Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Ciena Corporation Period ended April 30, 2022 June 2, 2022 Earnings Presentation

2Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Forward-looking statements and non-GAAP measures Information in this presentation and related comments of presenters contain a number of forward-looking statements. These statements are based on current expectations, forecasts, assumptions and other information available to the Company as of the date hereof. Forward-looking statements include Ciena’s prospective financial results, return of capital plans, business strategies, expectations about its addressable markets and market share, and business outlook for future periods, as well as statements regarding Ciena’s expectations, beliefs, intentions or strategies regarding the future. Often, these can be identified by forward-looking words such as “target” “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “plan,” “predict,” “potential,” “project, “continue,” and “would” or similar words. Ciena's actual results, performance or events may differ materially from these forward-looking statements made or implied due to a number of risks and uncertainties relating to Ciena's business, including: the effect of broader economic and market conditions on our customers and their business; our ability to execute our business and growth strategies; the impact of supply chain constraints or disruptions; the duration and severity of the COVID-19 pandemic and the impact of countermeasures taken to mitigate its spread on macroeconomic conditions, economic activity, demand for our technology solutions, short- and long-term changes in customer or end user needs, continuity of supply chain, our business operations, liquidity and financial results; changes in network spending or network strategy by our customers; seasonality and the timing and size of customer orders, including our ability to recognize revenue relating to such sales; the level of competitive pressure we encounter; the product, customer and geographic mix of sales within the period; changes in foreign currency exchange rates; factors beyond our control such as natural disasters, climate change, acts of war or terrorism, geopolitical events, including but not limited to the ongoing conflict between Ukraine and Russia, and public health emergencies; changes in tax or trade regulations, including the imposition of tariffs, duties or efforts to withdraw from or materially modify international trade agreements; and the other risk factors disclosed in Ciena’s periodic reports filed with the Securities and Exchange Commission (SEC) including Ciena’s Annual Report on Form 10-K filed with the SEC on December 17, 2021 and Ciena’s Quarterly Report on Form 10-Q for the second quarter of fiscal 2022 to be filed with the SEC. All information, statements, and projections in this presentation and the related earnings call speak only as of the date of this presentation and related earnings call. Ciena assumes no obligation to update any forward-looking or other information included in this presentation or related earnings calls, whether as a result of new information, future events or otherwise. In addition, this presentation includes historical, and may include prospective, non-GAAP measures of Ciena’s gross margin, operating expense, operating profit, EBITDA, net income, and net income per share. These measures are not intended to be a substitute for financial information presented in accordance with GAAP. A reconciliation of non- GAAP measures used in this presentation to Ciena’s GAAP results for the relevant period can be found in the Appendix to this presentation. Additional information can also be found in our press release filed this morning and in our reports on Form 10-Q filed with the Securities and Exchange Commission.

3Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Table of Contents 1 Overview & recent achievements 2 Market context and Ciena's portfolio 3 Recent financial performance 4 Appendix

4Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Overview & recent achievements

5Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Ciena is an industry-leading global networking systems, services, and software company ….. Leading technology and innovation … with a strong track record of creating shareholder value Diversification and scale of business Leader in Optical markets and disruptor in emerging opportunities Demonstrated track record of financial performance Flexibility with strong balance sheet

6Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Recent key achievements • Delivering industry-leading coherent technology including 107GBd WaveLogic™ 5 Extreme (WL5e) and the widest range of interoperable and performance pluggables ▪ Blue Planet revenue has grown at a 3-year (FY'18 - FY'21) CAGR of 44% ▪ Growing revenue with MCP multi- layer visualization service across multi-vendor IP/Optical infrastructure ▪ Continuing to expand our Routing and Switching portfolio with five new product introductions in 1H'22 We are driving the pace of innovation We are committed to our people and communities We have a durable business and financial model ▪ Despite the challenging environment, we continue to grow our revenue, and profitability and free cash flow have remained strong ▪ Our balance sheet represents a competitive advantage • Ended the quarter with approximately $1.6B in cash and investments • Leverage remains below our target level after a successful $400M Senior Notes offering • Published ESG Investor Presentation and conducting stockholder outreach • Established our Sustainability Governance model which includes board oversight and strategic executive leadership • Communicated FY22 compensation goals that address climate, diversity & inclusion and community impact • Earned Verizon's 2022 Supplier Environmental Excellence Award

7Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Market context and our portfolio

8Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Six mega trends and the innovations that will enable them Fiber Deep (Cable/MSO) Cloud Data Center Mobility & 5G IoT & Connected Objects Living a Hybrid Life

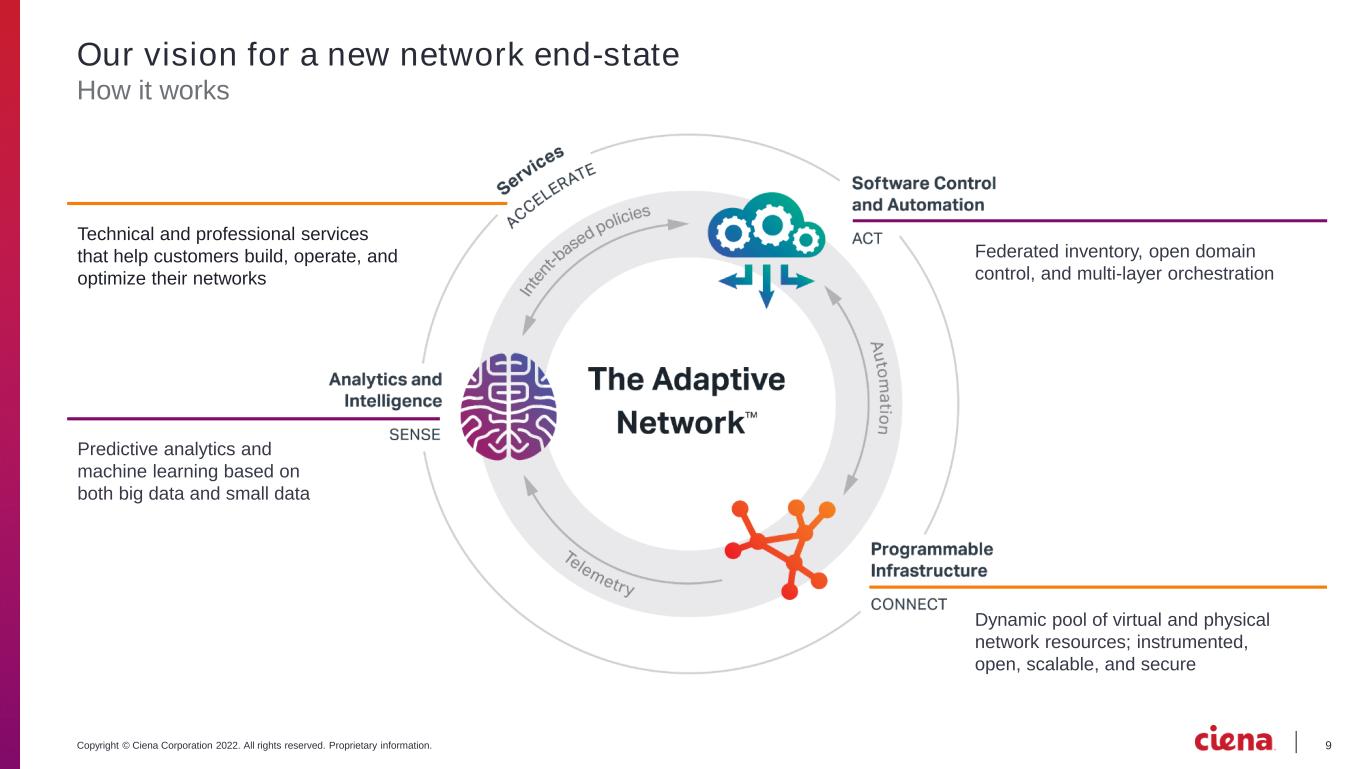

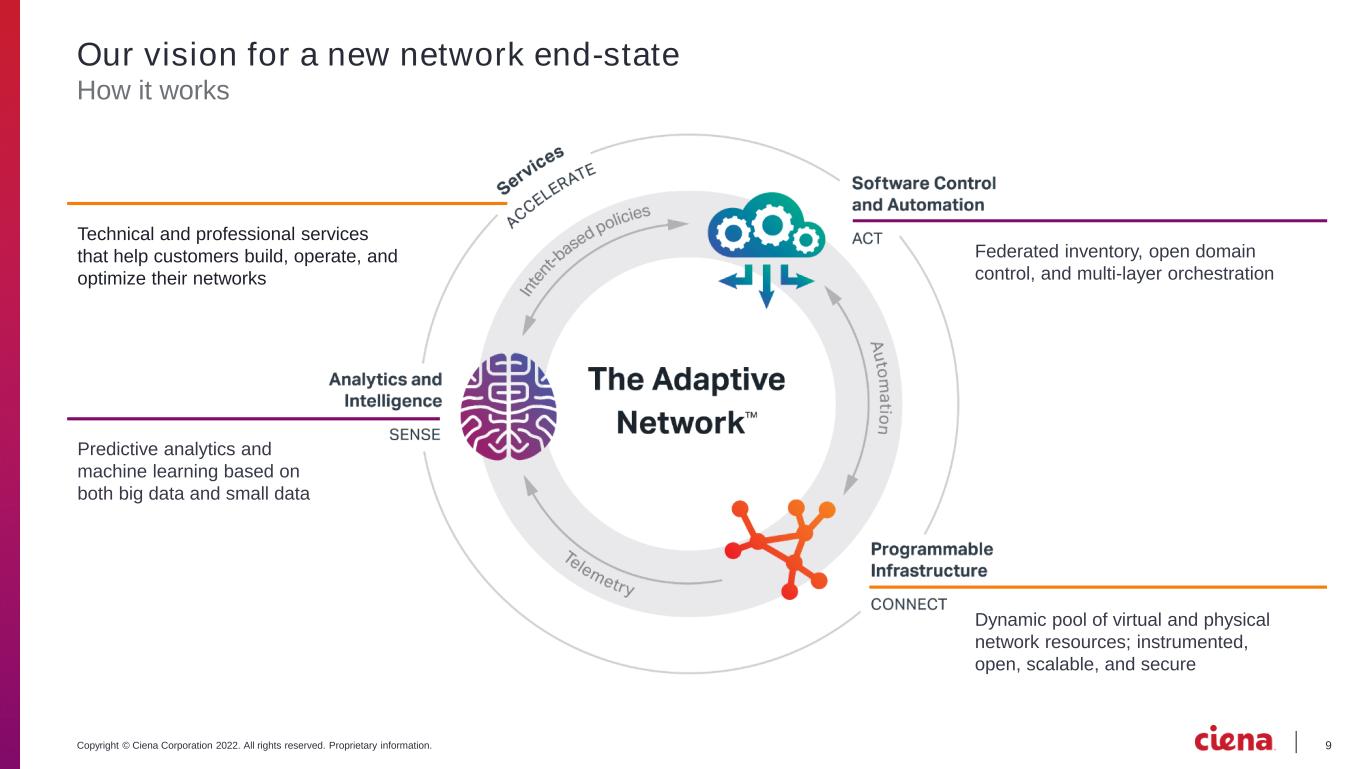

9Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Technical and professional services that help customers build, operate, and optimize their networks Predictive analytics and machine learning based on both big data and small data Dynamic pool of virtual and physical network resources; instrumented, open, scalable, and secure Federated inventory, open domain control, and multi-layer orchestration Our vision for a new network end-state How it works

