Morgan Stanley Global Electricity &

Energy Conference

Anthony F. Earley, Jr.

Chairman of the Board & Chief Executive Officer

March 16, 2006

Safe Harbor Statement

The information contained herein is as of the date of this presentation. DTE Energy expressly disclaims any current intention to update

any forward-looking statements contained in this document as a result of new information or future events or developments. Words

such as “anticipate,” “believe,” “expect,” “projected” and “goals” signify forward-looking statements. Forward-looking statements are

not guarantees of future results and conditions but rather are subject to various assumptions, risks and uncertainties. This

presentation contains forward-looking statements about DTE Energy’s financial results and estimates of future prospects, and actual

results may differ materially. Factors that may impact forward-looking statements include, but are not limited to: the higher price of oil

and its impact on the value of production tax credits, and the ability to utilize and/or sell interests in facilities producing such credits;

the uncertainties of successful exploration of gas shale resources and inability to estimate gas reserves with certainty; the effects of weather

and other natural phenomena on operations and sales to customers, and purchases from suppliers; economic climate and population

growth or decline in the geographic areas where we do business; environmental issues, laws, regulations, and the cost of remediation

and compliance; nuclear regulations and operations associated with nuclear facilities; implementation of electric and gas Customer

Choice programs; impact of electric and gas utility restructuring in Michigan, including legislative amendments; employee relations and

the impact of collective bargaining agreements; unplanned outages; access to capital markets and capital market conditions and

the results of other financing efforts which can be affected by credit agency ratings; the timing and extent of changes in interest

rates; the level of borrowings; changes in the cost and availability of coal and other raw materials, purchased power and natural gas;

effects of competition; impact of regulation by the FERC, MPSC, NRC and other applicable governmental proceedings and regulations;

contributions to earnings by non-utility subsidiaries; changes in federal, state and local tax laws and their interpretations, including the

Internal Revenue Code, regulations, rulings, court proceedings and audits; the ability to recover costs through rate increases; the availability,

cost, coverage and terms of insurance; the cost of protecting assets against, or damage due to, terrorism; changes in accounting

standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy

and other business issues; uncollectible accounts receivable; litigation and related appeals; and changes in the economic and financial

viability of our suppliers, customers and trading counterparties, and the continued ability of such parties to perform their obligations to

the Company. This presentation should also be read in conjunction with the “Forward-Looking Statements” section in each of

DTE Energy’s, MichCon’s and Detroit Edison’s 2005 Form 10-K (which sections are incorporated herein by reference), and in conjunction

with other SEC reports filed by DTE Energy, MichCon and Detroit Edison.

Cautionary Note – The Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose

only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and

legally producible under existing economic and operating conditions. We use certain terms in this presentation such as "probable

reserves" that the SEC's guidelines strictly prohibit us from including in filings with the SEC. You are urged to consider closely the

disclosure in our Forms 10-K and 10-Q, File No. 1-11607, available from our offices or from our website at www.dteenergy.com. You can

also obtain these Forms from the SEC by calling 1-800-SEC-0330.

