EXHIBIT 99.2 DTE to Acquire Midstream Assets Expanding DTE’s Midstream Business into High-Growth Basin with Strong Financial Returns 1

Safe Harbor Statement Certain information presented herein includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, and businesses of DTE Energy. Words such as “anticipate,” “believe,” “expect,” “projected,” “aspiration,” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions, but rather are subject to numerous assumptions, risks, and uncertainties that may cause actual future results to be materially different from those contemplated, projected, estimated, or budgeted. Many factors may impact these forward-looking statements including, but not limited to, the following: the failure to consummate the transaction, the risk that we will not achieve expected synergies, the risk that the operations being acquired in the acquisition will not be successfully integrated or that such integration will take longer than expected, the risk that the operations being acquired will not perform as expected; and the risks discussed in our public filings with the Securities and Exchange Commission. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This document should also be read in conjunction with the Forward-Looking Statements section of the joint DTE Energy and DTE Electric 2018 Form 10-K and 2019 Forms 10-Q (which sections are incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy. 2

Participants • Jerry Norcia – President and CEO • David Slater – GSP President and COO • Peter Oleksiak – Senior Vice President and CFO • Barbara Tuckfield – Director, Investor Relations 3

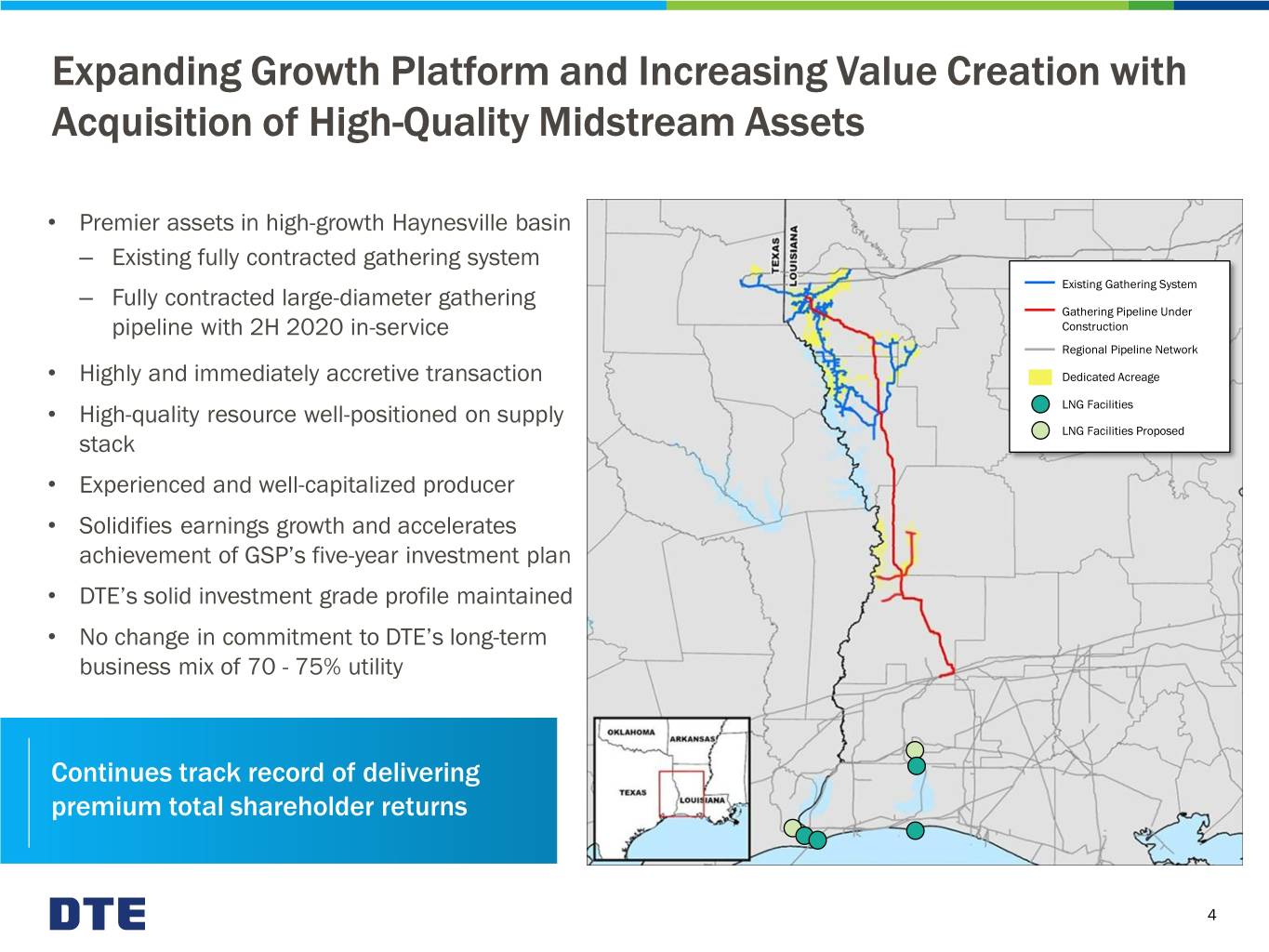

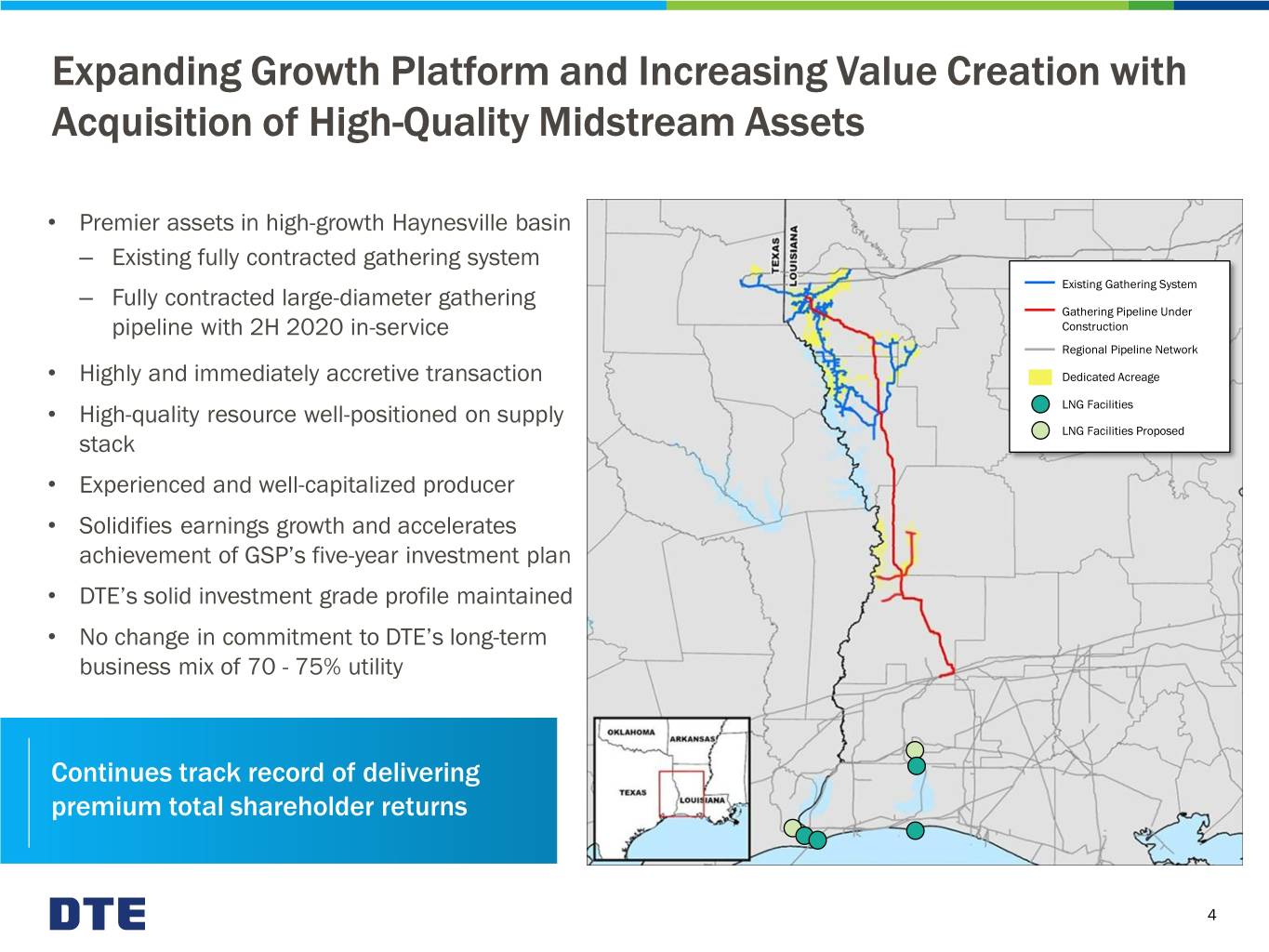

Expanding Growth Platform and Increasing Value Creation with Acquisition of High-Quality Midstream Assets • Premier assets in high-growth Haynesville basin – Existing fully contracted gathering system Existing Gathering System – Fully contracted large-diameter gathering Gathering Pipeline Under pipeline with 2H 2020 in-service Construction Regional Pipeline Network • Highly and immediately accretive transaction