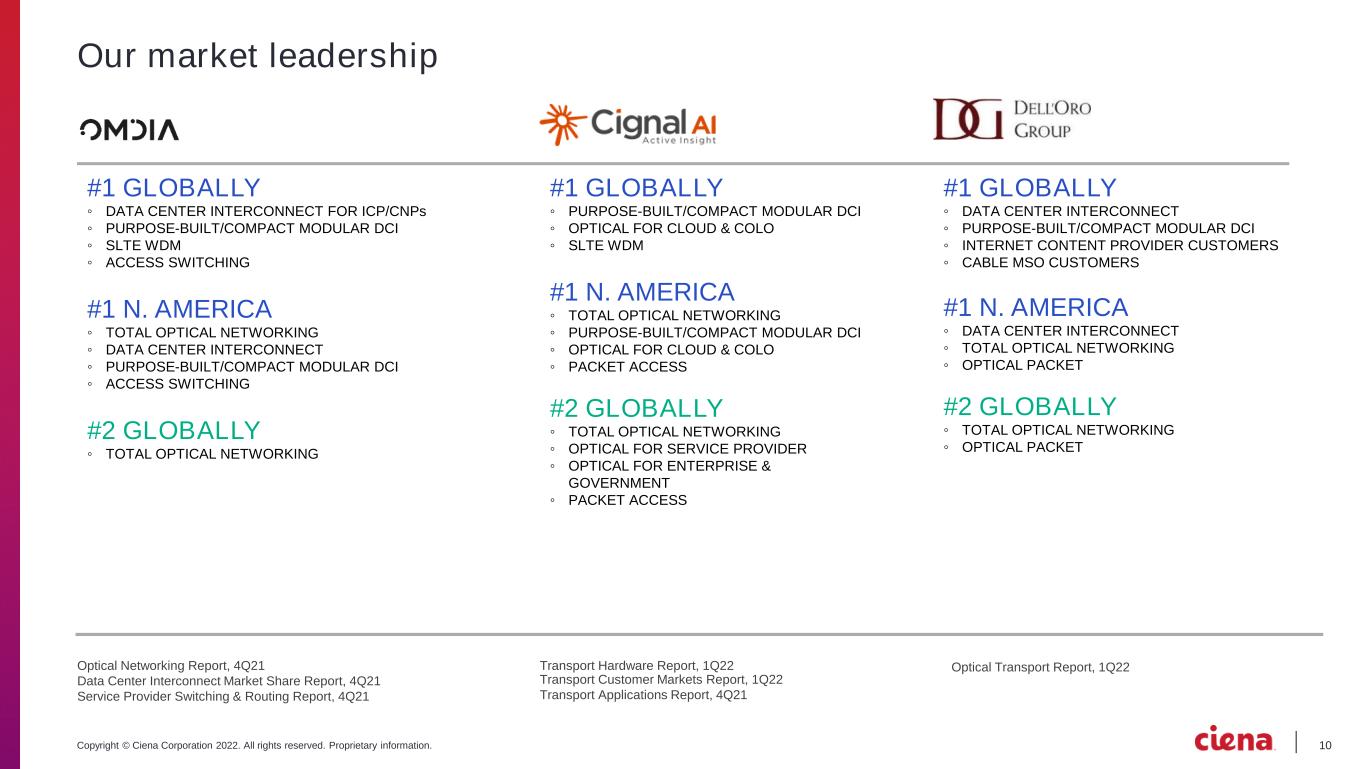

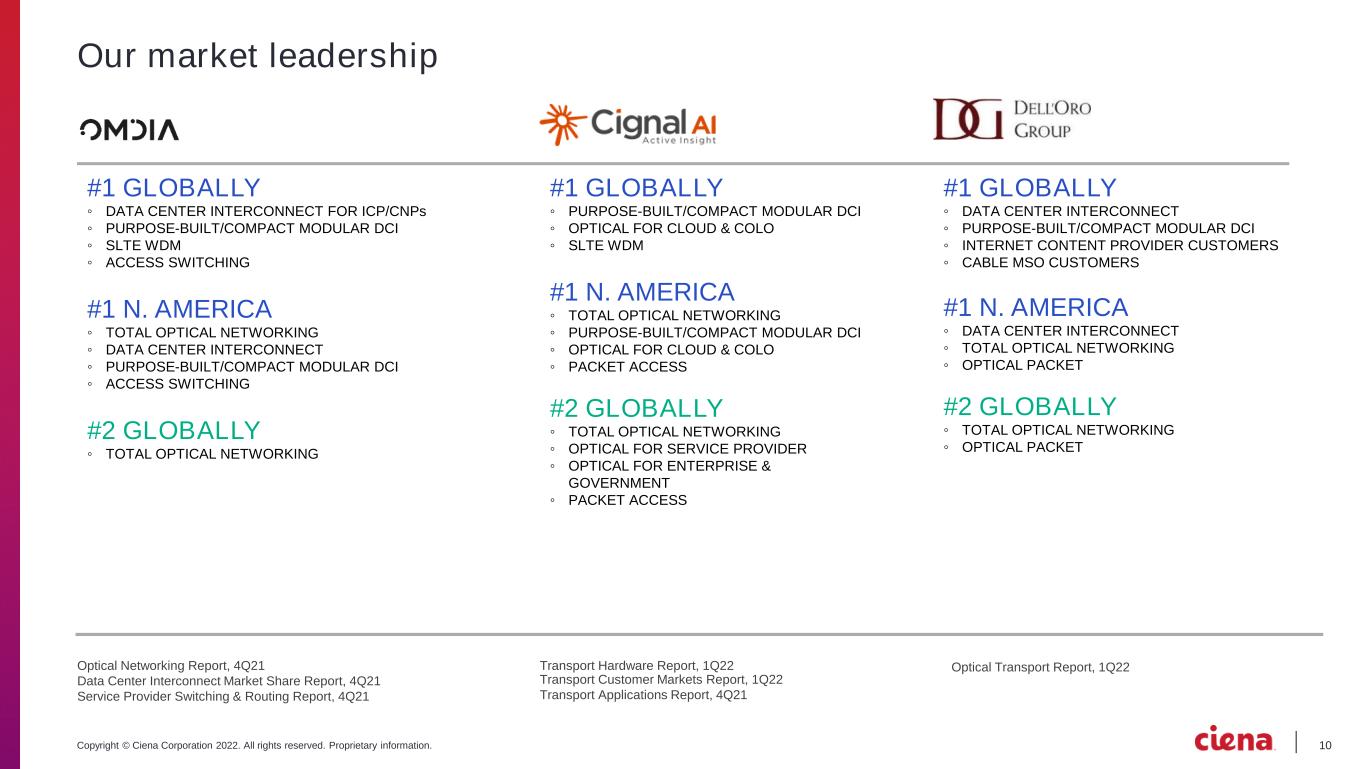

10Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Our market leadership Optical Transport Report, 1Q22Optical Networking Report, 4Q21 Data Center Interconnect Market Share Report, 4Q21 Service Provider Switching & Routing Report, 4Q21 Transport Hardware Report, 1Q22 Transport Customer Markets Report, 1Q22 Transport Applications Report, 4Q21 #1 GLOBALLY ◦ DATA CENTER INTERCONNECT ◦ PURPOSE-BUILT/COMPACT MODULAR DCI ◦ INTERNET CONTENT PROVIDER CUSTOMERS ◦ CABLE MSO CUSTOMERS #1 N. AMERICA ◦ DATA CENTER INTERCONNECT ◦ TOTAL OPTICAL NETWORKING ◦ OPTICAL PACKET #2 GLOBALLY ◦ TOTAL OPTICAL NETWORKING ◦ OPTICAL PACKET #1 GLOBALLY ◦ DATA CENTER INTERCONNECT FOR ICP/CNPs ◦ PURPOSE-BUILT/COMPACT MODULAR DCI ◦ SLTE WDM ◦ ACCESS SWITCHING #1 N. AMERICA ◦ TOTAL OPTICAL NETWORKING ◦ DATA CENTER INTERCONNECT ◦ PURPOSE-BUILT/COMPACT MODULAR DCI ◦ ACCESS SWITCHING #2 GLOBALLY ◦ TOTAL OPTICAL NETWORKING #1 GLOBALLY ◦ PURPOSE-BUILT/COMPACT MODULAR DCI ◦ OPTICAL FOR CLOUD & COLO ◦ SLTE WDM #1 N. AMERICA ◦ TOTAL OPTICAL NETWORKING ◦ PURPOSE-BUILT/COMPACT MODULAR DCI ◦ OPTICAL FOR CLOUD & COLO ◦ PACKET ACCESS #2 GLOBALLY ◦ TOTAL OPTICAL NETWORKING ◦ OPTICAL FOR SERVICE PROVIDER ◦ OPTICAL FOR ENTERPRISE & GOVERNMENT ◦ PACKET ACCESS

11Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Q2 FY 2022 results

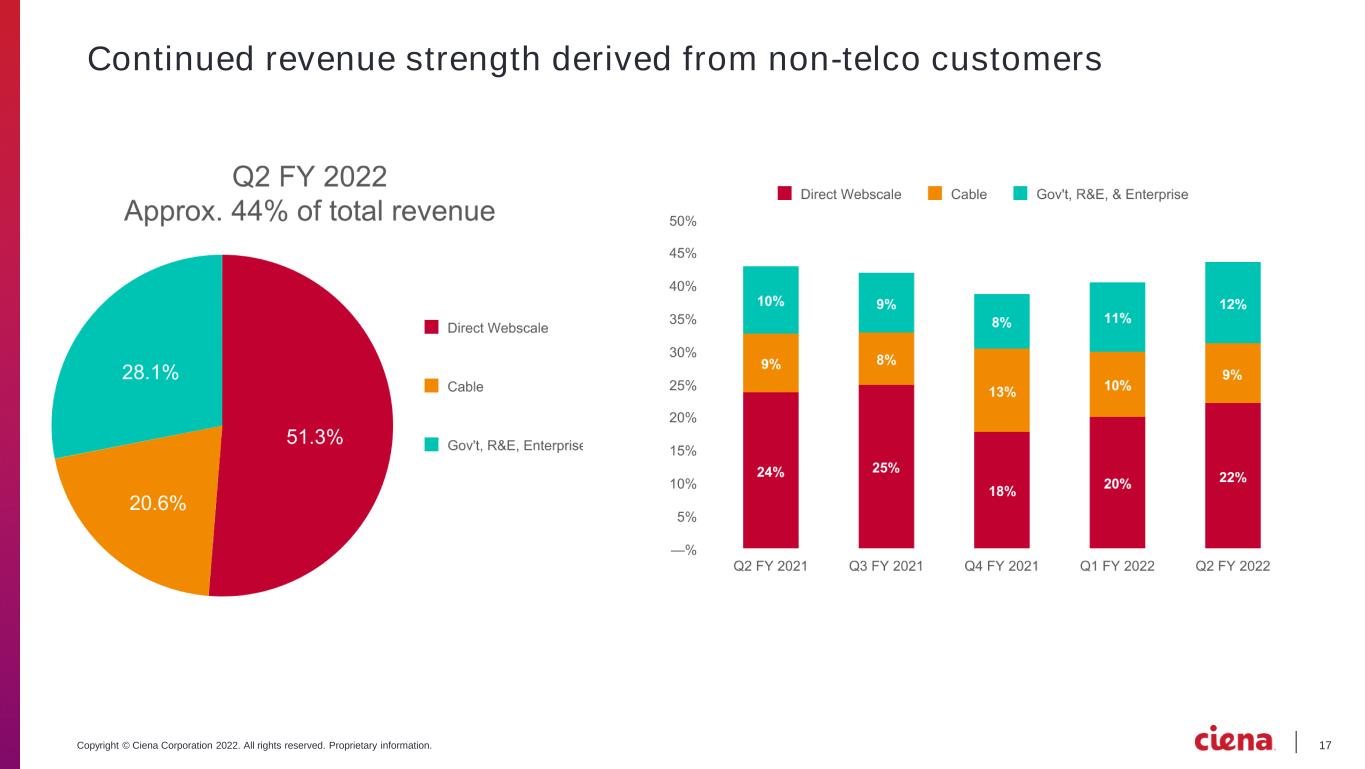

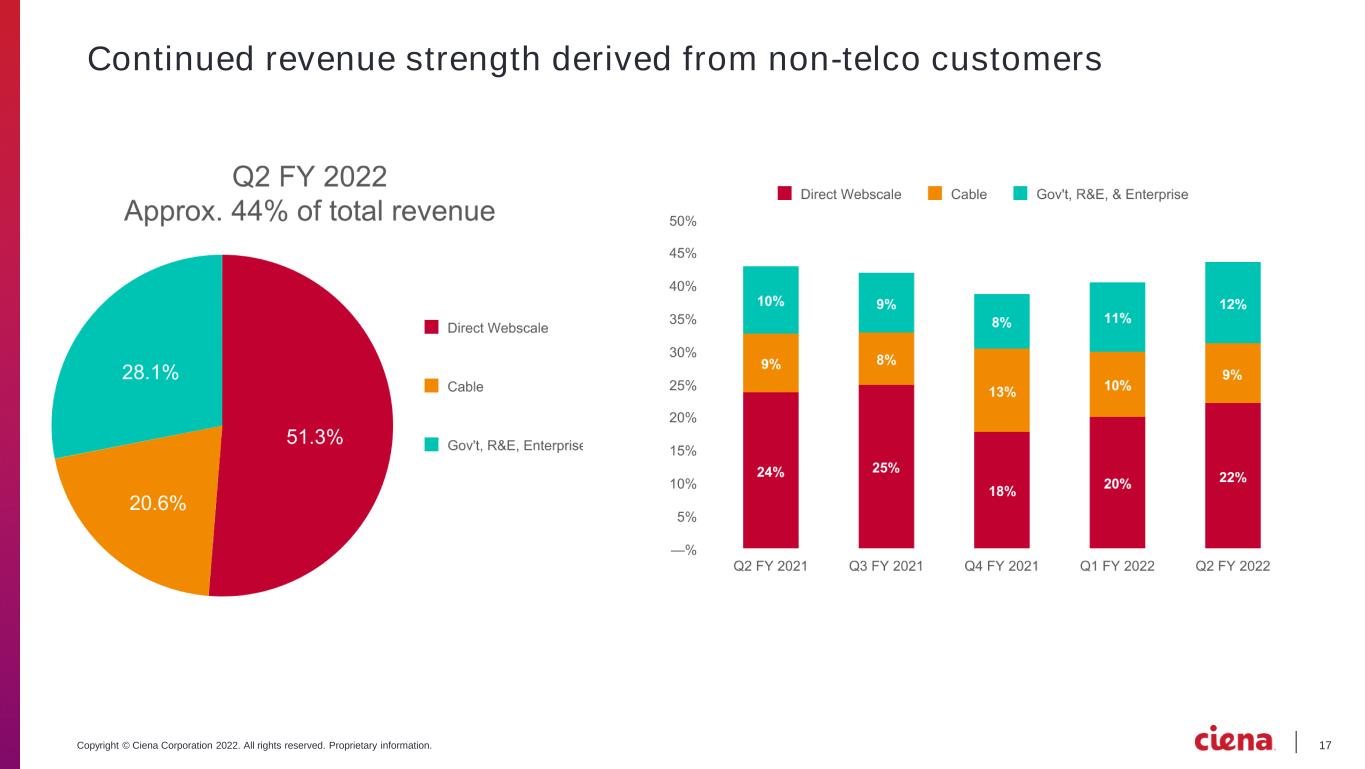

12Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Q2 FY 2022 key highlights ▪ Non-telco represented 44% of total revenue • Direct web-scale increased 7% YoY and represents 22% of total revenue • MSO increased 13% YoY and represents 9% of total revenue ▪ Routing and Switching revenue increased 72% YoY, reflecting strong contribution from the recently added Vyatta platform ▪ Platform Software and Services increased 22% YoY, representing 7% of total revenue ▪ GAAP R&D investment was approximately 17% of total revenue ▪ 737 100G+ total customers, which includes 17 new wins on WaveLogic Ai and 16 new wins on WaveLogic 5 Extreme ▪ Gaining business momentum with our Universal Aggregation and XGS-PON solution for residential and business services ▪ In our Routing and Switching Portfolio, we expanded our coherent routing capabilities with the introduction of the 8114 Coherent Aggregation Router ▪ Total shareholder return five year CAGR of 17%1 ▪ As part of our $1 billion stock repurchase program, we repurchased approximately 1.5 million shares2 during the quarter for $87 million 1 Based on closing share price between 5/19/2017 to 5/18/2022 2 Excludes the additional 0.9M shares of common stock in settlement of the ASR Agreement delivered on February 15, 2022 Achieving balanced growth Prioritizing long term shareholder value Driving the pace of innovation

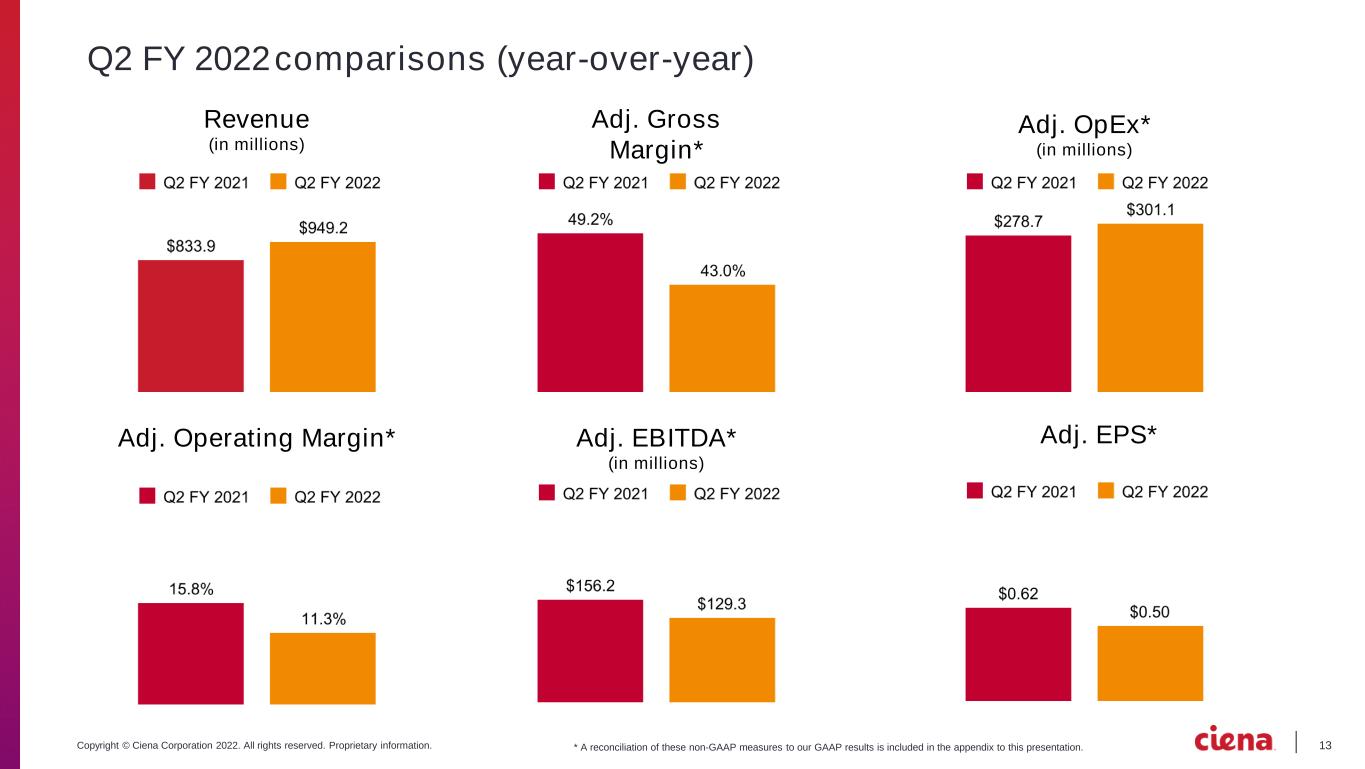

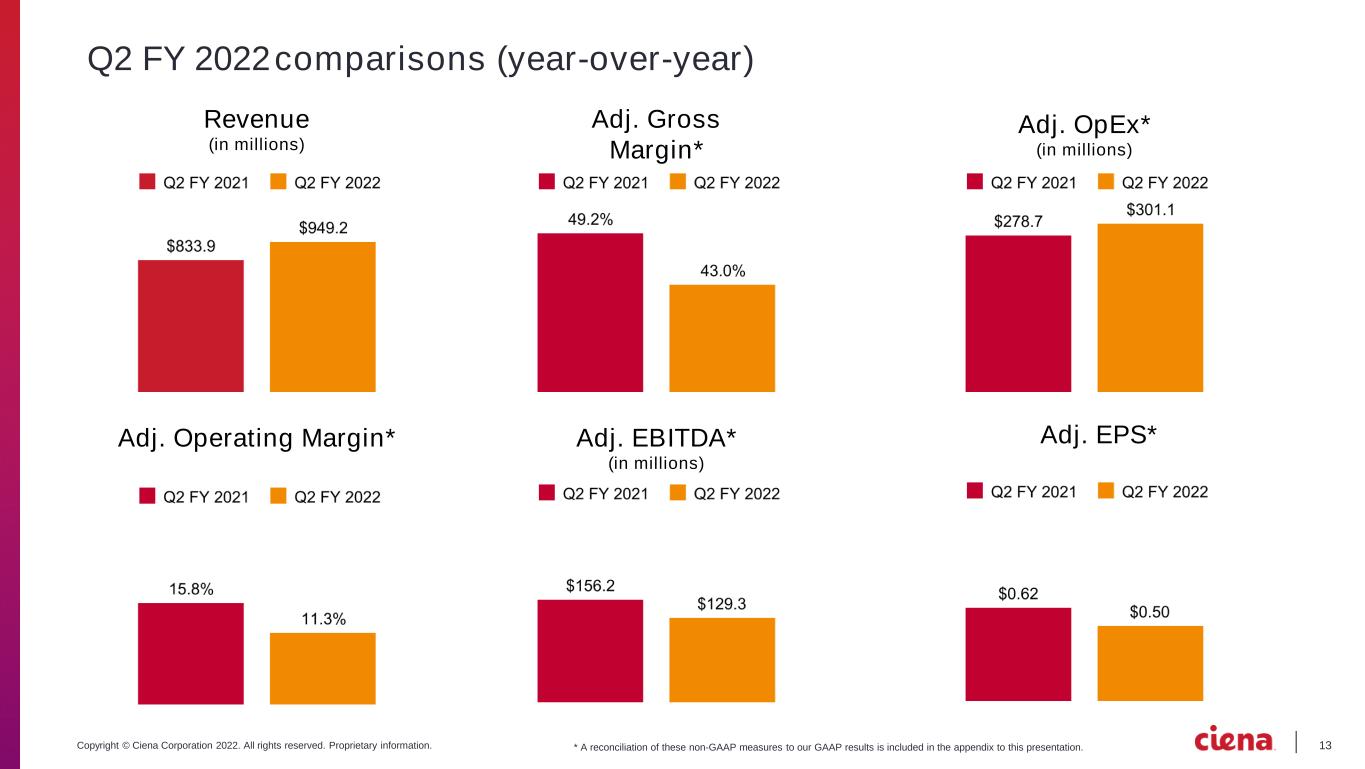

13Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Q2 FY 2022comparisons (year-over-year) * A reconciliation of these non-GAAP measures to our GAAP results is included in the appendix to this presentation. Revenue (in millions) Adj. Gross Margin* Adj. Operating Margin* Adj. OpEx* (in millions) Adj. EBITDA* (in millions) Adj. EPS*

