Ciena Corporation Q1 FY 2019 Investor Presentation Quarterly Period ended January 31, 2019 March 5, 2019 Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary.

Forward-looking statements and non-GAAP measures Information in this presentation and related comments of presenters contain a number of forward-looking statements. These statements are based on current expectations, forecasts, assumptions and other information available to the Company as of the date hereof. Forward-looking statements include Ciena’s long-term financial targets, prospective financial results, return of capital plans, business strategies, expectations about its addressable markets and market share, and business outlook for future periods, as well as statements regarding Ciena’s expectations, beliefs, intentions or strategies regarding the future. Often, these can be identified by forward-looking words such as “target” “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “plan,” “predict,” “potential,” “project, “continue,” and “would” or similar words. Ciena's actual results, performance or events may differ materially from these forward-looking statements made or implied due to a number of risks and uncertainties relating to Ciena's business, including: the effect of broader economic and market conditions on our customers and their business; our ability to execute our business and growth strategies; changes in network spending or network strategy by our customers; seasonality and the timing and size of customer orders, including our ability to recognize revenue relating to such sales; the level of competitive pressure we encounter; the product, customer and geographic mix of sales within the period; supply chain disruptions and the level of success relating to efforts to optimize Ciena's operations; changes in foreign currency exchange rates affecting revenue and operating expense; the impact of the Tax Cuts and Jobs Act; and the other risk factors disclosed in Ciena’s periodic reports filed with the Securities and Exchange Commission (SEC) including Ciena’s Quarterly Report on Form 10-Q to be filed with the SEC and Ciena’s Annual Report on Form 10-K filed with the SEC on December 21, 2018. All information, statements, and projections in this presentation and the related earnings call speak only as of the date of this presentation and related earnings call. Ciena assumes no obligation to update any forward-looking or other information included in this presentation or related earnings calls, whether as a result of new information, future events or otherwise. In addition, this presentation includes historical, and may include prospective, non-GAAP measures of Ciena’s gross margin, operating expense, operating profit, EBITDA, net income, and net income per share. These measures are not intended to be a substitute for financial information presented in accordance with GAAP. A reconciliation of non-GAAP measures used in this presentation to Ciena’s GAAP results for the relevant period can be found in the Appendix to this presentation. Additional information can also be found in our press release filed this morning and in our reports on Form 10-Q filed with the Securities and Exchange Commission. Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 2

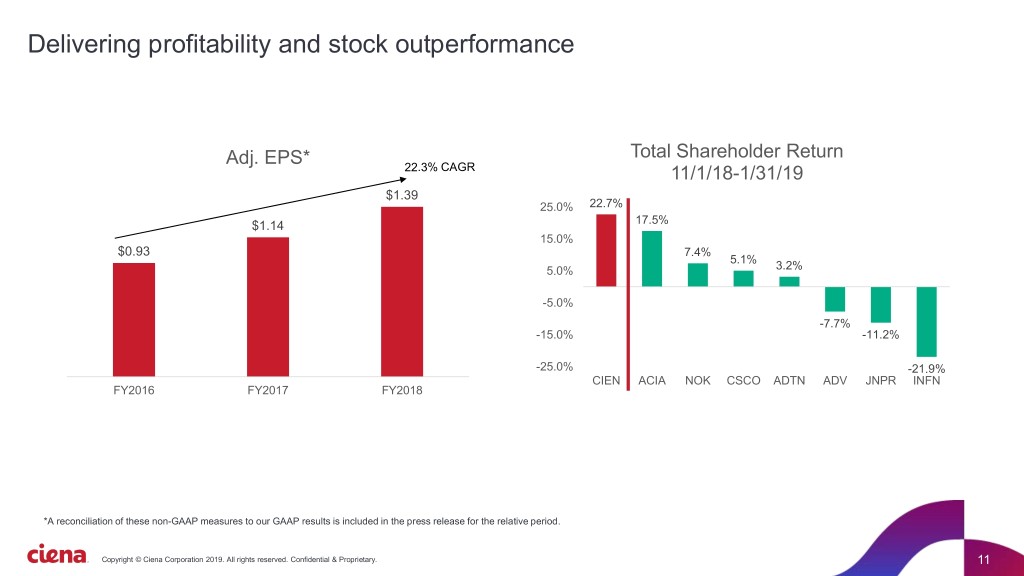

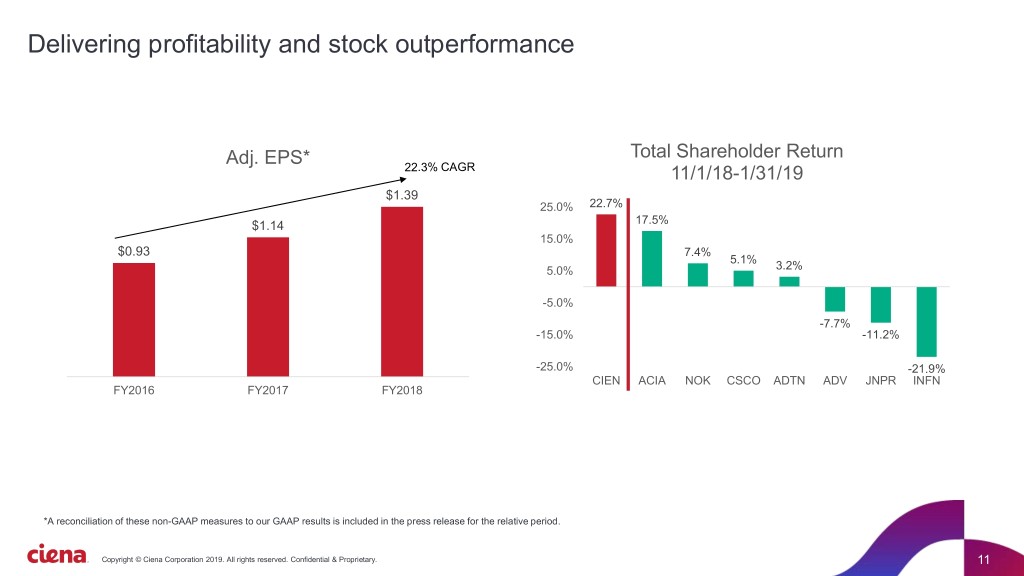

Diversifying and growing through market share gains . Non-telco represented over 35% of total revenue . Direct webscale was a record 22% of total revenue; one >10% webscale customer . EMEA up 32% YoY . APAC up 20% YoY Forcing the pace of innovation with next generation solutions . Announced WaveLogic 5; expected to ship in systems end of 2019 . WaveLogic Ai: 88 total customers . 23 new wins in Q1 . Waveserver: 125 customers; added 8 in Q1 Delivering shareholder value . Repurchased approximately 0.6 million shares of common stock for an aggregate price of $21.2 million . Q1’19 Total Shareholder Return of 22.7% versus peer¹ return of 3.7% Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 3 1. Peers include ACIA, ADTN, ADVA, CSCO, INFN, JNPR and NOKIA for the period 11/1/18-1/31/19

