© Ciena Corporation 2024. All rights reserved. Proprietary Information. Ciena Corporation Fiscal Q3 2024 Earnings Presentation Period ended July 27, 2024 September 4, 2024

© Ciena Corporation 2024. All rights reserved. Proprietary Information.2 Forward-looking statements and non-GAAP measures You are encouraged to review the Investors section of our website, where we routinely post press releases, Securities and Exchange Commission ("SEC") filings, recent news, financial results, supplemental financial information, and other announcements. From time to time we exclusively post material information to this website along with other disclosure channels that we use. This press release contains certain forward-looking statements that involve risks and uncertainties. These statements are based on current expectations, forecasts, assumptions and other information available to the Company as of the date hereof. Forward-looking statements include statements regarding Ciena's expectations, beliefs, intentions or strategies regarding the future and can be identified by forward-looking words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "should," "will," and "would" or similar words. Ciena's actual results, performance or events may differ materially from these forward-looking statements made or implied due to a number of risks and uncertainties relating to Ciena's business, including: the effect of broader economic and market conditions on our customers, their spending and their businesses and markets; our ability to execute our business and growth strategies; the impact of macroeconomic conditions and global supply chain constraints or disruptions including increased supply costs and lead times; the impact of the introduction of new technologies by us or our competitors; seasonality and the timing and size of customer orders, their delivery dates and our ability to recognize revenue relating to such sales; the level of competitive pressure we encounter; the product, customer and geographic mix of sales within the period; changes in foreign currency exchange rates; factors beyond our control such as natural disasters, climate change, acts of war or terrorism, geopolitical tensions or events, including but not limited to the ongoing conflicts between Ukraine and Russia, and Israel and Hamas, and public health emergencies or epidemics, including the COVID-19 pandemic; changes in tax or trade regulations, including the imposition of tariffs, duties or efforts to withdraw from or materially modify international trade agreements; cyberattacks, data breaches or other security incidents involving our enterprise network environment or our products; regulatory changes, litigation involving our intellectual property or government investigations; and the other risk factors disclosed in Ciena’s periodic reports filed with the Securities and Exchange Commission (SEC) including its Annual Report on Form 10-K filed with the SEC on December 15, 2023 and included in its Quarterly Report on Form 10-Q for the third quarter of fiscal 2024 to be filed with the SEC. All information, statements, and projections in this presentation and the related earnings call speak only as of the date of this presentation and related earnings call. Ciena assumes no obligation to update any forward-looking or other information included in this presentation or related earnings calls, whether as a result of new information, future events or otherwise. In addition, this presentation includes historical, and may include prospective, non-GAAP measures of Ciena’s gross margin, operating expense, operating margin, EBITDA, and net income per share. These measures are not intended to be a substitute for financial information presented in accordance with GAAP. A reconciliation of non-GAAP measures used in this presentation to Ciena’s GAAP results for the relevant period can be found in the Appendix to this presentation. Additional information can also be found in our press release filed this morning and in our reports on Form 10-Q and Form 10K filed with the Securities and Exchange Commission.

© Ciena Corporation 2024. All rights reserved. Proprietary Information.3 Table of Contents 1. Overview & Ciena's portfolio 2. Industry context & addressable market expansion 3. Fiscal Q3 2024 financial performance 4. Appendix

© Ciena Corporation 2024. All rights reserved. Proprietary Information. Overview & Ciena's portfolio

© Ciena Corporation 2024. All rights reserved. Proprietary Information.5 Ciena is an industry-leading global networking systems, services, and software company