2

DTE Energy’s Value Proposition

Utilities targeting earnings growth at 5% annual rate

through 2010

Building scale at the non-utility businesses

Stable dividend and attractive yield supported by

strong balance sheet

3

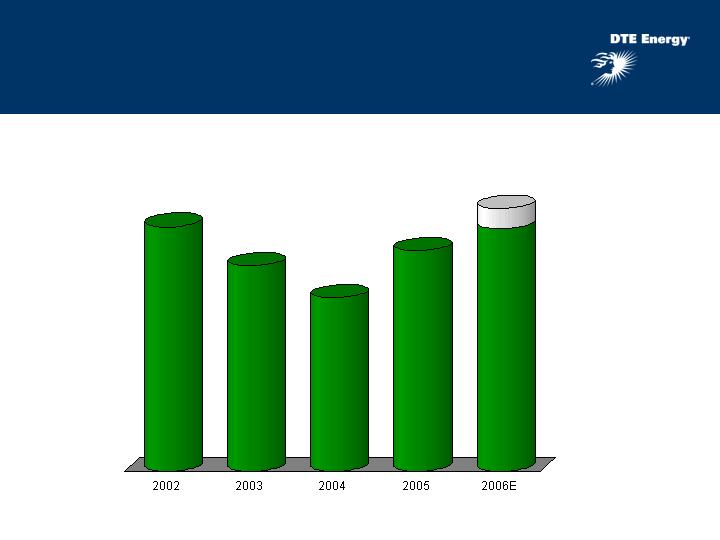

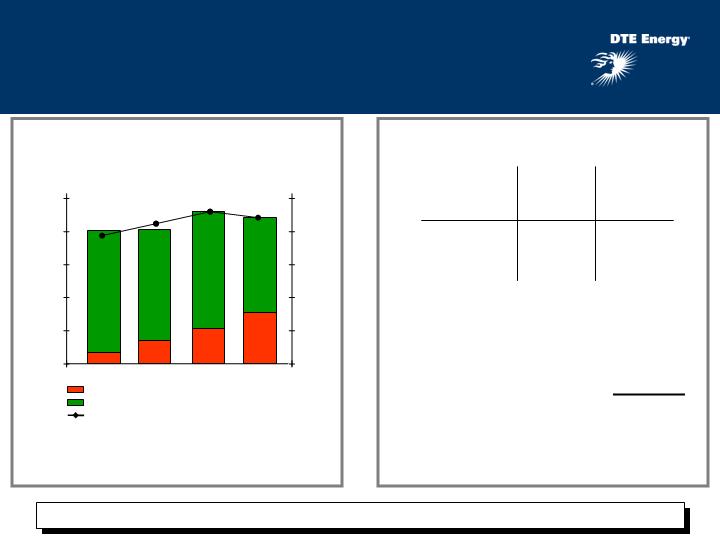

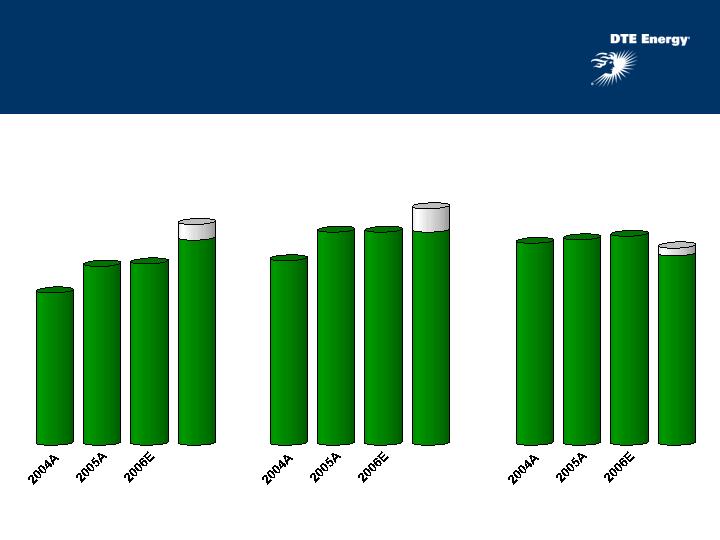

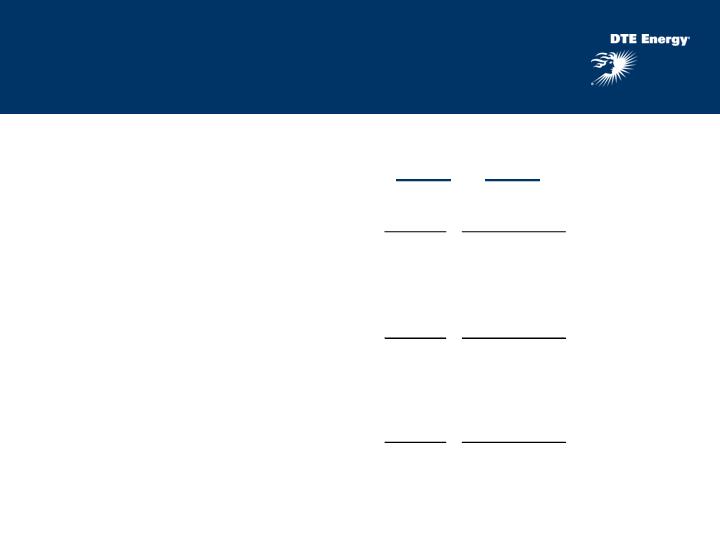

DTE Energy’s 2005 Results Demonstrate

a Return to Growth

$3.63

DTE Energy

Operating Earnings per Share*

$3.05

$2.57

$3.27

* Reconciliation to GAAP reported earnings included in the appendix

$3.60-3.90**

** 2006 guidance assume no synfuel tax credit phase out

4

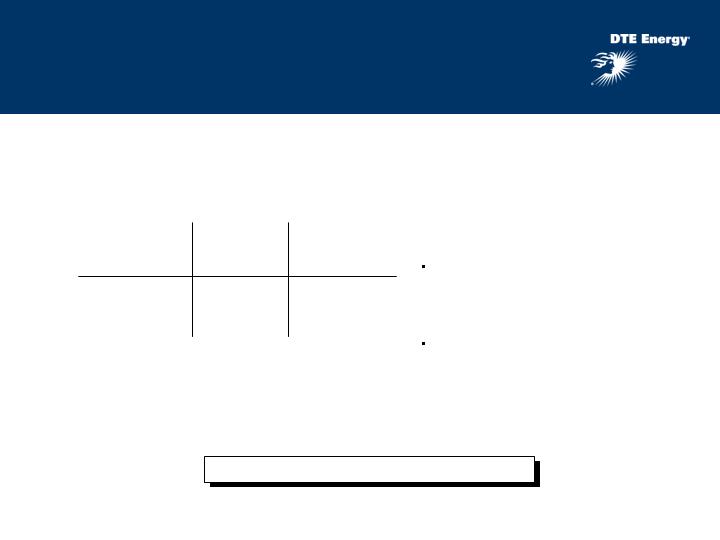

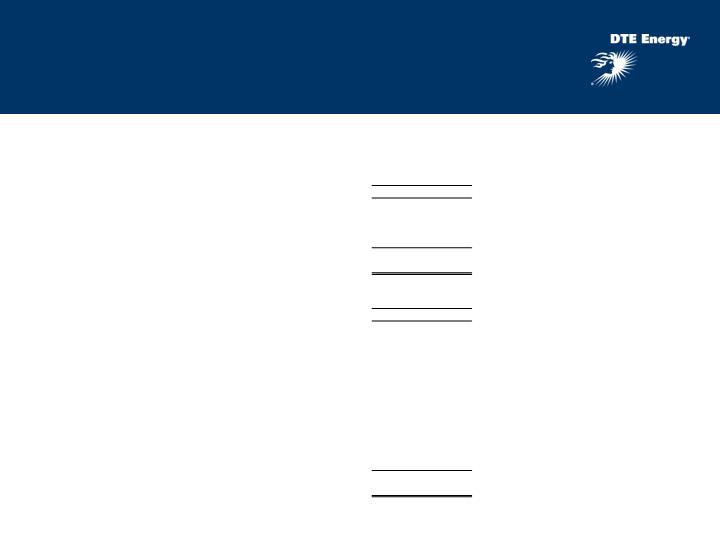

5% Utility Income Growth Driven by

Significant Investments

Potential utility asset base growth 2005-2010

Not including new base-load generation

($ millions)

~$1,600-1,800

Base

Utility

Environmental

Gas System

Expansion/Safety

Total

~$700-800

~$250

~$650-750

In addition to ongoing investments

to improve reliability and customer

satisfaction, we expect major new

investments over the next 5 years

These new investments grow utility

earnings while enhancing service to

customers

Through rate cases, we will pursue

a structure that ensures a full and

timely recovery of investments

MichCon rate case filing as

needed in 2006

Detroit Edison rate case

filing required July 1, 2007

Potential Net Income Impact*

($ millions)

~$90

~$40

~$15

Base

Utility

Environmental

Gas System

Expansion/Safety

Total

~$35

* Assumes earning 11% ROE on 50% equity

5

Recent Regulatory Rulings are

Indicative of Michigan’s Constructive

Regulatory Environment

MichCon Rate Case

$61M base rate increase

Uncollectible expense tracking mechanism

Detroit Edison Rate Case