Q1 Fiscal 2019 Financial Highlights * A reconciliation of these non-GAAP measures to our GAAP results is included in the appendix to this presentation. Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 4

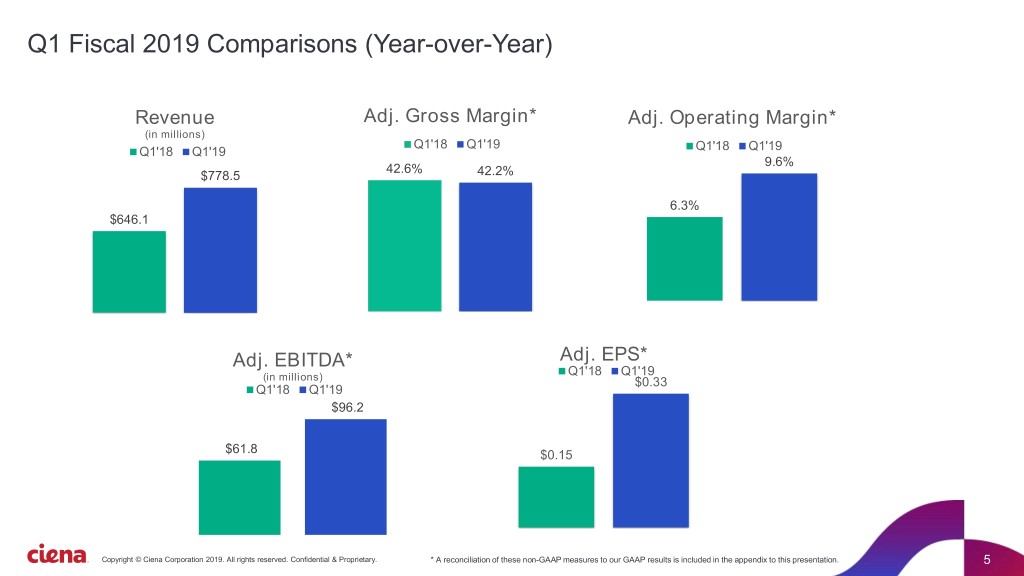

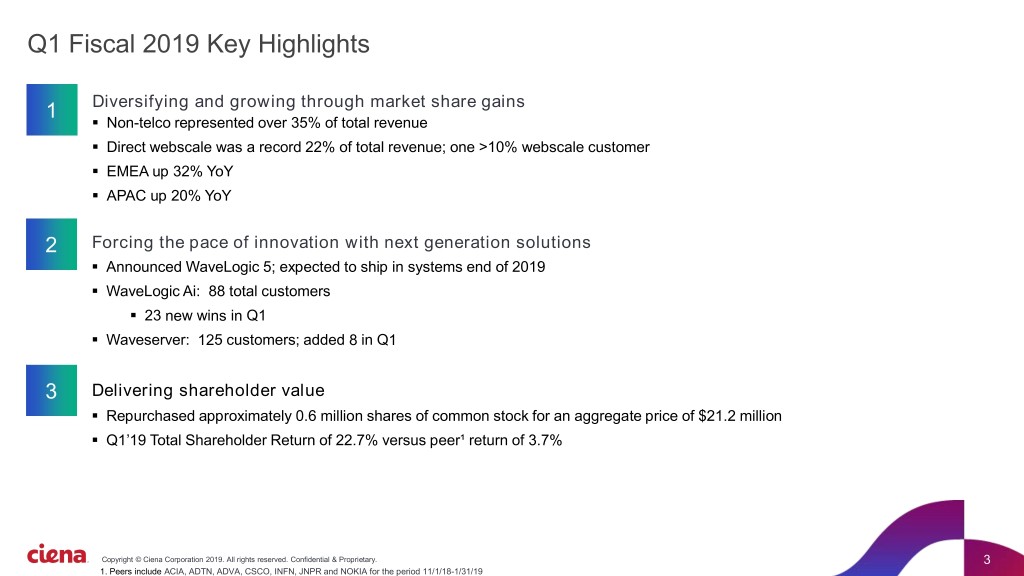

Q1 Fiscal 2019 Comparisons (Year-over-Year) Revenue Adj. Gross Margin* Adj. Operating Margin* (in millions) Q1'18 Q1'19 Q1'18 Q1'19 Q1'18 Q1'19 9.6% 42.6% $778.5 42.2% 6.3% $646.1 Adj. EPS* Adj. EBITDA* Q1'18 Q1'19 (in millions) $0.33 Q1'18 Q1'19 $96.2 $61.8 $0.15 Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. * A reconciliation of these non-GAAP measures to our GAAP results is included in the appendix to this presentation. 5