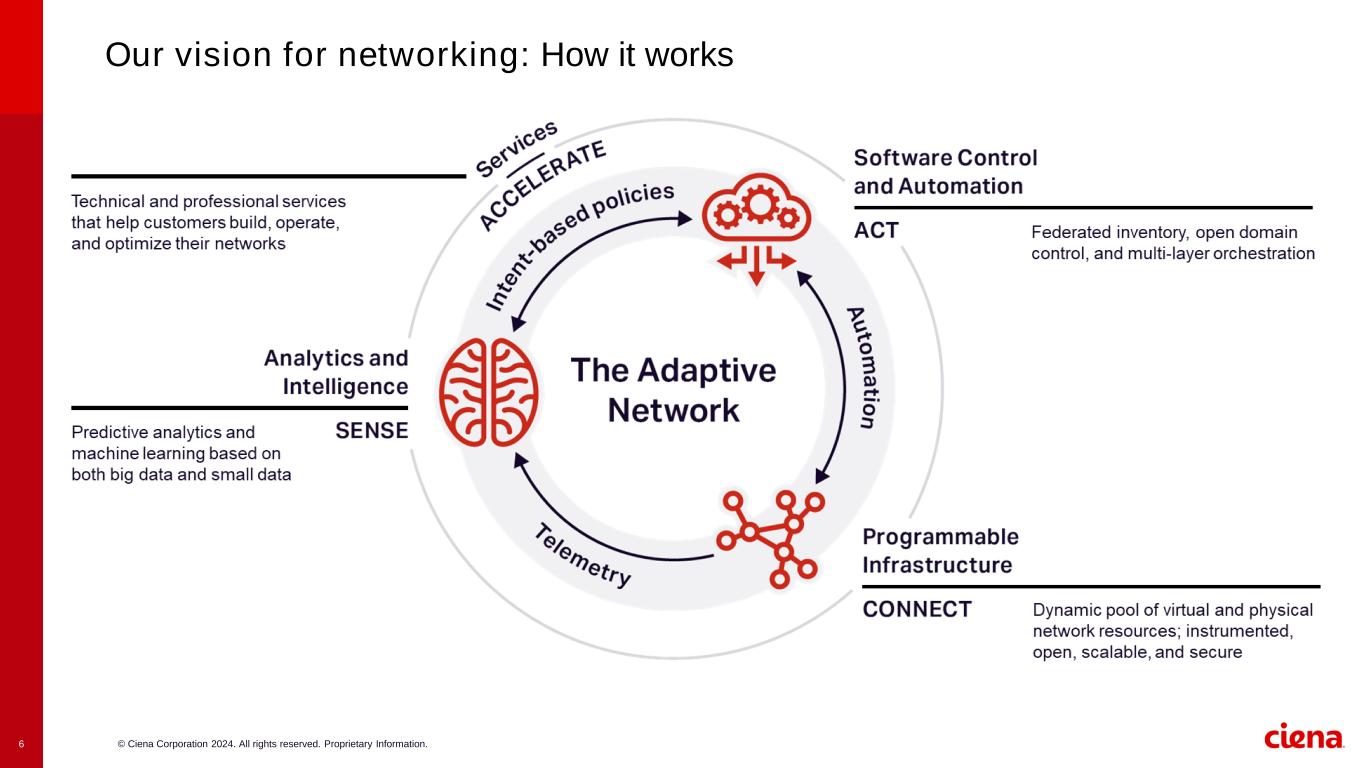

© Ciena Corporation 2024. All rights reserved. Proprietary Information.6 Our vision for networking: How it works

© Ciena Corporation 2024. All rights reserved. Proprietary Information. Industry context & addressable market expansion

© Ciena Corporation 2024. All rights reserved. Proprietary Information.8 Increasing bandwidth consumption as a driver of network expansion

© Ciena Corporation 2024. All rights reserved. Proprietary Information.9 Our strategy leverages our Optical technology to create expanded addressable market opportunities

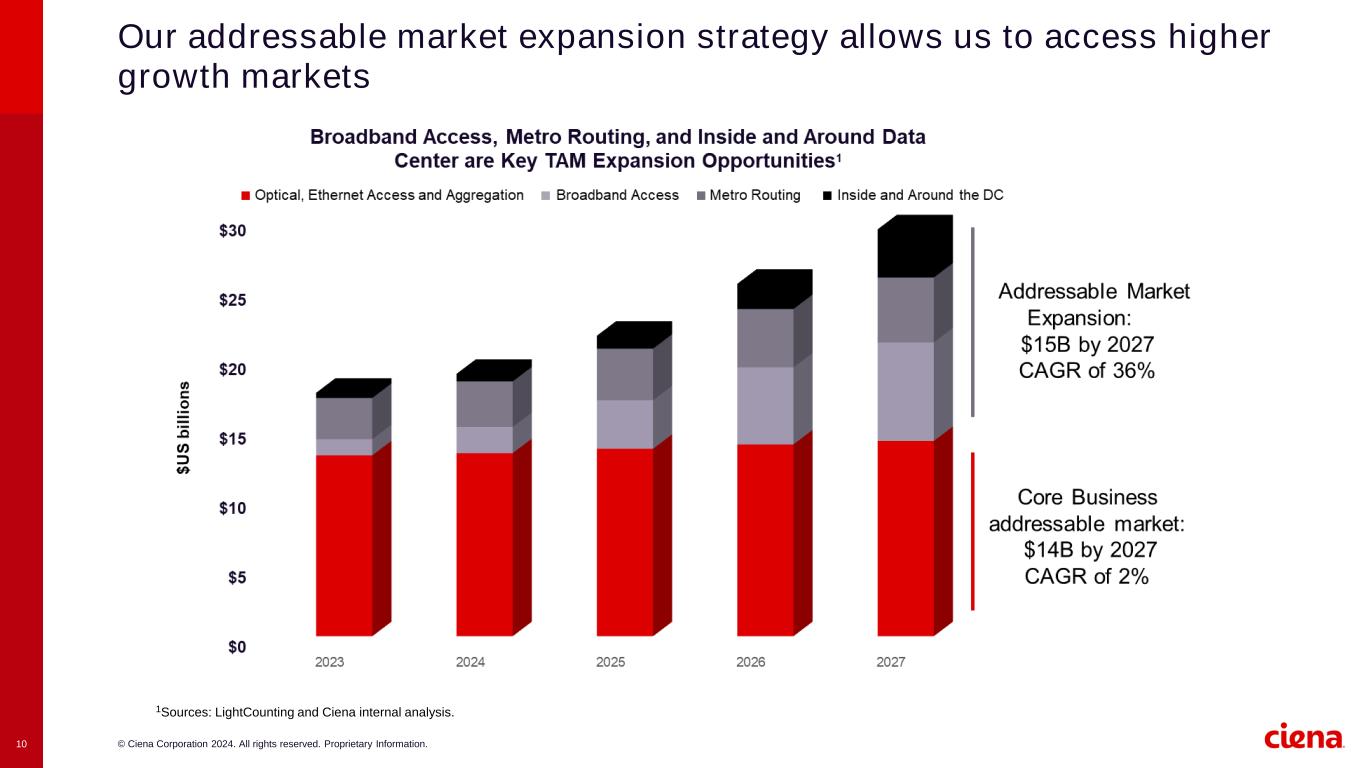

© Ciena Corporation 2024. All rights reserved. Proprietary Information.10 Our addressable market expansion strategy allows us to access higher growth markets 1Sources: LightCounting and Ciena internal analysis.

