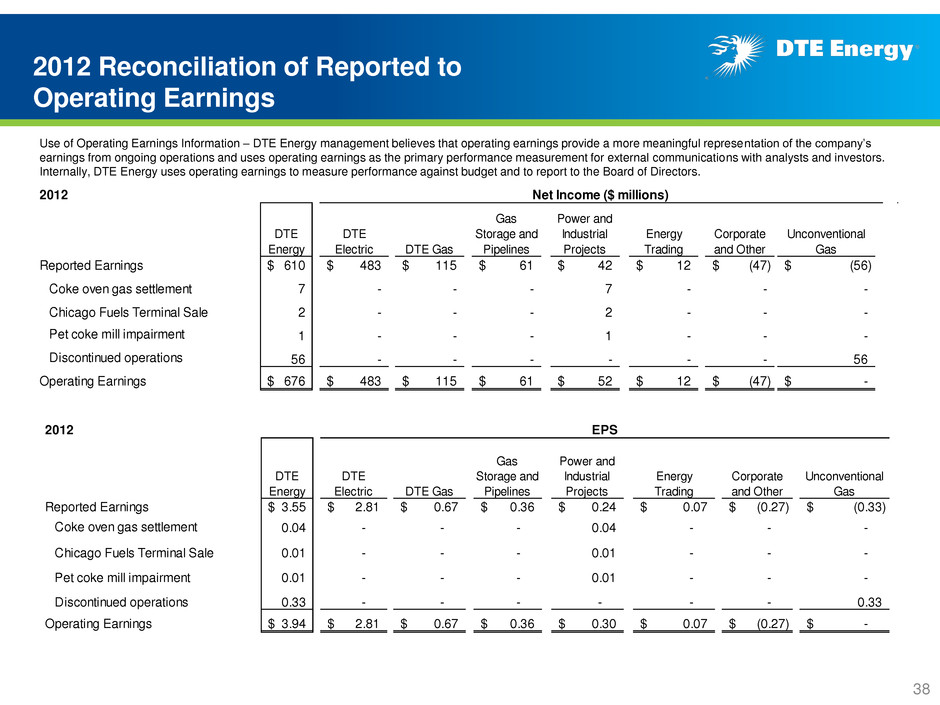

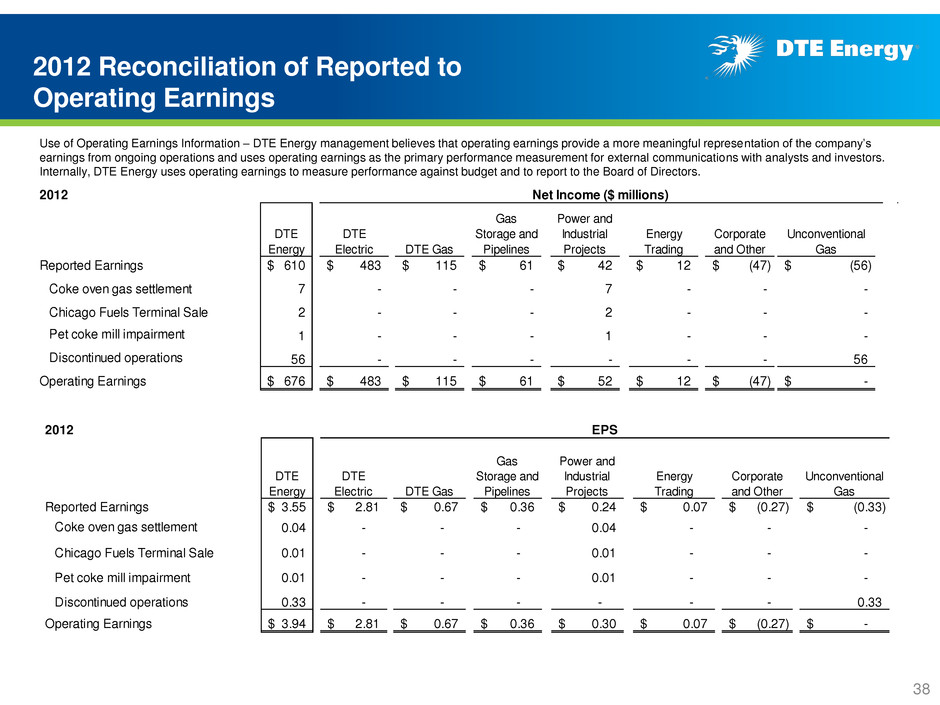

2012 Reconciliation of Reported to Operating Earnings 2012 DTE Energy DTE Electric DTE Gas Gas Storage and Pipelines Power and Industrial Projects Energy Trading Corporate and Other Unconventional Gas Reported Earnings 610$ 483$ 115$ 61$ 42$ 12$ (47)$ (56)$ Coke oven gas settlement 7 - - - 7 - - - Chicago Fuels Terminal Sale 2 - - - 2 - - - Pet coke mill impairment 1 - - - 1 - - - Discontinued operations 56 - - - - - - 56 Operating Earnings 676$ 483$ 115$ 61$ 52$ 12$ (47)$ -$ Net Income ($ millions) 2012 DTE Energy DTE Electric DTE Gas Gas Storage and Pipelines Power and Industrial Projects Energy Trading Corporate and Other Unconventional Gas Reported Earnings 3.55$ 2.81$ 0.67$ 0.36$ 0.24$ 0.07$ (0.27)$ (0.33)$ Coke oven gas settlement 0.04 - - - 0.04 - - - Chicago Fuels Terminal Sale 0.01 - - - 0.01 - - - Pet coke mill impairment 0.01 - - - 0.01 - - - Discontinued operations 0.33 - - - - - - 0.33 Operating Earnings 3.94$ 2.81$ 0.67$ 0.36$ 0.30$ 0.07$ (0.27)$ -$ EPS Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 38

2011 Reconciliation of Reported to Operating Earnings 2011 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Reported Earnings 711$ 434$ 110$ 57$ 38$ 52$ 23$ (3)$ Michigan Corporate Income Tax Adjustment (87) - - - - - (87) - Fermi 1 Asset Retirement Obligation 9 9 - - - - - - Discontinued Operations of Unconventional Gas 3 - - - - - - 3 Operating Earnings 636$ 443$ 110$ 