Dedicated Acreage • High-quality resource well-positioned on supply LNG Facilities LNG Facilities Proposed stack • Experienced and well-capitalized producer • Solidifies earnings growth and accelerates achievement of GSP’s five-year investment plan • DTE’s solid investment grade profile maintained • No change in commitment to DTE’s long-term business mix of 70 - 75% utility Continues track record of delivering premium total shareholder returns 4

Transaction Overview Purchase Price1 $2.25B in cash plus milestone payment upon completion of gathering pipeline in development Financing2 50% equity (predominantly mandatory convertible equity units) and 50% senior unsecured debt Strong balance sheet and solid investment grade profile maintained Project Accretion Immediately $0.15 accretive to operating EPS3 in 2020 Growing to $0.45 per share over five year period, including equity unit conversion, with strong cash flow profile Expected Close Fourth quarter of 20194 Strong project cash flows will allow DTE’s equity issuance to remain in guided range of $1B - $1.5B in 2019 - 2021 1 Total payment of $2.65B including $400M milestone payment to be paid upon completion of gathering pipeline under construction 2 No Offer or Solicitation. This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities 5 3 Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 4 Subject to Hart-Scott-Rodino expiration or waiting period termination

Midstream System with High-Quality Assets in Haynesville Basin Gathering System • Fully contracted including minimum volume commitments • Current capacity of 1.2 Bcf/d; current utilization exceeds 95% • Primarily dry gas gathering; the system also has 170 MMcf/d of wet gas • Ability to expand to 2.5 Bcf/d Gathering Pipeline Under Construction • Fully contracted with 100% demand charge contract • 1.0 Bcf/d, 150 mile, 36” pipeline in service 2H 2020 • Ability to economically expand to 2.0 Bcf/d with compression • Interconnects to Gillis hub, which provides access to several Gulf Coast interstate pipelines and LNG facilities Asset platform well-positioned for incremental future growth 6