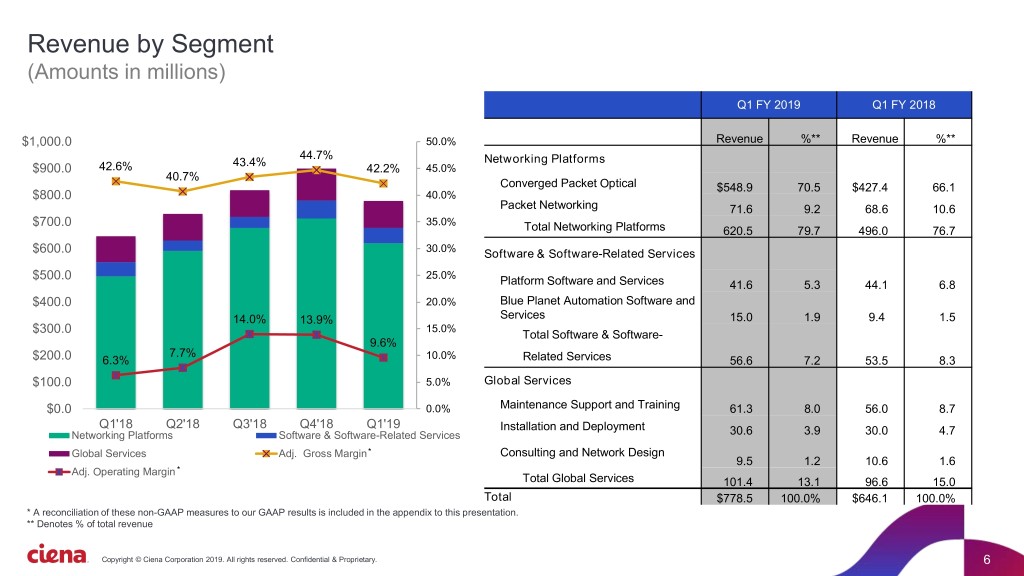

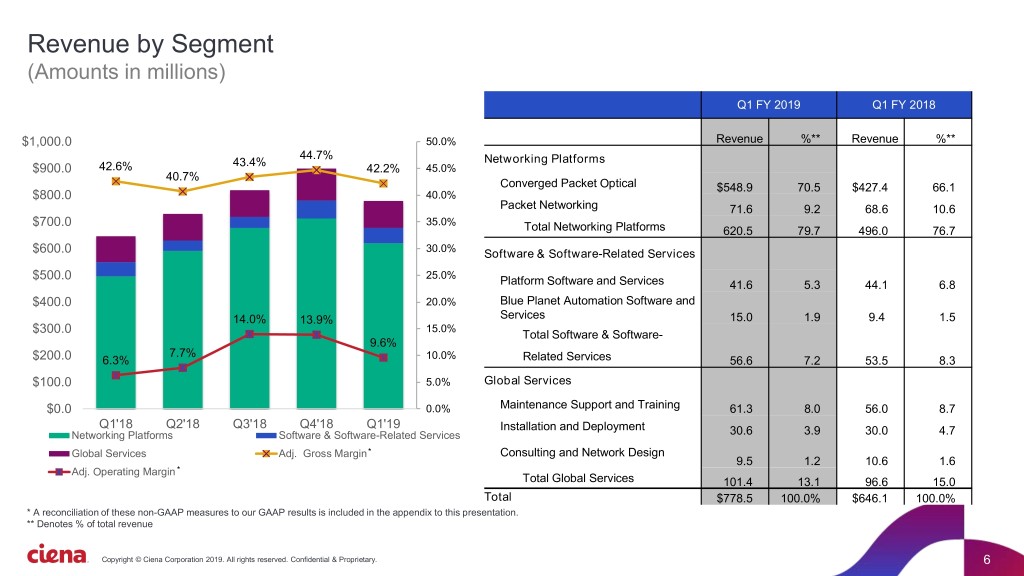

Revenue by Segment (Amounts in millions) Q1 FY 2019 Q1 FY 2018 $1,000.0 50.0% Revenue %** Revenue %** 44.7% 43.4% Networking Platforms $900.0 42.6% 42.2% 45.0% 40.7% Converged Packet Optical $548.9 70.5 $427.4 66.1 $800.0 40.0% Packet Networking 71.6 9.2 68.6 10.6 $700.0 35.0% Total Networking Platforms 620.5 79.7 496.0 76.7 30.0% $600.0 Software & Software-Related Services $500.0 25.0% Platform Software and Services 41.6 5.3 44.1 6.8 $400.0 20.0% Blue Planet Automation Software and 14.0% 13.9% Services 15.0 1.9 9.4 1.5 15.0% $300.0 Total Software & Software- 9.6% 7.7% $200.0 6.3% 10.0% Related Services 56.6 7.2 53.5 8.3 $100.0 5.0% Global Services $0.0 0.0% Maintenance Support and Training 61.3 8.0 56.0 8.7 Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Installation and Deployment Networking Platforms Software & Software-Related Services 30.6 3.9 30.0 4.7 Global Services Adj. Gross Margin* Consulting and Network Design 9.5 1.2 10.6 1.6 Adj. Operating Margin * Total Global Services 101.4 13.1 96.6 15.0 Total $778.5 100.0% $646.1 100.0% * A reconciliation of these non-GAAP measures to our GAAP results is included in the appendix to this presentation. ** Denotes % of total revenue Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 6

