Click to edit Master title style EXHIBIT 99.1 Business Update May 16, 2017

2 Safe Harbor Statement Many factors impact forward-looking statements including, but not limited to, the following: impact of regulation by the EPA, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; volatility in the short-term natural gas storage markets impacting third-party storage revenues related to DTE Energy; impact of volatility of prices in the oil and gas markets on DTE Energy's gas storage and pipelines operations; impact of volatility in prices in the international steel markets on DTE Energy's power and industrial projects operations; volatility in commodity markets, deviations in weather, and related risks impacting the results of DTE Energy's energy trading operations; changes in the financial condition of DTE Energy's significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; the cost of protecting assets against, or damage due to, cyber crime and terrorism; employee relations and the impact of collective bargaining agreements; the risk of a major safety incident at an electric distribution or generation facility and, for DTE Energy, a gas storage, transmission, or distribution facility; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; contract disputes, binding arbitration, litigation, and related appeals; implementation of new information systems; and the risks discussed in our public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This presentation should also be read in conjunction with the Forward-Looking Statements section of the joint DTE Energy and DTE Electric 2016 Form 10-K and 2017 Form 10-Q (which section is incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric.

3 • Overview • Long-Term Growth Update • Summary

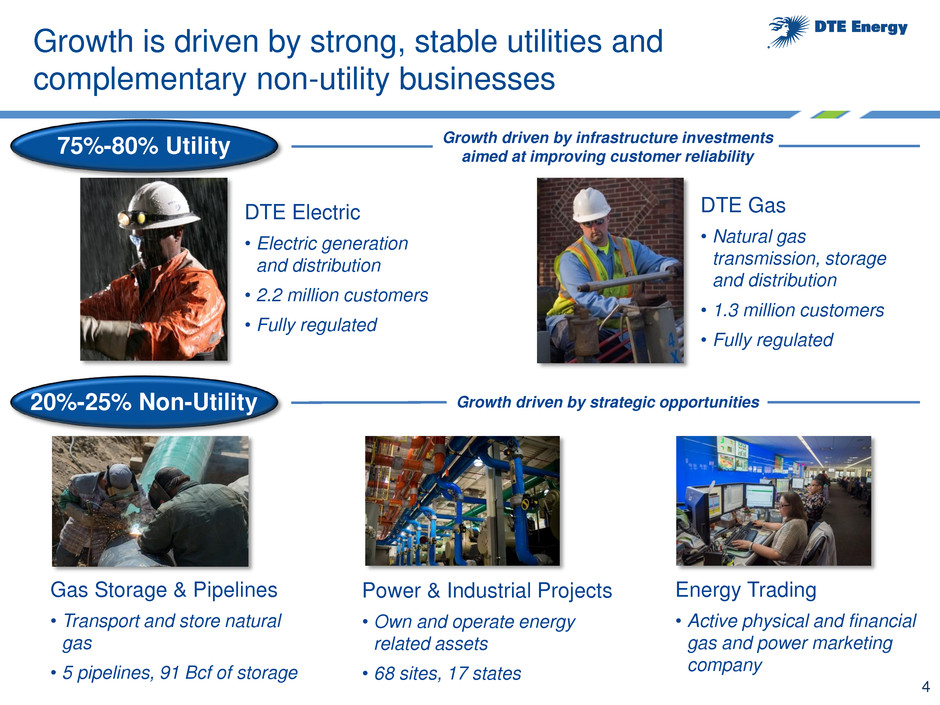

4 Growth is driven by strong, stable utilities and complementary non-utility businesses DTE Electric • Electric generation and distribution • 2.2 million customers • Fully regulated Growth driven by infrastructure investments aimed at improving customer reliability Growth driven by strategic opportunities 75%-80% Utility 20%-25% Non-Utility DTE Gas • Natural gas transmission, storage and distribution • 1.3 million customers • Fully regulated Gas Storage & Pipelines • Transport and store natural gas • 5 pipelines, 91 Bcf of storage Power & Industrial Projects • Own and operate energy related assets • 68 sites, 17 states Energy Trading • Active physical and financial gas and power marketing company

5 * Reconciliation of operating EPS (non-GAAP) to reported earnings included in the appendix ** Includes Appalachia Gathering System (AGS) and 55% of Stonewall Gas Gathering (SGG) 2017 has started strong and we are confident in achieving our operating EPS* guidance • On track to achieve 2017 operating EPS guidance range of $5.15 to $5.46 • Filed electric rate case April 2017 • Gas Storage & Pipelines (GSP) ‒ NEXUS in-service date will not affect 2017 guidance, 2018 plan or 5-7% EPS growth target ‒ Expanded key shipper contract for Link** • Power & Industrial Projects (P&I) ‒ Closed on two projects and are finalizing one more

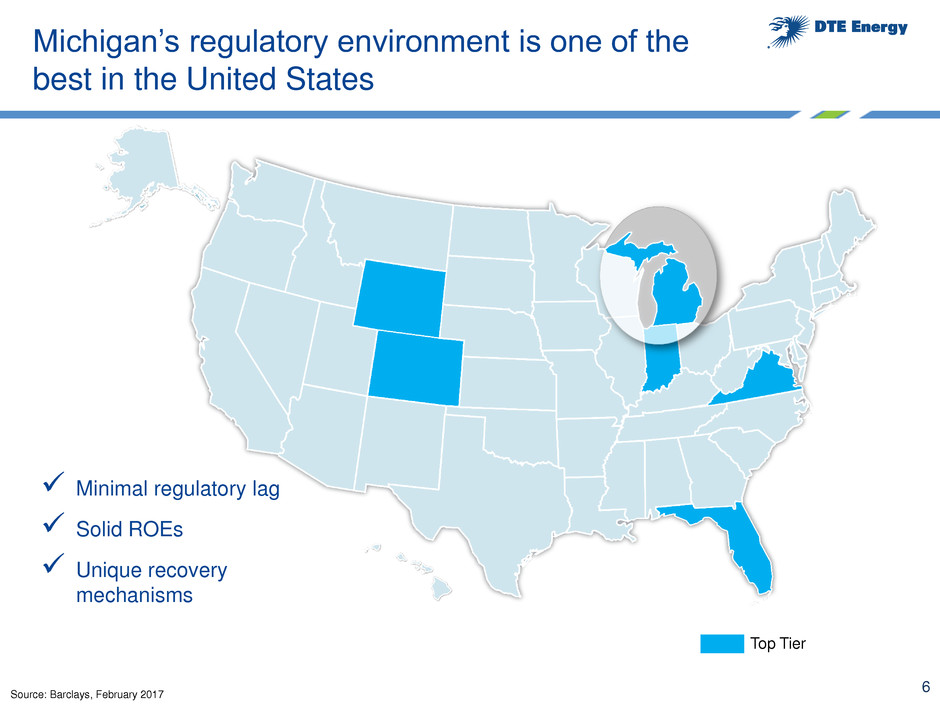

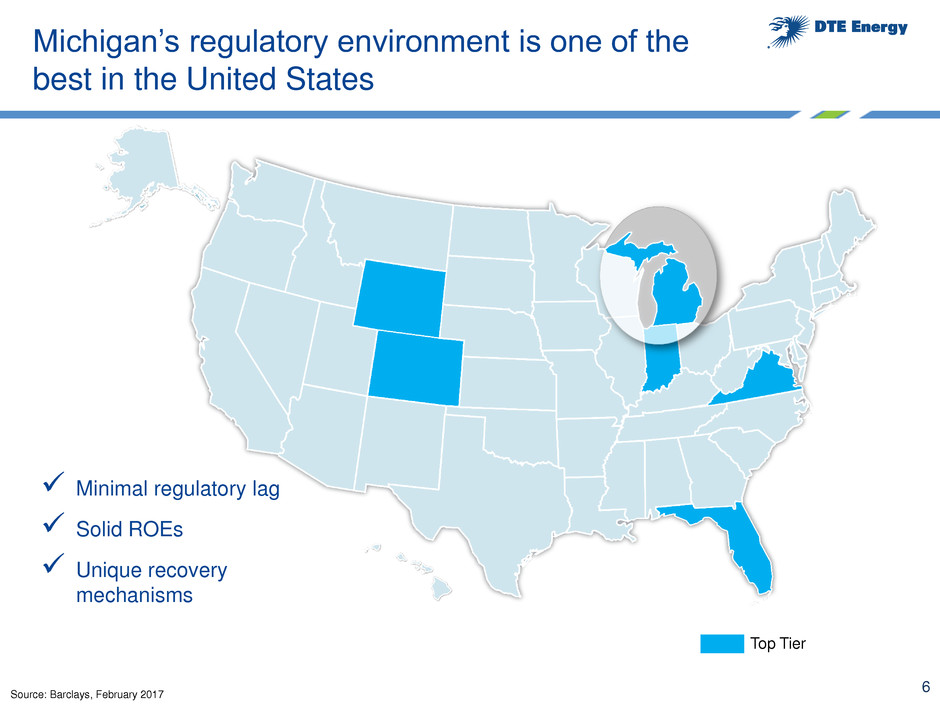

6 Minimal regulatory lag Solid ROEs Unique recovery mechanisms Source: Barclays, February 2017 Top Tier Michigan’s regulatory environment is one of the best in the United States

