EXHIBIT 99.2 DTE YEAR END 2019 EARNINGS CONFERENCE CALL FEBRUARY 5, 2020 1

Safe Harbor Statement Certain information presented herein includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, and businesses of DTE Energy. Words such as “anticipate,” “believe,” “expect,” “projected,” “aspiration,” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions, but rather are subject to numerous assumptions, risks, and uncertainties that may cause actual future results to be materially different from those contemplated, projected, estimated, or budgeted. Many factors impact forward-looking statements including, but not limited to, the following: impact of regulation by the EPA, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; the operational failure of electric or gas distribution systems or infrastructure; impact of volatility of prices in the oil and gas markets on DTE Energy's gas storage and pipelines operations; impact of volatility in prices in the international steel markets on DTE Energy's power and industrial projects operations; the risk of a major safety incident; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; the cost of protecting assets against, or damage due to, cyber incidents and terrorism; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; volatility in the short-term natural gas storage markets impacting third-party storage revenues related to DTE Energy; volatility in commodity markets, deviations in weather, and related risks impacting the results of DTE Energy's energy trading operations; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; advances in technology that produce power, store power, or reduce power consumption; changes in the financial condition of significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long- term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; contract disputes, binding arbitration, litigation, and related appeals; and the risks discussed in the Registrants' public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward- looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This document should also be read in conjunction with the Forward-Looking Statements section of the joint DTE Energy and DTE Electric 2019 Form 10-K (which section is incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric. 2

Participants Jerry Norcia – President and CEO Peter Oleksiak – Senior Vice President and CFO Barbara Tuckfield – Director Investor Relations 3

Strong operational and financial performance in 2019 Operating EPS1 9.0% $6.30 • Delivered strong financial results in 2019 $6.15 ‒ Operating EPS growth rate of 9.0% from 2018 original guidance $5.78 ‒ Exceeded original guidance midpoint for 11th consecutive year ‒ Increased dividend 7%; targeting 7% dividend growth through 20212 • Achieved excellent results around key customer and employee initiatives 2018 2019 2019 original original actual guidance guidance midpoint midpoint Solid results position DTE for future growth 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Subject to Board approval 4

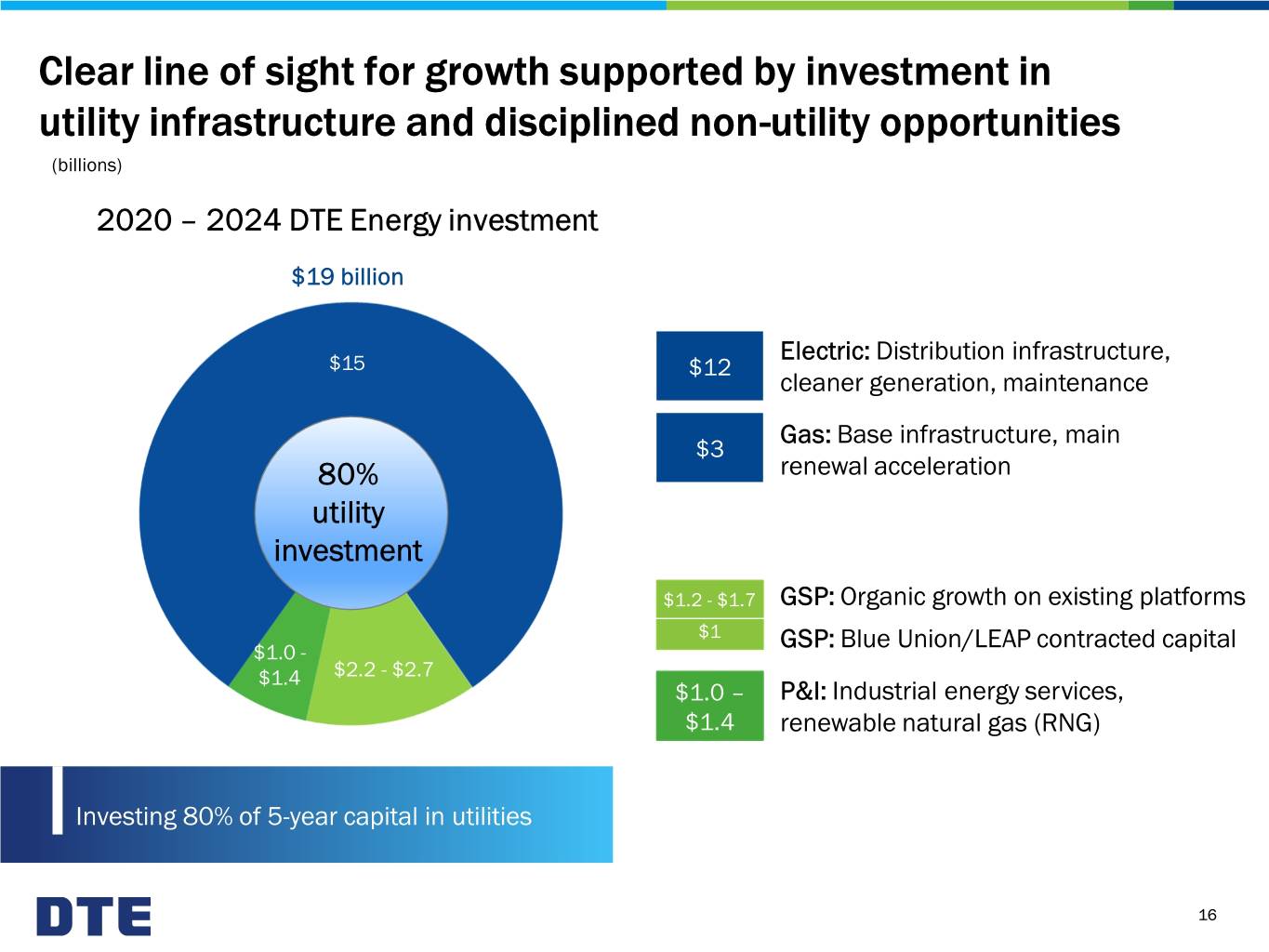

Positioned for continued growth from strong 2020 guidance 1 Operating EPS • 2020 operating EPS guidance midpoint provides 7.5% growth from 2019 original guidance 7.5% • Well-positioned for 5% – 7% operating EPS growth through 2024 • Continued investment in utilities $6.61 ‒ Investing 80% of 5-year capital in utility $6.15 infrastructure and cleaner energy • Delivering non-utility operating earnings with increased certainty 2019 2020 2024E ‒ Supported by deep development queue original guidance guidance midpoint and high-quality contracted assets midpoint • Commitment to positive culture provides a solid framework for success Targeting 5% – 7% operating EPS growth through 2024 from 2020 base 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 5

