Business Update January 7-8, 2016 EXHIBIT 99.1

Safe Harbor Statement The information contained herein is as of the date of this presentation. Many factors may impact forward-looking statements including, but not limited to, the following: impact of regulation by the EPA, FERC, MPSC, NRC and CFTC as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals or new legislation, including legislative amendments and Retail Access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation and increased thefts of electricity and, for DTE Energy, natural gas; environmental issues, laws, regulations, and the increased costs of remediation and compliance, including actual and potential new federal and state requirements; health, safety, financial, environmental and regulatory risks associated with ownership and operation of nuclear facilities; changes in the cost and availability of coal and other raw materials, purchased power and natural gas; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; volatility in the short-term natural gas storage markets impacting third-party storage revenues related to DTE Energy; volatility in commodity markets; deviations in weather and related risks impacting the results of DTE Energy’s energy trading operations; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant construction projects; changes in and application of federal, state and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; the cost of protecting assets against, or damage due to, terrorism or cyber attacks; employee relations and the impact of collective bargaining agreements; the risk of a major safety incident at an electric distribution or generation facility and, for DTE Energy, a gas storage, transmission or generation facility; the availability, cost, coverage and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy and other business issues; contract disputes; binding arbitration, litigation and related appeals; and the risks discussed in our public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause our results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This presentation should also be read in conjunction with the “Forward-Looking Statements” sections in each of DTE Energy’s and DTE Electric’s 2014 Forms 10-K and 2015 Forms 10-Q (which sections are incorporated herein by reference), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric. 2

There continue to be positive developments for DTE Energy 3 • Michigan energy policy reform ‒ Progress continues toward completion • Utility regulatory filings ‒ Received constructive rate order at DTE Electric ‒ Filed DTE Gas rate case ‒ Expect next electric rate case filing 1Q16 • NEXUS filed its FERC application in November ‒ Ontario Energy Board preapproval • Millennium filed its FERC application for Valley Lateral project

4 • Overview • Long-Term Growth Update • Summary

DTE Energy’s growth is driven by strong, stable utilities and complementary non-utility businesses 5 DTE Electric Electric generation and distribution DTE Gas Natural gas transmission, storage and distribution Complementary Non-Utility Businesses Strong, Stable and Growing Utilities Fully Regulated by Michigan Public Service Commission Gas Storage & Pipelines Transport and store natural gas Power & Industrial Projects Own and operate energy related assets Energy Trading Generate economic value and provide strategic benefits ~80% of total earnings ~20% of total earnings

Our system of priorities is fundamental to how we create value for our shareholders 6 5% - 6% Annual EPS Growth Attractive Dividend Strong Balance Sheet 6

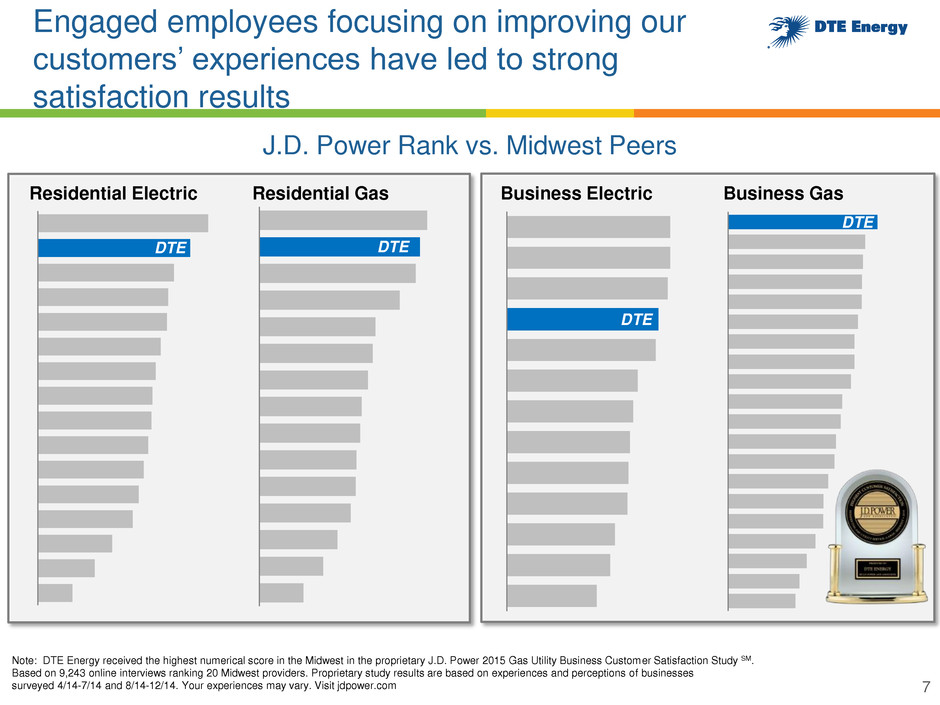

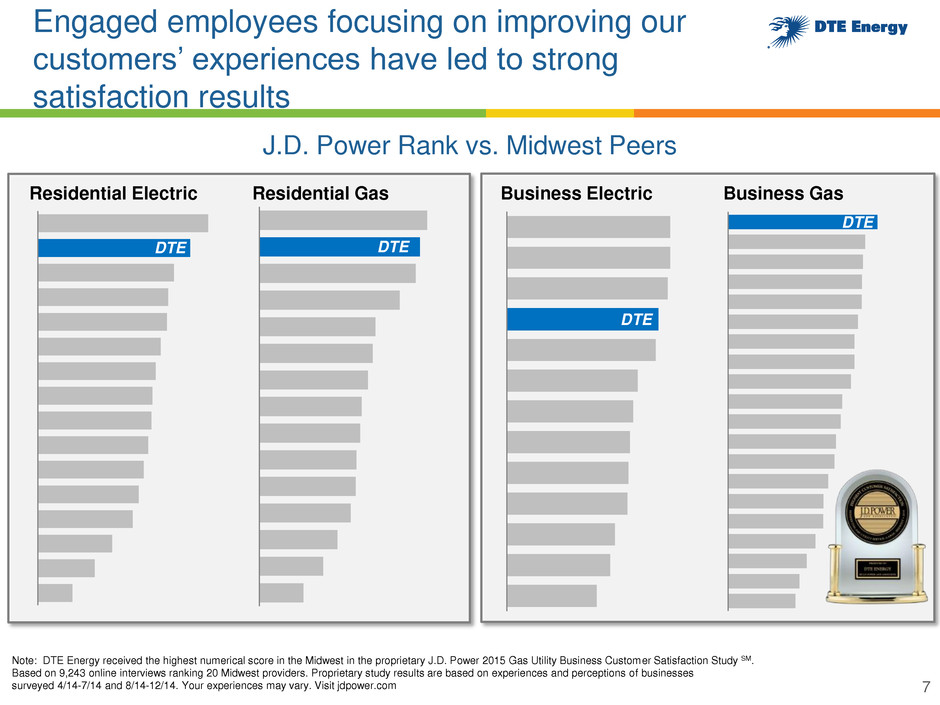

Engaged employees focusing on improving our customers’ experiences have led to strong satisfaction results J.D. Power Rank vs. Midwest Peers Note: DTE Energy received the highest numerical score in the Midwest in the proprietary J.D. Power 2015 Gas Utility Business Customer Satisfaction Study SM. Based on 9,243 online interviews ranking 20 Midwest providers. Proprietary study results are based on experiences and perceptions of businesses surveyed 4/14-7/14 and 8/14-12/14. Your experiences may vary. Visit jdpower.com Residential Electric Residential Gas DTE Business Electric Business Gas 7 DTE DTE DTE

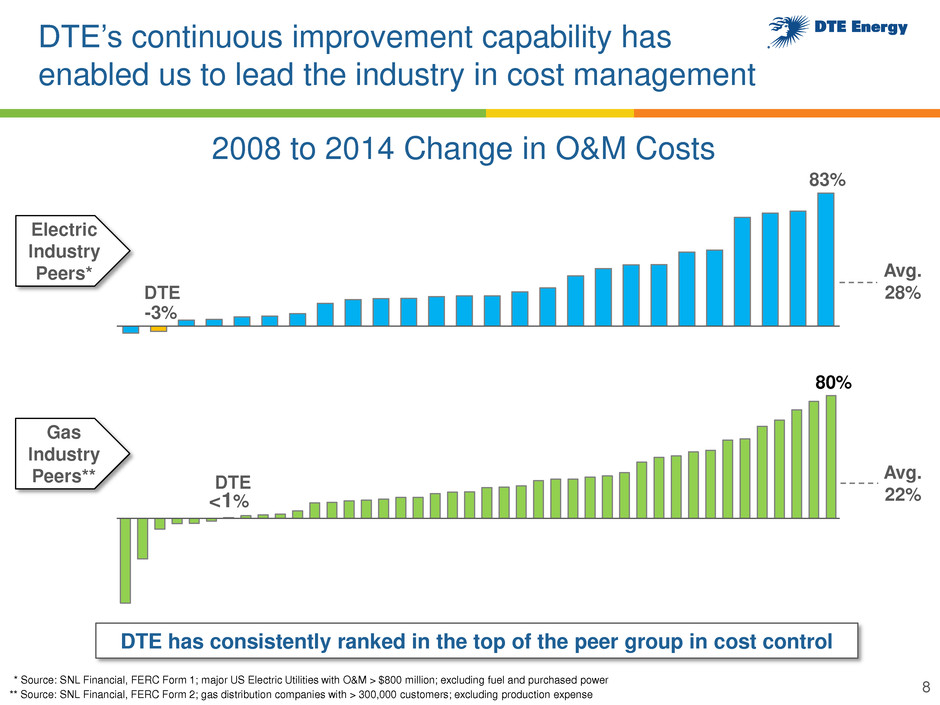

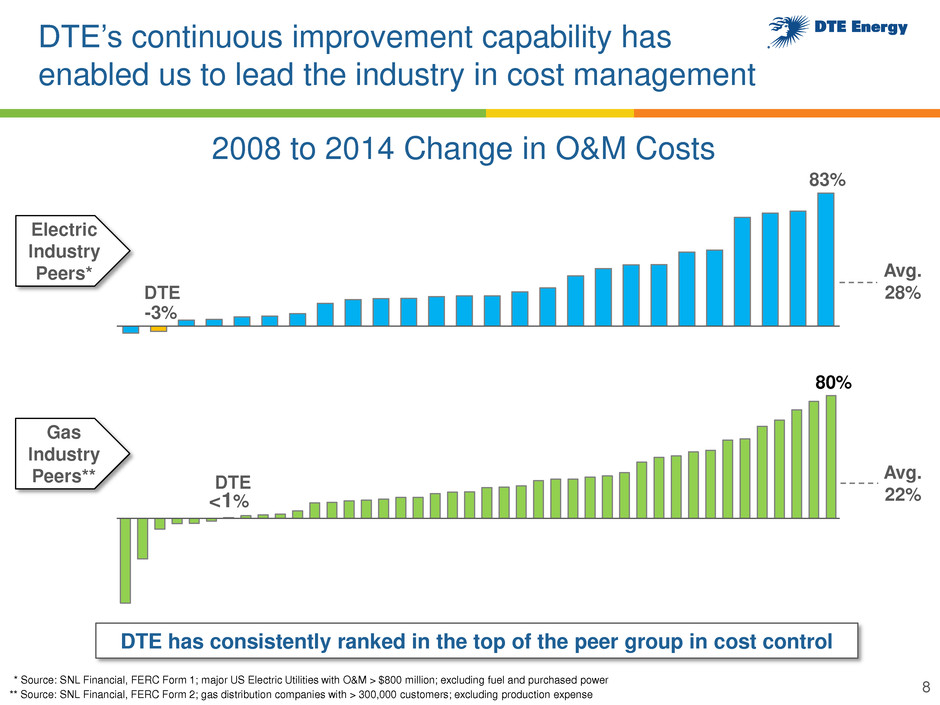

DTE’s continuous improvement capability has enabled us to lead the industry in cost management * Source: SNL Financial, FERC Form 1; major US Electric Utilities with O&M > $800 million; excluding fuel and purchased power ** Source: SNL Financial, FERC Form 2; gas distribution companies with > 300,000 customers; excluding production expense 2008 to 2014 Change in O&M Costs 83% DTE -3% Avg. 28% 80% DTE <1% Avg. 22% Electric Industry Peers* Gas Industry Peers** DTE has consistently ranked in the top of the peer group in cost control 8