7 • Overview • Long-Term Growth Update • Summary

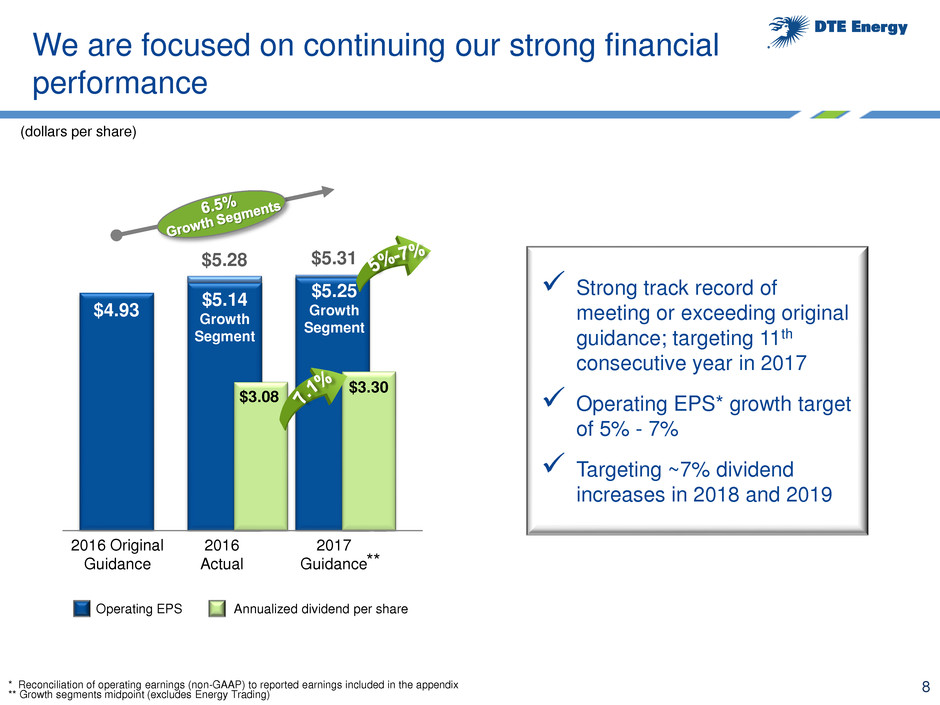

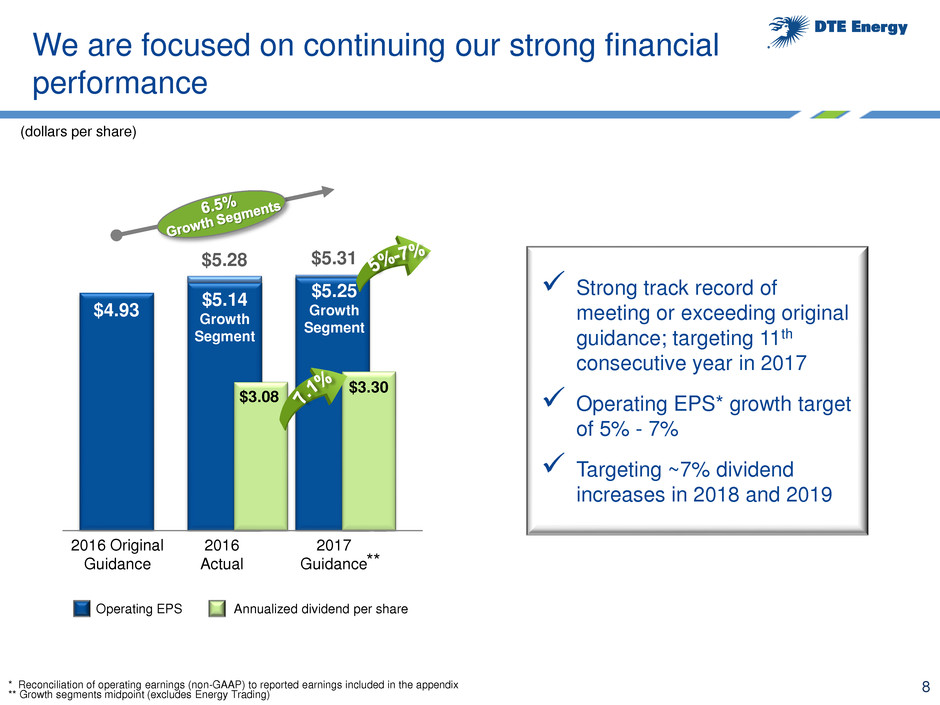

8 Strong track record of meeting or exceeding original guidance; targeting 11th consecutive year in 2017 Operating EPS* growth target of 5% - 7% Targeting ~7% dividend increases in 2018 and 2019 * Reconciliation to GAAP reported earnings included in the appendix We are focused on continuing our strong financial performance (dollars per share) ** Growth segments midpoint (excludes Energy Trading) 2017 Guidance $5.25 Growth Segment $4.93 ** $5.31 2016 Original Guidance 2016 Actual $3.08 $3.30 Operating EPS Annualized dividend per share $5.28 $5.14 Growth Segment * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

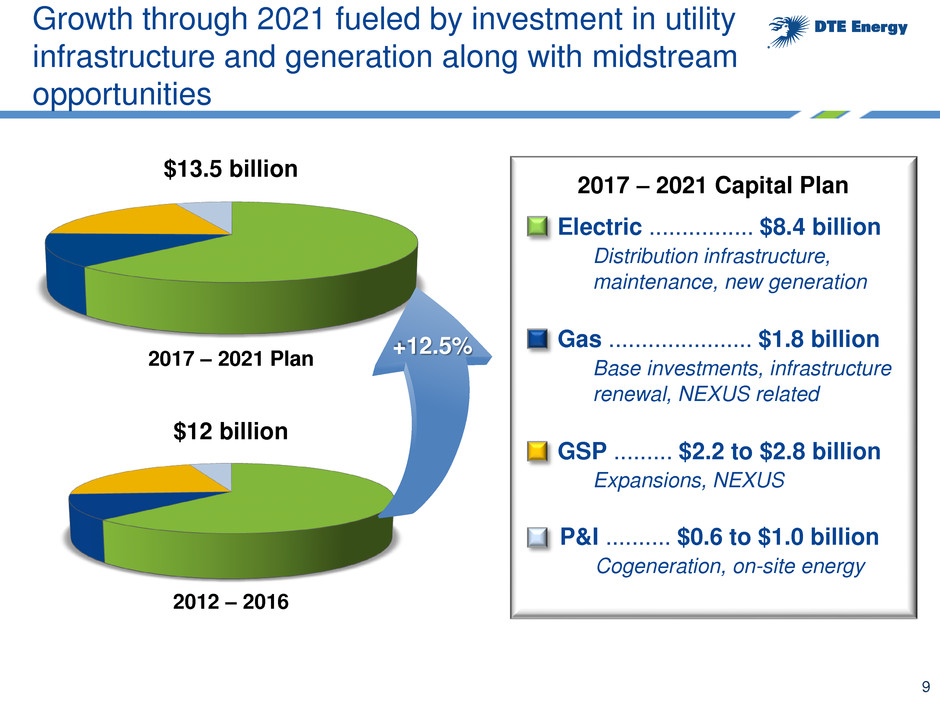

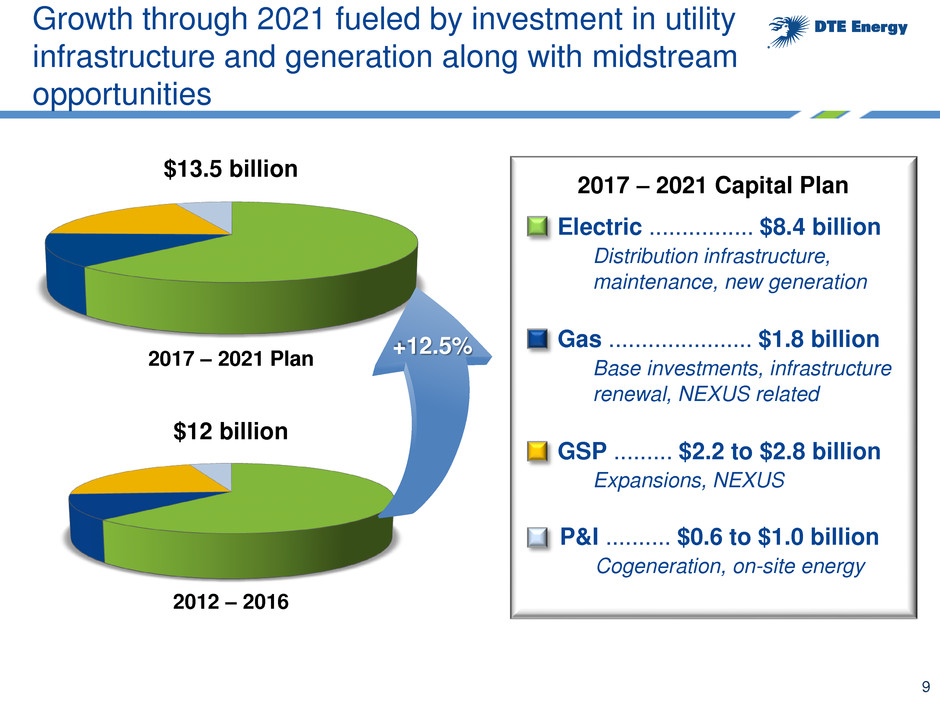

9 2017 – 2021 Plan 2012 – 2016 $12 billion $13.5 billion 2017 – 2021 Capital Plan Electric ................ $8.4 billion Distribution infrastructure, maintenance, new generation Gas ...................... $1.8 billion Base investments, infrastructure renewal, NEXUS related GSP ......... $2.2 to $2.8 billion Expansions, NEXUS P&I .......... $0.6 to $1.0 billion Cogeneration, on-site energy +12.5% Growth through 2021 fueled by investment in utility infrastructure and generation along with midstream opportunities

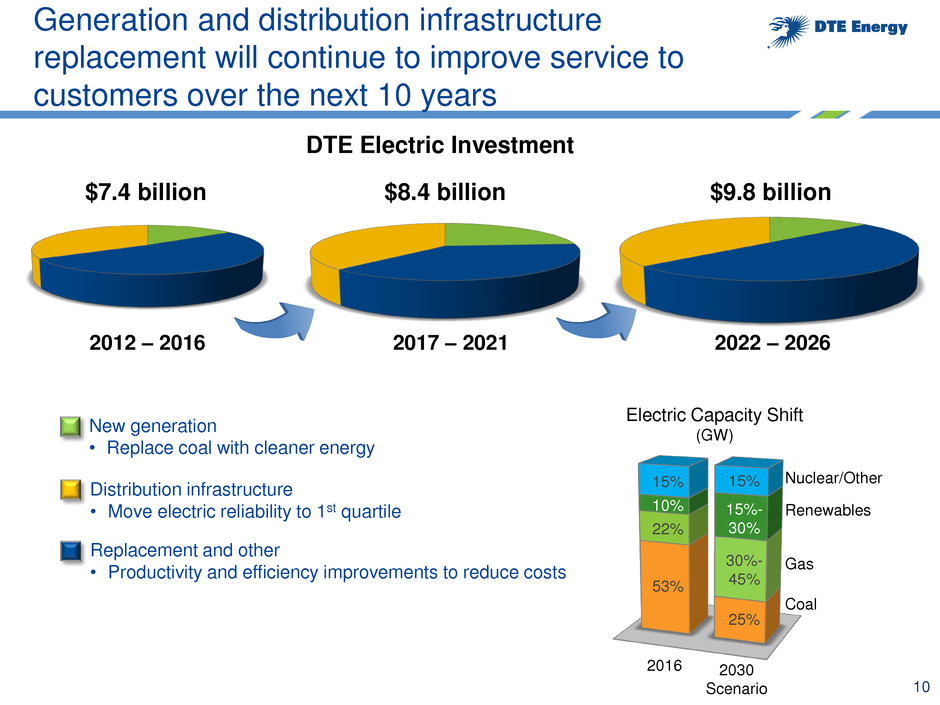

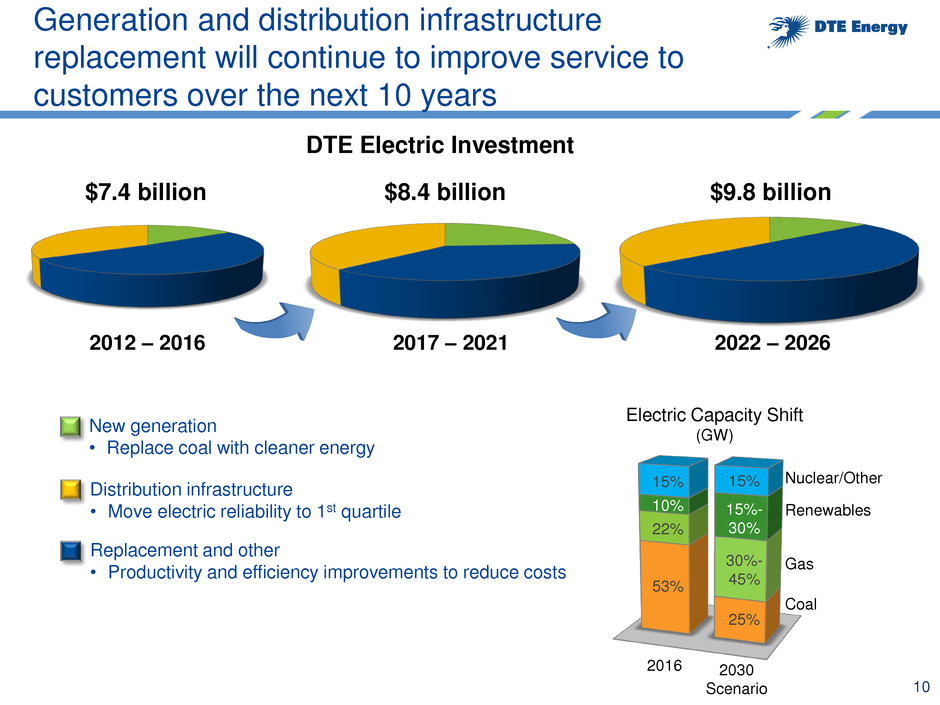

10 Generation and distribution infrastructure replacement will continue to improve service to customers over the next 10 years DTE Electric Investment New generation • Replace coal with cleaner energy Distribution infrastructure • Move electric reliability to 1st quartile Replacement and other • Productivity and efficiency improvements to reduce costs 2012 – 2016 2017 – 2021 2022 – 2026 $7.4 billion $8.4 billion $9.8 billion Nuclear/Other Gas Renewables Coal 2030 Scenario 2016 Electric Capacity Shift (GW) 15% 30%- 45% 15%- 30% 10% 22% 53% 25% 15%