© Ciena Corporation 2024. All rights reserved. Proprietary Information.11 Our market leadership Optical Transport Report, 2Q24Optical Networking Report, 1Q24 Service Provider Switching & Routing Report, 2Q24 Transport Hardware Report, 2Q24 #1 Globally • Data center interconnect • Purpose-built/compact modular DCI • Optical for internet content provider customers #1 N. America • Data center interconnect • Total optical networking • Optical packet #2 Globally • Total optical networking • Optical packet • Optical for cable MSO customers #1 Globally • Purpose-built/compact modular DCI • SLTE WDM • Access switching #1 N. America • Total optical networking • Purpose-built/compact modular DCI • Access switching #2 Globally • Total optical networking #1 Globally • Purpose-built/compact modular DCI • Optical for cloud and colo • SLTE WDM • Routing/Access #1 N. America • Total optical networking • Purpose-built/compact modular DCI • Optical for cloud and colo • Routing/Access #2 Globally • Total optical networking • Optical for enterprise and government

© Ciena Corporation 2024. All rights reserved. Proprietary Information. Q3 FY 2024 results

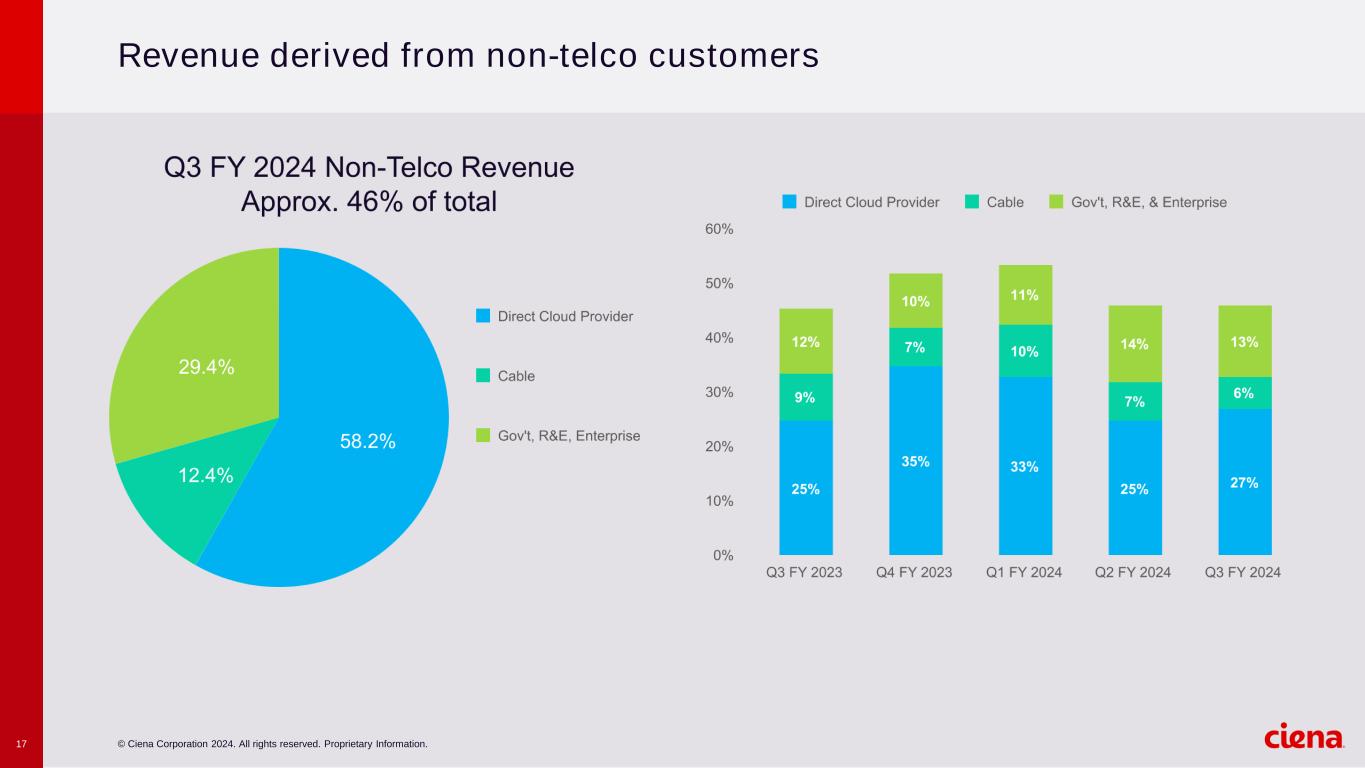

© Ciena Corporation 2024. All rights reserved. Proprietary Information.13 Q3 FY 2024 key highlights ▪ Non-telco represented 46% of total revenue ▪ Direct Cloud Provider revenue grew 9% sequentially ▪ India revenue grew 9% sequentially ▪ Blue Planet revenue nearly doubled YoY • Continued traction with cloud providers with strong ramp in 400ZR deployments by 3 Cloud Providers, multiple line system wins, and new MOFN awards • Surpassed 300 customers for WaveLogic 5 Extreme with 12 new customers added ▪ Surpassed 120 Routing and Switching customers using our WL5n pluggable technology • Total shareholder return five-year CAGR of 8%1 • Under our authorized $1 billion stock repurchase program, repurchased ~0.6 million shares for $29 million, and are targeting $250 million for FY 2024 to complete the plan 1 Based on closing share price between 8/27/2019 to 8/27/2024 Achieving balanced growth Prioritizing long term shareholder value Driving the pace of innovation