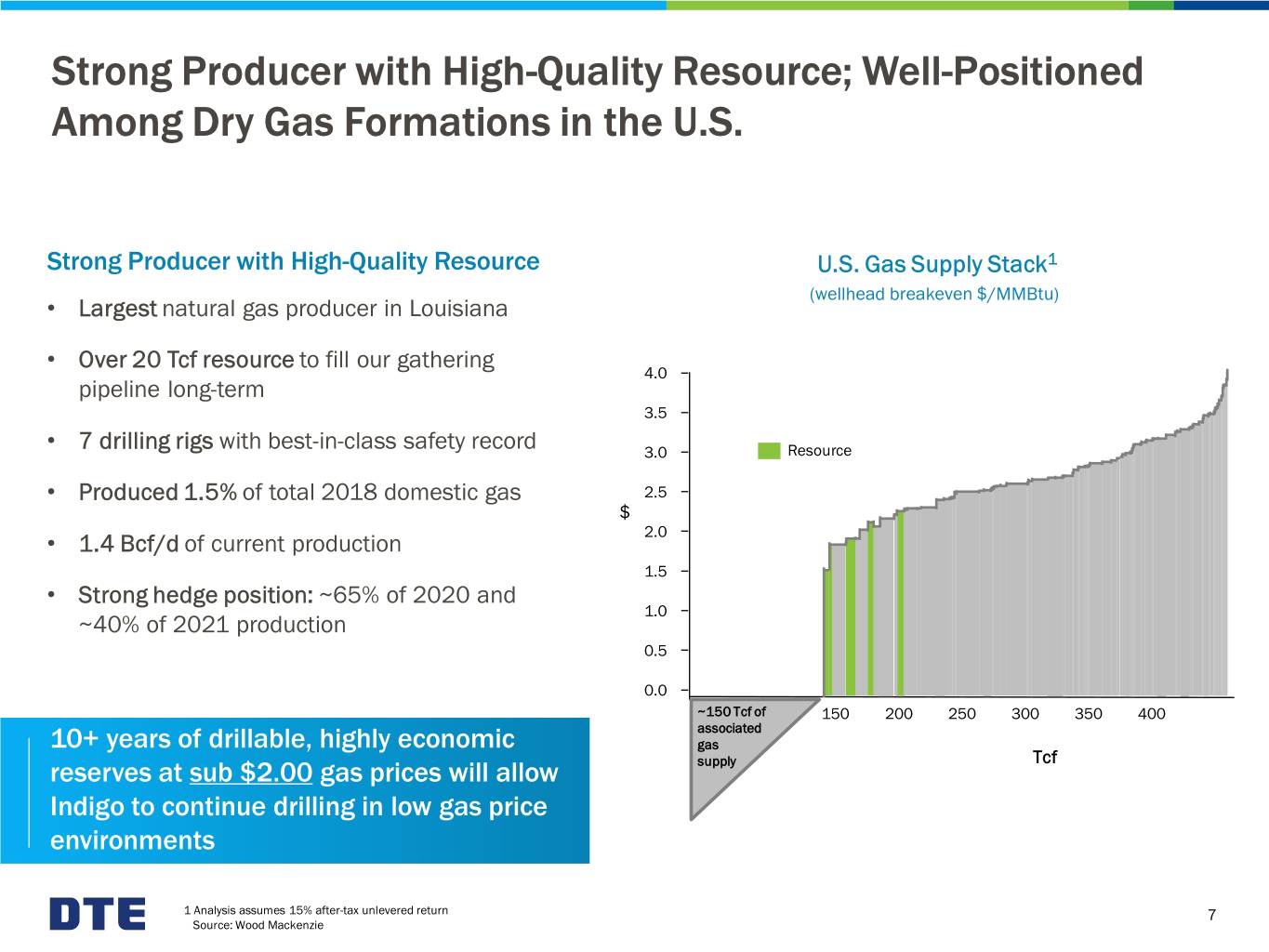

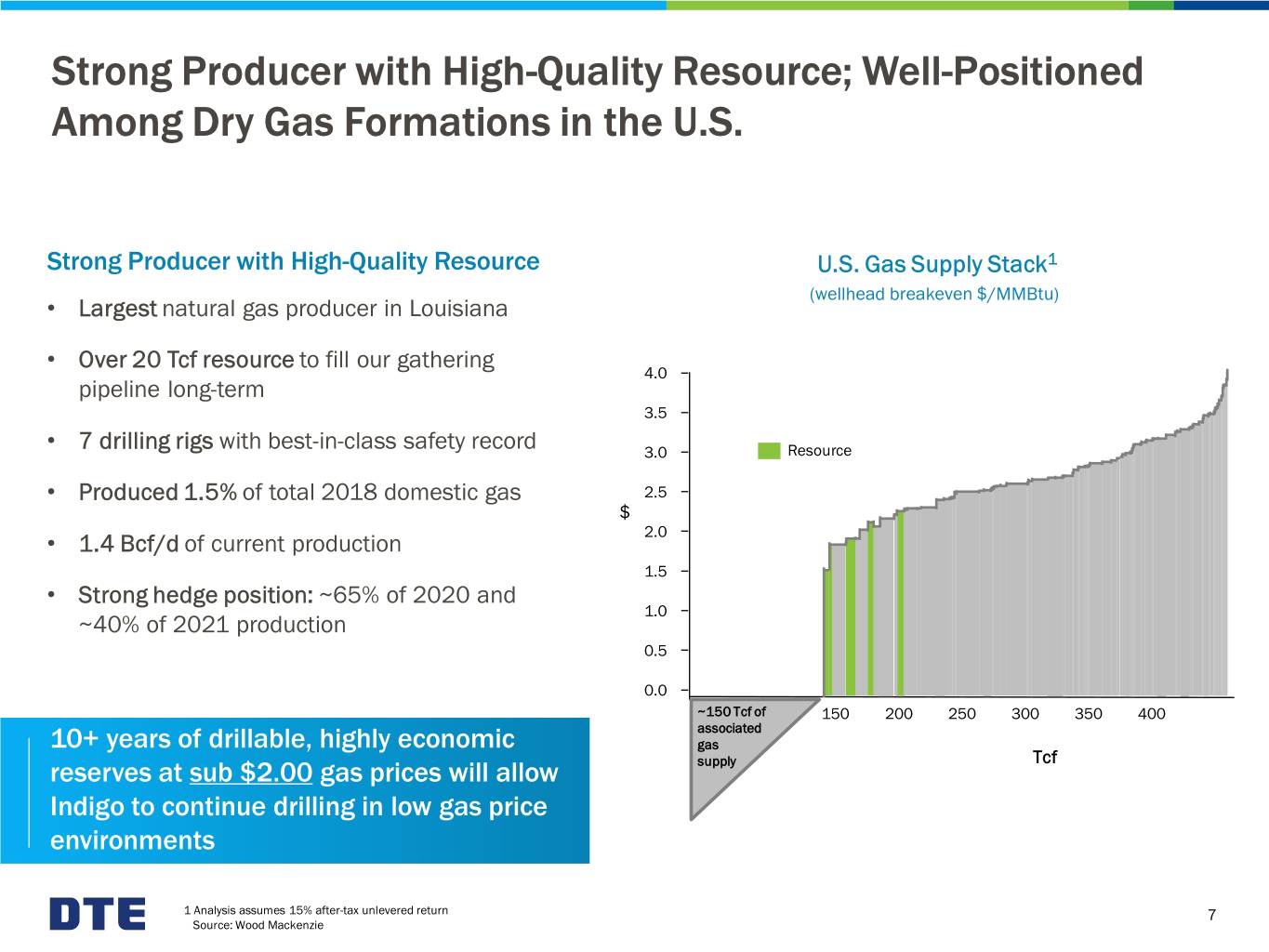

Strong Producer with High-Quality Resource; Well-Positioned Among Dry Gas Formations in the U.S. Strong Producer with High-Quality Resource U.S. Gas Supply Stack1 (wellhead breakeven $/MMBtu) • Largest natural gas producer in Louisiana • Over 20 Tcf resource to fill our gathering 4.0 pipeline long-term 3.5 • 7 drilling rigs with best-in-class safety record 3.0 Resource • Produced 1.5% of total 2018 domestic gas 2.5 $ 2.0 • 1.4 Bcf/d of current production 1.5 • Strong hedge position: ~65% of 2020 and 1.0 ~40% of 2021 production 0.5 0.0 ~150 Tcf of 150 200 250 300 350 400 associated 10+ years of drillable, highly economic gas Tcf reserves at sub $2.00 gas prices will allow supply Indigo to continue drilling in low gas price environments 1 Analysis assumes 15% after-tax unlevered return 7 Source: Wood Mackenzie