$248M base rate increase

Full recovery of $550M of past environmental expenditures

Pension expense tracking mechanism

Detroit Edison Rate Restructuring Case

Changes allowed continued reduction of Electric Choice

levels

6

DTE’s Performance

Excellence Process

Mitigate inflation

Offset higher

commodity

prices

Reduced need

for future rate

increases

Help fund improved

reliability and

customer service

Help to fund large

scale utility

investment program

Our Performance Excellence Process

Sharpens the Focus on Costs,

Productivity and Customer Satisfaction

7

Performance Excellence Process

Update

Broad cost reduction, productivity improvement effort

Comprehensive focus on all areas of Detroit Edison, MichCon and Corporate Staffs

Targeting first quartile cost/performance/customer satisfaction in all areas

Currently developing implementation plans

Restructuring charge likely in 2006

More details will be provided at our April 6th analyst meeting

Estimate at least $250M of annual O&M and capital savings, realized over

the next 24 months

Identify

Opportunities

Timeline

Evaluate

Opportunities

Program Overview

December 2005

January 2006

March 2006

Q2 2006

Plan

Implementation

Implement

8

Building Scale at our Non-Utility

Businesses

Leverages our expertise in owning and

operating large industrial projects, such as

on-site & biomass projects

Utilizes our knowledge of the electricity, coal

and natural gas markets through ownership of

pipelines, gas storage capacity, coal transport

network and asset-based trading

Build on our 15+ years of unconventional

production experience through sizable

positions in the Antrim and Barnett regions

Power & Industrial

Projects

Fuel Transportation

& Marketing

Unconventional Gas

Production

9

Power & Industrial Projects:

Executing Our Growth Plans

Expertise in large-scale on-site facilities

Utility services for industrial sites

Landfill gas production sites

Synfuels, coke batteries and power generation

plants

Investing where we see continuing success

Industrial site projects

Biomass and landfill gas projects

2006 plans

Capital expenditures of $100-200M in 2006

Targeted ROIC for new investments of 10-15%

Full pipeline of projects

10

Fuel Transportation & Marketing:

Growing Through Capacity Expansion

Expertise in commodity logistics and trading

Coal transportation and marketing

Natural gas storage and pipelines

Asset-based gas and electricity trading

Investing into very strong storage and

transportation fundamentals

Pipeline investments at Millennium ($45M)

and Vector expansion ($15M) in service late

2007

Michigan storage expansions of 14 Bcf now

($46M) plus 15-35 Bcf over the next five

years

2006 plans

Capital expenditures of $100-120M in 2006

Targeted ROICs of 10-20%

11

Unconventional Gas:

Hidden Value Becoming Visible

12

Expertise in unconventional gas production

15+ years in Michigan’s Antrim formation, 2 years

in Texas Barnett formation

2000+ active wells

21 Bcf of production

~550 Bcfe total proved and probable reserves

Investing to increase value

New production in Antrim offsets older well

decline; new production is near market price

while old production is sold forward at well below

current market levels

Development and production in Barnett shale

Reserve growth (proven & probable) of 16 Bcfe at

12/31/04 to 179 Bcfe at 12/31/05

2006 plans

Capital expenditures of $100-130M in 2006

Targeted ROICs of 15-20%

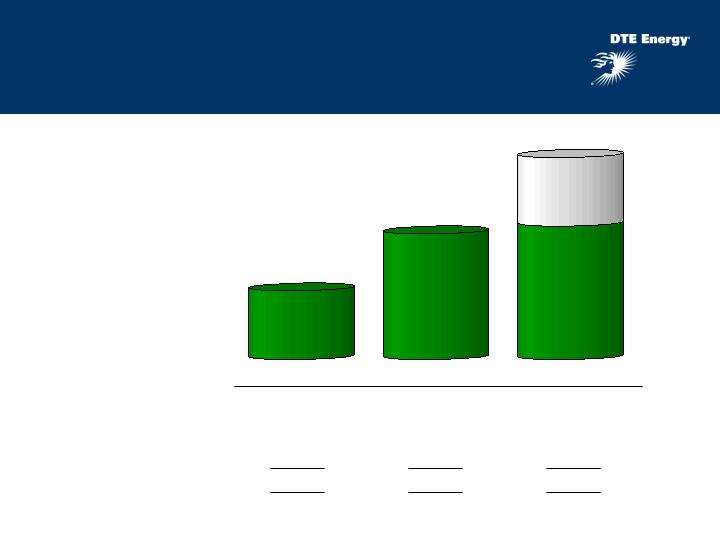

Unconventional Gas Production:

Antrim Reserves Have Significant Value

Antrim Net Income

Antrim Reserve Valuation

Less: Allocated debt

0.50-1.00

2.50-3.00

35

338

Probable

Proved

Valuation

Comparable

($/mcf)

Reserves

(Bcfe)

Component

~$420-620

Valuation

Net Income

($ millions)

Current Natural

Gas Pricing ($/Mcf)

$-

$20

$40

$60

$80

$100

2005A

2006E

2007E

2008E

$0

$2

$4

$6

$8

$10

Actual/Forecasted net income

Additional income without fixed price obligations

Current forward natural gas pricing

($ millions)

Gross Antrim Reserve Value

Less: Cost of Legacy Hedges

Based on $5 market to hedge price differential

(150)

(280)

$850-1,050

P/E valuation on 2005 earnings of <$0.50/share

Per share valuation of ~$2.35-3.50

Antrim production has material value that will be increasingly visible over next few years