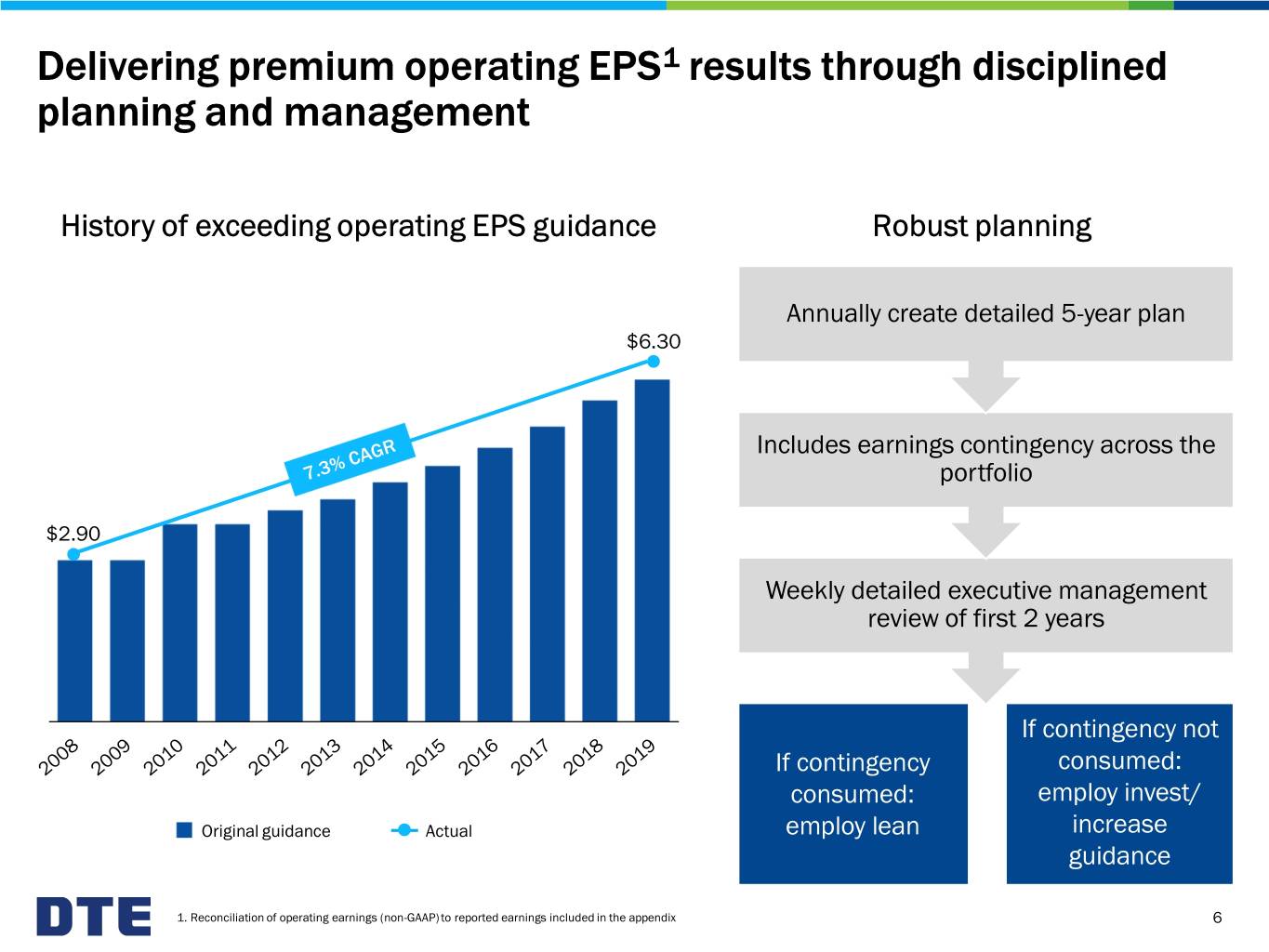

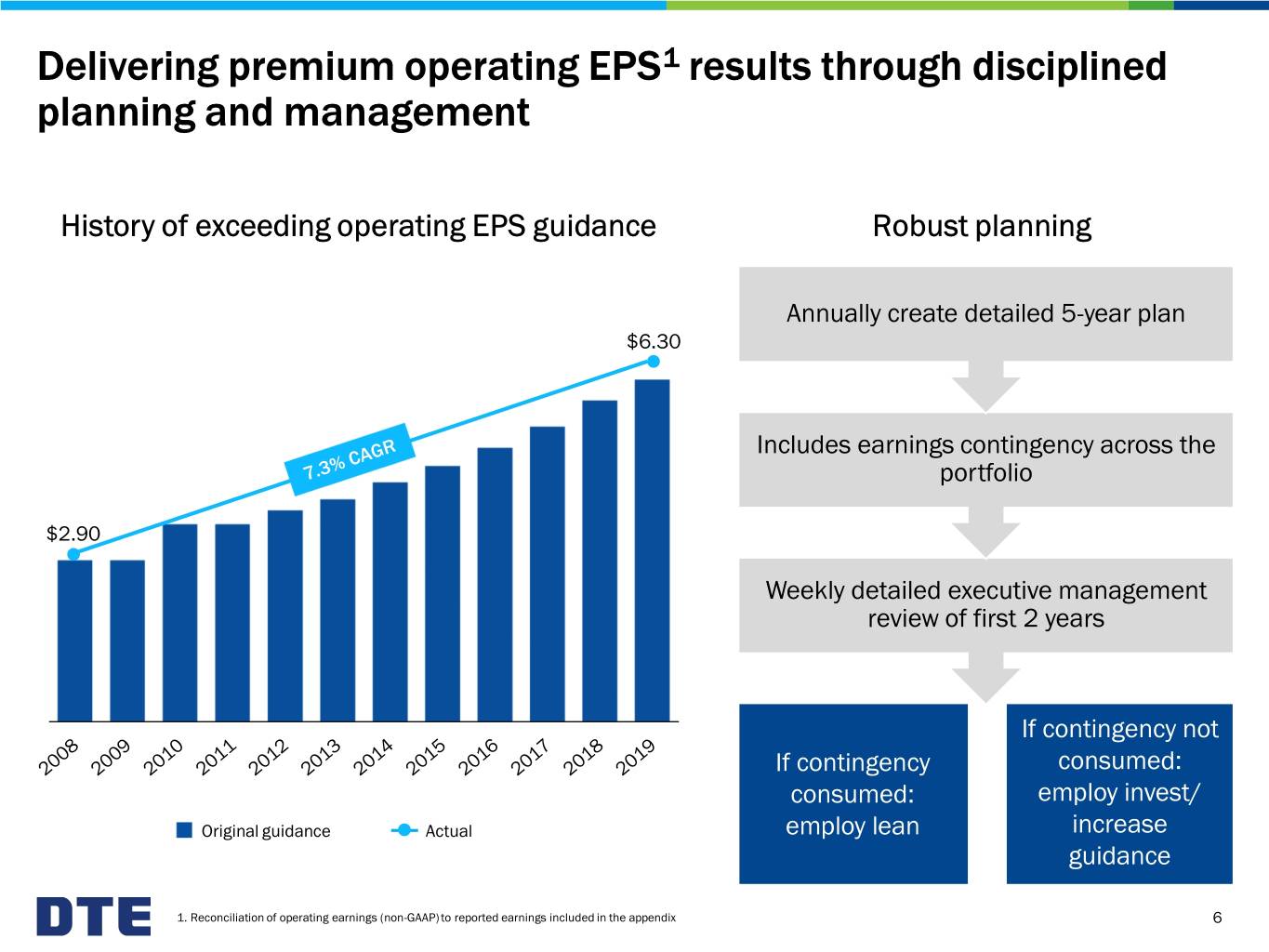

Delivering premium operating EPS1 results through disciplined planning and management History of exceeding operating EPS guidance Robust planning Annually create detailed 5-year plan $6.30 Includes earnings contingency across the portfolio $2.90 Weekly detailed executive management review of first 2 years If contingency not If contingency consumed: consumed: employ invest/ Original guidance Actual employ lean increase guidance 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 6

Commitment to strong culture provides a solid framework for success Safety National Safety Council’s top 2% of companies surveyed in safety culture Employee engagement Top 3% in the world by Gallup; 7 consecutive Gallup Great Workplace Awards Customer satisfaction Top quartile at both utilities for residential satisfaction as ranked by J.D. Power Community involvement One of the country's top corporate citizens as named by Points of Light and J.D. Power One of our top priorities for 2020 is to advance our culture of service excellence 7

DTE Electric: infrastructure investments drive strong growth Advanced on clean energy initiatives in 2019 • Accelerated carbon emissions reduction ‒ 80% carbon emissions reduction by 2040 ‒ Net zero carbon emissions by 2050 • Progressed on new natural gas power plant • Accelerated investments in Charging Forward electric vehicle program Investing in generation and distribution for clean and reliable energy • Doubling renewable investment and increasing voluntary renewables • Modernizing and automating electric circuits, substations and sub-transmission Targeting 7% – 8% operating earnings1 growth 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 8

DTE Gas: replacing aging infrastructure improves cost, performance and productivity Transformational investments in 2019 • Completed 180 miles of main renewal • Continued technology investment to reduce manual meter reads and improve operational efficiency Investing in infrastructure; progressing on methane reduction goal • Beginning construction of first transmission renewal project as part of our continued pipeline integrity work • Increasing main renewal to over 200 miles Committed to over 80% methane reduction by 2040 Targeting 9% operating earnings1 growth 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 9

Gas Storage & Pipelines: high-quality assets with revenue certainty is the foundation for 2019 success and long-term growth 2019 accomplishments 85% of total revenue covered by fixed • Successfully integrated disciplined revenue contracts and flowing gas acquisitions with growth potential and connections to power and industrial markets 100% Contract renewal and 15% ‒ Increased ownership in Link volume growth ‒ Generation Pipeline and Blue Union/LEAP acquisitions Minimum volume commitments and 85% ‒ Organic expansions completed on demand charges1 Millennium and Link 2020E – 2022E Focusing on continued organic growth from well- positioned platforms • Multiple platforms provide opportunity in • Majority of future growth secured and numerous markets supported by strong contracts • Asset franchises make GSP the primary service provider Several highly-accretive expansions are well advanced in the development cycle 1. Includes flowing volumes at committed levels 10

Power & Industrial Projects: continuing consistent growth in key focus areas 2019 accomplishments • Acquired one large industrial energy services project and secured the development of two additional projects • Began commercial operation of integrated RNG facilities in Wisconsin – recognized by the American Biogas Council as project of the year • Expanded RNG efforts as construction began at three additional sites, with further prospects being developed Developing high potential investment opportunities with multiple additional targets in early screening • Strong project pipeline to execute growth strategy in industrial energy services and RNG businesses Well-positioned to continue operating earnings1 origination pace of ~$15 million per year 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 11