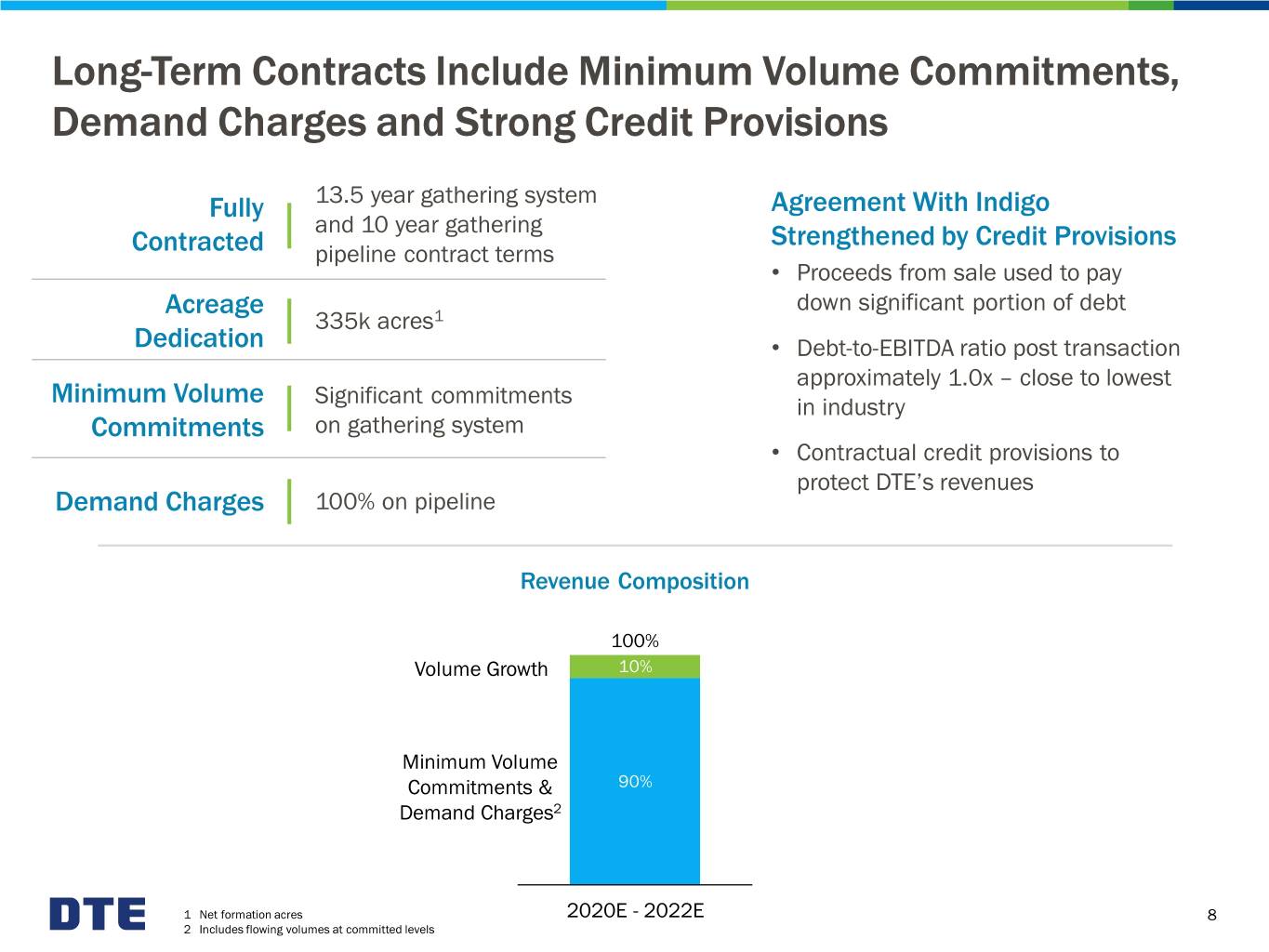

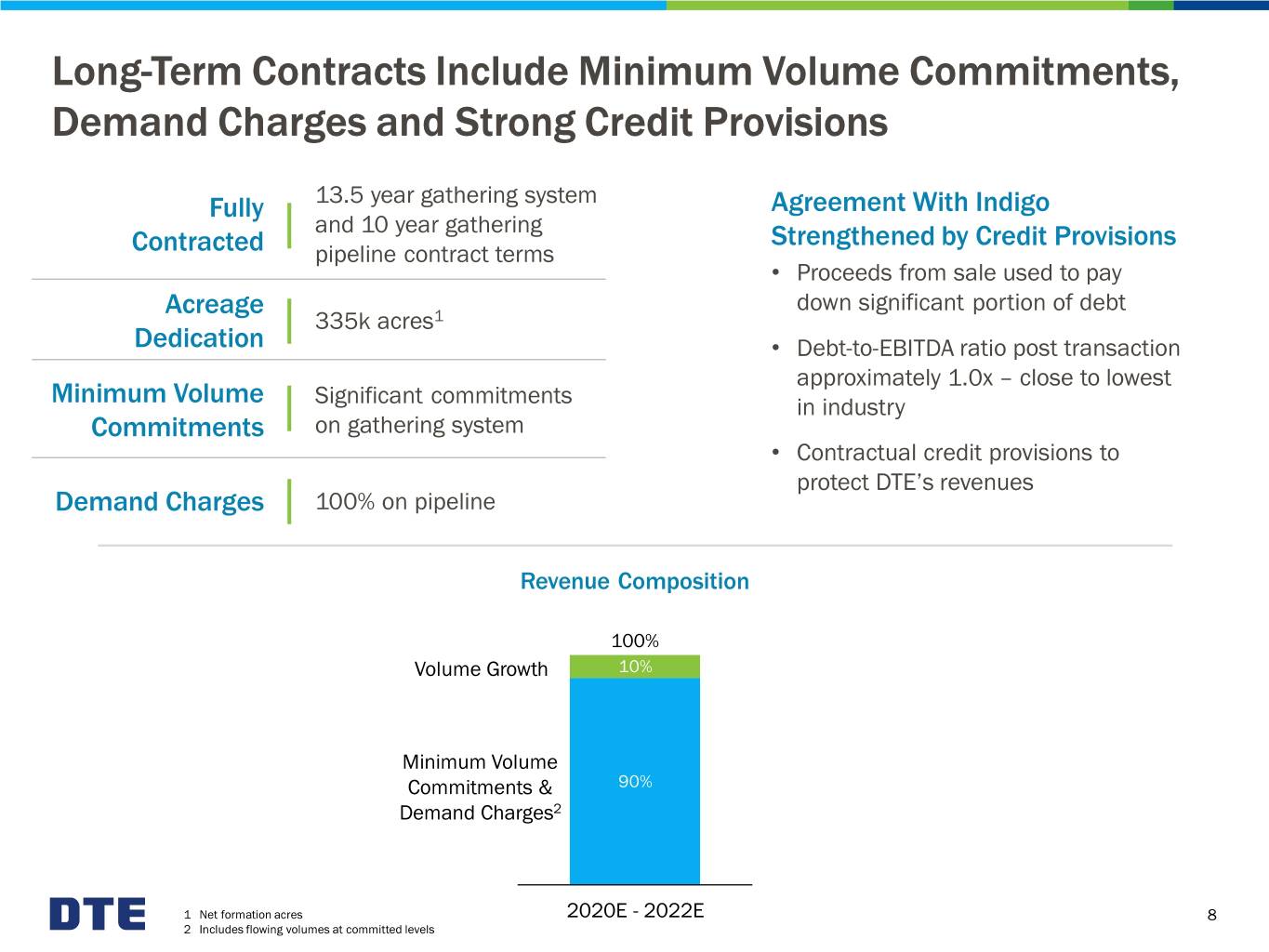

Long-Term Contracts Include Minimum Volume Commitments, Demand Charges and Strong Credit Provisions Fully 13.5 year gathering system Agreement With Indigo and 10 year gathering Strengthened by Credit Provisions Contracted pipeline contract terms • Proceeds from sale used to pay Acreage down significant portion of debt 335k acres1 Dedication • Debt-to-EBITDA ratio post transaction approximately 1.0x – close to lowest Minimum Volume Significant commitments in industry Commitments on gathering system • Contractual credit provisions to protect DTE’s revenues Demand Charges 100% on pipeline Revenue Composition 100% Volume Growth 10% Minimum Volume Commitments & 90% Demand Charges2 1 Net formation acres 2020E - 2022E 8 2 Includes flowing volumes at committed levels