We remain committed to delivering growth for our shareholders 9 * Reconciliation to GAAP reported earnings included in the appendix (dollars per share) $3.33 $3.64 $3.75 $3.94 $4.09 $4.60 2009 2010 2011 2012 2013 2014 $2.12 $2.24 $2.35 $2.48 $2.62 $2.76 $2.92 2009 2010 2011 2012 2013 2014 2015 Operating EPS* Annualized Dividend 6.7% CAGR Target 5% to 6% earnings growth Grow dividends with earnings

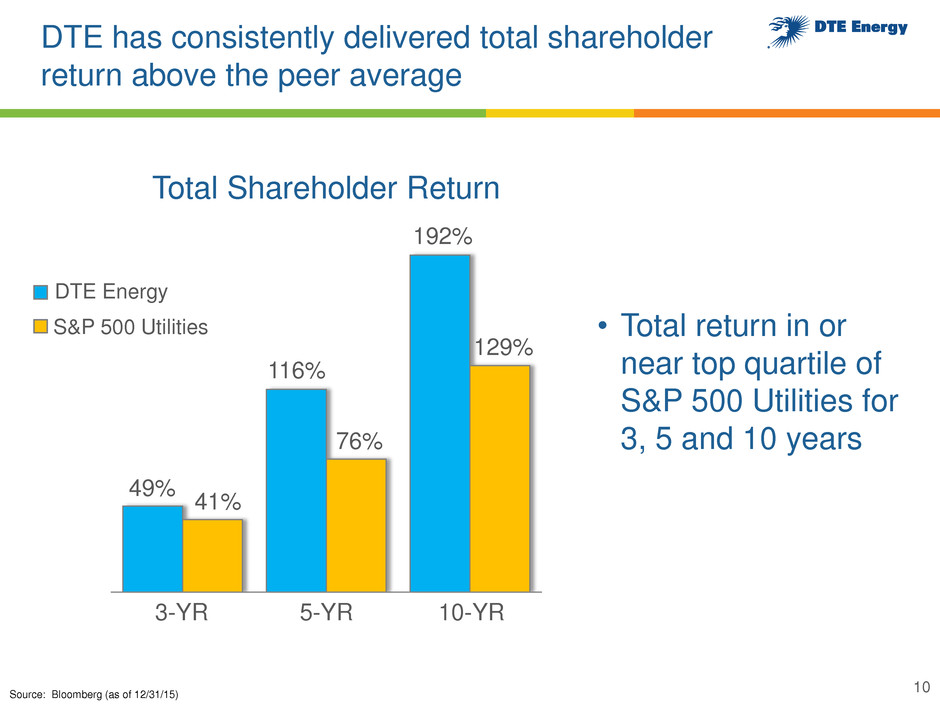

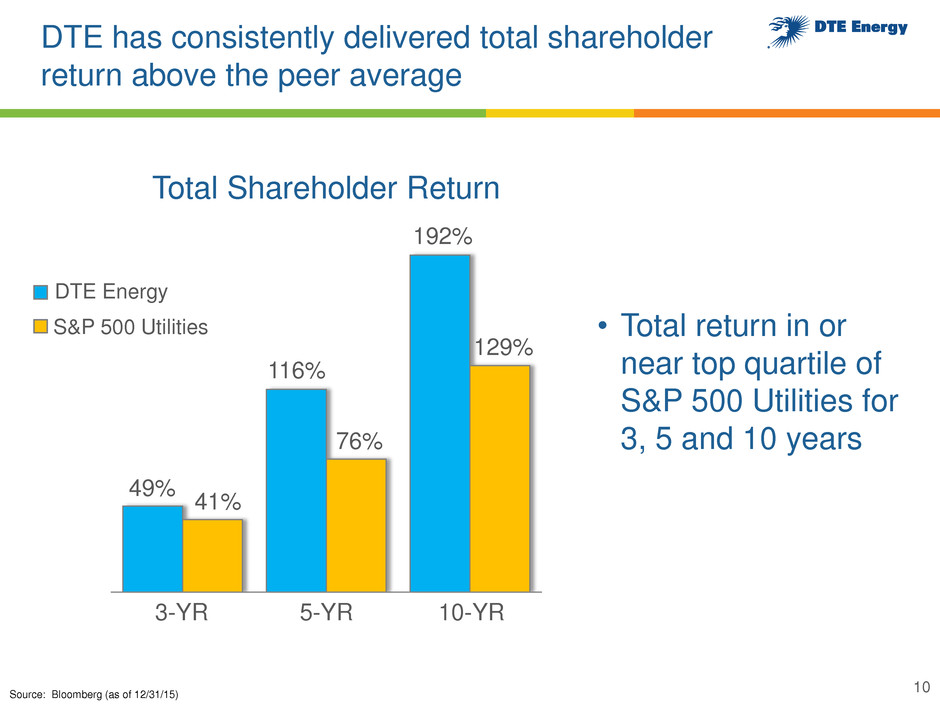

DTE has consistently delivered total shareholder return above the peer average Source: Bloomberg (as of 12/31/15) 10 Total Shareholder Return 49% • Total return in or near top quartile of S&P 500 Utilities for 3, 5 and 10 years 3-YR 116% 192% 10-YR 5-YR S&P 500 Utilities DTE Energy 41% 76% 129%

DTE Operating Earnings Growth Share Issuance Contingency DTE Operating EPS* Growth Non-Utilities 7% - 8% 5% - 6% * Reconciliation to GAAP reported earnings included in the appendix Strong growth opportunities coupled with contingency planning gives us confidence in our ability to deliver 5% to 6% operating EPS growth going forward 11 Non-Utilities Utilities Utilities

12 • Overview • Long-Term Growth Update • Summary

Our long-term plan will provide solid results for our stakeholders 13 * 5 year CAGR DTE Electric DTE Gas Gas Storage & Pipelines (GSP) Power & Industrial Projects (P&I) DTE Energy Capital Expenditures ($ billions) Operating Earnings Growth* Rate Base Growth* Targeted Utility ROE** / Non-utility IRR $8.2 $1.6 $2.0 - $2.6 $0.6 - $0.9 ~$13 6% - 7% 7% - 8% 10% - 15% 15% - 20%*** 7% - 8% *** Growth rates are for the non-REF (reduced emissions fuel) business lines within P&I DTE Energy Forecast 2016 – 2020 6% - 7% 7% - 8% 10.3% 10.5% 10% - 12% 10% - 12% These targets provide for 5% to 6% operating EPS growth long term ** Targeted utility ROE aligns with MPSC authorized ROE

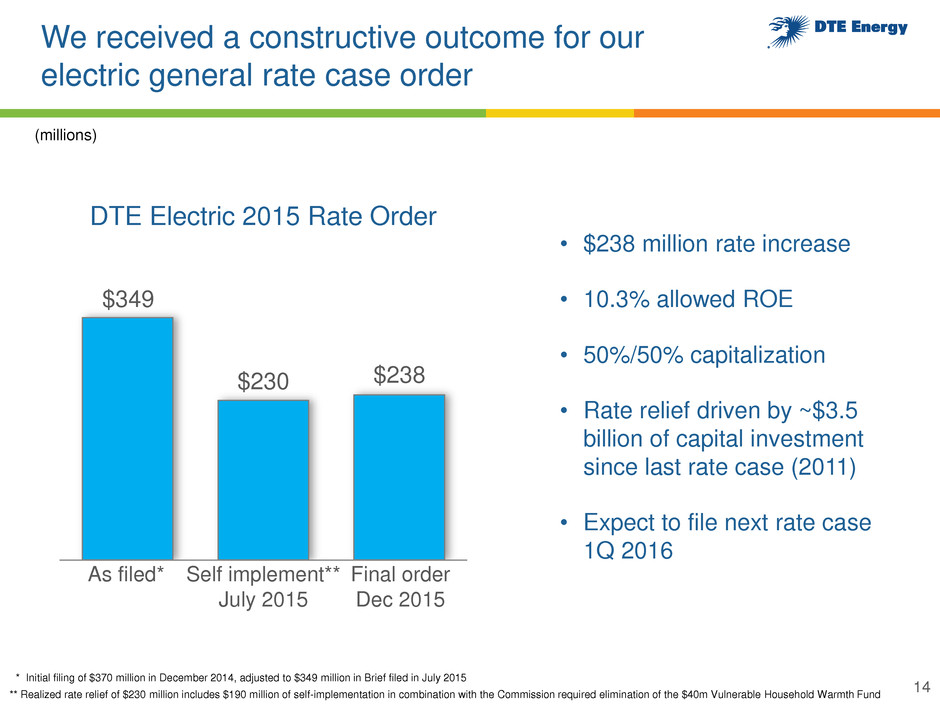

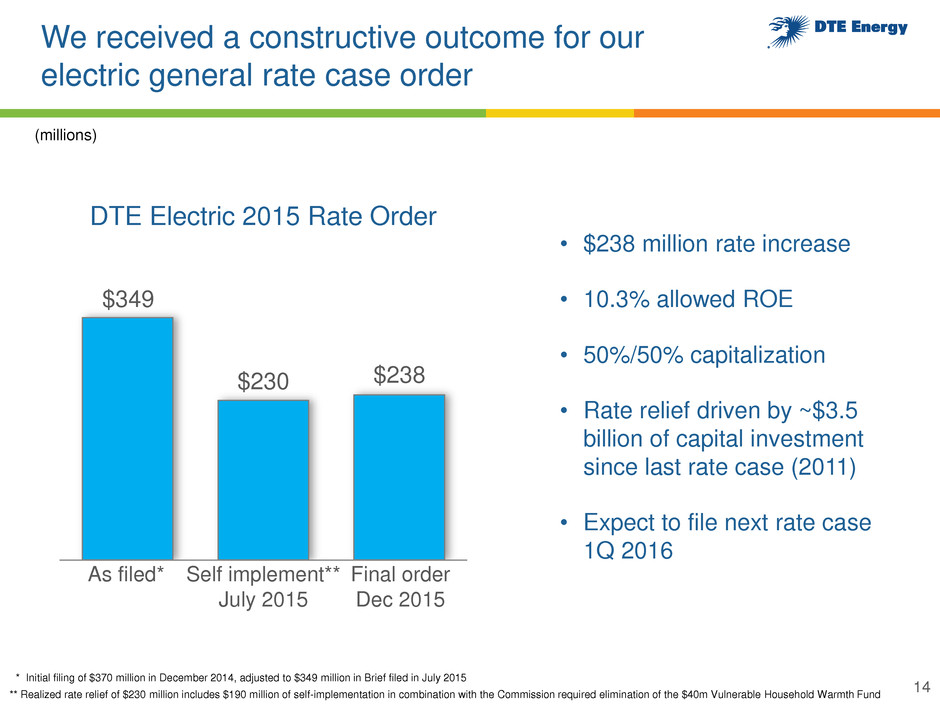

We received a constructive outcome for our electric general rate case order 14 $349 DTE Electric 2015 Rate Order (millions) As filed* Self implement** July 2015 Final order Dec 2015 $230 $238 • $238 million rate increase • 10.3% allowed ROE • 50%/50% capitalization • Rate relief driven by ~$3.5 billion of capital investment since last rate case (2011) • Expect to file next rate case 1Q 2016 ** Realized rate relief of $230 million includes $190 million of self-implementation in combination with the Commission required elimination of the $40m Vulnerable Household Warmth Fund * Initial filing of $370 million in December 2014, adjusted to $349 million in Brief filed in July 2015