57$ 38$ 52$ (64)$ -$ Net Income ($ millions) 2011 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Repor ed Earnings 4.18 2.55 0.65 0.34 0.22 0.31 0.13 (0.02) Michigan Corporate Income Tax Adjustment (0.50) - - - - - (0.50) - Fermi 1 Asset Retirement Obligation 0.05 0.05 - - - - - - Discontinued Operations of Unconventional Gas 0.02 - - - - - - 0.02 Operating Earnings 3.75$ 2.60$ 0.65$ 0.34$ 0.22$ 0.31$ (0.37)$ -$ $EPS Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 39

2010 Reconciliation of Reported to Operating Earnings * Deferral of previously expensed cost to achieve as allowed for in June 3, 2010 MPSC order (case - U-15985) 2010 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. eported Earnings 630$ 441$ 127$ 51$ 85$ 6$ (72)$ (8)$ Performance Excellence Process - Cost to Achieve Deferral* (20) - (20) - - - - - Settlement with Detroit Thermal (3) (3) - - - - - - Discontinued Operations of Unconventional Gas 8 - - - - - - 8 Operating Earnings 615$ 438$ 107$ 51$ 85$ 6$ (72)$ -$ Net Income ($ millions) 2010 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Reported Earnings 3.74$ 2.62$ 0.75$ 0.30$ 0.50$ 0.04$ (0.43)$ (0.04)$ P rformance Excellence Process - Cost to Achieve Deferral* (0.12) - (0.12) - - - - - Settlement with Detroit Thermal (0.02) (0.02) - - - - - - Discontinued Operations of Unconventional Gas 0.04 - - - - - - 0.04 Operating Earnings 3.64$ 2.60$ 0.63$ 0.30$ 0.50$ 0.04$ (0.43)$ -$ $EPS Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 40