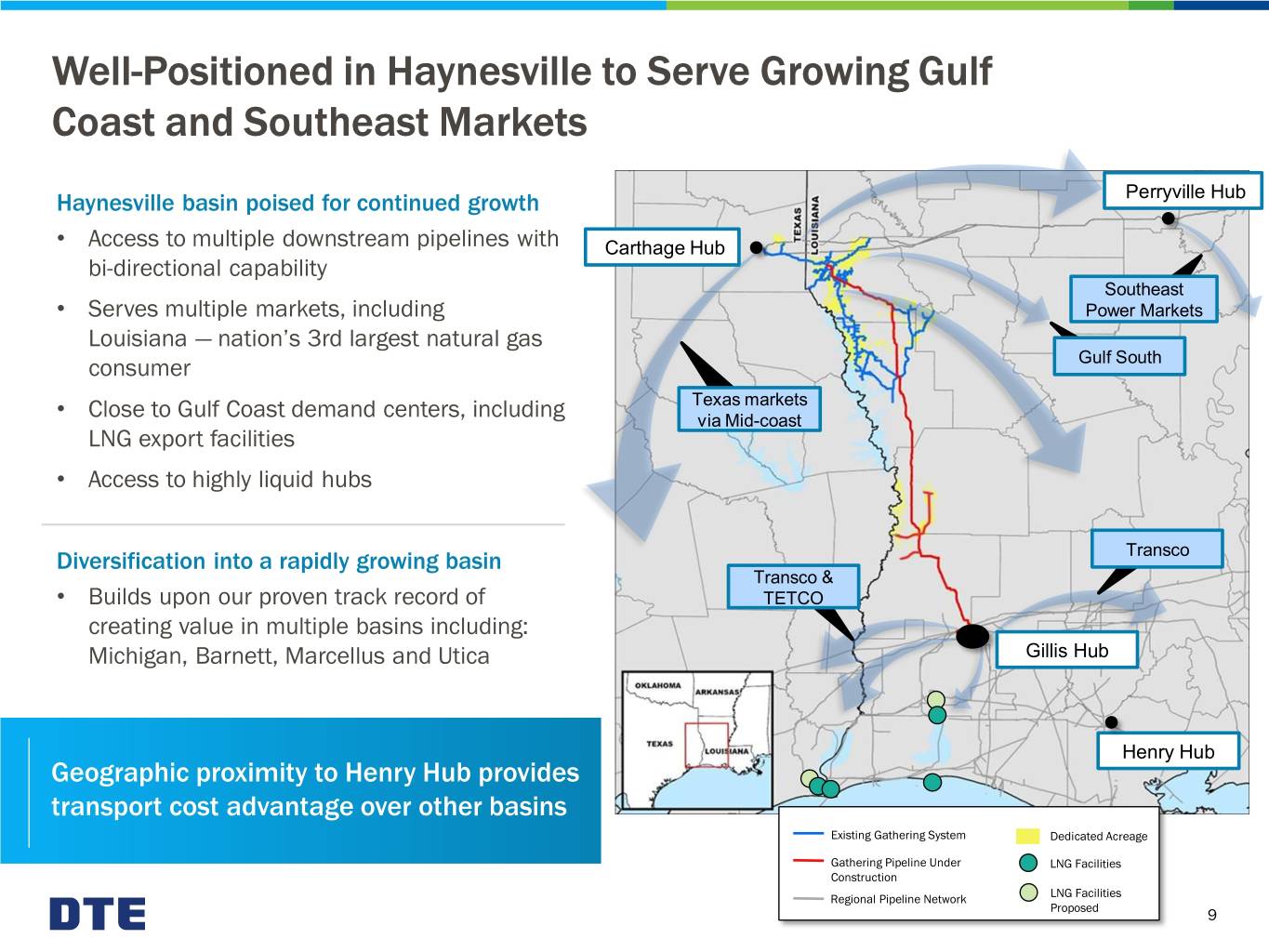

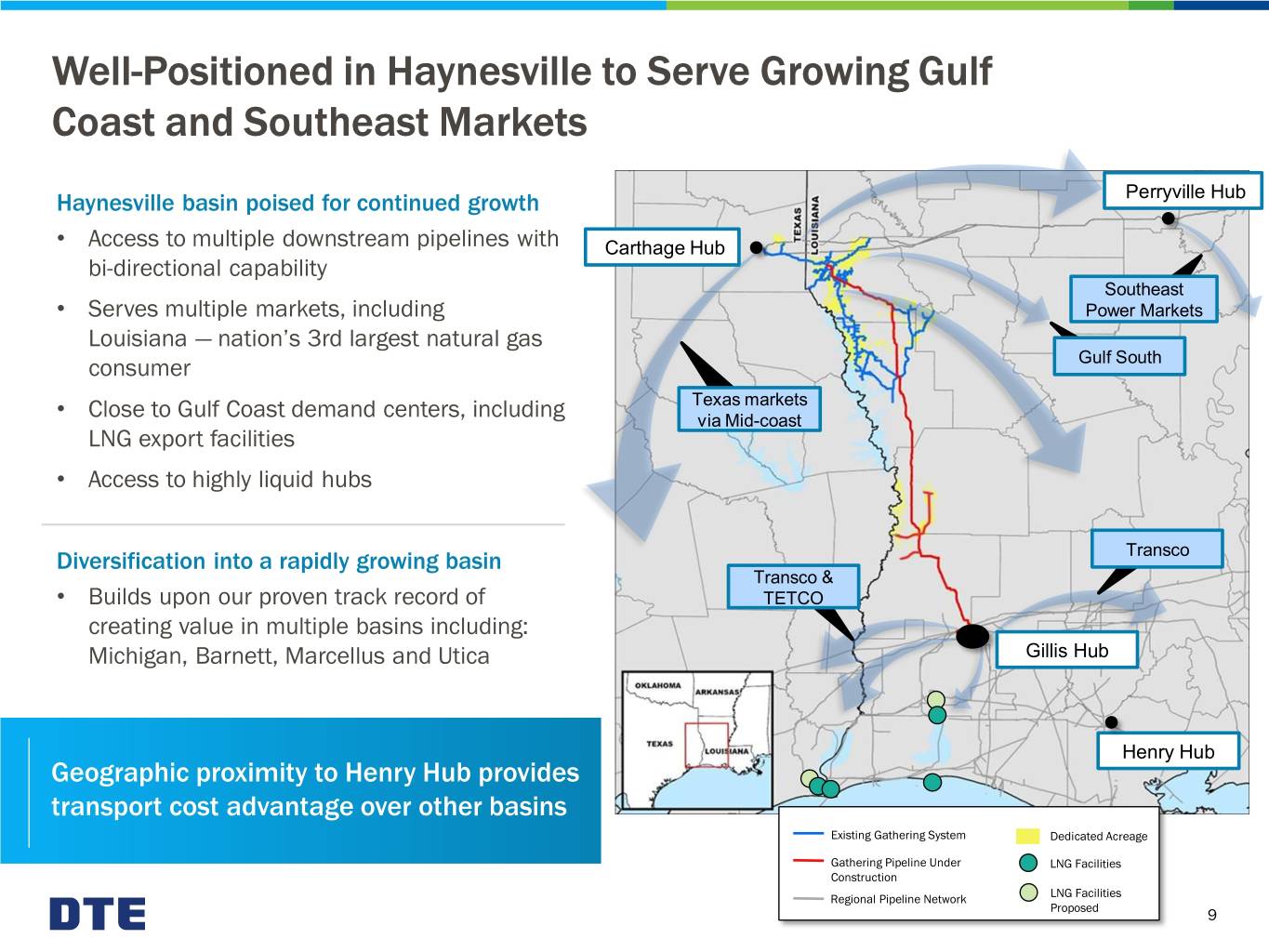

Well-Positioned in Haynesville to Serve Growing Gulf Coast and Southeast Markets Haynesville basin poised for continued growth Perryville Hub • Access to multiple downstream pipelines with Carthage Hub bi-directional capability Southeast • Serves multiple markets, including Power Markets Louisiana — nation’s 3rd largest natural gas consumer Gulf South Texas markets • Close to Gulf Coast demand centers, including via Mid-coast LNG export facilities • Access to highly liquid hubs Diversification into a rapidly growing basin Transco Transco & • Builds upon our proven track record of TETCO creating value in multiple basins including: Michigan, Barnett, Marcellus and Utica Gillis Hub Henry Hub Geographic proximity to Henry Hub provides transport cost advantage over other basins Existing Gathering System Dedicated Acreage Gathering Pipeline Under LNG Facilities Construction Regional Pipeline Network LNG Facilities Proposed 9