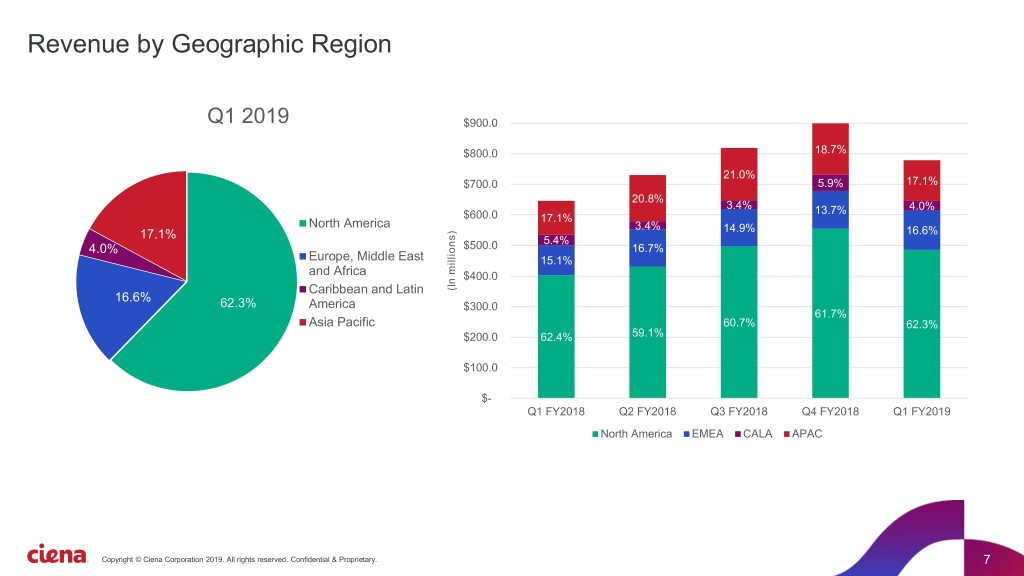

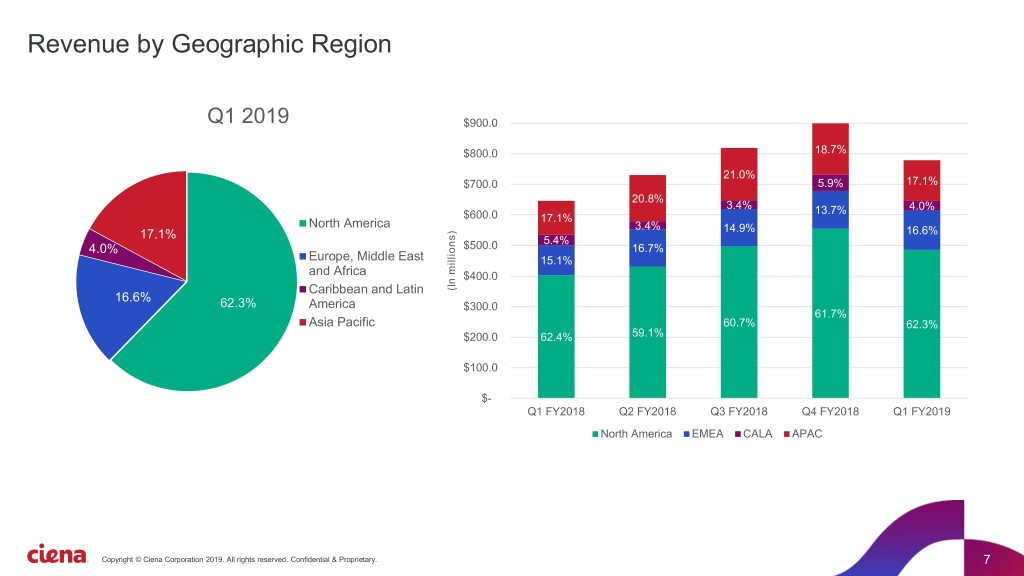

Revenue by Geographic Region Q1 2019 $900.0 $800.0 18.7% 21.0% $700.0 5.9% 17.1% 20.8% 3.4% 4.0% $600.0 13.7% North America 17.1% 3.4% 14.9% 16.6% 17.1% 5.4% 4.0% $500.0 16.7% Europe, Middle East 15.1% and Africa $400.0 Caribbean and Latin (In millions) 16.6% 62.3% America $300.0 61.7% Asia Pacific 60.7% 62.3% $200.0 62.4% 59.1% $100.0 $- Q1 FY2018 Q2 FY2018 Q3 FY2018 Q4 FY2018 Q1 FY2019 North America EMEA CALA APAC Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 7

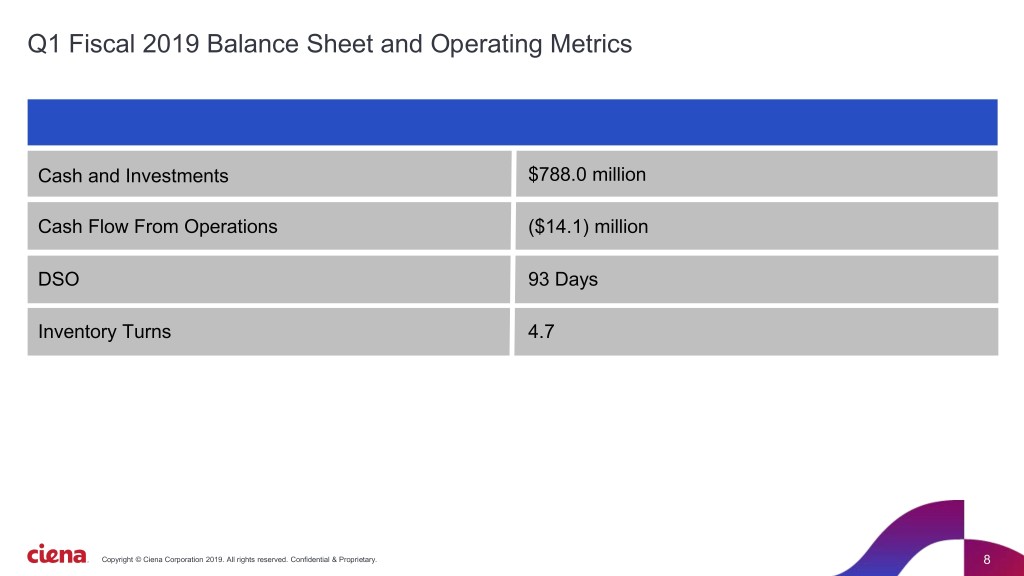

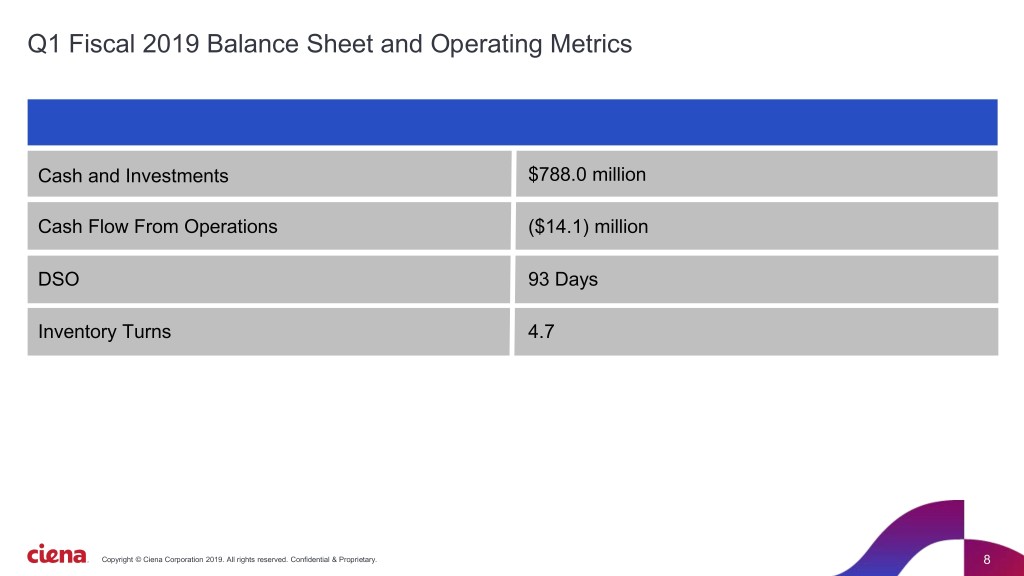

Q1 Fiscal 2019 Balance Sheet and Operating Metrics DSO Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 8

Strengthening balance sheet Leverage Trend Net Debt (Cash) Position (in millions) * Gross debt-to-Adj. EBITDA leverage ratio Cash** Debt Net Debt 8.0x 7.1x 7.2x $1,700 $1,451 7.0x $1,500 $1,264 $1,254 $1,300 $1,198 6.0x $1,143 $1,021 $1,100 $969 $953 5.0x $936 $900 $777 $788 4.0x $712 3.6x $674 $692 4.0x $700 $693 $486 2.5x 3.0x $500 2.0x $243 1.7x $300 2.0x $111 $100 ($33) 1.0x ($100) ($260) ($96) 0.0x ($300) 2013 2014 2015 2016 2017 2018 Q1 2019 2013 2014 2015 2016 2017 2018 Q1 2019 *A reconciliation of these non-GAAP measures to our GAAP results is included in the appendix to this presentation **Cash & cash equivalents Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 9