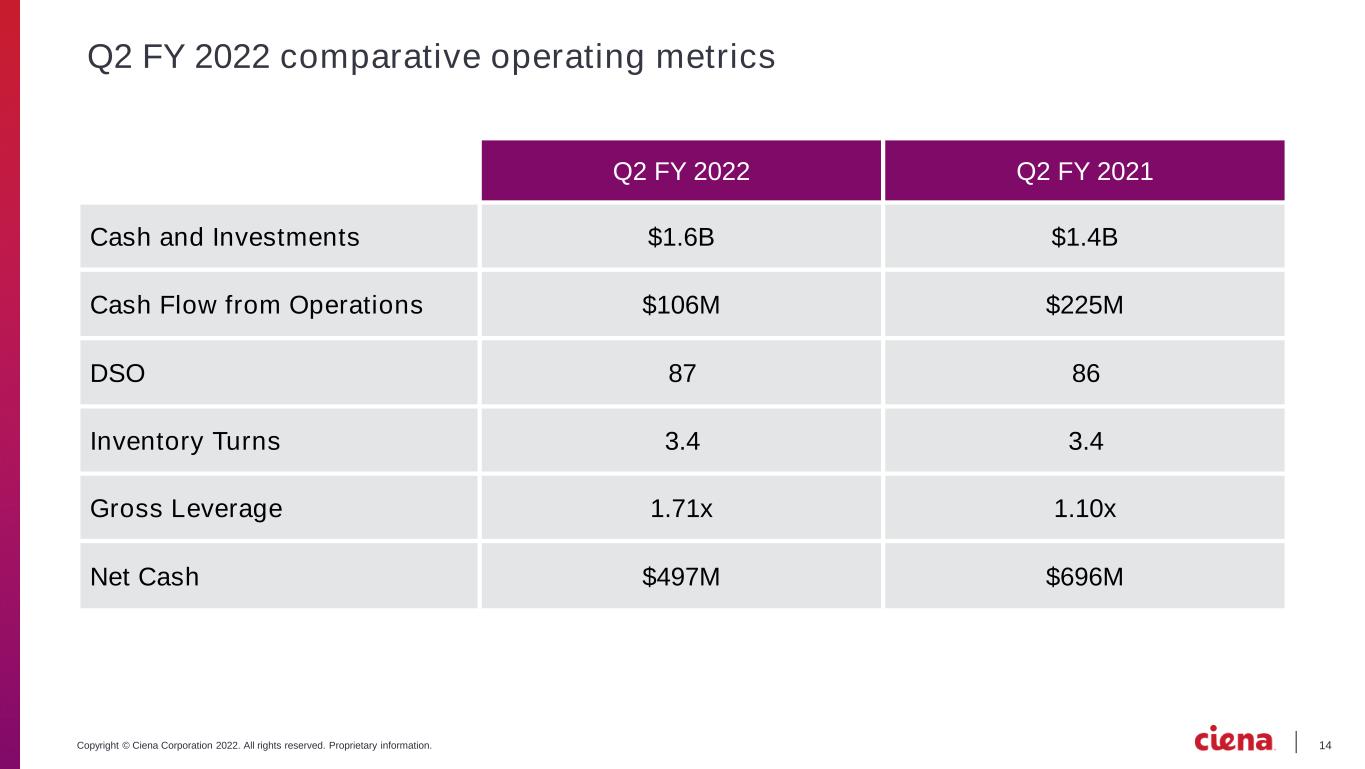

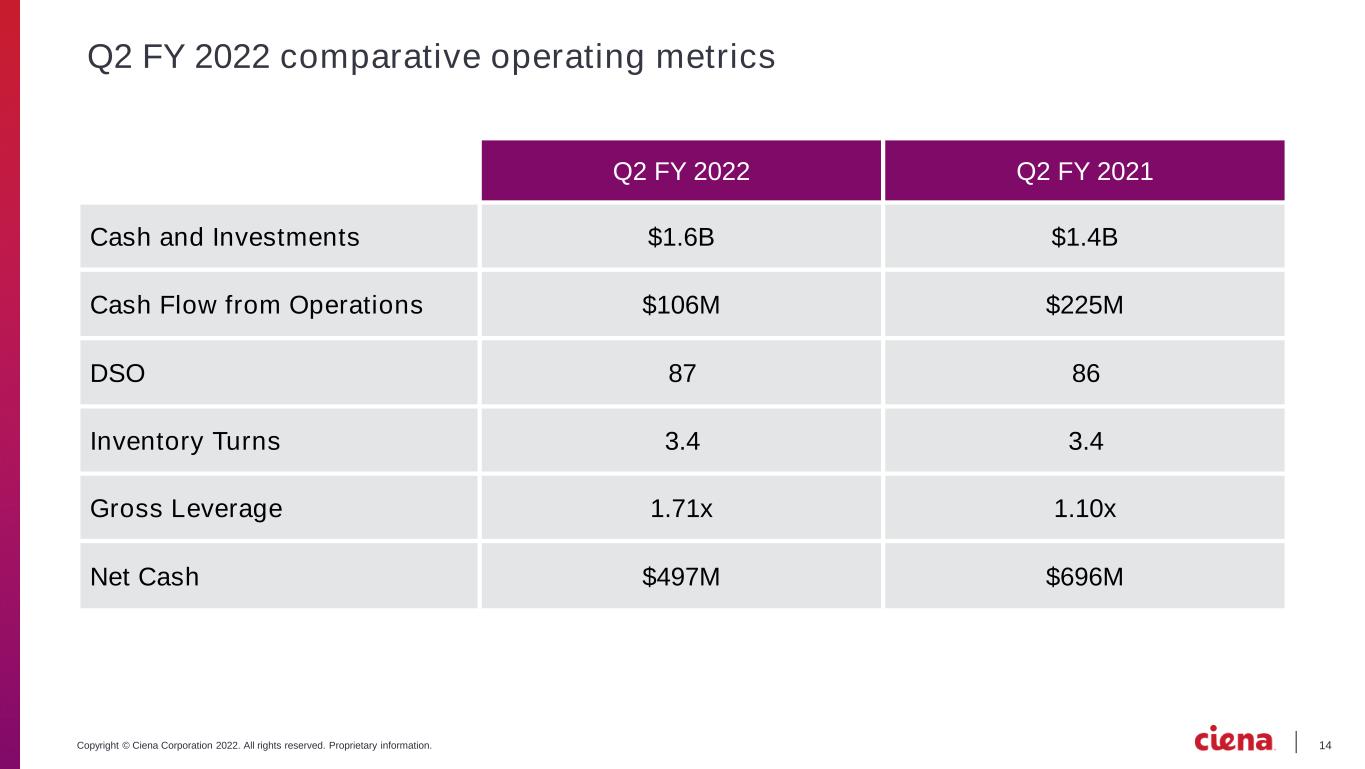

14Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Q2 FY 2022 comparative operating metrics Q2 FY 2022 Q2 FY 2021 Cash and Investments $1.6B $1.4B Cash Flow from Operations $106M $225M DSO 87 86 Inventory Turns 3.4 3.4 Gross Leverage 1.71x 1.10x Net Cash $497M $696M

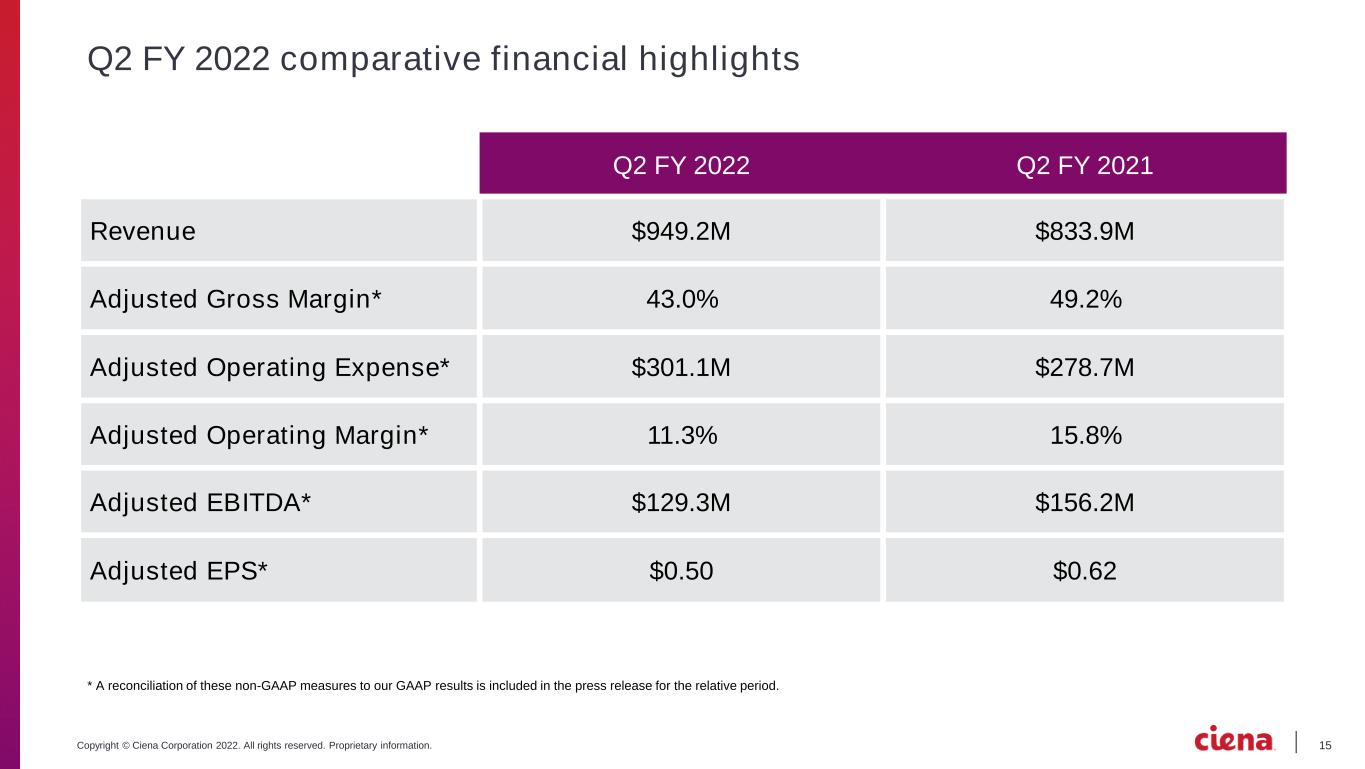

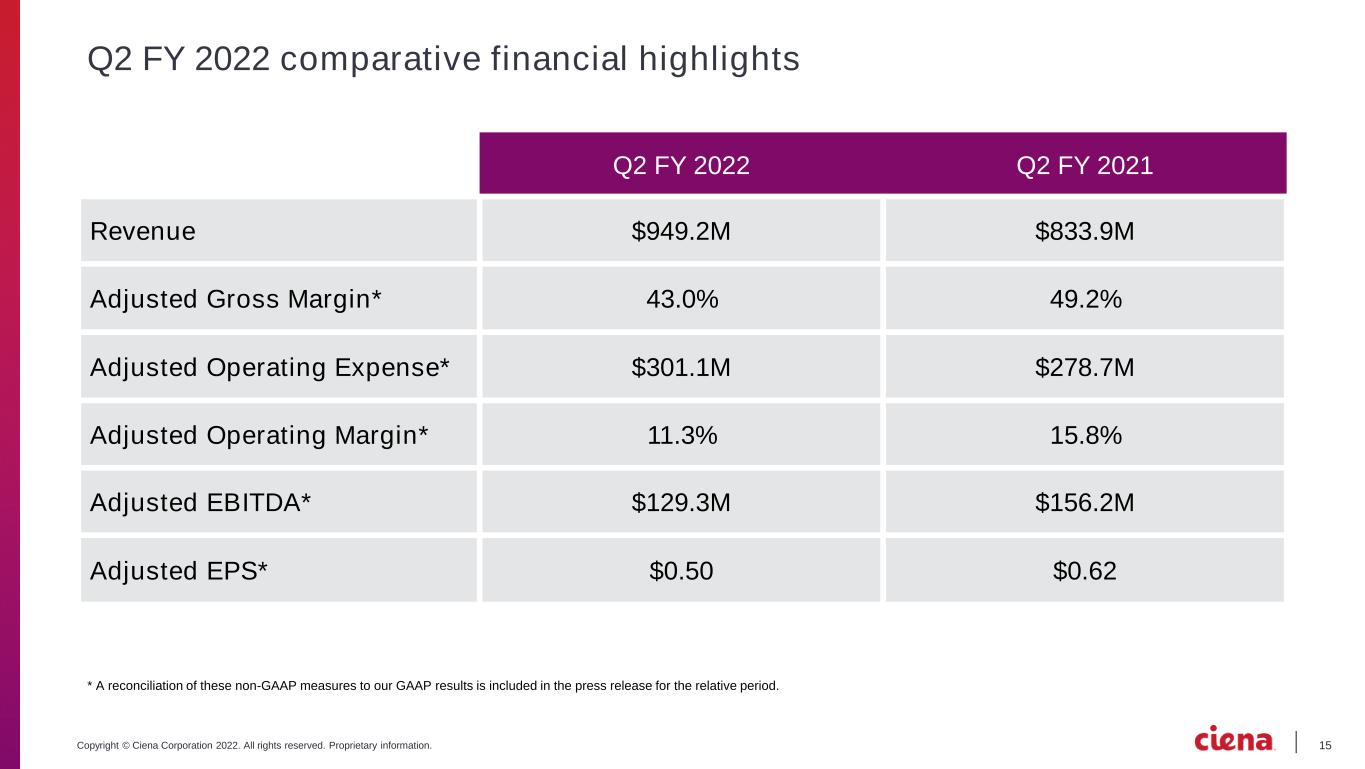

15Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Q2 FY 2022 comparative financial highlights * A reconciliation of these non-GAAP measures to our GAAP results is included in the press release for the relative period. Q2 FY 2022 Q2 FY 2021 Revenue $949.2M $833.9M Adjusted Gross Margin* 43.0% 49.2% Adjusted Operating Expense* $301.1M $278.7M Adjusted Operating Margin* 11.3% 15.8% Adjusted EBITDA* $129.3M $156.2M Adjusted EPS* $0.50 $0.62