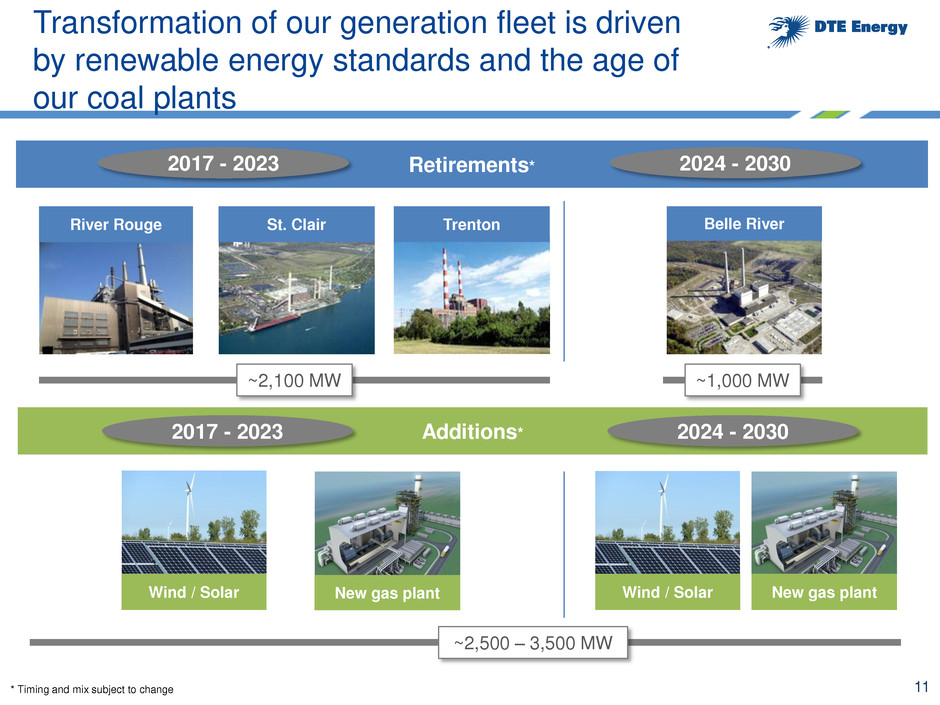

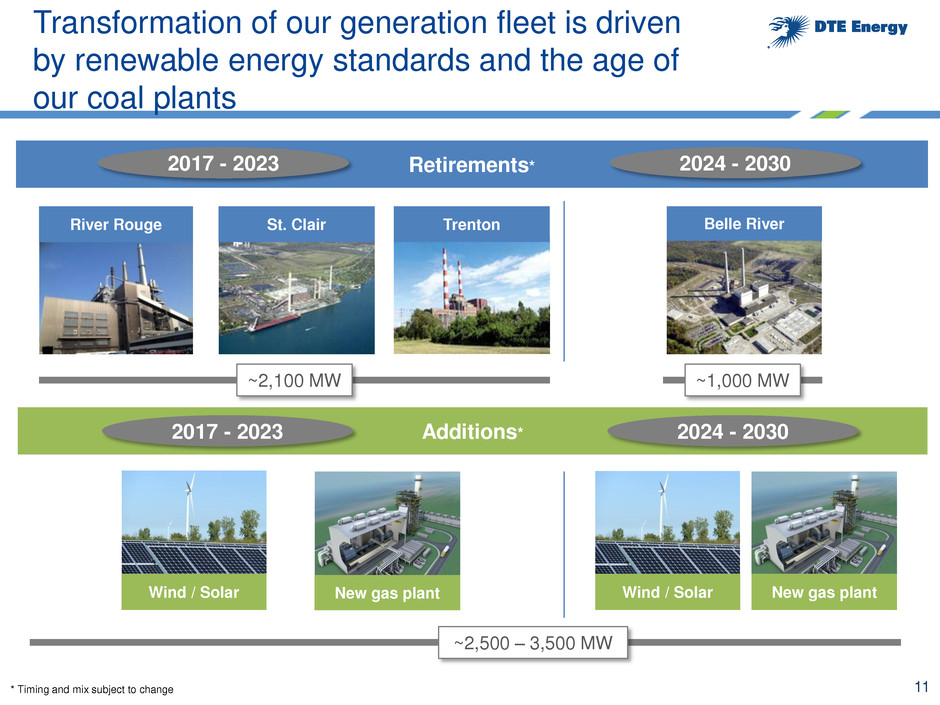

11 Transformation of our generation fleet is driven by renewable energy standards and the age of our coal plants Belle River St. Clair River Rouge Retirements* Additions* Wind / Solar Trenton New gas plant * Timing and mix subject to change 2024 - 2030 New gas plant Wind / Solar 2017 - 2023 2017 - 2023 2024 - 2030 ~2,100 MW ~1,000 MW ~2,500 – 3,500 MW

12 We have already achieved significant emissions reductions and continue on the path to even cleaner energy 2005 2015 2030 CO2 Emissions 16% Reduction 2005 2015 2030 2005 2015 2030 NOX Emissions SO2 Emissions Emissions reductions are largely due to $2 billion in controls installed at Monroe Power Plant, new technology and reduced reliance on coal-fired generation In addition, mercury emissions have been reduced 42% since 2005 with over 75% reduction expected by 2030 67% Reduction 61% Reduction 40% Reduction 85% Reduction 95% Reduction

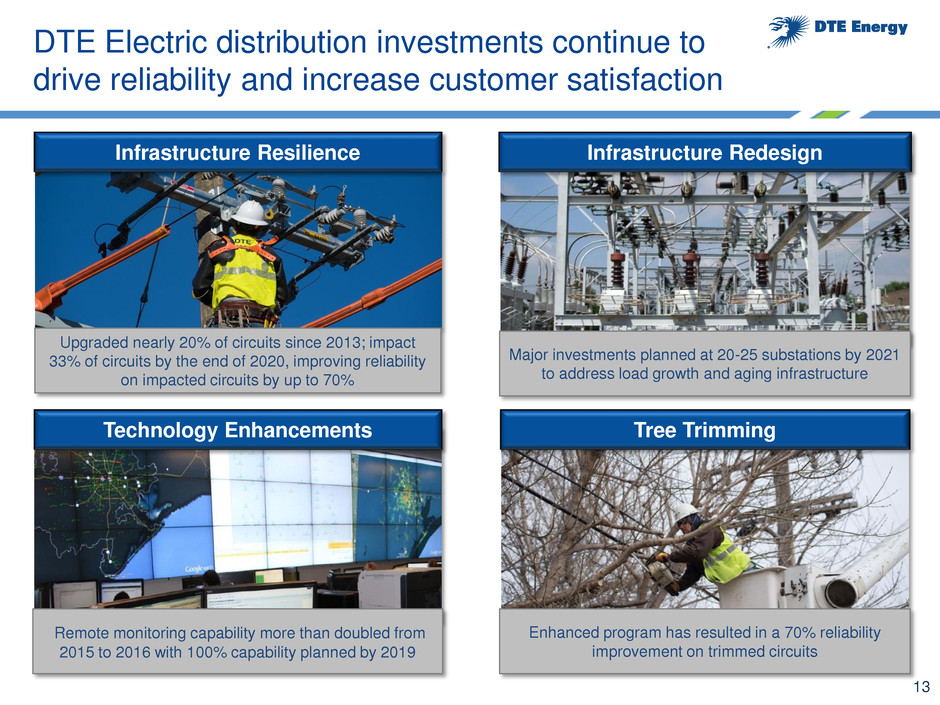

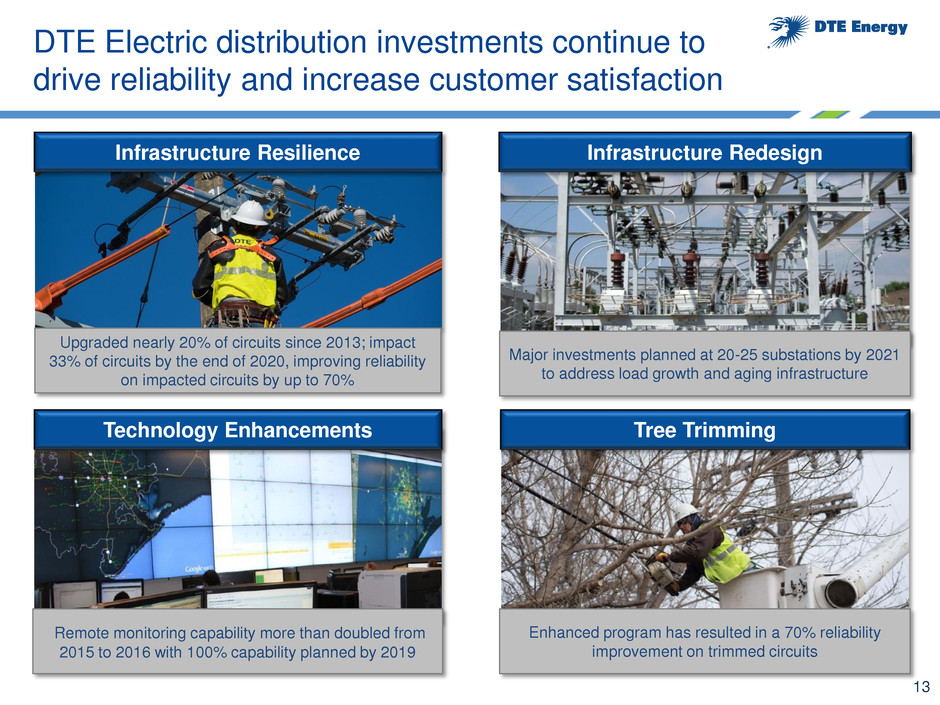

13 Infrastructure Resilience Infrastructure Redesign Technology Enhancements Upgraded nearly 20% of circuits since 2013; impact 33% of circuits by the end of 2020, improving reliability on impacted circuits by up to 70% Major investments planned at 20-25 substations by 2021 to address load growth and aging infrastructure Remote monitoring capability more than doubled from 2015 to 2016 with 100% capability planned by 2019 DTE Electric distribution investments continue to drive reliability and increase customer satisfaction Tree Trimming Enhanced program has resulted in a 70% reliability improvement on trimmed circuits