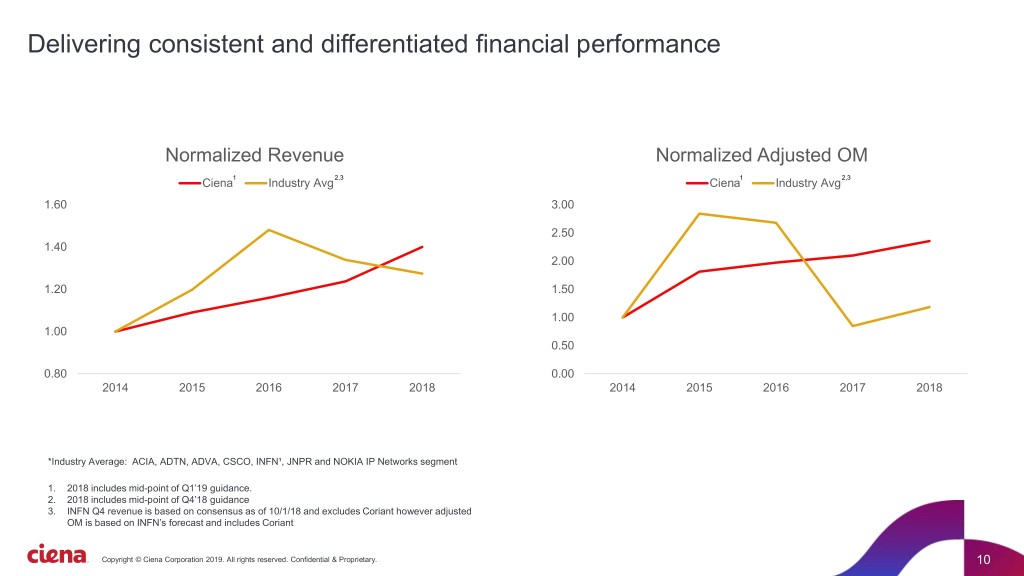

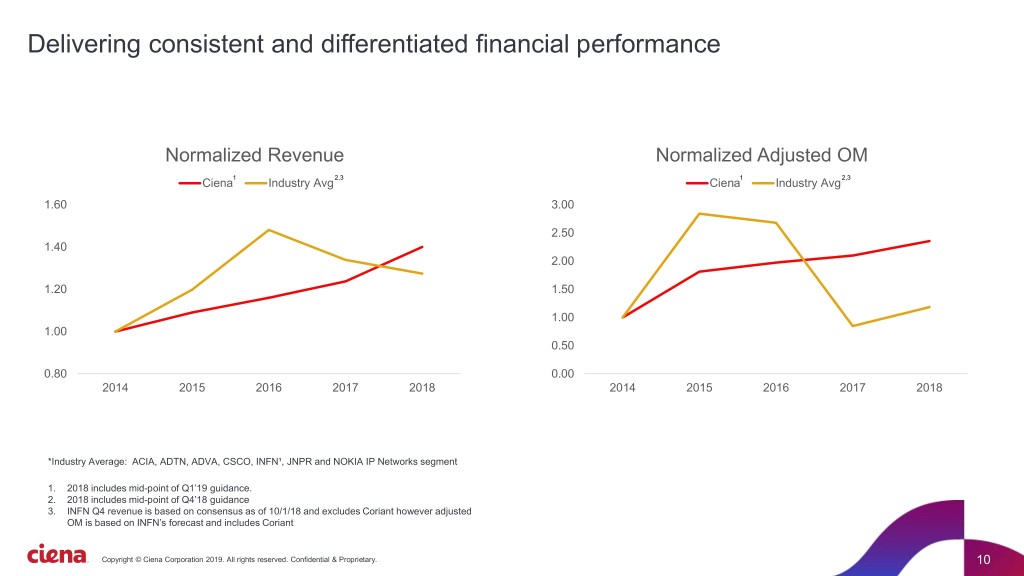

Delivering consistent and differentiated financial performance Normalized Revenue Normalized Adjusted OM Ciena1 Industry Avg 2,3 Ciena1 Industry Avg2,3 1.60 3.00 2.50 1.40 2.00 1.20 1.50 1.00 1.00 0.50 0.80 0.00 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 *Industry Average: ACIA, ADTN, ADVA, CSCO, INFN¹, JNPR and NOKIA IP Networks segment 1. 2018 includes mid-point of Q1’19 guidance. 2. 2018 includes mid-point of Q4’18 guidance 3. INFN Q4 revenue is based on consensus as of 10/1/18 and excludes Coriant however adjusted OM is based on INFN’s forecast and includes Coriant Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 10

Delivering profitability and stock outperformance Adj. EPS* Total Shareholder Return 22.3% CAGR 11/1/18-1/31/19 $1.39 25.0% 22.7% 17.5% $1.14 15.0% $0.93 7.4% 5.1% 5.0% 3.2% -5.0% -7.7% -15.0% -11.2% -25.0% -21.9% CIEN ACIA NOK CSCO ADTN ADV JNPR INFN FY2016 FY2017 FY2018 *A reconciliation of these non-GAAP measures to our GAAP results is included in the press release for the relative period. Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 11