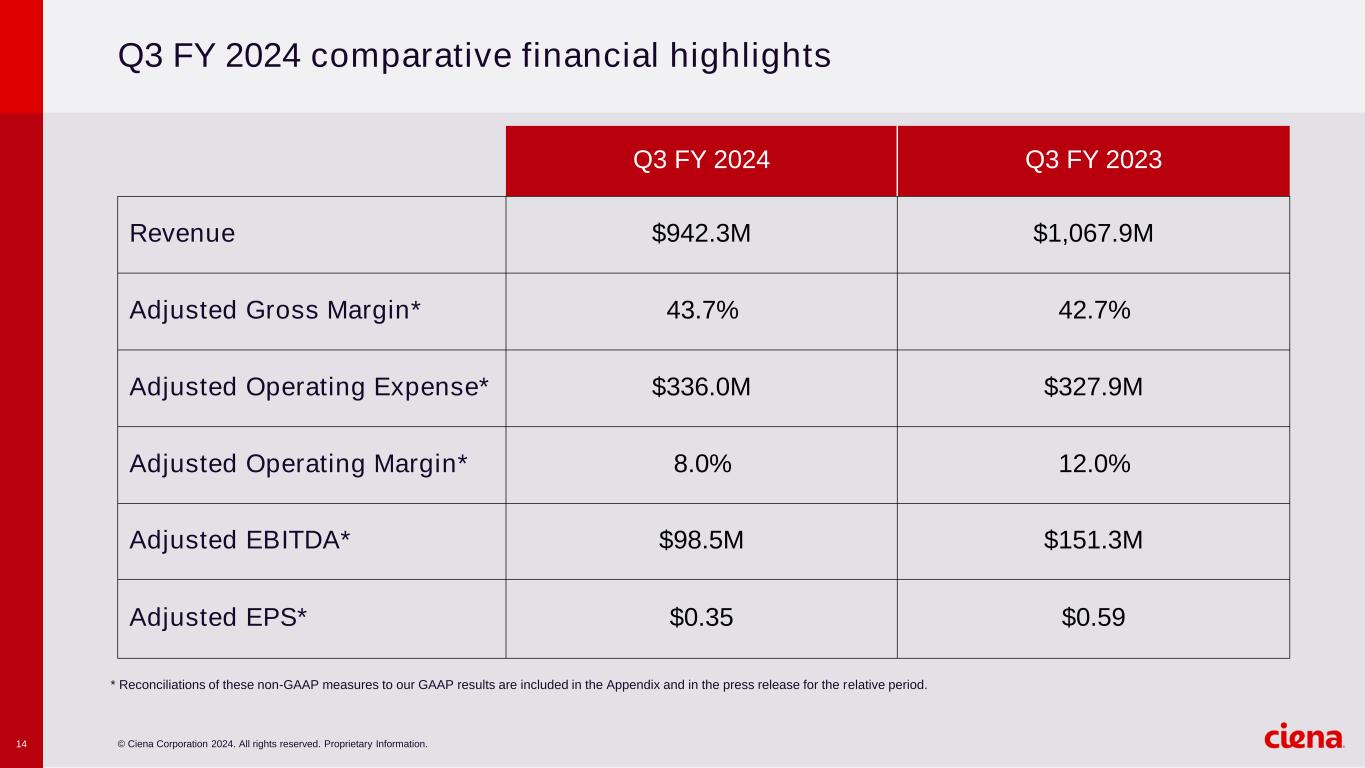

© Ciena Corporation 2024. All rights reserved. Proprietary Information.14 Q3 FY 2024 comparative financial highlights * Reconciliations of these non-GAAP measures to our GAAP results are included in the Appendix and in the press release for the relative period. Q3 FY 2024 Q3 FY 2023 Revenue $942.3M $1,067.9M Adjusted Gross Margin* 43.7% 42.7% Adjusted Operating Expense* $336.0M $327.9M Adjusted Operating Margin* 8.0% 12.0% Adjusted EBITDA* $98.5M $151.3M Adjusted EPS* $0.35 $0.59

© Ciena Corporation 2024. All rights reserved. Proprietary Information.15 Q3 FY 2024 comparative operating metrics Q3 FY 2024 Q3 FY 2023 Cash and investments $1.21B $1.28B Cash provided by (used in) operations $(159)M $9M DSO 100.0 96.0 Inventory Turns 1.8 1.7 Gross Leverage 3.08x 2.54x Net Debt $401M $344M