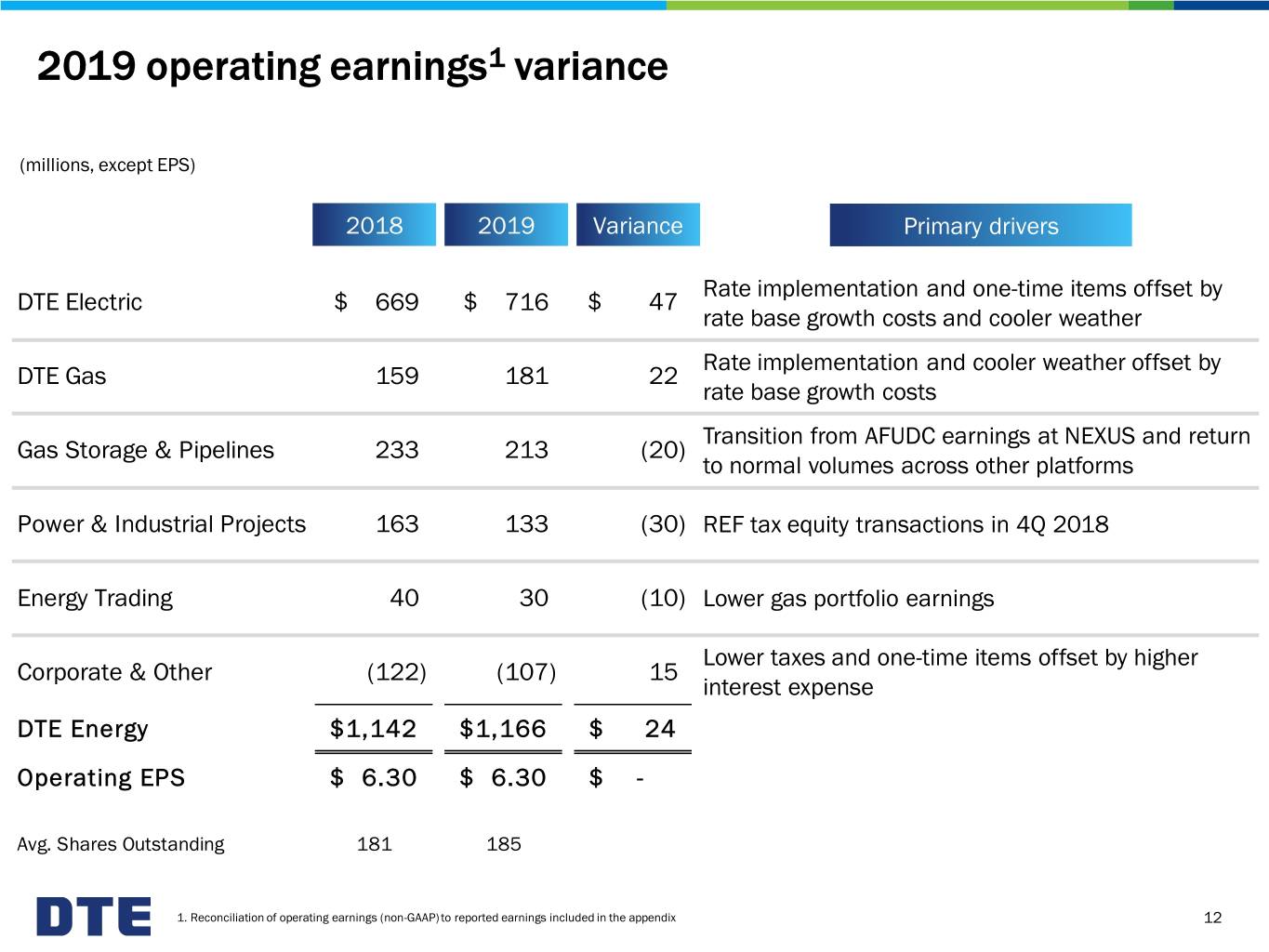

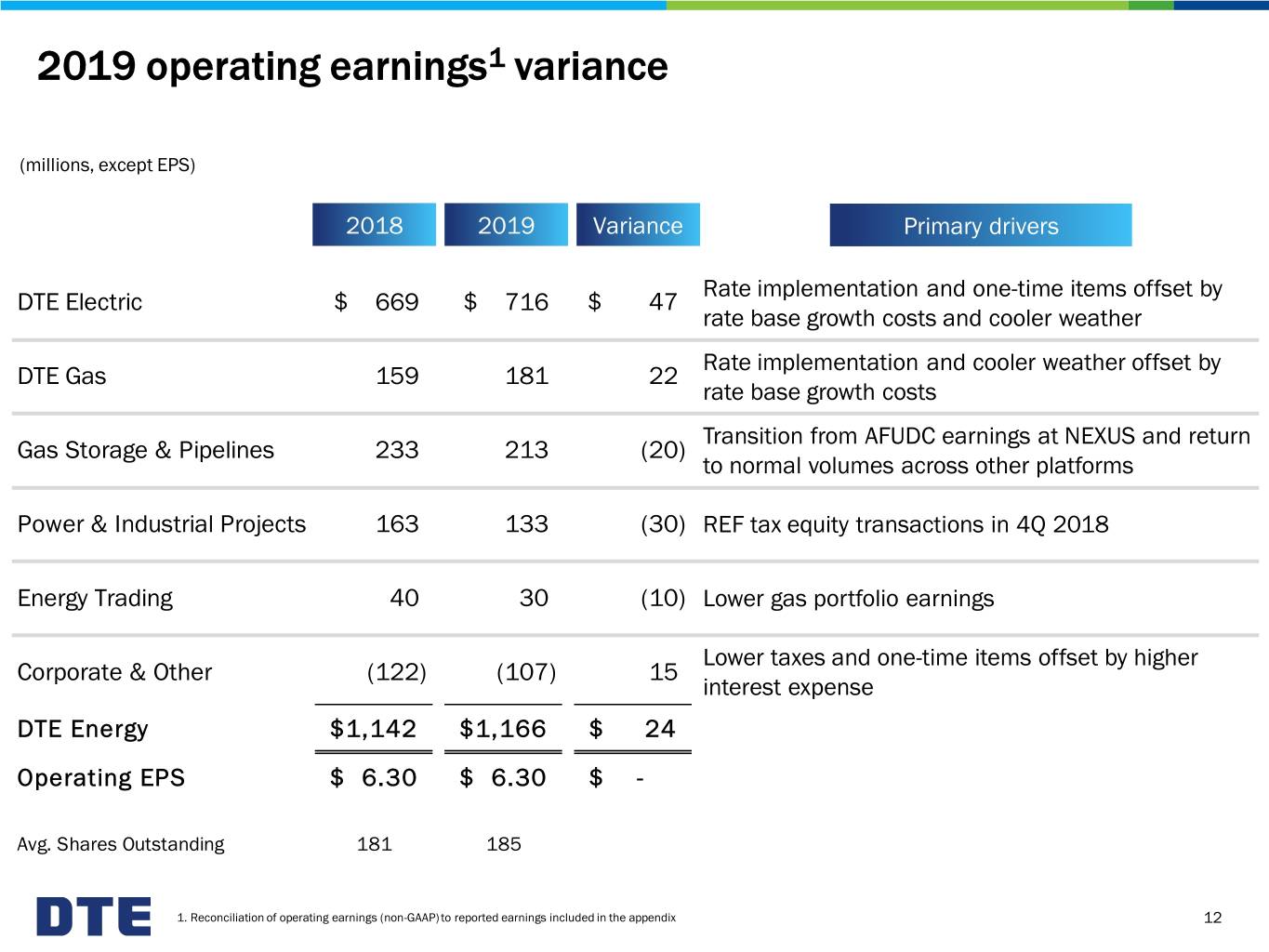

2019 operating earnings1 variance (millions, except EPS) 2018 2019 Variance Primary drivers Rate implementation and one-time items offset by DTE Electric $ 669 $ 716 $ 47 rate base growth costs and cooler weather Rate implementation and cooler weather offset by DTE Gas 159 181 22 rate base growth costs Transition from AFUDC earnings at NEXUS and return Gas Storage & Pipelines 233 213 (20) to normal volumes across other platforms Power & Industrial Projects 163 133 (30) REF tax equity transactions in 4Q 2018 Energy Trading 40 30 (10) Lower gas portfolio earnings Lower taxes and one-time items offset by higher Corporate & Other (122) (107) 15 interest expense DTE Energy $1,142 $1,166 $ 24 Operating EPS $ 6.30 $ 6.30 $ - Avg. Shares Outstanding 181 185 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 12

Continuing long track record of delivering premium shareholder returns Strong operational and financial performance in 2019; 1 well-positioned for future growth 5% – 7% operating EPS1 growth through 2024 from 2 2020 base 3 7% dividend growth extended through 20212 Driving utility growth by investing 80% of total 5-year 4 capital in utility infrastructure and cleaner energy Continuing strategic and sustainable growth in non- 5 utility businesses 6 Maintaining strong balance sheet and credit profile Committed to long-term business mix of 70% – 75% 7 utility 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Subject to Board approval 13

CONTACT US DTE Investor Relations www.dteenergy.com/investors 313.235.8030 14

Appendix 15

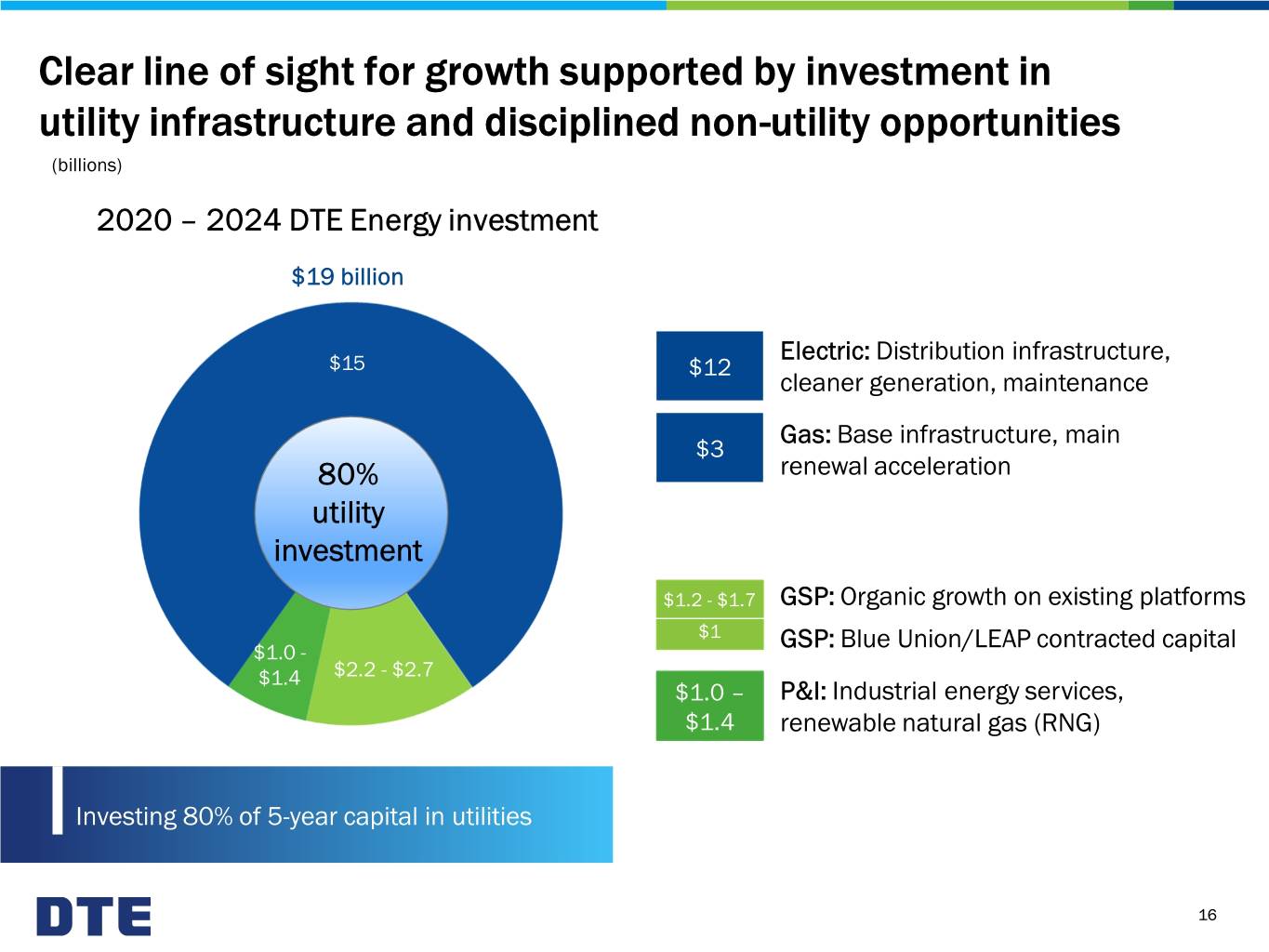

Clear line of sight for growth supported by investment in utility infrastructure and disciplined non-utility opportunities (billions) 2020 – 2024 DTE Energy investment $19 billion Electric: Distribution infrastructure, $15 $12 cleaner generation, maintenance Gas: Base infrastructure, main $3 80% renewal acceleration utility investment $1.2 - $1.7 GSP: Organic growth on existing platforms $1 GSP: Blue Union/LEAP contracted capital $1.0 - $1.4 $2.2 - $2.7 $1.0 – P&I: Industrial energy services, $1.4 renewable natural gas (RNG) Investing 80% of 5-year capital in utilities 16

2020 operating earnings1 guidance (millions, except EPS) 2020 operating earnings guidance DTE Electric $759 - $773 DTE Gas 185 - 193 Gas Storage & Pipelines 277 - 293 Power & Industrial Projects 133 - 148 Energy Trading 15 - 25 Corporate & Other (122) - (132) DTE Energy $1,247 - $1,300 Operating EPS $6.47 - $6.75 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 17

Maintaining strong cash flow, balance sheet and credit profile (billions) Planned equity issuances • $1.6 billion of available liquidity at year-end 2019 2020 – 2022 • Maintaining strong investment-grade credit $1.3 rating and FFO1/Debt2 target at 18% Convertible equity units $0.1 – $0.4 $0.1 – $0.3 Credit ratings S&P Moody’s Fitch 2020 2021 2022 DTE Energy BBB Baa2 BBB+ $1.5 – $2.0 (unsecured) DTE Electric A Aa3 A+ (secured) DTE Gas A A1 A (secured) 1. Funds from Operations (FFO) is calculated using operating earnings 2. Debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes and 100% of the convertible equity units as equity 18