13

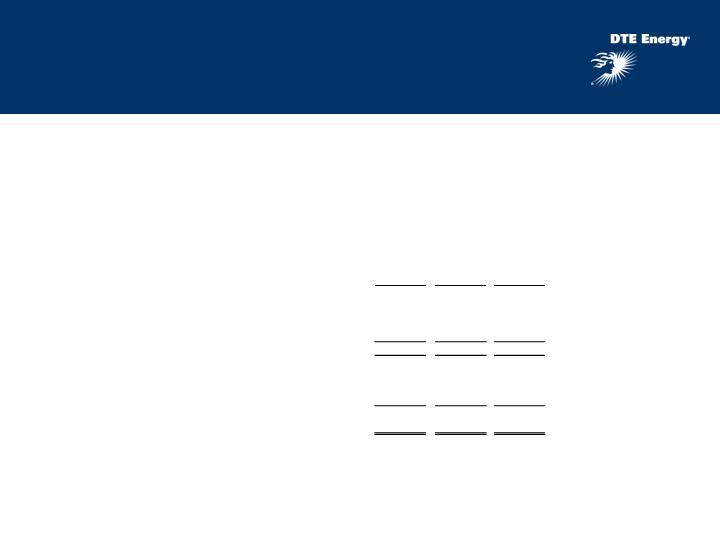

We Have Made Considerable Progress in

Developing Our Barnett Position

Production

(mmcf/day)

0

4.0

12/31/2005

12/31/2004

Gross Producing Wells

5

65

12/31/2005

12/31/2004

Reserves

(Bcfe)

Probable

Reserves

Proven

Reserves

8

16

120

59

179

8

12/31/2005

12/31/2004

Acreage Position

(thousands)

Net

Undeveloped

Acres

Net

Developed

Acres

49

0

49

62

14

76

12/31/2005

12/31/2004

14

While Currently Modest, Barnett’s

Valuation Should Grow

Barnett Reserve Valuation

1.50-2.50

1.50-3.00

120

59

Probable

Proved

Valuation

Comparable

($/mcf)

Reserves

(Bcfe)

Component

Valuation ($ millions)

$210-$420

Per share valuation of ~$1.20-2.40

Barnett probable reserves are

high quality and market would

value close to proved.

Southern acreage is not

included in this analysis

Less: Allocated debt ($ millions)

(60)

15

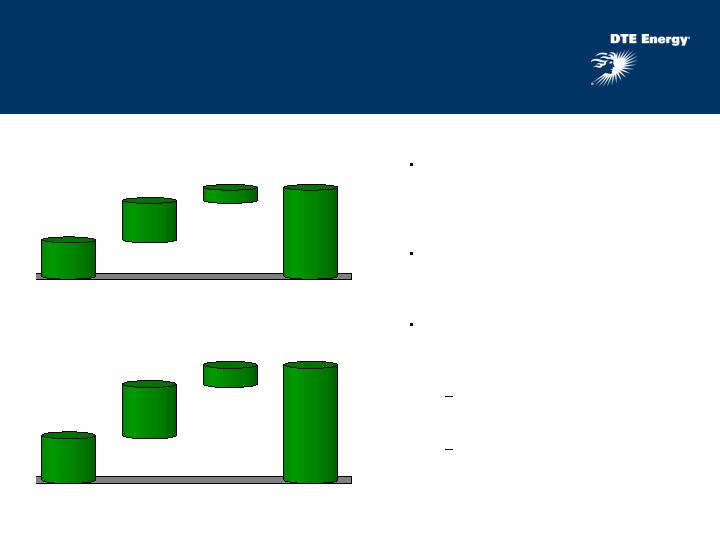

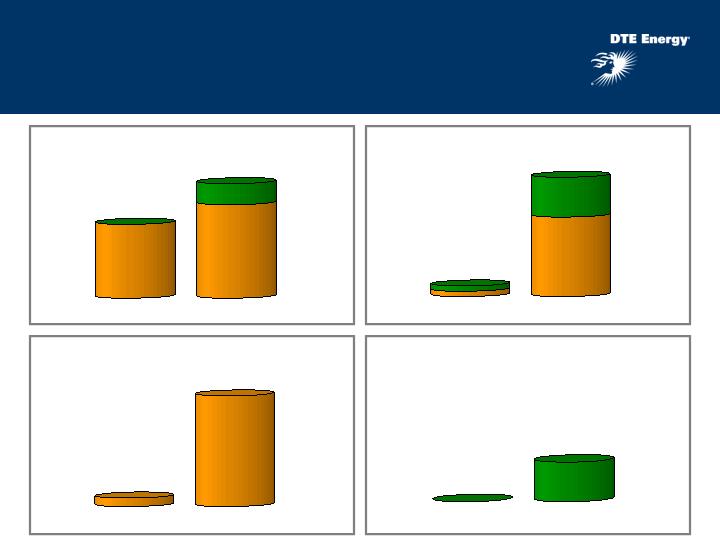

Non-Utility Scale Continues to Grow in

our Areas of Future Capital Investment

Non-Utility Operating Net Income*

In Areas of Expected Future Capital Investment

($ millions)

