2024 Year-end Earnings Conference Call February 13, 2025 EXHIBIT 99.2

Safe harbor statement 2 The information contained herein is as of the date of this document. DTE Energy expressly disclaims any current intention to update any forward-looking statements contained in this document as a result of new information or future events or developments. Words such as “anticipate,” “believe,” “expect,” “may,” “could,” “projected,” “aspiration,” “plans” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various assumptions, risks and uncertainties that may cause actual future results to be materially different from those contemplated, projected, estimated or budgeted. Many factors may impact forward-looking statements including, but not limited to, the following: the impact of regulation by the EPA, EGLE, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC and CARB, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; the operational failure of electric or gas distribution systems or infrastructure; impact of volatility in prices in international steel markets and in prices of environmental attributes generated from renewable natural gas investments on the operations of DTE Vantage; the risk of a major safety incident; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; the cost of protecting assets and customer data against, or damage due to, cyber incidents and terrorism; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; volatility in commodity markets, deviations in weather and related risks impacting the results of DTE Energy’s energy trading operations; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; advances in technology that produce power, store power or reduce or increase power consumption; changes in the financial condition of significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; impacts of inflation and the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena, including climate change, on operations and sales to customers, and purchases from suppliers; unplanned outages at our generation plants; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of generation and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; successful execution of new business development and future growth plans; contract disputes, binding arbitration, litigation, and related appeals; the ability of the electric and gas utilities to achieve goals for carbon emission reductions; and the risks discussed in DTE Energy’s public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This document should also be read in conjunction with the Forward-Looking Statements section in DTE Energy’s public filings with the Securities and Exchange Commission.

Participants 3 Jerry Norcia – Chairman and CEO Joi Harris – President and COO Dave Ruud – Executive Vice President and CFO Matt Krupinski – Director of Investor Relations

4 1. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings Delivered strong results in 2024; significant customer-focused utility investment drives growth in 2025 and beyond ✓ Strong 2024 operating EPS1 of $6.83 delivers at the high end of 2024 original guidance and provides 9% growth over 2023 original guidance midpoint ✓ Constructive outcome in DTE Electric rate case and solid financial strength allows us to make the necessary investments for improved reliability and cleaner generation ✓ 2025 operating EPS guidance midpoint provides 7% growth over 2024 original guidance midpoint; currently positioned to achieve high end of guidance in 2025 ✓ Increasing 5-year capital investment by $5 billion over previous plan primarily driven by increased customer-focused utility investment ✓ Potential incremental capital investment to support data center growth would be above current plan ✓ Updated plan provides higher quality earnings through increased customer-focused utility investments while moving to more utility-like investments at DTE Vantage ✓ Long-term operating EPS growth rate target of 6% - 8% through 2029 from 2025 original guidance midpoint 2024 2025 2023 2024 ActualOriginal guidance midpoint 2024 operating EPS 9% growth over 2023 guidance midpoint $6.25 $6.83 Guidance range Original guidance midpoint $6.69 $7.09 - $7.23 2025 operating EPS guidance midpoint 7% growth over 2024 guidance midpoint Positioned to achieve high end Achieved high end of guidance