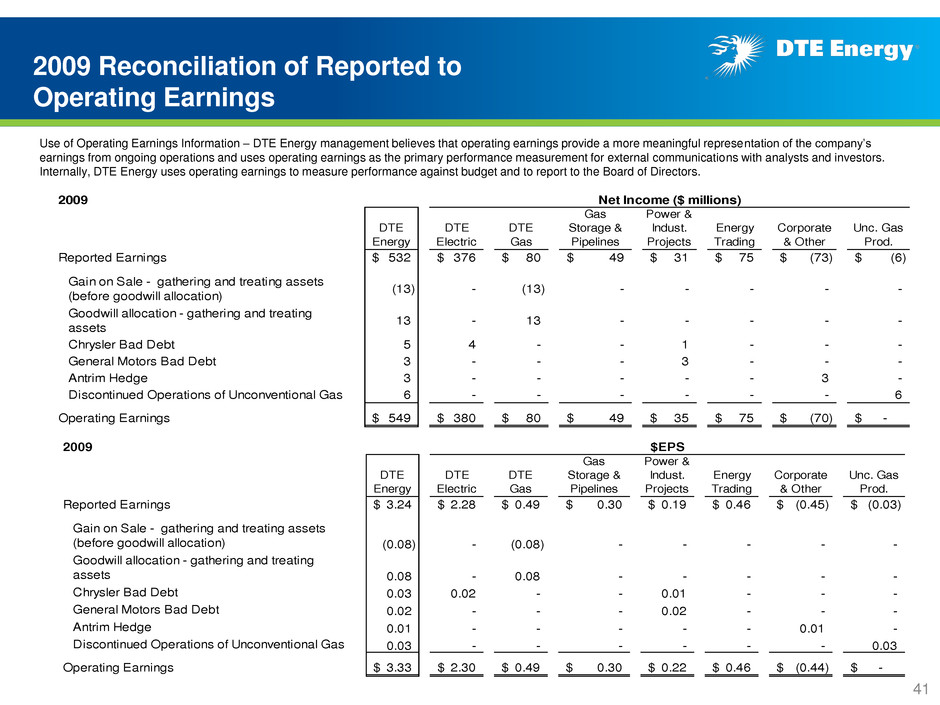

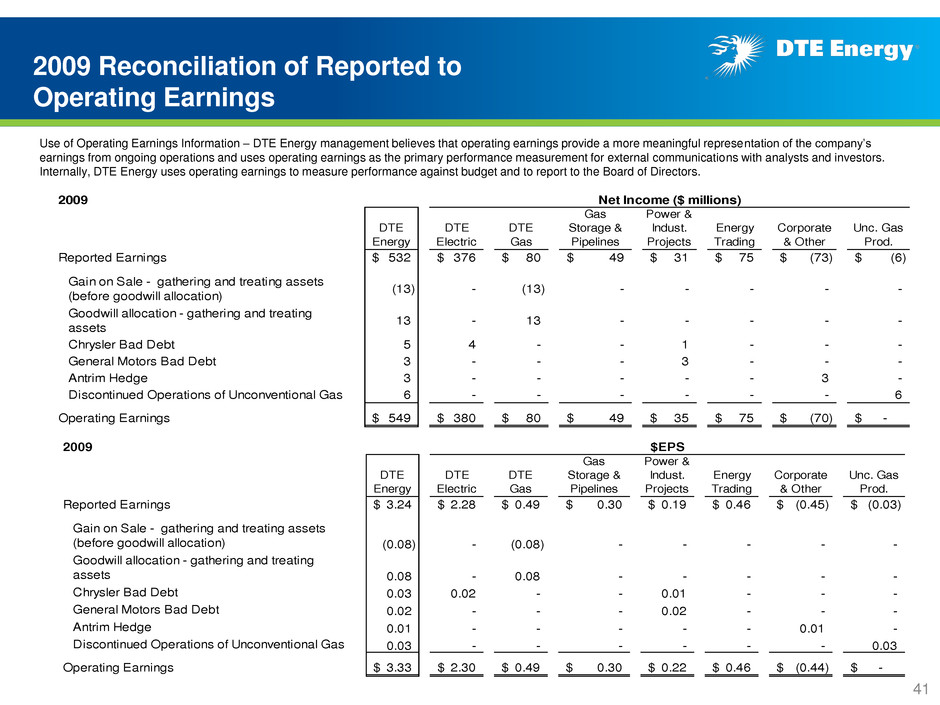

2009 Reconciliation of Reported to Operating Earnings 2009 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Reported Earnings 532$ 376$ 80$ 49$ 31$ 75$ (73)$ (6)$ Gain on Sale - gathering and treating assets (before goodwill allocation) (13) - (13) - - - - - Goodwill allocation - gathering and treating assets 13 - 13 - - - - - Chrysler Bad Debt 5 4 - - 1 - - - General Motors Bad Debt 3 - - - 3 - - - Antrim Hedge 3 - - - - - 3 - Discontinued Operations of Unconventional Gas 6 - - - - - - 6 Operating Earnings 549$ 380$ 80$ 49$ 35$ 75$ (70)$ -$ Net Income ($ millions) 2009 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Reported Earnings 3.24$ 2.28$ 0.49$ 0.30$ 0.19$ 0.46$ (0.45)$ (0.03)$ Gain on Sale - ga hering and treating assets (b fore go dwill allocation) (0.08) - (0.08) - - - - - Goodwill allocation - gathering and treating assets 0.08 - 0.08 - - - - - Chrysler B d Debt 0.03 0.02 - - 0.01 - - - General Motors Bad Debt 0.02 - - - 0.02 - - - Antrim Hedge 0.01 - - - - - 0.01 - Discontinued Operations of Unconventional Gas 0.03 - - - - - - 0.03 Operating Earnings 3.33$ 2.30$ 0.49$ 0.30$ 0.22$ 0.46$ (0.44)$ -$ $EPS Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 41