2004A

2005A

2006E**

$35

$64

$68-103

** 2006 guidance assume no synfuel tax credit phase out

Non-Utility Operating Net Income*

Synfuels, Power Generation,

Waste Coal & Energy Trading

Non-Utility Op. Net Income in Areas

Of Expected Future Capital Investment*

* Reconciliation to GAAP reported earnings included in the appendix

$255

(220)

$35

$285

(221)

$64

$325-345

(242-257)

$68-103

16

Balance Sheet Position

Funds from Operations/

Debt

* Excludes securitization debt and MichCon short term borrowings

** Assumes midpoint of applicable estimates, excludes expected cost to achieve for the Performance Excellence Process

Long-Run

Target

19.3%

22.7%

23%**

26-28%

Funds from Operations/

Interest

Long-Run

Target

3.9X

4.5X

4.5X**

4.5-5.0X

Leverage*

Long-Run

Target

51.2%

52.1%

53%**

48-50%

17

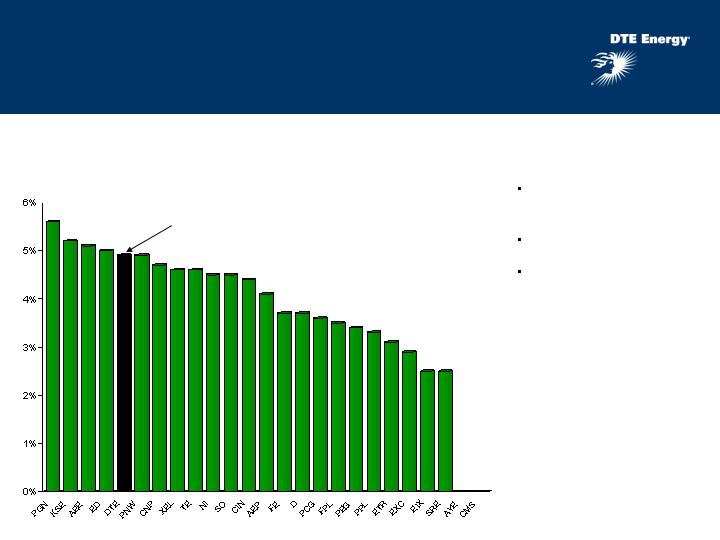

Stable Dividend and Attractive Yield

DTE ~4.9%

Current Dividend Yield

S&P Electrics/S&P MultiUtilities

Paid dividend for 96

consecutive years

Stable credit ratings

Strong liquidity with

$1.2B of short term

credit currently

available

18

Our Value Proposition

Utilities targeting earnings growth at 5% annual rate through 2010

Stable regulatory environment

Substantial expected additions to rate base

Implementation of Performance Excellence Process

Building scale at the non-utility businesses

Solid reinvestment progress in 2005 with strong pipeline of opportunities in

2006

Substantial and growing value in Unconventional Gas Production

Stable dividend with attractive yield supported by strong balance sheet

Improving credit metrics

Balance sheet strength to support investment plans

19

For More Information

DTE Energy Investor Relations

www.dteenergy.com/investors

313-235-8030

20

Appendix

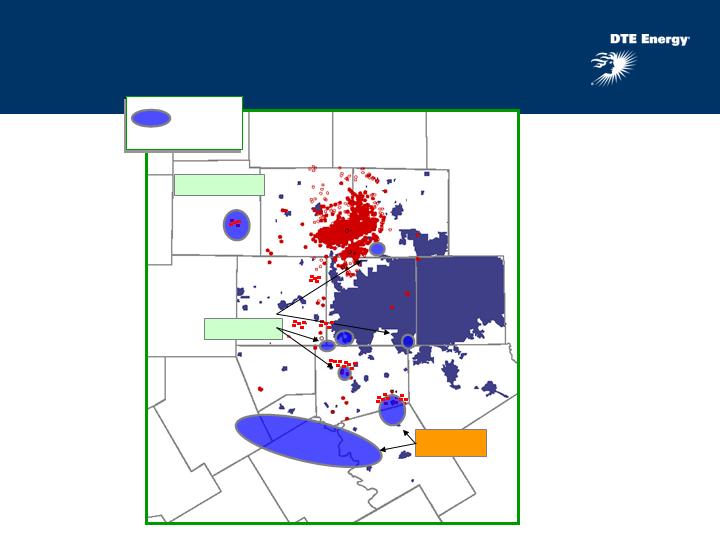

DTE Energy’s Barnett Shale Operations

Jack

Dallas/

Ft Worth

Metropolitan

Area

Clay

Montague

Wise

Denton

Cooke

Palker

Tarrant

Hood

Johnson

Erath

Hill

Bosque

Palo Pinto

Expansion area

Core area

Zones of

DTE Acreage

Cooke

52,000 acres

3,000 acres

23,000 acres

Somervell

22

Unconventional Gas Production

Statistics

23

Net Income

($ millions)