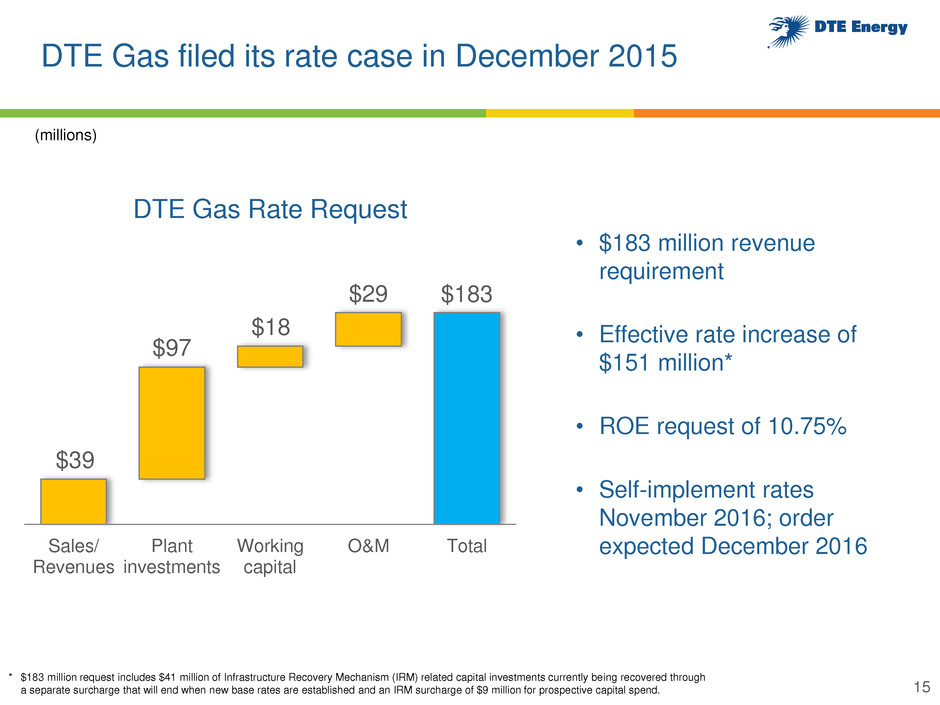

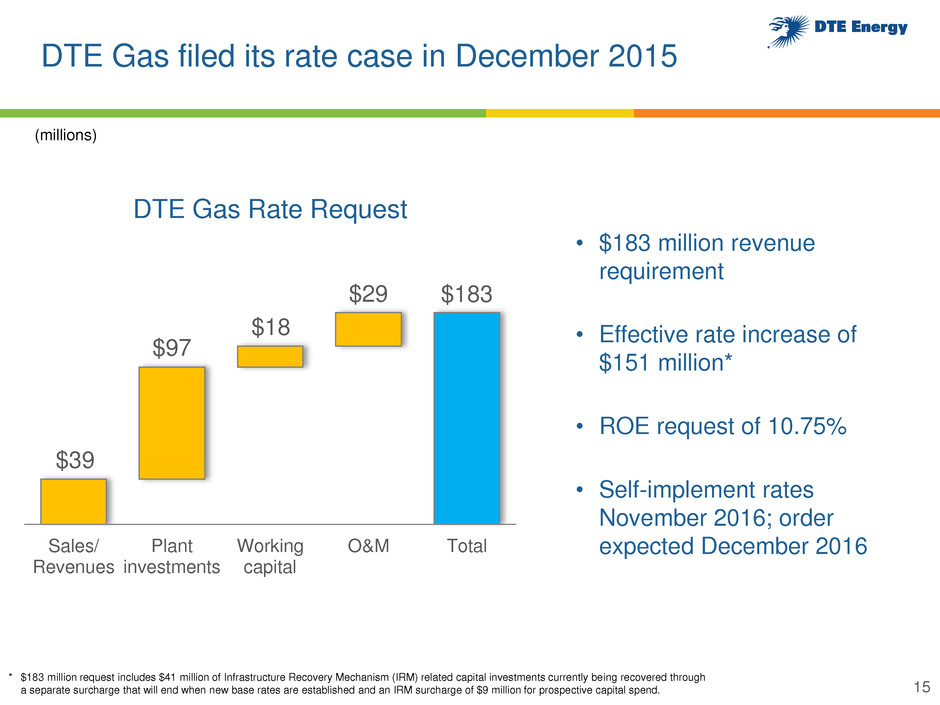

DTE Gas filed its rate case in December 2015 15 Sales/ Revenues Plant investments Working capital O&M Total $39 (millions) • $183 million revenue requirement • Effective rate increase of $151 million* • ROE request of 10.75% • Self-implement rates November 2016; order expected December 2016 $97 $18 $29 $183 DTE Gas Rate Request * $183 million request includes $41 million of Infrastructure Recovery Mechanism (IRM) related capital investments currently being recovered through a separate surcharge that will end when new base rates are established and an IRM surcharge of $9 million for prospective capital spend.

John Quackenbush Commissioner Appointed: 9/15/11 Term Ends: 3/31/16 Sally Talberg appointed chair of the Michigan Public Service Commission (MPSC) Sally Talberg Chair Appointed: 7/3/13 Term Ends: 7/2/19 Norm Saari Commissioner Appointed: 8/2/15 Term Ends: 7/2/21 Source: State of Michigan website - www.michigan.gov/ • In January 2016, Governor Snyder appointed Sally Talberg as chair of the MPSC, replacing John Quackenbush • Mr. Quackenbush will continue as a commissioner until March 31, 2016 to facilitate a smooth transition prior to his return to the private sector • MPSC is composed of three members appointed by the Governor with the advice and consent of the Senate; Mr. Quackenbush’s replacement will be announced at a later date TBD 16

We will invest ~$13 billion in capital projects to drive growth through 2020 17 (billions) ~$13 $8.2 Distribution infrastructure, maintenance, new generation $1.6 Base investments, infrastructure renewal, NEXUS related $2.0-$2.6 Gathering investments, NEXUS, pipeline expansions $0.6-$0.9 Cogeneration, on-site energy 2016 – 2020 Current Plan 17 ~$9 2010 – 2014 Actual P&I GSP Gas Electric

The EPA’s Clean Power Plan has set forth significant carbon reduction goals which will transform the electric industry The most transformational policy in the history of the electric industry Will cut CO2 emissions by 32% by 2030, compared to 2005 Initial compliance plans to be submitted by September 2016; final plans by September 2018 Initial compliance to begin 2022 with full compliance in 2030 18

Our generation mix shifts from coal to natural gas and renewables as we address the EPA’s Clean Power Plan 32% Coal Retirements 2030 Scenario ~6.7 2015 Gas / Renewables Additions ~2.2 ~2.2 ~12.3 (~3.5) ~25% 15%-30% ~15% Nuclear / Other Gas Renewables Coal ~1.2 30%-45% DTE Electric Capacity (GW) Note: Estimated amounts. Timing and mix of generation impacted by MISO capacity requirements and Michigan and EPA policies ~12 - 13 19 ~3.3 - 4.5

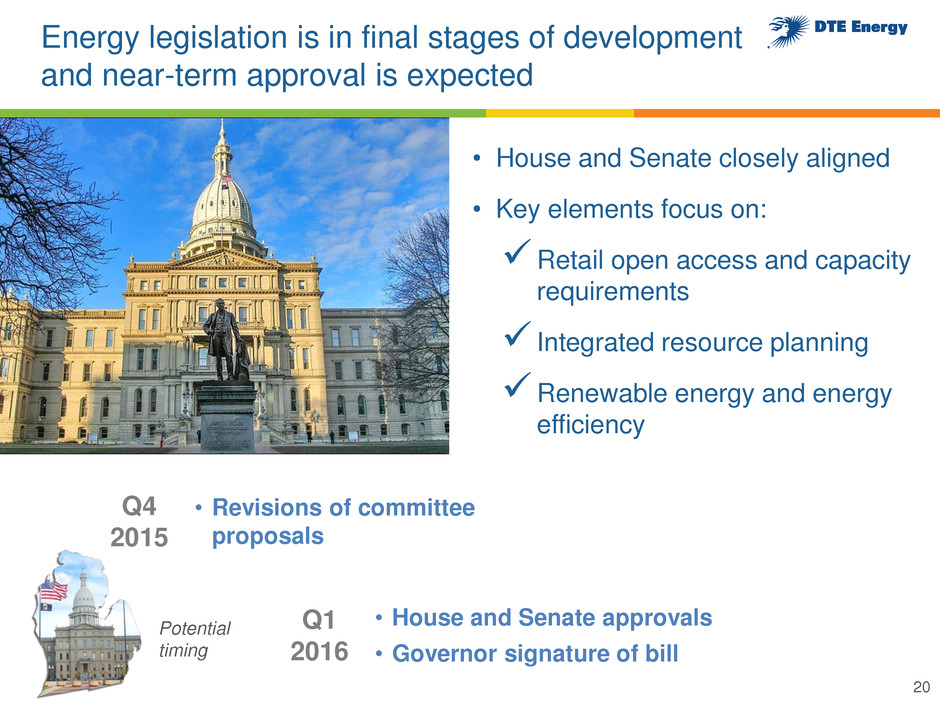

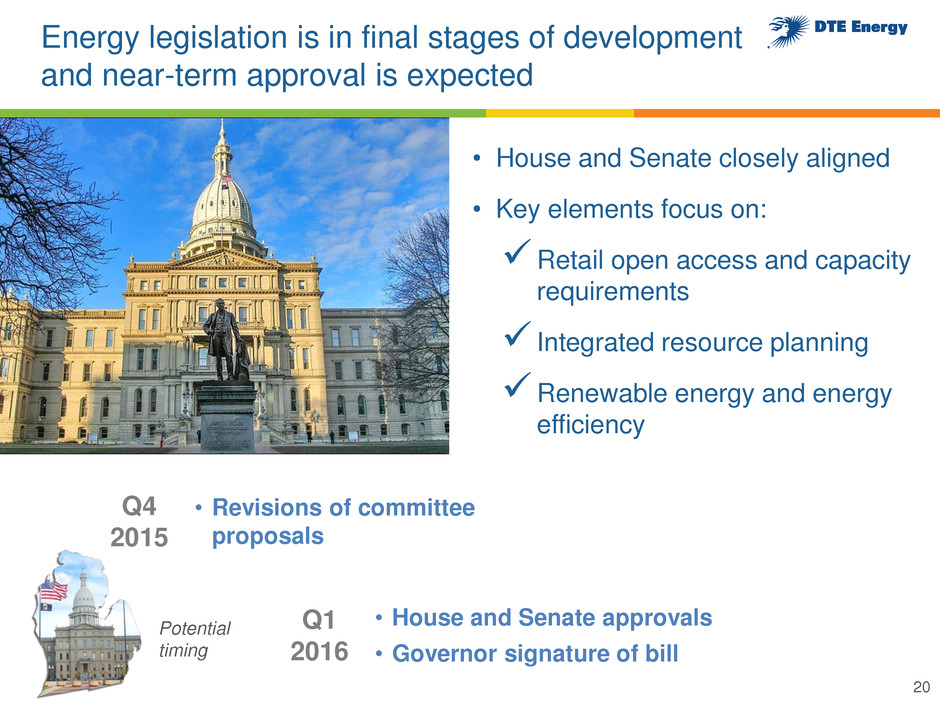

Energy legislation is in final stages of development and near-term approval is expected 20 • House and Senate closely aligned • Key elements focus on: Retail open access and capacity requirements Integrated resource planning Renewable energy and energy efficiency Q1 2016 • House and Senate approvals • Governor signature of bill Q4 2015 • Revisions of committee proposals Potential timing