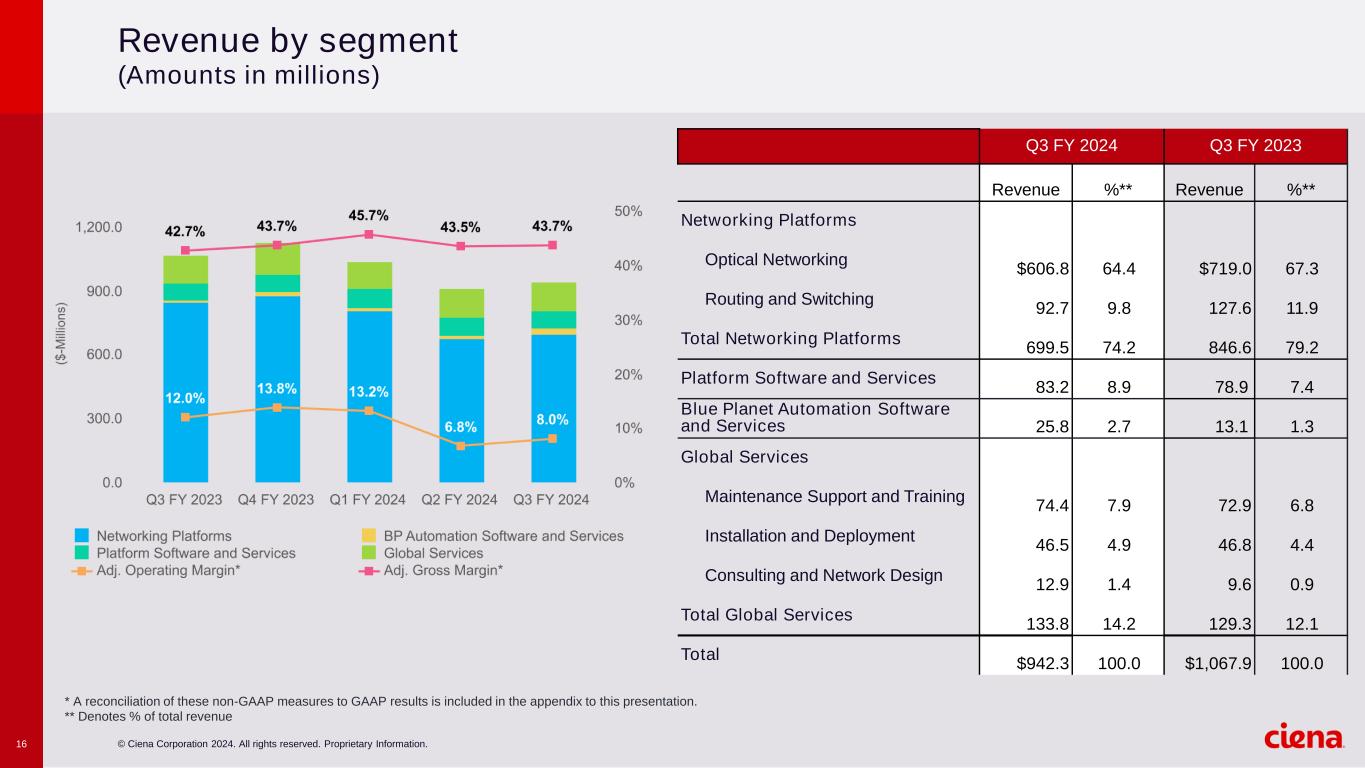

© Ciena Corporation 2024. All rights reserved. Proprietary Information.16 Revenue by segment (Amounts in millions) Q3 FY 2024 Q3 FY 2023 Revenue %** Revenue %** Networking Platforms Optical Networking $606.8 64.4 $719.0 67.3 Routing and Switching 92.7 9.8 127.6 11.9 Total Networking Platforms 699.5 74.2 846.6 79.2 Platform Software and Services 83.2 8.9 78.9 7.4 Blue Planet Automation Software and Services 25.8 2.7 13.1 1.3 Global Services Maintenance Support and Training 74.4 7.9 72.9 6.8 Installation and Deployment 46.5 4.9 46.8 4.4 Consulting and Network Design 12.9 1.4 9.6 0.9 Total Global Services 133.8 14.2 129.3 12.1 Total $942.3 100.0 $1,067.9 100.0 * A reconciliation of these non-GAAP measures to GAAP results is included in the appendix to this presentation. ** Denotes % of total revenue

© Ciena Corporation 2024. All rights reserved. Proprietary Information.17 Revenue derived from non-telco customers

© Ciena Corporation 2024. All rights reserved. Proprietary Information.18 Revenue by geographic region 15.5% 14.5% 10.1% 14.4% 14.5% 17.1% 70.1% 71.0% 69.2% 72.8% 20.0% 10.8% 9.4% 14.3% 76.3%

© Ciena Corporation 2024. All rights reserved. Proprietary Information. Q3 FY 2024 appendix