2008 Reconciliation of Reported to Operating Earnings 2008 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Syn Fuel Reported Earnings 546$ 331$ 85$ 38$ 40$ 42$ (97)$ 87$ 20$ Performance Excellence Process 6 - 4 - 1 1 - - - Core Barnett Sale (81) - - - - - - (81) - Antrim hedge 13 - - - - - 13 - - Barnett Lease impairment 5 - - - - - - 5 - Crete Sale - Tax True up 2 - - - - - 2 - - Synfuel Discontinued Operations (20) - - - - - - - (20) Discontinued Operations of Unconventional Gas (11) - - - - - - (11) - Operating Earnings 460$ 331$ 89$ 38$ 41$ 43$ (82)$ -$ -$ Net Income ($ millions) 2008 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Syn Fuel Reported Earnings 3.34$ 2.03$ 0.52$ 0.23$ 0.25$ 0.26$ (0.60)$ 0.53$ 0.12$ Perform nce E cellence Process 0.05 - 0.03 - 0.01 0.01 - - - Core Barnett Sale (0.50) - - - - - - (0.50) - Antrim hedge 0.08 - - - - - 0.08 - - Barnett Lease impairment 0.03 - - - - - - 0.03 - Crete Sale - Tax True up 0.01 - - - - - 0.01 - - Synfuel Discontinued Operations (0.12) - - - - - - - (0.12) Discontinued Operations of Unconventional Gas (0.06) - - - - - - (0.06) - Operating Earnings 2.83$ 2.03$ 0.55$ 0.23$ 0.26$ 0.27$ (0.51)$ -$ -$ $EPS Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with a alysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 42

Reconciliation of Other Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items. These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. For comparative purposes, 2008 through 2012 operating earnings exclude the Unconventional Gas Production segment that was classified as a discontinued operation on 12/31/2012. 43