Electric generation and infrastructure renewal will significantly increase investment in the decade ahead 32% DTE Electric Total Investment ~$8.2 ~$9.7 2016-2020 2021-2025 ~$7.1 2011-2015 New generation (billions) Distribution infrastructure 21 Maintenance and other projects

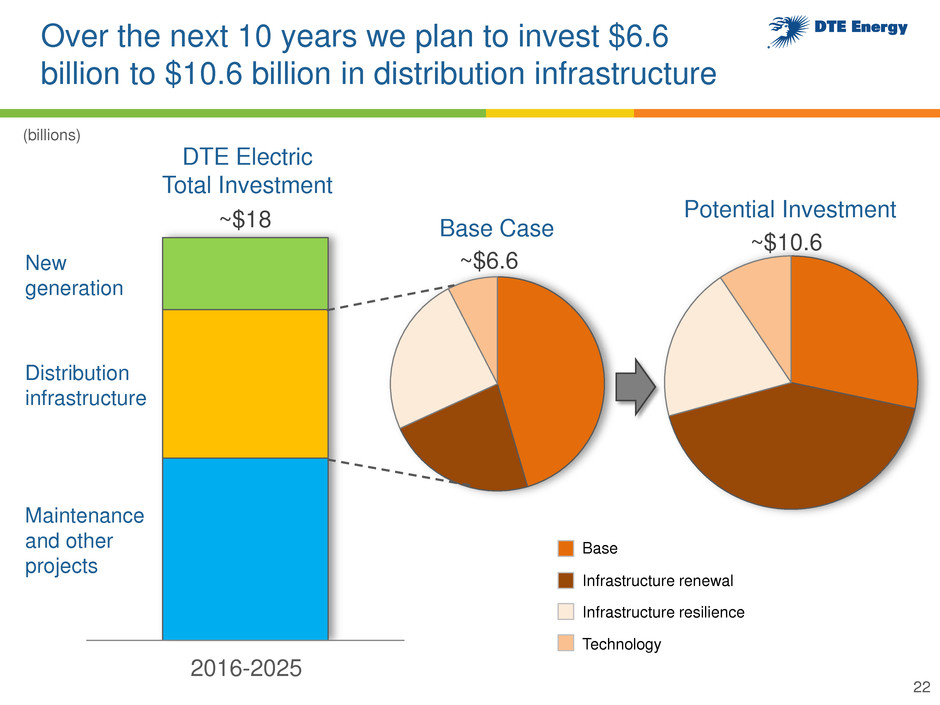

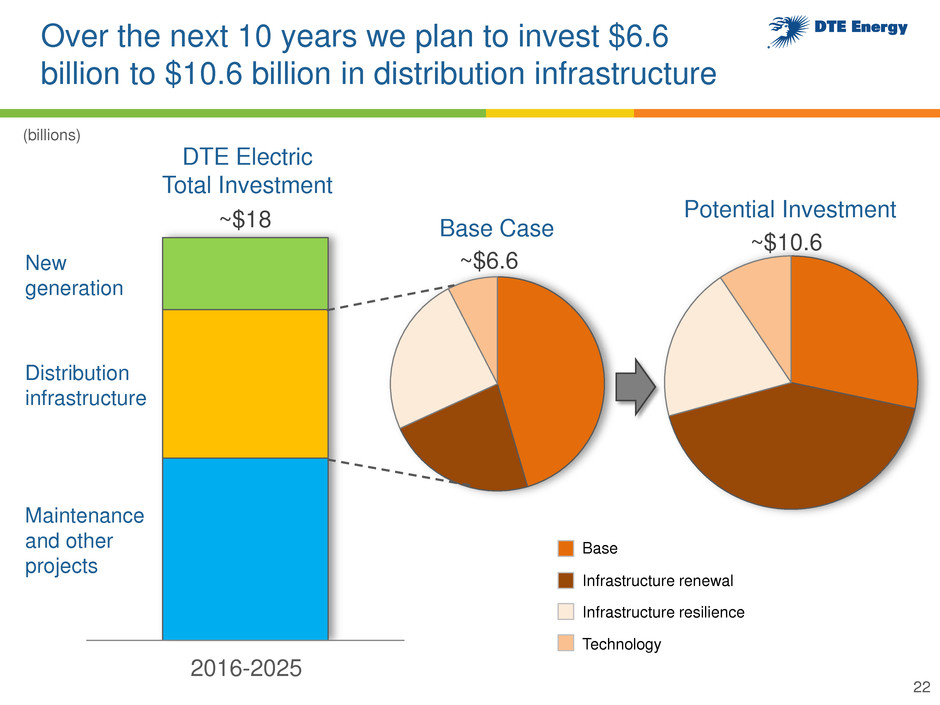

Over the next 10 years we plan to invest $6.6 billion to $10.6 billion in distribution infrastructure 32% 2016-2025 (billions) ~$18 Maintenance and other projects New generation Distribution infrastructure DTE Electric Total Investment Base Case Potential Investment Base Infrastructure renewal Infrastructure resilience Technology ~$6.6 ~$10.6 22

We enter this period of heavy investment with sharp declines in business rates 23 20%+* Large Industrial Customers 10%* Commercial Customers • $600 million of surcharge reductions in 2014 and 2015 • Business cost of service rates implemented in 2015 • $100 million PSCR** reduction in January 2016 • These reductions are after $238 million authorized increase * Average rate reduction from 2013 through January 2016 ** Power Supply Cost Recovery

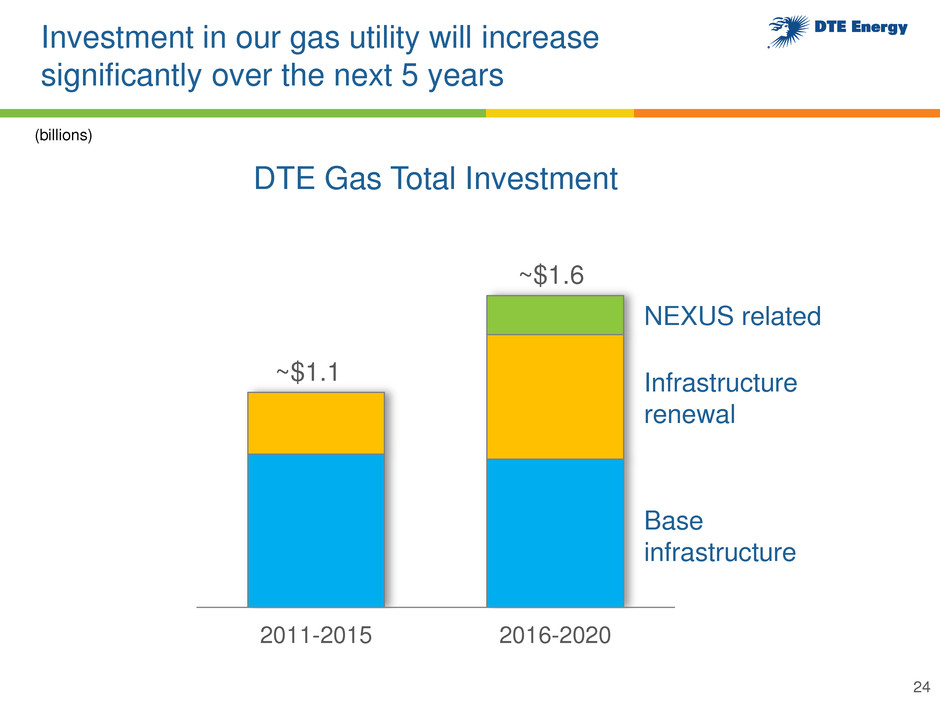

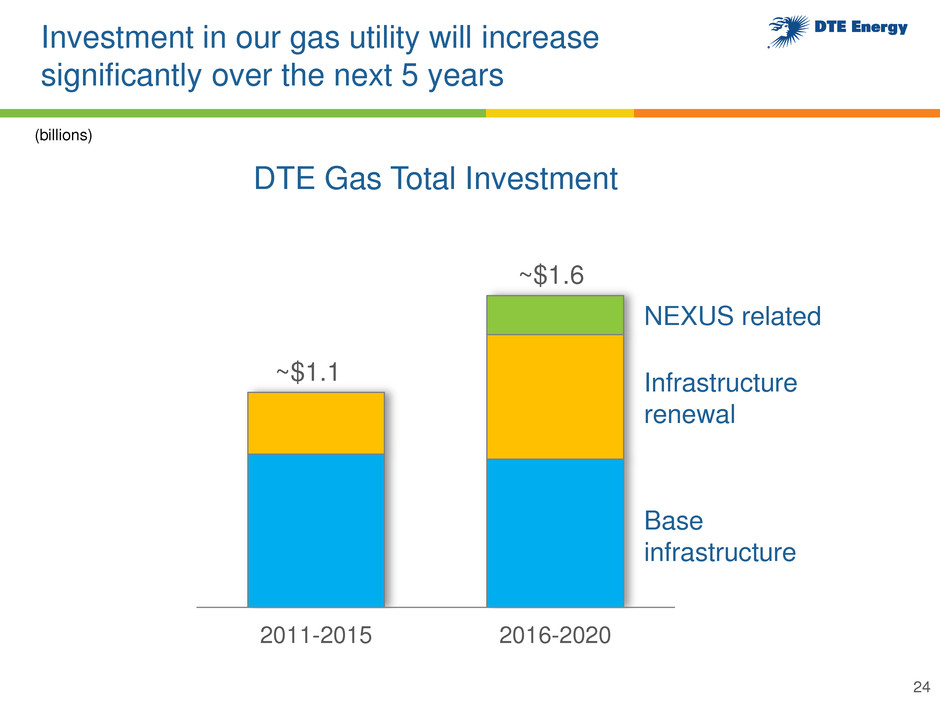

Investment in our gas utility will increase significantly over the next 5 years 24 2011-2015 2016-2020 ~$1.1 ~$1.6 DTE Gas Total Investment (billions) Base infrastructure Infrastructure renewal NEXUS related