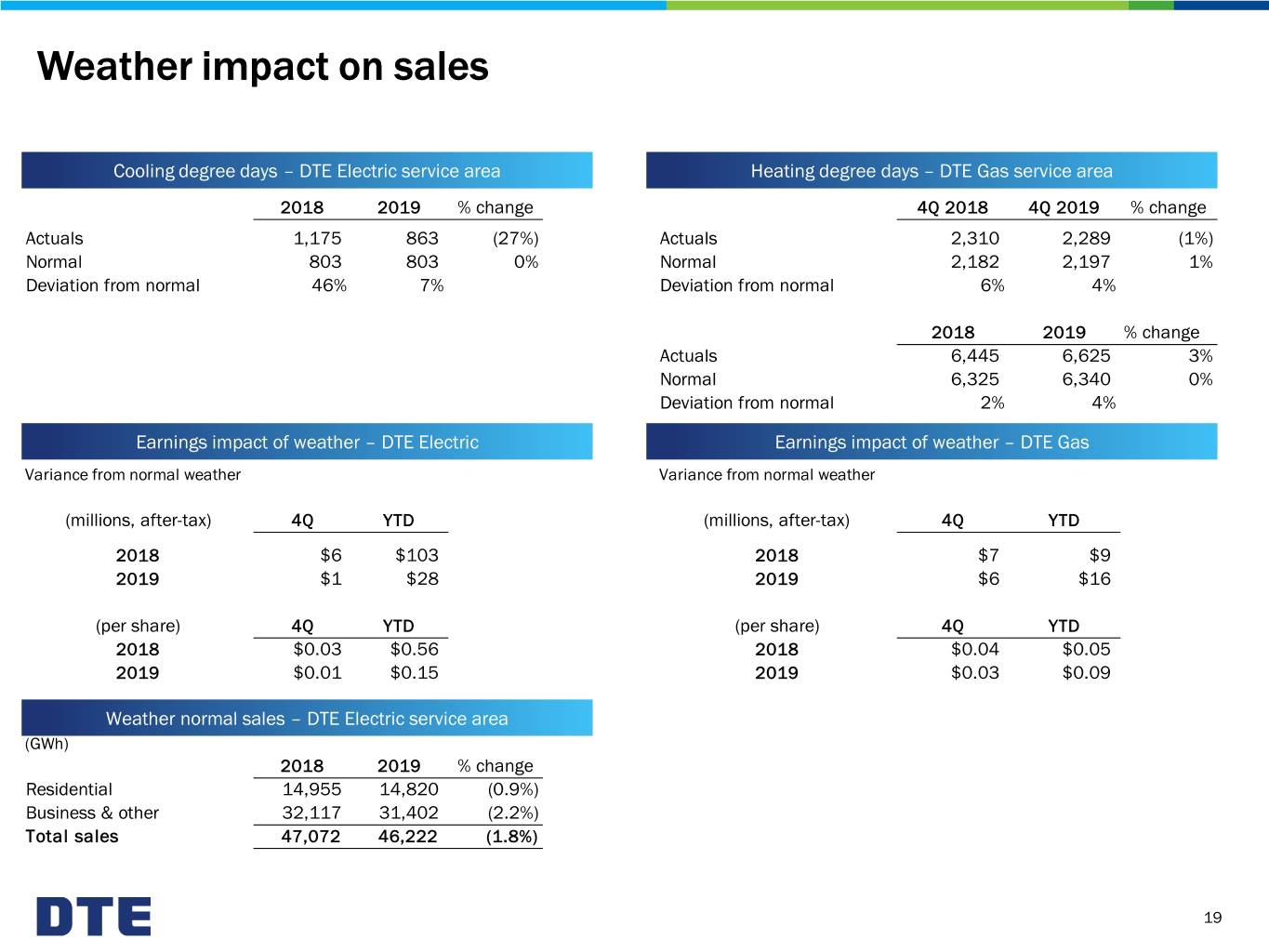

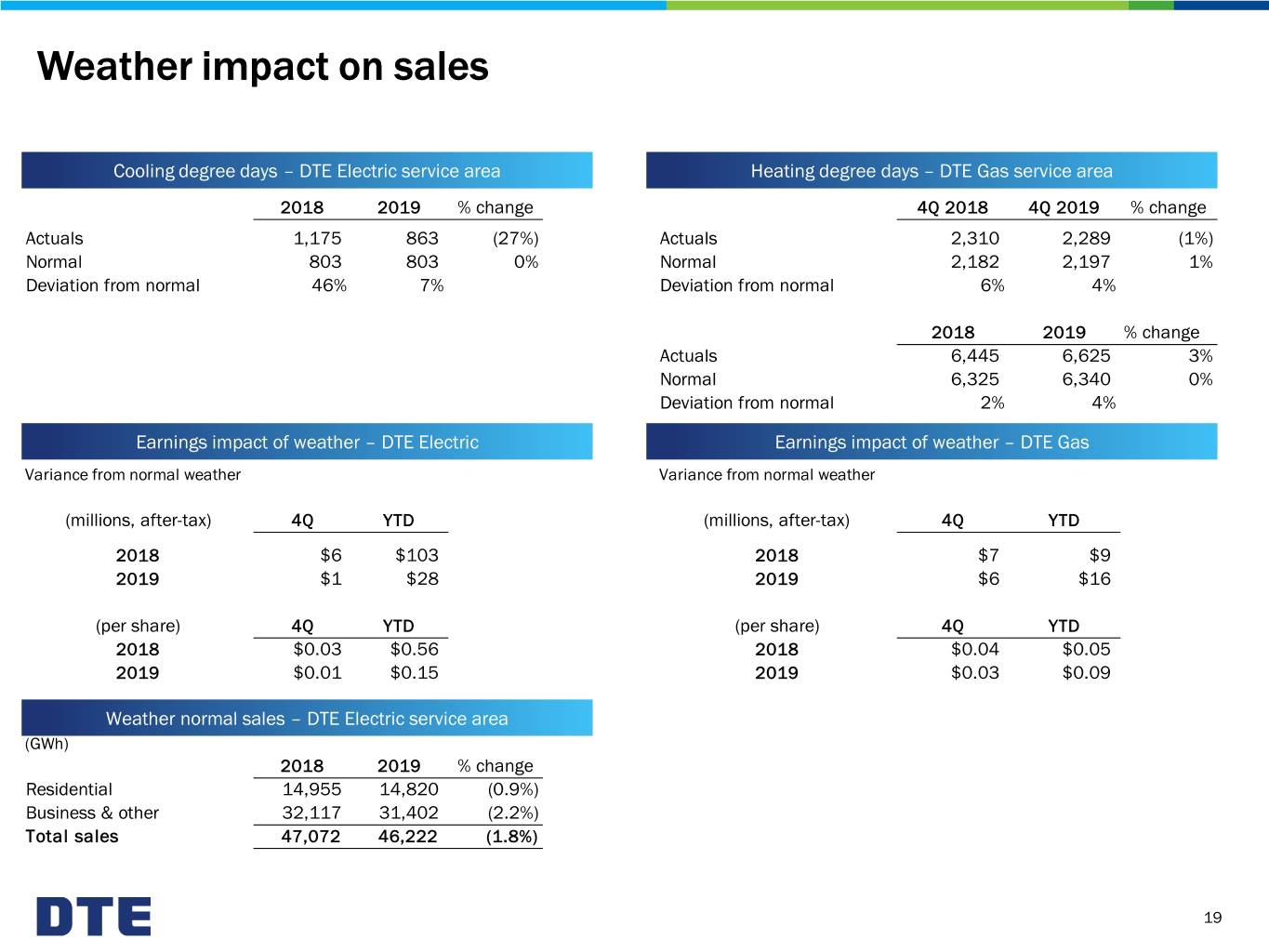

Weather impact on sales Cooling degree days – DTE Electric service area Heating degree days – DTE Gas service area 2018 2019 % change 4Q 2018 4Q 2019 % change Actuals 1,175 863 (27%) Actuals 2,310 2,289 (1%) Normal 803 803 0% Normal 2,182 2,197 1% Deviation from normal 46% 7% Deviation from normal 6% 4% 2018 2019 % change Actuals 6,445 6,625 3% Normal 6,325 6,340 0% Deviation from normal 2% 4% Earnings impact of weather – DTE Electric Earnings impact of weather – DTE Gas Variance from normal weather Variance from normal weather (millions, after-tax) 4Q YTD (millions, after-tax) 4Q YTD 2018 $6 $103 2018 $7 $9 2019 $1 $28 2019 $6 $16 (per share) 4Q YTD (per share) 4Q YTD 2018 $0.03 $0.56 2018 $0.04 $0.05 2019 $0.01 $0.15 2019 $0.03 $0.09 Weather normal sales – DTE Electric service area (GWh) 2018 2019 % change Residential 14,955 14,820 (0.9%) Business & other 32,117 31,402 (2.2%) Total sales 47,072 46,222 (1.8%) 19