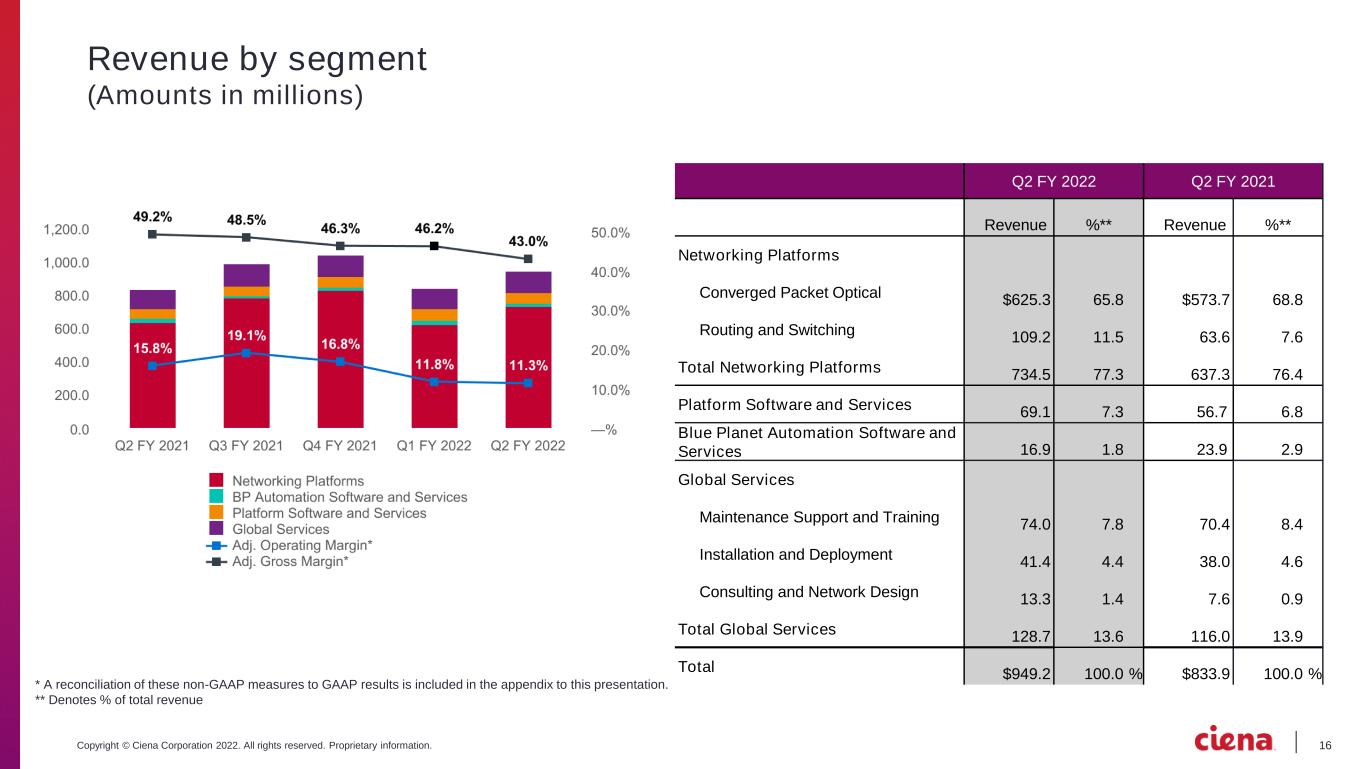

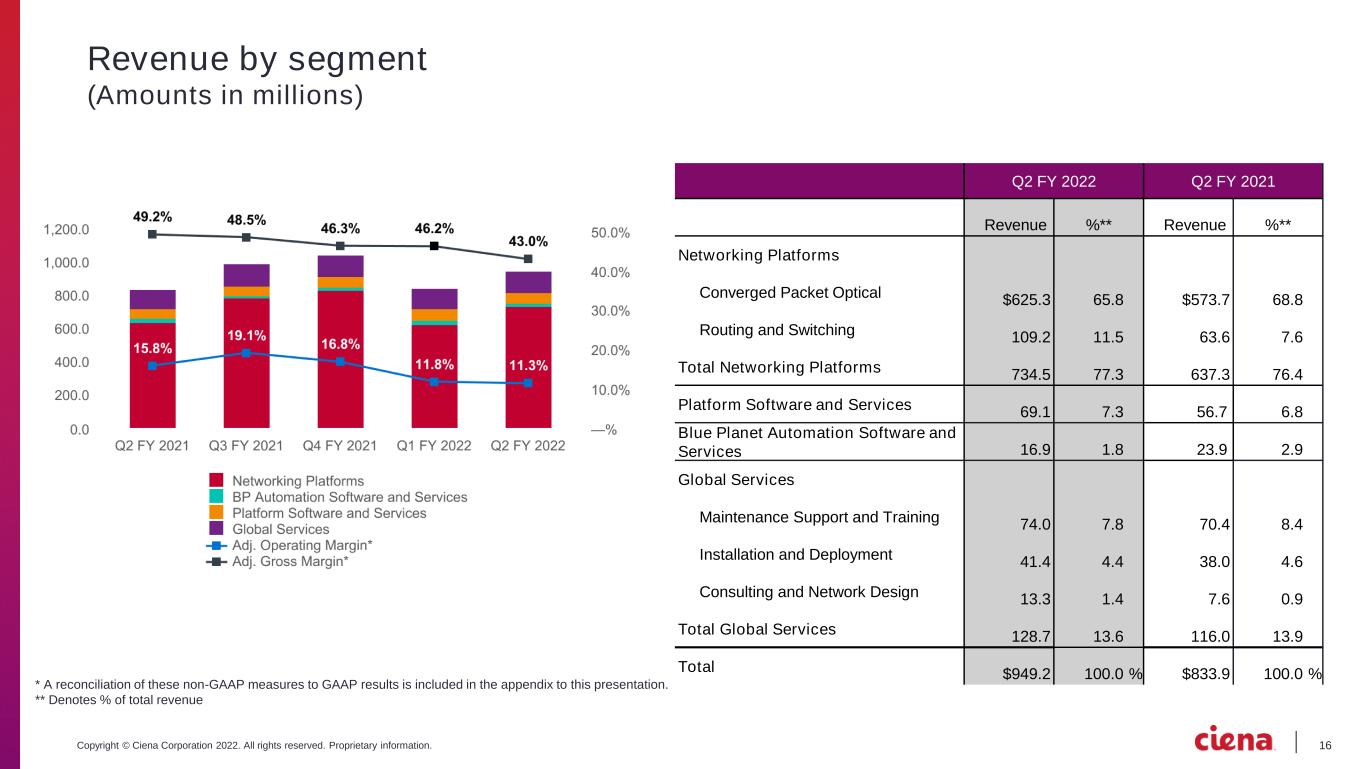

16Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Revenue by segment (Amounts in millions) Q2 FY 2022 Q2 FY 2021 Revenue %** Revenue %** Networking Platforms Converged Packet Optical $625.3 65.8 $573.7 68.8 Routing and Switching 109.2 11.5 63.6 7.6 Total Networking Platforms 734.5 77.3 637.3 76.4 Platform Software and Services 69.1 7.3 56.7 6.8 Blue Planet Automation Software and Services 16.9 1.8 23.9 2.9 Global Services Maintenance Support and Training 74.0 7.8 70.4 8.4 Installation and Deployment 41.4 4.4 38.0 4.6 Consulting and Network Design 13.3 1.4 7.6 0.9 Total Global Services 128.7 13.6 116.0 13.9 Total $949.2 100.0 % $833.9 100.0 % * A reconciliation of these non-GAAP measures to GAAP results is included in the appendix to this presentation. ** Denotes % of total revenue

17Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Continued revenue strength derived from non-telco customers