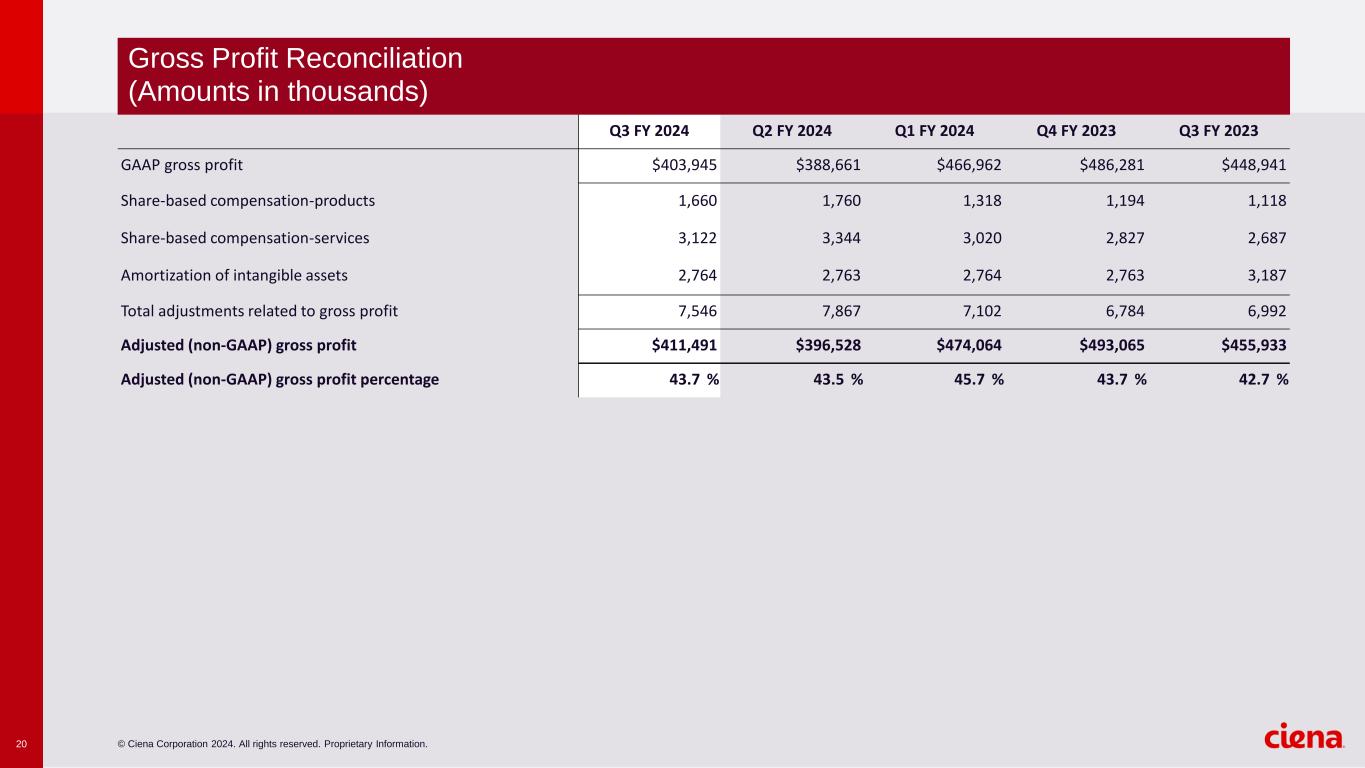

© Ciena Corporation 2024. All rights reserved. Proprietary Information.20 Q3 FY 2024 Q2 FY 2024 Q1 FY 2024 Q4 FY 2023 Q3 FY 2023 GAAP gross profit $403,945 $388,661 $466,962 $486,281 $448,941 Share-based compensation-products 1,660 1,760 1,318 1,194 1,118 Share-based compensation-services 3,122 3,344 3,020 2,827 2,687 Amortization of intangible assets 2,764 2,763 2,764 2,763 3,187 Total adjustments related to gross profit 7,546 7,867 7,102 6,784 6,992 Adjusted (non-GAAP) gross profit $411,491 $396,528 $474,064 $493,065 $455,933 Adjusted (non-GAAP) gross profit percentage 43.7 % 43.5 % 45.7 % 43.7 % 42.7 % Gross Profit Reconciliation (Amounts in thousands)

© Ciena Corporation 2024. All rights reserved. Proprietary Information.21 Q3 FY 2024 Q2 FY 2024 Q1 FY 2024 Q4 FY 2023 Q3 FY 2023 GAAP operating expense $377,202 $392,626 $382,333 $394,979 $370,727 Share-based compensation-research and development 13,118 14,066 12,880 11,412 10,954 Share-based compensation-sales and marketing 10,315 11,166 10,305 9,187 8,770 Share-based compensation-general and administrative 9,257 9,875 10,079 10,274 9,377 Significant asset impairments and restructuring costs 1,361 15,655 4,971 7,209 4,174 Amortization of intangible assets 7,185 7,947 7,252 10,578 9,487 Acquisition and integration costs — — — — 59 Legal Settlement — — — 8,750 — Total adjustments related to operating expense 41,236 58,709 45,487 57,410 42,821 Adjusted (non-GAAP) operating expense $335,966 $333,917 $336,846 $337,569 $327,906 Q3 FY 2024 Q2 FY 2024 Q1 FY 2024 Q4 FY 2023 Q3 FY 2023 GAAP income (loss) from operations $26,743 $(3,965) $84,629 $91,302 $78,214 Total adjustments related to gross profit 7,546 7,867 7,102 6,784 6,992 Total adjustments related to operating expense 41,236 58,709 45,487 57,410 42,821 Total adjustments related to income from operations 48,782 66,576 52,589 64,194 49,813 Adjusted (non-GAAP) income from operations $75,525 $62,611 $137,218 $155,496 $128,027 Adjusted (non-GAAP) operating margin percentage 8.0 % 6.8 % 13.2 % 13.8 % 12.0 % Operating Expense Reconciliation (Amounts in thousands) Income (Loss) from Operations Reconciliation (Amounts in thousands)