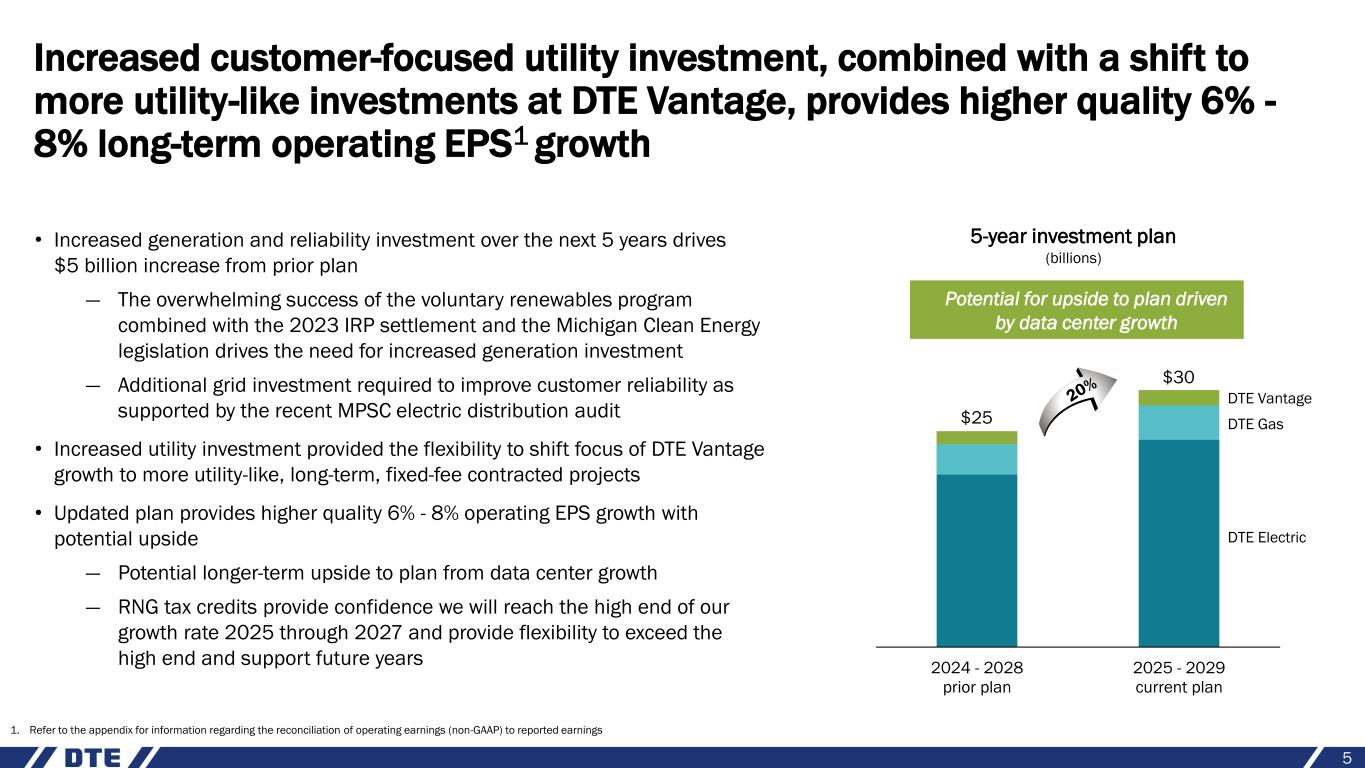

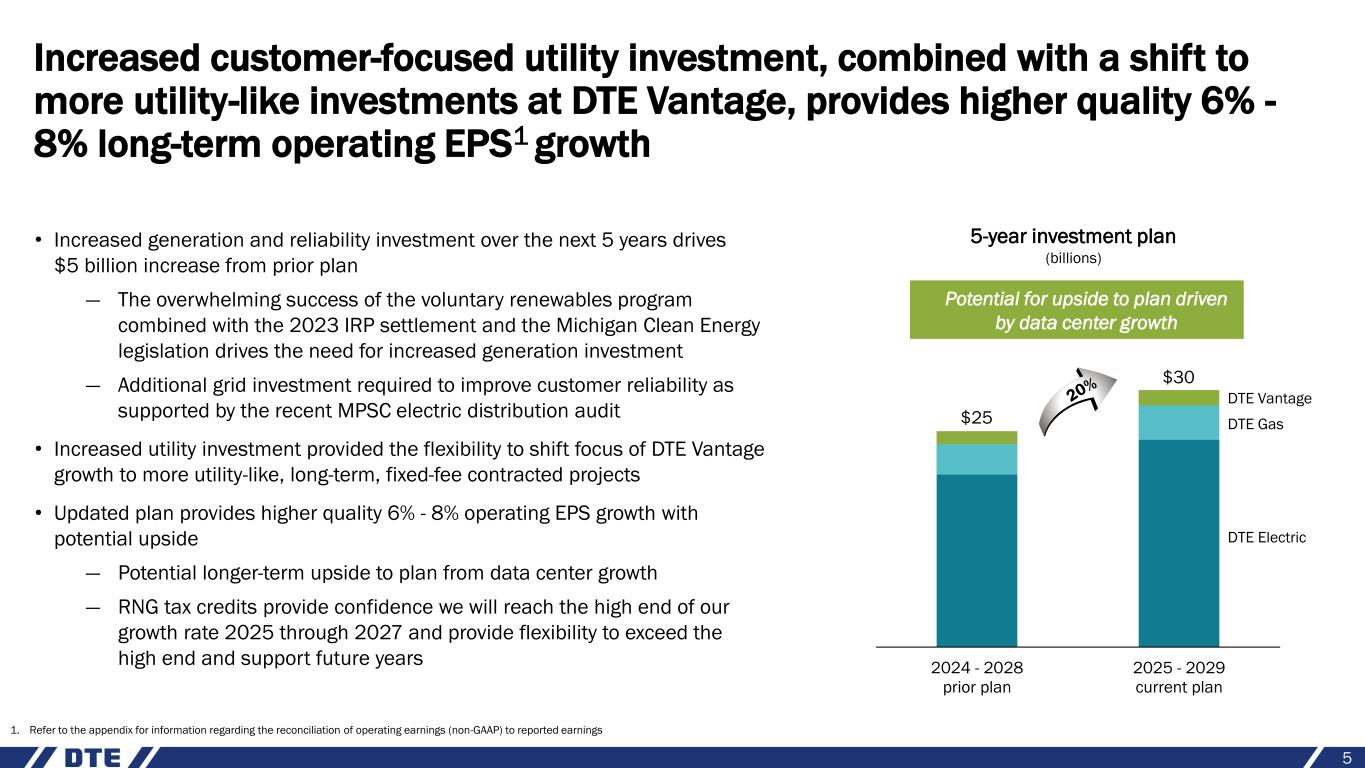

5 Increased customer-focused utility investment, combined with a shift to more utility-like investments at DTE Vantage, provides higher quality 6% - 8% long-term operating EPS1 growth • Increased generation and reliability investment over the next 5 years drives $5 billion increase from prior plan — The overwhelming success of the voluntary renewables program combined with the 2023 IRP settlement and the Michigan Clean Energy legislation drives the need for increased generation investment — Additional grid investment required to improve customer reliability as supported by the recent MPSC electric distribution audit • Increased utility investment provided the flexibility to shift focus of DTE Vantage growth to more utility-like, long-term, fixed-fee contracted projects • Updated plan provides higher quality 6% - 8% operating EPS growth with potential upside — Potential longer-term upside to plan from data center growth — RNG tax credits provide confidence we will reach the high end of our growth rate 2025 through 2027 and provide flexibility to exceed the high end and support future years 5-year investment plan (billions) 1. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings 2024 - 2028 prior plan 2025 - 2029 current plan $25 $30 DTE Electric DTE Gas DTE Vantage Potential for upside to plan driven by data center growth

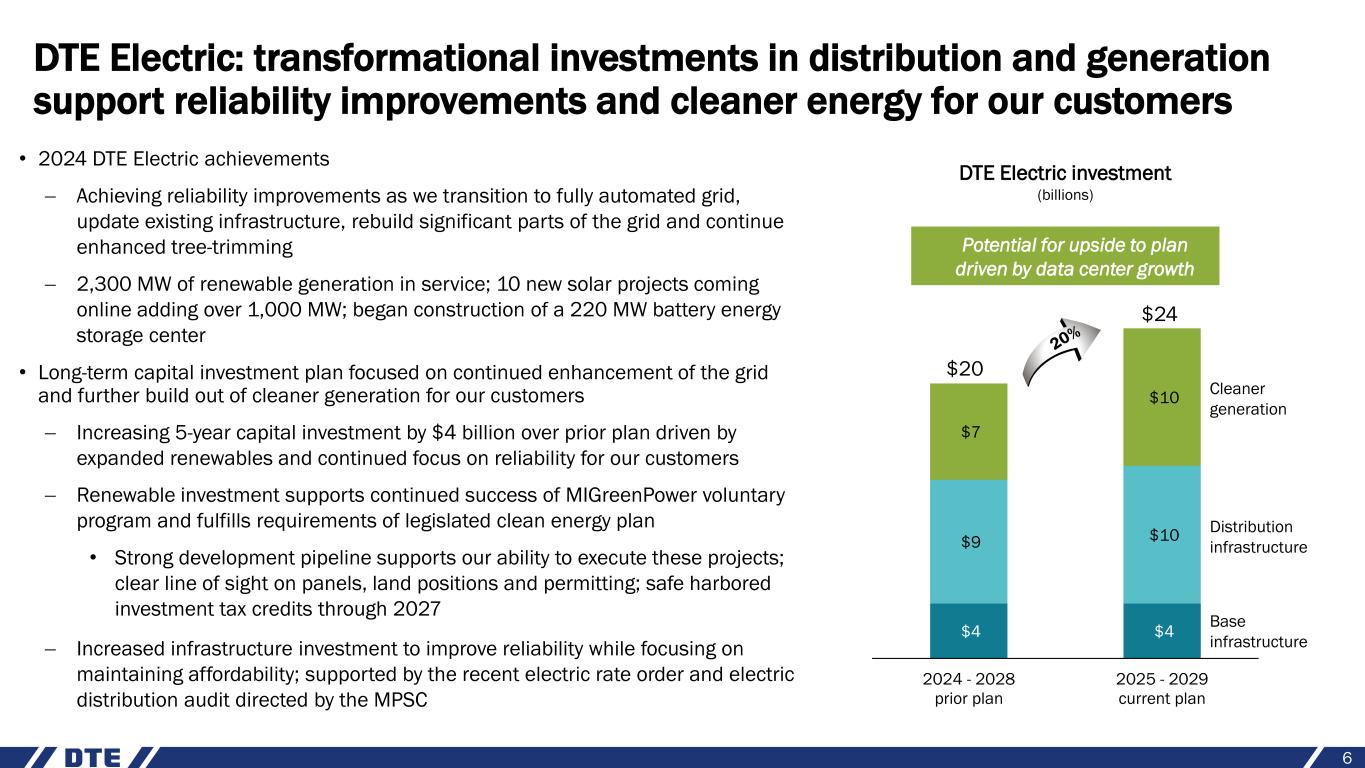

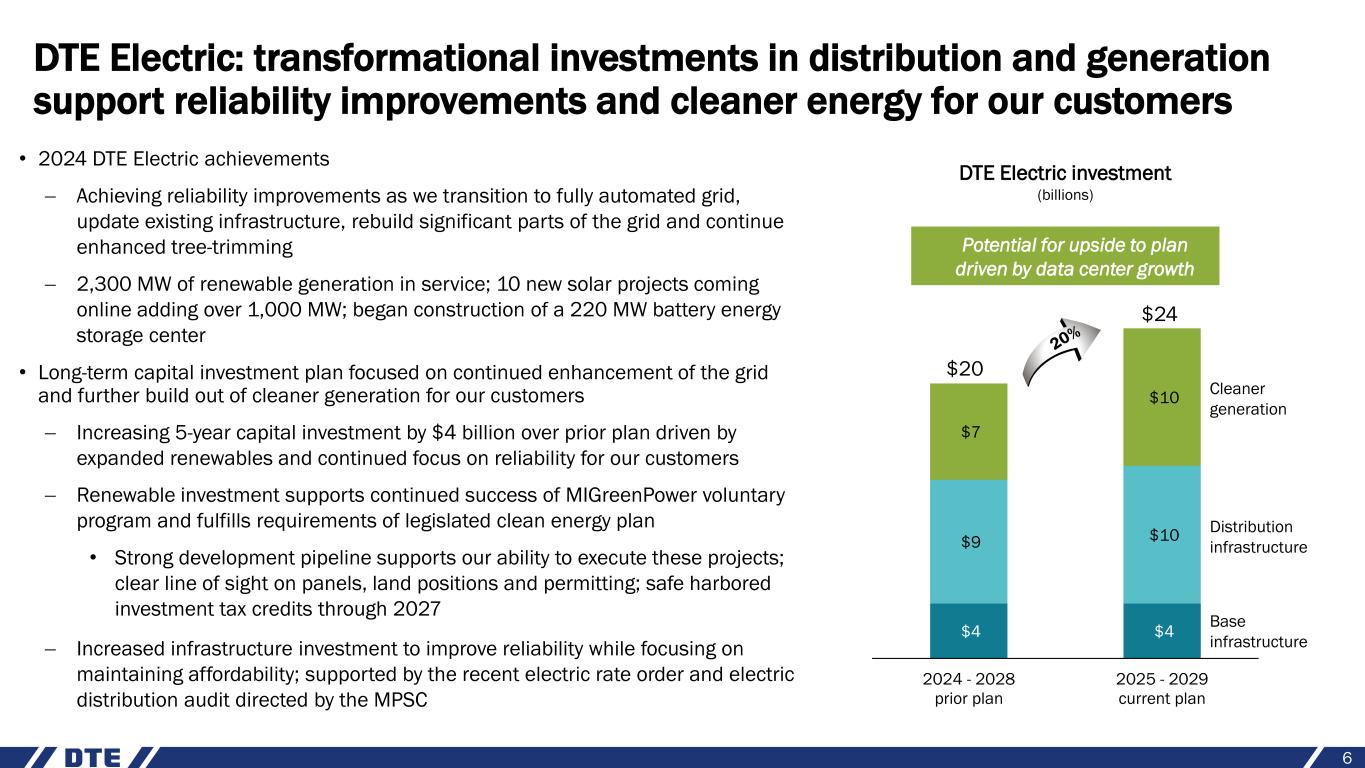

DTE Electric: transformational investments in distribution and generation support reliability improvements and cleaner energy for our customers 6 • 2024 DTE Electric achievements − Achieving reliability improvements as we transition to fully automated grid, update existing infrastructure, rebuild significant parts of the grid and continue enhanced tree-trimming − 2,300 MW of renewable generation in service; 10 new solar projects coming online adding over 1,000 MW; began construction of a 220 MW battery energy storage center • Long-term capital investment plan focused on continued enhancement of the grid and further build out of cleaner generation for our customers − Increasing 5-year capital investment by $4 billion over prior plan driven by expanded renewables and continued focus on reliability for our customers − Renewable investment supports continued success of MIGreenPower voluntary program and fulfills requirements of legislated clean energy plan • Strong development pipeline supports our ability to execute these projects; clear line of sight on panels, land positions and permitting; safe harbored investment tax credits through 2027 − Increased infrastructure investment to improve reliability while focusing on maintaining affordability; supported by the recent electric rate order and electric distribution audit directed by the MPSC $4 $4 $9 $10 $7 $10 2024 - 2028 prior plan 2025 - 2029 current plan Base infrastructure Cleaner generation $20 DTE Electric investment (billions) $24 Distribution infrastructure Potential for upside to plan driven by data center growth