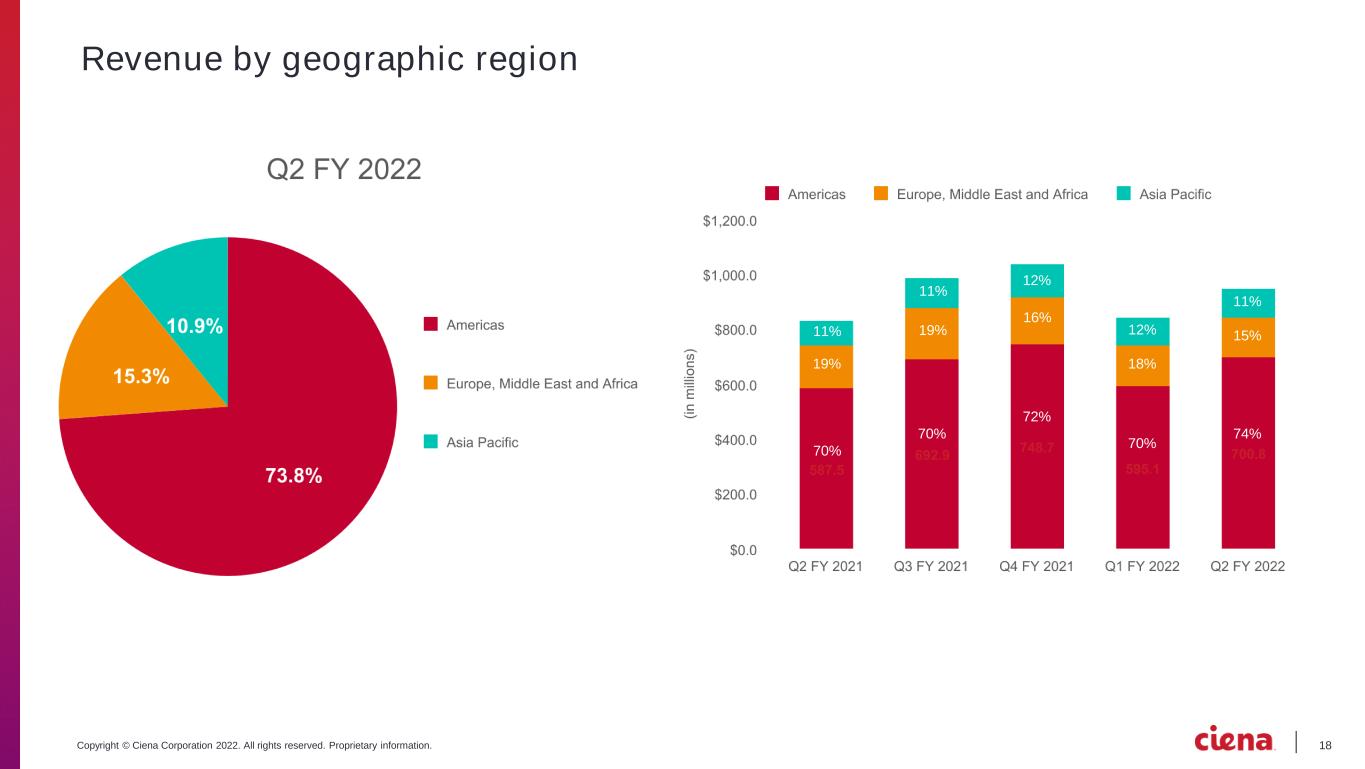

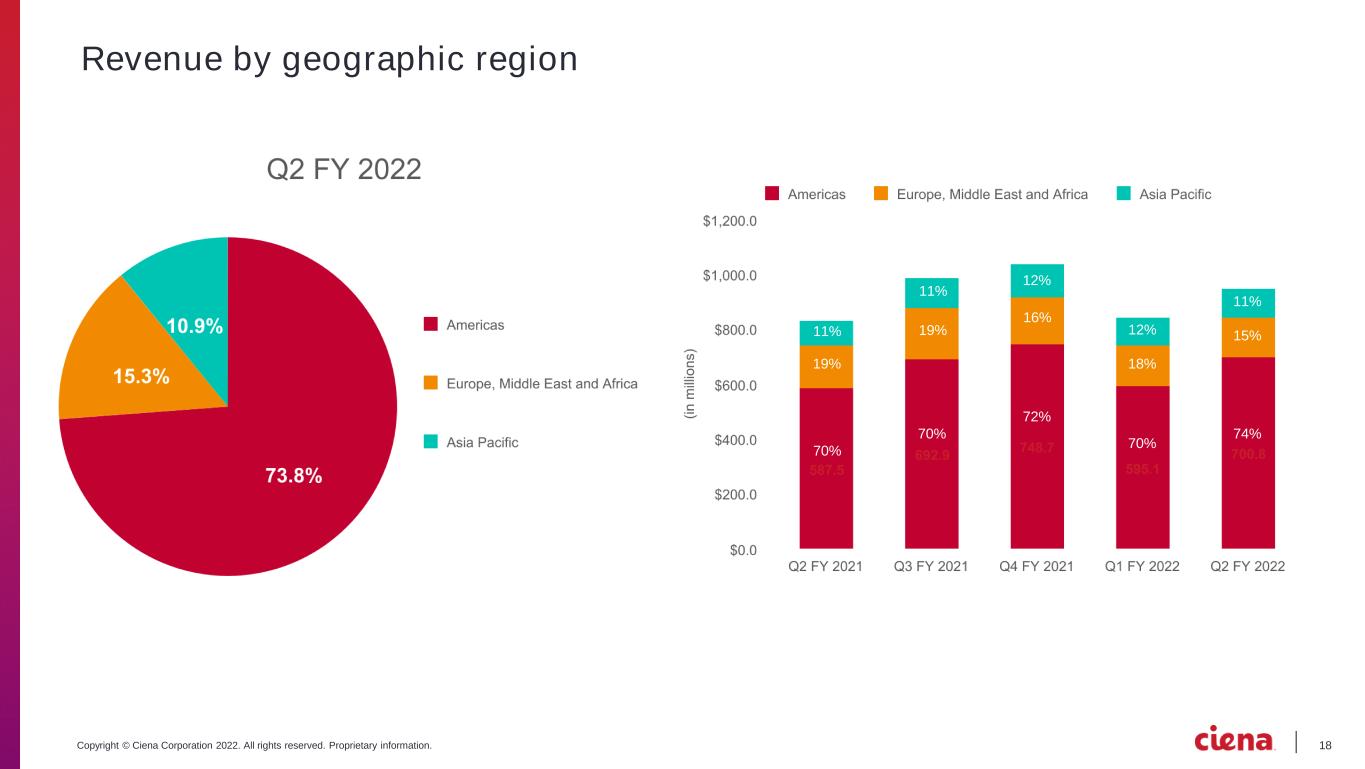

18Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Revenue by geographic region 11% 12% 11% 11% 19% 16% 15% 70% 70% 72% 70% 74% 19% 18% 12%

19Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Q2 FY 2022 appendix

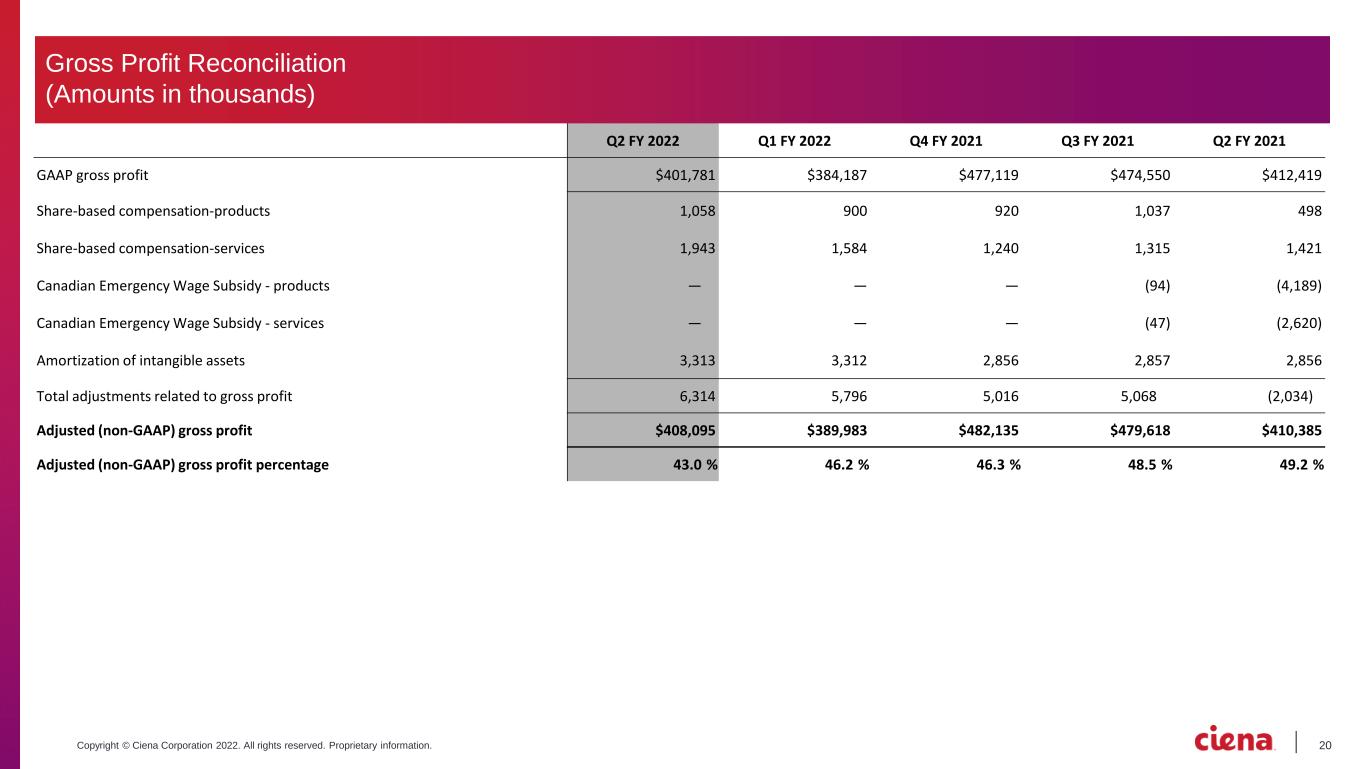

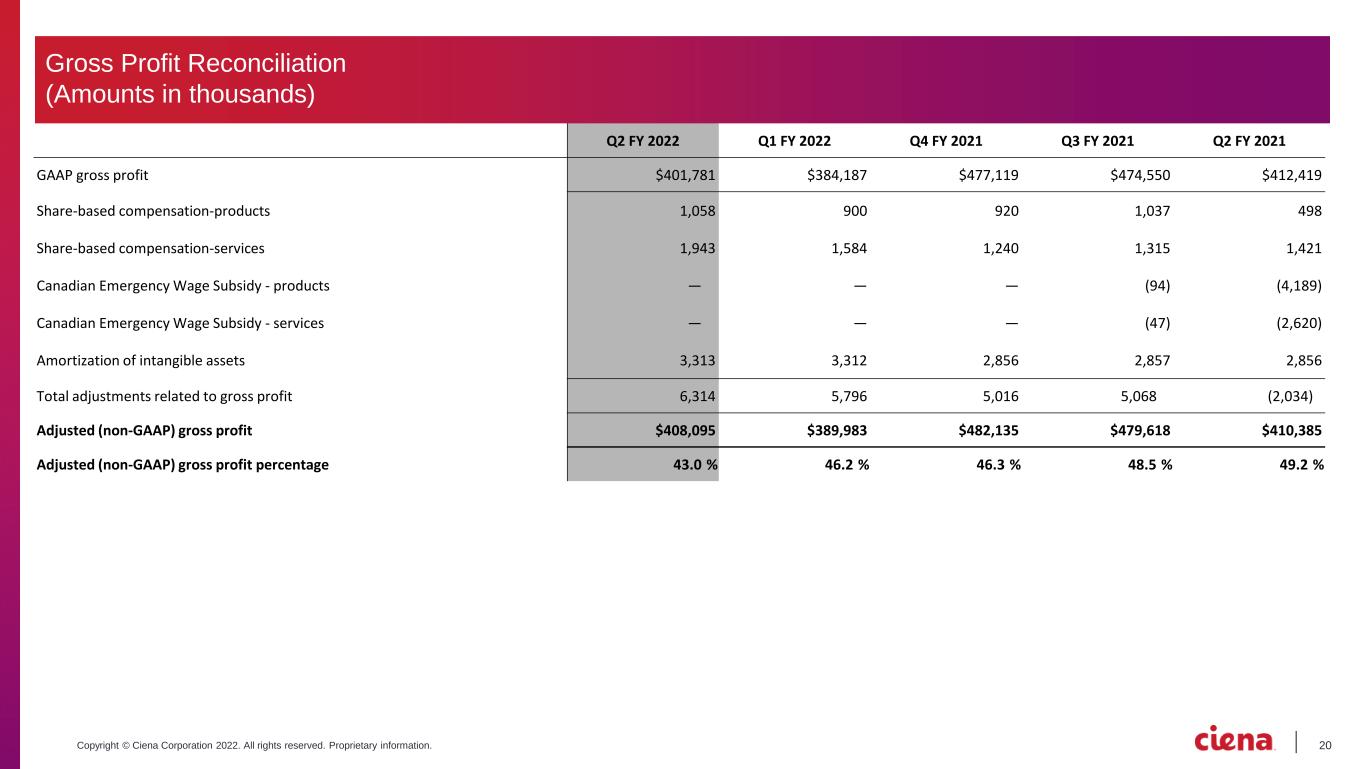

20Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Q2 FY 2022 Q1 FY 2022 Q4 FY 2021 Q3 FY 2021 Q2 FY 2021 GAAP gross profit $401,781 $384,187 $477,119 $474,550 $412,419 Share-based compensation-products 1,058 900 920 1,037 498 Share-based compensation-services 1,943 1,584 1,240 1,315 1,421 Canadian Emergency Wage Subsidy - products — — — (94) (4,189) Canadian Emergency Wage Subsidy - services — — — (47) (2,620) Amortization of intangible assets 3,313 3,312 2,856 2,857 2,856 Total adjustments related to gross profit 6,314 5,796 5,016 5,068 (2,034) Adjusted (non-GAAP) gross profit $408,095 $389,983 $482,135 $479,618 $410,385 Adjusted (non-GAAP) gross profit percentage 43.0 % 46.2 % 46.3 % 48.5 % 49.2 % Gross Profit Reconciliation (Amounts in thousands)