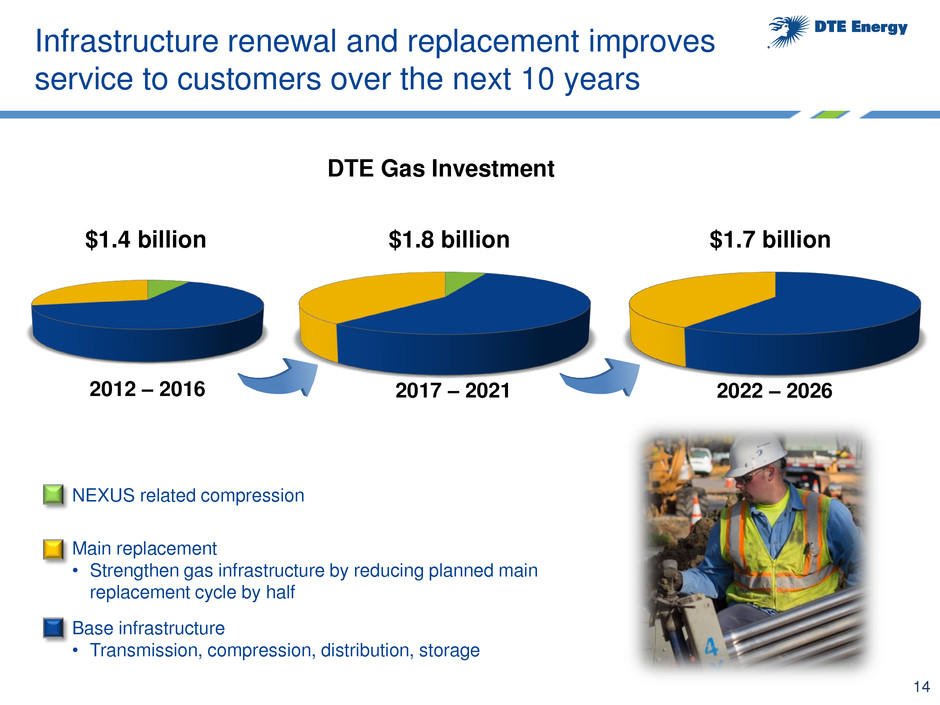

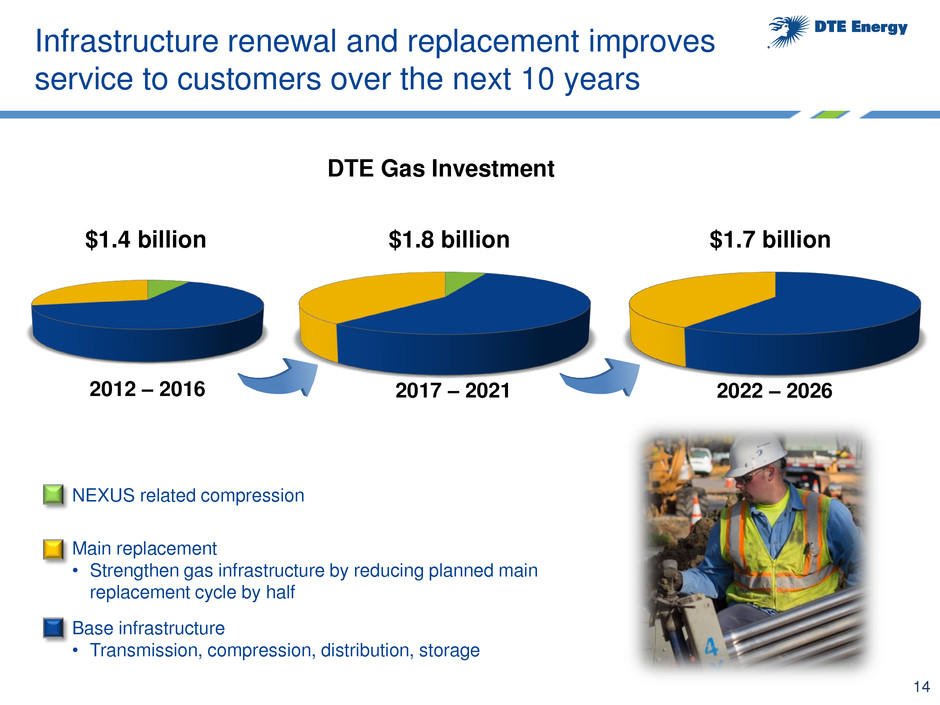

14 Infrastructure renewal and replacement improves service to customers over the next 10 years DTE Gas Investment Base infrastructure • Transmission, compression, distribution, storage Main replacement • Strengthen gas infrastructure by reducing planned main replacement cycle by half NEXUS related compression 2012 – 2016 2017 – 2021 $1.4 billion $1.8 billion 2022 – 2026 $1.7 billion

15 Main Replacement Pipeline Integrity Meter Move Out Systematically replaces poor performing unprotected main - minimizing leaks and improving customer satisfaction Drives productivity - reducing manual meter reading costs Strengthens the system - decreasing the potential for system failures Replacing aging infrastructure achieves a fundamental shift in performance, cost and productivity at DTE Gas i it l t

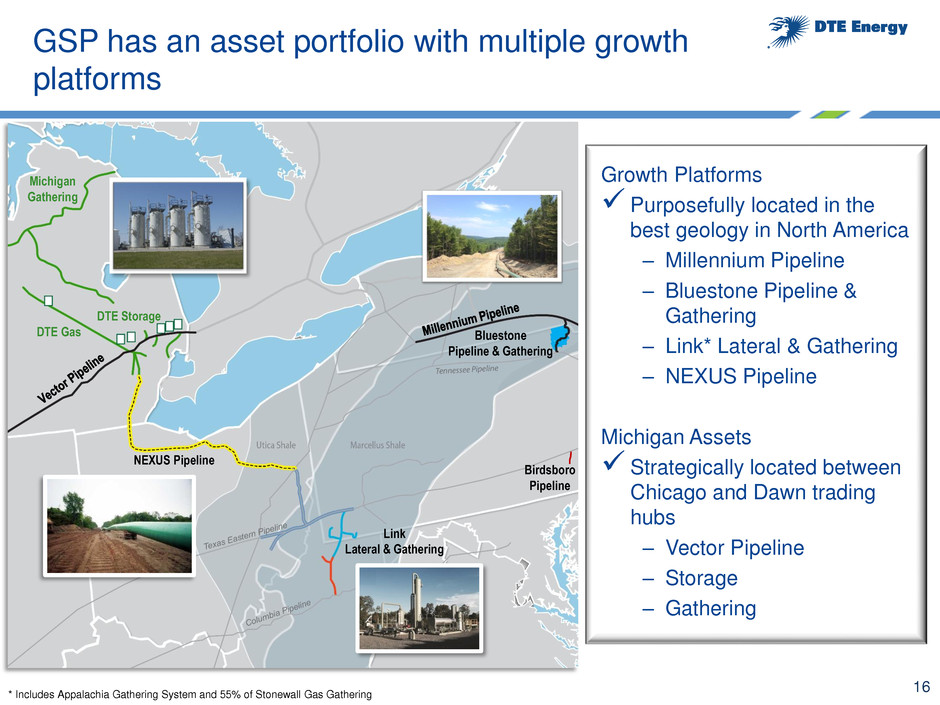

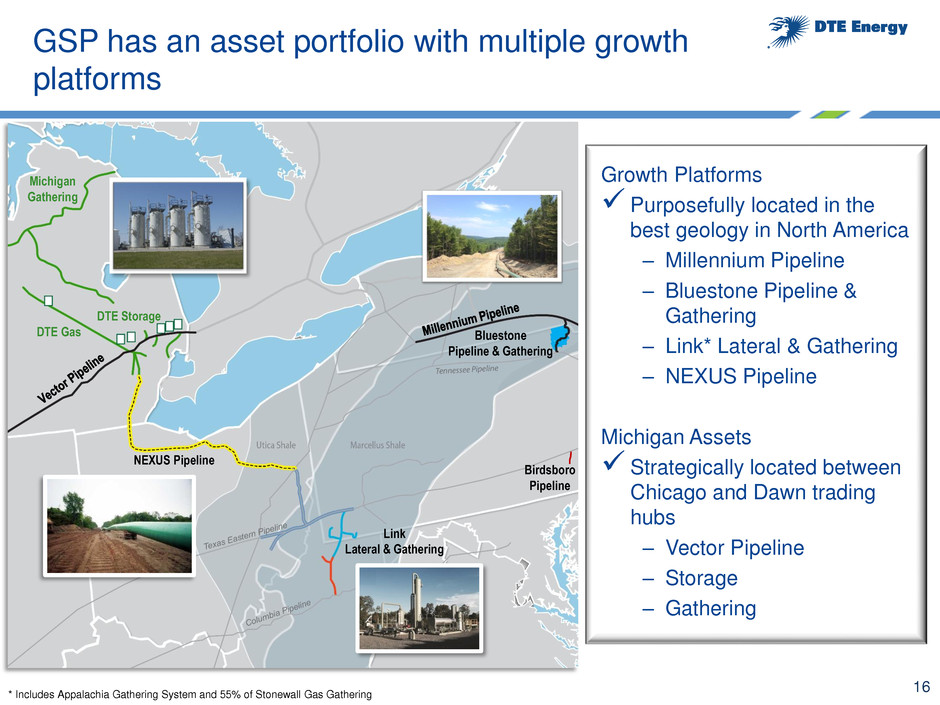

16 GSP has an asset portfolio with multiple growth platforms Growth Platforms Purposefully located in the best geology in North America ‒ Millennium Pipeline ‒ Bluestone Pipeline & Gathering ‒ Link* Lateral & Gathering ‒ NEXUS Pipeline Michigan Assets Strategically located between Chicago and Dawn trading hubs ‒ Vector Pipeline ‒ Storage ‒ Gathering Link Lateral & Gathering NEXUS Pipeline DTE Gas DTE Storage Bluestone Pipeline & Gathering Michigan Gathering Birdsboro Pipeline * Includes Appalachia Gathering System and 55% of Stonewall Gas Gathering

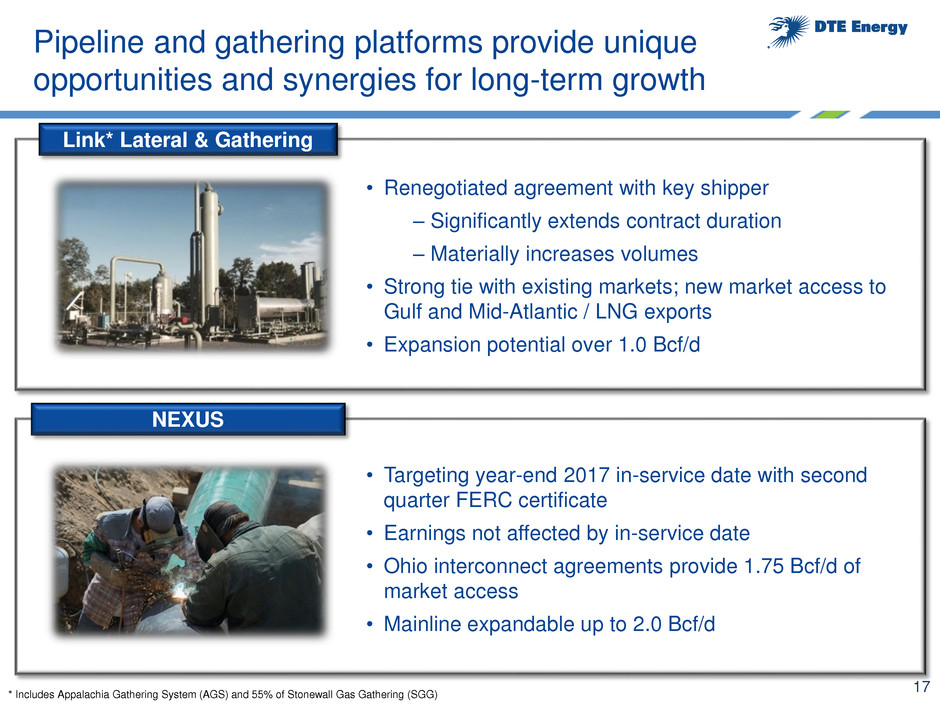

17 Link* Lateral & Gathering • Renegotiated agreement with key shipper – Significantly extends contract duration – Materially increases volumes • Strong tie with existing markets; new market access to Gulf and Mid-Atlantic / LNG exports • Expansion potential over 1.0 Bcf/d NEXUS Pipeline and gathering platforms provide unique opportunities and synergies for long-term growth * Includes Appalachia Gathering System (AGS) and 55% of Stonewall Gas Gathering (SGG) • Targeting year-end 2017 in-service date with second quarter FERC certificate • Earnings not affected by in-service date • Ohio interconnect agreements provide 1.75 Bcf/d of market access • Mainline expandable up to 2.0 Bcf/d