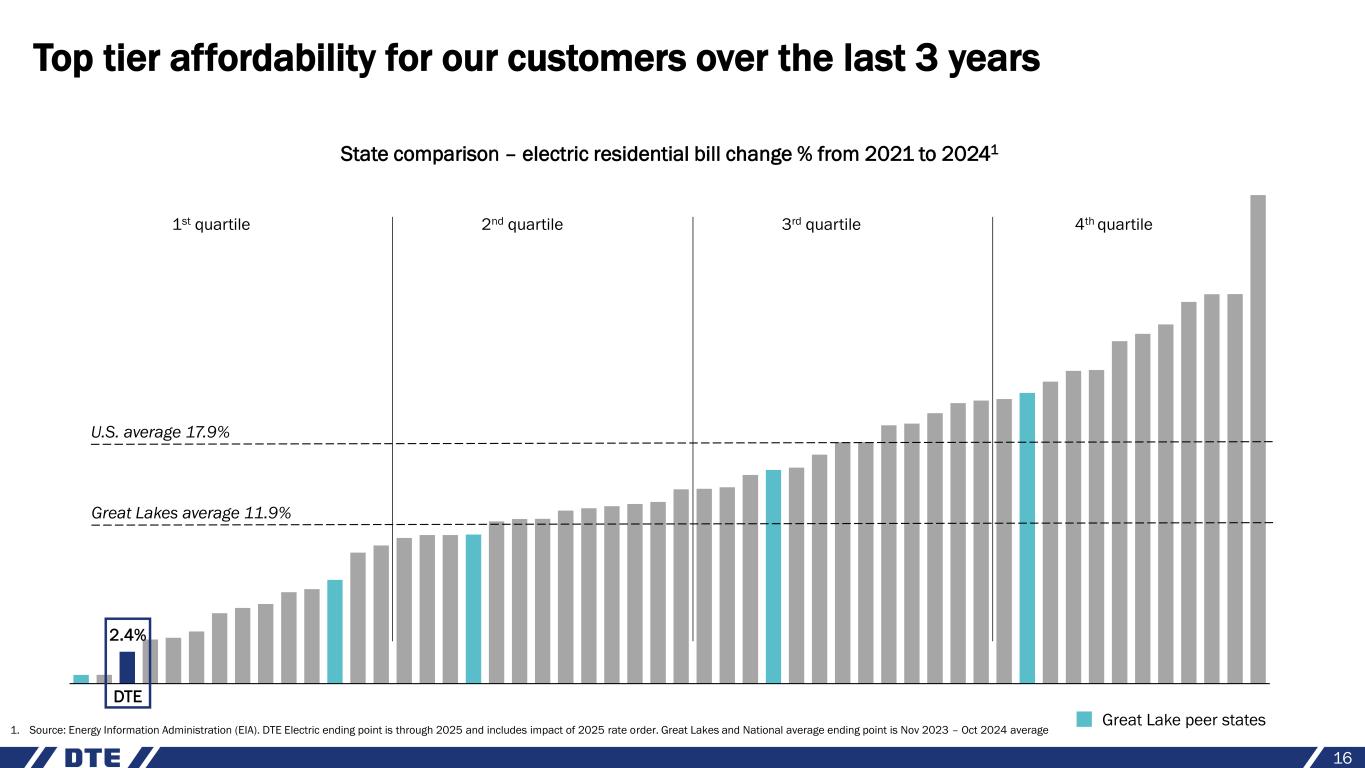

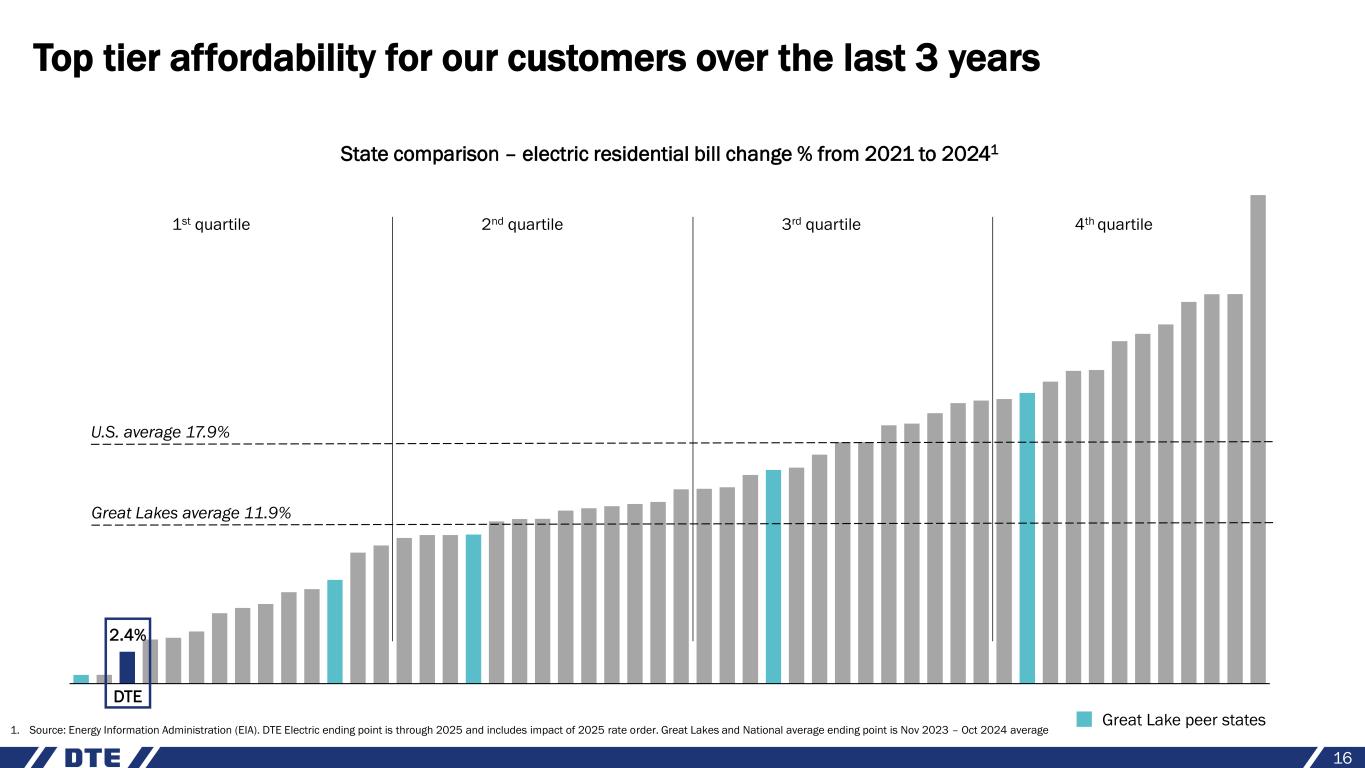

Economic development and advancement of data center opportunities support long-term growth and continued top tier customer affordability 7 • Strong pipeline of economic development opportunities − Executed non-binding term sheet with Switch to be supported by hyperscaler tenant(s) and other AI and enterprise customers; anticipate load ramping up to ~1,400 MW through 2032 − Signed a third non-binding agreement with additional party, increasing current potential data center load to ~2,100 MW2, will drive ~40% sales growth after full ramp − Actively engaged in discussions with multiple other data center opportunities which could provide additional growth − Data center load ramp supported by nearly ~1 GW of existing capacity and will also require new generation build in the near-term; longer term investment opportunity will be supported by the 2026 IRP − Maintaining strong collaboration on overall business development in Michigan to attract a range of additional customers • Near term data center growth will drive affordability headroom for existing customers − These economic development opportunities combined with our continuous improvement culture will continue our historical success of managing customer affordability Top Tier Affordability 3-year total electric bill increases well below national average Total electric residential bill change % from 2021 to 20241 2.4% 11.9% 17.9% DTE Electric Great Lakes average National average 1. Source: Energy Information Administration (EIA). DTE Electric ending point is through 2025 and includes impact of 2025 rate order. Great Lakes and National average ending point is Nov 2023 – Oct 2024 average 2. Includes Switch, UofM and undisclosed party