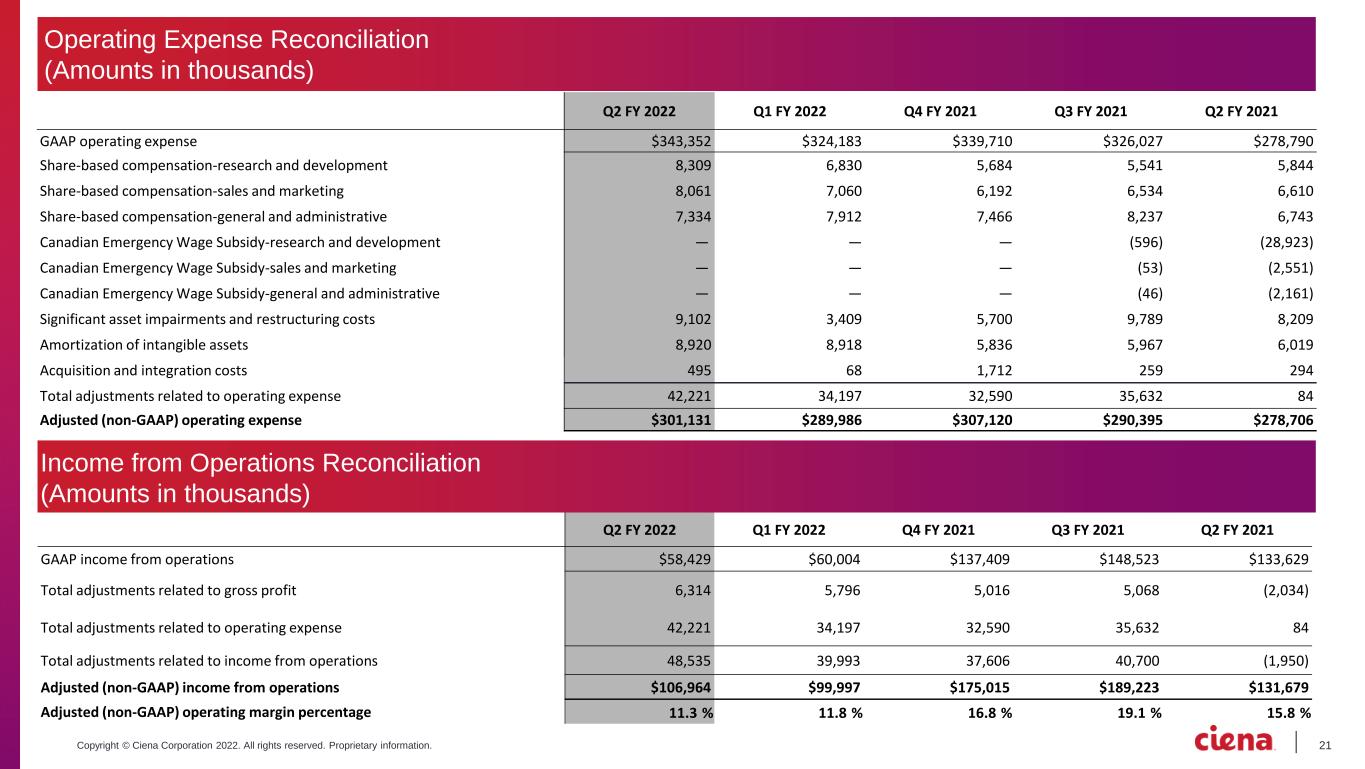

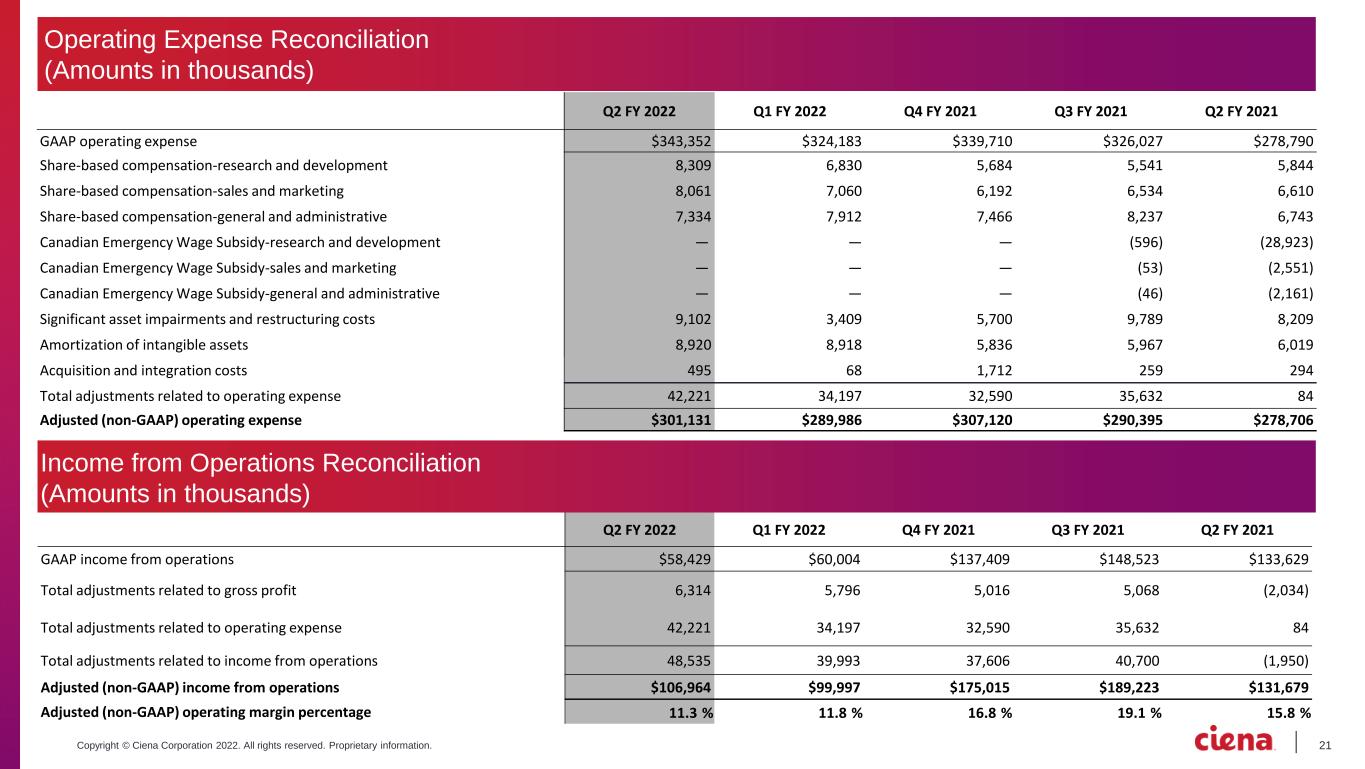

21Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Q2 FY 2022 Q1 FY 2022 Q4 FY 2021 Q3 FY 2021 Q2 FY 2021 GAAP operating expense $343,352 $324,183 $339,710 $326,027 $278,790 Share-based compensation-research and development 8,309 6,830 5,684 5,541 5,844 Share-based compensation-sales and marketing 8,061 7,060 6,192 6,534 6,610 Share-based compensation-general and administrative 7,334 7,912 7,466 8,237 6,743 Canadian Emergency Wage Subsidy-research and development — — — (596) (28,923) Canadian Emergency Wage Subsidy-sales and marketing — — — (53) (2,551) Canadian Emergency Wage Subsidy-general and administrative — — — (46) (2,161) Significant asset impairments and restructuring costs 9,102 3,409 5,700 9,789 8,209 Amortization of intangible assets 8,920 8,918 5,836 5,967 6,019 Acquisition and integration costs 495 68 1,712 259 294 Total adjustments related to operating expense 42,221 34,197 32,590 35,632 84 Adjusted (non-GAAP) operating expense $301,131 $289,986 $307,120 $290,395 $278,706 Q2 FY 2022 Q1 FY 2022 Q4 FY 2021 Q3 FY 2021 Q2 FY 2021 GAAP income from operations $58,429 $60,004 $137,409 $148,523 $133,629 Total adjustments related to gross profit 6,314 5,796 5,016 5,068 (2,034) Total adjustments related to operating expense 42,221 34,197 32,590 35,632 84 Total adjustments related to income from operations 48,535 39,993 37,606 40,700 (1,950) Adjusted (non-GAAP) income from operations $106,964 $99,997 $175,015 $189,223 $131,679 Adjusted (non-GAAP) operating margin percentage 11.3 % 11.8 % 16.8 % 19.1 % 15.8 % Operating Expense Reconciliation (Amounts in thousands) Income from Operations Reconciliation (Amounts in thousands)