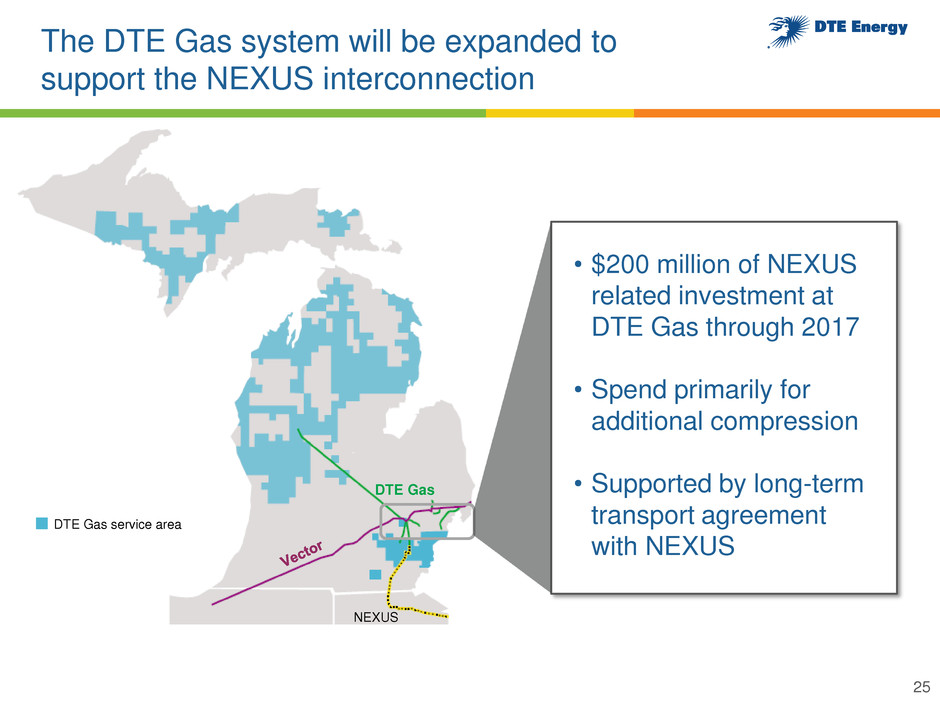

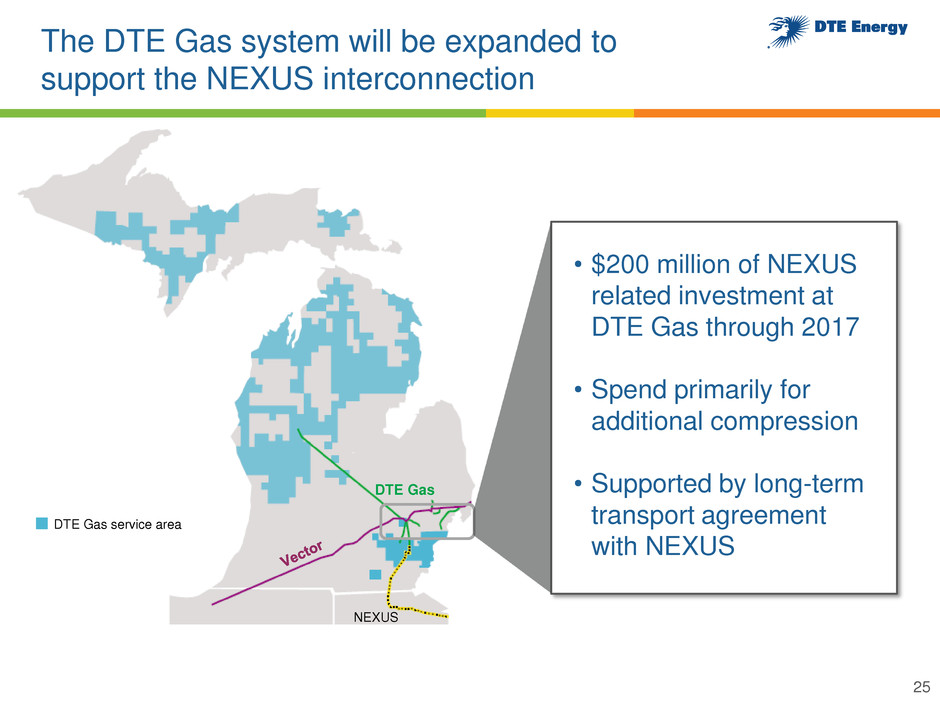

The DTE Gas system will be expanded to support the NEXUS interconnection • $200 million of NEXUS related investment at DTE Gas through 2017 • Spend primarily for additional compression • Supported by long-term transport agreement with NEXUS DTE Gas service area NEXUS DTE Gas 25

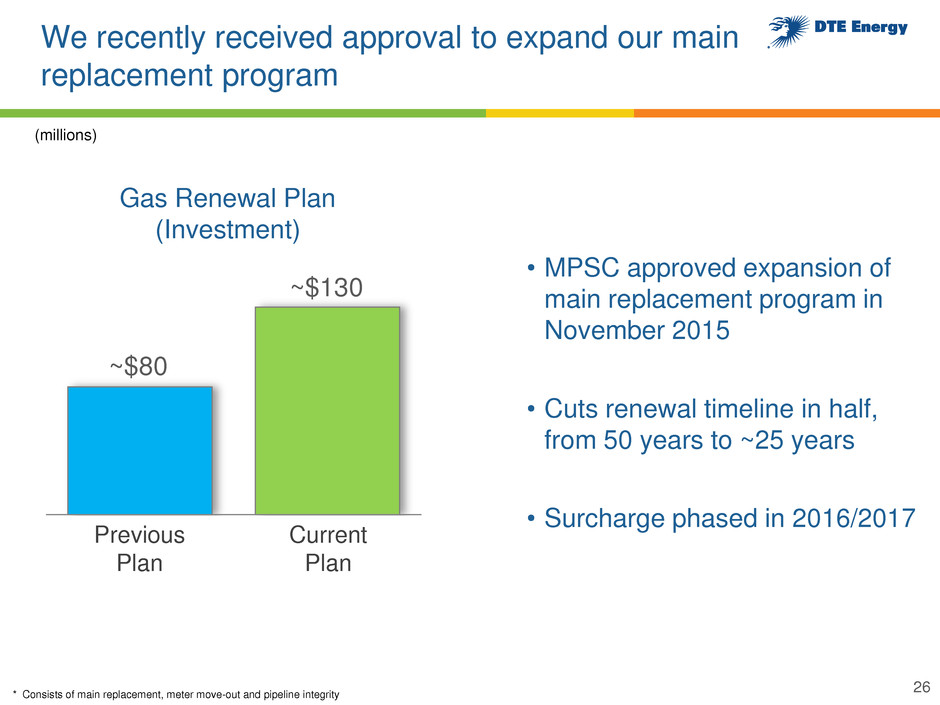

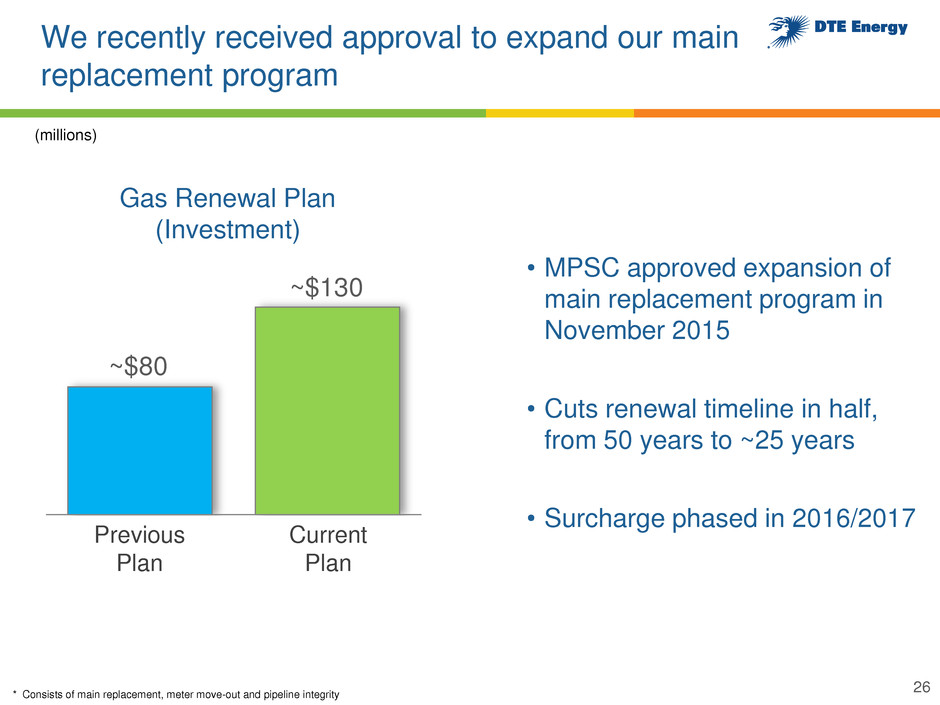

We recently received approval to expand our main replacement program ~$80 Previous Plan Current Plan ~$130 Gas Renewal Plan (Investment) * Consists of main replacement, meter move-out and pipeline integrity 26 • MPSC approved expansion of main replacement program in November 2015 • Cuts renewal timeline in half, from 50 years to ~25 years • Surcharge phased in 2016/2017 (millions)

Gas Storage & Pipelines is developing an asset portfolio with multiple growth platforms 27 NEXUS Pipeline DTE Gas DTE Storage Marcellus Shale Utica Shale Bluestone Pipeline Bluestone Gathering System Michigan Gathering