Long-Term Targets Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 12

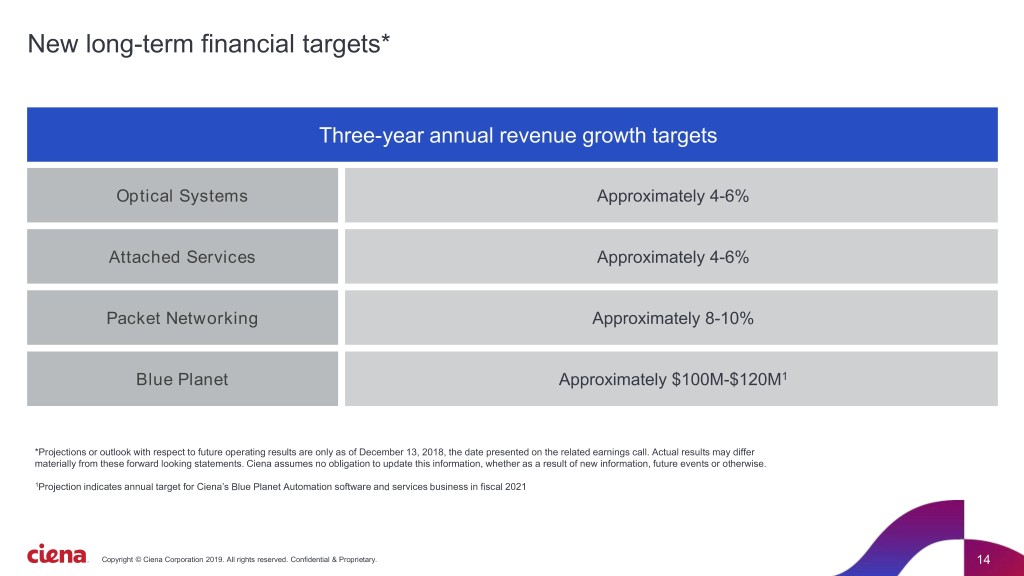

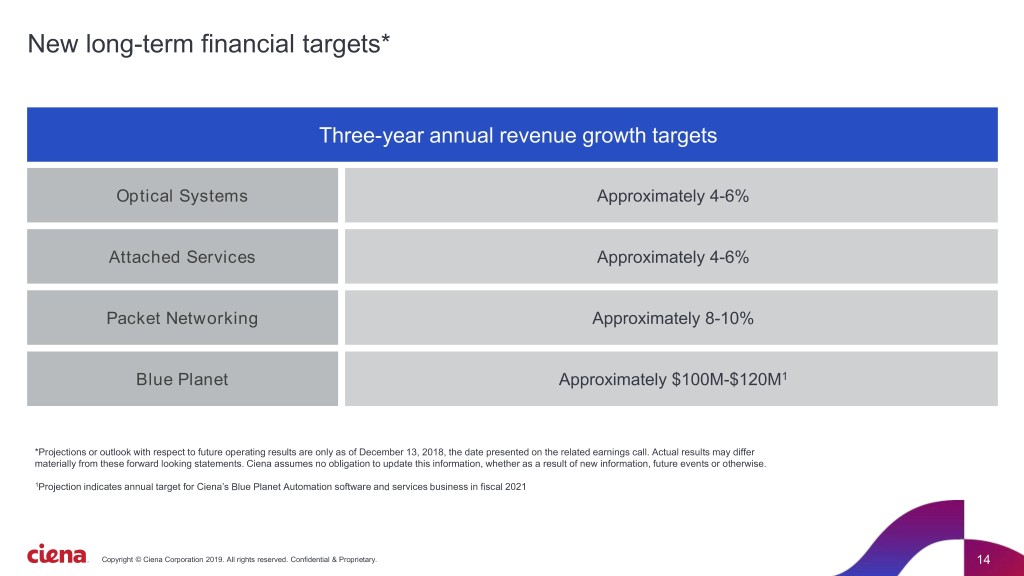

New long-term financial targets* Execution of our strategy will drive top-line growth, profitability and cash generation *Projections or outlook with respect to future operating results are only as of December 13, 2018, the date presented on the related earnings call. Actual results may differ materially from these forward looking statements. Ciena assumes no obligation to update this information, whether as a result of new information, future events or otherwise. Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 13

New long-term financial targets* Optical Systems Attached Services Packet Networking Blue Planet *Projections or outlook with respect to future operating results are only as of December 13, 2018, the date presented on the related earnings call. Actual results may differ materially from these forward looking statements. Ciena assumes no obligation to update this information, whether as a result of new information, future events or otherwise. 1Projection indicates annual target for Ciena’s Blue Planet Automation software and services business in fiscal 2021 Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 14

Q1 Fiscal 2019 Appendix Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 15

Q1 FY 2019 Q4 FY 2018 Q3 FY 2018 Q2 FY 2018 Q1 FY 2018 GAAP gross profit $323,341 $398,075 $351,543 $293,307 $271,765 Share-based compensation-products 637 705 783 824 672 Share-based compensation-services 770 651 618 722 625 Amortization of intangible assets 3,418 2,957 2,534 2,289 2,289 Total adjustments related to gross profit 4,825 4,313 3,935 3,835 3,586 Adjusted (non-GAAP) gross profit $328,166 $402,388 $355,478 $297,142 $275,351 Adjusted (non-GAAP) gross margin 42.2% 44.7% 43.4% 40.7% 42.6% Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 16