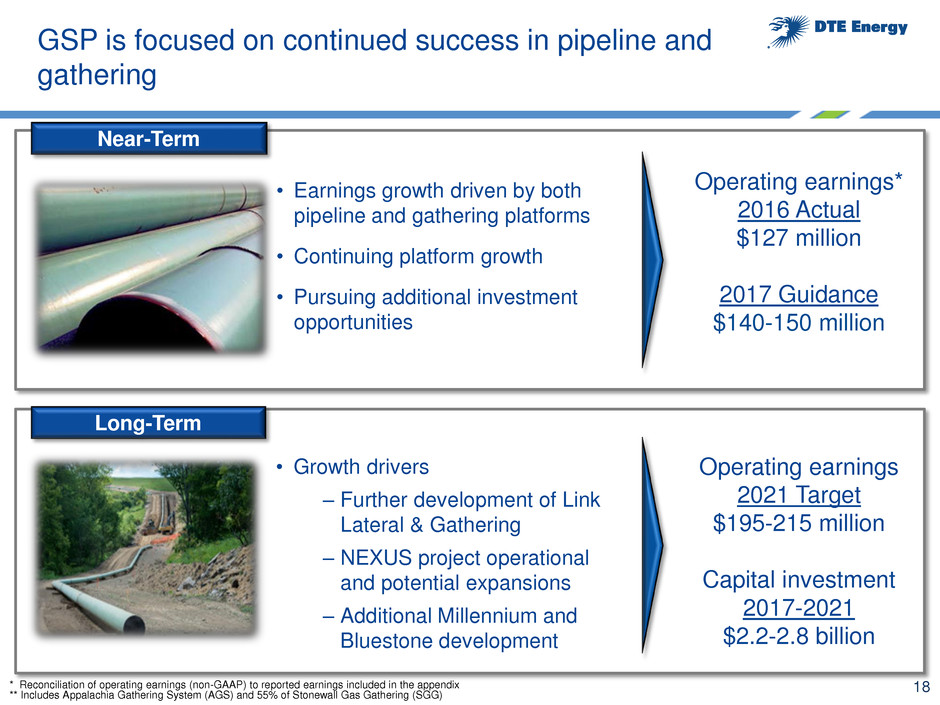

18 GSP is focused on continued success in pipeline and gathering • Earnings growth driven by both pipeline and gathering platforms • Continuing platform growth • Pursuing additional investment opportunities Near-Term • Growth drivers – Further development of Link Lateral & Gathering – NEXUS project operational and potential expansions – Additional Millennium and Bluestone development Long-Term Operating earnings* 2016 Actual $127 million 2017 Guidance $140-150 million Operating earnings 2021 Target $195-215 million Capital investment 2017-2021 $2.2-2.8 billion ** Includes Appalachia Gathering System (AGS) and 55% of Stonewall Gas Gathering (SGG) * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

19 P&I operates three distinct business lines across the United States Industrial Energy Services Renewable Energy Reduced Emissions Fuel (REF) • On-site utility services for industrial and commercial customers • Coke and pulverized coal for steel customers • Wood-fired power plants • Convert landfill gas to energy • Projects to reduce emissions from coal-fired plants • Utility contracted Typical contract 5-20 years Contract duration ~6 years Typical contract 10-25 years Contract duration ~14 years Contract duration ~4.5 years

20 P&I is focused on replacing REF earnings Near-Term • Closed on two landfill gas projects • Finalize combined heat and power project • Pursue additional investment opportunities Long-Term Operating earnings* 2016 Actual $95 million 2017 Guidance $90-100 million Operating earnings 2021 Target $100-110 million Capital investment 2017-2021 $0.6-1.0 billion • Identify and execute on additional asset acquisitions and utility-like projects • Recently announced projects cover approximately one-third of earnings growth needed to achieve 2021 target * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

21 • Overview • Long-Term Growth Update • Summary

22 • Strong start to year gives us confidence we will achieve our 2017 operating EPS* guidance • Utility growth plan driven by infrastructure investments focused on improving reliability and the customer experience • Strategic and sustainable growth in non-utility businesses continues • Continue to deliver strong balance sheet metrics • On track to deliver strong EPS and dividend growth that drive premium total shareholder return Summary * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

23 Appendix

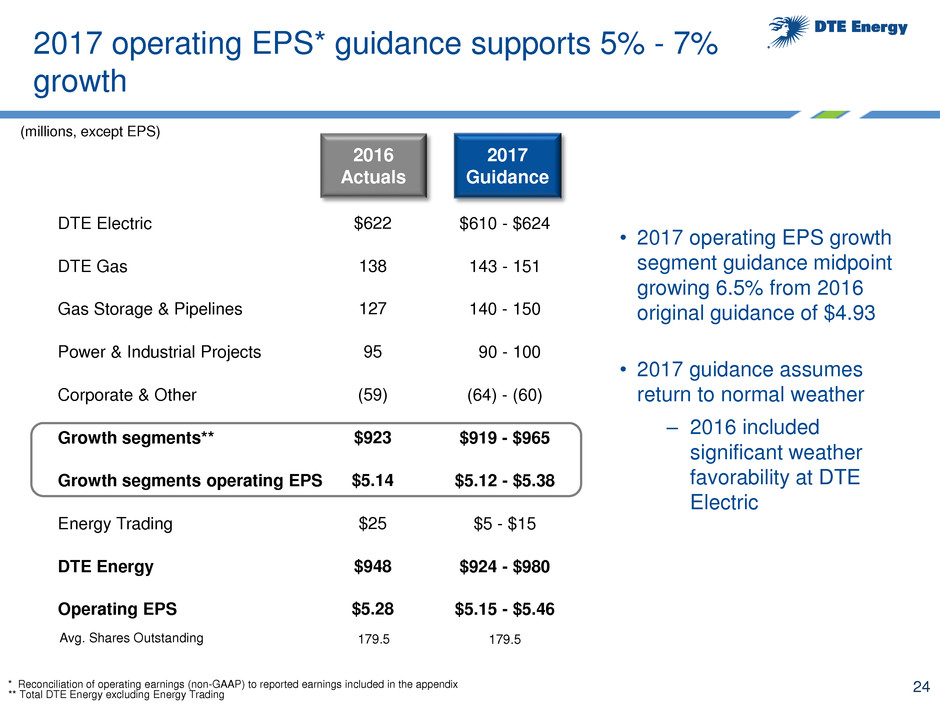

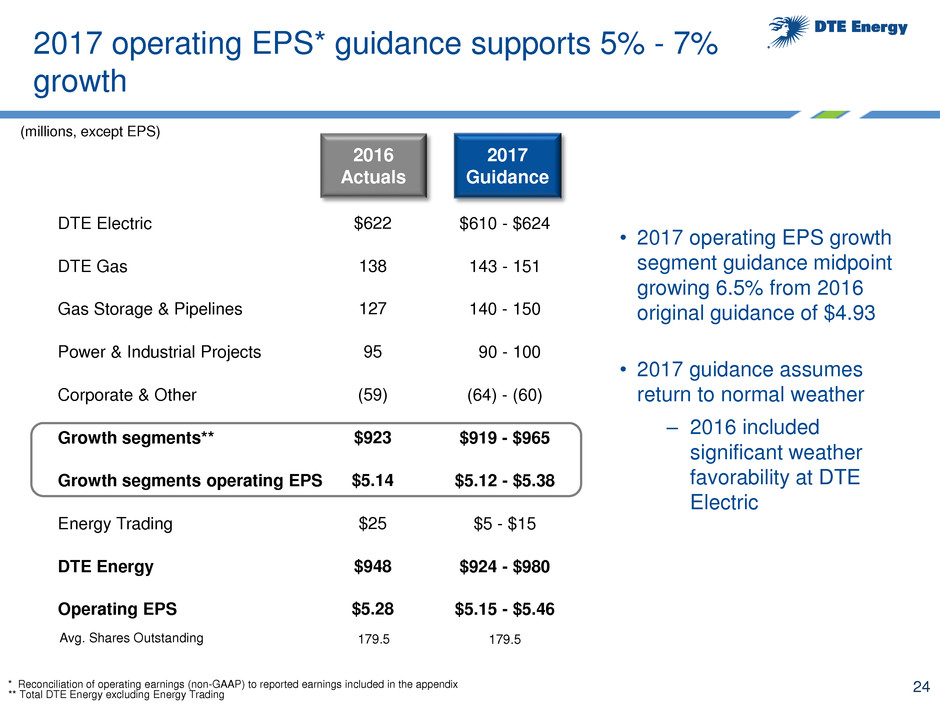

24 2017 Guidance DTE Electric DTE Gas Gas Storage & Pipelines Power & Industrial Projects Corporate & Other Growth segments** Growth segments operating EPS Energy Trading DTE Energy Operating EPS Avg. Shares Outstanding $610 - $624 143 - 151 140 - 150 90 - 100 (64) - (60) $919 - $965 $5.12 - $5.38 $5 - $15 $924 - $980 179.5 $5.15 - $5.46 2016 Actuals $622 138 127 95 (59) $923 $5.14 $25 $948 179.5 $5.28 2017 operating EPS* guidance supports 5% - 7% growth (millions, except EPS) ** Total DTE Energy excluding Energy Trading • 2017 operating EPS growth segment guidance midpoint growing 6.5% from 2016 original guidance of $4.93 • 2017 guidance assumes return to normal weather – 2016 included significant weather favorability at DTE Electric * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