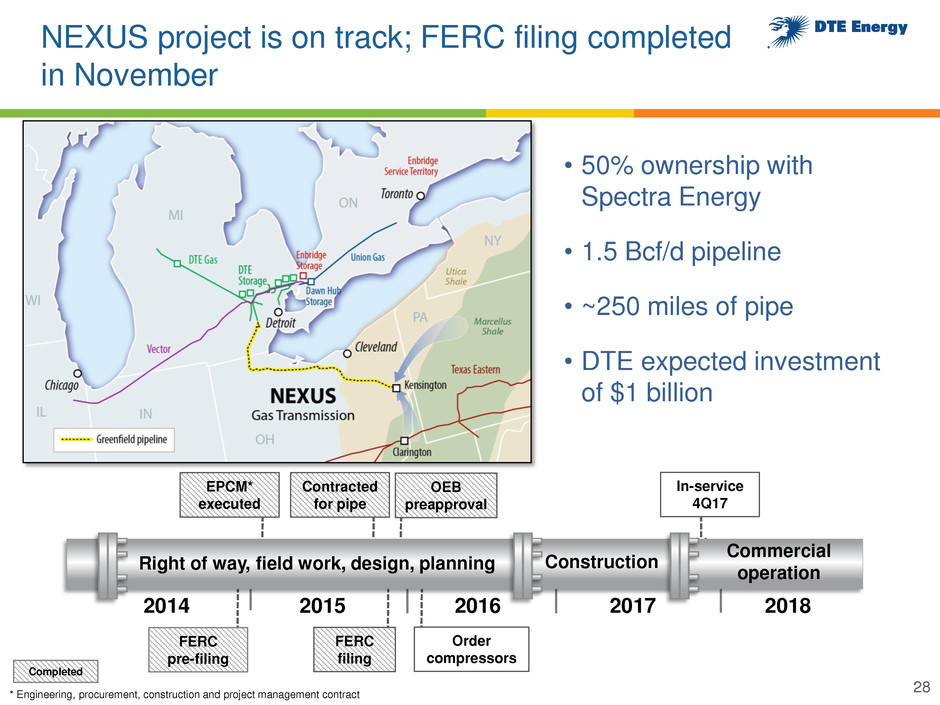

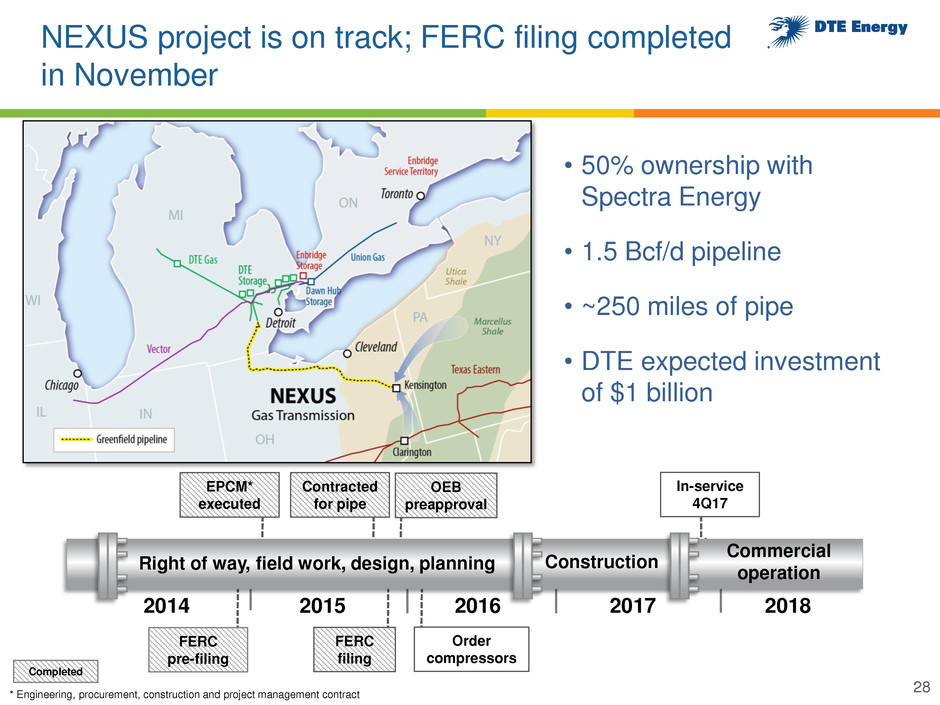

NEXUS project is on track; FERC filing completed in November 28 Right of way, field work, design, planning • 50% ownership with Spectra Energy • 1.5 Bcf/d pipeline • ~250 miles of pipe • DTE expected investment of $1 billion 2014 2015 2016 2017 2018 Construction Commercial operation Contracted for pipe In-service 4Q17 EPCM* executed * Engineering, procurement, construction and project management contract FERC pre-filing FERC filing Completed Order compressors OEB preapproval

The Ohio market has provided strong support on the NEXUS path 29 Interconnect agreements with local distribution companies, industrials and power generators in Ohio – 1.4 Bcf/d of opportunity Close proximity to significant additional power generation load

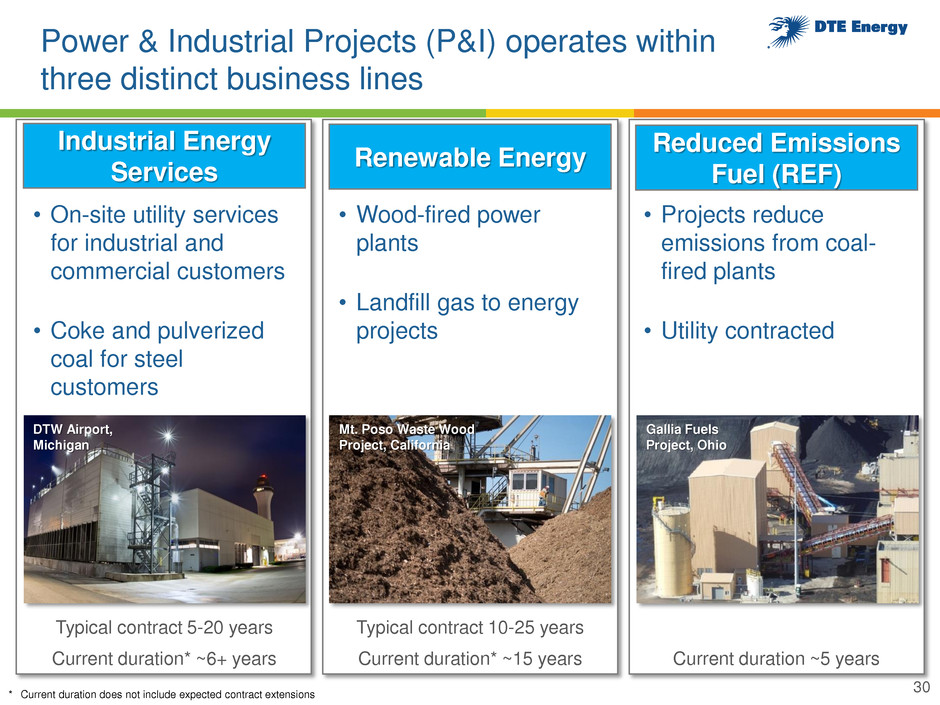

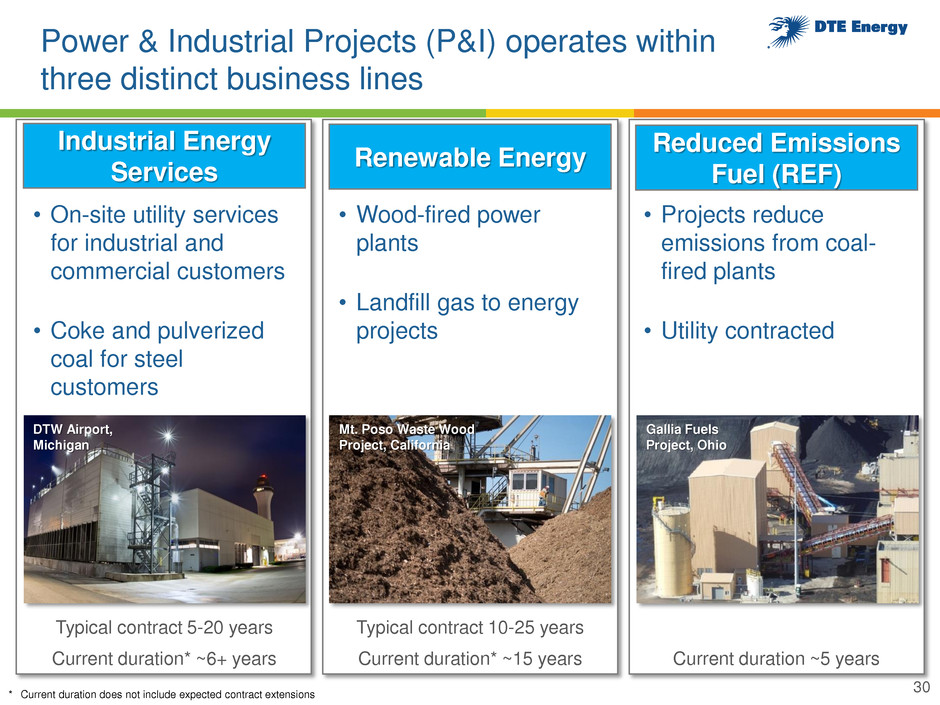

Power & Industrial Projects (P&I) operates within three distinct business lines DTW Airport, Michigan Gallia Fuels Project, Ohio Mt. Poso Waste Wood Project, California • On-site utility services for industrial and commercial customers • Coke and pulverized coal for steel customers • Wood-fired power plants • Landfill gas to energy projects • Projects reduce emissions from coal- fired plants • Utility contracted Industrial Energy Services Renewable Energy Reduced Emissions Fuel (REF) 30 Current duration* ~6+ years Current duration* ~15 years Current duration ~5 years Typical contract 5-20 years Typical contract 10-25 years * Current duration does not include expected contract extensions

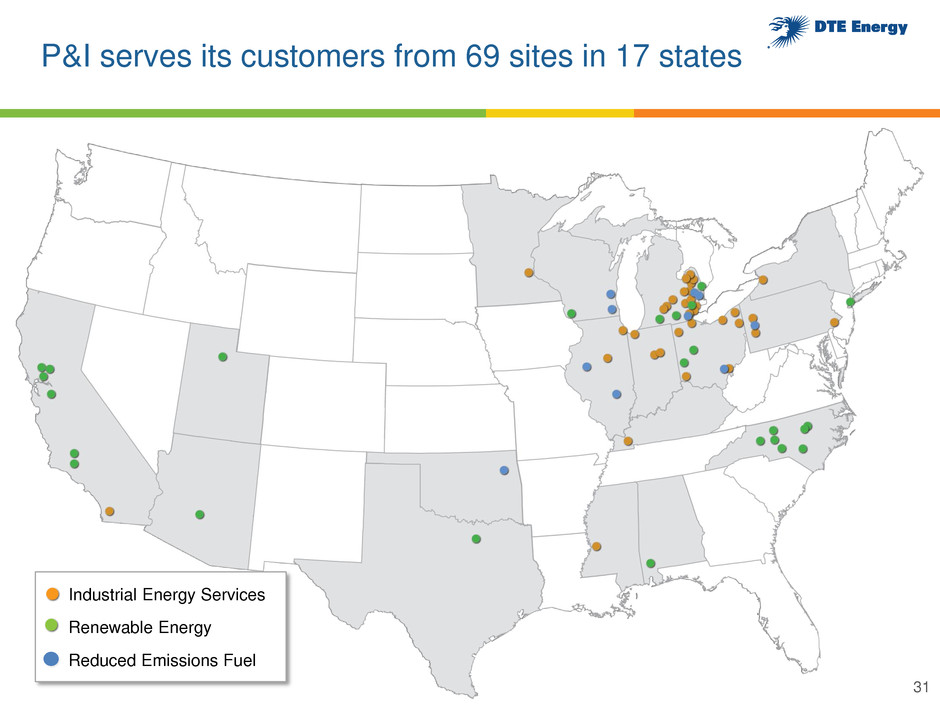

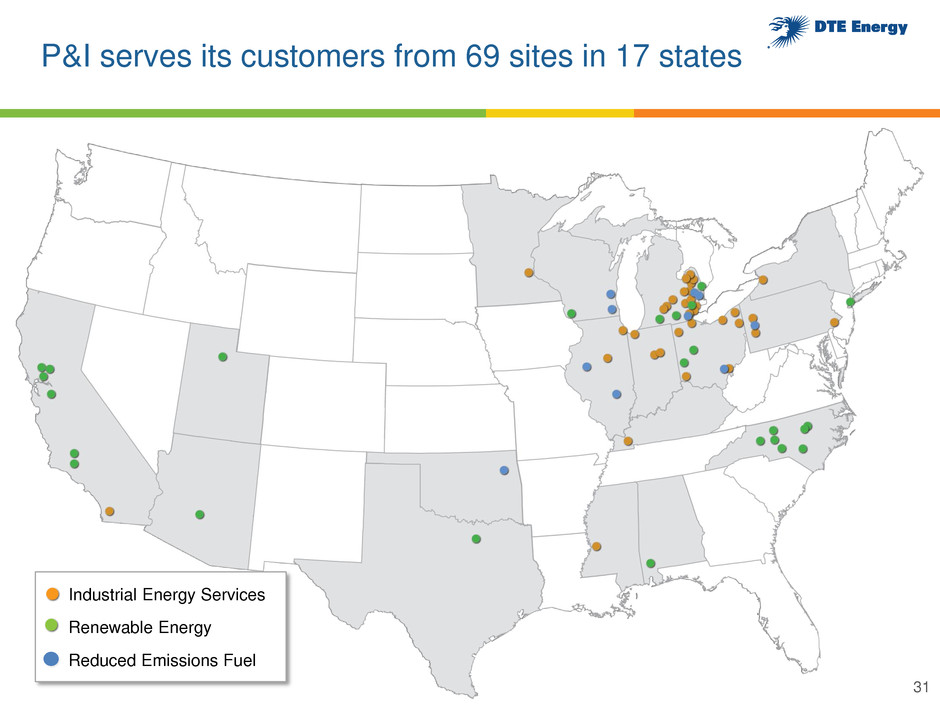

P&I serves its customers from 69 sites in 17 states 31 Industrial Energy Services Renewable Energy Reduced Emissions Fuel