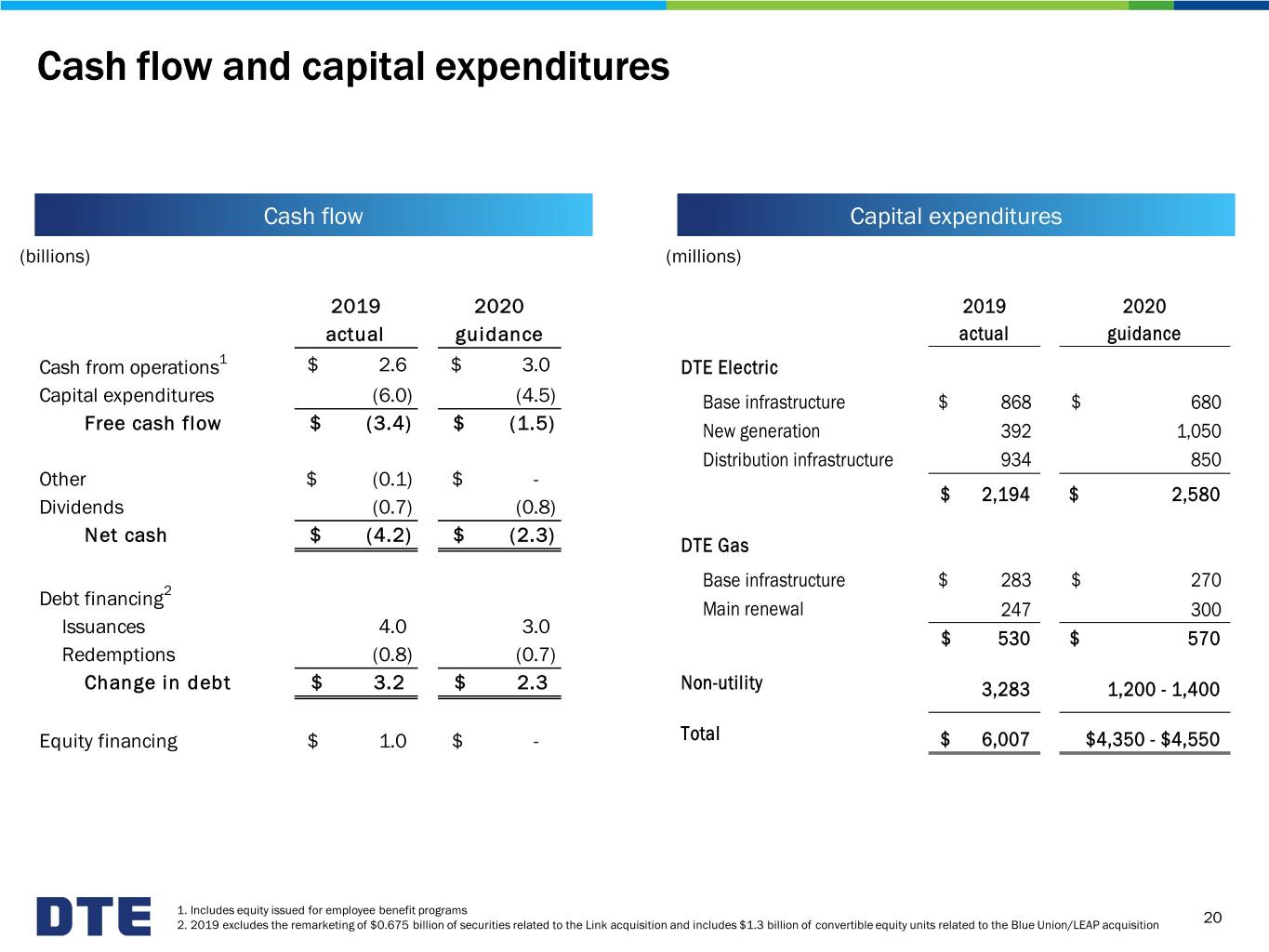

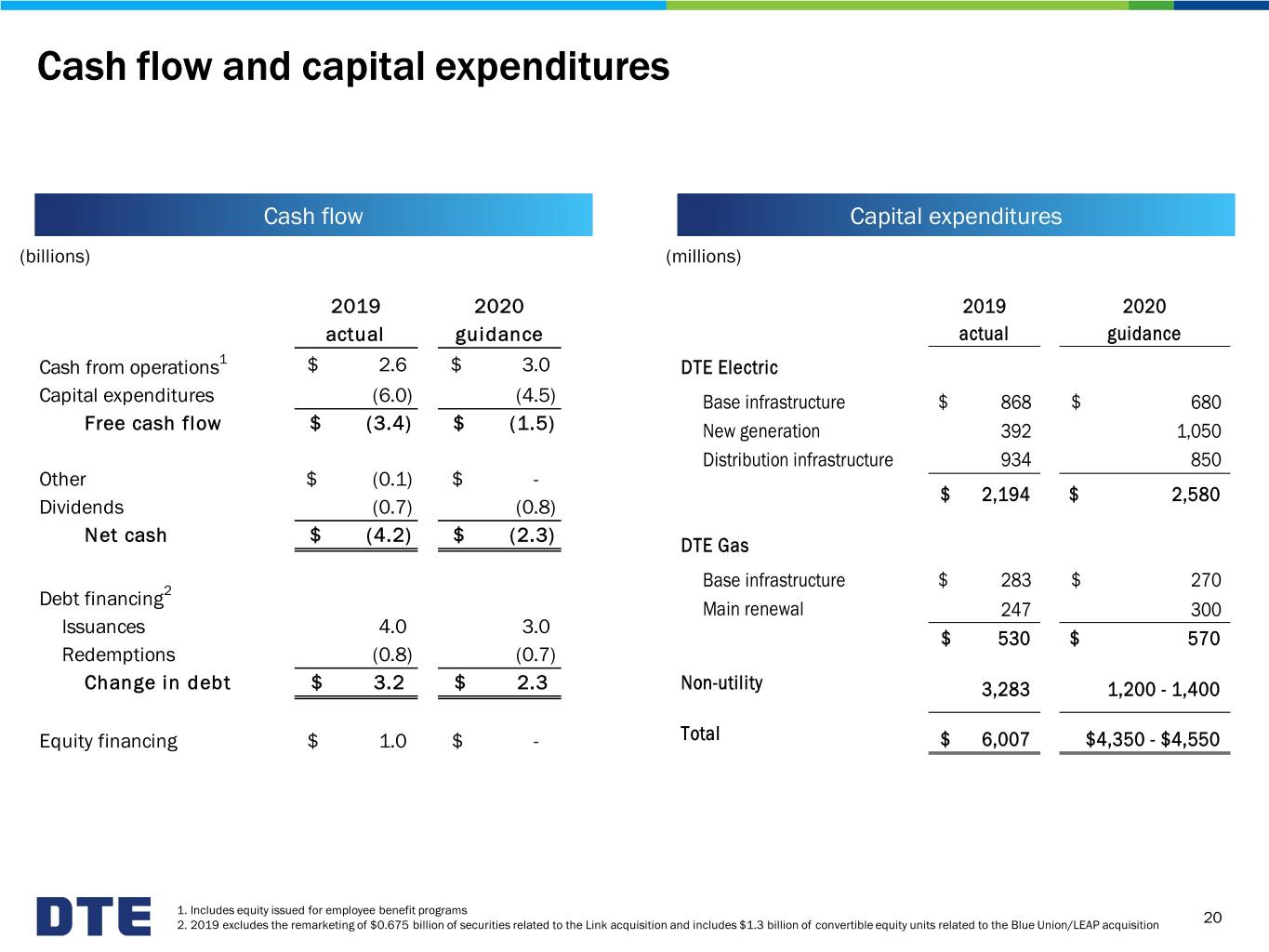

Cash flow and capital expenditures Cash flow Capital expenditures (billions) (millions) 2019 2020 2019 2020 actual guidance actual guidance Cash from operations1 $ 2.6 $ 3.0 DTE Electric Capital expenditures (6.0) (4.5) Base infrastructure $ 868 $ 680 Free cash flow $ (3.4) $ (1.5) New generation 392 1,050 Distribution infrastructure 934 850 Other $ (0.1) $ - $ 2,194 $ 2,580 Dividends (0.7) (0.8) Net cash $ (4.2) $ (2.3) DTE Gas Base infrastructure $ 283 $ 270 Debt financing2 Main renewal 247 300 Issuances 4.0 3.0 $ 530 $ 570 Redemptions (0.8) (0.7) Change in debt $ 3.2 $ 2.3 Non-utility 3,283 1,200 - 1,400 Equity financing $ 1.0 $ - Total $ 6,007 $4,350 - $4,550 1. Includes equity issued for employee benefit programs 2. 2019 excludes the remarketing of $0.675 billion of securities related to the Link acquisition and includes $1.3 billion of convertible equity units related to the Blue Union/LEAP acquisition 20

DTE Electric and DTE Gas regulatory update DTE Electric DTE Gas • General rate case – filed July 2019 • General rate case – filed November 2019 (U-20561) (U-20642) ‒ Effective: May 2020 ‒ Effective: October 2020 ‒ Rate recovery: $351 million ‒ Rate recovery: $204 million ‒ ROE: 10.5% ‒ ROE: 10.5% ‒ Capital structure: 50% debt, 50% equity ‒ Capital structure: 48% debt, 52% equity ‒ Rate base: $18.3 billion ‒ Rate base: $5.1 billion • Filed Integrated Resource Plan – March 2019 (U-20471) ‒ Order expected early 2020 21