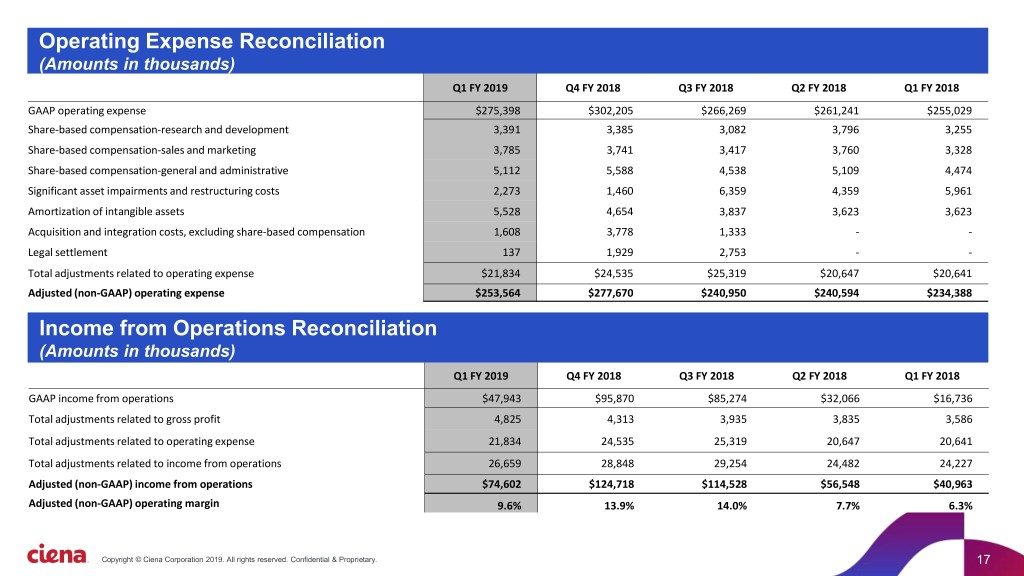

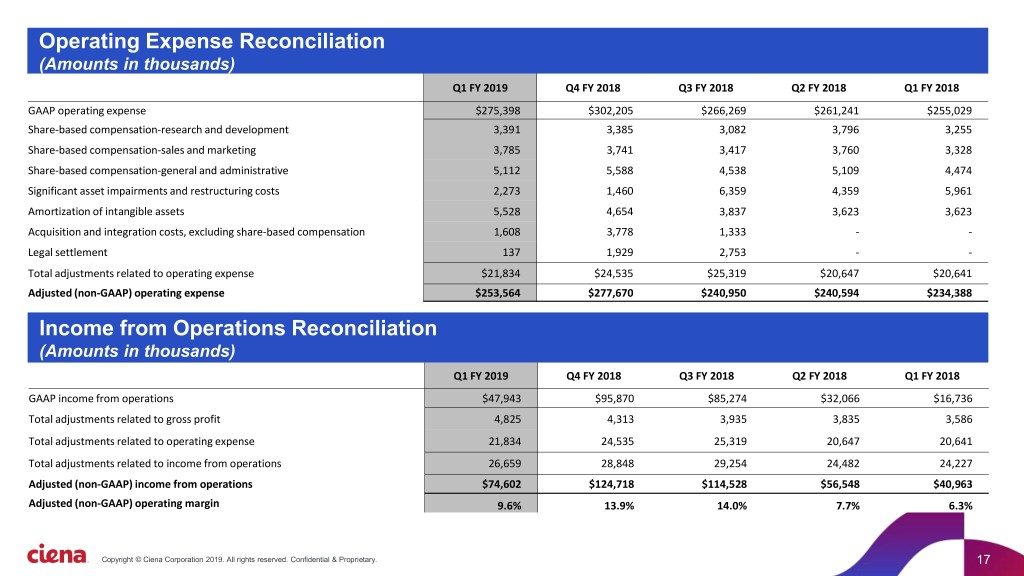

Q1 FY 2019 Q4 FY 2018 Q3 FY 2018 Q2 FY 2018 Q1 FY 2018 GAAP operating expense $275,398 $302,205 $266,269 $261,241 $255,029 Share-based compensation-research and development 3,391 3,385 3,082 3,796 3,255 Share-based compensation-sales and marketing 3,785 3,741 3,417 3,760 3,328 Share-based compensation-general and administrative 5,112 5,588 4,538 5,109 4,474 Significant asset impairments and restructuring costs 2,273 1,460 6,359 4,359 5,961 Amortization of intangible assets 5,528 4,654 3,837 3,623 3,623 Acquisition and integration costs, excluding share-based compensation 1,608 3,778 1,333 - - Legal settlement 137 1,929 2,753 - - Total adjustments related to operating expense $21,834 $24,535 $25,319 $20,647 $20,641 Adjusted (non-GAAP) operating expense $253,564 $277,670 $240,950 $240,594 $234,388 Q1 FY 2019 Q4 FY 2018 Q3 FY 2018 Q2 FY 2018 Q1 FY 2018 GAAP income from operations $47,943 $95,870 $85,274 $32,066 $16,736 Total adjustments related to gross profit 4,825 4,313 3,935 3,835 3,586 Total adjustments related to operating expense 21,834 24,535 25,319 20,647 20,641 Total adjustments related to income from operations 26,659 28,848 29,254 24,482 24,227 Adjusted (non-GAAP) income from operations $74,602 $124,718 $114,528 $56,548 $40,963 Adjusted (non-GAAP) operating margin 9.6% 13.9% 14.0% 7.7% 6.3% Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 17