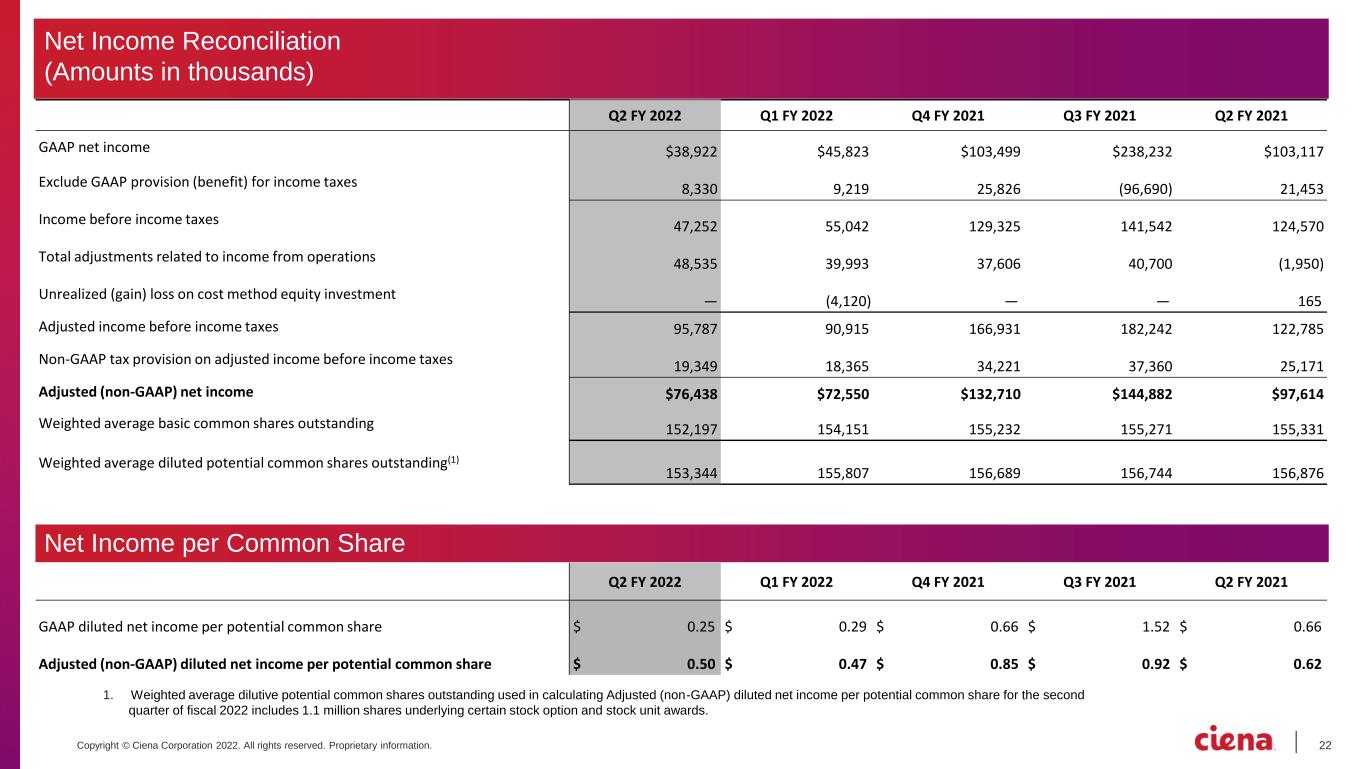

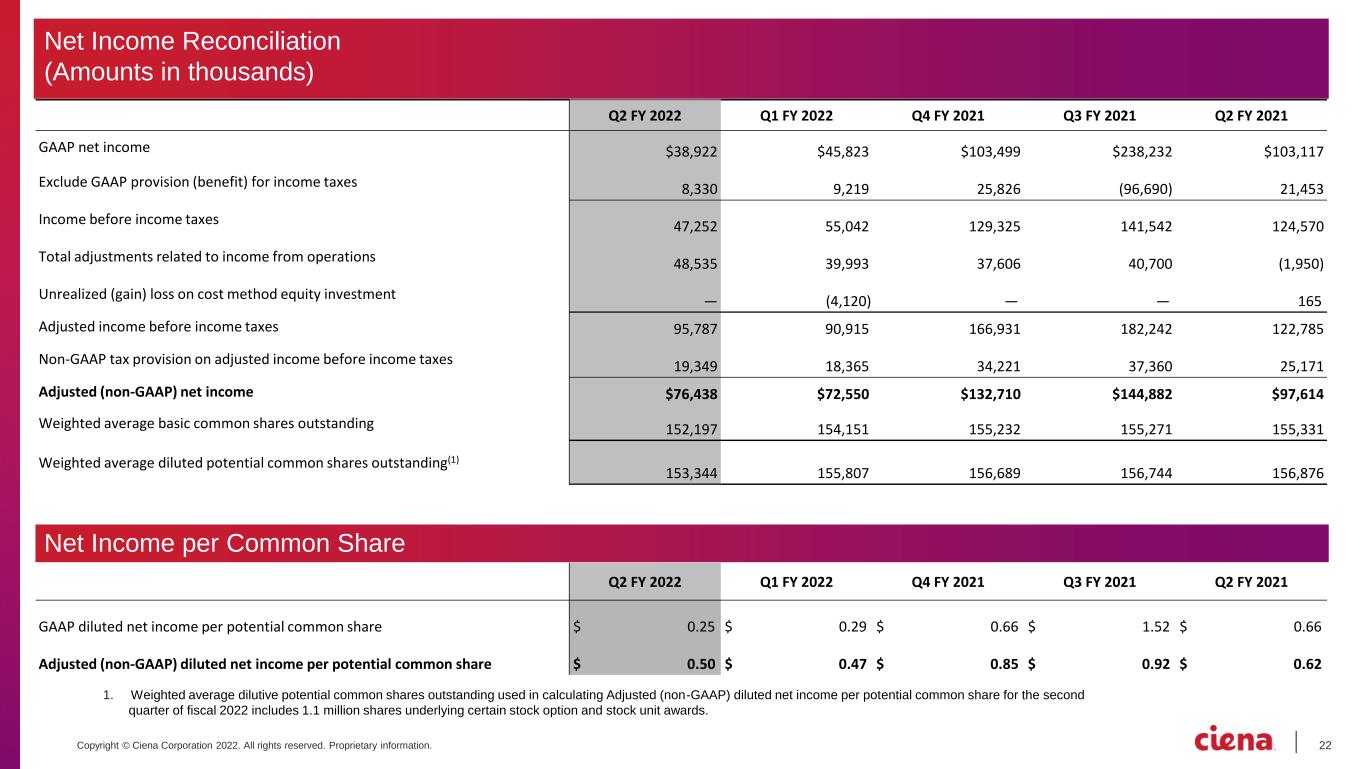

22Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Q2 FY 2022 Q1 FY 2022 Q4 FY 2021 Q3 FY 2021 Q2 FY 2021 GAAP net income $38,922 $45,823 $103,499 $238,232 $103,117 Exclude GAAP provision (benefit) for income taxes 8,330 9,219 25,826 (96,690) 21,453 Income before income taxes 47,252 55,042 129,325 141,542 124,570 Total adjustments related to income from operations 48,535 39,993 37,606 40,700 (1,950) Unrealized (gain) loss on cost method equity investment — (4,120) — — 165 Adjusted income before income taxes 95,787 90,915 166,931 182,242 122,785 Non-GAAP tax provision on adjusted income before income taxes 19,349 18,365 34,221 37,360 25,171 Adjusted (non-GAAP) net income $76,438 $72,550 $132,710 $144,882 $97,614 Weighted average basic common shares outstanding 152,197 154,151 155,232 155,271 155,331 Weighted average diluted potential common shares outstanding(1) 153,344 155,807 156,689 156,744 156,876 Q2 FY 2022 Q1 FY 2022 Q4 FY 2021 Q3 FY 2021 Q2 FY 2021 GAAP diluted net income per potential common share $ 0.25 $ 0.29 $ 0.66 $ 1.52 $ 0.66 Adjusted (non-GAAP) diluted net income per potential common share $ 0.50 $ 0.47 $ 0.85 $ 0.92 $ 0.62 1. Weighted average dilutive potential common shares outstanding used in calculating Adjusted (non-GAAP) diluted net income per potential common share for the second quarter of fiscal 2022 includes 1.1 million shares underlying certain stock option and stock unit awards. Net Income Reconciliation (Amounts in thousands) Net Income per Common Share

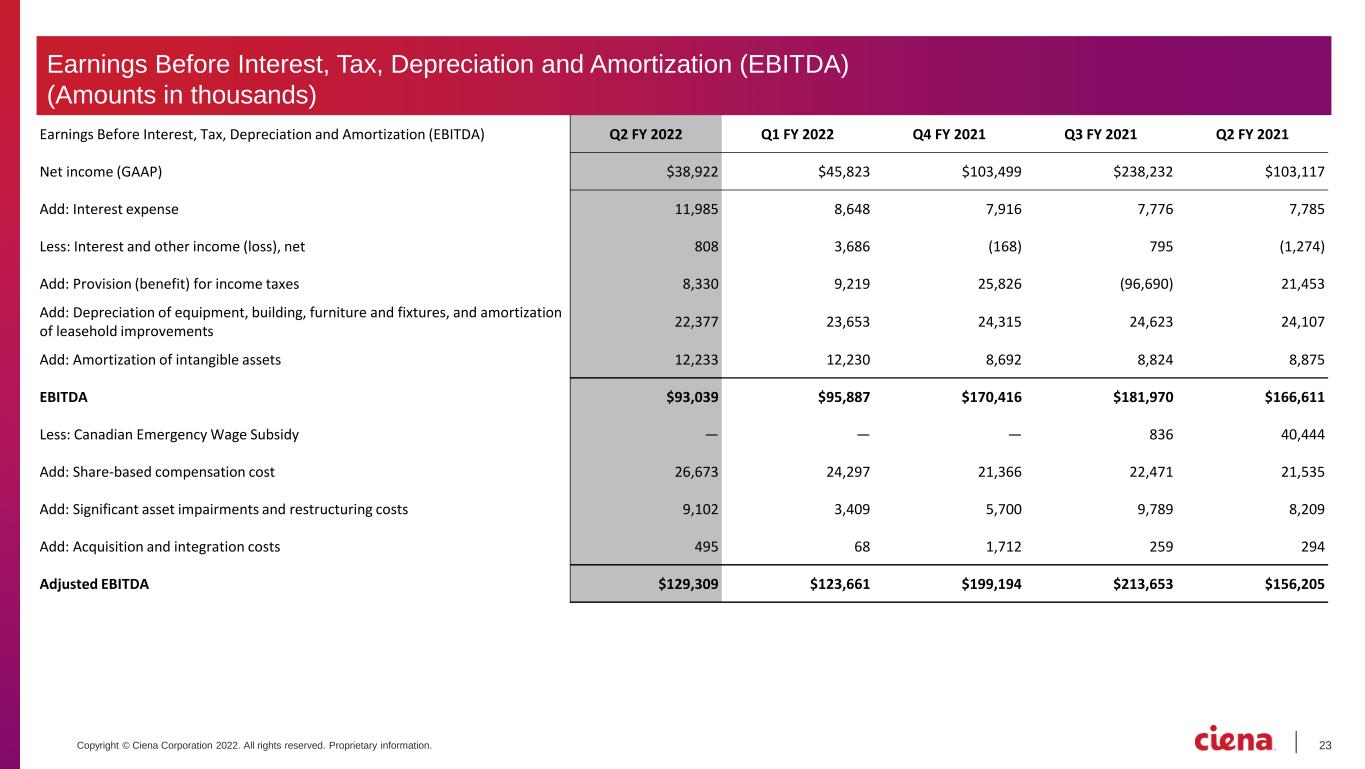

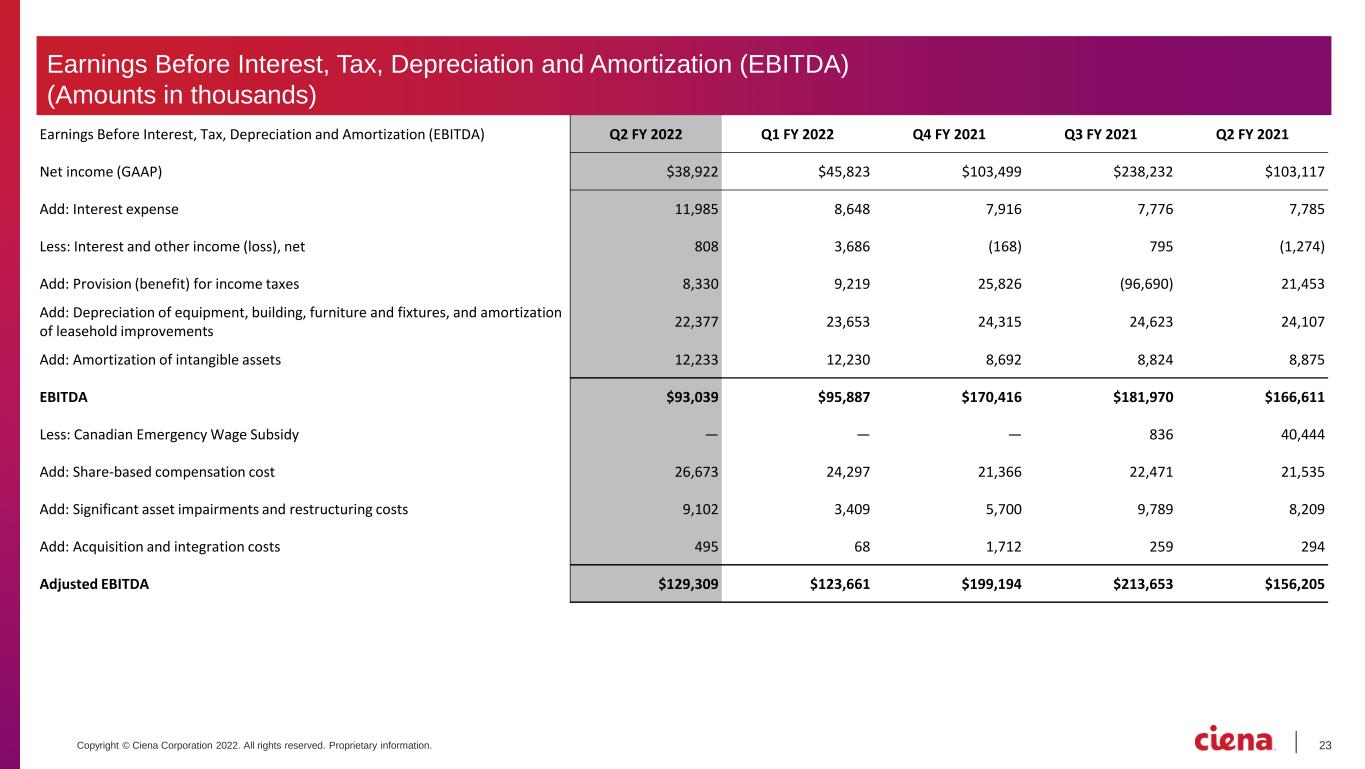

23Copyright © Ciena Corporation 2022. All rights reserved. Proprietary information. Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) Q2 FY 2022 Q1 FY 2022 Q4 FY 2021 Q3 FY 2021 Q2 FY 2021 Net income (GAAP) $38,922 $45,823 $103,499 $238,232 $103,117 Add: Interest expense 11,985 8,648 7,916 7,776 7,785 Less: Interest and other income (loss), net 808 3,686 (168) 795 (1,274) Add: Provision (benefit) for income taxes 8,330 9,219 25,826 (96,690) 21,453 Add: Depreciation of equipment, building, furniture and fixtures, and amortization of leasehold improvements 22,377 23,653 24,315 24,623 24,107 Add: Amortization of intangible assets 12,233 12,230 8,692 8,824 8,875 EBITDA $93,039 $95,887 $170,416 $181,970 $166,611 Less: Canadian Emergency Wage Subsidy — — — 836 40,444 Add: Share-based compensation cost 26,673 24,297 21,366 22,471 21,535 Add: Significant asset impairments and restructuring costs 9,102 3,409 5,700 9,789 8,209 Add: Acquisition and integration costs 495 68 1,712 259 294 Adjusted EBITDA $129,309 $123,661 $199,194 $213,653 $156,205 Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) (Amounts in thousands)