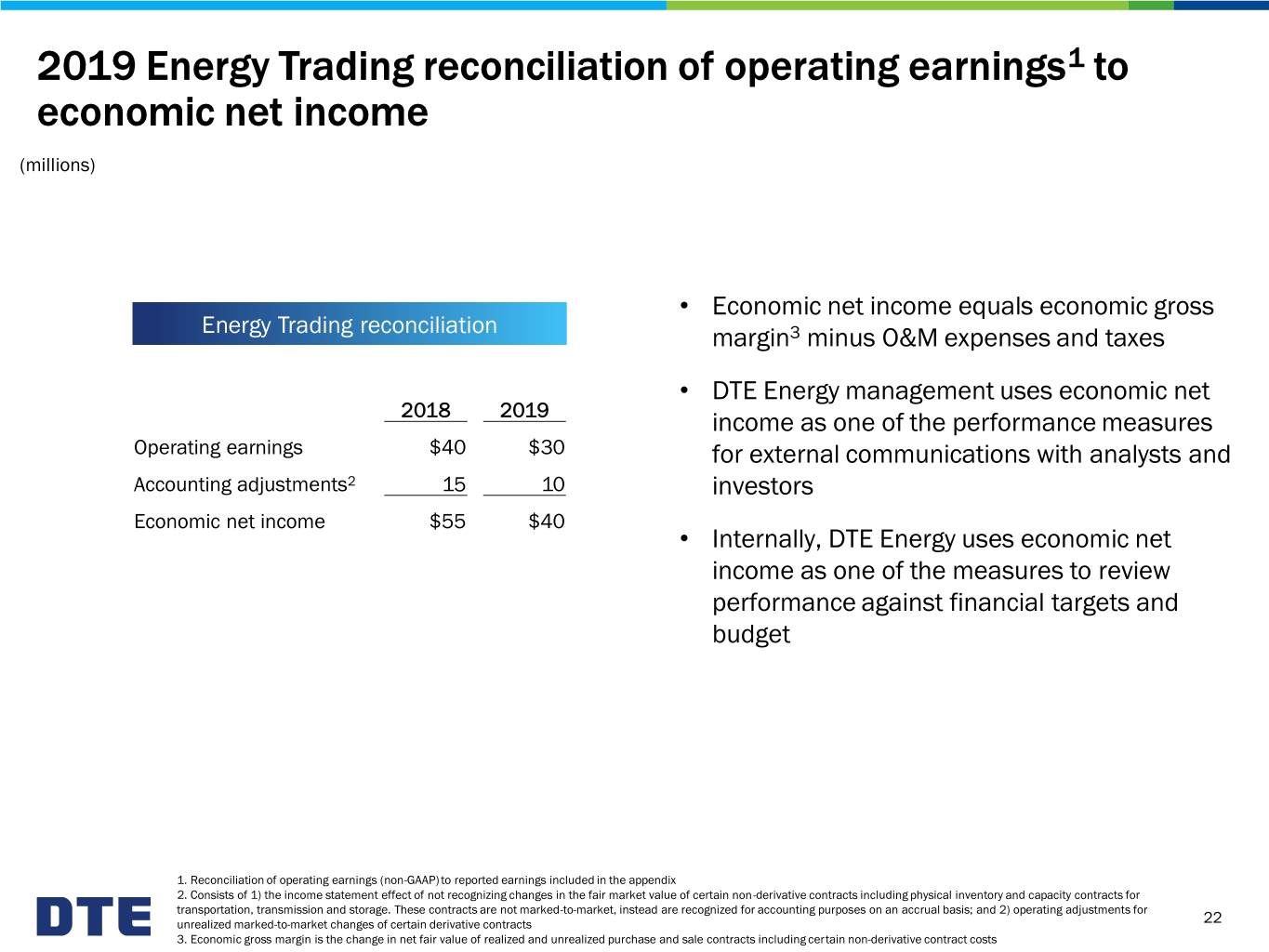

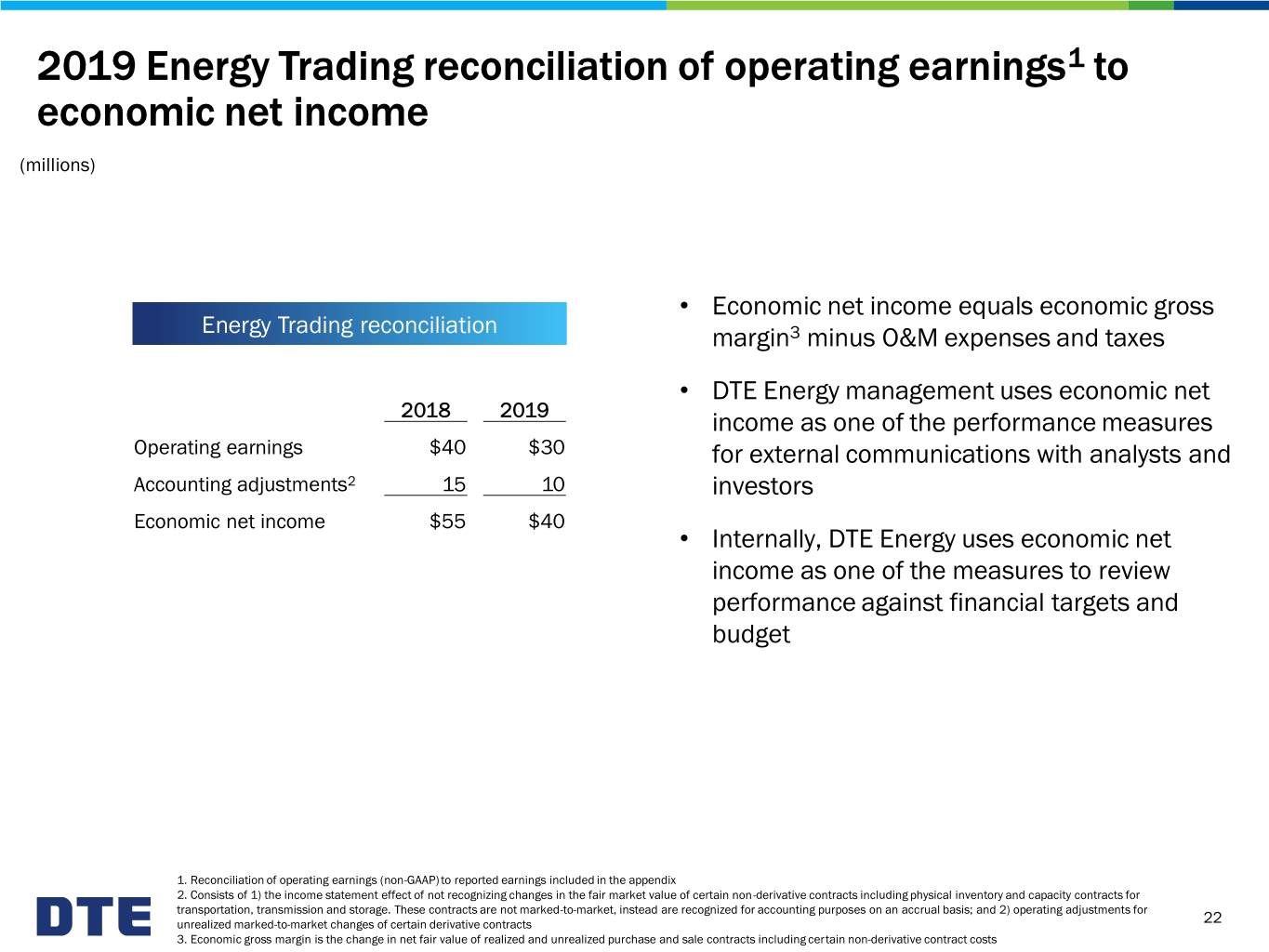

2019 Energy Trading reconciliation of operating earnings1 to economic net income (millions) • Economic net income equals economic gross Energy Trading reconciliation margin3 minus O&M expenses and taxes • DTE Energy management uses economic net 2018 2019 income as one of the performance measures Operating earnings $40 $30 for external communications with analysts and Accounting adjustments2 15 10 investors Economic net income $55 $40 • Internally, DTE Energy uses economic net income as one of the measures to review performance against financial targets and budget 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Consists of 1) the income statement effect of not recognizing changes in the fair market value of certain non-derivative contracts including physical inventory and capacity contracts for transportation, transmission and storage. These contracts are not marked-to-market, instead are recognized for accounting purposes on an accrual basis; and 2) operating adjustments for unrealized marked-to-market changes of certain derivative contracts 22 3. Economic gross margin is the change in net fair value of realized and unrealized purchase and sale contracts including certain non-derivative contract costs