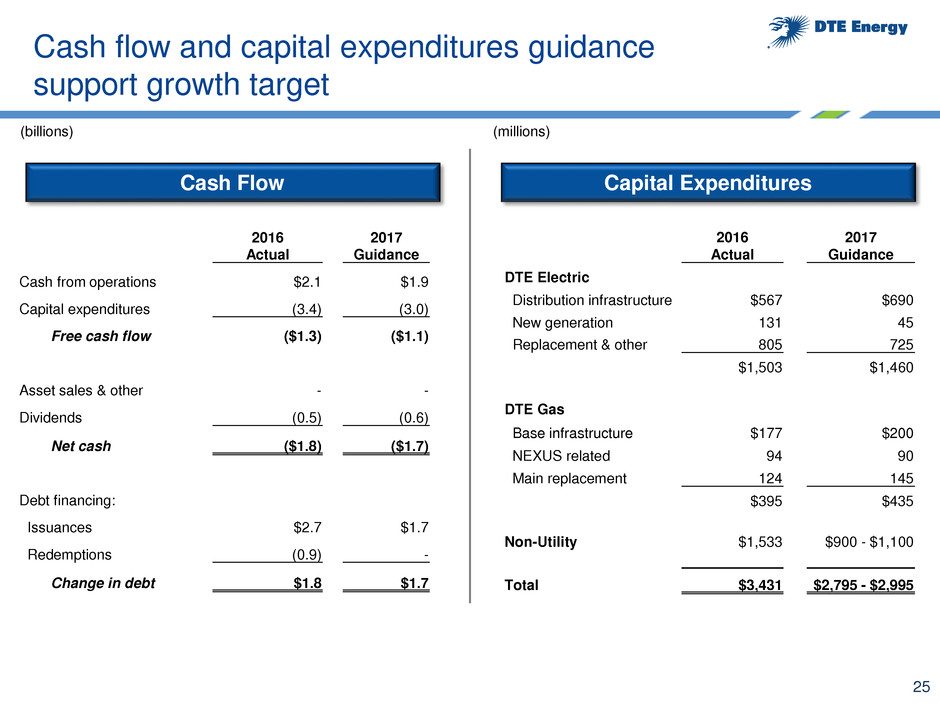

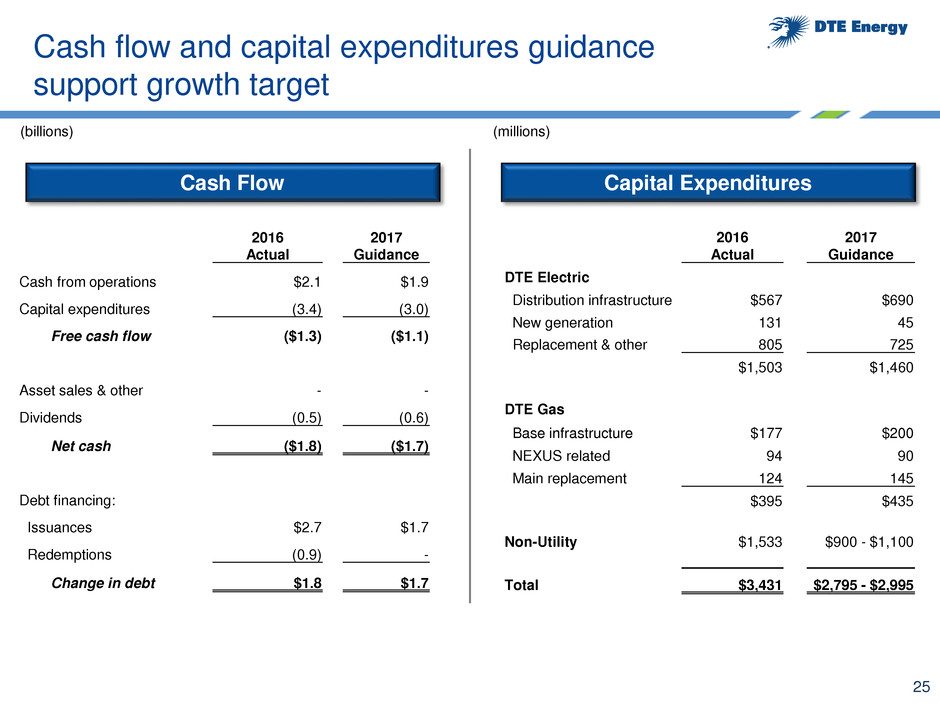

25 2016 Actual 2017 Guidance DTE Electric Distribution infrastructure $567 $690 New generation 131 45 Replacement & other 805 725 $1,503 $1,460 DTE Gas Base infrastructure $177 $200 NEXUS related 94 90 Main replacement 124 145 $395 $435 Non-Utility $1,533 $900 - $1,100 Total $3,431 $2,795 - $2,995 2016 Actual 2017 Guidance Cash from operations $2.1 $1.9 Capital expenditures (3.4) (3.0) Free cash flow ($1.3) ($1.1) Asset sales & other - - Dividends (0.5) (0.6) Net cash ($1.8) ($1.7) Debt financing: Issuances $2.7 $1.7 Redemptions (0.9) - Change in debt $1.8 $1.7 Capital Expenditures Cash Flow (billions) (millions) Cash flow and capital expenditures guidance support growth target

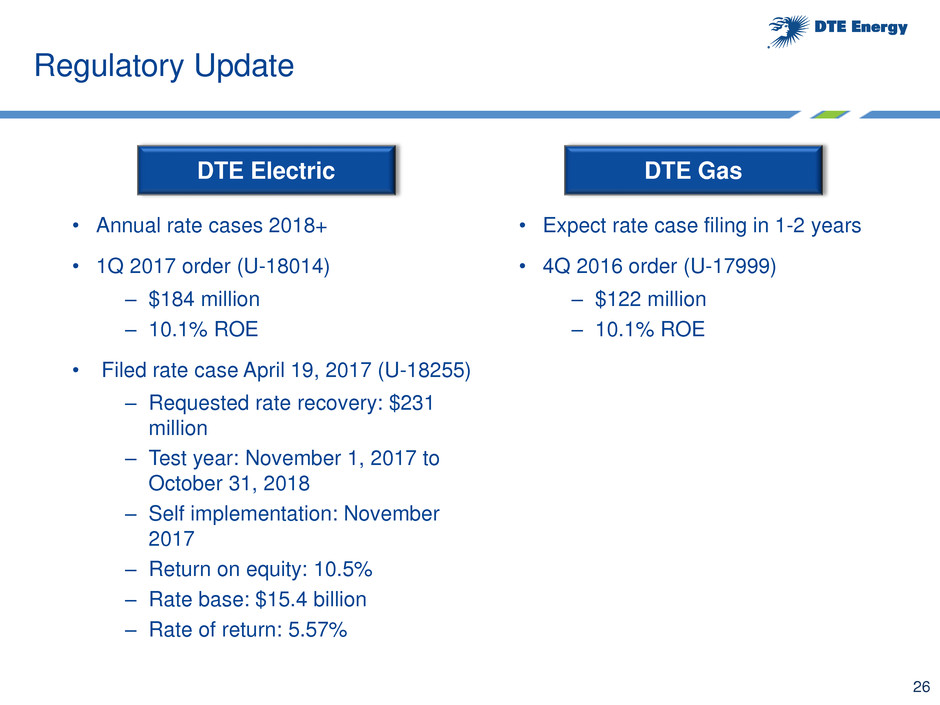

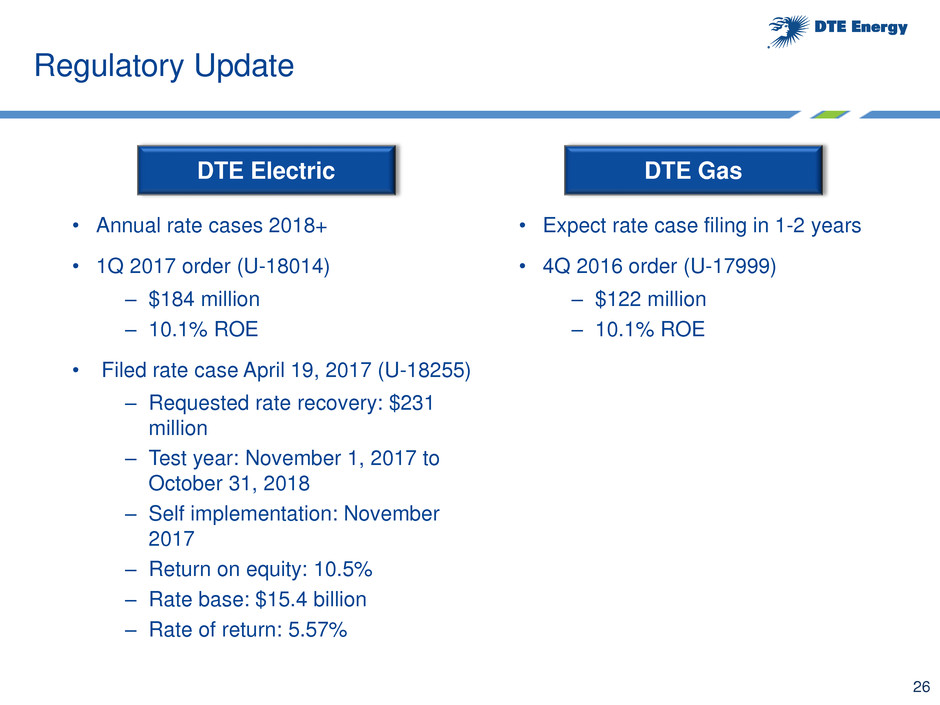

26 DTE Gas DTE Electric • Expect rate case filing in 1-2 years • 4Q 2016 order (U-17999) – $122 million – 10.1% ROE • Annual rate cases 2018+ • 1Q 2017 order (U-18014) – $184 million – 10.1% ROE • Filed rate case April 19, 2017 (U-18255) – Requested rate recovery: $231 million – Test year: November 1, 2017 to October 31, 2018 – Self implementation: November 2017 – Return on equity: 10.5% – Rate base: $15.4 billion – Rate of return: 5.57% Regulatory Update