DTE Gas: replacing aging infrastructure to ensure reliability and safety for our customers 8 Gas renewal program Base infrastructure $1.6 $1.5 $2.1 $2.5 2024 - 2028 prior plan 2025 - 2029 current plan $3.7 $4.0 DTE Gas investment (billions) • 2024 DTE Gas achievements − Ranked #1 in customer satisfaction for business natural gas service in the Midwest by J.D. Power1 − Continued progress on main renewal program; renewed nearly 1,900 miles since program inception • Long-term capital investment plan focused on infrastructure improvements including main renewal investments to minimize leaks and reduce costs for our customers − Significant investment to support main renewal recovered through Infrastructure Recovery Mechanism − Base infrastructure investments enhance distribution, transmission, compression and storage − Continued focus on safety and affordability for customers 1. J.D. Power 2024 Gas Utility Business Customer Satisfaction Study. Visit jdpower.com

2024 operating earnings1 variance 9 1. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings 2023 2024 Variance Primary drivers DTE Electric $791 $1,105 $314 Rate implementation, warmer weather, lower storm expense and higher renewable earnings partially offset by higher O&M and rate base costs DTE Gas 294 263 (31) Higher rate base, O&M costs and warmer weather partially offset by IRM and rate implementation DTE Vantage 153 133 (20) Solid 2024 performance drove earnings above midpoint of guidance range; timing and one-time items drove strong results in 2023 Energy Trading 105 100 (5) Stronger physical gas portfolio performance in 2023 Corporate & Other (159) (185) (26) Interest expense DTE Energy $1,184 $1,416 $232 Operating EPS $5.73 $6.83 $1.10 Avg. Shares Outstanding 206 207 (millions, except EPS)

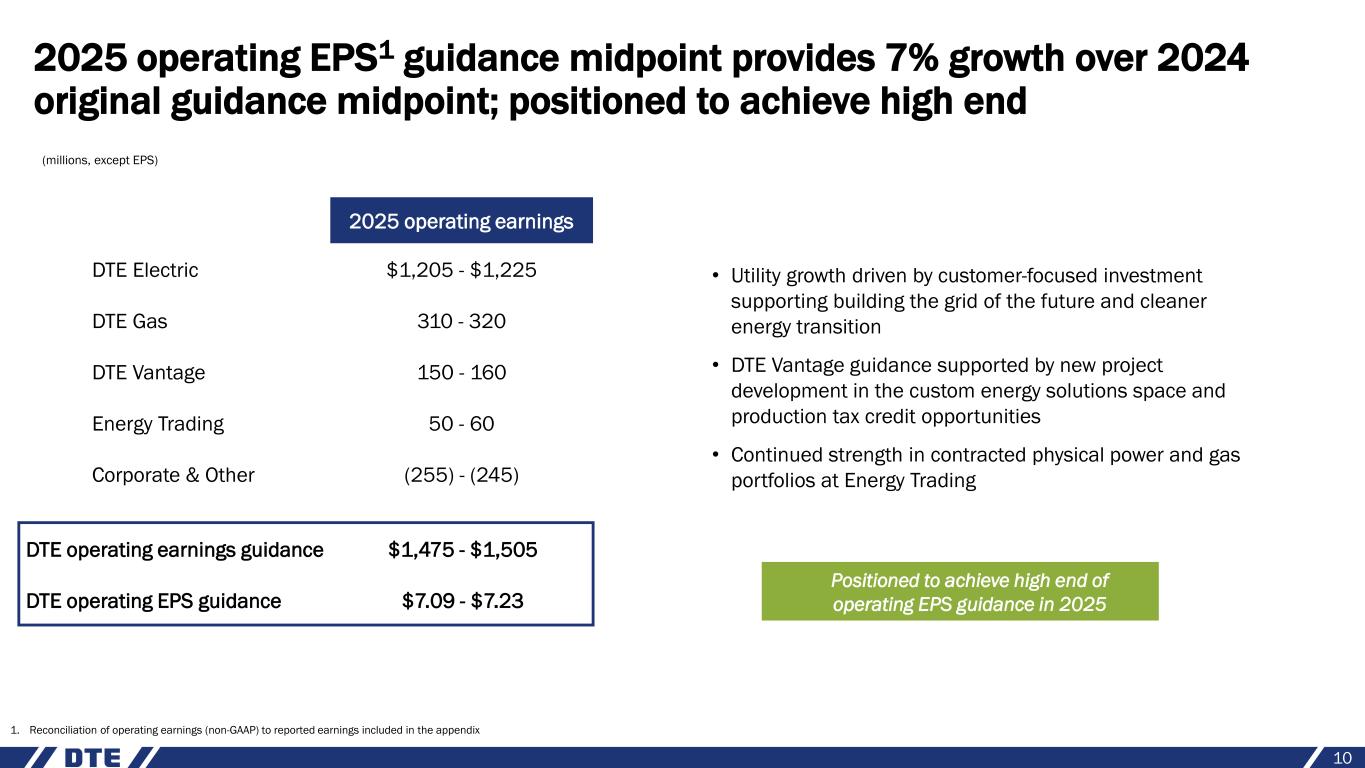

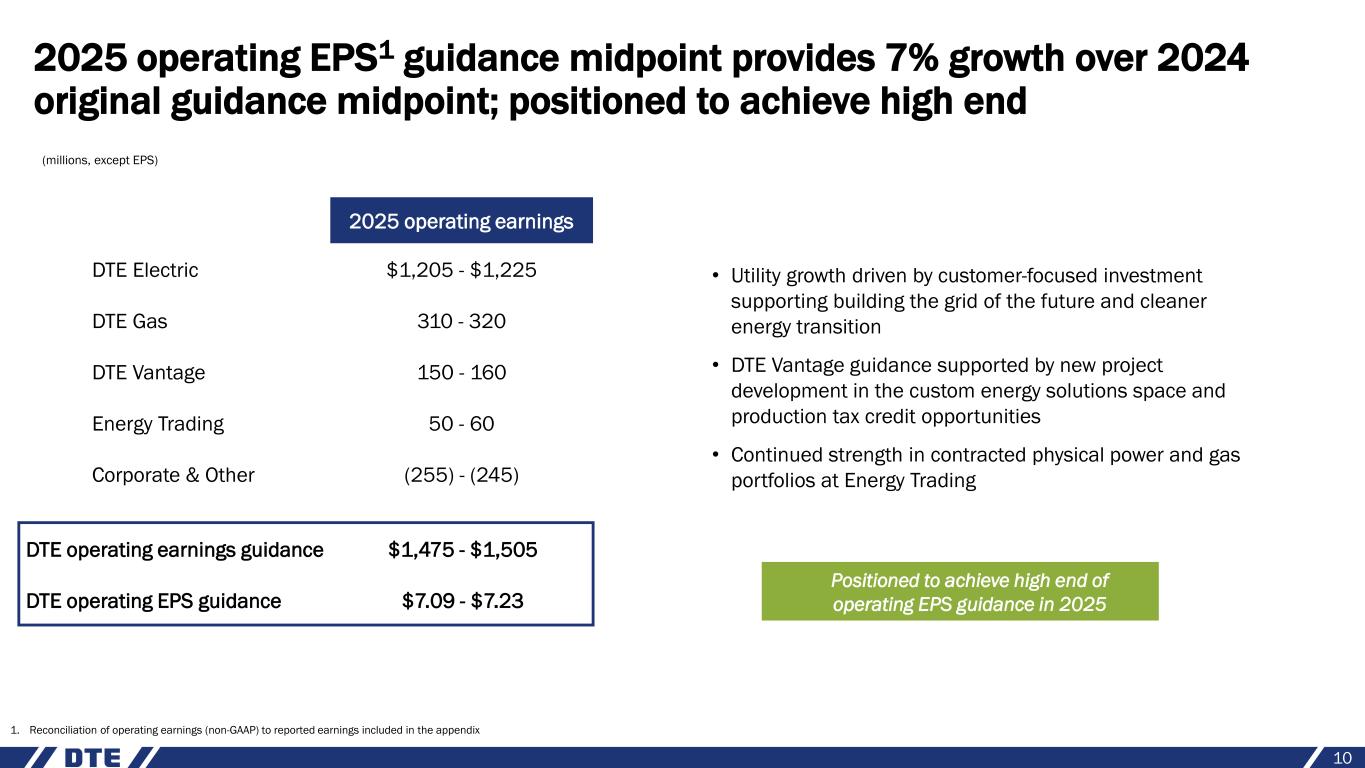

2025 operating EPS1 guidance midpoint provides 7% growth over 2024 original guidance midpoint; positioned to achieve high end 10 (millions, except EPS) 2025 operating earnings DTE Electric $1,205 - $1,225 DTE Gas 310 - 320 DTE Vantage 150 - 160 Energy Trading 50 - 60 Corporate & Other (255) - (245) 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix Positioned to achieve high end of operating EPS guidance in 2025 DTE operating earnings guidance $1,475 - $1,505 DTE operating EPS guidance $7.09 - $7.23 • Utility growth driven by customer-focused investment supporting building the grid of the future and cleaner energy transition • DTE Vantage guidance supported by new project development in the custom energy solutions space and production tax credit opportunities • Continued strength in contracted physical power and gas portfolios at Energy Trading