$4

$25-30

2006E

2005

Antrim

Barnett

2005 Natural Gas Production

(Bcfe)

21.5

0.7

2006 Natural Gas Production

(Bcfe)

22.4

4.1

Current Proven Reserves

(Bcfe)

338

59

Current Probable Reserves

(Bcfe)

35

120

Gross Current Producing Wells

2,010

65

Planned Additional Drilled Wells in

2006

130

55

2006 Rigs

2

5

Net Developed Acres

(thousands)

218

14

Net Undeveloped Acres

(thousands)

73

62

291

76

2006 Guidance

24

* Reconciliation to GAAP reported earnings included in the appendix

*** Includes Energy Trading earnings of ($39M) and $45-50M in 2005 & 2006, respectively

** Includes synfuel earnings of $273M and $210-220M in 2005 & 2006, respectively

Operating Earnings*

($ millions)

2005

Actuals

2006

Guidance

Detroit Edison

$272

$320-335

MichCon

73

70-80

Power & Industrial Projects**

280

215-225

Unconventional Gas Production

4

25-30

Fuel Transportation & Marketing***

2

85-90

Corporate & Other

(54)

(70-80)

Operating Earnings

$577

$635-690

Operating Earnings per Share

$3.27

$3.60-3.90

Capital Expenditures

($ millions)

25

* Includes maintenance and growth expenditures

2006

Estimate

2005

Actuals

Detroit Edison

- Operational

$584

$575-675

- Environmental

65

200-250

- DTE2/SAP Implementation

73

100-140

MichCon

- Operational

$113

$105-150

- Pipeline Integrity

15

20-25

Non-Utility*

- Power & Industrial Projects

$77

$100-200

- Unconventional Gas Production

144

100-130

- Fuel Transportation & Marketing

41

100-120

Total Non-Utility

$262

$300-450

Other

3

0-10

Total

1,115

$

$1,300-1,700

Cash Flow

26

($ millions)

2006

Estimate

2005

Actuals

Operating Activities

Cash from operations

$1,001

$1,100-1,150

Synfuel production payment*

349

325-375

Adjusted cash from operations

$1,350

$1,425-1,525

Investing Activities

Capital expenditures

($1,115)

($1,300-1,700)

Asset sales

60

0-25

Other investments

(96)

(30-80)

($1,151)

($1,305 - 1,780)

Financing Activities

Short-term borrowing

$437

$0-325

Net long-term debt**

(403)

275

Net issuance of common stock

159

-

Dividends paid

(360)

(370)

($167)

$(95) - 230

Net Increase (Decrease) in Cash

$32

-

* accounted for as 'investing activity' on statement of cash flows

** includes capital leases

Reconciliation of 2002 & 2003

Reported Earnings to Operating Earnings

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the

company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with

analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors.

27

2002

DTE Energy

Reported Earnings

$3.83

ITC Discontinued Ops

(0.28)

Dtech Discontinued Ops

0.08

Operating Earnings

$3.63

2003

DTE Energy

Reported Earnings

$3.09

Stranded Cost Adjustment

(0.12)

Blackout Costs

0.10

Adjustment of EITF 98-10 accounting change

(0.01)

Loss on sale of steam heating business

0.08

Disallowance of gas costs

0.10

Contribution to DTE Energy Foundation

0.06

Adjustment for discontinued operation

(0.03)

Gain on sale of ITC

(0.37)

Asset retirement obligations

0.07

Dtech Discontinued Ops

0.08

Operating Earnings

$3.05

Reconciliation of 2004 & 2005

Reported Earnings to

Operating Earnings

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s

earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors.

Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors.

28

2005

DTE

Energy

Electric

Utility

Gas

Utility

Power &

Indust.

Projects

Fuel

Trans. &

Market.

Uncov. Gas

Prod.

Holding

Company

DTE

Energy

Electric

Utility

Gas

Utility

Power &

Indust.

Projects

Fuel

Trans. &

Market.

Uncov.

Gas

Prod.