32 • Overview • Long-Term Growth Update • Summary

• Proven track record of premium returns • Targeting 5% to 6% operating EPS* growth and parallel dividend growth • Progress in Michigan’s energy policy reform and constructive outcomes in DTE’s regulatory filings provide certainty in utility investment • Strategic growth opportunities in non-utility businesses provide diversity in earnings and geography 33 * Reconciliation to GAAP reported earnings included in the appendix Summary 33

Detroit is in the midst of a revitalization 34 DTE Energy Investor Relations www.dteenergy.com/investors (313) 235-8030 DTE Energy Investor Relations www.dteenergy.com/investors (313) 235-8030

Appendix

A strong balance sheet remains a key priority and supports our growth 36 * Debt excludes securitization, a portion of DTE Gas’ short-term debt, and considers 50% of the Junior Subordinated Notes as equity ** FFO (Funds from Operations) is calculated using operating earnings 25% 21% 2014 2015E 2016-2018E 51% 52% 2014 2015E 2016-2018E Leverage* FFO** / Debt* Target 50% - 53% Target 20% - 22% • Completed 2015 equity issuances of $200 million ‒ Targeting ~$800 million of equity issuances next 3 years ‒ DTE Gas issued $165 million of long-term debt in 3Q15 • $1.8 billion of available liquidity as of September 30, 2015 • Consistently maintain strong balance sheet metrics

Michigan’s economy continues to improve 37 Source: IHS 8.5% 7.1% 5.4% 5.1% 5.0% 2013 2014 2015E 2016E 2017E 15.1 15.8 17.3 19.7 22.1 2013 2014 2015E 2016E 2017E Unemployment Rate Housing Start Ups (000s) Detroit Metro #8 in number of new or expansion projects* Lowest Michigan unemployment since 2001 #7 most competitive state for job creation* Michigan has most new manufacturing jobs since 2009** $410 $417 $426 $435 $444 2013 2014 2015E 2016E 2017E Gross State Product (billions) #6 best state to make a living in 2015*** * Source: Site Selection magazine ** Source: State of Michigan website *** Source: Forbes

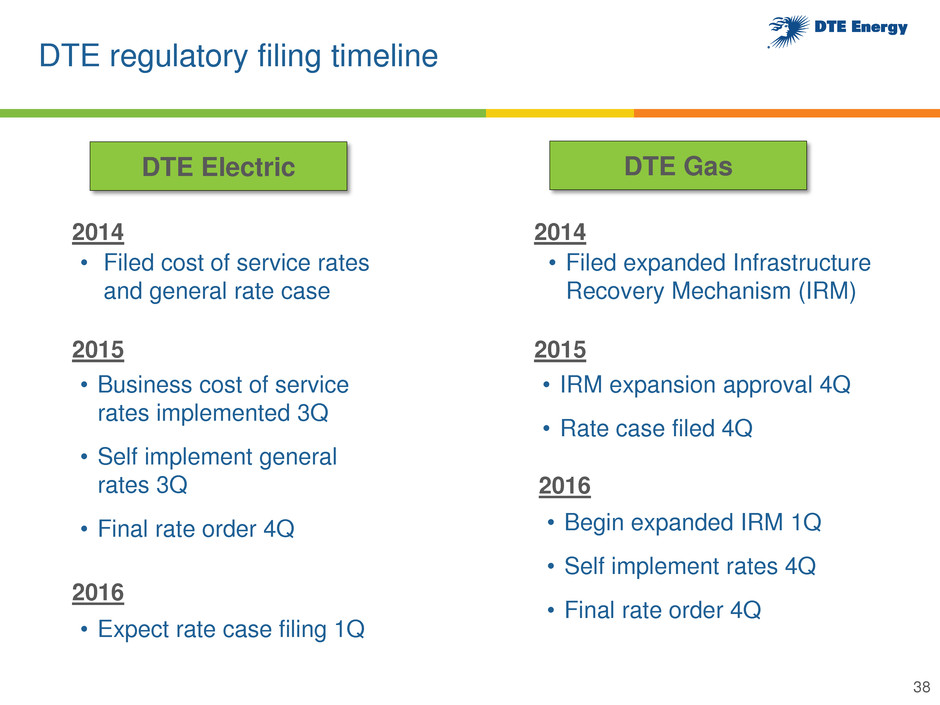

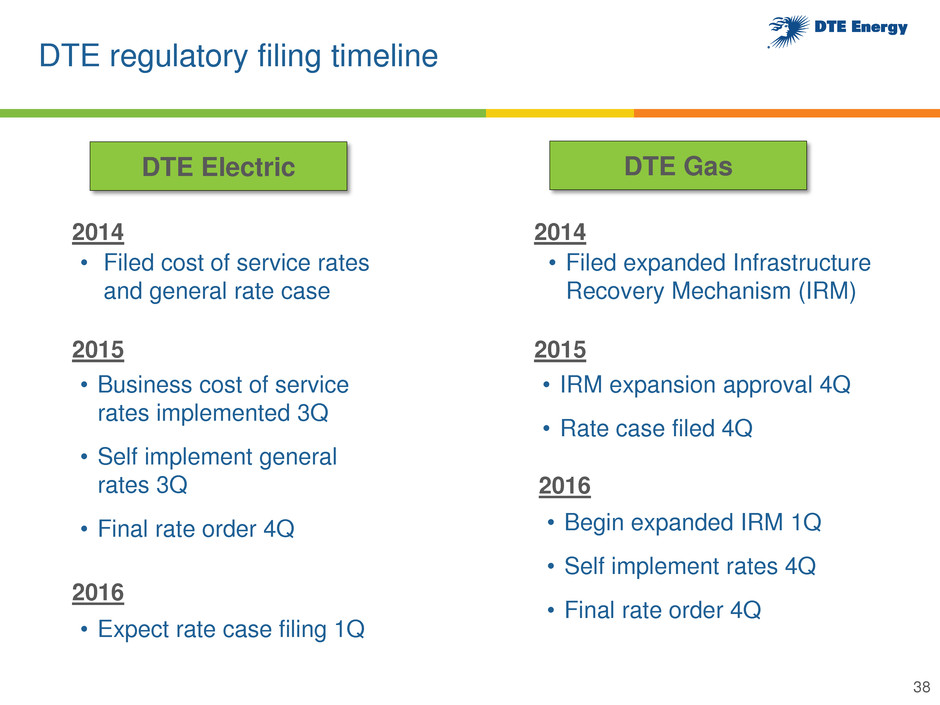

DTE regulatory filing timeline DTE Gas • Filed expanded Infrastructure Recovery Mechanism (IRM) 2015 • Filed cost of service rates and general rate case DTE Electric 2014 2016 • Business cost of service rates implemented 3Q • Self implement general rates 3Q • Final rate order 4Q • Expect rate case filing 1Q • IRM expansion approval 4Q • Rate case filed 4Q 38 2015 2014 • Begin expanded IRM 1Q • Self implement rates 4Q • Final rate order 4Q 2016

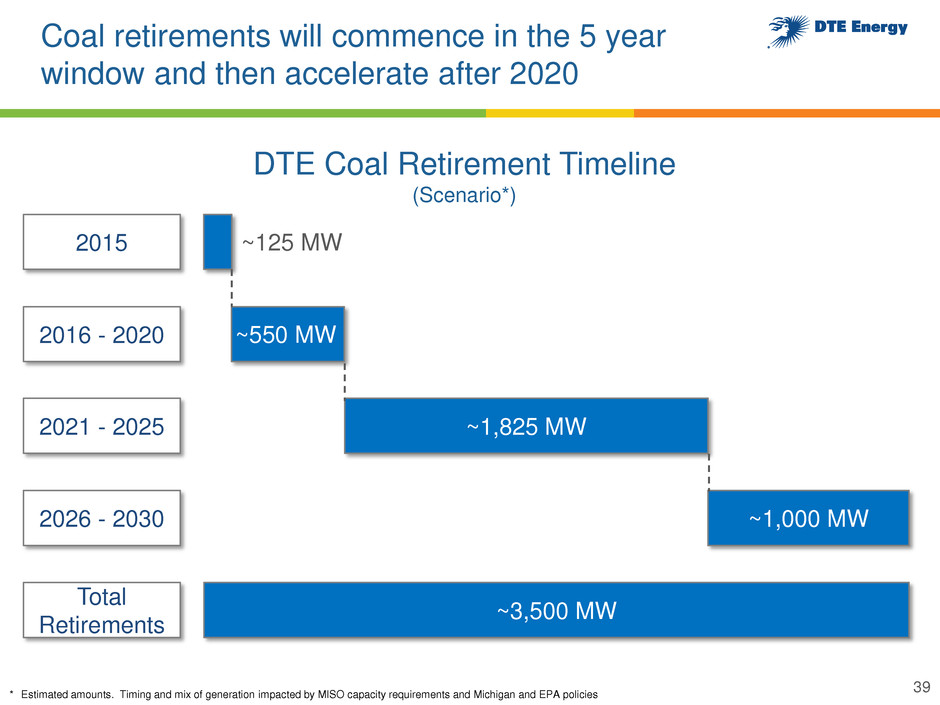

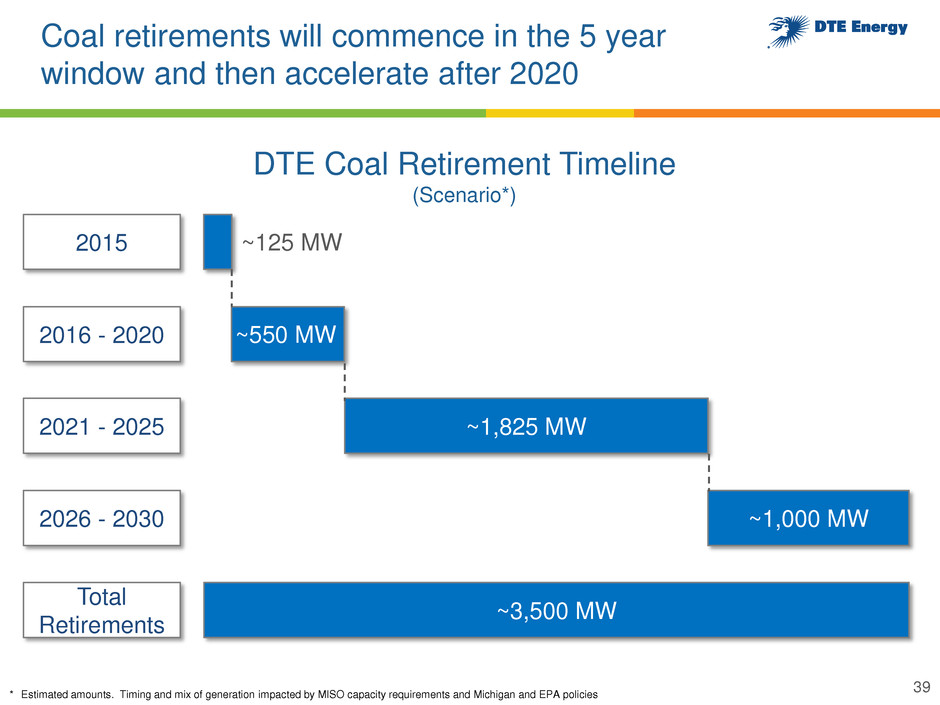

Coal retirements will commence in the 5 year window and then accelerate after 2020 32% 2015 2016 - 2020 2021 - 2025 ~1,825 MW ~125 MW ~550 MW 2026 - 2030 ~1,000 MW DTE Coal Retirement Timeline (Scenario*) * Estimated amounts. Timing and mix of generation impacted by MISO capacity requirements and Michigan and EPA policies 39 Total Retirements ~3,500 MW