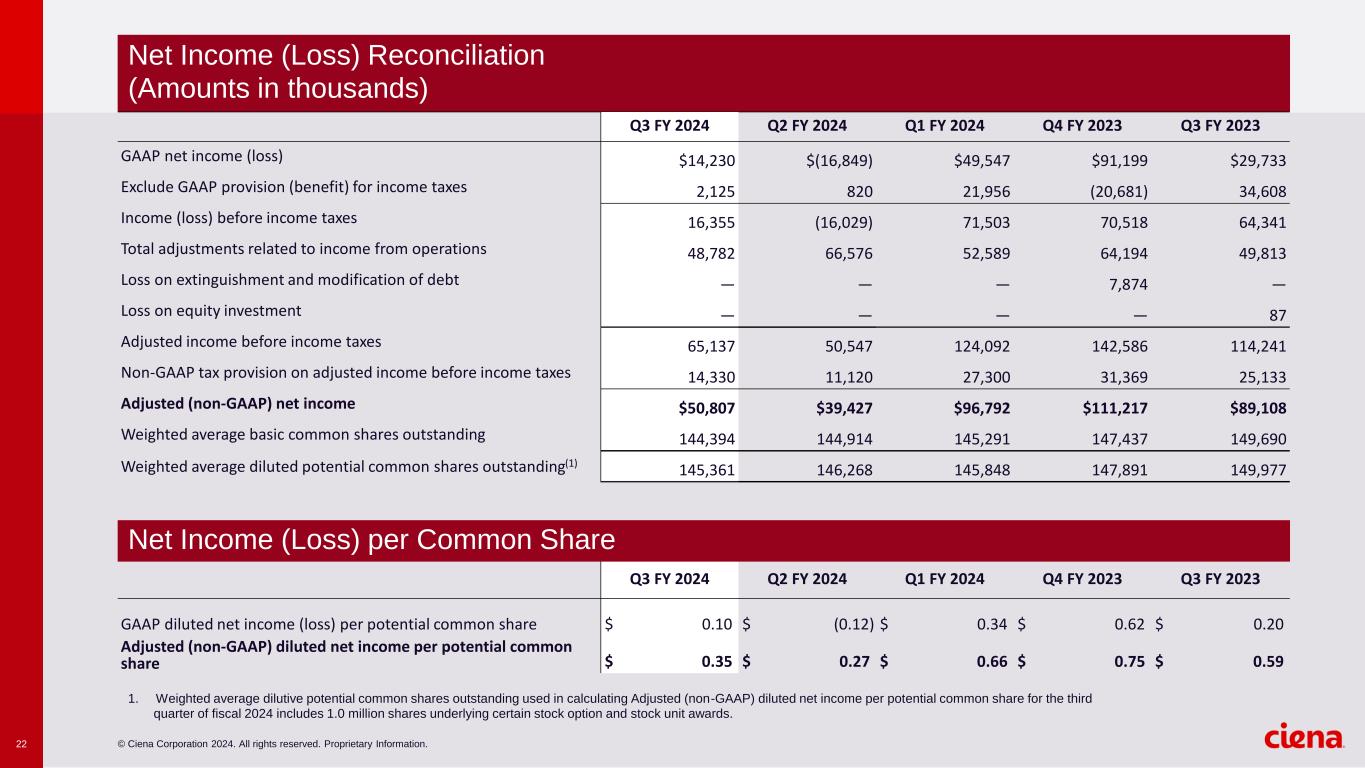

© Ciena Corporation 2024. All rights reserved. Proprietary Information.22 Q3 FY 2024 Q2 FY 2024 Q1 FY 2024 Q4 FY 2023 Q3 FY 2023 GAAP net income (loss) $14,230 $(16,849) $49,547 $91,199 $29,733 Exclude GAAP provision (benefit) for income taxes 2,125 820 21,956 (20,681) 34,608 Income (loss) before income taxes 16,355 (16,029) 71,503 70,518 64,341 Total adjustments related to income from operations 48,782 66,576 52,589 64,194 49,813 Loss on extinguishment and modification of debt — — — 7,874 — Loss on equity investment — — — — 87 Adjusted income before income taxes 65,137 50,547 124,092 142,586 114,241 Non-GAAP tax provision on adjusted income before income taxes 14,330 11,120 27,300 31,369 25,133 Adjusted (non-GAAP) net income $50,807 $39,427 $96,792 $111,217 $89,108 Weighted average basic common shares outstanding 144,394 144,914 145,291 147,437 149,690 Weighted average diluted potential common shares outstanding(1) 145,361 146,268 145,848 147,891 149,977 Q3 FY 2024 Q2 FY 2024 Q1 FY 2024 Q4 FY 2023 Q3 FY 2023 GAAP diluted net income (loss) per potential common share $ 0.10 $ (0.12) $ 0.34 $ 0.62 $ 0.20 Adjusted (non-GAAP) diluted net income per potential common share $ 0.35 $ 0.27 $ 0.66 $ 0.75 $ 0.59 1. Weighted average dilutive potential common shares outstanding used in calculating Adjusted (non-GAAP) diluted net income per potential common share for the third quarter of fiscal 2024 includes 1.0 million shares underlying certain stock option and stock unit awards. Net Income (Loss) Reconciliation (Amounts in thousands) Net Income (Loss) per Common Share