Holding

Company

Reported Earnings

$3.05

$1.57

$0.21

$1.75

$0.01

$0.02

($0.51)

$537

$277

$37

$308

$2

$4

($91)

SAP/DTE2 Implementation

0.07

0.04

0.03

-

-

-

-

13

8

5

-

-

-

-

Performance Excellence Process (CTA)

0.03

0.02

0.01

-

-

-

-

6

4

1

1

-

-

-

Dtech Discontinued Ops

0.20

-

-

-

-

-

0.20

35

-

-

-

-

-

35

2006/2007 Oil Hedges

(0.17)

-

-

(0.17)

-

-

-

(29)

-

-

(29)

-

-

-

Land Sale Gain

(0.10)

(0.09)

-

-

-

-

(0.01)

(19)

(17)

-

-

-

-

(2)

Rate Case Disallowances

0.17

-

0.17

-

-

-

-

30

-

30

-

-

-

-

ITC Gain Sharing Adjustment

0.01

-

-

-

-

-

0.01

3

-

-

-

-

-

3

Change in Accounting (FIN 47)

0.02

-

-

-

-

-

0.02

3

-

-

-

-

-

3

Southern Missouri Gain on Sale

(0.01)

-

-

-

-

-

(0.01)

(2)

-

-

-

-

-

(2)

Operating Earnings

$3.27

$1.54

$0.42

$1.58

$0.01

$0.02

($0.30)

$577

$272

$73

$280

$2

$4

($54)

2004

DTE

Energy

Electric

Utility

Gas

Utility

Power &

Indust.

Projects

Fuel

Trans. &

Market.

Uncov. Gas

Prod.

Holding

Company

DTE

Energy

Electric

Utility

Gas

Utility

Power &

Indust.

Projects

Fuel

Trans. &

Market.

Uncov.

Gas

Prod.

Holding

Company

Reported Earnings

$2.49

$0.87

$0.11

$1.03

$0.68

$0.03

($0.23)

$431

$150

$20

$179

$118

$6

($42)

SAP/DTE2 Implementation

0.06

0.04

0.02

-

-

-

-

11

7

4

-

-

-

-

Dtech Discontinued Ops

0.10

-

-

-

-

-

0.10

18

-

-

-

-

-

18

Southern Missouri Impairment Loss

0.04

-

-

-

-

-

0.04

7

-

-

-

-

-

7

Contract Termination/Modification

(0.27)

-

-

-

(0.27)

-

-

(48)

-

-

-

(48)

-

-

Gain on sale of ITC

0.03

-

-

-

-

-

0.03

5

-

-

-

-

-

5

Stranded Cost Adjustment

0.12

0.12

-

-

-

-

-

21

21

-

-

-

-

-

Operating Earnings

$2.57

$1.03

$0.13

$1.03

$0.41

$0.03

($0.06)

$445

$178

$24

$179

$70

$6

($12)

Net Income ($ Millions)

Earnings per Share

Net Income ($ Millions)

Earnings per Share

Reconciliations

In this presentation, DTE Energy provides 2006 guidance for operating earnings, non-utility operating net income and non-utility operating net income in areas of

expected future capital investment. It is likely that certain items that impact the company’s 2006 reported results will be excluded from operating results. A

reconciliation to the comparable 2006 reported earnings/net income guidance is not provided because it is not possible to provide a reliable forecast of specific line

items such as 2007 oil hedging costs, Performance Excellence Process restructuring charges and DTE2 implementation charges. These items may fluctuate

significantly from period to period and may have a significant impact on reported earnings.

2006 Reported Earnings to Operating Earnings

Non-Utility Operating Net Income in areas of Expected Future Capital Investment to Non-Utility Reported Earnings

29

Use of Non-Utility Operating Net Income – DTE Energy management believes that non-utility operating net income provides a more meaningful

representation of the company’s earnings from ongoing non-utility operations and this measure as the primary performance measurement for external

communications with analysts and investors. Internally, DTE Energy uses this measure to gauge performance against budget and to report to the Board of

Directors.

Use of Non-Utility Operating Net Income in areas of Expected Future Capital Investment - DTE Energy management believes the use of this measure

provides a meaningful depiction, for external communications with analysts and investors, of the net income growth in the non-utility businesses where the

company expects to invest significant capital in the future.

(excludes Corporate & Other)

2004A

2005A

2006E

Non-Utility Reported Net Income

$303

$314

n/a

Contract Termination/Modification

(48)

-

2006/2007 Oil Hedges

-

(29)

Non-Utility Operating Net Income

$255

$285

$325-345

Synfuels

(193)

(273)

(210-220)

Power Generation/Waste Coal

17

13

13

Energy Trading

(44)

39

(45-50)

Non-Utility Operating Net Income in areas of

Expected Future Capital Investment

$35

$64

$68-103