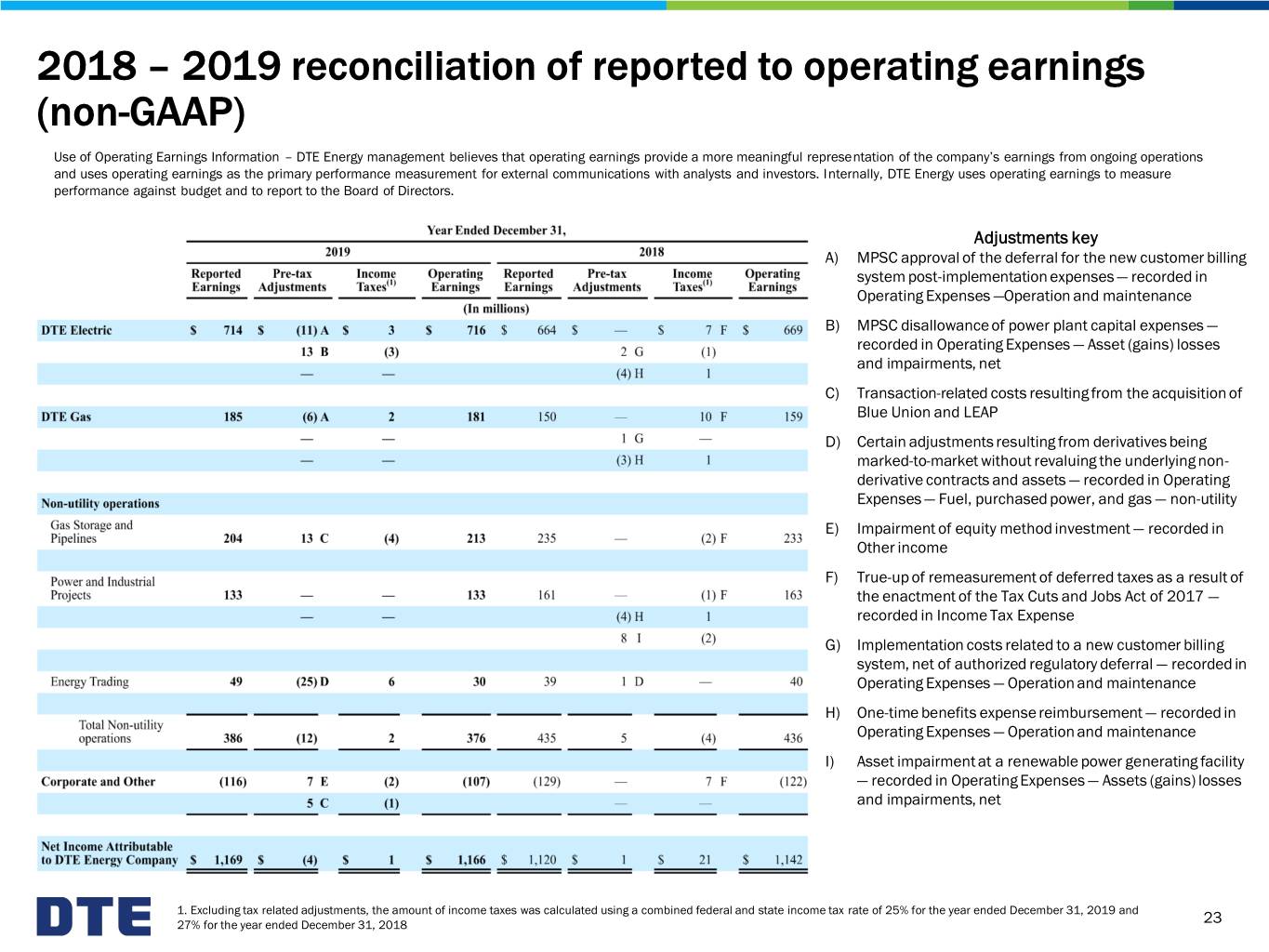

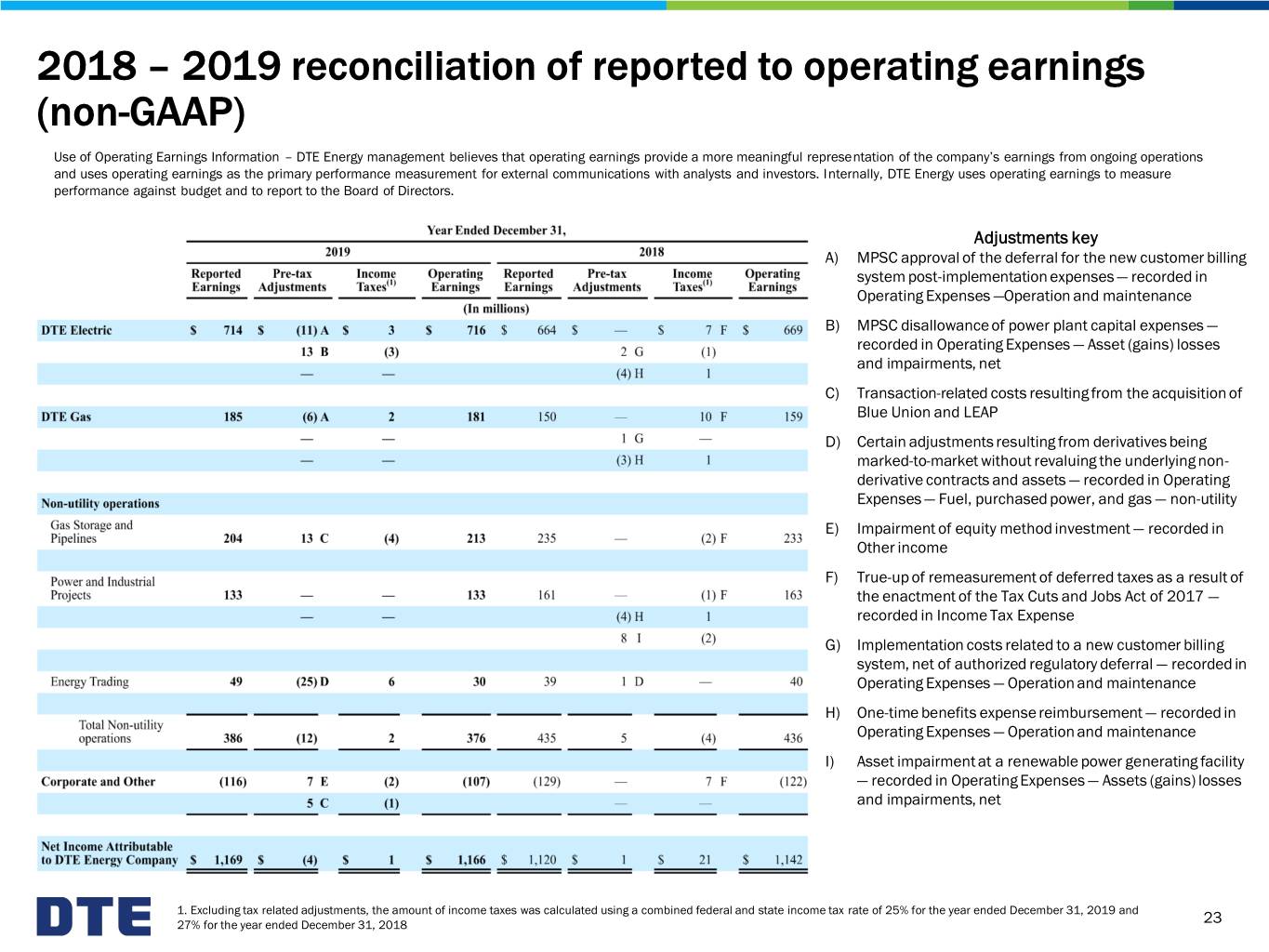

2018 – 2019 reconciliation of reported to operating earnings (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Adjustments key A) MPSC approval of the deferral for the new customer billing system post-implementation expenses — recorded in Operating Expenses —Operation and maintenance B) MPSC disallowance of power plant capital expenses — recorded in Operating Expenses — Asset (gains) losses and impairments, net C) Transaction-related costs resulting from the acquisition of Blue Union and LEAP D) Certain adjustments resulting from derivatives being marked-to-market without revaluing the underlying non- derivative contracts and assets — recorded in Operating Expenses — Fuel, purchased power, and gas — non-utility E) Impairment of equity method investment — recorded in Other income F) True-up of remeasurement of deferred taxes as a result of the enactment of the Tax Cuts and Jobs Act of 2017 — recorded in Income Tax Expense G) Implementation costs related to a new customer billing system, net of authorized regulatory deferral — recorded in Operating Expenses — Operation and maintenance H) One-time benefits expense reimbursement — recorded in Operating Expenses — Operation and maintenance I) Asset impairment at a renewable power generating facility — recorded in Operating Expenses — Assets (gains) losses and impairments, net 1. Excluding tax related adjustments, the amount of income taxes was calculated using a combined federal and state income tax rate of 25% for the year ended December 31, 2019 and 27% for the year ended December 31, 2018 23