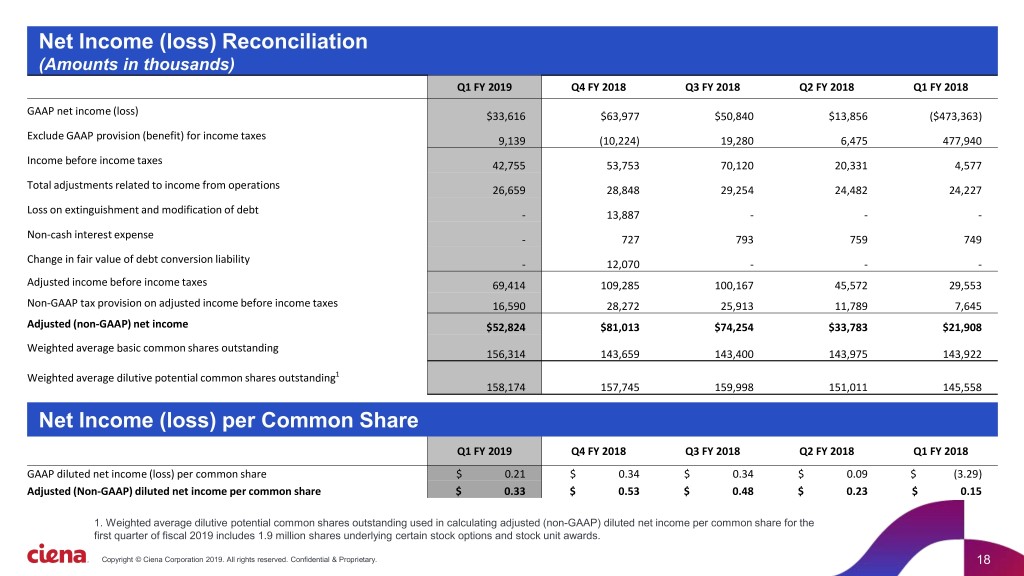

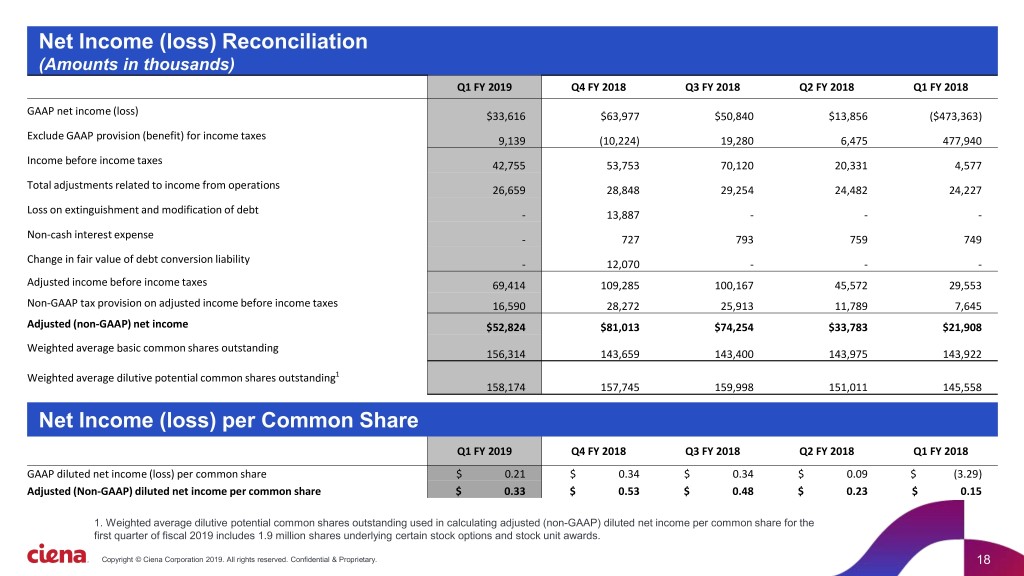

Q1 FY 2019 Q4 FY 2018 Q3 FY 2018 Q2 FY 2018 Q1 FY 2018 GAAP net income (loss) $33,616 $63,977 $50,840 $13,856 ($473,363) Exclude GAAP provision (benefit) for income taxes 9,139 (10,224) 19,280 6,475 477,940 Income before income taxes 42,755 53,753 70,120 20,331 4,577 Total adjustments related to income from operations 26,659 28,848 29,254 24,482 24,227 Loss on extinguishment and modification of debt - 13,887 - - - Non-cash interest expense - 727 793 759 749 Change in fair value of debt conversion liability - 12,070 - - - Adjusted income before income taxes 69,414 109,285 100,167 45,572 29,553 Non-GAAP tax provision on adjusted income before income taxes 16,590 28,272 25,913 11,789 7,645 Adjusted (non-GAAP) net income $52,824 $81,013 $74,254 $33,783 $21,908 Weighted average basic common shares outstanding 156,314 143,659 143,400 143,975 143,922 Weighted average dilutive potential common shares outstanding1 158,174 157,745 159,998 151,011 145,558 Q1 FY 2019 Q4 FY 2018 Q3 FY 2018 Q2 FY 2018 Q1 FY 2018 GAAP diluted net income (loss) per common share $ 0.21 $ 0.34 $ 0.34 $ 0.09 $ (3.29) Adjusted (Non-GAAP) diluted net income per common share $ 0.33 $ 0.53 $ 0.48 $ 0.23 $ 0.15 • Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 18

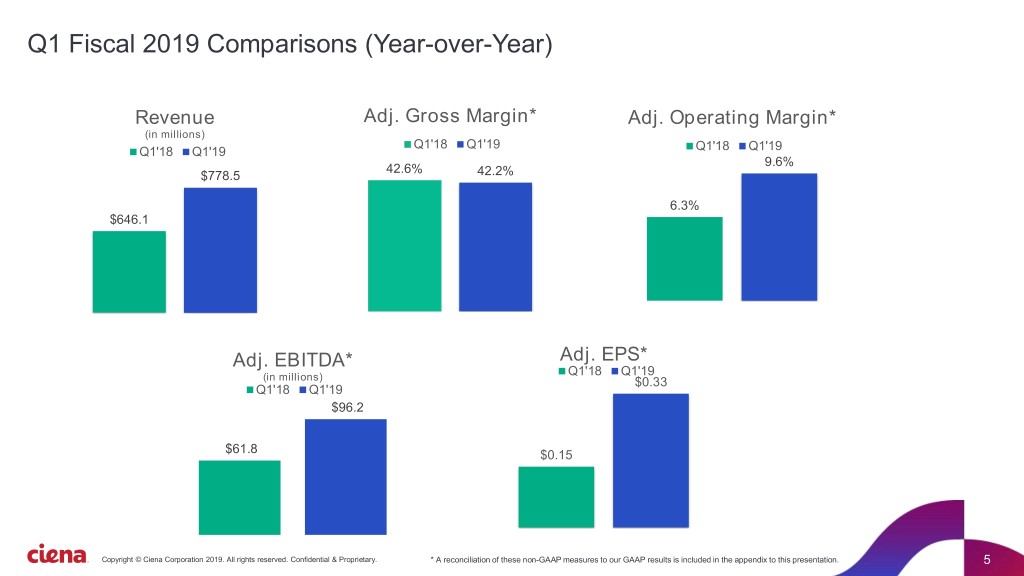

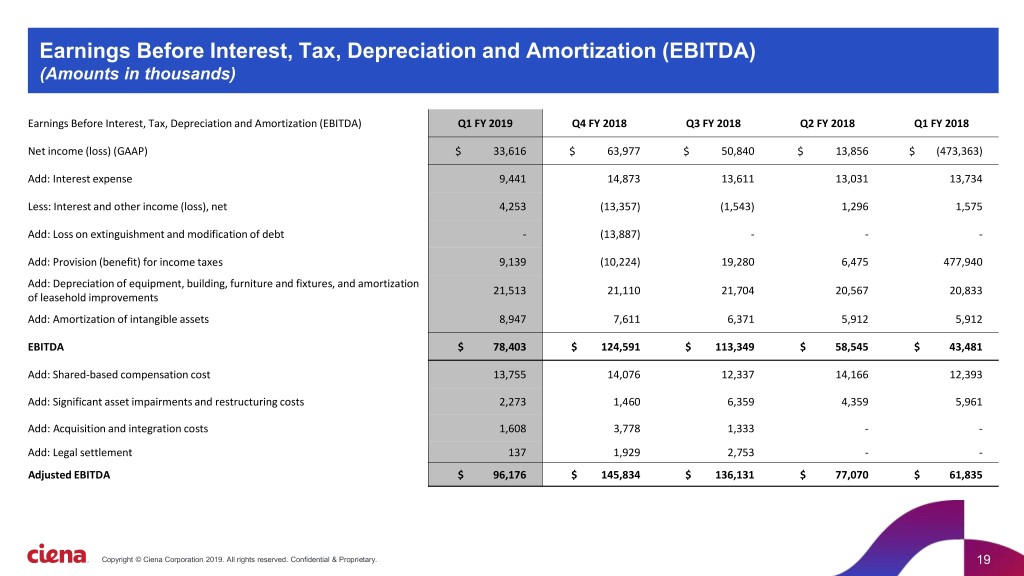

Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) Q1 FY 2019 Q4 FY 2018 Q3 FY 2018 Q2 FY 2018 Q1 FY 2018 Net income (loss) (GAAP) $ 33,616 $ 63,977 $ 50,840 $ 13,856 $ (473,363) Add: Interest expense 9,441 14,873 13,611 13,031 13,734 Less: Interest and other income (loss), net 4,253 (13,357) (1,543) 1,296 1,575 Add: Loss on extinguishment and modification of debt - (13,887) - - - Add: Provision (benefit) for income taxes 9,139 (10,224) 19,280 6,475 477,940 Add: Depreciation of equipment, building, furniture and fixtures, and amortization 21,513 21,110 21,704 20,567 20,833 of leasehold improvements Add: Amortization of intangible assets 8,947 7,611 6,371 5,912 5,912 EBITDA $ 78,403 $ 124,591 $ 113,349 $ 58,545 $ 43,481 Add: Shared-based compensation cost 13,755 14,076 12,337 14,166 12,393 Add: Significant asset impairments and restructuring costs 2,273 1,460 6,359 4,359 5,961 Add: Acquisition and integration costs 1,608 3,778 1,333 - - Add: Legal settlement 137 1,929 2,753 - - Adjusted EBITDA $ 96,176 $ 145,834 $ 136,131 $ 77,070 $ 61,835 Copyright © Ciena Corporation 2019. All rights reserved. Confidential & Proprietary. 19