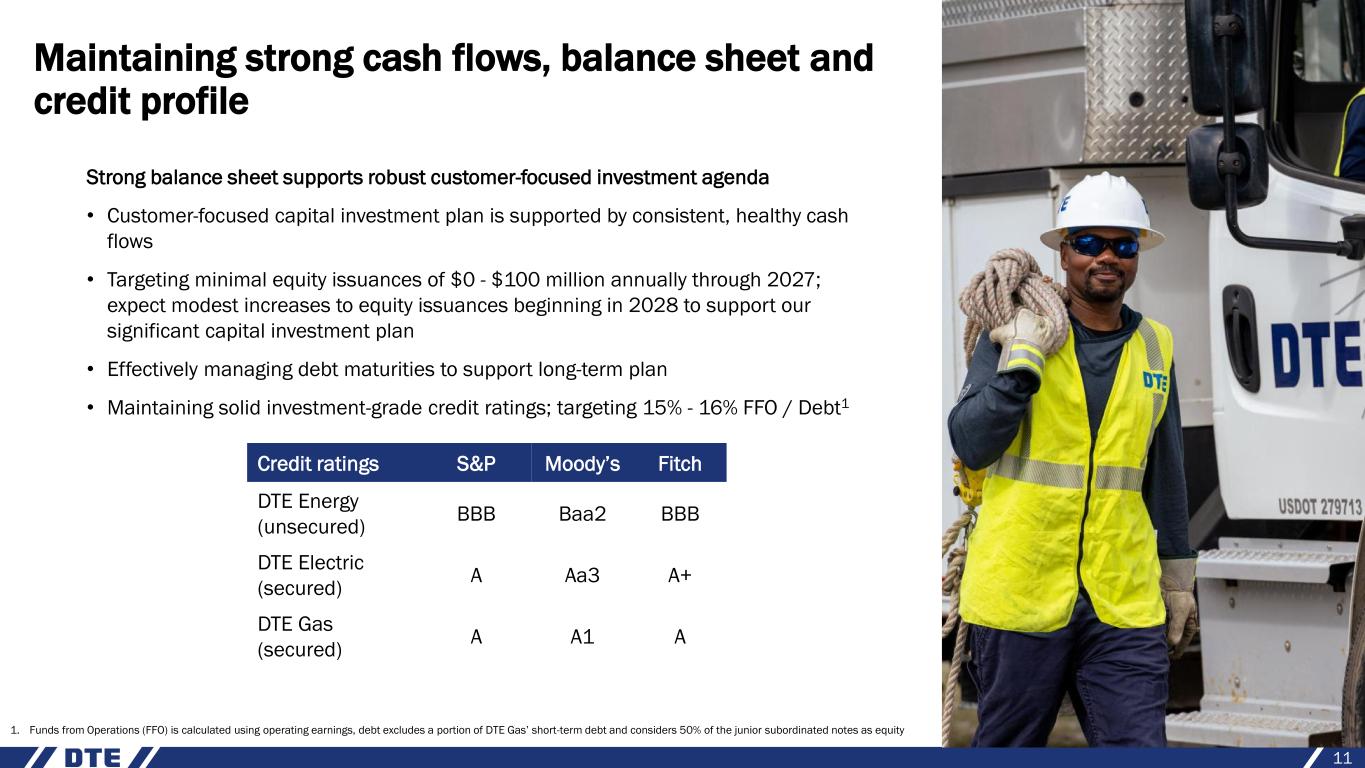

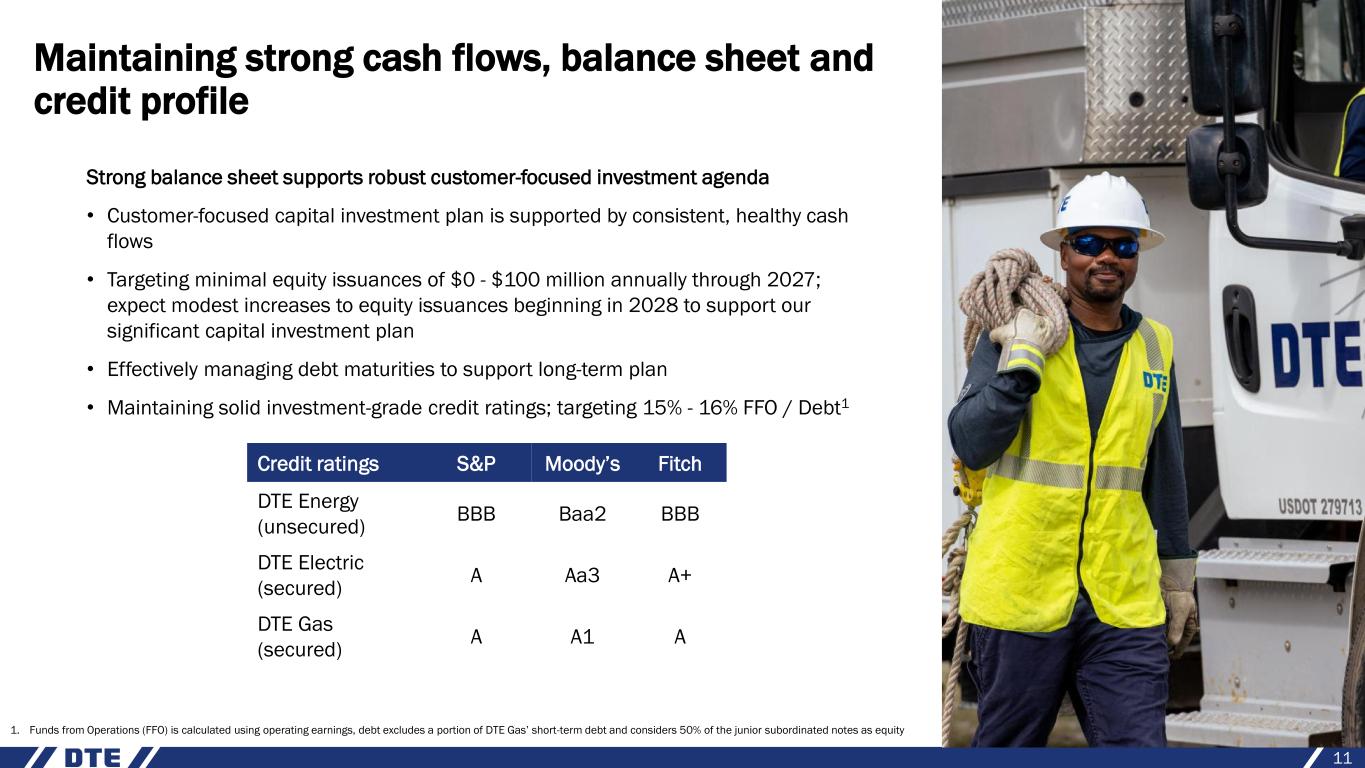

Maintaining strong cash flows, balance sheet and credit profile 11 Credit ratings S&P Moody’s Fitch DTE Energy (unsecured) BBB Baa2 BBB DTE Electric (secured) A Aa3 A+ DTE Gas (secured) A A1 A Strong balance sheet supports robust customer-focused investment agenda • Customer-focused capital investment plan is supported by consistent, healthy cash flows • Targeting minimal equity issuances of $0 - $100 million annually through 2027; expect modest increases to equity issuances beginning in 2028 to support our significant capital investment plan • Effectively managing debt maturities to support long-term plan • Maintaining solid investment-grade credit ratings; targeting 15% - 16% FFO / Debt1 1. Funds from Operations (FFO) is calculated using operating earnings, debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes as equity

Investment focused on improved reliability and cleaner generation; well-positioned for long-term growth 12 ✓ Highly engaged team committed to delivering best-in-class results for our customers, communities and investors ✓ Strong 2024 operating EPS1 of $6.83 achieved the high end of 2024 original guidance ✓ 2025 operating EPS guidance provides 7% growth from 2024 original guidance midpoint; positioned to achieve high end of operating EPS guidance in 2025 ✓ Updated plan provides higher quality long-term operating EPS growth through increased customer-focused utility investments and shifting to more utility-like investments at DTE Vantage ✓ Increasing 5-year capital investment by $5 billion over previous plan primarily driven by customer-focused utility investment; potential incremental investment to support data center opportunities would be above current plan ✓ Investment plan supported by strong balance sheet and solid investment-grade credit profile, combined with a continued focus on customer affordability ✓ Long-term operating EPS growth rate target of 6% - 8% through 2029, with 2025 original guidance midpoint as the base; RNG tax credits provide confidence we will reach the high end of our growth rate 2025 through 2027 and provide flexibility to exceed the high end and support future years 1. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings

13 Appendix

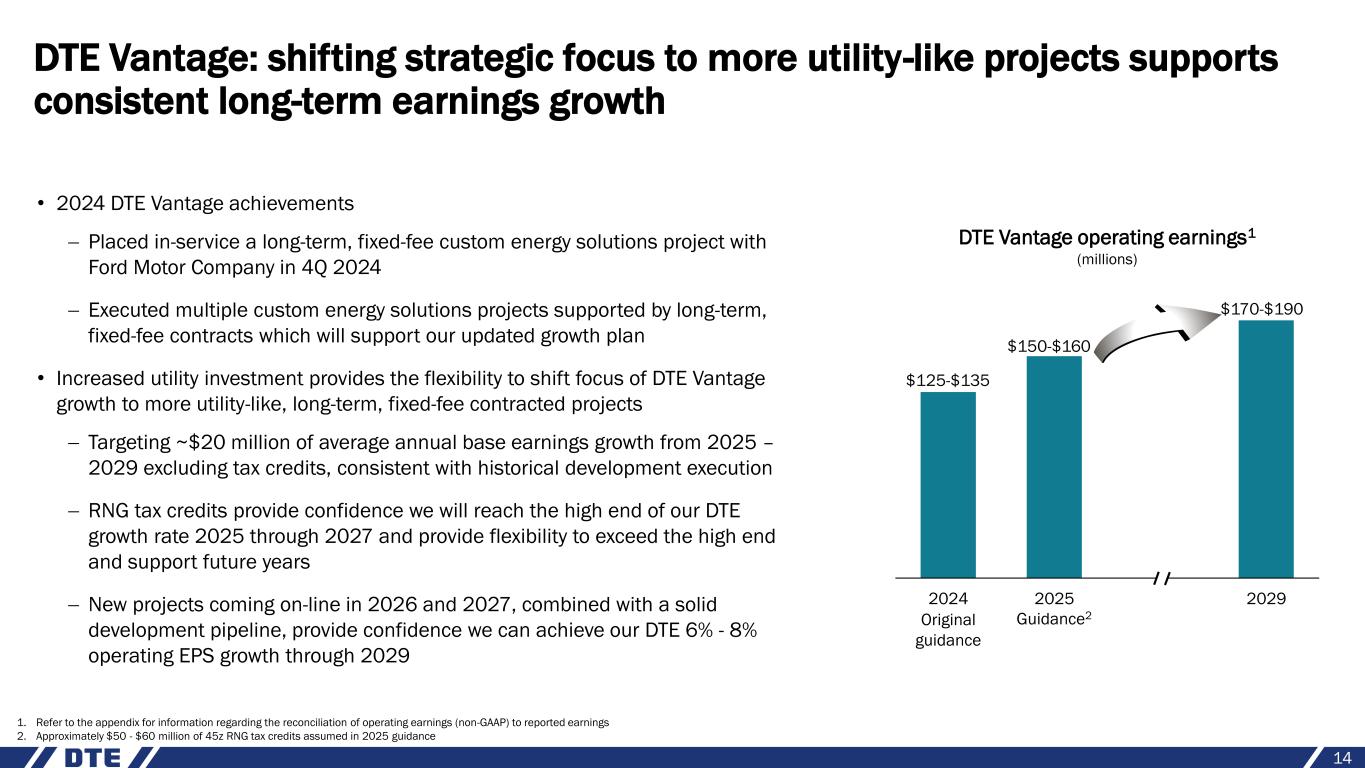

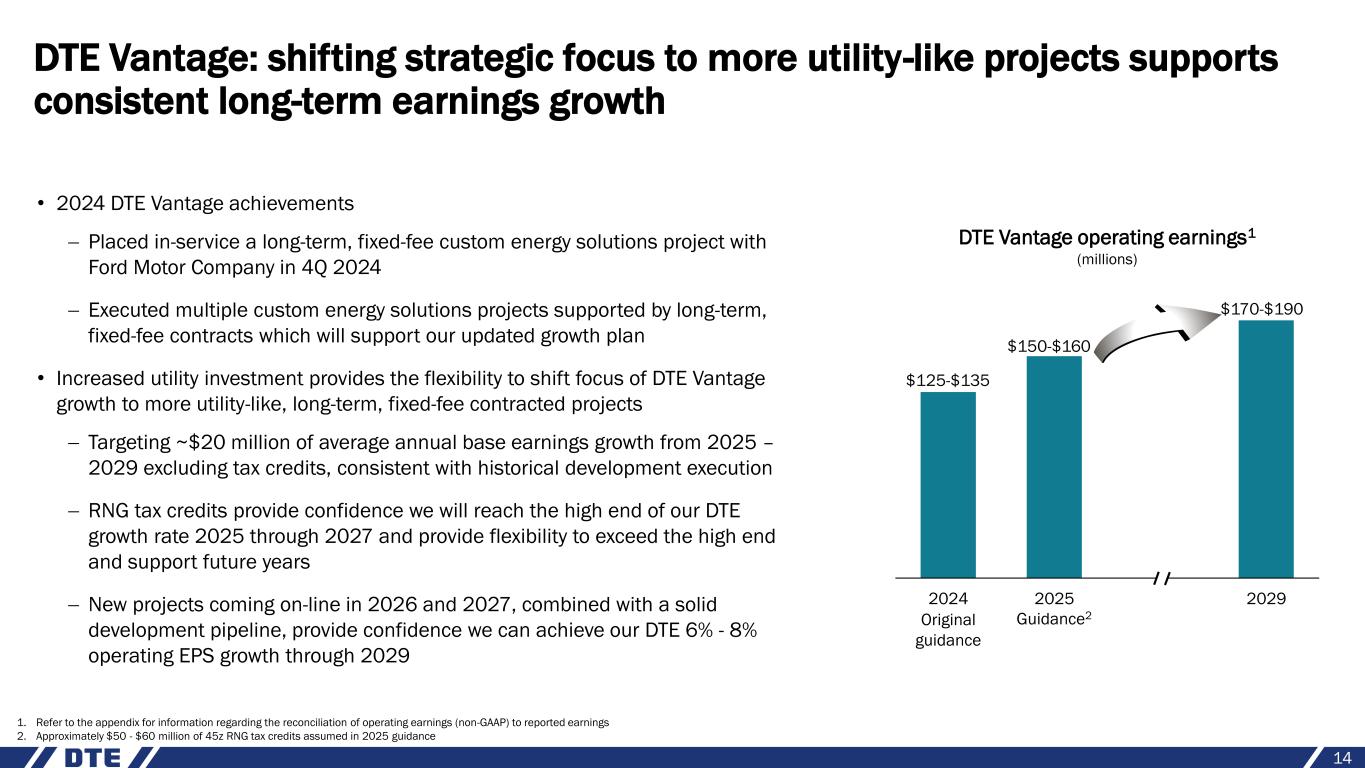

DTE Vantage: shifting strategic focus to more utility-like projects supports consistent long-term earnings growth 1. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings 2. Approximately $50 - $60 million of 45z RNG tax credits assumed in 2025 guidance 14 • 2024 DTE Vantage achievements − Placed in-service a long-term, fixed-fee custom energy solutions project with Ford Motor Company in 4Q 2024 − Executed multiple custom energy solutions projects supported by long-term, fixed-fee contracts which will support our updated growth plan • Increased utility investment provides the flexibility to shift focus of DTE Vantage growth to more utility-like, long-term, fixed-fee contracted projects − Targeting ~$20 million of average annual base earnings growth from 2025 – 2029 excluding tax credits, consistent with historical development execution − RNG tax credits provide confidence we will reach the high end of our DTE growth rate 2025 through 2027 and provide flexibility to exceed the high end and support future years − New projects coming on-line in 2026 and 2027, combined with a solid development pipeline, provide confidence we can achieve our DTE 6% - 8% operating EPS growth through 2029 2024 2025 2029 Guidance2Original guidance $125-$135 $150-$160 DTE Vantage operating earnings1 (millions) $170-$190

Economic development fuels Michigan’s growth • Michigan ranked in the top 10 by CNBC for America’s Top States for Business in 2024 • Maintaining strong collaboration on business development in Michigan to attract a range of customers, including data centers — Executed multiple non-binding agreements to serve significant data center load — Actively engaged in discussions with multiple other data center opportunities which could provide additional growth • Significant investment in Michigan, supporting thousands of jobs, including over $10 billion for: — General Motors investment to convert an assembly plant to produce full-size electric pickup trucks — Henry Ford Health, Detroit Pistons and Michigan State University investment in Detroit for hospital expansion, research facility and neighborhood redevelopment — Ilitch Organization and University of Michigan investment for an innovation campus — LG Energy Solution investment to expand battery manufacturing facility 15