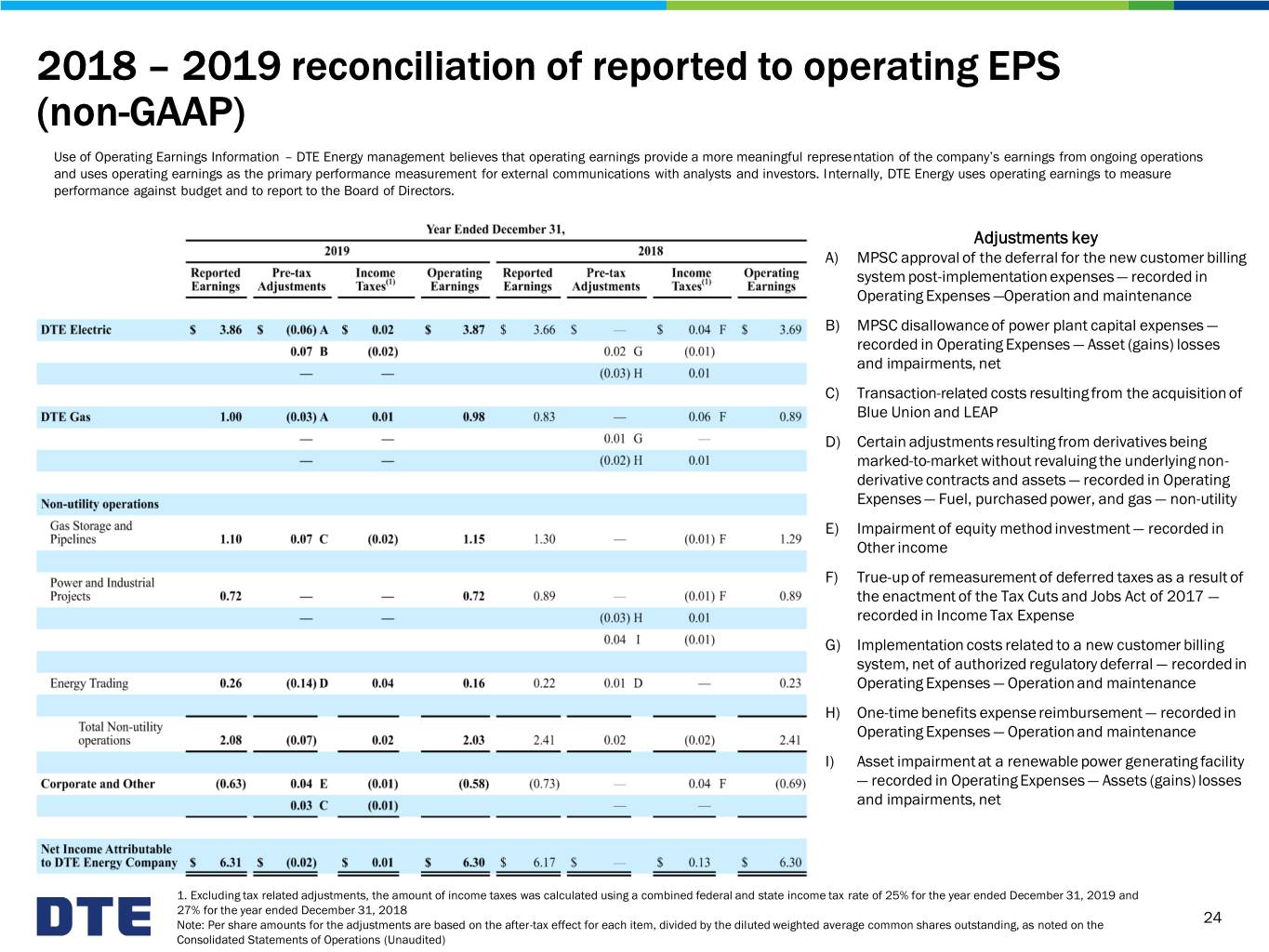

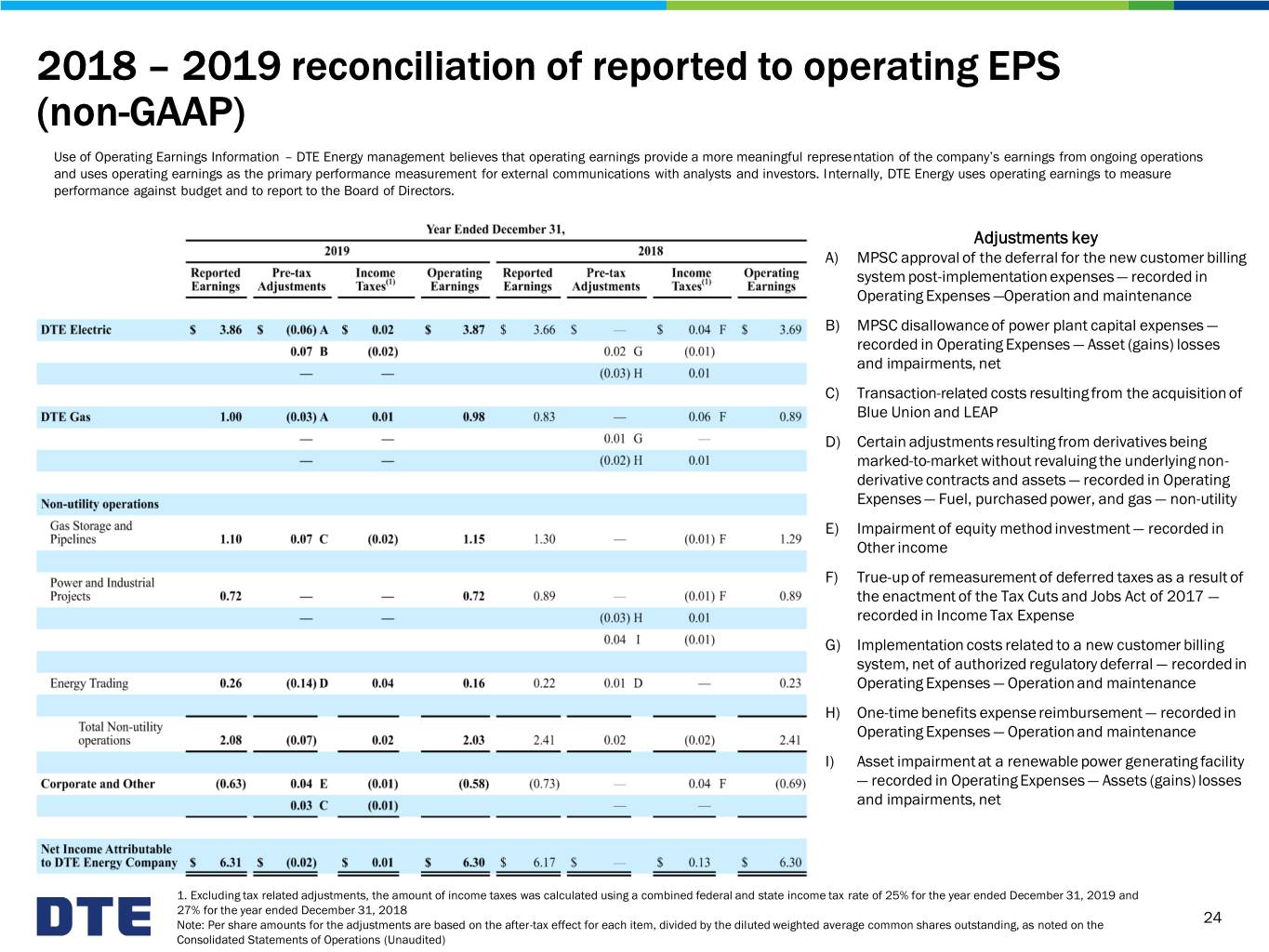

2018 – 2019 reconciliation of reported to operating EPS (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Adjustments key A) MPSC approval of the deferral for the new customer billing system post-implementation expenses — recorded in Operating Expenses —Operation and maintenance B) MPSC disallowance of power plant capital expenses — recorded in Operating Expenses — Asset (gains) losses and impairments, net C) Transaction-related costs resulting from the acquisition of Blue Union and LEAP D) Certain adjustments resulting from derivatives being marked-to-market without revaluing the underlying non- derivative contracts and assets — recorded in Operating Expenses — Fuel, purchased power, and gas — non-utility E) Impairment of equity method investment — recorded in Other income F) True-up of remeasurement of deferred taxes as a result of the enactment of the Tax Cuts and Jobs Act of 2017 — recorded in Income Tax Expense G) Implementation costs related to a new customer billing system, net of authorized regulatory deferral — recorded in Operating Expenses — Operation and maintenance H) One-time benefits expense reimbursement — recorded in Operating Expenses — Operation and maintenance I) Asset impairment at a renewable power generating facility — recorded in Operating Expenses — Assets (gains) losses and impairments, net 1. Excluding tax related adjustments, the amount of income taxes was calculated using a combined federal and state income tax rate of 25% for the year ended December 31, 2019 and 27% for the year ended December 31, 2018 Note: Per share amounts for the adjustments are based on the after-tax effect for each item, divided by the diluted weighted average common shares outstanding, as noted on the 24 Consolidated Statements of Operations (Unaudited)

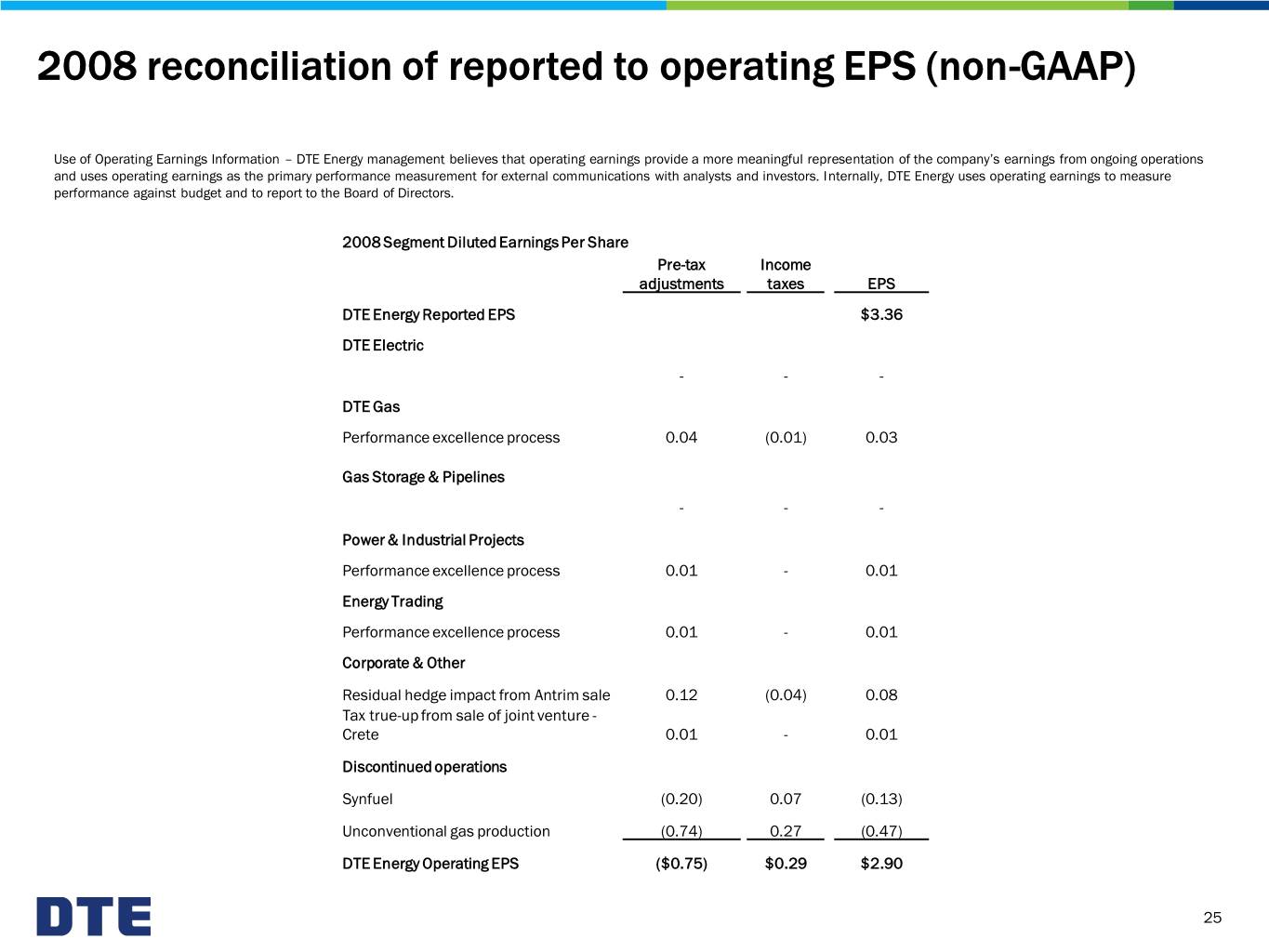

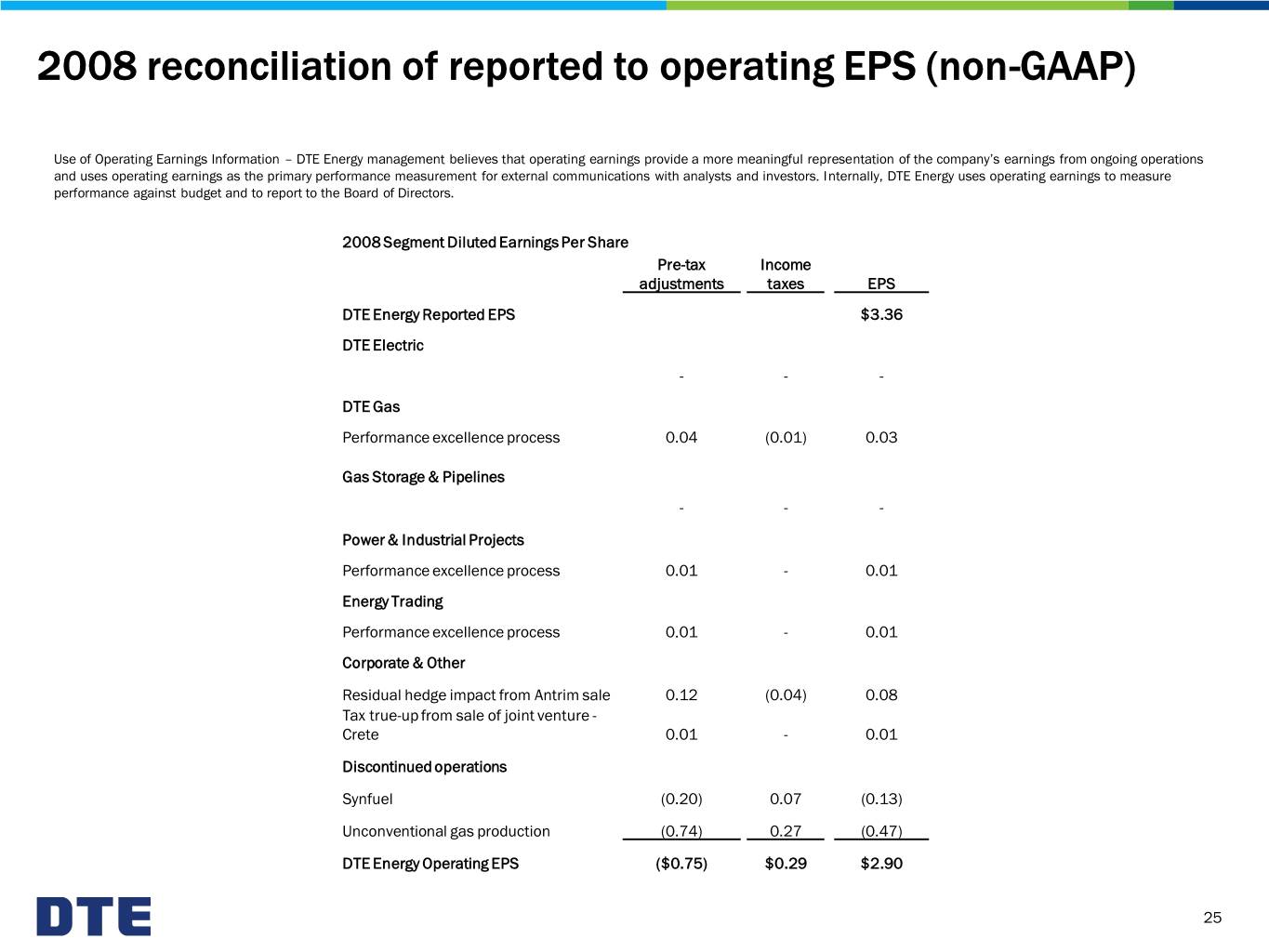

2008 reconciliation of reported to operating EPS (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2008 Segment Diluted Earnings Per Share Pre-tax Income adjustments taxes EPS DTE Energy Reported EPS $3.36 DTE Electric - - - DTE Gas Performance excellence process 0.04 (0.01) 0.03 Gas Storage & Pipelines - - - Power & Industrial Projects Performance excellence process 0.01 - 0.01 Energy Trading Performance excellence process 0.01 - 0.01 Corporate & Other Residual hedge impact from Antrim sale 0.12 (0.04) 0.08 Tax true-up from sale of joint venture - Crete 0.01 - 0.01 Discontinued operations Synfuel (0.20) 0.07 (0.13) Unconventional gas production (0.74) 0.27 (0.47) DTE Energy Operating EPS ($0.75) $0.29 $2.90 25

Reconciliation of reported to operating earnings (non-GAAP) Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. 26