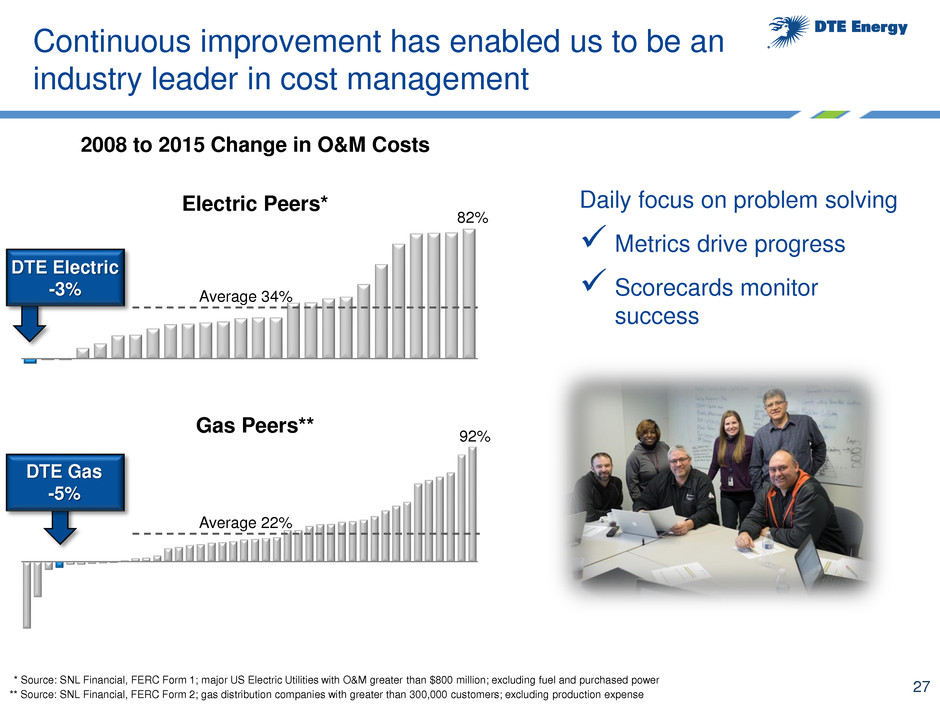

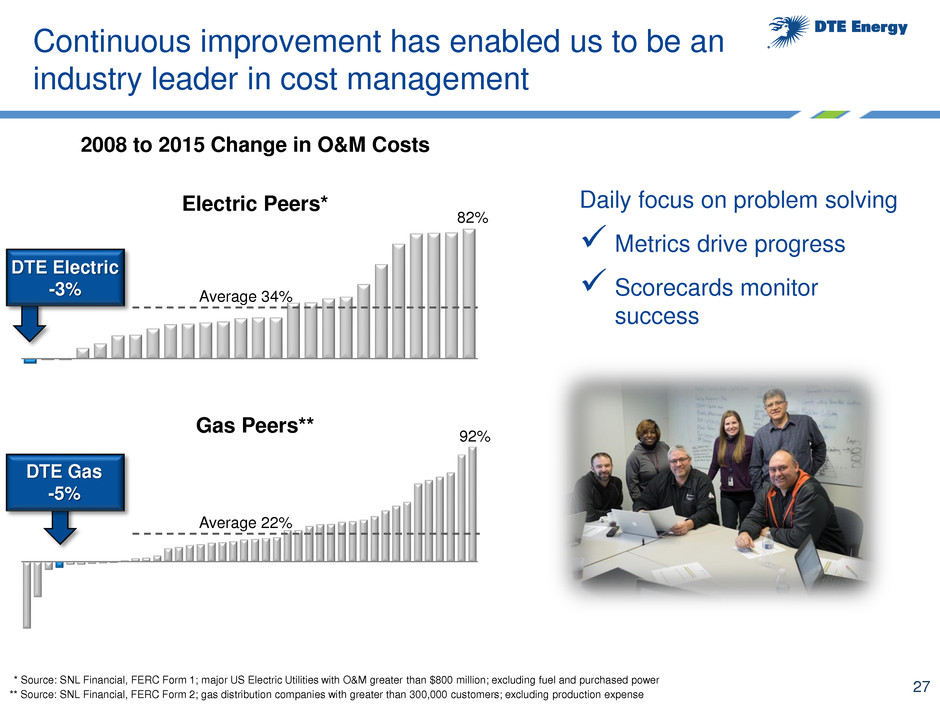

27 Continuous improvement has enabled us to be an industry leader in cost management * Source: SNL Financial, FERC Form 1; major US Electric Utilities with O&M greater than $800 million; excluding fuel and purchased power ** Source: SNL Financial, FERC Form 2; gas distribution companies with greater than 300,000 customers; excluding production expense Electric Peers* Gas Peers** 2008 to 2015 Change in O&M Costs 82% 92% Average 34% Daily focus on problem solving Metrics drive progress Scorecards monitor success DTE Gas -5% DTE Electric -3% Average 22%

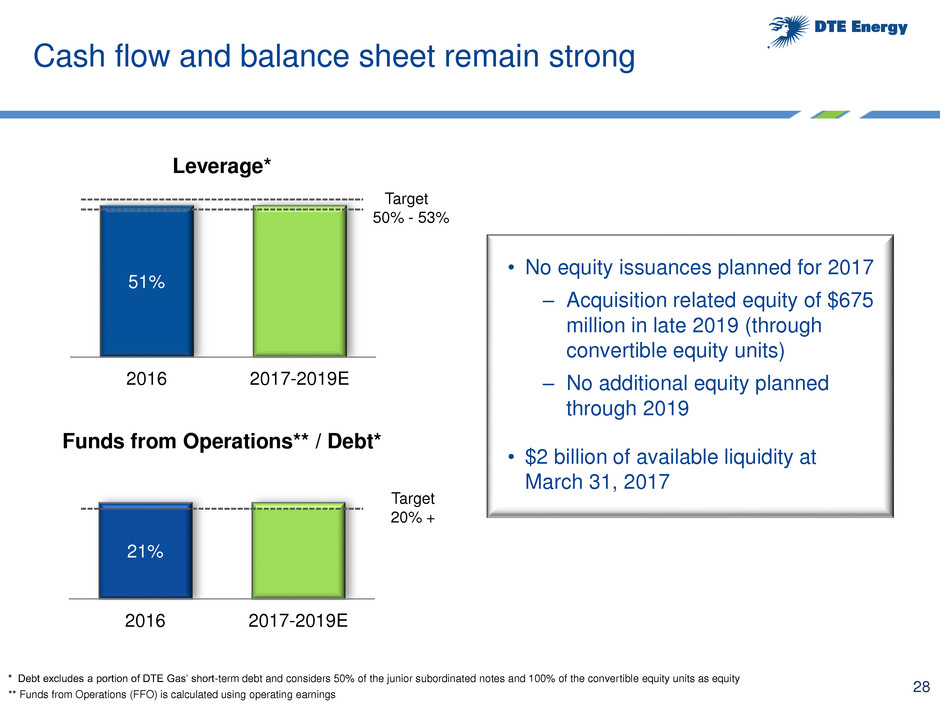

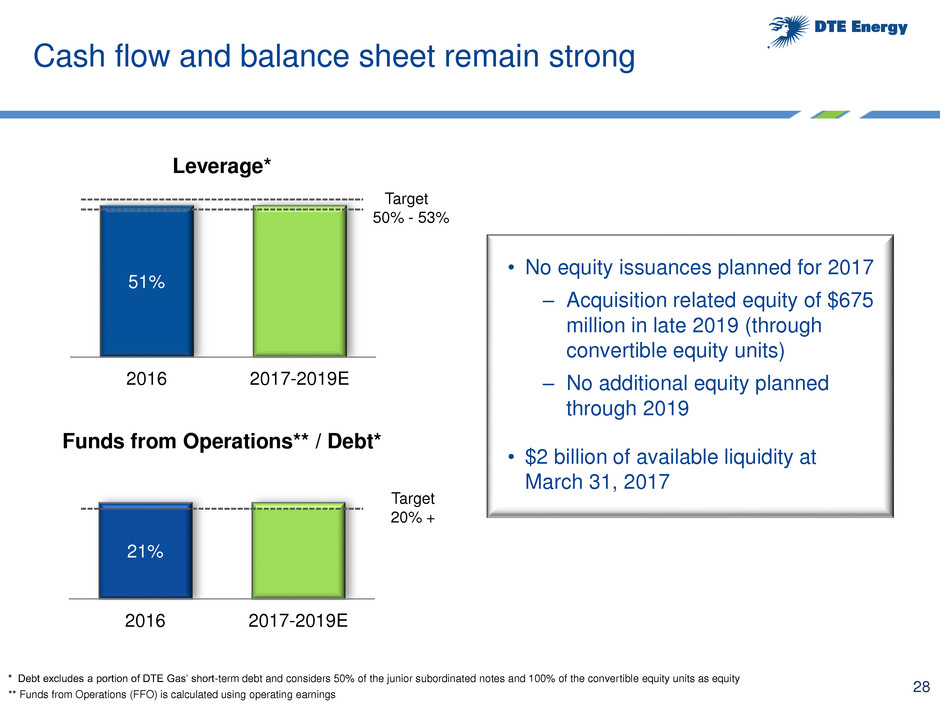

28 21% 2016 2017-2019E 51% 2016 2017-2019E Leverage* Funds from Operations** / Debt* Target 50% - 53% Target 20% + Cash flow and balance sheet remain strong * Debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes and 100% of the convertible equity units as equity ** Funds from Operations (FFO) is calculated using operating earnings • No equity issuances planned for 2017 ‒ Acquisition related equity of $675 million in late 2019 (through convertible equity units) ‒ No additional equity planned through 2019 • $2 billion of available liquidity at March 31, 2017

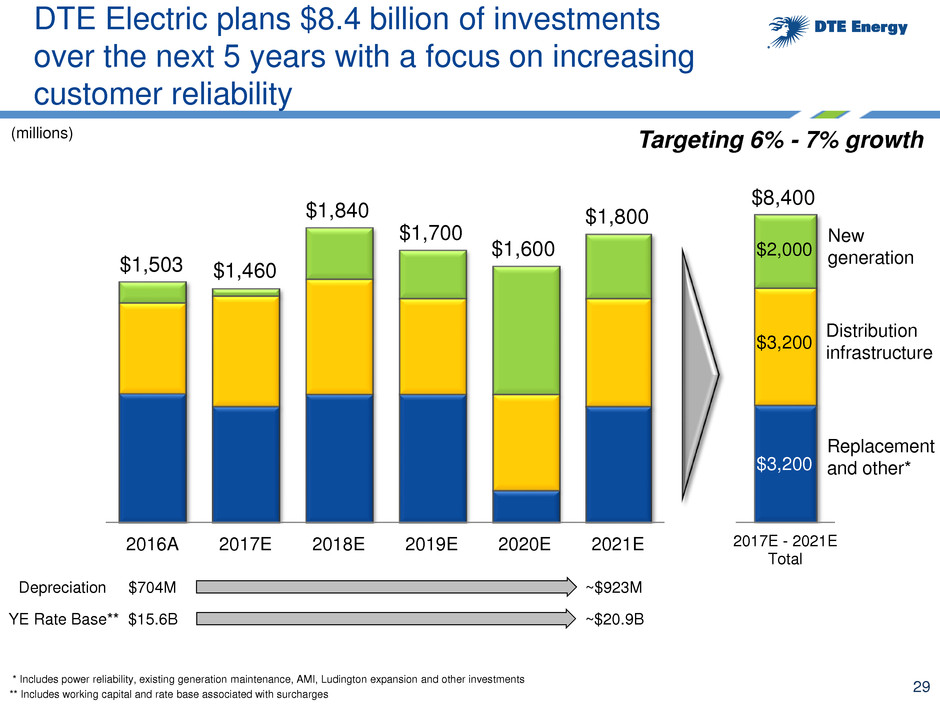

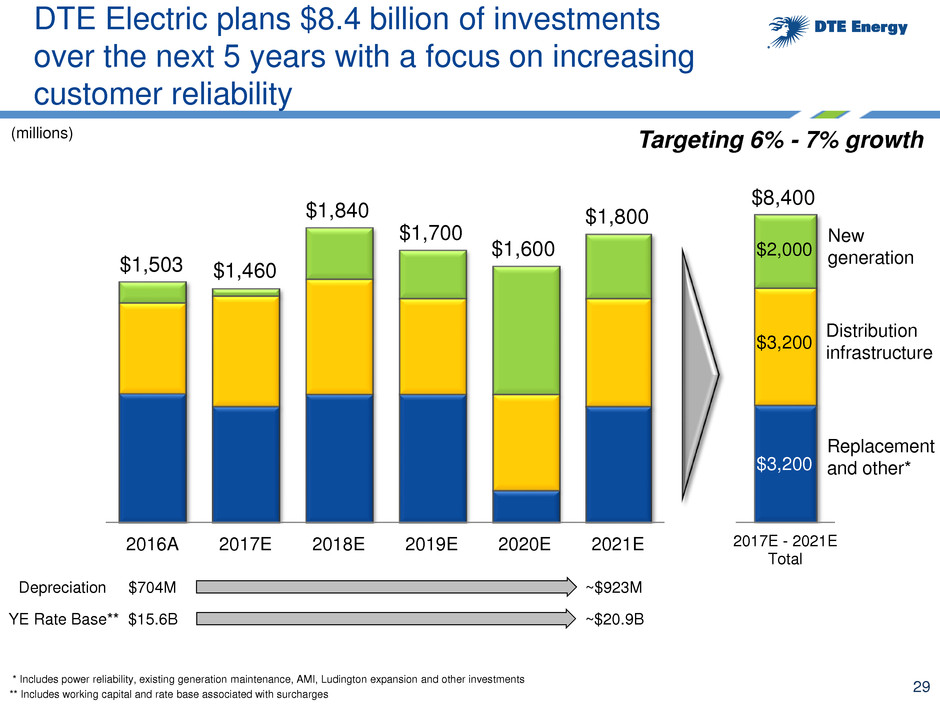

29 DTE Electric plans $8.4 billion of investments over the next 5 years with a focus on increasing customer reliability * Includes power reliability, existing generation maintenance, AMI, Ludington expansion and other investments ** Includes working capital and rate base associated with surcharges Targeting 6% - 7% growth (millions) $15.6B ~$20.9B YE Rate Base** $704M ~$923M Depreciation 2016A 2017E 2018E 2019E 2020E 2021E Distribution infrastructure New generation Replacement and other* 2017E - 2021E Total $2,000 $8,400 $3,200 $3,200 $1,503 $1,460 $1,700 $1,600 $1,800 $1,840

