Notes to Consolidated Financial Statements (Unaudited)

1. The Proposed Separation, Description of the Business, and Basis of Presentation

The Proposed Separation

On October 27, 2020, DTE Energy Company (“DTE Energy”) announced that DTE Energy’s Board of Directors authorized management to separate the DTE midstream business, DT Midstream, Inc., formerly known as DTE Gas Enterprises, LLC, and its consolidated subsidiaries (“DT Midstream”) from DTE Energy through a pro rata distribution (the “Distribution”) to DTE Energy shareholders of all of the outstanding common stock of DT Midstream. This separation (the “Separation” or “Spin-Off”) is expected to take place by mid-year 2021, subject to final approval by DTE Energy’s Board of Directors, a Form 10 registration statement being declared effective by the Securities and Exchange Commission, regulatory approvals and satisfaction of other conditions.

In connection with the Separation, on January 13, 2021, DTE Gas Enterprises, LLC converted into a Delaware corporation pursuant to a statutory conversion and changed its name to DT Midstream, Inc. At the conversion, DT Midstream issued 1,000 shares of common stock at $0.01 par value to its parent, a subsidiary of DTE Energy. As DT Midstream was a single member LLC as of March 31, 2020 and December 31, 2020 and a corporation with stockholder’s equity as of March 31, 2021, Consolidated Statements of Changes in Stockholder’s Equity/Member’s Equity are presented as of March 31, 2021, March 31, 2020 and December 31, 2020.

Following the Separation, DT Midstream will be an independent, publicly traded company, and DTE Energy will not retain any ownership interest in DT Midstream. In order to govern the ongoing relationships between DT Midstream and DTE Energy after the Spin-Off and to facilitate an orderly transition, DT Midstream will enter into a Separation and Distribution Agreement with DTE Energy, in addition to certain other agreements, including a Transition Services Agreement, a Tax Matters Agreement and an Employee Matters Agreement. These agreements will allocate between DT Midstream and DTE Energy the assets, employees, liabilities and obligations of DTE Energy and its subsidiaries attributable to periods prior to, at and after the Distribution, provide for certain services to be delivered on a transitional basis and govern the relationship between DT Midstream and DTE Energy following the Spin-Off.

Accordingly, following the termination of the Transition Services Agreement, DT Midstream will establish standalone functions to provide services currently received from DTE Energy, or obtain such services from unaffiliated third parties. These services include accounting, auditing, communications, tax, legal and ethics and compliance program administration, human resources, information technology, insurance, investor relations, risk management, treasury, other shared facilities and other general, administrative and limited operational functions.

Description of the Business

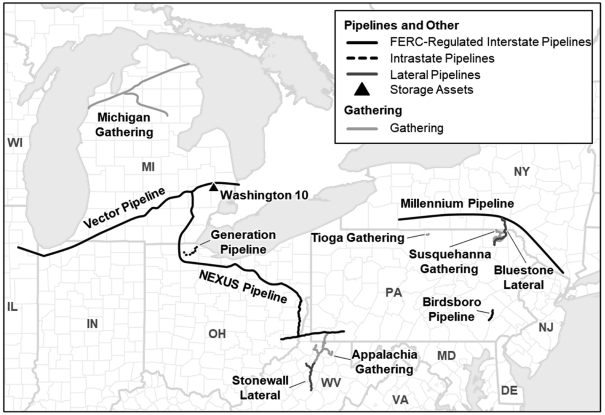

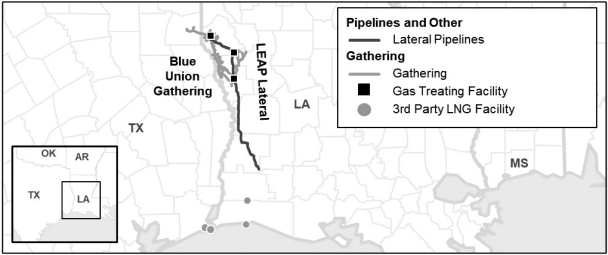

DT Midstream is an owner, operator, and developer of an integrated portfolio of natural gas interstate pipelines, intrastate pipelines, storage systems, gathering lateral pipelines, gathering systems, treatment plants and compression and surface facilities. DT Midstream owns both wholly owned pipeline and gathering assets which it operates directly, and interests in equity method investees which own and operate interstate pipelines, many of which have connectivity to DT Midstream’s wholly owned assets. DT Midstream provides multiple, integrated natural gas services to customers through two primary segments: (i) Pipelines and Other, which includes interstate pipelines, intrastate pipelines, storage systems, gathering lateral pipelines and related treatment plants and compression and surface facilities, and (ii) Gathering, which includes gathering systems and related treatment plants and compression and surface facilities.

DT Midstream’s core assets connect demand centers in the Midwestern U.S., Eastern Canada, Northeastern U.S. and Gulf Coast regions to production areas of the Marcellus/Utica and Haynesville dry natural gas formations in the Appalachian and Gulf Coast Basins.

F-44