Top tier affordability for our customers over the last 3 years 16 State comparison – electric residential bill change % from 2021 to 20241 DTE 2.4% Great Lakes average 11.9% U.S. average 17.9% 1st quartile 2nd quartile 3rd quartile 4th quartile Great Lake peer states 1. Source: Energy Information Administration (EIA). DTE Electric ending point is through 2025 and includes impact of 2025 rate order. Great Lakes and National average ending point is Nov 2023 – Oct 2024 average

Weather impact on sales 17 Cooling degree days1 Operating earnings2 impact of weather Weather normal sales1 DTE Electric Heating degree days3 Operating earnings2 impact of weather DTE Gas (GWh) 2023 2024 % Change Residential 15,313 15,369 0.4% Commercial 18,923 19,039 0.6% Industrial 10,273 10,125 (1.4%) Other 204 199 (2.5%) 44,713 44,732 0.0% (millions) (per share) 4Q YTD 4Q YTD 2023 ($11) ($106) ($0.05) ($0.52) 2024 ($10) ($31) ($0.05) ($0.15) (millions) (per share) 4Q YTD 4Q YTD 2023 ($20) ($52) ($0.10) ($0.25) 2024 ($12) ($61) ($0.06) ($0.30) 2023 2024 % Change Actuals 703 926 32% Normal 913 915 0% Deviation from normal (23%) 1% 4Q 2023 4Q 2024 % Change 2023 2024 % Change Actuals 1,924 1,948 1% 5,564 5,306 (5%) Normal 2,179 2,140 (2%) 6,319 6,288 0% Deviation from normal (12%) (9%) (12%) (16%) 1. DTE Electric 2023 weather normalized data based on 2007 – 2021 weather and 2024 weather normalized data based on 2008 – 2022 weather 2. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings 3. DTE Gas 2023 weather normalized data based on 2008 – 2022 weather and 2024 weather normalized data based on 2009 – 2023 weather

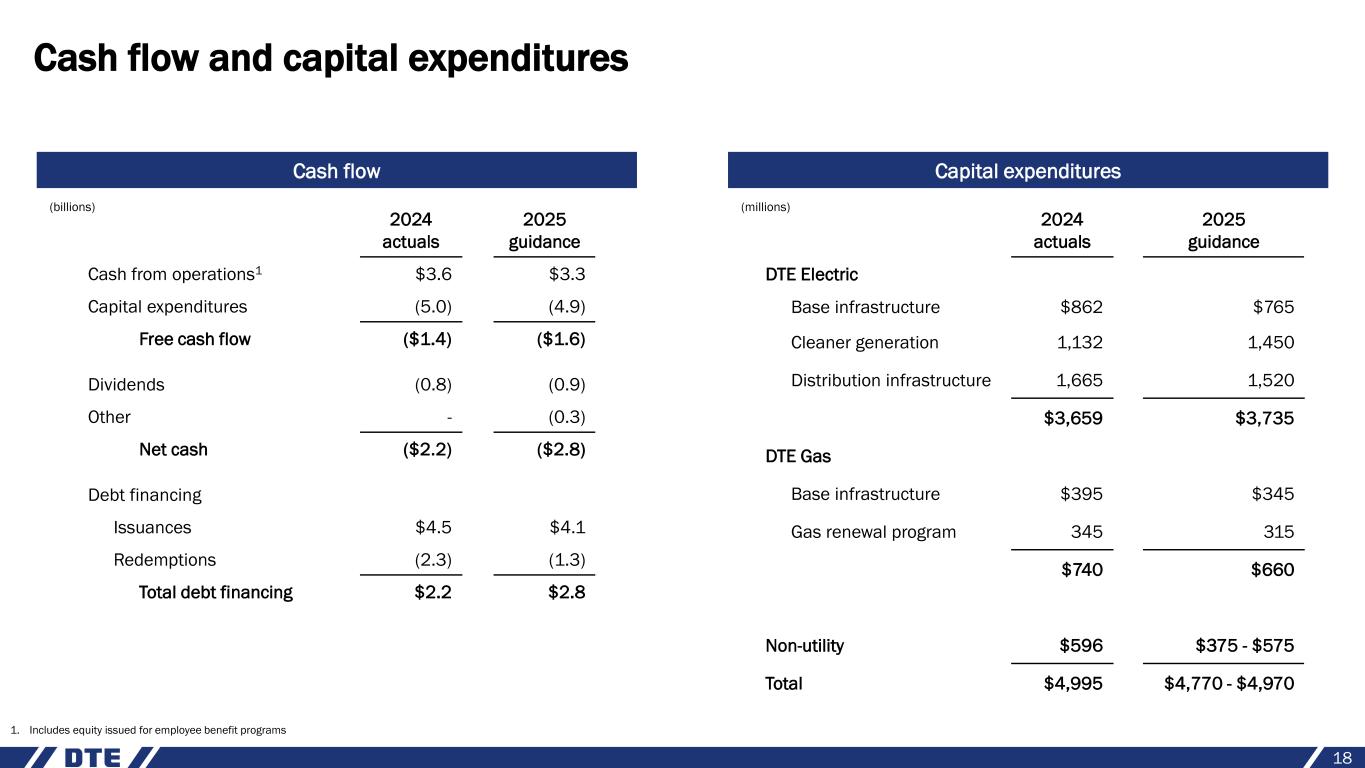

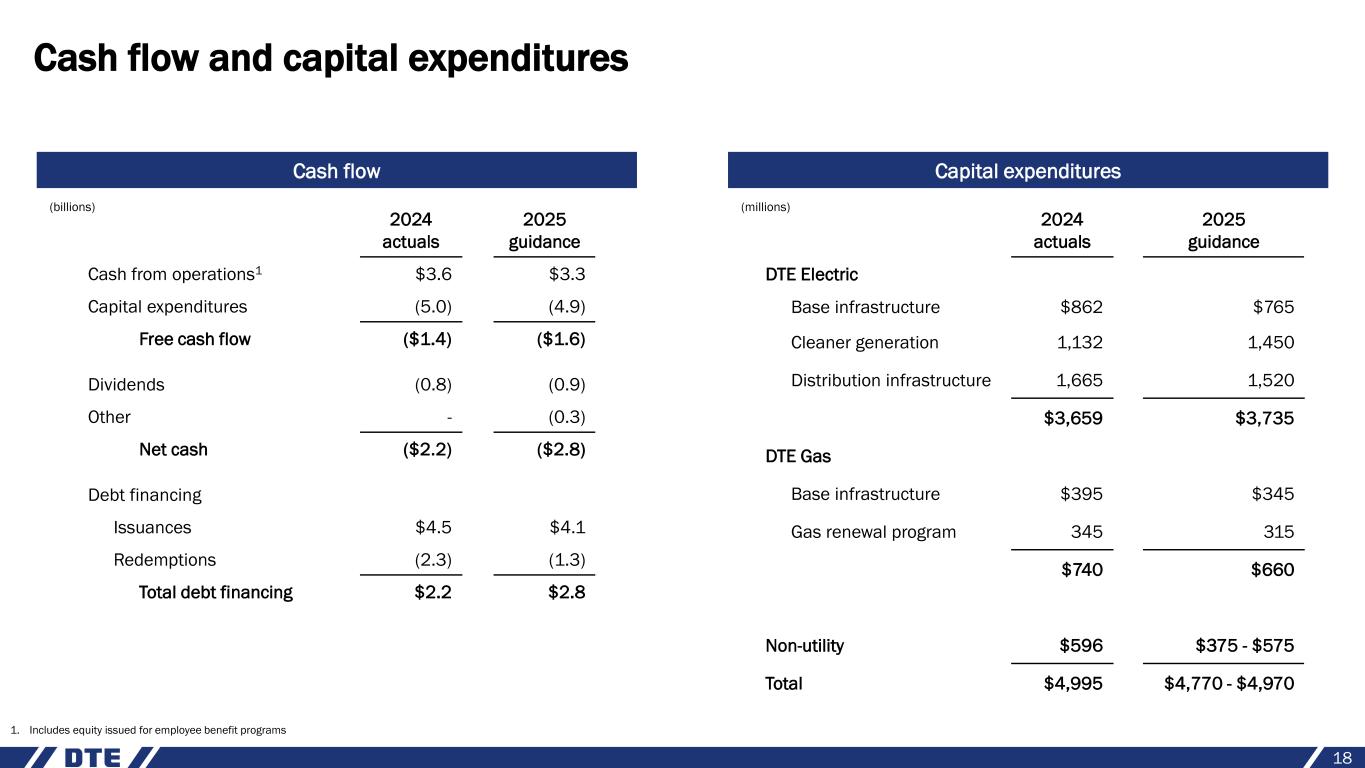

Cash flow and capital expenditures 18 1. Includes equity issued for employee benefit programs 2024 actuals 2025 guidance DTE Electric Base infrastructure $862 $765 Cleaner generation 1,132 1,450 Distribution infrastructure 1,665 1,520 $3,659 $3,735 DTE Gas Base infrastructure $395 $345 Gas renewal program 345 315 $740 $660 Non-utility $596 $375 - $575 Total $4,995 $4,770 - $4,970 2024 actuals 2025 guidance Cash from operations1 $3.6 $3.3 Capital expenditures (5.0) (4.9) Free cash flow ($1.4) ($1.6) Dividends (0.8) (0.9) Other - (0.3) Net cash ($2.2) ($2.8) Debt financing Issuances $4.5 $4.1 Redemptions (2.3) (1.3) Total debt financing $2.2 $2.8 (millions) Cash flow Capital expenditures (billions)