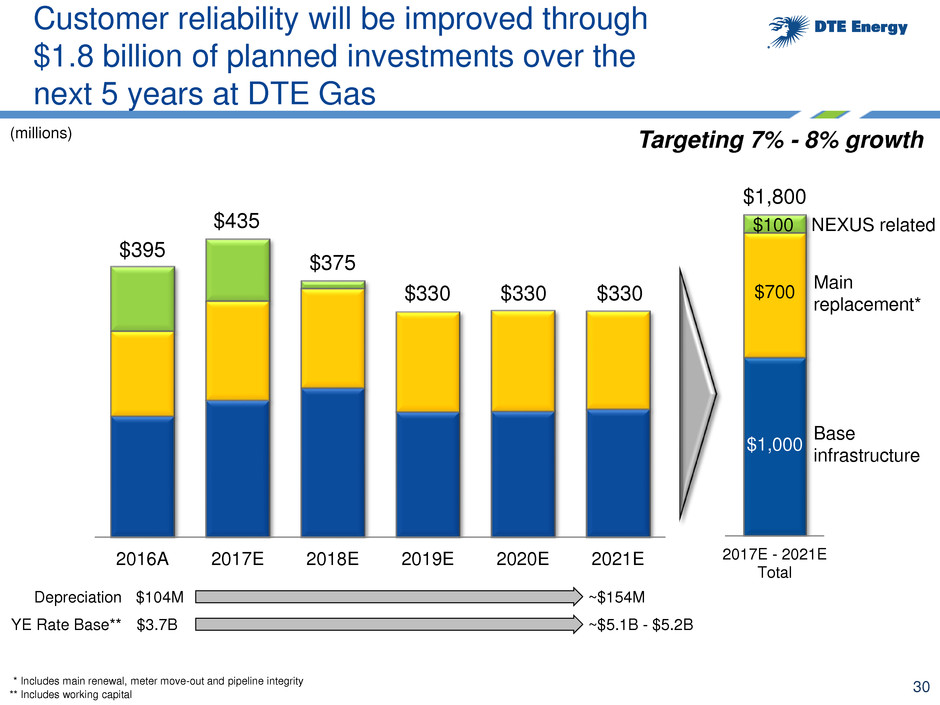

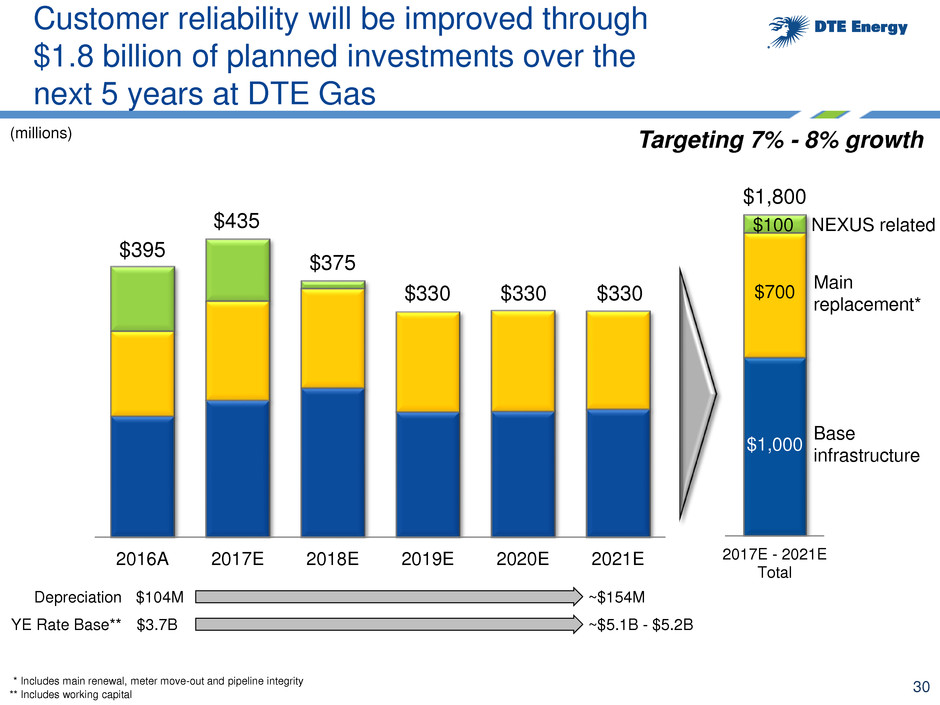

30 Customer reliability will be improved through $1.8 billion of planned investments over the next 5 years at DTE Gas 2016A 2017E 2018E 2019E 2020E 2021E 2017E - 2021E Total Base infrastructure Main replacement* NEXUS related $1,800 $100 $700 $1,000 $3.7B ~$5.1B - $5.2B YE Rate Base** $104M ~$154M Depreciation ** Includes working capital $395 $435 $375 $330 $330 $330 * Includes main renewal, meter move-out and pipeline integrity (millions) Targeting 7% - 8% growth

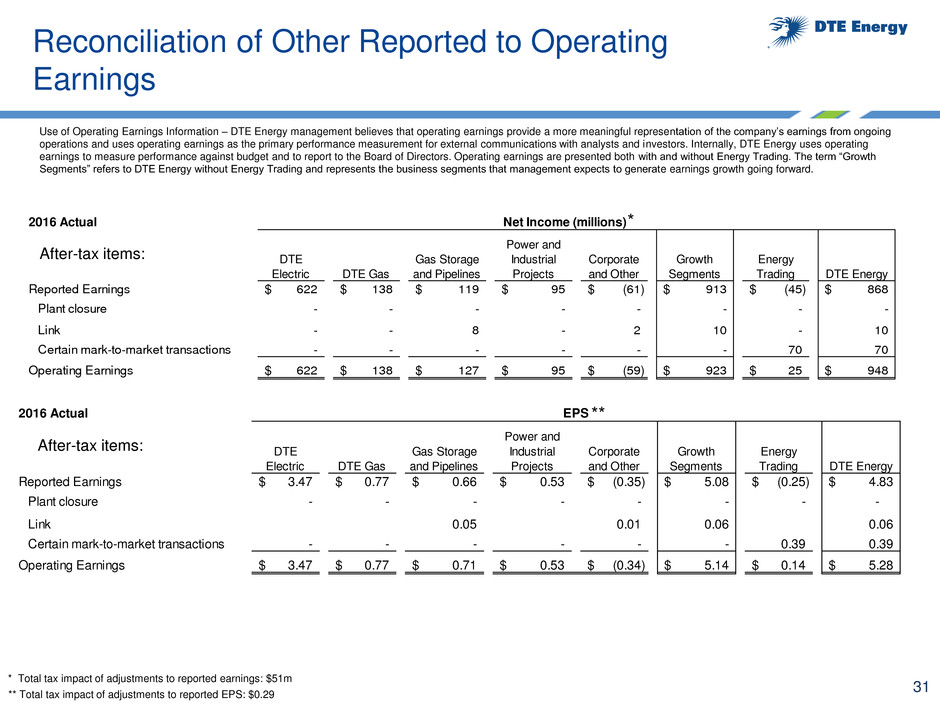

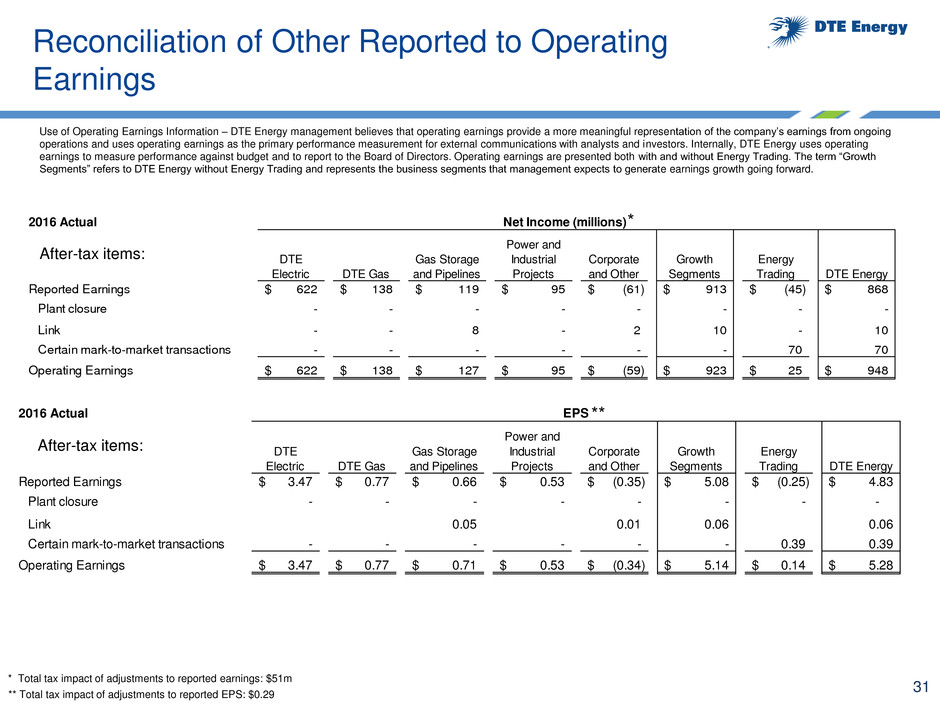

31 Reconciliation of Other Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Operating earnings are presented both with and without Energy Trading. The term “Growth Segments” refers to DTE Energy without Energy Trading and represents the business segments that management expects to generate earnings growth going forward. 2016 Actual DTE Electric DTE Gas Gas Storage and Pipelines Power and Industrial Projects Corporate and Other Growth Segments Energy Trading DTE Energy R d rnings 622$ 138$ 119$ 95$ (61)$ 913$ (45)$ 868$ Pl t cl sure - - - - - - - - Link - - 8 - 2 10 - 10 Certain mark-to-market transactions - - - - - - 70 70 Operating Earnings 622$ 138$ 127$ 95$ (59)$ 923$ 25$ 948$ Net Income (millions) 2016 A u l DTE Electric DTE Gas Gas Storage and Pipelines Power and Industrial Projects Corporate and Other Growth Segments Energy Trading DTE Energy Repor ed Earnings 3.47$ 0.77$ 0.66$ 0. 3$ 0.35)$ 5.08$ (0.25)$ 4.83$ Plant closure - - - - - - - - Link 0.05 0.01 0.06 0.06 Certain mark-to-market transactions - - - - - - 0.39 0.39 Operating Earnings 3.47$ 0.77$ 0.71$ 0.53$ (0.34)$ 5.14$ 0.14$ 5.28$ EPS After-tax items: After-tax items: * ** * Total tax impact of adjustments to reported earnings: $51m ** Total tax impact of adjustments to reported EPS: $0.29

32 Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to- market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to- market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. Reconciliation of Reported to Operating Earnings (non-GAAP)