Gas Storage & Pipelines operates projects within 3 asset platforms • Bluestone Pipeline • Millennium Pipeline ‒ Valley Lateral • Vector Pipeline • NEXUS Pipeline ‒ FERC filing completed • Bluestone Gathering • Michigan Gathering • 91 Bcf of working capacity • Strategically located between Chicago and Dawn trading hubs Pipeline Platform Gathering Platform Storage Platform 40

Contractual commitments materially expand the Millennium pipeline • Millennium Expansion – 200+ MMcf/day – In-service expected 4Q 2018 • Valley Lateral: ~130 MMcf/day on new 8 mile lateral – FERC filing complete November 2015; in-service expected April 2017 • Working with interested parties on additional expansion opportunities BLUESTONE Valley Lateral Eastern System Upgrade 41

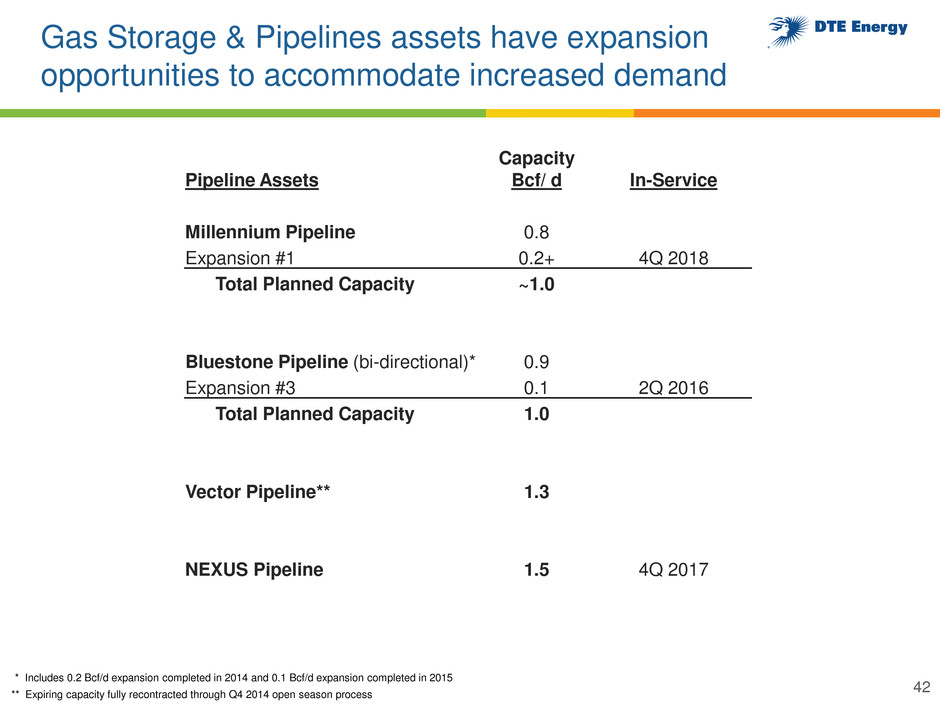

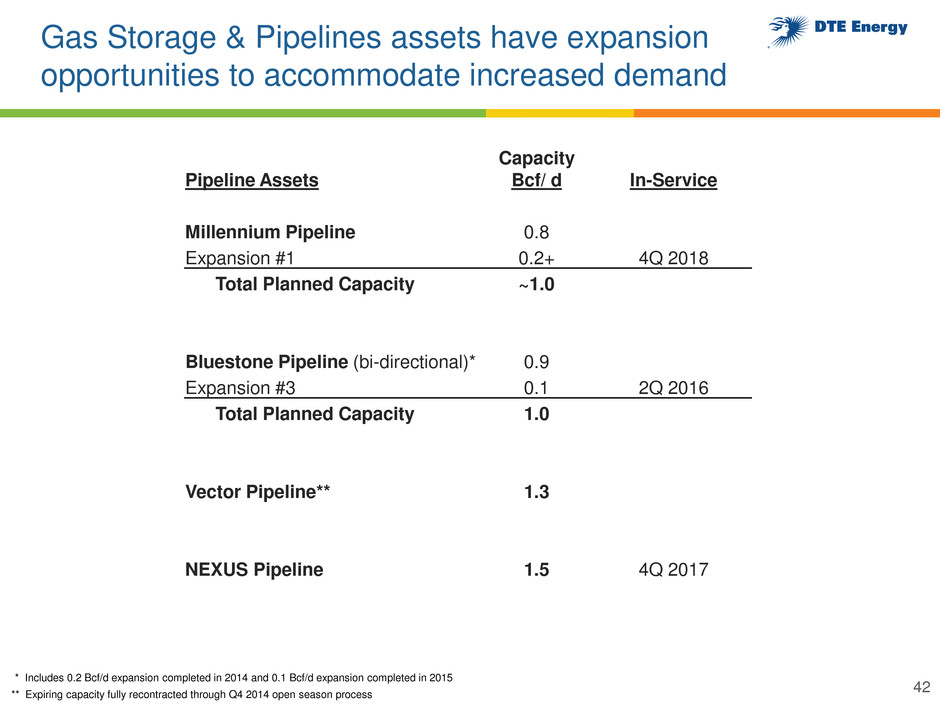

Gas Storage & Pipelines assets have expansion opportunities to accommodate increased demand Pipeline Assets Capacity Bcf/ d In-Service Millennium Pipeline 0.8 Expansion #1 0.2+ 4Q 2018 Total Planned Capacity ~1.0 Bluestone Pipeline (bi-directional)* 0.9 Expansion #3 0.1 2Q 2016 Total Planned Capacity 1.0 Vector Pipeline** 1.3 NEXUS Pipeline 1.5 4Q 2017 * Includes 0.2 Bcf/d expansion completed in 2014 and 0.1 Bcf/d expansion completed in 2015 ** Expiring capacity fully recontracted through Q4 2014 open season process 42

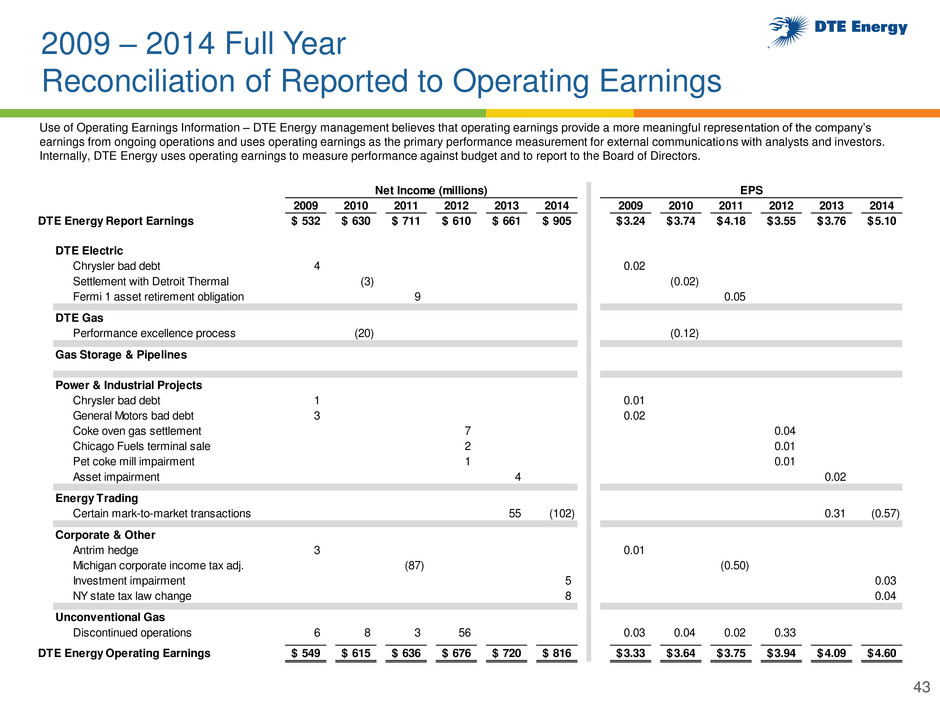

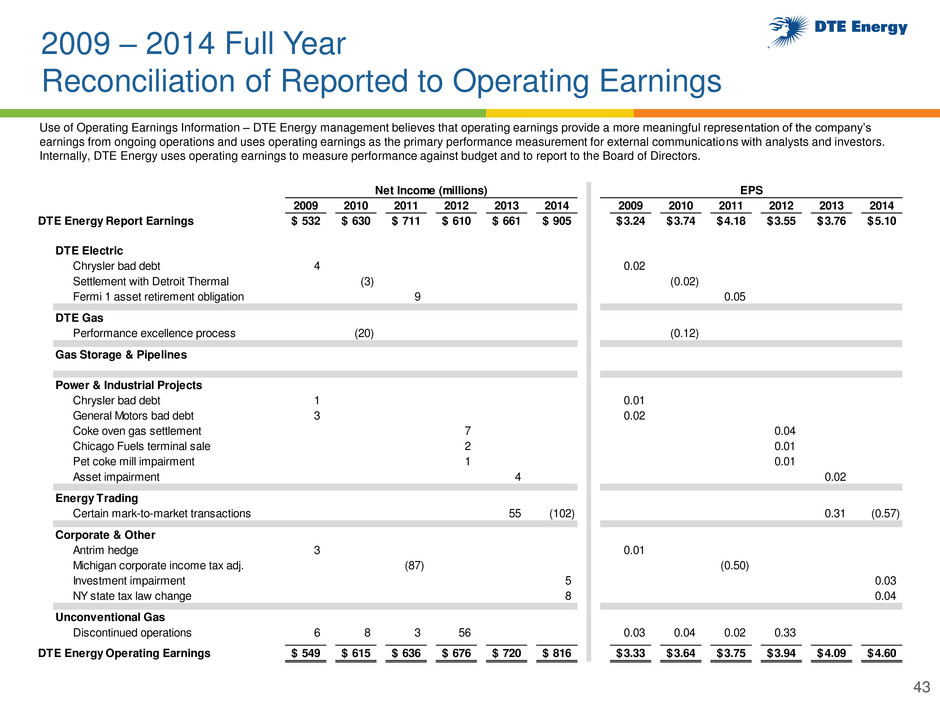

2009 – 2014 Full Year Reconciliation of Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 43 2009 2010 2011 2012 2013 2014 2009 2010 2011 2012 2013 2014 DTE Energy Report Earnings 532$ 630$ 711$ 610$ 661$ 905$ 3.24$ 3.74$ 4.18$ 3.55$ 3.76$ 5.10$ DTE Electric Chrysler bad debt 4 0.02 Settlement with Detroit Thermal (3) (0.02) Fermi 1 asset retirement obligation 9 0.05 DTE Gas Performance excellence process (20) (0.12) Gas Storage & Pipelines Power & Industrial Projects Chrysler bad debt 1 0.01 General Motors bad debt 3 0.02 Coke oven gas settlement 7 0.04 Chicago Fuels terminal sale 2 0.01 Pet coke mill impairment 1 0.01 Asset impairment 4 0.02 Energy Trading Certain mark-to-market transactions 55 (102) 0.31 (0.57) Corporate & Other Antrim hedge 3 0.01 Michigan corporate income tax adj. (87) (0.50) I t ent impairment 5 0.03 NY state tax law change 8 0.04 Unconventional Gas Discontinued operations 6 8 3 56 0.03 0.04 0.02 0.33 DTE Energy Operating Earnings 549$ 615$ 636$ 676$ 720$ 816$ 3.33$ 3.64$ 3.75$ 3.94$ 4.09$ 4.60$ Net Income (millions) EPS

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items. These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. For comparative purposes, 2009 through 2012 operating earnings exclude the Unconventional Gas Production segment that was classified as a discontinued operation on 12/31/2012. Reconciliation of Other Reported to Operating Earnings 44