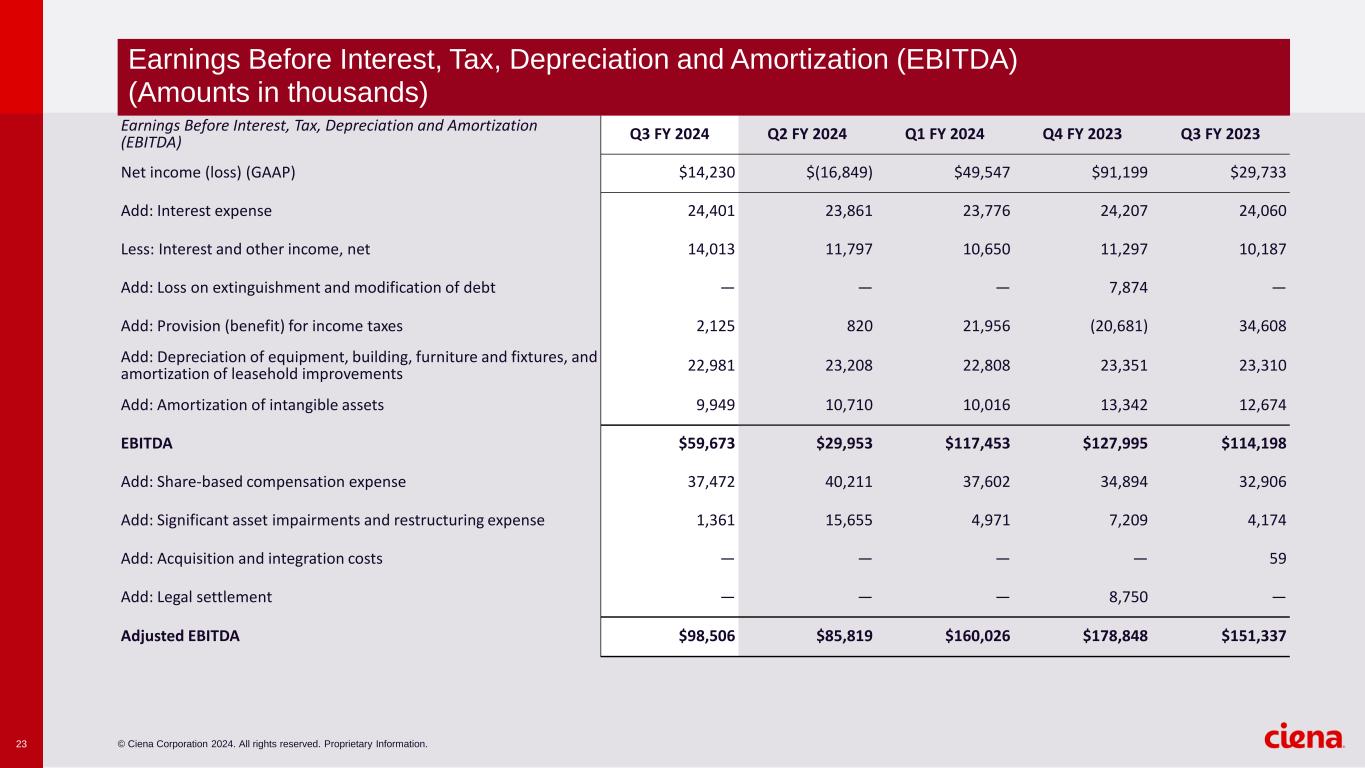

© Ciena Corporation 2024. All rights reserved. Proprietary Information.23 Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) Q3 FY 2024 Q2 FY 2024 Q1 FY 2024 Q4 FY 2023 Q3 FY 2023 Net income (loss) (GAAP) $14,230 $(16,849) $49,547 $91,199 $29,733 Add: Interest expense 24,401 23,861 23,776 24,207 24,060 Less: Interest and other income, net 14,013 11,797 10,650 11,297 10,187 Add: Loss on extinguishment and modification of debt — — — 7,874 — Add: Provision (benefit) for income taxes 2,125 820 21,956 (20,681) 34,608 Add: Depreciation of equipment, building, furniture and fixtures, and amortization of leasehold improvements 22,981 23,208 22,808 23,351 23,310 Add: Amortization of intangible assets 9,949 10,710 10,016 13,342 12,674 EBITDA $59,673 $29,953 $117,453 $127,995 $114,198 Add: Share-based compensation expense 37,472 40,211 37,602 34,894 32,906 Add: Significant asset impairments and restructuring expense 1,361 15,655 4,971 7,209 4,174 Add: Acquisition and integration costs — — — — 59 Add: Legal settlement — — — 8,750 — Adjusted EBITDA $98,506 $85,819 $160,026 $178,848 $151,337 Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) (Amounts in thousands)