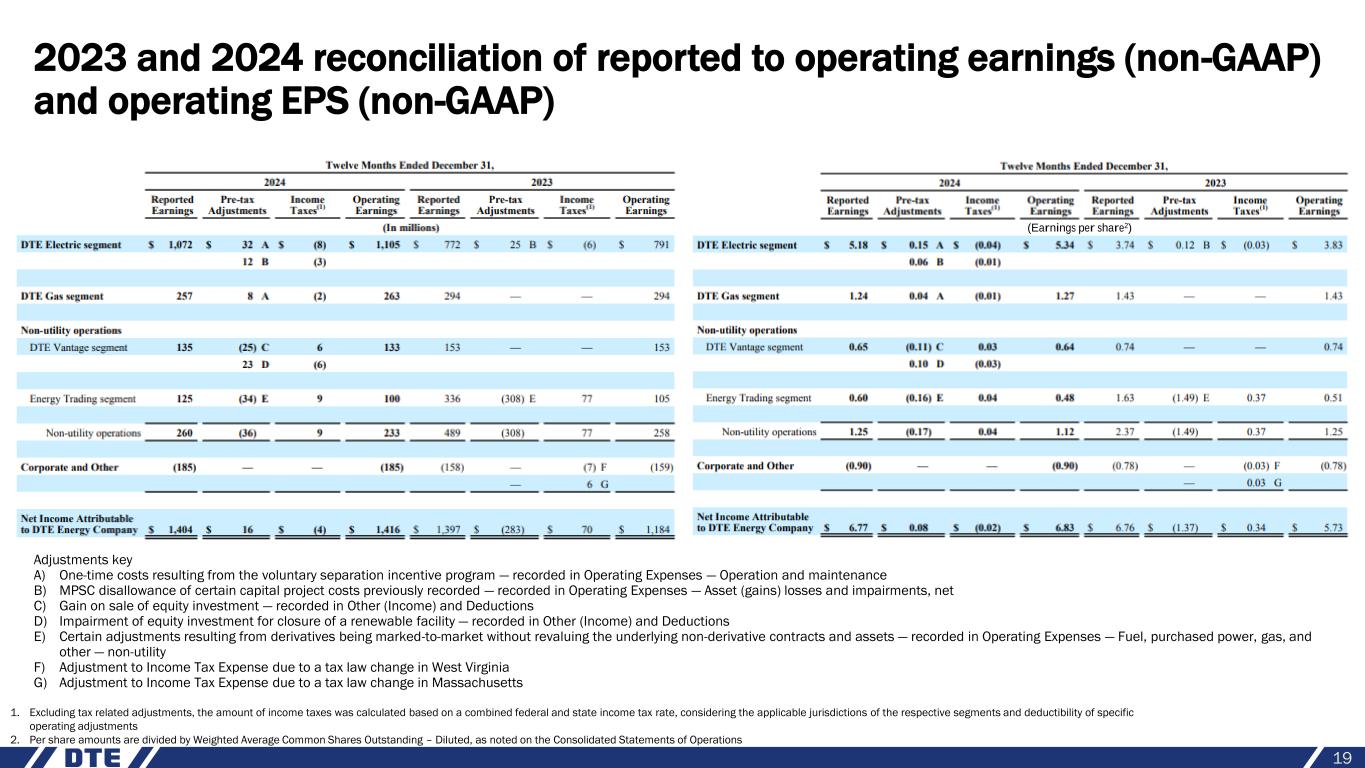

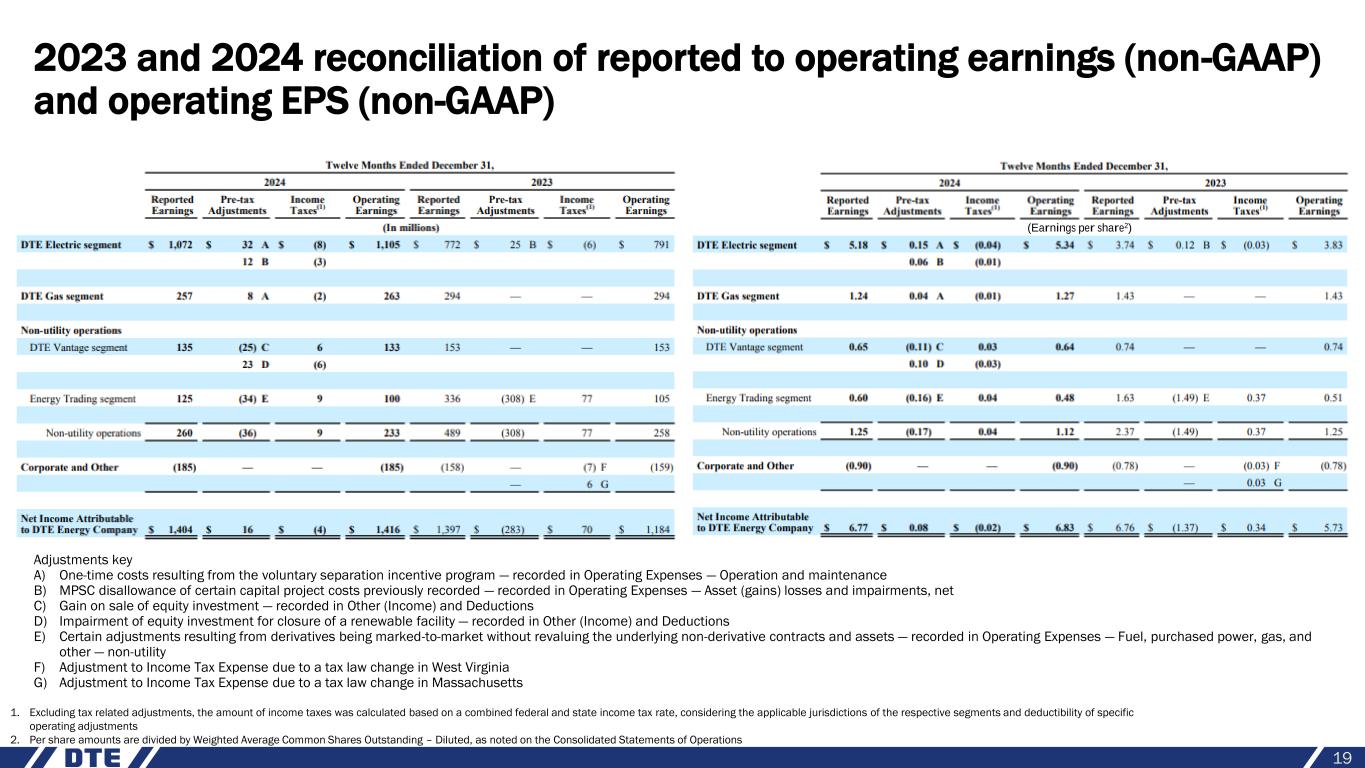

2023 and 2024 reconciliation of reported to operating earnings (non-GAAP) and operating EPS (non-GAAP) 19 Adjustments key A) One-time costs resulting from the voluntary separation incentive program — recorded in Operating Expenses — Operation and maintenance B) MPSC disallowance of certain capital project costs previously recorded — recorded in Operating Expenses — Asset (gains) losses and impairments, net C) Gain on sale of equity investment — recorded in Other (Income) and Deductions D) Impairment of equity investment for closure of a renewable facility — recorded in Other (Income) and Deductions E) Certain adjustments resulting from derivatives being marked-to-market without revaluing the underlying non-derivative contracts and assets — recorded in Operating Expenses — Fuel, purchased power, gas, and other — non-utility F) Adjustment to Income Tax Expense due to a tax law change in West Virginia G) Adjustment to Income Tax Expense due to a tax law change in Massachusetts 1. Excluding tax related adjustments, the amount of income taxes was calculated based on a combined federal and state income tax rate, considering the applicable jurisdictions of the respective segments and deductibility of specific operating adjustments 2. Per share amounts are divided by Weighted Average Common Shares Outstanding – Diluted, as noted on the Consolidated Statements of Operations (Earnings per share2)

Reconciliation of reported to operating earnings (non-GAAP) 20 Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Operating earnings is a non-GAAP measure and should be viewed as a supplement and not a substitute for reported earnings, which represents the company’s net income and the most comparable GAAP measure. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e., future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings.