Via Edgar and Fax

Mr. David R Humphrey, Branch Chief

Ms. Amy Geddes

Securities and Exchange Commission

Division of Corporate Finance

Mail Stop 3561

100 F Street, NE

Washington, DC 20549

Re: Precision Aerospace Components, Inc,

Form 10-KSB for the year ended December 31, 2007

File No. 000-30185

Dear Mr. Humphrey and Ms. Geddes:

The following response addresses the comments of the Staff of the Securities and Exchange Commission (the “Commissions”) as set forth in a follow-up comment letter dated September 15, 2008 (the “Comment Letter”) regarding the Form 10-KSB of Precision Aerospace Components, Inc. for the year ended December 31, 2007. The responses herein refer to the specific comments appearing in the Comment Letter.

Form 10-KSB for the year ended December 31, 2007

General

| 1. | Please completely revise your disclosures throughout your filing to indicate all share numbers, including those associated with option issuances, on a pre-split basis, as the 150:1 reverse split has not yet occurred. Your current disclosures are inconsistently presented with regard to pre-versus post-split numbers. We would not object to the inclusion of post-split share numbers parenthetically in each disclosure. |

RESPONSE: The Company has revised the disclosures as requested.

Item 8A. Controls and Procedures

| 2. | Please revise your current Disclosure Controls and Procedures evaluation to indicate the date your evaluation. |

RESPONSE: The Company revised the disclosure as requested. The evaluation was completed on or about February 20, 2008. Please see Item 8A(A) and 8A(B) of Form 10-K.

| 3. | It does not appear that your management has completed its assessment of internal control over financial reporting as of December 31, 2007. Since you were required to file or filed an annual report for the prior fiscal year, it appears you are required to report on your management’s assessment of internal control over financial reporting. |

If your management has not yet completed its assessment, we ask that you complete your evaluation and amend your filing within 30 calendar days to provide the required management’s report on internal control over financial reporting.

In completing your evaluation, you may find the following documents helpful:

| Ø | The Commission’s release Amendments to Rules Regarding Management’s Report on Internal Control Over Financial Reporting (Securities Act Release 8809/Financial Reporting Release 76). You can find this release at: http://www.sec.gov/rules/final/2007/33-8809.pdf |

| Ø | The Commission’s release Commission Guidance Regarding Management’s Report on Internal control Over Financial Reporting Under Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (Securities Act Release 8010/Financial Reporting Release 77). You can find this release at: http://sec.gov/rules/interp/2007/33-8810.pdf; and |

| Ø | The “Sarbanes-Oxley Section 404 – A Guide for Small Business” brochure at: http://www.sec.gov/info/smallbus/404guide.shtml. |

RESPONSE: The Company revised the disclosure as requested. The evaluation was completed on or about February 20, 2008. Please see Items 8A(A) and (B) of Form 10-KSB.

| 4. | In addition, please consider whether management’s failure to perform or complete its report on internal control over financial reporting impacts its conclusions regarding the effectiveness of your disclosure controls and procedures as of the end of the fiscal year covered by the report and revise your disclosure as appropriate. |

RESPONSE: Management performed the internal control over financial reporting and made its filing in consideration of the results.

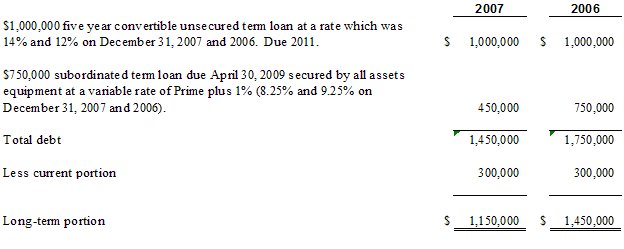

Note 8. Long Term Debt and Line of Credit, page 17

| 5. | We have reviewed your response to our prior comment 12 with regard to the existence of a beneficial conversion feature. However, we are unable to reconcile the numbers in your response with the high and low stock prices disclosed in the table on page 13 of the filing. Please tell us whether these prices are reported on a pre or a post split basis. In addition please reconcile them with the conversion prices and the actual market values of the stock as cited in your response. Address these measures both as of the issuance date of the note, as of December 2, 2006 and as of the date of the “one time adjustment of the conversion price.” We may have further comments upon review of your response. |

RESPONSE: The Company has revised its chart on page 13 to reflect .0001 as the low price of its common stock in the 3rd quarter of 2006. The prices shown in the Company’s report on page 13 are noted as being those reported on the web site Big Charts. [bigcharts.Marketwatch.com – a service of MarketWatch]. Since there has been no split, those prices of the shares are pre-split. The issuance date of the note was July 20, 2006. The table on page 13 of the filing shows that in the third quarter 2006, which is the quarter the note was issued, the high and low prices of the shares, carried out to two decimal prices were $0.11 and $0.00 respectively. Our response to comment 12 states that “On the date of the issuance of the Note, the opening and closing stock price as reported on Marketwatch.com was $0.0001” were this to have been rounded to the same two decimal places as shown in the filing it would have been $0.00. The Company reported high and low prices in the fourth quarter 2006 of $0.05 and $0.11. On December 2, 2006 the stock did not trade since it was a Saturday and no high and low stock prices, from Big Charts are reported. On Friday December 1, 2006, however the service does report a closing price of $0.025. The Company reported high and low prices in the third quarter 2007 of $0.05 and $0.03. On July 31, 2007, the date of the “one time adjustment of the conversion price,” Big Charts reports no data; the service reports high and low stock prices July 30, 2007 of $0.04. (These prices are pre-split prices-since there have not been any splits.)

Note 9. Acquisition. Page 18

| 6. | Your proposed revised disclosure in response to our previous comment 13 does not describe the accounting treatment of the DFAC transaction, nor does it clearly describe the overall timing of the acquisitions and transactions as they appear in your Form 10-KSB. Please revise this disclosure to first describe the DFAC transaction on a pre split basis as a capital transaction. Follow that description with a description of the Freundlich transaction as an asset purchase. Please ensure all the material terms to such transactions are completely and clearly described on a pre-split basis. You may also include post-split shares parenthetically. |

RESPONSE: The Company has revised the disclosure as shown below:

9. ACQUISITION

On July 20, 2006, the Company acquired all the assets and certain liabilities of Freundlich Supply, a New York corporation which operated as a distributor of fasteners to the aerospace industry. The purchase price totaled $6,066,930, consisting of the original purchase price of $5,000,000 plus $263,943 working capital adjustment and liabilities assumed of $802,987. The asset purchase agreement provided that the purchase price would be adjusted to the extent of the Seller’s net working capital (defined as the excess of accounts receivable, inventory and prepaid expenses over accounts payable and accrued expenses) exceeded, or was less than, $2,280,000 at closing. Net working capital totaled $2,543,943 at closing, and accordingly, the purchase price was increased by $263,943.

The acquisition was recorded by allocating the cost of the assets acquired and liabilities assumed based upon their estimated fair value at the acquisition date. The excess of the cost of the acquisition over the net of the amounts assigned to the fair value of the assets acquired and the liabilities assumed was recorded as goodwill.

The fair value of the assets and liabilities was determined and the purchase price was allocated as follows:

The Company acquired the Freundlich Assets in a series of transactions which occurred on the same date. The events were:

| 1. | The Company acquired DFAC in a stock for stock transaction |

| 2. | The Company issued a note, stock and warrants to finance the acquisition |

| 3. | DFAC acquired the assets of Freundlich |

| 1. | The Company acquired DFAC in a stock for stock transaction |

The July 20, 2006 asset purchase of the Freundlich assets were the result of the Company entering into an exchange agreement (the “Exchange Agreement”) pursuant to which the Company acquired all of the shares of Delaware Fastener Acquisition Corp., a Delaware corporation (“DFAC”), in return for 21,000,000 shares of the Company’s common stock and 2,611,000 shares of the Company’s Class B convertible preferred stock. The Company’s Class B convertible preferred stock automatically converts into post 150:1 reverse split stock in an amount equal to 783,300,000 shares of the Company’s presently existing common stock which would no longer be existing since the conversion cannot occur prior to the 150:1 reverse split discussed below; so it really converts into 5,222,000 shares of the Company’s post 150:1 reverse split common stock.

| 2. | The Company received financing |

The Investors in the Security Purchase Agreement provided the Company financing of $5,750,000. In return the Company issued (a) a $1 Million convertible note which has subsequently been repaid without conversion; (b) 5,277,778 shares of series A Preferred stock each originally convertible into 450 shares (3 post 150:1 reverse split shares) of the Company’s common stock and presently convertible into 777 shares (5.18 post 150:1 reverse split shares) of the Company’s common stock; (c) 10,541,000 Series A warrants convertible into 1,581,150,000 shares of the Company’s common stock at an original exercise price of .00233 per share which has been adjusted to .00135 per share (10,541,000 post 150:1 reverse split shares at an original exercise price of $0.35 per share which has been adjusted to $.203 per share) and (d) 10,541,000 Series B warrants convertible into 1,581,150,000 shares of the Company’s common stock at an original exercise price of .004 per share which has been adjusted to .00231 per share (10,541,000 post 150:1 reverse split shares of the Company’s common stock at an original exercise price of $0.60 per share which has been adjusted to $0.347 per share). Other than standard adjustment terms there are no other adjustment terms for either the Preferred stock or the warrants. As a result of the Exchange Agreement, DFAC became a wholly-owned subsidiary of the Company. The Company then caused its subsidiary, DFAC to carry out the asset purchase agreement as described below. Upon completion of the foregoing transactions, the Company changed its name to Precision Aerospace Components, Inc. and DFAC changed its name to Freundlich Supply Co., Inc. (“Freundlich”).

The adjusted conversion terms and prices shown above are a result of the Company, on July 31, 2007, negotiating adjustments to fix the conversion ratio or prices for the securities. The Securities Purchase Agreement required that the ratio or prices be the adjusted by the percentage shortfall of certain pre-tax income milestones to be reached by the Company in years 2006 and 2007. Due to these contingencies (possible reduction of conversion prices), the Company has reclassified its preferred A stock and warrants as liabilities at the time of issuance. Upon the fixing of the prices, in 2007, these preferred shares and warrants were reclassified as temporary equity because the Company is not authorized to issue a sufficient number of shares if the preferred A shares were converted to common stock or the warrants were exercised for common stock.

The Securities Purchase Agreement requires the Company to accomplish a 150:1 reverse split of its common stock; originally to have been accomplished by November 2006, this requirement has been extended several times, without additional consideration, and is now to occur by December 15, 2008 (subsequent to the date covered by this report the date has been further extended to December 15, 2009). In the event the Company does not timely accomplish the 150:1 reverse split it may have to pay a penalty of $287,500 and if it fails to timely file and maintain effective a registration statement it may be liable for liquidated damages which would be 2,100 shares of Series A stock per day it is in violation, up to a maximum of 750,000 shares.

| 3. | DFAC acquired the assets of Freundlich |

Also on July 20, 2006 and contemporaneously, DFAC acquired the assets, subject to certain liabilities, of Freundlich Supply Company, Inc., described above (“Freundlich Supply”), pursuant to an asset purchase agreement (the “Asset Purchase Agreement”) dated May 24, 2006 among DFAC, Freundlich Supply, and Michael Freundlich. The purchase of the assets was financed by the proceeds from the sale by the Company of its securities pursuant to a securities purchase agreement (the “Securities Purchase Agreement”) described in Paragraph 2 above.

| 7. | Refer to your response to our prior comment 14. We note your references to the requirements of Rules 3-02, 3-03 and 3-05 of Regulation S-X in support of your accounting. To facilitate our understanding of your response, please explain how your accounting complies with paragraphs 48 and 49 of SFAS 141. That is, we assume that the “date of acquisition” was considered to be July 20, 2006 and that the fair values of the assets acquired and liabilities assumed were determined as of that date. We also assume that the income of the acquired entity has been included in your statement of income after that date (and not before). Please confirm, or advise us as to how our understanding is not correct. If you elected to designate some other date as the effective date of the acquisition instead, please specifically explain how your accounting complied with the above referenced SFAS 141 guidance. |

RESPONSE: The date of acquisition was effective as of July 20, 2006. The Company is restating its financial statements to reflect the effective date as July 20, 2006, thus excluding financial activity for the period July 1 through July 20 which reflected a different effective date.

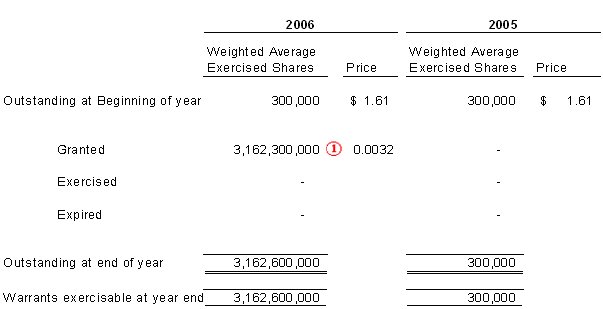

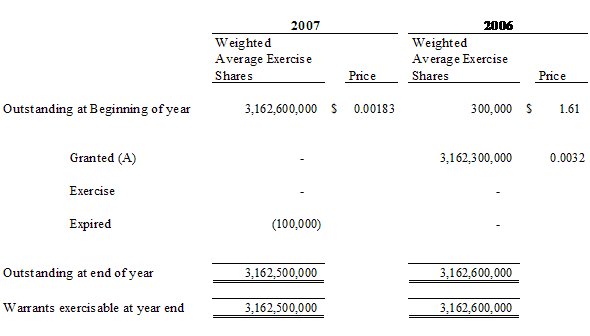

Note 11 – Warrants, page 19

| 8. | Please explain to us why you have not considered the warrants not issuable due to lack of authorized common shares as a liability, but have instead classified them as temporary equity. Include in your response how such obligations will be satisfied if not by issuance of shares. In this regard, we note that liquidated damages are due if the reverse split is not effective as of a specific date. However, please tell us how you would be required to satisfy this obligation if the reverse split is never completed. Tell us whether there are any circumstances under which settlement in cash could be required. |

RESPONSE: The Company will, as appropriate, restate its financials and record the warrant transaction as warrant liability. The Company has not incurred any of the liquidated damages, as a result of extensions that have been granted. The Company has previously provided the liquidated damages section of its agreement in its entirety. That is the extent of the Company’s obligation in its agreements. The “liquidated damages” provision does not specifically go into the scenarios envisioned by the reviewer and does not have a cash settlement provision. Any further comment would be speculative and could impair the Company’s legal or bargaining position should the envisioned scenario occur.

| 9. | We note that the exercise price of the warrants was modified on July 31, 2007. Please tell us how and why the exercise price was lowered and how the new price was determined. Discuss the applicability of paragraph 12 of SFAS 150 and tell us how you reached your conclusion. We may have further comments upon review of your response. |

RESPONSE: The exercise price was revised as a result of negotiations between the Company and the holders of the warrants. It was in the best interests of the Company to provide certainty to the exercise price at a level more beneficial to the Company than might have otherwise occurred by the then existing modification terms. The Company restated its financials to record the warrants as a liability when issued as requested. On July 31, 2007, when the Company renegotiated with the holders to fix the exercise price, the Company reclassified the warrant liability into temporary equity.

| 10. | Refer to our previous comment 17. Please confirm to us that the adjustments to the exercise prices of the warrants were not negotiated as part of the extension of the registration date. |

RESPONSE: The adjustments to the exercise prices of the warrants were not negotiated as part of the extension of the registration date.

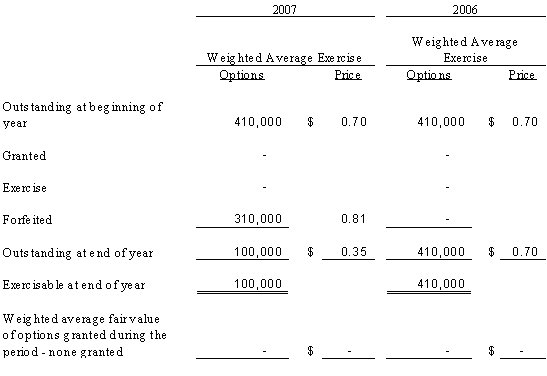

| 11. | Discuss the classifications and proposed accounting for the options approved on February 27, 2008 as well. |

RESPONSE: The Company will be restating its 2008 financial statements as previously discussed with the commission.

Form 10-QSB for Quarter Ended June 30, 2008

General

| 12. | We note that your recent quarterly report for the periods ending March 31, 2008 and June 30, 2008 were on Form 10-QSB and not Form 10-Q. Beginning February 4, 2008, companies formerly classified as “small business issuers” under Regulation S-B must file their quarterly reports on form 10-Q after they have filed an annual report for a fiscal year ending after December 15, 2007. Although small business issuers are now required to file on Form 10-Q, the disclosure requirements for that form are now tailored for smaller companies. |

Although we are not asking you to correct your most recent filing just to reflect the proper form type, we ask that you review your filing requirements and consider whether any action is necessary if your most recently filed quarterly report does not contain all required material information. In any event, you should file your next quarterly report on form 10-Q.

Information about recent changes to rules affecting small business issuer form types and disclosure and filing requirements is available on the SEC website at http://www.sec.gov/info/smallbus/secg/smrepcosysguid.dpf. If you have any questions about these changes, please feel free to contact the SEC’s Office of Small Business Policy at (202) 551-3460 or smallbusiness@SEC.gov.

RESPONSE: The Company will file its quarterly reports on Form 10-Q as requested. No further action by the Company in this regard is required.

Part 1. Financial Information, page 3

| 13. | Please file an amended Form 10-Q for the quarterly period ended March 31, 2008 restating your first quarter financial statements as indicated in your explanatory note and as presented in Footnote 8 to your financial statements. Further, please revise your explanatory note to eliminate reference to “actual financial operations and well being of the Company.” Such language is confusing. |

RESPONSE: The Company will file an amended March 31 2008 10-Q with the requested revisions.

| 14. | In view of the restatement, an item 4.02 Form 8-K appears to be required as well and should be filed at the earliest practicable date. |

RESPONSE: The Company filed a Form 8-K on January 13, 2009.

Note 7. Options and Agreements, page 10

| 15. | Refer to your response to our prior commitment 18. As stated in SAB Topic 14-F, it is the staff’s position that the charge related to share based payment arrangements should be presented (classified) in the same line or lines of the income statement as cash compensation paid to the same employees. Please reclassify the balances currently labeled “Stock Based Compensation” to “General and administrative expenses,” “Professional Fees” and/or “Total Cost of Goods Sold” as applicable. After reclassifying these expenses, you may also consider disclosing the amount of the expense to share-based payment arrangements included in specific line items in the financial statements if you elect to do so. Please see the above referenced SAB Topic for guidance in how to provide these disclosures. |

RESPONSE: While the Company respectfully disagrees and, as discussed with the SEC, believes that such a presentation could easily cause the financial condition of the Company and its operations to be misunderstood and misinterpreted. The Company will comply

| 16. | Refer to our previous comments 20 and 21. Please explain to us how you plan to determine the exercise price to be used in the Black-Scholes calculation on an ongoing basis given the manner in which the exercise price will be determined as discussed in your response. Specifically, from the response provided, it does not appear the exercise price has been determined |

RESPONSE: Per our discussion with the SEC the later options have not been issued and the exercise price has not been determined as such no accounting is necessary. When the foregoing factors have been determined proper accounting of these transactions will be recorded.

Note 8 – Restatement of Financial Statements, page 11

| 17. | Please revise your explanation here to indicate the facts and circumstances surrounding the restatement. Such disclosure should clarify whether the restatement related to the options issued to Mr.Prince, to the other non-management directors, or both, and should provide a detailed discussion as to how the revised amounts were calculated or determined. Please provide us with a draft of your proposed disclosures prior to amending your filing. |

RESPONSE: The restatement will address the reviewer’s issues and will be provided in draft.

| 18. | Please tell us how the change in operating results pursuant to the restatement has impacted your assessment of goodwill impairment as of March 31, 2008 and June 30, 2008. |

RESPONSE: The Company assesses its impairment of goodwill on an annual basis, unless circumstances warrant additional assessment, and will continue to adhere to this practice. The restatement will have no impact on good will based upon the facts and circumstances of the restatement.

Management’s Discussion and Analysis

Plan of Operation and Discussion of Operations, page 12

| 19. | We note your discussion of quarterly operating results beginning on page 14 focuses on results excluding the stock compensation charge. Although it is appropriate to specifically quantify and disclose the impact of the stock compensation charge as a way of explaining the decline in operating results, your primary discussion of operating results should focus on unadjusted results that comply with GAAP and that are consistent with your financial statements. Please revise. |

RESPONSE: The Company will revise in accordance with the guidance given by the SEC.

| 20. | Refer to our prior comment 22 and to the final paragraph under this caption (located on page 15). We note your description of the registration rights agreement including the contractual provision for liquidated damages. Please discuss your proposed accounting, and the consideration given to the applicability of FASB Staff Position No. EITF 00-19-2. If you do not consider this position to be applicable, please explain why. If you do consider this guidance to apply, please explain how your proposed accounting complies with this position. Finally, please also provide the disclosures required under paragraph 12 of the FSP in the footnotes to your financial statements. |

RESPONSE: The Company has not incurred any liquidated damages and does not anticipate incurring any based upon its past history and present relations (The Company has received a further extension through December 15, 2009). Should such damages become recognized, it is unclear what form they would take after negotiation and the Company will address the accounting at that time.

As requested by the staff, in connection with responding to your comments, the Company is providing the following statement in acknowledging that:

“The company is responsible for the adequacy and accuracy of the disclosure in the filing;

“Staff comments of changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and

“The company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.”

The Company is providing its amended 10-K’s for the 2006 and 2007 years, as correspondence, with this response letter with plans to file them upon the understanding that we have satisfactorily responded to the comments raised by the SEC. The Company plans to include any of the comments which have not already been included in the Company’s 2008 10-Q’s at the time of filing the 2009 10 Q for the respective quarters.

We trust that the foregoing appropriately addresses the issues raised by the Comment Letter.

| | Very truly yours, | |

| | | |

| | /s/ Andrew S. Prince | |

| | Andrew S. Prince | |

| | Chief Financial Officer | |

CURRENT REPORT FOR ISSUERS SUBJECT TO THE

1934 ACT REPORTING REQUIREMENTS

FORM 10-K/A

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act

For the Fiscal Year Ended December 31, 2006

Precision Aerospace Components, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | | 000-30185 | | 20-4763096 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | |

| | | | | |

| 2200 Arthur Kill Road Staten Island, NY | | | | 10309-1202 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

(718) 356-1500

(Registrant’s telephone number, including area code)

(Former address)

Securities registered pursuant to Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12(g) of the Act: Common Stock

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Act of 1934 during the past 12 months and (2) has been subject to such filing requirement for the past 90days Yes [ ] No [ X ].

Indicate by a check mark whether the company is a shell company (as defined by Rule 12b-2 of the Exchange Act: Yes [ ] No [XX ].

Aggregate market value of the voting stock held by non-affiliates of the Registrant as of December 31, 2006: $589,000

Shares of common stock outstanding at August 28, 2007: 33,324,691

EXPLANATORY STATEMENT

This 10-KSB report is being filed at the same time as the filing of the Company’s 10-QSB reports for the first and second quarters of 2007. The 10-KSB was delayed due to the need for successor management and its auditors to appropriately review the Company’s financial records subsequent to the acquisition in July 2006 and its inventory use and inventory valuation, which impacts the cost of goods sold and profitability. It was not until the 10-KSB had been finalized that the subsequent 10-QSB’s could be finalized. Assertions regarding activities conducted by management during the period of the 10-KSB refer to those of prior management.

Purpose of this Amended Annual Report on Form 10-KSB/A

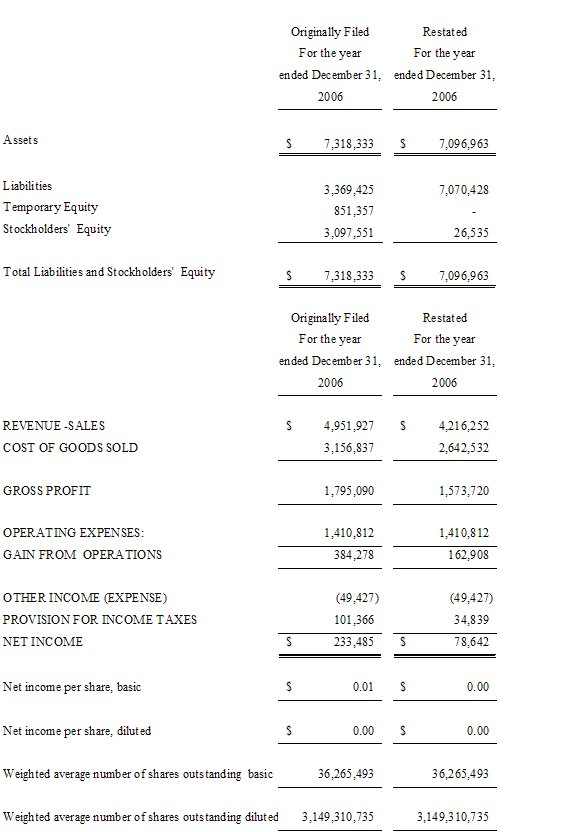

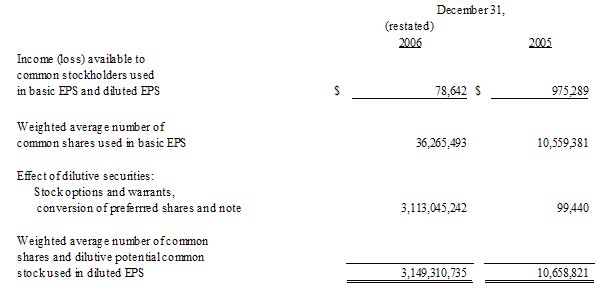

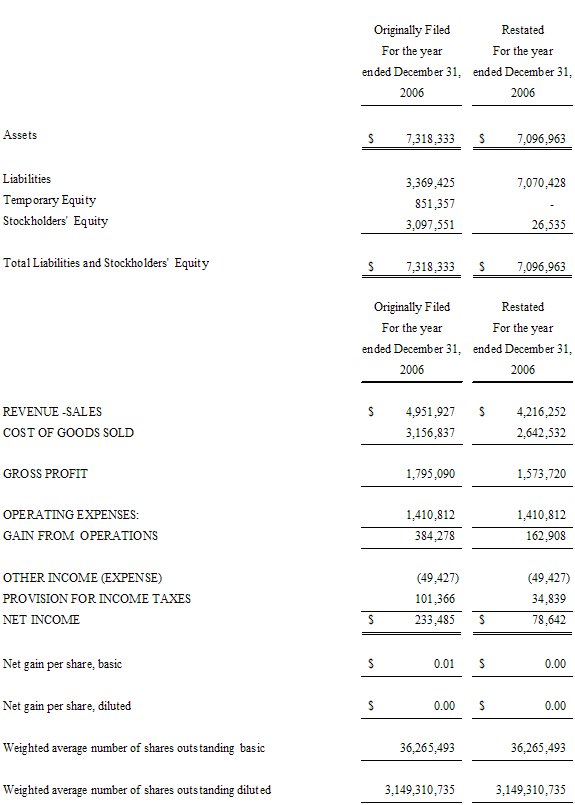

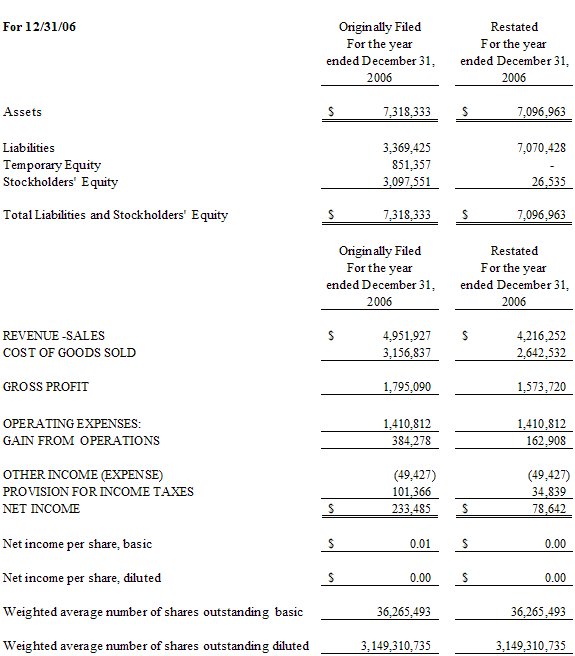

The Company is restating its financial statements and disclosures to reflect an effective date of July 20, 2006, for the acquisition of Freundlich Supply Company. The Company previously reported all financial activity for the period of July 1, 2006 to July 19, 2006 in its originally filed Form 10-KSB for the year ended December 31, 2006. This error caused revenues for 2006 to be overstated by $735,675, cost of sales to be overstated by $514,305 and goodwill to be overstated by $221,370. As a result of these adjustments to the 2006 financial statements, the Company is also restating its financial statements and related disclosures for the year ended December 31, 2006. Please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as the restated financial statements in this Report.

Additionally, the SEC randomly selected the Company’s 10-KSB filed for 2007 for a Sarbanes Oxley review which resulted in the SEC desiring certain changes be made to the information in the report, some of which are applicable to and are included in this report; including a change to the Balance Sheet which classified all of the Company’s series A Preferred Stock and its Warrants issued in connection with the acquisition as Liabilities because they had possible contingent changes to their conversion or exercise prices. These desired changes to the information included in the report have no impact on the Company’s operations or financial status, either at December 31, 2006 or 2007 or subsequently.

TABLE OF CONTENTS

| | | Page |

| EXPLANATORY STATEMENT | | 2 |

| | PART I | |

| INTRODUCTORY NOTE | | 4 |

| Item 1. | Description of Business | 4 |

| Item 2. | Description of Property | 13 |

| Item 3. | Legal Proceedings | 13 |

| Item 4. | Submission of Matters to a Vote of Security Holders | 13 |

| Item 5. | Market for Precision Aerospace Components, Inc.’s Common Equity and Related Stockholders Matters | 14 |

| Item 6. | Managements Discussion and Analysis or Plan of Operation | 15 |

| Item 7. | Financial Statements | 19 |

| Item 8A. | Controls and Procedures | 20 |

| Item 8B. | Other Information | 21 |

| Item 9. | Directors, Executive Officers, Promoters and Control Persons; Compliance with Section 16(a) of the Exchange Act | 22 |

| Item 10. | Executive Compensation | 24 |

| Item 11. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 26 |

| Item 12. | Certain Relationships and Related Transactions, and Director Independence | 26 |

| Item 13. | Exhibits | 27 |

| Item 14. | Principle Accountant Fees and Services | 27 |

| Signatures | | 28 |

PART I

INTRODUCTORY NOTE

FORWARD-LOOKING STATEMENTS

This Form 10-KSB/A contains "forward-looking statements" relating to Precision Aerospace Components, Inc. (the "Company") which represent the Company's current expectations or beliefs including, but not limited to, statements concerning the Company's operations, performance, financial condition and growth. For this purpose, any statements contained in this Form 10-KSB/A that are not statements of historical fact are forward-looking statements. Without limiting the generality of the foregoing, words such as "may", "anticipate", "intend", "could", "estimate", or "continue" or the negative or other comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, such as credit losses, dependence on management and key personnel, variability of quarterly results, and the ability of the Company to continue its growth strategy and the Company’s competition, certain of which are beyond the Company's control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, or any of the other risks herein occur, actual outcomes and results could differ materially from those indicated in the forward-looking statements.

Any forward-looking statement speaks only as of the date on which such statement is made, and the Company undertakes no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time and it is not possible for management to predict all of such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

DESCRIPTION OF PRECISION AEROSPACE COMPONENTS’ (FORMERLY JORDAN 1 HOLDINGS) BUSINESS

Organizational History

Precision Aerospace Components (Precision Aerospace or the “Company”) was previously known as Jordan 1 Holdings Company (“Jordan 1”) and was incorporated in Delaware on December 28, 2005. Jordan 1 is the successor to Gasel Transportation Lines, Inc. ("Gasel"), an Ohio corporation that was organized under the laws of the State of Ohio on January 27, 1988.

Gasel was a trucking company that filed for bankruptcy in the Southern District of Ohio, Eastern Division, in May 2003. On December 12, 2005, a final plan of reorganization was approved by the court and the bankruptcy proceeding was dismissed.

On December 30, 2005, Gasel entered into a private sale of stock under a Stock Purchase Agreement with Venture Fund I, Inc., a Nevada corporation owned and controlled by accredited investor Ruth Shepley (“Shepley”), of Houston, Texas. Under the terms of the Stock Purchase Agreement, Shepley purchased 29,000,000 shares of restricted common stock for a purchase price of $100,000.

Subsequent to December 30, 2005, Jordan 1 did not engage in any business activity until July 20, 2006 when it entered into an exchange agreement (the “Exchange Agreement”) pursuant to which the Company acquired all of the equity of Delaware Fastener Acquisition Corp., a Delaware corporation (“DFAC”), pursuant to an exchange agreement with the stockholders of DFAC. Contemporaneously, DFAC acquired the assets, subject to certain liabilities, of Freundlich Supply Company, Inc. (“Freundlich Supply”) pursuant to an asset purchase agreement (the “Asset Purchase Agreement”) dated May 24, 2006 among DFAC, Freundlich Supply, and Michael Freundlich. The purchase of the assets was financed by the proceeds from the sale by the Company of its securities pursuant to a securities purchase agreement (the “Securities Purchase Agreement”). As a result of the Exchange Agreement, DFAC became a wholly-owned subsidiary of the Company. Upon completion of the foregoing transactions, the Company changed its name to Precision Aerospace Components, Inc. and DFAC changed its name to Freundlich Supply Company, Inc. (“Freundlich”).

The Company’s present sole operating subsidiary and sole source of revenues is Freundlich.

Overview of Business

Freundlich and through it the Company is a stocking distributor of aerospace quality, internally-threaded fasteners. The organization from which the operating assets were acquired, Freundlich Supply, was founded in 1940 and had been operating in its present business line since that time. The Company distributes high-quality, domestically-manufactured nut products that are used primarily for aerospace and military applications and for industrial/commercial applications that require a high level of certified and assured quality. The Company’s products are manufactured, by others, to exacting specifications or are made from raw materials that provide strength and reliability required for aerospace applications.

Freundlich is a niche player in the North American aerospace fastener industry. Freundlich currently focuses exclusively on aero-space quality nut products, serving as an authorized stocking distributor for seven of the premier nut manufacturers in the United States.

Freundlich is a one-stop source for standard, self-locking, semi-special and special nuts manufactured to several military, aerospace and equivalent specifications. Freundlich maintains a large inventory of more than 7,000 SKUs comprised of more than 35 million parts of premium quality, brand name nut products. Management believes that Freundlich’s demonstrated ability to immediately fulfill a high percentage (approximately 40 percent) of customer orders from stock-on-hand gives Freundlich a distinct competitive advantage in the marketplace. Freundlich sells its products pursuant to written purchase orders it receives from its customers. All products are shipped via common carrier.

Industry Overview

The fastener distribution industry is highly fragmented. No one company holds a dominant position. This is primarily caused by the varied uses of fasteners and the size of the industry. Freundlich competes with the numerous fastener distributors which serve as authorized stocking distributors for the seven nut manufacturers in the Freundlich supplier base. Freundlich believes that the depth of its 7,000 SKU inventory represents a competitive advantage. As a stocking distributor, Freundlich has employed a business model of maintaining levels of inventory on hand or on order with its suppliers that can satisfy its customers’ projected needs. While this business model has allowed Freundlich to mitigate the supply shortage suffered by the industry, the extremely long supply times are creating challenges and creating shortages at Freundlich. Certain domestic manufacturing capacity was eliminated during a post-9/11 downturn in the aerospace industry. As the industry began a turnaround in 2004 and 2005, driven by increased levels of defense spending and increased commercial demand caused by new orders received by Boeing Company and others, manufacturer delivery on the increased level of demand was delayed because of the decreased capacity extant after 9/11.

Inventory

As a stocking distributor, Freundlich maintains levels of inventory on hand or on order to satisfy its customers’ projected needs. Freundlich has approximately 7,000 different types of nuts in its inventory, comprised of more than 35 million parts of premium quality, brand name nut products. Freundlich’s primary suppliers include the following:

| | SPS Technologies |

| | Greer Stop Nut |

| | Republic Fastener Mfg. Corp |

| | MacLean-ESNA |

| | Alcoa Fastening Systems |

| | Bristol Industries Inc. |

| | Abbott-Interfast Corporation |

Customers

In 2005, Freundlich Supply sold approximately 56% of its products to the United States Department of Defense. All of these products were sold for maintenance, repair and operations functions, were shipped to various government installations across the United States and were sold for many different government programs. For 2006, sales to the United States Department of Defense represented approximately 42% of total sales.

Freundlich’s commercial customers include original equipment manufacturers, repair facilities and other distributors. Other than the sales to the United States Department of Defense, no one customer represented more than 10 percent of total sales in 2005 or 2006.

Competition

The fastener distribution industry is highly fragmented. No one company holds a dominant position. This is primarily caused by the varied uses of fasteners and the size of the industry. The Company competes with the numerous fastener distributors which serve as authorized stocking distributors for the seven nut manufacturers in the Company's supplier base. The Company believes that the depth of its 7,000 SKU inventory represents a competitive advantage.

Few barriers to entry exist for fastener distributors generally. However, the business model employed by Freundlich promotes barriers to entry not generally seen in the industry.

Freundlich’s quality system is certified to AS9100:2004 and ISO 9001:2000 quality measures. Since quality is an important measure of aerospace suppliers, Freundlich strives to maintain its quality system to the highest standards in the industry.

As an authorized stocking distributor for the premier domestic manufacturers, Freundlich is able to maintain relationships with customers not generally available to the industry. Most manufacturers are not expanding their network of authorized distributors.

As a certified government supplier, i.e. because it is listed on the “Qualified Supplier/Manufacturer List,” Freundlich does not have to compete with companies not so listed.

Government Regulation

Freundlich is approved as a “qualified supplier” by the United States Department of Defense, and, as such, can provide certain critical parts that other suppliers not so approved cannot supply.

The Fastener Quality Act (“FQA”) and its implementing regulations issued by the United States Department of Commerce require certain distributors of fasteners to, among other things, maintain lot traceability for all of its products sold. This requires that companies like Freundlich keep their books and records such that they can trace the origin of each item sold to the manufacturer from which the item was purchased. The FQA imposes additional requirements on the manufacturers of subject parts and on the users. Because of the demands of the industry, its customers, and its own quality systems, Freundlich maintains strict lot traceability for each item in inventory, and has done so for many years.

Employees

Freundlich has 15 employees, all of whom are full time employees. We believe our employee relations are very good.

RISK FACTORS

An investment in our securities involves a high degree of risk. We are subject to various risks that may materially harm our business, financial condition and results of operations. An investor should carefully consider the risks and uncertainties described below and the other information in this filing before deciding to purchase our securities. If any of these risks or uncertainties actually occurs, our business, financial condition or operating results could be materially harmed. In that case, the trading price of our common stock could decline. You should only purchase our securities if you can afford to suffer the loss of your entire investment.

RISKS RELATED TO OUR BUSINESS

Fluctuations in our operating results and announcements and developments concerning our business affect our stock price.

Our quarterly operating results, the number of stockholders desiring to sell their shares, changes in general economic conditions and the financial markets, the execution of new contracts and the completion of existing agreements and other developments affecting us, could cause the market price of our common stock to fluctuate substantially.

As a result of the acquisition, our expenses have increased significantly.

As a result of the acquisition, our ongoing expenses have increased significantly, these include ongoing public company expenses, such as increased legal and accounting, administrative (including directors and insurance) expenses as a result of our status as a reporting company and the requirement that we register the shares of common stock issued underlying the convertible note, preferred stock and warrants issued to Barron Partners LP, as well as expenses incurred in complying with the internal controls requirements of the Sarbanes-Oxley Act, and obligations incurred in connection with the acquisition. Our failure to generate sufficient revenue and gross profit could result in reduced profits or losses as a result of the additional expenses

We may not be able to obtain necessary additional capital which could adversely impact our operations.

Unless the Company can increase its investment in inventory and meet operational expenses with the existing sources of funds we have available, we may need access to additional financing to grow our sales. Such additional financing, whether from external sources or related parties, may not be available if needed or on favorable terms. Our inability to obtain adequate financing will adversely affect the Company’s pace of business operations or could create liquidity and cash flow problems. This could be materially harmful to our business and may result in a lower stock price.

Our officers and directors are involved in other businesses which may cause them to devote less time to our business.

Our officers' and directors' involvement with other businesses may cause them to allocate their time and services between us and other entities. Consequently, they may give priority to other matters over our needs which may materially cause us to lose their services temporarily which could affect our operations and profitability.

We could fail to attract or retain key personnel, which could be detrimental to our operations

Our success largely depends on the efforts and abilities of key executives, employees and consultants. The loss of the services of a key executive, employee or consultant could materially harm our business because of the cost and time necessary to replace and train a replacement. Such a loss would also divert management attention away from operational issues. To the extent that we are smaller than our competitors and have fewer resources, we may not be able to attract the sufficient number and quality of staff.

We may not be able to grow through acquisitions.

In addition to our planned growth through the development of our business, an important part of our growth strategy is to expand our business and to acquire other businesses in related industries. Such acquisitions may be made with cash or our securities or a combination of cash and securities. If our stock price is less than the exercise price of the outstanding warrants, it is not likely that that warrants will be exercised at their present exercise price. To the extent that we require cash, we may have to borrow the funds or sell equity securities. Any issuance of equity as a portion of the purchase price or any sale of equity, to the extent that we are able to sell equity, to raise funds to enable us to pay the purchase price would result in dilution to our stockholders. We have no commitments from any financing source and we may not be able to raise any cash necessary to complete an acquisition. If we fail to make any acquisitions, our future growth may be limited. As of the date of this report, we do not have any agreement as to any acquisition. Further, any acquisition may be subject to government regulations.

If we make any acquisitions, they may disrupt or have a negative impact on our business.

If we make acquisitions, we could have difficulty integrating the acquired companies’ personnel and operations with our own. In addition, the key personnel of the acquired business may not be willing to work for us. We cannot predict the affect expansion may have on our core business. Regardless of whether we are successful in making an acquisition, the negotiations could disrupt our ongoing business, distract our management and employees and increase our expenses. In addition to the risks described above, acquisitions are accompanied by a number of inherent risks, including, without limitation, the following:

the difficulty of integrating acquired products, services or operations;

the potential disruption of the ongoing businesses and distraction of our management and the management of acquired companies;

the difficulty of incorporating acquired rights or products into our existing business;

difficulties in disposing of the excess or idle facilities of an acquired company or business and expenses in maintaining such facilities;

difficulties in maintaining uniform standards, controls, procedures and policies;

the potential impairment of relationships with employees and customers as a result of any integration of new management personnel;

the potential inability or failure to achieve additional sales and enhance our customer base through cross-marketing of the products to new and existing customers;

the effect of any government regulations which relate to the business acquired; and

potential unknown liabilities associated with acquired businesses or product lines, or the need to spend significant amounts to retool, reposition or modify the marketing or sales of acquired products or the defense of any litigation, whether of not successful, resulting from actions of the acquired company prior to our acquisition.

Our business could be severely impaired if and to the extent that we are unable to succeed in addressing any of these risks or other problems encountered in connection with these acquisitions, many of which cannot be presently identified. These risks and problems could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our results of operations.

We may be required to pay liquidated damages if our board does not consist of a majority of independent directors.

Our Securities Purchase Agreement with Barron Partners LP and Richard Henri Kreger requires us to (i) appoint such number of independent directors that would result in a majority of our directors being independent directors, (ii) have an audit committee that is composed solely of independent directors and (iii) have a compensation committee that is composed of a majority of independent directors. Our failure to maintain these requirements would results in our payment of liquidated damages that are payable in cash or by the issuance of additional shares of series A preferred stock at the election of the investors.

We are dependent on a few major industries.

We are dependent on the aerospace and defense industries for a majority of our revenue and, as a result, our business will be negatively impacted by any decline in those industries.

We face risks relating to government contracts.

There are inherent risks in contracting with the U.S. government, including risks that are peculiar to the defense industry, which could have a material adverse effect on our business, prospects, financial condition and operating results, including changes in the department of defense’s procurement policies and requirements.

RISKS RELATING TO OUR CURRENT FINANCING ARRANGEMENT

There are a large number of shares underlying our convertible note, series A and B convertible preferred stock and our warrants that may be available for future sale and the sale of these shares may depress the market price of our common stock.

The Company entered into a Securities Purchase Agreement with Barron Partners LP and Richard Henri Kreger (the “Investors”) pursuant to which the Investors purchased: (a) the Company’s convertible promissory note in the principal amount of $1,000,000. The note, upon full conversion, was, originally convertible into 500,000,000 shares of the Company’s common stock (the original conversion price was $0.002 per share), after the adjustment discussed below the note was convertible into 862,068,900 shares (the conversion price having been adjusted to is $0.00116 per share) (this Note has subsequently been paid off without conversion); (b) 5,277,778 shares of the Company’s series A convertible preferred stock (the “series A preferred stock”) which, were originally convertible into 2,375,000,100 shares of the Company’s common stock. (During 2006, and to date, 3,626 shares of the series A preferred stock were converted. After the adjustment discussed below, the 5,274,152 remaining shares of the series A preferred stock are convertible into 4,098,016,050 common shares. (c) warrants to purchase 1,581,150,000 shares of the Company’s common stock, originally at .00233, and after the adjustment discussed below $0.00135 per share; and (d) 1,581,150,000 shares of the Company’s common stock, originally at $0.004 per share and after the adjustment discussed below $0.00231 per share. The original securities conversion or exercise prices were all subject to certain adjustments of up to 35% per year in each of the years 2006 and 2007 if the Company failed to meet or exceed certain income levels. Subsequent to the date of this report the Company and the Investors agreed that the overall adjustment would be 42% which resulted in the adjustments noted above.

Additionally, all 2,811,000 shares of the Company’s series B convertible preferred stock convert into 843,300,000 common shares, however these shares cannot be converted until the stock reverse split described below.

The Securities Purchase Agreement provided that, within 120 days from the July 20, 2006 closing, the Company will have filed a restated certificate of incorporation that will (i) change the authorized capital stock to 10,000,000 shares of preferred stock and 90,000,000 shares of common stock and (ii) effect a one-for-150 reverse split of the common stock. After the adjustment discussed above, the original number of Total Shares, upon full conversion of all Investor securities which could be converted to common stock of the Company without giving effect to the reverse split, would be 8,999,009,550 shares. The Company presently has an authorized common stock limit of 100,000,000 shares. As a result, the Investors will not have the ability to convert the note or series A preferred stock or exercise the warrants in full unless the reverse split is effected. (The Investors have agreed to extend that the date of the reverse split to several times, as of the date of this refilling to December 15, 2009.). If the reverse split is not effective on or prior to the date of the reverse split, the Company is required to pay the investors liquidated damages in an amount equal to 5% of the investment made by the investors, which would be $287,500 and if it fails to timely file and maintain effective a registration statement it may be liable for liquidated damages which would be 2,100 shares of Series A stock per day it is in violation, up to a maximum of 750,000 shares.

The conversion price of the note and the conversion rate of the series A preferred stock are subject to adjustment in certain instances, including the issuance by the Company of stock at a price which is less than the conversion price.

The sale of these shares may adversely affect the market price of our common stock.

The terms of our Securities Purchase Agreement may restrict our ability to obtain necessary financing and could impede us from using our securities as consideration in contracts related to our operations.

Under the Securities Purchase Agreement, we are restricted, during the three year period commencing on the date of the agreement or such earlier time as the investors have sold certain of their securities, (i) from issuing or selling any of our common stock either (A) at a conversion, exercise or exchange rate or other price that is based upon and or varies with the trading prices of or quotations for the shares of Common Stock at any time after the initial issuance of such debt or equity securities, or (B) with a conversion, exercise or exchange price that is subject to being reset at some future date after the initial issuance of such debt or equity security or upon the occurrence of specified or content events directly or indirectly related to the business of the Company or the market for the Common stock, or (ii) in a transaction in which the Company issues or sells any securities in a capital raising transaction or series of related transactions which grants to an investor the right to receive additional shares based upon future transactions of the Company on terms which are more favorable to the Investors than the terms initially provided to the investor in its initial securities purchase agreement with the Company. In addition, the Company is restricted from issuing Preferred Stock and Convertible Debt. Further, each investor through the Securities Purchase Agreement has a right of first refusal in subsequent private placements of securities on a pro rata basis to the investor’s holdings in the total post financing total fully diluted shares of the Company. These restrictions could impede us from using our securities as consideration in contracts related to our operations, including, but not limited to, common stock issued to consultants and vendors and obtaining additional financing. This may force us to use our limited cash to pay third parties as opposed to issue our securities and may also lead to certain parties deciding to not enter into contracts with us to provide us with necessary financing. If we have difficulty in entering into contracts related to our operations or obtaining additional financing, we may be forced to curtail our business operations.

RISKS RELATING TO OUR COMMON STOCK

Our stock is presently not listed on the OTC Bulletin Board and there is no certainty that we will be re-listed.

Our stock was removed from listing on the OTC Bulletin Board and we have not yet reapplied for listing. We are not certain when we will be applying for re-listing and whether our application will be successful. As a result, the market liquidity for our securities is being adversely affected by limiting the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market.

Once re-listed, if we fail to remain current on our reporting requirements, we could be removed from the OTC Bulletin Board which would limit the ability of broker-dealers to sell our securities and the ability of stockholder to sell their securities in the secondary market.

Companies trading on the OTC Bulletin Board, such as us, must be reporting issuers under Section 12 of the Securities Exchange Act of 1934, as amended, and must be current in their reports under Section 13, in order to maintain price quotation privileges on the OTC Bulletin Board. If we fail to remain current on our reporting requirements, we could be removed from the OTC Bulletin Board. As a result, the market liquidity for our securities could be severely adversely affected by limiting the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market.

Our common stock may be affected by limited trading volume and may fluctuate significantly, which may affect shareholders' ability to sell shares of our common stock

There has been a limited public market for our common stock and a more active trading market for our common stock may not develop. An absence of an active trading market could adversely affect our shareholders' ability to sell our common stock in short time periods, or possibly at all. Our common stock has experienced, and is likely to experience in the future, significant price and volume fluctuations, which could adversely affect the market price of our common stock without regard to our operating performance. In addition, we believe that factors such as quarterly fluctuations in our financial results and changes in the overall economy or the condition of the financial markets could cause the price of our common stock to fluctuate substantially. These factors may negatively impact shareholders' ability to sell shares of the Company's common stock.

Our common stock may be affected by sales of short sellers, which may affect shareholders' ability to sell shares of our common stock

As stated above, our common stock has experienced, and is likely to experience in the future, significant price and volume fluctuations. These fluctuations could cause short sellers to enter the market from time to time in the belief that the Company will have poor results in the future. The market for our stock may not be stable or appreciate over time and the sale of our common stock may negatively impact shareholders' ability to sell shares of the Company's common stock.

Because we may be subject to the “penny stock” rules, you may have difficulty in selling our common stock.

If our stock price continues to be less than $5.00 per share, our stock may be subject to the SEC’s penny stock rules, (Rule 3a51-1 promulgated under the Securities Exchange Act of 1934) which impose additional sales practice requirements and restrictions on broker-dealers that sell our stock to persons other than established customers and institutional accredited investors. These requirements may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of them. This could cause our stock price to decline.

Our Common Stock is presently deemed To Be "Penny Stock."

Penny stocks are stock:

With a price of less than $5.00 per share;

That are not traded on a "recognized" national exchange;

Whose prices are not quoted on the NASDAQ automated quotation system (NASDAQ listed stock must still have a price of not less than $5.00 per share); or

Of issuers with net tangible assets less than $2.0 million (if the issuer has been in continuous operation for at least three years) or $10.0 million (if in continuous operation for less than three years), or with average revenues of less than $6.0 million for the last three years.

Broker/dealers dealing in penny stocks are required to provide potential investors with a document disclosing the risks of penny stocks. Moreover, broker/dealers are required to determine whether an investment in a penny stock is a suitable investment for a prospective investor.

According to the SEC, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer

Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases

“Boiler room” practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons;

Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and

The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses.

This may make it more difficult for investors to sell their shares due to suitability requirements.

As an issuer of “penny stock” the protection provided by the federal securities laws relating to forward looking statements does not apply to us.

Although the federal securities law provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, if we are a penny stock we will not have the benefit of this safe harbor protection in the event of any based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading.

Failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and operating results and stockholders could lose confidence in our financial reporting.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable financial reports or prevent fraud, our operating results could be harmed. We may be required in the future to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act, which requires increased control over financial reporting requirements, including annual management assessments of the effectiveness of such internal controls and a report by our independent certified public accounting firm addressing these assessments. Failure to achieve and maintain an effective internal control environment, regardless of whether we are required to maintain such controls could also cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

The Chairman of our board of directors will own a controlling interest in our voting stock following the completion of a proposed 1-for-150 reverse split.

The chairman of our board of directors, Alexander Kreger, will own approximately 53% of our outstanding common stock immediately following the completion of our proposed 1-for-150 reverse split. As a result, Mr. Kreger will have the ability to control substantially all matters submitted to our stockholders for approval, including:

election of our board of directors;

removal of any of our directors;

amendment of our certificate of incorporation or bylaws; and

adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us

ITEM 2. DESCRIPTION OF PROPERTY

Our principal executive office and the offices and distribution center of Freundlich is located at 2200 Arthur Kill Road, Staten Island, New York 10309. This was the prior location of the operations of the acquired assets of Freundlich. The space is subleased, pursuant to a triple net lease, by the Company through July 2007. The space is leased for approximately $12,000 per month. We have an option to extend our lease for this space. The approximately 18,000 square foot building is constructed from brick and cinder block and is maintained in excellent condition. The space is sufficient for our present and projected needs.

On March 23, 2007, the Company was notified that a complaint (the “Complaint”) had been filed against it, its directors and a major investor, in the United States District Court for the Eastern District of Pennsylvania by Robert Moyer, its former president and chief executive officer. The Complaint against the Company alleges breach of employment contract, violation of the New York Payment of Wages Law, wrongful discharge, unjust enrichment and civil conspiracy, all arising out of Moyer’s discharge. Mr. Moyer had been relieved of his responsibilities on January 18, 2007. The Complaint demands relief aggregating over $460,000 plus compensatory and punitive damages. The Company believes this Complaint has no merit and will vigorously defend the suit and will consider any appropriate rights and counterclaims.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None

PART II

ITEM 5. MARKET FOR PRECISION AEROSPACE COMPONENTS, INC.'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

The Company's common stock currently trades on the Pink Sheets under the trading symbol "PAOS.PK".

The following table sets forth the highest and lowest bid prices for the common stock for each calendar quarter and subsequent interim period since January 1, 2005, as reported on the web site Big Charts. It represents inter-dealer quotations, without retail markup, markdown or commission and may not be reflective of actual transactions.

| | | PRICES | |

| | | HIGH | | | LOW | |

| 2005 | | | | | | |

| First Quarter | | $ | 0.45 | | | $ | 0.10 | |

| Second Quarter | | $ | 0.50 | | | $ | 0.16 | |

| Third Quarter | | $ | 0.36 | | | $ | 0.01 | |

| Fourth Quarter | | $ | 0.03 | | | $ | 0.01 | |

| | | | | | | | | |

| 2006 | | | | | | | | |

| First Quarter | | $ | 0.14 | | | $ | 0.03 | |

| Second Quarter | | $ | 0.06 | | | $ | 0.01 | |

| Third Quarter | | $ | 0.11 | | | $ | 0.0001 | |

| Fourth Quarter | | $ | 0.05 | | | $ | 0.011 | |

The Company presently is authorized to issue 100,000,000 shares of common stock with a $0.001 par value. As of August 28, 2007, there were 79 holders of record of the Company's common stock and 33,324,691 shares issued and outstanding.

The Company is authorized to issue 10,000,000 shares of preferred stock with a $0.001 par value. As of August 28, 2007, there were 2 holders of record and 5,274,152 shares of series A convertible preferred stock outstanding, each of which is convertible into 777 shares of the Company’s common stock and there were 5 holders of record and 2,811,000 shares of series B convertible preferred stock outstanding each of which would be convertible into 300 shares of the Company’s common stock. (These shares convert automatically upon the reverse split described herein into 2 shares of the new common.)

Dividends

Precision Aerospace has not declared or paid cash dividends on its common stock since its inception and does not anticipate paying such dividends in the foreseeable future. The payment of dividends may be made at the discretion of the Board and will depend upon, among other factors, the Company's operations, its capital requirements, and its overall financial condition.

ITEM 6. MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

Note

The reader is directed to the explanatory statement at the first page of this Form 10-KSB.

General

The following discussion and analysis should be read in conjunction with the Consolidated Financial Statements, and the Notes thereto included herein. The information contained below includes statements of the Company's or management's beliefs, expectations, hopes, goals and plans that, if not historical, are forward-looking statements subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking statements. For a discussion on forward-looking statements, see the information set forth in the Introductory Note to this Annual Report under the caption "Forward Looking Statements" which information is incorporated herein by reference.

Restatement of Consolidated Financial Statements

The Company is restating its financial statements and disclosures to reflect an effective date of July 20, 2006, for the acquisition of Freundlich Supply Company. The Company previously reported all financial activity for the period of July 1, 2006 to July 19, 2006 in its originally filed Form 10-KSB for the year ended December 31, 2006. This error caused revenues for 2006 to be overstated by $735,675, cost of sales to be overstated by $514,305 and goodwill to be overstated by $221,370.

Additionally, the Company’s Balance Sheet has been revised to reclassify all of the Company’s Series A Preferred Stock and its Warrants issued in connection with the acquisition as Liabilities because they had possible contingent changes to their conversion or exercise prices. These contingencies were removed by the negotiation of agreement to fix the conversion and exercise prices on July 31, 2007. These changes to the information included in the report have no impact on the Company’s operations or financial status, either at December 31, 2006 or 2007 or subsequently.

Plan of Operation and Discussion of Operations

The Company's operations are presently carried out through its Freundlich subsidiary. A description of Freundlich's operations and marketplace is contained in section 1 of this report.

Freundlich

During the fiscal year 2007 the Company intends to have Freundlich build on the base that has made it successful since its predecessor was originally started in 1938.

In this regard, the Company last year invested in additional equipment and inventory to better enable Freundlich to meet the needs of its customers. The new, automated, packaging machine which became operational during the fourth quarter of 2006 enables Freundlich to more rapidly fulfill orders placed by its customers. The machine also provides Freundlich the ability to process additional orders utilizing its present shipping strengths.

Freundlich has also invested in new computer equipment as well as a new integrated management control, inventory control, sales and shipping management program which, when fully implemented, will enhance overall operations.

With these important investments in place, Freundlich does not anticipate any material additional capital expenditures on plant and equipment during this coming year. However, Freundlich will leverage its new capabilities consistent with both industry norms and enhancing Freundlich's operations. Additional communications capabilities, an improved Web presence and enhanced order capabilities, are all either planned or being explored.

During the period that the Company owned Freundlich the investment in inventory was significant. While some of this was necessary to meet customer demand, and an additional portion of the dollar amount was necessary to replenish stocks at new, higher prices, the investment created a strain on Freundlich's finances. The costs of materials in the fastener industry, and the lead-times for delivery have both increased. This has required more astute management of inventory ordering. Additionally, it has resulted in the need to make additional inventory investment.

It is important to fully recognize the value of the Freundlich inventory. Not only does Freundlich’s inventory enable Freundlich meet customer demand and obtain orders, but a significant portion of the inventory is carried on the Company’s balance sheet at a value well below the replacement cost were it to be reordered today. As Freundlich replaces its lower cost inventory with new higher-priced inventory, it will have to make this investment. Freundlich has the strategic benefit over a potential new entrant of having a lower cost of goods versus the seller of newly purchased items. The exact replacement cost of Freundlich’s inventory is difficult to exactly ascertain, since the cost of each particular item is generally increasing and the unit cost usually decreases as the quantity purchased increases. The Company believes that, in the interest of assuring that its belief is known in a formal filing, and based only on its knowledge of present market pricing, were it to immediately replace Freundlich’s entire inventory, the overall cost of replacement would significantly exceed the initial audited cost of $3,509,183 shown on the balance sheet.

Freundlich has successfully put in place a new line of credit in the first quarter of 2007. The line has a term of one year. The line, along with the positive cash flow from operations (without giving effect to inventory fluctuation), should be sufficient to enable Freundlich to carry on and expand its present operations, albeit at a lower rate than desired. However, Freundlich is investigating expansion of its product offerings as well as additional investment in inventory beyond that which could be accommodated by its present financing. Accordingly, to implement these expansion plans Freundlich intends to pursue additional financing. It should be emphasized that Freundlich believes that the impact of not obtaining additional financing will only be to restrain its rate of growth. Even without additional financing, Freundlich should continue to adequately service its customers.

During the first quarter of 2007, subsequent to the period of this report, Freundlich was awarded a significant portion of a Defense Department contract; its competitors received awards of significantly lesser amounts of the contract. Freundlich anticipates that it can fully satisfy the requirements of this contract without any additional financing.

Freundlich believes it can expand its business with its present staff. However, it is likely that one or two additional staff members will be retained to augment the growth and operation of Freundlich.

Additional Company initiatives

During the early part of 2007, the Company has completed all of the processes consistent with the acquisition of Freundlich. Accordingly, the Company can now investigate and pursue opportunities to both improve the Freundlich operation as well as additional operations which are both consistent with the Freundlich operation and with the Company's growth vision.

During the last quarter of 2006, the Company’s prior management improvidently pursued an acquisition opportunity that did not come about, but was costly to the Company. A loss and associated expenses of approximately $213,000 was recognized in connection with this activity. Additionally, in 2006, the Company incurred extraordinary costs in connection with its operations following the acquisition of Freundlich. These additional professional fees and General and Administrative expenses, in excess of what the Company anticipates for normal operations, exceeded $50,000. The effect of these expenses is magnified in view of the fact that the Company revenues and income only reflect the six months of operation of Freundlich from its acquisition in July. Prior to the July acquisition the Company was inactive and so had no revenues.

The opportunities presently under consideration by the Company, in addition to the expansion of the Freundlich operations, are the acquisition of horizontal, vertical and complementary operations. No specific acquisition opportunities or ventures are being actively pursued at this time. However it is anticipated that during the remainder of 2007, and beyond, the Company will actively evaluate and pursue acquisition and joint venture opportunities. In connection with these opportunities, the Company will also pursue the arrangement of adequate financing to carry out its plans.

In view of the size of the operations of the Company's sole operating subsidiary, and the costs involved in pursuing and consummating an acquisition, the Company will have to be selective and may have to obtain additional anticipatory financing.

Horizontal acquisitions would effectively improve the Company's overall volume which, in turn, would enable the Company to take advantage of economies of scale as they pertain to inventory management and certain administrative practices. Vertical or synergistic acquisitions could enhance the capability of the Company to satisfy potential customer desires to deal with multi-product companies or to deal with companies that have expanded service offerings not presently provided by Freundlich.

Additionally, acquisition of skills and product lines which are complementary to the Freundlich offering could mutually enhance the sales of each.

At the Company level, the Company does not intend to add any staff until and after acquisitions warrant such addition. Presently, many Company level activities are either outsourced or handled at the Freundlich level.

The present cash flow from the activities of Freundlich is sufficient to meet both the Freundlich and the company cash requirements, subject to the foregoing discussion regarding expansion.

Off balance sheet arrangements

None

Subsequent Events