Capitalizes on DTE’s Operating Expertise to Bolster Record of Value Creation Delivered HIGHLY ACCRETIVE organic growth from multiple platforms • Vector Pipeline • Millennium Pipeline • Bluestone Lateral & Gathering • NEXUS Pipeline Completed DISCIPLINED ACQUISITIONS with growth potential and connections to power and industrial markets • Link Lateral & Gathering Best-In-Class • Generation Pipeline Project Customer Execution Service Superior Operating Expertise Disciplined Safety & Achieved a 20% operating earnings CAGR at GSP over Developer Reliability past 10 years1 1 Operating earnings CAGR from 2008 to 2018; reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 10

Accelerates Growth that Solidifies Earnings and Provides Visibility to GSP’s $4B - $5B Five-Year Investment Plan DTE Capital Investment ($ billions) $20 • $3.25B acquisition related investment P&I $1.0 - $1.4 GSP Capital Investment – $2.25B initial purchase price Organic – $400M milestone payment upon GSP $4.0 - $5.0 growth completion of gathering pipeline under construction – $600M contracted future growth Gas $2.5 Acquisition capital related • Remaining investment for organic growth on existing platforms and maintenance 2019E - 2023E capital Electric $11.3 Opportunity for total 2019 - 2023 capital to be below the high end of guidance while achieving earnings targets 2019E - 2023E 11

Compelling Strategic and Financial Benefits Highly and immediately accretive transaction that accelerates achievement of five-year growth plan High-quality assets underpinned by a strong resource in attractive Haynesville basin with potential upside Contracted assets with an experienced producer Capitalizes on DTE’s proven operating expertise Positions GSP for continued growth in attractive market Maintains strong balance sheet and credit profile No change in commitment to long-term business mix of 70 - 75% utility 12

Appendix 13

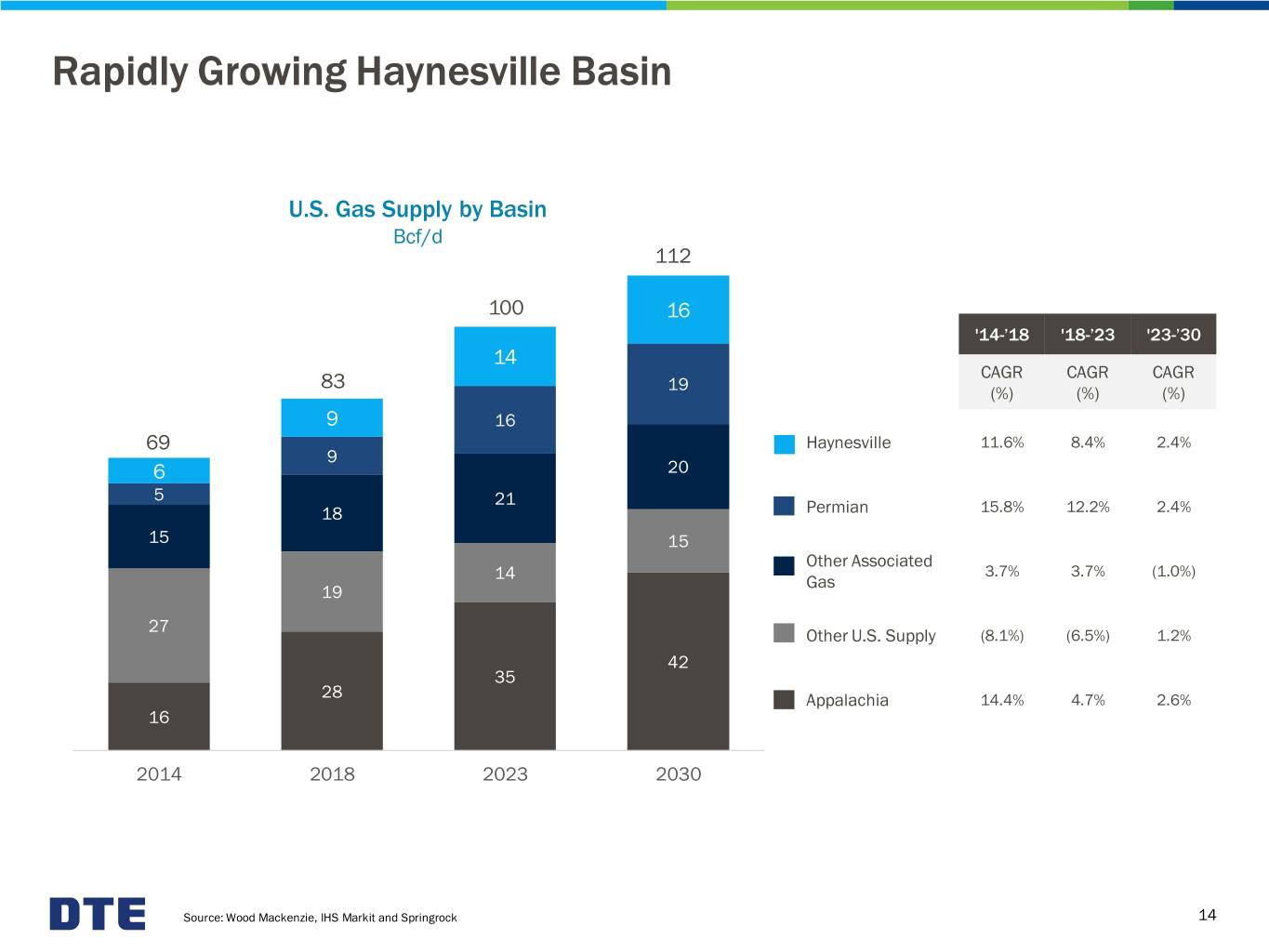

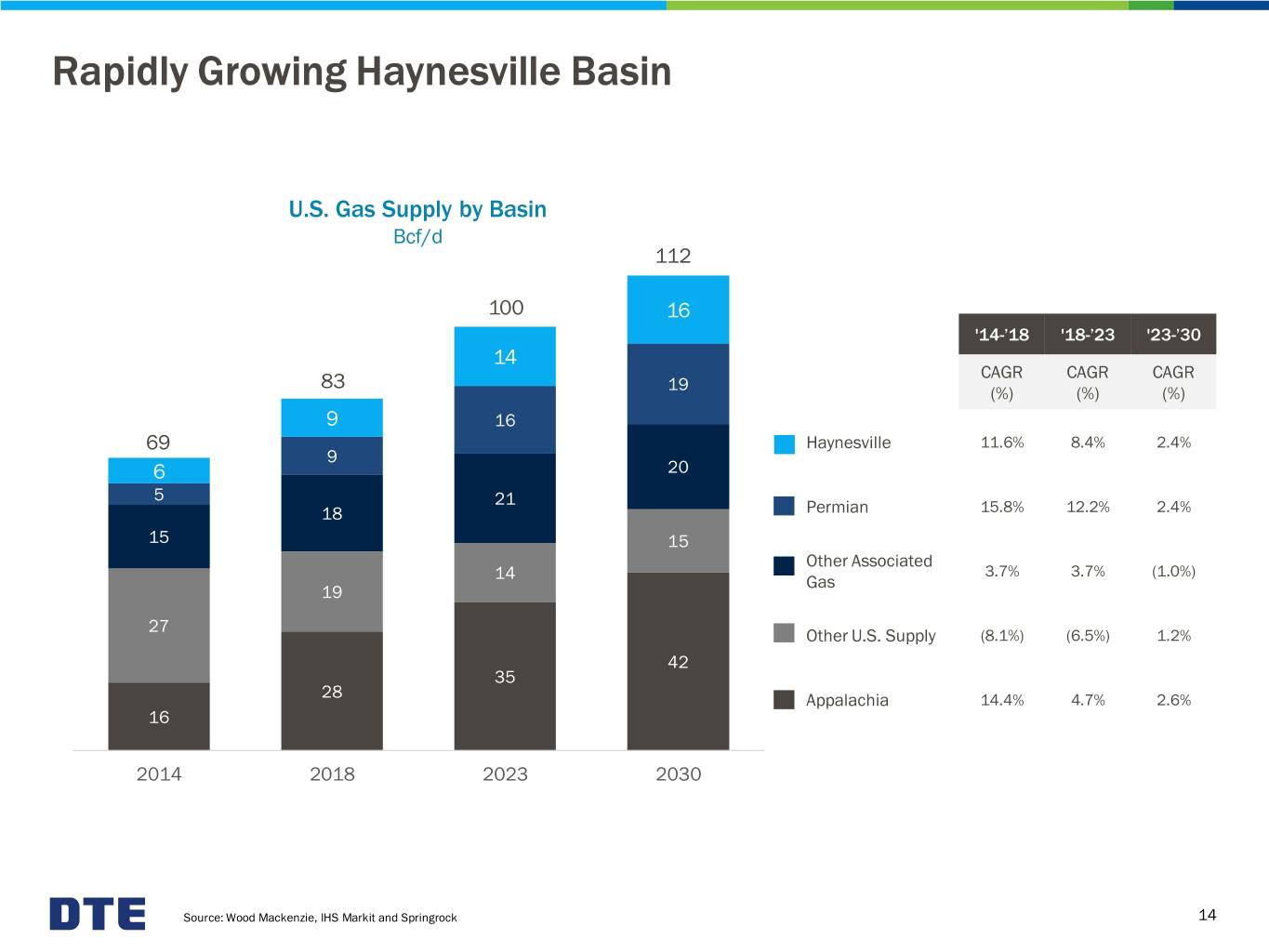

Rapidly Growing Haynesville Basin U.S. Gas Supply by Basin Bcf/d 112 100 16 '14-’18 '18-’23 '23-’30 14 CAGR CAGR CAGR 83 19 (%) (%) (%) 9 16 69 Haynesville 11.6% 8.4% 2.4% 9 6 20 5 21 18 Permian 15.8% 12.2% 2.4% 15 15 Other Associated 3.7% 3.7% (1.0%) 14 Gas 19 27 Other U.S. Supply (8.1%) (6.5%) 1.2% 42 35 28 Appalachia 14.4% 4.7% 2.6% 16 2014 2018 2023 2030 Source: Wood Mackenzie, IHS Markit and Springrock 14

Haynesville is Well-Positioned to Serve Growing Gulf Coast Demand Centers U.S. Gulf Coast Demand by Sector Bcf/d 43 • Gulf Coast demand growth is driven 1 Commercial by the electric and industrial sectors and LNG exports 11 Industrial 30 • LNG exports in 2023 are from 1 1 Residential facilities that are in-service or under 4 Other construction1 9 8 Electric 1 • Current Gulf Coast LNG exports are 3 ~6 Bcf/d (October 2019) 6 8 Mexican Exports 7 10 LNG Exports 3 2018 2023 1 Includes Sabine Pass (3.8 Bcf/d), Freeport (2.1 Bcf/d), Corpus Christi (2.0 Bcf/d), Cameron (2.1 Bcf/d) and Calcasieu Pass (0.3 Bcf/d) 15 Source: Wood Mackenzie

Reconciliation of Reported to Operating Earnings (Non-GAAP) Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. GSP full year reconciliation of reported to operating earnings (non-GAAP) (millions) Reported Pre-tax Income Operating Earnings Adjustments Taxes Earnings 2008 $38 $- $- $38 True-up of remeasurement of deferred taxes as a result of the enactment of the 2018 235 - (2) 233 Tax Cuts and Jobs Act of 2017 - recorded in Income Tax Expense 16